Attached files

| file | filename |

|---|---|

| EX-32.1 - CEO CERTIFICATION PURSUANT TO SECTION 906 - LPL Financial Holdings Inc. | exhibit32120141231.htm |

| EX-21.1 - EXHIBIT 21.1 - LPL Financial Holdings Inc. | exhibit2112014.htm |

| EX-23.1 - EXHIBIT 23.1 - LPL Financial Holdings Inc. | exhibit2312014.htm |

| EX-32.2 - CFO CERTIFICATION PURSUANT TO SECTION 906 - LPL Financial Holdings Inc. | exhibit32220141231.htm |

| EX-31.2 - CFO CERTIFICATION PURSUANT TO SECTION 302 - LPL Financial Holdings Inc. | exhibit31220141231.htm |

| EX-31.1 - CEO CERTIFICATION PURSUANT TO SECTION 302 - LPL Financial Holdings Inc. | exhibit31120141231.htm |

| EXCEL - IDEA: XBRL DOCUMENT - LPL Financial Holdings Inc. | Financial_Report.xls |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from________to | |

Commission file number 001-34963

LPL Financial Holdings Inc.

(Exact name of registrant as specified in its charter)

Delaware | 20-3717839 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

75 State Street, Boston, MA 02109

(Address of principal executive offices; including zip code)

617-423-3644

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Each Exchange on Which Registered |

Common Stock — $.001 par value per share | NASDAQ Global Select Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes o No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o | Smaller reporting company o |

(Do not check if a smaller reporting company) | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No x

As of June 30, 2014, the aggregate market value of the voting stock held by non-affiliates of the registrant was $4.3 billion. For purposes of this information, the outstanding shares of Common Stock owned by directors and executive officers of the registrant were deemed to be shares of the voting stock held by affiliates.

The number of shares of common stock, par value $0.001 per share, outstanding as of February 17, 2015 was 96,495,936.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the definitive Proxy Statement to be delivered to stockholders in connection with the Annual Meeting of Stockholders are incorporated by reference into Part III.

TABLE OF CONTENTS

Page | ||

i

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly, and current reports, proxy statements, and other information required by the Securities Exchange Act of 1934, as amended (“Exchange Act”), with the Securities and Exchange Commission ("SEC"). You may read and copy any document we file with the SEC at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549, U.S.A. Please call the SEC at 1-800-SEC-0330 for further information on the public reference room. Our SEC filings are also available to the public from the SEC’s internet site at http://www.sec.gov.

On our internet site, http://www.lpl.com, we post the following filings as soon as reasonably practicable after they are electronically filed with or furnished to the SEC: our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our proxy statements, our current reports on Form 8-K, and any amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act. Hard copies of all such filings are available free of charge by request via email (investor.relations@lpl.com), telephone (617) 897-4574, or mail (LPL Financial Investor Relations at 75 State Street, 24th Floor, Boston, MA 02109). The information contained or incorporated on our website is not a part of this Annual Report on Form 10-K.

When we use the terms “LPLFH”, “we”, “us”, “our”, and the “Company” we mean LPL Financial Holdings Inc., a Delaware corporation, and its consolidated subsidiaries, taken as a whole, unless the context otherwise indicates.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in Item 7 - “Management's Discussion and Analysis of Financial Condition and Results of Operations” and other sections of this Annual Report on Form 10-K regarding the Company's future financial and operating results, growth, business strategies, plans, liquidity, future share repurchases, and future dividends, including statements regarding projected savings, projected expenses, and anticipated improvements to the Company's operating model, services, and technology as a result of its Service Value Commitment or restructuring initiatives, as well as any other statements that are not related to present facts or current conditions or that are not purely historical, constitute forward-looking statements. These forward-looking statements are based on the Company's historical performance and its plans, estimates, and expectations as of February 20, 2015. The words “anticipates,” “believes,” “expects,” “may,” “plans,” “predicts,” “will” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words. Forward-looking statements are not guarantees that the future results, plans, intentions, or expectations expressed or implied by the Company will be achieved. Matters subject to forward-looking statements involve known and unknown risks and uncertainties, including economic, legislative, regulatory, competitive, and other factors, which may cause actual financial or operating results, levels of activity, or the timing of events, to be materially different than those expressed or implied by forward-looking statements. Important factors that could cause or contribute to such differences include: changes in general economic and financial market conditions, including retail investor sentiment; fluctuations in the value of brokerage and advisory assets; fluctuations in levels of net new advisory assets and the related impact on fee revenue; effects of competition in the financial services industry; changes in the number of the Company's financial advisors and institutions, and their ability to market effectively financial products and services; changes in interest rates and fees payable by banks participating in the Company's cash sweep program, including the Company's success in negotiating agreements with current or additional counterparties; changes in the growth of the Company’s fee-based business; the effect of current, pending, and future legislation, regulation, and regulatory actions, including disciplinary actions imposed by federal and state securities regulators and self-regulatory organizations; the costs of settling and remediating issues related to pending or future regulatory matters; the Company's success in integrating the operations of acquired businesses; execution of the Company's plans related to its Service Value Commitment or restructuring initiatives, including the Company's ability to successfully transform and transition business processes to third-party service providers; the Company's success in negotiating and developing commercial arrangements with third-party service providers that will enable the Company to realize the service improvements and efficiencies expected to result from its Service Value Commitment or restructuring initiatives; the performance of third-party service providers to which business processes are transitioned from the Company; the Company's ability to control operating risks, information technology systems risks, cybersecurity risks, and sourcing risks; and the other factors set forth in Part I, Item 1A - “Risk Factors”. Except as required by law, the Company specifically disclaims any obligation to update any forward-looking statements as a result of developments occurring after the date of this annual report, even if its estimates change, and you should not rely on statements contained herein as representing the Company's views as of any date subsequent to the date of this annual report.

ii

PART I

Item 1. Business

General Corporate Overview

We are the nation's largest independent broker-dealer, a top custodian for registered investment advisors ("RIAs"), and a leading independent consultant to retirement plans. We provide an integrated platform of brokerage and investment advisory services to more than 14,000 independent financial advisors, including financial advisors at more than 700 financial institutions (our "advisors") throughout the United States, enabling them to provide their retail investors (their "clients") with objective financial advice through a lower conflict model. We also support approximately 4,400 financial advisors who are affiliated and licensed with insurance companies through customized clearing services, advisory platforms, and technology solutions.

We believe that objective financial guidance is a fundamental need for everyone. We enable our advisors to focus on what they do best—create the personal, long-term relationships that are the foundation for turning life’s aspirations into financial realities. We do that through a singular focus on providing our advisors with the front-, middle-, and back-office support they need to serve the large and growing market for independent investment advice. We believe that LPL Financial is the only company that offers advisors the unique combination of an integrated technology platform, comprehensive self-clearing services, and open architecture access to leading financial products, all delivered in an environment unencumbered by conflicts from product manufacturing, underwriting, or market-making.

We are a leading financial services provider to independent advisors, RIAs, financial institutions, and retirement plan business. As a result, we are a market leader with the largest independent advisor base, and we believe we have the fourth-largest overall advisor base in the United States. Through our advisors, we are also one of the largest distributors of financial products and services in the United States, with over $77 billion in sales of mutual funds, annuities, alternative investments, and advisory services accounts in 2014.

We began operations through LPL Financial LLC ("LPL Financial"), our broker-dealer subsidiary, in 1989. LPL Financial Holdings Inc., which is the parent company of our collective businesses was incorporated in Delaware in 2005. LPL Financial is a clearing broker-dealer and an investment advisor that primarily transacts business as an agent for our advisors on behalf of their clients through a broad array of financial products and services. Fortigent Holdings Company, Inc. and its subsidiaries ("Fortigent") is a leading provider of solutions and consulting services to RIAs, banks and trust companies that serve high-net-worth clients. Through our subsidiary The Private Trust Company, N.A. ("PTC"), we offer trust administration, investment management oversight and RIA custodial services for estates and families. Our subsidiary, Independent Advisers Group Corporation (“IAG”), offers an investment advisory solution to insurance companies to support their financial advisors who are licensed with them. Our subsidiary, LPL Insurance Associates, Inc., ("LPLIA"), operates as a brokerage general agency that offers life, long-term care, and disability insurance sales and services.

Our Business

Our Advisor Relationships

Our business is dedicated exclusively to our advisors; we are not a market-maker nor do we offer investment banking or underwriting services. We offer no proprietary products of our own. Because we do not offer proprietary products, we enable the independent financial advisors, banks, and credit unions with whom we partner to offer their clients lower-conflict advice.

We believe we offer a compelling economic value proposition to independent advisors, which is a key factor in our ability to attract and retain advisors and their practices. The independent channels pay advisors a greater share of brokerage commissions and advisory fees than the captive channels — generally 80-90% compared to 30-50%. Through our scale and operating efficiencies, we are able to offer our advisors what we believe to be the highest average payout ratios among the five largest U.S. broker-dealers, ranked by number of advisors, providing us with a significant competitive advantage.

Furthermore, we believe our technology and service platforms enable our advisors to operate their practices with a greater focus on generating revenue opportunities and at a lower cost than other independent advisors. As a result, we believe our advisors who own practices earn more pre-tax profit than practice owners affiliated with other independent brokerage firms. Finally, as business owners, our independent financial advisors, unlike captive advisors, also have the opportunity to build equity in their own businesses.

1

Our advisors build long-term relationships with their clients in communities across the U.S. by guiding them through the complexities of investment decisions, retirement solutions, financial planning, and wealth-management. Our advisors support approximately 4.5 million client accounts. Our services support the evolution of our advisors’ businesses over time and are designed to change as our advisors' needs change.

Advisors licensed with LPL Financial as registered representatives and as investment advisory representatives are able to conduct both commission-based business on our brokerage platform and fee-based business on our corporate RIA platform. In order to be licensed with LPL Financial, advisors must be approved through our assessment process, which includes a thorough review of each advisor’s education, experience, and credit and compliance history. Approved advisors become registered with LPL Financial and enter into a representative agreement that establishes the duties and responsibilities of each party. Pursuant to the representative agreement, each advisor makes a series of representations, including that the advisor will disclose to all clients and prospective clients that the advisor is acting as LPL Financial's registered representative or investment advisory representative, that all orders for securities will be placed through LPL Financial, that the advisor will sell only products LPL Financial has approved, and that the advisor will comply with LPL Financial policies and procedures as well as securities rules and regulations. These advisors also agree not to engage in any outside business activity without prior approval from us and not to act as an agent for any of our competitors.

Our advisors average over 15 years of industry experience. This level of industry experience allows us to focus on supporting and enhancing our advisors’ businesses without needing to provide basic training or subsidizing advisors who are new to the industry. Our flexible business platform allows our advisors to choose the most appropriate business model to support their clients, whether they conduct brokerage business, offer brokerage and fee-based services on our corporate RIA platforms, or provide fee-based services through their own RIAs.

The majority of our advisors are entrepreneurial independent contractors that are primarily located in rural and suburban areas and as such are viewed as local providers of independent advice, many of whom operate under their own business name. We assist these advisors with their own branding, marketing and promotion, and regulatory review.

LPL Financial also supports over 320 stand-alone RIA practices ("Independent RIAs") with over 2,700 advisors who conduct their advisory business through separate entities by establishing their own RIAs, rather than using our corporate RIA. These Independent RIAs engage us for technology, clearing, compliance related and custody services, as well as access to certain of our investment platforms. These advisors retain 100% of their advisory fees. In return, we charge separate fees for custody, trading, and support services to the Independent RIAs. In addition, most Independent RIAs seeking to operate a hybrid model carry their brokerage license with LPL Financial and access our fully-integrated brokerage platform under standard terms.

We believe we are the market leader in providing support to over 2,200 financial advisors at approximately 700 banks and credit unions nationwide. For these institutions, whose core capabilities may not include investment and financial planning services, or who find the technology, infrastructure, and regulatory requirements to be cost prohibitive, we provide their financial advisors with the services they need to be successful, allowing the institutions to focus more energy and capital on their core businesses.

A subset of our advisors provides advice and serves group retirement plans primarily for small and mid-size businesses. These approximately 1,500 advisors serve over 31,600 retirement plans representing $80.3 billion in retirement plan assets custodied at various custodians. LPL Financial provides these advisors with marketing tools and technology capabilities that are designed for retirement solutions.

We also provide support to approximately 4,400 additional financial advisors who are affiliated and licensed with insurance companies. These arrangements allow us to provide outsourced customized clearing, advisory platforms, and technology solutions that enable the financial advisors at these insurance companies to offer a breadth of services to their client base in an efficient manner.

Our Value Proposition

The core of our business is dedicated to meeting the evolving needs of our advisors and providing the platform and tools to grow and enhance the profitability of their businesses. Our Service Value Commitment initiative expresses our dedication to continuous improvement in the processes, systems, and resources we leverage to meet these needs. This initiative is also designed to create a better service experience for our advisors, evolve our operating model to simplify processes and enhance our ability to invest in areas that are differentiators for our business by lowering our costs in areas where work can be performed more effectively by outsourcing partners specializing in this work.

2

We support our advisors by providing front-, middle-, and back-office solutions through our distinct value proposition: integrated technology solutions, comprehensive clearing and compliance services, consultive practice management programs and training, and independent research. The comprehensive and automated nature of our offering enables our advisors to focus on their clients while successfully and efficiently managing the complexities of running their own practice.

Integrated Technology Solutions

We provide our technology and service to advisors through an integrated technology platform that is server-based and web-accessible. This allows our advisors to effectively manage all critical aspects of their businesses while remaining highly efficient and responsive to their clients’ needs. Time-consuming processes, such as account opening and management, document imaging, transaction execution, and account rebalancing, are automated to improve efficiency and accuracy.

Comprehensive Clearing and Compliance Services

We custody and clear the majority of our advisors’ transactions, providing a simplified and streamlined advisor experience and expedited processing capabilities. Our self-clearing platform enables us to better control client data, more efficiently process and report trades, facilitate platform development, reduce costs, and ultimately enhance the service experience for our advisors and their clients. Our self-clearing platform also enables us to serve a wider range of advisors, including Independent RIAs.

Our services are backed by our service center and operations organizations focused on providing timely, accurate, and consistent support. To enhance the service effort, our service center utilizes Service360, a service paradigm available to the majority our advisors and Independent RIAs that offers a small team-based approach. This service model emphasizes personal accountability and empowerment within each Service360 team. Service360 currently serves over 10,300 advisors.

We continue to make substantial investments in our compliance function to provide our advisors with a strong framework through which to understand and operate within regulatory guidelines, as well as guidelines we establish. Protecting the best interests of investors and our affiliated advisors is of utmost importance to us. As the financial industry and regulatory environment evolve and become more complex, we remain devoted to serving our clients ethically and exceedingly well. We have made a long-term commitment to enhancing our risk management and compliance structure. Since 2012, we have made increasing investments in our core infrastructure—including people, process, and technology—to sustain a leading control environment focused on risk that matters. These investments include hiring and retaining experienced compliance and risk professionals and technology-related expenditures. Our compliance and risk management tools are integrated into our technology platform to further enhance the overall effectiveness and scalability of our control environment.

Our team of risk and compliance employees assist our advisors through:

• | training and advising advisors on new products, new regulatory guidelines, compliance and risk management tools, security policies and procedures, anti-money laundering, and best practices; |

• | supervising sales practice activities and facilitating the oversight of activities for branch managers; |

• | conducting technology-enabled surveillance of trading activities and sales practices; |

• | overseeing and monitoring of registered investment advisory activities; |

• | inspecting branch offices and advising on how to strengthen compliance procedures; and |

• | continuing to invest in technology assisted supervisory and surveillance tools. |

Practice Management Programs and Training

Our practice management programs are designed to help financial advisors in independent practices and financial institutions, as well as all levels of financial institution leadership, enhance and grow their businesses. Our experience gives us the ability to benchmark the best practices of successful advisors and develop customized recommendations to meet the specific needs of an advisor’s business and market. Because of our scale, we are able to dedicate an experienced group of practice management professionals who counsel our advisors to build and better manage their business and client relationships through one-on-one support as well as group training. In addition, we hold over 100 conferences and group training events around the country annually for the benefit of our advisors. Our practice management and training services include:

• | personalized business consulting that helps advisors and program leadership enhance the value and operational efficiency of their businesses; |

3

• | advisory and brokerage consulting and financial planning to support advisors in growing their businesses with our broad range of products and fee-based offerings, as well as wealth management services to assist advisors serving high-net-worth clients with comprehensive estate, tax, philanthropic, and financial planning processes; |

• | marketing strategies, including campaign templates, to enable advisors to build awareness of their services and capitalize on opportunities in their local markets; |

• | succession planning and an advisor loan program for advisors looking to either sell their own or buy another practice; |

• | transition services to help advisors establish independent practices and migrate client accounts to us; and |

• | training and educational programs on topics including technology, use of advisory platforms, and business development. |

Independent Research

We provide our advisors with integrated access to comprehensive research on a broad range of investments and market analysis, including on mutual funds, separate accounts, alternative investments and annuities, asset allocation strategies, financial markets, and the economy. Based on our research we create discretionary portfolios, for which we serve as a portfolio manager, that are available through the LPL Financial turnkey advisory asset management platforms. Our research team provides lower-conflict advice that is designed to empower our advisors to provide their clients with thoughtful advice in a timely manner. Our research team actively works with our product due diligence group to effectively scrutinize the financial products offered through our platform. Our lack of proprietary products or investment banking services helps ensure that our research remains unbiased and objective. A substantial portion of our research materials are approved by our Marketing Regulatory Review department for use with advisors' clients, allowing our advisors to leverage these materials to help their clients understand complex investment topics and make informed decisions.

We also offer independent investment research on macro-economic analysis, capital markets assumptions, and strategic and tactical asset allocation. We also provide robust third-party asset manager search, selection, and monitoring services for both traditional and alternative strategies across all investment access points (ETFs, mutual funds, separately managed accounts, unified managed accounts, and other products and services).

Our Product and Solution Access

We do not manufacture any financial products. Instead, we provide our advisors with open architecture access to a broad range of commission, fee-based, cash, and money market products and services. Our product due diligence group conducts extensive diligence on substantially all of our product offerings, including annuities, mutual funds, exchange-traded funds, and alternative investments, including real estate investment trusts. Our platform provides access to over 13,000 financial products, manufactured by 900 product sponsors. Typically, we enter into arrangements with these product sponsors pursuant to the sponsor’s standard distribution agreement.

The sales and administration of these products are facilitated through our technology solutions that allow our advisors to access client accounts, product information, asset allocation models, investment recommendations, and economic insight as well as to perform trade execution.

Commission-Based Products

Commission-based products are those for which we and our advisors receive an upfront commission and, for certain products, a trailing commission. Our brokerage offerings include variable and fixed annuities, mutual funds, equities, alternative investments such as non-traded real estate investment trusts and business development companies, retirement and 529 education savings plans, fixed income, and insurance. Our insurance offering is provided through LPLIA, a brokerage general agency that provides personalized advance case design, point-of-sale service, and product support for a broad range of life, disability, and long-term care products. As of December 31, 2014, the total assets in our commission-based products were $299.3 billion.

Fee-Based Advisory Platforms and Support

LPL Financial has five fee-based advisory platforms that provide centrally managed or customized solutions from which advisors can choose to meet the investment needs of their mass affluent clients (those investors with $100,000 or greater in investable assets) and high-net-worth clients. The fee structure aligns the interests of our advisors with their clients, while establishing a recurring revenue stream for the advisor and for us. Our fee-based platforms provide access to no-load/load-waived mutual funds, exchange-traded funds, stocks, bonds, conservative

4

option strategies, unit investment trusts, and institutional money managers and no-load multi-manager variable annuities. As of December 31, 2014, the total assets under custody in these platforms were $175.8 billion.

Cash Sweep Programs

We assist our advisors in managing their clients’ cash balances through two primary cash sweep programs depending on account type: a money market sweep vehicle involving money market fund providers and an insured bank deposit sweep vehicle. Our insured bank deposit sweep vehicle allocates client cash balances across multiple non-affiliated banks to provide advisors with up to $1.5 million ($3.0 million joint) of insurance through the Federal Deposit Insurance Corporation (“FDIC”). As of December 31, 2014, the total assets in our cash sweep programs, which are held within brokerage and advisory accounts, were approximately $26.0 billion, with $7.4 billion held in a money market sweep vehicle and $18.6 billion in an insured bank deposit sweep vehicle.

Retirement Services

We offer a retirement solution that is fee-based and allows qualified advisors to provide consultation and advice to plan sponsors using our corporate RIA. We also offer a retirement solution that provides for commission-based services. Our advisors, whether through our corporate RIA or through an Independent RIA, serve over 31,600 retirement plans representing at least $80.3 billion in retirement plan assets. These retirement plan assets are custodied with LPL Financial or various third-party providers of retirement plan administrative services who provide us with direct reporting feeds. There are additional retirement plan assets supported by our advisors that are custodied with third-party providers who do not provide reporting feeds to us. We estimate there are over 40,000 retirement plans served by our advisors with total retirement plan assets to be between $115.0 billion and $125.0 billion. The retirement plan assets that are not custodied at LPL Financial are not included in our reported advisory and brokerage assets.

Other Services

We provide a number of tools and services that enable advisors to maintain and grow their practices. Through our subsidiary PTC, we provide custodial services to trusts for estates and families. Under our unique model, an advisor may provide a trust with investment management services, while administrative services for the trust are provided by PTC.

Our Financial Model

Our overall financial performance is a function of the following dynamics of our business:

• | Our revenues stem from diverse sources, including advisor-generated commission and advisory fees as well as fees from product manufacturers, omnibus, networking services, cash sweep balances, and other ancillary services. Revenues are not concentrated by advisor, product, or geography. For the year ended December 31, 2014, no single relationship with our independent advisor practices, banks, credit unions, or insurance companies accounted for more than 3% of our net revenues, and no single advisor accounted for more than 1% of our net revenues. |

• | The largest variable component of our cost base, advisor payout percentages, is directly linked to revenues generated by our advisors. |

• | A portion of our revenues, such as software licensing and account and client fees, are not correlated with the equity financial markets. |

• | Our operating model is scalable and can deliver expanding profit margins over time. |

• | We are able to operate with low capital expenditures and limited capital requirements, and as a result generate substantial free cash flow, which we have committed to investing in our business as well as returning value to shareholders. |

5

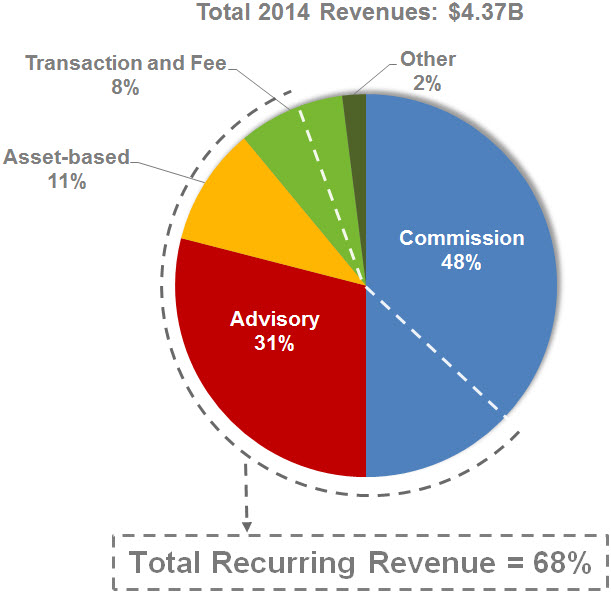

• | The majority of our revenue base is recurring in nature, with approximately 68% recurring revenue in 2014. |

Our Competitive Strengths

Market Leadership Position and Significant Scale

We are the established leader in the independent advisor market, which is our core business focus. Our scale enables us to benefit from the following dynamics:

• | Continual Reinvestment — We actively reinvest in our comprehensive technology platform and practice management support, which further improves the productivity of our advisors. |

• | Pricing Power — As one of the largest distributors of financial products in the United States, we are able to obtain attractive economics from product manufacturers. |

• | Payout Ratios to Advisors — Among the five largest U.S. broker-dealers by number of advisors, we offer the highest average payout ratios to our advisors. |

The combination of our ability to reinvest in our business and maintain highly competitive payout ratios has enabled us to attract and retain advisors. This, in turn, has driven our growth and led to a continuous cycle of reinvestment that reinforces our established scale advantage.

Unique Value Proposition

We deliver a comprehensive and integrated suite of products and services to support the practices of our independent advisors. We believe we are the only institution that offers a lower-conflict, open architecture, and scalable platform. The benefits of our purchasing power lead to high average payouts and greater economics to our advisors. Our platform also creates an entrepreneurial opportunity that empowers independent advisors to build equity in their businesses. This generates a significant opportunity to attract and retain highly qualified advisors who are seeking independence.

We provide comprehensive solutions to financial institutions, such as regional banks, credit unions, and insurers who seek to provide a broad array of services for their clients. We believe many institutions find the technology, infrastructure, and regulatory requirements associated with delivering financial advice to be cost-prohibitive. The solutions we provide enable financial advisors at these institutions to deliver their services on a cost-effective basis.

6

Flexibility of Our Business Model

Our business model allows our advisors the freedom to choose how they conduct their business, which helps us attract and retain advisors from multiple channels, including wirehouses, regional broker-dealers, and other independent broker-dealers. Our accommodating platform serves a variety of independent advisor models, including independent financial advisors, RIAs, and Independent RIAs. The flexibility of our business model makes it easy for our advisors to transition among independent advisor models and product mix as their business evolves and preferences change within the market. Our business model provides advisors with a multitude of customizable service and technology offerings, which allows them to increase their efficiency, focus on their clients and grow their practice.

Ability to Serve Approximately 90% of Retail Assets

Our historic focus has been on advisors who serve the mass-affluent market (investors with $100,000 or greater in investable assets) and believe there continues to be an attractive opportunity in this market. Although we have grown through our focus in this area, the flexibility of our platform allow us to expand our breadth of services to better support the high-net-worth market. As of December 31, 2014, our advisors supported accounts with more than $1 million in assets that in the aggregate represented $92.1 billion in advisory and brokerage assets, 19.4% of our total assets custodied. Our array of integrated technology and services can support advisors with significant production and can compete directly with wirehouses and custodians. We are able to support our advisors to meet the needs of their mass market clients up through the high-net-worth market, which, according to Cerulli Associates, accounts for approximately 90% of retail assets.

Our Sources of Growth

We expect to increase our revenue and profitability by benefiting from favorable industry trends and by executing strategies to accelerate our growth beyond that of the broader markets in which we operate.

Favorable Industry Trends

Growth in Investable Assets

According to Cerulli Associates, over the past five years, assets under management for the market segments in the United States that we address grew 8.5% per year, while retirement assets are expected to grow 6.4% per year over the next five years (in part due to the retirement of the baby boomer generation and the resulting assets that are projected to flow out of retirement plans and into individual retirement accounts). In addition, IRA assets are projected to grow from $7.5 trillion as of 2014 to $10.6 trillion by 2018. In addition to the retirement of the baby boomer generation, there is a general need in the United States for greater and smarter retirement savings as well as increased regulatory pressures on 401(k) plan sponsors.

(1) | The Cerulli Report: The State of U.S. Retail and Institutional Asset Management 2014. |

(2) | The Cerulli Report: U.S. Retirement Markets 2014: Sizing Opportunities in Private and Public Retirement Plans. |

7

Increasing Demand for Independent Financial Advice

Retail investors, particularly in the mass-affluent market, are increasingly seeking financial advice from independent sources. We are highly focused on helping independent advisors meet the needs of the mass-affluent market, which constitutes a significant and underserved portion of investable assets, in part because wirehouses have not typically focused on this space.

Advisor Migration to Independence

Independent channels continue to gain market share from captive channels. We believe that we are not just a beneficiary of this secular shift, but an active catalyst in the movement to independence. There is an increased shift towards advisors seeking complete independence by forming an RIA and registering directly with the SEC. However, these advisors are generally interested in retaining assets in brokerage accounts. This shift is leading to significant growth in the number of our Independent RIA advisors.

Macroeconomic Trends

While the current macroeconomic environment exhibits short-term volatility, we anticipate an appreciation in asset prices and a rise in interest rates over the long term. We expect that our business will benefit from growth in advisory and brokerage assets as well as increasing interest rates.

Executing Our Growth Strategies

Attracting New Advisors to Our Platform

We intend to grow the number of advisors who are served by our platform — either those who are independent or who are aligned with financial institutions. We have a 4.8% market share of the approximately 290,000 financial advisors in the United States, according to Cerulli Associates, and we believe that we have the ability to attract seasoned advisors of any practice size and from any channel, including wirehouses, regional broker-dealers and other independent broker-dealers.

Channel | Advisors | Market Share | ||

Independent Broker-Dealer(1) | 67,290 | 23.5% | ||

Insurance Broker-Dealer | 74,804 | 26.1% | ||

Wirehouse | 46,594 | 16.3% | ||

Regional Broker-Dealer | 29,955 | 10.5% | ||

RIA(1) | 28,528 | 9.9% | ||

Bank Broker-Dealer | 14,332 | 5.0% | ||

Dually registered RIAs(1) | 24,825 | 8.7% | ||

Total | 286,328 | 100.0% | ||

___________________

(1) The 24,825 advisors classified as "dually registered RIAs" are advisors who are both licensed through independent broker-dealers and registered as investment advisors.

Increasing Productivity of Existing Advisor Base

The productivity of advisors increases over time as we enable them to add new clients, gain shares of their clients’ investable assets, and expand their existing practices with additional advisors. We facilitate these productivity improvements by helping our advisors better manage their practices in an increasingly complex external environment, which results in assets per advisor improving over time.

Ramp-up of Newly-Attracted Advisors

We primarily attract experienced advisors who have established practices. In our experience, it takes an average of four years for newly recruited advisors to fully re-establish their practices and associated revenues. This seasoning process creates accelerated growth of revenue from new advisors.

8

Expansions of our Product & Service Offerings

Through internal development, as well as synergies obtained from opportunistic acquisitions, we have expanded our capabilities and product and service offerings in order to ensure we continue to provide a premium platform for our advisors to grow and enhance the profitability of their businesses. Presented below are a few examples of our expanded capabilities and product and service offerings.

Account View | Accessed from a computer, tablet, or smartphone, Account View is clients’ secure, convenient, 24-hour online access to their investment account information. The site gives clients the ability to access current market information and financial headlines, as well as export portfolio data for further analysis. Clients can also exchange secure messages, and manage their profile including password resets and paperless options. | ||||

Advisor Essentials | A strategic educational curriculum designed to help advisors create and run a profitable and productive practice, this program is tailored for advisors new to the business, staff who are on a career path to become a financial advisor, or producers who have not yet reached a club level at LPL Financial. The curriculum will enhance effectiveness across client service, value proposition, and office management. | ||||

Enhanced Trading & Rebalancing | The Enhanced Trading and Rebalancing provides an integrated single-platform solution to keep up with advisors’ fast pace of business demands. The trading platform provides advisors with the most efficient way to place trades on their advisory accounts. The rebalancing feature allows advisors to be more efficient and strategic by rebalancing accounts using custom models. | ||||

LPL Digital IQ | LPL Digital IQ is an interactive training program designed to make it simple for advisors to learn how to get started on social media and enhance their digital presence. The four levels of Digital IQ-Basics, Explorer, Master, and Elite-consist of video lessons that help advisors stay on the leading edge of client communications and one step ahead of the competition. The LPL Digital IQ program is ideal for advisors that need to learn the basics or the experienced social media user who wants to take digital marketing to an elite level. | ||||

Resource Center | The Resource Center is an informational hub that provides advisors and staff with information and resources to efficiently operate and grow their business including news and alerts, operation procedures and forms, research, client acquisition and retention, practice management, and training. | ||||

LPL Financial Mobile | LPL Financial Mobile provides advisors with the ability to look up clients and associated Account View and Resource Center information. Advisors have access to client account, position, transaction and statement information. Advisors are able to stay current with easy-to-access market data, including stock quotes, indices, and headlines. | ||||

RetirementU | A strategic educational curriculum that provides advisors and staff members with the training they need to access and effectively utilize retirement resources of LPL Financial. RetirementU helps to prepare administrative assistants to effectively support advisors providing investment policy development, compliance monitoring services for plan sponsors and research on retirement plans and asset managers. | ||||

Streamlined Office | Suite of solutions, incorporating eSignature, Remote Deposit, and iDoc, that can save advisors time and money, and enhance their clients’ experience. eSignature allows advisors and their clients to provide electronic signatures on the most commonly used operational forms. Remote Deposit is a mobile solution that provides an easy, fast, convenient, and secure way to deposit client checks into LPL Financial accounts. iDoc acts as an online vault, in which advisors can store documents electronically and securely. | ||||

Competition

We believe we offer a unique and dedicated value proposition to independent financial advisors and financial institutions. This value proposition is built upon the delivery of our services through our scale, independence, and integrated technology, the sum of which we believe is not replicated in the industry. As a result we believe that we do not have any direct competitors that offer our unique business model at the scale at which we offer it. For example, because we do not have any proprietary manufacturing products, we do not view firms that manufacture asset management products and other financial products as direct competitors.

We compete to attract and retain experienced and productive advisors with a variety of financial firms. Within the independent channel, the industry is highly fragmented, comprised primarily of small regional firms that rely on third-party custodians and technology providers to support their operations. The captive wirehouse channel tends to consist of large nationwide firms with multiple lines of business that have a focus on the highly competitive high-net-worth investor market. Competitors in this channel include Morgan Stanley; Bank of America Merrill Lynch; UBS

9

Financial Services Inc.; and Wells Fargo Advisors, LLC. Competition for advisors also includes regional firms, such as Edward D. Jones & Co., L.P. and Raymond James Financial Services, Inc. Independent RIAs, which are licensed directly with the SEC and not through a broker-dealer, may choose from a number of third-party firms to provide custodial services. Our significant competitors in this space include Charles Schwab & Co., Fidelity Brokerage Services LLC, and TD Ameritrade.

Those competitors that do not offer a complete clearing solution for advisors are frequently supported by third-party clearing and custody oriented firms. Pershing LLC, a subsidiary of Bank of New York Mellon, National Financial Services LLC, a subsidiary of Fidelity Investments, and J.P. Morgan Clearing Corp., a subsidiary of J.P. Morgan Chase & Co., offer custodial services and technology solutions to independent firms and RIAs that are not self-clearing. These clearing firms and their affiliates and other providers also offer an array of service, technology and reporting tools. Albridge Solutions, a subsidiary of Bank of New York Mellon, Advent Software, Inc., Envestnet, Inc., and Morningstar, Inc., provide an array of research, analytics and reporting solutions.

Our advisors compete for clients with financial advisors of brokerage firms, banks, insurance companies, asset management, and investment advisory firms. In addition, they also compete with a number of firms offering direct to investor on-line financial services and discount brokerage services, such as Charles Schwab & Co. and Fidelity Brokerage Services LLC.

Employees

As of December 31, 2014, we had 3,384 full-time employees. None of our employees is subject to collective bargaining agreements governing their employment with us. Our continued growth is dependent, in part, on our ability to be an employer of choice and an organization that recruits and retains talented employees who best fit our culture and business needs. We offer ongoing learning opportunities and programs that empower employees to grow in their professional development and careers. We provide comprehensive compensation and benefits packages, as well as financial education tools to assist our employees as they plan for their future. We give back to our local communities, encourage sustainability in our workplace, and embrace diversity and inclusion to appreciate the unique perspective and value that each of our employees brings based on their personal experiences. Through these initiatives, we work to help all employees be engaged and empowered.

Regulation

The financial services industry is subject to extensive regulation by U.S. federal, state, and international government agencies as well as various self-regulatory organizations. We take an active leadership role in the development of the rules and regulations that govern our industry. We have been investing in our compliance functions to monitor our adherence to the numerous legal and regulatory requirements applicable to our business.

Broker-Dealer Regulation

LPL Financial is a broker-dealer registered with the SEC, a member of FINRA and various other self-regulatory organizations, and a participant in various clearing organizations including the Depository Trust Company, the National Securities Clearing Corporation, and the Options Clearing Corporation. LPL Financial is registered as a broker-dealer in each of the 50 states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands.

Broker-dealers are subject to rules and regulations covering all aspects of the securities business, including sales and trading practices, public offerings, publication of research reports, use and safekeeping of clients’ funds and securities, capital adequacy, recordkeeping and reporting, and the conduct of directors, officers, and employees. Broker-dealers are also regulated by state securities administrators in those jurisdictions where they do business. Compliance with many of the rules and regulations applicable to us involves a number of risks because rules and regulations are subject to varying interpretations, among other reasons. Regulators make periodic examinations and review annual, monthly, and other reports on our operations, track record, and financial condition. Violations of rules and regulations governing a broker-dealer’s actions could result in censure, penalties and fines, the issuance of cease-and-desist orders, the suspension or expulsion from the securities industry of such broker-dealer, its financial advisor(s) or its officers or employees, or other similar adverse consequences. The rules of the Municipal Securities Rulemaking Board, which are enforced by the SEC and FINRA, apply to the municipal securities activities of LPL Financial.

Our margin lending is regulated by the Federal Reserve Board’s restrictions on lending in connection with client purchases and short sales of securities, and FINRA rules also require our subsidiaries to impose maintenance

10

requirements based on the value of securities contained in margin accounts. In many cases, our margin policies are more stringent than these rules.

Significant new rules and regulations continue to arise as a result of the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”), which was enacted in July 2010. Provisions of the Dodd-Frank Act that may impact our business include, but are not limited to, the potential implementation of a more stringent fiduciary standard for broker-dealers and the potential establishment of a new self-regulatory organization for investment advisors. Compliance with these provisions is likely to result in increased costs. Moreover, to the extent the Dodd-Frank Act impacts the operations, financial condition, liquidity and capital requirements of financial institutions with whom we do business, those institutions may seek to pass on increased costs, reduce their capacity to transact, or otherwise present inefficiencies in their interactions with us. The ultimate impact that the Dodd-Frank Act will have on us, the financial industry, and the economy cannot be known until all such applicable regulations called for under the Dodd-Frank Act have been finalized and implemented.

Investment Adviser Regulation

As investment advisers registered with the SEC, our subsidiaries LPL Financial, IAG, and Fortigent, LLC are subject to the requirements of the Investment Advisers Act of 1940, as amended (the "Advisers Act"), and the regulations promulgated thereunder, including examination by the SEC’s staff. Such requirements relate to, among other things, fiduciary duties to clients, performance fees, maintaining an effective compliance program, solicitation arrangements, conflicts of interest, advertising, limitations on agency cross and principal transactions between the advisor and advisory clients, recordkeeping and reporting requirements, disclosure requirements, and general anti-fraud provisions.

The SEC is authorized to institute proceedings and impose sanctions for violations of the Advisers Act, ranging from fines and censure to termination of an investment adviser’s registration. Investment advisers also are subject to certain state securities laws and regulations. Failure to comply with the Advisers Act or other federal and state securities laws and regulations could result in investigations, sanctions, profit disgorgement, fines or other similar consequences.

Retirement Plan Services Regulation

Certain of our subsidiaries, including LPL Financial, Fortigent, PTC, IAG, and LPLIA, are subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA") and Section 4975 of the Internal Revenue Code (the "Code"), and to regulations promulgated under ERISA or the Code, insofar as they provide services with respect to plan clients, or otherwise deal with plan clients that are subject to ERISA or the Code. ERISA imposes certain duties on persons who are "fiduciaries" (as defined in Section 3(21) of ERISA) and prohibits certain transactions involving plans subject to ERISA and fiduciaries or other service providers to such plans. Non-compliance with these provisions may expose an ERISA fiduciary or other service provider to liability under ERISA, which may include monetary penalties as well as equitable remedies for the affected plan. Section 4975 of the Code prohibits certain transactions involving plans (as defined in Section 4975(e)(1), which includes individual retirement accounts and Keogh plans) and service providers, including fiduciaries, to such plans. Section 4975 imposes excise taxes for violations of these prohibitions.

Commodities and Futures Regulation

LPL Financial is registered as an introducing broker with the Commodity Futures Trading Commission (“CFTC”) and is a member of the National Futures Association (“NFA”). LPL Financial introduces commodities and futures products to ADM Investor Services, Inc. (“ADM”), and all commodities accounts and related client positions are held by ADM. LPL Financial is regulated by the CFTC and NFA. Violations of the rules of the CFTC and the NFA could result in remedial actions including fines, registration terminations, or revocations of exchange memberships.

Trust Regulation

Through our subsidiary, PTC, we offer trust, investment management oversight and custodial services for estates and families. PTC is chartered as a non-depository national banking association. As a limited purpose national bank, PTC is regulated and regularly examined by the Office of the Comptroller of the Currency (“OCC”). PTC files reports with the OCC within 30 days after the conclusion of each calendar quarter. Because the powers of PTC are limited to providing fiduciary services and investment advice, it does not have the power or authority to accept deposits or make loans. For this reason, trust assets under PTC’s management are not insured by the FDIC.

Because of its limited purpose, PTC is not a “bank” as defined under the Bank Holding Company Act of 1956. Consequently, neither its immediate parent, PTC Holdings, Inc., nor its ultimate parent, LPLFH, is regulated by the

11

Board of Governors of the Federal Reserve System as a bank holding company. However, PTC is subject to regulation by the OCC and to various laws and regulations enforced by the OCC, such as capital adequacy, change of control restrictions and regulations governing fiduciary duties, conflicts of interest, self-dealing, and anti-money laundering. For example, the Change in Bank Control Act, as implemented by OCC supervisory policy, imposes restrictions on parties who wish to acquire a controlling interest in a limited purpose national bank such as PTC or the holding company of a limited purpose national bank such as LPL Financial Holdings Inc. In general, an acquisition of 10% or more of our common stock, or another acquisition of “control” as defined in OCC regulations, may require OCC approval. These laws and regulations are designed to serve specific bank regulatory and supervisory purposes and are not meant for the protection of PTC, LPL Financial, or their stockholders.

Regulatory Capital

The SEC, FINRA, CFTC, and NFA have stringent rules and regulations with respect to the maintenance of specific levels of net capital by regulated entities. Generally, a broker-dealer’s net capital is calculated as net worth plus qualified subordinated debt less deductions for certain types of assets. The net capital rule under the Exchange Act requires that at least a minimum part of a broker-dealer’s assets be maintained in a relatively liquid form. LPL Financial is also subject to the NFA's financial requirements and is required to maintain net capital that is in excess of or equal to the greatest of the NFA's minimum financial requirements. Under these requirements, LPL Financial is currently required to maintain minimum net capital that is in excess of or equal to the minimum net capital calculated and required pursuant to the SEC's Uniform Net Capital Rule.

The SEC, FINRA, CFTC, and NFA impose rules that require notification when net capital falls below certain predefined criteria. These broker-dealer capital rules also dictate the ratio of debt to equity in regulatory capital composition, and constrain the ability of a broker-dealer to expand its business under certain circumstances. If a broker-dealer fails to maintain the required net capital, it may be subject to suspension or revocation of registration by the applicable regulatory agency, and suspension or expulsion by these regulators ultimately could lead to the broker-dealer’s liquidation. Additionally, the net capital rule and certain FINRA rules impose requirements that may have the effect of prohibiting a broker-dealer from distributing or withdrawing capital, and that require prior notice to the SEC and FINRA for certain capital withdrawals. LPL Financial, which is subject to net capital rules has been, and currently is, in compliance with those rules and has net capital in excess of the minimum requirements.

Anti-Money Laundering and Sanctions Compliance

The USA PATRIOT Act of 2001 (the “PATRIOT Act”) contains anti-money laundering and financial transparency laws and mandates the implementation of various regulations applicable to broker-dealers, futures commission merchants and other financial services companies. Financial institutions subject to the PATRIOT Act generally must have anti-money laundering procedures in place, monitor for and report suspicious activity, implement specialized employee training programs, designate an anti-money laundering compliance officer, and are audited periodically by an independent party to test the effectiveness of compliance. In addition, sanctions administered by the U.S. Office of Foreign Asset Control prohibit U.S. persons from doing business with blocked persons and entities. We have established policies, procedures, and systems designed to comply with these regulations.

Security and Privacy

Regulatory activity in the areas of privacy and data protection continues to grow worldwide and is generally being driven by the growth of technology and related concerns about the rapid and widespread dissemination and use of information. To the extent they are applicable to us, we must comply with these federal and state information-related laws and regulations, including, for example, those in the United States, such as the 1999 Gramm-Leach-Bliley Act, SEC Regulation S-P, and the Fair Credit Reporting Act of 1970, as amended.

Financial Information about Geographic Areas

Our revenues for the periods presented were derived from our operations in the United States.

Trademarks

Access Alts®, Access Overlay®, BranchNet®, DO IT SMARTER®, Fortigent®, LPL®, LPL Career Match®, LPL Financial®, the LPL Financial logo, LPL Partners Program®, Manager Access Network®, Manager Access Select®, OMP®, National Retirement Partners®, the National Retirement Partners logo, Veritat Advisors®, and the Veritat Advisor logo are our registered trademarks. ClientWorks and SponsorWorks are among our service marks.

12

Item 1A. Risk Factors

Risks Related to Our Business and Industry

We depend on our ability to attract and retain experienced and productive advisors.

We derive a large portion of our revenues from commissions and fees generated by our advisors. Our ability to attract and retain experienced and productive advisors has contributed significantly to our growth and success, and our strategic plan is premised upon continued growth in the number of our advisors. If we fail to attract new advisors or to retain and motivate our current advisors, replace our advisors who retire, or assist our retiring advisors with transitioning their practices to existing advisors, or if advisor migration away from wirehouses and to independent channels decreases or slows, our business may suffer.

The market for experienced and productive advisors is highly competitive, and we devote significant resources to attracting and retaining the most qualified advisors. In attracting and retaining advisors, we compete directly with a variety of financial institutions such as wirehouses, regional broker-dealers, banks, insurance companies and other independent broker-dealers. If we are not successful in retaining highly qualified advisors, we may not be able to recover the expense involved in attracting and training these individuals. There can be no assurance that we will be successful in our efforts to attract and retain the advisors needed to achieve our growth objectives.

Our financial condition and results of operations may be adversely affected by market fluctuations and other economic factors.

Significant downturns and volatility in equity and other financial markets have had and could continue to have an adverse effect on our financial condition and results of operations.

General economic and market factors can affect our commission and fee revenue. For example, a decrease in market levels can:

• | reduce new investments by both new and existing clients in financial products that are linked to the equity markets, such as variable life insurance, variable annuities, mutual funds, and managed accounts; |

• | reduce trading activity, thereby affecting our brokerage commissions and our transaction revenue; |

• | reduce the value of advisory and brokerage assets, thereby reducing advisory fee revenue and asset-based fee income and |

• | motivate clients to withdraw funds from their accounts, reducing advisory and brokerage assets, advisory fee revenue, and asset-based fee income. |

Other more specific trends may also affect our financial condition and results of operations, including, for example, changes in the mix of products preferred by investors may result in increases or decreases in our fee revenues associated with such products, depending on whether investors gravitate towards or away from such products. The timing of such trends, if any, and their potential impact on our financial condition and results of operations are beyond our control.

In addition, because certain of our expenses are fixed, our ability to reduce them over short periods of time is limited, which could negatively impact our profitability.

Significant interest rate changes could affect our profitability and financial condition.

Our revenues are exposed to interest rate risk primarily from changes in fees payable to us from banks participating in our cash sweep programs, which are based on prevailing interest rates. In the current low interest rate environment, our revenue from our cash sweep programs has declined, and our revenue may decline further due to the expiration of contracts with favorable pricing terms, less favorable terms in future contracts with participants in our cash sweep programs, decreases in interest rates or clients moving assets out of our cash sweep programs. We may also be limited in the amount we can reduce interest rates payable to clients in our cash sweep programs and still offer a competitive return. A sustained low interest rate environment may have a negative impact upon our ability to negotiate contracts with new banks or renegotiate existing contracts on comparable terms with banks participating in our cash sweep programs.

Lack of liquidity or access to capital could impair our business and financial condition.

Liquidity, or ready access to funds, is essential to our business. We expend significant resources investing in our business, particularly with respect to our technology and service platforms. In addition, we must maintain certain levels of required capital. As a result, reduced levels of liquidity could have a significant negative effect on us. Some potential conditions that could negatively affect our liquidity include:

13

• | illiquid or volatile markets; |

• | diminished access to debt or capital markets; |

• | unforeseen cash or capital requirements; or |

• | regulatory penalties or fines, or adverse legal settlements or judgments (including, among others, risks associated with auction rate securities). |

The capital and credit markets continue to experience varying degrees of volatility and disruption. In some cases, the markets have exerted downward pressure on availability of liquidity and credit capacity for businesses similar to ours. Without sufficient liquidity, we could be required to curtail our operations, and our business would suffer.

Notwithstanding the self-funding nature of our operations, we may sometimes be required to fund timing differences arising from the delayed receipt of client funds associated with the settlement of client transactions in securities markets. These timing differences are funded either with internally generated cash flow or, if needed, with funds drawn under our revolving credit facility, or uncommitted lines of credit at our broker-dealer subsidiary LPL Financial.

In the event current resources are insufficient to satisfy our needs, we may need to rely on financing sources such as bank debt. The availability of additional financing will depend on a variety of factors such as:

• | market conditions; |

• | the general availability of credit; |

• | the volume of trading activities; |

• | the overall availability of credit to the financial services industry; |

• | our credit ratings and credit capacity; and |

• | the possibility that our lenders could develop a negative perception of our long-or short-term financial prospects if the level of our business activity decreases due to a market downturn. Similarly, our access to funds may be impaired if regulatory authorities or rating organizations take negative actions against us. |

Disruptions, uncertainty or volatility in the capital and credit markets may also limit our access to capital required to operate our business. Such market conditions may limit our ability to satisfy statutory capital requirements, generate commission, fee and other market-related revenue to meet liquidity needs and access the capital necessary to grow our business. As such, we may be forced to delay raising capital, issue different types of capital than we would otherwise, less effectively deploy such capital or bear an unattractive cost of capital, which could decrease our profitability and significantly reduce our financial flexibility.

If there is a default under the derivative instruments we use to hedge our foreign currency risk default, we may be exposed to risks we had sought to mitigate.

We, from time to time, use derivative instruments to hedge our foreign currency risk. In particular, our agreement with a third-party service provider provides for an annual adjustment of the currency exchange rate between the U.S. dollar and the Indian rupee. We bear the risk of currency movement at each annual reset date, and the reset rate then applies for the subsequent 12-month period. To mitigate foreign currency risk arising from such annual adjustments, we use derivative financial instruments consisting solely of non-deliverable foreign currency contracts. However, if either we or our counterparties fail to honor our respective obligations under such derivative instruments, we could be subject to the risk of loss and our hedges of the foreign currency risk will be ineffective. That failure could have an adverse effect on our financial condition, results of operations, and cash flows that could be material.

A loss of our marketing relationships with manufacturers of financial products could harm our relationship with our advisors and, in turn, their clients.

We operate on an open-architecture product platform offering no proprietary financial products. To help our advisors meet their clients’ needs with suitable investment options, we have relationships with most of the industry-leading providers of financial and insurance products. We have sponsorship agreements with some manufacturers of fixed and variable annuities and mutual funds that, subject to the survival of certain terms and conditions, may be terminated by the manufacturer upon notice. If we lose our relationships with one or more of these manufacturers, our ability to serve our advisors and, in turn, their clients, and our business may be materially adversely affected. As an example, recently certain variable annuity product sponsors have ceased offering and issuing new variable annuity contracts. If this trend continues, we could experience a loss in the revenue currently generated from the sale of such products. In addition, certain features of such contracts have been eliminated by variable annuity

14

product sponsors. If this trend continues, the attractiveness of these products would be reduced, potentially reducing the revenue we currently generate from the sale of such products.

Our business could be materially adversely affected as a result of the risks associated with acquisitions and investments.

We have made acquisitions and investments in the past and may pursue further acquisitions and investments in the future. These transactions are accompanied by risks. For instance, an acquisition could have a negative effect on our financial and strategic position and reputation or the acquired business could fail to further our strategic goals. Moreover, we may not be able to successfully integrate acquired businesses into ours, and therefore we may not be able to realize the intended benefits from an acquisition. We may have a lack of experience in new markets, products or technologies brought on by the acquisition and we may have an initial dependence on unfamiliar supply or distribution partners. An acquisition may create an impairment of relationships with customers or suppliers of the acquired business or our advisors or suppliers. All of these and other potential risks may serve as a diversion of our management's attention from other business concerns, and any of these factors could have a material adverse effect on our business.

Risks Related to Our Regulatory Environment

Regulatory developments and our failure to comply with regulations could adversely affect our business by increasing our costs and exposure to litigation, affecting our reputation and making our business less profitable.

Our business is subject to extensive U.S. regulation and supervision, including securities and investment advisory services. The securities industry in the United States is subject to extensive regulation under both federal and state laws. Our broker-dealer subsidiary, LPL Financial, is:

• | registered as a broker-dealer with the SEC, each of the 50 states, and the District of Columbia, Puerto Rico and the U.S. Virgin Islands; |

• | registered as an investment adviser with the SEC; |

• | a member of FINRA and various other self-regulatory organizations, and a participant in various clearing organizations including the Depository Trust Company, the National Securities Clearing Corporation, and the Options Clearing Corporation; and |

• | regulated by the CFTC with respect to the futures and commodities trading activities it conducts as an introducing broker. |

Much of the regulation of broker-dealers has been delegated to self-regulatory organizations (“SROs”). The primary regulators of LPL Financial are FINRA, and for municipal securities, the Municipal Securities Rulemaking Board (“MSRB”). The CFTC has designated the National Futures Association ("NFA") as LPL Financial’s primary regulator for futures and commodities trading activities.

The SEC, FINRA, CFTC, OCC, various securities and futures exchanges and other U.S. governmental or regulatory authorities continuously review legislative and regulatory initiatives and may adopt new or revised laws, regulations, or interpretations. There can also be no assurance that other federal or state agencies will not attempt to further regulate our business. These legislative and regulatory initiatives may affect the way in which we conduct our business and may make our business model less profitable.

Our ability to conduct business in the jurisdictions in which we currently operate depends on our compliance with the laws, rules and regulations promulgated by federal regulatory bodies and the regulatory authorities in each of the states and other jurisdictions in which we do business. Our ability to comply with all applicable laws, rules and regulations, and interpretations is largely dependent on our establishment and maintenance of compliance, audit and reporting systems and procedures, as well as our ability to attract and retain qualified compliance, audit and risk management personnel. While we have adopted policies and procedures reasonably designed to comply with all applicable laws, rules and regulations, and interpretations these systems and procedures may not be fully effective, and there can be no assurance that regulators or third-parties will not raise material issues with respect to our past or future compliance with applicable regulations.

Our profitability could also be affected by rules and regulations that impact the business and financial communities generally and, in particular, our advisors’ and their clients, including changes to the interpretation or enforcement of laws governing taxation (including the classification of independent contractor status of our advisors), trading, electronic commerce, privacy, and data protection. For instance, failure to comply with new rules and regulations, including in particular, rules and regulations that may arise pursuant to the Dodd-Frank Act, could subject us to regulatory actions or litigation and it could have a material adverse effect on our business, results of

15

operations, cash flows, or financial condition. Provisions of the Dodd-Frank Act that may affect our business include, but are not limited to, the potential implementation of a more stringent fiduciary standard for broker-dealers and the potential establishment of a new SRO for investment advisors. Compliance with these provisions would likely result in increased costs. Moreover, to the extent the Dodd-Frank Act affects the operations, financial condition, liquidity and capital requirements of financial institutions with which we do business, those institutions may seek to pass on increased costs, reduce their capacity to transact, or otherwise present inefficiencies in their interactions with us. The ultimate impact that the Dodd-Frank Act will have on us, the financial industry and the economy cannot be known until all such applicable regulations called for under the Dodd-Frank Act have been finalized and implemented.