Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - HARDINGE INC | ex991q1fy17earningsrelease.htm |

| 8-K - 8-K - HARDINGE INC | hardingeincq1fy17earningsr.htm |

© 2017 Hardinge Inc. 1 www.Hardinge.com

May 5, 2017

First Quarter 2017

Financial Results

© 2017 Hardinge Inc. 2 www.Hardinge.com

Safe Harbor Statement

This presentation may contain forward-looking statements (within the meaning of Section 27A of the Securities Act

of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended). Any such statements

are based upon management’s current expectations that involve risks and uncertainties. Any statements that are

not statements of historical fact or that are about future events may be deemed to be forward-looking statements.

For example, words such as “may”, “will”, “should”, “estimates”, “predicts”, “potential”, “continue”, “strategy”,

“believes”, “anticipates”, “plans”, “expects”, “intends” and similar expressions are intended to identify forward-

looking statements.

The Company’s actual results or outcomes and the timing of certain events may differ significantly from those

discussed in any forward-looking statements. The following factors are among those that could cause actual

results to differ materially from the forward-looking statements, which involve risks and uncertainties, and that

should be considered in evaluating any such statement: fluctuations in the machine tool business cycles,

changes in general economic conditions in the U.S. or internationally, the mix of products sold and the profit

margins thereon, the relative success of the Company’s entry into new product and geographic markets, the

Company’s ability to manage its operating costs, actions taken by customers such as order cancellations or

reduced bookings by customers or distributors, competitor’s actions such as price discounting or new product

introductions, governmental regulations and environmental matters, changes in the availability of cost of

materials and supplies, the implementation of new technologies and currency fluctuations. The Company

undertakes no obligation to publicly update any forward-looking statement, whether as a result of new

information, future events, or otherwise.

© 2017 Hardinge Inc. 3 www.Hardinge.com

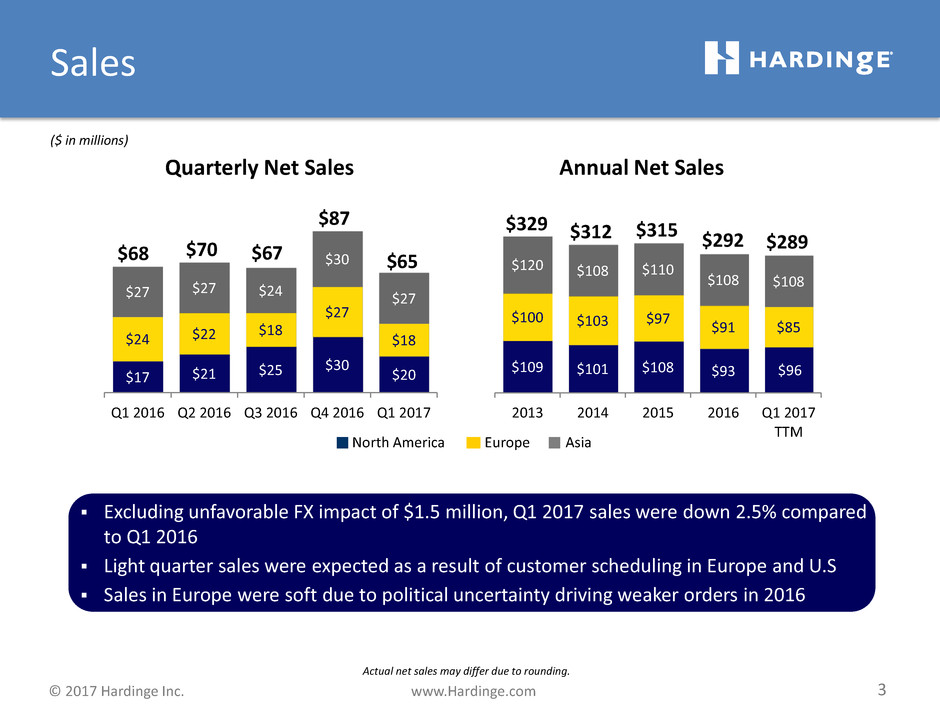

Sales

($ in millions)

$109 $101 $108 $93 $96

$100 $103 $97 $91 $85

$120 $108 $110

$108 $108

2013 2014 2015 2016 Q1 2017

TTM

$315 $292 $312 $289

$329

$17 $21 $25

$30

$20

$24 $22

$18

$27

$18

$27 $27 $24

$30

$27

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Quarterly Net Sales Annual Net Sales

Excluding unfavorable FX impact of $1.5 million, Q1 2017 sales were down 2.5% compared

to Q1 2016

Light quarter sales were expected as a result of customer scheduling in Europe and U.S

Sales in Europe were soft due to political uncertainty driving weaker orders in 2016

Actual net sales may differ due to rounding.

$68 $70 $67 $65

North America Europe Asia

$87

© 2017 Hardinge Inc. 4 www.Hardinge.com

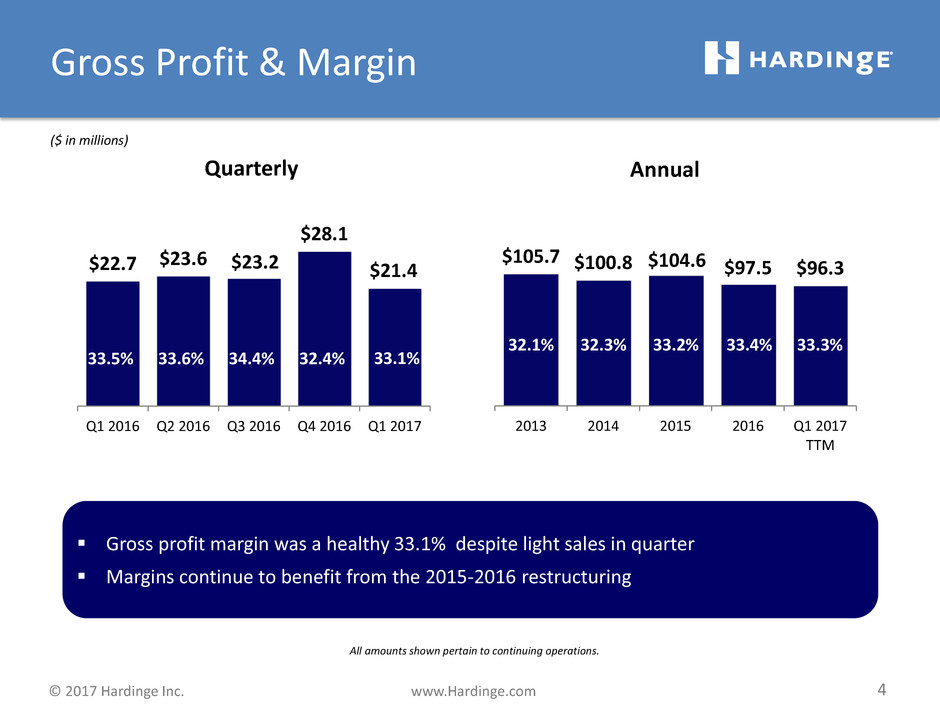

$22.7 $23.6 $23.2

$28.1

$21.4

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Gross Profit & Margin

Quarterly Annual

Gross profit margin was a healthy 33.1% despite light sales in quarter

Margins continue to benefit from the 2015-2016 restructuring

$105.7 $100.8 $104.6 $97.5 $96.3

2013 2014 2015 2016 Q1 2017

TTM

33.5% 33.6% 34.4% 32.4%

32.1% 32.3% 33.2% 33.4% 33.3%

All amounts shown pertain to continuing operations.

33.1%

($ in millions)

© 2017 Hardinge Inc. 5 www.Hardinge.com

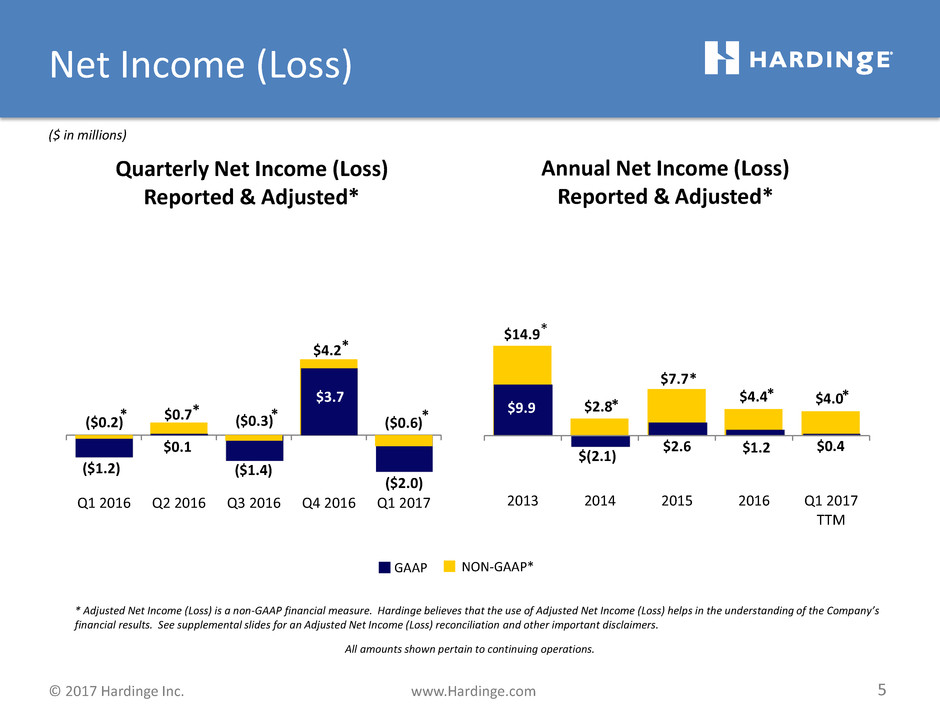

$14.9

$2.8

$7.7

$4.4 $4.0

*

($1.2)

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

($2.0)

$3.7

$0.1

($0.3) ($0.6)

* * * ($0.2)

$2.6

2013 2014 2015 2016 Q1 2017

TTM

$9.9

$(2.1)

$1.2 $0.4

Quarterly Net Income (Loss)

Reported & Adjusted*

Annual Net Income (Loss)

Reported & Adjusted*

Net Income (Loss)

($ in millions)

* Adjusted Net Income (Loss) is a non-GAAP financial measure. Hardinge believes that the use of Adjusted Net Income (Loss) helps in the understanding of the Company’s

financial results. See supplemental slides for an Adjusted Net Income (Loss) reconciliation and other important disclaimers.

All amounts shown pertain to continuing operations.

$0.7

GAAP NON-GAAP*

*

*

*

* *

($1.4)

$4.2 *

© 2017 Hardinge Inc. 6 www.Hardinge.com

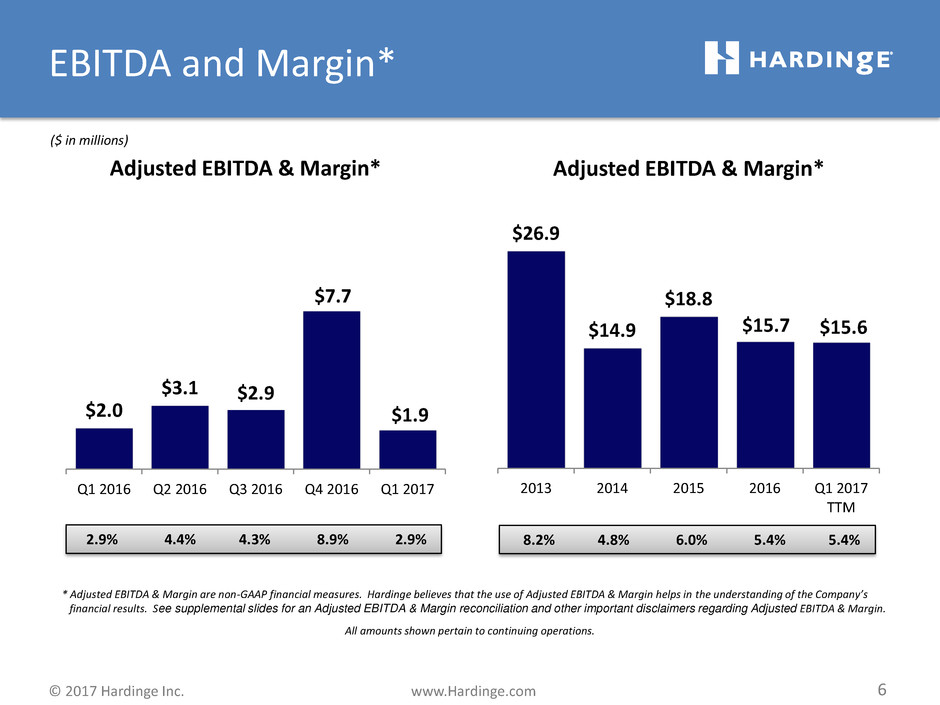

$26.9

$14.9

$18.8

$15.7 $15.6

2013 2014 2015 2016 Q1 2017

TTM

$2.0

$3.1 $2.9

$7.7

$1.9

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

EBITDA and Margin*

Adjusted EBITDA & Margin* Adjusted EBITDA & Margin*

* Adjusted EBITDA & Margin are non-GAAP financial measures. Hardinge believes that the use of Adjusted EBITDA & Margin helps in the understanding of the Company’s

financial results. See supplemental slides for an Adjusted EBITDA & Margin reconciliation and other important disclaimers regarding Adjusted EBITDA & Margin.

All amounts shown pertain to continuing operations.

8.2% 4.8% 6.0% 5.4% 5.4% 2.9% 4.4% 4.3% 8.9% 2.9%

($ in millions)

© 2017 Hardinge Inc. 7 www.Hardinge.com

($ in millions)

Annual Orders

$86 $105 $99 $102 $102

$95

$109 $97 $92 $96

$107

$117

$120 $117 $121

2013 2014 2015 2016 Q1 2017

TTM

$331

$288

$319

Quarterly Orders

$24 $26 $27 $25 $24

$17

$27 $20 $28 $21

$24

$28

$28

$37

$28

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

$81

$75

Orders were up 12% in Q1 2017 over Q1 2016, with strength in Europe and Asia:

Europe +24%, Asia +17%, North America (1)%

North America orders showed significant strength in March

Order strength globally driven by demand for grinding machines

Actual orders may differ due to rounding.

$316

$73

Geographic Diversity

$65

$311

North America Europe Asia

$90

© 2017 Hardinge Inc. 8 www.Hardinge.com

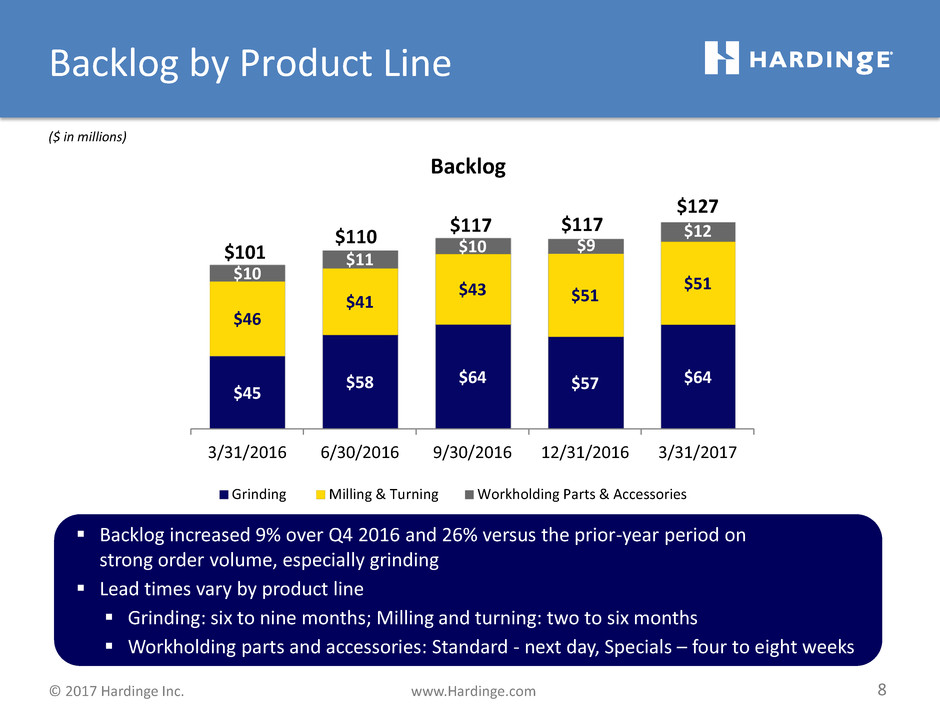

($ in millions)

Backlog

Backlog increased 9% over Q4 2016 and 26% versus the prior-year period on

strong order volume, especially grinding

Lead times vary by product line

Grinding: six to nine months; Milling and turning: two to six months

Workholding parts and accessories: Standard - next day, Specials – four to eight weeks

$45

$58 $64 $57 $64

$46

$41

$43 $51

$51

$10

$11

$10 $9

$12

3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Grinding Milling & Turning Workholding Parts & Accessories

$127

Backlog by Product Line

$101

$110

$117

$117

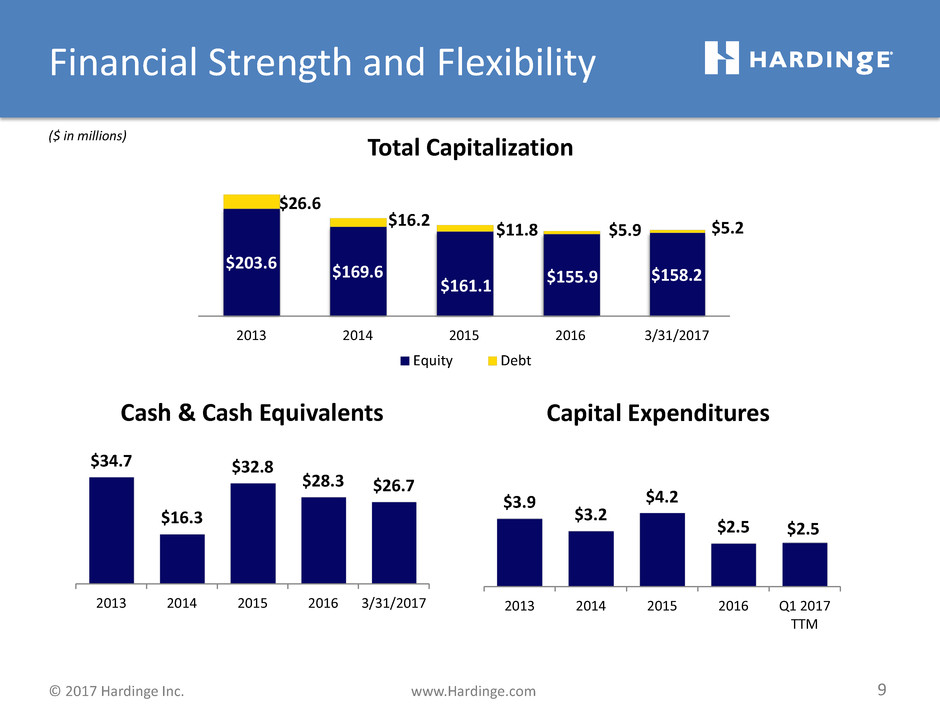

© 2017 Hardinge Inc. 9 www.Hardinge.com

$203.6 $169.6

$161.1 $155.9

$158.2

$26.6

$16.2

$11.8 $5.9 $5.2

2013 2014 2015 2016 3/31/2017

Equity Debt

$34.7

$16.3

$32.8

$28.3 $26.7

2013 2014 2015 2016 3/31/2017

Total Capitalization

($ in millions)

$3.9

$3.2

$4.2

$2.5 $2.5

2013 2014 2015 2016 Q1 2017

TTM

Cash & Cash Equivalents Capital Expenditures

Financial Strength and Flexibility

© 2017 Hardinge Inc. 10 www.Hardinge.com

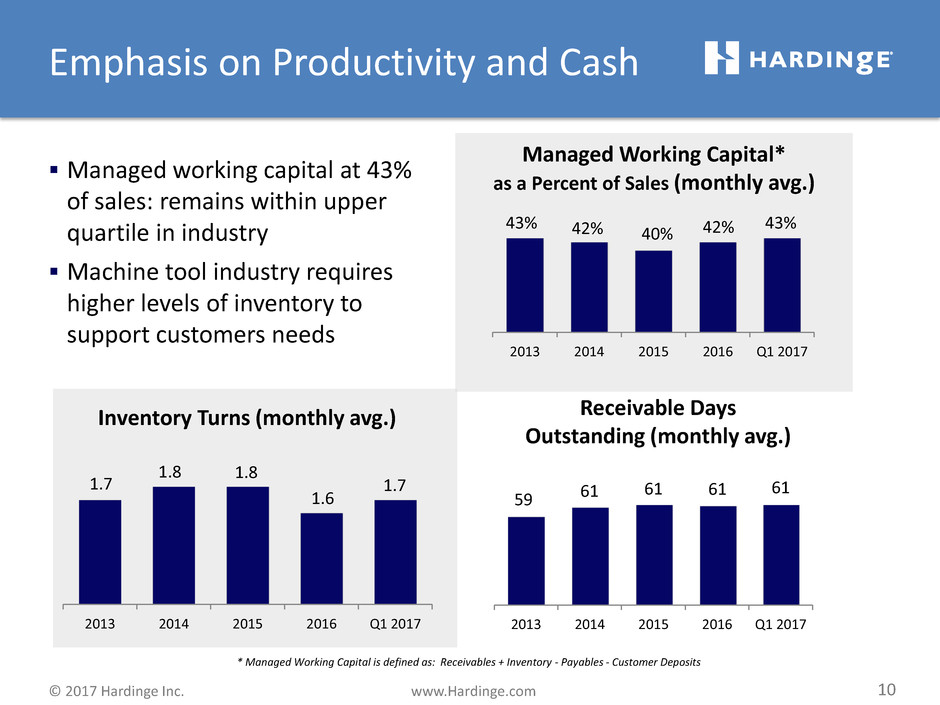

59 61

61 61 61

2013 2014 2015 2016 Q1 2017

Inventory Turns (monthly avg.) Receivable Days

Outstanding (monthly avg.)

* Managed Working Capital is defined as: Receivables + Inventory - Payables - Customer Deposits

43% 42% 40% 42%

43%

2013 2014 2015 2016 Q1 2017

1.7

1.8 1.8

1.6

1.7

2013 2014 2015 2016 Q1 2017

Managed Working Capital*

as a Percent of Sales (monthly avg.)

Emphasis on Productivity and Cash

Managed working capital at 43%

of sales: remains within upper

quartile in industry

Machine tool industry requires

higher levels of inventory to

support customers needs

© 2017 Hardinge Inc. 11 www.Hardinge.com

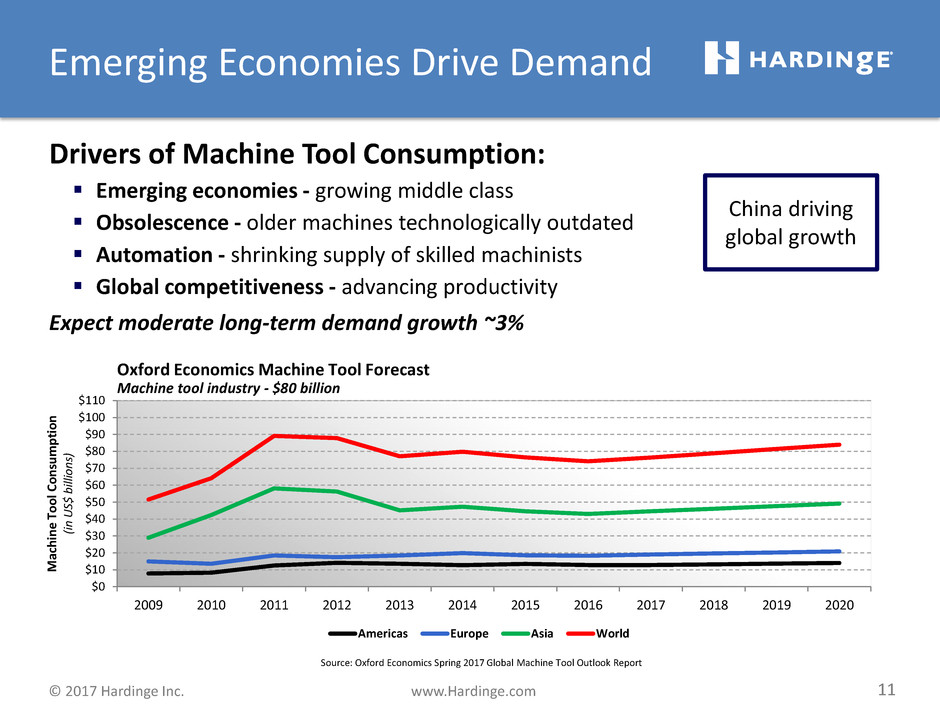

Source: Oxford Economics Spring 2017 Global Machine Tool Outlook Report

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

$110

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020

Americas Europe Asia World

M

ach

in

e

To

o

l C

o

n

su

m

p

ti

o

n

(in

U

S$

b

ill

io

n

s)

Oxford Economics Machine Tool Forecast

Machine tool industry - $80 billion

Drivers of Machine Tool Consumption:

Emerging economies - growing middle class

Obsolescence - older machines technologically outdated

Automation - shrinking supply of skilled machinists

Global competitiveness - advancing productivity

Expect moderate long-term demand growth ~3%

Emerging Economies Drive Demand

China driving

global growth

© 2017 Hardinge Inc. 12 www.Hardinge.com

2017 Outlook

Expecting moderate sales growth in 2017

Solid order activity across all product lines, particularly grinding

Order strength and backlog levels point to improved 2017 revenue

Strong aftermarket activity as leading indicator

Well positioned to benefit from building momentum in the machine tool

industry

EBITDA will reflect full year of post 2015-2016 restructuring

cost savings

New restructuring program to generate additional $2.0 million

to $2.5 million in annualized savings upon completion

To be completed by mid-2018

Restructuring costs estimated to be $3.8 million to $4.3 million;

approximately $1.6 million noncash

© 2017 Hardinge Inc. 13 www.Hardinge.com

May 5, 2017

First Quarter 2017

Financial Results

© 2017 Hardinge Inc. 14 www.Hardinge.com

SUPPLEMENTAL

INFORMATION

© 2017 Hardinge Inc. 15 www.Hardinge.com

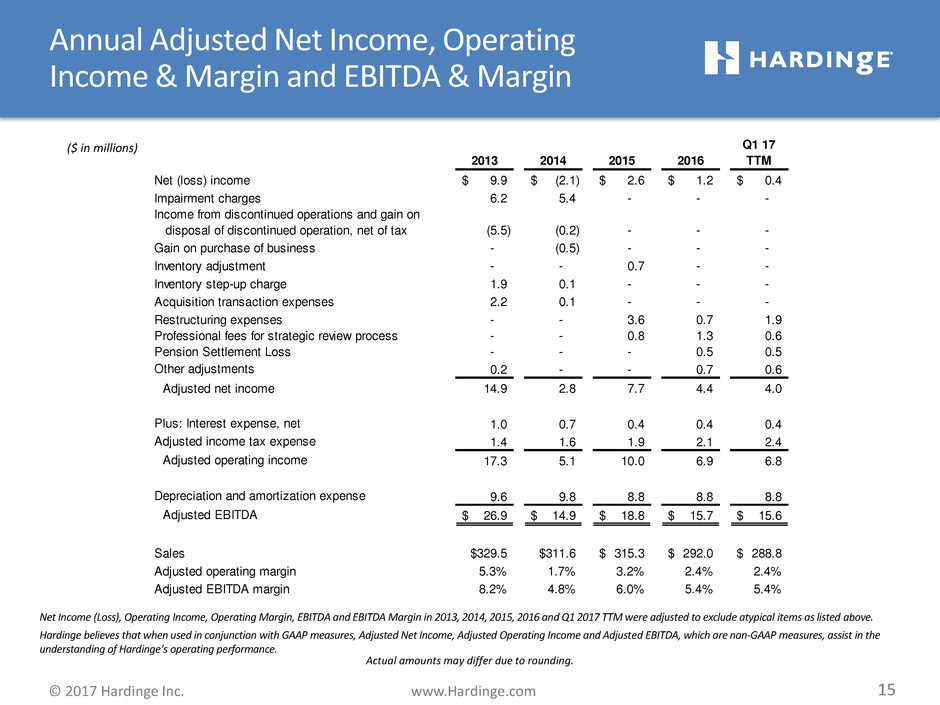

Annual Adjusted Net Income, Operating

Income & Margin and EBITDA & Margin

Net Income (Loss), Operating Income, Operating Margin, EBITDA and EBITDA Margin in 2013, 2014, 2015, 2016 and Q1 2017 TTM were adjusted to exclude atypical items as listed above.

Hardinge believes that when used in conjunction with GAAP measures, Adjusted Net Income, Adjusted Operating Income and Adjusted EBITDA, which are non-GAAP measures, assist in the

understanding of Hardinge’s operating performance.

Actual amounts may differ due to rounding.

($ in millions)

2013 2014 2015 2016

Q1 17

TTM

Net (loss) income 9.9$ (2.1)$ 2.6$ 1.2$ 0.4$

Impairment charges 6.2 5.4 - - -

Income from discontinued operations and gain on

disposal of discontinued operation, net of tax (5.5) (0.2) - - -

Gain on purchase of business - (0.5) - - -

Inventory adjustment - - 0.7 - -

Inventory step-up charge 1.9 0.1 - - -

Acquisition transaction expenses 2.2 0.1 - - -

Restructuring expenses - - 3.6 0.7 1.9

Professional fees for strategic review process - - 0.8 1.3 0.6

Pension Settlement Loss - - - 0.5 0.5

Other adjustments 0.2 - - 0.7 0.6

Adjusted net income 14.9 2.8 7.7 4.4 4.0

Plus: Interest expense, net 1.0 0.7 0.4 0.4 0.4

Adjusted income tax expense 1.4 1.6 1.9 2.1 2.4

Adjusted operating income 17.3 5.1 10.0 6.9 6.8

Depreciation and amortization expense 9.6 9.8 8.8 8.8 8.8

Adjusted EBITDA 26.9$ 14.9$ 18.8$ 15.7$ 15.6$

Sales $329.5 $311.6 315.3$ 292.0$ 288.8$

Adjusted operating margin 5.3% 1.7% 3.2% 2.4% 2.4%

Adjusted EBITDA margin 8.2% 4.8% 6.0% 5.4% 5.4%

© 2017 Hardinge Inc. 16 www.Hardinge.com

Quarterly Adjusted Net Income (Loss), Operating

Income (Loss) & Margin and EBITDA & Margin

Quarterly Net Income (Loss) , Operating Income (Loss) , Operating Margin, EBITDA and EBITDA Margin in all periods presented were adjusted to exclude atypical items as listed above.

Hardinge believes that when used in conjunction with GAAP measures, Adjusted Net Income (Loss), Adjusted Operating Income (Loss) and Adjusted EBITDA, which are non-GAAP

measures, assist in the understanding of Hardinge’s operating performance.

Actual amounts may differ due to rounding.

($ in millions)

Q1 2016 Q2 2016 Q3 2016 Q4 2016 Q1 2017

Net (loss) income (1.2)$ 0.1$ (1.4)$ 3.7$ (2.0)$

Restructuring expenses 0.2 0.2 0.2 0.1 1.4

Professional fees for strategic review process 0.7 0.4 0.1 0.1 -

Pension Settlement Loss - - 0.6 (0.1) -

Other adjustments 0.1 - 0.2 0.4 -

Adjusted net income (loss) (0.2) 0.7 (0.3) 4.2 (0.6)

Plus: Interest expense, net 0.1 0.1 0.1 0.1 0.1

Adjusted income tax expense (benefit) (0.1) 0.1 0.9 1.2 0.2

Adjusted operating income (loss) (0.2) 0.9 0.7 5.5 (0.3)

Depreciation and amortization expense 2.2 2.2 2.2 2.2 2.2

Adjusted EBITDA 2.0$ 3.1$ 2.9$ 7.7$ 1.9$

Sales 67.8 70.2 67.2 86.8 64.6

Adjusted operating margin (0.3)% 1.3 % 1.0 % 6.3 % (0.5)%

Adjusted EBITDA margin 2.9 % 4.4 % 4.3 % 8.9 % 2.9 %

© 2017 Hardinge Inc. 17 www.Hardinge.com

(in millions, except per share data)

Quarterly Financial Appendix

Actual amounts may differ due to rounding.

6/30/2015 9/30/2015 12/31/2015 3/31/2016 6/30/2016 9/30/2016 12/31/2016 3/31/2017

Sales 82.4$ 76.8$ 87.0$ 67.8$ 70.2$ 67.2$ 86.8$ 64.6$

Cost of sales 55.4 51.4 56.6 45.1 46.6 44.0 58.7 43.2

Gross profit 27.0 25.4 30.4 22.7 23.6 23.2 28.1 21.4

Gross profit margin 32.8% 33.1% 34.9% 33.5% 33.6% 34.4% 32.4% 33.1%

Selling, general and administrative expenses 21.1 19.9 20.7 20.5 19.7 20.0 19.3 18.0

Research & development 3.5 3.7 3.4 3.3 3.4 3.3 3.6 3.6

Restructuring charges - 0.9 2.7 0.2 0.2 0.2 0.1 1.4

Impairment charges - - - - - - - -

Other expense (income) - 0.2 0.4 (0.1) - 0.3 0.1 0.2

Income (loss) from operations 2.4 0.7 3.2 (1.2) 0.3 (0.6) 5.0 (1.8)

Operating margin 2.9 % 1.0 % 3.7 % (1.8)% 0.4 % (0.9)% 5.8 % (2.8)%

Interest expense, net 0.1 0.1 0.1 0.1 0.1 0.1 0.1 0.1

Income (loss) before income taxes 2.3 0.6 3.1 (1.3) 0.2 (0.7) 4.9 (1.9)

Income tax expense (benefit) 0.7 0.9 0.4 (0.1) 0.1 0.7 1.2 0.2

Net income (loss) 1.6$ (0.3)$ 2.7$ (1.2)$ 0.1$ (1.4)$ 3.7$ (2.0)$

Basic earnings (loss) per share:

Earnings (loss) per share 0.12$ (0.03)$ 0.22$ (0.10)$ 0.01$ (0.11)$ 0.29$ (0.16)$

Diluted earnings (loss) per share:

Earnings (loss) per share 0.12$ (0.03)$ 0.21$ (0.10)$ 0.01$ (0.11)$ 0.29$ (0.16)$

Cash dividends declared per share 0.02$ 0.02$ 0.02$ 0.02$ 0.02$ 0.02$ 0.02$ 0.02$

Weighted avg. shares outstanding: Basic 12.8 12.8 12.8 12.8 12.8 12.8 12.9 12.9

Weighted avg. shares outstanding: Diluted 12.9 12.8 12.9 12.8 12.9 12.8 12.9 12.9