Attached files

| file | filename |

|---|---|

| EX-99.1 - KIMBALL INTERNATIONAL, INC. EXHIBIT 99.1 - KIMBALL INTERNATIONAL INC | a8kexhibit991pressrelease0.htm |

| 8-K - KIMBALL INTERNATIONAL, INC. FORM 8-K - KIMBALL INTERNATIONAL INC | form8-kearningsrelease0630.htm |

INVESTOR PRESENTATION

Fourth Quarter Fiscal Year 2017

Exhibit 99.2

SAFE HARBOR STATEMENT

Certain statements contained within this release are considered forward-looking under the

Private Securities Litigation Reform Act of 1995 and are subject to risks and uncertainties

including, but not limited to, the risk that any projections or guidance, including revenues,

margins, earnings, or any other financial results are not realized, the outcome of a

governmental review of our subcontractor reporting practices, adverse changes in the global

economic conditions, significant volume reductions from key contract customers, significant

reduction in customer order patterns, financial stability of key customers and suppliers, and

availability or cost of raw materials. Additional cautionary statements regarding other risk

factors that could have an effect on the future performance of the Company are contained in

the Company's Form 10-K filing for the fiscal year ended June 30, 2016 and other filings

with the Securities and Exchange Commission.

1

COMPANY SNAPSHOT

Headquarters: Jasper, IN, USA

Founded: 1950

Employees: ~3,000

FY’17 Revenue: $670M

FY’17 Adj. Operating Income (1): $54.8M / 8.2%

FY’16 Revenue: $635M

FY’16 Adj. Operating Income (1): $40.8M / 6.4%

2

_____________________

(1) Unaudited. See Appendix for Non-GAAP reconciliation.

Design Driven and Award Winning Furniture Brands

Evolving Office Environment Driving Demand

Continued Hospitality Growth

Accelerating Revenue From New Product Introductions - Increasing Market Share

WHY INVEST IN US

Improving Financial Performance

Capital Available for Growth

3

Return on Capital Best in the Industry where Public information is available

WHO WE ARE

Kimball International, Inc. creates design

driven, innovative furnishings sold through

our family of brands: Kimball Office,

National Office Furniture, and Kimball

Hospitality. Our diverse portfolio offers

solutions for the workplace, learning,

healing, and hospitality

environments. Dedicated to our Guiding

Principles, our values and integrity are

evidenced by public recognition as a

highly trusted company and an employer

of choice.

“We Build Success” by establishing long-

term relationships with customers,

employees, suppliers, share owners and the

communities in which we operate.

We are committed to sales growth,

profitability and return on capital that is

among the best in each of our markets.

We Build Success

4

HOW WE ARE RECOGNIZED

5

S

ou

rc

e:

U

S

B

ur

ea

u

of

E

co

no

m

ic

A

na

ly

si

s

(M

ar

ch

2

01

7)

S

ou

rc

e:

B

IF

M

A

(M

ay

2

01

7)

S

ou

rc

e:

A

IA

(

Jn

ue

2

01

7)

IMPROVING U.S. FURNITURE LEADING INDICATORS

6

Architectural Billing Index

S

ou

rc

e:

C

on

fe

re

nc

e

B

oa

rd

(J

un

e

20

17

)

0

500

1000

1500

2000

9

/1

/2

0

0

3

3

/1

/2

0

0

4

9

/1

/2

0

0

4

3

/1

/2

0

0

5

9

/1

/2

0

0

5

3

/1

/2

0

0

6

9

/1

/2

0

0

6

3

/1

/2

0

0

7

9

/1

/2

0

0

7

3

/1

/2

0

0

8

9

/1

/2

0

0

8

3

/1

/2

0

0

9

9

/1

/2

0

0

9

3

/1

/2

0

1

0

9

/1

/2

0

1

0

3

/1

/2

0

1

1

9

/1

/2

0

1

1

3

/1

/2

0

1

2

9

/1

/2

0

1

2

3

/1

/2

0

1

3

9

/1

/2

0

1

3

3

/1

/2

0

1

4

9

/1

/2

0

1

4

3

/1

/2

0

1

5

9

/1

/2

0

1

5

3

/1

/2

0

1

6

9

/1

/2

0

1

6

3

/1

/2

0

1

7

US Corporate Profit After Tax

With IVA and CCA adjustment ($ billion)

0

20

40

60

80

6

/1

/2

0

0

7

1

/1

/2

0

0

8

8

/1

/2

0

0

8

3

/1

/2

0

0

9

1

0

/1

/2

0

0

9

5

/1

/2

0

1

0

1

2

/1

/2

0

1

0

7

/1

/2

0

1

1

2

/1

/2

0

1

2

9

/1

/2

0

1

2

4

/1

/2

0

1

3

1

1

/1

/2

0

1

3

6

/1

/2

0

1

4

1

/1

/2

0

1

5

8

/1

/2

0

1

5

3

/1

/2

0

1

6

1

0

/1

/2

0

1

6

5

/1

/2

0

1

7

Conference Board

CEO Confidence

5.8%

6.8%

2.7%

4.6%

5.3%

0%

1%

2%

3%

4%

5%

6%

7%

8%

$-

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

2013

Actual

2014

Actual

2015

Actual

2016

Prelim

Est

2017

Forecast

2018

Forecast

BIFMA

US Office Furniture US Ed. and Health Furniture

US Total Overall Growth

June = 54.2.

5th consecutive month

>50 indicating

increasing demand.

2.3%

2.0%

0.0%

0.5%

1.0%

1.5%

2.0%

2.5%

3.0%

3.5%

4.0%

Luxury Upper Scale Upscale Upper Middle

Scale

Midscale Economy Independents US

2017 2018

Source: PWC Hospitality Directions May 2015

Revenue Per Available Room (RevPAR) Growth Rates Estimated (1)

GROWTH IN HOSPITALITY LEADING INDICATORS

7

(1) Source PWC May 2017 Hospitality Directions

$500.0 $543.8 $600.9 $635.1 $669.9

[VALUE]

1.6%

4.8%

6.4%

[VALUE]

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017

Net Sales Adjusted Pro Forma Operating Income from Continuing Operations Percentage of Net Sales

IMPROVING PERFORMANCE

8

($ in millions)

(1) Unaudited. Adjusted Pro Forma Operating Income from Continuing Operations. See Appendix for Non-GAAP reconciliation.

(1)

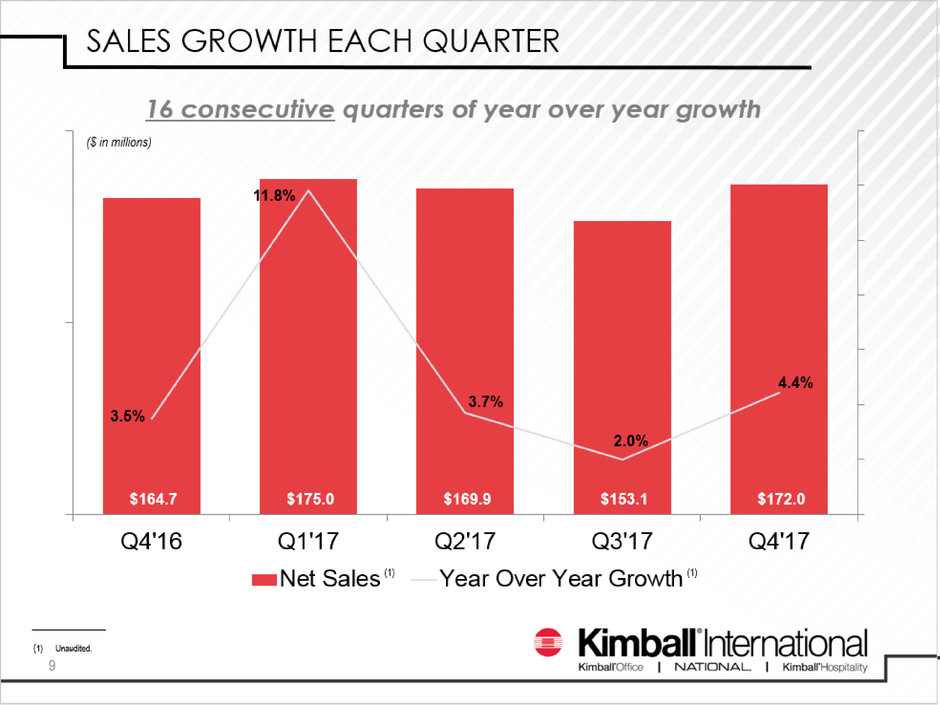

$164.7 $175.0 $169.9 $153.1 $172.0

[VALUE]

11.8%

3.7%

2.0%

[VALUE]

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Net Sales Year Over Year Growth

SALES GROWTH EACH QUARTER

9

($ in millions)

(1) Unaudited.

(1) (1)

16 consecutive quarters of year over year growth

STRONG NEW PRODUCT INTRODUCTIONS

OFFICE FURNITURE (1)

$21 $19 $19 $27 $28 $28 $29 $36 $39 $34 $35 $41

5%

21%

26%

57%

33%

45%

54%

34%

39%

21% 21%

14%

($ in millions)

(1) Gross Sales unaudited

Year Over Year Growth

10

$176.4 $177.2 $165.9 $166.4 $175.6

[VALUE]

6.9%

-1.3%

12.1%

[VALUE]

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Orders Received Year Over Year Growth

ORDERS

11

($ in millions)

(1) Unaudited.

(1) (1)

ORDER TREND RELATIVE TO OFFICE FURNITURE MARKET

12

* Sales and order data are not available for the Hospitality furniture industry (BIFMA

industry data excludes Hospitality furniture). Therefore, to get a comparable industry

comparison, sales and orders for the Hospitality vertical are excluded from the

Kimball International numbers presented in this graph.

6%

3%

0%

18%

-1% 3%

1%

-2%

6%

-2%

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Kimball Int'l (excluding Hospitality vertical) Office Furniture Industry (BIFMA)

Growth in orders exceeded industry growth for

each of the last 10 quarters

(1)

(1) BIFMA Q4’17 computed based upon April and May. June not yet available from BIFMA.

Price increase on April 1st ’17

pulled orders forward to Q3.

Without this effect, estimated

orders would have been up 12%

in Q3’17 and 4% in Q4’17.

SALES BY VERTICAL – GOOD DIVERSIFICATION (1)

13

_____________________

(1) Unaudited.

($ in millions)

$50.5

$42.8

$21.2 $19.7 $17.9

$12.6

$52.0

$37.2

$19.2

$23.2 $23.1

$17.2

Commercial Hospitality Healthcare Education Government Finance

Q4'16 Q4'17

ORDERS BY VERTICAL(1)

14

_____________________

(1) Unaudited.

($ in millions)

$56.4

$33.5

$23.2

$26.7

$21.8

$14.8

$49.5

$33.9

$20.2

$31.6

$24.3

$16.1

Commercial Hospitality Healthcare Education Government Finance

Q4'16 Q4'17

GROSS PROFIT (1)

15

32.6%

1

% of Net Sales

_____________________

(1) Unaudited.

SELLING AND ADMINISTRATIVE EXPENSES(1)

16

($ in millions)

_____________________

(1) Unaudited.

$42.8 $43.2 $42.7 $40.1 $42.4

[VALUE]

24.6%

25.1%

26.2%

[VALUE]

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

S&A S&A % of Net Sales

OPERATING INCOME

17

-1.4%

1.6%

4.8%

6.4%

8.2%

6.6%

8.8% 7.7%

7.2%

9.0%

2013 2014 2015 2016 2017 Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Adjusted Pro Forma Operating Income from Continuing Operations Percentage of Net Sales

Fiscal Year Quarterly

_____________________

(1) Unaudited. See Appendix for Non-GAAP reconciliation.

(2) Includes pre-tax gain of $1.2M on sale of land which had 70 basis point favorable impact on Q4’17 percent.

(1)

(2)

STRONG ADJUSTED RETURN ON CAPITAL(1)

18

18.4%

25.5%

21.1%

17.2%

23.0%

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

_____________________

(1) Unaudited. See Appendix for Non-GAAP reconciliation.

Among the BEST in the office furniture industry

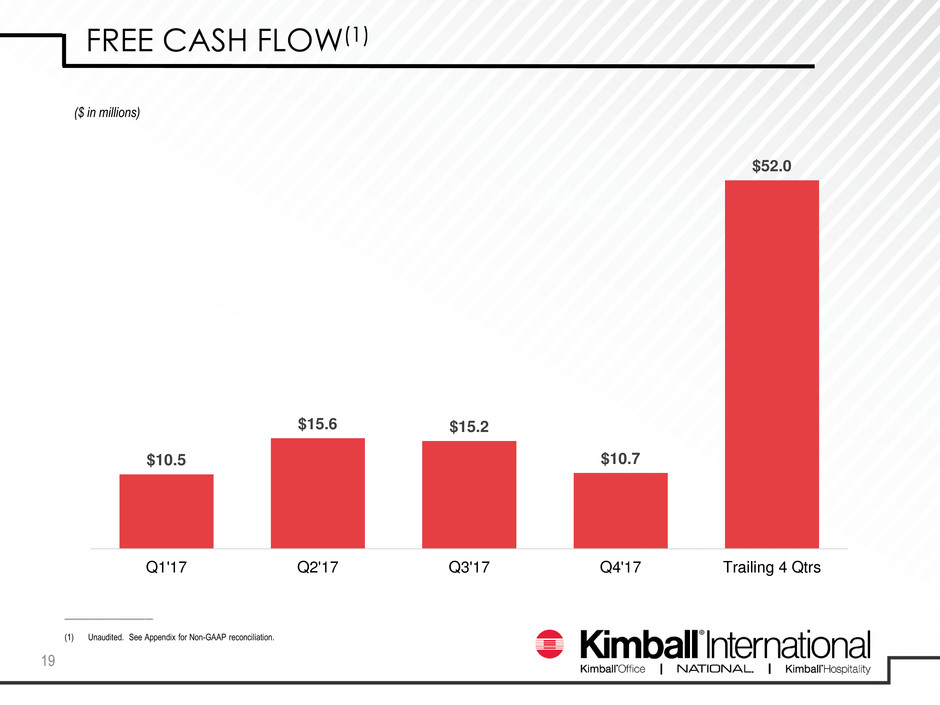

FREE CASH FLOW(1)

19

($ in millions)

_____________________

(1) Unaudited. See Appendix for Non-GAAP reconciliation.

$10.5

$15.6 $15.2

$10.7

$52.0

Q1'17 Q2'17 Q3'17 Q4'17 Trailing 4 Qtrs

PRIORITIES FOR CAPITAL ALLOCATION

20

_____________________

(1) Includes total Class A and Class B dividends declared.

(2) Accrual basis

Note: All periods presented above are unaudited

($ in millions)

$2.1 $2.2 $2.3 $2.3 $2.3

$4.4

$2.1 $0.1

Q4'16 Q1'17 Q2'17 Q3'17 Q4'17

Dividends Share Repurchases (2)

$7.5 $7.5 $7.7 $8.3 $9.0

$11.3 $8.7 $6.7

FY'13 FY'14 FY'15 FY'16 FY'17

Dividends (1) Share Repurchases (2)

Reinvestment for growth

Stock buy back offsetting dilution

Dividends comparable to peers

Acquisitions

Stock buy back if excess capital

$2.5 $3.5 $2.4

$4.4

$12.8

Q1'17 Q2'17 Q3'17 Q4'17 Trailing 4

Qtrs

Capital Expenditures

Fiscal Year Dividends and Share Repurchases Quarterly Dividends and Share Repurchases

Sales Growth over Prior Year Mid-Single Digits

Operating Income % By FY 2019 9.5%-10.5%

Adjusted Return on Capital (1) Exceeding 20%

(1) See appendix for definition.

(2) Unaudited. See Appendix for Non-GAAP reconciliation

FINANCIAL TARGETS

21

-2.0%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

FY 2013 FY 2014 FY 2015 FY 2016 FY 2017

Adjusted Pro Forma Operating Income from Continuing Operations Percentage of Net Sales

(2)

FY 2019

APPENDIX

22

ANNUAL NON-GAAP RECONCILIATION (UNAUDITED)

23

(millions $) 2013 2014 2015 2016 2017

Operating Income from Continuing Operations -$10.6 $1.9 $17.3 $33.5 $56.6

Add: Spin Cost – Included in SGA

Add (Deduct): Restructuring

$1.5 $3.2

$5.3

$7.3

-$1.8

Adjusted Operating Income from Continuing Operations -$10.6 $3.4 $25.8 $40.8 $54.8

Adjusted Operating Income from Continuing Operations as a %

of Sales

-2.1% .6% 4.3% 6.4% 8.2%

Add: Employee Retirements – Included in SGA (1)

Add: Other Non-operational – Included in SGA (2)

$5.0 $6.8

-$.5

$3.3

Adjusted Pro Forma Operating Income from Continuing

Operations before External Reverse Synergies

-$5.6 $9.7 $29.1 $40.8 $54.8

Deduct: External Reverse Synergies (3) -$1.3 -$1.2 -$0.4

Adjusted Pro Forma Operating Income from

Continuing Operations (3)

-$6.9 $8.5 $28.7 $40.8 $54.8

Adjusted Pro Forma Operating Income from

Continuing Operations as a % of Sales

-1.4% 1.6% 4.8% 6.4% 8.2%

_____________________

(1) Estimated cost associated with the retirement and separation of people due to spin. Costs include that for salary, incentive compensation, performance shares, retirement contribution, and payroll tax.

(2) Includes: pre-tax airplane write-off $1.2M and gain from sale of idle property of $1.7M in FY’14.

(3) Adjusted pro forma operating income includes external reverse synergies representing estimated increases to the cost structure necessitated by the split into two companies. For example, pre-spin Kimball had one board of directors, and such

costs were allocated to Furniture and Electronics. Post spin, there are two boards with each company experiencing a cost increase merely because of the separation. Other examples include IT expenditures and certain insurance cost among

others. The $1.3M per year reflected in the table above is a mid-point of a range estimated to be from $1.0M to $1.5M adjusting the adjusted pro forma operating income from continuing operations to reflect this estimated increase in cost

structure post spin. In addition to external cost, internal reverse synergy cost also exist and are embedded in the calculation of Operating Income from continuing operations reducing income. Different than external cost, these costs do not

have to be separately deducted in this reconciliation because by way of the discontinued operation calculation this cost increase remains within the computed Operating Income from continuing operations. As an example for this type of cost,

pre-spin Kimball had an SEC financial reporting function, and such costs were allocated to Furniture and Electronics. Post spin, there are two separate functions experiencing a cost increase as it takes more resource to perform this function

for two separate companies than one. This cost increase is estimated to be $500k to $1M. So in total, it is estimated that reverse synergy cost will increase cost structure post spin by $1.5 to $2.5M per year as already reflected in the

adjusted results included in the reconciliation above.

Note: We had formerly excluded Supplemental Employee Retirement Plan (SERP) expense from adjusted pro forma operating income. We

are no longer excluding SERP because it does not have a material impact on the trend of operating income. The annual amounts of SERP

expense now included in adjusted pro forma operating income are $1.7M in FY’13, $2.6M in FY’14, and $0.6M in FY’15, $0.0 in FY’16 and

$1.2M in FY’17.

QUARTERLY NON-GAAP RECONCILIATION (UNAUDITED)

24

(1) We had formerly excluded Supplemental Employee Retirement Plan (SERP) expense from adjusted pro forma operating income. We are no longer excluding SERP because it does not have a material impact on the trend of operating income.

The quarterly amounts of SERP expense that are included in adjusted operating income are $0.2 million in Q4’16, $0.4 million in Q1’17, $0.0 million in Q2’17, $0.5 million in Q3’17 and $0.3 million in Q4’17. Because SERP is no longer excluded,

and that was the only pro forma adjustment during the quarters presented, we are no longer reporting pro forma figures for these periods.

(2) Includes Cash And Investments

(millions $) Q4’16 Q1’17 Q2’17 Q3’17 Q4’17

Adjusted Operating Income – see non-GAAP reconciliation above $10.8 $15.5 $13.0 $10.9 $15.4

Median Effective Income Tax Rate for Trailing Four Quarters 37.3% 37.2% 36.2% 35.7% 35.1%

Median Income Tax Expense $4.0 $5.8 $4.7 $3.9 $5.4

Net Operating Profit After-Tax (NOPAT) $6.8 $9.7 $8.3 $7.0 $10.0

Average Capital (Total Equity plus Interest-Bearing Total Debt) (2) $147.4 $152.6 $158.0 $164.1 $173.8

Adjusted Return on Capital (annualized) 18.4% 25.5% 21.1% 17.2% 23.0%

(millions $) Q4’16 Q1’17 Q2’17 Q3’17 Q4’17

Operating Income, as reported $9.5 $17.3 $13.0 $10.9 $15.4

Pre-tax Restructuring (Gain) Expense $1.3 -$1.8

Adjusted Operating Income $10.8 $15.5 $13.0 $10.9 $15.4

Adjusted Operating Income as a % of Sales (1) 6.6% 8.8% 7.7% 7.2% 9.0%

QUARTERLY NON-GAAP RECONCILIATION (UNAUDITED)

25

(millions $) Q4’16 Q1’17 Q2’17 Q3’17 Q4’17

Operating Cash Flow, as reported $9.3 $13.0 $19.1 $17.6 $15.1

Total Capital Expenditures -$3.0 -$2.5 -$3.5 -$2.4 -$4.4

Free Cash Flow $6.3 $10.5 $15.6 $15.2 $10.7