Attached files

| file | filename |

|---|---|

| 8-K - 8-K - AVAYA INC | avaya8-k_cleansingx22may20.htm |

EXHIBIT 99.1

CONFIDENTIAL | SUBJECT TO FRE 408

FOR DISCUSSION PURPOSES ONLY

In re Avaya, Inc., et al., Case No. 17-10089

Plan Term Sheet

May 16, 2017

THIS TERM SHEET (THIS “TERM SHEET”) DESCRIBES A POTENTIAL JOINT CHAPTER 11 PLAN OF

REORGANIZATION (THE “PLAN”) FOR AVAYA INC. AND ITS AFFILIATED DEBTORS AND DEBTORS-IN-

POSSESSION (THE “DEBTORS”) TO BE CO-SPONSORED BY THE AD HOC GROUP OF THE DEBTORS’ FIRST AND

SECOND LIEN DEBTHOLDERS (THE “AD HOC CROSSHOLDER GROUP”). THIS TERM SHEET IS MERELY AN

EXPRESSION OF INTEREST TO BE USED FOR DISCUSSION PURPOSES IN CONNECTION WITH A

COMPREHENSIVE COMPROMISE AMONG THE DEBTORS AND THE AD HOC CROSSHOLDER GROUP, SHALL

NOT CONSTITUTE AN ADMISSION BY ANY PERSON OR ENTITY AND IS NOT INTENDED TO AND DOES NOT

CREATE ANY LEGAL OR EQUITABLE OBLIGATIONS OF ANY PERSON OR ENTITY. THIS TERM SHEET DOES

NOT CONSTITUTE (NOR SHALL IT BE CONSTRUED AS) AN OFFER OR A SOLICITATION WITH RESPECT TO ANY

SECURITIES OF THE DEBTORS, NOR IS IT A SOLICITATION OF ACCEPTANCES OR REJECTIONS OF ANY PLAN

OF REORGANIZATION. ANY SUCH OFFER OR SOLICITATION SHALL COMPLY WITH ALL APPLICABLE

SECURITIES LAWS AND/OR PROVISIONS OF TITLE 11 OF THE UNITED STATES CODE (THE

“BANKRUPTCY CODE”).

THIS TERM SHEET IS PROVIDED AS A POSSIBLE COMPROMISE AND IS THUS SUBJECT TO FEDERAL RULE OF

EVIDENCE 408. FURTHERMORE, THE PROPOSALS CONTAINED HEREIN ARE SUBJECT TO, AMONG OTHER

THINGS, THE COMPLETION OF DUE DILIGENCE BY THE AD HOC CROSSHOLDER GROUP, THE APPROVAL OF

THE DEBTORS’ BOARD OF DIRECTORS AND THE EXECUTION AND DELIVERY BY ALL RELEVANT PARTIES OF

LEGALLY BINDING DEFINITIVE DOCUMENTATION IN FORM AND SUBSTANCE ACCEPTABLE TO THE

AD HOC CROSSHOLDER GROUP AND THE DEBTORS.

TERM DESCRIPTION

Restructuring Support

Agreement

No later than April [●], 2017, the Debtors shall enter into a restructuring

support agreement (the “RSA”) with the members of the

Ad Hoc Crossholder Group (together with other holders of first and

second lien debt who become party to the RSA, the

“Consenting Creditors”), which shall contain customary terms regarding

the parties’ support for the Plan consistent with this Term Sheet and

otherwise acceptable to the Ad Hoc Crossholder Group and the Debtors.

Restructuring Summary Pursuant to the RSA, the Debtors shall file a Plan that provides for

(1) prior to the occurrence of a Toggle Event (as defined herein), the

consummation of a SaleCo Transaction (as defined herein) and the

reorganization of the Debtors’ remaining assets, or (2) after the

occurrence of a Toggle Event, the reorganization of the Debtors’ entire

business on a stand-alone basis (the “WholeCo Restructuring”), in each

case on terms consistent with this Term Sheet.

2

TERM DESCRIPTION

SaleCo Transaction “SaleCo Transaction” means a sale of the Debtors’ contact center

business (the “Contact Center”) to (1) a stalking horse purchaser (the

“Stalking Horse Purchaser”) pursuant to the Stalking Horse Purchase

Agreement (as defined herein), or (2) the party determined to have made

the highest or otherwise best bid for the Contact Center following an

auction (the “Successful Bidder”).

Milestones The RSA shall contain the following milestones regarding the Plan:

(1) The Debtors shall have filed the Plan and related disclosure

statement (the “Disclosure Statement”) with the Bankruptcy Court

no later than [14] days following the execution of the RSA;

(2) The Pension Settlement (as defined herein) shall have been accepted

by the PBGC no later than the deadline set for objections to approval

of the Disclosure Statement;

(3) An order approving the Disclosure Statement (the

“Disclosure Statement Order”) shall have been entered no later than

[40] days following the date upon which the Disclosure Statement is

filed;

(4) An order confirming the Plan (the “Confirmation Order”) shall have

been entered no later than [45] days following the date upon which

the Disclosure Statement Order is entered;

(5) The effective date of the Plan (the “Effective Date”) shall have

occurred no later than [14] days following the date upon which the

Confirmation Order becomes a final order.

Toggle Events

“Toggle Event” shall mean any of the following events unless waived or

extended in writing by the Requisite Consenting Creditors:

(1) A stalking horse purchase agreement (the “Stalking Horse Purchase

Agreement”) for the sale of the Contact Center at a minimum

purchase price of $3,800 million and in form and substance

acceptable to the Debtors and the Requisite Consenting Creditors

shall not have been executed within [30] days following the

execution of the RSA or, once executed, the Stalking Horse Purchase

Agreement shall be terminated in accordance with its terms (other

than as a result of another party becoming the Successful Bidder);

(2) An order approving a SaleCo Transaction (the “Sale Order”) shall

not have been entered within [60] days following the execution of

the Stalking Horse Purchase Agreement; or

(3) A SaleCo Transaction shall not have been consummated within

[●] days following the entry of the Sale Order.

Exit Facilities On the Effective Date, the reorganized Debtors shall enter into (1) a new

market-financed exit revolving credit facility in an aggregate committed

amount up to $[●] million (including LC capacity) (the “Exit Revolver”),

and (2) in the case of a WholeCo Restructuring, the reorganized Debtors

shall enter into a new market-financed term loan facility (the “Exit Term

Loan”), the proceeds of which shall, together with cash on hand, be

3

TERM DESCRIPTION

sufficient to repay all obligations under the DIP Facility and fund all cash

amounts required to be paid or reserved under the Plan (including the Exit

Cash Amount (as defined herein)).

New First Lien Debt “New First Lien Debt” means the new first lien debt to be issued by the

reorganized Debtors, which shall be (1) new market-financed term loans

(the “New First Lien Market Debt”), or (2) solely to the extent that market

financing is unavailable or otherwise undesirable as determined by the

Debtors and the Requisite Consenting Creditors, new first lien term loans

or notes issued to holders of First Lien Claims (the “New First Lien

Take-Back Debt”).

The reorganized Debtors shall issue the New First Lien Debt on the

Effective Date as follows:

(1) If a SaleCo Transaction is consummated, the New First Lien Debt

shall:

(i) Be in an aggregate principal amount of at least $[750] million,

but no more than $[1,250] million;

(ii) Have a maturity date that is [5] years following the

Effective Date;

(iii) Have a cash interest rate of [8]% per annum; and

(iv) Be secured by first priority liens on substantially all of the

reorganized Debtors’ assets.

(2) If a WholeCo Restructuring is effectuated, the New First Lien Debt

shall:

(i) Be in an aggregate principal amount of (x) $[2,750] million less

(y) the aggregate principal amount of the Exit Term Loan;

(ii) Have a maturity date that is [5] years following the

Effective Date;

(iii) Have a cash interest rate of [6]% per annum; and

(iv) Be secured by first priority liens on substantially all of the

reorganized Debtors’ assets.

The definitive terms and conditions with respect to the New First Lien

Debt shall be acceptable to the Debtors and the Requisite Consenting

Creditors.

New Second Lien Notes “New Second Lien Notes” means the new second lien notes to be issued

by the reorganized Debtors solely if a SaleCo Transaction is

consummated and the New First Lien Debt is issued in an aggregate

principal amount less than $[1,250] million, and which shall be (1) new

market-financed second lien notes (the “New Second Lien

Market Notes”), or (2) solely to the extent that market financing is

unavailable or otherwise undesirable by the Debtors and the

Requisite Consenting Creditors, new second lien notes issued to holders

of First Lien Claims (the “New Second Lien Take-Back Notes”).

4

TERM DESCRIPTION

If a SaleCo Transaction is consummated and the New First Lien Debt is

issued in an amount less than $[1,250] million, the reorganized Debtors

shall issue the New Second Lien Notes on the Effective Date, which shall:

(1) Be in an aggregate principal amount of (i) $[1,250] million less

(ii) the aggregate principal amount of the New First Lien Debt, but in

any case no more than $[500] million;

(2) Have a maturity date that is [6] years following the Effective Date;

(3) Have a cash interest rate of [12]% per annum; and

(4) Be secured by second priority liens on the collateral securing the

New First Lien Debt.

The definitive terms and conditions with respect to the New Second Lien

Notes shall be acceptable to the Debtors and the Requisite Consenting

Creditors.

PBGC Note To the extent that the PBGC accepts the Pension Settlement in accordance

with the terms hereof, the reorganized Debtors shall issue to the PBGC a

note on the Effective Date as follows:

(1) If a SaleCo Transaction is consummated, the note (the

“Third Lien PBGC Note”) shall:

(i) Be in an aggregate principal amount of $[150] million;

(ii) Have a maturity date that is [7] years following the

Effective Date;

(iii) Have a cash interest rate of [7]% per annum; and

(iv) Be secured by third priority liens on the collateral securing the

New First Lien Debt.

(2) If a WholeCo Restructuring is effectuated, the note (the

“Second Lien PBGC Note”) shall:

(i) Be in an aggregate principal amount of $[250] million;

(ii) Have a maturity date that is [7] years following the Effective

Date;

(iii) Have a cash interest rate of [7]% per annum; and

(iv) Be secured by second priority liens on the collateral securing

the New First Lien Debt.

The definitive terms and conditions with respect to the Third Lien

PBGC Note or the Second Lien PBGC Note, as applicable, shall be

acceptable to the Debtors and the Requisite Consenting Creditors.

Administrative and

Priority Claims

Administrative and Priority Claims shall be paid in full in cash on the

Effective Date or as soon as reasonably practicable thereafter.

5

TERM DESCRIPTION

Other Secured Claims Holders of secured claims other than First Lien Claims and Second Lien

Claims (collectively, the “Other Secured Claims”) shall receive, at the

reorganized Debtors’ discretion, subject to the reasonable consent of the

Requisite Consenting Creditors:

(1) Payment in full in cash of the unpaid portion of such Other Secured

Claims on the Effective Date or as soon thereafter as reasonably

practicable (or if payment is not then due, shall be paid in accordance

with its terms in the ordinary course);

(2) Reinstatement of such Other Secured Claims;

(3) The Debtors’ interest in the collateral securing such Other Secured

Claims; or

(4) Such other treatment rendering such Other Secured Claims

unimpaired.

DIP Facility Claims

DIP Facility Claims shall be paid in full in cash and all outstanding LCs

shall be replaced under the Exit Revolver on the Effective Date.

Cash Flow Credit

Facility Claims and

First Lien Notes Claims

(collectively, the

“First Lien Claims”)

Claims in respect of the Cash Flow Credit Facility shall be allowed in an

aggregate amount of approximately $3,235 million.

Claims in respect of the 7.00% First Lien Notes shall be allowed in an

aggregate amount of approximately $1,009 million.

Claims in respect of the 9.00% First Lien Notes shall be allowed in an

aggregate amount of approximately $290 million.

(1) If a SaleCo Transaction is consummated, holders of First Lien

Claims shall collectively receive their pro rata share of:

(i) The First Lien Cash Distribution (as defined herein);

(ii) New First Lien Take-Back Debt (if any); and

(iii) New Second Lien Take-Back Notes (if any) ((i) through (iii),

collectively, the “SaleCo First Lien Cash and Debt Amount”).

To the extent that the SaleCo First Lien Cash and Debt Amount is

not sufficient to provide at least a [94]% recovery to all holders of

First Lien Claims (such difference between (x) [94]% of the

aggregate amount of First Lien Claims and (y) the SaleCo First Lien

Cash and Debt Amount, the “First Lien Shortfall Amount”), holders

of First Lien Claims shall have the option to elect to receive a pro

rata distribution of Reorganized RemainCo Common Stock

(as defined herein) at a [25]% discount to the implied Plan value

predicated upon the Plan’s total enterprise value of $[●] billion

(subject to dilution by the MEIP) (the “First Lien Shortfall Equity”),

on account of First Lien Claims up to the First Lien Shortfall

Amount, in lieu of their ratable share of the SaleCo First Lien Cash

and Debt Amount (the “SaleCo First Lien Equity Option”).

The SaleCo First Lien Equity Option will be backstopped by the

members of the Ad Hoc Crossholder Group, provided that the

6

TERM DESCRIPTION

First Lien Shortfall Amount does not exceed [●], in consideration for

which the backstop parties will be entitled to a backstop fee (the

“Backstop Fee”) in an amount equal to [5]% of the First Lien

Shortfall Amount, and which shall be payable in Reorganized

RemainCo Common Stock (subject to dilution by the MEIP).

(2) If a WholeCo Restructuring is effectuated, holders of First Lien

Claims shall collectively receive their pro rata share of:

(i) The First Lien Cash Distribution;

(ii) New First Lien Take-Back Debt (if any); and

(iii) [81.2]% of the common stock of the reorganized Debtors (the

“Reorganized WholeCo Common Stock”), subject to dilution

by the MEIP.

“First Lien Cash Distribution” means all cash, including proceeds of asset

sales and any exit financing, available after payment of all obligations

under the DIP Facility and amounts required to be paid or reserved under

the Plan, including the Exit Cash Amount (as defined herein).

Second Lien Notes

(the “Second Lien Claims”)

Claims in respect of the Second Lien Notes shall be allowed in an

aggregate amount of approximately $1,440 million.

(1) If a SaleCo Transaction is consummated, holders of Second Lien

Claims shall receive their pro rata share of [95.8]% of the common

stock of the reorganized Debtors following consummation of a

SaleCo Transaction (the “Reorganized RemainCo Common Stock”),

subject to dilution by the MEIP, the First Lien Shortfall Equity

(if any) and the Backstop Fee (if any).

(2) If a WholeCo Restructuring is effectuated, holders of Second Lien

Claims shall receive their pro rata share of [18.0]% of the

Reorganized WholeCo Common Stock, subject to dilution by

the MEIP.

General Unsecured Claims

(1) If a SaleCo Transaction is consummated, holders of

General Unsecured Claims shall receive their pro rata share of

[4.2]% of the Reorganized RemainCo Common Stock, subject to

dilution by the MEIP.

(2) If a WholeCo Restructuring is effectuated, holders of

General Unsecured Claims shall receive their pro rata share of

[0.8]% of the Reorganized WholeCo Common Stock, subject to

dilution by the MEIP.

Intercompany Claims Claims by and among Debtors and between non-Debtors and Debtors

shall be cancelled, reinstated or left unimpaired, as determined by the

reorganized Debtors.

7

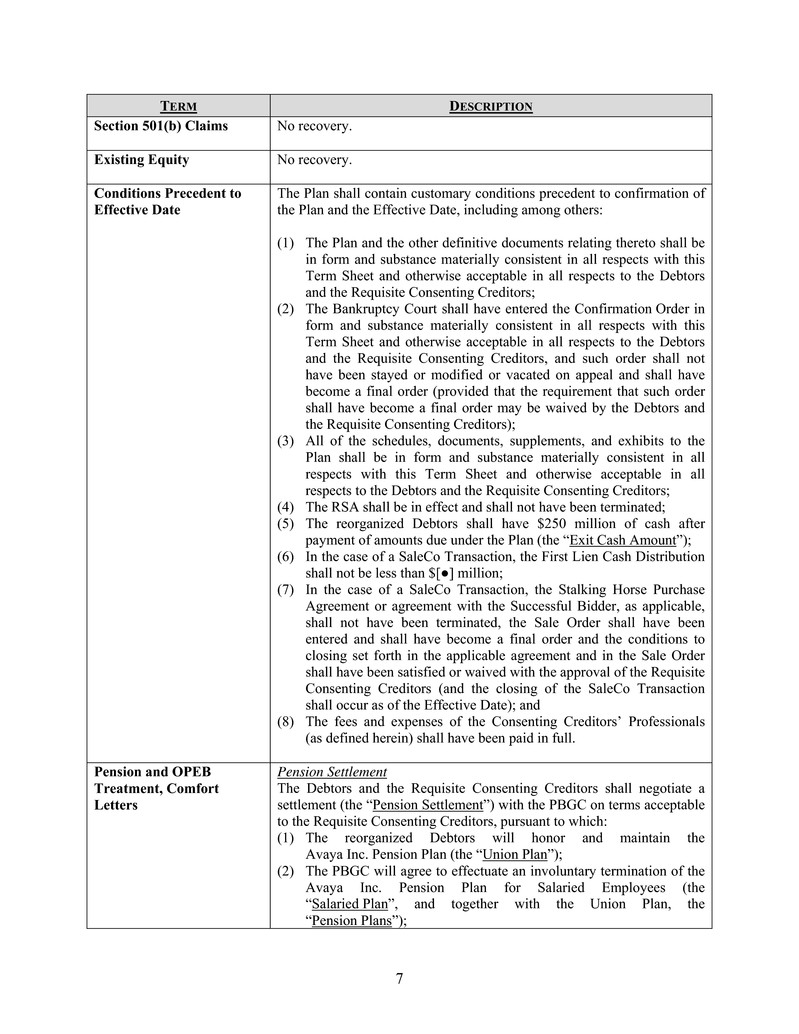

TERM DESCRIPTION

Section 501(b) Claims

No recovery.

Existing Equity No recovery.

Conditions Precedent to

Effective Date

The Plan shall contain customary conditions precedent to confirmation of

the Plan and the Effective Date, including among others:

(1) The Plan and the other definitive documents relating thereto shall be

in form and substance materially consistent in all respects with this

Term Sheet and otherwise acceptable in all respects to the Debtors

and the Requisite Consenting Creditors;

(2) The Bankruptcy Court shall have entered the Confirmation Order in

form and substance materially consistent in all respects with this

Term Sheet and otherwise acceptable in all respects to the Debtors

and the Requisite Consenting Creditors, and such order shall not

have been stayed or modified or vacated on appeal and shall have

become a final order (provided that the requirement that such order

shall have become a final order may be waived by the Debtors and

the Requisite Consenting Creditors);

(3) All of the schedules, documents, supplements, and exhibits to the

Plan shall be in form and substance materially consistent in all

respects with this Term Sheet and otherwise acceptable in all

respects to the Debtors and the Requisite Consenting Creditors;

(4) The RSA shall be in effect and shall not have been terminated;

(5) The reorganized Debtors shall have $250 million of cash after

payment of amounts due under the Plan (the “Exit Cash Amount”);

(6) In the case of a SaleCo Transaction, the First Lien Cash Distribution

shall not be less than $[●] million;

(7) In the case of a SaleCo Transaction, the Stalking Horse Purchase

Agreement or agreement with the Successful Bidder, as applicable,

shall not have been terminated, the Sale Order shall have been

entered and shall have become a final order and the conditions to

closing set forth in the applicable agreement and in the Sale Order

shall have been satisfied or waived with the approval of the Requisite

Consenting Creditors (and the closing of the SaleCo Transaction

shall occur as of the Effective Date); and

(8) The fees and expenses of the Consenting Creditors’ Professionals

(as defined herein) shall have been paid in full.

Pension and OPEB

Treatment, Comfort

Letters

Pension Settlement

The Debtors and the Requisite Consenting Creditors shall negotiate a

settlement (the “Pension Settlement”) with the PBGC on terms acceptable

to the Requisite Consenting Creditors, pursuant to which:

(1) The reorganized Debtors will honor and maintain the

Avaya Inc. Pension Plan (the “Union Plan”);

(2) The PBGC will agree to effectuate an involuntary termination of the

Avaya Inc. Pension Plan for Salaried Employees (the

“Salaried Plan”, and together with the Union Plan, the

“Pension Plans”);

8

TERM DESCRIPTION

(3) The PBGC shall not assert any controlled group or successor claims

with respect to the Pension Plans against any non-Debtor entities,

including the Stalking Horse Purchaser or the Successful Bidder, as

applicable, if a SaleCo Transaction is consummated; and

(4) If the reorganized Debtors apply for one or more minimum funding

waivers at any time within the next 15 years, the PBGC shall support

all such applications.

To the extent that the PBGC accepts the Pension Settlement in accordance

with the terms hereof, the PBGC will be provided the following

treatment:

(1) If a SaleCo Transaction is consummated, the PBGC shall receive:

(i) Cash in the amount of $100 million; and

(ii) The Third Lien PBGC Note.

(2) If a WholeCo Restructuring is effectuated, the PBGC shall receive

the Second Lien PBGC Note.

OPEB Obligations

The Debtors’ OPEB obligations shall be unimpaired by the Plan. Nothing

herein effects the rights of the reorganized Debtors to modify or terminate

any of their OPEB plans or benefit obligations after the Effective Date,

including the right to modify or terminate OPEB obligations after the

Effective Date in accordance with their terms.

Comfort Letters

Avaya Inc. shall assume or reaffirm its support obligations under the letter

agreement between Avaya Inc. and Avaya International Sales Limited

(Ireland), dated January 16, 2016.

Tax Attributes The terms of the Plan and the restructuring contemplated by this

Term Sheet shall be structured to preserve favorable tax attributes of the

Debtors to the extent practicable and otherwise acceptable to the

Requisite Consenting Creditors.

Releases, Exculpation,

Injunction

The Plan shall provide for customary release, exculpation, and injunction

provisions acceptable to the Requisite Consenting Creditors and the

Debtors.

Corporate Governance [TBD]

Management Equity

Incentive Plan

The Board of Directors of the reorganized Debtors (the “New Board”)

will be authorized to implement a management equity incentive plan (the

“MEIP”) that provides for the issuance of options and/or other equity-

based compensation to the management of the reorganized Debtors.

Up to [●]% of the Reorganized RemainCo Common Stock or the

Reorganized WholeCo Common Stock, as applicable, on a fully diluted

basis, shall be reserved for issuances in connection with the MEIP.

9

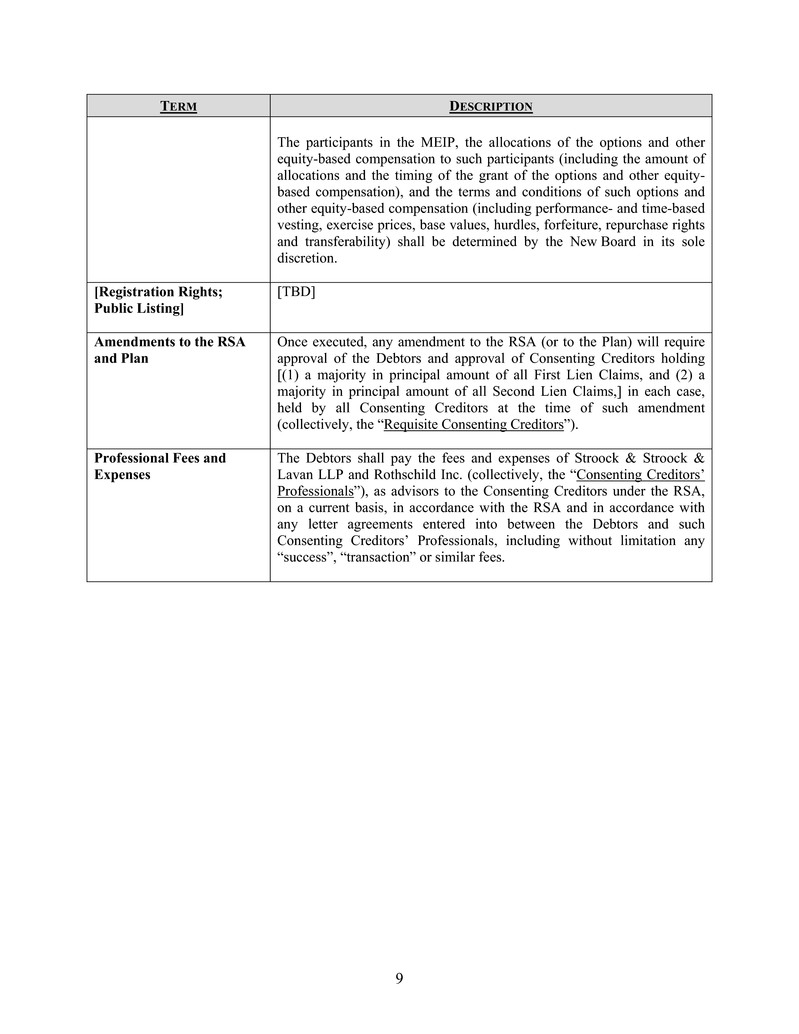

TERM DESCRIPTION

The participants in the MEIP, the allocations of the options and other

equity-based compensation to such participants (including the amount of

allocations and the timing of the grant of the options and other equity-

based compensation), and the terms and conditions of such options and

other equity-based compensation (including performance- and time-based

vesting, exercise prices, base values, hurdles, forfeiture, repurchase rights

and transferability) shall be determined by the New Board in its sole

discretion.

[Registration Rights;

Public Listing]

[TBD]

Amendments to the RSA

and Plan

Once executed, any amendment to the RSA (or to the Plan) will require

approval of the Debtors and approval of Consenting Creditors holding

[(1) a majority in principal amount of all First Lien Claims, and (2) a

majority in principal amount of all Second Lien Claims,] in each case,

held by all Consenting Creditors at the time of such amendment

(collectively, the “Requisite Consenting Creditors”).

Professional Fees and

Expenses

The Debtors shall pay the fees and expenses of Stroock & Stroock &

Lavan LLP and Rothschild Inc. (collectively, the “Consenting Creditors’

Professionals”), as advisors to the Consenting Creditors under the RSA,

on a current basis, in accordance with the RSA and in accordance with

any letter agreements entered into between the Debtors and such

Consenting Creditors’ Professionals, including without limitation any

“success”, “transaction” or similar fees.