Attached files

| file | filename |

|---|---|

| 8-K - PIPER JAFFRAY SEPTEMBER 2017 NEW ENGLAND BANK SYMPOSIUM - INDEPENDENT BANK CORP | piperjaffrayseptember20178.htm |

Piper Jaffray

New England Bank Symposium

September 28, 2017

Robert Cozzone – Chief Financial Officer and Treasurer

Gerard Nadeau – President of Rockland Trust Company

(2)

Who We Are

• Main Sub: Rockland Trust

• Market: Eastern Massachusetts

• Loans: $6.3 B

• Deposits: $6.7 B

• $AUA: $3.2 B

• Market Cap: $2.0 B

• NASDAQ: INDB

(3)

Key Messages

• Lengthy track record of consistent, solid performance

• Robust loan and core deposit activity

• Growing fee revenue sources, esp. Investment Mgmt.

• Expanding footprint in growth markets

• Tangible book value steadily growing *

• Steadily improving operating efficiency

• Disciplined risk management culture

• Proven integrator of acquired banks

• Deep, experienced management team

* See appendix A for reconciliation

(4)

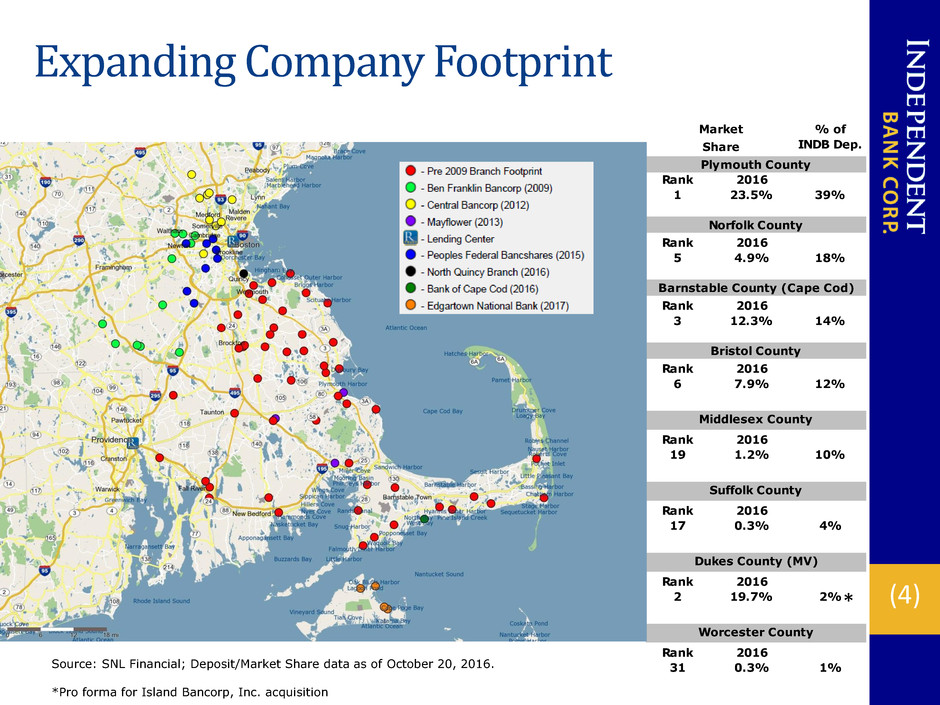

Expanding Company Footprint

Rank 2016

1 23.5% 39%

Rank 2016

5 4.9% 18%

Rank 2016

3 12.3% 14%

Rank 2016

6 7.9% 12%

Rank 2016

19 1.2% 10%

Rank 2016

17 0.3% 4%

Rank 2016

2 19.7% 2%

Rank 2016

31 0.3% 1%

Suffolk County

Bristol County

Worcester County

Dukes County (MV)

Middlesex County

Norfolk County

% of

INDB Dep.Share

Barnstable County (Cape Cod)

Market

Plymouth County

Source: SNL Financial; Deposit/Market Share data as of October 20, 2016.

*Pro forma for Island Bancorp, Inc. acquisition

*

(5)

Recent Accomplishments

• Four consecutive years of record earnings

• Finalized acquisition of New England Bancorp, Inc. of Cape Cod

and Island Bancorp, Inc. of Martha’s Vineyard

• Capitalizing on expansion moves in vibrant Greater Boston

market

• Growth initiatives – new commercial products, new and

revitalized branches, expanded digital offerings, lending staff

adds

• Strong household growth rate

• Consistently high rankings in third party surveys

(6)

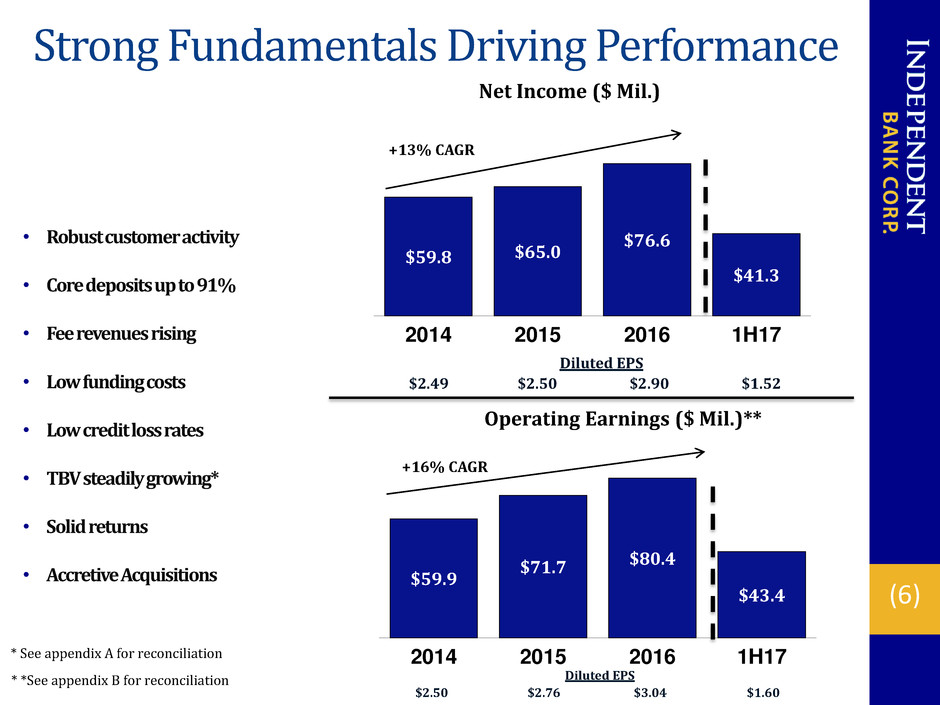

$59.9

$71.7 $80.4

$43.4

2014 2015 2016 1H17

Operating Earnings ($ Mil.)**

Strong Fundamentals Driving Performance

+16% CAGR

Diluted EPS

$2.49 $2.50 $2.90 $1.52

• Robust customer activity

• Core deposits up to 91%

• Fee revenues rising

• Low funding costs

• Low credit loss rates

• TBV steadily growing*

• Solid returns

• Accretive Acquisitions

Diluted EPS

$2.50 $2.76 $3.04 $1.60

* See appendix A for reconciliation

* *See appendix B for reconciliation

$59.8 $65.0

$76.6

$41.3

2014 2015 2016 1H17

Net Income ($ Mil.)

+13% CAGR

(7)

Vibrant Commercial Lending Franchise

TOTAL LOANS

$6.3 B

AVG. YIELD: 4.08%

2Q 2017

Comm'l

71%

Resi Mtg

12%

Home Eq

17%

• Long-term CRE/ C&I lender

• Increased small business focus

• Strong name recognition in local markets

• Expanded market presence

• Experienced, knowledgeable lenders

• Growing in sophistication and capacity

• Commercial banker development program

• Disciplined underwriting

(8)

Commercial Diversification

Total Commercial Real Estate Portfolio

Balance $3.4B as of 6/30/17

Industrial/

Warehouse

8.8%

Office Buildings

10.8%

Commercial

Buildings

17.8%

Residential-

Related*

31.2%

All Other

18.3%

Strip Malls

3.8%

Hotels/Motels

9.3%

Total C&I Loan Portfolio

Balance $911M as of 6/30/17

*Includes 1-4 Family, Multifamily, Condos and Approved Land

$784M

$861M $843M

$902M $911M

$0

$100

$200

$300

$400

$500

$600

$700

$800

$900

$1,000

2013 2014 2015 2016 6/30/2017

Mi

llio

ns

C&I

$2.5B

$2.6B

$3.0B

$3.3B $3.4B 317%

321%

299%

306%

312%

250%

260%

270%

280%

290%

300%

310%

320%

330%

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

2013 2014 2015 2016 6/30/2017

Bil

lio

ns

CRE NOO CRE/Capital**

** Non-Owner Occupied Real Estate divided by Total Capital

All Other 17.5%

Health Care and

Social

Assistance

5.2%

Finance and

Insurance 7.5%

Manufacturing

8.6%

Wholesale

Trade 11.2%

Construction

10.1%

Retail Trade

21.9%

Real Estat and

Rental and

Leasing 18.0%

(9)

Low Cost Deposit Base

Demand

Deposits

32%

Money Market

19%

Savings/Now

40%

CDs

9%

TOTAL DEPOSITS $6.5B

2Q 2017

• Sizable demand deposit

component

• Valuable source of liquidity

• Relationship-based

approach

• Expanded digital access

• Growing commercial base

$4.2B $4.6B

$5.3B

$5.8B $6.1B

84.9%

87.3%

88.6%

89.9% 90.5%

79.0%

81.0%

83.0%

85.0%

87.0%

89.0%

91.0%

93.0%

95.0%

$0.0

$1.0

$2.0

$3.0

$4.0

$5.0

$6.0

$7.0

2013 2014 2015 2016 6/30/2017

Bill

ion

s

Core Deposits Core to Total

0.23%

0.21%

0.20%

0.18% 0.18%

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

013 2014 2015 2016 6/30/2017

Cost of Deposits

(10)

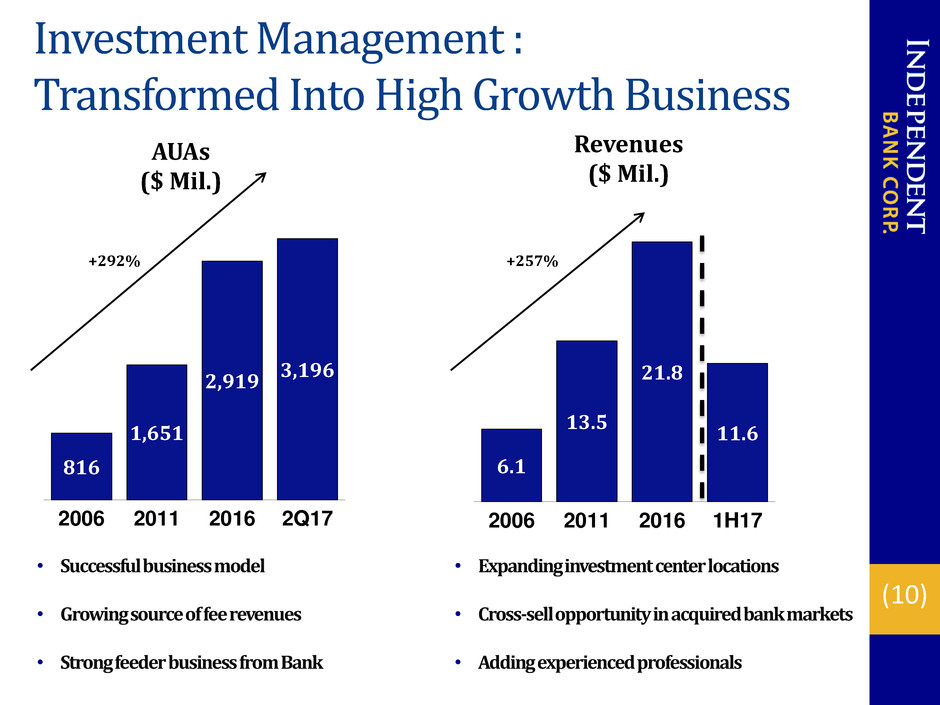

6.1

13.5

21.8

11.6

2006 2011 2016 1H17

Revenues

($ Mil.)

816

1,651

2,919

3,196

2006 2011 2016 2Q17

AUAs

($ Mil.)

Investment Management :

Transformed Into High Growth Business

+292% +257%

• Successful business model

• Growing source of fee revenues

• Strong feeder business from Bank

• Expanding investment center locations

• Cross-sell opportunity in acquired bank markets

• Adding experienced professionals

(11)

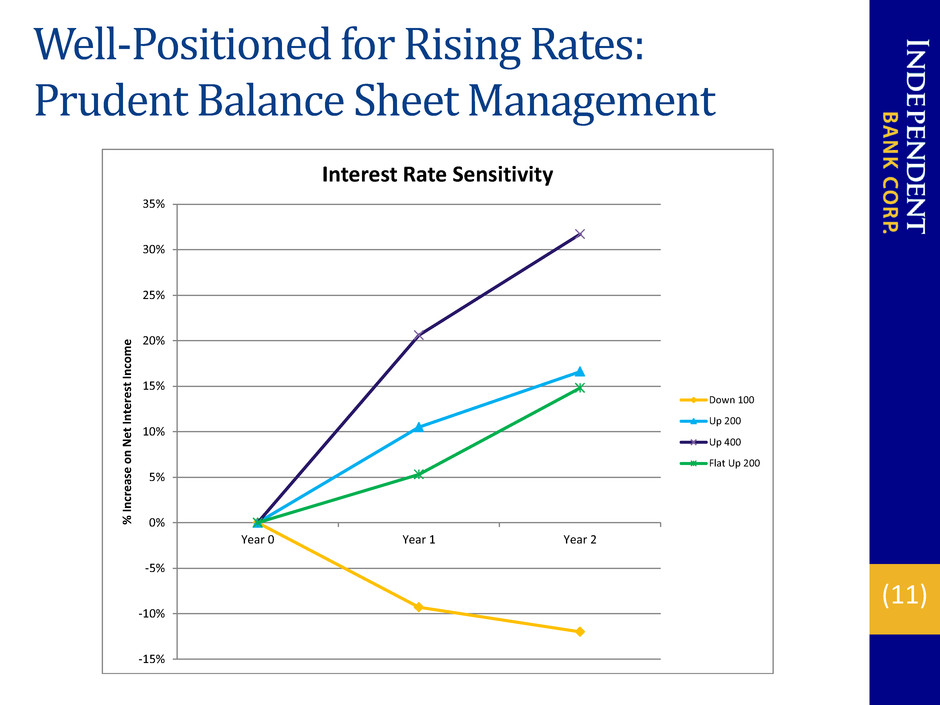

Well-Positioned for Rising Rates:

Prudent Balance Sheet Management

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

Year 0 Year 1 Year 2

%

In

cr

ease

o

n

N

et

In

te

re

st

In

co

m

e

Interest Rate Sensitivity

Down 100

Up 200

Up 400

Flat Up 200

(12)

$8.5

$0.8

$0.3

$3.7

2014 2015 2016 1H17

Net Chargeoffs

($ Mil.)

customer

fraud

Asset Quality: Well Managed

$27.5 $27.7

$57.4

$51.8

2014 2015 2016 2Q17

NPLs

($ Mil.)

NPL/Loan %

0.55% 0.50% 0.96% 0.83%

Peers 0.58%*

* Source: FFIEC Peer Group 2; $3-10 Billion in Assets, June 30, 2017

Incl. 90 days + overdue

Loss Rate

18bp 1bp 1bp 12bp

Peers 7bp*

(13)

Strong Capital Position (period end)

$19.18

$21.29

$23.45 $24.48

2014 2015 2016 2Q17

Tangible Book Value*

+28%

* See appendix A for reconciliation

$26.69

$29.40

$32.02 $33.34

2014 2015 2016 2Q17

Book Value Per Share

+25%

• Strong internal capital generation

• No storehousing of excess capital

• No external equity raising

• No dividend cuts

(14)

Attentive to Shareholder Returns

$0.96 $1.04

$1.16

$0.64

2014 2015 2016 1H17

Cash Dividends Declared Per Share

(15)

Sustaining Business Momentum

Business Line

• Expand Market Presence/Recruit Seasoned Lenders

• Grow Client Base

• Expand Specialty Products, e.g. ABL, Leasing

• Lender Development Programs

Commercial

• Continue to Drive Household Growth

• Expand Digital Offerings

• Optimize Branch Network

Retail Delivery

• Capitalize on Strong Market Demographics

• Continue Strong Branch/Commercial Referrals

• Expand COI Relationships

Investment Management

• Continue Aggressive H.E. Marketing

• Scalable Resi Mortgage Origination Platform

Consumer Lending

Focal Points

(16)

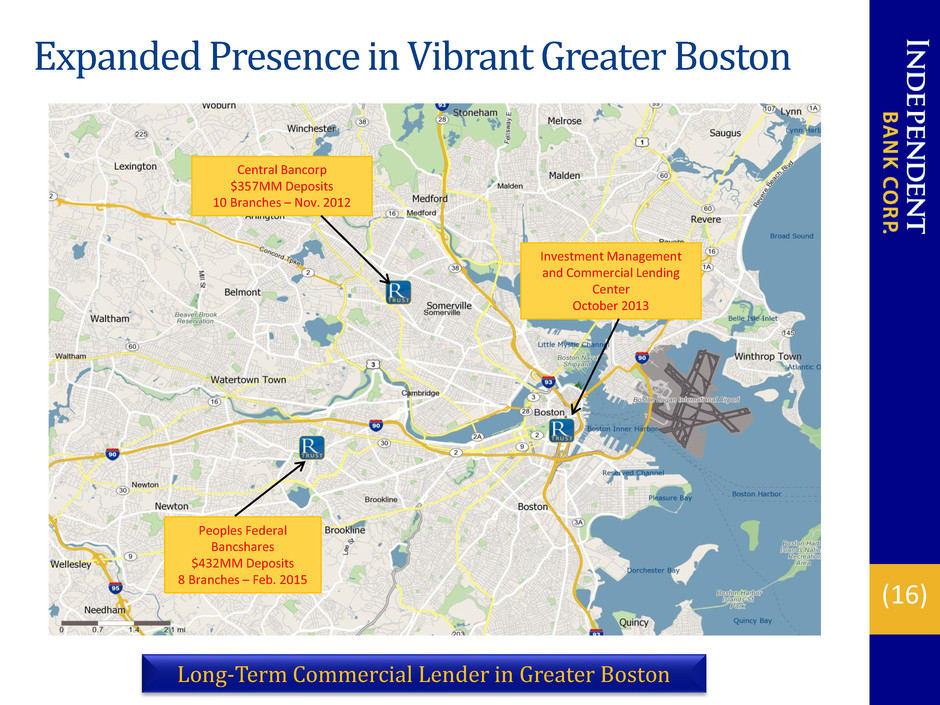

Expanded Presence in Vibrant Greater Boston

Long-Term Commercial Lender in Greater Boston

Central Bancorp

$357MM Deposits

10 Branches – Nov. 2012

Investment Management

and Commercial Lending

Center

October 2013

Peoples Federal

Bancshares

$432MM Deposits

8 Branches – Feb. 2015

(17)

Island Bancorp Acquisition

Edgartown National Bank

• Profitable, well-managed community bank

• Provides first retail presence on M.V.

• Excellent complement to growing Cape Cod presence

• Financially attractive

• $0.03 - $0.04 EPS accretion expected in 2018

• Neutral to TBV

• Modest, low-risk deal

• Asset size: ~$200 MM

• Transaction value: $29 MM

• Closed in May ‘17

INDB: A Proven Integrator

(18)

Building Franchise Value

Disciplined Acquisitions

Deal Value: $84.5MM

2% Core Dep. Premium*

Benjamin

Franklin Bancorp

Apr ‘09

$994mm Assets

$701mm Deposits

11 Branches

Deal Value: $52.0MM

8% Core Dep. Premium*

Central

Bancorp

Nov ‘12

$537mm Assets

$357mm Deposits

10 Branches

Deal Value: $40.3MM

8% Core Dep. Premium*

Mayflower

Bancorp

Nov’13

$243mm Assets

$219mm Deposits

8 Branches

$276 mm Assets

$176mm Deposits

Net 1 Branch

Deal Value: $41.7MM

12% Core Dep. Premium*

All Acquisitions Immediately Accretive

*Incl. CDs <$100k

Deal metrics based on closing price and actual acquired assets

New England Bancorp

Nov ‘16

Deal Value: $102.2 MM

17% Core Dep. Premium*

Slade’s Ferry

Bancorp

Mar ‘08

$630mm Assets

$411mm Deposits

9 Branches

Peoples Federal

Bancshares

Feb ’15

$640 mm Assets

$432mm Deposits

8 Branches

Deal Value: $141.8MM

10% Core Dep. Premium*

Island Bancorp

May ‘17

$194 mm Assets

$171mm Deposits

Net 4 Branches

Deal Value: $29MM

9% Core Dep. Premium*

(19)

Major Opportunities in Acquired Bank Markets:

Capitalizing on Rockland Trust Brand

Investment

Management

Commercial

Banking

Retail/

Consumer

• $3.2 billion AUA

• Wealth/Institutional

• Strong referral network

• Sophisticated products

• Expanded capacity

• In depth market knowledge

• Award winning customer service

• Electronic/mobile banking

• Competitive home equity products

Acquired Bank Customer Bases

(20)

Optimizing Retail Delivery Network

In the past twelve months we have:

• Utilized specialized analytics software/location model

• Shifted branch distribution

• Closed/consolidated 2

• Opened 1

• Relocated 1

• Redesigned 3

• Added 5 locations from acquisitions

• Added 3 off-site ATMs

• Introduced SecurLOCK feature that provides the customer with control

to manage the security of their debit card(turn off/on, alerts, etc.)

• Implemented Apple, Android and Samsung Pay

• Allowed for electronic scans of customer identification

• Enabled EMV compatible ATMs

• Converted all debit cards to EMV ready

(21)

INDB Investment Merits

• High quality franchise in attractive markets

• Strong organic business volumes

• Growing brand recognition

• Operating platform that can be leveraged further

• Capitalizing on in-market consolidation opportunities

• Diligent stewards of shareholder capital

• Grounded management team

• Positioned to grow, build, and acquire to drive long-term value

creation

(22)

Appendix A

The following table reconciles Book Value per share, which is a GAAP based measure to Tangible Book Value per share, which

is a non-GAAP based measure. It also reconciles the ratio of Equity to Assets, which is a GAAP based measure, to Tangible

Equity to Tangible Assets, a non-GAAP measure, for the dates indicated:

2014 2015 2016 2Q17

(Dollars in thousands, except share and per share data)

Tangible common equity

Stockholders' equity (GAAP) $ 640,527 $ 771,463 $ 864,690 $ 914,584 (a)

Less: Goodwill and other intangibles 180,306 212,909 231,374 243,005

Tangible common equity 460,221 558,554 633,316 671,579 (b)

Tangible assets

Assets (GAAP) 6,364,318 7,209,469 7,709,375 8,017,293 (c)

Less: Goodwill and other intangibles 180,306 212,909 231,374 243,005

Tangible assets 6,184,012 6,996,560 7,478,001 7,774,288 (d)

Common shares 23,998,738 26,236,352 27,005,813 27,431,171 (e)

Common equity to assets ratio (GAAP) 10.06% 10.70% 11.22% 11.41% (a/c)

Tangible common equity to tangible assets

ratio (Non-GAAP)

7.44% 7.98% 8.47% 8.64% (b/d)

Book Value per share (GAAP) $ 26.69 $ 29.40 $ 32.02 $ 33.34 (a/e)

Tangible book value per share (Non-GAAP) $ 19.18 $ 21.29 $ 23.45 $ 24.48 (b/e)

(23)

Appendix B

The following table reconciles net income and diluted EPS, which are GAAP measures, to operating earnings and

diluted EPS on an operating basis, which are Non-GAAP Measures as of the time periods indicated:

2014 2015 2016 1H 2017

(Dollars in thousands, except per share data)

Net income available to common

shareholders (GAAP) $ 59,845 $ 2.49 $ 64,960 $ 2.50 $ 76,648 $ 2.90 $ 41,288 $ 1.52

Non-GAAP adjustments

Noninterest income components

Gain on extinguishment of debt — — — — — — — —

Gain on life insurance benefits

(tax exempt) (1,964) (0.08) — — — — — —

Gain on sale of fixed income

securities (121) (0.01) (798) (0.03) — — — —

Noninterest expense components

Impairment on acquired facilities 524 0.02 109 — — — — —

Loss on extinguishment of debt — — 122 0.01 437 0.02 — —

Loss on sale of fixed income

securities 21 — 1,124 0.04 — — — —

Loss on termination of

derivatives 1,122 0.05 — — — — — —

Merger and acquisition expenses 1,339 0.06 10,501 0.40 5,455 0.20 3,393 0.12

Severance — — — — — — — —

Total impact of noncore items 921 0.04 11,058 0.42 5,892 0.22 3,393 0.12

Net tax benefit associated with

noncore items (866) (0.03) (4,285) (0.16) (2,163) (0.08) (1,241) (0.04)

Net operating earnings (Non-

GAAP) $ 59,900 $ 2.50 $ 71,733 $ 2.76 $ 80,377 $ 3.04 $ 43,440 $ 1.60

(24)

NASDAQ Ticker: INDB

www.rocklandtrust.com

Robert Cozzone – CFO & Treasurer

Shareholder Relations:

(781) 982-6737

Statements contained in this presentation that are not historical facts are “forward-looking

statements” that are subject to risks and uncertainties which could cause actual results to differ

materially from those currently anticipated due to a number of factors, which include, but are not

limited to, factors discussed in documents filed by the Company with the Securities and Exchange

Commission from time to time.