Attached files

| file | filename |

|---|---|

| EX-23 - EX-23 - HARDINGE INC | a2202580zex-23.htm |

| EX-32 - EX-32 - HARDINGE INC | a2202580zex-32.htm |

| EX-21 - EX-21 - HARDINGE INC | a2202580zex-21.htm |

| EX-31.1 - EX-31.1 - HARDINGE INC | a2202580zex-31_1.htm |

| EX-31.2 - EX-31.2 - HARDINGE INC | a2202580zex-31_2.htm |

| EX-10.23 - EX-10.23 - HARDINGE INC | a2202580zex-10_23.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One) |

||

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2010 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

|

For the transition period from to |

||

Commission File Number 0-15760 |

||

HARDINGE INC.

(Exact name of registrant as specified in its charter)

| New York | 16-0470200 | |

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) | |

One Hardinge Drive, Elmira, New York |

14902-1507 |

|

| (Address of principal executive offices) | (Zip Code) |

(607) 734-2281

(Registrant's telephone number, including area code)

Securities pursuant to section 12(b) of the Act: None

Securities pursuant to section 12(g) of the Act:

| Common Stock, $0.01 par value per share | NASDAQ Global Select Market (Name of exchange on which registered) |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d). Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted to its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulations S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes o No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definite proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendments to this Form 10-K. ý

Indicate by check mark whether the registrant: (1) is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer," and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer ý | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether registrant is a shell company (as defined by Exchange Act Rule 12b-2). Yes o No ý

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2010 was $95.5 million, based on the closing price of common stock on the NASDAQ Global Select Market on June 30, 2010.

There were 11,629,027 shares of Hardinge stock outstanding as of February 28, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of Hardinge Inc.'s Proxy Statement for its 2011 Annual Meeting of Shareholders to be filed with the Commission on or about March 31, 2011 are incorporated by reference to Part III of this Form 10-K.

General

Hardinge Inc.'s principal executive office is located within Chemung County at One Hardinge Drive, Elmira, New York 14902-1507.

Our website, www.hardinge.com, provides links to all of the Company's filings with the Securities and Exchange Commission. A copy of the 10-K is available on the website or can be obtained free of charge by contacting the Investor Relations Department at our principal executive office. Alternatively, such reports may be accessed at the Internet address of the SEC, which is www.sec.gov, or at the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549. Information about the operation of the SEC's Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330.

We are a global designer, manufacturer and distributor of machine tools, specializing in precision computer numerically controlled metal-cutting machines. The Company has the following direct and indirect wholly owned subsidiaries:

Canadian Hardinge Machine Tools, Ltd |

Toronto, Ontario, Canada | |

Hardinge Technology Systems, Inc. |

Elmira, New York | |

Hardinge Holdings GmbH |

St. Gallen, Switzerland | |

Hardinge Holdings B.V. |

Amsterdam, Netherlands | |

Hardinge GmbH |

Krefeld, Germany | |

Hardinge Machine Tools, Ltd. |

Leicester, England | |

Hardinge Machine Tools B.V. |

Raamsdonksveer, Netherlands | |

L. Kellenberger & Co. AG |

St. Gallen, Switzerland | |

Jones & Shipman Grinding Limited |

Leicester, England | |

Jones & Shipman SARL |

Cedex, France | |

Hardinge China, Limited |

Hong Kong, People's Republic of China | |

Hardinge Machine (Shanghai) Co., Ltd. |

Shanghai, People's Republic of China | |

Hardinge Precision Machinery (Jiaxing) Company, Limited |

Jiaxing, People's Republic of China | |

Hardinge Taiwan Precision Machinery Limited |

Nan Tou City, Taiwan, Republic of China | |

Hardinge Machine Tools B.V., Taiwan Branch |

Nan Tou City, Taiwan, Republic of China |

We have manufacturing facilities located in Switzerland, Taiwan, the United States, China, and the United Kingdom. We manufacture the majority of the products we sell.

Unless otherwise mentioned or unless the context requires otherwise, all references to "Hardinge," "we," "us," "our," "the Company" or similar references mean Hardinge Inc. and its predecessors together with its subsidiaries.

Products

We supply high precision computer controlled metal-cutting turning machines, grinding machines, vertical machining centers, and accessories related to those machines. We believe our products are known for accuracy, reliability, durability and value.

We have been a manufacturer of industrial-use high precision and general precision turning machine tools since 1890. Turning machines, or lathes, are power-driven machines used to remove material from either bar stock or a rough-formed part by moving multiple cutting tools against the surface of a part rotating at very high speeds in a spindle mechanism. The multi-directional movement of the cutting tools allows the part to be shaped to the desired dimensions. On parts produced by our machines, those dimensions are often measured in millionths of an inch. We consider Hardinge to be a

2

leader in the field of producing machines capable of consistently and cost-effectively producing parts to very close dimensions.

Grinding is a machining process in which a part's surface is shaped to closer tolerances with a rotating abrasive wheel or tool. Grinding machines can be used to finish parts of various shapes and sizes. The grinding machines of our Kellenberger subsidiary are used to grind the inside and outside diameters of cylindrical parts. Such grinding machines are typically used to provide a more exact finish on a part that has been partially completed on a lathe. The grinding machines of Kellenberger, which are manufactured in both computer and manually controlled models, are generally purchased by the same type of customers as other Hardinge equipment and further our ability to be a primary source for our customers.

Our Kellenberger precision grinding technology is complemented by the Hauser and Tschudin grinding brands. Hauser machines are jig grinders used to make demanding contour components, primarily for tool and mold-making applications. Tschudin product technology is focused on the specialized grinding of cylindrical parts when the customer requires high volume production. Our Tschudin machines are generally equipped with automatic loading and unloading mechanisms for the part being machined. These loading and unloading mechanisms significantly reduce the level of involvement a machine operator has to perform in the production process.

During 2010, the Company established Jones & Shipman Grinding Limited after acquiring the assets of Jones and Shipman, a UK-based manufacturer of grinding and super-abrasive machines and machining systems. Jones & Shipman manufactures and distributes a range of high-quality grinding (surface, creep feed and cylindrical) machines used by a diverse range of industries.

Machining centers cut material differently than a turning machine. These machines are designed to remove material from stationary, prismatic or box-like parts of various shapes with rotating tools that are capable of milling, drilling, tapping, reaming and routing. Machining centers have mechanisms that automatically change tools based on commands from a built-in computer control without the assistance of an operator. Machining centers are generally purchased by the same customers who purchase other Hardinge equipment. We supply a broad line of machining centers under the Bridgeport brand name addressing a range of sizes, speeds and powers.

Our machines are generally computer controlled and use commands from an integrated computer to control the movement of cutting tools, grinding wheels, part positioning, and in the case of turning and grinding machines, the rotation speeds of the part being shaped. The computer control enables the operator to program operations such as part rotation, tooling selection and tooling movement for a specific part and then store that program in memory for future use. The machines are able to produce parts while left unattended when connected to automatic bar-feeding, robotics equipment, or other material handling devices designed to supply raw materials and remove machined parts from the machine.

New products are critical to our growth plans. We gain access to new products through internal product development, acquisitions, joint ventures, license agreements and partnerships. Products are introduced each year to both broaden our product offering and to take advantage of new technologies available to us. These technologies generally allow our machines to run at higher speeds and with more power, thus increasing their efficiency. Customers routinely replace old machines with newer machines that can produce parts faster and with less time to set up the machine when converting from one type of part to another. Generally, our machines can be used to produce parts from all of the standard ferrous and non-ferrous metals, as well as plastics, composites and exotic materials.

We focus on products and solutions for companies making parts from hard to machine materials with hard to sustain close tolerances and hard to achieve surface finishes and which also may be hard to hold in the machine. We believe that with our high precision and super precision lathes, our grinding machines, and our rugged machining centers, combined with our accessory products and our technical

3

expertise, we are uniquely qualified to be the supplier of choice for customers manufacturing to demanding specifications.

On many of our machines, multiple options are available which allow customers to customize their machines to their specific operating performance and cost objectives. We produce machines for stock with popular option combinations for immediate delivery, as well as design and produce machines to specific customer requirements. In addition to our machines, we provide the necessary tooling, accessories and support services to assist customers in maximizing their return on investment.

The sale of repair parts is important to our business. Certain parts on machines wear over time or break through misuse. Customers will buy parts from us throughout the life of the machine, which is generally measured in multiple years. There are thousands of machines in operation in the world for which we provide those repair parts and in many cases the parts are available exclusively from us. In addition, we offer an extensive line of accessories including workholding, toolholding and other industrial support products, which may be used on both our machines and those produced by others.

We offer various warranties on our equipment and consider post-sale support to be a critical element of our business. Warranties on machines typically extend for twelve months after purchase. Services provided include operation and maintenance training, in-field maintenance, and in-field repair. We offer these post sales support services on a paid basis throughout the life of the machine. In territories covered by distributors, this support and service is offered through the distributor.

Sales, Markets and Distribution

We sell our products in most of the industrialized countries of the world through a combination of distributors, agents, and manufacturers' representatives. In certain areas of China, France, Germany, Netherlands, North America, and the United Kingdom, we have also used a direct sales force for portions of our product lines. Generally, our distributors have an exclusive right to sell our products in a defined geographic area. Our distributors operate as independent businesses and purchase products from us at discounted prices for their customers, while agents and representatives sell products on our behalf and receive commissions on sales. Our discount schedule is adjusted to reflect the level of pre and post sales support offered by our distributors. Our direct sales personnel earn a fixed salary plus commission. Sales through distributors are made only on standard commercial open account terms or through letters of credit. Distributors generally take title to products upon shipment from our facilities and do not have any special return privileges.

In 2010, we restructured our U.S. sales channels from a joint distributor network and direct sales force to a new group of distributors. These new distribution partners have exclusive sales, service, and support responsibilities for Hardinge and Bridgeport branded machines and repair parts in virtually all of the United States, with the exception of kneemills and workholding accessories, where they will operate on a non-exclusive basis. Additionally, members of this new distributor network will act as agents for our grinding products working with our direct technical team.

Our non-machine products are sold in the U.S. mainly through direct telephone orders to a toll-free telephone number and via our web site. In most cases, we are able to package and ship in-stock tooling and repair parts within 24 hours of receiving orders. We can package and ship items with heavy demand within a few hours. In other parts of the world, these products are sold on either a direct sales basis or through distributor arrangements.

We promote recognition of our products in the marketplace through advertising in trade publications, web presences, email newsletters, and participation in industry trade shows. In addition, we market our non-machine products through publication of general catalogues and other targeted catalogues, which we distribute to existing and prospective customers. We have a substantial presence on the internet at www.hardinge.com where customers can obtain information about our products and place orders for workholding, rotary, and kneemill products.

4

A substantial portion of our sales are to small and medium-sized independent job shops, which in turn sell machined parts to their industrial customers. Industries directly and indirectly served by us include aerospace, automotive, computer, communications, consumer-electronics, construction equipment, defense, energy, farm equipment, medical equipment, recreational equipment and transportation.

A customer who is a supplier to the consumer electronics industry accounted for 10.7% of our consolidated sales in 2010, and one customer who is a supplier to the automotive industry accounted for 6.8% of our consolidated sales in 2009. While valuing our relationship with each customer, we do not believe that the loss of any single customer, or any few customers, would have an adverse material effect on our business.

Hardinge Inc. operates in a single business segment, industrial machine tools.

Competitive Conditions

In our industry, the barriers to entry for competition vary based on the level of product performance required. For the products with the highest performance in terms of accuracy and productivity, the barriers are generally technical in nature. For basic products, often the barriers are not technical; they are tied to product availability, competitive price position, and an effective distribution model that offers the pre and post sales support required by customers. Another significant barrier in the global machine tool industry is the high level of working capital that is required to operate the business.

We compete in the various segments of the machine tool market within the products of turning, milling, grinding and workholding. We compete with numerous vendors in each market segment we serve. The primary competitive factors in the marketplace for our machine tools are reliability, price, delivery time, service and technological characteristics. Our management considers our segment of the industry to be extremely competitive. There are many manufacturers of machine tools in the world. They can be categorized by the size of material their products can machine and the precision level they can achieve. For our high precision, multi-tasking turning and milling equipment, competition comes primarily from companies such as Mori-Seiki, Mazak, and Okuma, which are based in Japan, and DMG, which is based in Germany. Competition in our more standard turning and milling equipment comes to some degree from those companies as well as Doosan, which is based in South Korea, and Haas which is based in the U.S., as well as several smaller Taiwanese and Korean companies. Our cylindrical grinding machines compete primarily with Studer, a Swiss Company as well as Toyoda and Shigiya, which are based in Japan. Our Hauser jig grinding machines compete primarily with Moore Tool, which is based in the U.S., and some Japanese suppliers. Our surface grinding machines compete with Okamota in Japan, and Chevalier in Taiwan. Our accessories products compete with many smaller companies.

The overall number of our competitors providing product solutions serving our market segments may increase. Also, the composition of competitors may change as we broaden our product offerings and the geographic markets we serve. As we expand into new market segments, we will face competition not only from our existing competitors but from other competitors as well, including existing companies with strong technological, marketing and sales positions in those markets. In addition, several of our competitors may have greater resources, including financial, technical and engineering resources, than we do.

Sources and Availability of Components

We produce certain of our lathes, knee-mills, and related products at our Elmira, New York plant. The Kellenberger grinding machines and related products are manufactured at our St. Gallen, Switzerland plant and Hauser and Tschudin products are produced at our Biel, Switzerland facility. The Jones & Shipman grinding machines are manufactured at our Leicester, England plant. We produce

5

machining centers and lathes at both Hardinge Taiwan in Nan Tou, Taiwan and Hardinge Machine (Shanghai) Co., Ltd. in Shanghai, China. We manufacture products from various raw materials, including cast iron, sheet metal, and bar steel. We purchase a number of components, sub-assemblies and assemblies from outside suppliers, including the computer and electronic components for our computer controlled lathes, grinding machines, and machining centers. There are multiple suppliers for virtually all of our raw material, components, sub-assemblies and assemblies and historically, we have not experienced a serious supply interruption, however with the recent increase in demand driven by worldwide order activity, producers of bearings, ballscrews, and linear guides have had difficulty meeting demand, which could impact our production schedules in the future.

In 2009, we began strategic changes within our Elmira, NY manufacturing facility, which historically was vertically integrated with machining operations converting parts from raw castings to finished goods, the costs of which proved to be prohibitive. We have moved towards a more variable cost business model, outsourcing many of the non-critical components and subassemblies for machines which were being made in the Elmira facility. In conjunction with our decision to outsource certain parts and subassemblies, we identified certain property, plant and equipment that was no longer required for our manufacturing operations and sold them in 2010.

A major component of our computer controlled machines is the computer and related electronics package. We purchase these components for our lathes and machining centers primarily from Fanuc Limited, a large Japanese electronics company and Heidenhain, a German control supplier. We also utilize controls from Siemens, another German control manufacturer, on certain machine models in our line of machining centers. On our grinding machines we offer Heidenhain and Fanuc controls. While we believe that design changes could be made to our machines to allow sourcing from several other existing suppliers, and we occasionally do so for special orders, a disruption in the supply of the computer controls from one of our suppliers could cause us to experience a substantial disruption of our operations, depending on the circumstances at the time. We purchase parts from these suppliers under normal trade terms. There are no agreements with these suppliers to purchase minimum volumes per year.

Research and Development

Our ongoing research and development program involves creating new products, modifying existing products to meet market demands, and redesigning existing products, both to add new functionality and to reduce the cost of manufacturing. The research and development departments throughout the world are staffed with experienced design engineers with varying levels of education, ranging from technical to doctoral degrees.

The worldwide cost of research and development, all of which has been charged to cost of goods sold, amounted to $9.4 million, $9.3 million and $9.8 million, in 2010, 2009, and 2008, respectively.

Patents

Although Hardinge Inc. holds several patents with respect to certain of its products, we do not believe that our business is dependent to any material extent upon any single patent or group of patents.

Seasonal Trends and Working Capital Requirements

Hardinge's business and that of the machine tool industry in general, is cyclical. It is not subject to significant seasonal trends. However, our quarterly results are subject to fluctuation based on the timing of our shipments of machine tools, which are largely dependent upon customer delivery requirements. Historically, we have experienced reduced activity during the third quarter of the year, largely as a result of vacations scheduled at our U.S. and European customers' plants and our policy of closing our U.S. and Switzerland facilities for two weeks during the third quarter. While not reflective of 2008

6

through 2010, due to the economic crisis (discussed further in Item 1A-Risk Factors), our third-quarter net sales, income from operations and net income typically have been the lowest of any quarter during the year. However, given the larger percentage of our sales now from Asia, the impact of plant shutdowns by us and our customers due to the Chinese New Year may impact first quarter net sales, income from operations and net income and result in the first quarter being the lowest quarter of the year.

The ability to deliver products within a short period of time is an important competitive criterion. We must have inventory on hand to meet customers' delivery expectations, which for standard machines are typically from immediate to eight weeks delivery. Meeting this requirement is especially difficult with some of our products, where delivery is extended due to ocean travel times, depending on the location of the customer. This creates a need to have inventory of finished machines available in our major markets to serve our customers in a timely manner.

We deliver many of our machine products within one to two months after the order. Some orders, especially multiple machine orders, are delivered on a turnkey basis with the machine or group of machines configured to make certain parts for the customer. This type of order often includes the addition of material handling equipment, tooling and specific programming. In those cases the customer usually observes and inspects the parts being made on the machine at our facility before it is shipped and the timing of the sale is dependent upon the customer's schedule and acceptance. Therefore, sales from quarter-to-quarter can vary depending upon the timing of those customers' acceptances and the significance of those orders.

We feel it is important, where practical, to provide readily available workholding and replacement parts for the machines we sell and we carry inventory at levels sufficient to meet these customer requirements.

Governmental Regulations

We believe that our current operations and our current uses of property, plant and equipment conform in all material respects to applicable laws and regulations.

Governmental Contracts

No material portion of our business is subject to government contracts.

Environmental Matters

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters.

Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Activities at properties we own or previously owned and on adjacent areas have resulted in environmental impacts.

In particular, our Elmira, New York manufacturing facility is located within the Kentucky Avenue Wellfield on the National Priorities List of hazardous waste sites designated for cleanup by the United States Environmental Protection Agency ("EPA") because of groundwater contamination. The Kentucky Avenue Wellfield Site (the "Site") encompasses an area which includes sections of the Town of Horseheads and the Village of Elmira Heights in Chemung County, New York. In February 2006, the Company received a Special Notice Concerning a Remedial Investigation/Feasibility Study ("RI/FS") for the Koppers Pond (the "Pond") portion of the Site. The EPA documented the release and threatened release of hazardous substances into the environment at the Site, including releases into and in the vicinity of the Pond. The hazardous substances, including metals and polychlorinated biphenyls, have been detected in sediments in the Pond.

7

A substantial portion of the Pond is located on our property. Hardinge, along with Beazer East, Inc., the Village of Horseheads, the Town of Horseheads, the County of Chemung, CBS Corporation, and Toshiba America, Inc., the Potentially Responsible Parties (the PRPs") have agreed to voluntarily participate in the Remedial Investigation and Feasibility Study ("RI/FS") by signing an Administrative Settlement Agreement and Order of Consent on September 29, 2006. On September 29, 2006, the Director of Emergency and Remedial Response Division of the U.S. Environmental Protection Agency, Region II, approved and executed the Agreement on behalf of the EPA. The PRPs also signed a PRP Member Agreement, agreeing to share the cost of the RI/FS study on a per capita basis. The cost of the RI/FS was estimated to be approximately $0.84 million. We estimate our portion of the study to be $0.12 million for which we have established a reserve of $0.13 million. As of December 31, 2010 we have incurred total expenses of $0.12 million with respect to the study and other activities relating to the Site. The remaining reserve balance at December 31, 2010 is $0.01 million.

The PRPs developed a Draft RI/FS with their consultants and, following EPA comments, submitted a Revised RI/FS on December 6, 2007. In May 2008, the EPA approved the RI/FS Work Plan. The PRPs commenced field work in the spring of 2008 and submitted a Draft Site Characterization Report to EPA in the fall. The PRPs currently are performing Risk Assessments in accordance with the Remedial Investigation portion of the RI/FS.

Until receipt of this Special Notice, Hardinge had never been named as a PRP at the Site nor had we received any requests for information from the EPA concerning the site. Environmental sampling on our property within this Site under supervision of regulatory authorities had identified off-site sources for such groundwater contamination and sediment contamination in the Pond and found no evidence that our operations or property have or are contributing to the contamination. Other than as described above, we have not established a reserve for any potential costs relating to this Site, as it is too early in the process to determine our responsibility as well as to estimate any potential costs to remediate. We have notified all appropriate insurance carriers and are actively cooperating with them, but whether coverage will be available has not yet been determined and possible insurance recovery cannot now be estimated with any degree of certainty.

Although we believe, based upon information currently available, that, except as described in the preceding paragraphs, we will not have material liabilities for environmental remediation, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to Hardinge.

Employees

As of December 31, 2010 Hardinge Inc. employed 1,189 persons, 363 of whom were located in the United States. None of our U.S. employees are covered by collective bargaining agreements. Management believes that relations with its employees are good.

Foreign Operations and Export Sales

Information related to foreign and domestic operations and sales is included in Note 7 to the Consolidated Financial Statements contained in this Annual Report. Our strategy has been to diversify our sales and operations geographically so that the impact of economic trends in different regions can be balanced.

The risks associated with conducting business on an international basis are discussed further in Item 1A-Risk Factors.

8

The various risks related to the Company's business include the risks described below. The business, financial condition or results of operations of Hardinge Inc. could be materially adversely affected by any of these risks. The risks and uncertainties described below or elsewhere in the Form 10-K are not the only ones to which we are exposed. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also adversely affect our business and operations. If any of the matters included in the following risks were to occur, our business, financial condition, results of operations, cash flows or prospects could be materially adversely affected.

Our customers' activity levels and spending for our products and services have been impacted by the current global economic conditions, especially deterioration in the credit markets.

Many of our customers finance their purchases of our products through cash flow from operations, the incurrence of debt or from the proceeds received in connection with an issuance of equity. Commencing in the fourth quarter of 2008, the global financial markets have experienced significant losses due to failures of many dominant financial institutions. During late 2008 and early 2009, the governments of the United States and several foreign countries instituted bailout plans to assist many banks and others impacted by the economic crisis. This crisis has resulted in, among other things, a significant decline in the credit markets and the availability of credit, the impact of which is still being experienced today. Additionally, many of our customers' equity values have substantially declined. The combination of a reduction in borrowing bases under asset based credit facilities and the lack of availability of debt or equity financing may result in a significant reduction in our customers' spending for our products and may impact the ability of our customers to pay amounts owed to us. In addition, this crisis and economic uncertainty has resulted in an overall decrease in consumer and business spending, which negatively impacted the need our customers have for our products. While economic conditions during 2010 began to show signs of improvement in many of our markets, future slow or negative growth in the global economy may materially and adversely affect our business, financial condition and results of operations.

Changes in general economic conditions and the cyclical nature of our business could harm our operating results.

Our business is cyclical in nature, following the strength and weakness of the manufacturing economies in the geographic markets we serve. As a result of this cyclicality, we have experienced, and in the future, we can be expected to experience, significant fluctuations in sales and operating income, which may affect our business, operating results, financial condition and the market price of our common shares.

The following factors, among others, significantly influence demand for our products:

- •

- Fluctuations in capacity at both OEMs and job shops;

- •

- The availability of skilled machinists;

- •

- The need to replace machines that have reached the end of their useful life;

- •

- The need to replace older machines with new technology that increases productivity, reduces general manufacturing costs,

and machines parts in a new way;

- •

- The evolution of end-use products requiring machining to more specific tolerances;

- •

- Our customers' use of new materials requiring machining by different processes;

- •

- General economic and manufacturing industry expansions and contractions; and

- •

- Changes in manufacturing capabilities in developing regions.

9

Our competitive position and prospects for growth may be diminished if we are unable to develop and introduce new and enhanced products on a timely basis that are accepted in the market.

The machine tool industry is subject to technological change, rapidly evolving industry standards, changing customer requirements and improvements in and expansion of product offerings, especially with respect to computer-controlled products. Our ability to anticipate changes in technology, industry standards, customer requirements and product offerings by competitors, and to develop and introduce new and enhanced products on a timely basis that are accepted in the market, will be significant factors in our ability to compete and grow. Moreover, if technologies or standards used in our products become obsolete or fail to gain widespread commercial acceptance, our business would be materially adversely affected. Developments by our competitors or others may render our products or technologies obsolete or noncompetitive. Failure to effectively introduce new products or product enhancements on a timely basis could materially adversely affect our business, operating results and financial condition.

We rely on a limited number of suppliers to obtain certain components, sub-assemblies, assemblies and products. Delays in deliveries from or the loss of any of these suppliers may cause us to incur additional costs, result in delays in manufacturing and delivering our products or cause us to carry excess or obsolete inventory.

Some components, sub-assemblies or assemblies we use in the manufacturing of our products are purchased from a limited number of suppliers. Our purchases from these suppliers are generally not made pursuant to long-term contracts and are subject to additional risks associated with purchasing products internationally, including risks associated with potential import restrictions and exchange rate fluctuations, as well as changes in tax laws, tariffs and freight rates. Although we believe that our relationships with these suppliers are good, there can be no assurance that we will be able to obtain these products from these suppliers on satisfactory terms indefinitely. The present economic environment could also pose the risk of one of these key suppliers going out of business, or cause delays in delivery times of critical components as business conditions rebound and demand increases.

We believe that design changes could be made to our machines to allow sourcing of components, sub-assemblies, assemblies or products from several other suppliers; however, a disruption in the supply from any of our suppliers could cause us to experience a material adverse effect on our operations.

Our business, financial condition and results of operations could be adversely affected by the political and economic conditions of the countries in which we conduct business and other factors related to our international operations.

We manufacture a substantial portion of our products overseas and sell our products throughout the world. In 2010, approximately 77% of our products were sold in countries outside of North America. In addition, a majority of our employees are located outside of the United States. Multiple factors relating to our international operations and to particular countries in which we operate could have a material adverse effect on our business, financial condition, results of operations and cash flows. These factors include:

- •

- A prolonged world-wide economic downturn or economic uncertainty in our principal international markets

including Asia and Europe;

- •

- Changes in political, regulatory, legal or economic conditions;

- •

- Restrictive governmental actions (such as restrictions on the transfer or repatriation of funds and foreign investments and trade protection measures, including export duties and quotas, customs duties and tariffs, or trade barriers erected by either the United States or other countries where we do business);

10

- •

- Disruptions of capital and trading markets;

- •

- Changes in import or export licensing requirements;

- •

- Transportation delays;

- •

- Civil disturbances or political instability;

- •

- Geopolitical turmoil, including terrorism or war;

- •

- Currency restrictions and exchange rate fluctuations;

- •

- Changes in labor standards;

- •

- Limitations on our ability under local laws to protect our intellectual property;

- •

- Nationalization and expropriation;

- •

- Changes in domestic and foreign tax laws;

- •

- Difficulty in obtaining distribution and support; and

- •

- Major health concerns.

Moreover, international conflicts are creating many economic and political uncertainties that are affecting the global economy. Escalation of existing international conflicts or the occurrence of new international conflicts could severely affect our operations and demand for our products.

We may face trade barriers that could have a material adverse effect on our results of operations and result in a loss of customers or suppliers.

Trade barriers established by the United States or other countries may interfere with our ability to offer our products in those markets. We manufacture a substantial portion of our products overseas and sell our products throughout the world. We cannot predict whether the United States or any other country will impose new quotas, tariffs, taxes or other trade barriers upon the importation or exportation of our products or supplies, any of which could have a material adverse effect on our results of operations and financial condition. Competition and trade barriers in those countries could require us to reduce prices, increase spending on marketing or product development, withdraw or not enter certain markets or otherwise take actions adverse to us.

In addition, our subsidiaries may require future equity-related financing, and any capital contributions to certain of our subsidiaries may require the approval of the relevant authorities in the jurisdiction in which the subsidiary is incorporated. Those approvals may be required from the investment commissions or similar agencies of the particular jurisdiction and relate to any initial or additional equity investment by foreign entities in local entities.

In all jurisdictions in which we operate, we are also subject to the laws and regulations that govern foreign investment and foreign trade, which may limit our ability to repatriate cash as dividends or otherwise.

Our business is highly competitive, and increased competition could reduce our sales, earnings and profitability.

The markets in which our machines and other products are sold are extremely competitive and highly fragmented. In marketing our products, we compete primarily with other businesses on quality, reliability, price, value, delivery time, service and technological characteristics. We compete with a number of U.S., European and Asian competitors, many of which are larger, have greater financial and other resources and are supported by governmental or financial institution subsidies. Increased

11

competition could force us to lower our prices or to offer additional product features or services at a higher cost to us, which could reduce our earnings.

The greater financial resources or the lower amount of debt of certain of our competitors may enable them to commit larger amounts of capital in response to changing market conditions. Certain competitors may also have the ability to develop product innovations that could put us at a disadvantage. If we are unable to compete successfully against other manufacturers in our marketplace, we could lose customers, and our sales may decline. There can also be no assurance that customers will continue to regard our products favorably, that we will be able to develop new products that appeal to customers, that we will be able to improve or maintain our profit margins on sales to our customers or that we will be able to continue to compete successfully in our core markets. While we believe our product lines compete effectively in their markets, we may not continue to do so.

Acquisitions could disrupt our operations and harm our operating results.

We may elect to increase our product offerings and the markets we serve through acquisitions of other companies, product lines, technologies and personnel. Acquisitions involve numerous risks, including the following:

- •

- Difficulties in integrating the operations, technologies, products and personnel of the acquired companies;

- •

- Diversion of management's attention from normal daily operations of the business;

- •

- Potential difficulties in completing projects associated with in-process research and development;

- •

- Difficulties in entering markets in which we have no or limited direct prior experience and where competitors in such

markets have stronger market positions;

- •

- Initial dependence on unfamiliar supply chains or relatively small supply partners;

- •

- Difficulties in predicting market demand for acquired products and technologies and the resultant risk of acquiring excess

or obsolete inventory;

- •

- Insufficient revenues to offset increased expenses associated with acquisitions; and

- •

- The potential loss of key employees of the acquired companies.

Acquisitions may also cause us to:

- •

- Issue common stock that would dilute our current shareholders' percentage ownership;

- •

- Increase our level of indebtedness;

- •

- Assume liabilities;

- •

- Record goodwill and non-amortizable intangible assets that will be subject to impairment testing on a regular

basis and potential periodic impairment charges;

- •

- Incur amortization expenses related to certain intangible assets;

- •

- Incur large and immediate write-offs and restructuring and other related expenses; and

- •

- Become subject to litigation.

Acquisitions are inherently risky, and no assurance can be given that our future acquisitions will be successful and will not materially adversely affect our business, operating results or financial condition. Failure to manage and successfully integrate acquisitions we make could harm our business and operating results in a material way. Prior acquisitions have resulted in a wide range of outcomes, from successful introduction of new products, technologies, facilities and personnel to an inability to do so.

12

Even when an acquired business has already developed and marketed products, there can be no assurance that product enhancements will be made in a timely fashion or that pre-acquisition due diligence will have identified all possible issues that might arise with respect to such products.

If we are unable to access additional capital on favorable terms, our liquidity, business and results of operations could be adversely affected.

The ability to raise financial capital, either in public or private markets or through commercial banks, is critical to our current business and future growth. Our business is generally working capital intensive requiring a long cash-out to cash-in cycle. In addition, we will rely on the availability of longer-term debt financing or equity financing to make investments in new opportunities. Our access to the financial markets could be adversely impacted by various factors including the following:

- •

- Changes in credit markets that reduce available credit or the ability to renew existing facilities on acceptable terms;

- •

- A deterioration in our financial condition that would violate current covenants or prohibit us from obtaining additional

capital from banks, financial institutions, or investors;

- •

- Extreme volatility in credit markets that increase margin or credit requirements; and

- •

- Volatility in our results that would substantially increase the cost of our capital.

We are subject to significant foreign exchange and currency risks that could adversely affect our operations and our ability to reinvest earnings from operations.

Our international operations generate sales in a number of foreign currencies including Swiss Francs, Chinese Renminbi, British Pound Sterling, Canadian Dollars, New Taiwanese Dollars, and Euros. Therefore, our results of operations and financial condition are affected by fluctuations in exchange rates between these currencies and the U.S. dollar. In addition, our purchases of components in Yen, Euros, New Taiwan Dollars, Swiss Francs, and Chinese Renminbi are affected by inter-currency fluctuations in exchange rates.

We prepare our financial statements in U.S. Dollars in accordance with U.S. GAAP, but a sizable portion of our revenue and operating expenses are in foreign currencies. As a result, we are subject to significant risks, including:

- •

- Foreign exchange risks resulting from changes in foreign exchange rates and the implementation of exchange controls; and

- •

- Limitations on our ability to reinvest earnings from operations in one country to fund the capital needs of our operations in other countries.

Changes in exchange rates will result in increases or decreases in our costs and earnings, and may also affect the book value of our assets located outside of the United States and the amount of our invested equity. Although we may seek to decrease our currency exposure by engaging in hedges against significant transactions and balance sheet currency exposures where we deem it appropriate, we do not hedge against translation risks. We cannot assure you that any efforts to minimize our risk to currency movements will be successful. To the extent we sell our products in markets other than the market in which they are manufactured, currency fluctuations may result in our products becoming too expensive for customers in those markets.

13

Prices of some raw materials, especially steel and iron, fluctuate, which can adversely affect our sales, costs, and profitability.

We manufacture products with a relatively high iron castings or steel content, commodities for which worldwide prices fluctuate. The availability of and prices for these and other raw materials are subject to volatility due to worldwide supply and demand forces, speculative actions, inventory levels, exchange rates, production costs, and anticipated or perceived shortages. In some cases, those cost increases can be passed on to customers in the form of price increases; in other cases, they cannot. If raw material prices increase and we are not able to charge our customers higher prices to compensate, it would adversely affect our business, results of operations and financial condition.

Our quarterly results may fluctuate based on customer delivery requirements.

Our quarterly results are subject to significant fluctuation based on the timing of our shipments of machine tools, which are largely dependent upon customer delivery requirements. With individual machines priced as high as $1,500,000 and several machines frequently sold together as a package, a request by a customer to delay shipment at quarter end could significantly affect our quarterly results. Historically, we have experienced reduced activity during the third quarter of the year, largely as a result of vacations scheduled at our customers' plants and our policy of closing our U.S. and Swiss facilities for two weeks in July or August. As a result, exclusive of the impact of the economic downturn experienced during 2008 and 2009, our third-quarter net sales, income from operations, and net income historically have been the lowest of any quarter during the year. However, given the larger percentage of our sales now from China, the impact of the one week to two week plant shut downs in China by us and our customers for the Chinese New Year, the first quarter net sales, income from operations and net income may result in the first quarter being the lowest quarter of the year.

Our expenditures for post-retirement pension obligations could be materially higher than we have predicted if our underlying assumptions prove to be incorrect or we are required to use different assumptions.

We provide defined benefit pension plans to eligible employees. Our pension expense, the funding status of our plans and related charges in other comprehensive income, and our required contributions to our pension plans are directly affected by the value of plan assets, the projected rate of return on plan assets, the actual rate of return on plan assets and the actuarial assumptions we use to measure our defined benefit pension plan obligations, including the rate at which future obligations are discounted to a present value, or the discount rate.

Our market-related value of assets recognizes asset losses and gains over a five-year period, which we believe is consistent with the long-term nature of our pension obligations. As a result, the effect of changes in the market value of assets on our pension expense may be experienced in future years rather than fully reflected in the expense for the year immediately following the year in which the fluctuations actually occurred.

For the year ended December 31, 2010, the value of our Pension Plan Assets increased by $11.7 million due to increases in market value of the underlying assets as the world markets continued to recover from the impacts the global economic recession had on the world financial markets and related investment valuations. The future investment performance of our pension plan assets could significantly impact the plan assets and future growth of the plan assets. Should the assets earn a return less than the assumed rate of return over time, it is likely that future pension expenses and funding requirements would increase. Investment earnings in excess of the assumed rate of return may reduce future pension expenses and funding requirements.

For our domestic and foreign plans, discount rates are based on the yields on high grade corporate bonds in each market with maturities matching the projected benefit payments. Discount rates are used to determine the present value of the projected and accumulated benefit obligation at the end of each year. A change in the discount rate would impact the funded status of our plans. An increase to the

14

discount rate would reduce the pension liability and future pension expense and conversely, a lower discount rate would raise pension liability and the future pension expense.

To develop the expected long-term rate of return on assets assumption, for our domestic and foreign plans, we consider the current level of expected returns on risk free investments (primarily government bonds) in each market, the historical level of the risk premium associated with the other asset classes in which the portfolio is invested, and the expectations for future returns of each asset class. The expected return for each asset class is then weighted based on the asset allocation to develop the expected long-term rate of return on assets assumption.

For pension accounting purposes in our U.S. based plan, which is the largest of our plans, the rate of return assumed on the market-related value of plan assets for determining pension expense was 8.00% for 2010 and 2009. The discount rate used for determining the obligation was 5.93% at December 31, 2010 compared to 6.27% at December 31, 2009.

In our Swiss subsidiary, we have two defined benefit plans, which when taken as a whole are about as large as the U.S. defined benefit plan. The rate of return assumed on the market-related value of plan assets for determining pension expense on plan assets was 3.90% for 2010 and 5.00% for 2009. The discount rate used for determining the obligation was 2.7% at December 31, 2010 compared to 3.5% at December 31, 2009.

Based on current guidelines, assumptions and estimates, including stock market prices and interest rates, we anticipate that we may be required to make a cash contribution of approximately $1.8 million to our U.S. pension plan in 2011 and approximately $2.3 million to the foreign plans in 2011. If our current assumptions and estimates are not correct, a contribution in years beyond 2011 may be more or less than the projected 2011 contribution.

In addition, we cannot predict whether changing market or economic conditions, regulatory changes or other factors will increase our pension expenses or our funding obligations, diverting funds we would otherwise apply to other uses. At December 31, 2010, the excess of consolidated projected benefit obligations over plan assets was $27.1 million and the excess of consolidated accumulated benefit obligations over plan assets was $21.8 million.

On June 15, 2009, the Company suspended future accrual of benefits under its U.S. defined benefit pension plan (which was closed to new participants in March 2004) and Company contributions to the 401(k) program were also suspended. In November 2010, the Company permanently froze accrual of benefits for participants in the U.S. defined pension plan as well as reinstated Company contributions to the 401(k) program as of January 1, 2011. Employees impacted by the actions related to the defined benefit plan now participate in a defined contribution plan.

If we are unable to attract and retain skilled employees to work at our manufacturing facilities our operations and growth prospects would be adversely impacted.

We conduct substantially all of our manufacturing operations in relatively small urban areas, with the exception of our Shanghai facility. Our continued success depends on our ability to attract and retain a skilled labor force at these locations. If we are not able to attract and retain the personnel we require, we may be unable to develop, manufacture and market our products and expand our operations in a manner that best exploits market opportunities and capitalizes on our investment in our business. This would materially adversely affect our business, operating results and financial condition.

Due to future technological changes, changes in market demand, or changes in market expectations, portions of our inventory may become obsolete or excessive.

The technologies within our products change and generally new versions of machines are brought to market in three to five year cycles. The phasing out of an old product involves both estimating the amount of inventory to hold to satisfy the final demand for those machines as well as to satisfy future

15

repair part needs. Based on changing customer demand and expectations of delivery times for repair parts, we may find that we have either obsolete or excess inventory on hand. Because of unforeseen changes in technology, market demand, or competition, we may have to write off unusable inventory at some time in the future, which may adversely affect our results of operations and financial condition. In 2009, we recorded a $5.0 million inventory write-down related to the strategic decision to cease manufacturing of non-critical parts and certain machine models in our Elmira, NY facility. In 2008, we recorded $7.6 million in inventory write-downs associated with discontinued product lines and the review of other expected inventory usage patterns.

Major changes in the economic situation of our customer base could require us to write off significant parts of our receivables from customers.

In difficult economic periods, our customers lose work and find it difficult if not impossible to pay for products purchased from us. Although appropriate credit reviews are done at the time of sale, rapidly changing economic conditions can have sudden impacts on customers' ability to pay. We run the risk of bad debt on existing time payment contracts and open accounts. If we write off significant parts of our customer accounts or notes receivable because of unforeseen changes in their business condition, it would adversely affect our results of operations, financial condition, and cash flows.

If we suffer loss to our factories, facilities or distribution system due to catastrophe, our operations could be seriously harmed.

Our factories, facilities and distribution system are subject to catastrophic loss due to fire, flood, terrorism or other natural or man-made disasters. In particular, several of our facilities could be subject to a catastrophic loss caused by earthquake due to their locations. Our facilities in Southeast Asia are located in areas with above average seismic activity. If any of our facilities were to experience a catastrophic loss, it could disrupt our operations, delay production, shipments and revenue and result in large expenses to repair or replace the facility.

We rely in part on independent distributors and the loss of these distributors could adversely affect our business.

In addition to our direct sales force, we depend on the services of independent distributors and agents to sell our products and provide service and aftermarket support to our customers. We support an extensive distributor and agent network worldwide. In 2010, approximately 64% of our sales were through distributors and agents. In December 2009, we reorganized our U.S. distribution from a joint distributor network and direct sales force to a new group of distributors. Rather than serving as passive conduits for delivery of product, many of our distributors are active participants in the sale and support of our products. Many of the distributors with whom we transact business offer competitive products and services to our customers. In addition, the distribution agreements we have are typically cancelable by the distributor after a relatively short notice period. The loss of a substantial number of our distributors or an increase in the distributors' sales of our competitors' products to our customers could reduce our sales and profits.

We rely on estimated forecasts of our customers' needs and inaccuracies in such forecasts could adversely affect our business.

We generally sell our products pursuant to individual purchase orders instead of long-term purchase commitments. Therefore, we rely on estimated demand forecasts, based upon input from our customers and the general economic environment, to determine how much material to purchase and product to manufacture. Because our sales are based on purchase orders, our customers may cancel, delay or otherwise modify their purchase commitments with little or no consequence to them and with little or no notice to us. For these reasons, we generally have limited visibility regarding our customers' actual product needs. The quantities or timing required by our customers for our products could vary

16

significantly. Whether in response to changes affecting the industry or a customer's specific business pressures, any cancellation, delay or other modification in our customers' orders could significantly reduce our revenue, cause our operating results to fluctuate from period to period and make it more difficult for us to predict our revenue. In the event of a cancellation or reduction of a customer order, we may not have enough time to reduce inventory purchases or our workforce to minimize the effect of the lost revenue on our business. During 2010 and 2009, orders and related sales were impacted by order cancellations of $10.2 million and $7.3 million, respectively, primarily due to the global economic conditions.

We could face potential product liability claims relating to products we manufacture, which could result in us having to expend significant time and expense to defend these claims and to pay material amounts in damages or settlement.

We face a business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in injury or other adverse effects. We currently maintain product liability insurance coverage; however, such insurance does not cover all types of damages that could be assessed against us in a product liability claim and the coverage amounts are subject to limitations under the applicable policies. We may not be able to obtain product liability insurance on acceptable terms in the future. Product liability claims can be expensive to defend and can divert the attention of management and other personnel for long periods of time, regardless of the ultimate outcome. An unsuccessful product liability defense could have a material adverse effect on our business, financial condition, results of operations or prospects. In addition, we believe our business depends on the strong brand reputation we have developed. In the event that our reputation is damaged, we may face difficulty in maintaining our pricing positions with respect to some of our products, which would reduce our sales and profitability.

Current employment laws or changes in employment laws could increase our costs and may adversely affect our business.

Various federal, state and foreign labor laws govern the relationship with our employees and affect operating costs. These laws include minimum wage requirements, overtime, unemployment tax rates, workers' compensation rates, citizenship requirements and costs to terminate or layoff employees. Significant additional government-imposed increases in the following areas could materially affect our business, financial condition, operating results or cash flow:

- •

- minimum wages;

- •

- mandated health benefits;

- •

- paid leaves of absence;

- •

- mandatory severance payments; and tax reporting.

We are subject to environmental laws that could impose significant costs on us and the failure to comply with such laws could subject us to sanctions and material fines and expenses.

Our operations are subject to extensive federal, state, local and foreign laws and regulations relating to environmental matters.

Certain environmental laws can impose joint and several liability for releases or threatened releases of hazardous substances upon certain statutorily defined parties regardless of fault or the lawfulness of the original activity or disposal. Activities at properties we own or previously owned and on adjacent areas have resulted in environmental impacts.

In particular, our Elmira, New York manufacturing facility is located within the Kentucky Avenue Wellfield on the National Priorities List of hazardous waste sites designated for cleanup by the United

17

States Environmental Protection Agency ("EPA") because of groundwater contamination. The Kentucky Avenue Wellfield Site (the "Site") encompasses an area which includes sections of the Town of Horseheads and the Village of Elmira Heights in Chemung County, New York. In February 2006, the Company received a Special Notice Concerning a Remedial Investigation/Feasibility Study ("RI/FS") for the Koppers Pond (the "Pond") portion of the Site. The EPA documented the release and threatened release of hazardous substances into the environment at the Site, including releases into and in the vicinity of the Pond. The hazardous substances, including metals and polychlorinated biphenyls, have been detected in sediments in the Pond.

A substantial portion of the Pond is located on our property. Hardinge, along with Beazer East, Inc., the Village of Horseheads, the Town of Horseheads, the County of Chemung, CBS Corporation, and Toshiba America, Inc., the Potentially Responsible Parties (the PRPs") have agreed to voluntarily participate in the Remedial Investigation and Feasibility Study ("RI/FS") by signing an Administrative Settlement Agreement and Order of Consent on September 29, 2006. On September 29, 2006, the Director of Emergency and Remedial Response Division of the U.S. Environmental Protection Agency, Region II, approved and executed the Agreement on behalf of the EPA. The PRPs also signed a PRP Member Agreement, agreeing to share the cost of the RI/FS study on a per capita basis. The cost of the RI/FS was estimated to be approximately $0.84 million. We estimate our portion of the study to be $0.12 million for which we have established a reserve of $0.13 million. As of December 31, 2010 we have incurred total expenses of $0.12 million with respect to the study and other activities relating to the Site. The remaining reserve balance at December 31, 2010 is $0.01 million.

The PRPs developed a Draft RI/FS with their consultants and, following EPA comments, submitted a Revised RI/FS on December 6, 2007. In May 2008, the EPA approved the RI/FS Work Plan. The PRPs commenced field work in the spring of 2008 and submitted a Draft Site Characterization Report to EPA in the fall. The PRPs currently are performing Risk Assessments in accordance with the Remedial Investigation portion of the RI/FS.

Until receipt of this Special Notice, Hardinge had never been named as a PRP at the Site nor had we received any requests for information from the EPA concerning the site. Environmental sampling on our property within this Site under supervision of regulatory authorities had identified off-site sources for such groundwater contamination and sediment contamination in the Pond and found no evidence that our operations or property have or are contributing to the contamination. Other than as described above, we have not established a reserve for any potential costs relating to this Site, as it is too early in the process to determine our responsibility as well as to estimate any potential costs to remediate. We have notified all appropriate insurance carriers and are actively cooperating with them, but whether coverage will be available has not yet been determined and possible insurance recovery cannot now be estimated with any degree of certainty.

Although we believe, based upon information currently available, that, except as described in the preceding paragraphs, we will not have material liabilities for environmental remediation, it is possible that future remedial requirements or changes in the enforcement of existing laws and regulations, which are subject to extensive regulatory discretion, will result in material liabilities to Hardinge.

The loss of current members of our senior management team and other key personnel may adversely affect our operating results.

The loss of senior management and other key personnel could impair our ability to carry out our business plan. We believe our future success will depend in part on our ability to attract and retain highly skilled and qualified personnel. The loss of senior management and other key personnel may adversely affect our operating results as we incur costs to replace the departing personnel and potentially lose opportunities in the transition of important job functions.

18

If we fail to maintain an effective system of internal controls, we may not be able to report our financial results accurately or prevent fraud.

Effective internal controls are necessary for us to provide reliable financial reports, to prevent fraud and to operate successfully as a publicly traded company. Our efforts to maintain an effective system of internal controls may not be successful, and we may be unable to maintain adequate controls over our financial processes and reporting in the future. Ineffective internal controls subject us to regulatory scrutiny and a loss of confidence in our reported financial information, which could have an adverse effect on our business and would likely have a negative effect on the trading price of our common stock.

Anti-takeover provisions in our charter documents and under New York law may discourage a third party from acquiring us.

Certain provisions of our certificate of incorporation and bylaws may have the effect of discouraging a third party from making a proposal to acquire us and, as a result, may inhibit a change in control of the Company under circumstances that could give the shareholders the opportunity to realize a premium over the then-prevailing market price of our common shares. These include:

A Staggered Board of Directors. Our certificate of incorporation and bylaws provide that our Board of Directors, currently consisting of seven members, is divided into three classes of directors, with each class consisting of two or three directors, and with the classes serving staggered three-year terms. This classification of the directors has the effect of making it more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Removal of Directors and Filling of Vacancies. Our certificate of incorporation provides that a member of our Board of Directors may be removed only for cause and upon the affirmative vote of the holders of 75% of the securities entitled to vote at an election of directors. Newly created directorships and Board of Director vacancies resulting from death, removal or other causes may be filled only by a majority vote of the then remaining directors. Accordingly, it is more difficult for shareholders, including those holding a majority of our outstanding shares, to force an immediate change in the composition of our Board of Directors.

Supermajority Voting Provisions for Certain Business Combinations. Our certificate of incorporation requires the affirmative vote of at least 75% of all of the securities entitled to vote and at least 75% of shareholders who are not Major Shareholders (defined as 10% beneficial holders) in order to effect certain mergers, sales of assets or other business combinations involving the Company. These provisions could have the effect of delaying, deferring or preventing a change of control of the Company.

In addition, as a New York corporation we are subject to provisions of the New York Business Corporation Law which may make it more difficult for a third party to acquire and exercise control over us pursuant to a tender offer or request or invitation for tenders. These provisions could have the effect of deterring or delaying changes in incumbent management, proxy contests or changes in control.

Item 1B.—UNRESOLVED STAFF COMMENTS

None.

19

Pertinent information concerning the principal properties of the Company and its subsidiaries is as follows:

| Location | Type of Facility | Acreage (Land) Square Footage (Building) |

||||

|---|---|---|---|---|---|---|

| Owned Properties: | ||||||

Horseheads, New York |

Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration |

80 acres 515,000 sq. ft. |

||||

St. Gallen, Switzerland |

Manufacturing, Engineering, Turnkey Systems, Marketing, Sales, Demonstration, Service, and Administration |

8 acres 162,924 sq. ft. |

||||

Nan Tou, Taiwan |

Manufacturing, Engineering, Marketing, Sales, Demonstration, Service, and Administration |

3 acres 123,204 sq. ft. |

||||

Biel, Switzerland |

Manufacturing, Engineering, and Turnkey Systems |

4 acres 41,500 sq. ft. |

||||

| Location | Type of Facility | Square Footage | Lease Expiration Date |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Leased Properties: | |||||||||

Shanghai, People's Republic of China |

Product Assembly, Marketing, Engineering, Turnkey Systems, Sales, Service, Demonstration, and Administration |

68,620 sq. ft. |

2/29/12 |

||||||

Leicester, England |

Manufacturing, Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration |

55,000 sq. ft. |

3/31/19 |

||||||

Taichung, Taiwan |

Manufacturing |

30,243 sq. ft. |

7/31/13 |

||||||

Leicester, England |

Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration |

30,172 sq. ft. |

1/31/15 |

||||||

Biel, Switzerland |

Sales, Marketing, Engineering, Turnkey Systems, Demonstration, Service, and Administration |

19,375 sq. ft. |

5/31/11 |

||||||

Krefeld, Germany |

Sales, Service, Demonstration, and Administration |

14,402 sq. ft. |

3/31/20 |

||||||

St. Gallen, Switzerland |

Manufacturing |

14,208 sq. ft. |

8/01/11 |

||||||

Raamsdonksveer, Netherlands |

Sales, Service, and Demonstration |

10,226 sq. ft. |

9/15/11 |

||||||

20

The Company is from time to time involved in routine litigation incidental to its operations. None of the litigation in which we are currently involved, individually or in the aggregate, is anticipated to be material to our financial condition, results of operations, or cash flows.

On October 28, 2008, a putative class-action lawsuit was filed in the United States District Court for the Western District of New York against the Company and certain former officers. This complaint, as amended, alleged that during the period from January 16, 2007 to February 21, 2008 the defendants made misleading statements and/or omissions relating to our business and operating results in violation of the Federal securities laws. On May 29, 2009, the Company filed a motion to dismiss the complaint. By a decision and order dated February 2, 2010, the Court dismissed the class action lawsuit. The plaintiff did not file a notice to appeal the Court's dismissal of the lawsuit and the time to appeal expired.

21

ITEM 5.—MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The following table reflects the highest and lowest values at which the stock traded in each quarter of the last two years. Hardinge Inc. common stock trades on The NASDAQ Global Select Market under the symbol "HDNG." The table also includes dividends per share, by quarter.

| |

2010 | 2009 | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Values | Values | ||||||||||||||||||

| |

High | Low | Dividends | High | Low | Dividends | ||||||||||||||

Quarter Ended |

||||||||||||||||||||

March 31, |

$ | 9.60 | $ | 5.18 | $ | 0.005 | $ | 5.64 | $ | 2.60 | $ | 0.01 | ||||||||

June 30, |

10.09 | 8.40 | 0.005 | 6.00 | 2.75 | 0.005 | ||||||||||||||

September 30, |

9.11 | 7.43 | 0.005 | 6.65 | 3.83 | 0.005 | ||||||||||||||

December 31, |

9.85 | 7.54 | 0.005 | 6.19 | 4.54 | 0.005 | ||||||||||||||

At March 7, 2011, there were 3,527 holders of common stock. This number includes both record holders and individual participants in security position listings.

Issuer Purchases of Equity Securities

There were no issuer repurchases of our common stock for the quarter ended December 31, 2010.

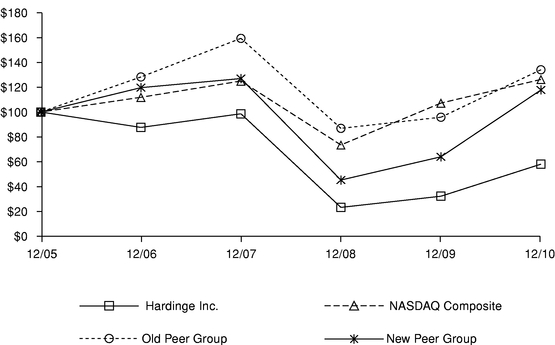

Share Repurchase Program