Attached files

| file | filename |

|---|---|

| EX-99.2 - EXHIBIT 99.2 - INDEPENDENT BANK CORP /MI/ | ex99_2.htm |

| EX-99.1 - EXHIBIT 99.1 - INDEPENDENT BANK CORP /MI/ | ex99_1.htm |

| 8-K - 8-K - INDEPENDENT BANK CORP /MI/ | form8k.htm |

Exhibit 99.3

2 Cautionary Note Regarding Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including statements of goals, intentions, and expectations as to future trends, plans, events, or results of Independent Bank Corporation’s operations and policies, including, but not limited to, Independent Bank Corporation’s outlook on earnings and the sufficiency of the allowance for loan losses, and statements regarding asset quality, projections of future revenue, earnings or other measures of economic performance, Independent Bank Corporation’s plans and expectations regarding non-performing assets, business opportunities, and general economic conditions. Forward-looking statements include expressions such as “will,” “may,” “should,” “believe,” “expect,” “forecast,” “anticipate,” “estimate,” “project,” “intend,” “likely,” “optimistic” and “plan,” and similar words or phrases, which are necessarily statements of belief as to expected outcomes of future events. These statements are based on current and anticipated economic conditions, nationally and in Independent Bank Corporation’s markets, interest rates and interest rate policy, competitive factors, and other conditions which by their nature are not susceptible to accurate forecast and are subject to significant uncertainty. Because of these uncertainties and the assumptions on which this presentation and the forward-looking statements are based, actual future operations and results may differ materially from those indicated in this presentation. For a discussion of certain factors, risks and uncertainties which could cause actual future operations and results to differ from estimates and projections discussed in these forward-looking statements, please read the “Risk Factors” section in Independent Bank Corporation’s 2016 Annual Report on Form 10-K. You should not place undue reliance on any such forward-looking statement. These forward-looking statements are not guarantees of future performance. Independent Bank Corporation does not undertake to publicly revise or update forward-looking statements in this presentation to reflect events or circumstances that arise after the date of this presentation.

3 Agenda Formal Remarks.William B. (Brad) Kessel, President and Chief Executive OfficerRobert N. Shuster, Executive Vice President and Chief Financial OfficerQuestion and Answer session.Closing Remarks.Note: This presentation is available at www.IndependentBank.com in the Investor Relations area under the “Presentations” tab.

4 Quarterly Financial Summary 3Q’17 2Q’17 1Q’17 4Q’16 3Q’16 Diluted EPS $ 0.32 $ 0.27 $ 0.28 $ 0.27 $ 0.30 Income before taxes $ 10,018 $ 8,594 $ 8,595 $ 8,443 $ 9,352 Net income $ 6,859 $ 5,931 $ 5,974 $ 5,855 $ 6,373 Return on average assets 1.01% 0.92% 0.95% 0.91% 1.02% Return on average equity 10.27% 9.15% 9.63% 9.29% 10.20% Total assets $2,753,446 $2,665,367 $2,596,482 $2,548,950 $2,538,319 Total portfolio loans $1,937,094 $1,811,677 $1,670,747 $1,608,248 $1,607,354 Total deposits $2,343,761 $2,246,219 $2,263,059 $2,225,719 $2,206,960 Loans to deposits ratio 82.65% 80.65% 73.83% 72.26% 72.83% Shareholders’ equity $ 267,710 $ 262,453 $ 255,475 $ 248,980 $ 250,902 Tangible BV per share $ 12.47 $ 12.22 $ 11.89 $ 11.62 $ 11.72 TCE to tangible assets 9.67% 9.79% 9.78% 9.70% 9.81% Note: Dollars in thousands, except per share data.

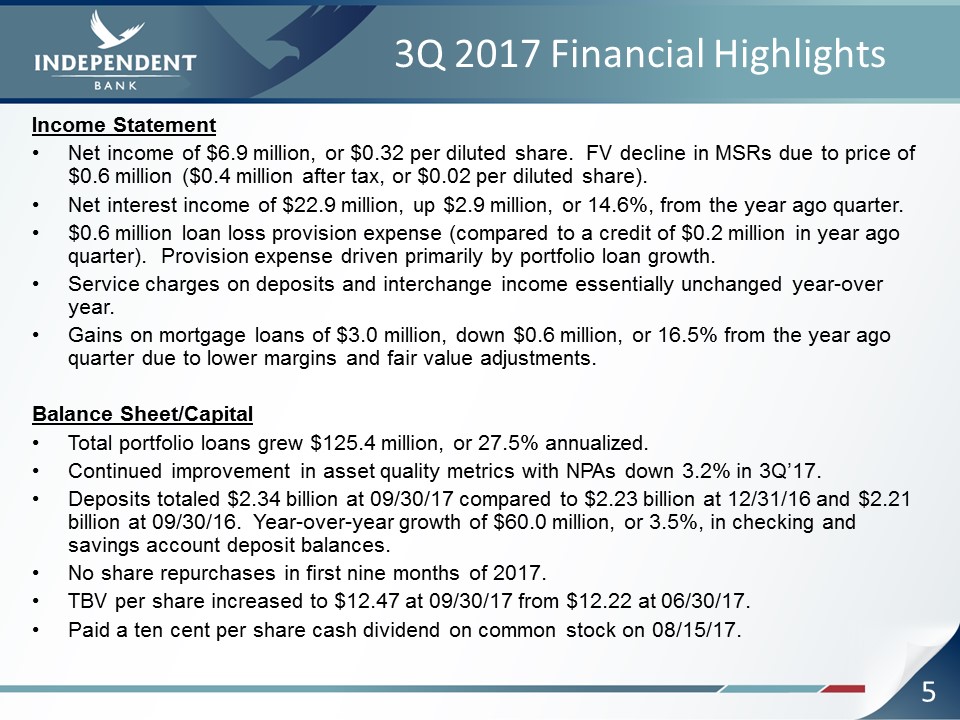

5 3Q 2017 Financial Highlights Income StatementNet income of $6.9 million, or $0.32 per diluted share. FV decline in MSRs due to price of $0.6 million ($0.4 million after tax, or $0.02 per diluted share). Net interest income of $22.9 million, up $2.9 million, or 14.6%, from the year ago quarter.$0.6 million loan loss provision expense (compared to a credit of $0.2 million in year ago quarter). Provision expense driven primarily by portfolio loan growth.Service charges on deposits and interchange income essentially unchanged year-over year.Gains on mortgage loans of $3.0 million, down $0.6 million, or 16.5% from the year ago quarter due to lower margins and fair value adjustments.Balance Sheet/CapitalTotal portfolio loans grew $125.4 million, or 27.5% annualized. Continued improvement in asset quality metrics with NPAs down 3.2% in 3Q’17.Deposits totaled $2.34 billion at 09/30/17 compared to $2.23 billion at 12/31/16 and $2.21 billion at 09/30/16. Year-over-year growth of $60.0 million, or 3.5%, in checking and savings account deposit balances.No share repurchases in first nine months of 2017. TBV per share increased to $12.47 at 09/30/17 from $12.22 at 06/30/17.Paid a ten cent per share cash dividend on common stock on 08/15/17.

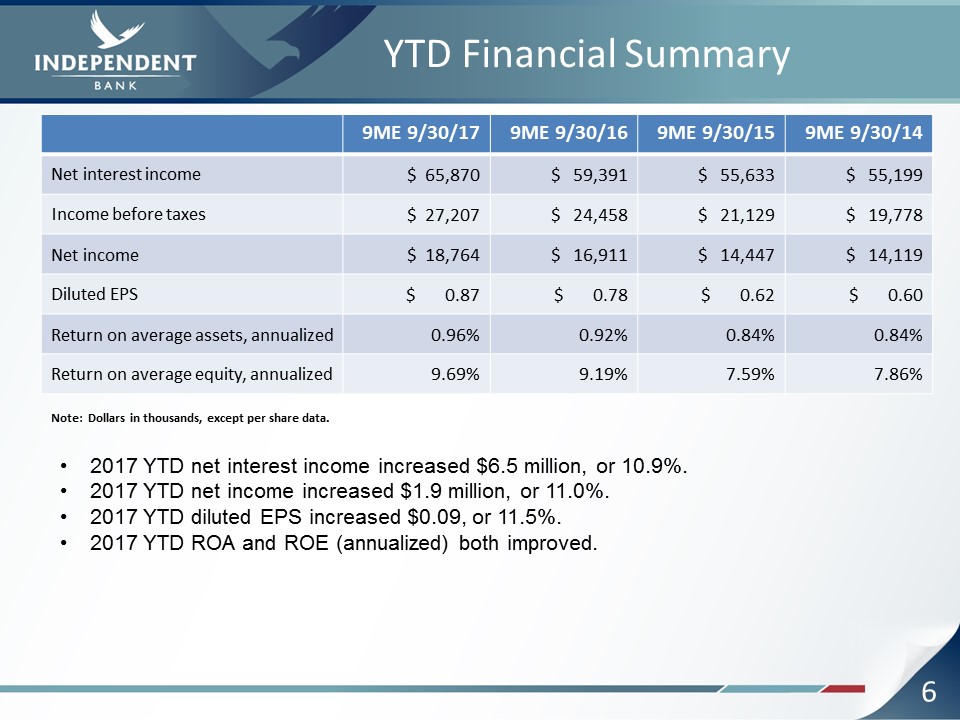

6 YTD Financial Summary 9ME 9/30/17 9ME 9/30/16 9ME 9/30/15 9ME 9/30/14 Net interest income $ 65,870 $ 59,391 $ 55,633 $ 55,199 Income before taxes $ 27,207 $ 24,458 $ 21,129 $ 19,778 Net income $ 18,764 $ 16,911 $ 14,447 $ 14,119 Diluted EPS $ 0.87 $ 0.78 $ 0.62 $ 0.60 Return on average assets, annualized 0.96% 0.92% 0.84% 0.84% Return on average equity, annualized 9.69% 9.19% 7.59% 7.86% Note: Dollars in thousands, except per share data. 2017 YTD net interest income increased $6.5 million, or 10.9%.2017 YTD net income increased $1.9 million, or 11.0%.2017 YTD diluted EPS increased $0.09, or 11.5%.2017 YTD ROA and ROE (annualized) both improved.

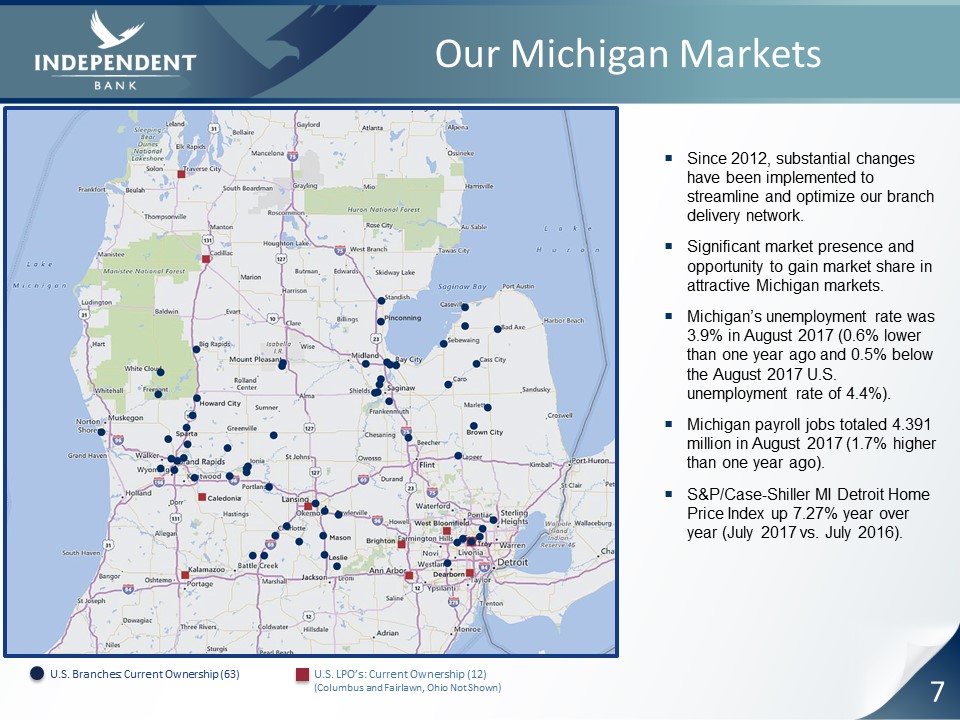

7 Our Michigan Markets U.S. Branches: Current Ownership (63) U.S. LPO’s: Current Ownership (12)(Columbus and Fairlawn, Ohio Not Shown) Since 2012, substantial changes have been implemented to streamline and optimize our branch delivery network.Significant market presence and opportunity to gain market share in attractive Michigan markets. Michigan’s unemployment rate was 3.9% in August 2017 (0.6% lower than one year ago and 0.5% below the August 2017 U.S. unemployment rate of 4.4%).Michigan payroll jobs totaled 4.391 million in August 2017 (1.7% higher than one year ago).S&P/Case-Shiller MI Detroit Home Price Index up 7.27% year over year (July 2017 vs. July 2016).

Our Markets – Regional Region Cities Branches 09/30/17Portfolio Loans(1) % ofLoans(1) 09/30/17Deposits(3) % of Deposits(3) 09/30/16 Portfolio Loans(2) 09/30/16 Deposits(3) East / “Thumb” Bay City / Saginaw 23 $ 365 20% $ 759 35% $ 318 $ 735 West Grand Rapids / Ionia 22 647 36% 712 33% 547 689 Central Lansing 11 208 11% 349 16% 207 328 Southeast(4) Troy 7 589 33% 350 16% 354 369 Total 63 $1,809 100% $2,170 100% $1,426 $2,121 Note: Dollars are in millions.Loans exclude those related to resort lending ($93 million) and purchased mortgage loans ($35 million).Loans exclude those related to resort lending ($107 million), payment plan receivables ($31 million) and purchased mortgage loans ($43 million). Deposits exclude reciprocal deposits, brokered deposits and certain other “non-market” deposits.9/30/17 total portfolio loans include approximately $72 million from Ohio. 8

9 Low Cost Deposit Franchise Focused on Core Deposit Growth Deposit Highlights$2.34 billion in total deposits at 09/30/17.Substantially all core funding.$1.81 billion of transaction accounts (77.1% of total deposits).Total deposits increased $49.2 million, or 2.2%, since 09/30/16 (excluding $87.6 million of brokered deposits at 9/30/17).Average deposits per branch of $35.8 million at 09/30/17 vs. $20.2 million at 12/31/11 (an increase of 77.2%).2017 focus:Commercial – small to middle market business and public funds.Treasury management services.Retail – checking accounts and debit card services. Deposit Composition – 09/30/17 Cost of Deposits (%)/Total Deposits (billions)

Diversified Loan PortfolioFocused on High Quality Growth Lending Highlights14 consecutive quarters of net loan growth.$1.985 billion in total loans at 09/30/17 (including $47.6 million of loans held for sale).3Q 2017 lending results include:Commercial loan net growth of $8.5 million, or 4.1% annualized.Consumer installment loan net growth of $10.1 million, or 13.0% annualized.Portfolio mortgage loan net growth of $106.8 million, or 62.8% annualized. 3Q’17 mortgage loan origination volume up 114.6% over 3Q’17.2017 focus:Commercial – businesses with $1 million to $50 million in annual sales.Consumer – through branch network, internet and indirect channels.Residential mortgage – purchase money (both salable and portfolio) and QRM and home equity lending opportunities. Loan Composition – 09/30/17 Yield on Loans (%)/Total Portfolio Loans (billions) 10

11 Strong Capital PositionFocused on Shareholder Return HighlightsPrudent capital management. Target TCE ratio – 9.50% to 10.50% near-term and 8.50% to 9.50% longer-term. Priorities are: (A) capital retention to support (1) organic growth and (2) acquisitions; and (B) return of capital through (1) strong and consistent dividend and (2) share repurchases.2017 share repurchase plan approved for up to 5% of outstanding common shares. During 2016, 1.15 million shares were repurchased; and since the start of 2015, 2.12 million shares have been repurchased.Bank retained earnings returned to a positive figure in 3Q’16 permitting resumption of quarterly dividends to parent company ($21.0 million of dividends have been paid since October 2016). Bank retained earnings were a positive $13.0 million at 9/30/17.Quarterly cash dividend rate increased by 20% to $0.12 per share effective 11/15/17.Goals of 1% ROA or better and 10% ROE or better. Note: ROA and ROE represent a four quarter rolling average. ROA, ROE and TCE Ratio

12 Net Interest Margin/Income HighlightsInterest rate sensitivity profile of the loan and securities portfolios, in combination with a low cost core deposit base, positions us to generally benefit from a rising interest rate environment.Net interest income increased 6.6% in 3Q’17 vs. 2Q’17 due primarily to a $98.8 million increase in average interest-earning assets as well as a six basis point increase in the net interest margin.Original 2017 goal was to grow net interest income by approximately 3% over 2016 as average loans increase (partially offset by sale of payment plan receivables). Now expect full year 2017 net interest income to grow by 12% to 13% over 2016. Starting to see some pressure on deposit rates due to the 0.25% bumps in the target federal funds rate in March and June 2017 and December 2016. Net Interest Margin (TE)(%) Net Interest Income ($ in Millions)

13 Net Interest Income and Net Interest Margin Details Summary3Q’17 net interest income of $22.912 million, up $1.420 million from 2Q’17. The linked quarter increase was due to a $1.882 million increase in interest income and fees on loans. This was partially offset by a $44K decrease in interest income on securities and investments and a $418K increase in interest expense on deposits and borrowings. The increase in interest income and fees on loans was due to an increase in average balance, an increase in the average yield and an increase in interest recoveries (net) on previously charged-off or non-accrual loans of $146K. One more day in the quarter increased net interest income by $125K net. The tax equivalent net interest margin (NIM) increased 6 bps (3.66% vs. 3.60%) due to an 11 bps increase in the yield on interest earning assets that was partially offset by a 5 bps increase in the cost of funds (interest expense as a percentage of average interest-earning assets). Average yield on new/renewed commercial loans was 4.63% on fixed rate (41.7% of production) and 4.57% on variable rate (58.3% of production), 3Q’17 volume of $56.7 million with an estimated average duration of 1.9 years. Average yield on new retail loans (mortgage and consumer installment) was 4.08%, 3Q’17 volume of $189.4 million with an estimated average duration of 3.9 years.Loan Portfolio DetailsCommercial loans: Interest income increased $656K due to a 20 bps increase in the average yield (4.83% vs. 4.63%), an $11.3 million increase in the average balance and one more day in the quarter ($111K impact). Interest recoveries (net) increased by $88K, this increased the average yield by 4 bps. Mortgage loans (includes loans held for sale): Interest income increased $1.222 million due to a $108.6 million increase in the average balance and a 4 bps increase in the average yield (4.24% vs. 4.20%) . Interest recoveries (net) increased by $70K, this increased the average yield by 4 bps.Consumer installment loans: Interest income increased $331K due to a $26.1 million increase in the average balance and one more day in the quarter ($38K impact) that were partially offset by a 1 bps decrease in the average yield (4.54% vs. 4.55%). Interest recoveries (net) decreased by $12K, this decreased the average yield by 2 bps.Payment plan receivables: Interest income decreased $327K (and was zero in 3Q’17) as this portfolio was sold in May 2017. Other FactorsSecurities and investments: Interest income decreased $44K due to a $29.9 million decrease in average balance that was partially offset by a 9 bps increase in the average TE yield (2.50% vs. 2.41%) and one more day in the quarter ($3K impact).Deposits and borrowings: Interest expense increased $418K due to a $68.8 million increase in the average balance of interest-bearing liabilities, an 8 basis point increase in the average cost of interest-bearing liabilities (0.59% vs. 0.51%), and one more day in the quarter ($27K impact). Analysis of Linked Quarter Increase

14 Non-interest Income HighlightsDiverse sources of non-interest income which totaled $10.3 million in 3Q’17.3Q’17 total non-interest income represents approximately 31.0% of total revenue (net interest income and non-interest income).Service charges on deposits have recently stabilized after previous longer-term decline and are up by 3.3% YTD 2017 vs. 2016.3Q’17 interchange revenue essentially unchanged compared to 3Q’16 and up by 1.2% YTD 2017 vs, 2016.3Q’17 gains on mortgage loans totaled $3.0 million, down $0.6 million, or 16.5%, from 3Q’16, due to margin pressure and fair value adjustments.3Q’17 mortgage loan servicing includes a $1.09 million decline in fair value adjustment ($0.572 million due to price and $0.518 million due to pay downs). 3Q’16 included amortization of $0.799 million and a recovery of previously recorded impairment charges on MSRs of $0.620 million. 2017 YTD Non-interest Income Breakout Non-interest Income Trends ($ in Millions)

15 Non-interest Expense HighlightsQ3’17 non-interest expenses totaled $22.6 million (a decrease from 2Q’17 and a slight increase from 3Q’16).Q3’17 compensation and benefits increased by $0.5 million over Q3’16 due primarily to higher salaries and wages, incentive compensation and payroll taxes. 3Q’17 average FTEs up by 66.4 (8.4%) over 3Q’16, with much of the growth related to the mortgage banking expansion (partially offset by sale of payment plan business in May 2017). Efficiency ratio: 2017 YTD – 70.3%; 2016 – 73.7%; 2015 – 77.2%; 2014 – 80.3%; and 2013 – 82.6%.Original target for 2017 was total non-interest expenses at $21.6 million to $22.7 million per quarter (with an average at $21.9 million). Actual 3Q’17 total non-interest expenses slightly below expected high end. Non-interest Expense ($ in Millions)

16 Investment Securities Portfolio HighlightsHigh quality, liquid, diverse portfolio with relatively short duration.60% of the portfolio is AAA rated (or backed by the U.S. Government).2.73 year estimated average duration with a weighted average yield of 2.62% (with TE gross up).Approximately 26% of the portfolio is variable rate.Fair value of $552.4 million(1) at 9/30/17.Net unrealized gain of $3.2 million at 9/30/17.Adopted ASU 2017-08 in 1Q’17. Now amortizing premium on callable securities to the earliest call date. (1) Includes investments in bank CD’s of $3.5 million but excludes trading securities of $0.3 million. Investment Portfolio by Type (9/30/17) Investment Portfolio by Rating (9/30/17)

17 Credit Quality Summary Note 1: Non-performing loans and non-performing assets exclude troubled debt restructurings that are performing.Note 2: 3/31/17 and 12/31/16 30 to 89 days delinquent data excludes $1.53 million and $1.63 million, respectively, of payment plan receivables that were held for sale. Non-performing Assets ($ in Millions) ORE/ORA ($ in Millions) Non-performing Loans ($ in Millions) 30 to 89 Days Delinquent ($ in Millions)

18 Credit Cost Summary Note: Dollars all in millions. Provision for Loan Losses Loan Net Charge-Offs Allowance for Loan Losses

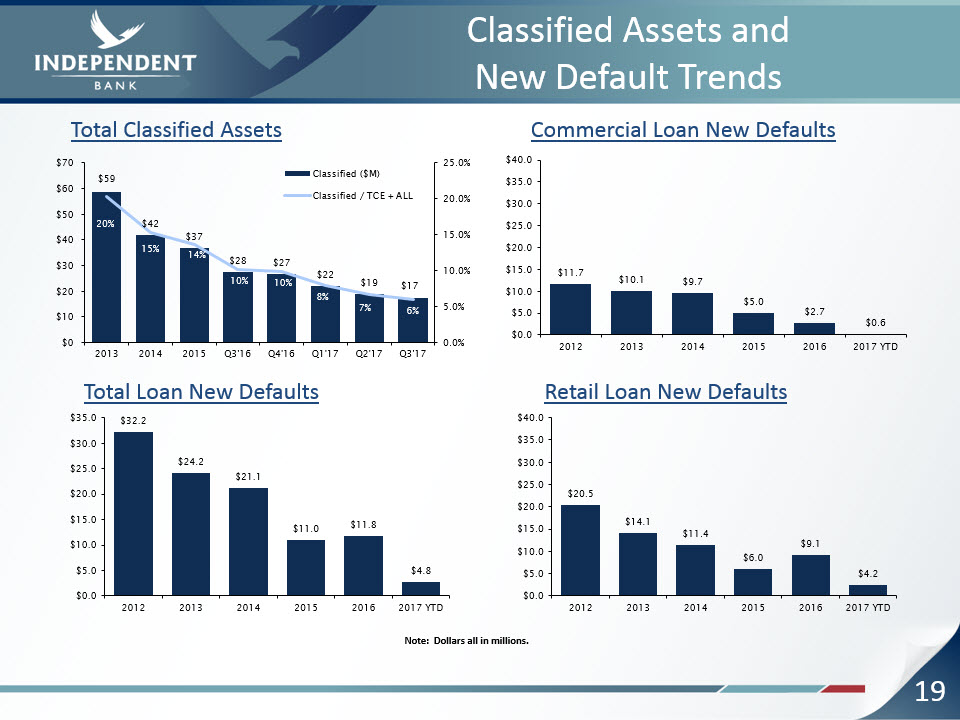

19 Classified Assets and New Default Trends Note: Dollars all in millions. Total Classified Assets Commercial Loan New Defaults Total Loan New Defaults Retail Loan New Defaults

20 Troubled Debt Restructurings (TDRs) TDR HighlightsWorking with client base to maximize sustainable performance.The specific reserves allocated to TDRs totaled $7.0 million at 9/30/17.A majority of our TDRs are performing under their modified terms but remain in TDR status for the life of the loan.90.1% of TDRs are current as of 9/30/17.Commercial TDR Statistics:49 loans with $9.8 million book balance.96.0% performing.WAR of 5.51% (accruing loans).Well seasoned portfolio; all accruing loans are not only performing but have been for over a year since modification.Retail TDR Statistics:653 loans with $58.3 million book balance.92.2% performing.WAR of 5.03% (accruing loans).Well seasoned portfolio; over 98% of accruing loans are not only performing but have been for over a year since modification. TDRs ($ in Millions) 90% of TDRs are Current

21 2017 Actual Performance vs. Original Outlook Category Outlook Lending Continued growthGoal of 10 to 11% overall loan growth in 2017, primarily supported by increases in commercial loans, mortgage loans and consumer loans. Expect much of this growth to occur in the last three quarters of 2017. This growth forecast also assumes a stable Michigan economy. 3Q’17 Update: Exceeded expectation. 3Q’17 annualized loan growth of 27.5%. Anticipate some seasonal slowdown in 4Q’17, however still expect total portfolio loans to exceed $2 billion by 12/31/17 (representing annual growth in excess of 25%). Net Interest Income Growth over 2016 despite sale of payment plan receivablesGoal of approximately 3% increase in net interest income over 2016. Pressure on the net interest margin expected to abate. Growth in net interest income in 2017 vs. 2016 due primarily to growth in loans as described above and somewhat higher short-term interest rates. Forecast assumes two 0.25% increases in the federal funds rate (one in mid 3Q’17 and one in early 4Q’17) and long-term rates up slightly over year end 2016 levels. 3Q’17 Update: Exceeded expectation. Increase of 14.6% over 3Q’16. Expect full year 2017 growth of 12% to 13% over 2016. Provision for Loan Losses Steady asset quality metricsVery difficult area to forecast. Future provision levels will be particularly sensitive to loan net charge-offs, watch credit levels, loan default volumes, and TDR portfolio performance as well as loan growth. The allowance as a percentage of total loans was at 1.26% at 12/31/16. Do not expect credit provision in 2017 due to portfolio loan growth and a decline in recoveries of previously charged-off loans. Quarterly provision (expense) for loan losses of $500K to $600K would not be unreasonable. 3Q’17 Update: $0.6 million loan loss provision expense driven primarily by loan growth. Strong asset quality metrics. Non-interest Income Forecasted quarterly range of $10.8 million to $11.7 million with total for year up by approximately $2.4 million vs. 2016Expect mortgage-banking revenues and mortgage lending volumes in 2017 to be higher than 2016. Expect service charges on deposits and interchange income in 2017 to be generally comparable to 2016. 3Q’17 Update: Actual non-interest income of $10.3 million in 3Q’17. Below forecasted range due primarily to lower than expected gains on mortgage loans as there was a higher mix of portfolio mortgage loans than expected and margin pressure. Additionally, 3Q’17 included $0.57 million fair value decline in MSRs due to price. Expect 4Q’17 to be near the low end of the forecasted range. Non-interest Expense Forecasted quarterly range of $21.6 to $22.7 million with total for the year down by approximately $2.8 million vs. 2016The expected decrease in non-interest expenses is primarily due to the elimination of $2.6 million of litigation expense and loss on sale of Mepco assets that were incurred in 2016. Decline in expenses associated with the sale of the payment plan processing business (Mepco) is expected to be somewhat offset by higher expenses related to the expansion of mortgage banking operations. 3Q’17 Update: Actual non-interest expenses of $22.6 million (slightly below high end of forecasted range). Expect 4Q’17 to be near or a somewhat above the high end of the forecasted quarterly range. Income Taxes Approximately 32% to 32.5% in 2017. This assumes no changes in corporate income tax rates or rules during 2017. 3Q’17 Update: 31.5% actual effective income tax rate. 3Q’17 included a $0.022 million tax benefit related to incentive share awards vested/exercised.

22 Strategic Initiatives Balance SheetGenerate quality loan growth with continued focus on commercial and consumer installment lending as well as salable and portfolio mortgage loans.Remain asset sensitive and positioned to benefit from higher interest rates (short duration investment portfolio, large variable rate loan portfolio and strong core deposit base with a significant amount of small to medium balance transaction accounts). Income StatementGenerate increased net interest income through change in earning asset mix (increased loans to deposits ratio and reduced level of investment securities).Increase non-interest income with focus on transaction related revenue (treasury management and debit card) and mortgage banking revenue.Continued selective reductions in certain non-interest expenses (credit related costs, branch optimization, process re-engineering and outsourcing). However, now expect growth in compensation and employee benefits expense and in occupancy expense as mortgage-banking operations are expanded.Improved efficiency ratio: Low 70% range near-term and mid 60% range longer-term. Achieve improvements primarily through revenue growth.Enterprise Risk ManagementSteady asset quality.Meet increased compliance and regulatory requirements.Focus on data security and loss prevention.

23 Q&A and Closing Remarks Question and Answer SessionClosing RemarksThank you for attending !NASDAQ: IBCP