Attached files

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[x] | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2017

OR

[ ] | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission file number 000-54755

CĪON Investment Corporation | ||

(Exact name of registrant as specified in its charter) | ||

Maryland | 45-3058280 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

3 Park Avenue, 36th Floor New York, New York | 10016 | |

(Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code (212) 418-4700

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Name of each exchange on which registered | |

None | Not applicable | |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001 per share | ||

(Title of class) | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [x] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

[ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer [ ] | Accelerated filer [ ] | |

Non-accelerated filer [x] (Do not check if a smaller reporting company) | Smaller reporting company [ ] | |

Emerging growth company [ ] | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

[ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [ ] No [x]

There is no established market for the Registrant’s shares of common stock. The Registrant is currently conducting an ongoing follow-on public offering of its shares of common stock pursuant to a Registration Statement on Form N-2, as amended (File No. 333-203683), which shares are being sold at $9.70 per share, with discounts available for certain categories of purchasers, or at a price necessary to ensure that shares are not sold at a price below net asset value per share.

The number of shares of the Registrant’s common stock, $0.001 par value, outstanding as of March 8, 2018 was 115,468,781.

Documents Incorporated by Reference

Portions of the Registrant’s Definitive Proxy Statement relating to the Registrant’s 2018 Annual Meeting of Shareholders, to be filed with the Securities and Exchange Commission within 120 days following the end of the Registrant’s fiscal year, are incorporated by reference in Part III of this Annual Report on Form 10-K as indicated herein.

CĪON INVESTMENT CORPORATION

FORM 10-K

TABLE OF CONTENTS

Page | ||

PART I

Forward-Looking Statements

Some of the statements within this Annual Report on Form 10-K constitute forward-looking statements because they relate to future events or our future performance or financial condition. The forward-looking statements contained in this Annual Report on Form 10-K may include statements as to:

• | our future operating results; |

• | our business prospects and the prospects of our portfolio companies; |

• | the impact of the investments that we expect to make; |

• | the ability of our portfolio companies to achieve their objectives; |

• | our current and expected financings and investments; |

• | the adequacy of our cash resources, financing sources and working capital; |

• | the use of borrowed money to finance a portion of our investments; |

• | the timing of cash flows, if any, from the operations of our portfolio companies; |

• | our contractual arrangements and relationships with third parties; |

• | the actual and potential conflicts of interest with CION Investment Management, LLC, or CIM, and Apollo Global Management, LLC, or Apollo, and their respective affiliates; |

• | the ability of CIM and Apollo Investment Management, L.P., or AIM, a subsidiary of Apollo and a registered investment adviser under the Investment Advisers Act of 1940, as amended, or the Advisers Act, to locate suitable investments for us and the ability of CIM to monitor and administer our investments; |

• | the ability of CIM and its affiliates to attract and retain highly talented professionals; |

• | the dependence of our future success on the general economy and its impact on the industries in which we invest; |

• | the effects of a changing interest rate environment; |

• | our ability to source favorable private investments; |

• | our tax status; |

• | the effect of changes to tax legislation and our tax position; |

• | the tax status of the companies in which we invest; and |

• | the timing and amount of distributions and dividends from the companies in which we invest. |

In addition, words such as “anticipate,” “believe,” “expect” and “intend” indicate a forward-looking statement, although not all forward-looking statements include these words. The forward-looking statements contained in this Annual Report on Form 10-K involve risks and uncertainties. Our actual results could differ materially from those implied or expressed in the forward-looking statements for any reason, including the factors set forth in “Risk Factors” in Item 1A of Part I of this Annual Report on Form 10-K. Other factors that could cause actual results to differ materially include:

• | changes in the economy; |

• | risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; and |

• | future changes in laws or regulations and conditions in our operating areas. |

We have based the forward-looking statements on information available to us on the date of this Annual Report on Form 10-K. Except as required by the federal securities laws, we undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise. You are advised to review any additional disclosures that we may make directly to you or through reports that we in the future may file with the Securities and Exchange Commission, or SEC, including annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K. The forward-looking statements contained in this Annual Report on Form 10-K are excluded from the safe harbor protection provided by Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act.

1

Amounts and percentages presented herein may have been rounded for presentation and all dollar amounts, excluding share and per share amounts, are presented in thousands unless otherwise noted.

Item 1. Business

CĪON Investment Corporation, or the Company, was incorporated under the general corporation laws of the State of Maryland on August 9, 2011. When used in this Annual Report on Form 10-K, the terms “we,” “us,” “our” or similar terms refer to the Company and its consolidated subsidiaries. In addition, the term “portfolio companies” refers to companies in which we have invested, either directly or indirectly through our total return swap, or TRS (described in further detail under “Item 1. Business – Financing Arrangements – Total Return Swap” below).

We are an externally managed, non-diversified closed-end management investment company that has elected to be regulated as a business development company, or BDC, under the Investment Company Act of 1940, as amended, or the 1940 Act. We elected to be treated for federal income tax purposes as a regulated investment company, or RIC, as defined under Subchapter M of the Internal Revenue Code of 1986, as amended, or the Code.

We are managed by CIM, our affiliate and a registered investment adviser under the Advisers Act. CIM oversees the management of our activities and is responsible for making investment decisions for our portfolio. CIM is a joint venture between CION Investment Group, LLC (formerly, ICON Investment Group, LLC), or CIG, and AIM. AIM’s responsibilities include, among other things, identifying and providing information about potential investment opportunities for approval by CIM's investment committee and providing reasonable expertise and knowledge with respect to CIM-sourced transactions. All of our investment decisions are the sole responsibility of, and are made at the sole discretion of, CIM.

Our investment objective is to generate current income and, to a lesser extent, capital appreciation for investors. We seek to meet our investment objective by utilizing the experienced management team of CIM, which includes its access to the relationships and human capital of its affiliates in sourcing, evaluating and structuring transactions, as well as monitoring and servicing our investments. Our portfolio is comprised primarily of investments in senior secured debt, including first lien loans, second lien loans and unitranche loans, and, to a lesser extent, collateralized securities, structured products and other similar securities, unsecured debt, including corporate bonds and long-term subordinated loans, referred to as mezzanine loans, and equity, of private and thinly-traded U.S. middle-market companies. See “Item 1. Business – Investment Types” below for a detailed description of the types of investments that may comprise our portfolio. We define middle-market companies as companies that generally possess annual earnings before interest, taxes, depreciation and amortization, or EBITDA, of $50 million or less, with experienced management teams, significant free cash flow, strong competitive positions and potential for growth.

In addition, we may from time to time invest up to 30% of our assets opportunistically in other types of investments, including collateralized securities, structured products and other similar securities and the securities of larger public companies and foreign securities, which may be deemed “non-qualifying assets” for the purpose of complying with investment restrictions under the 1940 Act. This treatment extended to the TRS, as we treated each loan underlying the TRS as a qualifying asset if the obligor on such loan was an eligible portfolio company and as a non-qualifying asset if the obligor was not an eligible portfolio company. See “Item 1. Business - Qualifying Assets” below.

In connection with our debt investments, we may receive equity interests such as warrants or options as additional consideration. We may also purchase minority interests in the form of common or preferred equity in our target companies, typically in conjunction with one of our debt investments or through a co-investment with a financial sponsor. We expect that our investments will generally range between $5 million and $50 million each, although investments may vary as the size of our capital base changes and will ultimately be at the discretion of CIM subject to oversight by our board of directors. We have made and intend to make smaller investments in syndicated loan opportunities, which typically include investments in companies with annual EBITDA of greater than $50 million, subject to liquidity and diversification constraints.

To enhance our opportunity for gain, we employ leverage as market conditions permit and at the discretion of CIM, but in no event can leverage employed exceed 50% of the value of our total assets as required by the 1940 Act. For purposes of the asset coverage ratio test applicable to us as a BDC, we treated the outstanding notional amount of the TRS, less the total amount of cash collateral posted by Flatiron Funding, LLC, or Flatiron, under the TRS, as a senior security for the life of that instrument.

2

Portfolio and Investment Activity

As of December 31, 2017, we engage in the direct purchase of debt securities primarily issued by portfolio companies and lend directly to portfolio companies. Prior to the expiration of the TRS on April 18, 2017, we also obtained economic exposure to additional portfolio companies by directing the creation of a portfolio of underlying corporate loans that served as reference assets under the TRS. The following table summarizes the composition of our investment portfolio at amortized cost and fair value as of December 31, 2017:

December 31, 2017 | |||||||||||

Investments Cost(1) | Investments Fair Value | Percentage of Investment Portfolio | |||||||||

Senior secured first lien debt | $ | 1,088,512 | $ | 1,100,336 | 73.0 | % | |||||

Senior secured second lien debt | 342,906 | 333,944 | 22.1 | % | |||||||

Collateralized securities and structured products - debt | 25,411 | 25,289 | 1.7 | % | |||||||

Collateralized securities and structured products - equity | 19,833 | 18,525 | 1.2 | % | |||||||

Unsecured debt | 7,653 | 7,639 | 0.5 | % | |||||||

Equity | 21,538 | 21,915 | 1.5 | % | |||||||

Subtotal/total percentage | 1,505,853 | 1,507,648 | 100.0 | % | |||||||

Short term investments(2) | 206,547 | 206,547 | |||||||||

Total investments | $ | 1,712,400 | $ | 1,714,195 | |||||||

Number of portfolio companies | 150 | ||||||||||

Purchased at a weighted average price of par | 95.83 | % | |||||||||

Gross annual portfolio yield based upon the purchase price(3) | 9.24 | % | |||||||||

(1) | Represents amortized cost for debt investments and cost for equity investments. Amortized cost represents the original cost adjusted for the amortization of premiums and/or accretion of discounts, as applicable, on our investments. |

(2) | Short term investments represent an investment in a fund that invests in highly liquid investments with average original maturity dates of three months or less. |

(3) | The gross annual portfolio yield does not represent and may be higher than an actual investment return to shareholders because it excludes our expenses and all sales commissions and dealer manager fees and does not consider the cost of leverage. |

We do not currently intend to list our securities on an exchange and do not expect a public market to develop for them in the foreseeable future. We believe that an unlisted structure is appropriate for the long-term nature of the assets in which we invest. In addition, because our common stock will not be listed on a national securities exchange, we will be able to pursue our investment objective without subjecting our investors to the daily share price volatility associated with the public markets. To provide our shareholders with limited liquidity, we conduct quarterly tender offers pursuant to our share repurchase program. In connection with that program, we intend, but are not required, to continue conducting quarterly repurchase offers. This is the only method of liquidity that we will offer prior to a liquidity event. We limit the number of shares of common stock to be repurchased in any calendar year to the lesser of (i) 15% of the weighted average number of shares of common stock outstanding in the prior calendar year, or 3.75% in each quarter; and (ii) the number of shares of common stock we can repurchase with the proceeds we receive from the issuance of shares of common stock pursuant to our fifth amended and restated distribution reinvestment plan. Accordingly, it is unlikely that shareholders will be able to sell their common stock when desired or at a desired price.

Although we do not currently intend to list our common stock on an exchange and do not expect a public market to develop for it in the foreseeable future, we intend to seek to complete a liquidity event within three to five years following the completion of our offering stage or at such earlier time as our board of directors may determine, taking into consideration market conditions and other factors. However, our offering of common stock may extend for an indefinite period. We will view our offering stage as complete as of the termination date of our most recent public equity offering if we have not conducted a public equity offering in any continuous two-year period. However, there can be no assurance that we will be able to complete a liquidity event.

As a BDC, we are subject to certain regulatory restrictions in negotiating or investing in certain investments with entities with which we may be restricted from doing so under the 1940 Act, such as CIM and its affiliates, unless we obtain an exemptive order from the SEC or co-invest alongside such affiliates in accordance with existing regulatory guidance. Furthermore, we are subject to certain regulatory restrictions on investing with AIM and its affiliates in transactions where AIM or its affiliates negotiate terms other than price on our behalf. We are currently seeking exemptive relief from the SEC to engage in co-investment transactions with CIM and its affiliates. However, there can be no assurance that we will obtain such exemptive relief. Even if we receive exemptive relief, neither CIM nor its affiliates will be obligated to offer us the right to participate in any transactions originated by them.

3

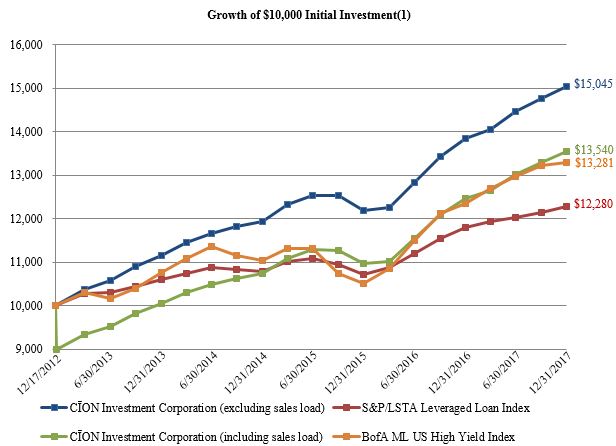

Status of Our Continuous Public Offerings

On December 17, 2012, we met our minimum offering requirement of $2,500 in capital raised from persons not affiliated with us, admitted our initial public investors as shareholders and officially commenced operations. Our initial continuous public offering ended on December 31, 2015 and our follow-on continuous public offering commenced on January 25, 2016. Since commencing our initial continuous public offering on July 2, 2012 and through March 8, 2018, we sold 115,468,781 shares of common stock for corresponding net proceeds of $1,172,457 at an average price per share of $10.15, including shares purchased by our affiliates. The net proceeds received include gross proceeds received from reinvested shareholder distributions of $130,958 pursuant to our distribution reinvestment plan, as amended and restated, for which we issued 14,369,911 shares of common stock, and gross proceeds paid for shares of common stock tendered for repurchase of $84,199 pursuant to our share repurchase program, for which we repurchased 9,276,383 shares of common stock.

Distributions

In January 2013, we began authorizing monthly distributions to our shareholders. On February 1, 2014, we changed from semi-monthly closings to weekly closings for the sale of our shares. As a result, from February 1, 2014 through July 17, 2017, our board of directors authorized and declared on a monthly basis a weekly distribution amount per share of our common stock. On July 18, 2017, our board of directors authorized and declared on a quarterly basis a weekly distribution amount per share of our common stock. Effective September 28, 2017, our board of directors delegated to management the authority to determine the amount, record dates, payment dates and other terms of distributions to shareholders, which will be ratified by our board of directors, each on a quarterly basis. Subject to our board of directors’ discretion and applicable legal restrictions, our management intends to continue to authorize and declare, and our board of directors intends to continue to ratify, each on a quarterly basis, a weekly distribution amount per share of our common stock. Declared distributions are paid monthly.

Our board of directors declared or ratified distributions for 52, 52 and 52 record dates during the years ended December 31, 2017, 2016 and 2015, respectively. The following table presents cash distributions per share that were declared during the years ended December 31, 2017, 2016 and 2015:

Distributions | ||||||||

Three Months Ended | Per Share | Amount | ||||||

2015 | ||||||||

March 31, 2015 (thirteen record dates) | $ | 0.1829 | $ | 10,767 | ||||

June 30, 2015 (thirteen record dates) | 0.1829 | 13,223 | ||||||

September 30, 2015 (thirteen record dates) | 0.1829 | 15,517 | ||||||

December 31, 2015 (thirteen record dates) | 0.1829 | 17,761 | ||||||

Total distributions for the year ended December 31, 2015 | $ | 0.7316 | $ | 57,268 | ||||

2016 | ||||||||

March 31, 2016 (thirteen record dates) | $ | 0.1829 | $ | 19,004 | ||||

June 30, 2016 (thirteen record dates) | 0.1829 | 19,167 | ||||||

September 30, 2016 (thirteen record dates) | 0.1829 | 19,480 | ||||||

December 31, 2016 (thirteen record dates) | 0.1829 | 19,808 | ||||||

Total distributions for the year ended December 31, 2016 | $ | 0.7316 | $ | 77,459 | ||||

2017 | ||||||||

March 31, 2017 (thirteen record dates) | $ | 0.1829 | $ | 20,123 | ||||

June 30, 2017 (thirteen record dates) | 0.1829 | 20,371 | ||||||

September 30, 2017 (thirteen record dates) | 0.1829 | 20,644 | ||||||

December 31, 2017 (thirteen record dates) | 0.1829 | 20,923 | ||||||

Total distributions for the year ended December 31, 2017 | $ | 0.7316 | $ | 82,061 | ||||

4

On December 26, 2017, our co-chief executive officers declared regular weekly cash distributions of $0.014067 per share for January 2018 through March 2018. Each distribution was paid or will be paid monthly to shareholders of record as of the weekly record dates set forth below.

Record Date | Payment Date | Distribution Amount Per Share | ||

January 2, 2018 | January 31, 2018 | $0.014067 | ||

January 9, 2018 | January 31, 2018 | $0.014067 | ||

January 16, 2018 | January 31, 2018 | $0.014067 | ||

January 23, 2018 | January 31, 2018 | $0.014067 | ||

January 30, 2018 | January 31, 2018 | $0.014067 | ||

February 6, 2018 | February 28, 2018 | $0.014067 | ||

February 13, 2018 | February 28, 2018 | $0.014067 | ||

February 20, 2018 | February 28, 2018 | $0.014067 | ||

February 27, 2018 | February 28, 2018 | $0.014067 | ||

March 6, 2018 | March 28, 2018 | $0.014067 | ||

March 13, 2018 | March 28, 2018 | $0.014067 | ||

March 20, 2018 | March 28, 2018 | $0.014067 | ||

March 27, 2018 | March 28, 2018 | $0.014067 | ||

About CIM

CIM is a registered investment adviser. CIM is a joint venture between CIG and AIM and part of the CION Investments group of companies, or CION Investments. We believe that CION Investments is a leading asset manager that provides innovative alternative investment products to individual and institutional investors through publicly-registered programs, private funds and separately managed accounts. CION Investments is headquartered in New York, with an office in Boston.

Mark Gatto and Michael A. Reisner, together with Keith S. Franz, Gregg A. Bresner and Stephen Roman, form the senior management team of CIM. Both Messrs. Gatto and Reisner have significant managerial and investing experience and serve as our co-chairmen and co-chief executive officers.

CIM’s senior management team has extensive experience in lending to private U.S. middle-market companies and has developed an expertise in using all levels of a firm’s capital structure to produce income-generating investments, focusing on risk management and delivering risk-adjusted returns that typically are collateralized by a company’s business-essential equipment or corporate infrastructure.

About CION Investments

With more than 30 years of experience in the alternative asset management industry, CION Investments has managed investments for more than 82,000 investors and made approximately $5.5 billion in total investments. CION Investments, through its managed funds, provides direct secured financing to private and public companies worldwide primarily in industries such as marine, manufacturing, transportation, automotive, energy and power, telecommunications, industrial and mining. CION Investments provides distribution services as well through CION Securities, LLC, or CION Securities, one of our affiliates.

Pursuant to an administration agreement, ICON Capital, LLC, or ICON Capital, furnishes us with office facilities and equipment, and clerical, bookkeeping and record keeping services. ICON Capital also oversees our financial records and prepares our reports to shareholders and reports filed with the SEC. ICON Capital also performs the calculation and publication of our net asset value, and oversees the preparation and filing of our tax returns, the payment of our expenses and the performance of various third party service providers. Furthermore, ICON Capital will provide on our behalf managerial assistance to those portfolio companies to which we are required to provide such assistance.

About AIM

We believe that AIM possesses skills that will aid us in achieving our investment objective.

AIM is a subsidiary of Apollo (NYSE: APO) and is the investment adviser to Apollo Investment Corporation (NASDAQ: AINV), or AINV. AINV is a publicly traded BDC that invests primarily in various forms of debt investments, including secured and unsecured loan investments and/or equity in private U.S. middle-market companies.

5

AIM’s responsibilities include, among other things, identifying and providing information about potential investment opportunities for approval by CIM's investment committee and providing reasonable expertise and knowledge with respect to CIM-sourced transactions.

Market Opportunity

We believe that the market for lending to private U.S. middle-market companies presents a compelling investment opportunity. CIM’s management team has witnessed significant demand for debt capital among middle-market companies that have the characteristics we target. We believe that this demand, coupled with the fragmented availability of funding within our target market, will enable us to achieve favorable transaction pricing. We continue to raise funds in an attempt to capitalize on what we believe is a favorable environment. We believe that the following characteristics and market trends support our belief:

•The middle-market is a large addressable market. According to GE Capital’s National Center for the Middle Market 4th Quarter 2017 Middle Market Indicator, there are approximately 200,000 U.S. middle-market companies employing approximately 47.9 million people, which generate an aggregate of $5.9 trillion in annual revenue. The U.S. middle-market accounts for approximately one-third of private sector gross domestic product, or GDP, which, measured on a global scale, would be the third largest global economy. GE defines middle-market companies as those with $10 million to $1 billion in annual revenue, which we believe has significant overlap with our definition of middle-market companies that generally possess EBITDA of $50 million or less.

•Greater demand for non-traditional sources of debt financing. We believe that commercial banks in the U.S., which have traditionally been the primary source of capital to middle-market companies, have experienced consolidation, capital impairments and stricter regulatory scrutiny. Consequently, we believe there is an increasing trend for middle-market companies to seek financing from other sources, such as us.

•Disruptions within the credit markets have reduced middle-market companies’ access to the capital markets for senior debt. While many middle-market companies were previously able to raise senior debt financing through traditional large financial institutions, we believe this approach to financing will become more difficult as implementation of U.S. and international financial reforms, such as Basel 3, are expected to limit the capacity of large financial institutions to hold loans of middle-market companies on their balance sheets.

•There is a large pool of uninvested private equity capital likely to seek additional senior debt capital to finance strategic transactions. We expect that middle-market private equity firms will continue to invest the approximately $748 billion raised since 2010 in middle-market companies, as reported in Pitchbook’s 3Q 2017 U.S. PE Middle Market Report, and that these private equity firms will seek to support their investments with senior loans from other sources, such as us.

6

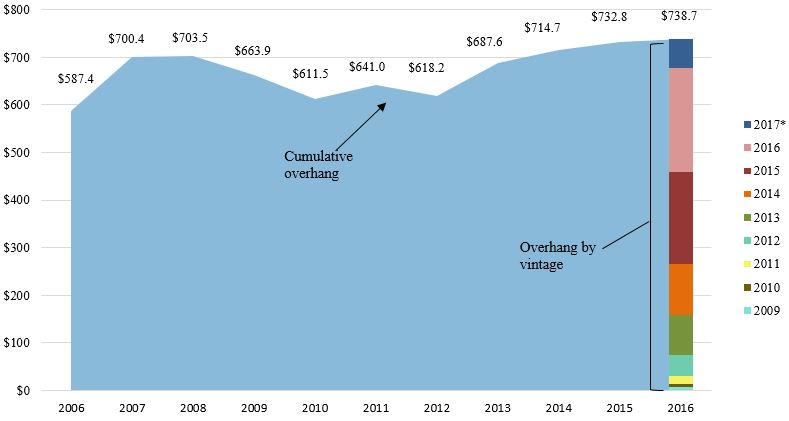

•Specialized lending and unfunded private equity commitments drive demand for debt capital. Lending to small- and middle-market companies requires in-depth diligence, credit expertise, structuring experience and active portfolio management. In addition, middle-market companies may require more active monitoring and participation on the lender’s part. As such, we believe that, of the U.S. financial institutions that are not liquidity constrained, few are capable of pursuing a sustained lending strategy successfully. We believe this creates a significant supply/demand imbalance for small and middle-market credit. We also expect that private equity firms will continue to pursue acquisitions and will seek to leverage their equity investments with debt financing, including senior debt, unitranche debt, and mezzanine loans provided by companies such as ours. Historically, according to the S&P LCD Leveraged Lending Review, such leverage has represented approximately 62% of a private equity acquisition. Therefore, adding to the imbalance in the availability of credit is the significant amount of unallocated private equity capital raised since 2010 described above, much of which will require debt financing in the coming years. As depicted in the chart below, almost $739 billion of unfunded private equity commitments were outstanding through the end of 2017.

U.S. PE Capital Overhang ($B) by Year

•Active private equity focus on small- and middle-market firms. Private equity firms have continued their active roles investing in small- and middle-market companies, and CIM expects this trend to continue. Private equity funds often seek to leverage their investments by combining equity capital with senior secured and mezzanine loans from other sources. Thus, we believe that significant private equity investment in middle-market firms will create substantial investment opportunities for us to fill the role of leverage provider. We believe that the network of relationships between CIM’s senior management team, Apollo’s management team and the private equity community will be a key channel through which we will seek to access significant investment opportunities.

•Middle-market companies compared to larger companies. We believe that middle-market companies compare favorably to larger companies with respect to our investment objective and strategy. According to the GE Capital 2012 National Middle Market Summit Report, almost 70% of middle-market companies have been in business for more than 20 years and are, on average, less financially leveraged than large companies. During the economic downturn from 2007 to 2010, surviving middle-market companies created more than two million jobs, as compared to nearly four million jobs eliminated by larger companies.

•Attractive market segment. We believe that the underserved nature of such a large segment of the market can at times create a significant opportunity for investment. In particular, we believe that middle-market companies are more likely to offer attractive economics in terms of transaction pricing (including higher debt yields), upfront and ongoing fees, prepayment penalties and more attractive security features in the form of stricter covenants and quality collateral. In addition, as compared to larger companies, middle-market companies often have simpler capital structures and carry less leverage, thus aiding the structuring and negotiation process and allowing us greater flexibility in structuring favorable transactions.

7

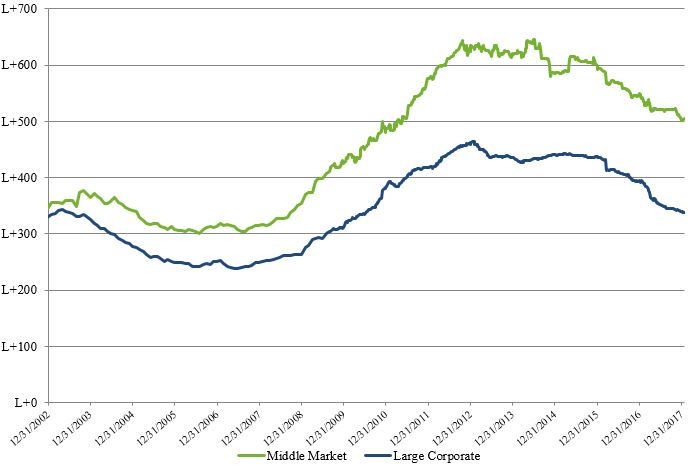

Average Nominal Spread of Leveraged Loans1

1 Excludes all facilities in default.

Source: S&P Capital IQ LCD and S&P/LSTA Leveraged Loan Index.

8

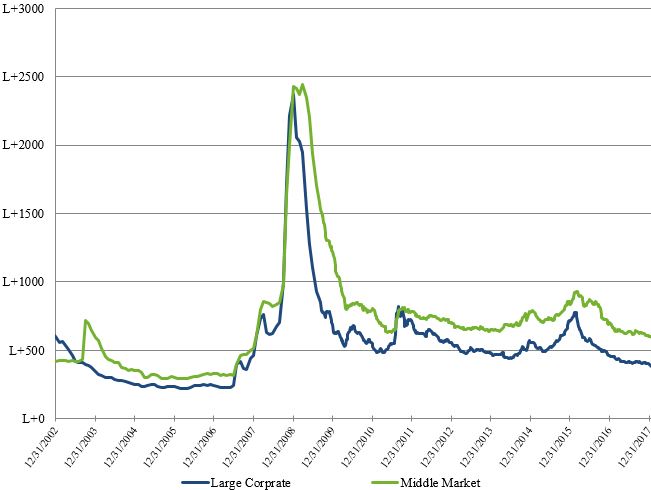

Average Discounted Spread of Leveraged Loans2

2 Excludes all facilities in default.

Spread calculations have been adjusted to be based off of the bid rather than par (that is assuming that the discounted margin is as a percent of the current market value rather than the par amount of the loan).

Source: S&P Capital IQ LCD and S&P/LSTA Leveraged Loan Index.

Characteristics of and Risks Related to Investments in Private Companies

We have invested and continue to invest primarily in the debt of privately held companies. Investments in private companies pose significantly greater risks as compared to investments in public companies. First, private companies have reduced access to the capital markets, resulting in diminished capital resources and ability to withstand financial distress. Second, the investments themselves are often illiquid. As such, we may have difficulty exiting an investment promptly or at a desired price prior to maturity or outside of a normal amortization schedule. In addition, little public information generally exists about private companies. Finally, these companies often do not have third-party debt ratings or audited financial statements. We must therefore rely on the ability of CIM to obtain adequate information through their due diligence efforts to evaluate the creditworthiness of, and risks involved with, investing in these companies. These companies and their financial information will also generally not be subject to the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act, and other rules and regulations that govern public companies that are designed to protect investors.

Investment Strategy

When evaluating an investment, we use the resources of CIM to develop an investment thesis and a proprietary view of a potential company’s value. When identifying prospective portfolio companies, we focus primarily on the following attributes, which we believe will help us generate higher total returns with an acceptable level of risk. These attributes are:

•Leading, defensible market positions that present attractive growth opportunities. We seek to invest in companies that we believe possess advantages in scale, scope, customer loyalty, product pricing or product quality versus their competitors, minimizing sales risk and protecting profitability.

9

•Companies with leading market positions and strong free cash flows. We seek to invest in the debt of companies that have a leading market position or other significant competitive advantages and significant free cash flow. We believe that such companies are able to maintain consistent cash flow to service and repay our loans and maintain growth or market share.

•Investing in middle-market, private companies. We seek to invest in middle-market, private companies that generally possess annual EBITDA of $50 million or less at the time of investment. We do not intend to invest in start-up companies, turnaround situations or companies with speculative business plans.

•Proven management teams with meaningful equity ownership. We focus on investments in which the target company has an experienced management team with an established track record of success. We typically require the portfolio companies to have in place proper incentives to align management’s goals with ours. Generally, we focus on companies in which the management teams have significant equity interests.

•Private equity sponsorship. Often we seek to participate in transactions sponsored by what we believe to be high-quality private equity firms. CIM’s management team believes that a private equity sponsor’s willingness to invest significant sums of equity capital into a company provides an additional level of due diligence investigation and is an implicit endorsement of the quality of the investment. Further, by co-investing with quality private equity firms that commit significant sums of equity capital with junior priority to our debt investments, we may benefit from having due diligence on our investments performed by both parties. Further, strong private equity sponsors with significant investments at risk have the ability and a strong incentive to contribute additional capital in difficult economic times should operational or financial issues arise.

•Broad portfolio. We seek to create a portfolio of portfolio companies engaged in a variety of industries and located in a variety of geographic locations, thereby potentially reducing the risk of a downturn in any one industry or geographic location having a disproportionate impact on the value of our portfolio. We are not a “diversified company” as such term is defined under the 1940 Act. Because we are a BDC, we focus on and invest at least 70% of our total assets in U.S. companies, but seek to maintain investments across the various geographic regions of the U.S. To the extent that we invest in foreign companies, we intend to do so in accordance with the limitations under the 1940 Act and only in jurisdictions with established legal frameworks and a history of respecting creditor rights, including countries that are members of the European Union, as well as Canada, Australia and Japan. We cannot assure investors that we will be successful in our efforts to maintain a broad portfolio of investments.

•Viable exit strategy. We focus our investment activity primarily in companies whose business models and growth prospects offer attractive exit possibilities, including repayment of our investments, with the potential for capital gain on any equity interest we hold through an initial public offering of common stock, a merger, a sale or other recapitalization.

Moreover, we may acquire investments in the secondary loan market, and, in analyzing such investments, we will employ the same analytical process that we use for our primary investments.

Potential Competitive Advantages

We believe that we offer to our investors the following potential competitive advantages over other capital providers to private U.S. middle-market companies:

•Proven ability to invest in middle-market companies. We believe that CIM has proven its ability to source, structure and manage private investments for us. In addition to its ability to call on its resources, CIM is able to draw upon Apollo’s team of 368 investment professionals that have approximately $249 billion of total assets under management as of December 31, 2017. Apollo has developed an expertise in sourcing and investing in debt issued by middle-market companies. We leverage this expertise, which we believe enables us to make investments that offer the most favorable risk/reward characteristics.

•Global platform with seasoned investment professionals. CIM’s senior management team believes that the breadth and depth of its experience, together with the wider resources of the Apollo investment team, who source, structure, execute, monitor and realize upon a broad range of private investments on behalf of Apollo, as well as the specific expertise of Apollo in the BDC arena, provides us with a significant competitive advantage in sourcing attractive investment opportunities worldwide.

•Long-term investment horizon. We believe that our flexibility to make investments with a long-term view provides us with the opportunity to generate favorable returns on invested capital and expands the types of investments that we may consider. The long-term nature of our capital structure helps us avoid disposing of assets at unfavorable prices and we believe makes us a better partner for portfolio companies.

•Transaction sourcing capability. CIM seeks to identify attractive investment opportunities both through active origination channels and through its long-term relationships with Apollo, numerous corporate and fund management teams, members of the financial community and potential corporate partners. We also have access to the experience of CIM’s officers in sourcing middle-market transactions through such persons’ network of originators and underwriters. In addition, CIM seeks to leverage Apollo’s significant access to transaction flow. We believe that the broad networks of CIM and its affiliates will produce a significant amount of investment opportunities for us.

10

•Disciplined, income-oriented investment philosophy. CIM employs a defensive investment approach focused on long-term credit performance and principal protection. This investment approach involves a multi-stage selection process for each investment opportunity as well as ongoing monitoring by CIM of each investment made, with particular emphasis on early detection of credit deterioration. This strategy is designed to maximize current yield and minimize the risk of capital loss while maintaining potential for long-term capital appreciation.

•Ability to utilize a wide range of transaction structures. We believe that each of CIM’s and Apollo’s broad expertise and experience in transaction structuring at all levels of a company’s capital structure affords us numerous tools to manage risk while preserving the opportunity for returns on investments. We attempt to capitalize on this expertise in an effort to produce an investment portfolio that will perform in a broad range of economic conditions. In addition, we believe that the ability to offer several forms of financing makes us an attractive provider of capital to prospective portfolio companies. Such flexible transaction structuring allows a prospective portfolio company to forego the substantial cost of conducting multiple negotiations and undergoing multiple due diligence processes to secure the different types of capital it requires.

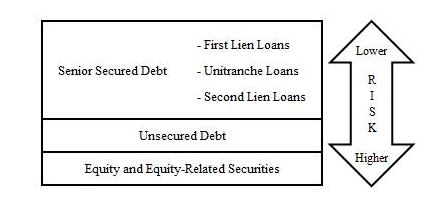

Investment Types

There are a number of investment types corresponding to a company’s capital structure. Typically, investors determine the appropriate type of investment based upon their risk and return requirements. Below is a diagram illustrating where these investments lie in a typical target company’s capital structure. First lien debt is situated at the top of the capital structure, and typically has the first claim on the assets and cash flows of the company, followed by second lien debt, mezzanine debt, preferred equity and finally common equity. Due to this priority of cash flows and claims on assets, an investment’s risk increases as it moves further down the capital structure. Investors are usually compensated for this risk associated with junior status in the form of higher returns, either through higher interest payments or potentially higher capital appreciation.

We focus primarily on investments in senior secured debt, including first lien loans, second lien loans and unitranche loans, and, to a lesser extent, collateralized securities, structured products and other similar securities, unsecured debt, including corporate bonds and long-term subordinated loans, referred to as mezzanine loans, and equity. The mix of investments in our portfolio and other aspects regarding the implementation of our strategy may change materially over time.

CIM seeks to tailor our investment focus as market conditions evolve. Depending on market conditions and other factors, we may, as noted above, increase or decrease our exposure to less senior portions of the capital structure, where returns tend to be stronger in a more stable or growing economy, but less secure in weak economic environments. We rely on CIM’s experience to structure investments, potentially using all levels of the capital structure, which we believe will perform in a broad range of economic environments.

Typical Leveraged Capital Structure Diagram

Senior Secured Debt

First Lien Loans

First lien secured loans are situated at the top of the capital structure. Because these loans have priority in payment, they carry the least risk among all investments in a company. Generally, our first lien secured loans are expected to have maturities of three to seven years, offer some form of amortization, and have first priority security interests in the assets of the borrower. We expect that our first lien secured loans typically will have variable interest rates ranging between 4.0% and 9.0% over a standard benchmark, such as the prime rate or the London InterBank Offered Rate, or LIBOR. In some cases, a portion of the total interest may accrue or be paid in kind.

11

Unitranche Loans

Unitranche loans provide all of the debt needed to finance a leveraged buyout or other corporate transaction, both senior and subordinated, but generally in a first lien position, while the borrower generally pays a blended, uniform interest rate rather than different rates for different tranches. Unitranche loans generally require payments of both principal and interest throughout the life of the loan. Unitranche loans generally have contractual maturities of five to six years and interest is generally paid quarterly. Generally, we expect these securities to carry a blended yield that is between first lien secured and subordinated debt interest rates. Unitranche loans provide a number of advantages for borrowers, including the following: simplified documentation, greater certainty of execution and reduced decision-making complexity throughout the life of the loan. In addition, we may receive additional returns from any warrants we may receive in connection with these investments. In some cases, a portion of the total interest may accrue or be paid in kind.

Second Lien Loans

Second lien secured loans are immediately junior to first lien secured loans and have substantially the same maturities, collateral and covenant structures as first lien secured loans. Second lien secured loans, however, are granted a second priority security interest in the assets of the borrower. In return for this junior ranking, second lien secured loans generally offer higher returns compared to first lien secured debt. These higher returns come in the form of higher interest and in some cases the potential for equity participation through warrants, though to a lesser extent than with mezzanine loans. Generally, we expect these loans to carry a fixed rate of 8.0% to 13.0% or a floating current yield of 7.0% to 12.0% over the prime rate or LIBOR. In addition, we may receive additional returns from any warrants we may receive in connection with these investments. In some cases, a portion of the total interest may accrue or be paid in kind.

Unsecured Debt

In addition to first lien loans and second lien loans, we also may invest a portion of our assets in unsecured debt, including corporate bonds and subordinated debt. Unsecured debt investments usually rank junior in priority of payment to first lien loans and second lien loans, but are situated above preferred equity and common stock in the capital structure. In return for their junior status compared to first lien loans and second lien loans, unsecured debt investments typically offer higher returns through both higher interest rates and possible equity ownership in the form of warrants, enabling the lender to participate in the capital appreciation of the borrower. These warrants typically require only a nominal cost to exercise. We intend to generally target unsecured debt with interest-only payments throughout the life of the security, with the principal due at maturity. Typically, unsecured debt investments have maturities of five to ten years. Generally, we expect these securities to carry a fixed rate of 10% to 15%. In addition, we may receive additional returns from any warrants we may receive in connection with these investments. In some cases, a portion of the total interest may accrue or be paid in kind.

Collateralized Securities, Structured Products and Other

We may also invest in collateralized securities, structured products and other similar securities, which may include collateralized debt obligations, or CDOs, collateralized bond obligations, or CBOs, collateralized loan obligations, or CLOs, structured notes and credit-linked notes. These investments may be structured as trusts or other types of pooled investment vehicles. They may also involve the deposit with or purchase by an entity of the underlying investments and the issuance by that entity of one or more classes of securities backed by, or representing interests in, the underlying investments or referencing an indicator related to such investments. CDOs, CBOs and CLOs are types of asset-backed securities issued by special purpose vehicles created to reapportion the risk and return characteristics of a pool of assets. The underlying pool for a CLO, for example, may include domestic and foreign senior loans, senior unsecured loans and subordinate corporate loans.

Equity and Equity-Related Securities

While we intend to maintain our focus on investments in debt securities, from time to time, when we see the potential for significant gains, or in connection with securing particularly favorable terms in a debt investment, we may make non-control investments in preferred or common equity, typically in conjunction with a private equity sponsor we believe to be of high quality. Alternatively, we may hold equity-related securities consisting primarily of warrants or other equity interests generally obtained in connection with our unsecured debt investments. In the future, we may achieve liquidity through a merger or acquisition of a portfolio company, a public offering of a portfolio company’s stock or by exercising our right, if any, to require a portfolio company to repurchase the equity-related securities we hold. With respect to any preferred or common equity investments, we expect to target an annual investment return of at least 20%.

Non-U.S. Securities

We may invest in non-U.S. securities, which may include securities denominated in U.S. dollars or in non-U.S. currencies, to the extent permitted by the 1940 Act.

12

Cash and Cash Equivalents

We may maintain a certain level of cash or equivalent instruments to make follow-on investments if necessary in existing portfolio companies or to take advantage of new opportunities.

Comparison of Targeted Debt Investments to Corporate Bonds

Loans to private companies are debt instruments that can be compared to corporate bonds to aid an investor’s understanding. As with corporate bonds, loans to private companies can range in credit quality depending on security-specific factors, including total leverage, amount of leverage senior to the security in question, variability in the issuer’s cash flows, the quality of assets securing debt and the degree to which such assets cover the subject company’s debt obligations. As is the case in the corporate bond market, we will require greater returns for securities that we perceive to carry increased risk. The companies in which we invest may be leveraged, often as a result of leveraged buyouts or other recapitalization transactions, and, in certain cases, will not be rated by national rating agencies. We believe that our targeted debt investments typically will carry ratings from a nationally recognized statistical ratings organization, or NRSRO, and that such ratings generally will be below investment grade (rated lower than “Baa3” by Moody’s or lower than “BBB-” by S&P). To the extent we make unrated investments, we believe that such investments would likely receive similar ratings if they were to be examined by an NRSRO. Compared to below-investment grade corporate bonds that are typically available to the public, our targeted first lien secured and second lien secured loan investments are higher in the capital structure, have priority in receiving payment, are secured by the issuer’s assets, allow the lender to seize collateral if necessary, and generally exhibit higher rates of recovery in the event of default. Corporate bonds, on the other hand, are often unsecured obligations of the issuer.

The market for loans to private companies possesses several key differences compared to the corporate bond market. For instance, due to a possible lack of debt ratings for certain middle market firms, and also due to the reduced availability of information for private companies, investors must conduct extensive due diligence investigations before committing to an investment. This intensive due diligence process gives the investor significant access to management, which is often not possible in the case of corporate bondholders, who rely on underwriters, debt rating agencies and publicly available information for due diligence reviews and monitoring of corporate issuers. While holding these investments, private debt investors often receive monthly or quarterly updates on the portfolio company’s financial performance, along with possible representation on the company’s board of directors, which allows the investor to take remedial action quickly if conditions happen to deteriorate. Due to reduced liquidity, the relative scarcity of capital and extensive due diligence and expertise required on the part of the investor, we believe that private debt securities typically offer higher returns than corporate bonds of equivalent credit quality.

Operating and Regulatory Structure

Our investment activities are managed by CIM and supervised by our board of directors, a majority of whom are independent. Pursuant to our investment advisory agreement, we pay CIM an annual base management fee based on our gross assets as well as incentive fees based on our performance.

On July 11, 2017, the members of CIM entered into the third amended and restated limited liability company agreement of CIM, or the Third CIM LLC Agreement, for the purpose of creating a joint venture between AIM and CIG. Under the Third CIM LLC Agreement, AIM was issued a newly-created class of membership interests in CIM pursuant to which AIM will, among other things, share in the profits, losses, distributions and expenses of CIM with the other members in accordance with the terms of the Third CIM LLC Agreement, which will ultimately result in CIG and AIM each owning a 50% economic interest in CIM.

On July 10, 2017, our independent directors unanimously approved the termination of the investment sub-advisory agreement with AIM, effective as of July 11, 2017, as part of the new and ongoing relationship among us, CIM and AIM. Although the investment sub-advisory agreement and AIM's engagement as our investment sub-adviser were terminated, AIM will continue to perform services for CIM and our company, including, without limitation, identifying investment opportunities for approval by CIM’s investment committee. AIM will not be paid a separate fee in exchange for such services, but will be entitled to receive distributions as a member of CIM as described above.

On December 4, 2017, the members of CIM entered into the fourth amended and restated limited liability company agreement of CIM, or the Fourth CIM LLC Agreement. Under the Fourth CIM LLC Agreement, AIM’s responsibilities include, among other things, identifying and providing information about potential investment opportunities for approval by CIM’s investment committee and providing reasonable expertise and knowledge with respect to CIM-sourced transactions.

Pursuant to an administration agreement, ICON Capital provides us with general ledger accounting, fund accounting, investor relations, employee compensation and benefit-related services, and other services associated with performing administrative services. In addition, we have contracted with U.S. Bancorp Fund Services, LLC to provide additional accounting and administrative services.

As a BDC, we are required to comply with certain regulatory requirements. Also, while we are permitted to finance investments using debt, our ability to use debt is limited in certain significant respects pursuant to the 1940 Act. Within the limits of existing regulation, we will adjust our use of debt, according to market conditions, to the level we believe will allow us to generate maximum risk-adjusted returns. We elected to be treated for federal income tax purposes, and intend to qualify annually, as a RIC under Subchapter M of the Code.

13

Sources of Income

The primary means through which our shareholders will receive a return of value is through interest income, dividends and capital gains generated by our investments. In addition to these sources of income, we may receive fees paid by our portfolio companies, including one-time closing fees paid at the time an investment is made and/or monitoring fees paid throughout the term of our investments. Closing fees typically range from 1.0% to 2.0% of the purchase price of an investment, while annual monitoring fees generally range from 0.25% to 1.0% of the purchase price of an investment. In addition, we may generate revenue in the form of commitment, structuring or diligence fees, amendment fees, monitoring fees, fees for providing managerial assistance and possibly consulting fees and performance-based fees.

Risk Management

We seek to limit the downside potential of our investment portfolio by:

• | applying our investment strategy guidelines for portfolio investments; |

• | requiring a total return on investments (including both interest and potential appreciation) that adequately compensates us for credit risk; |

• | creating and maintaining a broad portfolio of investments, size permitting, with an adequate number of companies, across different industries, with different types of collateral; and |

• | negotiating or seeking debt investments with covenants or features that protect us while affording portfolio companies flexibility in managing their businesses consistent with preservation of capital. |

Such restrictions may include affirmative and negative covenants, default penalties, lien protection, change of control provisions and board rights. We may also enter into interest rate hedging transactions at the sole discretion of CIM. Such transactions will enable us to selectively modify interest rate exposure as market conditions dictate. Furthermore, our ability to engage in hedging transactions may be adversely affected by recent rules adopted by the U.S. Commodity Futures Trading Commission, or CFTC.

Affirmative Covenants

Affirmative covenants require borrowers to take actions that are meant to ensure the solvency of the company, facilitate the lender’s monitoring of the borrower, and ensure payment of interest and loan principal due to lenders. Examples of affirmative covenants include covenants requiring the borrower to maintain adequate insurance, accounting and tax records, and to produce frequent financial reports for the benefit of the lender.

Negative Covenants

Negative covenants impose restrictions on the borrower and are meant to protect lenders from actions that the borrower may take that could harm the credit quality of the lender’s investment. Examples of negative covenants include restrictions on the payment of distributions and restrictions on the issuance of additional debt without the lender’s approval. In addition, certain covenants restrict a borrower’s activities by requiring it to meet certain earnings interest coverage ratio and leverage ratio requirements. These covenants are also referred to as financial or maintenance covenants.

Investment Process

The investment professionals employed by CIM have spent their careers developing the resources necessary to make investments in private companies. Our transaction process is highlighted below.

Our Transaction Process

Sourcing

CIM utilizes its access to transaction flow and seeks to leverage AIM’s significant access to transaction flow as well to source transactions. With respect to CIM’s origination channel, CIM seeks to leverage CION Investments' significant industry relationships and investment personnel that actively source new investments. We believe that CIM’s broad networks have and will continue to produce a significant pipeline of investment opportunities for us.

14

Evaluation

Initial Review. In its initial review of an investment opportunity to present to us, CIM’s transaction team examines information furnished by the target company and external sources, including rating agencies, if applicable, to determine whether the investment meets our basic investment criteria and other guidelines, within the context of creating and maintaining a broad portfolio of investments, and offers an acceptable probability of attractive returns with identifiable downside risk.

Credit Analysis/Due Diligence. Before undertaking an investment, the transaction team from CIM conducts a thorough due diligence review of the opportunity to ensure the company fits our investment strategy, which may include:

• | a full operational analysis to identify the key risks and opportunities of the target’s business, including a detailed review of historical and projected financial results; |

• | a detailed analysis of industry dynamics, competitive position, regulatory, tax and legal matters; |

• | on-site visits, if deemed necessary, as well as telephone calls and meetings with management and other key personnel; |

• | background checks to further evaluate management and other key personnel; |

• | a review by legal and accounting professionals, environmental or other industry consultants, if necessary; |

• | financial sponsor due diligence, including portfolio company and lender reference checks, if necessary; and |

• | a review of management’s experience and track record. |

When possible, our advisory team seeks to structure transactions in such a way that our target companies are required to bear the costs of due diligence, including those costs related to any outside consulting work we may require.

Execution

Recommendation. CIM seeks to maintain a defensive approach toward its investment recommendations by emphasizing risk control in its transaction process, which includes (1) the pre-review of each opportunity by one of its portfolio managers to assess the general quality, value and fit relative to our portfolio, (2) where possible, transaction structuring with a focus on preservation of capital in varying economic environments and (3) ultimate approval of investment recommendations by CIM’s investment committee.

Approval. After completing its internal transaction process, the CIM transaction team makes formal recommendations for review and approval by CIM's investment committee. In connection with its recommendation, it transmits any relevant underwriting material and other information pertinent to the decision-making process. Each new investment that we make requires the approval of a majority of members of CIM's investment committee.

Monitoring

Portfolio Monitoring. CIM closely monitors our portfolio companies on an ongoing basis, as well as monitors the financial trends of each portfolio company to determine if each is meeting its respective business plans and to assess the appropriate course of action for each company. In addition, depending on the size, nature and performance of the transaction, senior investment professionals of CIM may take board seats or obtain board observation rights for our portfolio companies.

CIM has several methods of evaluating and monitoring the performance and fair value of our investments, which includes, but are not limited to, the assessment of success in adhering to a portfolio company’s business plan and compliance with covenants; periodic and regular contact with portfolio company management and, if appropriate, the financial or strategic sponsor, to discuss financial position, requirements and accomplishments; comparisons to other portfolio companies in the industry; attendance at and participation in board meetings; and review of monthly and quarterly financial statements and financial projections for portfolio companies.

CIM uses an investment rating system to characterize and monitor our expected level of returns on each investment in our portfolio. These ratings are just one of several factors that CIM uses to monitor our portfolio, are not in and of themselves determinative of fair value or revenue recognition and are presented for indicative purposes. CIM rates the credit risk of all investments on a scale of 1 to 5 no less frequently than quarterly. This system is intended primarily to reflect the underlying risk of a portfolio investment relative to our initial cost basis in respect of such portfolio investment (i.e., at the time of acquisition), although it may also take into account under certain circumstances the performance of the portfolio company’s business, the collateral coverage of the investment and other relevant factors.

15

The following is a description of the conditions associated with each investment rating used in this ratings system:

Investment Rating | Description | |

1 | Indicates the least amount of risk to our initial cost basis. The trends and risk factors for this investment since origination or acquisition are generally favorable, which may include the performance of the portfolio company or a potential exit. | |

2 | Indicates a level of risk to our initial cost basis that is similar to the risk to our initial cost basis at the time of origination or acquisition. This portfolio company is generally performing in accordance with our analysis of its business and the full return of principal and interest or dividend is expected. | |

3 | Indicates that the risk to our ability to recoup the cost of such investment has increased since origination or acquisition, but full return of principal and interest or dividend is expected. A portfolio company with an investment rating of 3 requires closer monitoring. | |

4 | Indicates that the risk to our ability to recoup the cost of such investment has increased significantly since origination or acquisition, including as a result of factors such as declining performance and noncompliance with debt covenants, and we expect some loss of interest, dividend or capital appreciation, but still expect an overall positive internal rate of return on the investment. | |

5 | Indicates that the risk to our ability to recoup the cost of such investment has increased materially since origination or acquisition and the portfolio company likely has materially declining performance. Loss of interest or dividend and some loss of principal investment is expected, which would result in an overall negative internal rate of return on the investment. | |

For investments rated 3, 4 or 5, CIM enhances its level of scrutiny over the monitoring of such portfolio company.

CIM monitors and, when appropriate, changes investment ratings assigned to each investment in our portfolio. In connection with our valuation process, CIM reviews these investment ratings on a quarterly basis.

The following table summarizes the composition of our investment portfolio based on the 1 to 5 investment rating scale at fair value as of December 31, 2017, excluding short term investments of $206,547:

December 31, 2017 | ||||||||

Investment Rating | Investments Fair Value | Percentage of Investment Portfolio | ||||||

1 | $ | — | — | |||||

2 | 1,274,569 | 84.5 | % | |||||

3 | 202,950 | 13.5 | % | |||||

4 | 21,311 | 1.4 | % | |||||

5 | 8,818 | 0.6 | % | |||||

$ | 1,507,648 | 100.0 | % | |||||

The following table summarizes the composition of our investment portfolio and our underlying TRS loans portfolio based on the 1 to 5 investment rating scale at fair value as of December 31, 2016, excluding short term investments of $70,498:

December 31, 2016 | |||||||||||||||||||||

Investment Portfolio | Total Return Swap | Total | |||||||||||||||||||

Investment Rating | Investments Fair Value | Percentage of Investment Portfolio | Fair Value of Underlying TRS Loans | Percentage of Underlying TRS Loans | Fair Value | Percentage | |||||||||||||||

1 | $ | — | — | $ | — | — | $ | — | — | ||||||||||||

2 | 963,477 | 94.6 | % | 342,620 | 87.3 | % | 1,306,097 | 92.5 | % | ||||||||||||

3 | 50,942 | 5.0 | % | 34,657 | 8.8 | % | 85,599 | 6.1 | % | ||||||||||||

4 | 4,561 | 0.4 | % | 12,798 | 3.3 | % | 17,359 | 1.2 | % | ||||||||||||

5 | — | — | 2,370 | 0.6 | % | 2,370 | 0.2 | % | |||||||||||||

$ | 1,018,980 | 100.0 | % | $ | 392,445 | 100.0 | % | $ | 1,411,425 | 100.0 | % | ||||||||||

The amount of the investment portfolio and underlying TRS loans in each rating category may vary substantially from period to period resulting primarily from changes in the composition of each portfolio as a result of new investment, repayment and exit activities. In addition, changes in the rating of investments may be made to reflect our expectation of performance and changes in investment values.

16

Valuation Process. Each quarter, we value investments in our portfolio, and such values are disclosed each quarter in reports filed with the SEC. Investments for which market quotations are readily available are recorded at such market quotations. With respect to investments for which market quotations are not readily available, our board of directors determines the fair value of investments in good faith utilizing the input of our audit committee, CIM, and any other professionals or materials that our board of directors deems worthy and relevant, including independent third-party valuation firms, if applicable.

Managerial Assistance. As a BDC, we must offer, and provide upon request, managerial assistance to certain of our portfolio companies. This assistance could involve, among other things, monitoring the operations of our portfolio companies, participating in board and management meetings, consulting with and advising officers of portfolio companies and providing other organizational and financial guidance. Depending on the nature of the assistance required, CIM will provide such managerial assistance on our behalf to portfolio companies that request this assistance. To the extent fees are paid for these services, we, rather than CIM, will retain any fees paid for such assistance.

Exit

Exit Transactions. We seek to invest in companies that can generate consistent cash flow to repay their loans while maintaining growth in their businesses. We expect this internally generated cash flow to be a key means through which we will receive timely payment of interest and loan principal. Additionally, we attempt to invest in portfolio companies whose business models and growth prospects offer attractive exit possibilities via third-party transactions, including sales to strategic or other buyers and initial public offerings of common stock. Such third-party transactions may be particularly important in realizing capital gains through the equity portions of our investments. We also seek to exit investments in secondary market transactions when price targets are achieved or circumstances otherwise warrant.

Financing Arrangements

Total Return Swap

On December 17, 2012, Flatiron, our wholly-owned, consolidated financing subsidiary, entered into a TRS with Citibank, N.A., or Citibank. Flatiron and Citibank amended the TRS on several occasions, most recently on February 18, 2017 to extend the termination or call date from February 18, 2017 to April 18, 2017. Prior to the call date, the maximum aggregate market value of the portfolio of loans subject to the TRS (determined at the time each such loan became subject to the TRS) was $800,000 and the interest rate payable by Flatiron to Citibank with respect to each loan included in the TRS was a spread of 1.40% per year over the floating rate index specified for each such loan, which would not be less than zero. The agreements between Flatiron and Citibank, which collectively established the TRS, are referred to herein as the TRS Agreement.

A TRS is a contract in which one party agrees to make periodic payments to another party based on the change in the market value of and interest payments from the assets underlying the TRS in return for periodic payments based on a fixed or variable interest rate. A TRS effectively adds leverage to a portfolio by providing investment exposure to a security or market without owning or taking physical custody of such security or investing directly in such market. Because of the unique structure of a TRS, a TRS typically offers lower financing costs than are offered through more traditional borrowing arrangements.

The TRS with Citibank enabled us, through our ownership of Flatiron, to obtain the economic benefit of owning the loans subject to the TRS, without actually owning them, in return for an interest-type payment to Citibank. As such, the TRS was analogous to Flatiron borrowing funds to acquire loans and incurring interest expense to a lender.

On April 18, 2017, the TRS expired in accordance with its terms subsequent to the consummation of the Citibank Credit Facility (as defined and described below).

Citibank Credit Facility

On March 29, 2017, Flatiron Funding II, LLC, or Flatiron Funding II, our newly-formed, wholly-owned, consolidated, special purpose financing subsidiary, entered into a senior secured credit facility with Citibank. The senior secured credit facility with Citibank, or the Citibank Credit Facility, provides for a revolving credit facility in an aggregate principal amount of $325,000, subject to compliance with a borrowing base. On March 29, 2017, September 26, 2017 and November 17, 2017, Flatiron Funding II drew down $231,698, $50,000 and $42,844 of borrowings under the Citibank Credit Facility, respectively.

On July 11, 2017, Flatiron Funding II amended the Citibank Credit Facility, or the Amended Citibank Credit Facility, with Citibank to make certain immaterial administrative amendments as a result of the termination of AIM as our investment sub-adviser.

17

Advances under the Amended Citibank Credit Facility bear interest at a floating rate equal to (1) the higher of (a) the Citibank prime rate, (b) the federal funds rate plus 1.5% or (c) the three-month LIBOR plus 1.0%, plus (2) a spread of (a) 2% per year during the period from and including March 29, 2017 and the earlier of March 29, 2019 and the date the Amended Citibank Credit Facility matures, or (b) 3% per year during the period from the date the Amended Citibank Credit Facility matures until all obligations under the Amended Citibank Credit Facility have been paid in full. Interest is payable quarterly in arrears. All advances under the Amended Citibank Credit Facility will mature, and all accrued and unpaid interest thereunder will be due and payable, by no later than March 30, 2020. Flatiron Funding II may prepay advances pursuant to the terms and conditions of the credit and security agreement, subject to a 0.75% or 0.50% premium if the amount of the Amended Citibank Credit Facility is reduced or terminated on or prior to March 29, 2018 or March 29, 2019, respectively. In addition, Flatiron Funding II will be subject to a non-usage fee of 0.75% per year (subject to an increase to 2% in certain circumstances) on the amount, if any, of the aggregate principal amount available under the Amended Citibank Credit Facility that has not been borrowed. The non-usage fees, if any, are payable quarterly in arrears. Flatiron Funding II incurred certain customary costs and expenses in connection with obtaining the Citibank Credit Facility.

On March 29, 2017, Flatiron Funding II purchased loans and other corporate debt securities with a fair value of $354,967 from 15th Street Loan Funding LLC and 15th Street Loan Funding 2 LLC, each a special purpose subsidiary of Citibank. 15th Street Loan Funding LLC and 15th Street Loan Funding 2 LLC held loans and other corporate debt securities in connection with the TRS Agreement between Citibank and Flatiron. Flatiron Funding II’s obligations to Citibank under the Amended Citibank Credit Facility are secured by a first priority security interest in all of the assets of Flatiron Funding II. The obligations of Flatiron Funding II under the Amended Citibank Credit Facility are non-recourse to us, and our exposure under the Amended Citibank Credit Facility is limited to the value of our investment in Flatiron Funding II.

JPM Credit Facility

On August 26, 2016, 34th Street Funding, LLC, or 34th Street, our wholly-owned, consolidated, special purpose financing subsidiary, entered into a senior secured credit facility with JPMorgan Chase Bank, National Association, or JPM. The senior secured credit facility with JPM, or the JPM Credit Facility, provided for borrowings in an aggregate principal amount of $150,000, of which $25,000 may be funded as a revolving credit facility, each subject to conditions described in the JPM Credit Facility. On August 26, 2016, 34th Street drew down $57,000 of borrowings under the JPM Credit Facility.