Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - GENERAL CABLE CORP /DE/ | q22017earningsrelease.htm |

| 8-K - 8-K - GENERAL CABLE CORP /DE/ | bgc2017q2earnings8-k.htm |

1

Consolidated Adjusted

Operating Income

2nd Quarter

2017 2016

In millions, except per share amounts

Operating

Income EPS

Operating

Income EPS

Reported $ (22.8) $(1.42) $ 53.3 $ 0.57

Adjustments to Reconcile Operating Income/EPS

Non-cash convertible debt interest expense

(1)

- 0.01 - 0.01

Mark to market (gain) loss on derivative instruments

(2)

- 0.08 - (0.05)

Restructuring and divestiture costs

(3)

12.2 0.21 16.7 0.25

Legal and investigative costs

(4)

0.3 - 1.1 0.02

(Gain) loss on sale of assets

(5)

- - (46.5) (0.86)

Foreign Corrupt Practices Act (FCPA)

(6)

- 0.20 5.0 0.09

Asia-Pacific and Africa (income) loss

(7)

42.5 1.03 19.4 0.27

Total Adjustments 55.0 1.53 (4.3) (0.27)

Adjusted $ 32.2 $ 0.11 $ 49.0 $ 0.30

Note 1: The table above reflects EPS adjustments based on the Company's full year effective tax rate for 2017 and 2016 of 40% and 50%,

respectively

Note 2: See footnote definitions on slide 6

Exhibit 99.2

2

Segment Adjusted Operating Income

North America, Europe and Latin America

Note: See footnote definitions on slide 6

North America Operating Income

Q2 Q3 Q4 Q1 Q2

In millions 2016 2016 2016 2017 2017

As reported $ 73.8 $ 10.0 $ (39.1) $ 25.8 $ 19.9

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) 13.4 22.9 14.1 12.2 11.2

Legal and investigative costs (4) 1.1 0.8 (0.7) 0.3 0.3

(Gain) loss on the sale of assets (5) (53.2) (0.5) 1.0 3.5 -

Foreign Corrupt Practices Act (FCPA) (6) 5.0 - 49.3 - -

US Pension Settlement (9) - - 7.4 - -

Total Adjustments (33.7) 23.2 71.1 16.0 11.5

Adjusted $ 40.1 $ 33.2 $ 32.0 $ 41.8 $ 31.4

Europe Operating Income

Q2 Q3 Q4 Q1 Q2

In millions 2016 2016 2016 2017 2017

As reported $ (1.5) $ 10.8 $ (14.4) $ (3.6) $ (2.5)

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) 1.7 0.3 10.8 1.7 1.0

(Gain) loss on the sale of assets (5) 8.4 (5.9) - - -

Total Adjustments 10.1 (5.6) 10.8 1.7 1.0

Adjusted $ 8.6 $ 5.2 $ (3.6) $ (1.9) $ (1.5)

Latin America Operating Income

Q2 Q3 Q4 Q1 Q2

In millions 2016 2016 2016 2017 2017

As reported $ 0.4 $ (7.1) $ (4.0) $ 4.6 $ 2.3

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs (3) 1.6 0.8 2.9 0.2 -

(Gain) loss on the sale of assets (5) (1.7) - - - -

Total Adjustments (0.1) 0.8 2.9 0.2 -

Adjusted $ 0.3 $ (6.3) $ (1.1) $ 4.8 $ 2.3

Core Operations - Total Adjusted Operating Income $ 49.0 $ 32.1 $ 27.3 $ 44.7 $ 32.2

3

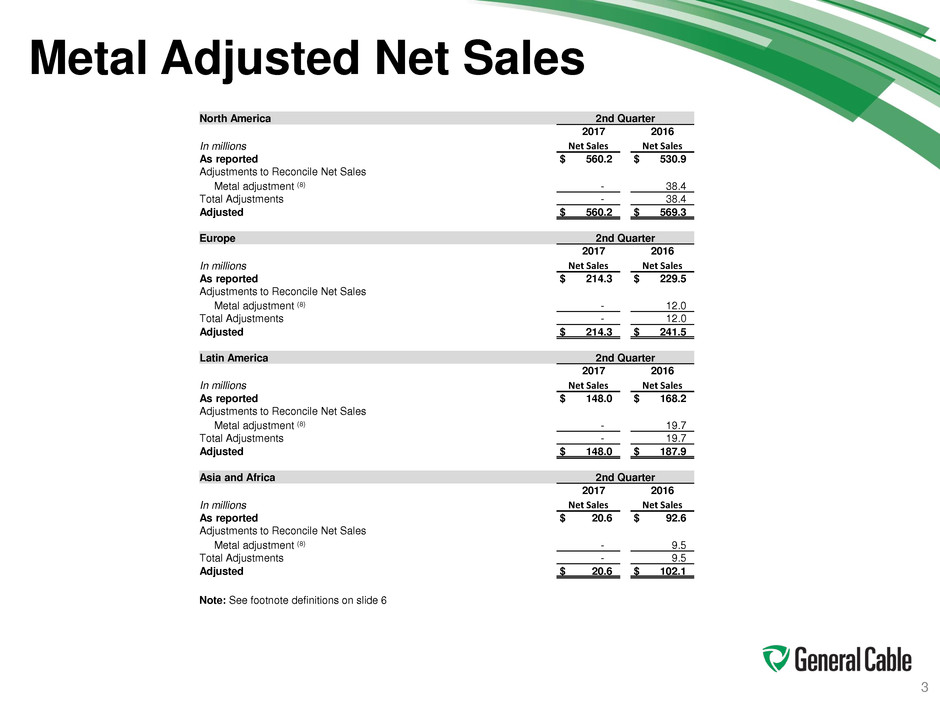

Metal Adjusted Net Sales

Note: See footnote definitions on slide 6

North America 2nd Quarter

2017 2016

In millions Net Sales Net Sales

As reported $ 560.2 $ 530.9

Adjustments to Reconcile Net Sales

Metal adjustment (8) - 38.4

Total Adjustments - 38.4

Adjusted $ 560.2 $ 569.3

Europe 2nd Quarter

2017 2016

In millions Net Sales Net Sales

As reported $ 214.3 $ 229.5

Adjustments to Reconcile Net Sales

Metal adjustment (8) - 12.0

Total Adjustments - 12.0

Adjusted $ 214.3 $ 241.5

Latin America 2nd Quarter

2017 2016

In millions Net Sales Net Sales

As reported $ 148.0 $ 168.2

Adjustments to Reconcile Net Sales

Metal adjustment (8) - 19.7

Total Adjustments - 19.7

Adjusted $ 148.0 $ 187.9

Asia and Africa 2nd Quarter

2017 2016

In millions Net Sales Net Sales

As reported $ 20.6 $ 92.6

Adjustments to Reconcile Net Sales

Metal adjustment (8) - 9.5

Total Adjustments - 9.5

Adjusted $ 20.6 $ 102.1

4

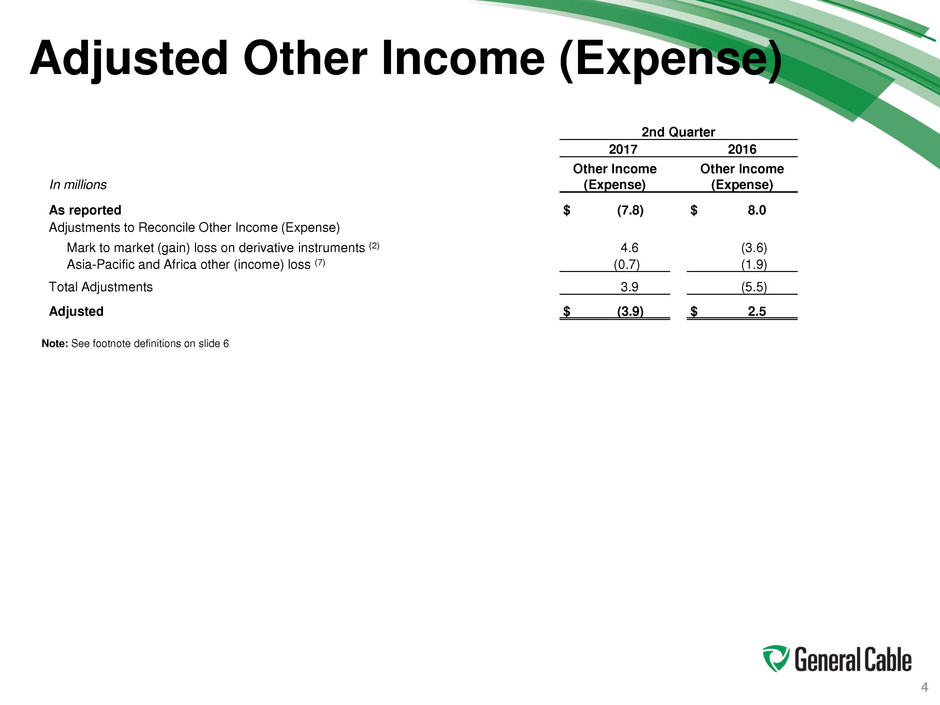

Adjusted Other Income (Expense)

Note: See footnote definitions on slide 6

2nd Quarter

2017 2016

In millions

Other Income

(Expense)

Other Income

(Expense)

As reported $ (7.8) $ 8.0

Adjustments to Reconcile Other Income (Expense)

Mark to market (gain) loss on derivative instruments (2) 4.6 (3.6)

Asia-Pacific and Africa other (income) loss (7) (0.7) (1.9)

Total Adjustments 3.9 (5.5)

Adjusted $ (3.9) $ 2.5

5

Adjusted EBITDA

Note: See footnote definitions on slide 6

12 Months

Ended

12 Months

Ended

In millions Q2 2017 2016

Net income (loss) attributable to Company common shareholders $ (177.3) $ (93.8)

Net income (loss) attributable to noncontrolling interest 3.6 0.3

Equity in net (earnings) losses of affiliated companies (0.5) (0.9)

Income tax provision (benefit) 8.4 (3.7)

Interest expense, net 82.3 87.0

Other (income) expense (7.6) (7.2)

Operating income (loss) $ (91.1) $ (18.3)

Adjustments to Reconcile Operating Income

Restructuring and divestiture costs

(3)

78.2 82.6

Legal and investigative costs

(4)

0.7 7.0

(Gain) loss on sale of assets

(5)

(1.9) (51.9)

Foreign Corrupt Practices Act (FCPA)

(6)

49.3 54.3

US Pension Settlement

(9)

7.4 7.4

Asia-Pacific and Africa (income) loss

(7)

93.7 68.9

Total Adjustments 227.4 168.3

Adjusted operating income 136.3 150.0

Depreciation and amortization (10) 76.7 80.9

Adjusted EBITDA $ 213.0 $ 230.9

6

Footnotes

(1) - The Company's adjustment for the non-cash convertible debt interest expense reflects the accretion of the equity component of the 2029 convertible notes, which is reflected in the

income statement as interest expense.

(2) - Mark to market (gains) and losses on derivative instruments represents the current period changes in the fair value of commodity instruments designated as economic hedges. The

Company adjusts for the changes in fair values of these commodity instruments as the earnings associated with the underlying contract have not been recorded in the same period.

(3) - Restructuring and divestiture costs represent costs associated with the Company's announced restructuring and divestiture programs. Examples consist of, but are not limited to,

employee separation costs, asset write-downs, accelerated depreciation, working capital write-downs, equipment relocation, contract terminations, consulting fees and legal costs incurred

as a result of the programs. The Company adjusts for these charges as management believes these costs will not continue at the conclusion of both the restructuring and divestiture

programs.

(4) - Legal and investigative costs represents costs incurred for external legal counsel and forensic accounting firms in connection with the restatement of our financial statements and the

Foreign Corrupt Practices Act investigation. The Company adjusts for these charges as management believe these costs will not continue at the conclusion of these investigations, which

are considered outside the normal course of business.

(5) - Gain and losses on the sale of assets are the result of divesting certain General Cable businesses. The Company adjusts for these gains and losses as management believes the

gains and losses are one-time in nature and will not occur as part of the ongoing operations.

(6) - Foreign Corrupt Practices Act (FCPA) represents expense recorded in 2016 related to the FCPA settlement of the SEC and DOJ investigations. The Company adjusts for this activity

as management believes this is a one-time charge and will not occur as part of ongoing operations. In 2017, the adjustment principally reflects additional tax expense associated with

changes in judgment concerning uncertain tax positions related to the FCPA settlement stemming from a recent change in law.

(7) - The adjustment excludes the impact of operations in the Africa and Asia Pacific segment which are not considered "core operations" under the Company's new strategic roadmap.

The Company is in the process of divesting or closing these operations which are not expected to continue as part of the ongoing business. For accounting purposes, the continuing

operations in Africa and Asia Pacific do not meet the requirement to be presented as discontinued operations. Second quarter of 2017 principally reflects the non-cash impact for the

release of cumulative foreign currency losses recognized on the sale of the Company’s investment in Algeria of $36 million and the closure of certain operations in Asia Pacific of $4 million

as well as the non-cash write-off of deferred tax assets of $6 million related to the divesture of certain operations in Asia Pacific. The second quarter of 2016 principally reflects the impact

of non-cash charges related to the dispositions of Zambia and Egypt principally due to the release of cumulative foreign currency losses.

(8) - The metal adjustment to net sales is the Company's estimate of metal price volatility to revenues from one period to another.

(9) - The US pension settlement charge is a one-time cost related to the lump sum payment to term-vested participants of the US Master Pension Plan. This charge represents the

payments made to those participants who elected to take the lump sum payment and for which the Company no longer has obligations to pay in the future. The Company has adjusted for

this US pension settlement charge as management does not expect it to occur in the future, nor is it part of the ongoing operations.

(10) - Excludes depreciation and amortization in Asia Pacific and Africa for the twelve months ended June 30, 2017 and 2016 of $4.9 million and $5.1 million, respectively.