Attached files

| file | filename |

|---|---|

| EX-31.1 - Breitburn Energy Partners LP | exhibit31_1.htm |

| EX-32.2 - Breitburn Energy Partners LP | exhibit32_2.htm |

| EX-32.1 - Breitburn Energy Partners LP | exhibit32_1.htm |

| EX-10.3 - Breitburn Energy Partners LP | exhibit10_3.htm |

| EX-32.3 - Breitburn Energy Partners LP | exhibit32_3.htm |

| EX-31.2 - Breitburn Energy Partners LP | exhibit31_2.htm |

| EX-31.3 - Breitburn Energy Partners LP | exhibit31_3.htm |

UNITED

STATES SECURITIES AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Form

10-Q

R Quarterly Report Pursuant To Section

13 or 15(d) of the Securities Exchange Act Of 1934

For

the quarterly period ended September 30, 2009

or

£ Transition Report Pursuant To Section

13 or 15(d) of the Securities Exchange Act Of 1934

For

the transition period from ___ to ___

Commission

File Number 001-33055

BreitBurn

Energy Partners L.P.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

74-3169953

|

|

(State

or other jurisdiction of

|

(I.R.S.

Employer

|

|

incorporation

or organization)

|

Identification

Number)

|

|

515

South Flower Street, Suite 4800

|

|

|

Los

Angeles, California

|

90071

|

|

(Address

of principal executive offices)

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (213) 225-5900

Indicate by check mark

whether the registrant (1) has filed all reports required to be filed by Section

13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12

months (or for such shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for the past 90

days. Yes þ No

£

Indicate

by check mark whether the registrant has submitted electronically and posted on

its corporate Web site, if any, every Interactive Data File required to be

submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this

chapter) during the preceding 12 months (or for such shorter period that the

registrant was required to submit and post such files). Yes £ No

£ (not yet

applicable to registrant)

Indicate

by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer. See definition of “accelerated

filer and large accelerated filer” in Rule 12b-2 of the Exchange

Act. (Check one):

|

Large

accelerated filer þ

|

Accelerated

filer o

|

|

Non-accelerated

filer o

(Do

not check if a smaller reporting company)

|

Smaller

reporting company o

|

Indicate

by check mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act).

Yes £ No

R

As of

November 6, 2009, the registrant had 52,784,201 Common Units

outstanding.

|

INDEX

|

||

|

Page

|

||

|

No.

|

||

|

FINANCIAL

INFORMATION

|

||

|

OTHER

INFORMATION

|

||

|

|

|

|

|

|

||

CAUTIONARY STATEMENT RELEVANT TO FORWARD-LOOKING

INFORMATION

Forward-looking

statements are included in this report and may be included in other public

filings, press releases, our website and oral and written presentations by

management. Statements other than historical facts are

forward- looking and may be identified by words such as “believes,”

“estimates,” “impact,” “future,” “projection,” “forecasts,” “affect,”

“restrict,” “result,” “expand,” “pursue,” “engage,” “could,” “will,” variations

of such words and words of similar meaning. These statements are not

guarantees of future performance and are subject to certain risks, uncertainties

and other factors, some of which are beyond our control and are difficult to

predict. Therefore, actual outcomes and results may differ materially

from what is expressed or forecasted in such forward-looking

statements. The reader should not place undue reliance on these

forward-looking statements, which speak only as of the date of this

report.

Among the

important factors that could cause actual results to differ materially from

those in the forward-looking statements are changes in crude oil and natural gas

prices; a significant reduction in the borrowing base under our bank credit

facility; the impact of the current economic downturn on our business

operations, financial condition and ability to raise capital; our level of

indebtedness; the ability of financial counterparties to perform their

obligations under existing agreements; delays in planned or expected drilling;

the discovery of previously unknown environmental issues; the competitiveness of

alternate energy sources or product substitutes; technological developments; the

uncertainty related to the litigation instituted by Quicksilver against us;

potential disruption or interruption of our net production due to accidents or

severe weather; the effects of changed accounting rules under generally accepted

accounting principles promulgated by rule-setting bodies; and the factors set

forth under “Cautionary Statement Relevant to Forward Looking Information” and

Part I—Item 1A. “—Risk Factors’’ of our Annual Report on Form 10-K for the year

ended December 31, 2008 (the “Annual Report”), Part II —Item 1A of our Quarterly

Reports on Form 10-Q for the quarters ended March 31, 2009 and June 30, 2009,

and in Part II—Item 1A of this report. Unpredictable or unknown

factors not discussed herein also could have material adverse effects on

forward-looking statements.

All

forward-looking statements, expressed or implied, included in this report

and attributable to us are expressly qualified in their entirety by this

cautionary statement. This cautionary statement should also be

considered in connection with any subsequent written or oral forward-looking

statements that we or persons acting on our behalf may

issue.

We

undertake no obligation to update the forward-looking statements in this report

to reflect future events or circumstances.

Available

Information

Our

internet website address is www.breitburn.com. We make available,

free of charge at the “Investor Relations” portion of our website, our annual

reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form

8-K and all amendments to those reports filed or furnished pursuant to Section

13(a) or 15(d) of the Securities Exchange Acts of 1934, as amended, as soon

as reasonably practicable after such reports are electronically filed

with, or furnished to, the Securities and Exchange Commission

(“SEC”). The information contained on our website does not constitute

part of this report.

1

The

following is a description of the meanings of some of the oil and gas industry

terms that may be used in this report. The definition of proved

reserves has been abbreviated from the applicable definitions contained in

Rule 4-10(a)(2-4) of Regulation S-X.

Bbl: One

stock tank barrel, or 42 U.S. gallons liquid volume, of crude oil or other

liquid hydrocarbons.

Bbl/d: Bbl

per day.

Boe: One

barrel of oil equivalent, determined using a ratio of six Mcf of natural gas to

one Bbl of crude oil.

Boe/d: Boe

per day.

Btu: British

thermal unit, which is the quantity of heat required to raise the temperature of

a one-pound mass of water by one degree Fahrenheit.

exploitation: A

drilling or other project which may target proven or unproven reserves (such as

probable or possible reserves), but which generally has a lower risk than that

associated with exploration projects.

field: An

area consisting of a single reservoir or multiple reservoirs, all grouped on or

related to the same individual geological structural feature and/or

stratigraphic condition.

LIBOR: London

Interbank Offered Rate.

MichCon: Michigan Consolidated Gas

Company.

MBbls: One

thousand barrels of crude oil or other liquid hydrocarbons.

MBoe: One

thousand barrels of crude oil equivalent.

MBoe/d: MBoe

per day.

Mcf: One

thousand cubic feet of natural gas.

MMcf: One

million cubic feet of natural gas.

MMcfe: One

million cubic feet of natural gas equivalent, determined using a ratio of one

Bbl of crude oil to six Mcf of natural gas.

MMBtu/d: One

million British thermal units per day.

NGLs: The

combination of ethane, propane, butane and natural gasolines that when removed

from natural gas become liquid under various levels of higher pressure and lower

temperature.

NYMEX: New

York Mercantile Exchange.

oil: Crude

oil, condensate and natural gas liquids.

2

proved

reserves: The estimated quantities of crude oil, natural gas

and natural gas liquids that geological and engineering data demonstrate with

reasonable certainty to be recoverable in future years from known reservoirs

under existing economic and operating conditions. This definition of

proved reserves has been abbreviated from the applicable definitions contained

in Rule 4-10(a)(2-4) of Regulation S-X.

reserve: That

part of a mineral deposit which could be economically and legally extracted or

produced at the time of the reserve determination.

reservoir:

A porous and permeable underground formation containing a natural accumulation

of producible oil and/or natural gas that is confined by impermeable rock or

water barriers and is individual and separate from other reserves.

West Texas

Intermediate (“WTI”): Light, sweet crude oil with high API

gravity and low sulfur content used as the benchmark for U.S. crude oil refining

and trading. WTI is deliverable at Cushing, Oklahoma to fill NYMEX

futures contracts for light, sweet crude oil.

3

_____________________________________

References

in this filing to “the Partnership,” “we,” “our,” “us” or like terms refer to

BreitBurn Energy Partners L.P. and its subsidiaries. References in

this filing to “BEC” or the “Predecessor” refer to BreitBurn Energy Company

L.P., our predecessor, and its predecessors and

subsidiaries. References in this filing to “BreitBurn GP” or the

“General Partner” refer to BreitBurn GP, LLC, our general partner and our

wholly-owned subsidiary as of June 17, 2008. References in this

filing to “Provident” refer to Provident Energy Trust. References in

this filing to “BreitBurn Corporation” refer to BreitBurn Energy Corporation, a

corporation owned by Randall Breitenbach and Halbert Washburn, the Co-Chief

Executive Officers of our general partner. References in this filing

to “BreitBurn Management” refer to BreitBurn Management Company, LLC, our asset

manager and operator, and wholly-owned subsidiary as of June 17,

2008. References in this filing to “BOLP” or “BreitBurn Operating”

refer to BreitBurn Operating L.P., our wholly-owned operating

subsidiary. References in this filing to “BOGP” refer to BreitBurn

Operating GP, LLC, the general partner of BOLP. References in this

filing to “our properties” refer to, as of December 31, 2006, the oil and gas

properties contributed to us and our subsidiaries by BEC in connection with our

initial public offering. These oil and gas properties include certain

fields in the Los Angeles Basin in California, including interests in the Santa

Fe Springs, Rosecrans and Brea Olinda Fields, and the Wind River and Big Horn

Basins in central Wyoming. As of January 1, 2007, “our properties”

include any additional properties that we have acquired since that date. As of

July 1, 2009, “our properties” exclude the Lazy JL Field, which was sold

effective July 1, 2009. References to “Quicksilver” refer to Quicksilver

Resources Inc. from whom we acquired oil and gas properties and facilities in

Michigan, Indiana and Kentucky on November 1, 2007. References in

this filing to “Calumet” refer to Calumet Florida L.L.C., from whom we acquired

certain interests in oil leases and related assets located in Florida on May 24,

2007. References in this filing to “BEPI” refer to BreitBurn Energy

Partners I, L.P. References in this filing to “TIFD” refer to TIFD

X-III LLC, from whom we acquired a 99 percent limited partner interest in BEPI

on May 25, 2007, which owned interests in the Sawtelle and East Coyote oil

fields located in California.

_____________________________________

4

PART I. FINANCIAL INFORMATION

Item 1. Financial

Statements

|

Unaudited

Consolidated Statements of Operations

|

||||||||||||||||

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

|||||||||||||||

|

Thousands

of dollars, except unit amounts

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

Revenues

and other income items:

|

||||||||||||||||

|

Oil,

natural gas and natural gas liquid sales

|

$ | 62,674 | $ | 130,249 | $ | 180,189 | $ | 386,060 | ||||||||

|

Gains

(losses) on commodity derivative instruments, net (note

14)

|

12,719 | 407,441 | (14,520 | ) | (29,228 | ) | ||||||||||

|

Other

revenue, net (note 9)

|

261 | 806 | 930 | 2,324 | ||||||||||||

|

Total

revenues and other income items

|

75,654 | 538,496 | 166,599 | 359,156 | ||||||||||||

|

Operating

costs and expenses:

|

||||||||||||||||

|

Operating

costs

|

33,888 | 41,915 | 100,273 | 118,952 | ||||||||||||

|

Depletion,

depreciation and amortization

|

24,130 | 21,477 | 81,393 | 64,228 | ||||||||||||

|

General

and administrative expenses

|

9,318 | 6,479 | 27,265 | 24,073 | ||||||||||||

|

Loss

on sale of assets (note 4)

|

5,470 | - | 5,470 | - | ||||||||||||

|

Total

operating costs and expenses

|

72,806 | 69,871 | 214,401 | 207,253 | ||||||||||||

|

Operating

income (loss)

|

2,848 | 468,625 | (47,802 | ) | 151,903 | |||||||||||

|

Interest

and other financing costs, net

|

4,549 | 9,021 | 14,682 | 19,569 | ||||||||||||

|

Losses

on interest rate swaps (note 14)

|

3,792 | 2,964 | 5,557 | 3,937 | ||||||||||||

|

Other

income, net

|

(84 | ) | (464 | ) | (124 | ) | (114 | ) | ||||||||

|

Total

other expense

|

8,257 | 11,521 | 20,115 | 23,392 | ||||||||||||

|

Gain

(loss) before taxes

|

(5,409 | ) | 457,104 | (67,917 | ) | 128,511 | ||||||||||

|

Income tax expense (benefit)

(note 5)

|

(13 | ) | 2,599 | (354 | ) | 1,262 | ||||||||||

|

Net

income (loss)

|

(5,396 | ) | 454,505 | (67,563 | ) | 127,249 | ||||||||||

|

Less:

Net income attributable to noncontrolling interest (note

13)

|

(12 | ) | (51 | ) | (14 | ) | (175 | ) | ||||||||

|

Net

income (loss) attributable to the partnership

|

(5,408 | ) | 454,454 | (67,577 | ) | 127,074 | ||||||||||

|

General

partner loss

|

- | - | - | (2,019 | ) | |||||||||||

|

Net

income (loss) attributable to limited partners

|

$ | (5,408 | ) | $ | 454,454 | $ | (67,577 | ) | $ | 129,093 | ||||||

|

Basic

net income (loss) per unit

|

$ | (0.10 | ) | $ | 8.43 | $ | (1.28 | ) | $ | 2.06 | ||||||

|

Diluted

net income (loss) per unit

|

$ | (0.10 | ) | $ | 8.40 | $ | (1.28 | ) | $ | 2.06 | ||||||

|

Weighted

average number of units used to calculate

|

||||||||||||||||

|

Basic

net income (loss) per unit

|

52,770,011 | 53,922,984 | 52,747,861 | 62,604,519 | ||||||||||||

|

Diluted

net income (loss) per unit

|

52,770,011 | 54,071,521 | 52,747,861 | 62,752,289 | ||||||||||||

See

accompanying notes to consolidated financial statements.

5

|

Unaudited

Consolidated Balance Sheets

|

||||||||

|

September

30,

|

December

31,

|

|||||||

|

Thousands

of dollars, except unit amounts

|

2009

|

2008

|

||||||

|

ASSETS

|

||||||||

|

Current

assets:

|

||||||||

|

Cash

|

$ | 2,199 | $ | 2,546 | ||||

|

Accounts

receivable, net

|

38,198 | 47,221 | ||||||

|

Derivative

instruments (note 14)

|

63,249 | 76,224 | ||||||

|

Related

party receivables (note 6)

|

4,744 | 5,084 | ||||||

|

Inventory

(note 7)

|

4,960 | 1,250 | ||||||

|

Prepaid

expenses

|

6,880 | 5,300 | ||||||

|

Intangibles

(note 8)

|

807 | 2,771 | ||||||

|

Other

current assets

|

170 | 170 | ||||||

|

Total

current assets

|

121,207 | 140,566 | ||||||

|

Equity investments (note

9)

|

8,686 | 9,452 | ||||||

|

Property,

plant and equipment

|

||||||||

|

Oil

and gas properties

|

2,046,860 | 2,057,531 | ||||||

|

Non-oil

and gas assets

|

8,145 | 7,806 | ||||||

| 2,055,005 | 2,065,337 | |||||||

|

Accumulated

depletion and depreciation

|

(300,831 | ) | (224,996 | ) | ||||

|

Net

property, plant and equipment

|

1,754,174 | 1,840,341 | ||||||

|

Other

long-term assets

|

||||||||

|

Intangibles

(note 8)

|

125 | 495 | ||||||

|

Derivative

instruments (note 14)

|

97,500 | 219,003 | ||||||

|

Other

long-term assets

|

8,362 | 6,977 | ||||||

|

Total

assets

|

$ | 1,990,054 | $ | 2,216,834 | ||||

|

LIABILITIES

AND EQUITY

|

||||||||

|

Current

liabilities:

|

||||||||

|

Accounts

payable

|

$ | 18,246 | $ | 28,302 | ||||

|

Book

overdraft

|

160 | 9,871 | ||||||

|

Derivative

instruments (note 14)

|

14,770 | 10,192 | ||||||

|

Revenue

distributions payable

|

10,727 | 16,162 | ||||||

|

Salaries

and wages payable

|

6,111 | 6,249 | ||||||

|

Accrued

liabilities

|

14,559 | 9,214 | ||||||

|

Total

current liabilities

|

64,573 | 79,990 | ||||||

|

Long-term

debt (note 10)

|

585,000 | 736,000 | ||||||

|

Deferred

income taxes (note 5)

|

3,385 | 4,282 | ||||||

|

Asset

retirement obligation (note 11)

|

35,692 | 30,086 | ||||||

|

Derivative

instruments (note 14)

|

31,322 | 10,058 | ||||||

|

Other

long-term liabilities

|

2,120 | 2,987 | ||||||

|

Total

liabilities

|

722,092 | 863,403 | ||||||

|

Equity:

|

||||||||

|

Partners'

equity (note 12)

|

1,267,528 | 1,352,892 | ||||||

|

Noncontrolling

interest (note 13)

|

434 | 539 | ||||||

|

Total

equity

|

1,267,962 | 1,353,431 | ||||||

|

Total

liabilities and equity

|

$ | 1,990,054 | $ | 2,216,834 | ||||

|

Common

units outstanding

|

52,770,011 | 52,635,634 | ||||||

See

accompanying notes to consolidated financial statements.

6

|

Unaudited

Consolidated Statements of Cash Flows

|

||||||||

|

Nine

Months Ended

|

||||||||

|

September

30,

|

||||||||

|

Thousands

of dollars

|

2009

|

2008

|

||||||

|

Cash

flows from operating activities

|

||||||||

|

Net

income (loss)

|

$ | (67,563 | ) | $ | 127,249 | |||

|

Adjustments

to reconcile to cash flow from operating activities:

|

||||||||

|

Depletion,

depreciation and amortization

|

81,393 | 64,228 | ||||||

|

Unit

based compensation expense

|

9,736 | 5,192 | ||||||

|

Unrealized

gain (loss) on derivative instruments

|

160,319 | (39,398 | ) | |||||

|

Distributions

greater than income from equity affiliates

|

766 | 772 | ||||||

|

Deferred

income tax

|

(897 | ) | 625 | |||||

|

Amortization

of intangibles

|

2,334 | 2,339 | ||||||

|

Loss

on sale of assets

|

5,470 | - | ||||||

|

Other

|

2,472 | 1,803 | ||||||

|

Changes

in net assets and liablities:

|

||||||||

|

Accounts

receivable and other assets

|

3,590 | 1,463 | ||||||

|

Inventory

|

(3,710 | ) | (2,292 | ) | ||||

|

Net

change in related party receivables and payables

|

340 | 27,614 | ||||||

|

Accounts

payable and other liabilities

|

(10,279 | ) | 1,366 | |||||

|

Net

cash provided by operating activities

|

183,971 | 190,961 | ||||||

|

Cash

flows from investing activities

|

||||||||

|

Capital

expenditures

|

(18,603 | ) | (86,811 | ) | ||||

|

Proceeds

from sale of assets

|

23,034 | - | ||||||

|

Property

acquisitions

|

- | (9,988 | ) | |||||

|

Net

cash provided (used) by investing activities

|

4,431 | (96,799 | ) | |||||

|

Cash

flows from financing activities

|

||||||||

|

Purchase

of common units

|

- | (336,216 | ) | |||||

|

Distributions

|

(28,038 | ) | (93,304 | ) | ||||

|

Proceeds

from the issuance of long-term debt

|

218,475 | 659,093 | ||||||

|

Repayments

of long-term debt

|

(369,475 | ) | (321,493 | ) | ||||

|

Book

overdraft

|

(9,711 | ) | 7,603 | |||||

|

Long-term

debt issuance costs

|

- | (4,974 | ) | |||||

|

Net

cash used by financing activities

|

(188,749 | ) | (89,291 | ) | ||||

|

Increase

(decrease) in cash

|

(347 | ) | 4,871 | |||||

|

Cash

beginning of period

|

2,546 | 5,929 | ||||||

|

Cash

end of period

|

$ | 2,199 | $ | 10,800 | ||||

See

accompanying notes to consolidated financial statements.

7

Notes to Consolidated Financial Statements

1. Organization

and Description of Operations

We are an

independent oil and gas partnership focused on the exploitation, development and

acquisition of oil and gas properties in the United States. We are a

Delaware limited partnership formed on March 23, 2006. Our general

partner is BreitBurn GP, a Delaware limited liability company, also formed on

March 23, 2006, and our wholly-owned subsidiary since June 17,

2008. The board of directors of our General Partner has sole

responsibility for conducting our business and managing our

operations. We conduct our operations through a wholly-owned

subsidiary, BOLP and BOLP’s general partner BOGP. We own all of the

ownership interests in BOLP and BOGP.

Prior to

June 17, 2008, the membership interests in our General Partner were held by

BreitBurn Management. In addition, prior to that date, 95.55 percent

of the membership interests in BreitBurn Management were held by Provident and

the remaining 4.45 percent of the membership interests in BreitBurn Management

were held by BreitBurn Energy Corporation, a California corporation wholly-owned

by the Co-Chief Executive Officers of our General Partner. On June

17, 2008, we, BreitBurn Corporation, BreitBurn Management, Provident and certain

of its subsidiaries completed a series of transactions (the “Purchase,

Contribution and Partnership Transactions”), pursuant to which, among other

things, our General Partner and BreitBurn Management became our wholly-owned

subsidiaries, the economic portion of the General Partner’s 0.66473 percent

general partner interest in us was eliminated and our limited partners were

given a right to nominate and vote in the election of directors to the Board of

Directors of the General Partner. The General Partner has no other

economic interests, does not conduct other operations, and has no assets or

liabilities. See Part I—Item 1 “—Business —Ownership and Structure”

in our Annual Report for a further discussion of the Purchase, Contribution and

Partnership Transactions.

BreitBurn Management manages our assets

and performs other administrative services for us such as accounting, corporate

development, finance, land administration, legal and engineering. See

Note 6 for information regarding our relationship with BreitBurn

Management. In connection with the acquisition of Provident’s ownership in

BEC by Metalmark Capital Partners, Greenhill Capital Partners, a third party

institutional investor and members of senior management, BreitBurn Management

entered into the Second Amended and Restated Administrative Services Agreement

to manage BEC's properties for a term of five years. In addition, we

entered into an Omnibus Agreement with BEC detailing rights with respect to

business opportunities and providing us with a right of first offer with respect

to the sale of assets by BEC.

BreitBurn

Finance Corporation was incorporated under the laws of the State of Delaware on

June 1, 2009, is wholly owned by us, and has no assets or

liabilities. Its activities are limited to co-issuing debt securities

and engaging in other activities incidental thereto.

8

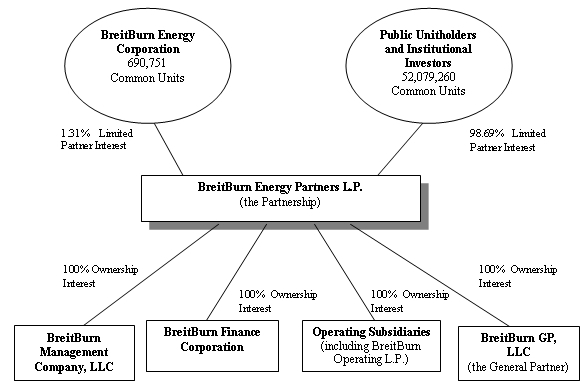

The following diagram depicts our

organizational structure as of September 30, 2009:

2. Basis

of Presentation

The

accompanying unaudited consolidated financial statements have been prepared in

accordance with United States generally accepted accounting principles (“GAAP”)

for interim financial information and with the instructions to Form 10-Q and

Article 10 of Regulation S-X. Accordingly, they do not include all of

the information and footnotes required by GAAP for complete financial

statements. In the opinion of management, all adjustments considered

necessary for a fair statement have been included. Operating results

for the three months and nine months ended September 30, 2009 are not

necessarily indicative of the results that may be expected for the year ending

December 31, 2009. The consolidated balance sheet at December 31,

2008 has been derived from the audited consolidated financial statements at that

date but does not include all of the information and footnotes required by GAAP

for complete financial statements. We follow the successful efforts

method of accounting for oil and gas activities. Depletion,

depreciation and amortization of proved oil and gas properties is computed using

the units-of-production method net of any estimated residual salvage

values. For further information, refer to the consolidated financial

statements and footnotes thereto included in our Annual Report.

9

In the

first quarter of 2009, we began classifying regional operation management

expenses as operating costs rather than general and administrative expenses to

better align our operating and management costs with our organizational

structure and to be more consistent with industry practices. As such,

we have revised classification of these expenses for the three months and nine

months ended September 30, 2008. The reclassification did not affect

previously reported total revenues, net income or net cash provided by operating

activities. The following table reflects all classification changes

for the three months and nine months ended September 30, 2008:

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||

|

Thousands

of dollars

|

September

30, 2008

|

September

30, 2008

|

||||||

|

Operating

costs

|

||||||||

|

As

previously reported

|

$ | 39,515 | $ | 110,210 | ||||

|

District

expense reclass from G&A

|

2,400 | 8,742 | ||||||

|

As

revised

|

$ | 41,915 | $ | 118,952 | ||||

|

G&A

expenses

|

||||||||

|

As

previously reported

|

$ | 8,879 | $ | 32,815 | ||||

|

District

expense reclass to operating costs

|

(2,400 | ) | (8,742 | ) | ||||

|

As

revised

|

$ | 6,479 | $ | 24,073 | ||||

3. Recently

Issued Accounting Standards

We

adopted new accounting standards in the first nine months of 2009 related to

fair value measurements as discussed in Notes 11 and 14, the earnings per share

impact of instruments granted in share-based payment transactions as discussed

in Note 12, noncontrolling interests as discussed in Note 13, disclosures about

derivative instruments and hedging activities as discussed in Note 14,

subsequent events as discussed in Note 17 and business combinations, which we

will apply prospectively to business combinations with acquisition dates after

January 1, 2009.

Financial

Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”)

Topic 105 “Generally Accepted Accounting Principles” establishes the FASB ASC as

the source of authoritative accounting principles recognized by the FASB to be

applied in the preparation of financial statements in conformity with

GAAP. ASC 105 explicitly recognizes rules and interpretive releases

of the SEC under federal securities laws as authoritative GAAP for SEC

registrants. This topic, which has changed the way we reference GAAP,

is effective for financial statements ending after September 15,

2009. This topic does not change GAAP and did not have an impact on

our financial position, results of operations or cash flows.

SEC Release No. 33-8995,

“Modernization of Oil and Gas Reporting” (“Release

33-8995”). In December 2008, the SEC issued Release

33-8995 adopting new rules for reserves estimate calculations and related

disclosures. The new reserve estimate disclosures apply to all annual

reports for fiscal years ending on or after December 31, 2009 and thereafter,

and to all registration statements filed after that date. The new

rules do not permit companies to voluntarily comply at an earlier

date. The revised proved reserve definition incorporates a new

definition of “reasonable certainty” using the PRMS (Petroleum Resource

Management System) standard of “high degree of confidence” for deterministic

method estimates, or a 90 percent recovery probability for probabilistic methods

used in estimating proved reserves. The new rules also permit a company to

establish undeveloped reserves as proved with appropriate degrees of reasonable

certainty established absent actual production tests and without artificially

limiting such reserves to spacing units adjacent to a producing well. For

reserve reporting purposes, the new rules also replace the end-of-the-year oil

and gas reserve pricing with an unweighted average first-day-of-the-month

pricing for the past 12 fiscal months. This would impact depletion

calculations. Costs associated with reserves will continue to be measured on the

last day of the fiscal year. A revised tabular presentation of reserves by

development category, final product type, and oil and gas activity disclosure by

geographic regions and significant fields and a general disclosure of the

internal controls a company uses to assure objectivity in reserves estimation

will be required. We are evaluating the impact Release 33-8995 will

have on our financial position, results of operations or cash flows. The

adoption of Release No. 33-8995 is expected to have a material impact, which

cannot be quantified at this point, on the calculation of our crude oil and

natural gas reserves.

10

Accounting Standards Update (“ASU”) 2009-05, “Fair Value Measurement and Disclosure: Measuring Liabilities at Fair Value” (“ASU 2009-05” or ASC 820-10). In August 2009, the FASB issued ASU 2009-05 (ASC 820-10) to provide clarification on measuring liabilities at fair value when a quoted price in an active market is not available. In particular, ASU 2009-05 specifies that a valuation technique should be applied that uses either the quote of the liability when traded as an asset, the quoted prices for similar liabilities when traded as assets, or another valuation technique consistent with existing fair value measurement guidance. ASU 2009-05 (ASC 820-10) is prospectively effective for financial statements issued for interim or annual periods ending after October 1, 2009. We do not expect the adoption of ASU 2009-05 (ASC 820-10) to have an impact our financial position, results of operations or cash flows.

4. Disposition

of Assets

On July

17, 2009, we sold the Lazy JL Field located in the Permian Basin of West Texas

to a private buyer for $23 million in cash. This transaction was

effective July 1, 2009. The proceeds from this transaction were used

to reduce our outstanding borrowings under our credit facility. In

connection with the sale, the borrowing base under our credit facility was

reduced by $3 million to $732 million.

The Lazy

JL Field properties produced approximately 249 Boe per day during the first six

months of 2009. 96 percent of the production was crude

oil. As of December 31, 2008, these assets contained estimated proved

reserves of 1.2 MMBoe, or approximately 1 percent of our total estimated proved

reserves of 103.6 MMBoe. The net carrying value at the date of sale

was $28.5 million, of which $28.7 million was reflected in net property, plant

and equipment on the balance sheet and $0.2 million was reflected in asset

retirement obligation on the balance sheet. We recognized a loss of

$5.5 million in the third quarter of 2009 related to the sale of the Lazy JL

Field.

5. Income Taxes

The

following tables present our income tax expense or benefit during the three

months and nine months ended September 30, 2009 and 2008 as well as our deferred

income tax liability at September 30, 2009 and December 31,

2008:

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

|||||||||||||||

|

Thousands

of dollars

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

Federal

current tax expense

|

$ | 407 | $ | 146 | $ | 432 | $ | 138 | ||||||||

|

Deferred

federal tax expense (benefit) (a)

|

(276 | ) | 2,315 | (946 | ) | 725 | ||||||||||

|

State

income tax expense (benefit) (b)

|

(144 | ) | 138 | 160 | 399 | |||||||||||

|

Total

income tax expense (benefit)

|

$ | (13 | ) | $ | 2,599 | $ | (354 | ) | $ | 1,262 | ||||||

|

As

of

|

||||||||

|

Thousands

of dollars

|

September

30, 2009

|

December

31, 2008

|

||||||

|

Deferred

income tax liability (a)

|

$ | 3,385 | $ | 4,282 | ||||

(a)

Related to Phoenix Production Company, a tax-paying corporation and our

wholly-owned subsidiary.

(b)

Related to various forms of state taxes imposed on profit margin or net income,

primarily in Michigan and California.

6. Related Party Transactions

BreitBurn Management operates our

assets and performs other administrative services for us such as accounting,

corporate development, finance, land administration, legal and

engineering. All of our employees, including our executives, are

employees of BreitBurn Management. Prior to June 17, 2008, BreitBurn

Management provided services to us and to BEC, and allocated its expenses

between the two entities. On June 17, 2008, in connection with the

Purchase, Contribution and Partnership Transactions, BreitBurn Management became

our wholly-owned subsidiary and entered into an Amended and Restated

Administrative Services Agreement with BEC, pursuant to which BreitBurn

Management agreed to continue to provide administrative services to BEC, in

exchange for a monthly fee of approximately $775,000 for indirect

expenses.

11

Beginning

on June 17, 2008, all of the costs charged to BOLP are consolidated with our

results. On August 26, 2008, BreitBurn Management entered into the

Second Amended and Restated Administrative Services Agreement (the

“Administrative Services Agreement”) to manage BEC's properties for a term of

five years. In addition to the monthly fee, BreitBurn Management

charges BEC for all direct expenses including incentive plan costs and direct

payroll and administrative costs related to BEC properties and

operations. The monthly fee is contractually based on an annual

projection of anticipated time spent by each employee who provides services to

both us and BEC during the ensuing year and is subject to renegotiation annually

by the parties during the term of the agreement. For 2009, each

BreitBurn Management employee estimated his or her time allocation independently

based on 2008. These estimates were then reviewed and approved by

each employee’s manager or supervisor. The results of this process

were provided to both the audit committee of the board of directors of our

General Partner (composed entirely of independent directors) (the “audit

committee”) and the board of representatives of BEC’s parent (the “BEC

board”). The audit committee and the non-management members of the

BEC board agreed on the 2009 monthly fee as provided in the Administrative

Services Agreement. Effective January 1, 2009, the monthly fee was

renegotiated to $500,000. The reduction in the monthly fee is

attributable to the overall reduction in general and administrative expenses,

excluding unit-based compensation, for BreitBurn Management for 2009, the new

time allocation study described above and the fact that additional costs are

being charged separately to us and BEC compared to prior years.

In addition, we entered into an Omnibus

Agreement with BEC detailing rights with respect to business opportunities and

providing us with a right of first offer with respect to the sale of assets by

BEC.

At

September 30, 2009 and December 31, 2008, we had current receivables of $4.0

million and $4.4 million, respectively, due from BEC related to the

Administrative Services Agreement, outstanding liabilities for employee related

costs and oil and gas sales made by BEC on our behalf from certain

properties. During the first nine months of 2009, the monthly charges

to BEC for indirect expenses totaled $4.5 million and charges for direct

expenses including direct payroll and administrative costs totaled $3.5

million. For the three months and nine months ended September 30,

2009, total oil and gas sales made by BEC on our behalf were approximately $0.4

million and $0.9 million, respectively. For the three months and nine

months ended September 30, 2008, total oil and gas sales made by BEC on our

behalf were approximately $0.6 million and $1.8 million,

respectively. At September 30, 2009, we had receivables of $0.5

million due from equity investments.

Pursuant

to a transition services agreement through March 2008, Quicksilver provided to

us services for accounting, land administration, and marketing and charged us

$0.9 million for the first quarter of 2008. These charges were

included in general and administrative expenses on the consolidated statements

of operations. Quicksilver also buys natural gas from us in

Michigan. For the three months and nine months ended September 30,

2009, total net gas sales to Quicksilver were approximately $0.5 million and

$2.1 million respectively. For the three months and nine months ended

September 30, 2008, total net gas sales to Quicksilver were approximately $1.7

million and $6.4 million respectively. The related receivables were

$0.2 million at September 30, 2009 and $0.6 million as of December 31,

2008.

7. Inventory

Our crude

oil inventory from our Florida operations at September 30, 2009 and December 31,

2008 was $5.0 million and $1.3 million, respectively. In the nine

months ended September 30, 2009, we sold 388 gross MBbls of crude oil and

produced 460 gross MBbls of crude oil from our Florida

operations. Inventory additions are stated at cost and represent our

production costs. We match production expenses with crude oil

sales. Production expenses associated with unsold crude oil inventory

are recorded to inventory. Crude oil sales are a function of the

number and size of crude oil shipments in each quarter and thus crude oil sales

do not always coincide with volumes produced in a given quarter.

For our

properties in Florida, there are a limited number of alternative methods of

transportation for our production. Substantially all of our oil

production is transported by pipelines, trucks and barges owned by third

parties. The inability or unwillingness of these parties to provide

transportation services for a reasonable fee could result in our having to find

transportation alternatives, increased transportation costs, or involuntary

curtailment of our oil production in Florida, which could have a negative impact

on our future consolidated financial position, results of operations or cash

flows.

12

8. Intangibles

In May

2007, we acquired certain interests in Florida oil leases and related assets

through the acquisition of a limited liability company from

Calumet. As part of this acquisition we assumed certain crude oil

sales contracts for the remainder of 2007 and for 2008 through

2010. A $3.4 million intangible asset was established to value the

portion of the crude oil contracts that were above market at closing in the

purchase price allocation. Realized gains or losses from these

contracts being recognized as part of oil sales and the intangible asset is

being amortized over the life of the contracts. As of September 30,

2009, our intangible asset related to the crude oil sales contracts was $0.7

million, of which $0.1 million is reflected in long-term intangibles on the

consolidated balance sheet.

In

November 2007, we acquired oil and gas properties and facilities located in

Michigan, Indiana and Kentucky from Quicksilver. Included in the

Quicksilver purchase price was a $5.2 million intangible asset related to

retention bonuses. In connection with the acquisition, we entered

into an agreement with Quicksilver which provides for Quicksilver to fund

retention bonuses payable to 139 former Quicksilver employees in the event these

employees remain continuously employed by BreitBurn Management from November 1,

2007 through November 1, 2009 or in the event of termination without cause,

disability or death. Amortization expense of $0.5 million and $1.6

million for the three months and nine months ended September 30, 2009 is

included in the operating costs line on the consolidated statements of

operations. For the same periods of 2008, $0.5 million and $1.6

million of amortization expense related to Quicksilver retention bonuses was

included in operating costs. As of September 30, 2009, our intangible

asset related to Quicksilver retention bonuses was $0.2 million, reflected in

current intangibles on the consolidated balance sheet.

9. Equity

Investments

We had

equity investments at September 30, 2009 and December 31, 2008 of $8.7 million

and $9.5 million, respectively. These investments are reported in the

“Equity investments” line on the consolidated balance sheets and primarily

represent investments in natural gas processing facilities. For the

three months and nine months ended September 30, 2009, we recorded an immaterial

amount and $0.1 million respectively, in earnings from equity investments and an

immaterial amount and $0.7 million respectively, in dividends. For

the three months and nine months ended September 30, 2008, we recorded $0.1

million and $0.6 million, respectively, in earnings from equity

investments. Amounts recorded for dividends during the three months

and nine months ended September 30, 2008 were $1.1 million and $1.2 million,

respectively. Earnings from equity investments are reported in the

“Other revenue, net” line on the consolidated statements of

operations.

10. Long-Term

Debt

On

November 1, 2007, in connection with the Quicksilver Acquisition, BOLP, as

borrower, and we and our wholly-owned subsidiaries, as guarantors, entered into

a four-year, $1.5 billion amended and restated revolving credit facility with

Wells Fargo Bank, N.A., Credit Suisse Securities (USA) LLC and a syndicate of

banks (the “Amended and Restated Credit Agreement”). The initial

borrowing base of the Amended and Restated Credit Agreement was $700 million and

was increased to $750 million on April 10, 2008.

On June

17, 2008, in connection with the Purchase, Contribution and Partnership

Transactions, we and our wholly-owned subsidiaries entered into the First

Amendment to the Amended and Restated Credit Agreement (“Amendment No. 1 to the

Credit Agreement”), with Wells Fargo Bank, National Association, as

administrative agent (the “Agent”). Amendment No. 1 to the Credit

Agreement increased the borrowing base available under the Amended and Restated

Credit Agreement, from $750 million to $900 million. In addition,

Amendment No. 1 to the Credit Agreement enacted certain additional amendments,

waivers and consents to the Amended and Restated Credit Agreement and the

related Security Agreement, dated November 1, 2007, among BOLP, certain of its

subsidiaries and the Agent, necessary to permit the Amendment No. 1 to the First

Amended and Restated Limited Partnership Agreement and the transactions

consummated in the Purchase, Contribution and Partnership

Transactions. Under Amendment No. 1 to the Credit Agreement, the

interest margins applicable to borrowings, the letter of credit fee and the

commitment fee under the Amended and Restated Credit Agreement were increased by

amounts ranging from 12.5 to 25 basis points.

In

January 2009, we monetized certain in-the-money commodity hedges for

approximately $46 million, the net proceeds of which were used to reduce

outstanding borrowings under our credit facility. In April 2009, in

connection with a scheduled redetermination, our borrowing base under our

Amended and Restated Credit Agreement was redetermined at $760

million. In June 2009, we monetized additional in-the-money commodity

hedges for approximately $25 million, the net proceeds of which were used to

reduce outstanding borrowings under our credit facility. As a result

of the monetization, our borrowing base was reset at $735 million.

13

On July

17, 2009, we sold the Lazy JL Field for $23 million in cash. The

proceeds from this transaction were used to reduce outstanding borrowings under

our credit facility and our borrowing base was reduced by $3 million to $732

million.

In

October 2009, in connection with our semi-annual borrowing base redetermination,

our borrowing base was reaffirmed at $732 million (see Note 17).

As of

September 30, 2009 and December 31, 2008, we had approximately $585.0 million

and $736.0 million, respectively, in indebtedness outstanding under the Amended

and Restated Credit Agreement. The credit facility will mature on

November 1, 2011. At September 30, 2009, the 1-month LIBOR interest

rate plus an applicable spread was 2.000 percent on the 1-month LIBOR portion of

$484.0 million, the 6-month LIBOR interest rate plus an applicable spread was

3.210 percent on the 6-month LIBOR portion of $100.0 million and the prime rate

plus an applicable spread was 4.000 percent on the prime debt portion of $1.0

million. The amounts reported on

our consolidated balance sheets for long-term debt approximate fair value due to

the variable nature of our interest rates.

The

credit facility contains customary covenants, including restrictions on our

ability to: incur additional indebtedness; make certain investments, loans or

advances; make distributions to our unitholders (including the restriction on

our ability to make distributions unless after giving effect to such

distribution, our outstanding debt is less than 90 percent of the borrowing

base, and we have the ability to borrow at least 10 percent of the borrowing

base while remaining in compliance with all terms and conditions of our credit

facility, including the leverage ratio not exceeding 3.50 to 1.00 (which is

total indebtedness to EBITDAX); make dispositions or enter into sales and

leasebacks; or enter into a merger or sale of our property or assets, including

the sale or transfer of interests in our subsidiaries.

As of

September 30, 2009 and December 31, 2008, we were in compliance with the credit

facility’s covenants. At September 30, 2009 and December 31, 2008, we

had $0.3 million in letters of credit outstanding.

Our

interest expense is detailed in the following table:

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

|||||||||||||||

|

Thousands

of dollars

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

Credit

agreement (including commitment fees)

|

$ | 3,726 | $ | 8,202 | $ | 12,213 | $ | 17,793 | ||||||||

|

Amortization

of discount and deferred issuance costs

|

823 | 819 | 2,469 | 1,776 | ||||||||||||

|

Total

|

$ | 4,549 | $ | 9,021 | $ | 14,682 | $ | 19,569 | ||||||||

|

Cash

paid for interest (including realized gains/losses on interest rate

swaps)

|

$ | 7,136 | $ | 8,842 | $ | 21,521 | $ | 18,916 | ||||||||

14

11. Asset

Retirement Obligation

Our asset

retirement obligation is based on our net ownership in wells and facilities and

our estimate of the costs to abandon and remediate those wells and facilities as

well as our estimate of the future timing of the costs to be

incurred. Payments to settle asset retirement obligations occur over

the operating lives of the assets, estimated to be from 7 to 50

years. Estimated cash flows have been discounted at our credit

adjusted risk free rate of 7 percent and adjusted for inflation using a rate of

2 percent. Our credit adjusted risk free rate is calculated based on

our cost of borrowing adjusted for the effect of our credit standing and

specific industry and business risk.

ASC 820

“Fair Value Measurements and

Disclosures” establishes a fair value hierarchy that prioritizes the

inputs to valuation techniques into three broad levels based upon how observable

those inputs are. The highest priority of Level 1 is given to unadjusted

quoted prices in active markets for identical assets or liabilities. Level

2 includes inputs other than quoted prices that are included in Level 1 and can

be derived by observable data, including third party data providers. These

inputs may also include observable transactions in the market place. Level

3 is given to unobservable inputs. We consider the inputs to our asset

retirement obligation valuation to be Level 3 as fair value is determined using

discounted cash flow methodologies based on standardized inputs that are not

readily observable in public markets.

Changes

in the asset retirement obligation for the nine months ended September 30, 2009

and the year ended December 31, 2008 are presented in the following

table:

|

|

|

|||||||

|

Nine

Months Ended

|

Year

Ended

|

|||||||

|

Thousands

of dollars

|

September

30, 2009

|

December

31, 2008

|

||||||

|

Carrying

amount, beginning of period

|

$ | 30,086 | $ | 27,819 | ||||

|

Liabilities

settled in the current period

|

- | (1,054 | ) | |||||

|

Revisions

(a)

|

4,073 | 1,363 | ||||||

|

Acquisitions

(dispositions) (b)

|

(252 | ) | - | |||||

|

Accretion

expense

|

1,785 | 1,958 | ||||||

|

Carrying

amount, end of period

|

$ | 35,692 | $ | 30,086 | ||||

|

(a)

Increased cost estimates and revisions to reserve life.

|

||||||||

|

(b)

Relates to disposition of Lazy JL field.

|

||||||||

12. Partners’

Equity

At

September 30, 2009, we had 52,770,011 Common Units outstanding representing

limited partner interests in us (“Common Units”), and at December 31, 2008, we

had 52,635,634 Common Units outstanding.

At

September 30, 2009 and December 31, 2008, we had 6,700,000 units authorized for

issuance under our long-term incentive compensation plans. At

September 30, 2009 and December 31, 2008, there were 2,960,731 and 1,422,171,

respectively, of partnership-based units outstanding that are eligible to be

paid in Common Units upon vesting.

Earnings

per Common Unit

ASC 260 “Earnings per Share” requires

use of the “two-class” method of computing earnings per unit for all periods

presented. The “two-class” method is an earnings allocation formula

that determines earnings per unit for each class of Common Unit and

participating security as if all earnings for the period had been

distributed. Unvested restricted unit awards that earn

non-forfeitable dividend rights qualify as participating securities and,

accordingly, are included in the basic computation. Our unvested

restricted phantom units (“RPUs”) and convertible phantom units (“CPUs”)

participate in dividends on an equal basis with Common Units; therefore, there

is no difference in undistributed earnings allocated to each participating

security. Accordingly, the presentation below is prepared on a

combined basis and is presented as earnings per Common Unit.

15

The following is a reconciliation of

net earnings and weighted average units for calculating basic net earnings per

Common Unit and diluted net earnings per Common Unit. For the three

months and nine months ended September 30, 2009, RPUs and CPUs have been

excluded from the calculation of basic earnings per unit, as we were in a net

loss position.

|

Three

Months Ended

|

Nine

Months Ended

|

|||||||||||||||

|

September

30,

|

September

30,

|

|||||||||||||||

|

Thousands

of dollars, except unit amounts

|

2009

|

2008

|

2009

|

2008

|

||||||||||||

|

Net

income (loss) attributable to limited partners

|

$ | (5,408 | ) | $ | 454,454 | $ | (67,577 | ) | $ | 129,093 | ||||||

|

Distributions

on participating units not expected to vest

|

- | 6 | 24 | 16 | ||||||||||||

|

Net

income (loss) attributable to common unitholders and participating

securities

|

$ | (5,408 | ) | $ | 454,460 | $ | (67,553 | ) | $ | 129,109 | ||||||

|

Weighted

average number of units used to calculate basic and diluted net income

(loss) per unit:

|

||||||||||||||||

|

Common

Units

|

52,770,011 | 52,635,634 | 52,747,861 | 61,455,638 | ||||||||||||

|

Participating

securities (a)

|

- | 1,287,350 | - | 1,148,880 | ||||||||||||

|

Denominator

for basic earnings per Common Unit

|

52,770,011 | 53,922,984 | 52,747,861 | 62,604,519 | ||||||||||||

|

Dilutive

units (b)

|

- | 148,537 | - | 147,770 | ||||||||||||

|

Denominator

for diluted earnings per Common Unit

|

52,770,011 | 54,071,521 | 52,747,861 | 62,752,289 | ||||||||||||

|

Net

income (loss) per common unit

|

||||||||||||||||

|

Basic

|

$ | (0.10 | ) | $ | 8.43 | $ | (1.28 | ) | $ | 2.06 | ||||||

|

Diluted

|

$ | (0.10 | ) | $ | 8.40 | $ | (1.28 | ) | $ | 2.06 | ||||||

|

(a)

The three and nine months ended September 30, 2009 exclude 2,848,962 and

2,599,438 potentially issuable weighted average RPUs and CPUs from

participating securities, as we were in a loss position. For the

three months and nine months ended September 30, 2008, basic earnings per

unit is based upon the weighted average number of Common Units outstanding

plus the weighted average number of potentially issuable RPUs and

CPUs.

|

||||||||||||||||

|

(b)

The three months and nine months ended September 30, 2009, exclude 106,280

and 105,460 weighted average anti-dilutive units from the calculation of

the denominator for diluted earnings per Common Unit. The three

months and nine months ended September 30, 2008 includes dilutive units

potentially issuable under compensation plans.

|

||||||||||||||||

Cash

Distributions

On

February 13, 2009, we paid a cash distribution of approximately $27.4

million to our common unitholders of record as of the close of business on

February 9, 2009. The distribution that was paid to unitholders was

$0.52 per Common Unit. During the three months ended March 31, 2009,

we also paid cash equivalent to the distribution paid to our unitholders of $0.7

million to holders of outstanding Restricted Phantom Units and Convertible

Phantom Units issued under our Long-Term Incentive Plans.

With the

borrowing base redetermination in April 2009 (see Note 10), our borrowings

exceeded 90 percent of the reset borrowing base and, therefore, under the terms

of our credit facility we were restricted from making a distribution for the

first quarter of 2009. Although we were not restricted from making

distributions under the terms of our credit facility for the second and third

quarters of 2009, we elected not to declare distributions in light of total

leverage levels and other factors. We are restricted from paying

distributions under our credit facility unless, after giving effect to such

distribution, our outstanding debt is less than 90 percent of the borrowing base

and we have the ability to borrow at least 10 percent of the borrowing base

while remaining in compliance with all terms and conditions of our credit

facility, including the leverage ratio not exceeding 3.50 to 1.00 (which is

total indebtedness to EBITDAX).

16

13. Noncontrolling

interest

ASC

810“Consolidation”

requires that noncontrolling interests be classified as a component of

equity and establishes reporting requirements that provide sufficient

disclosures that clearly identify and distinguish between the interests of the

parent and the interests of the noncontrolling owners.

On May

25, 2007, we acquired the limited partner interest (99 percent) of BEPI from

TIFD. As such, we are fully consolidating the results of BEPI and

thus are recognizing a noncontrolling interest liability representing the book

value of the general partner’s interests. At September 30, 2009 and

December 31, 2008, the amount of this noncontrolling interest liability was $0.4

million and $0.5 million, respectively.

BEPI’s

general partner interest is held by a wholly owned subsidiary of

BEC. The general partner of BEPI holds a 35 percent reversionary

interest under the existing limited partnership agreement applicable to the

properties. This reversionary interest is expected to occur at a

defined payout, which is estimated to occur in 2013 based on quarter-end price

and cost projections.

14. Financial

Instruments

Fair

Value of Financial Instruments

Our risk

management programs are intended to reduce our exposure to commodity prices and

interest rates and to assist with stabilizing cash flow. Routinely,

we utilize derivative financial instruments to reduce this

volatility. To the extent we have hedged prices for a significant

portion of our expected production through commodity derivative instruments and

the cost for goods and services increase, our margins would be adversely

affected.

Credit

and Counterparty Risk

Financial

instruments which potentially subject us to concentrations of credit risk

consist principally of derivatives and accounts receivable. Our

derivatives expose us to credit risk from counterparties. As of

September 30, 2009, our derivative counterparties were Barclays Bank PLC,

Bank of Montreal, Citibank, N.A, Credit Suisse International, Credit Suisse

Energy LLC, Union Bank, Wells Fargo Bank N.A., JP Morgan Chase Bank N.A., Royal

Bank of Scotland plc, The Bank of Nova Scotia and Toronto-Dominion

Bank. We terminated all derivative financial instruments with Lehman

Brothers on September 19, 2008. Our counterparties are all

lenders under our Amended and Restated Credit Agreement. During

2008, there was extreme volatility and disruption in the capital and credit

markets which reached unprecedented levels. Continued volatility and

disruption may adversely affect the financial condition of our derivative

counterparties. On all transactions where we are exposed to

counterparty risk, we analyze the counterparty's financial condition prior to

entering into an agreement, establish limits, and monitor the appropriateness of

these limits on an ongoing basis. We periodically obtain credit

default swap information on our counterparties. As of September

30, 2009, each of these financial institutions carried an S&P credit rating

of A- or above. Although we currently do not believe we have a specific

counterparty risk with any party, our loss could be substantial if any of these

parties were to default. As of September 30, 2009, our largest

derivative asset balances were with JP Morgan Chase Bank N.A., who accounted for

approximately 61 percent of our derivative asset balances, and Credit Suisse

International and Credit Suisse Energy LLC, who together accounted for

approximately 27 percent of our derivative asset balances.

Commodity

Activities

The

derivative instruments we utilize are based on index prices that may and often

do differ from the actual crude oil and natural gas prices realized in our

operations. These variations often result in a lack of adequate

correlation to enable these derivative instruments to qualify for cash flow

hedges under ASC 815 “Derivatives and

Hedging.” Accordingly, we do not attempt to account for our

derivative instruments as cash flow hedges for financial reporting purposes and

instead recognize changes in the fair value immediately in

earnings. We had a realized gain of $24.3 million and an unrealized

loss of $11.6 million for the three months ended September 30, 2009 relating to

our various market-based commodity contracts. We had a realized gain

of $149.9 million and an unrealized loss of $164.4 million for the nine months

ended September 30, 2009 relating to our various market-based commodity

contracts. We had net financial instruments receivable relating to

our commodity contracts of $127.9 million at September 30, 2009.

17

In

January 2009, we terminated a portion of our 2011 and 2012 crude oil derivative

contracts and replaced them with new contracts with the same counterparty for

the same volumes at market prices. We realized $32.3 million from

this termination. In January 2009, we also terminated a portion of

our 2011 and 2012 natural gas derivative contracts and replaced them with new

contracts with the same counterparty for the same volumes at market

prices. We realized $13.3 million from this

termination. Proceeds from these contracts were used to pay down

outstanding borrowings under our credit facility.

In June

2009, we terminated an additional portion of our 2011 and 2012 crude oil and

natural gas derivative contracts and replaced them with new contracts for the

same volumes at market prices. We realized $18.9 million from the

termination of natural gas derivative contracts and $6.1 million from the

termination of crude oil contracts. Proceeds from these contracts

were used to pay down outstanding borrowings under our credit

facility.

Including the impact of the changes

noted above and new contracts entered into during the quarter ended September

30, 2009, we had the following contracts in place at September 30,

2009:

|

Year

|

||||||||||||||||||||

|

2009

|

2010

|

2011

|

2012

|

2013

|

||||||||||||||||

|

Gas

Positions:

|

||||||||||||||||||||

|

Fixed

Price Swaps:

|

||||||||||||||||||||

|

Hedged

Volume (MMBtu/d)

|

22,362 | 43,869 | 25,955 | 19,129 | 27,000 | |||||||||||||||

|

Average

Price ($/MMBtu)

|

$ | 8.16 | $ | 8.20 | $ | 7.26 | $ | 7.10 | $ | 6.92 | ||||||||||

|

Collars:

|

||||||||||||||||||||

|

Hedged

Volume (MMBtu/d)

|

1,063 | 3,405 | 16,016 | 19,129 | - | |||||||||||||||

|

Average

Floor Price ($/MMBtu)

|

$ | 9.00 | $ | 9.00 | $ | 9.00 | $ | 9.00 | $ | - | ||||||||||

|

Average

Ceiling Price ($/MMBtu)

|

$ | 15.40 | $ | 12.79 | $ | 11.28 | $ | 11.89 | $ | - | ||||||||||

|

Total:

|

||||||||||||||||||||

|

Hedged

Volume (MMMBtu/d)

|

23,424 | 47,275 | 41,971 | 38,257 | 27,000 | |||||||||||||||

|

Average

Price ($/MMBtu)

|

$ | 8.20 | $ | 8.26 | $ | 7.92 | $ | 8.05 | $ | 6.92 | ||||||||||

|

Oil

Positions:

|

||||||||||||||||||||

|

Fixed

Price Swaps:

|

||||||||||||||||||||

|

Hedged

Volume (Bbls/d)

|

1,468 | 2,808 | 2,616 | 2,539 | 3,500 | |||||||||||||||

|

Average

Price ($/Bbl)

|

$ | 70.18 | $ | 81.35 | $ | 66.22 | $ | 67.24 | $ | 76.79 | ||||||||||

|

Participating

Swaps: (a)

|

||||||||||||||||||||

|

Hedged

Volume (Bbls/d)

|

1,205 | 1,993 | 1,439 | - | - | |||||||||||||||

|

Average

Price ($/Bbl)

|

$ | 66.48 | $ | 64.40 | $ | 61.29 | $ | - | $ | - | ||||||||||

|

Average

Participation %

|

60.7 | % | 55.5 | % | 53.2 | % | - | - | ||||||||||||

|

Collars:

|

||||||||||||||||||||

|

Hedged

Volume (Bbls/d)

|

257 | 1,279 | 2,048 | 2,477 | - | |||||||||||||||

|

Average

Floor Price ($/Bbl)

|

$ | 89.57 | $ | 102.85 | $ | 103.42 | $ | 110.00 | $ | - | ||||||||||

|

Average

Ceiling Price ($/Bbl)

|

$ | 118.83 | $ | 136.16 | $ | 152.61 | $ | 145.39 | $ | - | ||||||||||

|

Floors:

|

||||||||||||||||||||

|

Hedged

Volume (Bbls/d)

|

250 | 500 | - | - | - | |||||||||||||||

|

Average

Floor Price ($/Bbl)

|

$ | 100.00 | $ | 100.00 | $ | - | $ | - | $ | - | ||||||||||

|

Total:

|

||||||||||||||||||||

|

Hedged

Volume (Bbls/d)

|

3,180 | 6,580 | 6,103 | 5,016 | 3,500 | |||||||||||||||

|

Average

Price ($/Bbl)

|

$ | 72.69 | $ | 81.81 | $ | 77.51 | $ | 88.35 | $ | 76.79 | ||||||||||

(a) A

participating swap combines a swap and a call option with the same strike

price.

18

Interest

Rate Activities

We are

subject to interest rate risk associated with loans under our credit facility

that bear interest based on floating rates. As of September 30, 2009,

our total debt outstanding was $585.0 million. In order to mitigate

our interest rate exposure, we had the following interest rate derivative

contracts in place at September 30, 2009, to fix a portion of floating

LIBOR-based debt on our credit facility:

|

Notional

amounts in thousands of dollars

|

Notional

Amount

|

Fixed

Rate

|

||||||

|

Period

Covered

|

||||||||

|

October

1, 2009 to January 8, 2010

|

$ | 100,000 | 3.3873 | % | ||||

|

October

1, 2009 to December 20, 2010

|

300,000 | 3.6825 | % | |||||

|

January

20, 2010 to October 20, 2011

|

100,000 | 1.6200 | % | |||||

|

December

20, 2010 to October 20, 2011

|

200,000 | 2.9900 | % | |||||

We had

realized losses related to our interest rate derivative contracts of $3.4

million and $9.7 million for the three months and nine months ended September

30, 2009, respectively. We had unrealized losses related to our

interest rate derivative contracts of $0.4 million and unrealized gains of $4.1

million for the three months and nine months ended September 30, 2009,

respectively. We had net payables related to the interest rate

derivative contracts of $13.2 million at September 30, 2009.

ASC 815

requires disclosures about how and why an entity uses derivative instruments,

how derivative instruments and related hedge items are accounted for under ASC

815, and how derivative instruments and related hedged items affect an entity’s

financial position, financial performance, and cash flows. This topic

requires the disclosures detailed below.

Fair

value of derivative instruments not designated as hedging instruments under ASC

815:

|

Balance

sheet location, thousands of dollars

|

Oil

Commodity Derivatives

|

Natural

Gas Commodity Derivatives

|

Interest

Rate Derivatives

|

Total

Financial Instruments

|

||||||||||||

|

September

30, 2009

|

||||||||||||||||

|

Assets

|

||||||||||||||||

|

Current

assets - derivative instruments

|

$ | 21,980 | $ | 41,269 | $ | - | $ | 63,249 | ||||||||

|

Other

long-term assets - derivative instruments

|

59,358 | 38,142 | - | 97,500 | ||||||||||||

|

Total

assets

|

81,338 | 79,411 | - | 160,749 | ||||||||||||

|

Liabilities

|

||||||||||||||||

|

Current

liabilities - derivative instruments

|

(4,245 | ) | - | (10,525 | ) | (14,770 | ) | |||||||||

|

Long-term

liabilities - derivative instruments

|

(25,985 | ) | (2,660 | ) | (2,677 | ) | (31,322 | ) | ||||||||

|

Total

liabilities

|

(30,230 | ) | (2,660 | ) | (13,202 | ) | (46,092 | ) | ||||||||

|

Net

assets (liabilities)

|

$ | 51,108 | $ | 76,751 | $ | (13,202 | ) | $ | 114,657 | |||||||

|

December

31, 2008

|

||||||||||||||||

|

Assets

|

||||||||||||||||

|

Current

assets - derivative instruments

|

$ | 44,086 | $ | 32,138 | $ | - | $ | 76,224 | ||||||||

|

Other

long-term assets - derivative instruments

|

145,061 | 73,942 | - | 219,003 | ||||||||||||

|

Total

assets

|

189,147 | 106,080 | - | 295,227 | ||||||||||||

|

Liabilities

|

||||||||||||||||

|

Current

liabilities - derivative instruments

|

(1,115 | ) | - | (9,077 | ) | (10,192 | ) | |||||||||

|

Long-term

liabilities - derivative instruments

|

(1,820 | ) | - | (8,238 | ) | (10,058 | ) | |||||||||

|

Total

liabilities

|

(2,935 | ) | - | (17,315 | ) | (20,250 | ) | |||||||||

|

Net

assets (liabilities)

|

$ | 186,212 | $ | 106,080 | $ | (17,315 | ) | $ | 274,977 | |||||||

19

Gains and

losses on derivative instruments not designated as hedging instruments under ASC

815:

|

Location

of gain/loss, thousands of dollars

|

Oil

Commodity Derivatives (a)

|

Natural

Gas Commodity Derivatives (a)

|

Interest

Rate Derivatives (b)

|

Total

Financial Instruments

|

||||||||||||

|

Three

Months Ended September 30, 2009

|

||||||||||||||||

|

Realized

gains (losses)

|

$ | 3,646 | $ | 20,710 | $ | (3,411 | ) | $ | 20,945 | |||||||

|

Unrealized

gains (losses)

|