Attached files

| file | filename |

|---|---|

| EX-99.1 - EX-99.1 - LPL Financial Holdings Inc. | d443810dex991.htm |

| EX-2.1 - EX-2.1 - LPL Financial Holdings Inc. | d443810dex21.htm |

| 8-K - 8-K - LPL Financial Holdings Inc. | d443810d8k.htm |

August 15, 2017 LPL Financial Purchase of National Planning Holdings, Inc. Exhibit 99.2

Notice to Investors: Safe Harbor Statement Statements in this presentation regarding LPL Financial Holdings Inc. (together with its subsidiaries, including LPL Financial LLC, the “Company” or “LPL Financial”) and its potential future levels of assets serviced, advisor headcount, additional run-rate EBITDA and EPS accretion, future payments, onboarding costs, growth, business strategy, and plans, as well as any other statements that are not related to present facts or current conditions or that are not purely historical, constitute forward-looking statements. These forward-looking statements are based on the Company's historical performance and its plans, estimates and expectations as of August 15, 2017. The words “potential,” "anticipates," "intends," "believes," "expects," "may," "plans," "predicts," "will" and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are not guarantees that the future levels of assets serviced, results, plans, intentions or expectations expressed or implied by the Company will be achieved. Matters subject to forward-looking statements involve known and unknown risks and uncertainties, including economic, legislative, regulatory, competitive and other factors, which may cause levels of assets serviced, actual financial or operating results, levels of activity, or the timing of events, to be materially different than those expressed or implied by forward-looking statements. In particular, the Company can provide no assurance that the assets reported as serviced by financial advisors affiliated with the member firms of the independent broker-dealer network of National Planning Holdings, Inc. (“NPH Advisors”) will translate into assets serviced by LPL Financial or that NPH Advisors will join LPL Financial. Important factors that could cause or contribute to such differences include: difficulties and delays in recruiting NPH Advisors and/or onboarding the clients or businesses of NPH Advisors; the inability by the Company to sustain revenue and earnings growth or to fully realize revenue or expense synergies or the other expected benefits of the transaction which depend in part on the Company’s success in onboarding assets currently served by NPH Advisors; disruptions of the Company’s business due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with its financial advisors and their clients, employees, other business partners or governmental entities; the inability to implement onboarding plans and other consequences associated with acquisitions; the choice by clients of NPH Advisors not to open brokerage and/or advisory accounts at LPL Financial and/or move their respective assets from National Planning Holdings, Inc. (“NPH”) to a new account at LPL Financial; changes in general economic and financial market conditions, including retail investor sentiment; fluctuations in the value of assets under custody; effects of competition in the financial services industry, including competitors’ success in recruiting NPH Advisors; and the other factors set forth in Part I, "Item 1A. Risk Factors" in the Company's 2016 Annual Report on Form 10-K and any subsequent SEC filing. Except as required by law, the Company specifically disclaims any obligation to update any forward-looking statements as a result of developments occurring after the date of this presentation, even if its estimates change, and you should not rely on those statements as representing the Company's views as of any date subsequent to the date of August 15, 2017. Annualized, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

Notice to Investors: Non-GAAP Financial Measures The management of the Company believes that presenting certain non-GAAP measures by excluding or including certain items can be helpful to investors and analysts who may wish to use some or all of this information to analyze the Company’s current performance, prospects, and valuation. Management uses this non-GAAP information internally to evaluate operating performance and in formulating the budget for future periods. Management believes that the non-GAAP measures and metrics discussed herein are appropriate for evaluating the performance of the Company. Gross Profit is calculated as net revenues, less commission and advisory expenses and brokerage, clearing, and exchange fees. All other expense categories, including depreciation and amortization, are considered general and administrative in nature. Because the Company’s gross profit amounts do not include any depreciation and amortization expense, the Company considers its gross profit amounts to be non-GAAP measures that may not be comparable to those of others in its industry. Management believes that Gross Profit can be useful to investors because it shows the Company’s core operating performance before indirect costs that are general and administrative in nature. Core G&A consists of total operating expenses, excluding the following expenses: commission and advisory, regulatory charges, promotional, employee share-based compensation, depreciation and amortization, amortization of intangible assets, and brokerage, clearing, and exchange. Management presents Core G&A because it believes Core G&A reflects the corporate operating expense categories over which management can generally exercise a measure of control, compared with expense items over which management either cannot exercise control, such as commission and advisory expenses, or which management views as promotional expense necessary to support advisor growth and retention including conferences and transition assistance. Core G&A is not a measure of the Company’s total operating expenses as calculated in accordance with GAAP. For a reconciliation of Core G&A against the Company’s total operating expenses as of June 30, 2017, please see FN 7 on page 18 of the Company’s earnings press release, dated July 27, 2017, which is posted on the Company’s website (investor.lpl.com). Prior to 2016, the Company calculated Core G&A as consisting of total operating expenses, excluding the items described above, as well as excluding other items that primarily consisted of acquisition and integration costs resulting from various acquisitions and organizational restructuring and conversion costs. Beginning with results reported for Q1 2016, Core G&A was presented as including these items that were historically adjusted out, and for periods prior to Q1 2016, reflects those items in employee share-based compensation and other historical adjustments for comparative purposes. Run-rate EBITDA is defined as net income plus interest expense, income tax expense, depreciation, and amortization. The Company presents EBITDA because management believes that it can be a useful financial metric in understanding the Company’s earnings from operations. Run-rate EBITDA is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to net income or any other performance measure derived in accordance with GAAP, or as an alternative to cash flows from operating activities as a measure of profitability or liquidity. In addition, the Company’s Run-rate EBITDA can differ significantly from EBITDA calculated by other companies, depending on long-term strategic decisions regarding capital structure, the tax jurisdictions in which companies operate, and capital investments. The Company does not provide an outlook for Run-rate EBITDA because it contains certain components, such as taxes, over which the Company cannot exercise control. Because an outlook for Run-rate EBITDA cannot be made available without unreasonable effort by the Company, a reconciliation of the Company’s outlook for EBITDA against its outlook for net income also cannot be made available without unreasonable effort. Run-Rate EPS prior to amortization of intangible assets is a non-GAAP measure. The Company presents an outlook of expected accretion of Run-Rate EPS prior to amortization of intangibles with respect to the transaction discussed in this press release because management believes it can be a useful financial metric in understanding the Company’s expectations for the cash flow generation of this transaction. Run-Rate EPS prior to amortization of intangibles is not a measure of the Company's financial performance under GAAP and should not be considered as an alternative to GAAP EPS or any other performance measure derived in accordance with GAAP. The Company does not provide an outlook for GAAP EPS because it contains certain components, such as the effect of interest rates, over which the Company cannot exercise control. Because an outlook for GAAP EPS cannot be made available without unreasonable effort by the Company, a reconciliation of the Company’s outlook for Run-Rate EPS prior to amortization of intangibles against an outlook for GAAP EPS cannot be made.

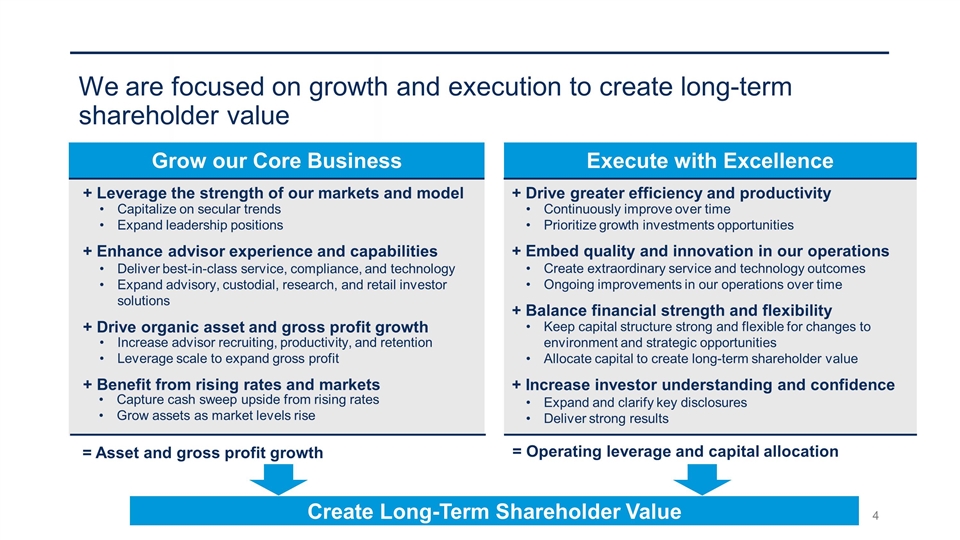

Grow our Core Business Execute with Excellence We are focused on growth and execution to create long-term shareholder value = Asset and gross profit growth = Operating leverage and capital allocation Create Long-Term Shareholder Value + Leverage the strength of our markets and model Capitalize on secular trends Expand leadership positions + Enhance advisor experience and capabilities Deliver best-in-class service, compliance, and technology Expand advisory, custodial, research, and retail investor solutions + Drive organic asset and gross profit growth Increase advisor recruiting, productivity, and retention Leverage scale to expand gross profit + Benefit from rising rates and markets Capture cash sweep upside from rising rates Grow assets as market levels rise + Drive greater efficiency and productivity Continuously improve over time Prioritize growth investments opportunities + Embed quality and innovation in our operations Create extraordinary service and technology outcomes Ongoing improvements in our operations over time + Balance financial strength and flexibility Keep capital structure strong and flexible for changes to environment and strategic opportunities Allocate capital to create long-term shareholder value + Increase investor understanding and confidence Expand and clarify key disclosures Deliver strong results

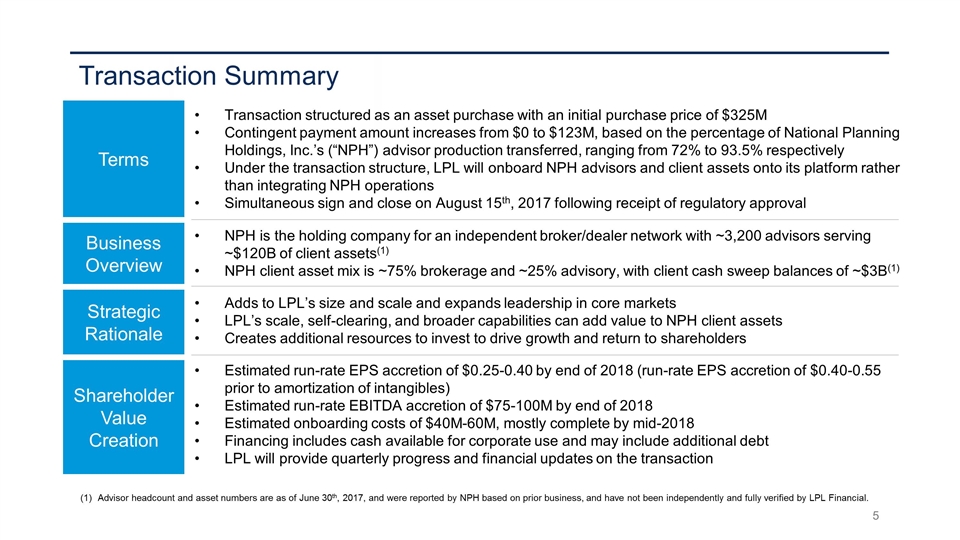

Transaction Summary Business Overview Strategic Rationale Shareholder Value Creation Terms NPH is the holding company for an independent broker/dealer network with ~3,200 advisors serving ~$120B of client assets(1) NPH client asset mix is ~75% brokerage and ~25% advisory, with client cash sweep balances of ~$3B(1) Adds to LPL’s size and scale and expands leadership in core markets LPL’s scale, self-clearing, and broader capabilities can add value to NPH client assets Creates additional resources to invest to drive growth and return to shareholders Estimated run-rate EPS accretion of $0.25-0.40 by end of 2018 (run-rate EPS accretion of $0.40-0.55 prior to amortization of intangibles) Estimated run-rate EBITDA accretion of $75-100M by end of 2018 Estimated onboarding costs of $40M-60M, mostly complete by mid-2018 Financing includes cash available for corporate use and may include additional debt LPL will provide quarterly progress and financial updates on the transaction Advisor headcount and asset numbers are as of June 30th, 2017, and were reported by NPH based on prior business, and have not been independently and fully verified by LPL Financial. Transaction structured as an asset purchase with an initial purchase price of $325M Contingent payment amount increases from $0 to $123M, based on the percentage of National Planning Holdings, Inc.’s (“NPH”) advisor production transferred, ranging from 72% to 93.5% respectively Under the transaction structure, LPL will onboard NPH advisors and client assets onto its platform rather than integrating NPH operations Simultaneous sign and close on August 15th, 2017 following receipt of regulatory approval

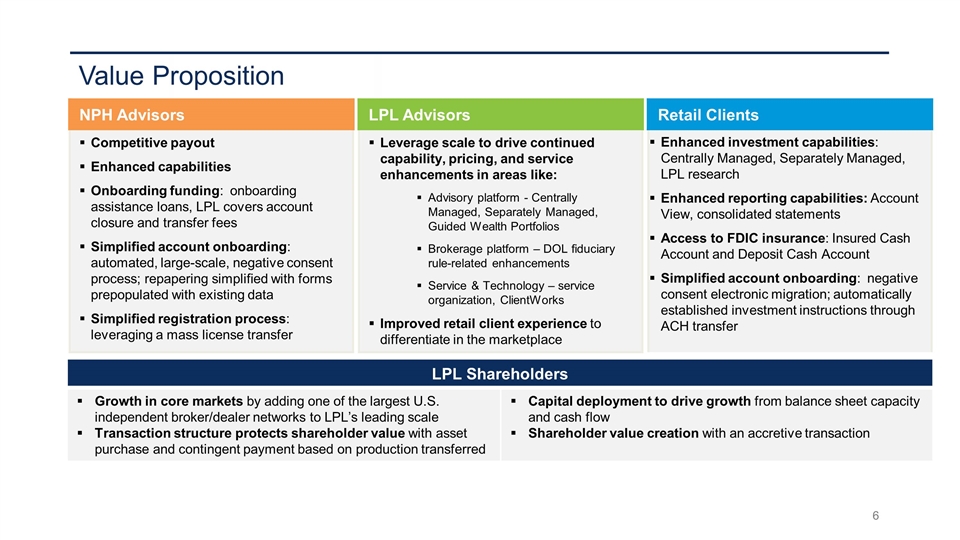

Value Proposition NPH Advisors LPL Advisors Retail Clients Competitive payout Enhanced capabilities Onboarding funding: onboarding assistance loans, LPL covers account closure and transfer fees Simplified account onboarding: automated, large-scale, negative consent process; repapering simplified with forms prepopulated with existing data Simplified registration process: leveraging a mass license transfer Leverage scale to drive continued capability, pricing, and service enhancements in areas like: Advisory platform - Centrally Managed, Separately Managed, Guided Wealth Portfolios Brokerage platform – DOL fiduciary rule-related enhancements Service & Technology – service organization, ClientWorks Improved retail client experience to differentiate in the marketplace Enhanced investment capabilities: Centrally Managed, Separately Managed, LPL research Enhanced reporting capabilities: Account View, consolidated statements Access to FDIC insurance: Insured Cash Account and Deposit Cash Account Simplified account onboarding: negative consent electronic migration; automatically established investment instructions through ACH transfer LPL Shareholders Growth in core markets by adding one of the largest U.S. independent broker/dealer networks to LPL’s leading scale Transaction structure protects shareholder value with asset purchase and contingent payment based on production transferred Capital deployment to drive growth from balance sheet capacity and cash flow Shareholder value creation with an accretive transaction

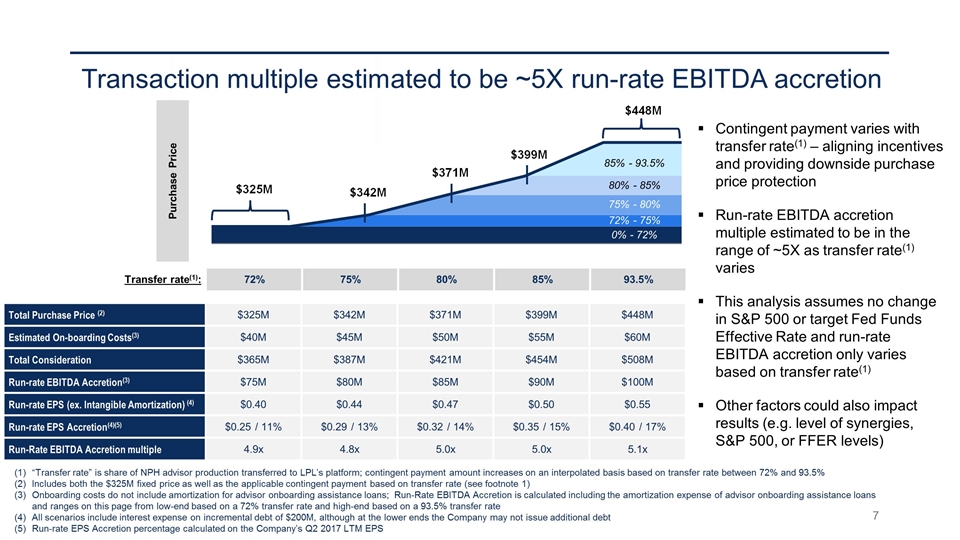

Transaction multiple estimated to be ~5X run-rate EBITDA accretion Total Purchase Price (2) $325M $342M $371M $399M $448M Estimated On-boarding Costs(3) $40M $45M $50M $55M $60M Total Consideration $365M $387M $421M $454M $508M Run-rate EBITDA Accretion(3) $75M $80M $85M $90M $100M Run-rate EPS (ex. Intangible Amortization) (4) $0.40 $0.44 $0.47 $0.50 $0.55 Run-rate EPS Accretion(4)(5) $0.25 / 11% $0.29 / 13% $0.32 / 14% $0.35 / 15% $0.40 / 17% Run-Rate EBITDA Accretion multiple 4.9x 4.8x 5.0x 5.0x 5.1x 72% 75% 80% 85% 93.5% Purchase Price “Transfer rate” is share of NPH advisor production transferred to LPL’s platform; contingent payment amount increases on an interpolated basis based on transfer rate between 72% and 93.5% Includes both the $325M fixed price as well as the applicable contingent payment based on transfer rate (see footnote 1) Onboarding costs do not include amortization for advisor onboarding assistance loans; Run-Rate EBITDA Accretion is calculated including the amortization expense of advisor onboarding assistance loans and ranges on this page from low-end based on a 72% transfer rate and high-end based on a 93.5% transfer rate All scenarios include interest expense on incremental debt of $200M, although at the lower ends the Company may not issue additional debt Run-rate EPS Accretion percentage calculated on the Company’s Q2 2017 LTM EPS Contingent payment varies with transfer rate(1) – aligning incentives and providing downside purchase price protection Run-rate EBITDA accretion multiple estimated to be in the range of ~5X as transfer rate(1) varies This analysis assumes no change in S&P 500 or target Fed Funds Effective Rate and run-rate EBITDA accretion only varies based on transfer rate(1) Other factors could also impact results (e.g. level of synergies, S&P 500, or FFER levels) Transfer rate(1): 85% - 93.5% 80% - 85% 75% - 80% 72% - 75% 0% - 72%

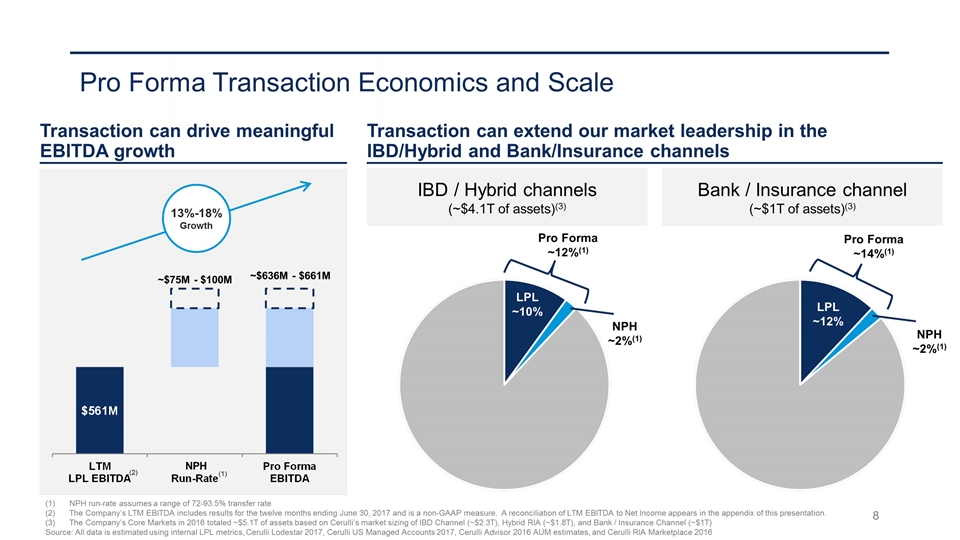

13%-18% Growth Pro Forma Transaction Economics and Scale Transaction can drive meaningful EBITDA growth Transaction can extend our market leadership in the IBD/Hybrid and Bank/Insurance channels (1) ~$75M - $100M ~$636M - $661M LPL ~10% NPH ~2%(1) Pro Forma ~12%(1) NPH ~2%(1) Pro Forma ~14%(1) LPL ~12% IBD / Hybrid channels (~$4.1T of assets)(3) Bank / Insurance channel (~$1T of assets)(3) NPH run-rate assumes a range of 72-93.5% transfer rate The Company’s LTM EBITDA includes results for the twelve months ending June 30, 2017 and is a non-GAAP measure. A reconciliation of LTM EBITDA to Net Income appears in the appendix of this presentation. The Company’s Core Markets in 2016 totaled ~$5.1T of assets based on Cerulli’s market sizing of IBD Channel (~$2.3T), Hybrid RIA (~$1.8T), and Bank / Insurance Channel (~$1T) Source: All data is estimated using internal LPL metrics, Cerulli Lodestar 2017, Cerulli US Managed Accounts 2017, Cerulli Advisor 2016 AUM estimates, and Cerulli RIA Marketplace 2016 (2) NPH

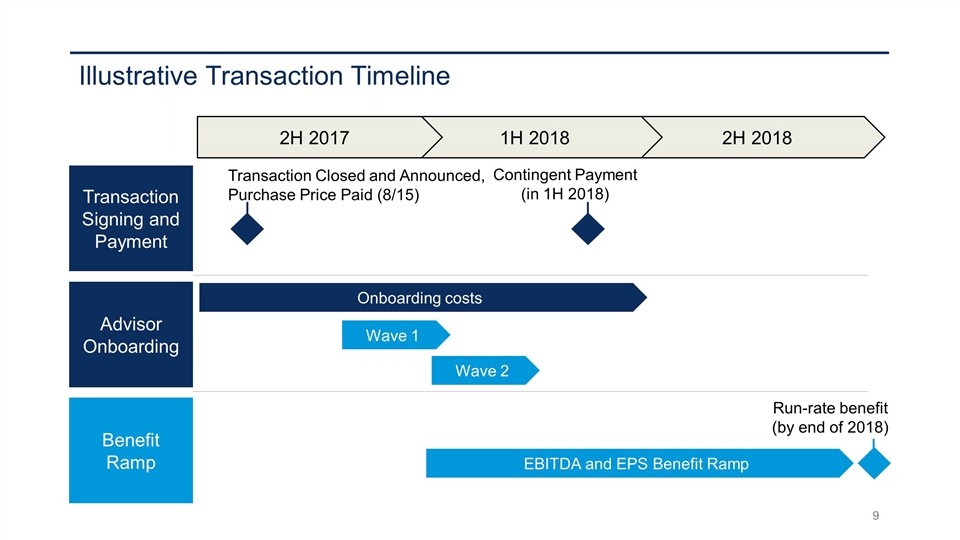

Illustrative Transaction Timeline 2H 2018 1H 2018 2H 2017 Transaction Signing and Payment Advisor Onboarding Benefit Ramp Transaction Closed and Announced, Purchase Price Paid (8/15) Contingent Payment (in 1H 2018) Onboarding costs Wave 1 EBITDA and EPS Benefit Ramp Run-rate benefit (by end of 2018) Wave 2

APPENDIX

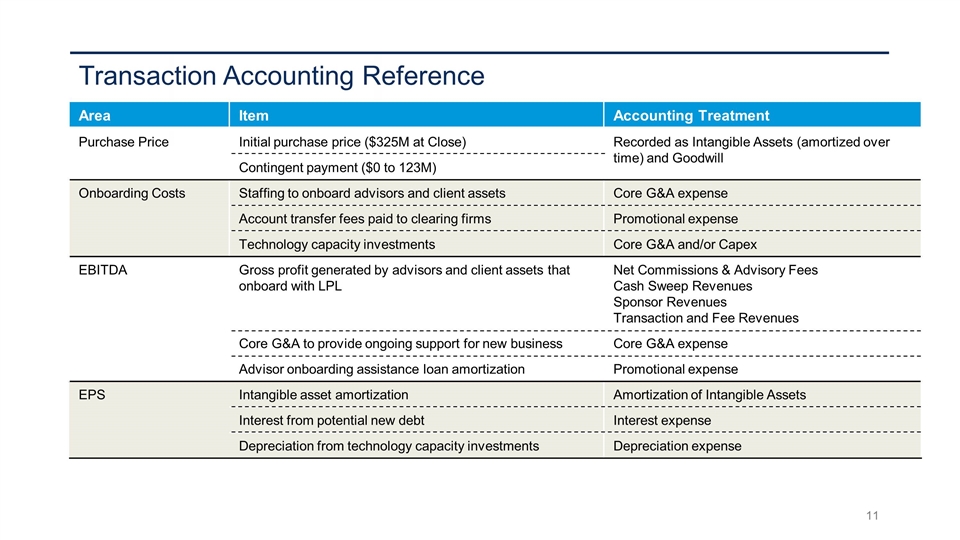

Transaction Accounting Reference Area Item Accounting Treatment Purchase Price Initial purchase price ($325M at Close) Recorded as Intangible Assets (amortized over time) and Goodwill Contingent payment ($0 to 123M) Onboarding Costs Staffing to onboard advisors and client assets Core G&A expense Account transfer fees paid to clearing firms Promotional expense Technology capacity investments Core G&A and/or Capex EBITDA Gross profit generated by advisors and client assets that onboard with LPL Net Commissions & Advisory Fees Cash Sweep Revenues Sponsor Revenues Transaction and Fee Revenues Core G&A to provide ongoing support for new business Core G&A expense Advisor onboarding assistance loan amortization Promotional expense EPS Intangible asset amortization Amortization of Intangible Assets Interest from potential new debt Interest expense Depreciation from technology capacity investments Depreciation expense

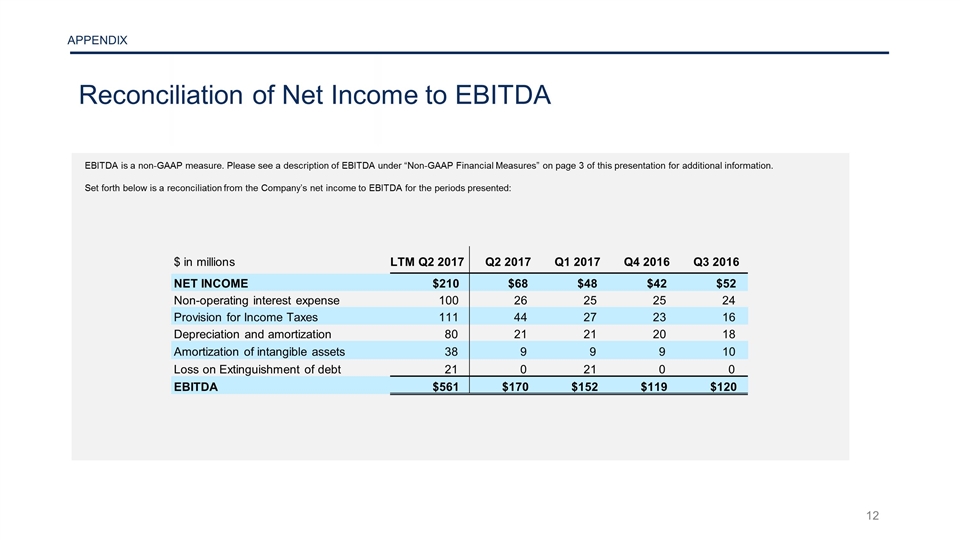

Reconciliation of Net Income to EBITDA APPENDIX EBITDA is a non-GAAP measure. Please see a description of EBITDA under “Non-GAAP Financial Measures” on page 3 of this presentation for additional information. Set forth below is a reconciliation from the Company’s net income to EBITDA for the periods presented: $ in millions LTM Q2 2017 Q2 2017 Q1 2017 Q4 2016 Q3 2016 NET INCOME $210 $68 $48 $42 $52 Non-operating interest expense 100 26 25 25 24 Provision for Income Taxes 111 44 27 23 16 Depreciation and amortization 80 21 21 20 18 Amortization of intangible assets 38 9 9 9 10 Loss on Extinguishment of debt 21 0 21 0 0 EBITDA $561 $170 $152 $119 $120