Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - NuStar GP Holdings, LLC | Financial_Report.xls |

| EX-99.02 - EXHIBIT 99.02 - NuStar GP Holdings, LLC | nsh2014ex9902.htm |

| EX-23.02 - EXHIBIT 23.02 - NuStar GP Holdings, LLC | nsh2014ex2302.htm |

| EX-21.01 - EXHIBIT 21.01 - NuStar GP Holdings, LLC | nsh2014ex2101.htm |

| EX-99.01 - EXHIBIT 99.01 - NuStar GP Holdings, LLC | nsh2014ex9901.htm |

| EX-31.01 - EXHIBIT 31.01 - NuStar GP Holdings, LLC | nsh2014ex3101.htm |

| EX-31.02 - EXHIBIT 31.02 - NuStar GP Holdings, LLC | nsh2014ex3102.htm |

| EX-23.01 - EXHIBIT 23.01 - NuStar GP Holdings, LLC | nsh2014ex2301.htm |

| EX-32.02 - EXHIBIT 32.02 - NuStar GP Holdings, LLC | nsh2014ex3202.htm |

| EX-32.01 - EXHIBIT 32.01 - NuStar GP Holdings, LLC | nsh2014ex3201.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

[X] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2014

OR

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission File Number 1-32940

NUSTAR GP HOLDINGS, LLC

(Exact name of registrant as specified in its charter)

Delaware | 85-0470977 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

19003 IH-10 West | 78257 | |

San Antonio, Texas | (Zip Code) | |

(Address of principal executive offices) | ||

Registrant’s telephone number, including area code (210) 918-2000

Securities registered pursuant to Section 12(b) of the Act: Units representing limited liability company membership interests listed on the New York Stock Exchange.

Securities registered pursuant to 12(g) of the Act: None.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [X] No [ ]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [X]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [X]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule12b-2 of the Exchange Act (Check one):

Large accelerated filer [X] | Accelerated filer [ ] |

Non-accelerated filer [ ] (Do not check if a smaller reporting company) | Smaller reporting company [ ] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

The aggregate market value of units held by non-affiliates was approximately $1,347 million based on the last sales price quoted as of June 30, 2014, the last business day of the registrant’s most recently completed second quarter.

The number of units outstanding as of January 31, 2015 was 42,913,277.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the proxy statement for the registrant’s 2015 annual meeting of unitholders, expected to be filed within 120 days after the end of the fiscal year covered by this Form 10-K, are incorporated by reference into PART III herein.

TABLE OF CONTENTS

Items 1., 1A. and 2. | ||

Item 1B. | ||

Item 3. | ||

Item 4. | ||

Item X. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

PART I

Unless otherwise indicated, the terms “NuStar GP Holdings,” “we,” “our” and “us” are used in this report to refer to NuStar GP Holdings, LLC, to one or more of our consolidated subsidiaries or to all of them taken as a whole. In this Form 10-K, we make certain forward-looking statements, including statements regarding our plans, strategies, objectives, expectations, intentions and resources. These forward-looking statements can generally be identified by the words “anticipates,” “believes,” “expects,” “plans,” “intends,” “estimates,” “forecasts,” “budgets,” “projects,” “will,” “could,” “should,” “may” and similar expressions. We do not undertake to update, revise or correct any of the forward-looking information. You are cautioned that such forward-looking statements should be read in conjunction with our disclosures beginning on page 26 of this report under the heading: “CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION.”

ITEMS 1., 1A. and 2. BUSINESS, RISK FACTORS AND PROPERTIES

OVERVIEW

NuStar GP Holdings, LLC (NuStar GP Holdings), a Delaware limited liability company, was formed in June 2000. Our units are traded on the New York Stock Exchange (NYSE) under the symbol “NSH.” Our principal executive offices are located at 19003 IH-10 West, San Antonio, Texas 78257 and our telephone number is (210) 918-2000.

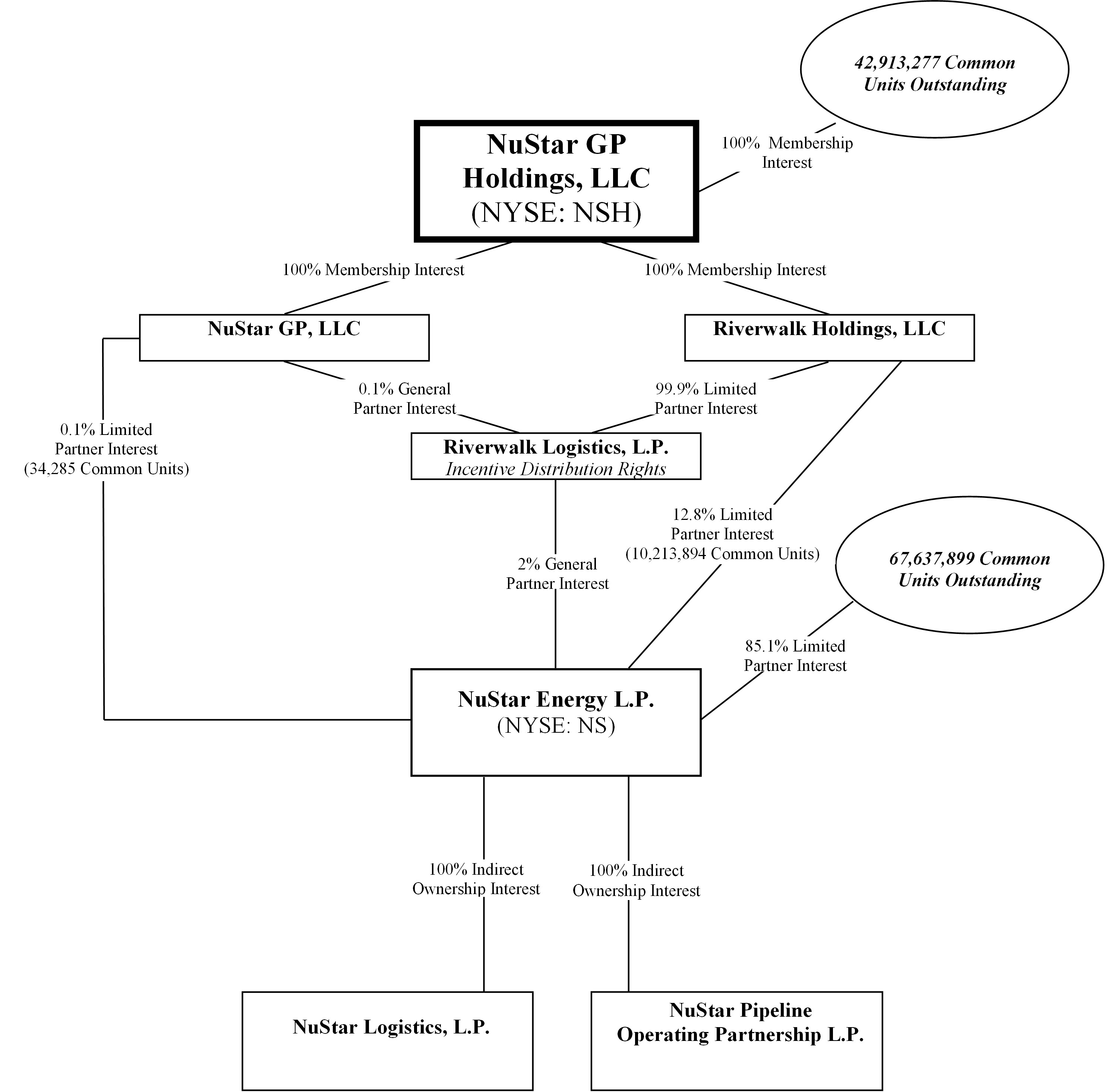

Our only cash generating assets are our ownership interests in NuStar Energy L.P. (NuStar Energy), a publicly traded Delaware limited partnership (NYSE: NS). NuStar Energy is engaged in the transportation of petroleum products and anhydrous ammonia, the terminalling and storage of petroleum products and the marketing of petroleum products. NuStar Energy has terminal and storage facilities in the United States, Canada, Mexico, the Netherlands, including St. Eustatius in the Caribbean, and the United Kingdom. As of December 31, 2014, our aggregate ownership interests in NuStar Energy consisted of the following:

• | the 2% general partner interest; |

• | 100% of the incentive distribution rights issued by NuStar Energy, which entitle us to receive increasing percentages of the cash distributed by NuStar Energy, currently at the maximum percentage of 23%; and |

• | 10,248,179 common units of NuStar Energy representing a 12.9% limited partner interest. |

Our primary objective is to increase per unit distributions to our unitholders by actively supporting NuStar Energy in executing its business strategy, which includes continued growth through expansion projects and strategic acquisitions. We may facilitate NuStar Energy’s growth through the use of our capital resources, which could involve capital contributions, loans or other forms of financial support.

NuStar Energy’s partnership agreement requires that it distribute all “Available Cash” to its partners each quarter, defined in its partnership agreement as cash on hand at the end of the quarter, plus certain permitted borrowings made subsequent to the end of the quarter, less cash reserves determined by NuStar Energy’s board of directors. Similarly, we are required by our limited liability company agreement to distribute all of our available cash at the end of each quarter, less reserves established by our board of directors. However, unlike NuStar Energy, we do not have a general partner or incentive distribution rights. Therefore, all of our distributions are made on our units, which are our only class of securities outstanding.

Our internet website address is http://www.nustargpholdings.com. Information contained on our website is not part of this report. Our annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K filed with (or furnished to) the Securities and Exchange Commission (SEC) are available on our internet website, free of charge, as soon as reasonably practicable after we file or furnish such material (select the “Investors” link, then the “SEC Filings” link). We also post our corporate governance guidelines, code of business conduct and ethics, code of ethics for senior financial officers and the charters of our board’s committees on our internet website free of charge (select “Investors” link, then the “Corporate Governance” link). Our governance documents are available in print to any unitholder that makes a written request to Corporate Secretary, NuStar GP Holdings, LLC, 19003 IH-10 West, San Antonio, Texas 78257 or corporatesecretary@nustarenergy.com.

3

RECENT DEVELOPMENTS

On January 2, 2015, NuStar Energy acquired full ownership of a refined products terminal in Linden, NJ, for $142.5 million. Prior to the acquisition, the terminal operated as a joint venture between NuStar Energy and Linden Holding Corp, with each party owning 50 percent.

On September 25, 2014, NuStar Energy sold its 75% interest in its facility in Mersin, Turkey for proceeds of $13.4 million.

On February 26, 2014, NuStar Energy sold its then-remaining 50% ownership interest in NuStar Asphalt LLC, which constituted all equity interests in that entity that it retained after the first sale in 2012. Effective February 27, 2014, NuStar Asphalt LLC changed its name to Axeon Specialty Products LLC (Axeon). The purchaser, Lindsay Goldberg LLC (Lindsay Goldberg), a private investment firm, now owns 100% of Axeon.

ORGANIZATIONAL STRUCTURE

The following chart depicts our organizational structure and relationship with NuStar Energy as of December 31, 2014:

4

EMPLOYEES

Our wholly owned subsidiary, NuStar GP, LLC, provides administrative services to us. Employees of NuStar GP, LLC also provide services to NuStar Energy pursuant to the GP Services Agreement (defined in Note 5 of the Notes to Consolidated Financial Statements in Item 8. “Financial Statements and Supplementary Data”). As of December 31, 2014, NuStar GP, LLC had 1,227 employees. We believe that NuStar GP, LLC has a satisfactory relationship with its employees.

ENVIRONMENTAL AND SAFETY REGULATION

Our only cash generating assets are our indirect ownership interests in NuStar Energy. We have no independent operations.

PROPERTIES

Our only cash generating assets are our indirect ownership interests in NuStar Energy. We have no independent operations.

RISK FACTORS

RISKS INHERENT IN AN INVESTMENT IN US

Our only cash generating assets are our ownership interests in NuStar Energy. Our cash flows and ability to make distributions at current levels are, therefore, completely dependent upon the ability of NuStar Energy to make cash distributions at current levels to its partners, including us. If NuStar Energy does not make cash distributions at its current levels or reduces the level of cash distributions to its partners, we may not have sufficient cash to pay distributions at our current levels.

Our operating cash flows currently are completely dependent upon NuStar Energy making cash distributions at current levels to its partners, including us. The amount of cash that NuStar Energy can distribute to its partners each quarter principally depends upon the amount of cash it generates from its operations, which will fluctuate from quarter to quarter based on, among other things:

• | the amount of throughput volumes transported in its pipelines; |

• | lease renewals or throughput volumes in its terminals and storage facilities; |

• | tariff rates and fees it charges and the returns it realizes for its services; |

• | the results of its marketing, trading and hedging activities, which fluctuate depending upon the relationship between refined product prices and prices of crude oil and other feedstocks; |

• | demand for and supply of crude oil, refined products and anhydrous ammonia; |

• | the effect of worldwide energy conservation measures; |

• | its operating costs; |

• | weather conditions; |

• | domestic and foreign governmental regulations and taxes; and |

• | prevailing economic conditions. |

In addition, the amount of cash that NuStar Energy will have available for distribution will depend on other factors, including:

• | its debt service requirements and restrictions on distributions contained in its current or future debt agreements; |

• | the sources of cash used to fund its acquisitions; |

• | its capital expenditures; |

• | fluctuations in its working capital needs; |

• | its issuances of debt and equity securities; and |

• | adjustments in cash reserves made by NuStar Energy’s general partner, in its discretion. |

Because of these factors, NuStar Energy may not have sufficient available cash each quarter to continue paying distributions at its current level or at all. Furthermore, cash distributions to NuStar Energy unitholders depend primarily upon cash flows, and not solely on profitability, which is affected by non-cash items. Therefore, NuStar Energy may make cash distributions during periods when it records net losses and may not make cash distributions during periods when it records net income.

5

In the future, we may not have sufficient cash to pay distributions at our current quarterly distribution level or to increase distributions.

Because our only source of operating cash flows consists of cash distributions from NuStar Energy, the amount of distributions we are able to make to our unitholders may fluctuate based on the level of distributions NuStar Energy makes to its unitholders, including us. We cannot assure you that NuStar Energy will continue to make quarterly distributions at its current level of $1.095 per unit, or any other amount, or increase its quarterly distributions in the future. In addition, while we would expect to increase or decrease distributions to our unitholders if NuStar Energy increases or decreases distributions to us, the timing and amount of such changes in distributions, if any, will not necessarily be comparable to the timing and amount of any changes in distributions made by NuStar Energy to us. Our ability to distribute cash received from NuStar Energy to our unitholders is limited by a number of factors, including:

• | interest expense and principal payments on any indebtedness we may incur; |

• | restrictions on distributions contained in any future debt agreements; |

• | our general and administrative expenses, including expenses we incur as a public company; |

• | expenses of our subsidiaries, including tax liabilities of our corporate subsidiaries; |

• | reserves necessary for us to make the necessary capital contributions to maintain our 2% general partner interest in NuStar Energy, as required by the partnership agreement of NuStar Energy upon the issuance of additional partnership securities by NuStar Energy; and |

• | reserves our board of directors believes prudent for us to maintain for the proper conduct of our business or to provide for future distributions. |

We cannot guarantee that in the future we will be able to pay distributions or that any distributions NuStar Energy pays to us will allow us to pay distributions at or above our current quarterly distribution of $0.545 per unit. The actual amount of cash that is available for distribution to our unitholders will depend on numerous factors, many of which are beyond our control or the control of NuStar Energy. Therefore, a reduction in the amount of cash distributed by NuStar Energy per unit or on the incentive distribution rights, or an increase in our expenses, may result in our not being able to pay our current quarterly distribution of $0.545 per unit.

NuStar Energy’s unitholders, excluding the owner of NuStar Energy’s general partner, have the right to remove NuStar Energy’s general partner by a simple majority vote, which would cause us to divest our general partner interest and incentive distribution rights in NuStar Energy in exchange for cash or common units of NuStar Energy and cause us to lose our ability to manage NuStar Energy.

We currently manage NuStar Energy through Riverwalk Logistics, L.P., NuStar Energy’s general partner and our indirect, wholly owned subsidiary. NuStar Energy’s partnership agreement, however, gives unitholders of NuStar Energy the right to remove the general partner of NuStar Energy upon the affirmative vote of holders of a majority of outstanding NuStar Energy common units, excluding the common units owned by us. As of December 31, 2014, we own a 12.9% limited partner interest in NuStar Energy, and the public unitholders own 85.1%. If Riverwalk Logistics, L.P. were removed as the general partner of NuStar Energy, it would receive cash or common units in exchange for its 2% general partner interest and its incentive distribution rights and would lose its ability to manage NuStar Energy. While the common units or cash that Riverwalk Logistics, L.P. would receive are intended under the terms of NuStar Energy’s partnership agreement to fully compensate it in the event it is removed as general partner, these common units or the investments made with the cash over time may not provide us with as much distributable cash, or be as valuable, as the 2% general partner interest and incentive distribution rights had we retained them.

NuStar Energy’s general partner, with our consent, may limit or modify the incentive distributions we are entitled to receive in order to facilitate the growth strategy of NuStar Energy. Our board of directors can give this consent without a vote of our unitholders.

We indirectly own NuStar Energy’s general partner, which owns the incentive distribution rights in NuStar Energy that entitle us to receive increasing percentages, up to a maximum of 23%, of any cash distributed by NuStar Energy as it exceeds a distribution of $0.60 per NuStar Energy common unit in any quarter. A substantial portion of the cash flows we receive from NuStar Energy are provided by these incentive distributions. Our limited liability company agreement provides that our board of directors may consent to the elimination, reduction or modification of the incentive distribution rights without our unitholders’ approval if our board determines that the elimination, reduction or modification will not adversely affect our unitholders in any material respect.

6

Restrictions in our credit facility limit our ability to make distributions to our unitholders; credit facility matures in June 2015.

Our credit facility contains covenants limiting our ability to incur indebtedness, grant liens, engage in transactions with affiliates and make distributions to our unitholders. The credit facility also contains covenants requiring NuStar Energy to maintain certain financial ratios. Our and NuStar Energy’s ability to comply with any restrictions and covenants may be affected by events beyond our control, including prevailing economic, financial and industry conditions. If we or NuStar Energy are unable to comply with these restrictions and covenants, a significant portion of any indebtedness under our credit facility may become immediately due and payable, and our lenders’ commitment to make loans to us under our credit facility may terminate. We might not have, or be able to obtain, sufficient funds to make these accelerated payments.

Our payment of principal and interest on any future indebtedness will reduce our cash available for distribution on our units. Our credit facility limits our ability to pay distributions to our unitholders during an event of default or if an event of default would result from the distribution.

In addition, this and any future levels of indebtedness may:

• | adversely affect our ability to obtain additional financing for future operations or capital needs; |

• | limit our ability to pursue acquisitions and other business opportunities; or |

• | make our results of operations more susceptible to adverse economic or operating conditions. |

Our revolving credit facility matures in June 2015. It is possible that our lenders may not agree to renew our credit facility or may only agree to renew it at substantially less favorable terms. If our credit facility is renewed on substantially less favorable terms, or if our credit facility is not renewed and we must enter into alternative financing arrangements, various limitations in these financing agreements may reduce our ability to incur additional indebtedness, to engage in some transactions or to capitalize on business opportunities. In the event we are unable to obtain adequate financing and NuStar Energy issues additional units, we may not be able to make contributions to NuStar Energy necessary to maintain our 2% general partner interest.

Our ability to sell our ownership interests in NuStar Energy may be limited by securities laws restrictions and liquidity constraints.

All of the units of NuStar Energy that we own are unregistered, restricted securities, within the meaning of Rule 144 under the Securities Act of 1933. Unless we exercise our registration rights with respect to these units, we are limited to selling into the market in any three-month period an amount of NuStar Energy common units that does not exceed the greater of 1% of the total number of common units outstanding or the average weekly reported trading volume of the common units for the four calendar weeks prior to the sale. We face contractual limitations on our ability to sell our 2% general partner interest and incentive distribution rights, and the market for such interests is illiquid.

The market price of our units could be adversely affected by sales of substantial amounts of our units into public markets, including sales by our existing unitholders.

Sales by us or any of our existing unitholders, including William E. Greehey, Chairman of the Boards of Directors of NuStar GP Holdings and NuStar GP, LLC, of a substantial number of our units in the public markets, or the perception that such sales might occur, could have a material adverse effect on the price of our units or could impair our ability to obtain capital through an offering of equity securities. Mr. Greehey currently owns 19.1% of our outstanding units.

Distributions on our incentive distribution rights in NuStar Energy are more uncertain than distributions on the common units we hold.

Our indirect ownership of the incentive distribution rights in NuStar Energy entitles us to receive our pro rata share of specified percentages of total cash distributions made by NuStar Energy with respect to any particular quarter only in the event that NuStar Energy distributes more than $0.60 per unit for such quarter. As a result, the holders of NuStar Energy’s common units have a priority over the holders of NuStar Energy’s incentive distribution rights to the extent of cash distributions by NuStar Energy up to and including $0.60 per unit for any quarter.

Our incentive distribution rights entitle us to receive increasing percentages, up to 23%, of all cash distributed by NuStar Energy. Because the incentive distribution rights currently participate at the maximum 23% target cash distribution level in all distributions made by NuStar Energy at or above the current distribution level, future growth in distributions we receive from NuStar Energy will not result from an increase in the target cash distribution level associated with the incentive distribution rights.

Furthermore, a decrease in the amount of distributions by NuStar Energy to less than $0.66 per unit per quarter would reduce our percentage of the incremental cash distributions above $0.60 per unit per quarter from 23% to 8%. As a result, any such

7

reduction in quarterly cash distributions from NuStar Energy would have the effect of disproportionately reducing the amount of all distributions that we receive from NuStar Energy based on our ownership interest in the incentive distribution rights in NuStar Energy as compared to cash distributions we receive from NuStar Energy on our 2% general partner interest in NuStar Energy and our NuStar Energy common units.

If NuStar Energy’s general partner is not fully reimbursed or indemnified for obligations and liabilities it incurs in managing the business and affairs of NuStar Energy, it may not be able to satisfy its obligations and its cash flows will be reduced.

The general partner of NuStar Energy and its affiliates may make expenditures on behalf of NuStar Energy for which they will seek reimbursement from NuStar Energy. In addition, under Delaware law, the general partner, in its capacity as the general partner of NuStar Energy, has unlimited liability for the obligations of NuStar Energy, such as its debts and environmental liabilities, except for those contractual obligations of NuStar Energy that are expressly made without recourse to the general partner. To the extent Riverwalk Logistics, L.P. incurs obligations on behalf of NuStar Energy, it is entitled to be reimbursed or indemnified by NuStar Energy. If NuStar Energy does not reimburse or indemnify its general partner, Riverwalk Logistics, L.P. may be unable to satisfy these liabilities or obligations, which would reduce its cash flows. In turn, Riverwalk Logistics, L.P. would have less cash to distribute to us.

If distributions on our units are not paid with respect to any fiscal quarter, our unitholders will not be entitled to receive such payments in the future.

Our distributions to our unitholders are not cumulative. Consequently, if distributions on our units are not paid with respect to any fiscal quarter at the current distribution rate, our unitholders will not be entitled to receive such payments in the future.

Our cash distribution policy limits our growth because we do not retain earnings to reinvest in any acquisitions or growth capital expenditures, and NuStar Energy’s distribution policy may limit NuStar Energy’s growth.

Because we distribute all of our available cash, our growth may not be as fast as businesses that reinvest their available cash to expand ongoing operations. In fact, our growth is currently completely dependent upon NuStar Energy’s ability to increase its quarterly distributions because our only cash-generating assets are indirect ownership interests in NuStar Energy. If we issue additional units or incur debt to fund acquisitions and growth capital expenditures, the payment of distributions on those additional units or interest on that debt could increase the risk that we will be unable to maintain or increase our current per unit distribution level.

Consistent with the terms of its partnership agreement, NuStar Energy distributes to its partners its available cash each quarter. In determining the amount of cash available for distribution, NuStar Energy sets aside cash reserves, which it uses to fund its growth capital expenditures. Additionally, it has relied upon external financing sources, including commercial borrowings and other debt and equity issuances, to fund its acquisition capital expenditures. Accordingly, to the extent NuStar Energy does not have sufficient cash reserves or is unable to finance growth externally, its cash distribution policy will significantly impair its ability to grow. In addition, to the extent NuStar Energy issues additional units in connection with any acquisitions or growth capital expenditures, the payment of distributions on those additional units may increase the risk that NuStar Energy will be unable to maintain or increase its per unit distribution level, which in turn may impact the available cash that we have to distribute to our unitholders. The incurrence of additional debt to finance its growth strategy would result in increased interest expense to NuStar Energy, which in turn may impact the available cash that we have to distribute to our unitholders.

If in the future we cease to manage NuStar Energy, we may be deemed to be an investment company under the Investment Company Act of 1940, which would cause us either to have to register as an investment company, obtain exemptive relief from the SEC, or modify our organizational structure or our contract rights.

If we cease to manage NuStar Energy as a consequence of Riverwalk Logistics, L.P.’s removal or withdrawal as NuStar Energy’s general partner or otherwise, and are deemed to be an investment company under the Investment Company Act of 1940 because of our ownership of NuStar Energy partnership interests, we would either have to register as an investment company under the Investment Company Act, obtain exemptive relief from the SEC, or modify our organizational structure or our contract rights to fall outside the definition of an investment company. Registering as an investment company could, among other things, materially limit our ability to engage in transactions with affiliates, including the sale and purchase of certain securities or other property to or from our affiliates, restrict our ability to borrow funds or engage in other transactions involving leverage.

An increase in interest rates may cause the market price of our units to decline.

As interest rates rise, the ability of investors to obtain higher risk-adjusted rates of return by purchasing government-backed debt securities may cause a corresponding decline in demand for riskier investments generally, including yield-based equity investments, such as limited liability company membership interests. Reduced demand for our units resulting from investors seeking other more favorable investment opportunities may cause the trading price of our units to decline.

8

We may issue an unlimited number of additional securities without the consent of our unitholders, which will dilute each unitholder’s ownership interest in us and may increase the risk that we will be unable to maintain or increase our per unit distribution level.

At any time we may issue an unlimited number of additional securities without the approval of our unitholders on terms and conditions determined by our board of directors. The issuance by us of additional units or other equity securities of equal or senior rank will have the following effects:

• | our unitholders’ proportionate ownership interest in us will decrease; |

• | the amount of cash available for distribution on each unit may decrease; |

• | the relative voting strength of each previously outstanding unit may be diminished; |

• | the ratio of taxable income to distributions may increase; and |

• | the market price of the units may decline. |

NuStar Energy may issue additional NuStar Energy units, which may increase the risk that NuStar Energy will not have sufficient available cash to maintain or increase its per unit cash distribution level and that we will have to make a capital contribution to NuStar Energy.

NuStar Energy may issue additional NuStar Energy units, including units that rank senior to the NuStar Energy common units and the incentive distribution rights as to quarterly cash distributions, on the terms and conditions established by its general partner. Additionally, we are required to make additional capital contributions to NuStar Energy upon NuStar Energy’s issuance of additional units in order to maintain our 2% general partner interest in NuStar Energy. Furthermore, to the extent NuStar Energy issues units that are senior to the NuStar Energy common units and the incentive distribution rights, their issuance will render more uncertain the payment of distributions on the common units and the incentive distribution rights. Neither the common units nor the incentive distribution rights are entitled to any arrearages from prior quarters. The payment of distributions on any additional NuStar Energy units may increase the risk that NuStar Energy will be unable to maintain or increase its per unit cash distribution level and the requirement that we make capital contributions to NuStar Energy to maintain our 2% general partner interest may impact the available cash that we have to distribute to our unitholders.

Anti-takeover provisions in our limited liability company agreement may make an acquisition of us complicated and the removal and replacement of our directors and executive officers difficult.

Our limited liability company agreement contains provisions that may delay or prevent a change in control. These provisions may also make it difficult for unitholders to remove and replace our board of directors and executive officers.

Section 203. Our limited liability company agreement effectively adopts Section 203 of the Delaware General Corporation Law (DGCL). Section 203 of the DGCL, as it applies to us, prevents an interested unitholder, defined as a person who owns 15% or more of our outstanding units, from engaging in business combinations with us for three years following the time such person becomes an interested unitholder. Section 203 broadly defines “business combination” to encompass a wide variety of transactions with or caused by an interested unitholder, including mergers, asset sales and other transactions in which the interested unitholder receives a benefit on other than a pro rata basis with other unitholders. This provision of our limited liability company agreement could have an anti-takeover effect with respect to transactions not approved in advance by our board of directors, including discouraging takeover attempts that might result in a premium over the market price for our units.

Limited Voting Rights. Our limited liability company agreement provides that if any person or group other than our affiliates acquires beneficial ownership of 20% or more of any class of units, that person or group loses voting rights on all of its units. This loss of voting rights does not apply to any person or group that acquires all of its units from our affiliates or any transferees of that person or group approved by our board of directors or to any person or group who acquires the units with the prior approval of our board of directors.

Staggered Board. In addition, our limited liability company agreement divides our board of directors into two classes serving staggered two-year terms and permits the board to be divided into three classes serving staggered three-year terms upon the election of a fifth director to our board. This provision, when coupled with the provision of our limited liability company agreement authorizing only the board of directors to fill vacant or newly created directorships or increase the size of the board of directors and the provision providing that directors may only be removed at a meeting of unitholders and cannot be done by written consent, may deter a unitholder from gaining control of our board of directors by removing incumbent directors or increasing the number of directorships and simultaneously filling the vacancies or newly created directorships with its own nominees.

Preferred Unit Purchase Rights. On July 19, 2006, we entered into a rights agreement with Computershare Investor Services, LLC, as amended by the first amendment effective February 28, 2008 and the second amendment effective October 23, 2012, under which our board of directors declared a distribution of one preferred unit purchase right for each of our outstanding units. The rights become exercisable under specified circumstances, including any person or group (an “acquiring person”) becoming

9

the beneficial owner of 15% or more of our outstanding units, subject to specified exceptions. If events specified in the rights agreement occur, each holder of rights, other than an acquiring person, can exercise their rights. When a holder exercises a right, the holder will be entitled to receive units valued at some multiple of the exercise price of the right. In some cases, the holder will receive cash, property or other securities instead of units. We may redeem the rights prior to a person or group becoming an acquiring person.

These provisions may delay or prevent a third party from acquiring us and any such delay or prevention could cause the market price of our units to decline.

NuStar Energy’s unitholders may not have limited liability if a court finds that limited partner actions constitute control of NuStar Energy’s business and may, therefore, become liable for certain of NuStar Energy’s obligations, which may have an impact on the cash we have available to make distributions.

Under Delaware law, unitholders could be held liable for NuStar Energy’s obligations to the same extent as a general partner if a court determined that actions of a unitholder constituted participation in the “control” of NuStar Energy’s business.

Under Delaware law, the general partner generally has unlimited liability for the obligations of the partnership, such as its debts and environmental liabilities, except for those contractual obligations of the partnership that are expressly made without recourse to the general partner. In addition, Section 17-607 of the Delaware Revised Uniform Limited Partnership Act provides that, under some circumstances, a limited partner may be liable to NuStar Energy for the amount of a distribution for a period of three years from the date of the distribution.

RISKS RELATED TO CONFLICTS OF INTEREST

Although we manage NuStar Energy through our indirect ownership of its general partner, NuStar Energy’s general partner owes fiduciary duties to NuStar Energy and NuStar Energy’s unitholders, which may conflict with our interests.

Conflicts of interest exist and may arise in the future as a result of the relationships between us and our affiliates, including NuStar Energy’s general partner, on the one hand, and NuStar Energy and its limited partners, on the other hand. The directors and officers of NuStar GP, LLC have fiduciary duties to manage NuStar Energy’s business in a manner beneficial to us, its owner. At the same time, NuStar GP, LLC has a fiduciary duty to manage NuStar Energy in a manner beneficial to NuStar Energy and its unitholders. The board of directors of NuStar GP, LLC or its conflicts committee will resolve any such conflict and have broad latitude to consider the interests of all parties to the conflict. Our independent directors will not be the same as the independent directors who serve on the conflicts committee of NuStar GP, LLC. The resolution of these conflicts may not always be in our best interest or that of our unitholders.

For example, conflicts of interest may arise in the following situations:

• | the allocation of shared overhead expenses to NuStar Energy and us; |

• | the determination and timing of the amount of cash to be distributed to NuStar Energy’s partners and the amount of cash to be reserved for the future conduct of NuStar Energy’s business; |

• | any proposal by NuStar GP, LLC to eliminate, reduce or modify the incentive distribution rights; |

• | the decision whether NuStar Energy should make acquisitions, and on what terms; |

• | the determination of whether NuStar Energy should use cash on hand, borrow or issue equity to raise cash to finance acquisitions or expansion capital projects, repay indebtedness, meet working capital needs, pay distributions to NuStar Energy’s partners or otherwise; and |

• | any decision we make in the future to engage in business activities independent of, or in competition with, NuStar Energy. |

Our limited liability agreement limits and modifies our directors’ fiduciary duties and the fiduciary duties of our officers and directors may conflict with those of the general partner of NuStar Energy’s general partner’s officers and directors.

Our limited liability company agreement contains provisions that modify and limit our directors’ fiduciary duties to our unitholders. For example, our limited liability company agreement provides that:

• | our directors will not have any liability to us or our unitholders for decisions made in good faith, meaning they believed the decision was in our best interests; and |

• | our board of directors will not be liable for monetary damages to us or our unitholders for any acts or omissions unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that the board of directors acted in bad faith or engaged in fraud or willful misconduct or, in the case of a criminal matter, acted with knowledge that such conduct was unlawful. |

Our directors and officers have fiduciary duties to manage our business in a manner beneficial to us and our unitholders. Simultaneously, two of our directors and all of our officers are also directors and officers of NuStar GP, LLC, the general partner of NuStar Energy’s general partner, and have fiduciary duties to manage the business of NuStar Energy in a manner

10

beneficial to NuStar Energy and its unitholders. For instance, William E. Greehey is our Chairman of the Board as well as the Chairman of the Board of NuStar GP, LLC. Consequently, these directors and officers may encounter situations in which their fiduciary obligations to NuStar Energy, on the one hand, and us, on the other hand, are in conflict. The resolution of these conflicts may not always be in our best interest or that of our unitholders. For example, we share certain executive officers and administrative personnel with NuStar GP, LLC to operate both our business and NuStar Energy’s business. Our executive officers, who are also the executive officers of NuStar GP, LLC, will allocate, in their reasonable and sole discretion, their time spent on our behalf and on behalf of NuStar Energy. These allocations may not be the result of arms-length negotiations between NuStar GP, LLC and us and, therefore, the allocations may not exactly match the actual time and overhead spent.

RISKS RELATED TO NUSTAR ENERGY’S BUSINESS

Failure to complete capital projects as planned could adversely affect NuStar Energy’s financial condition, results of operations and cash flows.

Delays or cost increases related to capital spending programs involving construction of new facilities (or improvements and repairs to NuStar Energy’s existing facilities) could adversely affect NuStar Energy’s ability to achieve forecasted operating results. Although NuStar Energy evaluates and monitors each capital spending project and tries to anticipate difficulties that may arise, such delays or cost increases may arise as a result of factors that are beyond its control, including:

• | denial or delay in issuing requisite regulatory approvals and/or permits; |

• | unplanned increases in the cost of construction materials or labor; |

• | disruptions in transportation of modular components and/or construction materials; |

• | severe adverse weather conditions, natural disasters or other events (such as equipment malfunctions, explosions, fires or spills) affecting NuStar Energy’s facilities, or those of vendors and suppliers; |

• | shortages of sufficiently skilled labor, or labor disagreements resulting in unplanned work stoppages; |

• | market-related increases in a project’s debt or equity financing costs; or |

• | non-performance by, or disputes with, vendors, suppliers, contractors or sub-contractors involved with a project. |

NuStar Energy’s forecasted operating results are also based upon its projections of future market fundamentals that are not within its control, including changes in general economic conditions, availability to its customers of attractively priced alternative solutions for storage, transportation or supplies of crude oil and refined products and overall customer demand.

NuStar Energy’s inability to develop and execute growth projects and acquire new assets could limit its ability to maintain and grow quarterly distributions to its unitholders, including us.

NuStar Energy’s ability to maintain and grow its distributions to unitholders, including us, depends on the growth of NuStar Energy’s existing businesses and strategic acquisitions. If NuStar Energy is unable to implement business development opportunities and finance such activities on economically acceptable terms, its future growth will be limited, which could adversely impact its results of operations and cash flows and, accordingly, result in reduced distributions to unitholders, including us, over time.

If NuStar Energy is unable to retain current, and attain new, customers through renewing or establishing leases and throughput agreements at current or better rates or the utilization of NuStar Energy’s leased assets suffers a material decrease, NuStar Energy’s revenue and cash flows could be reduced to levels that could adversely affect its ability to make quarterly distributions to its unitholders, including us.

NuStar Energy’s revenue and cash flows are generated primarily from its customers’ payments of fees under throughput contracts and lease agreements. Failure of NuStar Energy to renew or enter into new contracts or its leasing customers’ material reduction of their utilization under existing leases could result from many factors, including:

• | a material decrease in the supply or price of crude oil; |

• | a material decrease in demand for refined products in the markets served by NuStar Energy’s pipelines and terminals; |

• | scheduled refinery turnarounds or unscheduled refinery maintenance; |

• | operational problems or catastrophic events at a refinery or NuStar Energy’s assets; |

• | environmental proceedings or other litigation that compel the cessation of all or a portion of the operations at a refinery or NuStar Energy’s assets; |

• | a decision by NuStar Energy’s current customers to redirect refined products transported in NuStar Energy’s pipelines to markets not served by NuStar Energy’s pipelines or to transport crude oil or refined products by means other than NuStar Energy’s pipelines; |

• | increasingly stringent environmental regulations; or |

• | a decision by NuStar Energy’s current customers to sell one or more of the refineries NuStar Energy serves to a purchaser that elects not to use NuStar Energy’s pipelines and terminals. |

11

Competing midstream service providers, including certain major energy and chemical companies, possess, or have greater financial resources to acquire, assets better suited to customer demand, which could undermine NuStar Energy’s ability to attain and retain customers or reduce utilization of its leased assets, which could reduce NuStar Energy’s revenues and cash flows, thereby reducing its ability to make its quarterly distributions to unitholders, including us.

NuStar Energy’s competitors include major energy and chemical companies, some of which have greater financial resources, more pipelines or storage terminals, greater capacity pipelines or storage terminals and greater access to supply than NuStar Energy does. Certain of its competitors also may have advantages in competing for acquisitions or other new business opportunities because of their financial resources and synergies in operations. As a consequence of increased competition in the industry, some of NuStar Energy’s customers may be reluctant to renew or enter into long-term contracts or contracts that provide for minimum throughput amounts in the future. NuStar Energy’s inability to renew or replace current contracts as they expire, to enter into contracts for newly constructed or expanded assets and to respond appropriately to changing market conditions could have a negative effect on NuStar Energy’s revenue, cash flows and ability to make quarterly distributions to its unitholders, including us.

Reduced demand for or supply of crude oil and refined products could affect NuStar Energy’s results of operations and ability to make distributions to its partners at current levels, including us.

NuStar Energy’s business is dependent upon the demand for and supply of the crude oil and refined products transported by its pipelines and stored in its terminals. Any sustained decrease in demand for refined products in the markets served by NuStar Energy’s pipelines, terminals or fuels marketing operations could result in a significant reduction in throughputs in its pipelines, storage in its terminals or earnings in its fuels marketing operations, which would reduce NuStar Energy’s cash flows and its ability to make distributions at current levels to its partners, including us. Factors that could lead to a decrease in market demand include:

• | a recession or other adverse economic condition that results in lower spending by consumers on gasoline, diesel, and travel; |

• | higher fuel taxes or other governmental or regulatory actions that increase, directly or indirectly, the cost of gasoline; |

• | an increase in automotive engine fuel economy, whether as a result of a shift by consumers to more fuel-efficient vehicles or technological advances by manufacturers; |

• | an increase in the market price of crude oil that leads to higher refined product prices, which may reduce demand for refined products and drive demand for alternative products. Market prices for crude oil and refined products, including fuel oil, are subject to wide fluctuation in response to changes in global and regional supply that are beyond NuStar Energy’s control, and increases in the price of crude oil may result in a lower demand for refined products that NuStar Energy transports, stores and markets, including fuel oil; |

• | a decrease in corn acres planted, which may reduce demand for anhydrous ammonia; and |

• | the increased use of alternative fuel sources, such as battery-powered engines. |

Similarly, any sustained decrease in the supply of crude oil and refined products could result in a significant reduction in throughputs in NuStar Energy’s pipelines and storage in its terminals, which would reduce its cash flows and its ability to make distributions at current levels to its partners, including us. Factors that could lead to a decrease in supply to NuStar Energy’s pipelines and terminals include:

• | prolonged periods of low prices for crude oil and refined products, which could lead to a decrease in exploration and development activity and reduced production in markets served by NuStar Energy’s pipelines and storage terminals; |

• | changes in the regulatory environment, governmental policies or taxation that directly or indirectly delay production or increase the cost of production of refined products; and |

• | actions taken by foreign oil and gas producing nations that impact prices for crude oil and refined products. |

NuStar Energy’s future financial and operating flexibility may be adversely affected by its significant leverage, downgrades of its credit ratings, restrictions in its debt agreements or disruptions in the financial markets.

As of December 31, 2014, NuStar Energy’s consolidated debt was $2.8 billion. In addition to any potential direct financial impact of debt, it is possible that any material increase to NuStar Energy’s debt or other negative financial factors may be viewed negatively by credit rating agencies, which could result in ratings downgrades and increased costs for NuStar Energy to access the capital markets. The ratings of NuStar Logistics, L.P. (NuStar Logistics) were downgraded to Ba1 by Moody’s Investor Service Inc. (Moody’s) in January 2013, BB+ by Standard & Poor’s Ratings Services (S&P) in July 2012 and BB by Fitch, Inc. in November 2012. As a result of the S&P’s and Moody’s downgrades, interest rates on borrowings under NuStar Energy’s five-year revolving credit agreement and its 7.65% senior notes due 2018 increased. Also, NuStar Energy may be required to post cash collateral under certain of its hedging arrangements, which it expects to fund with borrowings under its revolving credit agreement. Any further downgrades in the future could result in additional increases to the interest rates on borrowings under NuStar Energy’s credit facilities and its 7.65% senior notes due 2018, significantly increase NuStar Energy’s capital costs and adversely affect its ability to raise capital in the future.

12

NuStar Energy’s revolving credit agreement contains restrictive covenants, such as limitations on indebtedness, liens, mergers, asset transfers and certain investing activities. In addition, the revolving credit agreement requires NuStar Energy to maintain, as of the end of each rolling period, which consists of any period of four consecutive fiscal quarters, a consolidated debt coverage ratio (consolidated debt to consolidated EBITDA, each as defined in the revolving credit agreement) not to exceed 5.00-to-1.00. Failure to comply with any of the revolving credit agreement restrictive covenants or this coverage ratio will result in a default and could result in acceleration of this agreement and possibly other indebtedness.

Debt service obligations, restrictive covenants in NuStar Energy’s credit facilities and the indentures governing its outstanding senior and subordinated notes and maturities resulting from its leverage may adversely affect NuStar Energy’s ability to finance future operations, pursue acquisitions, fund its capital needs and pay cash distributions at current levels to its unitholders, including us. In addition, this leverage may make NuStar Energy’s results of operations more susceptible to adverse economic or operating conditions. For example, during an event of default under certain of NuStar Energy’s debt agreements, NuStar Energy would be prohibited from making cash distributions to its unitholders, including us. If NuStar Energy’s lenders file for bankruptcy or experience severe financial hardship, they may not honor their pro rata share of NuStar Energy’s borrowing requests under the revolving credit agreement, which may significantly reduce its available borrowing capacity and, as a result, materially adversely affect NuStar Energy’s financial condition and ability to pay distributions at current levels to its unitholders, including us. Additionally, NuStar Energy may not be able to access the capital markets in the future at economically attractive terms, which may adversely affect its future financial and operating flexibility and its ability to pay cash distributions at current levels.

NuStar Energy is exposed to counterparty credit risk. Nonpayment and nonperformance by NuStar Energy’s customers, vendors or derivative counterparties could reduce its revenues, increase its expenses and otherwise have a negative impact on its ability to conduct its business, its operating results, cash flows and ability to make distributions to its unitholders, including us.

NuStar Energy is subject to risks of loss resulting from nonpayment or nonperformance by its customers to whom it extends credit. In addition, nonperformance by vendors who have committed to provide NuStar Energy with critical products or services could raise its costs or interfere with its ability to successfully conduct its business. Furthermore, nonpayment by the counterparties to any of NuStar Energy’s outstanding commodity derivatives could expose NuStar Energy to additional commodity price risk. Weak economic conditions and widespread financial stress could reduce the liquidity of its customers, vendors or counterparties, making it more difficult for them to meet their obligations to NuStar Energy. Any substantial increase in the nonpayment and nonperformance by NuStar Energy’s customers, vendors or counterparties could have a material adverse effect on its results of operations, cash flows and ability to make distributions at current levels to its unitholders, including us.

Axeon’s failure to repay the Axeon Term Loan and any liability NuStar Energy incurs as a result of the financing arrangements and guarantees of Axeon required by that loan could have a material and adverse impact on NuStar Energy’s financial condition, results of operations and cash flows and could adversely affect its ability to make quarterly distributions to its unitholders, including us.

In connection with NuStar Energy’s sale of NuStar Asphalt LLC (now known as Axeon), NuStar Logistics, an operating subsidiary of NuStar Energy, agreed to convert the revolving credit facility with Axeon into a $190 million term loan (the Axeon Term Loan). NuStar Energy also agreed to continue to provide credit support to Axeon in the form of guarantees, letters of credit and cash collateral of up to $150 million (the Credit Support) until February 2016, at which point the amount of Credit Support will begin to decline until the obligation is terminated no later than September 2019.

Axeon was scheduled to repay amounts under the Axeon Term Loan to reduce the amount outstanding to $175 million by December 31, 2014 and is scheduled to make further repayments to reduce the amount outstanding to $150 million by September 30, 2015, with repayment in full no later than September 2019 and earlier repayment possible, depending on the amount of excess cash flows (if any) generated by Axeon. Any repayments of the Axeon Term Loan are subject to Axeon meeting certain restrictive requirements contained in is third-party asset-based revolving credit facility (ABL Facility). Axeon failed to make the scheduled repayment by December 31, 2014.

In the event that Axeon defaults on any of its obligations under the Axeon Term Loan, NuStar Energy would have available only those measures available to an unsecured creditor with the rights and limitations provided in the Axeon Term Loan, and, to the extent provided in the agreements, the ABL Facility lenders would be senior to those rights. In the event of a default on any of the obligations underlying the Credit Support, NuStar Energy would be responsible for Axeon’s liabilities for the default and have only the rights of repayment associated with that instrument. The failure by Axeon to make scheduled repayments under the Axeon Term Loan or the default by Axeon of any of its obligations under the Axeon Term Loan or underlying the Credit

13

Support may have an adverse impact on NuStar Energy’s financial condition, results of operations, cash flows and ability to pay distributions to its unitholders, including us, at current levels.

Increases in interest rates could adversely affect NuStar Energy’s business and the trading price of NuStar Energy’s units.

NuStar Energy has significant exposure to increases in interest rates. As of December 31, 2014, NuStar Energy had approximately $2.8 billion of consolidated debt, of which $1.8 billion was at fixed interest rates and $1.0 billion was at variable interest rates. In addition, prior ratings downgrades on NuStar Energy’s existing indebtedness caused interest rates under its revolving credit agreement and its senior notes due 2018 to increase effective January 2013, and future downgrades may cause such interest rates to increase further. NuStar Energy’s results of operations, cash flows and financial position could be materially adversely affected by significant increases in interest rates above current levels. Further, the trading price of NuStar Energy’s common units is sensitive to changes in interest rates and any rise in interest rates could adversely impact such trading price.

NuStar Energy’s operations are subject to operational hazards and unforeseen interruptions, and NuStar Energy does not insure against all potential losses. Therefore, NuStar Energy could be seriously harmed by unexpected liabilities.

NuStar Energy’s operations are subject to operational hazards and unforeseen interruptions such as natural disasters, adverse weather, accidents, fires, explosions, hazardous materials releases, mechanical failures and other events beyond its control. These events might result in a loss of equipment or life, injury or extensive property damage, as well as an interruption in NuStar Energy’s operations. In the event any of NuStar Energy’s facilities are forced to shut down for a significant period of time, it may have a material adverse effect on NuStar Energy’s earnings, its other results of operations and its financial condition as a whole.

NuStar Energy may not be able to maintain or obtain insurance of the type and amount it desires at reasonable rates. As a result of market conditions, premiums and deductibles for certain of NuStar Energy’s insurance policies have increased substantially and could escalate further. Certain insurance coverage could become unavailable or available only for reduced amounts of coverage and at higher rates. For example, NuStar Energy’s insurance carriers require broad exclusions for losses due to terrorist acts. If NuStar Energy were to incur a significant liability for which it is not fully insured, such a liability could have a material adverse effect on NuStar Energy’s financial position and its ability to make distributions at current levels to its unitholders, including us, and to meet its debt service requirements.

A failure in NuStar Energy’s computer systems or a cyber-attack on NuStar Energy or third parties with whom NuStar Energy has a relationship may adversely affect NuStar Energy’s operations and reputation.

NuStar Energy relies on the use of technology to conduct its business. NuStar Energy’s business is dependent upon its operational and financial computer systems to process the data necessary to conduct almost all aspects of its business, including operating its pipelines and storage facilities, recording and reporting commercial and financial transactions and receiving and making payments. NuStar Energy’s systems and networks, as well as those of its customers, suppliers, vendors and counterparties, may become the target of cyber-attacks or information security breaches, which in turn could result in the unauthorized release and misuse of confidential and proprietary information as well as disrupt NuStar Energy’s operations, damage its facilities or those of third parties and harm NuStar Energy’s and, in turn, our reputation. Any failure or disruption of NuStar Energy’s systems could have an adverse effect on its revenues and increase its operating and capital costs, which could reduce the amount of cash otherwise available for distributions to unitholders, including us. NuStar Energy also may be required to incur additional costs to modify or enhance its systems in order to try to prevent or remediate any such attacks.

Potential future acquisitions and expansions, if any, may increase substantially the level of NuStar Energy’s indebtedness and contingent liabilities, and NuStar Energy may be unable to integrate them effectively into its existing operations.

From time to time, NuStar Energy evaluates and acquires assets and businesses that it believes complement or diversify its existing assets and businesses. Acquisitions may require substantial capital or the incurrence of substantial indebtedness. If NuStar Energy consummates any future material acquisitions, its capitalization and results of operations may change significantly, and you will not have the opportunity to evaluate the economic, financial and other relevant information that NuStar Energy will consider in connection with any future acquisitions.

Acquisitions and business expansions involve numerous risks, including difficulties in the assimilation of the assets and operations of the acquired businesses, inefficiencies and difficulties that arise because of unfamiliarity with new assets and the businesses associated with them and new geographic areas. Further, unexpected costs and challenges may arise whenever businesses with different operations or management are combined. Successful business combinations will require NuStar Energy’s management and other personnel to devote significant amounts of time to integrating the acquired businesses with NuStar Energy’s existing operations. These efforts may temporarily distract their attention from day-to-day business, the development or acquisition of new properties and other business opportunities. If NuStar Energy does not successfully integrate

14

any past or future acquisitions, or if there is any significant delay in achieving such integration, NuStar Energy’s business and financial condition could be adversely affected.

Moreover, part of NuStar Energy’s business strategy includes acquiring additional assets that complement NuStar Energy’s existing asset base and distribution capabilities or provide entry into new markets. NuStar Energy may not be able to identify suitable acquisitions, or it may not be able to purchase or finance any acquisitions on terms that it finds acceptable. Additionally, NuStar Energy competes against other companies for acquisitions, and NuStar Energy may not be successful in the acquisition of any assets or businesses appropriate for its growth strategy.

NuStar Energy does not own all of the land on which its pipelines and facilities have been constructed, and NuStar Energy is therefore subject to the possibility of increased costs or the inability to retain necessary land use.

NuStar Energy obtains the rights to construct and operate its pipelines, storage terminals and other facilities on land owned by third parties and governmental agencies. Many of these rights-of-way or other property rights are perpetual in duration while others are for a specific period of time. In addition, some of NuStar Energy’s facilities are located on leased premises. Its loss of these rights, through its inability to renew right-of-way contracts or leases or otherwise, could adversely affect its operations and cash flows available for distribution to unitholders, including us.

In addition, the construction of additions to NuStar Energy’s existing assets may require it to obtain new rights-of-way or property rights prior to construction. NuStar Energy may be unable to obtain such rights-of-way or other property rights to connect new supplies to its existing pipelines, storage terminals or other facilities or to capitalize on other attractive expansion opportunities. Additionally, it may become more expensive for NuStar Energy to obtain new rights-of-way or other property rights or to renew existing rights-of-way or property rights. If the cost of obtaining new or renewing existing rights-of-way or other property rights increases, it may adversely affect NuStar Energy’s operations and cash flows available for distribution to unitholders, including us.

NuStar Energy may have liabilities from its assets that pre-exist NuStar Energy’s acquisition of those assets, but that may not be covered by indemnification rights NuStar Energy may have against the sellers of the assets.

In some cases, NuStar Energy may have indemnified the previous owners and operators of acquired assets. Some of NuStar Energy’s assets have been used for many years to transport and store crude oil and refined products. Releases may have occurred in the past that could require costly future remediation. If a significant release or event occurred in the past, the liability for which was not retained by the seller, or for which indemnification from the seller is not available, it could adversely affect NuStar Energy’s financial position and results of operations.

Climate change legislation and other regulatory initiatives may decrease demand for the products NuStar Energy stores, transports and sells and increase NuStar Energy’s operating costs.

Scientific studies have suggested that emissions of certain gases, commonly referred to as “greenhouse gases” and including carbon dioxide and methane, may be contributing to warming of the Earth’s atmosphere. In response to such studies, the U.S. Congress, European Union and other political bodies have considered legislation or regulation to reduce emissions of greenhouse gases. In addition, several states and local governmental bodies, either individually or through multi-member initiatives, have already taken legal measures to reduce emissions of greenhouse gases, including through the development of greenhouse gas emission inventories and/or greenhouse gas cap and trade programs. As an alternative to reducing emission of greenhouse gases under cap and trade programs, governmental bodies may consider the implementation of a program to tax the emission of carbon dioxide and other greenhouse gases. Passage of climate change legislation or other regulatory initiatives in areas in which NuStar Energy conducts business, could result in changes to the demand for the products NuStar Energy stores, transports and sells, and could increase the costs of NuStar Energy’s operations, including costs to operate and maintain its facilities, install new emission controls on its facilities, acquire allowances to authorize its greenhouse gas emissions, pay any taxes related to its greenhouse gas emissions or administer and manage a greenhouse gas emissions program. Even though NuStar Energy attempts to mitigate such lost revenues or increased costs through the contracts it signs with its customers, NuStar Energy may be unable to recover those revenues or mitigate the increased costs, and any such recovery may depend on events beyond its control, including the outcome of future rate proceedings before the Federal Energy Regulatory Commission (the FERC), the Surface Transportation Board (STB) or other regulators and the provisions of any final legislation or regulations. Reductions in NuStar Energy’s revenues or increases in its expenses as a result of climate control or other initiatives could have adverse effects on NuStar Energy’s business, financial position, results of operations and prospects.

NuStar Energy operates a global business that exposes it to additional risks.

NuStar Energy operates in six foreign countries and a significant portion of its revenues comes from its business in these countries. Its operations outside the United States may be affected by changes in trade protection laws, policies and measures, and other regulatory requirements affecting trade and investment, including the Foreign Corrupt Practices Act, the United Kingdom Bribery Act and other foreign laws prohibiting corrupt payments, as well as import and export regulations. NuStar

15

Energy has assets in certain emerging markets, and the developing nature of these markets presents a number of risks. Deterioration of social, political, labor or economic conditions, including the increasing threat of drug cartels, in a specific country or region and difficulties in staffing and managing foreign operations may also adversely affect its operations or financial results.

NuStar Energy’s operations are subject to federal, state and local laws and regulations, in the U.S. and in the foreign countries in which it operates, relating to environmental protection and operational safety that could require NuStar Energy to make substantial expenditures.

NuStar Energy’s operations are subject to increasingly stringent environmental, health and safety laws and regulations. Transporting, storing and distributing products, including petroleum products, produces a risk that these products may be released into the environment, potentially causing substantial expenditures for a response action, significant government penalties, liability to government agencies for damages to natural resources, personal injury or property damages to private parties and significant business interruption. NuStar Energy owns or leases a number of properties that have been used to transport, store or distribute products for many years. Many of these properties were operated by third parties whose handling, disposal or release of products and wastes was not under NuStar Energy’s control.

If NuStar Energy were to incur a significant liability pursuant to environmental, health or safety laws or regulations, such a liability could have a material adverse effect on its financial position and its ability to make distributions at current levels to its unitholders, including us, and its ability to meet its debt service requirements.

NuStar Energy’s interstate common carrier pipelines are subject to regulation by the FERC.

The FERC regulates the tariff rates and terms and conditions of service for interstate oil movements on NuStar Energy’s common carrier pipelines. FERC regulations require that these rates must be just and reasonable and that the pipeline not engage in undue discrimination or undue preference with respect to any shipper. Under the Interstate Commerce Act, FERC or shippers may challenge NuStar Energy’s pipeline tariff filings, including rates and terms and conditions of service. Further, other than for rates set under market-based rate authority, if a new rate is challenged by protest and investigated by the FERC, the FERC may suspend collection of such new rate for up to seven months. If such new rate is found to be unjust and unreasonable, the FERC may order refunds of amounts collected in excess of amounts generated by the just and reasonable rate determined by FERC. A successful rate challenge could result in a common carrier paying refunds together with interest for the period that the rate was in effect. In addition, shippers may challenge by complaint tariff rates and terms and conditions of service even after the rates and terms and conditions of service are in effect. If the FERC, in response to such a complaint or on its own initiative, initiates an investigation of rates that are already in effect, the FERC may order a carrier to change its rates prospectively. If existing rates are challenged and are determined by the FERC to be in excess of a just and reasonable level, a shipper may obtain reparations for damages sustained during the two years prior to the date the shipper filed a complaint.

NuStar Energy uses various FERC-authorized rate change methodologies for its interstate pipelines, including indexing, cost-of-service rates, market-based rates and settlement rates. Typically, NuStar Energy adjusts its rates annually in accordance with FERC indexing methodology, which currently allows a pipeline to change their rates within prescribed ceiling levels that are tied to an inflation index. For the five-year period beginning July 1, 2011, the current index is measured by the year-over-year change in the Bureau of Labor’s producer price index for finished goods, plus 2.65%. However, some of NuStar Energy’s newer projects that involved an open season include negotiated indexation rate caps. These methodologies could result in changes in NuStar Energy’s revenue that do not fully reflect changes in costs it incurs to operate and maintain its pipelines. For example, NuStar Energy’s costs could increase more quickly or by a greater amount than the negotiated indexation rate cap. Shippers may protest rate increases made within the ceiling levels, but such protests must show that the portion of the rate increase resulting from application of the index is substantially in excess of the pipeline’s change in costs from the previous year. However, if the index results in a negative adjustment, NuStar Energy is required to reduce any rates that exceed the new maximum allowable rate. In addition, changes in the index might not be large enough to fully reflect actual increases in NuStar Energy’s costs. If the FERC’s rate-making methodologies change, any such change or new methodologies could result in rates that generate lower revenues and cash flow and could adversely affect NuStar Energy’s ability to make distributions at current levels to its unitholders, including us, and to meet its debt service requirements. Additionally, competition constrains NuStar Energy’s rates in various markets. As a result, NuStar Energy may from time to time be forced to reduce some of its rates to remain competitive.

Changes to FERC rate-making principles could have an adverse impact on NuStar Energy’s ability to recover the full cost of operating its pipeline facilities and its ability to make distributions at current levels to its unitholders, including us.

In May 2005, the FERC issued a statement of general policy stating it will permit pipelines to include in cost of service a tax allowance to reflect actual or potential tax liability on their public utility income attributable to all partnership or limited liability company interests, if the ultimate owner of the interest has an actual or potential income tax liability on such income. Whether a pipeline’s owners have such actual or potential income tax liability will be reviewed by the FERC on a case-by-case

16

basis. Although this policy is generally favorable for pipelines that are organized as pass-through entities, it still entails rate risk due to the case-by-case review requirement. This tax allowance policy and the FERC’s application of that policy were appealed to the United States Court of Appeals for the District of Columbia Circuit (D.C. Court), and on May 29, 2007, the D.C. Court issued an opinion upholding the FERC’s tax allowance policy.