Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - NuStar GP Holdings, LLC | a20170531nsh8-kregfdmlpa.htm |

Master Limited Partnership

Investor Conference

2017 MLPA

MAY 31 – June 1, 2017

Exhibit 99.1

Forward-Looking Statements

2

Statements contained in this presentation other than statements of historical fact are forward-looking

statements. While these forward-looking statements, and any assumptions upon which they are based,

are made in good faith and reflect our current judgment regarding the direction of our business, actual

results will likely vary, sometimes materially, from any estimates, predictions, projections, assumptions or

other future performance presented or suggested in this presentation. These forward-looking statements

can generally be identified by the words "anticipates," "believes," "expects," "plans," "intends,"

"estimates," "forecasts," "budgets," "projects," "could," "should," "may" and similar expressions. These

statements reflect our current views with regard to future events and are subject to various risks,

uncertainties and assumptions.

We undertake no duty to update any forward-looking statement to conform the statement to actual

results or changes in the company’s expectations. For more information concerning factors that could

cause actual results to differ from those expressed or forecasted, see NuStar Energy L.P.’s annual report

on Form 10-K and quarterly reports on Form 10-Q, filed with the SEC and available on NuStar’s website at

www.nustarenergy.com.

We use financial measures in this presentation that are not calculated in accordance with generally

accepted accounting principles (“non-GAAP”) and our reconciliations of non-GAAP financial measures to

GAAP financial measures are located in the appendix to this presentation. These non-GAAP financial

measures should not be considered an alternative to GAAP financial measures.

NuStar Overview

Two Publicly Traded Companies

4

IPO Date: 4/16/2001 G.P. Interest in NS

Common Unit Price (5/26/17): ~11% Common L.P. Interest in NS

Annualized Distribution/Common Unit: $4.38 Incentive Distribution Rights in NS (IDR)

Yield (5/26/17): 9.5% ~13% NS Distribution Take

Market Capitalization: $4.9 billion IPO Date: 7/19/2006

Enterprise Value: $7.9 billion Unit Price (5/26/17): $26.15

Credit Ratings Annualized Distribution/Unit: $2.18

Moody's: Ba1/Negative Yield (5/26/17): 8.3%

S&P: BB+/Stable Market Capitalization: $1.1 billion

Fitch: BB/Stable Enterprise Value: $1.2 billion

NYSE: NSH

NYSE: NS

William E. Greehey

9.0 million NSH Units

21.0% Membership Interest

Public Unitholders

93.0 million Common

9.1 million Series A Preferred

15.4 million Series B Preferred

Other

Public Unitholders

33.9 million NSH Units

79.0% Membership Interest

Assets:

81 terminals

More than 96 million barrels of storage capacity

More than 9,200 miles of crude oil and refined product pipelines

Corpus Christi, TX –

Destination for South Texas

Crude Oil Pipeline System

St. James, LA – 9.9MM bbls

Pt. Tupper, Nova Scotia – 7.8MM bbls

Linden, NJ – 4.6MM bbls

St. Eustatius –

14.4MM bbls

3.8MM bbls

Large and Diverse Geographic Footprint with

Assets in Key Locations

5

Navigator Acquisition

(Midland Basin) – Crude Oil

Gathering, Transportation

and Storage

Focus Has Been on De-Risking the

Business and Restoring Coverage

De-Risking the Business and Restoring

Coverage

7

For the last 3 years, we have been focused on...

Strengthening

Our Balance

Sheet

Restoring Our

Distribution

Coverage

De-Risking Our

Business

Refocusing On

Our Core

Pipeline and

Storage Business

With solid execution by our management team and our

employees, we have now set the stage for future growth

Percentage of Annual Segment EBITDA1

Refined Product Pipelines

Crude Oil Pipelines

Ammonia Pipeline

Refined Product Terminals

Crude Oil Storage

Fuels Marketing

Refined Products Marketing, Bunkering and Fuel Oil Trading

* 2011 percentage includes former asphalt operations and intersegment

eliminations

Storage Pipeline

Successfully De-Risked the Partnership - Exited

the Majority of our Margin-Based Businesses

8

2014

2016

2011

45%

51%

4%

1 - Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

49%

34%

*17%

49%

50%

Crude

41%

Refined

Products

49%

Other

10%

Pipeline Segment – Committed

and Diversified

Pipeline Receipts by Commodity

TTM as of 3/31/17

*Other includes ammonia, naphtha and NGL’s

~99% committed

through take or pay

contracts or through

structural exclusivity

(uncommitted lines

serving refinery

customers with no

competition)

Take or Pay

Contractual –

29%

Structurally

Exclusive –

70%

Committed1 Pipeline Revenues

(3/31/17 annual forecast)

1 – Excludes Navigator Acquisition

9

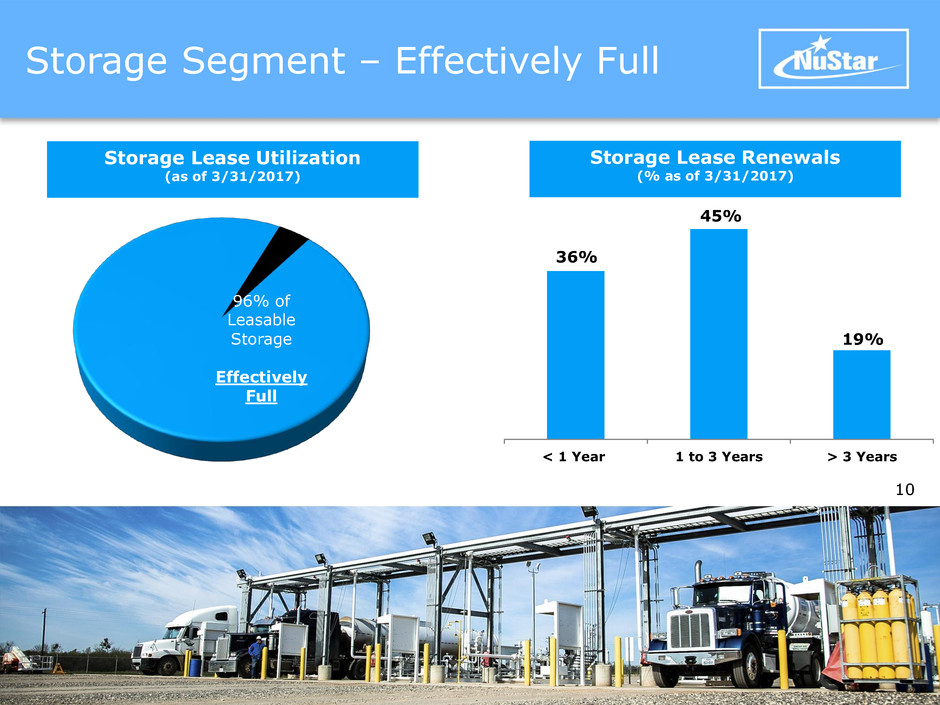

Storage Segment – Effectively Full

96% of

Leasable

Storage

Effectively

Full

Storage Lease Utilization

(as of 3/31/2017)

Storage Lease Renewals

(% as of 3/31/2017)

10

36%

45%

19%

< 1 Year 1 to 3 Years > 3 Years

$208

$242 $256

$279 $287 $277 $287

$335 $333

$186

$190

$199

$198

$211

$277

$323

$355 $338

2008 2009 2010 2011 2012 2013* 2014 2015 2016

Storage Segment Pipeline Segment * adjusted

$610

$394

$432

$455

$477

$498

$554

$690

$671

Historical Pipeline and Storage Segment EBITDA1 ($ in millions)

Base Business EBITDA – Consistent

Performance in Various Market Conditions

Great Recession

Backwardated Market Structure

Oil Price Crash

Shale Boom

1 - Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 11

Coverage Restored in the Midst of Low Crude

Oil Price Environment

20

30

40

50

60

70

80

90

100

110

0.7

0.8

0.9

1

1.1

1.2

1.3

7/1/2014 2/1/2015 9/1/2015 4/1/2016 11/1/2016

C

ru

d

e

P

ri

c

e

C

o

v

e

ra

g

e

R

a

ti

o

NS Coverage Ratio Price of Crude One-Times

1.07x

0.98x

1.04x

1.12x 1.12x 1.11x

1.08x

1.12x

1.08x 1.07x

1.05x

Coverage Ratio1 (Trailing Twelve Months) vs Price of Crude

(October 2013 – March 2017)

3Q-16 3Q-14 4Q-14 1Q-15 2Q-15 3Q-15 4Q-15 1Q-16 2Q-16 4Q-16 1Q-17*

* Adjusted for Common Unit

Issuance for Navigator Financing

1 - Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 12

Acquisition Overview

Navigator Acquisition Overview

Navigator Acquisition Overview

On May 4th, NuStar acquired 100% of the membership interests in Navigator Energy

Services, LLC from First Reserve Energy Infrastructure Fund for $1.475 billion in cash

Navigator owns and operates a leading crude oil gathering, transportation and storage

system in the core of the Midland Basin in the Permian

The Permian Basin currently represents approximately 40% of all U.S. onshore rig activity

For the past 18 months, we have actively looked at opportunities in the Permian

For one reason or another, they have not met our acquisition criteria or they included

assets that were either too risky or outside of our core areas of expertise

Acquisition provides a meaningful entry into the Permian and a significant growth platform

The addition of Navigator, coupled with NuStar’s existing Eagle Ford position, solidifies

NuStar’s presence in two of the most prolific basins in the U.S.

Navigator assets are consistent with NuStar’s existing crude oil operations, with no first

purchasing or gas processing exposure

14

Acquisition Overview (continued)

Significant growth prospects through volume ramp from existing producers, bolt-on

acquisitions and larger takeaway capacity opportunities

Diversified, high-quality producer portfolio with attractive long-term fee-based contracts

Expected acquisition multiple of high single digits as volumes ramp

Driven by existing producers with more than 500,000 dedicated acres on the system

15

Navigator Highlights

Navigator system located in 5 of the 6 most active counties in the Midland Basin

Midland is one of the most economic, resilient and fastest growing basins in the U.S.

Permian, in aggregate, represents ~40% of all U.S. onshore rig activity

Permian has unparalleled resource potential

Decades of drilling inventory with breakeven economics at $35 - $45/bbl

“Core of the

Core” of the

Midland Basin

System structured with long-term, fixed-fee contracts

Mainline transportation with ~92,000 bbl/d of ship-or-pay volume commitments and

nearly 7 year average contract life

Pipeline gathering contract portfolio with an average life of over 10 years

440,000 bbls of storage contracted with an average life of nearly 7 years

Well-diversified customer base, including 16 upstream producers with a meaningful and active

presence in the Midland Basin

Stable Cash

Flow

Rapid volume growth expected in 2017, 2018 and beyond, driven by existing producers with

more than 500,000 dedicated acres on the system

Further potential upside from undedicated producers, AMI acreage and improved drilling

results / technology

Significant

Volume Growth

Potential to expand the system organically

Numerous bolt-on acquisition opportunities

Platform enhances ability to develop larger takeaway capacity projects

Growth

Platform for

NuStar

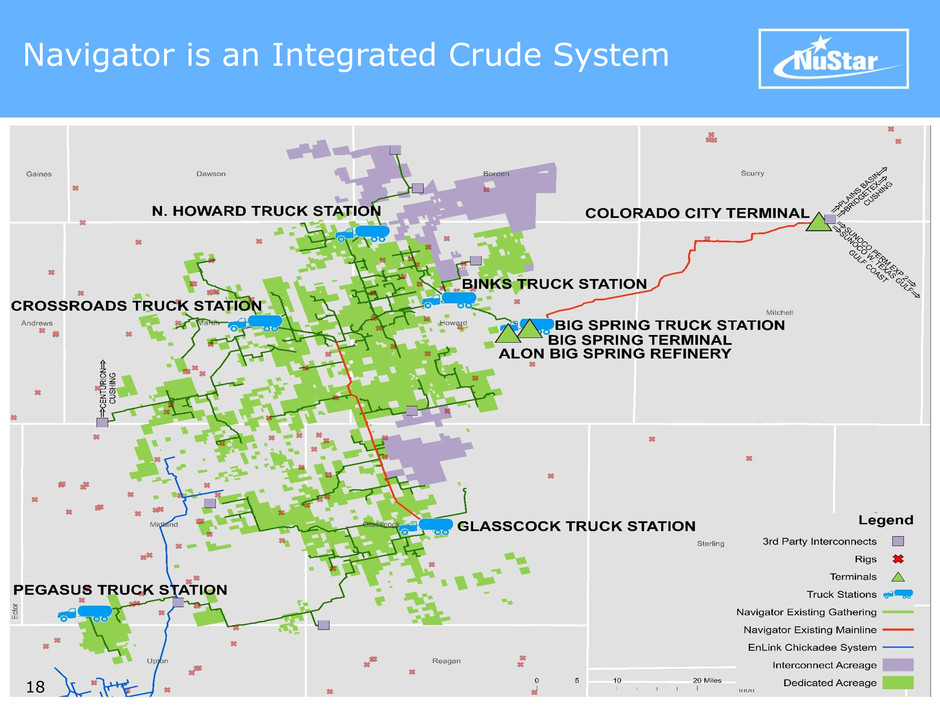

Fully integrated crude system centered around transportation, providing customers with

excellent access to multiple downstream end markets

Connection to nearly all destinations in Big Spring, Midland and Colorado City

Newly-built assets with minimal annual maintenance capex expected

Newly

Constructed/

Well Designed

System

16

1

2

3

4

4

5

10

14

15

15

20

26

37

0 25 50

Dawson

Borden

Ector

Irion

Crockett

Gaines

Andrews

Glasscock

Reagan

Upton

Howard

Martin

Midland

Navigator is in the Most Active Areas of the

Midland

Permian Basin has

362 rigs operating,

representing ~40% of

all U.S. onshore rig

activity

- 2.8x the rig count

in the Bakken /

Eagle Ford

combined

Navigator Overview:

Fully integrated crude

platform

~625 miles of

pipeline with

412,000 bbls/d of

current capacity

1 million bbls of

storage capacity

Pipeline gathering

with over 500,000

dedicated acres

Nearly 5 million

acres of “Areas of

Mutual Interest,” or

“AMI”

Delivery points into

Midland, Colorado City

and Big Spring

Source: Rig count per Baker Hughes data as of 5/26/2017

Rigs by Top U.S. Play

Rigs by Permian

Sub-Basin

Rigs by Midland

Counties

Navigator Counties

17

19

20

15

6

167

0 100 200

Other

Central

Basin

Platform

Midland

Delaware

9

25

27

40

45

45

56

86

362

0 200 400

Granite

Wash

Utica

DJ-Niobrara

Haynesville

Bakken

Marcellus

Cana

Woodford

Eagle Ford

Permian

Navigator is an Integrated Crude System

18

Navigator Acquisition Financing

The Navigator purchase price was funded by a combination of equity and debt offerings,

which is consistent with NuStar's targeted credit profile

NuStar GP Holdings IDR Waiver

To demonstrate its strong support for the transaction, NuStar GP Holdings has agreed to

temporarily forgo all IDR cash distributions to which it would be entitled from any NuStar

Energy L.P. common equity issuances after signing the acquisition agreement:

For a period of ten (10) quarters from the date of the acquisition closing (starting with

the distribution for the 2nd quarter of 2017)

Capped at $22 million in the aggregate

Common Equity Offering

On April 18, NuStar issued 14.4 million new common units for gross proceeds of ~$665

million (including exercise of overallotment option)

Our offering was the largest ever “wall-crossed” MLP equity offering, as well as the

largest MLP equity offering in 2017

19

Perpetual Preferred Offering

On April 28, we issued 15.4 million Series B perpetual preferred units for

gross proceeds of $385 million (including exercise of overallotment option)

Fixed distribution rate of 7.625% for five years

Thereafter, floating distribution rate of three-month LIBOR plus

5.643%, callable at par after five years

Senior Notes Offering

On April 28, we raised $550 million by issuing 5.625% 10-year senior notes

due April 28, 2027

Navigator Acquisition Financing

(continued)

20

Navigator Financial Projections

Expect assets to contribute $40 to $60 million of EBITDA1 in 2017

Partially offset by $10 to $20 million of transaction related costs associated with

closing the acquisition

See slide 30 for further detail on 2017 guidance estimates

2018 EBITDA multiple expected to be in the low teens

EBITDA multiple expected to be in the high single digits by 2020

Growth capital spending projected to be ~$250 million over the next five years

~$100 million of spend to occur in 2017, post close, on expansion of the system

Majority of 2017 spend related to expansion of transportation system and

gathering extensions

21 1 - Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures

Return to Growth

$374 $302 $328 $288

$166

$400

to

$440

$316

$143

$96

$1,475

$0

$500

$1,000

$1,500

$2,000

2012 2013 2014 2015 2016 2017

Forecast

Internal Growth and Other Acquisitions

$262

TexStar

Acquisition

Expect $400 to $440 Million of Internal Growth

Spending in 2017 (Dollars in Millions)

2017 Total Strategic Capital Spending (excluding Navigator Acquisition price),

which includes Reliability Capital, is expected to be in the range of $435 to $495

million

2012 to 2017

Average Internal Growth

Spend $310 Million per Year

Linden JV

Acquisition

Martin

Terminal

Acquisition

Navigator

Acquisition

23

$690

$431

Several projects have been completed or under development to increase distillate and

propane supply throughout the Upper Midwest for an investment of approximately $80 million

Propane supply projects complete and in service

Construction on remaining projects should be completed by the fourth quarter of 2017

Mid-Continent

Pipeline &

Terminals

Effective in the first quarter of 2017, recently recontracted 9.5 million barrels of storage

Approximately $100 million of facility enhancements with expected completion in 2017

St. Eustatius

Terminal

Purchased 1.15 mmbbls of crude and refined products storage for $93mm, net

Assets located adjacent to existing NuStar Corpus Christi North Beach Terminal

Completion of Port of Corpus Christi’s new state-of-the-art dock in 2H 2017 will allow for

increased volumes

Corpus Christi

Terminal

Acquisition

Purchased for $1.475 billion

Growth capital spending projected to be ~$250 million over the next five years

~$100 million of spend to occur in 2017 on expansion of the system

Navigator

Expansion

Base Business Projects and

Growth Opportunities – Included in 2017 Guidance

24

Linden Terminal

Constructing 500MBbls of new storage in the New York Harbor

Expected cost of ~$50 million in 2017

Expect to complete construction in the first quarter of 2018

Expansion of our Permian operations

Expansion of our South Texas Crude Oil Pipeline System

Solution to link the two systems and provide optionality to Corpus Christi, TX

In active discussion with potential shippers

Anticipate launching open season in the near future

Crude Oil

Pipeline

Expansion

South Texas refined product supply opportunities

Gulf coast NGL opportunities

Refined Product

Pipeline

Expansion

Terminal

Expansion

Growth Projects – Currently

Evaluating $1.0 to $1.5 Billion

Opportunities to expand Northeast operations

Additional tankage at our St. James Terminal

Renewal opportunities on the East and West Coast

25

Q&A

Appendix

$810

$350

$450

$300 $250

$550

$365

$403

$0

$250

$500

$750

$1,000

$1,250

2017 2018 2019 2020 2021 2022 2027 2038-2041

Sub Notes

GO Zone Financing

Senior Unsecured Notes

Revolver

$753

No Debt Maturities until 2018

($ in Millions)

Callable in 2018, but

final maturity in 2043

Note: Debt maturities as of 3/31/17, adjusted for Navigator Acquisition 28

Capital Structure after Navigator Acquisition

($ in Millions)

As of March 31, 2017 Actual As Adjusted

(Unaudited)

$1.5 billion Credit Facility $775 $810

NuStar Logistics Notes (4.75%) 250 250

NuStar Logistics Notes (4.80%) 450 450

NuStar Logistics Notes (5.63%) - 550

NuStar Logistics Notes (6.75%) 300 300

NuStar Logistics Notes (7.65%) 350 350

NuStar Logistics Sub Notes (7.63%) 403 403

GO Zone Bonds 365 365

Receivables Financing 61 -

Short-term Debt & Other 70 (8)

Total Debt $3,024 $3,470

Total Partners’ Equity 1,570 2,600

Total Capitalization $4,594 $6,070

Availability under $1.5 billion Credit Facility (as of March 31, 2017): ~$725 million

Debt to EBITDA1 calculation per Credit Facility of 4.3x (as of March 31, 2017)

As adjusted column includes net proceeds of $657.5 from common equity issuance, $543.8 million from senior

note issuance and $372.2 million from Series B perpetual preferred equity issuance used to finance the

Navigator acquisition.

1 – Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 29

2017 Guidance Summary

($ in Millions)

Annual EBITDA1

G&A

Expenses

Reliability Capital

Spending

Strategic Capital

Spending

Previous Guidance $600 - $650 $100 - $110 $35 - $55 $380 - $420

Impact of Navigator Acquisition $40 - $60 $90 - $110

Transaction related costs Associated

with Navigator

($10 - $20) $10 - $20

Impact of Increased Customer

Turnaround Activity

($10 - $20)

Deferred Strategic Project Spending,

Primarily PEMEX LPG Project

($70 - $90)

Current Guidance $620 - $670 $110 - $130 $35 - $55 $400 - $440

1 - Please see slides 31-35 for reconciliations of non-GAAP financial measures to their most directly comparable GAAP measures 30

Reconciliation of Non-GAAP

Financial Information

31

NuStar Energy L.P. utilizes financial measures, such as earnings before interest, taxes, depreciation and amortization (EBITDA), distributable cash flow

(DCF) and distribution coverage ratio, which are not defined in U.S. generally accepted accounting principles (GAAP). Management believes these financial

measures provide useful information to investors and other external users of our financial information because (i) they provide additional information about the

operating performance of the partnership’s assets and the cash the business is generating and (ii) investors and other external users of our financial

statements benefit from having access to the same financial measures being utilized by management and our board of directors when making financial,

operational, compensation and planning decisions.

Our board of directors and management use EBITDA and/or DCF when assessing the following: (i) the performance of our assets, (ii) the viability of potential

projects, (iii) our ability to fund distributions, (iv) our ability to fund capital expenditures and (v) our ability to service debt. In addition, our board of directors

uses a distribution coverage ratio, which is calculated based on DCF, as the metric for determining the company-wide bonus and the vesting of performance

units awarded to management. Our board of directors believes DCF appropriately aligns management’s interest with our unitholders’ interest in increasing

distributions in a prudent manner. DCF is a widely accepted financial indicator used by the master limited partnership (MLP) investment community to

compare partnership performance. DCF is used by the MLP investment community, in part, because the value of a partnership unit is partially based on its

yield, and its yield is based on the cash distributions a partnership can pay its unitholders.

None of these financial measures are presented as an alternative to net income, or for any period presented reflecting discontinued operations, income from

continuing operations. They should not be considered in isolation or as substitutes for a measure of performance prepared in accordance with GAAP. For

purposes of segment reporting, we do not allocate general and administrative expenses to our reported operating segments because those expenses relate

primarily to the overall management at the entity level. Therefore, EBITDA reflected in the segment reconciliations exclude any allocation of general and

administrative expenses consistent with our policy for determining segmental operating income, the most directly comparable GAAP measure.

Reconciliation of Non-GAAP

Financial Information (continued)

32

2008 2009 2010 2011 2012 2013 2014 2015 2016

Operating income 135,086$ 139,869$ 148,571$ 146,403$ 158,590$ 208,293$ 245,233$ 270,349$ 248,238$

Plus depreciation and amortization expense 50,749 50,528 50,617 51,165 52,878 68,871 77,691 84,951 89,554

EBITDA 185,835$ 190,397$ 199,188$ 197,568$ 211,468$ 277,164$ 322,924$ 355,300$ 337,792$

2008 2009 2010 2011 2012 2013 2014 2015 2016

Operating income (loss) 141,079$ 171,245$ 178,947$ 196,508$ 198,842$ (127,484)$ 183,104$ 217,818$ 214,801$

Plus depreciation and amortization expense 66,706 70,888 77,071 82,921 88,217 99,868 103,848 116,768 118,663

EBITDA 207,785$ 242,133$ 256,018$ 279,429$ 287,059$ (27,616)$ 286,952$ 334,586$ 333,464$

Impact from non-cash goodwill impairment charges 304,453

Adjusted EBITDA 276,837$

2011 2014 2016

Operating income 71,854$ 24,805$ 3,406$

Plus depreciation and amortization expense 20,949 16 -

EBITDA 92,803$ 24,821$ 3,406$

The following is a reconciliation of operating income to EBITDA for the fuels marketing segment (in thousands of dollars):

Year Ended December 31,

The following is a reconciliation of operating income (loss) to EBITDA for the storage segment (in thousands of dollars):

Year Ended December 31,

The following is a reconciliation of operating income to EBITDA for the pipeline segment (in thousands of dollars):

Year Ended December 31,

Reconciliation of Non-GAAP

Financial Information (continued)

33

Consolidated Consolidated Consolidated

Income from continuing operations 218,674$ 214,169$ 150,003$

Interest expense, net 81,539 131,226 138,350

Income tax expense 18,555 10,801 11,973

Depreciation and amortization expense 161,773 191,708 216,736

EBITDA from continuing operations 480,541 547,904 517,062

General and administrative expenses 103,050 96,056 98,817

Other expense (income), net 3,573 (4,499) 58,783

Equity in earnings of joint ventures (11,458) (4,796) -

Segment EBITDA 575,706$ 634,665$ 674,662$

Segment

EBITDA

Segment

Percentage (a)

Segment

EBITDA

Segment

Percentage (a)

Segment

EBITDA

Segment

Percentage (a)

Pipeline segment (see previous slide for EBITDA reconciliation) 197,568$ 34% 322,924$ 51% 337,792$ 50%

Storage segment (see previous slide for EBITDA reconciliation) 279,429 49% 286,952 45% 333,464 49%

Fuels marketing segment (see previous slide for EBITDA reconciliation) 92,803 16% 24,821 4% 3,406 1%

Elimination/consolidation 5,906 1% (32) - - -

Segment EBITDA 575,706$ 100% 634,665$ 100% 674,662$ 100%

(a) Segment Percentage calculated as segment EBITDA for each segment divided by total segment EBITDA.

The following are the non-GAAP reconciliations of income from continuing operations to EBITDA from continuing operations and for the calculation of EBITDA for each of our segments as a percentage of total

segment EBITDA (in thousands of dollars, except percentage data):

Year Ended December 31, 2011 Year Ended December 31, 2016Year Ended December 31, 2014

Reconciliation of Non-GAAP

Financial Information (continued)

34

Sept. 30, 2014 Dec. 31, 2014 Mar. 31, 2015 Jun. 30, 2015 Sept. 30, 2015 Dec. 31, 2015 Mar. 31, 2016 Jun. 30, 2016 Sept. 30, 2016 Dec. 31, 2016 Mar. 31, 2017

Income from continuing operations (116,202)$ 214,169$ 298,298$ 295,436$ 301,335$ 305,946$ 236,222$ 234,414$ 220,539$ 150,003$ 150,542$

Interest expense, net 132,208 131,226 129,901 129,603 130,044 131,868 133,954 135,359 136,933 138,350 140,641

Income tax expense 14,983 10,801 9,071 10,310 10,281 14,712 15,195 16,361 14,208 11,973 12,028

Depreciation and amortization expense 188,570 191,708 197,935 202,764 206,466 210,210 210,895 211,781 213,426 216,736 220,458

EBITDA from continuing operations 219,559$ 547,904$ 635,205$ 638,113$ 648,126$ 662,736$ 596,266$ 597,915$ 585,106$ 517,062$ 523,669$

Equity in losses (earnings) of joint ventures 11,604 (4,796) (9,102) (5,808) (3,059) - - - - - -

Interest expense, net (132,208) (131,226) (129,901) (129,603) (130,044) (131,868) (133,954) (135,359) (136,933) (138,350) (140,641)

Reliability capital expenditures (29,862) (28,635) (30,674) (29,464) (32,439) (40,002) (39,221) (44,497) (43,770) (38,155) (37,160)

Income tax expense (14,983) (10,801) (9,071) (10,310) (10,281) (14,712) (15,195) (16,361) (14,208) (11,973) (12,028)

Distributions from joint venture 8,048 7,587 7,721 6,993 4,208 2,500 - - - - -

Mark-to-market impact of hedge transactions (a) (90) 6,125 4,991 (261) (132) (5,651) 152 4,474 5,372 10,317 3,047

Unit-based compensation (b) - - - - - - 1,086 2,208 3,499 5,619 6,621

Other items (c) 323,764 19,732 (34,471) (36,351) (41,628) (44,032) 10,110 11,518 19,185 73,846 74,075

Preferred unit distributions - - - - - - - - - (1,925) (6,738)

DCF from continuing operations 385,832$ 405,890$ 434,698$ 433,309$ 434,751$ 428,971$ 419,244$ 419,898$ 418,251$ 416,441$ 410,845$

Less DCF from continuing operations available

to general partner 51,064 51,064 51,064 51,064 51,064 51,064 51,064 51,064 51,164 51,284 51,417 (d)

DCF from continuing operations available

to limited partners 334,768$ 354,826$ 383,634$ 382,245$ 383,687$ 377,907$ 368,180$ 368,834$ 367,087$ 365,157$ 359,428$

Distributions applicable to limited partners 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,140$ 341,798$ 342,598$ 343,485$ (d)

Distribution coverage ratio (e) 0.98x 1.04x 1.12x 1.12x 1.12x 1.11x 1.08x 1.08x 1.07x 1.07x 1.05x (d)

(a)

(b)

(c)

(d) For the three months ended March 31, 2017, amounts adjusted to exclude distributions that were paid on the 14,375,000 common units that were issued April 18, 2017.

(e) Distribution coverage ratio is calculated by dividing DCF from continuing operations available to limited partners by distributions applicable to limited partners.

The following is a reconciliation of income from continuing operations to EBITDA from continuing operations and DCF from continuing operations (in thousands of dollars, except ratio data):

For the Twelve Months Ended

DCF from continuing operations excludes the impact of unrealized mark-to-market gains and losses that arise from valuing certain derivative contracts, as well as the associated hedged inventory. The gain or loss associated with these

contracts is realized in DCF from continuing operations when the contracts are settled.

In connection with the employee transfer from NuStar GP, LLC on March 1, 2016, we assumed obligations related to awards issued under a long-term incentive plan, and we intend to satisfy the vestings of equity-based awards with the

issuance of our units. As such, the expenses related to these awards are considered non-cash and added back to DCF. Certain awards include distribution equivalent rights (DERs). Payments made in connection with DERs are

deducted from DCF.

Other items mainly consist of (i) adjustments for throughput deficiency payments and construction reimbursements for all periods presented, (ii) a $58.7 million non-cash impairment charge on the Axeon term loan in the fourth quarter of

2016, (iii) a $56.3 million non-cash gain associated with the Linden terminal acquisition in the first quarter of 2015 and (iv) a non-cash goodwill impairment charge totaling $304.5 million in the fourth quarter of 2013.

Reconciliation of Non-GAAP

Financial Information (continued)

35

The following are reconciliations of projected net income to projected EBITDA (in thousands of dollars):

Current Guidance Previous Guidance

Projected net income $ 175,000 - 190,000 $ 210,000 - 240,000

Projected interest expense, net 175,000 - 185,000 150,000 - 155,000

Projected income tax expense 10,000 - 15,000 10,000 - 15,000

Projected depreciation and amortization expense 260,000 - 280,000 230,000 - 240,000

Projected EBITDA $ 620,000 - 670,000 $ 600,000 - 650,000

The following is a reconciliation of projected operating income to projected EBITDA for Navigator (in thousands of dollars):

Year Ended

December 31, 2017

Projected operating income $ 10,000 - 20,000

Projected depreciation and amortization expense 30,000 - 40,000

Projected EBITDA $ 40,000 - 60,000

For the Four Quarters Ended

March 31, 2017

Net income 150,542$

Interest expense, net 140,641

Income tax expense 12,028

Depreciation and amortization expense 220,458

EBITDA 523,669

Other expense (a) 58,472

Mark-to-market impact on hedge transactions (b) 3,047

Pro forma effect of acquisitions (c) 7,758

Material project adjustments (d) 10,515

Consolidated EBITDA, as defined in the Revolving Credit Agreement 603,461$

Total consolidated debt 3,025,584$

NuStar Logistics' 7.625% fixed-to-floating rate subordinated notes (402,500)

Proceeds held in escrow associated with the Gulf Opportunity Zone Revenue Bonds (41,476)

Consolidated Debt, as defined in the Revolving Credit Agreement 2,581,608$

Consolidated Debt Coverage Ratio (Consolidated Debt to Consolidated EBITDA) 4.3x

(a)

(b)

(c)

(d)

Year Ended December 31, 2017

This adjustment represents the percentage of the projected Consolidated EBITDA attributable to any Material Project, as defined in the

Revolving Credit Agreement, based on the current completion percentage.

This adjustment represents the unrealized mark-to-market gains and losses that arise from valuing certain derivative contracts, as well as the

associated hedged inventory. The gain or loss associated with these contracts is realized in net income when the contracts are settled.

The following is the non-GAAP reconciliation for the calculation of our Consolidated Debt Coverage Ratio, as defined in our $1.5 billion five-year

revolving credit agreement (the Revolving Credit Agreement) (in thousands of dollars, except ratio data):

This adjustment consists mainly of a $58.7 million non-cash impairment charge on the Axeon term loan in the fourth quarter of 2016.

This adjustment represents the pro forma effect of the Martin Terminal Acquisition as if we had completed the acquisition on January 1, 2016.