Attached files

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended June 30, 2018

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 0-3279

KIMBALL INTERNATIONAL, INC. | ||

(Exact name of registrant as specified in its charter) | ||

Indiana | 35-0514506 | |

(State or other jurisdiction of | (I.R.S. Employer Identification No.) | |

incorporation or organization) | ||

1600 Royal Street, Jasper, Indiana | 47549-1001 | |

(Address of principal executive offices) | (Zip Code) | |

(812) 482-1600 | ||

Registrant’s telephone number, including area code | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each Class | Name of each exchange on which registered | |

Class B Common Stock, par value $0.05 per share | The NASDAQ Stock Market LLC | |

Securities registered pursuant to Section 12(g) of the Act: None | ||

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No x |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes o No x |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (Section 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. Large accelerated filer o Accelerated filer x Non-accelerated filer o Smaller reporting company o Emerging growth company o (Do not check if a smaller reporting company) |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x |

Class A Common Stock is not publicly traded and, therefore, no market value is available, but it is convertible on a one-for-one basis into Class B Common Stock. The aggregate market value of the Class B Common Stock held by non-affiliates, as of December 29, 2017 (the last business day of the Registrant’s most recently completed second fiscal quarter) was $676.1 million, based on 97.2% of Class B Common Stock held by non-affiliates.

The number of shares outstanding of the Registrant’s common stock as of August 27, 2018 was:

Class A Common Stock - 263,991 shares

Class B Common Stock - 36,898,278 shares

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement for the Annual Meeting of Shareowners to be held on October 30, 2018, are incorporated by reference into Part III.

KIMBALL INTERNATIONAL, INC.

FORM 10-K INDEX

Page No. | ||

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

2

PART I

Forward-Looking Statements

This document contains certain forward-looking statements as defined in the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These are statements made by management, using their best business judgment based upon facts known at the time of the statements or reasonable estimates, about future results, plans, or future performance and business of the Company. Such statements involve risk and uncertainty, and their ultimate validity is affected by a number of factors, both specific and general. They should not be construed as a guarantee that such results or events will, in fact, occur or be realized as actual results may differ materially from those expressed in these forward-looking statements. The statements may be identified by the use of words such as “believes,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “estimates,” “forecasts,” “seeks,” “likely,” “future,” “may,” “might,” “should,” “would,” “will,” and similar expressions. It is not possible to foresee or identify all factors that could cause actual results to differ from expected or historical results. We make no commitment to update these factors or to revise any forward-looking statements for events or circumstances occurring after the statement is issued, except as required in current and quarterly periodic reports filed with the Securities and Exchange Commission (“SEC”) or otherwise by law. These forward-looking statements are subject to risks and uncertainties including, but not limited to, the outcome of a governmental review of our subcontractor reporting practices, adverse changes in global economic conditions, the impact of changes in tariffs, increased global competition, significant reduction in customer order patterns, loss of key suppliers, loss of, or significant volume reductions from, key contract customers, financial stability of key customers and suppliers, relationships with strategic customers and product distributors, availability or cost of raw materials, components, or services, changes in the regulatory environment, or similar unforeseen events. Additional risks and uncertainties discussed in Item 1A - Risk Factors of this report could also cause our results to differ materially from those expressed in forward-looking statements. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. Any such risks could cause our results to differ materially from those expressed in forward-looking statements.

At any time when we make forward-looking statements, we desire to take advantage of the “safe harbor” which is afforded such statements under the Private Securities Litigation Reform Act of 1995 where factors could cause actual results to differ materially from forward-looking statements.

Item 1 - Business

As used herein, the terms “Company,” “Kimball International,” “we,” “us,” or “our” refer to Kimball International, Inc., the Registrant, and its subsidiaries. Reference to a year relates to a fiscal year, ended June 30 of the year indicated, rather than a calendar year unless the context indicates otherwise. Additionally, references to the first, second, third, and fourth quarters refer to those respective quarters of the fiscal year indicated.

Overview

Kimball International was incorporated in Indiana in 1939. Our corporate headquarters is located at 1600 Royal Street, Jasper, Indiana.

We create design driven, innovative furnishings sold through our family of brands: Kimball, National, and Kimball Hospitality. Our diverse portfolio offers solutions for the workplace, learning, healing, and hospitality environments. Our values and integrity are demonstrated daily by living our Guiding Principles and creating a culture of caring that establishes us as an employer of choice. “We Build Success” by establishing long-term relationships with customers, employees, suppliers, shareowners and the communities in which we operate.

We have been in the furniture business since 1950. Our core markets include the commercial, hospitality, healthcare, education, government, and finance markets. Through each of our brands, we offer a wide range of possibilities for creating functional environments that convey just the right image for each unique setting, as furniture solutions are tailored to the end user’s needs and demands. The workplace model is evolving to optimize human interaction, and Kimball and National provide furniture solutions which create spaces where people can connect. Our rich wood heritage and craftsmanship remain, while new products and mixed materials are integrated into our product portfolio, satisfying the marketplace’s need for multifunctional, open accommodations throughout all industries. Our furniture solutions are used in collaborative and open work space areas, conference and meeting/huddle rooms, training rooms, private offices, learning areas, classrooms, lobby/reception areas, and dining/café areas with a vast mix of wood, metal, laminate, paint, fabric, solid surface, and plastic options. In addition, we offer products designed specifically for the healthcare market such as patient/exam room and lounge seating and casegoods. In the hospitality industry, Kimball Hospitality works with leading designers, purchasing agents, and hotel owners to create furniture

3

which extends the unique ambiance of a property into guest rooms and public spaces by providing furniture solutions for hotel properties and mixed use developments, including commercial and residential. Hospitality products include, but are not limited to, headboards, tables, seating, vanities, casegoods, lighting, and products that are enhanced with technology features with a broad mix of wood, metal, stone, laminate, finish, glass, and fabric options.

Production currently occurs in Company-owned or leased facilities located in the United States and Mexico. We also engage with third-party manufacturers within the U.S. as well as internationally to produce select finished goods and accessories for our brands. In the United States, we have manufacturing facilities and showrooms in nine states and the District of Columbia. Financial information by geographic area for each of the three years in the period ended June 30, 2018 is included in Note 14 - Geographic Information of Notes to Consolidated Financial Statements and is incorporated herein by reference.

Spin-Off of Kimball Electronics

On October 31, 2014 (“Distribution Date”), we completed the spin-off of our Electronic Manufacturing Services (“EMS”) segment by distributing the related shares of Kimball Electronics, Inc. (“Kimball Electronics”), on a pro rata basis, to our shareowners of record as of October 22, 2014. After the Distribution Date, we no longer beneficially own any Kimball Electronics shares and Kimball Electronics is an independent publicly traded company. Kimball International, Inc. trades on the Nasdaq Stock Market LLC (“Nasdaq”) under the ticker symbol “KBAL” and Kimball Electronics, Inc. trades on Nasdaq under the ticker symbol “KE”.

The disclosures within this Part I describe the continuing operations of Kimball International, Inc. after the spin-off.

Recent Business Changes

Acquisition of D’style, Inc.

During the second quarter of fiscal year 2018, we acquired certain assets of D’style, Inc. (“D’style”), headquartered in Chula Vista, California. This acquisition expanded our reach into hospitality public spaces and added an attractive product portfolio of solutions for the residential market through the acquired Allan Copley Designs brand. These offerings enable us to take advantage of the trend where hospitality, residential and commercial designs are merging. As part of this acquisition, we also acquired all of the capital stock of Diseños de Estilo S.A. de C.V. headquartered in Tijuana, Mexico, another member of the D’style group which manufactures exclusively for D’style, strengthening our North American manufacturing footprint and serving as a distribution channel to the Mexico and Latin America hospitality markets. The cash paid for the acquisition totaled $18.2 million. An earn-out of up to $2.2 million may be paid, which is contingent based upon fiscal year 2018 and 2019 D’style, Inc. operating income compared to a predetermined target for each fiscal year. See Note 2 - Acquisition of Notes to Consolidated Financial Statements for more information on the acquisition.

Capacity Utilization Restructuring Plan

In November 2014, we announced a capacity utilization restructuring plan which included the consolidation of our metal fabrication production from an operation located in Post Falls, Idaho, into existing production facilities in Indiana, and the reduction of our Company plane fleet from two jets to one.

The transfer of work from our Idaho facility involved the start-up of metal fabrication capabilities in an existing Company-owned facility, along with the transfer of certain assembly operations into two additional existing Company-owned facilities, all located in southern Indiana. All production was transferred out of the Idaho facility as of March 2016, after which work continued in the Indiana facilities to train employees, ramp up production and eliminate the inefficiencies associated with the start-up of production in these facilities. The improvement of customer delivery, supply chain dynamics, and reduction of transportation costs began to generate pre-tax annual savings of approximately $5 million in fiscal year 2017. In addition, during the first quarter of fiscal year 2017, we sold our Post Falls, Idaho facility and land. See Note 4 - Property and Equipment of Notes to Consolidated Financial Statements for more information on the sale of the Idaho facility.

The reduction of our plane fleet from two jets to one reduced our cost structure while aligning the plane fleet size with our needs following the spin-off of Kimball Electronics on October 31, 2014. Previously, one of our jets was used primarily for the successful strategy of transporting customers to visit our showrooms, offices, research and development center, and manufacturing locations, while the remaining jet was used primarily for management travel. The plane used primarily for management travel was sold in the third quarter of fiscal year 2015, and as a result, we began realizing the expected annual pre-tax savings of $0.8 million. We believe that our location in rural Jasper, Indiana and the location of our manufacturing locations in small towns away from major metropolitan areas necessitates the need for the remaining jet to efficiently transport customers.

4

Outsourcing of Shipping Function

During fiscal year 2018 we outsourced the remainder of our outbound shipping that was previously transported by our Company-owned shipping fleet to a dedicated freight provider and sold our fleet of over-the-road tractors and trailers. The outsourcing to a dedicated freight provider is expected to partially mitigate increasing transportation costs from non-dedicated freight carriers. In addition, we expect to minimize risks associated with operating an internal shipping fleet and to increase utilization of the outsourced transportation fleet over our previous internal fleet which was being impacted by driver shortages. The dedicated freight provider operates transportation equipment with our Company branding. We continue to operate Company-owned tractors and trailers to move products between our production facilities and distribution warehouses.

Seasonality

The impact of seasonality on our revenue includes lower sales in the third quarter of our fiscal year due to the buying season of the government, lower sales to educational institutions during our second and third fiscal quarters, and lower sales of hospitality furniture during times of high hotel occupancy such as the summer months.

Locations

As of June 30, 2018, our products were primarily produced at eleven plants: seven located in Indiana, two in Kentucky, one in Virginia, and one in Mexico. In addition, select finished goods are purchased from domestic and foreign sources. As described above, our facility in Idaho was sold in fiscal year 2017. We continually assess manufacturing capacity and adjust such capacity as necessary.

A facility in Indiana which housed an education center for dealer and employee training, a research and development center, and a product showroom was sold near the end of fiscal year 2017. We leased a portion of the facility back until December 2017 to facilitate the transition of those functions to other existing Indiana locations. Furniture showrooms are currently maintained in eight cities in the United States. Office space is leased in Dongguan, Guangdong, China and Ho Chi Minh City, Vietnam to facilitate sourcing of select finished goods and components from the Asia Pacific Region. As a result of the acquisition of D’style, we also lease office and manufacturing space in Chula Vista, California and Tijuana, Mexico.

Marketing Channels

Our furniture is marketed to end users by both independent and employee sales representatives, office furniture dealers, wholesalers, brokers, designers, purchasing companies, and catalog houses throughout North America and on an international basis. Customers can access our products globally through a variety of distribution channels.

We categorize our sales by the following vertical markets:

Commercial - The largest portion of our business is in the commercial market. We are a full-facility provider offering products for a variety of commercial applications including: office, collaborative and open plan, lobby-lounge, conferencing and meeting/huddle, training, dining/café, learning, lobby and reception, and other public spaces.

Education - Whether K-12, higher education, vocational training or any other learning institution, we understand that furniture for education needs to enhance learning and social environments. We offer flexible, collaborative, and technology-driven furnishings designed to make students and faculty more productive and comfortable.

Healthcare - We are focused on better outcomes for patients, their families, the staff that heals them, and the environments surrounding them by offering products to value-conscious healthcare customers, including hospitals, clinics, physician office buildings, long-term care facilities, and assisted living facilities throughout the country.

Hospitality - We offer a complete package of products for guest rooms and public spaces plus service support to the hospitality industry. We partner with the most recognized hotel brands to meet their specific requirements for properties throughout the world by working with a worldwide manufacturing base to offer the best solution to fulfill the project.

Finance - Banking and financial offices require affordable, functional, and stylish environments. Our versatile and customizable furnishings offer sophisticated styles for reception areas, employee work spaces, executive offices, and boardrooms.

Government - We supply office furniture including desks, tables, seating, bookcases and filing and storage units for federal, state, and local government offices, as well as other government related entities. We hold two Federal Supply Service contracts with the General Services Administration (“GSA”) that are subject to government subcontract reporting requirements. We also partner with multiple general purchasing organizations which assist public agencies such as state and local governments with furniture purchases. The U.S. government, as well as state and local governments, can typically terminate or modify their contracts with us either at their discretion or if we default by failing to perform under the terms of the applicable contract, which could expose us to liability and impede our ability to compete in the future for contracts and orders. During fiscal year

5

2018, sales related to our GSA contracts were approximately 7.5% of our consolidated sales, with one contract accounting for approximately 5.3% of our consolidated sales and the other contract accounting for approximately 2.2% of our consolidated sales.

A table showing our net sales by end market vertical is included in Part II, Item 7 - Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Major Competitive Factors

Our products are sold in the contract furniture and hospitality furniture industries. These industries have similar major competitive factors which include price in relation to quality and appearance, product design, the utility of the product, supplier lead time, reliability of on-time delivery, sustainability, and the ability to respond to requests for special and non-standard products. We offer payment terms similar to industry standards and in unique circumstances may grant alternate payment terms.

Certain industries are more price sensitive than others, but all expect on-time, damage-free delivery. In addition to the many options available on our standard furniture products, custom furniture is produced to customer specifications and shipping timelines on a project basis.

Competitors

There are numerous furniture manufacturers competing within the marketplace, with a significant number of competitors offering similar products.

Our competition includes furniture manufacturers such as Steelcase Inc., Herman Miller, Inc., Knoll, Inc., HNI Corporation, and a large number of smaller privately-owned furniture manufacturers, both domestic and foreign-based.

Working Capital

We do not believe that we, or the industry in general, have any special practices or special conditions affecting working capital items that are significant for understanding our furniture business. We do receive advance payments from customers on select furniture projects primarily in the hospitality industry.

Raw Material Availability

Certain components used in the production of furniture are manufactured internally and are generally readily available, as are other raw materials used in the production of wood and non-wood furniture. Certain fabricated seating components, wood frame assemblies as well as finished furniture products, electrical components, stone, fabrics, and fabricated metal components, which are generally readily available, are sourced on a global scale in an effort to provide quality products at the lowest total cost. The cost and availability of both domestic and foreign sourced product could be impacted if tariffs are imposed on such products.

Order Backlog

The aggregate sales price of products pursuant to open orders, which may be canceled by the customer, was as follows:

(Amounts in Millions) | June 30, 2018 | June 30, 2017 | |||||

Order Backlog | $ | 148.9 | $ | 131.6 | |||

Of the order backlog increase, $7.5 million was due to orders of D’style products in fiscal year 2018, and $2.0 million was due to the acceleration of orders into the fourth quarter of fiscal year 2018 in connection with a pricing increase for one of our brands announced during the fourth quarter of fiscal year 2018 that took effect on July 2, 2018. The open orders as of June 30, 2018 are expected to be filled within the next fiscal year. Open orders may not be indicative of future sales trends.

Research and Development

Research and development activities include the development of manufacturing processes, engineering and testing procedures, major process and technology improvements, new product development and product redesign, and information technology initiatives.

6

Research and development costs were approximately:

Year Ended June 30 | |||||

(Amounts in Millions) | 2018 | 2017 | 2016 | ||

Research and Development Costs | $7 | $7 | $6 | ||

Intellectual Property

In connection with our business operations, we hold both trademarks and patents in various countries and continuously have additional pending trademarks and patents. The intellectual property which we believe to be the most significant to the Company includes: Kimball, National, D’style, Fringe, Waveworks, Xsite, Narrate, Pairings, and Dock, which are all registered trademarks. Our patents expire at various times depending on the patent’s date of issuance.

Environment and Energy Matters

Our operations are subject to various federal, state, local, and foreign laws and regulations with respect to environmental matters. We believe that we are in substantial compliance with present laws and regulations and that there are no material liabilities related to such items.

We are dedicated to excellence, leadership, and stewardship in matters of protecting the environment and communities in which we have operations. Reinforcing our commitment to the environment, six of our showrooms and one non-manufacturing location were designed under the guidelines of the U.S. Green Building Council’s LEED (Leadership in Energy and Environmental Design) for Commercial Interiors program. One manufacturing facility was designed under the LEED Operations and Maintenance program guidelines. Our National brand headquarters is Fitwel certified, which is a building certification that supports healthier workplace environments to improve occupant health and productivity.

We believe that continued compliance with foreign, federal, state, and local laws and regulations which have been enacted relating to the protection of the environment will not have a material effect on our capital expenditures, earnings, or competitive position. We believe capital expenditures for environmental control equipment during the next two fiscal years ending June 30, 2020, will not represent a material portion of total capital expenditures during those years.

Our manufacturing operations require the use of natural gas and electricity. Federal and state regulations may control the allocation of fuels available to us, but to date we have experienced no interruption of production due to such regulations. In our wood furniture manufacturing plants, a portion of energy requirements are satisfied internally by the use of our own scrap wood produced during the manufacturing of product.

Employees

June 30 2018 | June 30 2017 | ||||

United States | 2,921 | 3,024 | |||

Foreign Countries | 153 | 65 | |||

Total Employees | 3,074 | 3,089 | |||

Our U.S. operations are not subject to collective bargaining arrangements. Outside of the U.S., approximately 52 employees are represented by worker’s unions that operate to promote the interests of workers. We believe that our employee relations are good.

Available Information

We make available free of charge through our website, https://www.kimballinternational.com/public-filings, our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements, and all amendments to those reports as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. All reports we file with the SEC are also available via the SEC website, http://www.sec.gov, or may be read and copied at the SEC Public Reference Room located at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. Our Internet website and the information contained on, or accessible through, such website is not incorporated into this Annual Report on Form 10-K.

7

Item 1A - Risk Factors

The following important risk factors could affect future results and events, causing results and events to differ materially from those expressed or implied in forward-looking statements made in this report and presented elsewhere by management from time to time. Such factors may have a material adverse effect on our business, financial condition, and results of operations and should be carefully considered before deciding to invest in, or retain, shares of our common stock. Additional risks and uncertainties that we do not currently know about, we currently believe are immaterial or we have not predicted may also affect our business, financial condition, or results of operations. Because of these and other factors, past performance should not be considered an indication of future performance.

Changes to government regulations may significantly increase our operating costs in the United States and abroad. Legislative and regulatory reforms by the U.S. federal and foreign governments could significantly impact our profitability by burdening us with forced cost choices that are difficult to recover with increased pricing. For example:

• | We depend on suppliers globally to provide materials, parts, finished goods, and components for use in our products. We utilize both steel and aluminum in our products, most of which is sourced domestically. The U.S. recently imposed tariffs of 25% on steel and 10% on aluminum imported from several countries which could adversely impact our input costs. The government has also recently proposed to expand its list of products subject to tariffs to include furniture products, parts, and components, and if approved, the landed cost of our products could increase materially, which would reduce our net income if we are unable to mitigate the additional cost. Additional tariffs or changes in global trade agreements or in U.S. governmental import/export regulations could have an adverse impact on our financial condition, results of operations, or cash flows. |

• | We conduct business with entities in Canada and Mexico; therefore, a modification or withdrawal from the North American Free Trade Agreement by the U.S. federal government could have an adverse impact on our financial condition, results of operations, or cash flows. |

• | We import a portion of our wooden furniture products and are thus subject to an anti-dumping tariff specifically on wooden bedroom furniture supplied from China. The tariffs are subject to review and could result in retroactive and prospective tariff rate increases which could have an adverse impact on our financial condition, results of operations, or cash flows. |

• | State and foreign regulations are increasing in many areas such as hazardous waste disposal, labor relations, employment practices and data privacy, such as the California Consumer Privacy Act. Compliance with these regulations could require us to update our processes and could have an adverse impact on our financial condition, results of operations, or cash flows. |

We may be unable to purchase a sufficient amount of materials, parts, and components for use in our products at a competitive price, in a timely manner, or at all. We depend on suppliers globally to provide timely delivery of materials, parts, and components for use in our products. We monitor the financial stability of suppliers when feasible, as the loss of a significant supplier could have an adverse impact on our operations. Certain finished products and components we purchase are primarily manufactured in select regions of the world and issues in those regions could cause manufacturing delays. In addition, delays can occur related to the transport of products and components via container ships, which load and unload through various U.S. ports which sometimes experience congestion. Price increases of commodity components could have an adverse impact on our profitability if we cannot offset such increases with other cost reductions or by price increases to customers. New tariffs or trade regulations which have been and could be imposed by the U.S. federal government may adversely impact our access, price, and delivery of finished products and components from foreign sources, and therefore adversely affect our profitability. Materials we utilize are generally available, but future availability is unknown and could impact our ability to meet customer order requirements. If suppliers fail to meet commitments to us in terms of price, delivery, or quality, it could interrupt our operations and negatively impact our ability to meet commitments to customers.

Uncertain macroeconomic and industry conditions, or a sustained slowdown or significant downturn in our markets, could adversely impact demand for our products and adversely affect operating results. Market demand for our products, which impacts revenues and gross profit, is influenced by a variety of economic and industry factors such as:

• | global consumer confidence; |

• | volatility and the cyclical nature of worldwide economic conditions; |

• | weakness in the global financial markets; |

• | general corporate profitability of the end markets to which we sell; |

• | credit availability to the end markets to which we sell; |

• | service-sector unemployment rates; |

• | commercial property vacancy rates; |

8

• | new office construction and refurbishment rates; |

• | deficit status of many governmental entities which may result in declining purchases of office furniture; |

• | uncertainty surrounding potential reform of the Affordable Care Act; and |

• | new hotel and casino construction and refurbishment rates. |

We must make decisions based on order volumes in order to achieve manufacturing efficiency. These decisions include determining what level of additional business to accept, production schedules, component procurement commitments, and personnel requirements, among various other considerations. We must constantly monitor the changing economic landscape and may modify our strategic direction accordingly. If we do not react quickly enough to the changes in market or economic conditions, it could result in lost customers, decreased market share, and increased operating costs.

A shortage of capacity in the trucking industry could drive increases in freight costs. We outsource inbound and outbound shipping to third-party contract carriers, including a dedicated freight provider that operates transportation equipment with our Company branding, and other commercial contract carriers. We have experienced pressure on freight costs as the demand exceeds the capacity of available trucking fleets, particularly for commercial contract carriers. If capacity remains tight, and we are unable to mitigate a freight cost increase through our supply chain planning or by increasing prices on our products, it could adversely affect our profitability.

Changes in U.S. fiscal and tax policies may adversely affect our business. On December 22, 2017, the Tax Cuts and Jobs Act (“Tax Act”) was signed into law. The Tax Act reduced federal corporate income tax rates effective January 1, 2018 and changed numerous other provisions. Because Kimball International has a June 30 fiscal year-end, the lower corporate federal income tax rate was phased in, resulting in a U.S. federal statutory tax rate of 28.1% for our fiscal year ended June 30, 2018. The statutory federal tax rate will be 21% in subsequent fiscal years. Fiscal year 2018 included approximately $3.3 million in reduced income tax expense to reflect federal taxes on current year taxable income at the lower blended effective tax rate, partially offset by a discrete tax impact of $1.8 million in additional expense as a result of applying the new lower federal income tax rates to our net tax assets. The changes included in the Tax Act are broad and complex and future impacts may be dependent on interpretations of the Tax Act, legislative action to address questions that arise because of the Tax Act, or changes in accounting standards for income taxes or related interpretations in response to the Tax Act. While the Tax Act reduced our current rate, future changes to the federal tax rate could have an adverse impact. In addition, states or foreign jurisdictions may amend their tax laws and policies in response to the Tax Act, which could have a material impact on our future results and our effective tax rate.

Fluctuations in our effective tax rate could have a significant impact on our financial position, results of operations, or cash flows. We are subject to income taxes as well as non-income based taxes, mainly in the United States. Judgment is required in determining the worldwide provision for income taxes, other tax liabilities, interest, and penalties. Future events could change management’s assessment. We operate within multiple taxing jurisdictions and are subject to tax audits in these jurisdictions. These audits can involve complex issues, which may require an extended period of time to resolve. We have also made assumptions about the realization of deferred tax assets. Changes in these assumptions could result in a valuation allowance for these assets. Final determination of tax audits or tax disputes may be different from what is currently reflected by our income tax provisions and accruals.

Our failure to retain our existing management team, maintain our engineering, technical, and manufacturing process expertise, or continue to attract qualified personnel could adversely affect our business. We depend significantly on our executive officers and other key personnel. Our success is also dependent on keeping pace with technological advancements and adapting services to provide manufacturing capabilities which meet customers’ changing needs. To do that, we must retain our qualified engineering and technical personnel and successfully anticipate and respond to technological changes in a cost effective and timely manner. Our culture and guiding principles focus on continuous training, motivation, and development of employees, and we strive to attract, motivate, and retain qualified personnel. Failure to retain our executive officers and retain and attract other key personnel could adversely affect our business. Mr. Schneider, our Chief Executive Officer, plans to retire effective October 31, 2018. The Board of Directors has created a Continuity Committee to facilitate our succession planning process relative to Mr. Schneider’s retirement; however, the change in executive leadership could impact the execution of our business strategy. If we encounter difficulties in the transition, that could affect our relationship with our customers and could adversely impact our financial results.

Our sales to the U.S. government are subject to compliance with regulatory and contractual requirements and noncompliance could expose us to liability or impede current or future business. The U.S. government, as well as state and local governments, can typically terminate or modify their contracts with us either at their discretion or if we default by failing to perform under the terms of the applicable contract, which could expose us to liability and impede our ability to compete in the future for contracts and orders. The failure to comply with regulatory and contractual requirements could subject us to investigations, fines, or other penalties, and violations of certain regulatory and contractual requirements could also result in us being suspended or debarred from future government contracting.

9

In March 2016, in connection with a renewal of one of our contracts with the GSA, we became aware of noncompliance and inaccuracies in our GSA subcontractor reporting. Accordingly, we retained outside legal counsel to assist in conducting an internal review of our reporting practices, and we self-reported the matter and the results of the internal review to the GSA. We have promptly responded to inquiries from the GSA since our initial reporting, have met with government officials as requested on two occasions, and intend to cooperate fully with any further inquiries or investigations. While we are not able to reasonably estimate the future financial impact, if any, of the possible sanctions at this time, any of them could, if imposed, have a material adverse impact on our business, future financial position, results of operations, or cash flows. The timing of the government’s review and determination of any outcome of these matters is uncertain and, therefore, it is unclear as to when and to what extent, if any, our previously issued financial targets might be impacted. We have incurred, and may incur additional, legal and related costs in connection with our internal review and the government’s response to this matter. During fiscal year 2018, sales related to our GSA contracts were approximately 7.5% of our consolidated sales, with one contract accounting for approximately 5.3% of our consolidated sales and the other contract accounting for approximately 2.2% of our consolidated sales.

We may pursue acquisitions that present risks and may not be successful. Our sales growth plans may occur through both organic growth and acquisitions. Acquisitions involve many risks that could have an adverse effect on our business, financial condition or results of operations, including:

• | difficulties in identifying suitable acquisition candidates and in negotiating and consummating acquisitions on terms attractive to us; |

• | difficulties in the assimilation of the operations of the acquired company; |

• | the diversion of resources, including diverting management’s attention from our current operations; |

• | risks of entering new geographic or product markets in which we have limited or no direct prior experience; |

• | the potential loss of key customers of the acquired company; |

• | the potential loss of key employees of the acquired company; |

• | the potential incurrence of indebtedness to fund the acquisition; |

• | the potential issuance of common stock for some or all of the purchase price, which could dilute ownership interests of our current shareowners; |

• | the acquired business not achieving anticipated revenues, earnings, cash flow, or market share; |

• | excess capacity; |

• | failure to achieve the expected synergies resulting from the acquisition; |

• | inaccurate assessment of undisclosed, contingent, or other liabilities or problems and unanticipated costs associated with the acquisition; |

• | incorrect estimates made in accounting for acquisitions, incurrence of non-recurring charges, and write-off of significant amounts of goodwill that could adversely affect our financial results; and |

• | dilution of earnings. |

We may not be successful in launching start-up operations. We are committed to growing our business, and therefore from time to time, we may determine that it would be in our best interests to start up a new operation. Start-up operations involve a number of risks and uncertainties, such as funding the capital expenditures related to the start-up operation, developing a management team for the new operation, diversion of management focus away from current operations, and creation of excess capacity. Any of these risks could have a material adverse effect on our financial position, results of operations, or cash flows.

Our business depends on information technology systems and digital capabilities which are implemented in a manner intended to minimize the risk of a cybersecurity breach or other such threat, including the misappropriation of assets or other sensitive information, or data corruption which could cause operational disruption. An ongoing commitment of significant resources is required to maintain and enhance existing information systems and implement the new and emerging technology necessary to meet customer expectations and compete in our markets. The techniques used to obtain unauthorized access change frequently and are not often recognized until after they have been launched. We recognize that any breach could disrupt our operations, damage our reputation, erode our share value, drive remediation expenses, or increase costs related to the mitigation of, response to, or litigation arising from any such issue. We cannot guarantee that our cybersecurity measures will completely prevent others from obtaining unauthorized access to our enterprise network, system and data.

Many states and the U.S. federal government are increasingly enacting laws and regulations to protect consumers against identity theft and to also protect their privacy. As our business expands globally, we are subject to data privacy and other similar laws in various foreign jurisdictions. If we are the target of a cybersecurity attack resulting in unauthorized disclosure of sensitive or confidential data, we may be required to execute costly notification procedures. Compliance with these laws will likely increase the costs of doing business. If we fail to implement appropriate safeguards or to detect and provide prompt notice of unauthorized access as required by some of these laws, we could be subject to potential claims for damages and other remedies, which could harm our business.

10

If the distribution or certain internal transactions undertaken relating to the spin-off do not qualify as tax-free transactions, the Company, our shareowners as of the Distribution Date, and Kimball Electronics could be subject to substantial tax liabilities. On October 10, 2014 we received a favorable written tax ruling from the Internal Revenue Service (“IRS”) that our stock unification in connection with the spin-off will not cause us to recognize income or gain as a result of the unification. In addition, we have also received an opinion of Squire Patton Boggs (US) LLP to the effect that the distribution satisfies the requirements to qualify as a tax-free transaction (except for cash received in lieu of fractional shares) for U.S. federal income tax purposes to the Company, our shareowners and Kimball Electronics under Section 355 of the Internal Revenue Code of 1986, as amended (the “Code”).

The tax ruling and the tax opinion rely on the accuracy of certain factual representations and assumptions provided by the Company and Kimball Electronics in connection with obtaining the tax ruling and tax opinion, including with respect to post-spin-off operations and conduct of the parties. If these factual representations and assumptions are inaccurate or incomplete in any material respect, we will not be able to rely on the tax ruling and/or the tax opinion.

Furthermore, the tax opinion will not be binding on the IRS or the courts. Accordingly, the IRS or the courts may reach conclusions with respect to the spin-off that are different from the conclusions reached in the tax opinion. If, notwithstanding our receipt of the tax opinion, the spin-off is determined to be taxable, then (i) we would be subject to tax as if we sold the Kimball Electronics common stock in a taxable sale for its fair market value; and (ii) each shareowner who received Kimball Electronics common stock would be treated as receiving a distribution of property in an amount equal to the fair market value of the Kimball Electronics common stock that would generally result in varied tax liabilities for each shareowner depending on the facts and circumstances.

We entered into a Tax Matters Agreement with Kimball Electronics that governs the respective rights, responsibilities and obligations of us and Kimball Electronics after the spin-off with respect to tax liabilities and benefits, tax attributes, tax contests and other tax sharing regarding U.S. federal, state, local and foreign income taxes, other tax matters and related tax returns. The Tax Matters Agreement also provides special rules for allocating tax liabilities in the event that the spin-off or certain internal transactions undertaken in anticipation of the spin-off do not qualify as tax-free transactions. Though valid as between us and Kimball Electronics, the Tax Matters Agreement will not be binding on the IRS.

Pursuant to the Tax Matters Agreement, (i) we have agreed (a) not to enter into any transaction that could cause any portion of the spin-off to be taxable to Kimball Electronics, including under Section 355(e) of the Code; and (b) to indemnify Kimball Electronics for any tax liabilities resulting from such transactions entered into by us; and (ii) Kimball Electronics has agreed to indemnify us for any tax liabilities resulting from such transactions entered into by Kimball Electronics. In addition, under U.S. Treasury regulations, each member of our consolidated group at the time of the spin-off (including Kimball Electronics) would be jointly and severally liable for the resulting U.S. federal income tax liability if all or a portion of the spin-off does not or certain internal transactions undertaken in anticipation of the spin-off do not qualify as tax-free transactions. These obligations may discourage, delay or prevent a change of control of our Company.

If Kimball Electronics were to default in its obligation to us to pay taxes under the Tax Matters Agreement, we could be legally liable under applicable tax law for such liabilities and required to make additional tax payments. Accordingly, under certain circumstances, we may be obligated to pay amounts in excess of our agreed-upon share of tax liabilities. To the extent we are responsible for any liability under the Tax Matters Agreement, there could be a material adverse impact on our business, financial condition, results of operations and cash flows.

We may be exposed to the credit risk of our customers who are adversely affected by weakness in market conditions. Weakness in market conditions may drive an elevated risk of potential bankruptcy of our customers resulting in a greater risk of uncollectible outstanding accounts receivable. The realization of these risks could have a negative impact on our profitability.

Reduction of purchases by or the loss of a significant number of customers could reduce revenues and profitability. Significant declines in the level of purchases by customers or the loss of a significant number of customers could have a material adverse effect on our business. A reduction of, or uncertainty surrounding, government spending could also have an adverse impact on our sales levels. We can provide no assurance that we will be able to fully replace any lost sales, which could have an adverse effect on our financial position, results of operations, or cash flows.

We operate in a highly competitive environment and may not be able to compete successfully. The office and hospitality furniture industries are competitive due to numerous global manufacturers competing in the marketplace. In times of reduced demand for office furniture, large competitors may have greater efficiencies of scale or may apply more pressure to their aligned distribution to sell their products exclusively which could lead to reduced opportunities for our products. While we work toward reducing costs to respond to pricing pressures, if we cannot achieve the proportionate reductions in costs, profit margins may suffer.

11

Our operating results could be adversely affected by increases in the cost of fuel and other energy sources. The cost of energy is a critical component of freight expense and the cost of operating manufacturing facilities. Increases in the cost of energy could reduce our profitability.

We are subject to manufacturing inefficiencies due to the transfer of production among our facilities and other factors. At times we may experience labor or other manufacturing inefficiencies due to factors such as new product introductions, transfers of production among our manufacturing facilities, a sudden decline in sales, a new operating system, or turnover in personnel. Manufacturing inefficiencies could have an adverse impact on our financial position, results of operations, or cash flows.

A change in our sales mix among our diversified product offerings could have a negative impact on our gross profit margin. Changes in product sales mix could negatively impact our gross margin as margins of different products vary. We strive to improve the margins of all products, but certain products have lower margins in order to price the product competitively. An increase in the proportion of sales of products with lower margins could have an adverse impact on our financial position, results of operations, or cash flows.

Our international operations involve financial and operational risks. We have a manufacturing operation outside the United States in Mexico, and administrative offices in China and Vietnam which coordinate with suppliers in those countries. These international operations are subject to a number of risks, including the following:

• | economic and political instability; |

• | warfare, riots, terrorism, and other forms of violence or geopolitical disruption; |

• | compliance with laws, such as the Foreign Corrupt Practices Act, applicable to U.S. companies doing business outside the United States; |

• | changes in foreign regulatory requirements and laws; |

• | tariffs and other trade barriers; |

• | potentially adverse tax consequences including the manner in which multinational companies are taxed in the U.S.; and |

• | foreign labor practices. |

These risks could have an adverse effect on our financial position, results of operations, or cash flows. In addition, fluctuations in exchange rates could impact our operating results. Our risk management strategy can include the use of derivative financial instruments to hedge certain foreign currency exposures. Any hedging techniques we implement contain risks and may not be entirely effective. Exchange rate fluctuations could also make our products more expensive than competitor's products not subject to these fluctuations, which could adversely affect our revenues and profitability in international markets.

If efforts to introduce new products or start-up new programs are not successful, this could limit sales growth or cause sales to decline. We regularly introduce new products to keep pace with workplace trends and evolving regulatory and industry requirements, including environmental, health, and safety standards such as sustainability and ergonomic considerations, and similar standards for the workplace and for product performance. Shifts in workforce demographics, working styles, and technology may impact the quantity and types of furniture products purchased by our customers as commercial office spaces occupy smaller footprints and collaborative, open-plan workstations gain popularity. The introduction of new products or start-up of new programs require the coordination of the design, manufacturing, and marketing of such products. The design and engineering required for certain new products or programs can take an extended period of time, and further time may be required to achieve customer acceptance. Accordingly, the launch of any particular product or program may be delayed or may be less successful than we originally anticipated. Difficulties or delays in introducing new products or programs, or lack of customer acceptance of new products or programs could limit sales growth or cause sales to decline.

If customers do not perceive our products and services to be innovative and of high quality, our brand and name recognition and reputation could suffer. We believe that establishing and maintaining good brand and name recognition and a good reputation is critical to our business. Promotion and enhancement of our name and brands will depend on the effectiveness of marketing and advertising efforts and on successfully providing design driven, innovative, and high quality products and superior services. If customers do not perceive our products and services to be design driven, innovative, and of high quality, our reputation, brand and name recognition could suffer, which could have a material adverse effect on our business.

A loss of independent sales representatives, dealers, or other sales channels could lead to a decline in sales. Our office furniture is marketed to end users through both independent and employee sales representatives, office furniture dealers, wholesalers, brokers, designers, purchasing companies, and catalog houses. Our hospitality furniture is marketed to end users using independent sales representatives. A significant loss within any of these sales channels could result in a sales decline and thus have an adverse impact on our financial position, results of operations, or cash flows.

12

Failure to effectively manage working capital may adversely affect our cash flow from operations. We closely monitor inventory and receivable efficiencies and continuously strive to improve these measures of working capital, but customer financial difficulties, cancellation or delay of customer orders, transfers of production among our manufacturing facilities, or manufacturing delays could adversely affect our cash flow from operations.

We may not be able to achieve maximum utilization of our manufacturing capacity. Fluctuations and deferrals of customer orders may have a material adverse effect on our ability to utilize our fixed capacity and thus negatively impact our operating margins.

We could incur losses due to asset impairment. As business conditions change, we must continually evaluate and work toward the optimum asset base. It is possible that certain assets such as, but not limited to, facilities, equipment, goodwill, or other intangible assets, could be impaired at some point in the future depending on changing business conditions. Goodwill and certain intangible assets are tested for impairment annually or when triggering events occur. Such resulting impairment could have an adverse impact on our financial position and results of operations.

A failure to comply with the financial covenants under our $30 million credit facility could adversely impact us. Our credit facility requires us to comply with certain financial covenants. We believe the most significant covenants under this credit facility are the adjusted leverage ratio and the fixed charge coverage ratio. More detail on these financial covenants is discussed in Item 7 - Management's Discussion and Analysis of Financial Condition and Results of Operations of Part II of this Annual Report on Form 10-K. As of June 30, 2018, we had no borrowings under this credit facility and we had $1.4 million in letters of credit outstanding which reduced our borrowing capacity on the credit facility. At June 30, 2018, our cash and cash equivalents totaled $87.3 million. In the future, a default on the financial covenants under our credit facility could cause an increase in the borrowing rates or could make it more difficult for us to secure future financing which could adversely affect the financial condition of the Company.

Failure to protect our intellectual property could undermine our competitive position. We attempt to protect our intellectual property rights, both in the United States and in foreign countries, through a combination of patent, trademark, copyright, and trade secret laws, as well as licensing agreements and third-party non-disclosure and assignment agreements. Because of the differences in foreign laws concerning proprietary rights, our intellectual property rights do not generally receive the same degree of protection in foreign countries as they do in the United States, and therefore in some parts of the world, we have limited protections, if any, for our intellectual property. Competing effectively depends, to a significant extent, on maintaining the proprietary nature of our intellectual property. The degree of protection offered by our various patents and trademarks may not be broad enough to provide significant proprietary protection or competitive advantages to the Company, and patents or trademarks may not be issued on pending or contemplated applications. In addition, not all of our products are covered by patents. It is also possible that our patents and trademarks may be challenged, invalidated, canceled, narrowed, or circumvented.

We may be sued by third parties for alleged infringement of their intellectual property rights and incur substantial litigation or other costs. We could be notified of a claim regarding intellectual property rights which could lead us to spend time and money to defend or address the claim. Even if the claim is without merit, it could result in substantial costs and diversion of resources.

Our insurance may not adequately protect us from liabilities related to product defects. We maintain product liability and other insurance coverage that we believe to be generally in accordance with industry practices, but our insurance coverage does not extend to field visits to repair, retrofit or replace defective products, or to product recalls. As a result, our insurance coverage may not be adequate to protect us fully against substantial claims and costs that may arise from liabilities related to product defects, particularly if we have a large number of defective products that we must repair, retrofit, replace, or recall.

Increases in the cost of providing employee healthcare benefits could reduce our profitability. There may continue to be upward pressure on the cost of providing healthcare benefits to our employees. We are self-insured for healthcare benefits so we incur the cost of claims, including catastrophic claims that may occasionally occur, with employees bearing only a limited portion of healthcare costs through employee healthcare premium withholdings. There can be no assurance that we will succeed in limiting cost increases, and continued upward pressure could reduce our profitability.

We are subject to extensive environmental regulation and significant potential environmental liabilities. Our past and present operation and ownership of manufacturing plants and real property are subject to extensive federal, state, local, and foreign environmental laws and regulations, including those relating to discharges in air, water, and land, the handling and disposal of solid and hazardous waste, and the remediation of contamination associated with releases of hazardous substances. In addition, the increased prevalence of global climate issues may result in new regulations that may negatively impact us. We cannot predict what environmental legislation or regulations will be enacted in the future, how existing or future laws or regulations will be administered or interpreted or what environmental conditions may be found to exist with respect to our

13

facilities and real property. Compliance with more stringent laws or regulations, or stricter interpretation of existing laws, may require additional expenditures, some of which could be material. In addition, any investigations or remedial efforts relating to environmental matters could involve material costs or otherwise result in material liabilities.

Turnover in personnel could cause manufacturing inefficiencies. The demand for manufacturing labor in certain geographic areas makes retaining experienced production employees difficult. Turnover could result in lost time due to inefficiencies and additional training that could impact our operating results.

Natural disasters or other catastrophic events may impact our production schedules and, in turn, negatively impact profitability. Natural disasters or other catastrophic events, including severe weather, terrorist attacks, power interruptions, and fires, could disrupt operations and likewise our ability to produce or deliver products. Our manufacturing operations require significant amounts of energy, including natural gas and oil, and governmental regulations may control the allocation of such fuels. Employees are an integral part of our business and events such as a pandemic could reduce the availability of employees reporting for work. In the event we experience a temporary or permanent interruption in our ability to produce or deliver product, revenues could be reduced, and our business could be materially adversely affected. In addition, catastrophic events, or the threat thereof, can adversely affect U.S. and world economies, and could result in delayed or lost sales of our products. In addition, any continuing disruption in our computer system could adversely affect the ability to receive and process customer orders, manufacture products, and ship products on a timely basis, and could adversely affect relations with our customers, potentially resulting in a reduction in orders from customers or loss of customers. We maintain insurance to help protect us from costs relating to some of these matters, but such insurance may not be sufficient or paid in a timely manner to us in the event of such an interruption.

The value of our common stock may experience substantial fluctuations for reasons over which we may have little control. The value of our common stock could fluctuate substantially based on a variety of factors, including, among others:

• | actual or anticipated fluctuations in operating results; |

• | announcements concerning our Company, competitors, or industry; |

• | overall volatility of the stock market; |

• | changes in the financial estimates of securities analysts or investors regarding our Company, the industry, or competitors; |

• | general market or economic conditions; and |

• | proxy contests or other shareowner activism. |

We also provide financial targets for our expected operating results for future periods. While the information is provided based on current and projected data about the markets we deliver to and our operational capacity and capabilities, the financial targets are subject to risks and uncertainties. If our future results do not match our financial targets for a particular period, or if the financial targets are reduced in future periods, the value of our common stock could decline.

Furthermore, stock prices for many companies fluctuate widely for reasons that may be unrelated to their operating results. These fluctuations, coupled with changes in results of operations and general economic, political, and market conditions, may adversely affect the value of our common stock.

Item 1B - Unresolved Staff Comments

None.

14

Item 2 - Properties

The location, number, and use of our major facilities, including our executive and administrative offices, as of June 30, 2018, are as follows:

Number of Facilities | Use | |

North America | ||

United States: | ||

Indiana | 15 | Manufacturing, Warehouse, Office |

Kentucky | 2 | Manufacturing, Office |

California | 1 | Warehouse, Office |

Virginia | 1 | Manufacturing, Warehouse, Office |

Mexico | 1 | Manufacturing, Office |

Asia | ||

China | 1 | Office |

Vietnam | 1 | Office |

Total Facilities | 22 | |

The listed facilities occupy approximately 3,227,000 square feet in aggregate, of which approximately 3,050,000 square feet are owned, and 177,000 square feet are leased.

During fiscal year 2017, a facility in Indiana which housed an education center for dealer and employee training, a research and development center, and a product showroom was sold. We leased a portion of the facility back to facilitate the transition of those functions to other existing Indiana locations. The lease expired in fiscal year 2018.

During the second quarter of fiscal year 2018, we acquired certain assets of D’style, headquartered in Chula Vista, California, and all of the capital stock of Diseños de Estilo S.A. de C.V., a Mexican corporation located in Tijuana, Mexico, which resulted in our acquisition of 27,000 square feet and 33,000 square feet of leased space, respectively.

Generally, properties are utilized at normal capacity levels on a multiple shift basis. At times, certain facilities utilize a reduced second or third shift. Due to sales fluctuations, not all facilities were utilized at normal capacity during fiscal year 2018. We continually assess our capacity needs and evaluate our operations to optimize our service levels by geographic region.

Significant loss of income resulting from a facility catastrophe would be partially offset by business interruption insurance coverage.

Operating leases for all facilities and related land, including twelve leased office furniture showroom facilities which are not included in the table above, total 265,000 square feet and expire from fiscal year 2019 to 2027 with many of the leases subject to renewal options. The leased showroom facilities are in six states and the District of Columbia. See Note 5 - Commitments and Contingent Liabilities of Notes to Consolidated Financial Statements for additional information concerning leases.

We own approximately 331 acres of land which includes land where various facilities reside, including approximately 115 acres of land in the Kimball Industrial Park, Jasper, Indiana.

Item 3 - Legal Proceedings

We and our subsidiaries are not parties to any pending legal proceedings, other than ordinary routine litigation incidental to the business. The outcome of current routine pending litigation, individually and in the aggregate, is not expected to have a material adverse impact.

Item 4 - Mine Safety Disclosures

Not applicable.

15

Executive Officers of the Registrant

Our executive officers as of August 28, 2018 are as follows:

(Age as of August 28, 2018)

Name | Age | Office and Area of Responsibility | Executive Officer Since Calendar Year | |||

Robert F. Schneider | 57 | Chairman of the Board, Chief Executive Officer, Kimball International | 1992 | |||

Donald W. Van Winkle | 57 | President, Chief Operating Officer, Kimball International | 2010 | |||

Michelle R. Schroeder | 53 | Vice President, Chief Financial Officer, Kimball International | 2003 | |||

Michael S. Wagner | 46 | Vice President, Kimball International; President, Kimball | 2014 | |||

R. Gregory Kincer | 60 | Vice President, Corporate Development, Kimball International | 2014 | |||

Julia E. Heitz Cassidy | 53 | Vice President, Chief Ethics & Compliance Officer, General Counsel and Secretary, Kimball International | 2014 | |||

Lonnie P. Nicholson | 54 | Vice President, Chief Administrative Officer, Kimball International | 2014 | |||

Kourtney L. Smith | 48 | Vice President, Kimball International; President, National Office Furniture | 2015 | |||

Kathy S. Sigler | 55 | Vice President, Kimball International; President, Kimball Hospitality | 2018 | |||

Executive officers are elected annually by the Board of Directors.

Mr. Schneider was appointed Chairman of the Board, Chief Executive Officer in November 2014 and was appointed to our Board of Directors in February 2014. He led the Kimball Hospitality subsidiary in 2013 and 2014, and was Executive Vice President, Chief Financial Officer (“CFO”) from July 1997 to November 2014. He has been with the Company for 30 years in various financial and executive positions. As leader of Kimball Hospitality, he oversaw the business as it returned to profitability in fiscal year 2014. He was also responsible for strategic planning, SEC reporting, finance, capital structure, insurance, tax, internal audit, and treasury services as CFO of the Company. Mr. Schneider plans to retire effective October 31, 2018. The Board of Directors created a Continuity Committee to facilitate the succession planning process.

Mr. Van Winkle was appointed President, Chief Operating Officer in November 2014. He previously served as Executive Vice President, President — Furniture Group from March 2014 to November 2014. He also served as Vice President, President — Office Furniture Group from February 2010 until November 2013 when he was appointed Executive Vice President, President — Office Furniture Group. He had previously served as Vice President, General Manager of National from October 2003 until February 2010, and prior to that served as Vice President, Chief Finance and Administrative Officer for the Furniture Brands Group as well as other key finance roles within our Furniture business since joining the Company in January 1991.

Ms. Schroeder was appointed Vice President, Chief Financial Officer in November 2014. She previously served as Vice President and Chief Accounting Officer, a position she assumed in May 2009. She was appointed to Vice President in December 2004, served as Corporate Controller from August 2002 until May 2009, and prior to that served as Assistant Corporate Controller and Director of Financial Analysis. As CFO, Ms. Schroeder has responsibility for the accounting, internal audit, investor relations, tax and treasury functions, as well as setting financial strategy and policies for the Company.

Mr. Wagner was appointed President, Kimball in November 2014 and was also appointed as a Vice President of Kimball International, Inc. in February 2015. Prior to that, he served as Vice President, General Manager of Kimball. Since joining the Company in October 2013, Mr. Wagner has led the extensive sales growth and aggressive cost reductions at Kimball. Prior to joining the Company, he most recently served as Senior Vice President of Sales and Marketing with OFS Brands, Inc. (an office furniture manufacturing company) from 2004 until October 2013. His career spans over 20 years of experience in the office furniture industry with leadership positions in sales, sales management, marketing, and strategic planning.

Mr. Kincer was appointed Vice President, Corporate Development in November 2014. Prior to that, he served as Vice President, Business Development, Treasurer since 2006 with responsibility for global treasury operations managing Company-wide liquidity, commercial banking relationships, corporate debt facilities, foreign exchange risk, and insurance programs as well as the evaluation of acquisition opportunities. He also served in various finance and leadership roles of progressing responsibility since joining the Company in 1994.

16

Ms. Heitz Cassidy was appointed Vice President, General Counsel and Secretary in November 2014 and to the additional role of Chief Compliance Officer in July 2016, which was adjusted to Chief Ethics and Compliance Officer in October 2016, where she has the responsibility to provide and oversee the provision of legal advice and guidance as needed by the Company, oversee compliance with laws, assist in instilling and maintaining an ethical corporate culture, and implement and maintain our compliance policies and program. She provides strategic-thinking leadership, advice and counsel to our executive management, and as Secretary, assists the Board of Directors. She previously served as Deputy General Counsel since August 2009, with responsibility for handling all day-to-day legal activities of the Company and was appointed to Vice President in October 2013. She joined the Company in 1996 as an associate corporate counsel and has held positions of increasing responsibility within the legal department during her career.

Mr. Nicholson was appointed Vice President, Chief Administrative Officer in February 2015 with responsibility for the human resources and information technology functions. He also served as Vice President, Chief Information Officer from January 2014 until March 2015. Throughout 2013 he served as Director, Business Analytics and then Vice President, Business Analytics, with oversight of strategic application of data analysis, social media and mobile computing in support of the growth of our information management into more predictive analysis in order to build greater responsiveness to customer needs and improvement of operational decision making. He also served as Director of Organizational Development from November 2011 until January 2013, and Director of Employee Engagement from November 2008 until November 2011 following other roles of advancing responsibility in the areas of application development, systems analysis, process re-engineering, lean/continuous improvement and enterprise resource planning since joining the Company in 1986.

Ms. Smith was appointed President, National Office Furniture in January 2018 and has served as Vice President of Kimball International, Inc. since October 2015. Prior to January 2018, she held the position of President, Kimball Hospitality from August 2015 until January 2018, where she was responsible for strategic growth and direction. Previously, she served as Vice President, Marketing for National Office Furniture, a position she assumed in 2010 where she led product development, marketing, sustainability, vertical markets, and increasing brand awareness in the architect and design community. Prior to that, she held various other roles of increasing responsibility in marketing, product development, sales and service. She has over 25 years of experience in the office and hospitality industries.

Ms. Sigler was appointed President, Kimball Hospitality and also appointed as a Vice President of Kimball International, Inc. in January 2018. She is responsible for the strategic growth and direction of Kimball Hospitality. Prior to that, she served as Vice President, Operations, for the Kimball brand from February 2015 until January 2018, where she was responsible for the strategic and day-to-day execution of all direct manufacturing and manufacturing support (engineering, global supply chain, quality and continuous improvement) functions. From December 2012 until February 2015, she served as Director of Operations of a Kimball brand manufacturing facility. From August 2004 to December 2012, she held operational leadership roles of increasing responsibility within the Kimball brand. Before her time with the Kimball brand, Ms. Sigler held numerous roles in Kimball Hospitality from 1992 to 2004, including customer service, master scheduling, sales operations management, demand management, and program management.

17

PART II

Item 5 - Market for Registrant’s Common Equity, Related Shareowner Matters and Issuer Purchases of Equity Securities

Market Prices

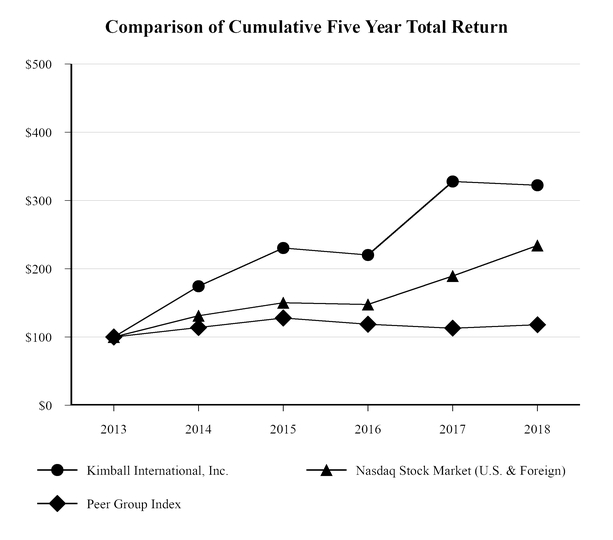

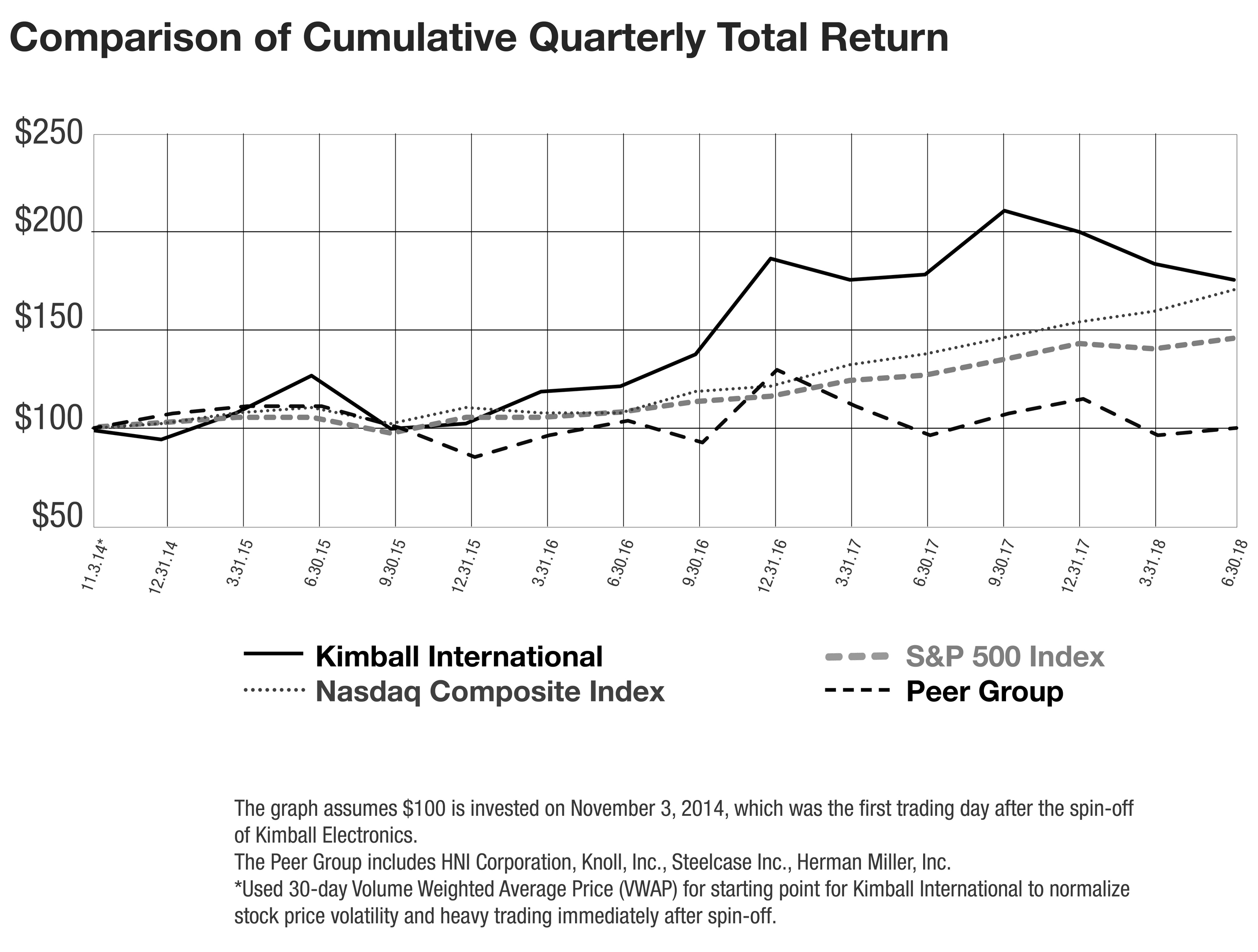

Our Class B common stock trades on the Global Select Market of Nasdaq under the symbol: KBAL. High and low sales prices by quarter for the last two fiscal years as quoted by the Nasdaq system were as follows:

2018 | 2017 | ||||||||||||||