Attached files

| file | filename |

|---|---|

| EX-12.1 - EXHIBIT 12.1 - CONSOLIDATED EDISON INC | ed-20170930xex121.htm |

| EX-32.2.2 - EXHIBIT 32.2.2 - CONSOLIDATED EDISON INC | ed-20170930xex3222.htm |

| EX-32.2.1 - EXHIBIT 32.2.1 - CONSOLIDATED EDISON INC | ed-20170930xex3221.htm |

| EX-31.2.2 - EXHIBIT 31.2.2 - CONSOLIDATED EDISON INC | ed-20170930xex3122.htm |

| EX-31.2.1 - EXHIBIT 31.2.1 - CONSOLIDATED EDISON INC | ed-20170930xex3121.htm |

| EX-12.2 - EXHIBIT 12.2 - CONSOLIDATED EDISON INC | ed-20170930xex122.htm |

| EX-32.1.2 - EXHIBIT 32.1.2 - CONSOLIDATED EDISON INC | ed-20170930xex3212.htm |

| EX-32.1.1 - EXHIBIT 32.1.1 - CONSOLIDATED EDISON INC | ed-20170930xex3211.htm |

| EX-31.1.2 - EXHIBIT 31.1.2 - CONSOLIDATED EDISON INC | ed-20170930xex3112.htm |

| EX-31.1.1 - EXHIBIT 31.1.1 - CONSOLIDATED EDISON INC | ed-20170930xex3111.htm |

| EX-10.1.2 - EXHIBIT 10.1.2 - CONSOLIDATED EDISON INC | ed-20170930xex1012.htm |

| EX-10.1.1 - EXHIBIT 10.1.1 - CONSOLIDATED EDISON INC | ed-20170930xex1011.htm |

| 10-Q - 10-Q - CONSOLIDATED EDISON INC | ed-20170930x10q.htm |

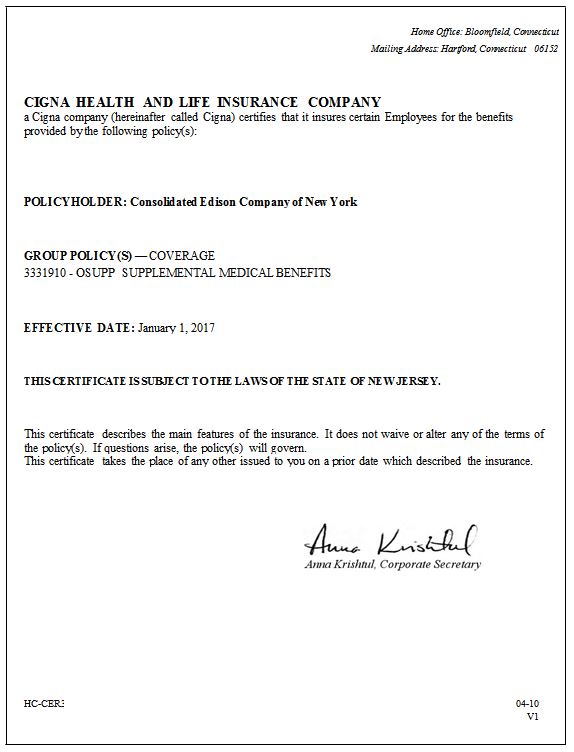

Exhibit 10.2.1

Consolidated Edison Company

of New York

SUPPLEMENTAL MEDICAL BENEFITS

EFFECTIVE DATE: January 1, 2017

CN007

3331910

This document printed in February, 2017 takes the place of any documents previously issued to you which described your benefits.

Printed in U.S.A.

Exhibit 10.2.1

Exhibit 10.2.1

Table of Contents

Certification......................................................................................................................................4

Important Notices............................................................................................................................6

How To File Your Claim..................................................................................................................9

Eligibility – Effective Date..............................................................................................................9

Supplemental Medical Benefits.....................................................................................................11

Covered Expenses................................................................................................................................11

General Limitations.......................................................................................................................15

Payment of Benefits.......................................................................................................................15

Termination of Supplemental Medical Benefits..........................................................................16

Employees...........................................................................................................................................16

Dependents..........................................................................................................................................16

Continuation........................................................................................................................................17

Rescissions..........................................................................................................................................18

Medical Benefits Extension Upon Policy Cancellation..............................................................19

Federal Requirements...................................................................................................................19

Qualified Medical Child Support Order (QMCSO)...............................................................................19

Special Enrollment Rights Under the Health Insurance Portability & Accountability Act (HIPAA)....20

Effect of Section 125 Tax Regulations on This Plan..............................................................................21

Eligibility for Coverage for Adopted Children.......................................................................................22

Coverage for Maternity Hospital Stay....................................................................................................22

Women’s Health and Cancer Rights Act (WHCRA)..............................................................................22

Group Plan Coverage Instead of Medicaid.............................................................................................22

Requirements of Medical Leave Act of 1993 (as amended) (FMLA)....................................................22

Uniformed Services Employment and Re-Employment Rights Act of 1994 (USERRA)......................23

Claim Determination Procedures under ERISA.....................................................................................23

COBRA Continuation Rights Under Federal Law.................................................................................24

ERISA Required Information.................................................................................................................27

Notice of an Appeal or a Grievance.......................................................................................................29

When You Have A Concern Or Complaint.................................................................................29

Definitions......................................................................................................................................33

Exhibit 10.2.1

Exhibit 10.2.1

Explanation of Terms

You will find terms starting with capital letters throughout your certificate. To help you understand your benefits, most of these terms are defined in the Definitions section of your certificate.

Exhibit 10.2.1

_____________________________________________________________________________________________

Important Notices

Notice of Grandfathered Plan Status

This plan is being treated as a “grandfathered health plan” under the Patient Protection and Affordable Care Act (the Affordable Care Act). As permitted by the Affordable Care Act, a grandfathered health plan can preserve certain basic health coverage that was already in effect when that law was enacted. Being a grandfathered health plan means that your coverage may not include certain consumer protections of the Affordable Care Act that apply to other plans, for example, the requirement for the provision of preventive health services without any cost sharing. However, grandfathered health plans must comply with certain other consumer protections in the Affordable Care Act, for example, the elimination of lifetime limits on benefits.

Questions regarding which protections apply and which protections do not apply to a grandfathered health plan and what might cause a plan to change from grandfathered health plan status can be directed to the plan administrator at the phone number or address provided in your plan documents, to your employer or plan sponsor or an explanation can be found on Cigna’s website at http://www.Cigna.com/sites/healthcare_reform/customer.html.

If your plan is subject to ERISA, you may also contact the Employee Benefits Security Administration, U.S. Department of Labor at 1-866-444-3272 or www.dol.gov/ebsa/healthreform. This website has a table summarizing which protections do and do not apply to grandfathered health plans.

If your plan is a nonfederal government plan or a church plan, you may also contact the U.S. Department of Health and Human Services at www.healthcare.gov.

HC-NOT4 | 01-11 | |||

Important Information

Mental Health Parity and Addiction Equity Act The Certificate is amended as stated below:

In the event of a conflict between the provisions of your plan documents and the provisions of this notice, the provisions that provide the better benefit shall apply.

The Schedule and Mental Health and Substance Abuse Covered Expenses:

Partial Hospitalization charges for Mental Health and Substance Abuse will be paid at the Outpatient level. Covered Expenses are changed as follows:

Mental Health and Substance Abuse Services

Mental Health Services are services that are required to treat a disorder that impairs the behavior, emotional reaction or thought processes. In determining benefits payable, charges made for the treatment of any physiological conditions related to Mental Health will not be considered to be charges made for treatment of Mental Health.

Substance Abuse is defined as the psychological or physical dependence on alcohol or other mind-altering drugs that requires diagnosis, care, and treatment. In determining benefits payable, charges made for the treatment of any physiological conditions related to rehabilitation services for alcohol or drug abuse or addiction will not be considered to be charges made for treatment of Substance Abuse.

Inpatient Mental Health Services

Services that are provided by a Hospital while you or your Dependent is Confined in a Hospital for the treatment and evaluation of Mental Health. Inpatient Mental Health Services include Mental Health Residential Treatment Services.

Mental Health Residential Treatment Services are services provided by a Hospital for the evaluation and treatment of the psychological and social functional disturbances that are a result of subacute Mental Health conditions.

Mental Health Residential Treatment Center means an institution which specializes in the treatment of psychological and social disturbances that are the result of Mental Health conditions; provides a subacute, structured, psychotherapeutic treatment program, under the supervision of Physicians; provides 24-hour care, in which a person lives in an open setting; and is licensed in accordance with the laws of the appropriate legally authorized agency as a residential treatment center.

A person is considered confined in a Mental Health Residential Treatment Center when she/he is a registered bed patient in a Mental Health Residential Treatment Center upon the recommendation of a Physician.

Outpatient Mental Health Services are Services of Providers who are qualified to treat Mental Health when treatment is provided on an outpatient basis, while you or your Dependent is not Confined in a Hospital, or for Partial Hospitalization sessions, and is provided in an individual, group or Mental Health Intensive Outpatient Therapy Program. Covered services include, but are not limited to, outpatient treatment of conditions such as: anxiety or depression which interfere with daily functioning; emotional adjustment or concerns related to chronic conditions, such as psychosis or depression; emotional reactions associated with marital problems or divorce; child/adolescent problems of conduct or poor impulse control; affective disorders; suicidal or homicidal threats or acts; eating

_____________________________________________________________________________________________________________

6 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

disorders; or acute exacerbation of chronic Mental Health conditions (crisis intervention and relapse prevention) and outpatient testing and assessment.

Partial Hospitalization sessions are services that are provided for not less than 4 hours and not more than 12 hours in any 24- hour period.

Inpatient Substance Abuse Rehabilitation Services

Services provided for rehabilitation, while you or your Dependent is Confined in a Hospital, when required for the diagnosis and treatment of abuse or addiction to alcohol and/or drugs. Inpatient Substance Abuse Services include Residential Treatment services.

Substance Abuse Residential Treatment Services are services provided by a Hospital for the evaluation and treatment of the psychological and social functional disturbances that are a result of subacute Substance Abuse conditions.

Substance Abuse Residential Treatment Center means an institution which specializes in the treatment of psychological and social disturbances that are the result of Substance Abuse; provides a subacute, structured, psychotherapeutic treatment program, under the supervision of Physicians; provides 24- hour care, in which a person lives in an open setting; and is licensed in accordance with the laws of the appropriate legally authorized agency as a residential treatment center.

A person is considered confined in a Substance Abuse Residential Treatment Center when she/he is a registered bed patient in a Substance Abuse Residential Treatment Center upon the recommendation of a Physician.

Outpatient Substance Abuse Rehabilitation Services

Services provided for the diagnosis and treatment of abuse or addiction to alcohol and/or drugs, while you or your Dependent is not Confined in a Hospital, including outpatient rehabilitation in an individual, or a Substance Abuse Intensive Outpatient Therapy Program and for Partial Hospitalization sessions.

Partial Hospitalization sessions are services that are provided for not less than 4 hours and not more than 12 hours in any 24- hour period.

A Substance Abuse Intensive Outpatient Therapy Program consists of distinct levels or phases of treatment that are provided by a certified/licensed Substance Abuse program. Intensive Outpatient Therapy Programs provide a combination of individual, family and/or group therapy in a day, totaling nine, or more hours in a week.

Substance Abuse Detoxification Services

Detoxification and related medical ancillary services are provided when required for the diagnosis and treatment of addiction to alcohol and/or drugs. Cigna will decide, based on

the Medical Necessity of each situation, whether such services will be provided in an inpatient or outpatient setting.

Mental Health and Substance Abuse Exclusions:

The following exclusion is hereby deleted and no longer applies:

• | any court ordered treatment or therapy, or any treatment or therapy ordered as a condition of parole, probation or custody or visitation evaluations unless Medically Necessary and otherwise covered under this policy or agreement. |

Terms within the agreement:

The term “mental retardation” within your Certificate is hereby changed to “intellectual disabilities”.

Visit Limits:

Any health care service billed with a Mental Health or Substance Abuse diagnosis, will not incur a visit limit, including but not limited to genetic counseling and nutritional evaluation/counseling.

HC-NOT69 | 12-14 | |||

Discrimination is Against the Law

Cigna complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability or sex. Cigna does not exclude people or treat them differently because of race, color, national origin, age, disability or sex.

Cigna:

• | Provides free aids and services to people with disabilities to communicate effectively with Cigna, such as qualified sign language interpreters and written information in other formats (large print, audio, accessible electronic formats, other formats). |

• | Provides free language services to people whose primary language is not English, such as qualified interpreters and information written in other languages. |

If you need these services, contact Customer Service/Member Services at the toll-free phone number shown on your ID card, and ask an associate for assistance.

If you believe that Cigna has failed to provide these services or discriminated in another way on the basis of race, color, national origin, age, disability or sex, you can file a grievance by sending an email to ACAGrievance@cigna.com or by writing to the following address: Cigna, Nondiscrimination Complaint Coordinator, P.O. Box 188016, Chattanooga, TN 37422.

_____________________________________________________________________________________________________________

7 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

If you need assistance filing a written grievance, please call the toll-free phone shown on your ID card or send an email to ACAGrievance@cigna.com.

You can also file a civil rights complaint with the U.S. Department of Health and Human Services, Office for Civil Rights electronically through the Office for Civil Rights Complaint Portal, available at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf, or by mail at:

U.S. Department of Health and Human Services, 200 Independence Avenue, SW, Room 509F, HHH Building, Washington, D.C. 20201; or by phone at 1-800-368-1019, 800-537-7697 (TDD).

Complaint forms are available at http://www.hhs.gov/ocr/office/file/index.html.

HC-NOT76 | 10-16 | |||

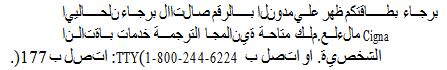

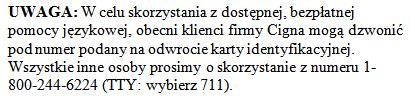

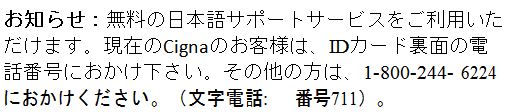

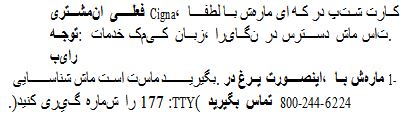

Proficiency of Language Assistance Services

ATTENTION: Language assistance services, free of charge, are available to you. For current Cigna customers, call the number on the back of your ID card. Otherwise, call 1-800- 244-6224 (TTY: Dial 711).

Spanish

ATENCIÓN: tiene a su disposición servicios gratuitos de asistencia lingüística. Si es un cliente actual de Cigna, llame al número que figura en el reverso de su tarjeta de identificación. Si no lo es, llame al 1-800-244-6224 (los usuarios de TTY deben llamar al 711).

Chinese

Vietnamese

CHÚ Ý: Có dịch vụ hỗ trợ ngôn ngữ miễn phí dành cho bạn. Dành cho khách hàng hiện tại của Cigna, gọi số ở mặt sau thẻ Hội viên. Các trýờng hợp khác xin gọi số 1- 800-244-6224 (TTY: Quay số 711).

Korean

Tagalog

PAUNAWA: Makakakuha ka ng mga serbisyo sa tulong sa wika nang libre. Para sa mga kasalukuyang customer ng Cigna, tawagan ang numero sa likuran ng iyong ID card. O kaya, tumawag sa 1-800-244-6224 (TTY: I-dial ang 711).

Russian

Arabic

French Creole

ATANSYON: Gen sèvis èd nan lang ki disponib gratis pou ou. Pou kliyan Cigna yo, rele nimewo ki dèyè kat ID ou.

Sinon, rele nimewo 1-800-244-6224 (TTY: Rele 711). French

ATTENTION: des services d’aide linguistique vous sont proposés gratuitement. Si vous êtes un client actuel de Cigna, veuillez appeler le numéro indiqué au verso de votre carte d’identité. Sinon, veuillez appeler le numéro 1-800-244-6224 (ATS: composez le numéro 711).

Portuguese

ATENÇÃO: Tem ao seu dispor serviços de assistência linguística, totalmente gratuitos. Para clientes Cigna atuais, ligue para o número que se encontra no verso do seu cartão de identificação. Caso contrário, ligue para 1-800-244-6224 (Dispositivos TTY: marque 711).

Polish

Japanese

Italian

ATTENZIONE: sono disponibili servizi di assistenza linguistica gratuiti. Per i clientI Cigna attuali, chiamare il

_____________________________________________________________________________________________________________

8 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

numero sul retro della tessera ID. In caso contrario, chiamare il numero 1-800-244-6224 (utenti TTY: chiamare il numero 711).

German

Achtung: Die Leistungen der Sprachunterstützung stehen Ihnen kostenlos zur Verfügung. Für gegenwärtige Cigna- Kunden, Bitte rufen Sie die Nummer auf der Rückseite Ihres Personalausweises. Sonst, rufen Sie 1-800-244-6224 (TTY: Wählen Sie 711).

Persian (Farsi)

HC-NOT77 | 10-16 | |||

How To File Your Claim

Claims can be submitted by the provider if the provider is able and willing to file on your behalf. If the provider is not submitting on your behalf, you must send your completed claim form and itemized bills to the claims address listed on the claim form.

You may get the required claim forms from the website listed on your identification card or by calling Member Services using the toll-free number on your identification card.

CLAIM REMINDERS

• | BE SURE TO USE YOUR MEMBER ID AND ACCOUNT/GROUP NUMBER WHEN YOU FILE CIGNA’S CLAIM FORMS, OR WHEN YOU CALL YOUR CIGNA CLAIM OFFICE. |

YOUR MEMBER ID IS THE ID SHOWN ON YOUR BENEFIT IDENTIFICATION CARD.

YOUR ACCOUNT/GROUP NUMBER IS SHOWN ON YOUR BENEFIT IDENTIFICATION CARD.

• | BE SURE TO FOLLOW THE INSTRUCTIONS LISTED ON THE BACK OF THE CLAIM FORM CAREFULLY WHEN SUBMITTING A CLAIM TO CIGNA. |

Timely Filing of Out-of-Network Claims

Cigna will consider claims for coverage under our plans when proof of loss (a claim) is submitted within one year (365 days) after services are rendered. If services are rendered on consecutive days, such as for a hospital confinement, the limit will be counted from the last date of service. If claims are not submitted within one year, the claim will not be considered valid and will be denied. However, if proof of loss is not given

in the time period stated in the paragraph, the claim will not be invalidated nor reduced if it is shown that proof of loss

was given as soon as reasonably possible.

WARNING: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties. Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

HC-CLM1 | 04-10 | |||

V6 | ||||

Eligibility - Effective Date

Eligibility for Employee Insurance

You will become eligible for Supplemental Medical Benefits on the day you are eligible under your Employer-Sponsored Medical and Vision Benefits Plans if you are in a Class of Eligible Employees.

Eligibility for Dependent Insurance

You will become eligible for Supplemental Medical Benefits for Dependents on the later of:

• | the day you become eligible for yourself; or |

• | the day you acquire your first Dependent. |

Classes of Eligible Employees

Each Employee

Employee Supplemental Medical Benefits

This Plan is offered to you as an Employee.

Effective Date of Your Supplemental Medical Benefits

You will become insured on the date you elect the insurance by signing an approved payroll deduction form (if required), but no earlier than the date you become eligible.

Dependent Supplemental Medical Benefits

For your Dependents to be insured, you may have to pay part of the cost of Dependent Supplemental Medical Benefits.

Effective Date of Your Supplemental Medical Benefits for Your Dependents

Supplemental Medical Benefits for your Dependents will become effective on the date you elect them by signing an approved payroll deduction form (if required), but no earlier than the date you become eligible for them. All of your Dependents as defined by the terms of your Employer- Sponsored Medical and Vision Benefits Plans will be included.

_____________________________________________________________________________________________________________

9 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Your Dependents will be insured only if you are insured.

HC-ELG2 | 04-10 | |||

V1 | ||||

_____________________________________________________________________________________________________________

10 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Supplemental Medical Benefits

If you or any one of your Dependents, while insured for Supplemental Medical Benefits, incurs Covered Expenses as defined below, Cigna will pay 100% of the amount of Covered Expenses so incurred. The amount of Supplemental Medical Benefits payable will be subject to the Maximum Benefit Provision.

Maximum Benefit Provision

The total amount of Supplemental Medical Benefits payable for all expenses incurred for you and your Dependents, if any, in a calendar year will not exceed $2,700 per individual and

$5,200 per family, per calendar year.

Covered Expenses

The term Covered Expenses means expenses incurred by or on behalf of you or any one of your Dependents. for the charges below. Expenses are considered Covered Expenses to the extent that the services or supplies provided are recommended by a Physician. Covered Expenses will include only those expenses incurred for charges made:

• | for medical services and supplies to the extent that no benefits are payable under your Employer's medical insurance plan solely because of: Coinsurance factors or Deductibles; dollar limits; or limits on the number of days for which benefits are payable. |

• | for or in connection with cosmetic surgery when: a person receives an Injury which results in bodily damage requiring the surgery; it qualifies as reconstructive surgery following a mastectomy, including surgery and reconstruction of the other breast to achieve symmetry; it qualifies as reconstructive surgery performed on a person following surgery, and both the surgery and the reconstructive surgery are essential and medically necessary; or it is performed to correct a congenital abnormality on one of your Dependents who has not reached skeletal maturity. |

• | for eye examinations and eyeglasses, including contact lenses. |

• | for hearing examinations and hearing aids. |

• | for routine physical examinations and immunizations. |

• | for dental services and supplies provided by a Dentist to the extent that no benefits are payable under your Employer's dental plan solely because of: Coinsurance factors or Deductibles; or dollar limits. |

• | for orthodontia. |

• | for or in connection with in vitro fertilization, artificial insemination or similar procedures. |

• | for charges made for or in connection with tired, weak or strained feet for which treatment consists of routine foot care, including but not limited to, the removal of calluses and corns or the trimming of toenails. |

Limitations

No payment will be made for expenses incurred to the extent that you or your Dependents are entitled to receive payment for such expenses under any other Group Health Plan sponsored by your Employer.

See the section in this certificate entitled General Limitations

for additional restrictions that apply to these benefits.

Extension Of Supplemental Medical Benefits

Covered Expenses incurred after a person's Supplemental Medical Benefits cease, but within one year, will be deemed to be incurred while he is insured if such expense is for an Injury or a Sickness which causes him to be Totally Disabled from the day his insurance ceases until that expense is incurred.

This Extension of Supplemental Medical Benefits will not apply to a child born as a result of a pregnancy which exists when these benefits cease.

General

There is no Conversion Privilege applicable to Supplemental Medical Benefits once insurance under the Policy ceases.

HC-MRP1 | 04-10 | |||

V1 | ||||

Covered Expenses

The term Covered Expenses means the expenses incurred by or on behalf of a person for the charges listed below if they are incurred after he becomes insured for these benefits. Expenses incurred for such charges are considered Covered Expenses to the extent that the services or supplies provided are recommended by a Physician, and are Medically Necessary for the care and treatment of an Injury or a Sickness, as determined by Cigna. Any applicable Copayments, Deductibles or limits are shown in The Schedule.

Covered Expenses

• | charges made by a Hospital, on its own behalf, for Bed and Board and other Necessary Services and Supplies; except that for any day of Hospital Confinement, Covered Expenses will not include that portion of charges for Bed and Board which is more than the Bed and Board Limit shown in The Schedule. |

• | charges for licensed ambulance service to or from the nearest Hospital where the needed medical care and treatment can be provided. |

_____________________________________________________________________________________________________________

11 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

• | charges made by a Hospital, on its own behalf, for medical care and treatment received as an outpatient. |

• | charges made by a Free-Standing Surgical Facility, on its own behalf for medical care and treatment. |

• | charges made on its own behalf, by an Other Health Care Facility, including a Skilled Nursing Facility, a Rehabilitation Hospital or a subacute facility for medical care and treatment; except that for any day of Other Health Care Facility confinement, Covered Expenses will not include that portion of charges which are in excess of the Other Health Care Facility Daily Limit shown in The Schedule. |

• | charges made for Emergency Services and Urgent Care. |

• | charges made by a Physician or a Psychologist for professional services. |

• | charges made by a Nurse, other than a member of your family or your Dependent's family, for professional nursing service. |

• | charges made for anesthetics and their administration; diagnostic x-ray and laboratory examinations; x-ray, radium, and radioactive isotope treatment; chemotherapy; blood transfusions; oxygen and other gases and their administration. |

• | charges made for a baseline mammogram for women between the ages of 35 and 40; an annual mammogram for women age 40 and over; and mammograms at any time if ordered by a woman’s health care provider for women with a family history of breast cancer or other breast cancer risk factors. |

• | charges made for an annual Papanicolaou laboratory screening test. Pap smear coverage includes an initial pap smear and any confirmatory tests, when Medically Necessary, as ordered by the attending Physician, including all associated laboratory tests. |

• | charges made for an annual prostate-specific antigen test (PSA), including a digital rectal examination, for men age 50 and over who are asymptomatic and for men age 40 and over with a family history of prostate cancer, or other prostate cancer risk factors. |

• | charges made for laboratory services, radiation therapy and other diagnostic and therapeutic radiological procedures. |

• | abortion when a Physician certifies in writing that the pregnancy would endanger the life of the mother, or when the expenses are incurred to treat medical complications due to abortion. |

• | charges made for the following preventive care services (detailed information is available at www.healthcare.gov.): |

(1) | evidence-based items or services that have in effect a rating of “A” or “B” in the current recommendations of the United States Preventive Services Task Force; |

(2) | immunizations that have in effect a recommendation from the Advisory Committee on Immunization Practices of the Centers for Disease Control and Prevention with respect to the Covered Person involved; |

(3) | for infants, children, and adolescents, evidence- informed preventive care and screenings provided for in the comprehensive guidelines supported by the Health Resources and Services Administration; |

(4) | for women, such additional preventive care and screenings not described in paragraph (1) as provided for in comprehensive guidelines supported by the Health Resources and Services Administration. |

• | charges made for Preventive Care consisting of the following health and wellness tests and services delivered or supervised by a Physician, in keeping with prevailing medical standards: |

• | for all persons 20 years of age and older, annual tests to determine blood hemoglobin, blood pressure, blood glucose level, and blood cholesterol level or, instead, low- density lipoprotein (LDL) level and blood high-density lipoprotein (HDL) level; for all persons 35 years of age or older, a glaucoma eye test every five years; for all persons 40 years of age or older, an annual stool examination for presence of blood; for all persons 45 years of age or older, a left-sided colon examination of 35 to 60 centimeters every five years; for all women 20 years of age and older; a Pap smear as recommended by a Physician; for all women 40 years and older, a mammogram annually; for all adults, recommended immunizations; and all persons 20 years of age and older, an annual consultation with a health care provider to discuss lifestyle behaviors that promote health and well-being including, but not limited to, smoking control, nutrition and diet recommendations, exercise plans, lower back protection, weight control, immunization practices, breast self-examination, testicular self-exam and seat belt usage in motor vehicles; excluding any charges for: |

• | services for which benefits are otherwise provided under this Medical Benefits section; |

• | services for which benefits are not payable according to the Expenses Not Covered section. |

Other wellness tests and time schedules will be covered upon the recommendation of a Physician. Any In-Network deductible will be waived for these preventive care services.

_____________________________________________________________________________________________________________

12 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Additionally, Covered Expenses include charges for childhood immunizations as recommended by the Advisory Committee on Immunization practices of the U.S. Public Health Service, the Department of Health and the New Jersey Department of Health and Senior Services for a Dependent child during that child’s lifetime. Any In- Network deductible will be waived for childhood immunizations.

• | charges for the following screening examinations and laboratory tests for colorectal cancer screening in average- risk adults, beginning at age 50: annual guaiac-based fecal occult blood test (gFOBT) with high tests sensitivity for cancer; annual immunochemical-based fecal occult blood test (FIT) with high test sensitivity for cancer; stool DNA (sDNA) test with high test sensitivity for cancer; flexible sigmoidoscopy every five years; colonoscopy every ten years; double contract barium enema every five years; computed tomography colonography (virtual colonoscopy) every five years. |

• | charges for maternity benefits to include 48 hours of inpatient care following a vaginal delivery and 96 hours of inpatient care following a cesarean section for a mother and her newborn child in a licensed health care facility if requested by the mother or determined by the attending Physician to be Medically Necessary. |

• | charges for screening by blood lead measurement for lead poisoning for children, including: confirmatory blood lead testing, medical evaluation, and any necessary medical follow-up and treatment for lead poisoning for children. |

• | charges for therapeutic treatment of inherited metabolic diseases, when diagnosed by a Physician and deemed to be medically necessary. Treatment includes the purchase of medical foods and low protein modified food products. Inherited metabolic diseases means a disease caused by an inherited abnormality of body chemistry. A low protein modified food product is one that is specially formulated to have less than one gram of protein per serving. It is intended to be used under the direction of a Physician for the dietary treatment of an inherited metabolic disease, but does not include a (natural) food that is naturally low in protein. |

Medical food means one that is intended for the dietary treatment of a disease or condition for which nutritional requirements are established by medical evaluation and is formulated to be consumed or administered enterally under the direction of a Physician.

• | charges for screening for newborn hearing loss by electrophysiologic screening measures and periodic monitoring. Any deductible will be waived for newborn and infant hearing screening. |

• | charges for or in connection with a drug that has been prescribed for a treatment for which it has not been |

approved by the Food and Drug Administration (FDA). Such drug must be covered, provided: it is recognized as medically appropriate for that specific treatment in one of the following reference compendia: the American Medical Association Drug Evaluations; the American Hospital Formulary Service Drug Information; the United States Pharmacopeia Drug Information; or it is recommended by a clinical study or review article in a major peer-reviewed professional journal; and the drug has not been contraindicated by the FDA for the use prescribed.

• | charges for insulin, insulin syringes, prefilled insulin cartridges for the blind, glucose test strips, visual reading strips and urine test strips, lancets, alcohol swabs and oral blood sugar control agents which are recommended or prescribed by a Physician, nurse practitioner or clinical nurse specialist for the treatment of diabetes. Diabetic pharmaceuticals are payable at the same Deductible and Coinsurance as any other Covered Expense. |

• | charges for blood glucose monitors (including monitors for the blind), insulin pumps, infusion devices and related accessories. Charges for these items are not subject to the Durable Medical Equipment Maximum shown in The Schedule. |

• | charges for the diagnosis and treatment of autism and other developmental disabilities. |

For a primary diagnosis of autism or another developmental disability, Cigna provides coverage for the following medically necessary therapies as prescribed through a treatment plan:

• | occupational therapy where occupational therapy refers to treatment to develop a covered person’s ability to perform the ordinary tasks of daily living; |

• | physical therapy where physical therapy refers to treatment to develop a covered person’s physical function; and |

• | speech therapy where speech therapy speech therapy refers to treatment of a speech impairment. |

If a covered person’s primary diagnosis is autism, and the covered person is under 21 years of age, in addition to coverage for the therapy services as described above, Cigna also covers Medically Necessary behavioral interventions based on the principles of applied behavioral analysis and related structured behavioral programs as prescribed through a treatment plan. Except as stated below, such coverage of medically necessary behavioral interventions based on the principles of applied behavioral analysis and related structured behavioral programs is subject to a

$36,000 maximum benefit per calendar year for each year through 2011. (Thereafter the maximum benefit shall be adjusted by New Jersey regulation.)

_____________________________________________________________________________________________________________

13 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Exception: If the Employer providing coverage under the Contract is subject to the Federal law governing parity in mental health and substance use disorder benefits the maximum benefit does not apply.

The treatment plan(s) referred to above must be in writing, signed by the treating physician, and must include: a diagnosis, proposed treatment by type, frequency and duration; the anticipated outcomes stated as goals; and the frequency by which the treatment plan will be updated.

Cigna may request additional information if necessary to determine the coverage under this plan. Cigna may require the submission of an updated treatment plan once every six months unless Cigna and the treating physician agree to more frequent updates.

Clinical Trials

Charges made for routine patient services associated with cancer clinical trials approved and sponsored by the federal government. In addition the following criteria must be met:

• | the cancer clinical trial is listed on the NIH web site www.clinicaltrials.gov as being sponsored by the federal government; |

• | the trial investigates a treatment for terminal cancer and: the person has failed standard therapies for the disease; cannot tolerate standard therapies for the disease; or no effective nonexperimental treatment for the disease exists; |

• | the person meets all inclusion criteria for the clinical trial and is not treated “off-protocol”; |

• | the trial is approved by the Institutional Review Board of the institution administering the treatment. |

Routine patient services do not include, and reimbursement will not be provided for:

• | the investigational service or supply itself; |

• | services or supplies listed herein as Exclusions; |

• | services or supplies related to data collection for the clinical trial (i.e., protocol-induced costs); |

• | services or supplies which, in the absence of private health care coverage, are provided by a clinical trial sponsor or other party (e.g., device, drug, item or service supplied by manufacturer and not yet FDA approved) without charge to the trial participant. |

Genetic Testing

Charges made for genetic testing that uses a proven testing method for the identification of genetically-linked inheritable disease. Genetic testing is covered only if:

• | a person has symptoms or signs of a genetically-linked inheritable disease; |

• | it has been determined that a person is at risk for carrier status as supported by existing peer-reviewed, evidence- |

based, scientific literature for the development of a genetically-linked inheritable disease when the results will impact clinical outcome; or

• | the therapeutic purpose is to identify specific genetic mutation that has been demonstrated in the existing peer- reviewed, evidence-based, scientific literature to directly impact treatment options. |

Pre-implantation genetic testing, genetic diagnosis prior to embryo transfer, is covered when either parent has an inherited disease or is a documented carrier of a genetically- linked inheritable disease.

Genetic counseling is covered if a person is undergoing approved genetic testing, or if a person has an inherited disease and is a potential candidate for genetic testing. Genetic counseling is limited to 3 visits per calendar year for both pre- and post-genetic testing.

Nutritional Evaluation

Charges made for nutritional evaluation and counseling when diet is a part of the medical management of a documented organic disease.

Internal Prosthetic/Medical Appliances

Charges made for internal prosthetic/medical appliances that provide permanent or temporary internal functional supports for nonfunctional body parts are covered. Medically Necessary repair, maintenance or replacement of a covered appliance is also covered.

Diabetic Services

Charges made for diabetic services, provided an official diagnosis of diabetes has been made by a Physician. Diabetic services include:

• | coverage for an annual screening via dilated eye examinations by a Physician for person with diabetes; |

• | glycohemoglobin A1c blood testing determination whenever needed to assess and achieve near-normal glycemia; and |

•microalbumin/urinalysis screening annually. Additional diabetic services include:

• | coverage for Medically Necessary fitting of therapeutic molded or depth-inlay shoes, replacement inserts, preventive devices and shoe modifications; |

• | calluses and nail trimming; |

• | complex evaluation of sensory loss; and |

• | treatment of ulcerations with total contact casting. |

_____________________________________________________________________________________________________________

14 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Diabetic services will also include inpatient and outpatient

self-management training services provided by a Physician, by a certified diabetes educator, or by a registered pharmacist qualified to provide management education for diabetes:

• | according to standards established under New Jersey Department of Health and Senior Services regulations upon diagnosis of diabetes; or |

• | when a Physician certifies that a change in self-management is needed due to a change in symptoms or conditions, or that new medication, therapy or retraining is Medically Necessary. |

Covered training will also include nutrition therapy by a licensed, certified dietician or nutritionist and must be supervised and certified as completed successfully by a Physician.

Second Surgical Opinion Benefits

Covered Expenses will include expenses incurred for charges made for a second surgical opinion if, as a result of an Injury or a Sickness, you or any one of your Dependents, while insured for these benefits and prior to the performance of an Elective Surgical Procedure recommended by a surgeon, asks for an opinion from another Physician who is qualified to diagnose and treat that Injury or Sickness. Covered Expenses will also include any diagnostic laboratory or x-ray examinations asked for by the Physician who gives that opinion.

Payment will be made whether or not the Surgical Procedure is performed.

Third Surgical Opinion Benefits

If your second surgical opinion does not confirm that an Elective Surgical Procedure is medically advisable, a third surgical opinion will also be covered.

Limitations

No payment will be made for expenses incurred in connection with:

• | cosmetic or dental Surgical Procedures not covered under the policy; |

• | minor Surgical Procedures that are routinely performed in a Physician's office, such as incision and drainage for abscess or excision of benign lesions; |

• | an opinion rendered by the Physician who performs the Surgical Procedure. |

• | other limitations shown in the General Limitations section. |

No payment will be made under any other section to the extent that benefits are payable for incurred expenses under this section.

Elective Surgical Procedure

The term Elective Surgical Procedure means a Surgical Procedure which is not considered emergency in nature and which may be avoided without undue risk to the individual.

HC-COV42 | 04-10 | |||

V1 | ||||

General Limitations Supplemental Medical Benefits

No payment will be made for expenses incurred for you or any one of your Dependents for:

• | cosmetic surgery which does not meet any of the requirements listed under Covered Expenses. |

• | electrolysis or other hair removal procedures. |

• | illegal operations or treatments. |

• | controlled substances, including, but not limited to, marijuana or laetrile. |

• | nursing services for a normal, healthy infant. |

• | weight-loss programs for general health, even if a Physician prescribes the program. |

• | over-the-counter drugs or medications or any drug or medication that does not require a Physician's prescription for use, if used for general well-being or for purely cosmetic purposes. |

• | nicotine gum or nicotine patches. |

HC-MRP2 | 04-10 | |||

V1 | ||||

Payment of Benefits

To Whom Payable

Medical Benefits are assignable to the provider. When you assign benefits to a provider, you have assigned the entire amount of the benefits due on that claim. If the provider is overpaid because of accepting a patient’s payment on the charge, it is the provider’s responsibility to reimburse the patient. Because of Cigna’s contracts with providers, all claims from contracted providers should be assigned.

Cigna may, at its option, make payment to you for the cost of any Covered Expenses even if benefits have been assigned. When benefits are paid to you or your Dependent, you or your Dependents are responsible for reimbursing the provider.

_____________________________________________________________________________________________________________

15 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

If any person to whom benefits are payable is a minor or, in the opinion of Cigna is not able to give a valid receipt for any payment due him, such payment will be made to his legal guardian. If no request for payment has been made by his legal guardian, Cigna may, at its option, make payment to the person or institution appearing to have assumed his custody and support.

When one of our participants passes away, Cigna may receive notice that an executor of the estate has been established. The executor has the same rights as our insured and benefit payments for unassigned claims should be made payable to the executor.

Payment as described above will release Cigna from all liability to the extent of any payment made.

Time of Payment

Benefits will be paid by Cigna within 30 days after it receives a proper claim by electronic means and within 40 days after it receives a proper claim by other than electronic means. A claim will be considered to be properly submitted if it is an eligible claim for a health care service provided by a Physician to an insured; the claim has no material defect such as missing substantiating documentation or incorrect coding; there is no dispute regarding the amount of the claim; Cigna has no reason to believe the claim is fraudulent; and the claim requires no special treatment that prevents timely payment. If the claim is in whole or in part denied, ineligible, incomplete of substantiating documentation, miscoded or contains misinformation, the amount is in dispute, or requires special treatment, Cigna will in writing or by electronic means as appropriate, give an explanation of: denial, what documentation is needed to perfect a claim, a disputed claim amount, or a claim requiring extra time to process. Cigna will give notice of receipt of a claim by electronic means no later than two working days following receipt of the transmission of the claim. An overdue payment shall bear simple interest at the rate of 12% per annum.

Recovery of Overpayment

When an overpayment has been made by Cigna, Cigna will have the right, as permitted by New Jersey law, to: recover that overpayment from the person to whom or on whose behalf it was made; or offset the amount of that overpayment from a future claim payment.

Calculation of Covered Expenses

Cigna, in its discretion, will calculate Covered Expenses following evaluation and validation of all provider billings in accordance with:

• | the methodologies in the most recent edition of the Current Procedural terminology, |

• | the methodologies as reported by generally recognized professionals or publications. |

HC-POB3 | 04-10 | |||

V1 | ||||

Termination of Supplemental Medical Benefits

Employees

Your Supplemental Medical Benefits will cease on the earliest date below:

• | The date you cease to be in a Class of Eligible Employees or cease to qualify for the insurance. |

• | The date your coverage under the Employer's Group Medical Benefits Plan ceases. |

• | The date the Supplemental Medical Benefits policy is canceled. |

• | The date your Active Service ends except as described below. |

Any continuation of insurance must be based on a plan which precludes individual selection.

Temporary Layoff or Leave of Absence

If your Active Service ends due to temporary layoff or leave of absence, your insurance will be continued until the date your Employer: stops paying premium for you; or otherwise cancels your insurance. However, your insurance will not be continued for more than 60 days past the date your Active Service ends.

Injury or Sickness

If your Active Service ends due to an Injury or Sickness, your insurance will be continued while you remain totally and continuously disabled as a result of the Injury or Sickness.

However, your insurance will not continue past the date your Employer stops paying premium for you or otherwise cancels your insurance.

Dependents

Your Supplemental Medical Benefits for all of your Dependents will cease on the earliest date below:

• | The date you cease to be in a Class of Eligible Employees or cease to qualify for the insurance. |

• | The date your coverage under the Employer's Group Medical Benefits Plan ceases. |

• | The date the Supplemental Medical Benefits policy is canceled. |

_____________________________________________________________________________________________________________

16 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

The insurance for any one of your Dependents will cease on the date that Dependent no longer qualifies as a Dependent, as defined under the Employer's Group Medical Benefits Plan.

Any continuation of insurance with premium waiver set forth in the Employer-Sponsored Medical Benefits Plan will not apply to the insurance under this Supplemental Medical Benefits policy.

HC-TRM2 | 04-10 | |||

VI | ||||

Continuation

Special Continuation of Medical Insurance - Total Disability

If your insurance would otherwise cease due to total disability, and if you have been insured for at least three consecutive months under the policy, and if you pay your Employer the required premium, your Medical Insurance will be continued until the earliest of:

• | the last day for which you have paid the required premium; |

• | the date you become employed and eligible for similar insurance under another group policy for medical and dental benefits; |

• | the date the policy is canceled. |

Within 31 days after the date the insurance would otherwise cease, you may elect such continuation by completing a continuation notification and by paying the required premium to your Employer.

If your insurance is being continued as outlined above, the Medical Insurance for any of your Dependents insured on the date your insurance would otherwise cease may be continued, subject to the above provisions. The Dependent Medical Insurance will be continued until the earlier of:

• | the date your insurance ceases; or |

• | with respect to any one Dependent, the date that Dependent no longer qualifies as a Dependent. |

This option will not operate to reduce any continuation of insurance otherwise provided.

Continuation of Coverage for Dependent Children under New Jersey Law

A Dependent child of a Covered Person who meets the limiting age for coverage of a Dependent, is eligible to continue coverage for himself until his 31st birthday, provided he meets all of the following “Special Eligibility Criteria” for this continuation coverage:

• | is a Covered Person’s child by blood or by law; and |

• | has reached the limiting age as specified under his parents’ policy, but has not yet reached his 31st birthday; and |

• | is unmarried; and |

• | has no Dependents of his own; and |

• | is either a resident of New Jersey OR is enrolled as a full- time student at an accredited public or private institution of higher education; and |

• | is not covered under any other group or individual health benefits plan, and is not entitled to benefits under Medicare. |

To obtain continued coverage under this provision, the Dependent child must make a written election for continuation coverage as a Dependent, complete any necessary enrollment forms and pay the premium, at any of the following times:

• | within 30 days prior to the termination of coverage at the specific age provided in this Plan; or |

• | within 30 days after meeting the “Special Eligibility Criteria” requirements, when coverage for the Dependent under this Plan previously terminated; or |

• | during an open enrollment period, if provided in the Plan, if the Dependent child meets the “Special Eligibility Criteria” during the open enrollment period; or |

• | for the initial 12 months after the effective date of this legislation, from 5/12/2006 to 5/11/2007 only, a Dependent child meeting the “Special Eligibility Criteria” whose coverage as a Dependent under a Covered Person’s policy terminated prior to 5/12/2006 due to attainment of limiting age under such Covered Person’s policy. |

A Dependent child is only entitled to make an election for continued coverage if the Dependent child was actually covered under his parent’s Plan on the date he reached the limiting age and was terminated due to reaching such limiting age.

To continue group health benefits, the Dependent child must meet all of the requirements specified in this section and must make written election to us. The effective date of the Dependent child’s continued coverage will be the later of: the date the Dependent child requests continued coverage with us; or the date the Dependent meets all of the “Special Eligibility Criteria.” This continued coverage is conditional upon the Dependent child completing the required enrollment form and sending us the first month’s premium due. The Dependent child covered under this continuation benefit must pay subsequent premiums monthly, in advance, at the times and in the manner specified by us. Premium payments, other than the first premium payment, will be considered timely if payment is made no later than 30 days of the date such premium payment is due.

For a Dependent child whose coverage has not yet terminated due to the attainment of the limiting age as specified under this Plan, the written election must be made within 30 days prior to

_____________________________________________________________________________________________________________

17 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

termination of coverage due to the attainment of the limiting age.

For a Dependent child who did not qualify for this continued coverage because he fails to meet all the “Special Eligibility Criteria,” but who subsequently meets all of the “Special Eligibility Criteria,” written election must be made within 30 days after the Dependent child first subsequently meets all of the requirements.

This election opportunity for the Dependent child is explained in greater detail as follows:

• | If a Dependent child did not qualify because he or she was married, the notice must be given within 30 days of the date he or she is no longer married. |

• | If a Dependent child did not qualify because he had a Dependent of his own, the election must be made within 30 days of the date he no longer has a Dependent. |

• | If a Dependent child did not qualify because he either was not a resident of New Jersey or was not a full-time student at an accredited school, the election must be made within 30 days of the date he becomes a resident of New Jersey, or becomes a full-time student at an accredited school. |

• | If a Dependent child did not qualify because he was covered under any other group or individual health benefits plan, group health plan, church plan or health benefits plan, or was entitled to Medicare, the election must be made within 30 days of the date he is no longer covered under any other group or individual health benefits plan, group health plan, church plan or health benefits plan, or is no longer entitled to Medicare. |

Each year, there will be an Open Enrollment Period as specified under this Plan during which a Dependent child who previously did not elect to continue coverage, may make an election to continue coverage.

A Dependent child who qualifies for this continuation coverage as of May 12, 2006, having reached the limiting age under his parents’ plan and lost coverage prior to May 12, 2006 due to reaching such limiting age, may give written notice of an election for continued coverage at any time beginning May 12, 2006 and continuing until May 11, 2007.

A Dependent child who was covered under prior Creditable Coverage that terminated no more than 90 days prior to making an election for continuation under this section will be given credit for the time he was covered under the Creditable Coverage toward the application of the Pre-Existing Conditions Exclusion under the Policy.

The continued coverage shall be identical to the coverage provided to the Dependent child continuant’s parent who is covered as an Employee under this Plan. If coverage is modified for Dependents who are under the limiting age as specified in this Plan, the coverage for Dependent child

continuants shall also be modified in the same manner. Evidence of insurability is not required for the continued coverage.

The Group is required to notify the Dependent child in writing of the option to continue coverage and the duties of continuing coverage at the following times:

• | on/before the coverage of the Dependent terminates due to reaching the limiting age; and |

• | at the time coverage terminates because the Dependent child no longer meets the “Special Eligibility Criteria”, except |

that notice is not required when the Dependent child turns 30 or has a dependent of his own; and

• | before any open enrollment period; and |

• | immediately following 5/12/2006, for the subsequent 12 months. |

Continuation of coverage under this section will end on the earliest of the following dates:

• | the date ending the period for which premium has been paid for the Dependent child continuant, subject to the Grace Period for such payment; or |

• | the date the Group ceases to provide coverage to the Covered Person, who is the Dependent child’s parent; or |

• | the date the Plan under which the Dependent child continuing coverage is amended to delete coverage for Dependents; or |

• | the date the Dependent child ceases to continue to meet any of the “Special Eligibility Criteria” requirements; or |

• | the date the Dependent child’s parent who is covered as an Employee under this Plan waives Dependent coverage. Except, if the Employee has no other Dependents, the Dependent child continuant’s coverage will not end as a result of the Employee waiving Dependent coverage. |

HC-TRM12 | 04-10 | |||

VI | ||||

Rescissions

Your coverage may not be rescinded (retroactively terminated) by Cigna or the plan sponsor unless the plan sponsor or an individual (or a person seeking coverage on behalf of the individual) performs an act, practice or omission that constitutes fraud; or the plan sponsor or individual (or a person seeking coverage on behalf of the individual) makes an intentional misrepresentation of material fact.

HC-TRM80 | 01-11 | |||

_____________________________________________________________________________________________________________

18 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Medical Benefits Extension Upon Policy Cancellation

If the Medical Benefits under this plan cease for you or your Dependent due to cancellation of the policy, and you are or you Dependent is Totally Disabled on that date due to an Injury or Sickness, Medical Benefits will be paid for Covered Expenses incurred in connection with that Injury or Sickness. However, no benefits will be paid after the earliest of:

• | the date you exceed the Maximum Benefit, if any, shown in the Schedule; |

• | the date you are covered for medical benefits under another group policy; |

• | the date you are no longer Totally Disabled (but only if benefits for that disabling condition are being paid for you under the replacing policy); |

• | 12 months from the date your Medical Benefits cease; or |

• | 12 months from the date the policy is canceled. |

Totally Disabled

You will be considered Totally Disabled if, because of an Injury or a Sickness:

• | you are unable to perform the basic duties of your occupation; and |

• | you are not performing any other work or engaging in any other occupation for wage or profit. |

Your Dependent will be considered Totally Disabled if, because of an Injury or a Sickness:

• | he is unable to engage in the normal activities of a person of the same age, sex and ability; or |

• | in the case of a Dependent who normally works for wage or profit, he is not performing such work. |

Please Note: The terms of this Medical Benefits Extension will not apply to a child born as a result of a pregnancy which exists when you or your Dependent's Medical Benefits cease.

HC-BEX10 | 04-10 | |||

V1 | ||||

Federal Requirements

The following pages explain your rights and responsibilities under federal laws and regulations. Some states may have similar requirements. If a similar provision appears elsewhere in this booklet, the provision which provides the better benefit will apply.

HC-FED1 | 10-10 | |||

Qualified Medical Child Support Order (QMCSO)

Eligibility for Coverage Under a QMCSO

If a Qualified Medical Child Support Order (QMCSO) is issued for your child, that child will be eligible for coverage as required by the order and you will not be considered a Late Entrant for Dependent Insurance.

You must notify your Employer and elect coverage for that child, and yourself if you are not already enrolled, within 31 days of the QMCSO being issued.

Qualified Medical Child Support Order Defined

A Qualified Medical Child Support Order is a judgment, decree or order (including approval of a settlement agreement) or administrative notice, which is issued pursuant to a state domestic relations law (including a community property law), or to an administrative process, which provides for child support or provides for health benefit coverage to such child and relates to benefits under the group health plan, and satisfies all of the following:

• | the order recognizes or creates a child’s right to receive group health benefits for which a participant or beneficiary is eligible; |

• | the order specifies your name and last known address, and the child’s name and last known address, except that the name and address of an official of a state or political subdivision may be substituted for the child’s mailing address; |

• | the order provides a description of the coverage to be provided, or the manner in which the type of coverage is to be determined; |

• | the order states the period to which it applies; and |

• | if the order is a National Medical Support Notice completed in accordance with the Child Support Performance and Incentive Act of 1998, such Notice meets the requirements above. |

The QMCSO may not require the health insurance policy to provide coverage for any type or form of benefit or option not otherwise provided under the policy, except that an order may require a plan to comply with State laws regarding health care coverage.

_____________________________________________________________________________________________________________

19 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

Payment of Benefits

Any payment of benefits in reimbursement for Covered Expenses paid by the child, or the child’s custodial parent or legal guardian, shall be made to the child, the child’s custodial parent or legal guardian, or a state official whose name and address have been substituted for the name and address of the child.

HC-FED4 | 10-10 | |||

Special Enrollment Rights Under the Health Insurance Portability & Accountability Act (HIPAA)

If you or your eligible Dependent(s) experience a special enrollment event as described below, you or your eligible Dependent(s) may be entitled to enroll in the Plan outside of a designated enrollment period upon the occurrence of one of the special enrollment events listed below. If you are already enrolled in the Plan, you may request enrollment for you and your eligible Dependent(s) under a different option offered by the Employer for which you are currently eligible. If you are not already enrolled in the Plan, you must request special enrollment for yourself in addition to your eligible Dependent(s). You and all of your eligible Dependent(s) must be covered under the same option. The special enrollment events include:

• | Acquiring a new Dependent. If you acquire a new Dependent(s) through marriage, birth, adoption or placement for adoption, you may request special enrollment for any of the following combinations of individuals if not already enrolled in the Plan: Employee only; spouse only; Employee and spouse; Dependent child(ren) only; Employee and Dependent child(ren); Employee, spouse and Dependent child(ren). Enrollment of Dependent children is limited to the newborn or adopted children or children who became Dependent children of the Employee due to marriage. |

• | Loss of eligibility for State Medicaid or Children’s Health Insurance Program (CHIP). If you and/or your Dependent(s) were covered under a state Medicaid or CHIP plan and the coverage is terminated due to a loss of eligibility, you may request special enrollment for yourself and any affected Dependent(s) who are not already enrolled in the Plan. You must request enrollment within 60 days after termination of Medicaid or CHIP coverage. |

• | Loss of eligibility for other coverage (excluding continuation coverage). If coverage was declined under this Plan due to coverage under another plan, and eligibility for the other coverage is lost, you and all of your eligible |

Dependent(s) may request special enrollment in this Plan. If required by the Plan, when enrollment in this Plan was

previously declined, it must have been declined in writing with a statement that the reason for declining enrollment was due to other health coverage. This provision applies to loss of eligibility as a result of any of the following:

• | divorce or legal separation; |

• | cessation of Dependent status (such as reaching the limiting age); |

• | death of the Employee; |

• | termination of employment; |

• | reduction in work hours to below the minimum required for eligibility; |

• | you or your Dependent(s) no longer reside, live or work in the other plan’s network service area and no other coverage is available under the other plan; |

• | you or your Dependent(s) incur a claim which meets or exceeds the lifetime maximum limit that is applicable to all benefits offered under the other plan; or |

• | the other plan no longer offers any benefits to a class of similarly situated individuals. |

• | Termination of employer contributions (excluding continuation coverage). If a current or former employer ceases all contributions toward the Employee’s or Dependent’s other coverage, special enrollment may be requested in this Plan for you and all of your eligible Dependent(s). |

• | Exhaustion of COBRA or other continuation coverage. Special enrollment may be requested in this Plan for you and all of your eligible Dependent(s) upon exhaustion of COBRA or other continuation coverage. If you or your Dependent(s) elect COBRA or other continuation coverage following loss of coverage under another plan, the COBRA or other continuation coverage must be exhausted before any special enrollment rights exist under this Plan. An individual is considered to have exhausted COBRA or other continuation coverage only if such coverage ceases: due to failure of the employer or other responsible entity to remit premiums on a timely basis; when the person no longer resides or works in the other plan’s service area and there is no other COBRA or continuation coverage available under the plan; or when the individual incurs a claim that would meet or exceed a lifetime maximum limit on all benefits and there is no other COBRA or other continuation coverage available to the individual. This does not include termination of an employer’s limited period of contributions toward COBRA or other continuation coverage as provided under any severance or other agreement. |

• | Eligibility for employment assistance under State Medicaid or Children’s Health Insurance Program |

_____________________________________________________________________________________________________________

20 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

(CHIP). If you and/or your Dependent(s) become eligible for assistance with group health plan premium payments under a state Medicaid or CHIP plan, you may request special enrollment for yourself and any affected Dependent(s) who are not already enrolled in the Plan. You must request enrollment within 60 days after the date you are determined to be eligible for assistance.

Except as stated above, special enrollment must be requested within 30 days after the occurrence of the special enrollment event. If the special enrollment event is the birth or adoption of a Dependent child, coverage will be effective immediately on the date of birth, adoption or placement for adoption. Coverage with regard to any other special enrollment event will be effective no later than the first day of the first calendar month following receipt of the request for special enrollment.

Domestic Partners and their children (if not legal children of the Employee) are not eligible for special enrollment.

HC-FED71 | 12-14 | |||

VI | ||||

Effect of Section 125 Tax Regulations on This Plan

Your Employer has chosen to administer this Plan in accordance with Section 125 regulations of the Internal Revenue Code. Per this regulation, you may agree to a pretax salary reduction put toward the cost of your benefits.

Otherwise, you will receive your taxable earnings as cash (salary).

A.Coverage Elections

Per Section 125 regulations, you are generally allowed to enroll for or change coverage only before each annual benefit period. However, exceptions are allowed if your Employer agrees and you enroll for or change coverage within 30 days of the following:

• | the date you meet the Special Enrollment criteria described above; or |

• | the date you meet the criteria shown in the following Sections B through H. |

B. | Change of Status |

A change in status is defined as:

• | change in legal marital status due to marriage, death of a spouse, divorce, annulment or legal separation; |

• | change in number of Dependents due to birth, adoption, placement for adoption, or death of a Dependent; |

• | change in employment status of Employee, spouse or Dependent due to termination or start of employment, strike, lockout, beginning or end of unpaid leave of absence, including under the Family and Medical Leave Act (FMLA), or change in worksite; |

• | changes in employment status of Employee, spouse or Dependent resulting in eligibility or ineligibility for coverage; |

• | change in residence of Employee, spouse or Dependent to a location outside of the Employer’s network service area; and |

• | changes which cause a Dependent to become eligible or ineligible for coverage. |

C. | Court Order |

A change in coverage due to and consistent with a court order of the Employee or other person to cover a Dependent.

D. | Medicare or Medicaid Eligibility/Entitlement |

The Employee, spouse or Dependent cancels or reduces coverage due to entitlement to Medicare or Medicaid, or enrolls or increases coverage due to loss of Medicare or Medicaid eligibility.

E. | Change in Cost of Coverage |

If the cost of benefits increases or decreases during a benefit period, your Employer may, in accordance with plan terms, automatically change your elective contribution.

When the change in cost is significant, you may either increase your contribution or elect less-costly coverage. When a significant overall reduction is made to the benefit option you have elected, you may elect another available benefit option. When a new benefit option is added, you may change your election to the new benefit option.

F.Changes in Coverage of Spouse or Dependent Under Another Employer’s Plan

You may make a coverage election change if the plan of your spouse or Dependent: incurs a change such as adding or deleting a benefit option; allows election changes due to Special Enrollment, Change in Status, Court Order or Medicare or Medicaid Eligibility/Entitlement; or this Plan and the other plan have different periods of coverage or open enrollment periods.

G. | Reduction in work hours |

If an Employee’s work hours are reduced below 30 hours/week (even if it does not result in the Employee losing eligibility for the Employer’s coverage); and the Employee (and family) intend to enroll in another plan that provides Minimum Essential Coverage (MEC). The new coverage must be effective no later than the 1st day of the 2nd month following the month that includes the date the original coverage is revoked.

_____________________________________________________________________________________________________________

21 | myCigna.com | |

Exhibit 10.2.1

_____________________________________________________________________________________________

H. Enrollment in Qualified Health Plan (QHP)

The Employee must be eligible for a Special Enrollment Period to enroll in a QHP through a Marketplace or the Employee wants to enroll in a QHP through a Marketplace during the Marketplace’s annual open enrollment period; and the disenrollment from the group plan corresponds to the intended enrollment of the Employee (and family) in a QHP through a Marketplace for new coverage effective beginning no later than the day immediately following the last day of the original coverage.

HC-FED70 | 12-14 | |||

Eligibility for Coverage for Adopted Children