Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - AMERICAN WOODMARK CORP | d525787dex992.htm |

| EX-99.1 - EX-99.1 - AMERICAN WOODMARK CORP | d525787dex991.htm |

| 8-K - 8-K - AMERICAN WOODMARK CORP | d525787d8k.htm |

Exhibit 99.3

NON-GAAP FINANCIAL MEASURES

We have included certain financial measures in this offering memorandum that have not been prepared in a manner that complies with GAAP, including EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, net debt and Free Cash Flow. The presentation of this financial information is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, and other companies may define such measures differently. Please see “Summary —Summary Financial and Other Data —Summary Historical and Pro Forma Financial and Operating Information of American Woodmark” for a discussion of EBITDA, EBITDA margin, Adjusted EBITDA, Adjusted EBITDA margin, net debt and Free Cash Flow.

We provide these non-GAAP financial measures because we believe they provide greater transparency and represent supplemental information used by management in its financial and operational decision making. We believe that these non-GAAP financial measures facilitate operating performance comparisons from period to period by eliminating potential differences caused by the existence and timing of certain expense items that would not otherwise be apparent on a GAAP basis. These non-GAAP performance measures should be considered in addition to, and not as a substitute for, results prepared in accordance with GAAP. Our non-GAAP performance measures may be different from those reported by other companies, including RSI.

CERTAIN DEFINITIONS

In this offering memorandum, unless otherwise specified or the context requires otherwise:

| • | “American Woodmark”, the “Company”, “we”, “our” and “us” refer to American Woodmark Corporation and its subsidiaries and affiliates as of the date hereof. |

| • | “Note Issuance” refers to, collectively, the (i) execution and delivery of the Indenture (as defined herein) and related documents, (ii) issuance of the Notes and Guarantees offered hereby and (iii) payment of fees, costs and expenses in connection with the issuance of the Notes and Guarantees. |

| • | “Refinancing Transactions” refers to, collectively, the (i) Conditional Redemption (as defined herein), (ii) Tender Offer and Consent Solicitation (as defined herein), (iii) Make-Whole Redemption (as defined herein), (iv) repayment of the outstanding balance of loans under the Senior Secured Revolving Facility and (v) payment of fees, commissions and expenses in connection with the foregoing. |

| • | “RSI” refers to RSI Home Products, Inc. and its subsidiaries as of the closing of the RSI Acquisition. |

| • | “RSI Acquisition” refers to the merger on December 29, 2017 of Alliance Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of American Woodmark (“Acquisition Sub”), with and into RSI, with RSI continuing as a wholly-owned subsidiary of American Woodmark, pursuant to the terms of the Agreement and Plan of Merger dated as of November 30, 2017 by and among American Woodmark, RSI, Acquisition Sub and Ronald M. Simon, as the stockholder representative (together with all exhibits, attachments and schedules thereto, the “Acquisition Agreement”), and the consummation of the other transactions contemplated by the Acquisition Agreement. |

| • | “RSI Notes” refer to RSI’s existing 6 1⁄2% Senior Secured Second Lien Notes due 2023. |

| • | “RSI Notes Indenture” refers to the Indenture, dated as of March 16, 2015, by and among RSI, Wells Fargo Bank, National Association, as trustee and collateral agent, and the guarantors from time to time party thereto, pursuant to which the RSI Notes were issued, as may be amended from time to time. |

| • | “RSI Transactions” refers to, collectively, the: (i) entry by the Company into the Senior Secured Credit Facilities (including the initial borrowings thereunder and the use of the proceeds thereof), (ii) RSI Acquisition, (iii) repayment and termination of American Woodmark’s revolving credit facility available under that certain Credit Agreement, dated as of December 2, 2009 (the “2009 Revolving Facility”), by and between American Woodmark and Wells Fargo Bank, National Association (as amended, amended and restated, modified or supplemented after the date thereof), and (iv) payment of fees, commissions and expenses in connection with the foregoing. |

1

| • | “Senior Secured Credit Facilities” refers to, collectively, the $250 million initial term loan facility (the “Senior Secured Initial Term Loan”), the $250 million delayed draw term loan facility (the “Senior Secured Delayed Draw Term Loan” and, together with the Senior Secured Initial Term Loan, the “Senior Secured Term Loans”) and the $100 million revolving credit facility (the “Senior Secured Revolving Facility”) available under that certain Credit Agreement, dated as of December 29, 2017, among American Woodmark, the lenders from time to time party thereto and Wells Fargo Bank, National Association, as administrative agent. |

| • | “Transactions” refers to, collectively, the: (i) RSI Transactions, (ii) Refinancing Transactions, and (iii) Note Issuance. |

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This offering memorandum contains statements concerning our expectations, plans, objectives, future financial performance, and other statements that are not historical facts. These statements may be “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. In most cases, the reader can identify forward-looking statements by words such as “anticipate,” “estimate,” “forecast,” “expect,” “believe,” “should,” “could,” “would,” “plan,” “may,” “intend,” “prospect,” “goal,” “will,” “predict,” “potential” or other similar words. Forward-looking statements contained in this offering memorandum are based on current expectations and our actual results may differ materially from those projected in any forward-looking statements. In addition, we participate in an industry that is subject to rapidly changing conditions and there are numerous factors that could cause us to experience a decline in sales and/or earnings or deterioration in financial condition. Factors that could cause actual results to differ materially from those in forward-looking statements made in this offering memorandum include but are not limited to:

| • | the loss of or a reduction in business from one or more of our key customers; |

| • | negative developments in the U.S. housing market or general economy and the impact of such developments on our and our customers’ business, operations and access to financing; |

| • | competition from other manufacturers and the impact of such competition on pricing and promotional levels; |

| • | an inability to develop new products or respond to changing consumer preferences and purchasing practices; |

| • | a failure to effectively manage manufacturing operations, alignment and capacity or an inability to maintain the quality of our products; |

| • | the impairment of goodwill, other intangible assets or our long-lived assets; |

| • | an inability to obtain raw materials in a timely manner or fluctuations in raw material and energy costs; |

| • | information systems interruptions or intrusions or the unauthorized release of confidential information concerning customers, employees or other third parties; |

| • | the cost of compliance with, or liabilities related to, environmental or other governmental regulations or changes in governmental or industry regulatory standards, especially with respect to health and safety and the environment; |

| • | a failure to attract and retain certain members of management or other key employees or other negative labor developments, including increases in the cost of labor; |

| • | risks associated with the implementation of our growth strategy; |

| • | risks related to sourcing and selling products internationally and doing business globally; |

2

| • | unexpected costs resulting from a failure to maintain acceptable quality standards; |

| • | changes in tax laws or the interpretations of existing tax laws; |

| • | the occurrence of significant natural disasters, including earthquakes, fires, floods, and hurricanes or tropical storms; |

| • | the unavailability of adequate capital for our business to grow and compete; |

| • | increased buying power of large customers and the impact on our ability to maintain or raise prices; |

| • | the effect of the RSI Acquisition on our ability to retain customers, maintain relationships with suppliers and hire and retain key personnel; |

| • | our ability to successfully integrate RSI into our business and operations and the risk that the anticipated economic benefits, costs savings and other synergies in connection with the RSI Acquisition are not fully realized or take longer to realize than expected; and |

| • | limitations on operating our business as a result of covenant restrictions under our indebtedness, and our ability to pay amounts due under our Senior Secured Credit Facilities and the Notes offered hereby. |

Other risks that could cause actual results to differ materially from those in forward-looking statements are set forth under the heading “Risk Factors” beginning on page 19. Any forward-looking statement speaks only as of the date of this offering memorandum, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances occurring after the date on which it is made. Prospective purchasers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof.

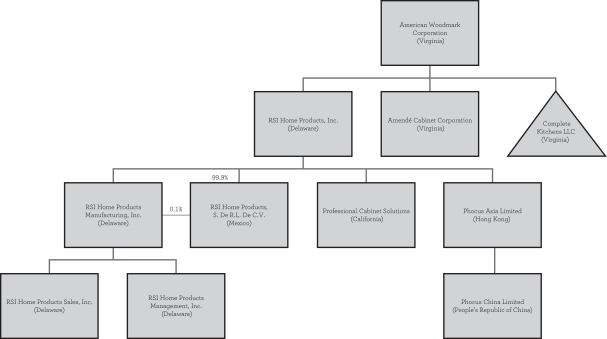

Our Organizational Structure

The following chart summarizes our current organizational structure.

3

SUMMARY FINANCIAL AND OTHER DATA

Summary Historical and Pro Forma Financial and Operating Information of American Woodmark

The following summary historical consolidated statements of operations data for the years ended April 30, 2017, 2016 and 2015 and summary historical consolidated balance sheet data as of April 30, 2017 and 2016 have been derived from American Woodmark’s historical audited consolidated financial statements and the related notes included in this offering memorandum. The summary historical consolidated balance sheet data as of April 30, 2015 is derived from our audited consolidated financial statements and related notes which are not included in this offering memorandum. The summary historical consolidated financial information of American Woodmark as of October 31, 2017 and for the six-month periods ended October 31, 2017 and 2016 have been derived from American Woodmark’s historical unaudited condensed consolidated financial statements and the related notes included in this offering memorandum. In the opinion of American Woodmark’s management, the unaudited condensed consolidated financial statements and the related notes of American Woodmark have been prepared on the same basis as its audited consolidated financial statements and the related notes and include all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the financial position of American Woodmark as of October 31, 2017 and its results of operations for the six-month periods ended October 31, 2017 and 2016. Results of interim periods are not necessarily indicative of the results expected for a full year or for future periods.

The following summary consolidated financial information should be read together with the information included in “Management’s Discussion and Analysis of Financial Condition and Results of Operation of American Woodmark” and American Woodmark’s consolidated financial statements and the related notes included elsewhere in this offering memorandum. The summary consolidated financial information in this section is not intended to replace American Woodmark’s consolidated financial statements and the related notes. American Woodmark’s historical results are not necessarily indicative of future performance.

The summary unaudited pro forma condensed combined balance sheet information gives effect to the Transactions as if they had been consummated on October 31, 2017, and includes pro forma adjustments based on American Woodmark management’s preliminary valuations of certain tangible and intangible assets. The summary unaudited pro forma condensed combined statements of operations information gives effect to the Transactions as if they had been consummated on May 1, 2016.

The summary unaudited pro forma condensed combined statement of operations information for the twelve months ended October 31, 2017 has been derived by combining the sum of (1) American Woodmark’s unaudited pro forma condensed combined statement of operations information for the fiscal year ended April 30, 2017 plus (2) American Woodmark’s unaudited pro forma condensed combined statement of operations information for the six months ended October 31, 2017 less (3) American Woodmark’s unaudited pro forma condensed combined statement of operations information for the six months ended October 31, 2016. Pro forma operating results for the periods presented herein are not necessarily indicative of results for a full year or for any other period.

The following summary unaudited pro forma condensed combined financial information has been prepared by applying the acquisition method of accounting with American Woodmark treated as the acquirer for accounting purposes and is dependent on certain valuations and other analyses that have yet to progress to a stage where there is sufficient information for a definitive measurement. Accordingly, any pro forma adjustments, including the allocation of the purchase price, are preliminary, have been made solely for the purpose of providing summary unaudited pro forma condensed combined financial information and may be revised as additional information becomes available and additional analysis is performed. The following summary unaudited pro forma condensed combined financial information has been derived from, and should be read in conjunction with, the historical consolidated financial statements and the related notes of both American Woodmark and RSI included elsewhere in this offering memorandum, together with the more detailed unaudited pro forma condensed combined financial information provided in the section entitled “Unaudited Pro Forma Condensed Combined Financial Information”. The following summary unaudited pro forma condensed combined financial information is subject to risks and uncertainties, including those discussed in the section of this offering memorandum entitled “Risk Factors”. See “Risk Factors —Risks Related to the RSI Acquisition —

4

The pro forma financial information included in this offering memorandum are presented for illustrative purposes only and may not be an indication of American Woodmark’s financial condition or results of operations following the RSI Acquisition”.

The summary unaudited pro forma condensed combined financial information set forth below has been presented for informational purposes only and is not necessarily indicative of what the combined financial condition or results of operations actually would have been had the RSI Acquisition been completed as of the assumed dates or for the periods presented. In addition, the summary unaudited pro forma condensed combined financial information presented below does not purport to project the combined financial condition or operating results for any future period.

| American Woodmark Historical Consolidated Financial Information |

Pro

Forma (Non-GAAP) Twelve Months Ended October 31, |

|||||||||||||||||||||||

| Year Ended April 30, | Six Months Ended October 31, |

|||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2016 | 2017 | 2017(a) | |||||||||||||||||||

| (dollars in thousands, other than percentages and ratios) | ||||||||||||||||||||||||

| Statement of Operations Information |

||||||||||||||||||||||||

| Net sales |

$ | 825,465 | $ | 947,045 | $ | 1,030,248 | $ | 522,226 | $ | 551,596 | $ | 1,628,644 | ||||||||||||

| Cost of sales & distributions |

672,933 | 747,351 | 805,612 | 406,757 | 435,767 | 1,236,777 | ||||||||||||||||||

| Gross profit |

152,532 | 199,694 | 224,636 | 115,469 | 115,829 | 391,867 | ||||||||||||||||||

| Sales & marketing expense |

64,304 | 66,489 | 70,979 | 33,609 | 36,230 | 97,319 | ||||||||||||||||||

| General & administrative expense |

33,773 | 40,045 | 45,419 | 21,607 | 17,950 | 124,031 | ||||||||||||||||||

| Operating income |

54,695 | 93,160 | 108,238 | 60,253 | 61,649 | 170,517 | ||||||||||||||||||

| Interest & other (income) expense |

308 | 1,374 | (687 | ) | (137 | ) | (1,186 | ) | 37,450 | |||||||||||||||

| Net income |

$ | 35,499 | $ | 58,723 | $ | 71,199 | $ | 39,298 | $ | 42,036 | $ | 92,483 | ||||||||||||

| Key Balance Sheet Items (as of period end) |

||||||||||||||||||||||||

| Cash and cash equivalents |

$ | 149,541 | $ | 174,463 | $ | 176,978 | $ | 155,644 | $ | 162,545 | $ | 102,019 | ||||||||||||

| Total assets |

398,835 | 466,360 | 501,273 | 494,510 | 513,305 | 1,719,036 | ||||||||||||||||||

| Total liabilities |

169,062 | 185,599 | 148,824 | 179,241 | 138,162 | 1,167,431 | ||||||||||||||||||

| Total liabilities and shareholders’ equity |

398,835 | 466,360 | 501,273 | 494,510 | 513,305 | 1,719,036 | ||||||||||||||||||

| Other Key Performance Metrics |

||||||||||||||||||||||||

| Net cash provided by operating activities |

$ | 60,164 | $ | 74,604 | $ | 77,080 | $ | 40,146 | $ | 41,838 | ||||||||||||||

| Net cash used by investing activities |

(56,606 | ) | (40,773 | ) | (53,744 | ) | (50,417 | ) | (31,136 | ) | ||||||||||||||

| Net cash provided by (used in) financing activities |

10,283 | (8,909 | ) | (20,821 | ) | (8,548 | ) | (25,135 | ) | |||||||||||||||

| Capital expenditures |

20,015 | 28,685 | 21,811 | 10,354 | 20,660 | |||||||||||||||||||

| EBITDA(b) |

69,347 | 108,363 | 127,367 | 69,205 | 72,664 | 255,979 | ||||||||||||||||||

| EBITDA margin(b) |

8 | % | 11 | % | 12 | % | 13 | % | 13 | % | 16 | % | ||||||||||||

| Net debt (as of period end)(c) |

(126,655 | ) | (150,744 | ) | (160,101 | ) | (130,149 | ) | (143,038 | ) | 755,432 | |||||||||||||

| Adjusted EBITDA(b) |

73,237 | 113,548 | 133,966 | 71,028 | 74,357 | 268,139 | ||||||||||||||||||

| Adjusted EBITDA margin(b) |

9 | % | 12 | % | 13 | % | 14 | % | 13 | % | 16 | % | ||||||||||||

| Ratio of total debt to Adjusted EBITDA(b) |

0.31x | 0.21x | 0.13x | 0.36x | 0.24x | 3.20x | ||||||||||||||||||

| Ratio of net debt to Adjusted EBITDA(c) |

(1.73x | ) | (1.33x | ) | (1.20x | ) | (1.83x | ) | (1.95x | ) | 2.82x | |||||||||||||

| Free Cash Flow(d) |

40,149 | 45,919 | 55,269 | 29,792 | 21,178 | |||||||||||||||||||

| (a) | Due to transitions out of select markets, RSI’s net sales declined in the third quarter of 2017. This trend continued in the fourth quarter of 2017, which we expect to have a modest effect on RSI’s operating results in the fourth quarter of 2017. |

| (b) | EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin are measurements of operational performance that are not prepared and presented in accordance with GAAP. While we believe that the presentation of these non-GAAP measures will enhance an investor’s understanding of our operating performance, the use of these non-GAAP measures as an analytical tool has limitations and should not be considered in isolation, or as substitutes for an analysis of our results of operations as reported in accordance with GAAP. We define EBITDA as net income adjusted to exclude interest income and add back such items as: interest expense, income tax provision, and depreciation and amortization. We define EBITDA margin as EBITDA divided by net sales. We define Adjusted EBITDA as EBITDA adjusted to exclude such items as: restructuring charges, stock based compensation, corporate business development |

5

| expense and loss on disposal of property, plant and equipment. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net sales. EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin should not be considered as alternatives to comparable GAAP measures of profitability and may not be comparable with the measures as defined by other companies. |

The table below reconciles EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin to net income.

Reconciliation of Net Income (GAAP) to EBITDA (Non-GAAP), EBITDA Margin (Non-GAAP),

Adjusted EBITDA (Non-GAAP) and Adjusted EBITDA Margin (Non-GAAP)

| Year Ended April 30, | Six Months Ended October 31, |

Pro Forma (Non-GAAP) Twelve Months Ended October 31, |

||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2016 | 2017 | 2017 | |||||||||||||||||||

| (dollars in thousands, other than percentages) | ||||||||||||||||||||||||

| Net income (GAAP)(1) |

$ | 35,499 | $ | 58,723 | $ | 71,199 | $ | 39,298 | $ | 42,036 | $ | 92,483 | ||||||||||||

| Less: |

||||||||||||||||||||||||

| Interest income |

81 | 257 | 1,125 | 387 | 1,253 | 567 | ||||||||||||||||||

| Add: |

||||||||||||||||||||||||

| Interest expense |

515 | 378 | 885 | 329 | 105 | 39,593 | ||||||||||||||||||

| Income tax provision |

18,888 | 33,063 | 37,726 | 21,092 | 20,799 | 40,584 | ||||||||||||||||||

| Depreciation and amortization |

14,526 | 16,456 | 18,682 | 8,873 | 10,977 | 83,886 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA (Non-GAAP) |

$ | 69,347 | $ | 108,363 | $ | 127,367 | $ | 69,205 | $ | 72,664 | $ | 255,979 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| EBITDA Margin (Non-GAAP) |

8 | % | 11 | % | 12 | % | 13 | % | 13 | % | 16 | % | ||||||||||||

| Restructuring charges |

$ | 240 | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||||

| Stock based compensation |

3,497 | 3,609 | 3,469 | 1,649 | 1,609 | 8,220 | ||||||||||||||||||

| Corporate business development expense |

— | — | 2,686 | — | — | — | ||||||||||||||||||

| Loss on disposal of property, plant and equipment |

153 | 1,576 | 444 | 174 | 84 | 343 | ||||||||||||||||||

| Facility closure and restructuring |

— | — | — | — | — | 4,467 | ||||||||||||||||||

| Non-recurring/other non-cash charges |

— | — | — | — | — | (870 | ) | |||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA (Non-GAAP) |

$ | 73,237 | $ | 113,548 | $ | 133,966 | $ | 71,028 | $ | 74,357 | $ | 268,139 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Adjusted EBITDA margin (Non-GAAP) |

9 | % | 12 | % | 13 | % | 14 | % | 13 | % | 16 | % | ||||||||||||

| (1) | Net income is in accordance with GAAP except for Pro Forma Twelve Months Ended October 31, 2017. |

6

| (c) | Net debt is a measurement of liquidity and financial health that is not prepared and presented in accordance with GAAP. While we believe that the presentation of this non-GAAP measure will enhance an investor’s understanding of our financial position, the use of this non-GAAP measure as an analytical tool has limitations and should not be considered in isolation, or as a substitute for an analysis of our results of operations as reported in accordance with GAAP. We define net debt as total long-term debt less cash and cash equivalents. |

| Reconciliation of Net Debt (Non-GAAP) (dollars in thousands) |

As of April 30, | As of October 31, |

Pro Forma As of October 31, |

|||||||||||||||||

| 2015 | 2016 | 2017 | 2016 | 2017 | ||||||||||||||||

| Economic Development Loans |

$ | 4,957 | $ | 3,689 | $ | 4,439 | 9,132 | 8,607 | ||||||||||||

| Capital Lease Obligations |

7,929 | 7,165 | 6,848 | 2,199 | 2,807 | |||||||||||||||

| Other long term debt, net of debt issuance costs |

— | 2,865 | 5,590 | 14,164 | 6,383 | |||||||||||||||

| 2009 Revolving Facility |

10,000 | 10,000 | — | — | ||||||||||||||||

| Senior Secured Revolving Facility |

— | — | — | — | ||||||||||||||||

| Senior Secured Initial Term Loan, net of debt issuance costs |

— | — | — | — | 243,534 | |||||||||||||||

| Senior Secured Delayed Draw Term Loan, net of deferred issuance costs |

— | — | — | — | 249,300 | |||||||||||||||

| RSI Employee Notes |

— | — | — | — | 3,020 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Credit Facilities and Capital Lease Obligations |

22,886 | 23,719 | 16,877 | 25,495 | 513,651 | |||||||||||||||

| Notes due 2026 offered hereby |

— | — | — | — | 343,800 | |||||||||||||||

| RSI Notes |

— | — | — | — | — | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total debt (GAAP) |

22,886 | 23,719 | 16,877 | 25,495 | 857,451 | |||||||||||||||

| Less: Cash and cash equivalents |

149,541 | 174,463 | 176,978 | 155,644 | 102,019 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net debt (Non-GAAP) |

$ | (126,655 | ) | $ | (150,744 | ) | $ | (160,101 | ) | $ | (130,149 | ) | $ | 755,432 | ||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| (d) | Free Cash Flow is a measurement of liquidity and financial health that is not prepared and presented in accordance with GAAP. While we believe that the presentation of this non-GAAP measure will enhance an investor’s understanding of our financial position, the use of this non-GAAP measure as an analytical tool has limitations and should not be considered in isolation, or as a substitute for an analysis of our results of operations or cash flows as reported in accordance with GAAP. We define free cash flow as net cash provided by operating activities less capital expenditures. |

| Reconciliation of Free Cash Flow (Non-GAAP) (dollars in thousands) |

Year Ended April 30, | Six Months Ended October 31, |

||||||||||||||||||

| 2015 | 2016 | 2017 | 2016 | 2017 | ||||||||||||||||

| Net cash provided by operating activities (GAAP) |

$ | 60,164 | $ | 74,604 | $ | 77,080 | $ | 40,146 | $ | 41,838 | ||||||||||

| Less: |

||||||||||||||||||||

| Capital expenditures |

20,015 | 28,685 | 21,811 | 10,354 | 20,660 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free Cash Flow (Non-GAAP) |

$ | 40,149 | $ | 45,919 | $ | 55,269 | $ | 29,792 | $ | 21,178 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

7

Summary Historical Financial and Operating Information of RSI

The summary historical consolidated statements of operations of RSI for the years ended December 31, 2016, January 2, 2016 and January 3, 2015 and summary historical consolidated balance sheet as of December 31, 2016 and January 2, 2016 have been derived from RSI’s historical audited consolidated financial statements and the related notes included in this offering memorandum. The selected consolidated balance sheet as of January 3, 2015 is derived from RSI’s audited consolidated financial statements and the related notes which are not included in this offering memorandum. The summary historical consolidated financial information of RSI as of September 30, 2017 and for the nine-month periods ended September 30, 2017 and October 1, 2016 have been derived from RSI’s historical unaudited condensed consolidated financial statements and the related notes included in this offering memorandum. In the opinion of management, the unaudited condensed consolidated financial statements and the related notes of RSI have been prepared on the same basis as its audited consolidated financial statements and the related notes and include all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the financial position of RSI as of September 30, 2017 and its results of operations for the nine-month periods ended September 30, 2017 and 2016. Results of interim periods are not necessarily indicative of the results expected for a full year or for future periods.

The following summary consolidated financial information should be read together with the information included in “Management’s Discussion and Analysis of Financial Condition and Results of Operation of RSI” and RSI’s consolidated financial statements and the related notes included elsewhere in this offering memorandum. The summary consolidated financial information in this section is not intended to replace RSI’s consolidated financial statements and the related notes. RSI’s historical results are not necessarily indicative of future performance.

| Year Ended | Nine Months Ended | |||||||||||||||||||

| (dollars in thousands, other

than |

January 3, 2015 |

January 2, 2016 |

December 31, 2016 |

October 1, 2016 |

September 30, 2017 |

|||||||||||||||

| Statement of Operations Information |

||||||||||||||||||||

| Net sales |

$ | 540,033 | $ | 595,527 | $ | 598,094 | $ | 457,546 | $ | 428,478 | ||||||||||

| Cost of sales |

374,851 | 418,015 | 420,160 | 322,368 | 304,520 | |||||||||||||||

| Gross profit |

165,182 | 177,512 | 177,934 | 135,178 | 123,958 | |||||||||||||||

| Operating income |

98,865 | 80,079 | 136,535 | 108,598 | 78,618 | |||||||||||||||

| Interest expense, net |

39,463 | 39,306 | 38,641 | 29,248 | 29,207 | |||||||||||||||

| Net income |

$ | 39,113 | $ | 4,380 | $ | 65,605 | $ | 51,752 | $ | 33,067 | ||||||||||

| Key Balance Sheet Items (as of period end) |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 88,182 | $ | 47,509 | $ | 49,293 | $ | 80,941 | ||||||||||||

| Total assets |

281,543 | 268,256 | 271,344 | 290,437 | ||||||||||||||||

| Total liabilities |

593,458 | 664,014 | 650,978 | 637,004 | ||||||||||||||||

| Other Key Performance Metrics |

||||||||||||||||||||

| Net cash provided by operating activities |

$ | 53,760 | $ | 67,871 | $ | 80,360 | $ | 54,137 | $ | 42,940 | ||||||||||

| Net cash used in investing activities |

(10,668 | ) | (19,161 | ) | (28,327 | ) | (21,878 | ) | (11,042 | ) | ||||||||||

| Net cash provided by (used in) financing activities |

1,012 | (89,383 | ) | (50,249 | ) | (322 | ) | (250 | ) | |||||||||||

| Capital expenditures |

11,873 | 19,756 | 28,339 | 21,890 | 11,153 | |||||||||||||||

| EBITDA (a) |

111,334 | 58,861 | 151,351 | 119,336 | 92,500 | |||||||||||||||

| EBITDA margin (a) |

21 | % | 10 | % | 25 | % | 26 | % | 22 | % | ||||||||||

| Adjusted EBITDA (a) |

127,849 | 140,039 | 142,113 | 106,205 | 95,113 | |||||||||||||||

| Adjusted EBITDA margin (a) |

24 | % | 24 | % | 24 | % | 23 | % | 22 | % | ||||||||||

| Free Cash Flow (b) |

41,887 | 48,115 | 52,021 | 32,247 | 31,787 | |||||||||||||||

8

| (a) | EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin are measurements of operational performance that are not prepared and presented in accordance with GAAP. While we believe that the presentation of these non-GAAP measures will enhance an investor’s understanding of our operating performance, the use of these non-GAAP measures as an analytical tool has limitations and should not be considered in isolation, or as substitutes for an analysis of our results of operations as reported in accordance with GAAP. We define EBITDA as net income adjusted to exclude interest income and add back such items as: interest expense, income tax provision, and depreciation and amortization. We define EBITDA margin as EBITDA divided by net sales. We define Adjusted EBITDA as EBITDA adjusted to exclude such items as: stock based compensation, debt and equity related transaction costs, facility closure and restructuring costs, and other noncash/nonrecurring charges. We define Adjusted EBITDA margin as Adjusted EBITDA divided by net sales. EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin should not be considered as alternatives to comparable GAAP measures of profitability and may not be comparable with the measures as defined by other companies. |

The table below reconciles EBITDA, EBITDA margin, Adjusted EBITDA and Adjusted EBITDA margin to net income.

Reconciliation of Net Income (GAAP) to EBITDA (Non-GAAP), EBITDA Margin (Non-GAAP), Adjusted EBITDA (Non-GAAP) and Adjusted EBITDA margin (Non-GAAP)

| Year Ended | Nine Months Ended | |||||||||||||||||||

| January 3, 2015 |

January 2, 2016 |

December 31, 2016 |

October 1, 2016 |

September 30, 2017 |

||||||||||||||||

| (dollars in thousands, other than percentages) | ||||||||||||||||||||

| Net income (GAAP) |

$ | 39,113 | $ | 4,380 | $ | 65,605 | $ | 51,752 | $ | 33,067 | ||||||||||

| Less: |

||||||||||||||||||||

| Interest income |

15 | 24 | 52 | 40 | 148 | |||||||||||||||

| Add: |

||||||||||||||||||||

| Interest expense |

39,478 | 39,330 | 38,693 | 29,288 | 29,355 | |||||||||||||||

| Income tax provision |

19,737 | 1,521 | 31,955 | 27,320 | 17,773 | |||||||||||||||

| Depreciation and amortization |

13,021 | 13,654 | 15,150 | 11,016 | 12,453 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA (Non-GAAP) |

$ | 111,334 | $ | 58,861 | $ | 151,351 | $ | 119,336 | $ | 92,500 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| EBITDA Margin (Non-GAAP) |

21 | % | 10 | % | 25 | % | 26 | % | 22 | % | ||||||||||

| Stock compensation expense (benefit) |

$ | 11,403 | $ | 37,353 | $ | (12,608 | ) | $ | (14,881 | ) | $ | (780 | ) | |||||||

| Debt & equity related transaction costs |

425 | 43,235 | 22 | 22 | 1,416 | |||||||||||||||

| Facility closure & restructuring costs |

4,135 | 782 | 1,661 | 171 | 2,977 | |||||||||||||||

| Non-recurring/other non-cash charges (income) |

552 | (192 | ) | 1,687 | 1,557 | (1,000 | ) | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA (Non-GAAP) |

$ | 127,849 | $ | 140,039 | $ | 142,113 | $ | 106,205 | $ | 95,113 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Adjusted EBITDA margin (Non-GAAP) |

24 | % | 24 | % | 24 | % | 23 | % | 22 | % | ||||||||||

| (b) | Free Cash Flow is a measurement of liquidity and financial health that is not prepared and presented in accordance with GAAP. While we believe that the presentation of this non-GAAP measure will enhance an investor’s understanding of our financial position, the use of this non-GAAP measure as an analytical tool has limitations and should not be considered in isolation, or as a substitute for an analysis of our results of operations or cash flows as reported in accordance with GAAP. We define free cash flow as net cash provided by operating activities less capital expenditures. |

9

| Reconciliation of Free Cash

Flow |

Year Ended | Nine Months Ended | ||||||||||||||||||

| January 3, 2015 |

January 2, 2016 |

December 31, 2016 |

October 1, 2016 |

September 30, 2017 |

||||||||||||||||

| Net cash provided by operating activities (GAAP) |

$ | 53,760 | $ | 67,871 | $ | 80,360 | $ | 54,137 | $ | 42,940 | ||||||||||

| Less: |

||||||||||||||||||||

| Capital expenditures |

11,873 | 19,756 | 28,339 | 21,890 | 11,153 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Free Cash Flow (Non-GAAP) |

$ | 41,887 | $ | 48,115 | $ | 52,021 | $ | 32,247 | $ | 31,787 | ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

10

Risks Related to American Woodmark’s Business and Industry

Because of the concentration of our sales to our two largest customers, the loss of either customer or a significant reduction in orders from either customer could adversely affect our financial results.

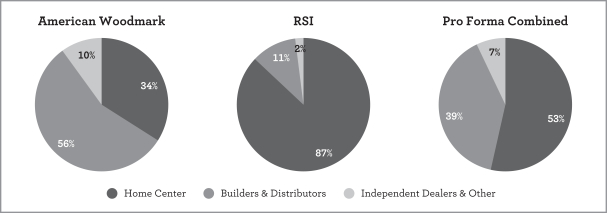

Home Depot and Lowe’s collectively accounted for approximately 53% and 58% of our pro forma net sales in fiscal 2017 and 2016, respectively. We do not typically enter into long-term sales contracts with Home Depot or Lowe’s and our sales usually occur on a “purchase order” basis. Our customers can make significant changes in their purchase volumes and can seek to significantly affect the prices we receive for our products and services and the other terms and conditions on which we do business. They have discontinued, and may in the future choose to discontinue, purchasing some or all of our products with little or no notice. In the past, purchase volumes from our customers, including Home Depot and Lowe’s, have fluctuated substantially, and we expect such fluctuations to occur from time to time in the future. Any reduction in, or termination of, our sales to either Home Depot or Lowe’s could have a material adverse effect on our business, financial condition or results of operations.

In addition, the potential for orders from these large retail customers to increase significantly from time to time requires us to have sufficient manufacturing capacity. These large retailers also impose strict logistics and performance obligations. Failure to comply with these obligations may result in these customers reducing or stopping their purchase of our products.

We could also experience delays or defaults in payment from Home Depot or Lowe’s, which could adversely affect our business, financial condition or results of operations. The loss of a substantial portion of our order volumes or revenue from either Home Depot or Lowe’s for any reason would have a material adverse effect on our business, financial condition, or results of operations.

Our business primarily relies on U.S. home improvement, repair and remodel and new home construction activity levels, all of which are impacted by risks associated with fluctuations in the housing market. Downward changes in the general economy, the housing market or other business conditions could adversely affect our results of operations, cash flows and financial condition.

Our business primarily relies on home improvement, repair and remodel, and new home construction activity levels in the United States. The housing market is sensitive to changes in economic conditions and other factors, such as the level of employment, access to labor, consumer confidence, consumer income, availability of financing and interest rate levels. Adverse changes in any of these conditions generally, or in any of the markets where we operate, could decrease demand and could adversely impact our businesses by: causing consumers to delay or decrease homeownership; making consumers more price conscious resulting in a shift in demand to smaller, less expensive homes; making consumers more reluctant to make investments in their existing homes, including large kitchen and bath repair and remodel projects; or making it more difficult to secure loans for major renovations. Although the U.S. new home construction market is improving, demand for new homes is still recovering after the 2007-2009 U.S. economic recession and continues to remain below historical levels.

Prolonged economic downturns may adversely impact our sales, earnings and liquidity.

Our industry historically has been cyclical in nature and has fluctuated with economic cycles. During economic downturns, our industry could experience longer periods of recession and greater declines than the general economy. We believe that our industry is significantly influenced by economic conditions generally and particularly by housing activity, consumer confidence, the level of personal discretionary spending, demographics and credit availability. These factors may affect not only the ultimate consumer of our products, but also may impact home centers, builders and our other primary customers. As a result, a worsening of economic conditions could adversely affect our sales and earnings as well as our cash flow and liquidity.

The U.S. cabinetry industry is highly competitive, and we may not be able to compete successfully.

We operate within the highly competitive U.S. cabinetry industry, which is characterized by competition from a number of other manufacturers. Competition is further intensified during economic downturns. We

11

compete with numerous large national and regional home products companies for, among other things, customers, orders from Home Depot and Lowe’s, raw materials and skilled management and labor resources. Purchase volumes from our main home center customers have fluctuated substantially from time to time in the past, and we expect such fluctuations to occur from time to time in the future.

Some of our competitors have greater financial, marketing and other resources than we do and, therefore, may be able to adapt to changes in customer preferences more quickly, devote more resources to the marketing and sale of their products, generate greater national brand recognition or adopt more aggressive pricing policies than we can.

In addition, some of our competitors may resort to price competition to sustain or gain market share and manufacturing capacity utilization, and we may have to adjust the prices on some of our products to stay competitive, which could reduce our revenues. We may not ultimately succeed in competing with other manufacturers and distributors in our market, which may have a material adverse effect on our business, financial condition or results of operations.

Our failure to develop new products or respond to changing consumer preferences and purchasing practices could have a material adverse effect on our business, financial condition or results of operations.

The U.S. cabinetry industry is subject to changing consumer trends, demands and preferences. The uncertainties associated with developing and introducing new products, such as gauging changing consumer preferences and successfully developing, manufacturing, marketing and selling new products, could lead to, among other things, rejection of a new product line, reduced demand and price reductions for our products. If our products do not keep up with consumer trends, demands and preference, we could lose market share, which could have a material adverse effect on our business, financial condition or results of operations.

Changes to consumer shopping habits and potential trends toward “online” purchases could also impact our ability to compete as we currently sell our products mainly through our distribution channel. Further, the volatile and challenging economic environment of recent years has caused shifts in consumer trends, demands, preferences and purchasing practices and changes in the business models and strategies of our customers. Shifts in consumer preferences, which may or may not be long-term, have altered the quantity, type and prices of products demanded by the end-consumer and our customers. If we do not timely and effectively identify and respond to these changing consumer preferences and purchasing practices, our relationships with our customers could be harmed, the demand for our products could be reduced and our market share could be negatively affected.

We may fail to fully realize the anticipated benefits of our growth strategy within the dealer and homebuilder channels.

Part of our growth strategy depends on expanding our business in the dealer and homebuilder channels. We may fail to compete successfully against other companies that are already established providers within the dealer and homebuilder channels. Demand for our products within the homebuilder and dealer channels may not grow, or might even decline. In addition, we may not accurately gauge consumer preferences and successfully develop, manufacture and market our products at a national level. Further, the implementation of our growth strategy may place additional demands on our administrative, operational and financial resources and may divert management’s attention away from our existing business and increase the demands on our financial systems and controls. If our management is unable to effectively manage growth, our business, financial condition or results of operations could be adversely affected. If our growth strategy is not successful then our revenue and earnings may not grow as anticipated or may decline, we may not be profitable, our reputation and brand may be damaged. In addition, we may change our financial strategy or other components of our overall business strategy if we believe our current strategy is not effective, if our business or markets change, or for other reasons, which may cause fluctuations in our financial results.

Manufacturing expansion to add capacity, manufacturing realignments, and other cost savings programs could result in a decrease in our near-term earnings.

We continually review our manufacturing operations. These reviews could result in the expansion of capacity, manufacturing realignments and various cost savings programs. Effects of manufacturing expansion,

12

realignments or cost savings programs could result in a decrease in our short-term earnings until the additional capacity is in place, cost reductions are achieved and/or production volumes stabilize. Such manufacturing expansions, realignments and programs involve substantial planning, often require capital investments, and may result in charges for fixed asset impairments or obsolescence and substantial severance costs. We also cannot assure you that we will achieve all of the intended cost savings. Our ability to achieve cost savings and other benefits within expected time frames is subject to many estimates and assumptions. These estimates and assumptions are subject to significant economic, competitive, and other uncertainties, some of which are beyond our control. If these estimates and assumptions are incorrect, if we experience delays, or if other unforeseen events occur, our business, financial condition, and results of operations could be materially and adversely affected. In addition, downturns in the economy could potentially have a larger impact on American Woodmark as a result of this added capacity.

We may record future goodwill impairment charges or other asset impairment charges which could negatively impact our future results of operations and financial condition.

In our third quarter reporting period we will have recorded significant goodwill as a result of the RSI Acquisition, and goodwill and other acquired intangible assets represent a substantial portion of our assets. We also have long-lived assets consisting of property and equipment and other identifiable intangible assets which we review both on an annual basis as well as when events or circumstances indicate that the carrying amount of an asset may not be recoverable. If a determination is made that a significant impairment in value of goodwill, other intangible assets or long-lived assets has occurred, such determination could require us to impair a substantial portion of our assets. Asset impairments could have a material adverse effect on our financial condition and results of operations.

Fluctuating raw material and energy costs could have a material adverse effect on our business and results of operations.

We purchase various raw materials, including, among others, wood, wood-based and resin products, which are subject to price fluctuations that could materially increase our manufacturing costs. Further, increases in energy costs increase our production costs and also the cost to transport our products, each of which could have a material adverse effect on our business and results of operations. In addition, some of our suppliers have consolidated and other suppliers may do so in the future. Combined with increased demand, such consolidation could increase the price of our supplies and raw materials.

We also may be unwilling or unable to pass on to customers commensurate cost increases. Competitive considerations and customer resistance to price increases may delay or make us unable to adjust selling prices. To the extent we are unable to either reengineer or otherwise offset increased costs or are unwilling or unable to build price increases into our sales prices, our margins will be negatively affected. Even if we are able to increase our selling prices, sustained price increases for our products may lead to sales declines and loss of market share, particularly if our competitors do not increase their prices. Conversely, when raw materials or energy prices decline, we may receive customer pressure to reduce our sales prices.

These prices are market-based and fluctuate based on factors beyond our control. We do not have long- term fixed supply agreements and do not hedge against price fluctuations. We, therefore, cannot predict our raw materials costs for the coming year.

The inability to obtain raw materials from suppliers in a timely manner would adversely affect our ability to manufacture and market our products.

Our ability to offer a wide variety of products depends on our ability to obtain an adequate supply of components from manufacturers and other suppliers, particularly wood-based and resin products. Failure by our suppliers to provide us with quality products on commercially reasonable terms, and to comply with legal requirements for business practices, could have a material adverse effect on our business, financial condition or results of operations. Furthermore, we rely heavily or, in certain cases, exclusively, on outside suppliers for some of our key components. While we do not rely exclusively on any one supplier for any particular raw materials, loss of a major supplier could increase our costs to obtain raw materials until we obtain an adequate alternative source of materials.

13

We typically do not enter into long-term contracts with our suppliers or sourcing partners. Instead, most raw materials and sourced goods are obtained on a “purchase order” basis. Although these components are generally obtainable in sufficient quantities from other sources, resourcing them from another supplier could take time. Financial, operating, or other difficulties encountered by our suppliers or sourcing partners or changes in our relationships with them could result in manufacturing or sourcing interruptions, delays and inefficiencies, and prevent us from manufacturing enough products to meet customer demands.

Our operations may be adversely affected by information systems interruptions or intrusions.

We rely on a number of information technology systems to process, transmit, store and manage information to support our business activities. Increased global cybersecurity vulnerabilities, threats and more sophisticated and targeted attacks pose a risk to its information technology systems. We have established security policies, processes and layers of defense designed to help identify and protect against intentional and unintentional misappropriation or corruption of its systems and information and disruption of its operations. Despite these efforts, systems may be damaged, disrupted, or shut down due to attacks by unauthorized access, malicious software, undetected intrusion, hardware failures, or other events, and in these circumstances our disaster recovery planning may be ineffective or inadequate. These breaches or intrusions could lead to business interruption, exposure of proprietary or confidential information, data corruption, damage to our reputation, exposure to litigation and increased operational costs. Such events could have a material adverse impact on our business, financial condition and results of operation. In addition, we could be adversely affected if any of its significant customers or suppliers experience any similar events that disrupt their business operations or damage their reputation.

Increased compliance costs or liabilities associated with environmental regulations could have a material adverse effect on our business, financial condition or results of operations.

Our facilities are subject to numerous environmental laws, regulations and permits, including those governing emissions to air, discharges to water, storage, treatment and disposal of waste, remediation of contaminated sites and protection of worker health and safety. We may not be in complete compliance with these laws, regulations or permits at all times. Our efforts to comply with environmental requirements do not remove the risk that we may incur material liabilities, fines or penalties for, among other things, releases of regulated materials occurring on or emanating from current or formerly owned or operated properties or any associated offsite disposal location, or for contamination discovered at any of our properties from activities conducted by previous occupants. Liability for environmental contamination or a release of hazardous materials may be joint and several, so that we may be held responsible for more than our share of the contamination or other damages, or even for the entire share.

Changes in environmental laws and regulations or the discovery of previously unknown contamination or other liabilities relating to our properties and operations could result in significant environmental liabilities that could impact our business, financial condition or results of operation. In addition, we may incur capital and other costs to comply with increasingly stringent environmental laws and enforcement policies. These laws, including, for example, the regulations relating to formaldehyde emissions promulgated by the California Air Resources Board, require us to rely on compliance by our suppliers of raw materials. Should a supplier fail to comply with such regulations, notify us of non-compliance, or provide us with a product that does not comply, we could be subject to disruption in our business and incur substantial liabilities.

Unauthorized disclosure of confidential information provided to us by customers, employees or third parties could harm our business.

We rely on the internet and other electronic methods to transmit confidential information and stores confidential information on our networks. If there were a disclosure of confidential information provided by, or concerning, our employees, customers or other third parties, including through inadvertent disclosure, unapproved dissemination, or unauthorized access, our reputation could be harmed and we could be subject to civil or criminal liability and regulatory actions.

14

Changes in government and industry regulatory standards could have a material adverse effect on our business, financial condition or results of operations.

Government regulations pertaining to health and safety and environmental concerns continue to emerge, domestically as well as internationally. These regulations include the Occupational Safety and Health Administration and other worker safety regulations for the protection of employees, as well as regulations for the protection of consumers. It is necessary for us to comply with current requirements (including requirements that do not become effective until a future date), and even more stringent requirements could be imposed on our products or processes. Compliance with these regulations may require us to alter our manufacturing and installation processes and our sourcing. Such actions could increase our capital expenditures and adversely impact our business, financial condition or results of operations, and our inability to effectively and timely meet such regulations could adversely impact our competitive position.

The loss of certain members of our management may have an adverse effect on our operating results.

Our success will depend, in part, on the efforts of our senior management and other key employees. These individuals possess sales, marketing, engineering, manufacturing, financial and administrative skills and know-how that are critical to the operation of our business. If we lose or suffer an extended interruption in the services of one or more of our senior officers or other key employees, our financial condition and results of operations may be negatively affected. Moreover, the pool of qualified individuals may be highly competitive and we may not be able to attract and retain qualified personnel to replace or succeed members of our senior management or other key employees, should the need arise. The loss of the services of any key personnel, or our inability to hire new personnel with the requisite skills, could impair our ability to develop new products or enhance existing products, sell products to our customers or manage our business effectively.

We could continue to pursue growth opportunities through either acquisitions, mergers or internally developed projects, which may be unsuccessful or may adversely affect future financial condition and operating results.

We could continue to pursue opportunities for growth through either acquisitions, mergers or internally developed projects as part of our growth strategy. We cannot assure you that we will be successful in integrating an acquired business or that an internally developed project will perform at the levels we anticipate. American Woodmark may pay for future acquisitions using cash, stock, the assumption of debt, or a combination of these. Future acquisitions could result in dilution to existing shareholders and to earnings per share. In addition, we may fail to identify significant liabilities or risks associated with a given acquisition that could adversely affect our future financial condition and operating results or result in us paying more for the acquired business or assets than they are worth.

Our ability to operate and our growth potential could be materially and adversely affected if we cannot employ, train and retain qualified personnel at a competitive cost.

Many of the products that we manufacture and assemble require manual processes in plant environments. We believe that our success depends upon our ability to attract, employ, train and retain qualified personnel with the ability to design, manufacture and assemble these products. In addition, our ability to expand our operations depends in part on our ability to increase our skilled labor force as the housing market continues to recover in the United States. A significant increase in the wages paid by competing employers could result in a reduction of our qualified labor force, increases in the wage rates that we must pay, or both. In addition, we believe that our success depends in part on our ability to quickly and effectively train additional workforce to handle the increased volume and production while minimizing labor inefficiencies and maintaining product quality in a housing market recovery. If either of these events were to occur, our cost structure could increase, our margins could decrease, and any growth potential could be impaired.

We manufacture our products internationally and are exposed to risks associated with doing business globally.

We manufacture our products in the United States and Mexico and sell our products in the United States. Accordingly, we are subject to risks associated with potential disruption caused by changes in political,

15

monetary, economic and social environments, including civil and political unrest, terrorism, possible expropriation, local labor conditions, changes in laws, regulations and policies of foreign governments and trade disputes with the United States, and compliance with U.S. laws affecting activities of U.S. companies abroad, including tax laws, economic sanctions and enforcement of contract and intellectual property rights.

We are also subject to the Foreign Corrupt Practices Act and other anti-bribery laws. While we have implemented safeguards and policies to discourage these practices by our employees and agents, our existing safeguards and policies to assure compliance and any future improvements may prove to be less than effective and our employees or agents may engage in conduct for which we might be held responsible. If employees violate our policies, we may be subject to regulatory sanctions. Violations of these laws or regulations could result in sanctions including fines, debarment from export privileges and penalties and could have a material adverse effect on our business, financial condition or results of operations.

We hedge certain foreign currency transactions; however, a change in the value of the currencies will impact our financial statements when translated into U.S. dollars. In addition, fluctuations in currency can adversely impact the cost position in local currency of our products, making it more difficult for us to compete. Our success will depend, in part, on our ability to effectively manage our business through the impact of these potential changes.

In addition, we source raw materials and components from Asia where we have recently experienced higher manufacturing costs and longer lead times due to currency fluctuations, higher wage rates, labor shortages and higher raw material costs. Our international sourcing of materials could be harmed by a variety of factors including:

| • | introduction of non-native invasive organisms into new environments; |

| • | recessionary trends in international markets; |

| • | legal and regulatory changes and the burdens and costs of our compliance with a variety of laws, including export controls, import and customs trade restrictions and tariffs; |

| • | increases in transportation costs or transportation delays; |

| • | work stoppages and labor strikes; |

| • | fluctuations in exchange rates, particularly the value of the U.S. dollar relative to other currencies; and |

| • | political unrest, terrorism and economic instability. |

If any of these or other factors were to render the conduct of our business in a particular country undesirable or impractical, our business, financial condition or results of operations could be materially adversely affected.

Our failure to maintain acceptable quality standards could result in significant unexpected costs.

Any failure to maintain acceptable quality standards could require us to recall or redesign such products, or pay substantial damages, any of which would result in significant unexpected costs. We may also have difficulty controlling the quality of products or components sourced from other manufacturers, so we are exposed to risks relating to the quality of such products and to limitations on our recourse against such suppliers. Further, any claim or product recall could result in adverse publicity against us, which could decrease our credibility, harm our reputations, adversely affect our sales, or increase our costs. Defects in our products could also result in decreased orders or sales to our customers, which could have a material adverse effect on our business, financial condition or results of operations.

New U.S. tax legislation could adversely affect us and our debt holders.

On December 22, 2017, President Trump signed into law legislation referred to as the “Tax Cuts and Jobs Act” (the “TCJA”). The TCJA is generally effective for taxable years beginning after December 31, 2017. The TCJA includes significant amendments to the Internal Revenue Code of 1986 (as amended, the “Code”), including amendments that significantly change the taxation of individuals and business entities, including the taxation of offshore earnings and the deductibility of interest. Some of the amendments could adversely affect our business and financial condition.

16

Although we are currently evaluating the impact of the TCJA on our business, significant uncertainty exists with respect to how the TCJA will affect our business. Some of this uncertainty will not be resolved until clarifying Treasury regulations are promulgated or other relevant authoritative guidance is published.

Prospective investors should consult their tax advisors about the TCJA and its potential impact before investing in the Notes offered hereby.

Future tax law changes or the interpretation of existing tax laws may materially impact our effective income tax rate and the resolution of unrecognized tax benefits.

Our businesses are subject to taxation in the United States as well as internationally. Tax legislation may be enacted that could have a material adverse impact on our worldwide income tax provision. Tax authorities in many jurisdictions routinely audit us. Because there are significant uncertainties in the outcome of such audits, the ultimate outcome from any audit could be materially different from amounts reflected in our income tax provisions and accruals. Future settlements of income tax audits may have a material adverse effect on earnings between the period of initial recognition of tax estimates in our financial statements and the point of ultimate tax audit settlement.

Natural disasters could have a material adverse effect on our business, financial condition or results of operations.

Many of our facilities are located in regions that are vulnerable to natural disasters and other risks, such as earthquakes, fires, floods, tropical storms and snow and ice, which at times have disrupted the local economy and posed physical risks to our property. In addition, the continued threat of terrorism and heightened security and military action in response to this threat, or any future acts of terrorism, may cause further disruptions to the economies of the United States and other countries. Our redundant, multiple site capacity may not be sufficient in the event of a natural disaster, terrorist act or other catastrophic event. Such disruptions could, among other things, disrupt our manufacturing or distribution facilities and result in delays or cancellations of customer orders for our products, which in turn could have a material adverse effect on our business, financial condition and results of operations. Further, if a natural disaster occurs in a region from which we derive a significant portion of our revenue, end-user customers in that region may delay or forego purchases of our products, which may materially and adversely impact our operating results for a particular period.

Our ability to grow and compete in the future will be adversely affected if adequate capital is not available to us or not available on terms favorable to us.

The ability of our business to grow and compete depends on the availability of adequate capital, which in turn depends in large part on our cash flow from operations and the availability of equity and debt financing. We cannot assure you that our cash flow from operations will be sufficient or that we will be able to obtain equity or debt financing on acceptable terms, if at all, to implement our growth strategy. As a result, we cannot assure you that adequate capital will be available to finance our current growth plans, take advantage of business opportunities or respond to competitive pressures, any of which could harm our business.

Certain of our customers have been expanding and may continue to expand through consolidation and internal growth, which may increase their buying power, which could materially and adversely affect our sales, results of operations and financial position.

Certain of our customers are large companies with significant buying power. In addition, potential further consolidation in the distribution channels could enhance the ability of certain of our customers to seek more favorable terms, including pricing, for the products that they purchase from us. Accordingly, our ability to maintain or raise prices in the future may be limited, including during periods of raw material and other cost increases. If we are forced to reduce prices or to maintain prices during periods of increased costs, or if we lose customers because of pricing or other methods of competition, our sales, operating results and financial position may be materially and adversely affected.

17

Risks Related to the RSI Acquisition

The pro forma financial information included in this offering memorandum are presented for illustrative purposes only and may not be an indication of American Woodmark’s financial condition or results of operations following the RSI Acquisition.

The pro forma financial information contained in this offering memorandum are presented for illustrative purposes only, are based on various adjustments, assumptions and preliminary estimates and may not be an indication of American Woodmark’s financial condition or results of operations following the RSI Acquisition for several reasons. See “Unaudited Pro Forma Condensed Combined Financial Information”. The actual financial condition and results of operations of the combined company following the RSI Acquisition may not be consistent with, or evident from, these pro forma financial statements. In addition, the assumptions used in preparing the pro forma financial information may not prove to be accurate, and other factors may affect American Woodmark’s financial condition or results of operations following the RSI Acquisition.

We may experience difficulties in integrating American Woodmark and RSI’s operations and realizing the expected benefits of the RSI Acquisition.

The success of the proposed RSI Acquisition will depend in part on our ability to realize the anticipated business opportunities and growth prospects from combining with RSI in an efficient and effective manner. We may never realize these business opportunities and growth prospects. Further, our management might have its attention diverted while trying to integrate operations and corporate and administrative infrastructures.

The integration process could take longer than anticipated and could result in the loss of key employees, the disruption of our and RSI’s ongoing businesses, tax costs or inefficiencies, or inconsistencies in standards, controls, information technology systems, procedures and policies, any of which could adversely affect our ability to maintain relationships with customers, employees or other third parties, or our ability to achieve the anticipated benefits of the transaction, and could harm our financial performance. If we are unable to successfully or timely integrate the operations of RSI’s business with our business, we may incur unanticipated liabilities and be unable to realize the revenue growth, synergies and other anticipated benefits resulting from the proposed transaction, and our business, results of operations and financial condition could be adversely affected.

The consummation of the RSI Acquisition could adversely affect RSI’s business, financial condition, and results of operations.

The consummation of the RSI Acquisition could disrupt RSI’s business and create uncertainty about it, which could have an adverse effect on RSI’s business, financial condition, and results of operations. These risks to RSI’s business include:

| • | potential uncertainty in the marketplace, which could lead current and prospective customers to purchase from other vendors or delay purchasing from RSI; |

| • | the possibility of disruption to RSI’s business and operations, including diversion of significant management time and resources towards the integration of RSI’s business with our business; |

| • | impairment of RSI’s ability to attract and retain key personnel; |

| • | difficulties maintaining relationships with employees, customers, and other business partners; and |

| • | potential future stockholder litigation relating to the RSI Acquisition and the related costs. |

American Woodmark and RSI’s important business relationships may be disrupted due to the RSI Acquisition, which could adversely affect American Woodmark’s and RSI’s business, respectively.

Some of the parties with which American Woodmark and RSI do business may be uncertain about their business relationships with the combined company as a result of the RSI Acquisition. For example, customers, partners, resellers, suppliers, vendors and others may consider entering into alternative business relationships with other parties. Some of RSI’s customers, partners, resellers, suppliers, vendors and others may decide to exercise their rights to terminate contracts that were triggered upon completion of the RSI Acquisition. These disruptions could have an adverse effect on RSI’s and/or American Woodmark’s businesses, financial condition or results of operations, or the prospects of the combined company.

18

SELECTED HISTORICAL CONSOLIDATED FINANCIAL INFORMATION OF RSI

The following selected consolidated statement of operations data for the years ended December 31, 2016, January 2, 2016 and January 3, 2015 and the selected consolidated balance sheet data as of December 31, 2016 and January 2, 2016 are derived from RSI’s audited consolidated financial statements and the related notes included in this offering memorandum. The selected consolidated balance sheet data as of January 3, 2015 is derived from RSI’s audited consolidated financial statements and the related notes which are not included in this offering memorandum.

The following selected consolidated statement of operations data for the nine months ended September 30, 2017 and October 1, 2016 and the selected consolidated balance sheet data as of September 30, 2017 are derived from RSI’s unaudited consolidated financial statements and the related notes included in this offering memorandum. The consolidated balance sheet data as of October 1, 2016 are derived from RSI’s unaudited consolidated financial statements and the related notes which are not included in this offering memorandum. In the opinion of management, the unaudited consolidated financial statements of RSI have been prepared on the same basis as the audited consolidated financial statements and include all adjustments, consisting of normal recurring adjustments, necessary for a fair statement of the financial position of RSI as of September 30, 2017 and its results of operations for the nine month periods ended September 30, 2017 and October 1, 2016. Results of interim periods are not necessarily indicative of the results expected for a full year or for future periods.

The following selected consolidated financial information should be read together with the information included in “Management’s Discussion and Analysis of Financial Condition and Results of Operation of RSI” and RSI’s consolidated financial statements and the related notes included in this offering memorandum. The selected consolidated financial information in this section is not intended to replace RSI’s consolidated financial statements and the related notes. RSI’s historical results are not necessarily indicative of future performance.

| Fiscal Year Ended | Nine Months Ended | |||||||||||||||||||

| January 3, 2015 |

January 2, 2016 |

December 31, 2016 |

October 1, 2016 |

September 30, 2017 |

||||||||||||||||

| (dollars in thousands) | ||||||||||||||||||||

| Consolidated Statements of Income Data |

||||||||||||||||||||

| Net sales |

$ | 540,033 | $ | 595,527 | $ | 598,094 | $ | 457,546 | $ | 428,478 | ||||||||||

| Cost of sales |

374,851 | 418,015 | 420,160 | 322,368 | 304,520 | |||||||||||||||

| Gross profit |

165,182 | 177,512 | 177,934 | 135,178 | 123,958 | |||||||||||||||

| Operating income |

98,865 | 80,079 | 136,535 | 108,598 | 78,618 | |||||||||||||||

| Net income |

39,113 | 4,380 | 65,605 | 51,752 | 33,067 | |||||||||||||||

| Consolidated Balance Sheet Data |

||||||||||||||||||||

| Cash and cash equivalents |

$ | 88,182 | $ | 47,509 | $ | 49,293 | $ | 80,941 | ||||||||||||

| Total assets |

281,543 | 268,256 | 271,344 | 290,437 | ||||||||||||||||

| Long term debt, less current maturities |

518,176 | 565,960 | 567,028 | 569,699 | ||||||||||||||||

| Stockholders’ deficit |

(311,915 | ) | (395,758 | ) | (379,634 | ) | (346,567 | ) | ||||||||||||

19

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL INFORMATION

On November 30, 2017, American Woodmark, Merger Sub, RSI and Ronald M. Simon, as the RSI stockholder representative, entered into the Merger Agreement, pursuant to which the parties agreed to merge Merger Sub with and into RSI pursuant to the terms and subject to the conditions set forth in the Merger Agreement, with RSI continuing as the surviving corporation and as a wholly owned subsidiary of American Woodmark. On December 29, 2017 (the “Acquisition Date”), American Woodmark consummated the RSI Acquisition pursuant to the terms of the Merger Agreement. As a result of the merger of Merger Sub with and into RSI, Merger Sub’s separate corporate existence ceased, and RSI continued as the surviving corporation a wholly owned subsidiary of American Woodmark.