Attached files

| file | filename |

|---|---|

| EX-23.1 - CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM - California Resources Corp | a2017yeexhibit231kpmgconse.htm |

| EX-99.1 - REPORT OF INDEPENDENT PETROLEUM ENGINEERS - California Resources Corp | a2017yeexhibit991ryderscott.htm |

| EX-32.1 - CERTIFICATIONS OF CEO AND CFO - California Resources Corp | a2017yeexhibit321ceoandcfo.htm |

| EX-31.2 - CERTIFICATION OF CFO - California Resources Corp | a2017yeexhibit312cfocertif.htm |

| EX-31.1 - CERTIFICATION OF CEO - California Resources Corp | a2017yeexhibit311ceocertif.htm |

| EX-23.2 - CONSENT OF INDEPENDENT PETROLEUM ENGINEERS - California Resources Corp | a2017yeexhibit232ryderscot.htm |

| EX-21 - LIST OF SUBSIDIARIES - California Resources Corp | a2017yeexhibit21listofsubs.htm |

| EX-12 - RATIO OF EARNINGS TO FIXED CHARGES - California Resources Corp | a2017yeexhibit12ratioofear.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2017 |

¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to |

Commission File Number 001-36478 |

California Resources Corporation

(Exact name of registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 46-5670947 (I.R.S. Employer Identification No.) | |

9200 Oakdale Ave. Los Angeles, California (Address of principal executive offices) | 91311 (Zip Code) | |

(888) 848-4754

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered | |

Common Stock | New York Stock Exchange | |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act: | Yes¨ No þ |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Date File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or such shorter period as the registrant was required to submit and post files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large Accelerated Filer | ¨ | Accelerated Filer | þ | Non-Accelerated Filer | ¨ |

Smaller Reporting Company | ¨ | Emerging Growth Company | ¨ | ||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act) Yes ¨ No þ

The aggregate market value of the voting common stock held by nonaffiliates of the registrant was approximately $363 million, computed by reference to the closing price on the New York Stock Exchange composite tape of $8.55 per share of Common Stock on June 30, 2017. Shares of Common Stock held by each executive officer and director have been excluded from this computation in that such persons may be deemed to be affiliates. This determination of potential affiliate status is not a conclusive determination for other purposes.

At January 31, 2018, there were 42,901,946 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed with the Securities and Exchange Commission in connection with the registrant's 2018 Annual Meeting of Stockholders, are incorporated by reference into Part III of this Form 10-K.

1

TABLE OF CONTENTS

Page | ||

Part I | ||

Item 1 | BUSINESS | |

General | ||

Business Operations and Environment | ||

Our Business Strategy | ||

Key Characteristics of our Operations | ||

Portfolio Management and Capital Program | ||

Reserves and Production Information | ||

Marketing Arrangements | ||

Regulation of the Oil and Natural Gas Industry | ||

Employees | ||

Spin-Off and Reverse Stock Split | ||

Available Information | ||

Item 1A | RISK FACTORS | |

Item 1B | UNRESOLVED STAFF COMMENTS | |

Item 2 | PROPERTIES | |

Our Operations | ||

Exploration Program | ||

Our Reserves | ||

Drilling Locations | ||

Production, Price and Cost History | ||

Productive Wells | ||

Acreage | ||

Drilling Activities | ||

Delivery Commitments | ||

Our Infrastructure | ||

Item 3 | LEGAL PROCEEDINGS | |

Item 4 | MINE SAFETY DISCLOSURES | |

EXECUTIVE OFFICERS | ||

Part II | ||

Item 5 | MARKET FOR REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES | |

Item 6 | SELECTED FINANCIAL DATA | |

Item 7 | MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | |

Basis of Presentation and Certain Factors Affecting Comparability | ||

Business Environment and Industry Outlook | ||

Seasonality | ||

Joint Ventures | ||

Private Placement | ||

Acquisitions and Divestitures | ||

Income Taxes | ||

Operations | ||

Production and Prices | ||

Balance Sheet Analysis | ||

Statement of Operations Analysis | ||

Liquidity and Capital Resources | ||

Cash Flow Analysis | ||

2017 and 2018 Capital Program | ||

Off-Balance-Sheet Arrangements | ||

Lawsuits, Claims, Commitments and Contingencies | ||

Critical Accounting Policies and Estimates | ||

Significant Accounting and Disclosure Changes | ||

Item 7A | QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK | |

2

FORWARD-LOOKING STATEMENTS | ||

Item 8 | FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA | |

Report of Independent Registered Public Accounting Firm | ||

Consolidated Balance Sheets | ||

Consolidated Statements of Operations | ||

Consolidated Statements of Comprehensive Income | ||

Consolidated Statements of Equity | ||

Consolidated Statements of Cash Flows | ||

Notes to Consolidated Financial Statements | ||

Quarterly Financial Data (Unaudited) | ||

Supplemental Oil and Gas Information (Unaudited) | ||

SCHEDULE II - VALUATION AND QUALIFYING ACCOUNTS | ||

Item 9 | CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE | |

Item 9A | CONTROLS AND PROCEDURES | |

Item 9B | OTHER INFORMATION | |

Part III | ||

Item 10 | DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE | |

Item 11 | EXECUTIVE COMPENSATION | |

Item 12 | SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | |

Item 13 | CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS AND DIRECTOR INDEPENDENCE | |

Item 14 | PRINCIPAL ACCOUNTANT FEES AND SERVICES | |

Part IV | ||

Item 15 | EXHIBITS | |

3

PART I

Item 1 | BUSINESS |

General

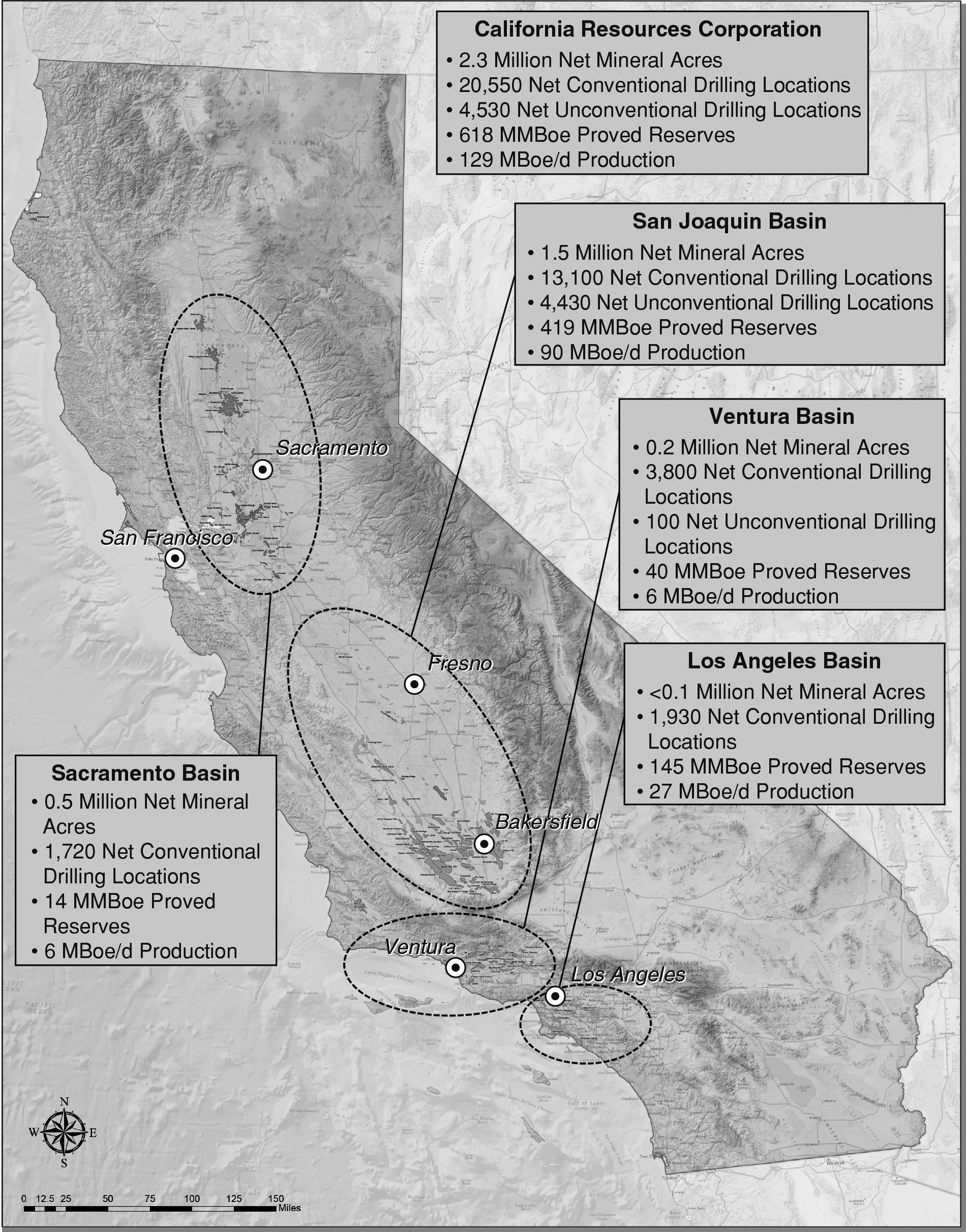

We are an independent oil and natural gas exploration and production company operating properties within California. We are the largest oil and gas producer in California on a gross operated basis and we believe we have the largest privately held mineral acreage position in the state, consisting of approximately 2.3 million net mineral acres spanning the state’s four major oil and gas basins. We produced approximately 129 thousand barrels of oil equivalent per day (MBoe/d) for the year ended December 31, 2017. As of December 31, 2017, we had net proved reserves of 618 million barrels of oil equivalent (MMBoe), of which approximately 71% was categorized as proved developed reserves. Oil represented 72% of our proved reserves. We were formed in April 2014 and listed on the New York Stock Exchange on December 1, 2014. All references to ‘‘CRC,’’ the ‘‘Company,’’ ‘‘we,’’ ‘‘us’’ and ‘‘our’’ refer to California Resources Corporation and its subsidiaries.

Business Operations and Environment

Our business is focused on the production, development and exploration of conventional and unconventional oil and gas assets in California.

Our large acreage position and extensive drilling inventory provide us a diversified portfolio of oil and natural gas locations that are economically viable in a variety of operating and commodity price conditions, including many that are high-value projects throughout the price cycle. Our large fee mineral acreage position also enhances our returns because we do not make royalty and other lease payments related to these assets. Our acreage position contains numerous development and growth opportunities due to its varied geologic characteristics and multiple stacked pay reservoirs which are in many cases thousands of feet thick. We have a large portfolio of low-risk and low-decline conventional opportunities in each of our major oil and gas basins comprising approximately 71% of our proved reserves. Conventional reservoirs are capable of natural flow during primary recovery phase, often followed by waterflood and steamflood recovery methods to enhance ultimate recovery. We also have a significant portfolio of lower permeability unconventional reservoirs that typically utilize established well stimulation techniques. Our conventional and unconventional reservoirs currently include approximately 20,550 and 4,530 net identified drilling locations, respectively, primarily in the San Joaquin basin.

We are in various phases of developing many of our conventional assets and will continue to develop them using internally generated cash flow and, when appropriate, capital raised through joint ventures. Prior to the severe price declines that began in late 2014, we were focused on higher-value unconventional production from seven discrete stacked pay horizons within the Monterey formation, primarily within the upper Monterey. As commodity prices and project economics improved in 2017, we renewed our development activities in the upper Monterey and started to appraise and delineate the Kreyenhagen formation within our Kettleman North Dome field. We expect to continue pursuing unconventional opportunities in 2018 and beyond if prices remain at current levels. Over the longer term, we believe our project economics will improve, which should allow us to duplicate our successful upper Monterey results to develop opportunities in the unconventional reservoirs of the lower Monterey, Kreyenhagen and Moreno formations, which have similar geological attributes.

We have also built a 3D seismic library that covers approximately 4,820 square miles, representing over 90% of the 3D seismic data available in California. We have developed unique, proprietary stratigraphic and structural models of the subsurface geology and hydrocarbon potential in each of the four basins in which we operate. In recent years we have tested and successfully implemented various exploration, drilling, completion and enhanced recovery technologies to increase recoveries, growth and value from our portfolio. We continue working to build depth in our exploration inventory and identify new prospects based on the competitive advantage provided by this proprietary data set and our experience.

4

We develop our capital program by prioritizing life-of-project returns to grow our net asset value over the long term, while balancing the short- and long-term growth potential of each of our assets. We use a Value Creation Index (VCI) metric for project selection and capital allocation across our asset portfolio. We calculate the VCI for each of our projects by dividing the net present value of the project's expected pre-tax cash flow over its life by the present value of the investments, each using a 10% discount rate. Projects are expected to meet a VCI of 1.3, meaning that 30% of expected value is created above our cost of capital for every dollar invested. Our technical teams are consistently working to enhance value by improving the economics of our inventory through detailed geologic studies as well as application of more effective and efficient drilling and completion techniques. As a result, we expect many projects that do not currently meet our VCI threshold today will do so by the time of development. We regularly monitor internal performance and external factors and adjust our capital investment program with the objective of creating the most value from our asset portfolio.

With significant operating control of our properties, we have the ability to adjust our drilling and workover rig count based on commodity prices and to increase or decrease our program according to changing market conditions. We began 2017 with two drilling rigs and ended the year with nine; seven in the San Joaquin basin and one each in the Los Angeles and Ventura basins. We drilled and completed 109 net development wells with 92 wells in the San Joaquin basin, 15 in the Los Angeles basin and two in the Ventura basin. These included six primary wells, 52 steamflood wells, 31 waterflood wells, and 20 unconventional wells. We also drilled and completed five net exploration wells in the San Joaquin basin. In 2017, we increased our workover rig count from 43 at the beginning of 2017 to 59 at the end of the year to focus on projects that meet our investment criteria. In total, we performed approximately 460 capital workover projects during 2017.

The following table summarizes certain information concerning our acreage, wells and drilling locations as of December 31, 2017:

Mineral Acreage(a) (in millions) | Average Net Mineral Acreage Held in Fee (%) | Producing Wells, gross | Average Net Revenue Interest (%) | Identified Drilling Locations(b) | ||||||||||||||||

Gross | Net | Gross | Net | |||||||||||||||||

San Joaquin Basin | 1.7 | 1.5 | 66 | % | 6,192 | 79 | % | 25,190 | 17,530 | |||||||||||

Los Angeles Basin | <0.1 | <0.1 | 46 | % | 1,300 | 76 | % | 1,950 | 1,930 | |||||||||||

Ventura Basin | 0.3 | 0.2 | 73 | % | 467 | 82 | % | 4,310 | 3,900 | |||||||||||

Sacramento Basin | 0.6 | 0.5 | 38 | % | 677 | 75 | % | 2,420 | 1,720 | |||||||||||

Total | 2.7 | 2.3 | 60 | % | 8,636 | 78 | % | 33,870 | 25,080 | |||||||||||

(a) | We currently hold approximately 38,500 gross (30,300 net) acres in the Los Angeles basin. Our Los Angeles basin operations primarily rely on dense multi-well pad drilling. |

(b) | Our total identified drilling locations exclude approximately 6,400 gross (5,300 net) exploration drilling locations related to unconventional reservoirs. They include approximately 2,090 gross (1,870 net) locations associated with proved undeveloped reserves and approximately 2,520 gross (2,350 net) injection well locations. Please see Item 2 – Properties – Drilling Locations for more information regarding the processes and criteria through which we identified our drilling locations. |

Compared to 2016, our 2017 production declined 8%, with only $266 million of drilling and workover capital invested for the year. This performance reflects the resilience of our asset base and the further flattening of our base production decline. In 2017, our production profile comprised roughly 64% oil, 24% natural gas and 12% natural gas liquids. Recognizing the relative value of crude oil, we are devoting the majority of our 2018 capital program to grow our oil production.

We have created a dynamic capital program for 2018 that can be adjusted to align investments with projected cash flows and joint venture (JV) funding. We believe our expanded 2018 capital program focusing primarily on low-decline crude oil assets will provide meaningful deleveraging over time while we continue to pursue additional opportunities to strengthen our balance sheet. Our capital program will also allow us to continue to delineate our high-potential conventional and unconventional areas like Buena Vista Nose and Kettleman, respectively.

5

We currently sell all of our crude oil into the California refining markets, which offer favorable pricing for comparable grades relative to other U.S. regions. Although California state policies actively promote and subsidize renewable energy, including solar, wind, biomass and geothermal resources, demand for oil and natural gas in California remains strong. California is heavily reliant on imported sources of energy, with approximately 72% of oil and 90% of natural gas consumed in 2017 imported from outside the state. A vast majority of the imported oil arrives via supertanker, mostly from foreign locations. As a result, California refiners have typically purchased crude oil at international waterborne-based Brent prices. We believe that the limited crude transportation infrastructure from other parts of the U.S. and California refiners' preference to run on heavy grades of oil found in California will continue contributing to favorable prices and realizations compared to other U.S. markets. During the second half of 2017, Brent crude prices began to recover, rising above $65 per barrel and reaching the highest level since 2015 as the premium of Brent over West Texas Intermediate (WTI) widened with the Organization of the Petroleum Exporting Countries (OPEC) production cuts. Additionally, our differentials improved against Brent during 2017 as a result of an increase in the official selling price to North America from the Middle East and higher-than-expected demand in Asia.

During 2017, as oil prices and activity increased, the energy industry in certain parts of the country started experiencing increases in service costs. However, the California energy industry experienced only limited cost inflation due to excess capacity in the service and supply sector. At current commodity price levels, we expect this trend to continue in 2018.

Recent Developments

In February 2018, we entered into a midstream JV with ECR Corporate Holdings L.P. (ECR), a portfolio company of Ares Management L.P. (Ares). This JV (Ares JV) holds the Elk Hills’ power plant, a 550 MW natural gas fired power plant, and a 200 million cubic foot per day cryogenic gas processing plant. For more on the Ares JV, see Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Joint Ventures.

Our Business Strategy

We plan to drive long-term stockholder value by applying modern technologies to develop our resource base and increase production. We have significant conventional opportunities to pursue, which we develop through their life cycles to increase recovery factors by transitioning them from primary production to waterfloods, steamfloods and other enhanced recovery mechanisms.

In a sustained higher price environment, we intend to direct additional available capital to projects that provide high-value returns. A higher sustained price environment also gives us the opportunity to acquire assets that would be complementary to our existing operations. The principal elements of our business strategy include the following:

• | Focus on high-value projects. |

In the near term, we anticipate directing the majority of our capital investments toward oil-weighted opportunities to the extent the oil-to-gas price relationship remains favorable. As a result, we expect the percentage of our oil production to continue to increase over time and favorably impact our overall margins. In 2018, approximately 95% of our identified drilling inventory is associated with oil projects. Currently, 64% of our production is oil compared to 72% of our proved reserves. Over time, we expect our share of oil production to approach the share of oil reserves.

Over the longer term, we believe we can generate significant production growth from unconventional reservoirs such as tight sandstones and shales. We hold mineral interests in approximately 1.3 million net mineral acres with unconventional potential and have identified approximately 4,930 gross (4,530 net) drilling locations on this acreage. A meaningful portion of our production already comes from unconventional assets. While we have not yet developed sufficient information to reliably predict success rates across our entire portfolio, our continued technical reviews of these projects are allowing us to better understand performance of these reservoirs in addition to improving our overall cycle time from project identification to development. As a result, we believe we will be able to direct future available capital more precisely to higher value projects, allowing us to strategically increase our investment levels in unconventional drilling over time.

6

• | Maintain an appropriate share of conventional projects in our production mix to manage production declines and base maintenance capital requirements. |

Our portfolio of assets includes a large number of steamflood and waterflood projects that have much lower decline rates than many unconventional projects. We intend to focus a significant portion of our capital investments on such projects, which we expect will maintain our low production decline rates. We have approximately 28,940 gross (20,550 net) identified drilling locations associated with lower-risk conventional opportunities, 56% of which are Improved Oil Recovery (IOR) and Enhanced Oil Recovery (EOR) projects. The remaining 44% are associated with primary recovery methods, many of which we expect will develop into IOR and EOR projects in the future.

• | Enhance stockholder value by pursuing upstream and midstream joint venture opportunities including exploration ventures. |

We believe both upstream and midstream joint ventures will enhance value by giving us the ability to significantly accelerate the development of our high-value portfolio of assets. We have already announced a number of joint ventures that have given us substantial development resources and will continue to evaluate similar opportunities in the future. We have entered into a number of exploration joint ventures, which, if successful, could result in significant long-term production growth.

• | Increase natural gas production over time to provide clean energy to California. |

We are the largest producer of natural gas in California through our operations in the Sacramento basin. Our portfolio has a large number of mature gas fields that can be targeted for further development, with growth opportunities in under-developed areas of our asset base, including significant growth potential in the Sacramento basin. We are focused on developing technologies and execution approaches that will generate commercial projects at current price levels while maintaining a targeted exploration program for new resources. In addition, we expect to pursue strategic joint ventures to unlock the value of our asset portfolio.

• | Maintain a proactive and collaborative approach to safety, environmental protection and community outreach, while helping the state address its energy and water needs. |

We are committed to managing our assets in a manner that safeguards people and protects the environment, and to reducing California's dependence on imported energy. We proactively engage with regulatory agencies, communities, organized labor and other stakeholders to pursue mutually beneficial outcomes that supply affordable and reliable energy from local sources and that expand opportunities for the communities in which we live and work. As a California company, helping our state meet its water needs is a key priority. We are a net water supplier to agriculture due to our dedicated team and investments in water conservation and the recycling of produced water from oil and gas reservoirs. In 2017, our operations supplied 4.9 billion gallons of reclaimed water for agricultural use, a new company record that far exceeds the volume of fresh water we purchased for our operations statewide.

• | Apply proven modern development and production methods to enhance production growth and cost efficiency. |

Over the last several decades, the oil and gas industry has focused significantly less effort on utilizing modern development and exploration processes and technologies in California relative to other prolific U.S. basins. We believe this is largely due to other oil companies’ limited capital investments in California, concentration on shallow-zone thermal projects and investments in other assets within their global portfolios. As an independent company focused on California, we use proven modern technologies in drilling and completing wells, as well as production methods that we expect will substantially increase both our production and cost efficiency over time. We have developed an extensive 3D seismic library covering almost 4,820 square miles in all four of our basins, representing over 90% of the 3D seismic data available for California, and have tested and successfully implemented various exploration, drilling, completion, IOR and EOR technologies in the state.

• | Utilize advanced technologies to improve our operations. |

We have a dedicated Big Data Analytics team focused on analyzing data to help us make better operating and development decisions that enhance the value of our assets. We are evaluating advanced technologies such as artificial intelligence, machine learning, algorithms, complex math analysis and other digital solutions to predictively optimize our business processes, development criteria and our drilling and production techniques.

7

Key Characteristics of our Operations

The following are among the key characteristics of our operations:

• | Operational control of our diverse asset base provides flexibility during commodity price cycles and preserves future value and growth potential. |

Our near 100% operational control of 135 fields in California provides us flexibility to adapt our investments to various market environments through our ability to select drilling locations, the timing of our development and the drilling and completion techniques we use. Our large and diverse mineral acreage position allows us to choose to develop conventional or unconventional reservoirs of either oil or natural gas using multiple recovery mechanisms, such as primary, steamflood and waterflood. In addition, approximately 60% of our acreage position is held in fee and 15% is held by production, which gives us flexibility to choose the timing of our development projects. A majority of our interests are in producing properties located in reservoirs characterized by what we believe have long-lived production profiles with repeatable development opportunities. Approximately 95% of our identified drilling inventory is associated with oil-rich projects, primarily located in the San Joaquin, Los Angeles and Ventura basins, and the remaining inventory is associated with natural gas properties in the Sacramento, San Joaquin and Ventura basins. The variety of recovery mechanisms and product types available to us, together with our operating control, allows us to allocate capital in a manner designed to optimize cash flow over a wide range of commodity prices. The low base decline of our conventional assets allows us to limit production declines with minimal investment, positioning us to achieve oil-production growth in the current price environment while living within our means.

• | Largest acreage position in a world-class oil and natural gas province. |

We believe we are the largest private oil and natural gas mineral acreage holder in California, with interests in approximately 2.3 million net mineral acres. California is one of the most prolific oil and natural gas producing regions in the world. California is also the nation’s largest state economy, and the world's sixth largest, with significant energy demands that exceed local supply. Our large acreage position with a diverse development portfolio enables us to pursue the appropriate production strategy for the relevant commodity price environment without the need to acquire new acreage. For example, in a high natural gas price environment we can rapidly increase our investments in the Sacramento basin to generate significant production growth. Our large acreage position also allows us to quickly deploy the knowledge we gain in our existing operations, together with our seismic data, in other areas within our portfolio.

• | Opportunity rich drilling and workover portfolio. |

Our drilling inventory at December 31, 2017 consisted of approximately 33,870 gross (25,080 net) identified well locations, including approximately 28,940 gross (20,550 net) conventional drilling locations and approximately 4,930 gross (4,530 net) unconventional drilling locations. Our drilling inventory count increased by about 10% from the prior year as a result of our technical teams' continued efforts. We also have approximately 1,200 workover projects that can deliver high returns. At about $65 Brent, we estimate we have increased the investment opportunities for drilling and workover capital that meet our 1.3 VCI threshold by 20%. In the process, our inventory of lower-risk conventional development opportunities with attractive returns has increased even more than our unconventional opportunities. In a sustained favorable oil and gas price environment, we believe we can also achieve further long-term production growth through the development of unconventional reservoirs. In addition, our rich conventional and unconventional portfolio can provide attractive JV opportunities.

• | Proven operational management and technical teams with extensive experience operating in California. |

The members of our operational management and technical teams have an average of over 25 years of experience in the oil and natural gas industry, with an average of over 15 years focused on our California oil and gas operations through different price cycles. Our teams have a proven track record of applying modern technologies and operating methods to develop our assets and improve their operating efficiencies. For example, we have successfully reduced field operating costs by approximately 27% since 2014.

8

Portfolio Management and Capital Program

We develop our capital program by prioritizing projects that have returns that will grow our net asset value over the long term, while balancing the short- and long-term growth potential of each of our assets. We use the VCI metric for project selection and capital allocation across our asset portfolio. Typically, we create the highest value by reinvesting our cash flow back into our business, including attractive acquisitions. Our low decline rates compared to our industry peers together with our high level of operational control give us the flexibility to adjust the level of such capital investments as circumstances warrant.

2017 Capital Program

Our 2017 capital program predominantly targeted projects in the San Joaquin and Los Angeles basins, and virtually all of our capital was directed towards oil-weighted production, consistent with 2016 and 2015. The program was initially set at approximately $300 million but increased to $371 million when we entered into JVs with Benefit Street Partners (BSP) and Macquarie Infrastructure and Real Assets Inc. (MIRA). Our $371 million capital program included $96 million of funding from BSP and excluded $58 million of funding from MIRA, which is not reported in our consolidated results. Excluding MIRA capital, we invested approximately $177 million for drilling wells, $89 million for capital workovers, $71 million for facilities and compression expansion, $25 million for maintenance and occupational health, safety and environmental projects and $9 million for exploration and other items. We ended 2017 with nine rigs running and anticipate our activity levels to remain at an average nine-rig pace for the first quarter of 2018.

2018 Capital Program

We are focusing our 2018 capital on oil projects, which provide higher margins and low decline rates that we believe will generate cash flow to fund increasing capital budgets that will grow production. Our approach to our 2018 drilling program is consistent with our stated strategy to remain financially disciplined and fund projects through either internally generated cash flow or JV capital to maintain our liquidity and further strengthen our balance sheet. We continue to deploy our partners' capital as part of our BSP and MIRA joint ventures and opportunistically pursue additional strategic relationships. We will deploy capital to projects that help continue to stabilize our production, develop our long-term resources and return our production to a growth profile. We will continue to focus on our core fields: Elk Hills, Wilmington, Kern Front and the delineation and appraisal of Kettleman North Dome and Buena Vista. We will also restart our development activities in the Huntington Beach field.

With stronger expected cash flow, we estimate our 2018 capital program will range from $425 million to $450 million, which includes approximately $100 to $150 million in JV capital. Our 2018 capital program may grow further through additional tranches from existing JVs as well as potential new JVs.

Our current drilling inventory comprises a diversified portfolio of oil and natural gas locations that are economically viable in a variety of operating and commodity price conditions. Our 2018 drilling program includes development of conventional and unconventional resources. The depth of our primary conventional wells is expected to range from 2,000 to 15,000 feet. With a significant reduction in our drilling costs since 2014, many of our deep conventional and unconventional wells have become more competitive, and we expect to use approximately 60% of our capital on drilling. We expect to focus our conventional program of approximately 130 wells primarily in Wilmington, Huntington Beach, Kern Front, Pleito Ranch and Mount Poso, which will largely consist of waterfloods and steamfloods along with some primary drilling. We intend to drill approximately 20 unconventional wells in the Buena Vista and Kettleman areas.

We also plan to use over 20% of our 2018 capital program for capital workovers on existing well bores. Capital workovers are some of the highest VCI projects in our portfolio and generally include well deepenings, recompletions, changes of lift methods and other activities designed to add incremental productive intervals and reserves.

Further, over 15% of our 2018 capital program is intended for development facilities for our projects, including pipeline and gathering line interconnections, gas compression and water management systems, and about 5% is intended to be used for exploration and to maintain the mechanical integrity, safety and environmental performance of our operations.

9

Reserves and Production Information

The table below summarizes our proved reserves and average net daily production as of and for the year ended December 31, 2017 in each of California's four major oil and gas basins:

Proved Reserves as of December 31, 2017 | Average Net Daily Production for the Year Ended December 31, 2017 | ||||||||||||||||||||||||

Oil (MMBbl) | NGLs (MMBbl) | Natural Gas (Bcf) | Total (MMBoe) | Oil (%) | Proved Developed (%) | (MBoe/d) | Oil (%) | R/P Ratio (Years)(a) | |||||||||||||||||

San Joaquin Basin | 265 | 56 | 585 | 419 | 63 | % | 70 | % | 90 | 58 | % | 12.8 | |||||||||||||

Los Angeles Basin | 143 | — | 10 | 145 | 99 | % | 72 | % | 27 | 100 | % | 14.7 | |||||||||||||

Ventura Basin | 34 | 2 | 26 | 40 | 85 | % | 73 | % | 6 | 67 | % | 18.3 | |||||||||||||

Sacramento Basin | — | — | 85 | 14 | — | 86 | % | 6 | — | % | 6.4 | ||||||||||||||

Total operations | 442 | 58 | 706 | 618 | 72 | % | 71 | % | 129 | 64 | % | 13.1 | |||||||||||||

Note: MMBbl refers to millions of barrels; Bcf refers to billion cubic feet of natural gas; MMBoe refers to million barrels of oil equivalent; and MBoe/d refers to thousands of barrels of oil equivalent per day. Natural gas volumes have been converted to Boe based on the equivalence of energy content between six Mcf of natural gas and one Bbl of oil.

(a) | Calculated as total proved reserves as of December 31, 2017 divided by annualized Average Net Daily Production for the year ended December 31, 2017. |

Marketing Arrangements

Crude Oil – Substantially all of our crude oil production is connected to California markets via our crude oil gathering pipelines, which are used almost entirely for our production. We generally do not transport, refine or process the crude oil we produce and do not have any significant long-term crude oil transportation arrangements. We currently sell all of our crude oil into the California refining markets, which we believe have offered relatively favorable pricing compared to other U.S. regions for similar grades. In addition, we evaluate opportunities to export our crude oil production. The majority of the oil imported into California arrives via supertanker, with a minor amount arriving by rail. As a result, California refiners have typically purchased crude oil at international waterborne-based prices. Currently, our index-based crude oil sales contracts have 30- to 90-day terms with no such contracts extending past one year.

Natural Gas – California imports approximately 90% of the natural gas consumed in the state. We have firm transportation capacity contracts to access markets and to facilitate deliveries. We sell virtually all of our natural gas production under individually negotiated contracts using market-based pricing on a monthly or shorter basis.

NGLs – We extract substantially all of our NGLs through our gas processing plants, which facilitate access to third-party delivery points near the Elk Hills field. We currently have pipeline capacity contracts to transport 20,000 barrels per day of NGLs to market. We sell virtually all of our NGLs using index-based pricing. Our NGLs are generally sold pursuant to one-year contracts that are renewed annually. Approximately 36% of our NGLs are sold to export markets.

Electricity – Part of the electrical output of the Elk Hills power plant operated by one of our subsidiaries is used by the Elk Hills field, which reduces operating costs and increases reliability. We sell the excess to the grid and to utilities.

Hedging

We maintain a commodity hedging program primarily focused on crude oil to help protect our cash flows, margins and capital program from the volatility of commodity prices and to improve our ability to comply with the covenants under our credit facilities. We will continue to be strategic and opportunistic in implementing our hedging program. Unless otherwise indicated, we use the term "hedge" to describe derivative instruments that are designed to achieve our hedging program goals, even though they are not necessarily accounted for as cash-flow or fair-value hedges. For more on our current derivative contracts, see Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources.

10

Our Principal Customers

We sell crude oil, natural gas and NGLs to marketers, California refineries and other purchasers that have access to transportation and storage facilities. Our ability to sell our products can be affected by factors that are beyond our control, and which cannot be accurately predicted.

For the years ended December 31, 2017 and 2016, our principal customers included Phillips 66 Company, Andeavor (formerly Tesoro Refining & Marketing Company LLC), Valero Marketing & Supply Company and Shell Trading (US) Company, each accounted for at least 10%, and, collectively, 67% of our revenue. For the year ended December 31, 2015, our principal customers included Phillips 66 Company, Tesoro Refining & Marketing Company LLC and Valero Marketing & Supply Company, each accounted for more than 10%, and collectively, 64% of our revenue.

Title to Properties

As is customary in the oil and natural gas industry for acquired properties, we initially conduct a high-level review of the title to our properties at the time of acquisition. Individual properties may be subject to ordinary course burdens that we believe do not materially interfere with the use or affect the value of such properties. Burdens on properties may include customary royalty interests, liens incident to operating agreements and for current taxes, obligations or duties under applicable laws, development obligations, or net profits interests, among others. Prior to the commencement of drilling operations on those properties, we conduct a more thorough title examination and perform curative work with respect to significant defects. We generally will not commence drilling operations on a property until we have cured known title defects that are material to the project. In addition, substantially all of our properties have been pledged as collateral for our secured debt.

Competition

We encounter strong competition from numerous parties in the oil and gas industry, ranging from small independent producers to major international oil companies. The oil market in California is a captive market with no interstate crude pipeline and rail lines that only run north to south. As a result, 72% of the oil the state consumes is imported, virtually all from waterborne sources. Our proximity to the California refineries gives us a competitive edge through lower transportation costs. The California natural gas market is serviced from a network of pipelines, including interstate and intrastate pipelines. We deliver our natural gas to customers using capacity on our firm transportation commitments.

We compete for third-party services to profitably develop our assets, to find or acquire additional reserves, to sell our production and to find and retain qualified personnel. Historically, higher commodity prices intensify competition for drilling and workover rigs, pipe, other oil field equipment and personnel. However, the California energy industry experienced only limited cost inflation in 2017 due to excess capacity in the service and supply sector. Given our relative size compared to other in-state producers, our activity influences the pricing of third-party services in the local market.

Regulation of the Oil and Natural Gas Industry

Our operations are subject to a wide range of federal, state and local laws and regulations. Those that specifically relate to oil and natural gas exploration and production are described in this section.

Regulation of Exploration and Production

Federal, state and local laws and regulations govern most aspects of exploration and production in California, including:

• | oil and natural gas production, including well spacing on federal, state and private lands; |

• | methods of constructing, drilling, completing, stimulating, operating, maintaining and abandoning wells; |

• | the design, construction, operation, maintenance and decommissioning of facilities, such as natural gas processing plants, power plants, compressors and liquid and natural gas pipelines or gathering lines; |

• | improved or enhanced recovery techniques such as fluid injection for pressure management, waterflooding or steamflooding; |

• | sourcing and disposal of water used in the drilling, completion, stimulation, maintenance and enhanced recovery processes; |

11

• | imposition of taxes and fees with respect to our properties and operations; |

• | the conservation of oil and natural gas, including provisions for the unitization or pooling of oil and natural gas properties; |

• | posting of bonds or other financial assurance to drill, operate and abandon or decommission wells and facilities; and |

• | occupational health, safety and environmental matters and the transportation, marketing and sale of our products as described below. |

Collectively, the effect of these regulations is to potentially limit the number and location of our wells and the amount of oil and natural gas that we can produce from our wells compared to what we otherwise would be able to do.

The Division of Oil, Gas, and Geothermal Resources (DOGGR) of the Department of Conservation is California's primary regulator of the oil and natural gas industry on private and state lands, with additional oversight from the State Lands Commission’s administration of state surface and mineral interests. The Bureau of Land Management (BLM) of the U.S. Department of the Interior exercises similar jurisdiction on federal lands in California, on which DOGGR also asserts jurisdiction over certain activities. Government actions, including the issuance of certain permits or approvals, by state and local agencies or by federal agencies may be subject to environmental reviews, respectively, under the California Environmental Quality Act or the National Environmental Policy Act (NEPA), which may result in delays, imposition of mitigation measures or litigation. For example, in September 2016, a federal judge issued an order finding that the BLM’s NEPA review of the Resource Management Plan for portions of Ventura, Kern and other counties failed to sufficiently analyze the potential environmental impacts of hydraulic fracturing and directed the BLM to prepare a supplemental environmental impact statement. The result of this NEPA review has the potential to impact future leasing of federal lands in those counties for oil and gas exploration and production activities.

The jurisdiction and enforcement authority of DOGGR and other state agencies have significantly increased with respect to oil and gas activities in recent years, and these agencies have significantly revised their regulations, regulatory interpretations and data collection requirements. DOGGR has undertaken a comprehensive examination of existing regulations and plans to issue additional regulations with respect to certain oil and gas activities in 2018, such as management of idle wells, pipelines and underground fluid injection. Pursuant to Assembly Bill 2729 (AB 2729), DOGGR requires operators annually starting in 2018 to either submit idle well management plans describing how they will plug and abandon or reactivate long-term idle wells or pay additional annual fees for each such well. AB 2729 also requires that DOGGR update its regulations pertaining to idle well testing and management by June 1, 2018. In September 2017, DOGGR proposed regulations that seek to impose more stringent inspection and integrity management requirements on pipelines that are four inches or less in diameter and located in sensitive areas. DOGGR’s plan to update underground injection regulations in 2018, which may address injection approvals, project data requirements, mechanical integrity testing of injection wells, monitoring and reporting requirements with respect to injection parameters, containment or seismic activity, and incident response.

In 2013 California adopted Senate Bill 4 (SB 4), which increased regulation of certain well stimulation techniques, including acid matrix stimulation and hydraulic fracturing, which involves the injection of fluid under pressure into underground rock formations to create or enlarge fractures to allow oil and gas to flow more freely. Among other things, SB 4 requires operators to obtain specific well stimulation permits, make disclosures and implement groundwater monitoring and water management plans. The U.S. Environmental Protection Agency (EPA) and the BLM also regulate certain well stimulation activities, though their regulations are currently being challenged in court. The implementation of federal and state well stimulation regulations has delayed, and increased the cost of, certain operations.

12

In addition, certain local governments have proposed or adopted ordinances that would restrict certain drilling activities in general and well stimulation, completion or injection activities in particular, or ban such activities outright. The most onerous of these local measures was adopted in 2016 by Monterey County, where we own mineral interests but do not have any production. The measure prohibits drilling of new oil and gas wells, hydraulic fracturing, other well stimulation and phases out the injection of produced water. This measure was challenged in state court, and the Monterey County Superior Court issued a decision in December 2017, finding that the bans on drilling new wells and water injection are preempted and invalid by existing state and federal regulations and, if implemented, would constitute a taking of our property without compensation under the federal and state constitutions. The court did not rule on the ban on hydraulic fracturing because the court found that the issue was not ripe since hydraulic fracturing is not currently being conducted in Monterey County, noting that the ban could be challenged in the event a hydraulic fracturing is proposed. The decision is expected to be appealed.

Regulation of Health, Safety and Environmental Matters

Numerous federal, state, local, and other laws and regulations that govern health and safety, the release or discharge of materials, land use or environmental protection may restrict the use of our properties and operations, increase our costs or lower demand for or restrict the use of our products and services. Applicable federal health, safety and environmental laws include the Occupational Safety and Health Act, Clean Air Act, Clean Water Act, Safe Drinking Water Act, Oil Pollution Act, Natural Gas Pipeline Safety Act, Pipeline Safety Improvement Act, Pipeline Safety, Regulatory Certainty, and Job Creation Act, Endangered Species Act, Migratory Bird Treaty Act, Comprehensive Environmental Response, Compensation, and Liability Act, Resource Conservation and Recovery Act and National Environmental Policy Act, among others. California imposes additional laws that are analogous to, and often more stringent than, such federal laws. These laws and regulations:

• | establish air, soil and water quality standards for a given region, such as the San Joaquin Valley, and require attainment plans to meet those regional standards, which may include significant restrictions on development, economic activity and transportation in such region; |

• | require various permits, approvals and mitigation measures before drilling, workover, production, underground fluid injection or waste disposal commences, or before facilities are constructed or put into operation; |

• | require the installation of sophisticated safety and pollution control equipment, such as leak detection, monitoring and shutdown systems, to prevent or reduce releases or discharges of regulated materials to air, land, surface water or ground water; |

• | restrict the use, types or sources of water, energy, land surface, habitat or other natural resources, require conservation and reclamation measures, and impose energy efficiency or renewable energy standards on us or users of our products and services; |

• | restrict the types, quantities and concentrations of regulated materials, including oil, natural gas, produced water or wastes, that can be released or discharged into the environment, or any other uses of those materials resulting from drilling, production, processing, power generation, transportation or storage activities; |

• | limit or prohibit operations on lands lying within coastal, wilderness, wetlands, groundwater recharge, endangered species habitat and other protected areas, and require the dedication of surface acreage for habitat conservation; |

• | establish standards for the management of solid and hazardous wastes or the closure, abandonment, cleanup or restoration of former operations, such as plugging and abandonment of wells and decommissioning of facilities; |

• | impose substantial liabilities for unauthorized releases or discharges of regulated materials into the environment with respect to our current or former properties and operations and other locations where such materials generated by us or our predecessors were released or discharged; |

• | require comprehensive environmental analyses, recordkeeping and reports with respect to operations affecting federal, state and private lands or leases; |

• | impose taxes or fees with respect to the foregoing matters; |

• | may expose us to litigation with government authorities, counterparties, special interest groups or others; and |

• | may restrict our rate of oil, NGLs, natural gas and electricity production. |

13

Due to the severe drought in California over the last several years, water districts and the state government have implemented regulations and policies that may restrict groundwater extraction and water usage and increase the cost of water. Water management is an essential component of our operations. We treat and reuse water that is co-produced with oil and natural gas for a substantial portion of our needs in activities such as pressure management, waterflooding, steamflooding and well drilling, completion and stimulation. We also provide reclaimed produced water to certain agricultural water districts. We also use supplied water from various local and regional sources, particularly for power plants and to support operations like steam injection in certain fields.

In 2014, at the request of the EPA, DOGGR commenced a detailed review of the multi-decade practice of permitting underground injection wells and associated aquifer exemptions under the Safe Drinking Water Act (SDWA). In 2015, the state set deadlines to obtain the EPA’s confirmation of aquifer exemptions under the SDWA in certain formations in certain fields. Since the state and the EPA did not complete their review before the state's deadlines, the state announced that it will not rescind permits or enforce the deadlines with respect to many of the formations pending completion of the review, but has applied the deadlines to others. During the review, the state has restricted injection in certain formations or wells in several fields, including some operated by us, requested that we change injection zones in certain fields, and held certain pending injection permits in abeyance. Several industry groups and operators challenged DOGGR’s implementation of its aquifer exemption regulations. In March 2017, the Kern County Superior Court issued an injunction barring the blanket enforcement of DOGGR’s aquifer exemption regulations. The court found that DOGGR must find actual harm results from an injection well’s operations and go through a hearing process before the agency can issue fines or shut down operations.

Separately, the state began a review in 2015 of permitted surface discharge of produced water and the use of reclaimed water for agricultural irrigation, which has led to additional permitting and monitoring requirements in 2017 for surface discharge of produced water. To date, the foregoing regulatory actions have not affected our oil and natural gas production in a material way. These reviews are ongoing, and government authorities may ultimately restrict injection of produced water or other fluids in additional formations or certain wells, restrict the surface discharge or use of produced water or take other administrative actions. The foregoing reviews could also give rise to litigation with government authorities and third parties.

Federal, state and local agencies may assert overlapping authority to regulate in these areas. In addition, certain of these laws and regulations may apply retroactively and may impose strict or joint and several liability on us for events or conditions over which we and our predecessors had no control, without regard to fault, legality of the original activities, or ownership or control by third parties.

Regulation of Climate Change and Greenhouse Gas (GHG) Emissions

A number of international, federal, state, regional and local efforts seek to prevent or mitigate the effects of climate change or to track and reduce GHG emissions associated with energy use and industrial activity, including operations of the oil and natural gas production sector and those who use our products as a source of energy. The EPA has adopted federal regulations to:

• | require reporting of annual GHG emissions from power plants and gas processing plants; gathering and boosting compression and pipeline facilities; and certain completions and workovers; |

• | incorporate measures to reduce GHG emissions in permits for certain facilities; and |

• | restrict GHG emissions from certain mobile sources. |

California has adopted the most stringent such laws and regulations. These state laws and regulations:

• | established a “cap-and-trade” program for GHG emissions that sets a statewide maximum limit on covered GHG emissions, and this cap declines annually to reach 40% below 1990 levels by 2030, the year that the cap-and-trade program currently expires; |

• | require allowances or qualifying offsets for GHGs emitted from California operations and for the volume of propane and liquid transportation fuels sold for use in California; |

• | established a low carbon fuel standard, which requires the use of fuels with lower carbon intensities than traditional gasoline and diesel fuels; |

• | impose state goals to derive 50% of California’s electricity from renewable sources and to double the energy efficiency of buildings in the state by 2030; and |

• | impose state goals of reducing emissions of methane and fluorocarbon gases by 40% and black carbon by 50% below 2013 levels by 2030. |

14

The EPA and the California Air Resources Board (CARB) have also expanded direct regulation of methane as a contributor to greenhouse gas emissions. In 2016, the EPA adopted regulations to require additional emission controls for methane, volatile organic compounds and certain other substances for new or modified oil and natural gas facilities. Although the EPA proposed in June 2017 to stay its 2016 methane requirements for two years and revisit their implementation, CARB has adopted more stringent regulations to require monitoring, leak detection, repair and reporting of methane emissions from both existing and new oil and gas production, pipeline gathering and boosting facilities and natural gas processing plants beginning in 2018 and additional controls such as tank vapor recovery to capture methane emissions in subsequent years.

Legislation and regulation to address climate change could also increase the cost of consuming, and thereby reduce demand for, oil, natural gas and other products produced by us, and potentially lower the value of our reserves and other assets.

Regulation of Transportation, Marketing and Sale of Our Products

Our sales prices of oil, NGLs and natural gas in the U.S. are set by the market and are not presently regulated. In late 2015, the U.S. federal government lifted restrictions on the export of domestically produced oil that allows for the sale of U.S. oil production, including ours, in additional markets, which may affect the prices we realize.

Federal and state laws regulate transportation rates for, and marketing and sale of, petroleum products and electricity with respect to certain of our operations and those of certain of our customers, suppliers and counterparties. Such regulations also govern:

• | interstate and intrastate pipeline transportation rates for oil, natural gas and NGLs in regulated pipeline systems; |

• | prevention of market manipulation in the oil, natural gas, NGL and power markets; |

• | market transparency rules with respect to natural gas and power markets; |

• | the physical and futures energy commodities market, including financial derivative and hedging activity; and |

• | prevention of discrimination in natural gas gathering operations in favor of producers or sources of supply. |

The federal and state agencies overseeing these regulations have substantial rate-setting and enforcement authority, and violation of the foregoing regulations could expose us to litigation with government authorities, counterparties, special interest groups and others.

Employees

We had approximately 1,450 employees as of December 31, 2017, of whom approximately 1,070 were employed in field operations. Approximately 70 of our employees are represented by labor unions. We have not experienced any strikes or work stoppages by our employees since our formation in 2014. We also utilize the services of independent contractors to perform drilling, well work, operations, construction and other services, including construction contractors whose workforce is often represented by labor unions.

15

Spin-Off and Reverse Stock Split

We were incorporated in Delaware as a wholly owned subsidiary of Occidental on April 23, 2014, and remained a wholly owned subsidiary of Occidental until November 30, 2014 when Occidental distributed shares of our common stock on a pro-rata basis to Occidental stockholders (the Spin-off). On December 1, 2014, we became an independent, publicly traded company. Occidental initially retained approximately 18.5% of our outstanding shares of common stock, which were distributed to its stockholders on March 24, 2016. All references to ‘‘Occidental’’ refer to Occidental Petroleum Corporation, our former parent, and its subsidiaries.

On May 31, 2016 we completed a reverse stock split using a ratio of one share of common stock for every ten shares then outstanding. Share and per share amounts included in this report have been restated to reflect this reverse stock split.

Available Information

We make the following information available free of charge on our website at www.crc.com:

• | Forms 10-K, 10-Q, 8-K and amendments to these forms as soon as reasonably practicable after they are electronically filed with, or furnished to, the Securities and Exchange Commission (SEC); |

• | Other SEC filings including Forms 3, 4 and 5; |

• | Corporate governance information, including our corporate governance guidelines, board-committee charters and code of business conduct (see Item 10 – Directors, Executive Officers and Corporate Governance for further information); and |

• | Other important additional information, including GAAP to non-GAAP reconciliations. |

Information contained on our website is not part of this report.

ITEM 1A | RISK FACTORS |

RISK FACTORS

We are subject to certain risks and hazards due to the nature of our business activities. The risks discussed below, any of which could materially and adversely affect our business, financial condition, cash flows and results of operations, are not the only risks we face. We may experience additional risks and uncertainties not currently known to us or, as a result of developments occurring in the future, conditions that we currently deem to be immaterial may ultimately materially and adversely affect our business, financial condition, cash flows and results of operations.

Commodity pricing can fluctuate widely and strongly affects our results of operations, financial condition, cash flow and ability to invest in our assets.

Our results of operations, financial condition, cash flow and ability to invest in our assets are highly dependent on commodity prices. Compared to early to mid-2014, global energy commodity prices have declined significantly. We are particularly dependent on Brent crude prices that have declined from over $110 per barrel in June 2014 to below $30 per barrel in January 2016. Brent prices have improved since early 2016 and averaged $54.82 in 2017. However, such improvements may not continue or may be reversed. Continued low prices for our products or further price decreases could have several adverse effects including:

• | reduced cash flow and decreased funds available for capital investments, interest payments and operational expenses; |

• | reduced proved oil and gas reserves over time and related cash flows; |

• | impairments of our oil and gas properties; |

• | reduced borrowing base capacity under our 2014 Revolving Credit Facility as proved oil and gas reserves values fall; |

• | the potential for a reduction of our liquidity, mandatory loan repayments and default and foreclosure by our banks and bondholders against our secured assets; |

• | forced monetization events and potential issues under our JV arrangements; |

• | inability to attract counterparties to our transactions, including hedging transactions; and |

• | inability to access funds through the capital markets and the price we could obtain for, or the ability to conduct, asset sales or other monetization transactions. |

16

Commodity pricing can fluctuate widely and is affected by a variety of factors, including changes in consumption patterns; inventory levels; global and local economic conditions; the actions of OPEC and other significant producers and governments; actual or threatened production, refining and processing disruptions; worldwide drilling and exploration activities; the effects of conservation; weather, geophysical and technical limitations; currency exchange rates; technological advances; transportation and storage capacity, bottlenecks and costs in producing areas; alternative energy sources; regional market conditions; other matters affecting the supply and demand dynamics for our products; and the effect of changes in these variables on market perceptions. These and other factors make it impossible to predict realized prices reliably. While our hedging activities provide some downside protection for a significant portion of our 2018 production, they may not adequately protect us from commodity price reductions and we may be unable to enter into acceptable additional hedges.

Our lenders require us to comply with covenants and can limit our borrowing capabilities, which may materially limit our ability to use or access capital and our business activities.

Our ability to borrow funds under our 2014 Revolving Credit Facility is limited by our borrowing base, the size of our lenders' commitments, our ability to comply with covenants and a minimum monthly liquidity requirement of $150 million. Currently, the lenders' aggregate commitment under our 2014 Revolving Credit Facility is $1 billion, and we had approximately $850 million in availability, before taking into account the minimum liquidity requirement. We may need to draw on our 2014 Revolving Credit Facility for a portion of our future capital or operating needs.

The financial covenants that we must satisfy under our 2014 Revolving Credit Facility include a monthly minimum liquidity test and quarterly first-out leverage, interest expense coverage and first-lien asset coverage ratios. The 2014 Revolving Credit Facility also restricts our ability to monetize assets and issue or purchase debt. Our borrowing base under our 2014 Revolving Credit Facility is redetermined each May 1 and November 1. The borrowing base is determined with reference to a number of factors, including commodity prices and reserves. Restrictions under our 2014 Revolving Credit Facility are further described in Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Credit Agreements.

If we were to breach any of the covenants under our 2014 Revolving Credit Facility, our lenders would be permitted to accelerate the principal amount due under the 2014 Revolving Credit Facility and foreclose against the assets securing them. If payment were accelerated, or we failed to make certain payments, under our 2014 Revolving Credit Facility, it would result in a default under our 2016 and 2017 Credit Agreements and outstanding notes and permit acceleration and foreclosure against the assets securing the 2016 and 2017 Credit Agreements and the Second Lien Notes.

Low commodity prices, coupled with substantial interest payments, could constrain our liquidity. A significant reduction in our liquidity may force us to take actions that could have significant adverse effects.

The primary source of liquidity and resources to fund our capital program and other obligations is cash flow from operations and borrowings under our 2014 Revolving Credit Facility. As noted above, our borrowing capacity is limited.

Further price declines would reduce our cash flows from operations and may limit our access to borrowing capacity or cause a default under our financing agreements. Under these conditions, if we were unable to achieve improved liquidity through additional financing, asset monetizations, restructuring of our debt obligations, equity issuances or otherwise, cash flow from operations and expected available credit capacity could be insufficient to meet our commitments. Successfully completing these actions could have significant adverse effects such as higher operating and financing costs, loss of certain tax benefits or dilution of equity. Past refinancing activities have resulted in increases in our annual interest expense and future refinancing activities may have the same effect.

17

We have significant indebtedness that could make us more vulnerable in economic downturns.

As of December 31, 2017, we had long-term consolidated indebtedness of $5.3 billion. Our financing agreements permit us to incur significant additional indebtedness as well as certain other obligations. We may seek amendments or waivers to the extent we need to incur indebtedness above amounts currently permitted by our financing agreements.

Certain of our outstanding indebtedness bears interest at variable rates and a rise in interest rates will increase our interest expense to the extent we do not purchase interest-rate hedges.

Our level of indebtedness may have several important consequences, including:

• | jeopardizing our ability to execute our business plans; |

• | increasing our vulnerability to adverse changes in our business and in economic and industry conditions; |

• | putting us at a disadvantage against competitors that have lower fixed obligations and more cash flow to devote to their businesses; |

• | limiting our ability to obtain favorable financing for working capital, capital investments and general corporate and other purposes; and |

• | limiting our flexibility to operate our business, compete for capital, react to competitive pressures, and engage in certain transactions that might otherwise be beneficial to us. |

Subject to certain exceptions, our financing agreements limit:

• | incurring additional indebtedness; |

• | repaying junior indebtedness, including our Second Lien Notes and Senior Notes; |

• | making investments; |

• | entering into JVs; |

• | paying dividends and other restricted payments; |

• | creating liens on our assets; |

• | selling assets; |

• | using the proceeds of asset sales for certain purposes; |

• | entering into mergers or acquisitions; and |

• | releasing collateral. |

These limitations are further described in Item 7 – Management's Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources – Credit Agreement; Second Lien Notes; Senior Notes and the documents governing our indebtedness that are filed with the Securities and Exchange Commission (SEC).

Our ability to meet our debt obligations and other financial needs will depend on our future performance, which is influenced by market, financial, business, economic, regulatory and other factors. If our cash flow is not sufficient to service our debt, we may be required to refinance debt, sell assets or issue additional equity on terms that may be unattractive, if it can be done at all. Further, our failure to comply with the financial and other restrictive covenants relating to our indebtedness could result in a default. Any of these factors could result in a material adverse effect on our business, financial condition, cash flows or results of operations and a default on our indebtedness could result in acceleration of all of our debt and foreclosure against assets constituting collateral for our secured credit facilities and secured notes.

Our business requires substantial capital investments, which may include acquisitions. We may be unable to fund these investments through operating cash flow or obtain any needed additional capital on satisfactory terms or at all, which could lead to a decline in our oil and gas reserves or production. Our capital investment program is also susceptible to risks that could materially affect its implementation.

The oil and gas industry is capital intensive. We make and expect to increase capital investments for the development and exploration of oil and gas reserves. Our ability to deploy capital as planned depends on a number of variables, including:

•commodity prices;

•regulatory and third-party approvals;

18

•our ability to timely drill, complete and stimulate wells;

•the availability of, and our ability to compete for, capital, equipment, services and personnel; and

•the availability of external sources of financing, including from JVs.

Future capital availability may be reduced by (i) our lenders, (ii) our JV partners, (iii) capital markets constraints, (iv) activist funds or investors or (v) poor stock price performance. Because of these and other potential variables, we may be unable to deploy capital in the manner planned, which may negatively impact our production decline and constrain our development or acquisition activities.

Unless we make sufficient capital investments and conduct successful development and exploration activities or acquire properties containing proved reserves, our proved reserves will decline as those reserves are produced. Our ability to make the necessary long-term capital investments or acquisitions needed to maintain or expand our reserves may be impaired to the extent cash flow from operations or external sources of capital are insufficient. We may not be successful in developing, exploring for or acquiring additional reserves. Over the long term, a continuing decline in our production and reserves would reduce our liquidity and ability to satisfy our debt obligations by reducing our cash flow from operations and the value of our assets.

Estimates of proved reserves and related future net cash flows are not precise. The actual quantities of our proved reserves and future net cash flows may prove to be lower than estimated.

Many uncertainties exist in estimating quantities of proved reserves and related future net cash flows. Our estimates are based on various assumptions, which may ultimately prove to be inaccurate.

Generally, lower prices adversely affect the quantity of our reserves as those reserves expected to be produced in later years, which tend to be costlier on a per unit basis, become uneconomic. In addition, a portion of our proved undeveloped reserves may no longer meet the economic producibility criteria under the applicable rules or may be removed due to a lower amount of capital available to develop these projects within the SEC-mandated five-year limit.

In addition, our reserves information represents estimates prepared by internal engineers. Although over 80% of our 2017 proved reserve estimates were audited by our independent petroleum engineers, Ryder Scott Company, L.P., we cannot guarantee that the estimates are accurate. Reserves estimation is a partially subjective process of estimating accumulations of oil and natural gas. Estimates of economically recoverable oil and natural gas reserves and of future net cash flows from those reserves depend upon a number of variables and assumptions, including:

• | historical production from the area compared with production from similar areas; |

• | the quality, quantity and interpretation of available relevant data; |

• | commodity prices; |

• | production and operating costs; |

• | ad valorem, excise and income taxes; |

• | development costs; |

• | the effects of government regulations; and |

• | future workover and asset retirement costs. |

Changes in these variables and assumptions could require us to make significant negative reserves revisions, which could affect our liquidity by reducing the borrowing base under our 2014 Revolving Credit Facility. In addition, factors such as the availability of capital, geology, government regulations and permits, the effectiveness of development plans and other factors could affect the source or quantity of future reserves additions.

Risks related to our acquisition and disposition activities could adversely impact our financial condition and results of operations.