Attached files

| file | filename |

|---|---|

| 8-K - 8-K - COLUMBUS MCKINNON CORP | a8k060117.htm |

1 1

Gregory P. Rustowicz

Vice President – Finance & Chief Financial Officer

KeyBanc Industrials

Conference

June 1, 2017

2 2

Safe Harbor Statement

These slides contain (and the accompanying oral discussion will contain) “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks,

uncertainties and other factors that could cause the actual results of the Company to differ materially from the

results expressed or implied by such statements, including general economic and business conditions, conditions

affecting the industries served by the Company and its subsidiaries, conditions affecting the Company’s customers

and suppliers, competitor responses to the Company’s products and services, the overall market acceptance of

such products and services, the integration of acquisitions and other factors disclosed in the Company’s periodic

reports filed with the Securities and Exchange Commission. Consequently such forward looking statements should

be regarded as the Company’s current plans, estimates and beliefs. The Company does not undertake and

specifically declines any obligation to publicly release the results of any revisions to these forward-looking

statements that may be made to reflect any future events or circumstances after the date of such statements or

to reflect the occurrence of anticipated or unanticipated events.

This presentation will discuss some non-GAAP financial measures, which we believe are useful in evaluating

our performance. You should not consider the presentation of this additional information in isolation or as a

substitute for results compared in accordance with GAAP. We have provided reconciliations of comparable

GAAP to non-GAAP measures in tables found in the Supplemental Information portion of this presentation.

3 3

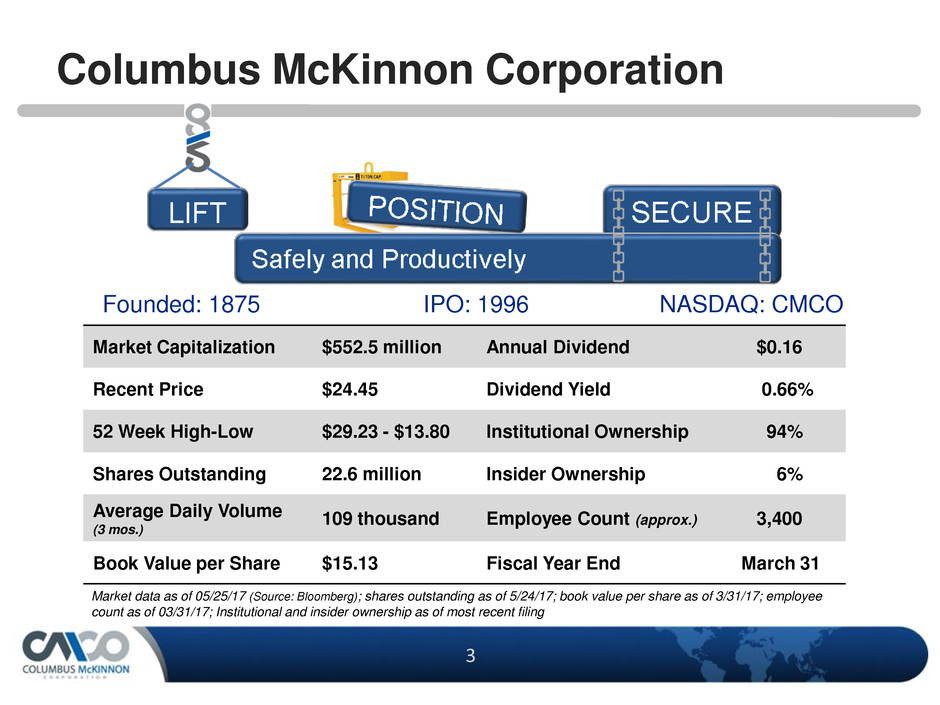

Columbus McKinnon Corporation

Market Capitalization $552.5 million Annual Dividend $0.16

Recent Price $24.45 Dividend Yield 0.66%

52 Week High-Low $29.23 - $13.80 Institutional Ownership 94%

Shares Outstanding 22.6 million Insider Ownership 6%

Average Daily Volume

(3 mos.)

109 thousand Employee Count (approx.) 3,400

Book Value per Share $15.13 Fiscal Year End March 31

Market data as of 05/25/17 (Source: Bloomberg); shares outstanding as of 5/24/17; book value per share as of 3/31/17; employee

count as of 03/31/17; Institutional and insider ownership as of most recent filing

Founded: 1875 IPO: 1996 NASDAQ: CMCO

4 4

Near-term Priorities

Integrate STAHL

Expect $5m in synergies in FY2018

Realizing growth opportunities

Leverage Magnetek technology

Cost effectively embedding digital controls in hoists

Products will include information intelligence

Strengthen the core

Identifying actions to grow market share

Pay down debt

Reduce debt in FY2018 by $45 million to $50 million

Expect 3X net debt/EBITDA by fiscal year end

5 5

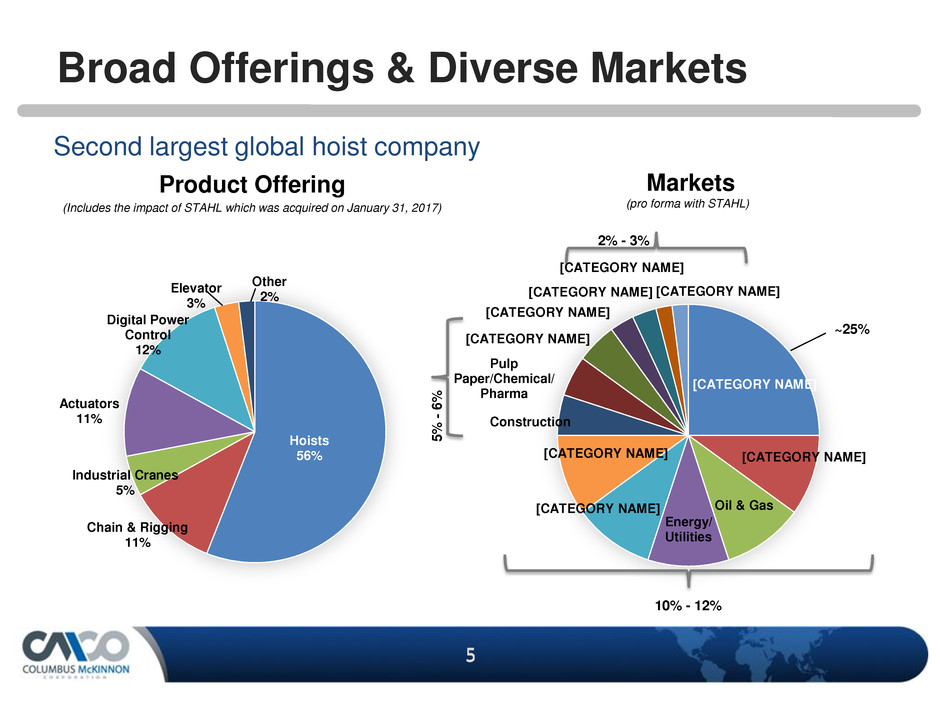

Broad Offerings & Diverse Markets

Hoists

56%

Chain & Rigging

11%

Industrial Cranes

5%

Actuators

11%

Digital Power

Control

12%

Elevator

3%

Other

2%

Second largest global hoist company

(Includes the impact of STAHL which was acquired on January 31, 2017)

Product Offering Markets

(pro forma with STAHL)

[CATEGORY NAME]

[CATEGORY NAME]

Oil & Gas

Energy/

Utilities

[CATEGORY NAME]

[CATEGORY NAME]

Construction

Pulp

Paper/Chemical/

Pharma

[CATEGORY NAME]

[CATEGORY NAME]

[CATEGORY NAME]

[CATEGORY NAME]

[CATEGORY NAME]

~25%

10% - 12%

2% - 3%

5

%

-

6

%

6 6

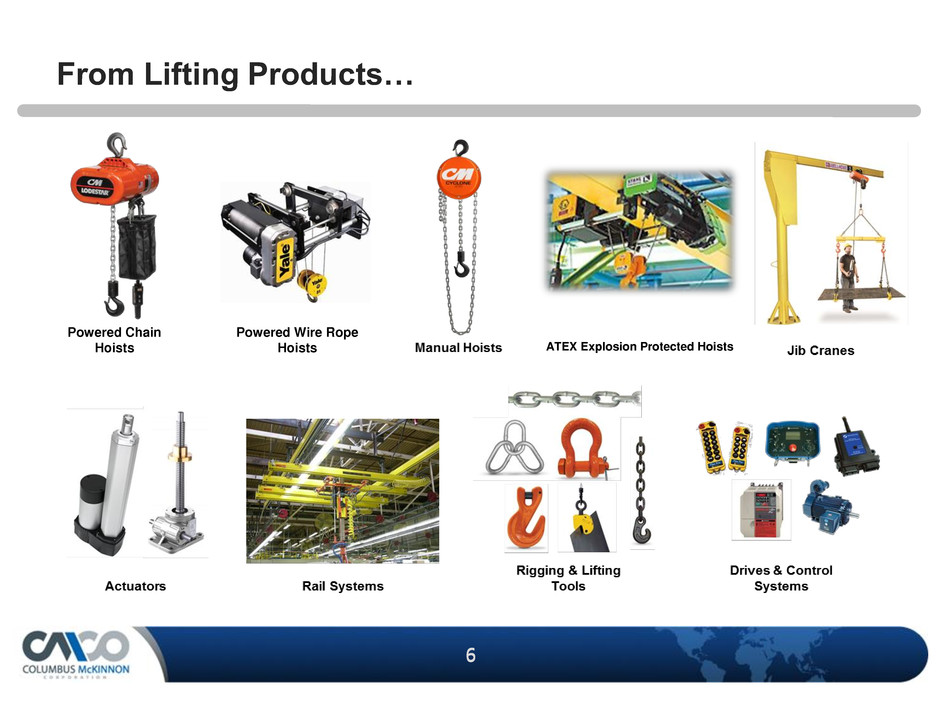

From Lifting Products…

Powered Chain

Hoists

Powered Wire Rope

Hoists ATEX Explosion Protected Hoists

7 7

…to Solutions

8 8

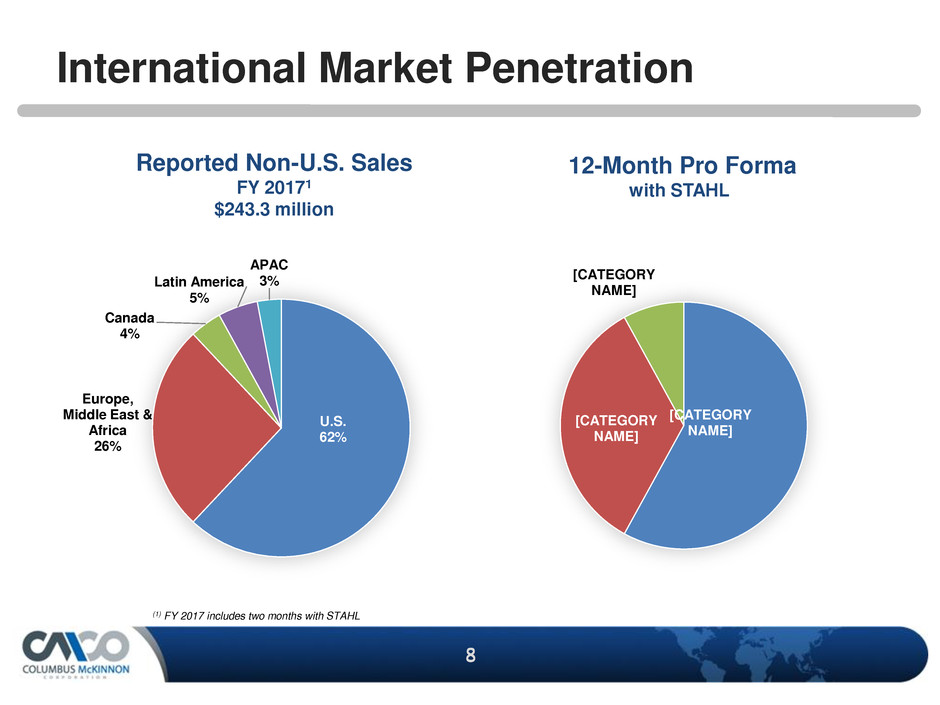

International Market Penetration

Reported Non-U.S. Sales

FY 20171

$243.3 million

U.S.

62%

Europe,

Middle East &

Africa

26%

Canada

4%

Latin America

5%

APAC

3%

(1) FY 2017 includes two months with STAHL

[CATEGORY

NAME]

[CATEGORY

NAME]

[CATEGORY

NAME]

12-Month Pro Forma

with STAHL

9 9

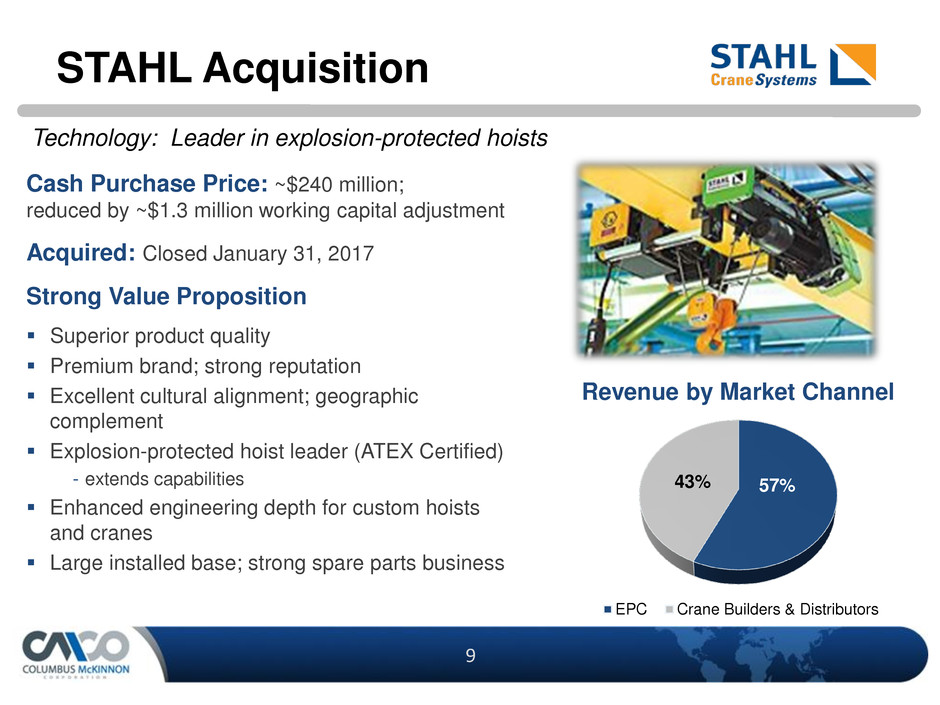

STAHL Acquisition

Cash Purchase Price: ~$240 million;

reduced by ~$1.3 million working capital adjustment

Acquired: Closed January 31, 2017

Strong Value Proposition

Superior product quality

Premium brand; strong reputation

Excellent cultural alignment; geographic

complement

Explosion-protected hoist leader (ATEX Certified)

- extends capabilities

Enhanced engineering depth for custom hoists

and cranes

Large installed base; strong spare parts business

Technology: Leader in explosion-protected hoists

57% 43%

EPC Crane Builders & Distributors

Revenue by Market Channel

10 10

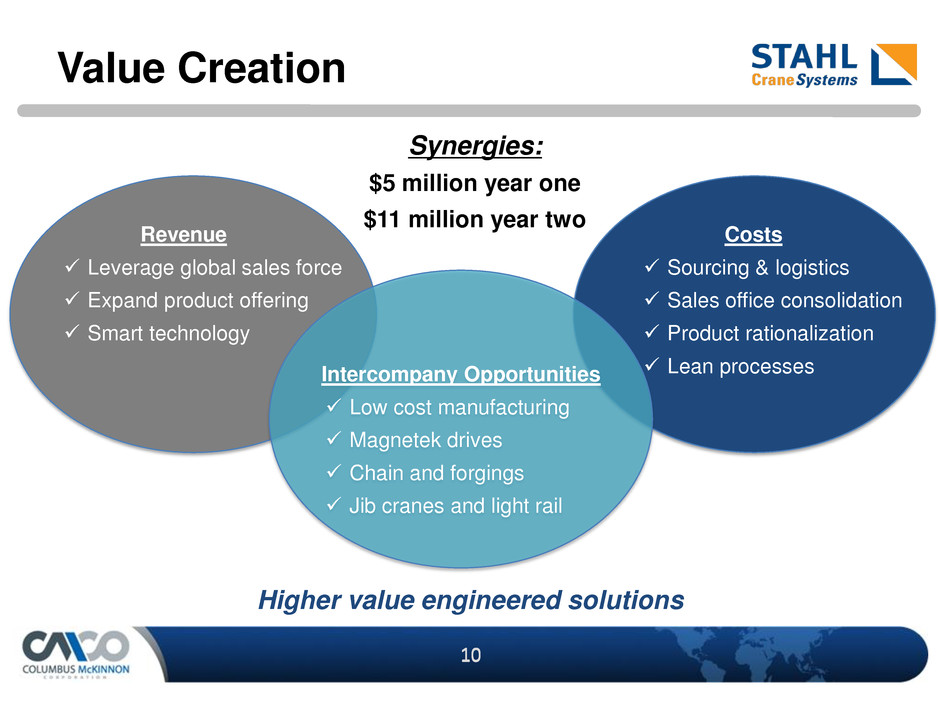

Value Creation

Costs

Sourcing & logistics

Sales office consolidation

Product rationalization

Lean processes

Revenue

Leverage global sales force

Expand product offering

Smart technology

Intercompany Opportunities

Low cost manufacturing

Magnetek drives

Chain and forgings

Jib cranes and light rail

Synergies:

$5 million year one

$11 million year two

Higher value engineered solutions

11 11

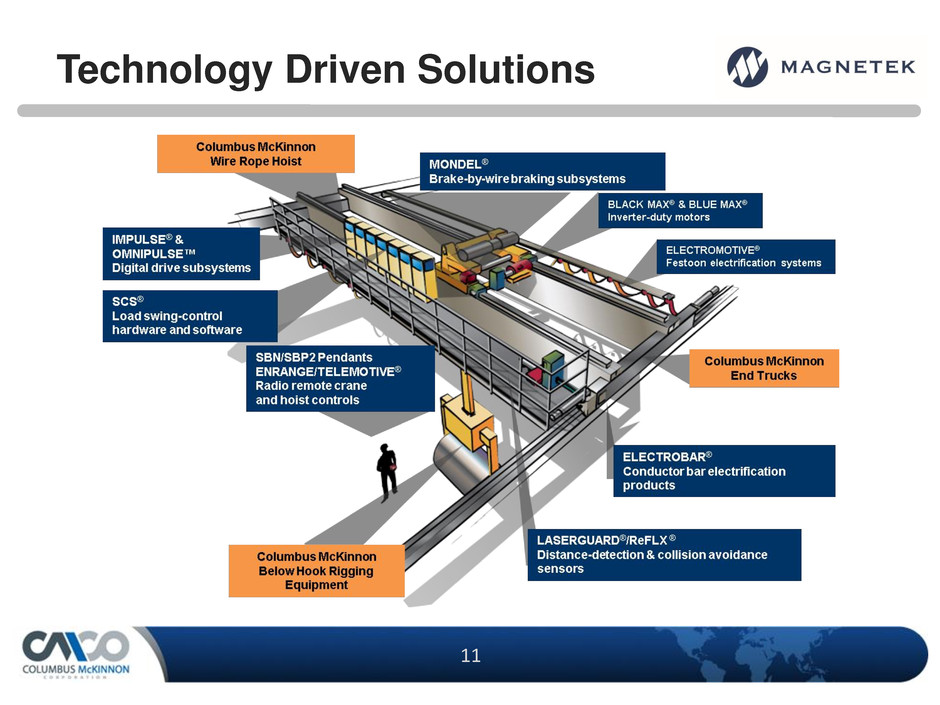

Technology Driven Solutions

12 12

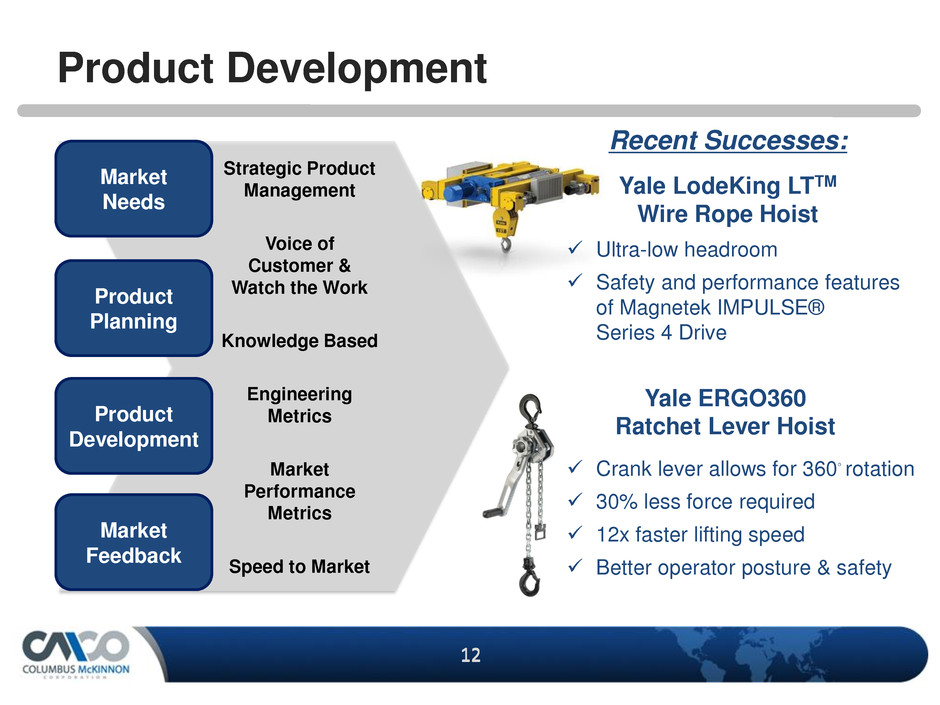

Product Development

Market

Needs

Market

Feedback

Product

Planning

Product

Development

Recent Successes:

Yale LodeKing LTTM

Wire Rope Hoist

Strategic Product

Management

Voice of

Customer &

Watch the Work

Knowledge Based

Engineering

Metrics

Market

Performance

Metrics

Speed to Market

Yale ERGO360

Ratchet Lever Hoist

Crank lever allows for 360◦ rotation

30% less force required

12x faster lifting speed

Better operator posture & safety

Ultra-low headroom

Safety and performance features

of Magnetek IMPULSE®

Series 4 Drive

13 13

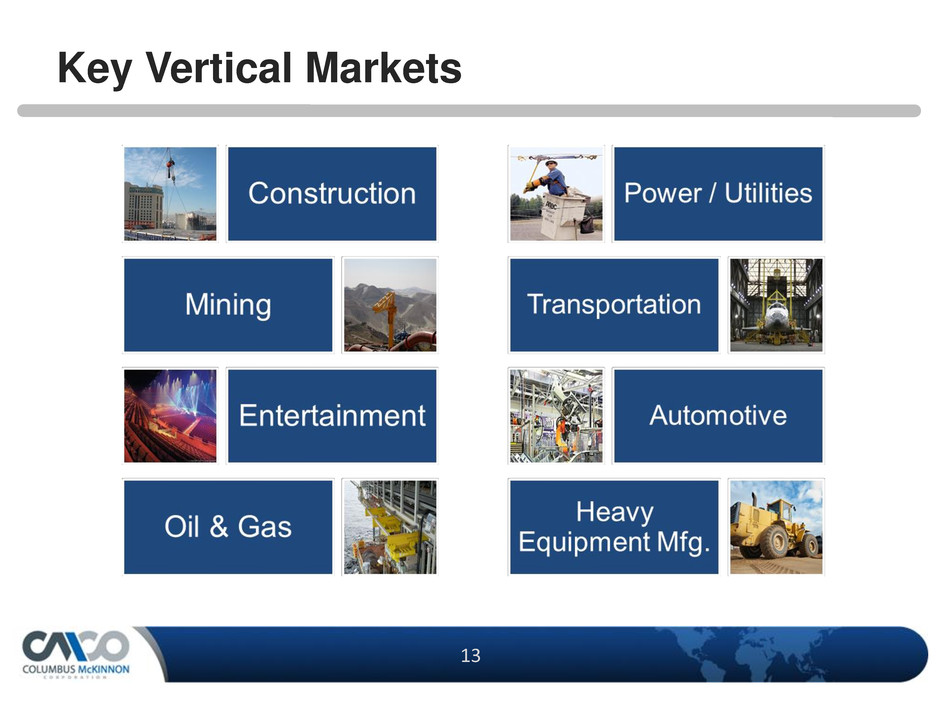

Key Vertical Markets

14 14

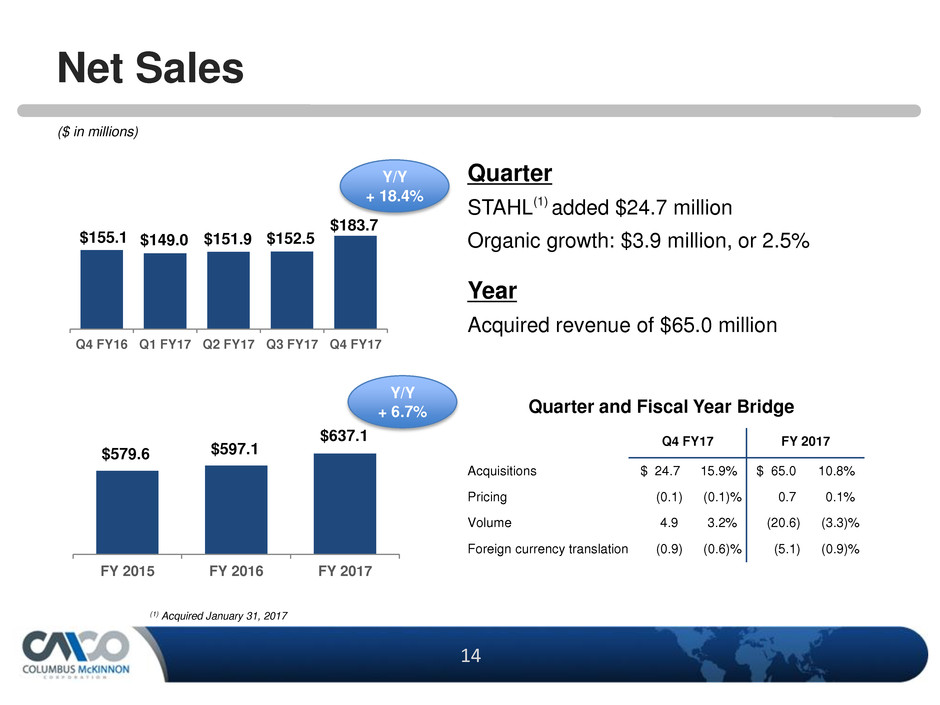

$155.1 $149.0 $151.9 $152.5

$183.7

Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17

Net Sales

($ in millions)

$579.6 $597.1

$637.1

FY 2015 FY 2016 FY 2017

Quarter

STAHL(1) added $24.7 million

Organic growth: $3.9 million, or 2.5%

Year

Acquired revenue of $65.0 million

Q4 FY17 FY 2017

Acquisitions $ 24.7 15.9% $ 65.0 10.8%

Pricing (0.1) (0.1)% 0.7 0.1%

Volume 4.9 3.2% (20.6) (3.3)%

Foreign currency translation (0.9) (0.6)% (5.1) (0.9)%

Quarter and Fiscal Year Bridge

Y/Y

+ 18.4%

Y/Y

+ 6.7%

(1) Acquired January 31, 2017

15 15

$48.4

$48.0 $49.7 $44.8

$1.5

[CELLREF]

[CELLRE

F]

[CELLRE

F]

$8.9

Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17

$181.6

[CELLRE

F]

[CELLRE

F]

$1.7

[CELLREF]

[CELLRE

F]

FY 2015 FY 2016 FY 2017

$187.3

$3.9

$192.9

$8.9

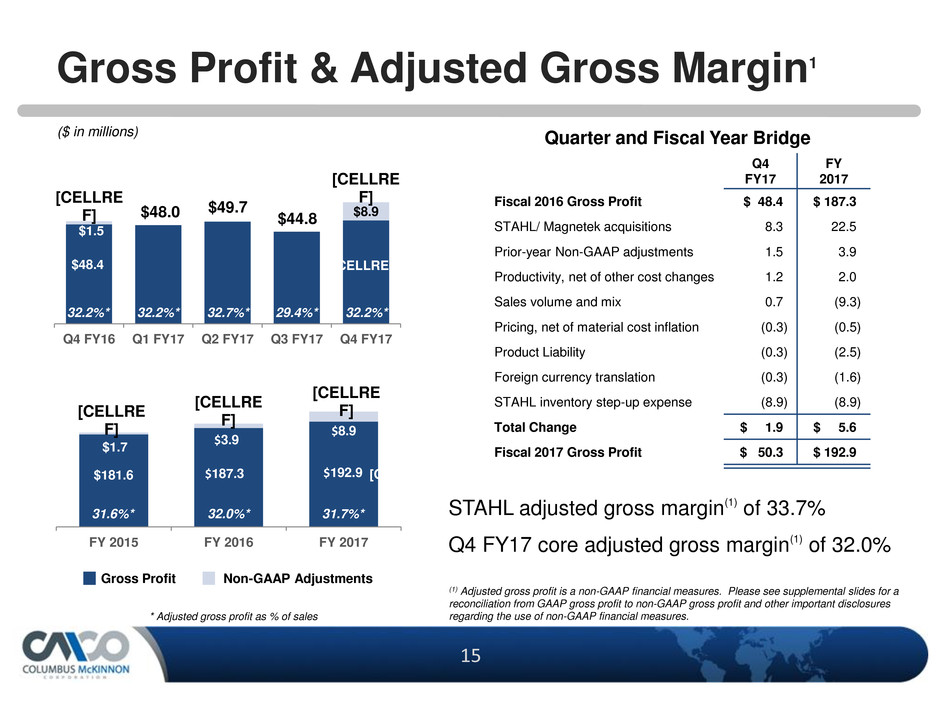

Gross Profit & Adjusted Gross Margin1

Non-GAAP Adjustments Gross Profit

* Adjusted gross profit as % of sales

Quarter and Fiscal Year Bridge

(1) Adjusted gross profit is a non-GAAP financial measures. Please see supplemental slides for a

reconciliation from GAAP gross profit to non-GAAP gross profit and other important disclosures

regarding the use of non-GAAP financial measures.

32.2%* 29.4%* 32.7%* 32.2%* 32.2%*

($ in millions)

31.7%* 32.0%* 31.6%* STAHL adjusted gross margin

(1) of 33.7%

Q4 FY17 core adjusted gross margin(1) of 32.0%

Q4

FY17

FY

2017

Fiscal 2016 Gross Profit $ 48.4 $ 187.3

STAHL/ Magnetek acquisitions 8.3 22.5

Prior-year Non-GAAP adjustments 1.5 3.9

Productivity, net of other cost changes 1.2 2.0

Sales volume and mix 0.7 (9.3)

Pricing, net of material cost inflation (0.3) (0.5)

Product Liability (0.3) (2.5)

Foreign currency translation (0.3) (1.6)

STAHL inventory step-up expense (8.9) (8.9)

Total Change $ 1.9 $ 5.6

Fiscal 2017 Gross Profit $ 50.3 $ 192.9

16 16

[VALUE]

[CELLRE

F]

$12.6

[CELLRE

F]

[VALUE]

[CELLREF]

[CELLRE

F]

[CELLRE

F]

[VALUE]

Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17

$3.1

$0.2

$11.2

$12.6

$5.3

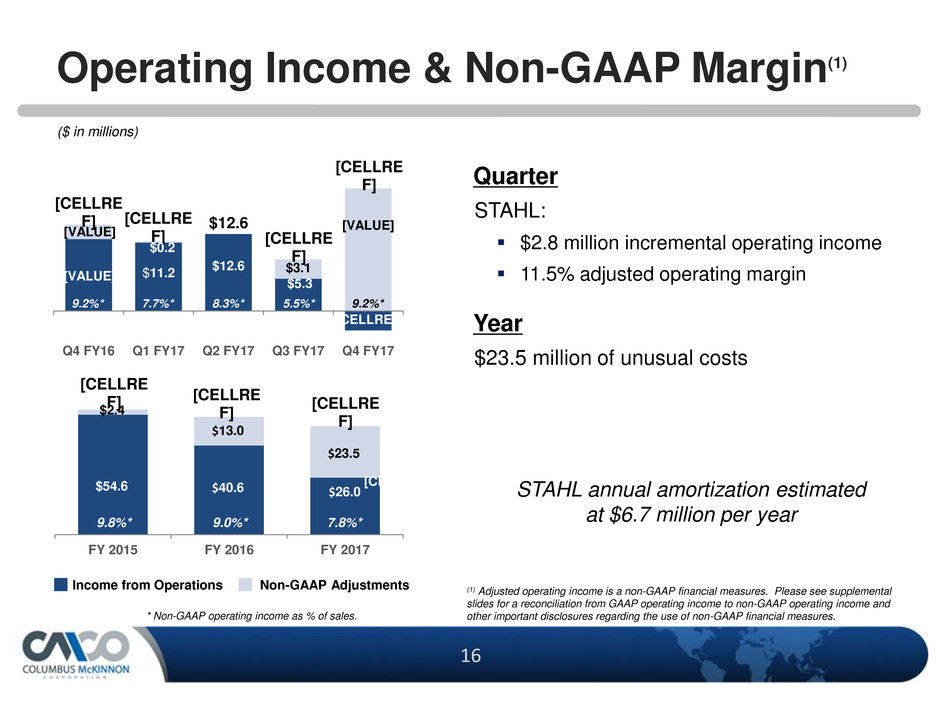

Operating Income & Non-GAAP Margin(1)

Non-GAAP Adjustments Income from Operations

Quarter

STAHL:

$2.8 million incremental operating income

11.5% adjusted operating margin

Year

$23.5 million of unusual costs

STAHL annual amortization estimated

at $6.7 million per year

* Non-GAAP operating income as % of sales.

(1) Adjusted operating income is a non-GAAP financial measures. Please see supplemental

slides for a reconciliation from GAAP operating income to non-GAAP operating income and

other important disclosures regarding the use of non-GAAP financial measures.

($ in millions)

9.2%* 5.5%* 8.3%* 7.7%* 9.2%*

$54.6

[CELLRE

F]

[CELLRE

F]

$2.4

[CELLREF]

[CELLRE

F]

FY 2015 FY 2016 FY 2017

7.8%* 9.0%* 9.8%*

$40.6

$13.0

$26.0

$23.5

17 17

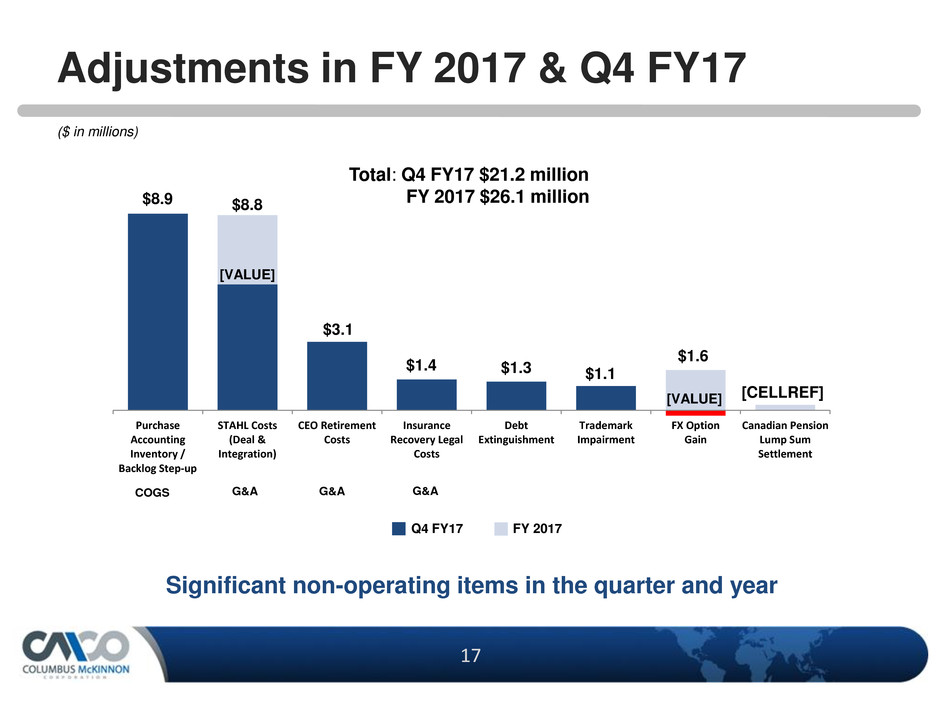

Adjustments in FY 2017 & Q4 FY17

($ in millions)

$8.9

[VALUE]

$3.1

$1.4 $1.3 $1.1

[VALUE] [CELLREF]

Purchase

Accounting

Inventory /

Backlog Step-up

STAHL Costs

(Deal &

Integration)

CEO Retirement

Costs

Insurance

Recovery Legal

Costs

Debt

Extinguishment

Trademark

Impairment

FX Option

Gain

Canadian Pension

Lump Sum

Settlement

$8.8

$1.6

Total: Q4 FY17 $21.2 million

FY 2017 $26.1 million

Significant non-operating items in the quarter and year

COGS G&A G&A G&A

FY 2017 Q4 FY17

18 18

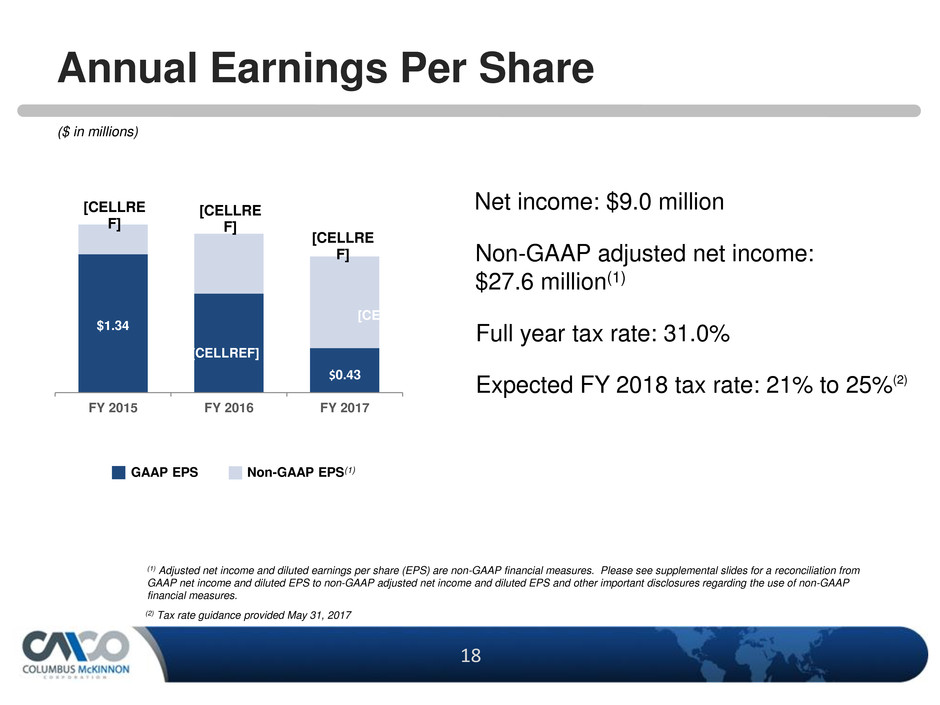

Annual Earnings Per Share

$1.34

[CELLRE

F]

[CELLRE

F]

[CELLREF]

[CELLREF]

[CELLRE

F]

FY 2015 FY 2016 FY 2017

$0.43

(1) Adjusted net income and diluted earnings per share (EPS) are non-GAAP financial measures. Please see supplemental slides for a reconciliation from

GAAP net income and diluted EPS to non-GAAP adjusted net income and diluted EPS and other important disclosures regarding the use of non-GAAP

financial measures.

Net income: $9.0 million

Non-GAAP adjusted net income:

$27.6 million(1)

Full year tax rate: 31.0%

Expected FY 2018 tax rate: 21% to 25%(2)

Non-GAAP EPS(1) GAAP EPS

(2) Tax rate guidance provided May 31, 2017

($ in millions)

19 19

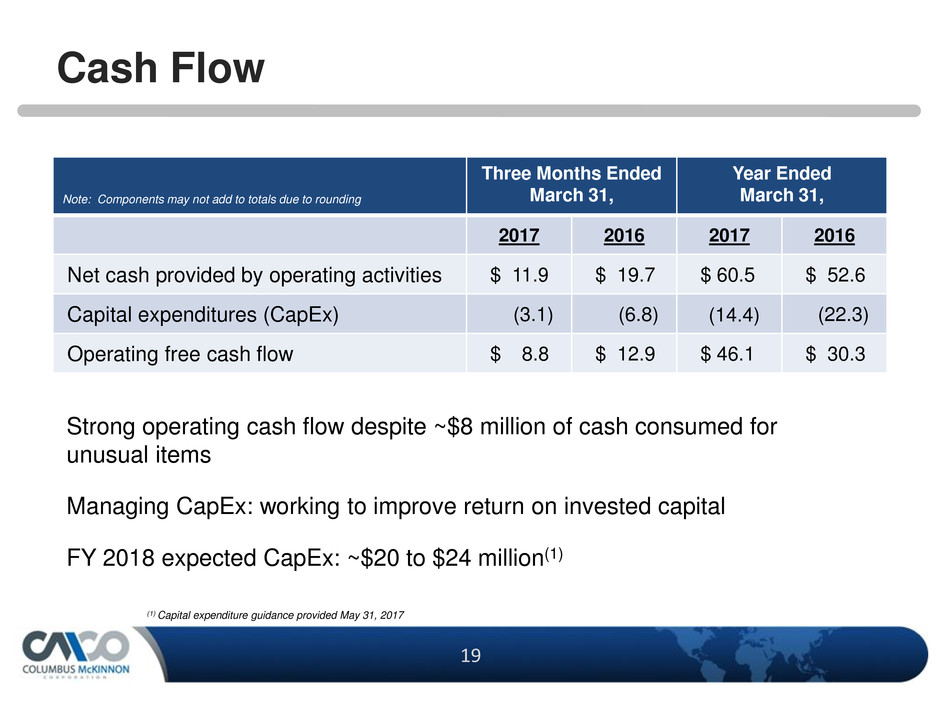

Strong operating cash flow despite ~$8 million of cash consumed for

unusual items

Managing CapEx: working to improve return on invested capital

FY 2018 expected CapEx: ~$20 to $24 million(1)

Cash Flow

Note: Components may not add to totals due to rounding

Three Months Ended

March 31,

Year Ended

March 31,

2017 2016 2017 2016

Net cash provided by operating activities $ 11.9 $ 19.7 $ 60.5 $ 52.6

Capital expenditures (CapEx) (3.1) (6.8) (14.4) (22.3)

Operating free cash flow $ 8.8 $ 12.9 $ 46.1 $ 30.3

(1) Capital expenditure guidance provided May 31, 2017

20 20

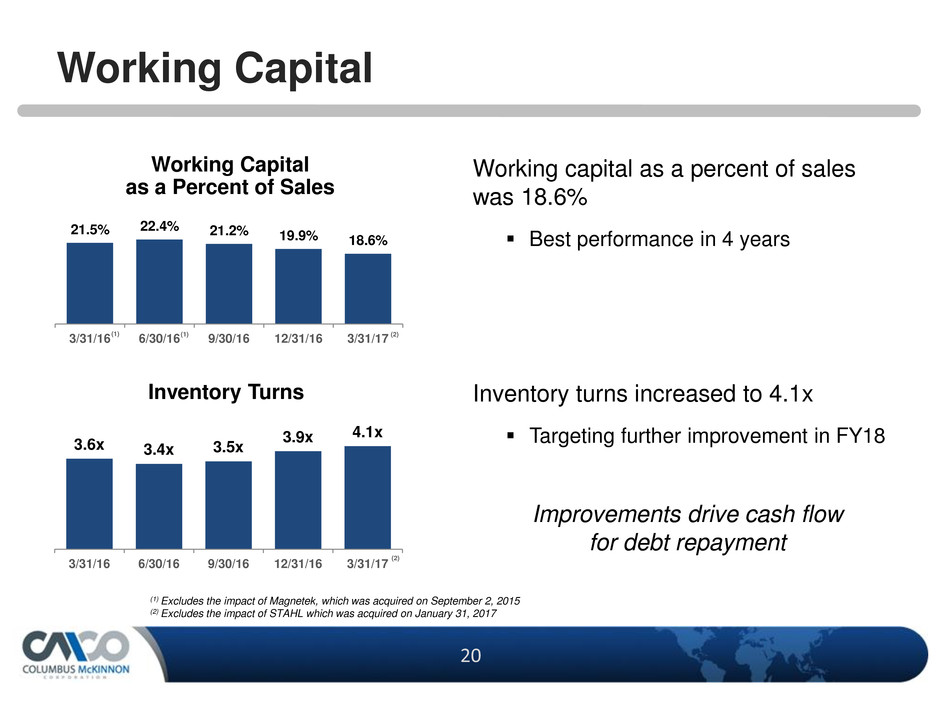

21.5% 22.4% 21.2% 19.9% 18.6%

3/31/16 6/30/16 9/30/16 12/31/16 3/31/17

Working Capital

3.6x 3.4x 3.5x

3.9x 4.1x

3/31/16 6/30/16 9/30/16 12/31/16 3/31/17

Working Capital

as a Percent of Sales

Inventory Turns

(1) Excludes the impact of Magnetek, which was acquired on September 2, 2015

(2) Excludes the impact of STAHL which was acquired on January 31, 2017

(1) (1)

Working capital as a percent of sales

was 18.6%

Best performance in 4 years

(2)

(2)

Inventory turns increased to 4.1x

Targeting further improvement in FY18

Improvements drive cash flow

for debt repayment

21 21

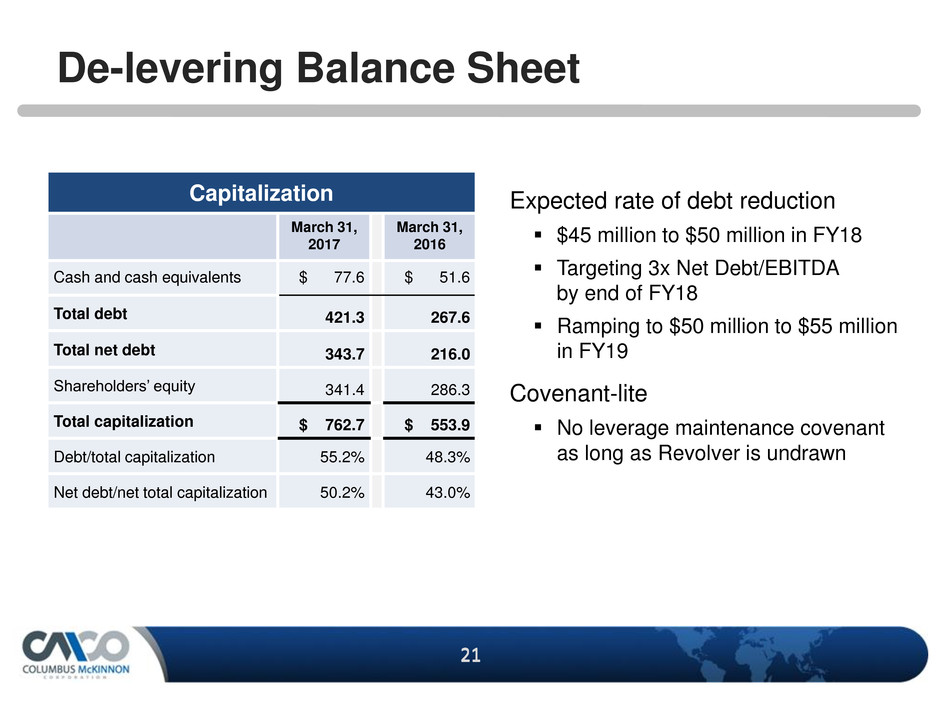

Capitalization

March 31,

2017

March 31,

2016

Cash and cash equivalents $ 77.6 $ 51.6

Total debt 421.3 267.6

Total net debt 343.7 216.0

Shareholders’ equity 341.4 286.3

Total capitalization $ 762.7 $ 553.9

Debt/total capitalization 55.2% 48.3%

Net debt/net total capitalization 50.2% 43.0%

De-levering Balance Sheet

Expected rate of debt reduction

$45 million to $50 million in FY18

Targeting 3x Net Debt/EBITDA

by end of FY18

Ramping to $50 million to $55 million

in FY19

Covenant-lite

No leverage maintenance covenant

as long as Revolver is undrawn

22 22

Key Takeaways

Leading US market share, strong brands, key vertical markets

Magnetek and STAHL strengthen value proposition

Broad products offering focused on safety and productivity

Extensive market channels & growing global presence

Improving margins & strong cash flow

23 23

Supplemental

Information

24 24

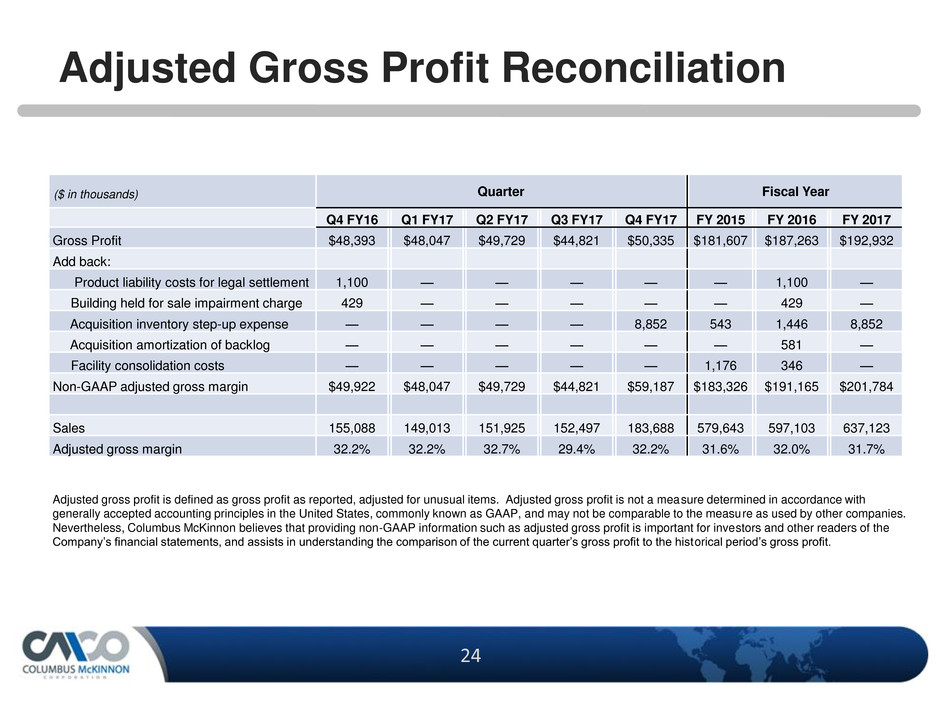

Adjusted Gross Profit Reconciliation

Adjusted gross profit is defined as gross profit as reported, adjusted for unusual items. Adjusted gross profit is not a measure determined in accordance with

generally accepted accounting principles in the United States, commonly known as GAAP, and may not be comparable to the measure as used by other companies.

Nevertheless, Columbus McKinnon believes that providing non-GAAP information such as adjusted gross profit is important for investors and other readers of the

Company’s financial statements, and assists in understanding the comparison of the current quarter’s gross profit to the historical period’s gross profit.

Quarter Fiscal Year

Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY 2015 FY 2016 FY 2017

Gross Profit $48,393 $48,047 $49,729 $44,821 $50,335 $181,607 $187,263 $192,932

Add back:

Product liability costs for legal settlement 1,100 — — — — — 1,100 —

Building held for sale impairment charge 429 — — — — — 429 —

Acquisition inventory step-up expense — — — — 8,852 543 1,446 8,852

Acquisition amortization of backlog — — — — — — 581 —

Facility consolidation costs — — — — — 1,176 346 —

Non-GAAP adjusted gross margin $49,922 $48,047 $49,729 $44,821 $59,187 $183,326 $191,165 $201,784

Sales 155,088 149,013 151,925 152,497 183,688 579,643 597,103 637,123

Adjusted gross margin 32.2% 32.2% 32.7% 29.4% 32.2% 31.6% 32.0% 31.7%

($ in thousands)

25 25

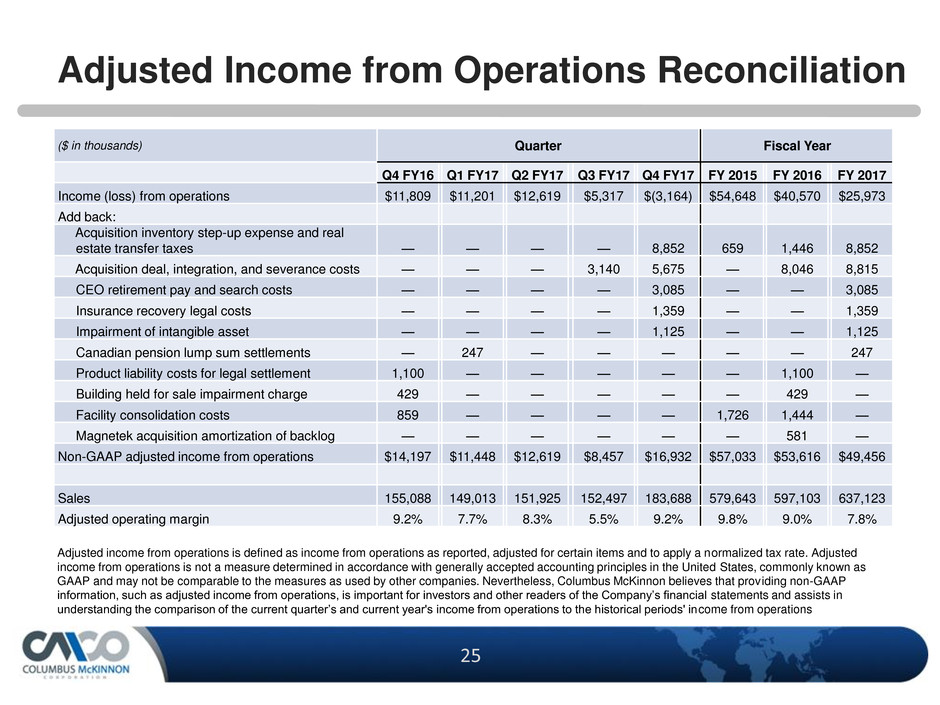

Adjusted Income from Operations Reconciliation

Adjusted income from operations is defined as income from operations as reported, adjusted for certain items and to apply a normalized tax rate. Adjusted

income from operations is not a measure determined in accordance with generally accepted accounting principles in the United States, commonly known as

GAAP and may not be comparable to the measures as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-GAAP

information, such as adjusted income from operations, is important for investors and other readers of the Company’s financial statements and assists in

understanding the comparison of the current quarter’s and current year's income from operations to the historical periods' income from operations

Quarter Fiscal Year

Q4 FY16 Q1 FY17 Q2 FY17 Q3 FY17 Q4 FY17 FY 2015 FY 2016 FY 2017

Income (loss) from operations $11,809 $11,201 $12,619 $5,317 $(3,164) $54,648 $40,570 $25,973

Add back:

Acquisition inventory step-up expense and real

estate transfer taxes — — — — 8,852 659 1,446 8,852

Acquisition deal, integration, and severance costs — — — 3,140 5,675 — 8,046 8,815

CEO retirement pay and search costs — — — — 3,085 — — 3,085

Insurance recovery legal costs — — — — 1,359 — — 1,359

Impairment of intangible asset — — — — 1,125 — — 1,125

Canadian pension lump sum settlements — 247 — — — — — 247

Product liability costs for legal settlement 1,100 — — — — — 1,100 —

Building held for sale impairment charge 429 — — — — — 429 —

Facility consolidation costs 859 — — — — 1,726 1,444 —

Magnetek acquisition amortization of backlog — — — — — — 581 —

Non-GAAP adjusted income from operations $14,197 $11,448 $12,619 $8,457 $16,932 $57,033 $53,616 $49,456

Sales 155,088 149,013 151,925 152,497 183,688 579,643 597,103 637,123

Adjusted operating margin 9.2% 7.7% 8.3% 5.5% 9.2% 9.8% 9.0% 7.8%

($ in thousands)

26 26

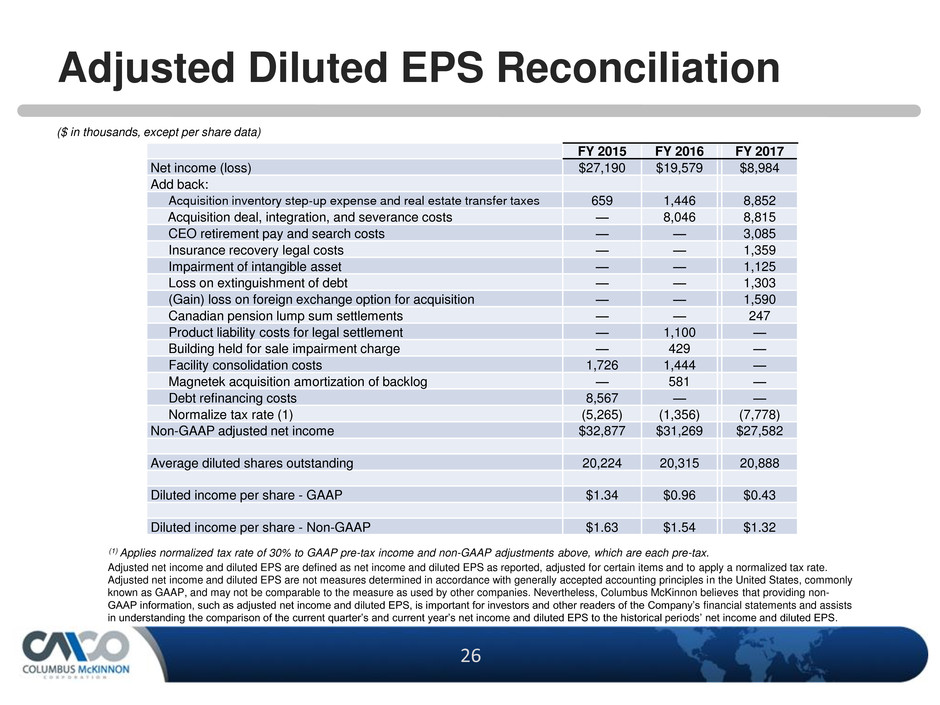

Adjusted Diluted EPS Reconciliation

Adjusted net income and diluted EPS are defined as net income and diluted EPS as reported, adjusted for certain items and to apply a normalized tax rate.

Adjusted net income and diluted EPS are not measures determined in accordance with generally accepted accounting principles in the United States, commonly

known as GAAP, and may not be comparable to the measure as used by other companies. Nevertheless, Columbus McKinnon believes that providing non-

GAAP information, such as adjusted net income and diluted EPS, is important for investors and other readers of the Company’s financial statements and assists

in understanding the comparison of the current quarter’s and current year’s net income and diluted EPS to the historical periods’ net income and diluted EPS.

(1) Applies normalized tax rate of 30% to GAAP pre-tax income and non-GAAP adjustments above, which are each pre-tax.

FY 2015 FY 2016 FY 2017

Net income (loss) $27,190 $19,579 $8,984

Add back:

Acquisition inventory step-up expense and real estate transfer taxes 659 1,446 8,852

Acquisition deal, integration, and severance costs — 8,046 8,815

CEO retirement pay and search costs — — 3,085

Insurance recovery legal costs — — 1,359

Impairment of intangible asset — — 1,125

Loss on extinguishment of debt — — 1,303

(Gain) loss on foreign exchange option for acquisition — — 1,590

Canadian pension lump sum settlements — — 247

Product liability costs for legal settlement — 1,100 —

Building held for sale impairment charge — 429 —

Facility consolidation costs 1,726 1,444 —

Magnetek acquisition amortization of backlog — 581 —

Debt refinancing costs 8,567 — —

Normalize tax rate (1) (5,265) (1,356) (7,778)

Non-GAAP adjusted net income $32,877 $31,269 $27,582

Average diluted shares outstanding 20,224 20,315 20,888

Diluted income per share - GAAP $1.34 $0.96 $0.43

Diluted income per share - Non-GAAP $1.63 $1.54 $1.32

($ in thousands, except per share data)

27 27

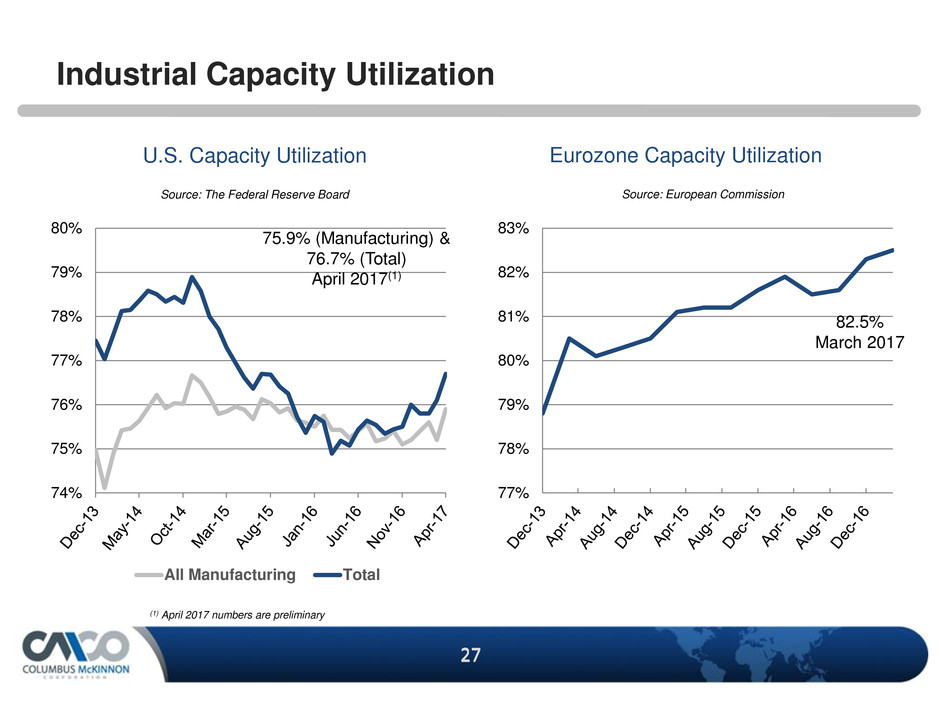

77%

78%

79%

80%

81%

82%

83%

74%

75%

76%

77%

78%

79%

80%

All Manufacturing Total

Source: The Federal Reserve Board

Eurozone Capacity Utilization U.S. Capacity Utilization

Source: European Commission

82.5%

March 2017

75.9% (Manufacturing) &

76.7% (Total)

April 2017(1)

Industrial Capacity Utilization

(1) April 2017 numbers are preliminary

28 28

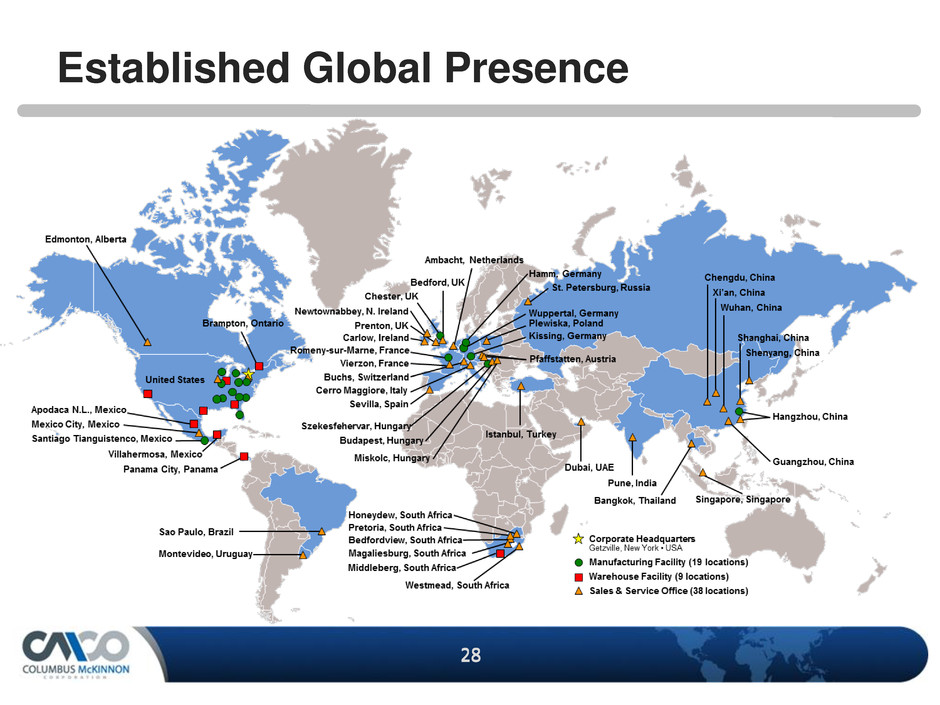

Established Global Presence