Attached files

| file | filename |

|---|---|

| EX-10.2 - EXHIBIT 10.2 - Breitburn Energy Partners LP | exhibit102.htm |

| EX-99.1 - EXHIBIT 99.1 - Breitburn Energy Partners LP | a20171013exhibit991.htm |

| EX-10.1 - EXHIBIT 10.1 - Breitburn Energy Partners LP | exhibit101.htm |

| 8-K - 8-K - Breitburn Energy Partners LP | a20171013form8-k.htm |

UNITED STATES BANKRUPTCY COURT

SOUTHERN DISTRICT OF NEW YORK

------------------------------------------------------x

:

In re : Chapter 11

:

BREITBURN ENERGY : Case No. 16-11390 (SMB)

PARTNERS LP, et al., :

:

Debtors.1 : (Jointly Administered)

:

------------------------------------------------------x

PROPOSED DISCLOSURE STATEMENT FOR

DEBTORS’ JOINT CHAPTER 11 PLAN

WEIL, GOTSHAL & MANGES LLP

Ray C. Schrock, P.C.

Stephen Karotkin

767 Fifth Avenue

New York, New York 10153

Telephone: (212) 310-8000

Facsimile: (212) 310-8007

Attorneys for Debtors and

Debtors in Possession

Dated: October 11, 2017

New York, New York

THIS IS NOT A SOLICITATION OF ACCEPTANCE OR REJECTION OF THE PLAN. ACCEPTANCES OR REJECTIONS MAY NOT BE SOLICITED UNTIL A DISCLOSURE STATEMENT HAS BEEN APPROVED BY THE BANKRUPTCY COURT. THE DISCLOSURE STATEMENT IS BEING SUBMITTED FOR APPROVAL BUT HAS NOT BEEN APPROVED BY THE BANKRUPTCY COURT TO DATE. |

____________________

1 The Debtors in these chapter 11 cases, along with the last four digits of each Debtor’s federal tax identification number, as applicable, are: Breitburn Energy Partners LP (9953); Breitburn GP LLC (9948); Breitburn Operating LP (5529); Breitburn Operating GP LLC (5525); Breitburn Management Company LLC (2858); Breitburn Finance Corporation (2548); Alamitos Company (9156); Beaver Creek Pipeline, L.L.C. (7887); Breitburn Florida LLC (7424); Breitburn Oklahoma LLC (4714); Breitburn Sawtelle LLC (7661); Breitburn Transpetco GP LLC (7222); Breitburn Transpetco LP LLC (7188); GTG Pipeline LLC (3760); Mercury Michigan Company, LLC (3380); Phoenix Production Company (1427); QR Energy, LP (3069); QRE GP, LLC (2855); QRE Operating, LLC (9097); Terra Energy Company LLC (9616); Terra Pipeline Company LLC (3146); and Transpetco Pipeline Company, L.P. (2620). The Debtors’ mailing address is 707 Wilshire Boulevard, Suite 4600, Los Angeles, California 90017.

Table of Contents

Page

I. INTRODUCTION | 1 |

A. | Definitions and Exhibits 1 |

1. | Definitions 1 |

2. | Exhibits 1 |

B. | Notice to Creditors 1 |

C. | Background and Overview of the Plan 4 |

D. | Restructuring Support Agreement and Backstop Commitment Agreement 6 |

1. | Restructuring Support Agreement 6 |

2. | Backstop Commitment Agreement 7 |

E. | Summary of Plan Classification and Treatment of Claims and Interests 7 |

F. | Disclosure Statement Enclosures 10 |

G. | Inquiries 11 |

II. OVERVIEW OF THE DEBTORS’ OPERATIONS | 11 |

A. | The Debtors’ Corporate Structure 11 |

B. | The Debtors’ Business Operations 12 |

C. | Prepetition Capital Structure 14 |

1. | MLP Common and Preferred Units 14 |

2. | Indebtedness 14 |

3. | Derivative and Hedge Agreements 16 |

4. | Trade Payables 16 |

D. | Events Leading to Commencement of the Chapter 11 Cases 17 |

1. | The Oil and Gas Industry Experiences Fundamental Changes 17 |

2. | Stabilization Efforts 17 |

3. | Prepetition Restructuring Efforts 18 |

III. OVERVIEW OF THE CHAPTER 11 CASES | 19 |

A. | Commencement of Chapter 11 Cases 19 |

B. | First Day Motions 19 |

C. | Procedural Motions 20 |

D. | Appointment of Creditors’ Committee 20 |

E. | Appointment of Equity Committee 20 |

F. | Claims Reconciliation Process 20 |

G. | Exclusivity 21 |

H. | Employee Compensation Matters 21 |

I. | Executory Contracts and Unexpired Leases 22 |

J. | Second Lien Proof of Claim and Disputes Related Thereto 22 |

K. | Postpetition Plan Negotiations 24 |

i

Table of Contents

Page

IV. SUMMARY OF THE PLAN | 25 |

A. | General 25 |

B. | Classification of Claims and Interests 26 |

1. | Classification in General 26 |

2. | Formation of Debtor Groups for Convenience Only 26 |

3. | Summary of Classification of Claims and Interests 26 |

C. | Treatment of Claims and Interests 27 |

1. | Class 1 - Priority Non-Tax Claims. 27 |

2. | Class 2 - Other Secured Claims. 27 |

3. | Class 3 - Revolving Credit Facility Claims. 28 |

4. | Class 4 - Secured Notes Claims. 28 |

5. | Class 5 - Unsecured Notes Claims. 29 |

6. | Class 6 - General Unsecured Claims. 29 |

7. | Class 7A - Ongoing Trade Claims of LegacyCo. 29 |

8. | Class 7B - Ongoing Trade Claims of New Permian Corp. 30 |

9. | Class 8 - Intercompany Claims. 30 |

10. | Class 9 - Subordinated Claims. 30 |

11. | Class 10 - Intercompany Interests. 30 |

12. | Class 11 - Existing BBEP Equity Interests. 30 |

D. | Nonconsensual Confirmation 30 |

E. | Administrative Expenses and Priority Tax Claims 31 |

1. | Administrative Expenses 31 |

2. | Professional Fee Claims 31 |

3. | DIP Facility Claims 32 |

4. | Priority Tax Claims 32 |

F. | Means for Implementation and Execution of the Plan 32 |

1. | General Settlement of Claims and Interests 32 |

2. | Continued Corporate Existence 33 |

3. | Authorization, Issuance, and Delivery of LegacyCo Units and New |

Permian Corp. Shares. 34

4. | Cancelation of Existing Securities and Agreements 34 |

5. | Cancelation of Certain Existing Security Agreements 35 |

6. | Rights Offering and Minimum Allocation Rights 35 |

7. | New Permian Corp. Certificate of Incorporation 36 |

8. | Exit Facility 36 |

9. | Restructuring Transactions 36 |

10. | Board of Directors 39 |

11. | Corporate Action 39 |

12. | LegacyCo Management Incentive Plan 40 |

ii

Table of Contents

Page

13. | New Permian Corp. Management Incentive Plan 40 |

iii

Table of Contents

Page

14. | Separability 40 |

15. | Director, Officer, Manager, and Employee Liability Insurance 40 |

16. | Preservation of Royalty and Working Interests 40 |

17. | Hart-Scott-Rodino Antitrust Improvements Act 41 |

18. | Post-Effective Date Tax Filings and Audits 41 |

G. | Provisions Governing Distributions 41 |

1. | No Postpetition Interest on Claims 41 |

2. | Date of Distributions 41 |

3. | Distribution Record Date 41 |

4. | Delivery of Distributions 42 |

5. | Unclaimed Property 42 |

6. | Satisfaction of Claims 43 |

7. | Fractional Shares and De Minimis Cash Distributions 43 |

8. | Allocation of Distributions between Principal and Interest 43 |

9. | Exemption from Securities Laws 43 |

10. | Setoffs and Recoupments 44 |

11. | Withholding and Reporting Requirements 45 |

H. | Procedures for Disputed Claims 45 |

1. | Objections to Claims 45 |

2. | Resolution of Disputed Administrative Expenses and Disputed Claims 45 |

3. | Payments and Distributions with Respect to Disputed Claims 46 |

4. | Distributions After Allowance 46 |

5. | Disallowance of Claims 46 |

6. | Estimation 46 |

7. | Interest 47 |

I. | Executory Contracts and Unexpired Leases 47 |

1. | General Treatment 47 |

2. | Determination of Cure Disputes and Deemed Consent 48 |

3. | Rejection Damages Claims 49 |

4. | Payment of Cure Amounts 49 |

5. | Survival of the Debtors’ Indemnification Obligations 49 |

6. | Employee Obligations 50 |

7. | Insurance Policies 50 |

8. | Reservation of Rights 50 |

9. | Modifications, Amendments, Supplements, Restatements, or Other |

Agreements 51

J. | Conditions Precedent 51 |

1. | Conditions Precedent to Confirmation of Plan 51 |

2. | Conditions Precedent to Effective Date 52 |

3. | Satisfaction or Waiver of Conditions 53 |

iv

Table of Contents

Page

4. | Effect of Non-Occurrence of Effective Date 53 |

v

Table of Contents

Page

K. | Effect of Confirmation 53 |

1. | Released and Settled Claims 53 |

2. | Binding Effect 54 |

3. | Vesting of Assets 54 |

4. | Release and Discharge of Debtors 54 |

5. | Terms of Injunctions or Stays 54 |

6. | Injunction Against Interference with Plan 54 |

7. | Plan Injunction 55 |

8. | Exculpation 55 |

9. | Releases 56 |

10. | Injunction Related to Releases and Exculpation 59 |

11. | Subordinated Claims 59 |

12. | Avoidance Actions 59 |

13. | Retention of Causes of Action and Reservation of Rights 60 |

14. | Preservation of Causes of Action 60 |

15. | Special Provisions for Governmental Units 61 |

16. | Protections Against Discriminatory Treatment 61 |

L. | Retention of Jurisdiction 61 |

M. | Miscellaneous Provisions 63 |

1. | Dissolution of Statutory Committees 63 |

2. | Substantial Consummation 64 |

3. | Exemption from Transfer Taxes 64 |

4. | Plan Modifications and Amendments 64 |

5. | Revocation or Withdrawal of Plan 65 |

V. ALTERNATIVES TO CONFIRMATION AND CONSUMMATION OF THE PLAN | 65 |

A. | Continuation of the Chapter 11 Cases 66 |

B. | Liquidation under Chapter 7 66 |

VI. TRANSFER RESTRICTIONS AND CONSEQUENCES UNDER FEDERAL SECURITIES

LAW 66

VII. CERTAIN TAX CONSEQUENCES OF THE PLAN | 68 |

A. | Consequences to the Debtors and to BBEP Common Unitholders 69 |

1. | Taxable Transfer of Assets 69 |

2. | Cancellation of Debt and other Income from the Plan 72 |

B. | Consequences to Holders of Certain Claims and Interests 74 |

1. | Holders of Revolving Credit Facility Claims 74 |

2. | Holders of Secured Notes Claims 77 |

3. | Holders of Unsecured Notes Claims 78 |

4. | Holders of General Unsecured Claims 79 |

vi

Table of Contents

Page

5. | Distributions in Discharge of Accrued Interest or OID 80 |

6. | Character of Gain or Loss 81 |

7. | Ownership and Disposition of LegacyCo Units 81 |

8. | Information Reporting and Backup Withholding 83 |

VIII. VOTING PROCEDURES AND REQUIREMENTS | 84 |

A. | Voting Deadline 84 |

B. | Voting Procedures 85 |

C. | Parties Entitled to Vote 85 |

1. | Beneficial Holders 86 |

2. | Nominees 86 |

3. | Miscellaneous 87 |

4. | Fiduciaries and Other Representatives 88 |

5. | Agreements upon Furnishing Ballots 88 |

6. | Change of Vote 88 |

D. | Waivers of Defects, Irregularities, etc. 89 |

E. | Further Information, Additional Copies 89 |

IX. FACTORS TO CONSIDER BEFORE VOTING | 89 |

A. | Risks Relating to the Debtors’ Business Operations and Financial Condition 89 |

1. | Volatile Oil and Gas Prices 89 |

2. | High Costs and Risks of Oil and Natural Gas Drilling and Production 90 |

3. | Depletion of Oil and Gas Reserves 92 |

4. | Intense Competitive Environment 92 |

5. | Substantial Capital Requirements 93 |

6. | Hedging and Derivative Risks 93 |

7. | Insurance Coverage and Excess Liability Risks 94 |

8. | Extensive Domestic Regulation and Legislation 94 |

9. | New Permian Corp. Will Be a New Company That Has Never Operated Independently 95 |

10. | Future New Permian Corp. Debt or Equity Financings. 95 |

11. | Additional Business and Industry Risk Factors 96 |

B. | Certain Bankruptcy Law Considerations 96 |

1. | Risk of Non-Confirmation of the Plan 96 |

2. | Non-Consensual Confirmation 96 |

3. | Inaccuracy of Projected Financial Results 96 |

4. | Claims Could Be More than Projected 97 |

5. | U.S. Federal Income Tax Risks 97 |

6. | Risk of Non-Occurrence of the Effective Date 97 |

7. | Conversion into Chapter 7 Cases 97 |

vii

Table of Contents

Page

C. | Factors Relating to Securities to Be Issued 97 |

viii

Table of Contents

Page

1. | Market for Securities 97 |

2. | Potential Dilution 98 |

3. | Significant Holders of LegacyCo Units or New Permian Corp. Shares 98 |

4. | Interests Subordinated to the Reorganized Debtors’ Indebtedness 98 |

5. | Implied Valuation of LegacyCo Units or New Permian Corp. Shares Not |

Intended to Represent the Trading Value of the LegacyCo Units or New

Permian Corp. Shares 99

6. | Dividends 99 |

7. | Restrictions on Ability to Resell LegacyCo Units and New Permian |

Corp. Shares 99

D. | Factors Relating to Rights Offering 99 |

1. | Debtors Could Modify the Rights Offering Procedures 99 |

2. | The Backstop Commitment Agreement Could be Terminated 100 |

E. | Additional Factors 100 |

1. | Debtors Could Withdraw Plan 100 |

2. | Debtors Have No Duty to Update 100 |

3. | No Representations Outside this Disclosure Statement Are Authorized 100 |

4. | No Legal or Tax Advice Is Provided by this Disclosure Statement 100 |

5. | No Admission Made 100 |

X. CONFIRMATION OF THE PLAN | 101 |

A. | Acceptance of the Plan 101 |

B. | Best Interest Test 102 |

C. | Feasibility 104 |

D. | Valuation Analysis 105 |

E. | Notices and Confirmation Hearing 108 |

XI. CONCLUSION AND RECOMMENDATION | 110 |

EXHIBIT A: Plan

EXHIBIT B: Liquidation Analysis

EXHIBIT C: Projected Financial Information

EXHIBIT D: Backstop Commitment Agreement

EXHIBIT E: Restructuring Support Agreement

EXHIBIT F: Rights Offering Procedures

ix

I.

INTRODUCTION

This is the disclosure statement (the “Disclosure Statement”) of Breitburn Energy Partners LP (“BBEP”); Breitburn GP LLC; Breitburn Operating LP (“BOLP”); Breitburn Operating GP LLC; Breitburn Management Company LLC (“BMC”); Breitburn Finance Corporation (“Breitburn Finance”); Alamitos Company; Beaver Creek Pipeline, L.L.C.; Breitburn Florida LLC; Breitburn Oklahoma LLC; Breitburn Sawtelle LLC; Breitburn Transpetco GP LLC; Breitburn Transpetco LP LLC; GTG Pipeline LLC; Mercury Michigan Company, LLC; Phoenix Production Company; QR Energy, LP; QRE GP, LLC; QRE Operating, LLC; Terra Energy Company LLC; Terra Pipeline Company LLC; and Transpetco Pipeline Company, L.P. (collectively, the “Debtors”), in the above-captioned chapter 11 cases (collectively, the “Chapter 11 Cases”) pending in the United States Bankruptcy Court for the Southern District of New York (the “Bankruptcy Court”), filed pursuant to section 1125 of title 11 of the United States Code (the “Bankruptcy Code”) and in connection with the Debtors’ Joint Chapter 11 Plan dated October 11, 2017 (the “Plan”), a copy of which is annexed to this Disclosure Statement as Exhibit A. The Plan constitutes a separate chapter 11 plan for each Debtor.

A. | Definitions and Exhibits |

1. | Definitions |

Unless otherwise defined herein, capitalized terms used in this Disclosure Statement shall have the meanings ascribed to such terms in the Plan.

2. | Exhibits |

The following exhibits to this Disclosure Statement are incorporated as if fully set forth herein and part of this Disclosure Statement:

● Exhibit A - Plan

● Exhibit B - Liquidation Analysis

● Exhibit C - Projected Financial Information

● Exhibit D - Backstop Commitment Agreement

● Exhibit E - Restructuring Support Agreement

● Exhibit F - Rights Offering Procedures

B. | Notice to Creditors |

The purpose of this Disclosure Statement is to set forth information that (1) summarizes the Plan and alternatives to the Plan, (2) advises holders of Claims and Interests of their rights under the Plan, (3) assists parties entitled to vote on the Plan in making informed decisions as to whether they should vote to accept or reject the Plan, and (4) assists the Bankruptcy Court in determining whether the Plan complies with the provisions of chapter 11 of the Bankruptcy Code and should be confirmed.

By Order dated _______, 2017 (the “Disclosure Statement Approval Order”), the Bankruptcy Court approved this Disclosure Statement, finding that it contains “adequate information,” as that term is used in section 1125(a)(1) of the Bankruptcy Code. The Bankruptcy Court’s approval of this Disclosure Statement is not an endorsement of the Plan.

IT IS THE DEBTORS’ OPINION THAT CONFIRMATION AND IMPLEMENTATION OF THE PLAN IS IN THE BEST INTERESTS OF THE DEBTORS’ ESTATES, CREDITORS, AND EQUITY INTEREST HOLDERS. THEREFORE, THE DEBTORS RECOMMEND THAT CREDITORS VOTE TO ACCEPT THE PLAN.

BALLOTS FOR VOTING TO ACCEPT OR REJECT THE PLAN MUST BE RECEIVED BY [_______], 2017 AT 5:00 P.M. (EASTERN TIME) (THE “VOTING DEADLINE”).

THE RECORD DATE FOR DETERMINING WHICH HOLDERS OF CLAIMS MAY VOTE ON THE PLAN IS [_______], 2017 (THE “RECORD DATE”). BECAUSE HOLDERS OF EQUITY INTERESTS IN BBEP WILL NOT RECEIVE ANY DISTRIBUTION OR CONSIDERATION UNDER THE PLAN AND THEIR EQUITY INTERESTS WILL BE CANCELED, THEY ARE DEEMED TO REJECT THE PLAN AND, ACCORDINGLY, WILL NOT VOTE ON THE PLAN.

A HEARING TO CONSIDER CONFIRMATION OF THE PLAN (THE “CONFIRMATION HEARING”) WILL BE HELD BEFORE THE HONORABLE STUART M. BERNSTEIN, UNITED STATES BANKRUPTCY JUDGE, IN ROOM 723 OF THE UNITED STATES BANKRUPTCY COURT FOR THE SOUTHERN DISTRICT OF NEW YORK, ONE BOWLING GREEN, NEW YORK, NEW YORK 10004, ON [DECEMBER 21], 2017 AT [10]:00 A.M. (EASTERN TIME), OR AS SOON THEREAFTER AS COUNSEL MAY BE HEARD. THE BANKRUPTCY COURT HAS DIRECTED THAT ANY OBJECTIONS TO CONFIRMATION OF THE PLAN BE SERVED AND FILED ON OR BEFORE [_______], 2017 AT [•]:00 A.M. (EASTERN TIME).

PLEASE READ THIS DISCLOSURE STATEMENT, INCLUDING THE PLAN, IN ITS ENTIRETY. A COPY OF THE PLAN IS ANNEXED HERETO AS EXHIBIT A. THE DISCLOSURE STATEMENT SUMMARIZES THE TERMS OF THE PLAN, BUT SUCH SUMMARY IS QUALIFIED IN ITS ENTIRETY BY THE ACTUAL TERMS AND PROVISIONS OF THE PLAN. ACCORDINGLY, IF THERE ARE ANY INCONSISTENCIES BETWEEN THE PLAN AND THIS DISCLOSURE STATEMENT, THE TERMS OF THE PLAN SHALL CONTROL.

SECURITIES LAW NOTICES: THE ISSUANCE OF AND THE DISTRIBUTION UNDER THE PLAN (A) OF THE LEGACYCO UNITS AND (B) OF THE NEW PERMIAN CORP. SHARES COMPRISING THE PUT OPTION PREMIUM OR ISSUED PURSUANT TO SECTIONS 4.5(c) or 4.6 OF THE PLAN WILL BE EXEMPT FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933 (AS AMENDED, THE “SECURITIES ACT”) AND ANY OTHER APPLICABLE SECURITIES LAWS TO THE FULLEST EXTENT PERMITTED BY SECTION 1145 OF THE BANKRUPTCY CODE.

2

THESE SECURITIES MAY BE RESOLD WITHOUT REGISTRATION UNDER THE SECURITIES ACT OR OTHER FEDERAL SECURITIES LAWS PURSUANT TO THE EXEMPTION PROVIDED BY SECTION 4(A)(1) OF THE SECURITIES ACT, UNLESS THE HOLDER IS AN “UNDERWRITER” WITH RESPECT TO SUCH SECURITIES, AS THAT TERM IS DEFINED IN SECTION 1145(b) OF THE BANKRUPTCY CODE. IN ADDITION, SUCH SECTION 1145 EXEMPT SECURITIES GENERALLY MAY BE RESOLD WITHOUT REGISTRATION UNDER STATE SECURITIES LAWS PURSUANT TO VARIOUS EXEMPTIONS PROVIDED BY THE RESPECTIVE LAWS OF THE SEVERAL STATES.

THE AVAILABILITY OF THE EXEMPTION UNDER SECTION 1145 OF THE BANKRUPTCY CODE OR ANY OTHER APPLICABLE SECURITIES LAWS WILL NOT BE A CONDITION TO THE OCCURRENCE OF THE EFFECTIVE DATE.

THE RIGHTS OFFERING AND THE ISSUANCE AND SALE OF THE NEW PERMIAN CORP. SHARES PURSUANT TO THE RIGHTS OFFERING AND TO THE COMMITMENT PARTIES UNDER THE BACKSTOP COMMITMENT AGREEMENT (INCLUDING THE NEW PERMIAN CORP. SHARES ISSUED PURSUANT TO THE MINIMUM ALLOCATION RIGHTS, BUT NOT INCLUDING THE PUT OPTION PREMIUM) ARE BEING MADE IN RELIANCE ON THE EXEMPTION FROM REGISTRATION SET FORTH IN SECTION 4(A)(2) OF THE SECURITIES ACT AND REGULATION D THEREUNDER. SUCH SECURITIES WILL BE CONSIDERED “RESTRICTED SECURITIES” AND MAY NOT BE TRANSFERRED EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR UNDER AN AVAILABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT, SUCH AS, UNDER CERTAIN CONDITIONS, THE RESALE PROVISIONS OF RULE 144 OF THE SECURITIES ACT.

THE LEGACYCO UNITS AND THE NEW PERMIAN CORP. SHARES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION (THE “SEC”) OR BY ANY STATE SECURITIES COMMISSION OR SIMILAR PUBLIC, GOVERNMENTAL, OR REGULATORY AUTHORITY, AND NEITHER THE SEC NOR ANY SUCH STATE AUTHORITY HAS PASSED UPON THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED IN THIS DISCLOSURE STATEMENT OR UPON THE MERITS OF THE PLAN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

CERTAIN STATEMENTS CONTAINED IN THIS DISCLOSURE STATEMENT, INCLUDING STATEMENTS INCORPORATED BY REFERENCE, PROJECTED FINANCIAL INFORMATION, AND OTHER FORWARD-LOOKING STATEMENTS, ARE BASED ON ESTIMATES AND ASSUMPTIONS. THERE CAN BE NO ASSURANCE THAT SUCH STATEMENTS WILL BE REFLECTIVE OF ACTUAL OUTCOMES. FORWARD-LOOKING STATEMENTS ARE PROVIDED IN THIS DISCLOSURE STATEMENT PURSUANT TO THE SAFE HARBOR ESTABLISHED UNDER THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995 AND SHOULD BE

3

EVALUATED IN THE CONTEXT OF THE ESTIMATES, ASSUMPTIONS, UNCERTAINTIES, AND RISKS DESCRIBED HEREIN.

FURTHERMORE, READERS ARE CAUTIONED THAT ANY FORWARD-LOOKING STATEMENTS HEREIN ARE BASED ON ASSUMPTIONS THAT ARE BELIEVED TO BE REASONABLE, BUT ARE SUBJECT TO A WIDE RANGE OF RISKS IDENTIFIED IN THIS DISCLOSURE STATEMENT. DUE TO THESE UNCERTAINTIES, READERS CANNOT BE ASSURED THAT ANY FORWARD-LOOKING STATEMENTS WILL PROVE TO BE CORRECT. THE DEBTORS ARE UNDER NO OBLIGATION TO (AND EXPRESSLY DISCLAIM ANY OBLIGATION TO) UPDATE OR ALTER ANY FORWARD-LOOKING STATEMENTS WHETHER AS A RESULT OF NEW INFORMATION, FUTURE EVENTS, OR OTHERWISE, UNLESS INSTRUCTED TO DO SO BY THE BANKRUPTCY COURT.

WHERE TO FIND ADDITIONAL INFORMATION: BBEP currently files annual reports with, and furnishes other information to, the SEC. Copies of any document filed with the SEC may be obtained by visiting the SEC website at http://www.sec.gov and performing a search under the “Company Filings” link. Each of the following filings is incorporated as if fully set forth herein and is a part of this Disclosure Statement (but later information filed with the SEC that updates information in the filings incorporated by reference will update and supersede that information):

● | Form 10-K for the fiscal year ended December 31, 2016, filed with the SEC on March 8, 2017 and amended on April 28, 2017 |

● | Form 10-Q for the quarterly period ended June 30, 2017, filed with the SEC on August 9, 2017 |

● | Form 8-K filed with the SEC on August 10, 2017 |

● | Form 8-K filed with the SEC on August 25, 2017 |

C. | Background and Overview of the Plan2 |

The Plan encompasses a comprehensive restructuring of the Debtors, that is the product of the Debtors’ arms-length negotiations and an agreement with (1) holders of claims under the Third Amended and Restated Credit Agreement dated November 19, 2014 (the lenders thereunder, the “Revolving Credit Facility Lenders”), (2) certain holders of the Debtors’ 9.25% Senior Secured Second Lien Notes due 2020 (the “Second Lien Group”),3 and (3) certain holders of the

____________________

2 This overview is qualified in its entirety by reference to the Plan. The treatment of Claims and Interests under the Plan is not intended to, and will not, waive, compromise or limit any rights, claims or causes of action if the Plan is not confirmed. You should read the Plan in its entirety before voting to accept or reject the Plan.

3 The constitution of the Second Lien Group is set forth in their verified statement pursuant to Bankruptcy Rule 2019 (ECF No. 914)

4

Debtors’ 7.875% Senior Notes due 2022 and 8.625% Senior Notes due 2020 (the “Unsecured Senior Notes Group”).4

The Plan is premised on the division of the Debtors’ existing businesses and assets into two separate entities upon the occurrence of the Effective Date under the Plan: (1) a newly-formed limited liability company (“LegacyCo”) that will own all of the Debtors’ assets other than certain assets related to the Permian Basin (such assets, the “Permian Assets”, that are set forth in Exhibit II of the Plan); and (2) a newly-formed corporation (“New Permian Corp.”) that will own all of the equity of a newly-formed limited liability company (“New Permian LLC”) that will own the Permian Assets.

The Plan provides for the following treatment of claims and equity interests:

● | Revolving Credit Facility Lenders, holding claims in the aggregate amount of approximately $747,316,435.62 with respect to principal and two interest rate derivative obligations plus such amounts as may be owing for any other outstanding “Obligations” (as such term is defined in the Revolving Credit Agreement) (collectively, the “Allowed Revolving Credit Facility Claims”), will receive (a) Cash in an amount equal to such holder’s pro rata share of the Allowed Revolving Credit Facility Claims minus $400 million (i.e., the original principal amount of an amended and restated term loan facility to be entered into on the Effective Date, the “Exit Facility”) and (b) such holder’s Pro Rata share of the Exit Facility. Each Revolving Credit Facility Lender will also have the right to convert all of its portion of the Exit Facility on a dollar-for-dollar basis to an equal amount of a revolving credit facility. |

● | Holders of the 9.25% Senior Secured Second Lien Notes due 2020 (the “Second Lien Noteholders”), with claims, solely for purposes of the Plan, in the aggregate amount of $793.3 million plus accrued unpaid pre- and postpetition default interest on all obligations, costs, fees, indemnities, and all other obligations payable under the Secured Notes Indenture, 5 will receive a pro rata share of 92.5% of new common units of LegacyCo (the “LegacyCo Units”), potentially subject to dilution. |

● | Holders of Unsecured Notes Claims (the “Unsecured Noteholders”) that are Eligible Offerees will receive the right to purchase their pro rata share of an aggregate of 60% of the common shares issued by New Permian Corp. (the “New Permian Corp. Shares”), subject to certain dilution, pursuant to a $465 million rights offering (the “Rights Offering”). The Plan contemplates that the Rights Offering will be backstopped by certain Unsecured Noteholders (the “Backstop Parties”) pursuant to the Amended and Restated Backstop Commitment Agreement annexed hereto as Exhibit D. New Permian Corp. will also own the remaining 7.5% of the LegacyCo Units as of the Effective Date, potentially subject to certain dilution. |

____________________

4 The constitution of the Unsecured Senior Notes Group is set forth in their verified statement pursuant to Bankruptcy Rule 2019 (ECF No. 1452).

5 If the Plan is not confirmed or the Effective Date does not occur, this amount is not binding and is without prejudice to the rights of all parties as to the allowed amount of the Secured Notes Claims.

5

Pursuant to the Backstop Commitment Agreement, the Backstop Parties also have committed to exercise rights to purchase the remaining 40% of the New Permian Corp. Shares (the “Minimum Allocation Rights”), subject to certain dilution, for the aggregate amount of $310 million. In consideration for Minimum Allocation Rights and the backstop of the Rights Offering, the Backstop Parties are to receive 10% of the New Permian Corp. Shares, which will dilute the New Permian Corp. Shares issued pursuant to the Minimum Allocation Rights and the Rights Offering.

● | Holders of General Unsecured Claims (including Unsecured Noteholders that are not Eligible Offerees or that do not elect to participate in the Rights Offering) will receive their pro rata share of [$500,000 in Cash or [•]% of the New Permian Corp. Shares]. |

● | The holders of Allowed Ongoing Trade Claims of LegacyCo and Allowed Ongoing Trade Claims of New Permian Corp. will be paid in Cash in full. |

● | All Royalty and Working Interests will be preserved and remain in full force and effect in accordance with the terms of their underlying documents, and no Royalty and Working Interests will be compromised, or obligations with respect thereto discharged, by the Plan. |

● | BBEP’s common and preferred unitholders will receive no distribution or consideration under the Plan on account of their equity interests, and all such units will be canceled on the Effective Date. The Plan, however, based on certain assumptions, structures the Debtors’ reorganization so as to attempt to mitigate any cancellation of debt (“COD”) and other income risk for the Debtors’ unitholders. However, that risk still remains. See Section VII of this Disclosure Statement for a discussion of tax consequences. |

Accordingly, upon consummation and implementation of the Plan, 92.5% of the equity of LegacyCo will be distributed to the Second Lien Noteholders. Simultaneously, New Permian Corp. will acquire the equity of New Permian LLC (which will hold the Permian Assets), and New Permian Corp. also will acquire the remaining 7.5% of the equity of LegacyCo. In turn, New Permian Corp. will be owned 40% by the Commitment Parties that exercised the Minimum Allocation Rights and the remainder by the Unsecured Noteholders that participate in the Rights Offering.

D. | Restructuring Support Agreement and Backstop Commitment Agreement |

1. | Restructuring Support Agreement |

In connection with negotiation of the Plan, the Debtors, certain Second Lien Noteholders holding substantially all of the principal amount of the Secured Notes (the “Consenting Second Lien Creditors”), and certain Unsecured Noteholders holding approximately 68% in principal amount of the Unsecured Notes (the “Consenting Senior Unsecured Creditors” and together with the Consenting Second Lien Creditors, the “Consenting Creditors”) entered into the Amended and Restated Restructuring Support Agreement dated as of October 11, 2017 (the “Restructuring Support Agreement”), a copy of which is annexed hereto as Exhibit E. The Restructuring Support Agreement provides that the Consenting Creditors will support the Plan and the restructuring transactions contemplated thereby, subject to the terms and provisions of the Restructuring Support

6

Agreement. In addition, in the Restructuring Support Agreement, the Debtors have agreed to move forward expeditiously with confirmation and consummation of the Plan, and to be subject to certain milestones which, if not achieved, enable the Consenting Creditors to terminate the Restructuring Support Agreement. The relevant milestones to be achieved include: (a) entry of the Confirmation Order by no later than [______], 2017 and (b) the occurrence of the Effective Date under the Plan by no later than the 25th day after entry of the Confirmation Order.

2. | Backstop Commitment Agreement |

Contemporaneously with the execution of the Restructuring Support Agreement, the Debtors, the Consenting Second Lien Creditors, and the Backstop Parties (that are comprised of the Consenting Senior Unsecured Creditors) entered into the Backstop Commitment Agreement.

On [______], 2017, the Bankruptcy Court entered an Order authorizing and approving the Backstop Commitment Agreement (ECF No. [__]), a copy of which is annexed hereto as Exhibit D. The Backstop Commitment Agreement generally provides as follows:

● | The Backstop Parties commit to (a) exercise rights to purchase 40% of the New Permian Corp. Shares to be issued pursuant to the Plan, and (b) backstop the purchase of the remaining 60% of the New Permian Corp. Shares to be issued pursuant to the Plan and the Rights Offering. |

● | In consideration of the foregoing, the Backstop Parties will receive a Put Option Premium of 10% of the aggregate number of New Permian Corp. Shares issued on the Effective Date. |

● | The Backstop Parties will be entitled to have all of their reasonable fees and expenses paid by the Debtors, including the reasonable fees and expenses of their attorneys and advisors. |

● | The Backstop Parties will be entitled to a break-up premium equal to $38.75 million payable in cash under certain circumstances if the Backstop Commitment Agreement is terminated. Payment of such break-up premium will only be made after all claims held by the Second Lien Noteholders are paid in full in cash. |

The Backstop Parties have the right to terminate the Backstop Commitment Agreement under certain circumstances, including if the Debtors breach the covenants contained therein or fail to meet certain milestones toward confirmation and consummation of the Plan, and including if the Debtors terminate based on the pursuit of an alternative transaction consistent with the exercise of their fiduciary duties.

E. | Summary of Plan Classification and Treatment of Claims and Interests |

The following table provides a summary of the classification and treatment of Claims and Interests under the Plan and is qualified in its entirety by reference to the Plan.

7

Class and Designation | Impairment and Entitlement to Vote | Treatment under the Plan | Estimated Allowed Amount and Approx. Percentage Recovery |

1 (Priority Non-Tax Claims) | Unimpaired (Not entitled to vote because deemed to accept) | Each holder of an Allowed Priority Non-Tax Claim shall receive, in full satisfaction of such Claim, at the option of the Debtors, with the consent of the Requisite Consenting Second Lien Creditors: (a) Cash in an amount equal to the Allowed amount of such Claim, or (b) other treatment consistent with section 1129(a)(9) of the Bankruptcy Code; provided, that Priority Non-Tax Claims that arise in the ordinary course of the Debtors’ business, shall be paid in the ordinary course of business. | Estimated Allowed Amount: $0 Estimated Percentage Recovery: N/A |

2 (Other Secured Claims) | Unimpaired (Not entitled to vote because deemed to accept) | Each holder of an Allowed Other Secured Claim shall receive, at the option of the Debtors, with the consent of the Requisite Consenting Second Lien Creditors, and, to the extent that such treatment adversely affects the Exit Facility, the Exit Facility Agent, and in full satisfaction of such Claim, either (a) Cash in an amount equal to one hundred percent (100%) of the unpaid amount of such Allowed Other Secured Claim, (b) the proceeds of the sale or disposition of the Collateral securing such Allowed Other Secured Claim, net of the costs of disposition of such Collateral, (c) the Collateral securing such Allowed Other Secured Claim, (d) such treatment that leaves unaltered the legal, equitable, and contractual rights to which the holder of such Allowed Other Secured Claim is entitled, or (e) such other distribution as necessary to satisfy the requirements of section 1124 of the Bankruptcy Code. In the event an Other Secured Claim against any of the Debtors is treated under clause (a) or (b) of this Section, the liens securing such Other Secured Claim shall be deemed released immediately upon payment of the Cash or proceeds as provided in such clauses. | Estimated Allowed Amount: $700,000 Estimated Percentage Recovery: 100% |

3 (Revolving Credit Facility Claims) | Impaired (Entitled to vote) | The Revolving Credit Facility Claims shall be deemed Allowed in the amount of $747,316,435.62, plus such amounts as may be owing for any other outstanding “Obligations” (as such term is defined in the Revolving Credit Agreement). Each holder of an Allowed Revolving Credit Facility Claim shall receive: (a) Cash in an amount equal to such holder’s Pro Rata share of the Allowed Revolving Credit Facility Claims minus the original principal amount of the Exit Facility on the Effective Date of $400 million, and (b) such holder’s Pro Rata share of the Exit Facility. | Estimated Allowed Amount: $747,316,435.62 Estimated Percentage Recovery: 100% |

8

Class and Designation | Impairment and Entitlement to Vote | Treatment under the Plan | Estimated Allowed Amount and Approx. Percentage Recovery |

4 (Secured Notes Claims) | Impaired (Entitled to vote) | The Secured Notes Claims shall be deemed Allowed solely for purposes of the Plan in the amount of $793,300,000 plus accrued unpaid pre and postpetition default interest on all outstanding obligations, costs, fees, indemnities, and all other obligations payable under the Secured Notes Indenture. Each holder of an Allowed Secured Notes Claim that is a Certified Holder, shall receive, in accordance with the Restructuring Transactions, its Pro Rata share of 92.5% of the LegacyCo Units, which may be subject to dilution by the LegacyCo Management Incentive Plan. | Estimated Allowed Amount: $838 million to $949 million6 Estimated Percentage Recovery: 82% to 73%% |

5 (Unsecured Notes Claims) | Impaired (Entitled to vote) | The 7.875% Unsecured Notes Claims shall be deemed Allowed in the aggregate principal amount outstanding as of the Petition Date plus all accrued and unpaid interest as of the Petition Date. The 8.625% Unsecured Notes Claims shall be deemed Allowed in the aggregate principal amount outstanding as of the Petition Date plus all accrued and unpaid interest as of the Petition Date. Each holder of an Allowed Unsecured Notes Claim that is an Eligible Offeree shall receive, in accordance with the Rights Offering and the Rights Offering Procedures, the right to participate in the Rights Offering. Each holder of an Allowed Unsecured Notes Claim that is not an Eligible Offeree or that elects not to participate in the Rights Offering shall receive, on the Initial Distribution Date and Final Distribution Date, in full satisfaction of such claim, its Class 6 Pro Rata share of [(a) $500,000 in cash payable from general accounts (the “GUC Cash Pool”), or (b) [•]% of the New Permian Corp. Shares]. | Estimated Allowed Amount of 7.785% Unsecured Notes Claims: $889,046,875.00 Estimated Allowed Amount of 8.625% Unsecured Notes Claims: $320,345,312.50 Recovery: Right to subscribe in Rights Offering |

6 (General Unsecured Claims) | Impaired (Entitled to vote) | Each holder of an Allowed General Unsecured Claim shall receive, on the Initial Distribution Date and Final Distribution Date, in full satisfaction of such Claim, its Class 6 Pro Rata share of [(a) the GUC Cash Pool, or (b) [•]% of the New Permian Corp. Shares]. | Estimated Allowed Amount: $21,500,000 Estimated Percentage Recovery: 7 2.3% |

7A (Ongoing Trade Claims of LegacyCo) | Unimpaired (Not entitled to vote because deemed to accept) | Each holder of an Allowed Ongoing Trade Claim of LegacyCo shall receive Cash in an amount equal to such Allowed Ongoing Trade Claim of LegacyCo. | Estimated Allowed Amount: $5,200,000 Estimated Percentage Recovery: 100% |

____________________

6 These amounts are estimates with a range based on an unresolved dispute as to the appropriate allowed amount of postpetition interest. If the Plan is not confirmed or the Effective Date does not occur, these amounts are not binding and will be without prejudice to the rights of all parties as to the allowed amount of the Secured Notes Claims.

7 Assumes that no claimants in Class 5 share in the distribution to Allowed Claims in Class 6.

9

Class and Designation | Impairment and Entitlement to Vote | Treatment under the Plan | Estimated Allowed Amount and Approx. Percentage Recovery |

7B (Ongoing Trade Claims of New Permian Corp.) | Unimpaired (Not entitled to vote because deemed to accept) | Each holder of an Allowed Ongoing Trade Claim of New Permian Corp. shall receive Cash in an amount equal to such Allowed Ongoing Trade Claim of New Permian Corp. | Estimated Allowed Amount: $150,000 Estimated Percentage Recovery: 100% |

8 (Intercompany Claims) | Unimpaired (Not entitled to vote because deemed to accept) | All Allowed Intercompany Claims shall either be (a) canceled (or otherwise eliminated) and receive no distribution under the Plan or (b) Reinstated. | Estimated Allowed Amount: $0 Estimated Percentage Recovery: 0% / 100% |

9 (Subordinated Claims) | Impaired (Not entitled to vote because deemed to reject) | Subordinated Claims are subordinated pursuant to the Plan and section 510 of the Bankruptcy Code. The holders of Subordinated Claims shall not receive or retain any property under the Plan. | Estimated Allowed Amount: $0 Estimated Percentage Recovery: N/A |

10 (Intercompany Interests) | Unimpaired (Not entitled to vote because deemed to accept) | All Allowed Intercompany Interests shall either be (a) canceled (or otherwise eliminated) and receive no distribution under the Plan or (b) Reinstated. | Estimated Allowed Amount: N/A Estimated Percentage Recovery: 0% / 100% |

11 (Existing BBEP Equity Interests) | Impaired (Not entitled to vote because deemed to reject) | On the Effective Date, all Existing BBEP Equity Interests shall be canceled and all holders of Existing BBEP Equity Interests shall not receive or retain any property under the Plan. | Estimated Allowed Amount: N/A Estimated Percentage Recovery: 0% |

F. | Disclosure Statement Enclosures |

The following three enclosures accompany this Disclosure Statement:

1. | Disclosure Statement Approval Order. A copy of the Disclosure Statement Approval Order, without exhibits which, among other things, approves this Disclosure Statement, establishes procedures for voting on the Plan (the “Voting Procedures”), and schedules the Confirmation Hearing and the deadline for objecting to confirmation of the Plan. |

2. | Confirmation Hearing Notice. A copy of the notice of the Voting Deadline and, among other things, notice of the date, time, and place of the Confirmation Hearing and the deadline for filing objections to confirmation of the Plan (the “Confirmation Hearing Notice”). |

10

3. | Ballots. One or more Ballots (and return envelopes) for voting to accept or reject the Plan unless you are not entitled to vote because you are (a) not impaired under the Plan and are presumed to accept the Plan, (b) deemed to reject the Plan, or (c) a holder of a Claim subject to an objection filed by the Debtors, which Claim is temporarily disallowed for voting purposes. See Section VIII of this Disclosure Statement for an explanation of which parties are entitled to vote and a description of the Voting Procedures. |

G. | Inquiries |

If you have any questions about the packet of materials you have received, please contact Prime Clerk LLC, the Debtors’ voting agent (the “Voting Agent”), at 1-855-851-7887 (domestic toll-free) or 1-917-258-6103 (international). Additional copies of this Disclosure Statement, the Plan, or the Plan Supplement are available upon written request made to the Voting Agent at the following address:

Breitburn Energy Partners LP

c/o Prime Clerk, LLC

830 Third Avenue, 3rd Floor

New York, NY 10022

Copies of this Disclosure Statement, which includes the Plan and the Plan Supplement (when filed) are also available on the Voting Agent’s website, http://cases.primeclerk.com/breitburn. PLEASE DO NOT DIRECT INQUIRIES TO THE BANKRUPTCY COURT.

II.

OVERVIEW OF THE DEBTORS’ OPERATIONS

A. | The Debtors’ Corporate Structure |

BBEP was formed in 2006 after its predecessor, Breitburn Energy Company, determined that a portion of the company would go public as a master limited partnership. BBEP successfully completed its initial public offering in October 2006, listing as “BBEP” on the NASDAQ exchange. On May 16, 2016, the Listing Qualifications Department of The Nasdaq Stock Market LLC notified BBEP of its determination to delist BBEP’s common units from the NASDAQ exchange. On June 10, 2016, NASDAQ filed a Form 25-NSE with the SEC to remove BBEP’s securities from listing and registration on NASDAQ.

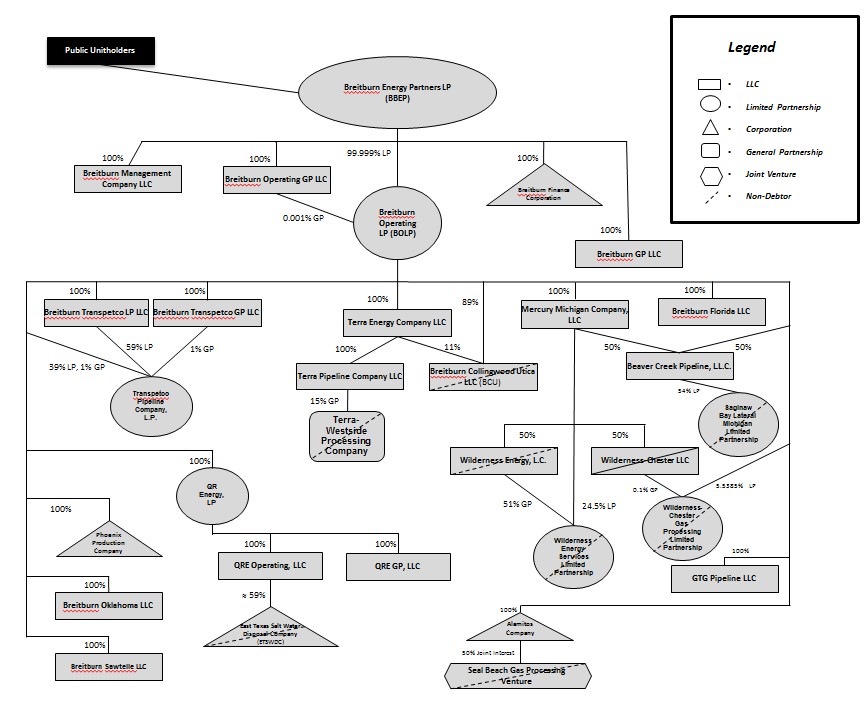

The organizational structure of the Debtors as of the Petition Date is set forth below:

11

B. | The Debtors’ Business Operations |

The Debtors are an independent oil and gas partnership engaged in the acquisition, exploitation and development in the United States of oil and natural gas properties, midstream assets,8 and a combination of ethane, propane, butane, and natural gasolines that when removed from natural gas become liquid under various levels of higher pressure and lower temperature (“NGL”). The Debtors conduct their operations through BBEP’s wholly-owned subsidiary, Breitburn Operating LP (BOLP), and BOLP’s general partner, Breitburn Operating GP LLC (BOGP).

The Debtors’ assets consist primarily of producing and non-producing oil, NGL, and natural gas reserves located in seven producing areas:

1) | Midwest (Michigan, Indiana, and Kentucky): As of December 31, 2016, Midwest properties approximated 20% of the Debtors’ total estimated proved reserves. The Antrim Shale underlies the Midwest properties and tends to produce relatively predictable amounts of natural gas, with an average expected life of greater than 14 years. Growth opportunities for the Antrim Shale include infill drilling and recompletions, horizontal drilling, and bolt-on acquisitions. Non-Antrim Shale interests include the Prairie du Chien, Richfield, Detroit River Zone III and Niagaran pinnacle reefs. |

____________________

8 The term “midstream assets” refers to transmission and gathering pipelines, gas processing plants, NGL recovery plants, a controlling interest in a salt water disposal company and the 120-mile Transpecto Pipeline.

12

2) | Ark-La-Tex (Arkansas, Louisiana, and East Texas): As of December 31, 2016, the Ark-La-Tex properties approximated 17% of the Debtors’ total estimated proved reserves. The Ark-La-Tex area includes properties located in southern Arkansas, northern Louisiana and eastern Texas. These properties produce from formations including the Cotton Valley Sand, Haynesville Sand, Woodbine Sand and Smackover Carbonate. |

3) | Permian Basin: As of December 31, 2016, the Permian Basin properties approximated 22% of the Debtors’ total estimated proved reserves. The Permian Basin properties are primarily located in the southern Midland Basin and Eastern Shelf in Texas and New Mexico. |

4) | Other Operating Regions: The following table summarizes the Debtors’ other operating regions, which as of December 31, 2016 comprise the remaining 41% of the Debtors’ total estimated proved reserves. |

Operating Region | Description | Average Daily Production in 2016 (Boe/d) | Percentage of Total Estimated Proved Reserves |

Mid-Continent | Properties located in western Oklahoma, southwestern Kansas and the Texas Panhandle. These properties produce from regionally significant geologic formations such as the Cottage Grove, Morrow, Atoka, Redfork and Lansing. | 5,881 | 15% |

Rockies | Properties in the Powder River Basin in eastern Wyoming and Wind River and Big Horn Basins in central Wyoming and natural gas properties in the Evanston and Green River Basins in southwestern Wyoming. The Debtors also own non-operated producing assets in Weld County, Colorado. | 5,874 | 12% |

Southeast | Significant holdings in two major geologic trends, the Sunniland trend in southwest Florida and the Jay trend in the northwest Florida Panhandle. These properties produce from the Cretaceous formations of the South Florida Basin and the Smackover Carbonate formation, respectively. | 4,769 | 7% |

California | Several large, complex oil fields within the Los Angeles Basin. The Debtors also operate oil properties in the San Joaquin Basin in Kern County, California. | 4,149 | 7% |

The Debtors generally do not hold 100% of the interests in any real property in which they have interests. The Debtors and the other interest holders usually enter into joint operating agreements to govern the parties’ responsibilities with respect to the land, including which party will be responsible for the exploration and production of the oil and gas thereon. As of December 31, 2016, the Debtors operate or have working interests in approximately 11,900 gross operating oil and gas wells, and approximately 8,000 net oil and gas wells. The Debtors own interests in approximately 623,000 net acres and had estimated proved reserves, as of December 31, 2016, of 205.3 million barrels of oil equivalent of which approximately 55% was oil, 9% was NGLs, and 36% was natural gas. The Debtors maintain operational control over approximately 89% of their proved reserves. The Debtors’ production in 2016 was 18.3 million barrels of oil equivalent, of which approximately 52% was oil, 11% was NGLs, and 37% was natural gas.

13

Before the Petition Date, the Debtors’ long-term business strategy had consistently been to manage their oil, NGL, and natural gas producing properties for the purpose of generating cash flow and making distributions to their economic stakeholders. The Debtors’ core investment strategy included the following principles:

● | Acquire long-lived assets with low-risk exploitation and development opportunities; |

● | Optimize reserve recovery by using technical expertise and state-of-the-art technologies; |

● | Reduce cash flow volatility through commodity price and interest rate derivatives; and |

● | Maximize asset value and distributable cash flow through operating expertise. |

In particular, the strategic selection of the right oil and gas acquisitions was a focal point of the Debtors’ business strategy before the severe oil and gas price decline that began at the end of 2014 and that adversely affected the entire industry.

The Debtors manage their assets and perform other administrative services, such as accounting, corporate development, finance, land administration, legal, and engineering through BBEP’s wholly-owned subsidiary, Breitburn Management Company LLC (BMC). As the operator, BMC designs and manages the development of wells and supervises operation and maintenance activities on a day-to-day basis. BMC does not own any drilling rigs or other oil field services equipment used for drilling or maintaining wells on properties that it operates. Instead, BMC employs independent contractors to provide all the equipment and personnel associated with these activities. In addition to independent contractors, the Debtors’ work force includes, as of December 31, 2016, 671 employees. All employees are employed by BMC and none of the employees are party to any collective bargaining agreements.

C. | Prepetition Capital Structure |

1. | MLP Common and Preferred Units |

As of June 30, 2017, BBEP had approximately 213.8 million common units representing limited partnership interests outstanding. BBEP also had, as of June 30, 2017, 8 million 8.25% Series A Cumulative Redeemable Perpetual Preferred Units (“Series A Preferred Units”) outstanding, and 49.6 million 8% Series B Perpetual Convertible Preferred Units (“Series B Preferred Units”) outstanding.

2. | Indebtedness |

The Debtors are composed of entities incorporated or organized in Delaware, Wyoming, California, Michigan, Virginia, and Texas. All of the Debtors are direct and indirect subsidiaries of BBEP, and together, constitute the issuers or guarantors of the Debtors’ funded debt.

14

As of the Petition Date, the Debtors had approximately $3.1 billion in total outstanding funded debt:

Debt | Approximate Principal Amount Outstanding ($mm) |

First Lien Revolving Credit Facility | $1,2429 |

9.25% Senior Secured Second Lien Notes due 2020 | $650 |

7.875% Senior Unsecured Notes due 2022 | $850 |

8.625% Senior Unsecured Notes due 2020 | $305 |

Total Debt | $3,047 |

The below description of the Debtors’ prepetition indebtedness is for informational purposes only and is qualified in its entirety by reference to the specific agreements evidencing the indebtedness.

(a) | Revolving Credit Facility |

Prior to the Petition Date, the Debtors were party to the Third Amended and Restated Credit Agreement, dated November 19, 2014 (as amended, the “Revolving Credit Agreement”), with the Revolving Credit Facility Agent and the Revolving Credit Facility Lenders. Pursuant to the Revolving Credit Agreement, the Revolving Credit Facility Lenders provided the Debtors with revolving loans and letters of credit (the “Revolving Credit Facility”).

The obligations under the Revolving Credit Agreement are secured by first priority liens on and security interests in substantially all of the Debtors’ property and assets (collectively, the “Prepetition Collateral”). As of the Petition Date, approximately $1.25 billion in principal amount was outstanding under the Revolving Credit Facility, including approximately $45.3 million of outstanding but undrawn letters of credit. As discussed below, the amount outstanding under the Revolving Credit Facility was reduced by the payment of approximately $450 million of hedge proceeds in July 2017, as authorized by an Order of the Bankruptcy Court (ECF No. 1451).

(b) | Secured Notes |

On April 8, 2015, the Debtors issued $650 million of 9.25% senior secured second lien notes due 2020 (the “Secured Notes”) pursuant to an Indenture dated April 8, 2015 (as amended, the “Secured Notes Indenture”), between BBEP, BOLP, and Breitburn Finance, as issuers, each of the guarantors named therein, and Delaware Trust Company, as successor indenture trustee. The obligations under the Secured Notes Indenture are secured by liens on the Prepetition Collateral that are junior and subordinate to the liens securing the obligations under the Revolving Credit Agreement.

____________________

9 As discussed herein, pursuant to an Order of the Bankruptcy Court (ECF No. 1451), this principal amount has been reduced to approximately $750 million.

15

(c) | 8.625% Unsecured Notes |

On October 6, 2010, the Debtors issued 8.625% senior notes due 2020 (the “8.625% Unsecured Notes”) in an aggregate principal amount of $305 million, pursuant to an Indenture dated October 6, 2010 (as amended), between BBEP, Breitburn Finance, each of the other Debtors named therein as guarantors, and Wilmington Trust Company, as successor indenture trustee. As of the Petition Date, the entire principal amount of the 8.625% Unsecured Notes was outstanding. The 8.625% Unsecured Notes are unsecured.

(d) | 7.875% Unsecured Notes |

On January 13, 2012, the Debtors issued 7.875% senior notes due in 2022 (the “7.875% Unsecured Notes” and together with the 8.625% Unsecured Note, the “Unsecured Notes”) in an aggregate principal amount of $250 million, pursuant to an indenture dated January 13, 2012 (as amended), among BBEP, Breitburn Finance, each of the other Debtors named therein as guarantors, and Wilmington Trust Company, as successor indenture trustee. On September 27, 2012, the Debtors issued an additional $200 million in aggregate principal amount of 7.875% Unsecured Notes. On November 22, 2013, the Debtors issued $400 million in aggregate principal amount of additional 7.875% Unsecured Notes. As of the Petition Date, the entire principal amount of $850 million of the 7.875% Unsecured Notes was outstanding. The 7.875% Unsecured Notes are unsecured and are pari passu with the 8.625% Unsecured Notes.

3. | Derivative and Hedge Agreements |

Because the Debtors’ revenues and cash flow are sensitive to oil and natural gas prices, historically and before the Petition Date, BOLP regularly entered into commodity derivative contracts (the “Hedge Agreements”) intended to achieve more predictable cash flow and to reduce the Debtors’ exposure to adverse fluctuations in the price of oil and natural gas. The Debtors maintained the Hedge Agreements for a significant portion of their oil and gas production. Notably, all of the counterparties to the Hedge Agreements were lenders (or affiliates of lenders) under the Revolving Credit Facility. As a consequence of the commencement of the Chapter 11 Cases, all Hedge Agreements were terminated. After such termination, the Debtors were owed approximately $450 million by the applicable Hedge Agreement counterparties. Pursuant to an Order of the Bankruptcy Court dated July 17, 2017 (ECF No. 1451), the Bankruptcy Court authorized the application of such amount to the amounts owed by the Debtors to the hedge counterparties, and thereafter as a dollar-for-dollar reduction of the amounts outstanding under the Revolving Credit Facility. As a result of such application, the outstanding principal amount under the Revolving Credit Facility was reduced to approximately $750 million.

4. | Trade Payables |

In the ordinary course of their business, the Debtors incur trade debt with numerous vendors in connection with their operations. The Debtors estimate that as of the Petition Date their outstanding trade payables total approximately $50 million.

16

D. | Events Leading to Commencement of the Chapter 11 Cases |

1. | The Oil and Gas Industry Experiences Fundamental Changes |

Since early 2014, the persistent and severely distressed market conditions in the oil and gas industry have negatively impacted all levels of the industry, with a particularly adverse impact on upstream companies that produce oil and gas. Notably, natural gas prices were depressed for a significant period of time and the precipitous decline in crude oil prices since 2014 was virtually unprecedented, with prices well below what anyone in the business could have reasonably anticipated, and resulted in a substantial decline in revenue, reserves, and asset values across the spectrum.

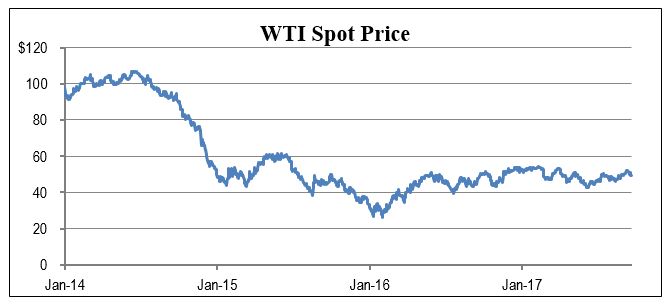

For example, in 2016, the West Texas Intermediate (“WTI”) spot price averaged approximately $43 per barrel (“Bbl”), compared with approximately $48 per Bbl in 2015 and $93 per Bbl in 2014. During 2016, the WTI monthly average ranged from a monthly average low of $30 per Bbl in January and a monthly average high of $52 per Bbl in December. Historically, there has been a strong relationship between changes in NGL and crude oil prices. NGL prices are correlated to North American supply and petrochemical demands. Lower crude oil prices not only decrease revenues, but may also reduce the amount of crude oil that can be produced economically and therefore lower crude oil reserves.

The following chart sets forth the WTI crude oil spot pricing historical data from January 2014 to October 10, 2017.

2. | Stabilization Efforts |

The Debtors were not immune to these severely adverse market conditions and its impact on their reserves, cash flow, borrowing capacity, and ability to service their outstanding indebtedness. Consequently, commencing in 2015, the Debtors took significant efforts to respond to this crisis by initiating a series of financial and operational actions set forth below:

● | In January 2015, the Debtors reduced distributions to common unitholders by 52% from $2.08 per unit to $1.00 per unit on an annualized basis. |

17

● | In April 2015, the Debtors raised approximately $1 billion by issuing the Secured Notes and Series B Preferred Units, the net proceeds of which were used to repay borrowings under the Revolving Credit Facility. The Debtors also further reduced their distributions to common unitholders by another 50%, from $1.00 per unit to $0.50 per unit on an annualized basis. |

● | In connection with the April 2015 capital raise, the Debtors negotiated a redetermination of their borrowing base to $1.8 billion under the Revolving Credit Facility for one year, which provided stable liquidity in 2015. |

● | The Debtors reduced their general, administrative, and technical workforce in 2015 by over 60 positions through a combination of a workforce reduction plan, resignations, and early retirements. The Debtors also reduced their general, administrative and technical workforce by an additional 20% in 2016. |

● | The Debtors significantly reduced their capital spending, focusing primarily on drilling and rate-generating projects and carbon dioxide purchases that are designed to increase either production or reserves. |

● | In November 2015, the Debtors suspended the payment of distributions on their common units, which preserved approximately $9 million per month in cash expenditures. |

3. | Prepetition Restructuring Efforts |

Despite these efforts, however, and the moderate increase in crude oil prices in the weeks before the Petition Date, the Debtors’ revenue and cash flow generating capacity was insufficient to service their outstanding debt on a long-term basis and to maintain the liquidity necessary to operate their business and preserve their long-term viability and enterprise value.

In view of the circumstances and the inevitable reduction of their borrowing base under the Revolving Credit Agreement, the Debtors focused their attention and resources on preserving liquidity and developing a strategy to implement a comprehensive restructuring that would right-size their balance sheet and maximize value for their economic stakeholders. In furtherance of this effort, commencing April 2016, the Debtors initiated preliminary discussions with the Revolving Credit Facility Agent and the Second Lien Noteholders with respect to a significant deleveraging transaction and also started discussions with advisors retained by an ad hoc group of holders of both series of the Unsecured Notes.

On April 15, 2016, an aggregate of approximately $46.7 million in interest payments became due and payable on the Unsecured Notes. Pursuant to the provisions of the indentures governing the Unsecured Notes, there was a 30-day grace period for the payment of interest before an event of default matured thereunder - that grace period expired on May 16, 2016. To preserve their liquidity while pursuing restructuring negotiations, the Debtors elected not to pay the interest on April 15, 2016 and to take advantage of the grace period.

Although the Debtors’ discussions and negotiations with their several creditor constituencies were productive, it became clear that the negotiations could not be concluded and an appropriate

18

restructuring consummated on an out-of-court basis in a timeframe that would assure the Debtors’ ongoing access to sufficient liquidity to operate their business. The need for liquidity was particularly urgent because of the imminent expiration of the grace period to pay interest on the Unsecured Notes, the cross-defaults to other indebtedness that would ensue, the resultant inability to borrow under the Revolving Credit Facility, and the risk of precipitous remedial action on the Debtors’ hedging assets, among other things, that could have a significant adverse impact on the Debtors’ ongoing operations with the attendant severe impairment of value. Under the circumstances, the Debtors had no reasonable alternative but to seek relief under chapter 11.

III.

OVERVIEW OF THE CHAPTER 11 CASES

A. | Commencement of Chapter 11 Cases |

On May 15, 2016, the Debtors commenced the Chapter 11 Cases. The Debtors believed that the chapter 11 process would not only assure the Debtors’ continued access to sufficient liquidity necessary to maximize enterprise value but would also provide a forum to continue the restructuring negotiations in an atmosphere most conducive to achieving a successful result. The Debtors continue managing their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code.

B. | First Day Motions |

On the Petition Date, the Debtors filed multiple motions seeking various relief from the Bankruptcy Court to enable the Debtors to facilitate a smooth transition into chapter 11 (the “First Day Motions”). The Bankruptcy Court granted substantially all of the relief requested in the First Day Motions and entered various orders authorizing the Debtors to, among other things:

● | Continue paying employee wages and benefits; |

● | Continue the use of the Debtors’ cash management system, bank accounts, and business forms; |

● | Continue insurance programs and the processing of workers’ compensation Claims; |

● | Continue the Debtors’ surety bond program; |

● | Pay certain prepetition taxes and assessments; |

● | Pay certain royalty interests; |

● | Pay certain joint interest billings, operating expenses, and shipping and delivery charges; |

● | Establish procedures for utility companies to request adequate assurance of payment and to prohibit utility companies from altering or discontinuing service; and |

19

● | Obtain senior secured superpriority financing and use cash collateral. |

C. | Procedural Motions |

Throughout the Chapter 11 Cases, the Bankruptcy Court has entered various orders regarding procedural issues common to chapter 11 cases of similar size and complexity, including orders authorizing and establishing procedures for de minimis asset transactions (ECF No. 602), authorizing the Debtors to employ professionals used in the ordinary course of business (ECF No. 297), and establishing procedures for the interim compensation and reimbursement of expenses of professionals (ECF No. 132).

D. | Appointment of Creditors’ Committee |

On May 26, 2016, the Official Committee of Unsecured Creditors (the “Creditors’ Committee”) was appointed by the Office of the United States Trustee for Region 2 (the “U.S. Trustee”) pursuant to section 1102 of the Bankruptcy Code to represent the interests of unsecured creditors in the Chapter 11 Cases. The initial members of the Creditors’ Committee were Ares Special Situations Fund IV, L.P. (“Ares”), BPC UKI LP (“BPC”), and Wexford Spectrum Investors, LLC (“Wexford”). Ares, Wexford, and BPC have resigned from the Creditors’ Committee. On October 6, 2017, the U.S. Trustee appointed Transpetco Transport Co. and Wilmington Trust Company (which previously served ex officio) to the Creditors’ Committee.

The Creditors’ Committee retained Milbank, Tweed, Hadley & McCloy LLP as its attorneys; Houlihan Lokey Capital, Inc. as its investment banker; Berkeley Research Group, LLC as its financial adviser; Prime Clerk LLC as its information agent; Porter Hedges LLP as special counsel; and Quinn Emanuel Urquhart & Sullivan LLP as conflicts counsel.

E. | Appointment of Equity Committee |

On November 15, 2016, the Official Committee of Equity Security Holders (the “Equity Committee”) was appointed by the U.S. Trustee pursuant to section 1102 of the Bankruptcy Code to represent the interests of the Debtors’ preferred and common interest holders in the Chapter 11 Cases. The Equity Committee currently consists of Andrew M. Parker, Gerald Epling, Jim Lemezis, Robert Menjivar, Rodger R. Stelter (Beneficiary for Rodger R. Stelter 401k), John Myrick, and Ira Wilsker. The Equity Committee retained Proskauer Rose LLP as its attorneys; Carl Marks & Co. as its financial advisor; and Barchan Advisory Services Ltd. as its engineering consultant.

F. | Claims Reconciliation Process |

On August 23, 2016, the Bankruptcy Court entered an order (the “Bar Date Order”), which, among other things, (1) established October 14, 2016 at 5:00 p.m. (the “Bar Date”) as the deadline for certain persons and entities to file proofs of Claim in the Chapter 11 Cases and (2) approved the form and manner of the Bar Date notice. The Debtors provided notice of the Bar Date as required by the Bar Date Order. As of August 31, 2017, approximately 3,100 proofs of Claim had been filed against the Debtors in the aggregate amount of approximately $3.8 billion.

20

The Debtors continue to review, analyze, reconcile, and file objections to the filed Claims. The Debtors have identified many Claims they believe should be disallowed because they are, among other things, duplicative, without merit, overstated, or have already been paid pursuant to Orders of the Bankruptcy Court. Accordingly, the Debtors have filed 25 omnibus objections to approximately 2,000 Claims. As of August 31, 2017, the Bankruptcy Court has disallowed approximately $230 million of Claims. Because the process of analyzing and objecting to Claims is ongoing, the amount of disallowed Claims may change significantly in the future.

G. | Exclusivity |

Section 1121(b) of the Bankruptcy Code provides for a period of 120 days after the commencement of a chapter 11 case during which time a debtor has the exclusive right to file a plan of reorganization (the “Exclusive Plan Period”). In addition, section 1121(c)(3) of the Bankruptcy Code provides that if a debtor files a plan within the Exclusive Plan Period, it has a period of 180 days after commencement of the chapter 11 case to obtain acceptances of such plan (the “Exclusive Solicitation Period,” and together with the Exclusive Plan Period, the “Exclusive Periods”). Pursuant to section 1121(d) of the Bankruptcy Code, the Bankruptcy Court may, upon a showing of cause, extend the Exclusive Periods.

The Bankruptcy Court has entered several orders extending the Exclusive Periods. The Exclusive Periods currently remain in effect and may be further extended by the Bankruptcy Court through no later than January 15, 2018.

H. | Employee Compensation Matters |

As of the Petition Date, the Debtors employed approximately 700 employees. The Debtors have historically maintained incentive and compensation programs designed to attract, retain, or incentivize (as appropriate) employees.

On July 27, 2016, the Debtors filed the Motion of Debtors Pursuant to 11 U.S.C. §§ 105, 363(b), and 503(c)(3) for Entry of an Order Approving Debtors’ Retention and Incentive Programs for Certain Key Employees (the “Employee Programs Motion”, ECF No. 309) seeking approval of the Employee Programs (as defined and described in the Employee Programs Motion). In August and September 2016, the Bankruptcy Court entered Orders approving the relief sought in the Employee Programs Motion (ECF Nos. 434 and 548).

On February 1, 2017, the Debtors filed the Motion of Debtors Pursuant to 11 U.S.C. §§ 105, 363(b), and 503(c)(3) for Entry of an Order Approving Debtors’ 2017 Retention and Incentive Programs for Certain Key Employees (the “2017 Employee Programs Motion”, ECF No. 992), seeking approval of the 2017 Employee Programs (as defined and described in the 2017 Employee Programs Motion). On March 6, 2017, the Bankruptcy Court entered an Order approving the relief sought in the 2017 Employee Programs Motion (ECF No. 1058).

Both the Employee Programs Motion and the 2017 Employee Programs Motion provided for a retention program for certain key employees, and incentive-based programs for more senior-level employees, including the Debtors’ senior management. The incentive payments are tied to customary industry performance metrics measured 50% by oil and gas production and 50% by lease operating expense reductions. All of the programs provide for cash payments.

21

I. | Executory Contracts and Unexpired Leases |

As of the Petition Date, the Debtors were parties to or held thousands of oil and gas leases and interests in oil and gas leases in numerous forms, including surface leases, subsurface leases, rights of way, easements, real property licenses, royalty interests, net profits interests, overriding royalty interests, and similar agreements (collectively, the “Oil and Gas Leases”).

By Order dated August 22, 2016, the initial 120-day period for the Debtors to assume, assign, or reject unexpired leases of nonresidential real property was extended through December 12, 2016 (ECF No. 447). On November 23, 2016, the Debtors filed a motion to assume all unexpired leases of nonresidential real property (including all oil and gas leases) not previously assumed or rejected (ECF No. 765). On December 13, 2016, the Bankruptcy Court entered an Order granting the Debtors’ motion to assume substantially all unexpired nonresidential real property leases not previously assumed or rejected and subject to section 365 of the Bankruptcy Code, including all Oil and Gas Leases (and other than certain federal or tribal oil and gas leases) (ECF No. 838). Pursuant to a stipulation with the United States government (ECF No. 815), the deadline to assume or reject unexpired leases of nonresidential real property on federal or tribal lands was extended to the date on which the Bankruptcy Court enters an Order confirming the Plan.

During the Chapter 11 Cases, the Debtors have filed motions to reject certain leases of nonresidential real property. On July 6, 2016, the Debtors filed a motion to reject a certain lease for premises located at 600 Travis Street, Houston Texas, effective as of May 31, 2016 (ECF No. 234). After the Debtors resolved the landlord’s objection (ECF No. 265), the Bankruptcy Court entered an Order approving the rejection on November 30, 2016 (ECF No. 772). On September 1, 2016, the Debtors filed a motion to, among other things, reject a lease located at 1401 McKinney Street, Houston, Texas (ECF No. 478) and on September 23, 2016, the Bankruptcy Court entered an Order approving, among other things, such rejection (ECF No. 478).

J. | Second Lien Proof of Claim and Disputes Related Thereto |

The Plan incorporates and reflects a global compromise and settlement of issues related to the Debtors’ prepetition indebtedness, including certain issues raised in the Chapter 11 Cases as to the aggregate amount of the Allowed Claim held by the Second Lien Noteholders and the enforceability of certain liens securing such claims.

As described in Section II(C)(2)(b), on April 8, 2015, the Debtors closed a private offering of approximately $650 million of Secured Notes. The Secured Notes are secured by a second priority lien on substantially all of the Debtors’ assets, and under the agreements relating to the issuance of the Secured Notes, EIG Redwood Equity Aggregator LP (“EIG”) was permitted to appoint a seat on the board of Breitburn GP LLC, the general partner of BBEP. On October 10, 2016, the trustee for the Secured Notes filed proof of claim 1855 (the “Second Lien Proof of Claim”), which asserted Secured Notes Claims of approximately $793.3 million, including: (a) $650 million in outstanding principal amount of Secured Notes, (b) unpaid interest on the Secured Notes of approximately $7.5 million, and (c) a make-whole or prepayment premium of approximately $134 million, plus interest on all other Obligations (as defined in the Secured Notes Indenture), fees, costs, and indemnities.

22

On December 19, 2016, the Creditors’ Committee (a) objected to the Second Lien Proof of Claim on the basis that the make-whole claim asserted by the Second Lien Noteholders is not allowable because, among other reasons, the holders of Secured Notes may be reinstated and that it overcompensates the Second Lien Noteholders if they also receive postpetition interest, (b) sought conditional standing to prosecute certain claims relating to certain mortgages securing the Secured Notes on the basis that such mortgages constituted preferential transfers under the Bankruptcy Code or applicable state law, and, therefore, were subject to avoidance; and (c) sought clarification that the stipulations in the final order authorizing the Debtors to obtain postpetition senior secured superpriority financing, authorizing the Debtors’ limited use of cash collateral, and granting adequate protection to the prepetition secured parties (“Final DIP Order,” ECF No. 431) did not apply to estate claims against the Debtors’ current or former directors and officers (the “Standing Motion and Claim Objection,” ECF No. 867).

Various responsive pleadings have been filed to the Standing Motion and Claim Objection by parties in interest, including by the Revolving Credit Facility Agent and the DIP Facility Agent (ECF No. 1082), the Equity Committee (ECF No. 1084), the Secured Notes Indenture Trustee (ECF No. 1085), certain of the Second Lien Noteholders (the “Second Lien Group’s Objection to Standing Motion and Claim Objection,” ECF No. 1083), and the Debtors (“Debtors’ Objections to Standing Motion and Claim Objection,” ECF No. 1086).

In the Second Lien Group’s Objection to Standing Motion and Claim Objection, the responding Second Lien Noteholders asserted that the Creditors’ Committee claims were meritless, the Creditors’ Committee’s objection to the Second Lien Proof of Claim was premature, and the Creditors’ Committee’s request for clarification was untimely. Specifically, the responding Second Lien Noteholders argued that none of the claims the Creditors’ Committee sought conditional standing to pursue had merit: (a) the mortgages the Creditors’ Committee sought to avoid as preferential transfers were protected from avoidance under section 546(e) of the Bankruptcy Code as transfers to a financial institution in connection with a securities contract; (b) the transfers were made more than 90 days before the Petition Date; and (c) the Creditors’ Committee had offered no basis to support their claim that EIG was an insider of the Debtors at the time of the alleged preference. The responding Second Lien Noteholders also argued that none of the Creditors’ Committee’s other claims asserted against the Second Lien Noteholders as a whole had any merit: (a) the Creditors’ Committee contended that certain mortgages securing the Second Lien Notes were improperly perfected, but made no effort to identify the allegedly defective mortgages; (b) although the Creditors’ Committee had otherwise failed to identify specific liens subject to a defect or what those alleged defects were; and (c) the Creditors’ Committee’s claim that certain of the Debtors’ assets were unencumbered could be resolved by stipulation and not litigation. Finally, the responding Second Lien Noteholders asserted that the Creditors’ Committee’s objection to the make-whole claim was premised on contingencies that would be addressed through plan negotiations and confirmation proceedings, and therefore was not ripe for adjudication.

In the Debtors’ Objection to Standing Motion and Claim Objection, the Debtors likewise objected to the Standing Motion and Claim Objection, arguing that it was premature. Specifically, the Debtors asserted that the Standing Motion and Claim Objection, by its own admission, was premature because the Creditors’ Committee specifically stated that it was not seeking to commence litigation against any defendant at the time. Even if the Standing Motion and Claim Objection was not

23