Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Planet Green Holdings Corp. | Financial_Report.xls |

| EX-21 - EXHIBIT 21 - Planet Green Holdings Corp. | exhibit21.htm |

| EX-32.2 - EXHIBIT 32.2 - Planet Green Holdings Corp. | exhibit32-2.htm |

| EX-31.2 - EXHIBIT 31.2 - Planet Green Holdings Corp. | exhibit31-2.htm |

| EX-31.1 - EXHIBIT 31.1 - Planet Green Holdings Corp. | exhibit31-1.htm |

| EX-23.1 - EXHIBIT 23.1 - Planet Green Holdings Corp. | exhibit23-1.htm |

| EX-32.1 - EXHIBIT 32.1 - Planet Green Holdings Corp. | exhibit32-1.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2011

[_] TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from __________ to ____________

Commission File Number: 000-50883

AMERICAN LORAIN CORPORATION

(Exact name of registrant as specified in its charter)

| Nevada | 87-0430320 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification Number) |

Beihuan Zhong Road

Junan County

Shandong,

People’s Republic of China, 276600

(Address of principal executive

office and zip code)

(86) 539-7318818

(Registrant’s telephone

number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| Common Stock, par value $0.001 per share | NYSE AMEX |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes [_] No [X]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes [_] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes [X] No [_]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such file).

Yes [_] No [_]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’ s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [_] | Accelerated filer [_] | Non-accelerated filer [_] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act).

Yes [_] No [X]

The number of shares and aggregate market value of common stock held by non-affiliates as of the last business day of the registrant’s most recently completed second fiscal quarter were 18,351,383 and $28,261,130, respectively.

There were 34,507,874 shares of common stock outstanding as of March 29, 2012.

- 2 -

PART I

Item 1. BUSINESS

Conventions

In this annual report on Form 10-K:

- “We,” “us” and “our” refer to the combined business of ALN, ILH and their direct and indirect Chinese operating subsidiaries.

- “ALN” refers to American Lorain Corporation, a Nevada corporation (formerly known as Millennium Quest, Inc.).

- “ILH” refers to International Lorain Holding, Inc., a Cayman Islands company that is wholly - owned by ALN.

- “Junan Hongrun” refers to Junan Hongrun Foodstuff Co., Ltd.

- “Luotian Lorain” refers to Luotian Green Foodstuff Co., Ltd.

- “Beijing Lorain” refers to Beijing Green Foodstuff Co., Ltd.

- “Shandong Lorain” refers to Shandong Green Foodstuff Co., Ltd.

- “Dongguan Lorain” refers to Dongguan Green Foodstuff Co., Ltd.

- “Shandong Greenpia” refers to Shandong Greenpia Foodstuff Co., Ltd.

- “RMB” refers to Renminbi, the legal currency of China.

- “U.S. dollar,” “$” and “US$” refer to the legal currency of the United States.

- “China” and “PRC” refer to the People’s Republic of China.

Overview of Our Business

We are an integrated food manufacturing company headquartered in Shandong Province, China. We develop, manufacture and sell the following types of food products:

- chestnut products,

- convenience foods (including ready-to-cook, or RTC, foods, ready-to-eat, or RTE, foods and meals ready-to-eat, or MRE); and

- frozen food products.

We conduct our production activities in China. Our products are sold in 26 provinces and administrative regions in China and 42 foreign countries. We derive most of our revenues from sales in China, Japan and South Korea. In 2012, our primary strategy was to continue building our brand recognition in China through consistent marketing efforts towards supermarkets, wholesalers, and significant customers, enhancing the cooperation with other manufacturers and factories and enhancing the turnover for our exsting chestnut, convenience and frozen food products. In addition, we are working to expand our marketing efforts in Asia, Europe, the Middle East and North America. We currently have limited sales and marketing activity in the United States, although our long-term plan is to significantly expand our activities there.

Organizational Structure

ALN is a Nevada corporation that was incorporated on February 4, 1986 and was formerly known as Millennium Quest, Inc. Prior to May 3, 2007, when ALN completed a recapitalization, or reverse merger, with ILH, ALN did not engage in active business operations other than to search for a potential acquisition target. Effective November 16, 2009, ALN reincorporated in Nevada from Delaware.

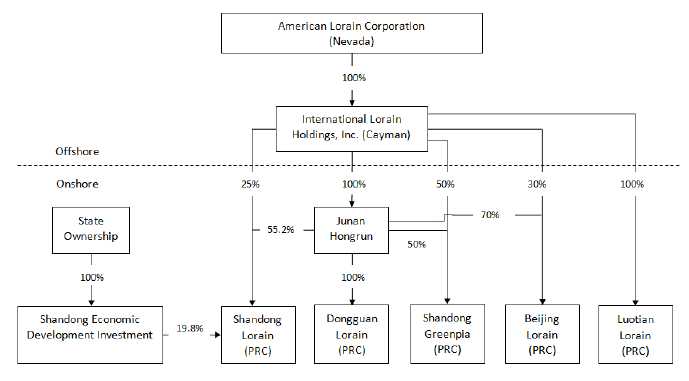

ALN owns 100% of ILH. ILH wholly owns two Chinese operating subsidiaries, Luotian Lorain and Junan Hongrun, directly. Junan Hongrun, in turn, wholly owns Dongguan Lorain. In addition, together with Junan Hongrun, ILH wholly owns Beijing Lorain, Shandong Greenpia, and owns approximately 80% of Shandong Lorain (Shandong Economic Development Investment Co. Ltd. owns approximately 20%). We sometimes refer to our six Chinese operating subsidiaries throughout this annual report on Form 10-K as the Lorain Group Companies. Below is an organizational chart of ALN, ILH and the Lorain Group Companies:

- 3 -

Products

Our products are categorized into the following three segments:

- chestnut products,

- convenience food products, and

- frozen food products.

We produced 254 products in 2011, including 16 new products in our chestnut and convenience foods segment. We also discontinued 3 products in 2011 in the convenience segment due to slow sales.

Our chestnut products and convenience foods were our main profit centers in 2011. Our convenience foods segment has been the fastest growing portion of our business and was one of the main catalysts of our growth during 2011. Frozen food products accounted for a smaller portion of our revenues in 2011 as compared with 2010 because we have been more focused on generating revenues from higher margin chestnut and convenience food products.

Chestnut Products

We believe that we are the largest chestnut processor and manufacturer in China. We have developed brand equity for our chestnut products in China, Japan and South Korea over the past 10 to 15 years. We produced 57 high value-added processed chestnut products in 2011. In 2011 and 2010, this segment contributed 51.7% and 54.9% of our total revenues, respectively.

Our best selling products in 2011 included our aerated open-bottom chestnuts, which are chestnuts packaged with nitrogen; sweetheart chestnuts, which are sweet preserved chestnuts; chestnuts in syrup, which are very popular in Japan and South Korea; and golden chestnut kernels. The majority of our chestnut products are natural and do not contain chemical additives.

The chestnut, in contrast to many other tree nuts, contains small quantities of oil and is very high in complex carbohydrates. This makes them useful for a wider food range than other common nuts. Chestnuts are commonly steamed, boiled, sugar stir-fried, roasted or added into dishes or desserts as an ingredient.

- 4 -

China is the largest grower of chestnuts in the world, followed by South Korea and Japan. In recent years, the chestnut production in South Korea and Japan has declined. This has been attributed to the increasing labor costs and operational costs incurred in growing chestnuts. Because of the declining domestic production, South Korean and Japanese customers have grown to rely more on imported chestnut products. Our strategy is to take advantage of these trends.

We differentiate our chestnut products based on flavor, size and method of packaging. For instance, some of our chestnut products that are sold in Japan are packaged in plastic bags or tin cans, each considered a different product. Similarly, some of our chestnut products are processed with hot water or cold water, each considered a different product.

Chestnut season in China lasts from September to January. We purchase and produce raw chestnuts during these months and store them in our refrigerated storage facilities throughout the year. Once we obtain a purchase order during the rest of the year, we remove the chestnuts from storage, process them and ship them within one day of production.

Convenience Foods

Our convenience food products are characterized as follows:

- Ready-to-cook, or RTC, food products,

- Ready-to-eat, or RTE, food products and

- Meals ready-to-eat, or MRE, food products.

These products are intended to meet the current demands of our customers for safe, wholesome and tasty foods that are easily prepared.

RTCs can be served after a few easy cooking procedures. Typically, when preparing a RTC, customers need only to heat the food in a microwave or boil it for several minutes before eating. Our best selling RTCs in 2011 were beef and lamb products.

RTEs can be served without any cooking. Our best selling RTEs in 2011 were various bean products and pickle products.

MREs are meal kits with self-heating devices or microwavable kits, such as microwavable rice boxes. Our self heating MREs are primarily for military use since no cooking device or other ingredients are needed other than water. We also introduced microwavable MREs for civilian uses such as camping, traveling and other situations since only simple preparation and a cooking device such as a microwave oven is required.

We produce various MREs based on Chinese cuisine, the best sellers of which were our pork with garlic sauce over rice and kungpao chicken with rice in 2011. Other MREs are based on other styles of food, such as Italian cuisine. Many of our convenience products are natural and do not contain chemical additives.

We produced 138 convenience food products in 2011, including 14 new products such as filled buns and fried sweet potato. In 2011 and 2010, this segment contributed 34.2% and 30.8%, respectively, of our total revenues.

Our convenience foods segment has been the fastest growing portion of our business and was one of the main catalysts of our growth during 2011. We expect our convenience foods segment to continue to be an important area of growth for our business in the future.

Frozen Food Products

We produce a variety of frozen foods, including frozen vegetables, frozen fruits, frozen fish, and frozen meats. We produced 63 frozen food products in 2011. Our best selling frozen foods in 2011 were frozen asparagus and frozen corn.

Our frozen food business allows us to mitigate the significant production seasonality of chestnut products and to increase the utilization rate of our production capacity. Historically, our frozen food division has been a significant portion of our business. We continue to see steady increase in sales of our frozen food segment, but with the fast increase in sales of our convenience food products, the percentage weight frozen foods accounted for in our total revenue decreased from 14.3% in 2010 to 14.1% in 2011. Gross margins in this segment are lower than the margins for chestnut products and convenience foods.

Our Manufacturing Facilities

General

- 5 -

We currently manufacture our products in six facilities in China, three of which are located in Junan County, Shandong Province, one in Luotian County, Hubei Province, one in Miyun County, Beijing City and one leased facility in Dongguan, Guandong Province. The following table indicates the year that operations commenced at each of the facilities and the size of the facilities

| Year Operations | Facility Size | |

| Facility | Commenced | (square meters) |

| Junan Hongrun | 2002 | 38,865 |

| Shandong Lorain | 1995 | 15,392 |

| Beijing Lorain | 2003 | 21,000 |

| Luotian Lorain | 2003 | 9,558 |

| Dongguan | 2008 | 9,250 |

| Shandong Greenpia | 2010 | 9,179 |

Production Lines

We currently manufacture our products using 26 production lines. Each production line is used to produce between 10 and 50 products. We currently run three types of product lines:

- deep-freezing lines, which are used to freeze raw materials for year-round production and to produce frozen food;

- canning lines, which are used to produce canned products, including chestnut products; and

- convenience food lines, which are used for producing RTCs, RTEs and MREs, all of which have nitrogen preservation capacity.

The production process for our chestnut products initially involves sorting and cleaning the raw chestnuts purchased during the chestnut season. We then store the raw chestnuts in our refrigerated storage facilities throughout the year. Once we obtain a purchase order, we remove the chestnuts from storage and process them by steaming, decladding and deep-freezing the chestnuts, depending on the particular product. We then package and ship the processed chestnuts within one day of production.

The production process of our convenience products generally involves various steps, including soaking, boiling, coating, drying, deep freezing, packing, sealing and sterilizing.

The following table shows the number and types of production lines, the types of products produced and the production capacity at each facility:

| Facilities | Production Lines | Product Portfolio | 2011 Capacity |

| Junan Hongrun | 1 Deep-freezing line 3 Convenience food lines 4 Canning lines |

Chestnut products, frozen foods, beans, bean paste |

Multi-purpose production lines with 44,000 tons of production capacity and 11,400 tons of cold and frozen storage |

| Shandong Lorain | 1 Deep-freezing line 1 Convenience food line |

Chestnut products, convenience foods, frozen foods |

Multi-purpose production lines with 20,000 tons of production capacity and 3,500 tons of cold and frozen storage |

| Beijing Lorain | 6 Convenience food lines 1 Deep-freezing line |

Chestnut products, frozen foods |

Multi-purpose production lines with 34,000 tons of production capacity and 4,650 tons of cold and frozen storage |

| Luotian Lorain | 3 Convenience food lines 2 Deep-freezing lines |

Chestnut products, convenience foods, frozen foods |

Multi-purpose production lines with 24,000 tons of production capacity and 6,500 tons of cold and frozen storage |

| Dongguan factory | 2 Convenience food lines |

Convenience food |

Multi-purpose production lines with 3,000 tons of production capacity and 2,250 tons of cold and frozen storage |

| Shandong Greenpia | 2 Convenience food lines | Chestnut products, convenience foods | Multi-purpose production lines with 9,000 tons of production capacity and 1,500 tons of cold and frozen storage |

- 6 -

We allocate our production lines based upon the location of our facilities to take advantage of efficiencies in the transportation of required raw materials. For example, Junan Hongrun and Shandong Lorain, which manufacture primarily chestnut and frozen products, are located in Shandong Province, which is China’s largest supplier of fresh products by volume. Shandong Province is also a major chestnut producing region.

Our production lines and facilities have all been designed to meet the standards and requirements of our largest customers in Japan and Europe, with Japan being our largest export market. We employ advanced methods of quality control and have obtained various certifications for many of our products, packages and processes, including ISO 9000 or ISO 9001 certification for certain of our chestnut and frozen vegetable products, BRC certification for certain of our frozen fruit and vegetable products and HACCP certification for certain of our frozen vegetable, fruit and chestnut products and our bottom-open chestnuts. We believe that our quality controls and standards of products distinguish our products both in domestic and international markets. The import approvals that we have obtained from the Japanese government for our chestnuts and other convenience foods have been helpful in advocating with the Chinese government for domestic approvals to increase our product offerings.

With limited exception, we operate our production lines year round. In the past, when our production was focused almost exclusively on chestnuts, we experienced seasonal underutilization of our product lines. However, our current facilities have multiple-function designs allowing us to use our production lines for our convenience and frozen products when we are not producing chestnuts at full capacity. Consequently, as we have increased our processed and convenience food offerings over the last several years, we have generally been able to run our production lines at increasing efficiency.

Previously, most of our processed and convenience foods were produced at our Beijing Lorain plant. With the introduction of bean products in 2009, we expanded our facility in Junan Hongrun with the addition of three convenience food production lines designed specifically for bean products with current annual capacity of 13,500 metric tons.

We believe our facilities are adequate for our current levels of production. We anticipate, however, that we may require additional facilities and/or product lines as our business grows. We are exploring the possibility of alliances with one or more OEM partners for the production, in the short-term, of some of our convenience food products and frozen products should our facilities be inadequate to meet increasing demand. We are also exploring the possibility of leasing additional production lines to expand our production capacity. In 2008, we leased two convenience foods production lines in Dongguan, Guangdong Province, which increased production capacity by approximately 3,000 metric tons per year to meet our short-term needs. We did not lease any production facility during 2011. Given the relatively low cost to lease, we may decide to lease additional facilities in 2012, should circumstances require. In the long-term, we plan to increase our own production capacity by acquiring or building new facilities, subject to the availability of adequate sources of funding.

Storage Capacity

Storage of our raw materials and inventory is a critical element of our business. Our raw materials and partially finished products need to be preserved in frozen storages (-18ºC to -20ºC) or constant temperature storages (-5ºC to 5ºC). Storage is particularly critical for our chestnut products because chestnuts are a seasonal fruit.

The following table illustrates on a facility by facility basis the type and capacity of our storage resources:

| Facility | Storage Type | Number of | Capacity |

| Storage Units | (metric tons) | ||

| Junan Hongrun | Frozen Storage | 19 | 20,100 |

| Constant Temperature | 8 | 4,800 | |

| Shandong Lorain | Frozen Storage | 5 | 2,000 |

| Constant Temperature | 3 | 1,500 | |

| Luotian Lorain | Frozen Storage | 8 | 4,500 |

| Constant Temperature | 4 | 2,000 | |

| Beijing Lorain | Frozen Storage | 6 | 2,850 |

| Constant Temperature | 3 | 1,800 | |

| Dongguan | Frozen Storage | 2 | 800 |

| Constant Temperature | 2 | 1,450 | |

| Shandong Greenpia | Constant Temperature | 4 | 1,500 |

| TOTAL | 64 | 43,300 |

- 7 -

As we have expanded our production capacity, we have also expanded our storage capacity. All of the listed storage facilities are owned by us. In 2009, we expanded our storage capacity in Junan Hongrun by an additional 3,600 metric tons. In 2010, we also expanded storage facility in Dongguan by 1,000 metric tons and, through our acquisition of Shandong Greenpia, we have added four additional storage units with an aggregate capacity of 1,500 metric tons. We also added 13,500 metric tons of cold storage at the Junan Hongrun facility during 2011. We may also lease additional storage facilities from time to time should circumstance require.

Agricultural Operations

We grow or set up agricultural co-ops with local farmers to supply ourselves with a small portion of chestnut, fruit and vegetable products. For the year ended December 31, 2010 and 2011, the supplies coming from agricultural operations have been immaterial. We believe, however, that development of agricultural facilities is a good strategy for the long-term. We anticipate that self grown agricultural products and agricultural products grown in cooperation with local farmers will enable us to assure adequacy of supply, promote quality and reduce cost, particularly for our high margin offerings. For example, by growing Korean cultivar chestnuts domestically, we expect to significantly reduce our supply costs for this premium product, while ensuring superior quality.

Lands in which we grow our agricultural products for such products are shown in the following table.

| Area | Location | |

| Harvest | (acres) | (PRC) |

| Chestnut (South Korean, Japanese, Australian cultivar) | 329 | Shandong |

| Chestnut (Japanese cultivar) | 165 | Beijing |

| Sticky Corn | 342 | Beijing |

| Sweet Corn | 118 | Beijing |

| Green Pea | 217 | Beijing |

| Sweet Pea | 167 | Beijing |

| Organic Chestnut | 165 | Beijing |

| Mixed Vegetables | 417 | Shandong |

| Mixed Vegetables | 83 | Beijing |

| Japanese Pumpkin | 197 | Inner Mongolia |

| Black Beans | 500 | Shandong |

| Strawberry | 392 | Shandong |

| Broccoli | 165 | Beijing |

| Green Asparagus | 591 | Beijing |

| White Asparagus | 263 | Shandong |

| Sweet Potato | 500 | Shandong |

| Peach | 329 | Beijing |

| Apricot | 411 | Beijing |

| Pear | 329 | Beijing |

| Blackberry | 165 | Beijing |

We began growing chestnuts in Shandong Province in 2003. Unlike most vegetables and fruits, chestnut trees have a 3-5 year growing phase before they can be harvested. Our current chestnut planting base has been self-supplying limited quantities of chestnuts to our production since 2007.

We began growing strawberries in 2008 in Shandong and peaches, apricots, pears and blackberries in 2009 in Beijing. We use these fruits in some of our frozen fruit products. We plan to continue to expand our agricultural operations over the next few years. Among other things, we plan to increase our self-production in China of Korean cultivar chestnuts. We expect to obtain funding for this expansion through a combination of commercial and government loans, including loans under Chinese government programs to promote agricultural industrialization. There is no assurance, however, that adequate funding for these purposes will be available to us.

Raw Materials

In 2011 and 2010, approximately 88% and 93% of our procured raw materials, respectively, consisted of agricultural products, including primarily chestnuts and vegetables, approximately 7% and 4%, respectively, consisted of packaging materials and approximately 5% and 3% consisted of condiments such as sugar, salt and flour.

- 8 -

Our Supply Sources

Our business depends on obtaining a reliable supply of various agricultural products, including chestnuts, vegetables, red meat, fish, eggs, rice and flour. Because of the diversity of available sources of these raw materials, we believe that our raw materials are currently in adequate supply and will continue to be so in the future.

We obtain our agricultural raw materials from three sources: domestic procurement (excluding self-supply), overseas markets, and self-supply. Domestic and overseas procurement accounted 98.4% and 1.4%, respectively, of our total raw material costs in 2011, with self-supply accounted for less than 1%. We obtained substantially all of our agricultural raw materials from domestic sources during 2011.

In 2011 and 2010, respectively, we procured approximately 64,851 and 55,200 metric tons of chestnuts and approximately 54,827 and 44,500 metric tons of vegetables and other raw materials from a number of third party suppliers, domestic and overseas, and produced approximately 258 and 60 metric tons of chestnuts from our own agricultural operations.

We select suppliers based on price and product quality. We typically rely on numerous domestic and international suppliers, including some with whom we have a long-term relationship. Our top 10 suppliers accounted for 17.9% and 17.4%, respectively, of the total procurement in 2011 and 2010 in value terms. We purchase from suppliers and farmers pursuant to supply contracts and underlying purchase orders. We have not entered into any long-term contracts with any of our suppliers.

Our suppliers generally include wholesale agricultural product companies, agricultural associations and distributors. Some raw materials must be imported at higher costs, however. Occasionally, we also work directly with farmers. For instance, we operate an initiative which involves a series of cooperation and lease agreements between Shandong Lorain, Beijing Lorain and local farmers. This initiative involves approximately 1,000 acres of land which is used primarily to produce Japanese and Korean style chestnuts, sticky corn and pumpkins for our operations.

Procurement Cost and Quality Control

To control procurement costs, we have located our facilities near domestic sources of agricultural raw materials. For example, Junan Hongrun and Shandong Lorain are located in Shandong Province, which is China’s largest supplier of fresh products by volume. Shandong Province is also a major chestnut producing region. Local procurement reduces our costs, especially transportation costs. It also gives us first-hand harvest and market information, which provides us with an advantage in price negotiations with suppliers.

Some raw materials must be imported at higher cost. As discussed, we have begun to develop our agricultural capabilities in order to control costs, particularly with respect to imported raw materials such as Korean-style chestnuts.

Pricing for agricultural products reflects several external factors, such as weather conditions and commodity market fluctuations, which are beyond our control. We obtain contemporaneous information on local harvests and collect daily reported price information on harvests in other markets from which we procure our products. We also attempt to predict harvest yields in advance based on our information gathering. We use this harvest information to negotiate best pricing with our suppliers.

We impose strict standards on our suppliers. During the harvest season, our internal procurement function may visit our sources of supply to assure that the products we are purchasing comply with our standards.

Our Customers

We sell our products in 26 provinces and administrative regions in China and 42 foreign countries globally. In 2011 and 2010, approximately 73.7 and 73.3%, respectively, of our sales were made domestically and approximately 26.3% and 26.7%, respectively, were to international customers, primarily Japan and South Korea.

Our top ten customers contributed 15.5% and 20.5% of our total revenues in 2011 and 2010. Approximately 5.3% in 2010 and 11.2% in 2011 of our total sales were attributable to revenues from Shandong Lvan Import & Export Co., Ltd., a food trading company in China.

Domestic

In China, we sell our products through our own sales team and through third-party distributors. We have 36 sales offices in 21 provinces in China. In 2011 and 2010, we sold approximately 88% and 89%, respectively, of our products directly to our Chinese customers and approximately 12% and 11% through third-party distributors.

- 9 -

We sell our products in all first-tier cities in China, including Beijing, Shanghai, Tianjin and Guangzhou, through our own sales efforts in order to capture the profit margin that would otherwise go to intermediate wholesalers and to enhance our brand recognition. Our sales team sells our products directly to supermarket chains, mass merchandisers, large wholesalers and others in these markets. In second-tier and third-tier cities, we currently sell our products to third-party distributors, such as food companies or trading companies with established distribution channels in such regions, rather than through our own sales team, in order to enable us to penetrate such markets more quickly without spending significant capital. We also sell to small customers through independent sales representatives.

Generally, our direct sales customers are required to pay us on 30 to 60 day credit terms. Third-party distributors, however, generally do not pay on credit, allowing us to obtain quicker payment terms and thereby decrease our accounts receivables.

The terms of a typical sales contract between us and our distributors provide that we are responsible for transportation costs and the distributors are responsible for storage costs. Furthermore, the distributors have the right to return products that fail to satisfy specified quality standards, at our cost. The majority of such contracts require the distributors to pay us in cash in full upon delivery, and the remaining contracts provide for short-term credit, usually two to three weeks. In addition, we typically offer distributors performance-based incentives, such as a cash bonus equal to 1% of total revenues generated by such distributor which exceed previously established sales targets.

We plan to gradually increase the portion of sales to third party distributors in order to access new markets in China in a cost effective manner and to improve our cash position. Such plans are subject to our ability to restructure the sales force and manage the increased number of distributors without compromising our profit margins.

International

Our export sales destinations include:

- Asia pacific, primarily Japan, South Korea and Malaysia, but also Singapore, Philippines, Indonesia and Australia;

- Europe, primarily Belgium and the United Kingdom, but also France, Germany, the Netherlands, Spain, Poland, and Denmark

- the Middle East, primarily Saudi Arabia, Kuwait and Israel;

- North America, including the United States and Canada

We generate most of our sales in Asia. In 2011 and 2010, respectively, approximately 93.8% and 92.7% of our international sales were in Asia and approximately 5.7% and 5.3% were in Europe.

We sell our products to international markets primarily through export and trading agents and companies in China, as well as our own sales team located in China. Our sales team sells directly to wholesalers, food processors and mass merchandisers. Many of our customers are well known in their local food market. We have established long-term relationships with many international customers, especially in Japan and South Korea. We currently have no sales offices outside of China and do not use alternative methods to sell our products outside of China. We attend trade shows in Europe and other international markets in order to promote our products.

In March 2011, the northern region of Japan experienced a severe earthquake followed by a tsunami. These geological events caused significant damage in that region and have adversely affected Japan's infrastructure and economy. However, the crisis did not harm our export sales to Japan because most of our products are distributed to Tokyo, Osaka, Nagoya, Kobe and Kyoto, which did not suffer direct damages in the earthquake or the tsunami. Japan accounted for 13.0% and 10.7% of our total revenue for the years ended December 31, 2011 and 2010, respectively.

Our Sales and Marketing Efforts

We seek to expand our customer base by:

- direct sales communications with our large customers;

- sales through distributors to new customer bases;

- referrals from existing customers; and

- participation in domestic and international food exhibitions and trade conferences.

We have not spent a significant amount of capital on advertising in the past, and our advertising budget continues to be limited. In 2011 our marketing and branding efforts included supermarket advertising, and internet advertising. We intend to increase our advertising and branding efforts given the consumer nature for many of our products. For the near future, our marketing efforts will continue to focus primarily on the domestic Chinese market for our chestnut and convenience food products.

Competition and Market Position

- 10 -

The overall food market is diverse, both globally and in China. We do not have a significant market share in any of our business segments.

Chestnut Products

We compete in the chestnut market primarily on the basis of the uniqueness of our products, quality, price and brand recognition. We also utilize our proprietary, patented and patent-pending technology in the production of our chestnut products to our competitive advantage.

The world market for chestnut products is highly fragmented. Our principal competitors in the chestnut product market are currently Hebei Liyuan, a Chinese company, and Foodwell Corporation, a South Korean company.

Convenience Food Products

Convenience food products market competition is based mostly upon quality and product variety. We attempt to use our modern food processing technology, such as nitrogen preservation, to produce a wide variety of high quality convenience foods.

The convenience food market in China is highly fragmented and we do not face competitive pressure from any particular competitor or small group of competitors.

Frozen Food Products

In the frozen food product market, competition is based primarily upon quality, ability to provide a reliable product supply and customer relationships.

Our strongest competitors in the frozen food products market are currently Weifang Langdong Food Co. Ltd., Yuyao Hongji Food Co. Ltd. and Yantai Pengshun Food Co. Ltd., all of which are located in China.

Competitive Advantages

We believe that we enjoy a number of competitive advantages, both domestically and internationally.

We have developed brand equity for our chestnut products in China, Japan and South Korea over the past 10 to 15 years. Our customers are willing to pay a premium for some of our chestnut products because of our brand equity. In addition, we believe that we have a strong distribution channel for our products in the markets in which we currently operate.

We believe that we are able to provide our customers with greater selection and a more reliable supply than many of our competitors, which is especially important for our supermarket chain and large wholesaler customers. We produced 57 chestnut products in 2011. We believe that we are the sole provider of certain bottom-open chestnut and sweetheart chestnut products in China.

Labor is a large portion of total operating costs for food companies. We believe that we have a lower labor cost structure and a more abundant labor supply than many of our international competitors.

We are focused on managing our costs in other ways as well. We seek to locate our production facilities in close proximity to our main domestic sources of raw materials supply to reduce transportation costs and give us first-hand knowledge of market factors affecting our cost of raw material supply. Our agricultural self-supply program, while modest at present, is expected to grow and to become a significant element of our cost containment efforts.

We use modern food processing technology and innovation in our formulations and manufacturing processes to create high quality products. Nitrogen preservation in particular, used in the production of convenience foods, is an innovative technology which has not been widely applied in China.

In 2008, we submitted an application for patent protection in the PRC for two of our technologies which support the production of our chestnut and convenience food products, with one successful patent grant and one denial. During 2009 and 2010, we submitted four additional patent applications, with one successful patent grant and and three remaining under review. (See “Intellectual Property” below.) We believe that our technology gives us an advantage over our Chinese competitors, allowing us to produce chestnut and convenience food products that are superior in quality and to offer more products varieties.

We believe that our reputation for quality also contributes to our competitiveness. We maintain high food safety standards, in order to satisfy both domestic and international requirements. We regularly test our products for quality and compliance with standards.

- 11 -

Intellectual Property

Trademarks

We use the trademarks

and

and

on all of our products sold in China.

on all of our products sold in China.

Patents

We have developed the following four proprietary technologies to support our chestnut and convenience food production:

-

The sweetheart chestnut is a premium product that is more expensive, and yields greater profit margins than our other chestnut products. Our proprietary technology relates to the process for evenly distributing throughout the chestnuts the syrup used to preserve the chestnuts. This technology enhances the texture of the chestnuts, preserves the natural form of the chestnuts and promotes the stability and uniformity of the chestnuts’ sweetness. In 2008, our patent application for this technology was approved by the State Intellectual Property Office of the PRC and is protected by PRC patent law for 20 years. We expect this technology to contribute to the growth of our sales of sweetheart chestnuts, which had been increasing at an annual rate of 25% to 30% over the past several years.

-

Oden is a popular traditional Japanese dish, typically consisting of boiled eggs, daikon radish, konnyaku and processed fish cakes stewed in a light, soy-flavored dashi broth. Our technology relates to the process used to control the sterilization of the packaging for oden eggs. Our technology enables us to deliver convenience food products with unique freshness and authentic taste. This technology has been an important factor in expanding the market for our convenience foods products, particularly in Japan. Our patent application for this product was approved by the State Intellectual Property Office in February 2009.

-

The pickle vegetable exhibition counter is ideal for shopping malls and supermarkets. It consists of the refrigerator cabinet which keeps the temperature low, and the exhibition cabinet, which sits above the refrigerator cabinet and with glass covers. The exhibition counter is intended for convenience observation and better preservation for the pickle vegetables. Our patent for this device was granted in April 2009.

-

High-temperature chestnut roasting machine is an innovative chestnut roasting device, which overcomes shortcomings of traditional roasters such as low efficiency and uneven heating. It is a sealed cylinder device and also quipped with thermometer and manometer to gauge the temperature and pressure inside the roaster. This new roasting device is also energy efficient and environmentally friendly. Our patent application for this device was approved by the State Intellectual Property Office in July 2011, and protected by PRC patent law for 10 years.

We also have three patent applications pending with the State Intellectual Property Office of the PRC, including the preparation of aerated snack beans, frozen bottom open chestnuts, as well as the device and the preparation procedure for chestnut roasting within a high pressure cylinder device. The approval for patents typically takes 3 to 4 years.

We take reasonable steps to protect our proprietary information and trade secrets, such as limiting disclosure of proprietary plans, methods and the like on a need-to-know basis and requiring employees with access to our proprietary technology to enter into confidentiality arrangements. We believe that our proprietary technology and trade secrets are adequately protected.

Our Employees

As of December 31, 2011, we had a total of 2,122 full-time employees and 484 part-time employees. 720 of our full-time employees are directly employed by our subsidiary companies and the remaining employees are employed by Linyi Zhifu Labor Service Company, an outside company that leases employees to us to meet our staffing needs. As required by Chinese law, all employees are party to a written employment contract. We compensate the employees leased from Linyi Zhifu directly and pay Linyi Zhifu a service fee. Linyi Zhifu is responsible for the pension and social insurance benefits of the leased employees, as described below.

The following table sets forth the allocation of employees, both direct and leased, by job function.

- 12 -

| Department | Number of |

| Employees | |

| Production | 2,223 |

| Quality Control | 75 |

| Domestic Sales | 110 |

| Human Resources | 8 |

| Research and Development | 40 |

| International Sales | 38 |

| Finance | 40 |

| Procurement | 25 |

| Administration | 40 |

| Strategic planning | 7 |

| Total | 2,606 |

We believe that the relationship between management and our employees is good. We have not experienced any significant problems or disruption to our operations due to labor disputes, nor have we experienced any difficulties in recruitment and retention of experienced staff.

Our Shandong Lorain subsidiary has an employee relations department for the purpose of advancing employee welfare, encouraging employee participation in decision making and enhancing relations among employees and between employees and our management team.

We compensate our production line employees by unit produced (piece work) and compensate other employees with a base salary and bonus based on performance. We also provide training for our staff from time to time to enhance their technical and product knowledge, including knowledge of industry quality standards.

Our employees in China participate in a state pension scheme organized by Chinese municipal and provincial governments. We were required to contribute to the scheme on behalf of our direct employees at a rate of 24% of the average monthly salary for the years ended December 31, 2011 and 2010. In addition, we are required by Chinese law to cover our employees with various types of social insurance. We made contributions to the social insurance scheme on behalf of our direct employees at a rate of 4% of the average monthly salary for each employee for the years ended December 31, 2011, 2010, and 2009. As indicated above, Linyi Zhifu is responsible for contributions on behalf of the leased employees.

Our Research and Development Activities

Our research and development efforts are focused on three objectives:

-

Superior product safety and quality;

-

Reduction of operating costs; and

-

Sustaining growth through the development of new products.

We have research and development staff at each of our facilities. In total, 40 employees are dedicated to research and development.

We rely heavily on customer feedback to assist us in the modification and development of our products. We also utilize customer feedback to assist us in the development of new products. Over the past several years, on average, we added 10 to 20 new varieties to our product portfolio each year. In 2011, we added 16 new products, most in our convenience and frozen foods segment. In 2011, we discontinued 3 products in the convenience food segment primarily due to slow sales.

The amount we spent on research and development activities during the years ended December 31, 2011 and 2010 was not a material portion of our total expenses for those years.

Government Regulation

As a manufacturer and distributor of food products, we are subject to regulations of China’s Agricultural Ministry. This regulatory scheme governs the manufacture (including composition and ingredients), labeling, packaging and safety of food. It also regulates manufacturing practices, including quality assurance programs, for foods through its current goods manufacturing practices regulations, and specifies the standards of identity for certain foods, including the products sold by us, and prescribes the format and content of many of the products sold by us, the format and content of certain nutritional information required to appear on food products labels and approves and regulates claims of health benefits of food products.

- 13 -

We have obtained approvals from Chinese authorities for the production of certain categories of products, including chestnuts, frozen vegetables and fruits, fish, and canned products. Production of new products that do not fall into approved categories of products would require separate approval from the appropriate Chinese authorities. We have consistently obtained such approvals for our newly developed products in the past and do not anticipate any difficulties in obtaining new approvals in the future if needed.

In addition, we are required to obtain governmental approval, and to register with the State Administration for Industry and Commerce, in order to open a new facility in China. We have consistently obtained such approvals, and made such registrations, for our new facilities in the past and do not anticipate any difficulties in filing new registrations and obtaining new approvals in the future if needed.

Under the relevant Provisions of the PRC on Sanitation of Food for Export (for Trial Implementation), unless an exporter’s products are exempted from inspection, products must be inspected in accordance with the Law of the PRC on Import and Export Commodity Inspection. We have not been exempted from inspection. In the past, we were authorized by the relevant authorities to conduct self-inspection of certain of our export products. However, currently, the relevant authorities have imposed tighter food safety control in China, and as a result, all of our exported food products must be inspected by qualifying government agencies. We believe that all of our exported products are currently in compliance with such requirements and we do not anticipate any difficulties in complying with such rules in the future.

In addition, we are required to obtain a license from the local branch of the Entry-Exit Inspection and Quarantine Bureau of China for our exported products. We have consistently obtained such licenses in the past and we do not anticipate any difficulties in obtaining such licenses in the future.

Item 1A. RISK FACTORS

RISK FACTORS

From time to time, information provided by us, including but not limited to statements in this report, or other statements made by or on our behalf, may contain “forward-looking” information within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve a number of risks, uncertainties, and contingencies, many of which are beyond our control, which may cause actual results, performance, or achievements to differ materially from those anticipated. Set forth below are important factors that could cause our results, performance, or achievements to differ materially from those in any forward-looking statements made by us or on our behalf.

Business Risks

We may not be able to obtain an adequate supply of high quality raw materials.

Our business depends on obtaining a reliable supply of various agricultural products, including chestnuts, vegetables, fruits, red meat, fish, eggs, rice, flour and packaging products. During 2011, the cost of our raw materials increased from $102,751,348 to $127,798,200 for an increase of approximately 23.3% . We may have to increase the number of our suppliers of raw materials and expand our own agricultural operations in the future to meet growing production demands. Despite our efforts to control our supply of raw materials and maintain good relationships with our suppliers, we could lose one or more of our suppliers at any time. The loss of several suppliers may be difficult to replace and could increase our reliance on higher cost or lower quality suppliers, which could negatively affect our profitability. In addition, if we have to increase the number of our suppliers of raw materials in the future to meet growing production demands, we may not be able to locate new suppliers who could provide us with sufficient materials to meet our needs. Any interruptions to, or decline in, the amount or quality of our raw materials supply could materially disrupt our production and adversely affect our business and financial condition and financial prospects.

The prices that we have paid for our raw materials recently have experienced significant fluctuation. If these price fluctuations continue, our profit margins may be materially adversely affected.

The average price that we paid for chestnuts in 2011 and 2010 was approximately $1,071 per metric ton and $1,119 per metric ton, respectively, excluding value added taxes. We do not currently hedge against changes in our raw material prices. Consequently, if the costs of our raw materials increase further, and we are unable to offset these increases by raising the prices of our products, our profit margins and financial condition could be adversely affected.

- 14 -

Price inflation in China could affect our results of operation if we are unable to pass along raw material price increases to our customers.

Inflation in China has been consistently increasing in recent years. Because we purchase raw materials from suppliers in China, price inflation directly causes an increase in the cost of our raw materials. Price inflation could affect our results of operation if we are unable to pass along raw material price increases to customers. In addition, if inflationary trends continue in China, China could lose its competitive advantage as a low-cost manufacturing venue, which could in turn lessen some of the competitive advantages of our being based in China. Accordingly, inflation in China may weaken our competitiveness domestically or in international markets.

Our sales and reputation may be affected by product liability claims, litigation or, product recalls in relation to our products.

The sale of products for human consumption involves an inherent risk of injury to consumers. We face risks associated with product liability claims, litigation, or product recalls, if our products cause injury or become adulterated or misbranded. Our products are subject to product tampering and contamination, such as mold, bacteria, insects, shell fragments and off-flavor contamination, during any of the procurement, production, transportation and storage processes. If any of our products were to be tampered with, or become tainted in any of these respects, and we were unable to detect this, our products could be subject to product liability claims or product recalls. Our ability to sell products could be reduced if certain pesticides, herbicides or other chemicals used by growers have left harmful residues on portions of our raw materials or if our raw materials have been contaminated by other agents.

We have never had a product recall in the past but we have experienced product liability claims that were made by our customers. The amounts of such claims were immaterial. However, claims of product defect or product liability for material amounts, individually or in the aggregate, may be made in the future.

We have not procured a product liability or general liability insurance policy for our business, as the insurance industry in China is still in an early stage of development. To the extent that we suffer a loss of a type which would normally be covered by product liability or general liability insurance in the United States, we would incur significant expenses in defending any action against us and in paying any claims that result from a settlement or judgment against us. Product liability claims and product recalls could have a material adverse effect on the demand for our products and on our business goodwill and reputation. Adverse publicity could result in a loss of consumer confidence in our products.

We may be unable to manage future rapid growth.

We have grown rapidly over the last few years. Our sales increased from $27,735,833 in 2004 to $213,222,106 in 2011. The number of product types we sold increased from approximately 100 in 2004 to approximately 254 in 2011. We intend to continue to expand the volume and variety of products we offer, as well as the geographical scope of our sales and production facilities. Our business growth could place a significant strain on our managerial, operational and financial resources. Our ability to manage future growth will depend on our ability to continue to implement and improve operational, financial and management information systems on a timely basis and to expand, train, motivate and manage our workforce. Our personnel, systems, procedures and controls may not be adequate to support our future growth. Failure to effectively manage our expansion may lead to increased costs, a decline in sales and reduced profitability.

Our expansion strategy may not prove successful and could adversely affect our existing business.

Our growth strategy includes the expansion of our manufacturing operations, including new production lines and agricultural operations. We plan to expand our sales in China and internationally. We will need to engage in various forms of promotional and marketing activities in order to further develop the branding of our products and to increase our market share in new and existing markets. The implementation of this strategy may involve large transactions and present financial, managerial and operational challenges. We could also experience financial or other setbacks if any of our growth strategies incur problems of which we are not presently aware. If we fail to generate sufficient sales in new markets or increase our sales in existing markets, we may not be able to recover the production, distribution, promotional and marketing expenses, as well as administrative costs we have incurred in developing such markets.

Our results of operations could be affected by natural events in the locations in which our customers operate.

Several of our customers have operations in locations that are subject to natural disasters, such as severe weather and geological events, which could disrupt the operations of those customers and suppliers as well as our operations. If our customers suffer from these events, their operations may be negatively impacted. As a result, some or all of those customers may reduce their orders for our products, which could adversely affect our revenue and results of operations.

- 15 -

The acquisition of other businesses could pose risks to our profitability.

We may try to grow through acquisitions in the future. Any proposed acquisition could result in accounting charges, potentially dilutive issuances of equity securities, and increased debt and contingent liabilities, any of which could have a material adverse effect on our existing business and the market price of our common stock. Acquisitions, in general, entail many risks, including risks relating to the failed integration of the acquired operations, diversion of management’s attention, and the potential loss of key employees of the acquired organizations. We may be unable to successfully integrate businesses or the personnel of any business that might be acquired in the future, and our failure to do so could have a material adverse effect on our business and on the market price of our common stock.

We are subject to risks of doing business internationally. If the international market does not grow as we expect, our business and financial condition may be adversely affected.

We conduct a substantial amount of business internationally. Our export sales destinations include countries in Asia, Europe, the Middle East and North America. Our international operations are subject to a number of inherent risks, including:

- chestnut products may not be widely recognized internationally, especially in Western countries;

- local economic and political conditions, including disruptions in trading markets;

- restrictive foreign governmental actions, including restrictions on transfers of funds and trade;

- protection measures, including export duties and quotas and customs tariffs;

- currency exchange rate fluctuations;

- earthquakes, tsunamis, floods or other major disasters may limit the imported food products; and

- unexpected incidents related to food safety.

Any of the foregoing risks could have a material and adverse effect on our operating results.

A significant amount of our revenues is dependent on a limited number of customers and the loss of any one of our major customers could materially and adversely affect our growth and our revenues.

A significant portion of our revenues has historically been derived from a limited number of customers, particularly in our chestnut products segment. Sales to our ten largest customers accounted for approximately 21% and 16% of our total revenues in 2010 and 2011, respectively. The loss of any one of these customers, or a material decrease in purchases by any one of these customers, could adversely impact our revenues.

We rely primarily on distributors to sell our products. Any delays in delivery or poor handling by our distributors or third-party transport operators may affect our sales and damage our reputation.

In 2011, we sold our products through over 100 distribution service providers. The services provided could be suspended and could cause interruption to the supply of our products to domestic or overseas customers. Delivery disruptions may occur for various reasons beyond our control, including poor handling by service providers or third party transport operators, transportation bottlenecks, natural disasters and labor strikes, and could lead to delayed, damaged or lost deliveries. If our products are not delivered in a timely manner, our reputation could be harmed. If our products are damaged in the process of being delivered, we may be liable to pay for such damages incurred.

Failure of the market to accept our new products, or failure to obtain regulatory approval for our new products, may cause us to lose our competitive position in the food industry.

We introduced 15 new products in 2010 and 16 new products in 2011. We plan to introduce approximately 10 to 20 new products in 2012. The success of the new products we introduce depends on our ability to anticipate the tastes and dietary habits of consumers and to offer products that appeal to their preferences. We intend to introduce new products as well as alternative flavors, sizes and packaging for our existing products. We may not be able to gain market acceptance for our new products. Consumer preferences change, and any new products that we introduce may fail to meet the particular tastes or requirements of consumers, or may be unable to replace their existing preferences. Our failure to anticipate, identify or react to these particular tastes or changes could result in reduced demand for our products, which could in turn cause us to be unable to recover our development, production and marketing costs.

We are dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our research and development, operations and revenue.

- 16 -

The Lorain Group Companies were founded in 1995 by Si Chen, our Chairman and Chief Executive Officer. Mr. Chen, together with other senior management, has been a key driver of our strategy and has been fundamental to our achievements to date. The successful management of our business is, to a considerable extent, dependent on the services of Mr. Chen and other senior management. We compete for qualified personnel with other food processing companies, food retailers and research institutions. Consequently, we may either lose key employees to our competitors or we may need to significantly increase the compensation of such employees in order to retain them. The loss of the services of any key management employee or failure to recruit a suitable or comparable replacement could have a significant impact upon our ability to manage our business effectively, and our business and future growth may be adversely affected.

We face increasing competition from domestic and foreign companies.

The food industry in China is fragmented. Our ability to compete against other national and international enterprises is, to a significant extent, dependent on our ability to distinguish our products from those of our competitors by providing large volumes of high quality products that appeal to consumers’ tastes and preferences at reasonable prices. Some of our competitors have been in business longer than we have and are more established. Our competitors may provide products comparable or superior to those we provide or adapt more quickly than we do to evolving industry trends or changing market requirements. Increased competition may result in price reductions, higher raw materials prices, reduced margins and loss of market share, any of which could materially adversely affect our profit margins.

An increase in the cost of energy could affect our profitability.

Recently, we have experienced significant increases in energy costs, and energy costs could continue to rise, which would result in higher distribution, freight and other operating costs. Our future operating expenses and margins will be dependent on our ability to manage the impact of cost increases.

Our products are subject to counterfeiting or imitation, which could impact our reputation.

To date, we have experienced limited counterfeiting and imitation of our products. However, counterfeiting or imitation of our products may occur in the future and we may not be able to detect it and deal with it effectively. Any occurrence of counterfeiting or imitation could impact negatively upon our reputation, particularly if the counterfeit or imitation products cause sickness, or injury to consumers. In addition, counterfeit or imitation products could result in our need to incur costs with respect to the detection or prosecution of such activities.

We rely on an outside contractor to provide a majority of our labor.

We have hired Linyi Zhifu Labor Service Company to provide employees to our production facilities. Should Linyi Zhifu Labor Service Company be unable to continue to provide the number of employees we need, our production could be disrupted. In addition, Linyi Zhifu Labor Service Company could raise their service fees or terminate their relationship with us in the future, which may result in increased production costs.

Regulatory Risks

We are subject to extensive regulations by the Chinese government.

The food industry is subject to extensive regulations by Chinese government agencies. Among other things, these regulations govern the manufacturing, importation, processing, packaging, storage, exportation, distribution and labeling of our products. New or amended statutes and regulations, increased production at our existing facilities, and our expansion into new operations and jurisdictions may require us to obtain new licenses and permits and could require us to change our methods of operations at costs that could be substantial.

Our failure to comply with PRC environmental laws may require us to incur significant costs.

We carry on our business in an industry that is subject to PRC environmental protection laws and regulations. These laws and regulations require enterprises engaged in manufacturing and construction that may cause environmental waste to adopt effective measures to control such waste. In addition, such enterprises are required to pay fines, or to cease operations entirely under extreme circumstances, should they discharge waste substances. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

Our failure to comply with PRC hygiene laws may require us to incur significant costs.

- 17 -

Manufacturers in the Chinese food industry are subject to compliance with PRC food hygiene laws and regulations. These food hygiene laws require all enterprises engaged in the production of chestnuts and various vegetables and fruits to obtain a hygiene license for each of their production facilities. Such laws also require manufacturers to comply with regulations with respect to food, food additives, packaging, and food production sites, facilities and equipment. Failure to comply with PRC food hygiene laws may result in fines, suspension of operations, loss of hygiene licenses and, in more extreme cases, criminal proceedings against an enterprise and its management. The Chinese government may also change the existing laws or regulations or impose additional or stricter laws or regulations, compliance with which may cause us to incur significant capital expenditures, which we may be unable to pass on to our customers through higher prices for our products.

Financial Risks

Our operations are cash intensive, and our business could be adversely affected if we fail to maintain sufficient levels of working capital.

We spend a significant amount of cash on our operations, principally to procure raw materials for our products. Many of our suppliers, including chestnut, vegetable and fruit farmers, and suppliers of packaging materials, do not allow us to pay on credit. However, some of the suppliers with whom we have a long-standing business relationship allow us to pay on credit. We fund the majority of our working capital requirements out of cash flow generated from operations. If we fail to generate sufficient sales, or if our suppliers stop offering us credit terms, we may not have sufficient liquidity to fund our operating costs and our business could be adversely affected.

We also fund approximately 43.8% of our working capital requirements from the proceeds of short-term loans from Chinese banks. We expect to continue to do so in the future. Such loans are generally secured by our fixed assets, receivables and/or guarantees by third parties. Our average loan balance from short-term bank loans in 2011 was approximately $20.9 million. The term of almost all such loans is one year or less. Historically, we have rolled over such loans on an annual basis. However, we may not have sufficient funds available to pay all of our borrowings upon maturity. Failure to roll over our short-term borrowings at maturity or to service our debt could result in the imposition of penalties, including increases in rates of interest, legal actions against us by our creditors, or even insolvency.

Management anticipates that our existing capital resources and cash flows from operations and current and expected short-term bank loans will be adequate to satisfy our liquidity requirements through 2012. However, if available liquidity is not sufficient to meet our operating and loan obligations as they come due, our plans include considering pursuing alternative financing arrangements or further reducing expenditures as necessary to meet our cash requirements. However, there is no assurance that, if required, we will be able to raise additional capital or reduce discretionary spending to provide the required liquidity. Currently, the capital markets for small capitalization companies are difficult and banking institutions have become stringent in their lending requirements. Accordingly, we cannot be sure of the availability or terms of any third party financing.

We are subject to credit risk in respect of account receivables.

In 2008 and 2009, some of our customers, including some of our large supermarket customers, delayed their payments for up to 60 to 90 days beyond their term. Our cash flow suffered while waiting for such payments. Consequently, at times we had to delay payments to our suppliers and to postpone business expansion as a result of these delayed payments. Starting in 2008 and through 2011, we gradually shortened credit terms for many of our international and domestic customers from between 30 and 180 days to between 30 and 60 days. Our large customers may fail to meet these shortened credit terms, in which case we may not have sufficient cash flow to fund our operating costs and our business could be adversely affected.

The discontinuation of any preferential tax treatment or other incentives currently available to us in the PRC could materially and adversely affect our business, financial condition and results of operations.

Our subsidiaries are entitled to certain special or preferential tax treatments regarding foreign enterprise income tax in accordance with the “Income Tax Law of the PRC for Enterprises with Foreign Investment and Foreign Enterprises” and related rules.

Accordingly, we have been entitled to tax concessions whereby the profit for the first two financial years beginning with the first profit-making year (after setting off tax losses carried forward from prior years) is exempt from income tax in the PRC and the profit for each of the subsequent three financial years is taxed at 50% of the prevailing tax rates set by the relevant tax authorities. However, on March 16, 2007, the PRC’s National People’s Congress passed a new corporate income tax law, which became effective on January 1, 2008. This new corporate income tax unifies the corporate income tax rate, cost deduction and tax incentive policies for both domestic and foreign-invested enterprises. According to the new corporate income tax law, the applicable corporate income tax rate of our operating subsidiaries has been increased to a rate of 25% over a five-year grandfather period. This tax rate increase applies across the board, for all enterprises whether domestic or foreign. The PRC government has established a set of transition rules to allow enterprises that already started tax holidays before January 1, 2008, to continue utilizing the tax holidays until fully utilized. The discontinuation of any such special or preferential tax treatment or other incentives could have an adverse affect on our business, financial condition and results of operations.

- 18 -

In addition, under current PRC tax law, regulations and rulings, dividends from our operations in China paid to us are not currently subject to PRC income tax. If these distributions become subject to tax in the future, our net income would be adversely affected.

We may enter into additional financing agreements which may have a dilutive effect to our earnings per share and the rights of certain stockholders.

Additional financings could result in significant dilution to our earnings per share or the issuance of securities with rights superior to our current outstanding securities. For instance, we may grant registration rights to investors purchasing our equity or debt securities in the future.

We may be unable to raise additional capital.

If we are unable to raise additional financing when needed, we may be unable to implement our long-term business plan, develop or enhance our products and services, take advantage of future opportunities or respond to competitive pressures on a timely basis, if at all. In addition, a lack of additional financing could force us to substantially curtail or cease operations.

We may be exposed to potential risks relating to our internal control over financial reporting and our ability to have such controls attested to by our independent auditors.

The SEC, under Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring public companies to provide in their annual reports on Form 10-K a report by management with respect to the company’s disclosure controls and procedures and internal control over financial reporting. We are currently required to comply with this requirement. In addition, such rules require the independent registered public accounting firm auditing a company’s financial statements to attest to the operating effectiveness of such company’s internal controls. However, because we are a smaller reporting company, we are not required to receive an attestation report from a registered public accounting firm. We can provide no assurance that we will comply with all of the requirements imposed thereby. Further, we cannot assure that we will receive a positive attestation from our independent auditors. Investors and others may lose confidence in the reliability of our financial statements in the event we identify significant deficiencies or material weaknesses in our internal controls that we cannot remediate in a timely manner or if we are unable to receive a positive attestation from our independent auditors with respect to our internal controls.

Risks Related To Doing Business In China

Changes in China’s political or economic situation could harm us and our operating results.

Economic reforms adopted by the Chinese government have had a positive effect on the economic development of the country. However, the Chinese government could change these economic reforms at any time. Such changes could negatively impact our operations and profitability.

The structure of the Chinese economy may inhibit our ability to expand our business.

The Chinese economy differs from the economies of most countries belonging to the Organization for Economic Cooperation and Development, or OECD, in several ways. For example, state-owned enterprises constitute a large portion of the Chinese economy. In addition, weak corporate governance practices and the lack of flexible currency exchange policies continue to persist. As a result of these differences, we may not develop in the same way or at the same rate as might be expected if the Chinese economy were similar to those of the OECD member countries.

Our business is largely subject to the uncertain legal environment in China.

The Chinese legal system is a civil law system based on written statutes. Unlike common law systems, it is a system in which precedents set in earlier legal cases are not generally used. Laws, regulations and legal requirements relating to foreign investments in China are still evolving, and their interpretation and enforcement involve uncertainties. These uncertainties could limit the legal protections available to foreign investors, such as the right of foreign enterprises to hold required business licenses and permits.

It may be difficult for our stockholders to affect service of process against our subsidiaries or our officers and directors.

- 19 -

Our operating subsidiaries were organized under the laws of China and substantially all of their assets are located outside the U.S. In addition, our executive officers and directors are residents of China and substantially all of their assets are located outside the U.S. As a result, it could be difficult for our stockholders to affect service of process in the U.S., or to enforce a judgment obtained in the U.S., against our officers and directors.

Restrictions on currency exchange may limit our ability to receive and use our revenues effectively.