Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Taylor Morrison Home Corp | tmhc-123117xex322q4.htm |

| EX-32.1 - EXHIBIT 32.1 - Taylor Morrison Home Corp | tmhc-123117xex321q4.htm |

| EX-31.2 - EXHIBIT 31.2 - Taylor Morrison Home Corp | tmhc-123117xex312q4.htm |

| EX-31.1 - EXHIBIT 31.1 - Taylor Morrison Home Corp | tmhc-123117xex311q4.htm |

| EX-23.1 - EXHIBIT 23.1 - Taylor Morrison Home Corp | tmhc-123117xex231q4.htm |

| EX-21.1 - EXHIBIT 21.1 - Taylor Morrison Home Corp | tmhc-123117xex211q4.htm |

| 10-K - 10-K - Taylor Morrison Home Corp | tmhc-123117x10k.htm |

EXECUTION VERSION

[[3679594v16]]

AMENDMENT NO. 5 dated as of January 26, 2018 (this

“Amendment”), to the SECOND AMENDED AND RESTATED

CREDIT AGREEMENT dated as of July 13, 2011 (as amended,

supplemented or otherwise modified prior to the date hereof, the

“Credit Agreement”), among TAYLOR MORRISON

COMMUNITIES, INC., a Delaware corporation (the “U.S.

Borrower”), TMM HOLDINGS LIMITED PARTNERSHIP, a

British Columbia limited partnership (“Holdings”), TAYLOR

MORRISON HOLDINGS II, INC. (f/k/a MONARCH

COMMUNITIES INC., and the surviving corporation of the

amalgamation with Taylor Morrison Communities II, Inc.), a

company continued under the laws of the province of British

Columbia (“Canada Holdings”), TAYLOR MORRISON

HOLDINGS, INC., a Delaware corporation (“U.S. Holdings”),

TAYLOR MORRISON FINANCE, INC., a Delaware corporation

(“U.S. FinCo”), each lender from time to time party thereto (each

individually referred to therein as a “Lender” and collectively as

“Lenders”) and CREDIT SUISSE AG, as administrative agent for

the Lenders (in such capacity, the “Administrative Agent”).

A. Holdings has requested that the Credit Agreement be amended as set forth

herein.

B. The Lenders are willing to so amend the Credit Agreement on the terms and

subject to the conditions set forth herein.

Accordingly, in consideration of the mutual agreements herein contained and

other good and valuable consideration, the sufficiency and receipt of which are hereby

acknowledged, the parties hereto agree as follows:

SECTION 1. Defined Terms. Capitalized terms used and not defined herein shall

have the meanings assigned to such terms in the Credit Agreement. The rules of

interpretation set forth in Section 1.2A of the Credit Agreement are hereby incorporated

by reference herein, mutatis mutandis.

SECTION 2. Assignments. (a) Effective as of the Amendment Effective Date

(as defined below), each of the lenders listed on Exhibit A hereto under the captions

“Departing Lenders” (the “Departing Lenders”), “Continuing Lenders” (the “Continuing

Lenders”) and “Additional Lenders” (the “Additional Lenders”) shall sell, assign and

transfer, or purchase and assume, as the case may be, such interests in (i) the

Commitments and (ii) the participations in the Letters of Credit outstanding as of the

Amendment Effective Date (the “Existing Letters of Credit”), in each case as shall be

necessary in order that, after giving effect to all such assignments and purchases, the

Commitments and the participations in the Existing Letters of Credit will be held by the

Continuing Lenders and Additional Lenders ratably in accordance with their

Commitments as set forth in Schedule 2.1 of the Credit Agreement, as amended by this

2

[[3679594v16]]

Amendment. Each Lender purchasing interests of any type under this Section 2 shall be

deemed to have purchased such interests from each Departing Lender and Continuing

Lender selling interests of such type ratably in accordance with the amounts of such

interests sold by them. The assignments and purchases provided for in this Section 2

shall be without recourse, warranty or representation, except that each assigning Lender

shall be deemed to have represented that it is the legal and beneficial owner of the

interests assigned by it and that such interests are free and clear of any adverse claim.

(b) Each of the parties hereto hereby consents to the assignments and

purchases provided for in paragraph (a) above and agrees that (i) each Additional

Lender and each Continuing Lender that is purchasing interests in the

Commitments and the Existing Letters of Credit pursuant to paragraph (a) above

are Eligible Assignees permitted under Section 10.1 of the Credit Agreement, (ii)

each Additional Lender shall become a “Lender” for all purposes of the Credit

Agreement and the other Loan Documents, in accordance with the terms thereof

and (iii) each Additional Lender and each Continuing Lender shall have all the

rights and obligations of a Lender under the Credit Agreement with respect to the

interests purchased by it pursuant to such paragraphs, in accordance with the

terms thereof.

SECTION 3. Commitments. Effective as of the Amendment Effective Date, (i)

the Commitment of each Departing Lender shall terminate, (ii) the Commitment of each

Continuing Lender and each Additional Lender shall be as set forth in Schedule 2.1 of the

Credit Agreement, as amended by this Amendment, and (iii) each Departing Lender shall

cease to be a party to the Credit Agreement and shall be released from all further

obligations thereunder, in each case under this clause (iii) in accordance with terms of the

Credit Agreement, including such terms with respect to continuing benefits under

Sections 2.7 and 10.2 of the Credit Agreement which the Departing Lenders are entitled

to.

SECTION 4. Amendments. Effective as of the Amendment Effective Date, the

Credit Agreement is hereby amended as follows:

(a) Section 1.1 of the Credit Agreement is hereby amended by

inserting the following new defined terms in the appropriate alphabetical order

therein:

“Amendment No. 5” means Amendment No. 5 dated as of January 26,

2018 to this Agreement.

“Amendment No. 5 Effective Date” has the meaning assigned to the term

“Amendment Effective Date” in Amendment No. 5.

“Bail-In Action” means the exercise of any Write-Down and Conversion

Powers by the applicable EEA Resolution Authority in respect of any

liability of an EEA Financial Institution.

3

[[3679594v16]]

“Bail-In Legislation” means, with respect to any EEA Member Country

implementing Article 55 of Directive 2014/59/EU of the European

Parliament and of the Council of the European Union, the implementing

law for such EEA Member Country from time to time which is described

in the EU Bail-In Legislation Schedule.

“EEA Financial Institution” means (a) any credit institution or

investment firm established in any EEA Member Country which is subject

to the supervision of an EEA Resolution Authority, (b) any entity

established in an EEA Member Country which is a parent of an institution

described in clause (a) of this definition or (c) any financial institution

established in an EEA Member Country which is a subsidiary of an

institution defined in clause (a) or (b) of this definition and is subject to

consolidated supervision with its parent.

“EEA Member Country” means (a) any of the member states of the

European Union, (b) Iceland, (c) Liechtenstein and (d) Norway.

“EEA Resolution Authority” means any public administrative authority

or any Person entrusted with public administrative authority of any EEA

Member Country (including any delegee) having responsibility for the

resolution of any EEA Financial Institution.

“EU Bail-In Legislation Schedule” means the EU Bail-In Legislation

Schedule published by the Loan Market Association (or any successor

Person), as in effect from time to time.

“Interpolated Rate” means, at any time, the rate per annum determined

by the Administrative Agent (which determination shall be conclusive and

binding absent manifest error) to be equal to the rate that results from

interpolating on a linear basis between: (a) the Screen Rate for the longest

period (for which that Screen Rate is available in Dollars) that is shorter

than the Impacted Interest Period and (b) the Screen Rate for the shortest

period (for which the Screen Rate is available in Dollars) that exceeds the

Impacted Interest Period, in each case, at such time; provided that if the

Interpolated Rate shall be less than 0.00%, such rate shall be deemed to be

0.00% for purposes of this Agreement.

“Write-Down and Conversion Powers” means, with respect to any EEA

Resolution Authority, the write-down and conversion powers of such EEA

Resolution Authority from time to time under the Bail-In Legislation for

the applicable EEA Member Country, which write-down and conversion

powers are described in the EU Bail-In Legislation Schedule.

(b) The definition of the term “Canadian Dollar Letter of Credit” in

Section 1.1 of the Credit Agreement is hereby amended and restated in its entirety

as follows:

4

[[3679594v16]]

“Canadian Dollar Letter of Credit” means any Letter of Credit

denominated in Canadian Dollars. Notwithstanding the foregoing, from

and after the Amendment No. 5 Effective Date, no Canadian Dollar

Letters of Credit may be requested or issued under this Agreement.

(c) The definition of the term “Canadian Loan” in Section 1.1 of the

Credit Agreement is hereby amended and restated in its entirety as follows:

“Canadian Loan” means any Loan denominated in Canadian Dollars.

Notwithstanding the foregoing, from and after the Amendment No. 5

Effective Date, no Canadian Loans may be requested or made under this

Agreement.

(d) The definition of the term “Canadian Sublimit” in Section 1.1 of

the Credit Agreement is hereby amended and restated in its entirety as follows:

“Canadian Sublimit” means $0.

(e) The definition of the term “Commitment Termination Date” in

Section 1.1 of the Credit Agreement is hereby amended by deleting therefrom the

words “April 12, 2019” and substituting therefor the words “January 26, 2022”.

(f) The definition of the term “Eurodollar Base Rate” in Section 1.1 of

the Credit Agreement is hereby amended and restated in its entirety as follows:

“Eurodollar Base Rate” shall mean, with respect to any borrowing of

Eurodollar Rate Loans for any Interest Period, the rate per annum

determined by the Administrative Agent at approximately 11:00 a.m.,

London time, on the date which is two Business Days prior to the

beginning of such Interest Period by reference to the ICE Benchmark

Administration Interest Settlement Rates for deposits in Dollars (as

published by any service selected by the Administrative Agent which has

been nominated by the ICE Benchmark Administration Limited (or its

successor) as an authorized information vendor for the purpose of

displaying such rates, in each case, the “Screen Rate”) for a period equal

to such Interest Period; provided that, if such rate is not available at such

time for such Interest Period (an “Impacted Interest Period”) for any

reason, the “Eurodollar Base Rate” shall be the Interpolated Rate;

provided further that, to the extent that an interest rate is not ascertainable

pursuant to the foregoing provisions of this definition for any Interest

Period, then the “Eurodollar Base Rate” shall mean (x) such other

interbank rate with respect to such Interest Period set forth by any

authorized service selected by the Administrative Agent that reflects an

alternative index rate widely recognized in the U.S. syndicated loan

market as the successor to the ICE Benchmark Administration Interest

Settlement Rates for deposits in Dollars or (y) if there is no such

authorized service with respect to an alternative index rate widely

5

[[3679594v16]]

recognized as the successor to the ICE Benchmark Administration Interest

Settlement Rates for deposits in Dollars, such other index rate as may be

agreed to by the Administrative Agent and Borrower with the consent of

the Requisite Lenders; provided further that the Eurodollar Base Rate with

respect to any Loans shall be deemed to be not less than 0.00% per annum.

(g) The definition of the term “Initial Yield” in Section 1.1 of the

Credit Agreement is hereby amended by deleting therefrom the words “(i) any

“Facility Fee Rate” applicable on the date of the calculation and (ii)”.

(h) The definition of the term “Lender Default” in Section 1.1 of the

Credit Agreement is hereby amended by inserting immediately after the words

“any such proceeding or appointment” in clause (d) thereof the words “or

becomes the subject of a Bail-In Action”.

(i) The definition of the term “Letter of Credit Commitment” is

hereby amended and restated in its entirety as follows:

“Letter of Credit Commitment” means, with respect to each Issuing

Bank, the commitment of such Issuing Bank to issue Letters of Credit

hereunder as set forth on Schedule 3.1. The aggregate Letter of Credit

Commitments of all Issuing Banks on the Amendment No. 5 Effective

Date is $160,000,000.

(j) The definition of the term “Revolving Loan Yield” in Section 1.1

of the Credit Agreement is hereby amended by deleting the parenthetical “(as

increased by the Facility Fee Rate applicable on such date)” from clause (i)

thereof.

(k) Section 2.3A of the Credit Agreement is hereby amended and

restated in its entirety as follows:

A. Facility Fees. The Borrower agrees to pay to the Administrative

Agent, for distribution to each Lender in proportion to that Lender’s

Pro Rata Share of the Commitments, facility fees (the “Facility Fees”)

for the period from and including the Amendment No. 5 Effective

Date to and excluding the Commitment Termination Date equal to (i)

the actual daily amount of the unused aggregate Commitments (i.e.,

the aggregate Commitments minus the Total Utilization of

Commitments) multiplied by (ii) a rate per annum equal to the Facility

Fee Rate at such time. In addition, the Facility Fees accrued with

respect to the Commitment of a Defaulting Lender during the period

prior to the time such Lender became a Defaulting Lender and unpaid

at such time shall not be payable by the Borrower so long as such

Lender shall be a Defaulting Lender except to the extent that the

Facility Fees shall otherwise have been due and payable by the

Borrower prior to such time; provided, that no Facility Fees shall

6

[[3679594v16]]

accrue on the Commitment of a Defaulting Lender so long as such

Lender shall be a Defaulting Lender. The Facility Fees shall be

payable in arrears on the last Business Day in each of March, June,

September and December of each year, commencing on March 31,

2018, and ending on the Commitment Termination Date, and shall be

calculated based on the actual number of days elapsed over a 360-day

year.

(l) Section 3.2 of the Credit Agreement is hereby amended by

inserting the following phrase at the end of the second sentence:

; provided that, subject to Section 3.6B, no Defaulting Lender shall

be entitled to receive Letter of Credit fees pursuant to clause (i)(b)

of this Section 3.2 for any period during which that Lender is a

Defaulting Lender except to the extent allocable to its Pro Rata

Share of the stated amount of Letters of Credit for which it has

provided Cash Collateral.

(m) Section 3.6B of the Credit Agreement is hereby amended by

inserting at the end thereof the following:

With respect to any Letter of Credit fee not required to be paid to

any Defaulting Lender pursuant to Section 3.2, the U.S. Borrower

shall (x) pay to each Lender that portion of any such fee with

respect to participation in Letters of Credit that has been

reallocated to such Lender pursuant to this Section and (y) without

duplication of clause (x) above, pay to each Issuing Bank the

amount of any such fee otherwise payable to such Defaulting

Lender to the extent allocable to such Issuing Bank’s Fronting

Exposure to such Defaulting Lender (subject to decreases in such

Fronting Exposure pursuant to the terms hereof, including Section

3.6A and 3.6C).

(n) Section 5.15 of the Credit Agreement is hereby amended and

restated as follows:

5.15 Anti-Corruption Laws; Sanctions.

A. Anti-Corruption Laws. Holdings, U.S. Holdings, Canada

Holdings, Canada Intermediate Holdings, U.S. FinCo, the U.S.

Borrower, and each of their respective Subsidiaries and, to the

Knowledge of Holdings and the Borrower, any director, officer,

agent or employee of Holdings, U.S. Holdings, Canada Holdings,

Canada Intermediate Holdings, U.S. FinCo, the Borrower or any of

their respective Subsidiaries are in compliance with all applicable

sanctions administered or enforced by the U.S. Department of the

Treasury’s Office of Foreign Assets Control (“OFAC”), the U.S.

7

[[3679594v16]]

Department of State, the United Nations Security Council, the

European Union or Her Majesty’s Treasury (“Sanctions”) and with

the Foreign Corrupt Practices Act of 1977, as amended, and the

rules and regulations thereunder (the “FCPA”) and any other

applicable anti-corruption law, in all material respects. Holdings,

U.S. Holdings, Canada Holdings, Canada Intermediate Holdings,

U.S. FinCo, the Borrower, and each of their respective Subsidiaries

have instituted and maintain policies and procedures designed to

ensure continued compliance with applicable Sanctions, the FCPA

and any other applicable anti-corruption laws.

(b) None of Holdings, U.S. Holdings, Canada Holdings, Canada

Intermediate Holdings, U.S. FinCo, the Borrower or any of their

respective Subsidiaries nor, to the Knowledge of Holdings or the U.S.

Borrower, any director, officer, agent or employee of Holdings, U.S.

Holdings, Canada Holdings, Canada Intermediate Holdings, U.S. FinCo,

the Borrower or any of their respective Subsidiaries is currently (i) the

target of any U.S. sanctions administered by the Office of Foreign Assets

Control of the U.S. Treasury Department or (ii) located, organized or

resident in a country or territory that is, or whose government is, the target

of comprehensive Sanctions.

(c) The Borrower will not, directly or indirectly, use the proceeds of

the Loans or use the Letters of Credit, or lend, contribute or otherwise

make available such proceeds to any subsidiary, joint venture partner or

other Person, (i) in furtherance of an offer, payment, promise to pay, or

authorization of the payment or giving of money, or anything else of

value, to any Person in violation of the FCPA or any other applicable anti-

corruption law, or (ii) (A) to fund any activities or business of or with any

Person, or in any country or territory, that, at the time of such funding, is,

or whose government is, the target of Sanctions, or (B) in any other

manner that would result in a violation of Sanctions by any Person

(including any Person participating in the Loans or Letters of Credit,

whether as Administrative Agent, Arranger, Issuing Bank, Lender,

underwriter, advisor, investor, or otherwise).

(o) Section 6.9 of the Credit Agreement is hereby amended by

inserting immediately after the words “or any entity that becomes a Restricted

Subsidiary” in clause (a) thereof the words “or a Loan Party”.

(p) Clause (a)(i) to the proviso to Section 7.6A of the Credit

Agreement is hereby amended by inserting immediately after the words “or any

territory thereof” the words “and, at least five Business Days prior to such merger,

amalgamation or consolidation, the Administrative Agent and the Lenders shall

have received all documentation and other information required by regulatory

authorities under applicable “know your customer” and anti-money laundering

rules and regulations”.

8

[[3679594v16]]

(q) Section 7.6A of the Credit Agreement is hereby amended by

amending and restating clause (iii) thereof in its entirety as follows:

“Canada Holdings may sell, lease, transfer or otherwise dispose of any or

all of its assets (upon voluntary liquidation or otherwise) to Holdings, U.S.

Holdings or any one or more Subsidiaries of U.S. Holdings;”.

(r) Section 7.6A of the Credit Agreement is hereby amended by

inserting immediately after the words “or any one or more Subsidiaries of Canada

Holdings” in clause (iv) thereof the words “and Canada Holdings may be merged,

amalgamated or consolidated with or into Holdings, U.S. Holdings or any one or

more Subsidiaries of U.S. Holdings”.

(s) Section 10.25A of the Credit Agreement is hereby amended by

inserting immediately after the words “that the Administrative Agent” in the first

sentence thereof the words “and the Lenders”.

(t) A new Section 10.27 of the Credit Agreement is hereby added to

read as follows:

10.27 Acknowledgment and Consent to Bail-In of EEA Financial

Institutions.

Notwithstanding anything to the contrary in any Loan Document or in any

other agreement, arrangement or understanding among the parties hereto,

each party hereto acknowledges that any liability of any EEA Financial

Institution arising under any Loan Document to the extent such liability is

unsecured, may be subject to the Write-Down and Conversion Powers of

any EEA Resolution Authority and agrees and consents to, and

acknowledges and agrees to be bound by:

(i) the application of any Write-Down and Conversion Powers by an EEA

Resolution Authority to any such liabilities arising hereunder which may

be payable to it by any party hereto that is an EEA Financial Institution;

and

(ii) the effects of any Bail-In Action on any such liability, including, if

applicable, (a) a reduction in full or in part or cancellation of any such

liability, (b) a conversion of all, or a portion of, such liability into shares

or other instruments of ownership in such EEA Financial Institution, its

parent entity or a bridge institution that may be issued to it or otherwise

conferred on it, and that such shares or other instruments of ownership

will be accepted by it in lieu of any rights with respect to any such liability

under this Agreement or any other Loan Document or (c) the variation of

the terms of such liability in connection with the exercise of the Write-

Down and Conversion Powers of any EEA Resolution Authority.

9

[[3679594v16]]

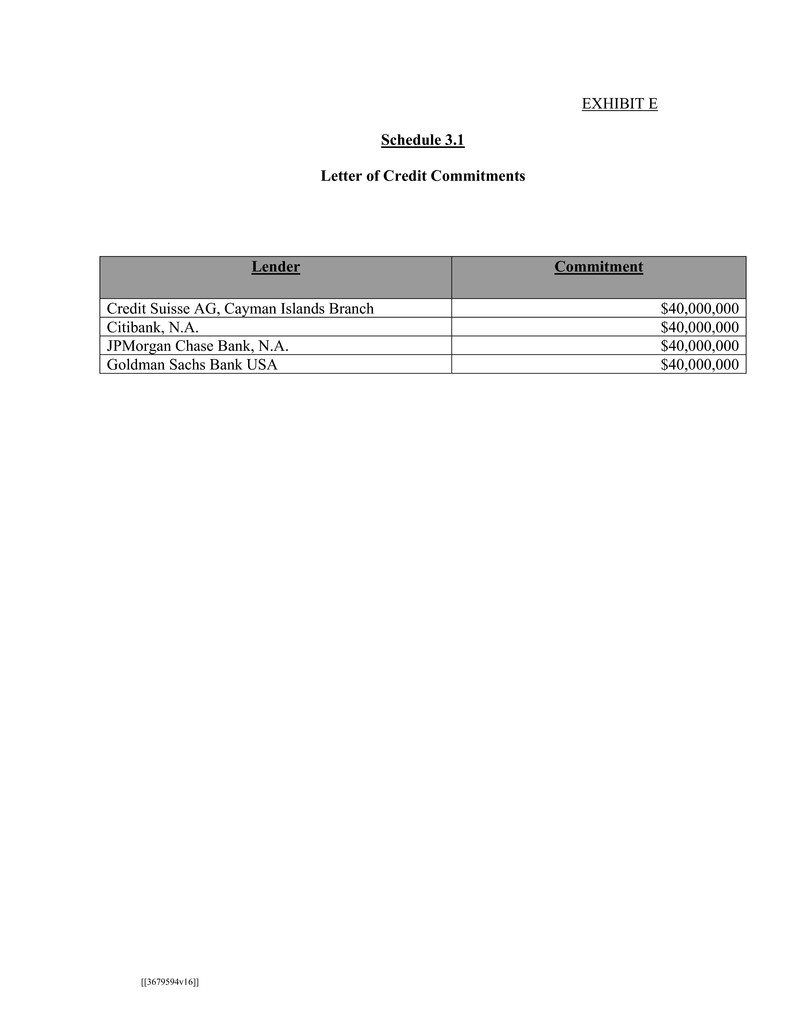

(u) Schedule 2.1 of the Credit Agreement is hereby amended and

restated in its entirety with Schedule 2.1 attached as Exhibit B to this

Amendment.

(v) Schedule 3.1 of the Credit Agreement is hereby amended and

restated in its entirety with Schedule 3.1 attached as Exhibit E to this Amendment.

SECTION 5. Representations and Warranties. To induce the other parties hereto

to enter into this Agreement, each of Holdings, U.S. Holdings, Canada Holdings, U.S.

FinCo and the U.S. Borrower, jointly and severally, hereby represents and warrants to the

Administrative Agent and each of the other parties hereto that:

(a) As of the Amendment Effective Date, each Loan Party has duly

executed and delivered and authorized this Amendment and this Amendment

constitutes the legal, valid and binding obligation of such Loan Party enforceable

in accordance with its terms, subject to the effects of bankruptcy, insolvency,

fraudulent conveyance, reorganization and other similar laws relating to or

affecting creditors’ rights generally and general principles of equity (whether

considered in a proceeding in equity or law).

(b) As of the Amendment Effective Date, (i) the representations and

warranties set forth in Section 5 of the Credit Agreement and in the other Loan

Documents are true and correct in all material respects (unless qualified as to

materiality or Material Adverse Effect, in which case such representations and

warranties shall be true and correct in all respects) on and as of the Amendment

Effective Date to the same extent as though made on and as of such date, except

(x) to the extent such representations and warranties specifically relate to an

earlier date, in which case such representations and warranties were true and

correct in all material respects (unless qualified as to materiality or Material

Adverse Effect, in which case such representations and warranties were true and

correct in all respects) on and as of such earlier date, and (y) the reference to the

Restatement Effective Date in Section 5.12 of the Credit Agreement shall, for

purposes of this Section 3(b), be deemed to refer to the Amendment Effective

Date, and (ii) no Default or Event of Default has occurred and is continuing.

SECTION 6. Fees. On the Amendment Effective Date, the Borrower shall pay to

the Administrative Agent, for the accounts of the Departing Lender(s) and the Continuing

Lenders, the fees payable pursuant to Sections 2.3 and 3.2 of the Credit Agreement which

have accrued for the period from the last date such fees were paid to but excluding the

Amendment Effective Date. The fees described in this Section 6 shall be payable in

immediately available funds. Once paid, such fees shall not be refundable under any

circumstances.

SECTION 7. Conditions to Effectiveness. The effectiveness of this Amendment

is subject to the satisfaction or waiver, on or prior to January 26, 2018, of the following

conditions precedent (the date on which all such conditions are satisfied or waived, the

“Amendment Effective Date”):

10

[[3679594v16]]

(a) The Administrative Agent (or its counsel) shall have received from

each Loan Party and each Lender either (i) a counterpart of this Agreement signed

on behalf of such parties or (ii) written evidence satisfactory to the Administrative

Agent (which may include facsimile or other electronic transmission of a signed

signature page of this Agreement) that such parties have signed a counterpart of

this Agreement.

(b) The Administrative Agent shall have received reimbursement of all

costs and expenses required to be paid by the Loan Parties in connection with the

transactions contemplated hereby.

(c) The representations and warranties set forth in Section 5 shall be

true and correct, and the Administrative Agent shall have received a certificate to

that effect dated as of the Amendment Effective Date and executed by a

Responsible Officer of Holdings.

(d) The Administrative Agent and its counsel shall have received

executed copies of favorable written opinions of Paul, Weiss, Rifkind, Wharton &

Garrison LLP, counsel for the Loan Parties, and each local counsel listed on

Exhibit C, in each case, in form and substance reasonably satisfactory to the

Administrative Agent and its counsel, dated as of the Amendment Effective Date.

(e) On or before the Amendment Effective Date, each Loan Party shall

deliver or cause to be delivered to the Administrative Agent and each of the

Lenders the following, each, unless otherwise noted, dated the Amendment

Effective Date:

(i) Certified copies of the certificate of incorporation,

organization or formation, together with a good standing certificate,

certificate of status or certificate of compliance (as applicable) from the

applicable Governmental Authority of its jurisdiction of incorporation,

organization or formation, each dated a recent date prior to the

Amendment Effective Date (or, in lieu of such certificate of incorporation,

organization or formation, a certification by a Responsible Officer that

there has been no change to such certificate of incorporation, organization

or formation since the most recent copy delivered to the Administrative

Agent, together with a good standing certificate, certificate of status or

certificate of compliance (as applicable) from the applicable

Governmental Authority of its jurisdiction of incorporation, organization

or formation dated a recent date prior to the Amendment Effective Date);

(ii) Copies of its Organizational Documents, other than such

Organizational Documents required to be delivered under clause (i) above,

certified as of the Amendment Effective Date by its corporate secretary or an

assistant secretary (or, in lieu of such Organizational Documents, a certification

by a Responsible Officer that there has been no change to such Organizational

Documents since the most recent copy delivered to the Administrative Agent);

11

[[3679594v16]]

(iii) A certification by a Responsible Officer, certified as of the

Amendment Effective Date, that board resolutions or similar authorizing

documents authorizing the execution, delivery and performance of this

Amendment have been approved by the board of directors or similar governing

body of each Loan Party and that such resolutions or documents are in full force

and effect without modification or amendment; and

(iv) An incumbency certificate of its Responsible Officers executing

this Amendment (or, in lieu of such incumbency certificate, a certification by a

Responsible Officer that there has been no change to such incumbency certificate

since the most recent copy delivered to the Administrative Agent).

(f) The Borrower shall have paid the fees required to be paid pursuant

to Section 6 hereof.

(g) The Borrower shall have paid (i) to the Administrative Agent, for

the account of each Continuing Lender, an upfront fee in an amount equal to the

sum of (A) 0.15% of the amount of such Continuing Lender’s Commitment under

the Credit Agreement as in effect immediately prior to the Amendment Effective

Date and (B) 0.35% of the amount by which such Continuing Lender’s

Commitment under the Credit Agreement as in effect on the Amendment

Effective Date, as amended by this Amendment, exceeds such Continuing

Lender’s Commitment under the Credit Agreement as in effect immediately prior

to the Amendment Effective Date and (ii) to the Administrative Agent, for the

account of each Additional Lender, an upfront fee in an amount equal to 0.35% of

the amount of such Additional Lender’s Commitment under the Credit Agreement

as in effect on the Amendment Effective Date, as amended by this Amendment.

The Administrative Agent shall notify the U.S. Borrower and the Lenders of the

Amendment Effective Date, and such notice shall be conclusive and binding.

SECTION 8. Consent and Reaffirmation. Each of the Loan Parties hereby

(i) consents to this Amendment and the transactions contemplated hereby, (ii) agrees that,

notwithstanding the effectiveness of this Amendment, the Guaranty and each of the other

Loan Documents continues to be in full force and effect, (iii) affirms and confirms its

guarantee (in the case of a Guarantor) of the Obligations pursuant to the Guaranty, all as

provided in the Loan Documents, and (iv) acknowledges and agrees that such guarantee

continues in full force and effect in respect of, the Obligations under the Credit

Agreement and the other Loan Documents. The parties hereto expressly acknowledge

that it is not their intention that this Amendment or any of the other Loan Documents

executed or delivered pursuant hereto constitute a novation of any of the obligations,

covenants or agreements contained in the Credit Agreement or any other Loan

Document, but a modification thereof pursuant to the terms contained herein.

SECTION 9. Loan Documents. This Amendment shall constitute a “Loan

Document” for all purposes of the Credit Agreement and the other Loan Documents.

12

[[3679594v16]]

SECTION 10. Counterparts. This Amendment may be executed in counterparts

(and by different parties hereto on different counterparts), each of which shall constitute

an original, but all of which when taken together shall constitute a single contract.

Delivery of an executed counterpart of a signature page of this Amendment by facsimile

or other electronic transmission shall be as effective as delivery of an original executed

counterpart of this Amendment.

SECTION 11. Governing Law. THIS AMENDMENT SHALL BE

CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF

THE STATE OF NEW YORK.

SECTION 12. Headings. Section headings used herein are for convenience of

reference only, are not part of this Amendment and shall not affect the construction of, or

be taken into consideration in interpreting, this Amendment.

SECTION 13. Tax Matters. For purposes of determining withholding Taxes

imposed under FATCA, from and after the Amendment Effective Date, the U.S.

Borrower and the Administrative Agent shall treat (and the Lenders hereby authorize the

Administrative Agent to treat) the Credit Agreement as not qualifying as a “grandfathered

obligation” within the meaning of Treasury Regulation Section 1.1471-2(b)(2)(i).

[Remainder of page intentionally left blank]

SIGNATURE PAGE TO AMENDMENT NO. 5 TO

THE TAYLOR MORRISON COMMUNITIES INC.

SECOND AMENDED AND RESTATED CREDIT

AGREEMENT DATED AS OF JULY 13, 2011, AS

AMENDED

NAME OF LENDER: MIZUHO BANK, LTD.

By: CWC~,

Na . John Davies

Title: Authorized Signatory

By:

Name:

Title

*For any Lender requiring a second signature.

[Signature Page to Amendment No. SJ

SIGNATURE PAGE TO AMENDMENT NO.S TO

THE TAYLOR MORRISON COMMUNITIES INC.

SECOND AMENDED AND RESTATED CREDIT

AGREEMENT DATED AS OF JULY 13, 2011, AS

AMENDED

NAME OF LENDER: GOLDMAN SACHS BANK USA

By:

ame: Josh Rosenthal

Title: Authorized Signatory

[Signature Page to Amendment No. S]

[[3679594v16]]

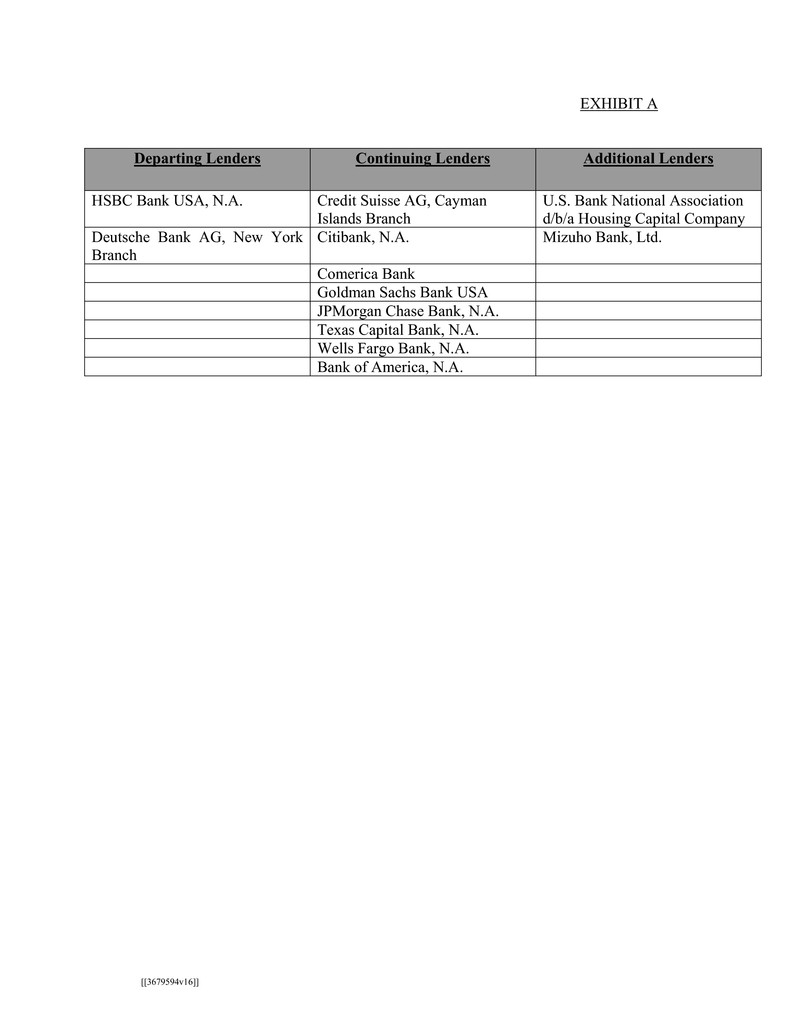

EXHIBIT A

Departing Lenders Continuing Lenders Additional Lenders

HSBC Bank USA, N.A. Credit Suisse AG, Cayman

Islands Branch

U.S. Bank National Association

d/b/a Housing Capital Company

Deutsche Bank AG, New York

Branch

Citibank, N.A. Mizuho Bank, Ltd.

Comerica Bank

Goldman Sachs Bank USA

JPMorgan Chase Bank, N.A.

Texas Capital Bank, N.A.

Wells Fargo Bank, N.A.

Bank of America, N.A.

[[3679594v16]]

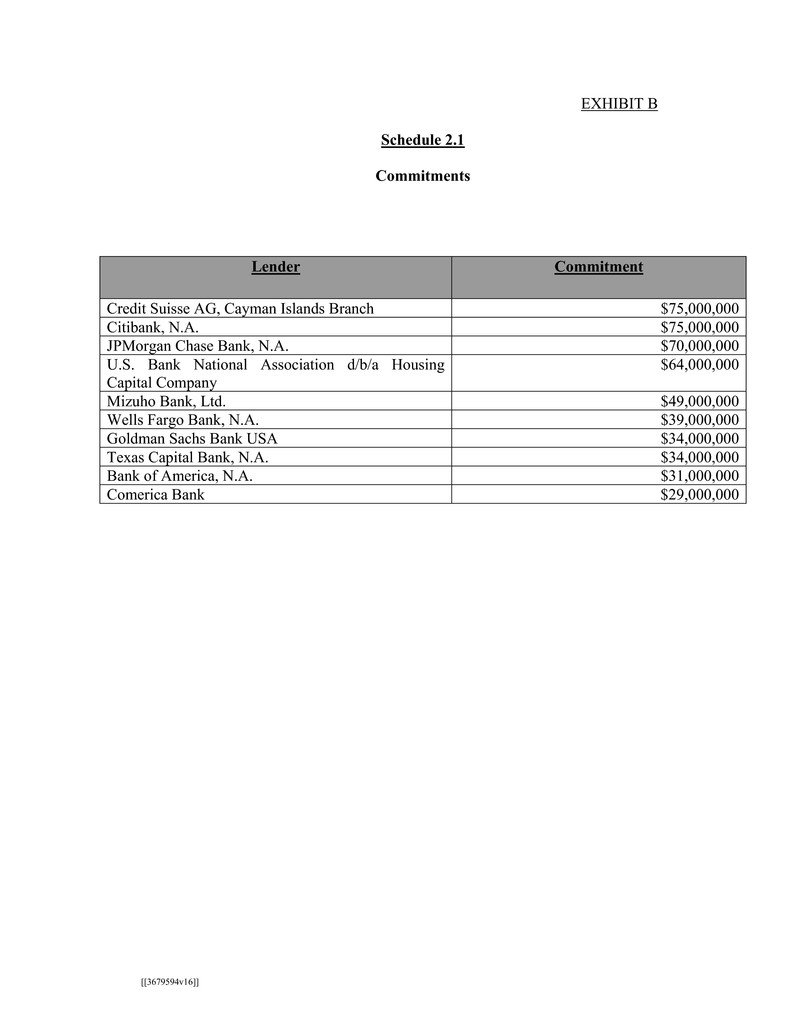

EXHIBIT B

Schedule 2.1

Commitments

Lender Commitment

Credit Suisse AG, Cayman Islands Branch $75,000,000

Citibank, N.A. $75,000,000

JPMorgan Chase Bank, N.A. $70,000,000

U.S. Bank National Association d/b/a Housing

Capital Company

$64,000,000

Mizuho Bank, Ltd. $49,000,000

Wells Fargo Bank, N.A. $39,000,000

Goldman Sachs Bank USA $34,000,000

Texas Capital Bank, N.A. $34,000,000

Bank of America, N.A. $31,000,000

Comerica Bank $29,000,000

[[3679594v16]]

EXHIBIT C

Local Counsel

1. Armbrust & Brown, PLLC, Texas counsel

2. GrayRobinson, P.A., Florida counsel

3. Holland & Hart LLP, Colorado counsel

4. Stikeman Elliot LLP, Canada counsel

5. Cox, Castle & Nicholson LLP, California counsel

6. Brier, Irish, Hubbard & Erhart, P.L.C., Arizona counsel

7. Meltzer, Purtill & Stelle LLC, Illinois counsel

8. Alexander Ricks PLLC, North Carolina counsel

9. Schreeder, Wheeler & Flint, LLP, Georgia counsel

[[3679594v16]]

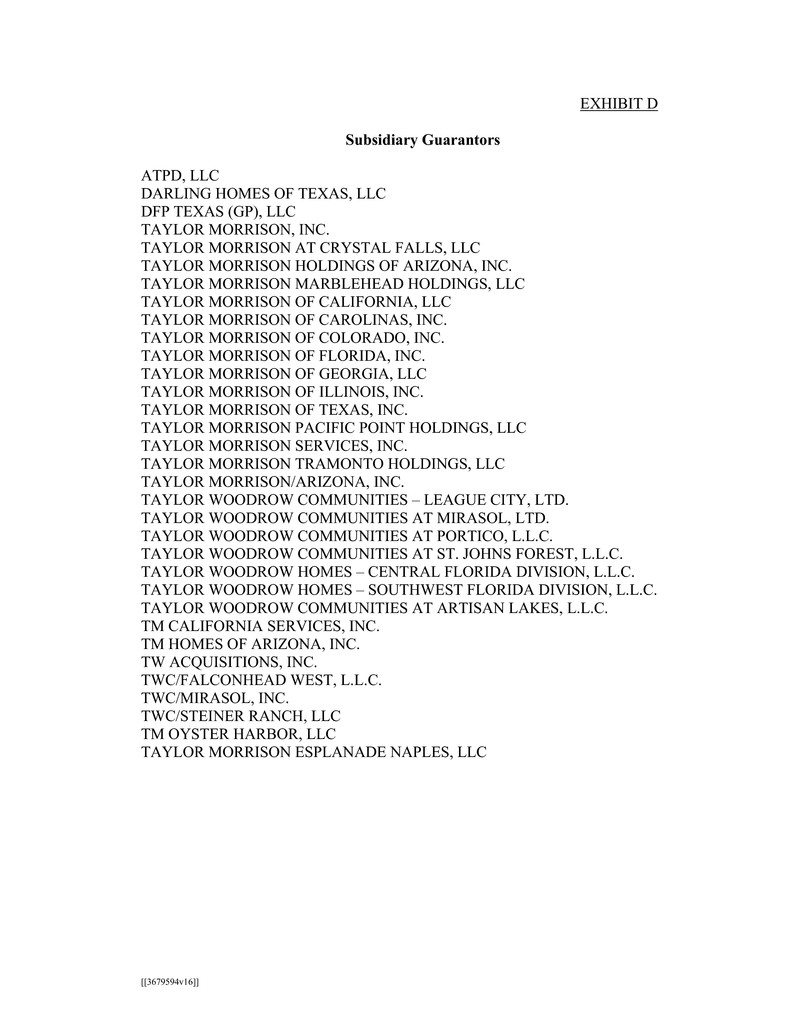

EXHIBIT D

Subsidiary Guarantors

ATPD, LLC

DARLING HOMES OF TEXAS, LLC

DFP TEXAS (GP), LLC

TAYLOR MORRISON, INC.

TAYLOR MORRISON AT CRYSTAL FALLS, LLC

TAYLOR MORRISON HOLDINGS OF ARIZONA, INC.

TAYLOR MORRISON MARBLEHEAD HOLDINGS, LLC

TAYLOR MORRISON OF CALIFORNIA, LLC

TAYLOR MORRISON OF CAROLINAS, INC.

TAYLOR MORRISON OF COLORADO, INC.

TAYLOR MORRISON OF FLORIDA, INC.

TAYLOR MORRISON OF GEORGIA, LLC

TAYLOR MORRISON OF ILLINOIS, INC.

TAYLOR MORRISON OF TEXAS, INC.

TAYLOR MORRISON PACIFIC POINT HOLDINGS, LLC

TAYLOR MORRISON SERVICES, INC.

TAYLOR MORRISON TRAMONTO HOLDINGS, LLC

TAYLOR MORRISON/ARIZONA, INC.

TAYLOR WOODROW COMMUNITIES – LEAGUE CITY, LTD.

TAYLOR WOODROW COMMUNITIES AT MIRASOL, LTD.

TAYLOR WOODROW COMMUNITIES AT PORTICO, L.L.C.

TAYLOR WOODROW COMMUNITIES AT ST. JOHNS FOREST, L.L.C.

TAYLOR WOODROW HOMES – CENTRAL FLORIDA DIVISION, L.L.C.

TAYLOR WOODROW HOMES – SOUTHWEST FLORIDA DIVISION, L.L.C.

TAYLOR WOODROW COMMUNITIES AT ARTISAN LAKES, L.L.C.

TM CALIFORNIA SERVICES, INC.

TM HOMES OF ARIZONA, INC.

TW ACQUISITIONS, INC.

TWC/FALCONHEAD WEST, L.L.C.

TWC/MIRASOL, INC.

TWC/STEINER RANCH, LLC

TM OYSTER HARBOR, LLC

TAYLOR MORRISON ESPLANADE NAPLES, LLC

[[3679594v16]]

EXHIBIT E

Schedule 3.1

Letter of Credit Commitments

Lender Commitment

Credit Suisse AG, Cayman Islands Branch $40,000,000

Citibank, N.A. $40,000,000

JPMorgan Chase Bank, N.A. $40,000,000

Goldman Sachs Bank USA $40,000,000