Attached files

| file | filename |

|---|---|

| EX-32.2 - EXHIBIT 32.2 - Planet Green Holdings Corp. | exhibit32-2.htm |

| EX-32.1 - EXHIBIT 32.1 - Planet Green Holdings Corp. | exhibit32-1.htm |

| EX-31.2 - EXHIBIT 31.2 - Planet Green Holdings Corp. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Planet Green Holdings Corp. | exhibit31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Planet Green Holdings Corp. | exhibit23-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2016

[_] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to

____________

Commission File Number: 001-34449

AMERICAN LORAIN CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 87-0430320 |

| (State or other jurisdiction of | (I.R.S. Employer Identification Number) |

| incorporation or organization) |

BeihuanZhong Road

Junan County

Shandong, People’s Republic of China, 276600

(Address of principal executive office and zip code)

(86) 539-7317959

(Registrant’s

telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | NYSE American |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [ ] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the issuer was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

Yes [ ] No [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] | |

| Non-accelerated filer [ ] | Smaller reporting company [X] | |

| Emerging growth company [ ] |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. [ ]

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes [ ] No [X]

The number of shares and aggregate market value of common stock held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter were 19,259,570 and $7,318,636.6 respectively.

There were 38,274,490 shares of common stock outstanding as of September 29, 2017.

Documents Incorporated by Reference: Portions of the registrant's Proxy Statement related to its 2017 Annual Stockholders' Meeting to be filed subsequently are incorporated by reference into Part III of this Annual Report on Form 10-K. Except as expressly incorporated by reference, the registrant's Proxy Statement shall not be deemed to be part of the report.

1

FORM 10-K INDEX

PART I

Use of Certain Defined Terms

In this annual report on Form 10-K:

| • |

“We,” “us” and “our” refer to ALN, and except where the context requires otherwise, our wholly-owned and majority-owned direct and indirect operating subsidiaries. | |

| • |

“ALN” refers to American Lorain Corporation, a Nevada corporation (formerly known as Millennium Quest, Inc.). | |

| • |

“Athena” refers to Athena, a limited liability company organized under the laws of France that is majority- owned by Junan Hongrun. | |

| • |

“ILH” refers to International Lorain Holding, Inc., a Cayman Islands company that is wholly - owned by ALN. | |

| • |

“Junan Hongrun” refers to Junan Hongrun Foodstuff Co., Ltd. | |

| • |

“Luotian Lorain” refers to Luotian Green Foodstuff Co., Ltd. | |

| • |

“Beijing Lorain” refers to Beijing Green Foodstuff Co., Ltd. | |

| • |

“Shandong Lorain” refers to Shandong Green Foodstuff Co., Ltd. | |

| • |

“Dongguan Lorain” refers to Dongguan Green Foodstuff Co., Ltd. | |

| • |

“Shandong Greenpia” refers to Shandong Greenpia Foodstuff Co., Ltd. | |

| • |

“RMB” refers to Renminbi, the legal currency of China. | |

| • |

“U.S. dollar”, “$” and “US$” refer to the legal currency of the United States. | |

| • |

“China” and “PRC” refer to the People’s Republic of China (excluding Hong Kong and Macau). |

This report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including, without limitation, statements regarding our expectations, beliefs, intentions or future strategies that are signified by the words “expect,” “anticipate,” “intend,” “believe,” or similar language. All forward-looking statements included in this document are based on information available to us on the date hereof, and we assume no obligation to update any such forward-looking statements. Our business and financial performance are subject to substantial risks and uncertainties. Actual results could differ materially from those projected in the forward-looking statements. In evaluating our business, you should carefully consider the information set forth under the heading “Risk Factors.” Readers are cautioned not to place undue reliance on these forward-looking statements.

2

ITEM 1. BUSINESS

Overview of Our Business

We are an integrated food manufacturing company headquartered in Shandong Province, China. We develop, manufacture and sell the following types of food products:

| • |

Chestnut products; | |

| • |

Convenience foods (including ready-to-cook, or RTC, foods, ready-to-eat, or RTE, foods; and | |

| • |

Frozen food products. |

We conduct our production activities in China. Our products are sold in Chinese domestic markets as well as exported to foreign countries and regions such as Japan, South Korea and Europe. We derive most of our revenues from sales in China, Japan and South Korea. In 2017, our primary strategy is to continue building our brand recognition in China through consistent marketing efforts towards supermarkets, wholesalers, and significant customers, enhancing the cooperation with other manufacturers and factories and enhancing the turnover for our existing chestnut, convenience and frozen food products. In addition, we are working to develop new products and new sales channels. We currently have limited sales and marketing activity in the United States, although our long-term plan is to significantly expand our activities there.

Recent Developments

The Company has discovered errors in the timing of revenues recognized during the year ended December 31, 2015. The Company recognizes revenue upon shipping of products to its customers where title of the goods passes upon departure from the Company’s facilities; however, in certain instances, contractual terms dictate that the customers are afforded seven days after the receipt of goods at their premises to inspect the goods for defects or spoilage and notify the Company. If the Company is not contacted within those seven days, the Company’s obligation to the customer are considered fully discharged and revenue should be recognized. Given the timing of these seven days, the Company believes that certain sales transactions have been erroneously recognized during the year ended December 31, 2015. The Company has rectified this error and the impact of the Company’s financial position and result of operations

On December 22, 2016, the Company entered into a Share Exchange Agreement with Shengrong Environmental Protection Holding Company Limited, a business company incorporated in the British Virgin Islands with limited liability (“Shengrong”), and each of Shengrong’s shareholders (collectively, the “Sellers”), pursuant to which, among other things and subject to the terms and conditions contained therein, the Company agreed to effect an acquisition of Shengrong and its subsidiaries, including Hubei Shengrong Environmental Protection Energy-Saving and Technology Co. Ltd., a registered company in Hubei China by acquiring from the Sellers all outstanding equity interests of Shengrong. However, such agreement was terminated and abandoned in June 2017.

Revenues from sales in the China domestic market decreased by approximately $79.2 million, or approximately 46.05%, in 2016. The reasons for the decrease in revenues in China decreased are:

| o |

Shandong Lorain was required to move its production lines to our factory in Junan Hongrun according to a new city zoning plan, so that Shandong Lorain’s land can be used for other urban use. Shandong Lorain started this relocation process in July 2016 and finished this process in December 2016. During the relocation process, we were unable to produce our products with full capacity. As a result, the revenue from sales of chestnuts food products by Shandong Lorain was $30.4 million and $54.3 million in 2016 and in 2015, respectively, decreasing by approximately 44%. | |

| o |

The domestic sale of our chestnuts has decreased due to increased prices of chestnut in Luotian, Hubei, our main chestnut supply region, because of flooding. As a result, the sales revenue of Luotian Lorain was deceased by 44.9% in 2016. |

We liquidated our French operations in 2016 following an investigation with respect to the origin of canned chestnuts sold by Conserverie Minerve (“Minerve”, a former subsidiary of Athena) issued Centre Technique Conservation of Produits Agricoles (“CTCPA”), an industry trade association for canned, preserved and dehydrated food products in France. CTCPA stated that only chestnuts based on the European or Japanese cultivars can be used in canned chestnut products sold in France according to CTCPA policies and that canned chestnut products must also have received certification from the International Featured Standards (“IFS”), a qualified third party certification agency in Europe that certifies food products, especially for retail industry.

3

As a result of such liquidation, our exports have decreased substantially due to weak demand in the international market. Revenue from sales in international markets decreased by approximately $29.1 million, or approximately 67.12% . We mainly relied on Athena, our French subsidiary, to sell our products in European market. But since we suffered a significant loss from the result of investigation of CTCPA during 2015 and 2016, we decided to shut down the operation of Athena. As a result, the export amount of chestnuts to Europe markets decreased markedly by 95.40% in 2016.

Revenues from sales of convenience food decreased by approximately 65.0% in 2016 due to increasing market competition. Since 2015, more competitors entered the convenience food industry that develop more types of products. Our current products have not met customers’ demand in the most recent year due to our failure to invest in research and development. In addition, we have faced significant competition from Chinese online ordering platforms since 2015, which platforms offer convenient and efficient meals directly from restaurants. In addition, Dongguan Lorain ceased operations in October 2016 due to its high cost of environmental compliance, the overlap of products and market with Luotian Lorain, both of which focus on the southern market of China, and poor performance of sales revenue.

Revenues from sales of our frozen food products decreased by 10.9% compared with that in 2015. The decrease is mainly due to the fact that the sales amount declined, because of the relocation of Shandong Lorain, one of our frozen food producing and sales company, discussed above.

Our general and administrative expenses increased approximately $35.1 million, or 620.0%, to $ 40.8 million in 2016 from $5.7 million in 2015. The increase mainly due to the bad debt including $35,590,795 unrecovered trade receivables and other receivables that management determined cannot be recovered, which accounted for 87.2% of total general and administrative expenses in 2016, respectively. In 2016, the credit terms for many of our domestic customers was between 30 and 60 days; international customers are typically extended 90 days credit. Our cash flow suffered while waiting for such payments. Many of our direct clients, such as supermarkets and restaurants, did not make payments promptly due to poor sales. In addition, third party distributors’ ability to collect accounts receivable was worsened due to the bad sales performance and such distributors’ inability to collect receivables from their own clients. Other receivables that become bad debt include (i) raw materials we paid for but the suppliers did not provide the raw materials ordered by us and refused to refund the advance payment, or we did not agree on the quality of the raw materials and (ii) advance payments made by our procurement department for raw materials, and such salesmen left the company before we could confirm that the goods had been warehoused. Most of the aforementioned receivables were incurred after 2014, and under accounting principles we determined that 2016 was a suitable time to increase the ratio of provision for bad debts exceeding half a year to 50% and to 100% for over one year.

Organizational Structure

ALN is a Nevada corporation that was incorporated on February 4, 1986 and was formerly known as “Millennium Quest, Inc.” Effective November 12, 2009, ALN reincorporated in Nevada from Delaware.

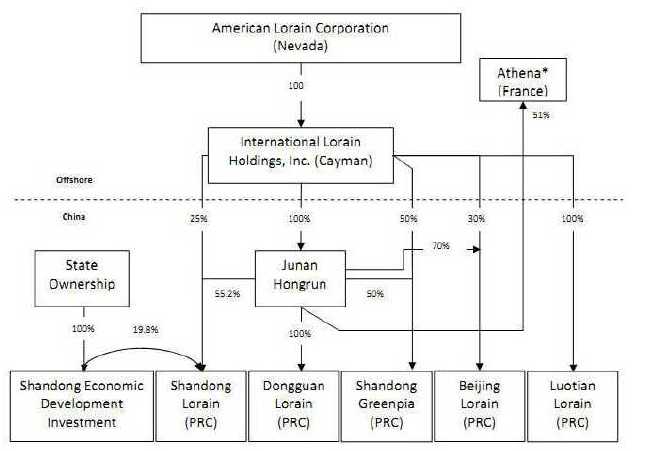

ALN owns 100% of ILH. ILH wholly owns two Chinese operating subsidiaries, Luotian Lorain and Junan Hongrun, directly. Junan Hongrun, in turn, owns 100% and 51% of Dongguan Lorain and Athena respectively. In addition, together with Junan Hongrun, ILH wholly owns Beijing Lorain, Shandong Greenpia, and owns approximately 80% of Shandong Lorain (Shandong Economic Development Investment Co. Ltd. owns approximately 20%). We sometimes refer to our six Chinese operating subsidiaries and the Athena Group throughout this annual report on Form 10-K as the Lorain Group Companies. Below is an organizational chart of ALN, ILH and the Lorain Group Companies:

4

* Athena is a holding company which holds majority of the capital and the voting shares of Conserverie Minerve, a company organized under French law. Conserverie Minerve specializes in the processing and sale of chestnut and prepared foods products in Europe. Conserverie Minerve operates its businesses through the following, direct and indirect, wholly owned subsidiaries:

| • |

Sojafrais, a company organized under French law; | |

| • |

SCI SIAM, a real estate company organized under French law; | |

| • |

SCI GIU LONG, a real estate company organized under French law; and | |

| • |

CACOVIN, a company organized under Portuguese law. |

On June 6, 2015, Athena approved the merger of its wholly owned subsidiary Conserverie Minerve into Athena. Athena assumed all contracts, rights, assets and liabilities of Conserverie Minerve after the merger. Athena was a holding company with no operations and its only asset was the equity of Conserverie Minerve. On August 8, 2015, the merger was completed. In April 2016, Athena ceased operations as discussed above.

Products

Our products are categorized into the following three segments:

| • |

Chestnut products, | |

| • |

Convenience food products, and | |

| • |

Frozen food products. |

We produced 214 products in 2016, including 1 new product in frozen food products. We also discontinued 25 products in 2016 in the convenience a foods products.

5

Chestnut Products

We have developed brand equity for our chestnut products in China, Japan and South Korea over the past 18 years. We produced 60 high value-added processed chestnut products in 2016. In 2016 and 2015, this segment contributed 57% and 53.6% of our total revenues, respectively.

Our best selling products in 2016 included our frozen chestnuts. The majority of our chestnut products are natural and do not contain chemical additives.

The chestnut, in contrast to many other tree nuts, contains small quantities of oil and is very high in complex carbohydrates. This makes them useful for a wider food range than other common nuts. Chestnuts are commonly steamed, boiled, sugar stir-fried, roasted or added into dishes or desserts as an ingredient.

We position our chestnut products as middle to high end products. We differentiate our chestnut products based on production process, high quality raw materials inputs, flavor, size and method of packaging. For instance, some of our chestnut products that are sold in Japan are packaged in plastic bags or tin cans, each considered a different product. Similarly, some of our chestnut products are processed with hot water or cold water, each considered a different product.

Chestnut season in China lasts from September to January. We purchase and produce raw chestnuts during these months and store them in our refrigerated storage facilities throughout the year. Once we obtain a purchase order during the rest of the year, we remove the chestnuts from storage, process them and ship them within one day of production.

Convenience Foods

Our convenience food products are characterized as follows:

| • |

Ready-to-cook, or RTC, food products, | |

| • |

Ready-to-eat, or RTE, food products, and |

These products are intended to meet the current demands of our customers for safe, wholesome and tasty foods that are easily prepared.

RTCs can be served after a few easy cooking procedures. Typically, when preparing a RTC, customers need only to heat the food in a microwave or boil it for several minutes before eating. Our best-selling RTCs in 2016 were French fries.

RTEs can be served without any cooking. Our best-selling RTEs in 2016 were various bean products and various fried vegetables.

We produced 92 convenience food products in 2016. In 2016 and 2015, this segment contributed 20.3% and 25.3%, respectively, of our total revenues.

Frozen Food Products

We produce a variety of frozen foods, mostly frozen vegetables and frozen fruits. We produced 62 frozen food products in 2016. Our best-selling frozen food products in 2016 was sweet corn products.

Our frozen food business allows us to mitigate the significant production seasonality of chestnut products and to increase the utilization rate of our production capacity. Through our sales network, we are seeking to further penetrate into domestic and overseas market for our frozen food segment as it may not only raise our spare production capacity without additional heavy capital investment, but also boost our brand equity as we are selected to be the provider for international fast food giants. The frozen foods accounted for in our total revenue increased from 21.0% in 2016 to 22.7% in 2015. Gross margins in this segment are lower than the margins for chestnut products and convenience foods.

6

Our Manufacturing Facilities

General

We currently manufacture our products in four facilities in China, two of which are located in Junan County, Shandong Province, one in Luotian County, Hubei Province, and one in Miyun County, Beijing. As described above, in 2016, we ceased operations in France, Dongguang and Shandong.

The following table indicates the year that operations commenced at each of the facilities and the size of the facilities.

| Year Operations Facility Size | ||||||

| Facility | Commenced | (square meters) | ||||

| Junan Hongrun | 2002 | 38,865 | ||||

| Beijing Lorain | 2003 | 21,000 | ||||

| Luotian Lorain | 2003 | 9,558 | ||||

| Shandong Greenpia | 2010 | 9,179 | ||||

Production Lines

We currently manufacture our products using 29 production lines. Except Chinese doughnuts production lines, each production line is used to produce between 10 and 50 products. We currently run four types of product lines:

| • |

Deep-freezing lines, which are used to freeze raw materials for year-round production and to produce frozen food; | |

| • |

Canning lines, which are used to produce canned products, including chestnut products; | |

| • |

Convenience food lines, which are used for producing RTCs and RTEs, all of which have nitrogen preservation capacity; and | |

| • |

Chinese doughnuts lines, which are used to produce Chinese doughnut products. |

The production process for our chestnut products initially involves sorting and cleaning the raw chestnuts purchased during the chestnut season. We then store the raw chestnuts in our refrigerated storage facilities throughout the year. Once we obtain a purchase order, we remove the chestnuts from storage and process them by steaming, decladding and deep-freezing the chestnuts, depending on the particular product. We then package and ship the processed chestnuts within one day of production.

The production process of our convenience products generally involves various steps, including soaking, boiling, coating, drying, deep freezing, packing, sealing and sterilizing.

The following table shows the number and types of production lines, the types of products produced and the production capacity at each facility:

| Facilities | Production Lines | Product

Portfolio |

2016 Capacity |

| Junan Hongrun | 3 Deep-freezing line 4 Convenience food lines 4 Canning lines 4 Chinese doughnut lines |

Chestnut products, frozen foods, beans, bean paste |

Multi-purpose production lines with 74,000 tons of production capacity Chinese doughnut lines with 2000 tons production capacity 24,900 tons of cold and frozen storage |

| Beijing Lorain | 6 Convenience food lines 1 Deep-freezing line |

Chestnut products, frozen foods |

Multi-purpose production lines with 34,000 tons of production capacity 4,650 tons of cold and frozen storage |

| Luotian Lorain | 3 Convenience food lines 2 Deep-freezing lines |

Chestnut products, convenience foods, frozen foods |

Multi-purpose production lines with 24,000 tons of production capacity 6,500 tons of cold and frozen storage |

| Shandong Greenpia | 2 Convenience food lines | Chestnut products, convenience foods |

Multi-purpose production lines with 9,000 tons of production capacity 1,500 tons of cold and frozen storage |

7

* Shandong Lorain relocated its convenience food product line, completed in December 2016, to Junan Hongrun due to the local government land seizures requirement.

We allocate our production lines based upon the location of our facilities to take advantage of efficiencies in the transportation of required raw materials. For example, Junan Hongrun and Shandong Lorain, which manufacture primarily chestnut and frozen products, are located in Shandong Province, which is China’s largest supplier of fresh products by volume. Shandong Province is also a major chestnut producing region.

Our production lines and facilities have all been designed to meet the standards and requirements of our largest customers in South Korea and Japan, with Japan being our top overseas markets in value term.

We employ advanced methods of quality control and have obtained various certifications for many of our products, packages and processes, including ISO 9000 or ISO 9001 certification for certain of our chestnut and frozen vegetable products, BRC certification for certain of our frozen fruit and vegetable products and HACCP certification for certain of our frozen vegetable, fruit and chestnut products and our bottom-open chestnuts. We believe that our quality controls and standards of products distinguish us from other manufacturers in both domestic and international markets.

With limited exception, we operate our production lines year round. In the past, when our production was focused almost exclusively on chestnuts, we experienced seasonal underutilization of our product lines. However, our current facilities have multiple-function designs allowing us to use our production lines for our convenience and frozen products when we are not producing chestnuts at full capacity. Consequently, as we have increased our processed and convenience food offerings over the last several years, we have generally been able to run our production lines at increasing efficiency.

We believe our facilities are adequate for our current levels of production. We anticipate, however, that we may require additional facilities and/or product lines as our business grows. We are exploring the possibility of alliances with one or more OEM partners for the production, in the short-term, of some of our convenience food products and frozen products should our facilities be inadequate to meet increasing demand. We are also exploring the possibility of leasing additional production lines to expand our production capacity. We did not lease any production facility during 2016. We may decide to lease additional facilities in 2017, should circumstances require and subject to acceptable costing. In the long-term, we plan to increase our own production capacity by acquiring or building new facilities, subject to the availability of adequate sources of funding.

Storage Capacity

Storage of our raw materials and inventory is a critical element of our business. Our raw materials and partially finished products need to be preserved in frozen storages (-18ºC to -20ºC) or constant temperature storages (-5ºC to 5ºC). Storage is particularly critical for our chestnut products because chestnuts are a seasonal fruit.

The following table illustrates on a facility by facility basis the type and capacity of our storage resources:

| Number of | Capacity | ||

| Facility | Storage Type | Storage Units | (metric tons) |

| Junan Hongrun | Frozen Storage | 19 | 20,100 |

| Constant Temperature | 11 | 5,300 | |

| Beijing Lorain | Frozen Storage | 6 | 2,850 |

| Constant Temperature | 3 | 1,800 | |

| Luotian Lorain | Frozen Storage | 8 | 4,500 |

| Constant Temperature | 4 | 2,000 | |

| Shandong Greenpia | Constant Temperature | 4 | 1,500 |

| TOTAL | 60 | 41,050 |

* Shandong Lorain move its convenience food product line, completed in December 2016, to Junan Hongrun due to the local government land seizures requirement.

All of the listed storage facilities are owned by us. We did not add to our storage capacity during 2016.

8

Agricultural Operations

We grow or set up agricultural co-ops with local farmers to supply ourselves with a small portion of chestnut, fruit and vegetable products. For the year ended December 31, 2016, the supplies coming from agricultural operations is still a low proportion of the total. We believe that we will continue to develop more agricultural facilities in the long-term. We anticipate that self-grown agricultural products and agricultural products grown in cooperation with local farmers will enable us to assure adequacy of supply, promote quality and reduce cost, particularly for our high margin offerings. For example, by growing Korean cultivar chestnuts domestically, we expect to significantly reduce our supply costs for this premium product, while ensuring superior quality.

Lands in which we grow our agricultural products for such products are shown in the following table.

| Area | Location | |

| Harvest | (acres) | (PRC) |

| Chestnut (South Korean, Japanese, Australian cultivar) | 1,052 | Shandong |

| Chestnut (Japanese cultivar) | 165 | Beijing |

| Sticky Corn | 342 | Beijing |

| Sweet Corn | 118 | Beijing |

| Green Pea | 217 | Beijing |

| Sweet Pea | 167 | Beijing |

| Organic Chestnut | 165 | Beijing |

| Mixed Vegetables | 417 | Shandong |

| Mixed Vegetables | 83 | Beijing |

| Inner | ||

| Japanese Pumpkin | 197 | Mongolia |

| Black Beans | 500 | Shandong |

| Strawberry | 392 | Shandong |

| Broccoli | 165 | Beijing |

| Green Asparagus | 591 | Beijing |

| White Asparagus | 263 | Shandong |

| Sweet Potato | 500 | Shandong |

| Peach | 329 | Beijing |

| Apricot | 411 | Beijing |

| Pear | 329 | Beijing |

| Blackberry | 165 | Beijing |

We began growing chestnuts in Shandong Province in 2003. Unlike most vegetables and fruits, chestnut trees have a 3-5 year growing phase before they can be harvested. Our current chestnut planting base has been self-supplying limited quantities of chestnuts to our production since 2007. In the end of 2016, we leased two woods in Junan County Shandong Province, China to plant more chestnuts trees, which we expect will expand the production of our self-supplied chestnuts in a near future. However, there is no guarantee that we will be successful in that regard.

We began growing strawberries in 2008 in Shandong and peaches, apricots, pears and blackberries in 2009 in Beijing. We use these fruits in some of our frozen fruit products.

We plan to continue to expand our agricultural operations over the next a few years. Among other things, we plan to increase our self-production in China of Korean cultivar chestnuts. We expect to obtain funding for this expansion through a combination of commercial and government loans, including loans under Chinese government programs to promote agricultural industrialization. There is no assurance, however, that adequate funding for these purposes will be available to us.

Raw Materials

In 2015 and 2016, approximately 78% and 85% of our procured raw materials, respectively, consisted of agricultural products, including primarily chestnuts and vegetables, approximately 7% and 6%, respectively, consisted of packaging materials and approximately 15% and 9% consisted of condiments such as sugar, salt and flour.

Our Supply Sources

Our business depends on obtaining a reliable supply of various agricultural products, including chestnuts, vegetables, red meat, fish, eggs, rice and flour. Because of the diversity of available sources of these raw materials, we believe that our raw materials are currently in adequate supply and will continue to be so in the future.

9

We obtain our agricultural raw materials from three sources: domestic procurement (excluding self-supply), overseas markets, and self-supply. Domestic and overseas procurement accounted for 91% and 6.8%, respectively, of our total raw material costs in 2016, while self-supply accounted for 2.2% . We obtained substantially all of our agricultural raw materials from domestic sources during 2016.

In 2016 and 2015, respectively, we procured approximately 31,892 and 44,383 metric tons of chestnuts and approximately 32,487 and 53,106 metric tons of vegetables and other raw materials from a number of third party suppliers, domestic and overseas, and produced approximately 438 and 568 metric tons of chestnuts and other products from our own agricultural operations.

We select suppliers based on price and product quality. We typically rely on numerous domestic and international suppliers, including some with whom we have a long-term relationship. Our top 10 suppliers accounted for 13.4% and 13.6% of the total procurement in 2015 and 2016 in value terms respectively. We purchase from suppliers and farmers pursuant to supply contracts and underlying purchase orders. We have not entered into any long-term contracts with any of our suppliers.

Our suppliers generally include wholesale agricultural product companies, agricultural associations and distributors. Some raw materials must be imported at higher costs, however. Occasionally, we also work directly with farmers. For instance, we operate an initiative which involves a series of cooperation and lease agreements between Shandong Lorain, Beijing Lorain and local farmers. This initiative involves approximately 1,000 acres of land which is used primarily to produce Japanese and Korean style chestnuts, sticky corn and pumpkins for our operations.

Procurement Cost and Quality Control

To control procurement costs, we have built our facilities near domestic sources of agricultural raw materials. For example, Junan Hongrun and Shandong Lorain are located in Shandong Province, which is China’s largest supplier of fresh products by volume. Shandong Province is also a major chestnut producing region. Local procurement reduces our costs, especially transportation costs. It also gives us first-hand harvest and market information, which provides us with an advantage in price negotiations with suppliers.

Some raw materials must be imported at higher cost. As discussed, we have begun to develop our agricultural capabilities in order to control costs, particularly with respect to imported raw materials such as Korean-style chestnuts.

Pricing for agricultural products reflects several external factors, such as weather conditions and commodity market fluctuations, which are beyond our control. We obtain contemporaneous information on local harvests and collect daily reported price information on harvests in other markets from which we procure our products. We also attempt to predict harvest yields in advance based on our information gathering. We use this harvest information to negotiate best pricing with our suppliers.

We impose strict standards on our suppliers. During the harvest season, our internal procurement function personnel may visit our sources of supply to assure that the products we are purchasing comply with our standards.

Our Customers

Our products are sold in Chinese domestic markets as well as exported to foreign countries and regions such as Japan and South Korea. In 2015 and 2016, approximately 80.1% and 82.1%, respectively of our sales were made domestically in China and approximately 19.9% and 17.9% were to international customers, primarily Japan and South Korea. Our top ten customers contributed 12.3% and 12.1% of our total revenues in 2015 and 2016 respectively.

Domestic

In China, we sell our products through our own sales team and through third-party distributors. We have 26 sales offices in 31 provinces in China. In 2015 and 2016, we sold approximately 60.0% and 72.6%, respectively, of our products directly to our Chinese and overseas customers and approximately 40.0% and 27.4% through third-party distributors. In view of a significant decline in our sales volume in 2016, we decided to cut spending. By comparison, the performance of our third-party distributors is far from expected, and our direct-selling business is the main source of revenue. In addition, due to the low demand of the market, the third-party distributors need less the products, which result that our relationship not as close as the previous years, leading to the increase of bad debts. Therefore, we decided to reduce the proportion of third-party distributors and enhance our own sales team.

10

We sell our products in all first-tier cities in China, including Beijing, Shanghai, Tianjin and Guangzhou. Our sales team sells our products directly to supermarket chains, mass merchandisers, large wholesalers and others in these markets. In second-tier and third-tier cities, we currently sell our products to third-party distributors, such as food companies or trading companies with established distribution channels in such regions, rather than through our own sales team, in order to enable us to penetrate such markets more quickly without spending significant capital. We also sell to small customers through independent sales representatives.

The terms of a typical sales contract between us and our distributors provide that we are responsible for transportation costs and the distributors are responsible for storage costs. Furthermore, the distributors have the right to return products that fail to satisfy specified quality standards, at our cost. The majority of such contracts require the distributors to pay us in cash in full upon delivery, and the remaining contracts provide for short-term credit, usually two to three weeks. In addition, we typically offer distributors performance-based incentives, such as a cash bonus equal to 1% to 1.5% of total revenues generated by such distributor which exceed previously established sales targets.

International

Our export sales destinations include:

| • |

Asia pacific, primarily Japan, South Korea and Malaysia, but also Singapore, Philippines, and Australia; | |

| • |

Europe, primarily France and Portugal, but also Belgium; | |

| • |

the Middle East, primarily Israel; | |

| • |

North America, including the United States |

Outside China, sales in Europe decreased by 95.4% in 2016 as a result of a bad sales performance in France and Portugal and the shutdown of Athena Group. Sales in Asia countries also decreased by 19.2% due to weak demand in Asia countries.

We sell our products to international markets primarily through export and trading agents and companies in China, as well as our own sales team located in China and Japan. Our sales team sells directly to wholesalers, food processors and mass merchandisers. Many of our customers are well known in their local food market. We have established long-term relationships with many international customers, especially in Japan and South Korea.

Our Sales and Marketing Efforts

We seek to expand our customer base by:

| • |

Direct sales communications with our large customers; | |

| • |

Sales through distributors to new customer bases; | |

| • |

Referrals from existing customers; and | |

| • |

Participation in domestic and international food exhibitions and trade conferences. |

We have not spent a significant amount of capital on advertising in the past, and our advertising budget continues to be limited. In 2016 our marketing and branding efforts included supermarket advertising and internet advertising.

We intend to increase our advertising and branding efforts given the consumer nature for many of our products. For the near future, our marketing efforts will continue to focus primarily on the domestic Chinese, Japan and South Korea markets for our chestnut and convenience food products.

Competition and Market Position

The overall food market is diverse, both globally and in China. We do not have a significant market share in any of our business segments.

Chestnut Products

We compete in the chestnut market primarily on the basis of the uniqueness of our products, quality, price and brand recognition. We also utilize our proprietary, patented and patent-pending technology in the production of our chestnut products to our competitive advantage.

11

The world market for chestnut products is highly fragmented. Our principal competitors in the chestnut product market are currently Hebei Liyuan, a Chinese company, and Foodwell Corporation, a South Korean company and Concept Fruit, a European company.

Convenience Food Products

The market competition for convenience food products is based mostly upon quality and product variety. We attempt to use our modern food processing technology, such as nitrogen preservation, to produce a wide variety of high quality convenience foods.

The convenience food market in China is highly fragmented and we do not face competitive pressure from any particular competitor or small group of competitors.

Frozen Food Products

In the frozen food product market, competition is based primarily upon quality, ability to provide a reliable product supply and customer relationships.

Our strongest competitors in the frozen food products market are currently Beijing Liliangzi Food Co. Ltd., Hangzhou Dadi Food Co. Ltd. and Tianjin Jinkaili Food Co. Ltd., all of which are located in China.

Competitive Advantages

We believe that we enjoy a number of competitive advantages, both domestically and internationally.

We have developed brand equity for our chestnut products in China, Japan and South Korea over the past 18 years. Our customers are willing to pay a premium for some of our chestnut products because of our brand equity. In addition, we believe that we have a strong distribution channel for our products in the markets in which we currently operate.

We believe that we are able to provide our customers with greater selection and a more reliable supply than many of our competitors, which is especially important for our supermarket chain and large wholesaler customers. We produced 60 chestnut products in 2016. We believe that we are the only provider of certain bottom-open chestnut and sweetheart chestnut products in China.

Labor is a large portion of total operating costs for food companies. We believe that we have a lower labor cost structure and a more abundant labor supply than many of our international competitors.

We are focused on managing our costs in other ways as well. We seek to locate our production facilities in close proximity to our main domestic sources of raw material supply to reduce transportation costs and give us first-hand knowledge of market factors affecting our cost of raw material supply. Our agricultural self-supply program, while modest at present, is expected to grow and to become a significant element of our cost containment efforts.

We use modern food processing technology and innovation in our formulation and manufacturing processes to create high quality products. Nitrogen preservation in particular, used in the production of convenience foods, is an innovative technology which has not been widely applied in China.

We are dedicated to innovation of our products. From 2012 to 2016, we were successfully granted 4 new patents. We applied for three patents to State Intellectual Property Office of the PRC during 2015. In addition, As of December 31, 2016, we possessed 16 patents for utility models and 15 patents for appearance design. See “Intellectual Property” below. We believe that our technology gives us an advantage over our Chinese and international competitors, allowing us to produce chestnut and convenience food products that are superior in quality and to offer more product varieties.

We believe that our reputation for quality contributes to our competitiveness. We maintain high food safety standards, in order to satisfy both domestic and international requirements. We also regularly conduct tests for quality of our products and compliance with standards.

12

Intellectual Property

Trademarks

We have registered in the PRC the trademark

![]() which we use on all of our products sold in China.

which we use on all of our products sold in China.

Patents

We were granted two patents by the State Intellectual Property Office of the PRC during 2012, including the preparation of aerated snack beans and frozen bottom open chestnuts. One patent for preparation of liquor preserved fish and soup was approved in 2013. In 2014, our patent application during 2012 for the preservation, storage and processing procedures for chestnuts was approved. We made application for three patents to State Intellectual Property Office of the PRC during 2015.

In addition to the above-mentioned patents, we also possess 16 patents for utility models and 15 patents for appearance design.

We take reasonable steps to protect our proprietary information and trade secrets, such as limiting disclosure of proprietary plans, methods and other similar information on a need-to-know basis and requiring employees with access to our proprietary technology to enter into confidentiality arrangements. We believe that our proprietary technology and trade secrets are adequately protected.

Our Employees

As of December 31, 2016, we had a total of 1,425 employees. Approximately 1,075 of our full-time employees are directly employed by our subsidiary companies and the remaining employees are employed by outsourcing agents that we use to meet our staffing needs. Compared to 2015, the total employees decreased by 54.8% due to our significant production capacity declining and bad operating performance. All of the departments were hit as a result of huge loss, especially the production department and domestic sales department, because (a) all the part-time employees belong to production department. Since our revenue from main business decreased significantly, we dismissed almost all of part-time workers, approximately 1,500 workers in 2016. (b) we shut down 12 sales offices in 2016 to reduce the personnel and administrative expenses. As required by Chinese law, all employees are party to a written employment contract. We compensate the employees outsourced from agents directly and pay agents a service fee. Agents are responsible for the pension and social insurance benefits of the leased employees, as described below.

The following table sets forth the allocation of employees, both direct and leased, by job function.

| Number of | |

| Department | Employees |

| Production | 940 |

| Quality Control | 43 |

| Domestic Sales | 240 |

| Human Resources | 31 |

| Research and Development | 32 |

| International Sales | 30 |

| Finance | 40 |

| Procurement | 24 |

| Administration | 40 |

| Strategic planning | 5 |

| Total | 1,425 |

We believe that the relationship between management and our employees is good. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff.

Our Shandong Lorain subsidiary has an employee relations department for the purpose of advancing employee welfare, encouraging employee participation in decision making and enhancing relations among employees and between employees and our management team.

We compensate our production line employees by unit produced (piece work) and compensate other employees with a base salary and bonus based on performance. We also provide training for our staffs from time to time to enhance their technical and product knowledge, including knowledge of industry quality standards.

13

Our employees participate in state pension scheme and various types of social insurance organized by municipal and provincial governments. Outsourcing agents are responsible for contributions on behalf of the leased employees.

Our Research and Development Activities

Our research and development efforts are focused on three objectives:

| • |

Superior product safety and quality; and | |

| • |

Reduction of operating costs; and | |

| • |

Driving growth through the development of new products. |

We have research and development staffs at each of our facilities. In total, 32 employees are dedicated to research and development.

We rely heavily on customer feedback to assist us in the modification and development of our products. We also utilize customer feedback to assist us in the development of new products. In 2016, we added 1 new product in our frozen foods segments.

The amount we spent on research and development activities during the years ended December 31, 2016 and 2015 was not a material portion of our total expenses for those years.

Government Regulation

As a manufacturer and distributor of food products, we are subject to regulations of China’s Agricultural Ministry and Ministry of Health. This regulatory scheme governs the manufacture (including composition and ingredients), labeling, packaging and safety of food. It also regulates manufacturing practices, including quality assurance programs, for foods through its current manufacturing practice regulations, and specifies the standards of identity for certain foods.

We have obtained approvals from Chinese authorities for products that requires the approval under regulations, including chestnuts, frozen vegetables and fruits, fish, and canned products. Production of new products that do not fall into categories of products would require separate approval from the appropriate Chinese authorities. We have consistently obtained such approvals for our newly developed products in the past and do not anticipate any difficulties in obtaining new approvals in the future if needed.

In addition, we are required to obtain governmental approval, and to register with the State Administration for Industry and Commerce, in order to open a new facility in China. We have consistently obtained such approvals, and made such registrations, for our new facilities in the past and do not anticipate any difficulties in filing new registrations and obtaining new approvals in the future if needed.

Under the relevant PRC sanitation laws governing food export, unless an exporter’s products are exempted from inspection, products must be inspected in accordance with the Law of the PRC on Import and Export Commodity Inspection. We have not been exempted from inspection. In the past, we were authorized by the relevant authorities to conduct self-inspection of certain of our export products. However, currently, the relevant authorities have imposed tighter food safety control in China, and as a result, all of our exported food products must be inspected by relevant government agencies. We believe that all of our exported products are currently in compliance with such requirements and we do not anticipate any difficulties in complying with such rules in the future.

In addition, we are required to obtain a license from the local branch of the Entry-Exit Inspection and Quarantine Bureau of China for our exported products. We have consistently obtained such licenses in the past and we do not anticipate any difficulties in obtaining such licenses in the future.

ITEM 1A. RISK FACTORS

RISK FACTORS

Business Risks

We may be forced to delisting from NYSE Exchange if we are failure to satisfy a continued listing rule or standard.

On April 18, 2017, we received a letter from NYSE MKT LLC (the “Exchange”) stating that the Exchange has determined that we are not in compliance with Sections 134 and 1101 of the NYSE MKT Company Guide (the “Company Guide”) due to we are failure to timely file with the SEC its Annual Report on Form 10-K for the year ended December 31, 2016. The letter also states that the failure to timely file its Annual Report on Form 10-K is a material violation of its listing agreement with the Exchange and, therefore, pursuant to Section 1003(d) of the Company Guide, the Exchange is authorized to suspend and, unless prompt corrective action is taken, remove the Company’s securities from the Exchange. The Exchange has informed us that, in order to maintain its listing on the Exchange, we must, by May 18, 2017, submit a plan of compliance (the “Plan”) advising the Exchange of actions it has taken or will take to regain compliance with Sections 134 and 1101 of the Company Guide by October 18, 2017 (the “Plan Period”). The Plan was submitted and accepted by the Exchange, allowing us to be able to continue listing during the Plan Period. However, based on recent discussions with the Exchange, the Exchange staff may initiate delisting proceedings. Because we have not filed all of our required SEC reports as of the close of the Plan Period, among other concerns.

14

Our operating results may have been material adverse effected during the year ended December 31, 2015 due to the restatement of prior financial statements

We have discovered errors in the timing of revenues recognized during the year ended December 31, 2015. We recognize revenue upon shipping of products to its customers where title of the goods passes upon departure from our facilities; however, in certain instances, contractual terms dictate that the customers are afforded seven days after the receipt of goods at their premises to inspect the goods for defects or spoilage and notify us. If we are not contacted within those seven days, our obligation to the customer are considered fully discharged and revenue should be recognized. Given the timing of these seven days, we believe that certain sales transactions have been erroneously recognized during the year ended December 31, 2015. We have rectified this error and the impact of our financial position and result of operations during the year ended December 31, 2015, which may result in material adverse effect.

We lack the ability to sustain our operations if our cash flow continues to decline and cannot be replenished through financing

Our financial statements have been prepared on a going-concern basis. The going-concern basis assumes that assets will be realized and liabilities will be settled in the ordinary course of business in the amounts disclosed in the financial statements. Our ability to continue as a going concern is greatly dependent on our ability to realize its non-cash current assets such as receivables and inventory into cash in order to settle its current obligations. For the year ended December 31, 2016, we incurred a substantial loss of $136,361,080. As of December 31, 2016, we had a working capital deficit of approximately $21,271,226. These conditions raise substantial doubt as to whether we may continue as a going concern. To improve our solvency, we are working to obtain new working capital through private placements of our common stock or convertible debt securities to qualified investors. But we cannot assure the financing succeed.

We may not be able to obtain an adequate supply of high quality raw materials.

Our business depends on obtaining a reliable supply of various agricultural products, including chestnuts, vegetables, fruits, red meat, fish, eggs, rice, flour and packaging products. During 2016, the cost of our raw materials decreased from $143,226,607 to $85,249,363, a decrease of approximately 40.48% . We may have to increase the number of our suppliers of raw materials and expand our own agricultural operations in the future to meet growing production demands. Despite our efforts to control our supply of raw materials and maintain good relationships with our suppliers, we could lose one or more of our suppliers at any time. The loss of several suppliers may be difficult to replace and could increase our reliance on higher cost or lower quality suppliers, which could negatively affect our profitability. In addition, if we have to increase the number of our suppliers of raw materials in the future to meet growing production demands, we may not be able to locate new suppliers who could provide us with sufficient materials to meet our needs. Any interruptions to, or decline in, the amount or quality of our raw materials supply could materially disrupt our production and adversely affect our business and financial condition and financial prospects.

The prices that we have paid for our raw materials recently have experienced significant fluctuation. If these price fluctuations continue, our profit margins may be materially adversely affected.

The average price that we paid for chestnuts in China in 2015 and 2016 was approximately $1,600 per metric ton and $1,765 per metric ton, respectively, excluding value added taxes. We do not currently hedge against changes in our raw material prices. Consequently, if the costs of our raw materials increase further, and we are unable to offset these increases by raising the prices of our products, our profit margins and financial condition could be adversely affected.

Price inflation in China could affect our results of operation if we are unable to pass along raw material price increases to our customers.

Inflation in China has been consistently increasing in recent years. Because we purchase raw materials from suppliers in China, price inflation directly causes an increase in the cost of our raw materials. Price inflation could affect our results of operation if we are unable to pass along raw material price increases to customers. In addition, if inflationary trends continue in China, China could lose its competitive advantage as a low-cost manufacturing venue, which could in turn lessen some of the competitive advantages of our being based in China. Accordingly, inflation in China may weaken our competitiveness domestically or in international markets.

Our sales and reputation may be affected by product liability claims, litigation or, product recalls in relation to our products.

The sale of products for human consumption involves an inherent risk of injury to consumers. We face risks associated with product liability claims, litigation, or product recalls, if our products cause injury or become adulterated or misbranded. Our products are subject to product tampering and contamination, such as mold, bacteria, insects, shell fragments and off-flavor contamination, during any of the procurement, production, transportation and storage processes. If any of our products were to be tampered with, or become tainted in any of these respects, and we were unable to detect this, our products could be subject to product liability claims or product recalls. Our ability to sell products could be reduced if certain pesticides, herbicides or other chemicals used by growers have left harmful residues on portions of our raw materials or if our raw materials have been contaminated by other agents.

15

We have never had any major product recall in the past but we have experienced product liability claims that were made by our customers. The amounts of such claims were immaterial. However, claims of product defect or product liability for material amounts, individually or in the aggregate, may be made in the future.

We have not procured a product liability or general liability insurance policy for our business, as the insurance industry in China is still in an early stage of development. To the extent that we suffer a loss of a type which would normally be covered by product liability or general liability insurance in the United States, we would incur significant expenses in defending any action against us and in paying any claims that result from a settlement or judgment against us. Product liability claims and product recalls could have a material adverse effect on the demand for our products and on our business goodwill and reputation. Adverse publicity could result in a loss of consumer confidence in our products.

Our expansion strategy may not prove successful and could adversely affect our existing business.

Our growth strategy includes the expansion of our manufacturing operations, including new production lines and agricultural operations. We plan to expand our sales in China and internationally. We will need to engage in various forms of promotional and marketing activities in order to further develop the branding of our products and to increase our market share in new and existing markets. The implementation of this strategy may involve large transactions and present financial, managerial and operational challenges. We could also experience financial or other setbacks if any of our growth strategies incur problems of which we are not presently aware. If we fail to generate sufficient sales in new markets or increase our sales in existing markets, we may not be able to recover the production, distribution, promotional and marketing expenses, as well as administrative costs we have incurred in developing such markets.

Our results of operations could be affected by natural events in the locations in which our customers operate.

Several of our customers have operations in locations that are subject to natural disasters, such as severe weather and geological events, which could disrupt the operations of those customers and suppliers as well as our operations. If our customers suffer from these events, their operations may be negatively impacted. As a result, some or all of those customers may reduce their orders for our products, which could adversely affect our revenue and results of operations.

The acquisition of other businesses could pose risks to our profitability.

We may try to grow through acquisitions in the future. Any proposed acquisition could result in accounting charges, potentially dilutive issuances of equity securities, and increased debt and contingent liabilities, any of which could have a material adverse effect on our existing business and the market price of our common stock. Acquisitions, in general, entail many risks, including risks relating to the failed integration of the acquired operations, diversion of management’s attention, and the potential loss of key employees of the acquired organizations. We may be unable to successfully integrate businesses or the personnel of any business that might be acquired in the future, and our failure to do so could have a material adverse effect on our business and on the market price of our common stock.

A significant amount of our revenues is dependent on a limited number of customers and the loss of any one of our major customers could materially and adversely affect our growth and our revenues.

A significant portion of our revenues has historically been derived from a limited number of customers, particularly in our chestnut products segment. Sales to our ten largest customers accounted for approximately 12.3% and 12.1% of our total revenues in 2015 and 2016, respectively. The loss of any one of these customers, or a material decrease in purchases by any one of these customers, could adversely impact our revenues.

We rely primarily on distributors to sell our products. Any delays in delivery or poor handling by our distributors or third-party transport operators may affect our sales and damage our reputation.

In 2016, we sold our products through over 130 distribution service providers. The services provided could be suspended and could cause interruption to the supply of our products to domestic or overseas customers. Delivery disruptions may occur for various reasons beyond our control, including poor handling by service providers or third party transport operators, transportation bottlenecks, natural disasters and labor strikes, and could lead to delayed, damaged or lost deliveries. If our products are not delivered in a timely manner, our reputation could be harmed. If our products are damaged in the process of being delivered, we may be liable to pay for such damages incurred.

16

Failure of the market to accept our new products, or failure to obtain regulatory approval for our new products, may cause us to lose our competitive position in the food industry.

We introduced 7 new products in 2012, 6 new products in 2013, 3 new products in 2014, 6 new products in 2015 and 1 new product in 2016. We plan to introduce approximately 5 new products in 2017. The success of the new products we introduce depends on our ability to anticipate the tastes and dietary habits of consumers and to offer products that appeal to their preferences. We intend to introduce new products as well as alternative flavors, sizes and packaging for our existing products. We may not be able to gain market acceptance for our new products. Consumer preferences change, and any new products that we introduce may fail to meet the particular tastes or requirements of consumers, or may be unable to replace their existing preferences. Our failure to anticipate, identify or react to these particular tastes or changes could result in reduced demand for our products, which could in turn cause us to be unable to recover our development, production and marketing costs.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our research and development, operations and revenue.

The Lorain Group Companies were founded in 1994 by Si Chen, our chairman and chief executive officer. Mr. Chen, together with other senior management, has been a key driver of our strategy and has been fundamental to our achievements to date. The successful management of our business is, to a considerable extent, dependent on the services of Mr. Chen and other senior management. We compete for qualified personnel with other food processing companies, food retailers and research institutions. Consequently, we may either lose key employees to our competitors or we may need to significantly increase the compensation of such employees in order to retain them. The loss of the services of any key management employee or failure to recruit a suitable or comparable replacement could have a significant impact upon our ability to manage our business effectively, and our business and future growth may be adversely affected.

We face increasing competition from domestic and foreign companies.

The food industry in China is fragmented. Our ability to compete against other national and international enterprises is, to a significant extent, dependent on our ability to distinguish our products from those of our competitors by providing large volumes of high quality products that appeal to consumers’ tastes and preferences at reasonable prices. Some of our competitors have been in business longer than we have and are more established. Our competitors may provide products comparable or superior to those we provide or adapt more quickly than we do to evolving industry trends or changing market requirements. Increased competition may result in price reductions, higher raw materials prices, reduced margins and loss of market share, any of which could materially adversely affect our profit margins.

An increase in the cost of energy could affect our profitability.

Although energy costs were stable in 2016, we might experience significant increases in energy costs in the future, which would result in higher distribution, freight and other operating costs. Our future operating expenses and margins will be dependent on our ability to manage the impact of cost increases.

Our products are subject to counterfeiting or imitation, which could impact our reputation.

To date, we have experienced limited counterfeiting and imitation of our products. However, counterfeiting or imitation of our products may occur in the future and we may not be able to detect it and deal with it effectively. Any occurrence of counterfeiting or imitation could impact negatively upon our reputation, particularly if the counterfeit or imitation products cause sickness, or injury to consumers. In addition, counterfeit or imitation products could result in our need to incur costs with respect to the detection or prosecution of such activities.

We may face challenges in expanding our cross-border operations

As we continue expanding our existing cross-border operations into existing and other markets, we will face risks associated with expanding into markets in which we have limited or no experience. The expansion of our cross-border business will also expose us to risks relating to staffing and managing cross-border operations, tariffs and other trade barriers, differing and potentially adverse tax consequences, increased and conflicting regulatory compliance requirements and policies, lack of acceptance of our products, challenges caused by distance, language and cultural differences, exchange rate risk and political instability. Accordingly, any efforts we make to expand our cross-border operations may not be successful, which could limit our ability to grow our revenue, net income and profitability.

17

We may have liquidity risk in relating to the decrease of cash flow and the bad debt loss.

We have a markedly decrease on our revenue from sales in 2016. At December 31, 2016 and 2015, cash and cash equivalents (including restricted cash) were $1.4 million and $25.5 million, respectively. The decrease of cash and cash equivalents (including restricted cash) are by $18.7 million, or by 36.5% due to the bad debt loss. If we cannot increase the quantity of our products sales, we may not be available to manage cash flow.

We may no longer be able to compete in Europe and have suffered significant losses in China.

We terminated the French operation due to its operational loss. We suffered from the investigation with respect to the origin of canned chestnuts sold by Conserverie Minerve (“Minerve”, a former subsidiary of Athena) issued Centre Technique Conservation of Produits Agricoles (“CTCPA”), an industry trade association for canned, preserved and dehydrated food products in France. CTCPA stated that only chestnuts based on the European or Japanese cultivars can be used in canned chestnut products sold in France according to CTCPA policies and that canned chestnut products must also have received certification from the International Featured Standards (“IFS”), a qualified third party certification agency in Europe that certifies food products, especially for retail industry. Although, a proceeding from local court provided Minerve (now Athena) protection from creditors initiating any actions against Athena until March 2016, Athena still cost a lot to recycle market products, seal the finished products, and thousands of tons of chestnuts during 2016.

Since the sales of revenue from Chinese market decreased by 46.05% in 2016 and we may lose our Europe market due to the termination of our French company, our competition advantage has been greatly weakened.

Chinese chestnut sales declined due to natural hazard and fierce market competition.

Chinese Domestic sales of chestnuts has decreased due to competition from the market and the raw material expense increased. In 2016, Luotian, Hubei, our main chestnuts supply area, has been hit by flooding, cutting chestnuts production by about 50% and the purchase price increased by 20% to 30%. As in previous years, the annual chestnuts output was 40,000 tons in Luotian, accounted for 8% of the Chinese chestnut production. About 50% chestnuts in Luotian supplied to Luotian market to further processing, and about 20% of which supplied to Wuhan market. But, due to the rise in price in 2016, less than 20% will be supplied to Luotian market. However, other main chestnuts producing area in China were harvest in China which result in a much lower price compared with that in Luotian. Our chestnuts purchased in Luotian much increased by 20% and the sales revenue in Luotian Lorain was deceased by 44.9 % in 2016.

Regulatory Risks

We are subject to extensive regulations by the Chinese government.

The food industry is subject to extensive regulations by Chinese government agencies. Among other things, these regulations govern the manufacturing, importation, processing, packaging, storage, exportation, distribution and labeling of our products. New or amended statutes and regulations, increased production at our existing facilities, and our expansion into new operations and jurisdictions may require us to obtain new licenses and permits and could require us to change our methods of operations at costs that could be substantial.

Our failure to comply with PRC environmental laws may require us to incur significant costs.

We carry on our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction that may cause environmental waste to adopt effective measures to control such waste. In addition, such enterprises are required to pay fines, or to cease operations entirely under extreme circumstances, should they discharge waste substances. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

Our failure to comply with PRC hygiene laws may require us to incur significant costs.

Manufacturers in the Chinese food industry are subject to compliance with PRC food hygiene laws and regulations. These food hygiene laws require all enterprises engaged in the production of chestnuts and various vegetables and fruits to obtain a hygiene license for each of their production facilities. Such laws also require manufacturers to comply with regulations with respect to food, food additives, packaging, and food production sites, facilities and equipment. Failure to comply with PRC food hygiene laws may result in fines, suspension of operations, loss of hygiene licenses and, in more extreme cases, criminal proceedings against an enterprise and its management. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

18

Chinese government forcing relocation may require us to incur significant costs.

Shandong Lorain was demanded to move its production lines to the factory of Junan Hongrun according to a new city zoning plan where Shandong Lorain resident, so that the land can be used for other urban use. Shandong Lorain has started this relocation process in July 2016 and finished this process in December,2016. During the relocation process, we were not allowed to produce our products with full capacity. As a result, the revenue from sales of chestnuts food products was $ 30.4 million and $54.3 million in 2016 and in 2015, respectively, decreasing by approximately 44%.

We cannot predict when the compensation for relocation will be received and whether the amount of compensation for land requisition can make up for our loss during the relocation period. If we cannot receive sufficient compensation next year, the relocation will cost us a significant loss.

Financial Risks

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of working capital.

We spend a significant amount of cash on our operations, principally to procure raw materials for our products. Many of our suppliers, including chestnut, vegetable and fruit farmers, and suppliers of packaging materials, do not allow us to pay on credit. However, some of the suppliers with whom we have a long-standing business relationship allow us to pay on credit. We fund the majority of our working capital requirements out of cash flow generated from operations. If we fail to generate sufficient sales, or if our suppliers stop offering us credit terms, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected.

We also fund approximately 30.2% of our working capital requirements from the proceeds of short-term loans from Chinese and overseas banks. Our average loan balance from short-term bank loans in 2016 was approximately $30.7 million. We expect to continue to do so in the future. Such loans are generally secured by our fixed assets, receivables and/or guarantees by third parties. The term of almost all such loans is one year or less. Historically, we have rolled over such loans on an annual basis. However, we may not be able to roll over such loans in the future or may not have sufficient funds available to pay all of our borrowings upon maturity. Failure to roll over our short-term borrowings at maturity or to service our debt could result in the imposition of penalties, including increases in rates of interest, legal actions against us by our creditors, or even insolvency.

Management anticipates that our existing capital resources and cash flows from operations and current and expected short-term bank loans will be adequate to satisfy our liquidity requirements through 2017. However, if available liquidity is not sufficient to meet our operating and loan obligations as they come due, our plans include considering pursuing alternative financing arrangements or further reducing expenditures as necessary to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital or reduce discretionary spending to provide the required liquidity. Currently, the capital markets for small capitalization companies are difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing.

We are subject to credit risk in respect of accounts receivables.

In 2008 and 2009, some of our customers, including some of our large supermarket customers, delayed their payments for up to 60 to 90 days beyond their term. Our cash flow suffered while waiting for such payments. Consequently, at times we had to delay payments to our suppliers and to postpone business expansion as a result of these delayed payments. Starting in 2008 and through 2016, we gradually shortened credit terms for many of our domestic customers from between 30 and 180 days to between 30 and 60 days; international customers are typically extended 90 days credit. Our large customers may fail to meet these shortened credit terms, in which case we may not have sufficient cash flow to fund our operating costs and our business could be adversely affected.

19