Attached files

| file | filename |

|---|---|

| EX-31.2 - CERTIFICATION - YBCC, Inc. | ybcc_10k-3102.htm |

| EX-32.2 - CERTIFICATION - YBCC, Inc. | ybcc_10k-3202.htm |

| EX-32.1 - CERTIFICATION - YBCC, Inc. | ybcc_10k-3201.htm |

| EX-31.1 - CERTIFICATION - YBCC, Inc. | ybcc_10k-3101.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark one)

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the fiscal year ended December 31, 2016

or

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. |

For the transition period from________________________ to _________________________

Commission file number 0-21384

YBCC, INC.

(Exact name of registrant as specified in its charter)

| Nevada | 8980 | 13-3367421 |

| (State or other jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer |

| incorporation or organization) | Classification Code Number) | Identification No.) |

| 17800 CASTLETON ST. STE 386, CITY OF INDUSTRY, CA | 91748 |

| (Address of principal executive offices) | (Zip code) |

626-213-3945

Registrant’s telephone number, including area code

International Packaging and Logistics Group, Inc.

(Former name, former address and former fiscal year, if changed since last report)

| Title of each class | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | None |

| Convertible Preferred stock, Series A, par value $0.0001 per share | None |

Securities registered pursuant to section 12(g) of the Act:

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Non-accelerated filer ☐ | Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). ☐ Yes ☒ No

As of June 30, 2016, the aggregate market value of the shares of the Registrant’s common stock held by non-affiliates was $236,739 based upon the closing price ($0.65) of such shares as quoted on the OTC Markets as of June 30, 2016. Shares of the Registrant’s common stock held by each executive officer and director and each by each person who owns 10 percent or more of the outstanding common stock have been excluded in that such persons may be deemed to be affiliates of the Registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

There were a total of 9,894,214 shares of the registrant’s common stock outstanding as of April 21, 2017.

DOCUMENTS INCORPORATED BY REFERENCE

| i |

ITEM 1. Description of Business

Overview

On August 31, 2016, YBCC, Inc. (“YBCC” or the “Company”) through its subsidiary, YibaoConfucian Co. Ltd. (“YibaoHK”) entered into a series of contractual arrangements with Shandong Confucian Biologics Co., Ltd. (“Confucian”) which is a limited liability company headquartered in, and organized under the laws of the PRC. Confucian is a manufacture and research based bio-science company. It has a large capacity to manufacture tablets, granule, oral liquid, powders, soft gels and capsules products. Confucian distributes its products through its own network and white label products. It also has access to a member-based distribution system owned by an affiliated company.

The Company through its subsidiaries possesses manufacturing permits for food product, hygienic products, sanitary products, and health products. The Company's main business includes: research and development of chondroitin and garlic oil; trading, cold storage, and pretreating of garlic, fruit, and vegetables products; trading of chemical products (excluding hazardous chemicals); import and export of goods and technology (excluding those restricted by government); and, the manufacturing and sale of health products including powder, granules, tablets, hard capsule, and soft capsule products.

History

YBCC

YBCC, formerly known as International Packaging and Logistics Group, was originally incorporated as Interactive Medical Technologies, Ltd., on June 2, 1986 in the state of Delaware. On April 17, 2008, IPLO was redomiciled from the State of Delaware to the State of Nevada.

Effective February 3, 1998, Interactive Medical Technologies, Ltd., changed its name to Kaire Holdings Incorporated, which was changed again on May 28, 2008 to International Packaging and Logistics Group, Inc.

On July 2, 2007, IPLO through its wholly-owned subsidiary, YesRx.com (“YesRx”), acquired all the outstanding shares of H&H Glass, Inc. (“H&H Glass”), in exchange for 3,915,000 shares of its common stock in a reverse triangular merger.

On May 15, 2016, the Company and Xiuhua Song (the “Purchaser”) entered into a Stock Purchase Agreement (the “Purchase Agreement”), pursuant to which IPLO (the “Seller”) sold to the Purchaser, and the Purchaser purchased from the Seller an aggregate of 3,915,000 newly issued shares of IPLO Common Stock (the “Shares”). The Shares represented 87% of the issued and outstanding shares of Common Stock. On July 1, 2016, this transaction was completed.

On July 1, 2016, Standard Resources Ltd. (“Standard”), previously IPLO’s majority stockholder, and IPLO entered into a share purchase agreement (“H&H Vend Out”) whereby Standard cancelled 3,915,000 shares of IPLO common stock held by it in exchange for all of the outstanding shares of H&H Glass. The H&H Glass Vend Out was completed on August 31, 2016.

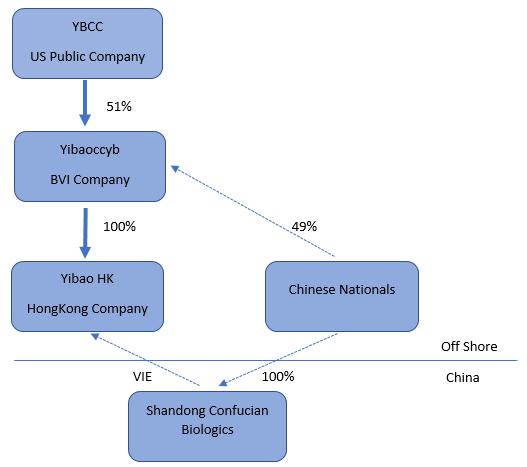

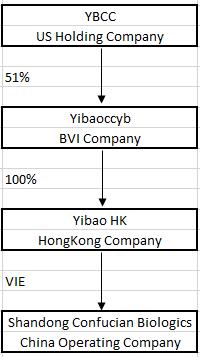

On July 1, 2016, the Company executed an Exchange Agreement with Yibaoccyb Ltd., a British Virgin Islands limited liability company (“Yibaoccyb”) and the Yibaoccyb Shareholders. On August 31, 2016, Yibaoccyb became a 51% owned subsidiary of the Company. Yibaoccyb owns 100% of YibaoConfucian Co., Ltd. (“YibaoHK”), a Hong Kong company. YibaoHK will own 100% of Shenzhen Confucian Biologics Co. Ltd. (yet to be formed, “Yibao”), which will be a wholly foreign-owned enterprise (“WFOE”) under the laws of the Peoples’ Republic of China (“PRC” or “China”). On August 31, 2016, YibaoHK entered into a series of contractual arrangements with Confucian. Our relationship with Confucian is governed by a series of contractual agreements. We do not own any equity interest in Confucian.

On December 22, 2016, the Company amended its Certificate of Incorporation (the “Amendment”). As a result of the Amendment, the Company’s corporate name changed from International Packaging and Logistics Group, Inc. to YBCC, Inc. Effective December 22, 2016, the Registrant’s ticker symbol changed from IPLO to YBAO.

| 1 |

YIBAOCCYB

Yibaoccyb is a limited liability company incorporated under the laws of the British Virgin Islands on May 30, 2016. On August 31, 2016, Yibaoccyb became a 51% owned subsidiary of IPLO. Yibaoccyb, in turn, is the sole owner of YibaoHK. Other than 100% of the issued and outstanding shares of YibaoHK, Yibaoccyb has no other assets or operations.

YIBAOHK

YibaoHK is a limited liability company incorporated under the laws of the Hong Kong on June 15, 2016. YibaoHK was formed by Yibaoccyb. YibaoHK will be the sole owner of Yibao (yet to be formed). On August 31, 2016, YibaoHK entered into a series of contractual arrangements with Confucian.

YIBAO

Yibao, a wholly foreign owned enterprise under the laws of the PRC is in the process of being established. All of the issued and outstanding shares of Yibao will be held by YibaoHK. The principal purpose of Yibao will be to manage, hold and own rights in the business of Confucian and other potential PRC businesses. Other than management contracts with the aforementioned companies and related activities, Yibao is expected to have no other separate operations of its own.

CONFUCIAN

PRC law currently has limits on foreign ownership of certain companies. To comply with these foreign ownership restrictions, we operate our businesses in China through Confucian which is a limited liability company headquartered in China and organized under the laws of China. Confucian has the licenses and approvals necessary to operate our businesses in China. We have contractual arrangements with Confucian and their respective shareholders pursuant to which we provide these companies with technology consulting and other general business operation services. Through these contractual arrangements, we also have the ability to substantially influence these companies’ daily operations and financial affairs, appoint their senior executives and approve all matters requiring shareholder approval. As a result of these contractual arrangements, which enable us to control Confucian, we are considered the primary beneficiary of Confucian. Accordingly, we consolidate the results, assets and liabilities of Confucian in our financial statements.

The following chart summarizes our organizational and ownership structure as of December 31, 2016:

Going Concern

As described in auditor’s report on our consolidated financial statements, our auditors have included a “going concern” provision in their opinion on our consolidated financial statements, expressing substantial doubt that we can continue as an ongoing business for the next twelve months.

| 2 |

CONTRACTUAL ARRANGEMENTS WITH CONFUCIAN AND THEIR SHAREHOLDERS

Our relationships with the Confucian and their shareholders are governed by a series of contractual arrangements between YibaoHK, and Confucian, which is the operating company of the Yibao Group in the PRC. Under PRC laws, each of YibaoHK and Confucian is an independent legal person and none of them is exposed to liabilities incurred by the other parties. The contractual arrangements constitute valid and binding obligations of the parties of such agreements. Each of the contractual arrangements and the rights and obligations of the parties thereto are enforceable and valid in accordance with the laws of the PRC. Other than pursuant to the contractual arrangements between YibaoHK and Confucian described below, Confucian does not transfer any other funds generated from its respective operations to any other member of the Yibao Group. On August 31, 2016, we entered into the following contractual arrangements (“VIE Agreements”) with Confucian:

Consulting Services Agreement. Pursuant to the exclusive consulting services agreements between YibaoHK and Confucian, YibaoHK has the exclusive right to provide to Confucian general business operation services, including advice and strategic planning, as well as consulting services related to the technological research and development of dietary supplements and related products (the “Services”). Under this agreement, YibaoHK owns the intellectual property rights developed or discovered through research and development, in the course of providing the Services, or derived from the provision of the Services. Confucian pays a quarterly consulting service fees in Renminbi (“RMB”) to Yibaoccyb that is equal to all of Confucian’s profits for such quarter.

Operating Agreement. Pursuant to the operating agreement among YibaoHK, Confucian and all shareholders of Confucian (collectively the “Shandong Confucian Biologics Shareholders”), YibaoHK provides guidance and instructions on Confucian’s daily operations, financial management and employment issues. Confucian Shareholders must designate the candidates recommended by YibaoHK as their representatives on the boards of directors of each of Confucian. YibaoHK has the right to appoint senior executives of Confucian. In addition, YibaoHK agrees to guarantee Confucian’ performance under any agreements or arrangements relating to Confucian’ business arrangements with any third party. Confucian, in return, agrees to pledge their accounts receivable and all of their assets to YibaoHK. Moreover, Confucian agrees that without the prior consent of YibaoHK, Confucian will not engage in any transactions that could materially affect their respective assets, liabilities, rights or operations, including, without limitation, incurrence or assumption of any indebtedness, sale or purchase of any assets or rights, incurrence of any encumbrance on any of their assets or intellectual property rights in favor of a third party or transfer of any agreements relating to their business operation to any third party. The term of this agreement is ten (10) years from August 31, 2016 and may be extended only upon YibaoHK’s written confirmation prior to the expiration of this agreement, with the extended term to be mutually agreed upon by the parties.

Equity Pledge Agreement. Under the equity pledge agreement between Confucian Shareholders and YibaoHK, Confucian Shareholders pledged all of their equity interests in Confucian to YibaoHK to guarantee Confucian’ performance of their obligations under the consulting services agreement. If Confucian or Confucian Shareholders breaches their respective contractual obligations, YibaoHK, as pledgee, will be entitled to certain rights, including the right to sell the pledged equity interests. Confucian Shareholders also agreed that upon occurrence of any event of default, YibaoHK shall be granted an exclusive, irrevocable power of attorney to take actions in the place and stead of Confucian Shareholders to carry out the security provisions of the equity pledge agreement and take any action and execute any instrument that YibaoHK may deem necessary or advisable to accomplish the purposes of the equity pledge agreement. Confucian Shareholders agreed not to dispose of the pledged equity interests or take any actions that would prejudice YibaoHK’s interest. The equity pledge agreement will expire two (2) years after Confucian’ obligations under the consulting services agreements have been fulfilled.

Option Agreement. Under the option agreement between Confucian Shareholders and YibaoHK, Confucian Shareholders irrevocably granted YibaoHK or its designated person an exclusive option to purchase, to the extent permitted under PRC law, all or part of the equity interests in Confucian for the cost of the initial contributions to the registered capital or the minimum amount of consideration permitted by applicable PRC law. YibaoHK or its designated person has sole discretion to decide when to exercise the option, whether in part or in full. The term of this agreement is ten (10) years from August 31, 2016 and may be extended prior to its expiration by written agreement of the parties.

Voting Rights Proxy Agreement. Pursuant to the proxy agreement between Confucian Shareholders and YibaoHK, Confucian Shareholders agreed to irrevocably grant a person to be designated by YibaoHK with the right to exercise Confucian Shareholders’ voting rights and their other rights, including the attendance at and the voting of Confucian Shareholders’ shares at shareholders’ meetings (or by written consent in lieu of such meetings) in accordance with applicable laws and its Articles of Association, including but not limited to the rights to sell or transfer all or any of his equity interests of Confucian, and appoint and vote for the directors and Chairman as the authorized representative of the shareholders of Confucian. The proxy agreement may be terminated by joint consent of the parties or upon 30-day written notice from YibaoHK.

| 3 |

CONFUCIAN BUSINESS

History

Confucian was founded under the laws of the People's Republic of China on October 31, 2012. Confucian is located in Food Industrial Park inside the economic development Zone of JinXiang County, Ji’ning City in the province of Shandong in China. Confucian is a limited liability company.

Overview

Confusion is a manufacture and research based bio-science company. It has a large capacity to manufacture tablets, granule, oral liquid, powders, soft gels and capsules products. Confucian distributes its products through its own network and white label products. It also has access to a member-based distribution system owned by an affiliated company.

Confusion possesses manufacturing permits for food product, hygienic products, sanitary products, and health products. Confusion's main business includes: technology study and transfer of chondroitin and garlic oil; trading, cold storage, and pretreating of garlic, fruit, and vegetables products; trading of chemical products (excluding hazardous chemicals); import and export of goods and technology (excluding those restricted by government); the manufacturing and sale of health products including powder, granules, tablets, hard capsule, and soft capsule products.

Ownership

During the phase of incorporation, Qingbao Kong accounted for 51% of the initial equity, Xiuhua Song accounted for 49%.

In 2013, Xiuhua Song transferred her 49% of equity to WenXiu Song.

In March 2016, Qingbao Kong transferred his 51% of equity to Hengchun Zhang.

As of today, the Company’s equity is owned 51% by Hengchun Zhang and 49% by Wenxiu Song

Product Overview

The Company’s main products can be divided into health food products and hygienic products

Health Food Products

| · | Phytocholesterol tableting candy, |

Phytosterol has strong anti-inflammatory effects to the human body, which can inhibit the absorption of cholesterol for human and biochemical synthesis of cholesterol. Additionally, it can promote the degradation and metabolism of cholesterol. Phytosterol can be used for prevention & therapy of coronary atherosclerosis heart disease. It has the potential for treating ulcers, skin squamous carcinoma and cervical cancer. Phytosterol may promote wound healing, muscle proliferation, enhance capillary circulation. Phytosterol may be used as blocking agent of formation of gallstones.

| · | Polydextrose tableting candy, |

Polydextrose is used for regulating blood lipid in order to reduce fat accumulation.

| · | Dunaliella Salina Haematococcus Pluvialis tableting candy, |

Dunaliella Salina Haematococcus Pluvialis is used to replenishing the body's astaxanthin, natural carotene and variety of minerals. It has an effect on antioxidant activity, protect skin, protect vision and improve immunity.

| · | Dunaliella Salina Gum Base Candy, |

Dunaliella salina is rich in antioxidant needed by the human body health, resistance to radiation and enhance human immunity of natural carotenoids and 70 kinds of minerals and trace elements.

| · | Haematococcus Pluvialis Gum Candy, |

The main component of Haematococcus Pluvialis is astaxanthin. It has six anti-aging effect protect the skin; protect eye health; helps to support the cardiovascular system; maintain a healthy joints and connective tissue; and, increase strength and endurance.

| 4 |

| · | Fish Oil Gum Candy, |

Fish Oil adjusts the blood liquid which may, prevent blood clots, cerebral thrombosis, cerebral hemorrhage and stroke. Additionally, fish oil may prevent arthritis, Alzheimer’s disease, improve the memory and vision, and control presbyopia.

| · | Earthworm Protein tableting Candy, |

Earthworm Protein is used to improve blood circulation, inhibit platelet aggregation, reduce glucose concentrations, and prevent blood clots. It may be a control efficiency for coronary heart disease, arteriosclerosis, and other hematologic disorders.

| · | Collagen Protein tableting candy, |

Collagen Protein is rich in glycine, proline hydroxyproline and other amino acid needed for human body. Collagen protein may have a beneficial effect for skin, hair, bones and muscles.

| · | Krill Oil Gum candy, |

Krill Oil is rich in EPA and DHA. This may have beneficial health effects, including cardiovascular, nerve, bones, joints, vision, and skin care.

| · | Phosphatidylserine tableting candy, |

Phosphatidylserine may improve the function of the brain by promoting the recovery of brain; and central nervous system. Phosphatidylserine can be used for auxiliary treatment dementia and age related memory loss.

| · | Milk Powder tableting candy, |

Milk powder tablet is a nutrition supplement.

Hygienic Products

The hygienic product line includes the following products:

| · | Feminine Gel products for women, |

Anti-bacteria product used as an auxiliary treatment for vaginal bacterial.

| · | Anti-bacterial skin liquid |

Anti-bacteria liquids used for skin sterilization. Inhibit the bromhidrosis and relief beriberi itch

Confucian owns a 100,000 stage purification workshops, advanced production lines and manufacturing equipment. The Company has a higher capacity for OEM processing of tablets, hard capsules, soft capsules, oral liquid, granules, and powders.

Plan

By following the Company motto of being “passionate for the health industry, bringing together the world's resources, focusing on consumer demand, and creating a win-win situation ‘, the Company is eager to develop businesses in the international health and pharmaceutical market.

The Company’s near term goal is to reach breakeven within a 6-month period time. In order to reach such goal, the Company is increasing its sales and production volume through arrangements and networking with its existing customers and its affiliated companies. Additionally, it plans to increase the size of its sales department to develop new customers.

The Company’s ultimate goal is to make the business profitable and competitive in the international health and pharmaceutical market. To achieve such goal, the Company needs to cooperate with other businesses having capital, market, technology, or products. Additionally, the Company needs to recruit sufficient workforce and talents and actively develop new technology and new products through research and development.

| 5 |

Market Overview

Domestic Markets

Through member based distribution network, the Company has access to the major markets in Jining City area and most other cities in the Shandong province.

International Market

Currently international markets show an interest in Chinese herb medicine. For instance, European and US companies in the food industry use advanced technology to extract ginkgo biloba, then add it in gum, chocolate, and other health foods. The Company focuses on product diversification and innovation. It plans to sell its produces in well-known retail stores in Europe and US, such as Walmart.

Market Opportunity

Consumers are increasingly concerned about their own health. The spending on health-related products has increased year by year, and the demand for nutrition and health food is high. According to the international standard classification, medicine and health care is one of the world's fastest growing trade sectors. Sales of health food is currently experiencing a rapid annual growth.

In China, the health products market is expanding along with the growth of economy and acceleration of aged population. People used to see health products as optional. Now they are necessities of daily life. The sixty and older group is expected to keep growing fast. The elderly group tends to draw attention to nutrition and health product, which will boost the development of the health market. In addition, young people are beginning to pay more attention to their heath, and health food and products are the new powerful impetus. Therefore, the Company believes it will be able to take advantage of this increased demand.

Competition

At present, Chinese health food manufacturers are mainly concentrated in Shandong, Jiangsu, Zhejiang, Anhui, Ningxia and a few other regions. Although in recent years, the health and production conditions of the eastern coastal areas have been improved to some extent. Overall, China’s nutrition and health food businesses are small scaled, use outdated technology, and lack brand recognition.

Intellectual Property

Confucian is actively planning research and development activities in order to patent these products.

Government Regulation

The great social demand of nutrition and health care products has led to a policy of governmental support. In December 2011, the Nutrient agency released “125 Development Plan for Food Industry”, in which nutrition and health care products manufacturing was first listed as the most important development within the industry. In addition, “the opinions of State Council on Promoting Health Development of Service Industry” published in 2013, “Notice on Promoting Health and Pension Services” published in 2014, and “Chinese Food and Nutrition Development Program” published in 2014 all had positive effects on the development of health products industry.

Employees

Confucian currently has 38 full time employees, including 2 management employees, 7 office employees handling finance and administrative functions, 4 scientific researchers and technicians; and 25 production workers.

Property

YBCC’s corporate headquarters are located at 17800 Castleton St. Ste 180, City of Industry, California 91748. YBCC rents approximately 983 square feet of office space for its headquarters. The lease began on September 1, 2016 and expires on September 30, 2018. As of December 31, 2016, the total monthly base rent is $2,802.

Confucian is located in Food Industrial Park inside the economic development Zone of JinXiang County, Jining City in the province of Shandong in China. It has three land use rights with the total cost of approximately $736,632. One land use right expires in 2063, while the other two land use rights expire in 2065. It has nearly 30,000 square meters standardized plant facilities.

| 6 |

Litigation

There are no known potential litigation matters.

You should carefully consider the risks described below together with all of the other information included in this report before making an investment decision with regard to our securities. The statements contained in or incorporated into this offering that are not historic facts are forward-looking statements that are subject to risks and uncertainties that could cause actual results to differ materially from those set forth in or implied by forward-looking statements. If any of the following risks actually occurs, our business, financial condition or results of operations could be harmed. In that case, the trading price of our common stock could decline, and you may lose all or part of your investment.

Risks Related to Our Industry

Our businesses are subject to fluctuations in operating results due to general economic conditions, specific economic conditions in the industries in which it operates and other external forces.

Our businesses and operations could be affected by the following, among other factors:

| - | changes in general economic conditions and specific conditions in industries in which our businesses operate that can result in the deferral or reduction of purchases by end-use customers; |

| - | the size, timing and cancellation of significant orders, which can be non-recurring; |

| - | market acceptance of new products and product enhancements; |

| - | announcements, introductions and transitions of new products by us or our competitors; |

| - | deferrals of customer orders in anticipation of new products or product enhancements introduced by us or our competitors; |

| - | changes in pricing in response to competitive pricing actions; |

| - | supply constraints; |

| - | the level of expenditures on research and development and sales and marketing programs; |

| - | our ability to achieve targeted cost reductions; |

| - | rising interest rates; and |

| - | excess facilities. |

The loss of Confucian as our operating business would have a material adverse effect on our business and the price of our common stock.

We have no equity ownership interest in Confucian. Our ability to control Confucian and consolidate its financial results is through a series of contractual agreements between it and YibaoHK. Management of Confucian is affiliates of us and the stockholders of Confucian are also our stockholders. Thus, the VIE Agreements were not entered into as a result of arms’ length negotiations because the parties to the agreement are under common control. Ms. Song, our CEO and Chairman has control over of the shares of Confucian and of our common stock. The VIE Agreements may be terminated upon the termination of the business of Confucian. Any other termination would be a breach of the agreement. While the Company believes that the VIE Agreements are legal and enforceable under PRC law, these affiliates control the parties to the VIE Agreements and it could be possible for them to cause Confucian to breach the VIE Agreements and our unaffiliated investors would have little or no recourse because of the inherent difficulties in enforcing their rights since all our assets are located in the PRC. (See, PRC laws and regulations governing Confucian' current business are sometimes vague and uncertain.) In the event that management of Confucian decides to breach the VIE Agreements, the risk of loss of the affiliated shareholders of Confucian could be lower than unaffiliated investors and the interests of the management and shareholders of Confucian would be in conflict with the interest of our other stockholders.

| 7 |

Confucian’s failure to compete effectively may adversely affect our ability to generate revenue.

Confucian competes with other companies, many of whom are developing or can be expected to develop products similar to Confucian. Confucian’s market is a large market with many competitors. Many of its competitors are more established than Confucian is, and have significantly greater financial, technical, marketing and other resources than it presently possesses. Some of Confucian’s competitors have greater name recognition and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers, and adopt more aggressive pricing policies. We cannot assure you that Confucian will be able to compete effectively with current or future competitors or that the competitive pressures it faces will not harm it business.

We may not be able to effectively control and manage the growth of Confucian.

If Confucian’s business and markets grow and develop, it will be necessary for us to finance and manage expansion in an orderly fashion. An expansion would increase demands on its existing management, workforce and facilities. Failure to satisfy such increased demands could interrupt or adversely affect its operations and cause delay in production and delivery of its pharmaceutical prescription, over the counter and medical nutrient products as well as administrative inefficiencies.

We may require additional financing in the future and a failure to obtain such required financing will inhibit Confucian’s ability to grow.

The continued growth of Confucian’s business may require additional funding from time to time which we expect to raise in private placements of our equity or debt securities with accredited investors or by offering our securities for sale pursuant to an effective registration statement on a market where our common stock is traded. The proceeds of these funding will be forwarded to Confucian and accounted for as a loan to Confucian and eliminated during consolidation. The proceeds would be used for general corporate purposes of Confucian, which could include acquisitions, investments, repayment of debt and capital expenditures among other things. We may also use the proceeds to repurchase our capital stock or for our corporate overhead expenses. If we borrow funds we expect to be the primary obligor on any debt. Obtaining additional funding would be subject to a number of factors including market conditions, operating performance and investor sentiment, many of which are outside of our control. These factors could make the timing, amount, terms and conditions of additional funding unattractive or unavailable to us.

Our management believes that Confucian currently has sufficient funds from working capital to meet its current operating costs over the next 6 months.

The terms of any future financing may adversely affect your interest as stockholders.

If we require additional financing in the future, we may be required to incur indebtedness or issue equity securities, the terms of which may adversely affect your interests in us. For example, the issuance of additional indebtedness may be senior in right of payment to your shares upon our liquidation. In addition, indebtedness may be under terms that make the operation of Confucian's business more difficult because the lender's consent could be required before we take certain actions. Similarly, the terms of any equity securities we issue may be senior in right of payment of dividends to your common stock and may contain superior rights and other rights as compared to your common stock. Further, any such issuance of equity securities may dilute your interest in us.

We may engage in future acquisitions that could dilute the ownership interests of our stockholders, cause us to incur debt and assume contingent liabilities.

We may review acquisition and strategic investment prospects that we believe would complement the current product offerings of Confucian, augment its market coverage or enhance its technical capabilities, or otherwise offer growth opportunities. From time to time we review investments in new businesses and expect to make investments in, and to acquire, businesses, products, or technologies in the future. We expect that when we raise funds from investors for any of these purposes we will be either the issuer or the primary obligor while the proceeds will be forwarded to Confucian and accounted for as a loan to Confucian and eliminated during consolidation. In the event of any future acquisitions, we could:

| · | issue equity securities which would dilute current stockholders’ percentage ownership; |

| · | incur substantial debt; |

| · | assume contingent liabilities; or |

| · | expend significant cash. |

| 8 |

These actions could have a material adverse effect on our operating results or the price of our common stock. Moreover, even if we do obtain benefits in the form of increased sales and earnings, there may be a lag between the time when the expenses associated with an acquisition are incurred and the time when we recognize such benefits. Acquisitions and investment activities also entail numerous risks, including:

| · | difficulties in the assimilation of acquired operations, technologies and/or products; |

| · | unanticipated costs associated with the acquisition or investment transaction; |

| · | the diversion of management’s attention from other business concerns; |

| · | adverse effects on existing business relationships with suppliers and customers; |

| · | risks associated with entering markets in which Confucian has no or limited prior experience; |

| · | the potential loss of key employees of acquired organizations; and |

| · | substantial charges for the amortization of certain purchased intangible assets, deferred stock compensation or similar items. |

We cannot ensure that we will be able to successfully integrate any businesses, products, technologies, or personnel that we might acquire in the future and our failure to do so could have a material adverse effect on our and/or Confucian' business, operating results and financial condition.

We are responsible for the indemnification of our officers and directors.

Our certificate of incorporation provides for the indemnification and/or exculpation of our directors, officers, employees, agents and other entities which deal with it to the maximum extent provided, and under the terms provided, by the laws and decisions of the courts of the state of Nevada. Since we do not hold any indemnification insurance, these indemnification provisions could result in substantial expenditures, which we may be unable to recoup, which could adversely affect our business and financial conditions. Xiuhua Song, our Chairman of Board, President, Chief Executive Officer, and Chief Financial Officer are key personnel with rights to indemnification under our certificate of incorporation.

We may not have adequate internal accounting controls. While we have certain internal procedures in our budgeting, forecasting and in the management and allocation of funds, our internal controls may not be adequate.

We are constantly striving to improve our internal accounting controls. We expect to continue to improve our internal accounting control for budgeting, forecasting, managing and allocating our funds and to better account for them as we grow. There is no guarantee that such improvements will be adequate or successful or that such improvements will be carried out on a timely basis. If we do not have adequate internal accounting controls, we may not be able to appropriately budget, forecast and manage our funds, we may also be unable to prepare accurate accounts on a timely basis to meet our continuing financial reporting obligations and we may not be able to satisfy our obligations under US securities laws.

Confucian is dependent on certain key personnel and loss of these key personnel could have a material adverse effect on our business, financial condition and results of operations.

Our success is, to a certain extent, attributable to the management, sales and marketing, and manufacturing expertise of key personnel at Confucian. Xiuhua Song, our President, Chief Executive Officer and Chairman of the Board, performs key functions in the operation of our and Confucian's business. There can be no assurance that Confucian will be able to retain these officers after the term of their employment contracts expire. The loss of these officers could have a material adverse effect upon our business, financial condition, and results of operations. Confucian must attract, recruit and retain a sizeable workforce of technically competent employees. We do not carry key man life insurance for any of our key personnel or personnel at Confucian nor do we foresee purchasing such insurance to protect against a loss of key personnel and the key personnel of Confucian.

| 9 |

We and Confucian are dependent upon the services of Mrs. Song, for the continued growth and operation of our company because of her experience in the industry and her personal and business contacts in China. Although we have no reason to believe that Mrs. Song will discontinue her services with us or Confucian, the interruption or loss of her services would adversely affect our ability to effectively run Confucian's business and pursue its business strategy as well as our results of operations.

Confucian may not be able to hire and retain qualified personnel to support its growth and if it is unable to retain or hire these personnel in the future, its ability to improve its products and implement its business objectives could be adversely affected.

Competition for senior management and senior personnel in the PRC is intense, the pool of qualified candidates in the PRC is very limited, and Confucian may not be able to retain the services of its senior executives or senior personnel, or attract and retain high-quality senior executives or senior personnel in the future. This failure could materially and adversely affect our future growth and financial condition. Confucian expects to hire additional sales and plant personnel throughout fiscal year 2017 in order to accommodate its growth.

If Confucian fails to increase its brand recognition, it may face difficulty in obtaining new customers and business partners.

We believe that establishing, maintaining and enhancing Confucian’s brand in a cost-effective manner is critical to achieving widespread acceptance of Confucian’s current and future products and services and is an important element in Confucian's effort to increase its customer base and obtain new business partners. We believe that the importance of brand recognition will increase as competition in Confucian’s market develops. Some of Confucian’s potential competitors already have well-established brands in the pharmaceutical promotion and distribution industry. Successful promotion of Confucian’s brand will depend largely on its ability to maintain a sizeable and active customer base, its marketing efforts and its ability to provide reliable and useful products and services at competitive prices. Brand promotion activities may not yield increased revenue, and even if they do, any increased revenue may not offset the expenses Confucian incurs in building its brand. If Confucian fails to successfully promote and maintain its brand, or if Confucian incurs substantial expenses in an unsuccessful attempt to promote and maintain its brand, it may fail to attract enough new customers or retain its existing customers to the extent necessary to realize a sufficient return on its brand-building efforts, in which case Confucian's business, operating results and financial condition, further ours would be materially adversely affected.

Confucian's operating results may fluctuate as a result of factors beyond its control.

Confucian's operating results may fluctuate significantly in the future as a result of a variety of factors, many of which are beyond its control. These factors include:

| · | the costs of raw material and development; |

| · | the relative speed and success with which Confucian can obtain and maintain customers, merchants and vendors for its products; |

| · | capital expenditures for equipment; |

| · | marketing and promotional activities and other costs; |

| · | changes in Confucian’s pricing policies, suppliers and competitors; |

| · | the ability of Confucian’s suppliers to provide products in a timely manner to its customers; |

| · | changes in operating expenses; |

| · | increased competition in Confucian’s markets; and |

| · | other general economic and seasonal factors. |

| 10 |

Confucian faces risks related to product liability claims.

Confucian does not maintain product liability insurance. It faces the risk of loss because adverse publicity associated with product liability lawsuits, whether or not such claims are valid. It may not be able to avoid such claims. Although product liability lawsuits in the PRC are rare, and Confucian has not to date experienced significant failure of its products, there is no guarantee that it will not face such liability in the future. This liability could be substantial and the occurrence of such loss or liability may have a material adverse effect on its business, financial condition and prospects.

Confucian faces marketing risks.

Newly developed dietary supplements and technologies may not be compatible with market needs. Because markets for drugs differentiate geographically inside China, Confucian must develop and manufacture its products to accurately target specific markets to ensure product sales. If Confucian fails to invest in extensive market research to understand the health needs of consumers in different geographic areas, it may face limited market acceptance of its products, which could have material adverse effect on its sales and earnings.

We face risks relating to difficulty in defending intellectual property rights from infringement.

Our success depends on protection of the current and future technologies and products of Confucian and its ability to defend its intellectual property rights. Confucian has filed for copyright protection for the various names and brands of its products sold in the PRC. However, it is possible for its competitors to develop similar competitive products even though it has taken steps to protect its intellectual property. If we fail to protect Confucian’s intellectual property adequately, competitors may manufacture and market products similar to Confucian.

Confucian also relies on trade secrets, non-patented proprietary expertise and continuing technological innovation that it shall seek to protect, in part, by entering into confidentiality agreements with licensees, suppliers, employees and consultants. These agreements may be breached and there may not be adequate remedies in the event of a breach. Disputes may arise concerning the ownership of intellectual property or the applicability of confidentiality agreements. Moreover, its trade secrets and proprietary technology may otherwise become known or be independently developed by its competitors. If patents are not issued with respect to products arising from research, Confucian may not be able to maintain the confidentiality of information relating to these products.

We face risks relating to third parties that may claim that Confucian infringes on their proprietary rights and may prevent Confucian from manufacturing and selling certain of its products.

There has been substantial litigation in the pharmaceutical industry with respect to the manufacturing, use and sale of new products. These lawsuits relate to the validity and infringement of patents or proprietary rights of third parties. We and/or Confucian may be required to commence or defend against charges relating to the infringement of patent or proprietary rights. Any such litigation could:

| · | require Confucian or us to incur substantial expense, even if covered by insurance or are successful in the litigation; |

| · | require Confucian to divert significant time and effort of its technical and management personnel; |

| · | result in the loss of Confucian’s rights to develop or make certain products; and |

| · | require Confucian or us to pay substantial monetary damages or royalties in order to license proprietary rights from third parties. |

Although patent and intellectual property disputes within our have often been settled through licensing or similar arrangements, costs associated with these arrangements may be substantial and could include the long-term payment of royalties. These arrangements may be investigated by regulatory agencies and, if improper, may be invalidated. Furthermore, the required licenses may not be made available to Confucian on acceptable terms. Accordingly, an adverse determination in a judicial or administrative proceeding or a failure to obtain necessary licenses could prevent Confucian from manufacturing and selling some of its products or increase its costs to market these products.

| 11 |

In addition, when seeking regulatory approval for some of its products, Confucian is required to certify to regulatory authorities, including the SFDA that such products do not infringe upon third party patent rights. Filing a certification against a patent gives the patent holder the right to bring a patent infringement lawsuit against Confucian. Any lawsuit would delay the receipt of regulatory approvals. A claim of infringement and the resulting delay could result in substantial expenses and even prevent Confucian from manufacturing and selling certain of its products.

Confucian’s launch of a product prior to a final court decision or the expiration of a patent held by a third party may result in substantial damages to Confucian or us. If Confucian is found to infringe a patent held by a third party and become subject to such damages, these damages could have a material adverse effect on the results of its operations and financial condition.

We face risks related to research and the ability to develop new products.

Our growth and survival depends on Confucian’s ability to consistently discover, develop and commercialize new products and find new and improve on existing technologies and platforms. As such, if Confucian fails to make sufficient investments in research, be attentive to consumer needs or does not focus on the most advanced technologies, its current and future products could be surpassed by more effective or advanced products of other companies.

Risk Related To Confucian’s Industry

Confucian’s certificates, permits, and licenses related to its operations are subject to governmental control and renewal and failure to obtain renewal will cause all or part of its operations to be terminated.

Confucian is subject to various PRC laws and regulations pertaining to our industry. Confucian has attained certificates, permits, and licenses required for the operation of a dietary supplement enterprise and the manufacturing of our products in the PRC.

Confucian intends to apply for renewal of these health food production permits prior to expiration. During the renewal process, Confucian will be re-evaluated by the appropriate governmental authorities and must comply with the then prevailing standards and regulations which may change from time to time. In the event that it is not able to renew the certificates, permits and licenses, all or part of its operations may be terminated. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of its operations, it may adversely affect its operation and our profitability.

According to Drug Administration Law of the PRC and its implemental rules, SFDA approvals may be suspended or revoked prior to the expiration date under circumstances that include:

| · | producing counterfeit medicine, |

| · | producing inferior quality products, |

| · | failing to meet the drug GMP standards; |

| · | purchasing medical ingredients used in the production of products sources that do not have a Pharmaceutical Manufacturing Permit or Pharmaceutical Trade Permit; |

| · | fraudulent reporting of results or product samples in application process, |

| · | failing to meet drug labeling and direction standards, |

| · | bribing doctors or hospital personnel to entice them to use products, |

| · | producing pharmaceuticals for use or resale by companies that are not approved by the SFDA, or |

| · | the approved drug has a serious side effect. |

| 12 |

If Confucian’s products fail to receive regulatory approval or are severely limited in these products' scope of use, it may be unable to recoup considerable research and development expenditures.

Confucian’s research and development of pharmaceutical products is subject to the regulatory approval of the SFDA in China. The regulatory approval procedure for pharmaceuticals can be quite lengthy, costly, and uncertain. Depending upon the discretion of the SFDA, the approval process may be significantly delayed by additional clinical testing and require the expenditure of resources not currently available; in such an event, it may be necessary for Confucian to abandon its application. Even where approval of the product is granted, it may contain significant limitations in the form of narrow indications, warnings, precautions, or contra-indications with respect to conditions of use. If approval of Confucian’s product is denied, abandoned, or severely limited in terms of the scope of products use, it may result in the inability to recoup considerable research and development expenditures.

Price control regulations may decrease Confucian’s profitability.

The laws of the PRC provide for the government to fix and adjust prices. The prices of certain medicines Confucian distributes, including those listed in the Chinese government's catalogue of medications that are reimbursable under China's social insurance program, or the Insurance Catalogue, are subject to control by the relevant state or provincial price administration authorities. The PRC establishes price levels for products based on market conditions, average industry cost, supply and demand and social responsibility. In practice, price control with respect to these medicines sets a ceiling on their retail price. The actual price of such medicines set by manufacturers, wholesalers and retailers cannot historically exceed the price ceiling imposed by applicable government price control regulations. Although, as a general matter, government price control regulations have resulted in drug prices tending to decline over time, there has been no predictable pattern for such decreases.

None of our products are subject to price controls. It is possible that products may be subject to price control, or that price controls may be increased in the future. To the extent that Confucian’s products are subject to price control, its revenue, gross profit, gross margin and net income will be affected since the revenue we derive from Confucian’s sales will be limited and it may face no limitation on its costs. Further, if price controls affect both Confucian’s revenue and costs, its ability to be profitable and the extent of our profitability will be effectively subject to determination by the applicable regulatory authorities in the PRC.

Adverse publicity associated with Confucian’s products, ingredients or network marketing program, or those of similar companies, could harm its financial condition and operating results.

The results of Confucian’s operations may be significantly affected by the public's perception of Confucian’s product and similar companies. This perception is dependent upon opinions concerning:

| · | the safety and quality of its products and ingredients; |

| · | the safety and quality of similar products and ingredients distributed by other companies; and |

| · | its sales force. |

Adverse publicity concerning any actual or purported failure of Confucian to comply with applicable laws and regulations regarding product claims and advertising, good manufacturing practices, or other aspects of Confucian’s business, whether or not resulting in enforcement actions or the imposition of penalties, could have an adverse effect on the goodwill of Confucian and could negatively affect its sales and ability generate revenue.

In addition, Confucian’s consumers' perception of the safety and quality of its products and ingredients as well as similar products and ingredients distributed by other companies can be significantly influenced by media attention, publicized scientific research or findings, widespread product liability claims and other publicity concerning Confucian’s products or ingredients or similar products and ingredients distributed by other companies. Adverse publicity, whether or not accurate or resulting from consumers' use or misuse of Confucian’s products, that associates consumption of its products or ingredients or any similar products or ingredients with illness or other adverse effects, questions the benefits of Confucian’s or similar products or claims that any such products are ineffective, inappropriately labeled or have inaccurate instructions as to their use, could negatively impact its reputation or the market demand for Confucian’s products.

| 13 |

If Confucian fails to develop new products with high profit margins, and its high profit margin products are substituted by competitor's products, our gross and net profit margins will be adversely affected.

There is no assurance that Confucian will be able to sustain its profit margins in the future. The supplement industry is very competitive, and there may be pressure to reduce sale prices of products without a corresponding decrease in the price of raw materials. In addition, the supplement industry in China is highly competitive and new products are constantly being introduced to the market. In order to increase the sales of Confucian’s products and expand its market, it may be forced to reduce prices in the future, leading to a decrease in gross profit margin. The research and development of new products and technologies is costly and time consuming, and there are no assurances that Confucian’s research and development of new products will either be successful or completed within the anticipate timeframe, if ever at all. There is no assurance that Confucian’s competitors' new products, technologies, and processes will not render its existing products obsolete or non-competitive. To the extent that Confucian fails to develop new products with high profit margins and its high profit margin products are substituted by competitors' products, our gross profit margins will be adversely affected.

Risks Related To Doing Business In The PRC

Changes in the policies of the PRC government could have a significant impact upon the business we may be able to conduct in the PRC and the profitability of such business.

Confucian’s business operations may be adversely affected by the current and future political environment in the PRC. The PRC has operated as a socialist state since the mid-1900s and is controlled by the Communist Party of China. The Chinese government exerts substantial influence and control over the manner in which we and it must conduct our business activities. The PRC has only permitted provincial and local economic autonomy and private economic activities since 1988. The government of the PRC has exercised and continues to exercise substantial control over virtually every sector of the Chinese economy, particularly the pharmaceutical industry, through regulation and state ownership. Our ability to operate in China may be adversely affected by changes in Chinese laws and regulations, including those relating to taxation, import and export tariffs, raw materials, environmental regulations, land use rights, property and other matters. Under current leadership, the government of the PRC has been pursuing economic reform policies that encourage private economic activity and greater economic decentralization. There is no assurance, however, that the government of the PRC will continue to pursue these policies, or that it will not significantly alter these policies from time to time without notice.

The PRC's economy is in a transition from a planned economy to a market oriented economy subject to five-year and annual plans adopted by the government that set national economic development goals. Policies of the PRC government can have significant effects on the economic conditions of the PRC. The PRC government has confirmed that economic development will follow the model of a market economy. Under this direction, we believe that the PRC will continue to strengthen its economic and trading relationships with foreign countries and business development in the PRC will follow market forces. While we believe that this trend will continue, there can be no assurance that this will be the case.

A change in policies by the PRC government could adversely affect our interests by, among other factors: changes in laws, regulations or the interpretation thereof, confiscatory taxation, restrictions on currency conversion, imports or sources of supplies, or the expropriation or nationalization of private enterprises. Although the PRC government has been pursuing economic reform policies for more than two decades, there is no assurance that the government will continue to pursue such policies or that such policies may not be significantly altered, especially in the event of a change in leadership, social or political disruption, or other circumstances affecting the PRC's political, economic and social life.

The PRC laws and regulations governing Confucian’s current business operations are sometimes vague and uncertain. Any changes in such PRC laws and regulations may harm its business.

The PRC laws and regulations governing Confucian’s current business operations are sometimes vague and uncertain. The PRC’s legal system is a civil law system based on written statutes, in which system decided legal cases have little value as precedents unlike the common law system prevalent in the United States. There are substantial uncertainties regarding the interpretation and application of PRC laws and regulations, including but not limited to the laws and regulations governing its business, or the enforcement and performance of its arrangements with customers in the event of the imposition of statutory liens, death, bankruptcy and criminal proceedings. The Chinese government has been developing a comprehensive system of commercial laws, and considerable progress has been made in introducing laws and regulations dealing with economic matters such as foreign investment, corporate organization and governance, commerce, taxation and trade. However, because these laws and regulations are relatively new, and because of the limited volume of published cases and judicial interpretation and their lack of force as precedents, interpretation and enforcement of these laws and regulations involve significant uncertainties. New laws and regulations that affect existing and proposed future businesses may also be applied retroactively. We are considered a foreign persons or foreign funded enterprises under PRC laws, and as a result, we are required to comply with PRC laws and regulations. We cannot predict what effect the interpretation of existing or new PRC laws or regulations may have on its businesses. If the relevant authorities find that we are in violation of PRC laws or regulations, they would have broad discretion in dealing with such a violation, including, without limitation:

| 14 |

| · | levying fines; |

| · | revoking Confucian’s business and other licenses; |

| · | requiring that we restructure its ownership or operations; and |

| · | requiring that we discontinue any portion or all of our business. |

A slowdown, inflation or other adverse developments in the PRC economy may harm Confucian’s customers and the demand for Confucian’s services and products.

All of Confucian’s operations are conducted in the PRC and all of its revenues are generated from sales in the PRC. Although the PRC economy has grown significantly in recent years, we cannot assure you that this growth will continue. A slowdown in overall economic growth, an economic downturn, a recession or other adverse economic developments in the PRC could significantly reduce the demand for its products and harm Confucian’s business.

While the PRC economy has experienced rapid growth, such growth has been uneven among various sectors of the economy and in different geographical areas of the country. Rapid economic growth could lead to growth in the money supply and rising inflation. If prices for Confucian’s products rise at a rate that is insufficient to compensate for the rise in the costs of supplies, it may harm its profitability. In order to control inflation in the past, the PRC government has imposed controls on bank credit, limits on loans for fixed assets and restrictions on state bank lending. Such an austere policy can lead to a slowing of economic growth. In October 2004, the People's Bank of China, the PRC's central bank, raised interest rates for the first time in nearly a decade and indicated in a statement that the measure was prompted by inflationary concerns in the Chinese economy. Repeated rises in interest rates by the central bank would likely slow economic activity in China which could, in turn, materially increase its costs and also reduce demand for its products.

Governmental control of currency conversion may affect the value of your investment.

The PRC government imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of the PRC. We receive substantially all of our revenues in Renminbi, which is currently not a freely convertible currency. Shortages in the availability of foreign currency may restrict our ability to remit sufficient foreign currency to pay dividends, or otherwise satisfy foreign currency dominated obligations. Under existing PRC foreign exchange regulations, payments of current account items, including profit distributions, interest payments and expenditures from the transaction, can be made in foreign currencies without prior approval from the PRC State Administration of Foreign Exchange by complying with certain procedural requirements. However, approval from appropriate governmental authorities is required where Renminbi is to be converted into foreign currency and remitted out of China to pay capital expenses such as the repayment of bank loans denominated in foreign currencies.

The PRC government may also in the future restrict access to foreign currencies for current account transactions. If the foreign exchange control system prevents us from obtaining sufficient foreign currency to satisfy our currency demands, we may not be able to pay certain of our expenses as they come due.

The fluctuation of the Renminbi may harm your investment.

The value of the Renminbi against the U.S. dollar and other currencies may fluctuate and is affected by, among other things, changes in the PRC's political and economic conditions. As we rely entirely on revenues earned in the PRC, any significant revaluation of the Renminbi may materially and adversely affect our cash flows, revenues and financial condition. For example, to the extent that we need to convert U.S. dollars we receive from an offering of our securities into Renminbi for Confucian’s operations, appreciation of the Renminbi against the U.S. dollar would diminish the value of the proceeds of the offering and this could harm Confucian’s business, financial condition and results of operations because it would reduce the proceeds available to us for capital investment in proportion to the appreciation of the Renminbi. In addition, the depreciation of significant RMB denominated assets could result in a charge to our income statement and a reduction in the dollar value of these assets.

| 15 |

On July 21, 2005, the PRC government changed its decade-old policy of pegging the value of the Renminbi to the U.S. dollar. Under the new policy, the Renminbi is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. While the international reaction to the Renminbi revaluation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the Renminbi against the U.S. dollar.

PRC state administration of foreign exchange ("SAFE") regulations regarding offshore financing activities by PRC residents which may increase the administrative burden we face. The failure by our shareholders who are PRC residents to make any required applications and filings pursuant to such regulations may prevent us from being able to distribute profits and could expose us and our PRC resident shareholders to liability under PRC law.

SAFE, issued a public notice ("SAFE #75") effective from November 1, 2005, which requires registration with SAFE by the PRC resident shareholders of any foreign holding company of a PRC entity. Without registration, the PRC entity cannot remit any of its profits out of the PRC as dividends or otherwise.

In October 2005, SAFE issued a public notice, the Notice on Relevant Issues in the Foreign Exchange Control over Financing and Return Investment Through Special Purpose Companies by Residents Inside China, or the SAFE notice, which requires PRC residents, including both legal persons and natural persons, to register with the competent local SAFE branch before establishing or controlling any company outside of China, referred to as an "offshore special purpose company," for the purpose of overseas equity financing involving onshore assets or equity interests held by them. In addition, any PRC resident that is the shareholder of an offshore special purpose company is required to amend its SAFE registration with the local SAFE branch with respect to that offshore special purpose company in connection with any increase or decrease of capital, transfer of shares, merger, division, equity investment or creation of any security interest over any assets located in China. Moreover, if the offshore special purpose company was established and owned the onshore assets or equity interests before the implementation date of the SAFE notice, a retroactive SAFE registration is required to have been completed before March 31, 2006. If any PRC shareholder of any offshore special purpose company fails to make the required SAFE registration and amendment, the PRC subsidiaries of that offshore special purpose company may be prohibited from distributing their profits and the proceeds from any reduction in capital, share transfer or liquidation to the offshore special purpose company. Moreover, failure to comply with the SAFE registration and amendment requirements described above could result in liability under PRC laws for evasion of applicable foreign exchange restrictions.

It is unclear whether our other PRC resident shareholders must make disclosure to SAFE. We believe that only PRC resident shareholders who receive ownership of the foreign holding company in exchange for ownership in the PRC operating company are subject to SAFE #75, there can be no assurance that SAFE will not require our other PRC resident shareholders to register and make the applicable disclosure. In addition, SAFE #75 requires that any monies remitted to PRC residents outside of the PRC be returned within 180 days; however, there is no indication of what the penalty will be for failure to comply or if shareholder non-compliance will be considered to be a violation of SAFE #75 by us or otherwise affect us.

In the event that the proper procedures are not followed under SAFE #75, we could lose the ability to remit monies outside of the PRC and would therefore be unable to pay dividends or make other distributions. Our PRC resident shareholders could be subject to fines, other sanctions and even criminal liabilities under the PRC Foreign Exchange Administrative Regulations promulgated January 29, 1996, as amended.

The PRC's legal and judicial system may not adequately protect our business and operations and the rights of foreign investors.

The PRC legal and judicial system may negatively impact foreign investors. In 1982, the National People's Congress amended the Constitution of China to authorize foreign investment and guarantee the "lawful rights and interests" of foreign investors in the PRC. However, the PRC's system of laws is not yet comprehensive. The legal and judicial systems in the PRC are still rudimentary, and enforcement of existing laws is inconsistent. Many judges in the PRC lack the depth of legal training and experience that would be expected of a judge in a more developed country. Because the PRC judiciary is relatively inexperienced in enforcing the laws that do exist, anticipation of judicial decision-making is more uncertain than would be expected in a more developed country. It may be impossible to obtain swift and equitable enforcement of laws that do exist, or to obtain enforcement of the judgment of one court by a court of another jurisdiction. The PRC's legal system is based on the civil law regime, that is, it is based on written statutes; a decision by one judge does not set a legal precedent that is required to be followed by judges in other cases. In addition, the interpretation of Chinese laws may be varied to reflect domestic political changes.

| 16 |

The promulgation of new laws, changes to existing laws and the pre-emption of local regulations by national laws may adversely affect foreign investors. However, the trend of legislation over the last 20 years has significantly enhanced the protection of foreign investment and allowed for more control by foreign parties of their investments in Chinese enterprises. There can be no assurance that a change in leadership, social or political disruption, or unforeseen circumstances affecting the PRC's political, economic or social life, will not affect the PRC government's ability to continue to support and pursue these reforms. Such a shift could have a material adverse effect on Confucian’s business and prospects.

The practical effect of the PRC legal system on Confucian’s business operations in the PRC can be viewed from two separate but intertwined considerations. First, as a matter of substantive law, the Foreign Invested Enterprise laws provide significant protection from government interference. In addition, these laws guarantee the full enjoyment of the benefits of corporate Articles and contracts to Foreign Invested Enterprise participants. These laws, however, do impose standards concerning corporate formation and governance, which are qualitatively different from the general corporation laws of the United States. Similarly, the PRC accounting laws mandate accounting practices, which are not consistent with U.S. generally accepted accounting principles. PRC's accounting laws require that an annual "statutory audit" be performed in accordance with PRC accounting standards and that the books of account of Foreign Invested Enterprises are maintained in accordance with Chinese accounting laws. Article 14 of the People's Republic of China Wholly Foreign-Owned Enterprise Law requires a wholly foreign-owned enterprise to submit certain periodic fiscal reports and statements to designated financial and tax authorities, at the risk of business license revocation. While the enforcement of substantive rights may appear less clear than United States procedures, the Foreign Invested Enterprises and Wholly Foreign-Owned Enterprises are Chinese registered companies, which enjoy the same status as other Chinese registered companies in business-to-business dispute resolution. Any award rendered by an arbitration tribunal is enforceable in accordance with the United Nations Convention on the Recognition and Enforcement of Foreign Arbitral Awards (1958). Therefore, as a practical matter, although no assurances can be given, the Chinese legal infrastructure, while different in operation from its United States counterpart, should not present any significant impediment to the operation of Foreign Invested Enterprises

Because our principal assets are located outside of the United States and all of our directors and all of our officers reside outside of the United States, it may be difficult for you to enforce your rights based on U.S. federal securities laws against us and our officers or to enforce U.S. court judgment against us or them in the PRC.

All of our directors and all of our officers reside outside of the United States. In addition, Confucian’s operating company is located in the PRC and substantially all of its assets are located outside of the United States. It may therefore be difficult for investors in the United States to enforce their legal rights based on the civil liability provisions of the U.S. Federal securities laws against us in the courts of either the U.S. or the PRC and, even if civil judgments are obtained in U.S. courts, to enforce such judgments in PRC courts. Further, it is unclear if extradition treaties now in effect between the United States and the PRC would permit effective enforcement against us or our officers and directors of criminal penalties, under the U.S. Federal securities laws or otherwise.

The relative lack of public company experience of our management team may put us at a competitive disadvantage.

Our management team lacks public company experience, which could impair our ability to comply with legal and regulatory requirements such as those imposed by Sarbanes-Oxley Act of 2002. The individuals who now constitute our senior management have never had responsibility for managing a publicly traded company. Such responsibilities include complying with federal securities laws and making required disclosures on a timely basis. Our senior management may not be able to implement programs and policies in an effective and timely manner that adequately responds to such increased legal, regulatory compliance and reporting requirements. Our failure to comply with all applicable requirements could lead to the imposition of fines and penalties and distract our management from attending to the growth of our business.

RISKS RELATED TO OUR COMMON STOCK.

Our officers and directors control us through their positions and stock ownership and their interests may differ from other stockholders.

Our officers and directors beneficially own approximately 42% of our common stock. As a result, she is able to influence the outcome of stockholder votes on various matters, including the election of directors and extraordinary corporate transactions including business combinations. Yet Mrs. Song's interests may differ from those of other stockholders. Furthermore, ownership of 42% of our common stock by our officers and directors reduces the public float and liquidity, and may affect the market price.

| 17 |

We are not likely to pay cash dividends in the foreseeable future.