Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Vanguard Natural Resources, Inc. | exhibit32-2x2017xq4x10k.htm |

| EX-32.1 - EXHIBIT 32.1 - Vanguard Natural Resources, Inc. | exhibit32-1x2017xq4x10k.htm |

| EX-31.2 - EXHIBIT 31.2 - Vanguard Natural Resources, Inc. | exhibit31-2x2017xq4x10k.htm |

| EX-31.1 - EXHIBIT 31.1 - Vanguard Natural Resources, Inc. | exhibit31-1x2017xq4x10k.htm |

| EX-23.2 - EXHIBIT 23.2 - Vanguard Natural Resources, Inc. | exhibit232mlconsent2017.htm |

| EX-23.1 - EXHIBIT 23.1 - Vanguard Natural Resources, Inc. | exhibit231bdoconsent2017.htm |

| EX-21.1 - EXHIBIT 21.1 - Vanguard Natural Resources, Inc. | exhibit21-1x2017xq4x10k.htm |

| EX-10.15 - EXHIBIT 10.15 - Vanguard Natural Resources, Inc. | exhibit10-15formofdirector.htm |

| 10-K - 10-K - Vanguard Natural Resources, Inc. | vnr-20171231x10k.htm |

January 31, 2018

Vanguard Natural Resources, Inc.

5847 San Felipe, Suite 3000

Houston, Texas 77057

Re: Audit of Reserves

As of December 31, 2017

SEC Proved Case

Ladies and Gentlemen:

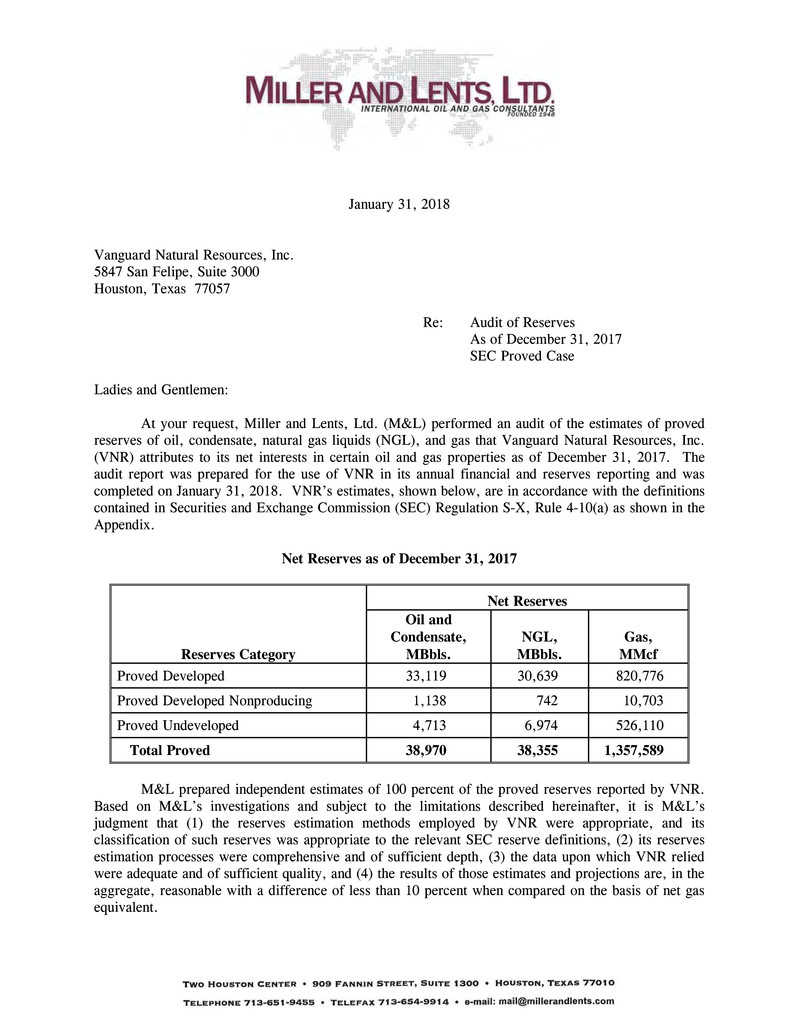

At your request, Miller and Lents, Ltd. (M&L) performed an audit of the estimates of proved

reserves of oil, condensate, natural gas liquids (NGL), and gas that Vanguard Natural Resources, Inc.

(VNR) attributes to its net interests in certain oil and gas properties as of December 31, 2017. The

audit report was prepared for the use of VNR in its annual financial and reserves reporting and was

completed on January 31, 2018. VNR’s estimates, shown below, are in accordance with the definitions

contained in Securities and Exchange Commission (SEC) Regulation S-X, Rule 4-10(a) as shown in the

Appendix.

Net Reserves as of December 31, 2017

Reserves Category

Net Reserves

Oil and

Condensate,

MBbls.

NGL,

MBbls.

Gas,

MMcf

Proved Developed 33,119 30,639 820,776

Proved Developed Nonproducing 1,138 742 10,703

Proved Undeveloped 4,713 6,974 526,110

Total Proved 38,970 38,355 1,357,589

M&L prepared independent estimates of 100 percent of the proved reserves reported by VNR.

Based on M&L’s investigations and subject to the limitations described hereinafter, it is M&L’s

judgment that (1) the reserves estimation methods employed by VNR were appropriate, and its

classification of such reserves was appropriate to the relevant SEC reserve definitions, (2) its reserves

estimation processes were comprehensive and of sufficient depth, (3) the data upon which VNR relied

were adequate and of sufficient quality, and (4) the results of those estimates and projections are, in the

aggregate, reasonable with a difference of less than 10 percent when compared on the basis of net gas

equivalent.

Vanguard Natural Resources, Inc. January 31, 2018

Page 2

VNR’s reserves estimates were based on decline curve extrapolations, analogies, volumetric

calculations, or combinations of these methods for each well, reservoir, or field. Proved undeveloped

reserves were assigned to some locations offset by more than one location from existing production.

These proved undeveloped reserves are supported by production and geological data that appropriately

demonstrate reservoir continuity with a high degree of certainty. All proved undeveloped reserves are

scheduled to be developed within five years of initial booking. Reserves estimates from analogies are

often less certain than reserves estimates based on well performance obtained over a period during

which a substantial portion of the reserves were produced.

All reserves discussed herein are located within the Continental United States. Gas volumes

were estimated at the appropriate pressure base and temperature base that are established for each well

or field by the applicable sales contract or regulatory body. Total gas reserves were obtained by

summing the reserves for all the individual properties and are therefore stated herein at a mixed

pressure base.

VNR represented that prices for oil, condensate, NGL, and gas were based on a reference price

utilizing the 12-month averages of the first-day-of-the-month prices, in accordance with SEC

guidelines. VNR supplied oil, condensate, and NGL differentials based on a benchmark price of

$51.22 per barrel to a West Texas Intermediate Spot Price at Cushing, Oklahoma. VNR supplied gas

differentials based on a benchmark price of $2.99 per MMBtu to a Henry Hub Spot Price. The average

realized prices used in this report for proved reserves, after appropriate adjustments, were $44.58 per

barrel for oil, $2.24 per Mcf for gas, and $19.24 per barrel for NGL.

In making its projections, VNR included cost estimates for well abandonments. VNR's

estimates include no adjustments for production prepayments, exchange agreements, gas balancing, or

similar arrangements. M&L was provided with no information concerning these conditions and it has

made no investigations of these matters as such was beyond the scope of this investigation.

In conducting this evaluation, M&L relied upon, without independent verification, VNR’s

representation of (1) ownership interests, (2) production histories, (3) accounting and cost data,

(4) geological, geophysical, and engineering data, and (5) development schedules. These data were

accepted as represented and were considered appropriate for the purpose of the audit report. To a

lesser extent, nonproprietary data existing in the files of M&L, and data obtained from commercial

services were used. M&L employed all methods, procedures, and assumptions considered necessary in

utilizing the data provided to prepare the report.

The evaluations presented in this report, with the exceptions of those parameters specified by

others, reflect M&L’s informed judgments and are subject to the inherent uncertainties associated with

interpretation of geological, geophysical, and engineering information. These uncertainties include, but

are not limited to, (1) the utilization of analogous or indirect data and (2) the application of professional

judgments. Government policies and market conditions different from those employed in this study

may cause (1) the total quantity of oil, natural gas liquids, or gas to be recovered, (2) actual production

rates, (3) prices received, or (4) operating and capital costs to vary from those presented in this report.

Reserves Definitions In Accordance With

Securities and Exchange Commission Regulation S-X

Reserves

Reserves are estimated remaining quantities of oil and gas and related substances anticipated to be

economically producible, as of a given date, by application of development projects to known accumulations. In

addition, there must exist, or there must be a reasonable expectation that there will exist, the legal right to produce or a

revenue interest in the production, installed means of delivering oil and gas or related substances to market, and all

permits and financing required to implement the project.

Reserves should not be assigned to adjacent reservoirs isolated by major, potentially sealing, faults until those

reservoirs are penetrated and evaluated as economically producible. Reserves should not be assigned to areas that are

clearly separated from a known accumulation by a non-productive reservoir (i.e., absence of reservoir, structurally low

reservoir, or negative test results). Such areas may contain prospective resources (i.e., potentially recoverable

resources from undiscovered accumulations).

Proved Oil and Gas Reserves

Proved oil and gas reserves are those quantities of oil and gas, which, by analysis of geoscience and

engineering data, can be estimated with reasonable certainty to be economically producible—from a given date

forward, from known reservoirs, and under existing economic conditions, operating methods, and government

regulations—prior to the time at which contracts providing the right to operate expire, unless evidence indicates that

renewal is reasonably certain, regardless of whether deterministic or probabilistic methods are used for the estimation.

The project to extract the hydrocarbons must have commenced or the operator must be reasonably certain that it will

commence the project within a reasonable time.

1. The area of the reservoir considered as proved includes:

a. The area identified by drilling and limited by fluid contacts, if any, and

b. Adjacent undrilled portions of the reservoir that can, with reasonable certainty, be judged to be

continuous with it and to contain economically producible oil or gas on the basis of available

geoscience and engineering data.

2. In the absence of data on fluid contacts, proved quantities in a reservoir are limited by the lowest

known hydrocarbons (LKH) as seen in a well penetration unless geoscience, engineering, or

performance data and reliable technology establishes a lower contact with reasonable certainty.

3. Where direct observation from well penetrations has defined a highest known oil (HKO) elevation and

the potential exists for an associated gas cap, proved oil reserves may be assigned in the structurally

higher portions of the reservoir only if geoscience, engineering, or performance data and reliable

technology establish the higher contact with reasonable certainty.

4. Reserves which can be produced economically through application of improved recovery techniques

(including, but not limited to, fluid injection) are included in the proved classification when:

a. Successful testing by a pilot project in an area of the reservoir with properties no more favorable

than in the reservoir as a whole, the operation of an installed program in the reservoir or an

analogous reservoir, or other evidence using reliable technology establishes the reasonable

certainty of the engineering analysis on which the project or program was based; and

b. The project has been approved for development by all necessary parties and entities, including

governmental entities.

Appendix

Page 1 of 3

5. Existing economic conditions include prices and costs at which economic producibility from a

reservoir is to be determined. The price shall be the average price during the 12-month period prior to

the ending date of the period covered by the report, determined as an unweighted arithmetic average of

the first-day-of-the-month price for each month within such period, unless prices are defined by

contractual arrangements, excluding escalations based upon future conditions.

Developed Oil and Gas Reserves

Developed oil and gas reserves are reserves of any category that can be expected to be recovered:

1. Through existing wells with existing equipment and operating methods or in which the cost of the

required equipment is relatively minor compared to the cost of a new well; and

2. Through installed extraction equipment and infrastructure operational at the time of the reserves

estimate if the extraction is by means not involving a well.

Undeveloped Oil and Gas Reserves

Undeveloped oil and gas reserves are reserves of any category that are expected to be recovered from new

wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

1. Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas

that are reasonably certain of production when drilled, unless evidence using reliable technology exists

that establishes reasonable certainty of economic producibility at greater distances.

2. Undrilled locations can be classified as having undeveloped reserves only if a development plan has

been adopted indicating that they are scheduled to be drilled within five years, unless the specific

circumstances, justify a longer time.

3. Under no circumstances shall estimates for undeveloped reserves be attributable to any acreage for

which an application of fluid injection or other improved recovery technique is contemplated, unless

such techniques have been proved effective by actual projects in the same reservoir or an analogous

reservoir, as defined below, or by other evidence using reliable technology establishing reasonable

certainty.

Analogous Reservoir

Analogous reservoirs, as used in resources assessments, have similar rock and fluid properties,

reservoir conditions (depth, temperature, and pressure) and drive mechanisms, but are typically at a more

advanced stage of development than the reservoir of interest and thus may provide concepts to assist in

the interpretation of more limited data and estimation of recovery. When used to support proved

reserves, an “analogous reservoir” refers to a reservoir that shares the following characteristics with the

reservoir of interest:

1. Same geological formation (but not necessarily in pressure communication with the

reservoir of interest);

2. Same environment of deposition;

3. Similar geological structure; and

4. Same drive mechanism.

Reservoir properties must, in aggregate, be no more favorable in the analog than in the

reservoir of interest.

Appendix

Page 2 of 3

Probable Reserves

Probable reserves are those additional reserves that are less certain to be recovered than proved reserves but

which, together with proved reserves, are as likely as not to be recovered.

1. When deterministic methods are used, it is as likely as not that actual remaining quantities recovered

will exceed the sum of estimated proved plus probable reserves. When probabilistic methods are used,

there should be at least a 50% probability that the actual quantities recovered will equal or exceed the

proved plus probable reserves estimates.

2. Probable reserves may be assigned to areas of a reservoir adjacent to proved reserves where data

control or interpretations of available data are less certain, even if the interpreted reservoir continuity

of structure or productivity does not meet the reasonable certainty criterion. Probable reserves may be

assigned to areas that are structurally higher than the proved area if these areas are in communication

with the proved reservoir.

3. Probable reserves estimates also include potential incremental quantities associated with a greater

percentage recovery of the hydrocarbons in place than assumed for proved reserves.

4. See also guidelines in Items 4 and 6 under Possible Reserves.

Possible Reserves

Possible reserves are those additional reserves that are less certain to be recovered than probable reserves.

1. When deterministic methods are used, the total quantities ultimately recovered from a project have a

low probability of exceeding proved plus probable plus possible reserves. When probabilistic methods

are used, there should be at least a 10% probability that the total quantities ultimately recovered will

equal or exceed the proved plus probable plus possible reserves estimates.

2. Possible reserves may be assigned to areas of a reservoir adjacent to probable reserves where data

control and interpretations of available data are progressively less certain. Frequently, this will be in

areas where geoscience and engineering data are unable to define clearly the area and vertical limits of

commercial production from the reservoir by a defined project.

3. Possible reserves also include incremental quantities associated with a greater percentage recovery of

the hydrocarbons in place than the recovery quantities assumed for probable reserves.

4. The proved plus probable and proved plus probable plus possible reserves estimates must be based on

reasonable alternative technical and commercial interpretations within the reservoir or subject project

that are clearly documented, including comparisons to results in successful similar projects.

5. Possible reserves may be assigned where geoscience and engineering data identify directly adjacent

portions of a reservoir within the same accumulation that may be separated from proved areas by faults

with displacement less than formation thickness or other geological discontinuities and that have not

been penetrated by a wellbore, and the registrant believes that such adjacent portions are in

communication with the known (proved) reservoir. Possible reserves may be assigned to areas that are

structurally higher or lower than the proved area if these areas are in communication with the proved

reservoir.

6. Pursuant to Item 3 under Proved Oil and Gas Reserves, where direct observation has defined a highest

known oil (HKO) elevation and the potential exists for an associated gas cap, proved oil reserves

should be assigned in the structurally higher portions of the reservoir above the HKO only if the higher

contact can be established with reasonable certainty through reliable technology. Portions of the

reservoir that do not meet this reasonable certainty criterion may be assigned as probable and possible

oil or gas based on reservoir fluid properties and pressure gradient interpretations.

Appendix

Page 3 of 3