Attached files

| file | filename |

|---|---|

| 8-K - HUMANIGEN, INC | k4191708k.htm |

Exhibit 99.1

Near-Term Value Creation for Neglected and Rare Diseases Through Innovative Business Models OTC: KBIO www.kalobios.com | Corporate Overview April 20, 2017 1

Forward-Looking Statements | Corporate Overview 2 This presentation contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements reflect management’s current knowledge, assumptions, judgment and expectations regarding future performance or events. Although management believes that the expectations reflected in such statements are reasonable, they give no assurance that such expectations will prove to be correct, and actual results could differ materially from the forward-looking statements.Words such as “will,” “expect,” “intend,” “plan,” “predict,” “potential,” “possible,” and similar expressions identify forward-looking statements, including, without limitation, statements related to the scope, progress, expansion, and costs of developing and commercializing the Company’s product candidates; opportunity to benefit from anticipated regulatory incentives for product candidates; and anticipated expenses related to development activities, clinical trials and the development and potential commercialization of product candidates.Forward-looking statements are subject to risks and uncertainties including, but not limited to, the Company’s lack of revenues, history of operating losses, limited cash reserves and ability to obtain additional capital to develop and commercialize its product candidates, including the additional capital which will be necessary to complete the clinical trials that the Company has initiated or plans to initiate, and continue as a going concern; the Company’s ability to execute its strategy and business plan; the ability of the Company to list its common stock on a national securities exchange, whether through a new listing or by completing a reverse merger or other strategic transaction; the availability of a 505(b)(2) development pathway for the potential approval by FDA of the Company’s benznidazole candidate as a treatment for Chagas disease remaining acceptable to FDA in the future; the fact that a 505(b)(2) pathway does not assure a product candidate will be deemed safe or effective, or that FDA approval will be obtained; the requirement that the Company be first to receive FDA approval for benznidazole as a treatment for Chagas disease as a prerequisite to the Company’s ability to apply for or receive a Priority Review Voucher in respect of that candidate; uncertainties relating to the timetable for FDA action under the new presidential administration; the potential timing and outcomes of clinical studies of benznidazole, lenzilumab, ifabotuzumab or any other product candidates and the uncertainties inherent in clinical testing; the commercial viability of the Company’s proposed drug pricing program; the ability of the Company to timely source adequate supply of its development products from third-party manufacturers on which the Company depends; the potential, if any, for future development of any of its present or future products; the Company's ability to successfully progress, partner or complete further development of its programs; the ability of the Company to identify and develop additional products; the Company's ability to attain market exclusivity or to protect its intellectual property; competition; changes in the regulatory landscape that may prevent the Company from pursuing or realizing any of the expected benefits from the various regulatory incentives at the center of its strategy, or the imposition of regulations that affect the Company's products; and the various risks described in the "Risk Factors" and elsewhere in the Company's periodic and other filings with the Securities and Exchange Commission.You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this presentation. The company has no obligation, and expressly disclaims any obligation to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Turnaround story focused on delivering value to shareholders Clinical stage neglected and rare disease assets with clear development pathway and modest investment needed to reach potentially significant value inflection pointsBenznidazole franchise: potential approval with market exclusivity plus potential PRV sale in latter half of 2018; standalone, focused commercial opportunity in US that can be leveraged with synergistic products in adjacent therapeutic areas to Chagas; larger patient market opportunity in LATAM; compelling strategic partnership opportunity; lifecycle management plan Lenzilumab franchise: multiple potential indications plus potential PRV; significant markets in Orphan areas; multiple licensing and commercial opportunities; lifecycle management planExperienced, focused management with track record of efficient execution and commitment to leadership in responsible, transparent pricing Unique Investment Opportunity | Corporate Overview 3

Leadership Cameron Durrant, MD, MBAChairman and CEOSenior pharmaceutical and biotech exec, turnaround specialistSenior exec roles at Pharmacia/Pfizer, J+J in US, Merck, GSK in Europe; experience as Exec Chairman, CEO and CFO; CEO roles at three specialty pharma groupsExpertise in anti-infectives, pediatrics, oncologyMorgan LamChief Scientific OfficerExtensive industry experience in clinical researchHead of Clinical Operations and Development KaloBiosExecutive Director, Medical Affairs, GeronDave Tousley, MBA, CPAInterim Chief Financial Officer More than 35 years experience in biotech, spec pharma, big pharmaSenior exec roles, President, COO, CFOPasteur, Merieux, Connaught, AVAX, airPharma, PediaMed, DARA Biosciences Tariq Arshad, MD, MBAHead of Clinical and Medical AffairsExtensive industry experience in clinical developmentExperienced in orphan, pediatrics, oncology, pediatric oncology, immunologyPharmacia/Pfizer, Genentech, XomaNiv Caviar, MBAHead of Corporate/Business DevelopmentSenior functional roles in marketing, business development, strategic planningSenior exec roles, CEO, EVP-CBO, CFO, VP Bus DevLa Jolla Pharma, Allergan, Suneva, SpineOvations, Affymetrix, AccentureChristopher BoweHead of Corporate AffairsDeep experience advising CEOs on articulating, executing strategy through corporate affairsFormer Strategic Affairs advisor at Schering-PloughIndustry thought leader, prior award-winning writer Financial Times Steve Pal, MBAHead of CommercialGlobal pharma and consumer healthcare product commercialisationFormer Corporate VP Global Strategic Marketing, Health Outcomes, Strategy and Research, Global Medical Affairs, Allergan | Corporate Overview 4

Management Experience Developing And Launching Relevant Products | Corporate Overview 5

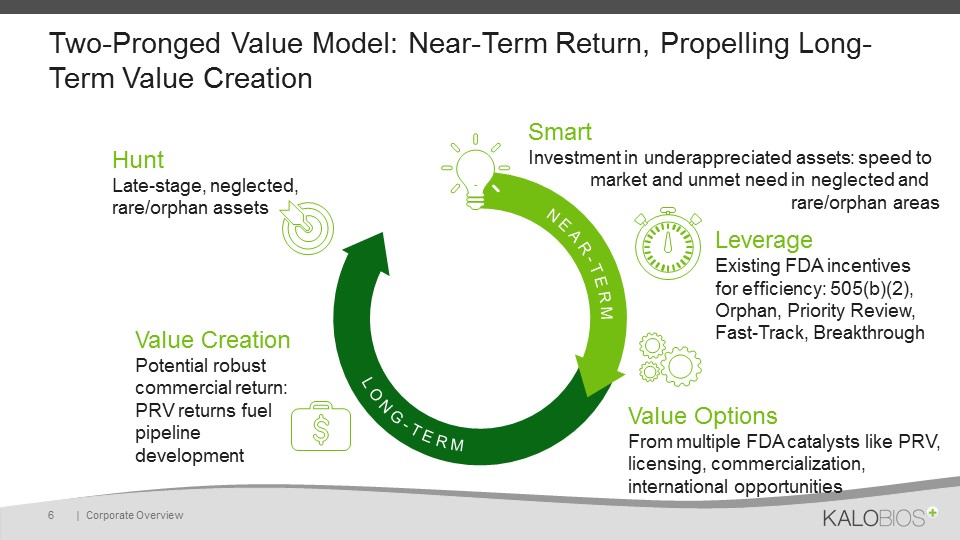

Two-Pronged Value Model: Near-Term Return, Propelling Long-Term Value Creation | Corporate Overview 6 Smart Investment in underappreciated assets: speed to market and unmet need in neglected and rare/orphan areas Leverage Existing FDA incentives for efficiency: 505(b)(2), Orphan, Priority Review, Fast-Track, Breakthrough Value Options From multiple FDA catalysts like PRV, licensing, commercialization, international opportunities Value Creation Potential robust commercial return:PRV returns fuel pipeline development HuntLate-stage, neglected, rare/orphan assets NEAR-TERM LONG-TERM

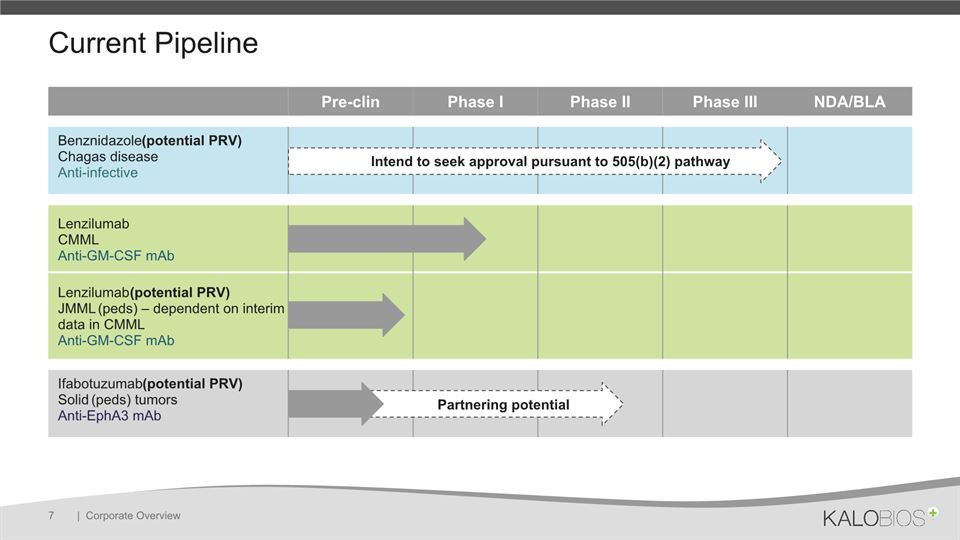

Current Pipeline | Corporate Overview 7 Pre-clin Phase I Phase II Phase III NDA/BLA Benznidazole (potential PRV)Chagas diseaseAnti-infective LenzilumabCMML Anti-GM-CSF mAb Lenzilumab (potential PRV)JMML (peds) – dependent on interim data in CMMLAnti-GM-CSF mAb Ifabotuzumab (potential PRV)Solid (peds) tumorsAnti-EphA3 mAb Partnering potential Intend to seek approval pursuant to 505(b)(2) pathway

Benznidazole a potential treatment for Chagas disease (CD) | Corporate Overview 8

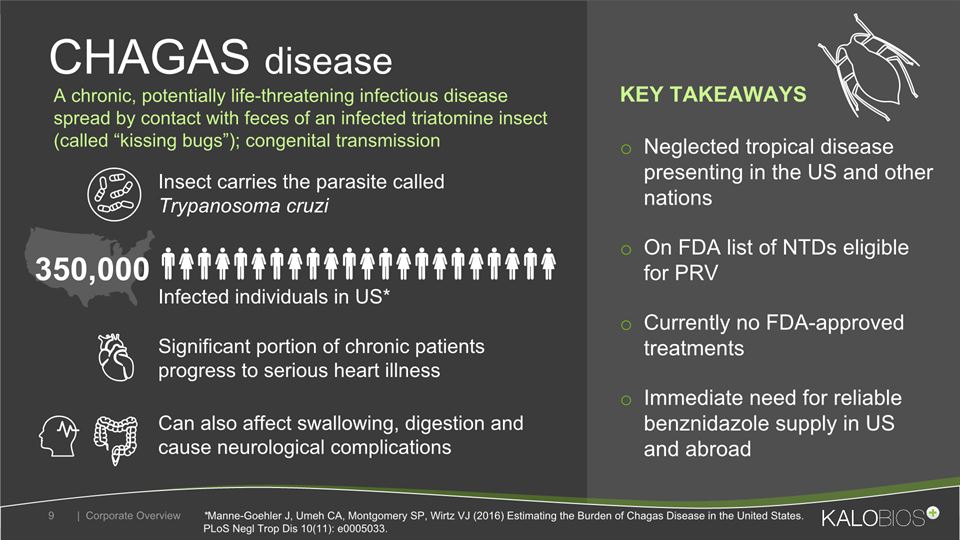

Neglected tropical disease presenting in the US and other nations On FDA list of NTDs eligible for PRVCurrently no FDA-approved treatmentsImmediate need for reliable benznidazole supply in US and abroad CHAGAS disease | Corporate Overview 9 Insect carries the parasite called Trypanosoma cruzi Infected individuals in US* Can also affect swallowing, digestion and cause neurological complications 350,000 *Manne-Goehler J, Umeh CA, Montgomery SP, Wirtz VJ (2016) Estimating the Burden of Chagas Disease in the United States. PLoS Negl Trop Dis 10(11): e0005033. A chronic, potentially life-threatening infectious disease spread by contact with feces of an infected triatomine insect (called “kissing bugs”); congenital transmission KEY TAKEAWAYS Significant portion of chronic patients progress to serious heart illness

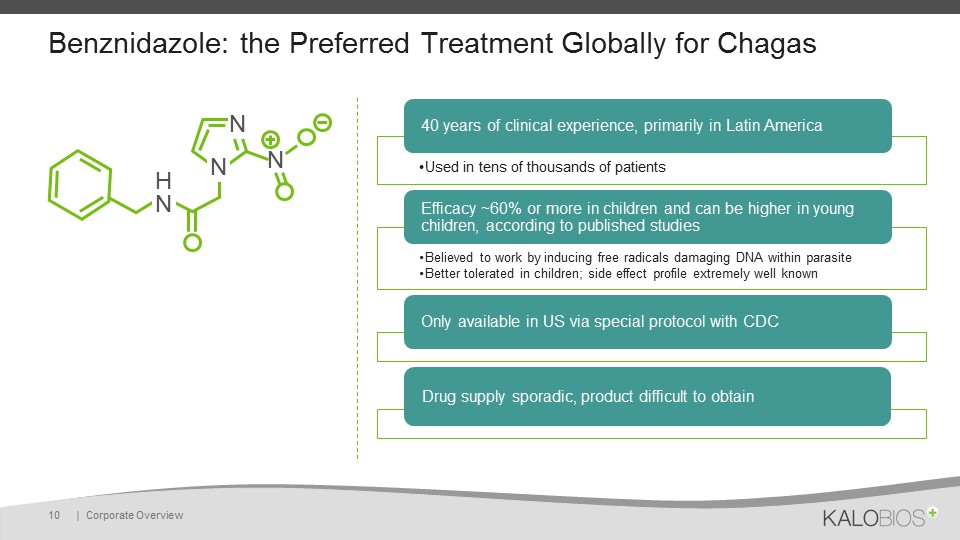

Benznidazole: the Preferred Treatment Globally for Chagas | Corporate Overview 10 N N HN N

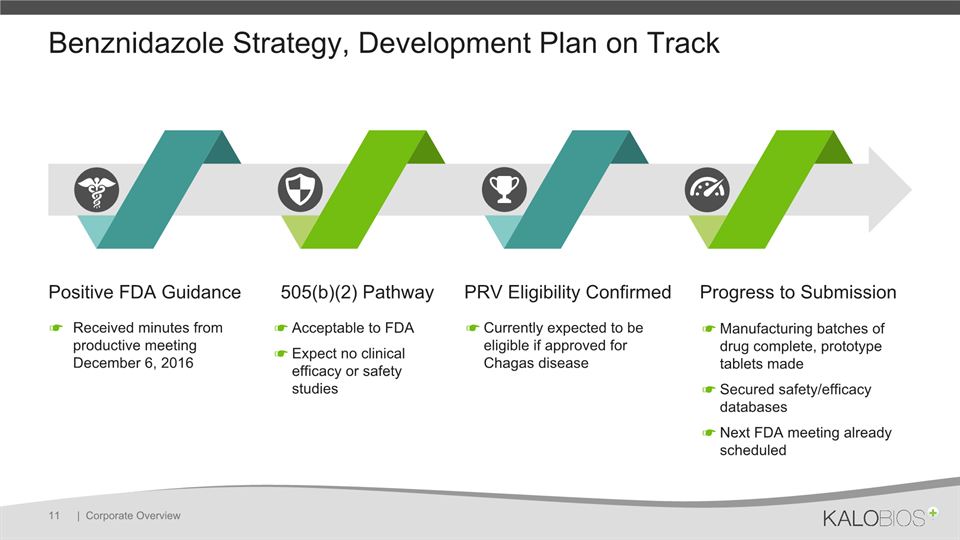

Benznidazole Strategy, Development Plan on Track | Corporate Overview 11 Positive FDA Guidance 505(b)(2) Pathway PRV Eligibility Confirmed Progress to Submission Received minutes from productive meeting December 6, 2016 Acceptable to FDAExpect no clinical efficacy or safety studies Currently expected to be eligible if approved for Chagas disease Manufacturing batches of drug complete, prototype tablets madeSecured safety/efficacy databasesNext FDA meeting already scheduled

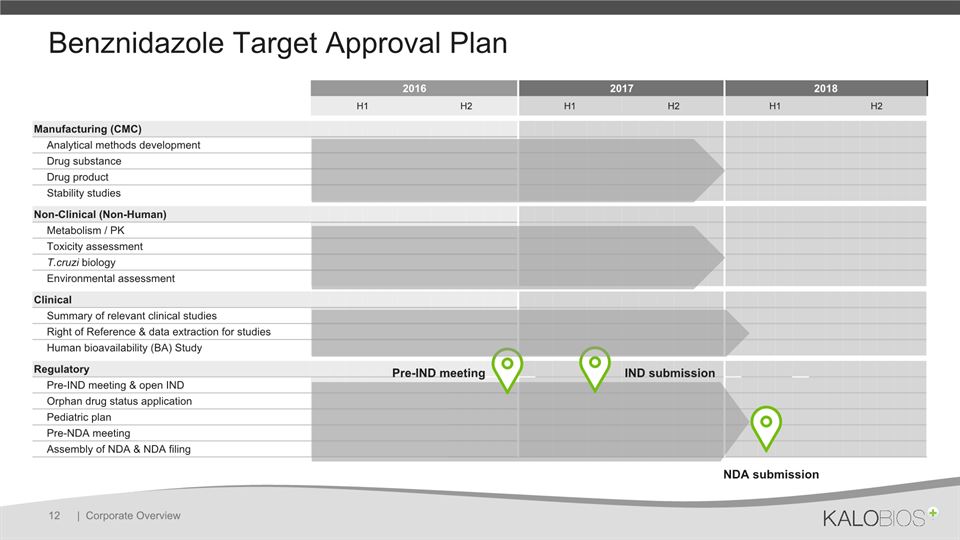

2016 2017 H1 H2 H1 H2 Manufacturing (CMC) Analytical methods development Drug substance Drug product Stability studies Non-Clinical (Non-Human) Metabolism / PK Toxicity assessment T.cruzi biology Environmental assessment Clinical Summary of relevant clinical studies Right of Reference & data extraction for studies Human bioavailability (BA) Study Regulatory Pre-IND meeting & open IND Orphan drug status application Pediatric plan Pre-NDA meeting Assembly of NDA & NDA filing Benznidazole Target Approval Plan | Corporate Overview 12 Pre-IND meeting IND submission NDA filing 2018 NDA submission 2018 H1 H2

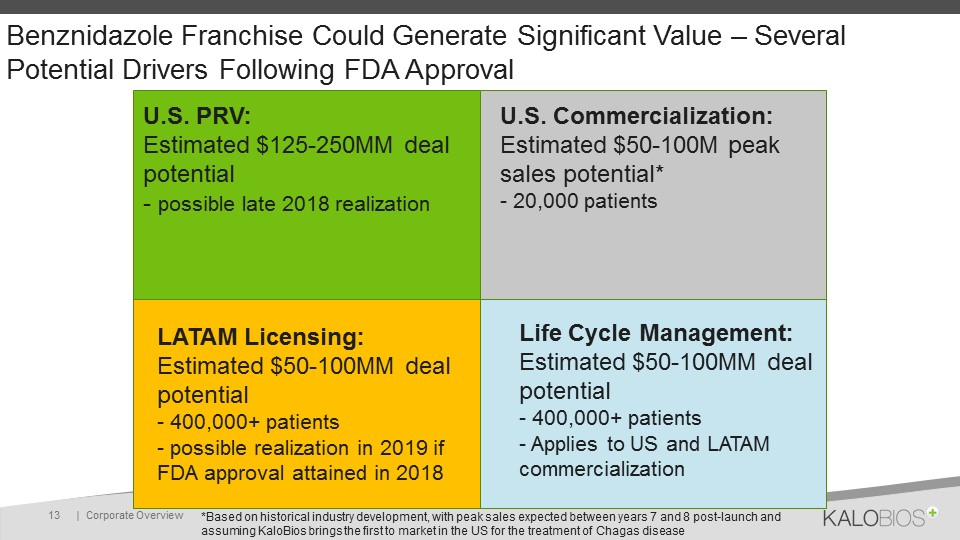

Benznidazole Franchise Could Generate Significant Value – Several Potential Drivers Following FDA Approval | Corporate Overview 13 U.S. PRV:Estimated $125-250MM deal potential- possible late 2018 realization U.S. Commercialization:Estimated $50-100M peak sales potential*- 20,000 patients LATAM Licensing:Estimated $50-100MM deal potential- 400,000+ patients- possible realization in 2019 if FDA approval attained in 2018 Life Cycle Management:Estimated $50-100MM deal potential- 400,000+ patients- Applies to US and LATAM commercialization *Based on historical industry development, with peak sales expected between years 7 and 8 post-launch and assuming KaloBios brings the first to market in the US for the treatment of Chagas disease

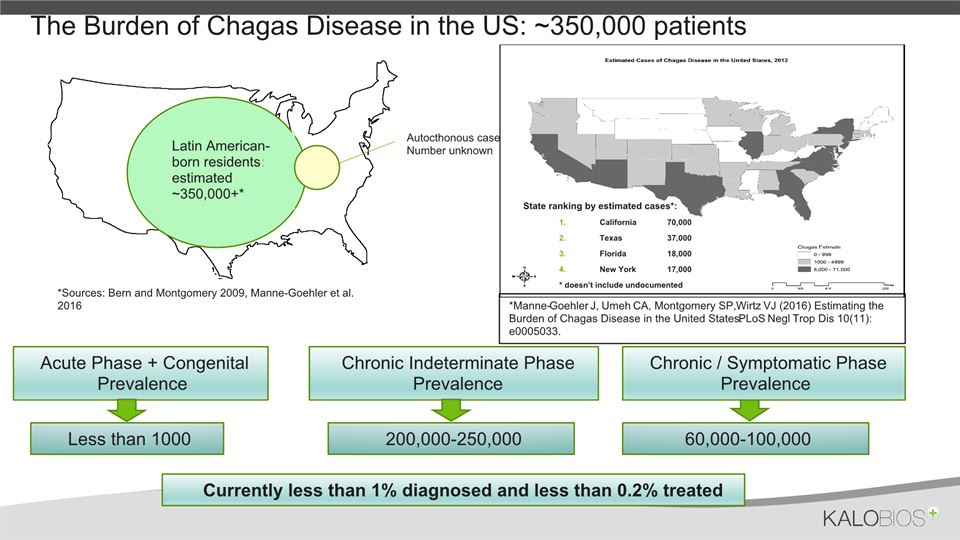

The Burden of Chagas Disease in the US: ~350,000 patients *Sources: Bern and Montgomery 2009, Manne-Goehler et al. 2016 Autocthonous cases:Number unknown Latin American-born residents:: estimated ~350,000+* *Manne-Goehler J, Umeh CA, Montgomery SP, Wirtz VJ (2016) Estimating the Burden of Chagas Disease in the United States. PLoS Negl Trop Dis 10(11): e0005033. State ranking by estimated cases*:California 70,000Texas 37,000Florida 18,000New York 17,000* doesn’t include undocumented Acute Phase + Congenital Prevalence Less than 1000 Chronic Indeterminate Phase Prevalence 200,000-250,000 Chronic / Symptomatic Phase Prevalence 60,000-100,000 Currently less than 1% diagnosed and less than 0.2% treated

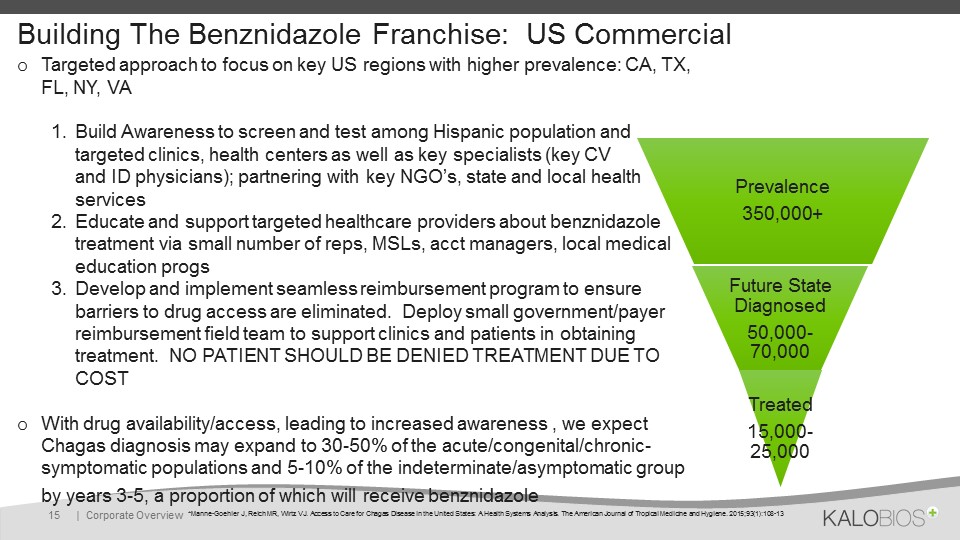

Building The Benznidazole Franchise: US Commercial Targeted approach to focus on key US regions with higher prevalence: CA, TX, FL, NY, VABuild Awareness to screen and test among Hispanic population and targeted clinics, health centers as well as key specialists (key CV and ID physicians); partnering with key NGO’s, state and local health servicesEducate and support targeted healthcare providers about benznidazole treatment via small number of reps, MSLs, acct managers, local medical education progsDevelop and implement seamless reimbursement program to ensure barriers to drug access are eliminated. Deploy small government/payer reimbursement field team to support clinics and patients in obtaining treatment. NO PATIENT SHOULD BE DENIED TREATMENT DUE TO COSTWith drug availability/access, leading to increased awareness , we expect Chagas diagnosis may expand to 30-50% of the acute/congenital/chronic-symptomatic populations and 5-10% of the indeterminate/asymptomatic group by years 3-5, a proportion of which will receive benznidazole | Corporate Overview 15 *Manne-Goehler J, Reich MR, Wirtz VJ. Access to Care for Chagas Disease in the United States: A Health Systems Analysis. The American Journal of Tropical Medicine and Hygiene. 2015;93(1):108-13

Building The Benznidazole Franchise: LATAM Commercial 8-10 million estimated patients, 120 million people at risk, 300,000 new cases a year, 12-14,000 deaths Large volume, lower cost commercial opportunity vs. US; potential for pricing differentiation with multiple KBIO benz versions according to manufacturing source US FDA approved product has significant advantages in this market to local companiesSignificant market opportunity Synergies with other anti-infectives product or cardiovascular companiesHF companies have begun local Chagas heart failure market expansion programs Potential for strategic licensing/partnership with an anti-infectives or HF company with LATAM presence | Corporate Overview 16

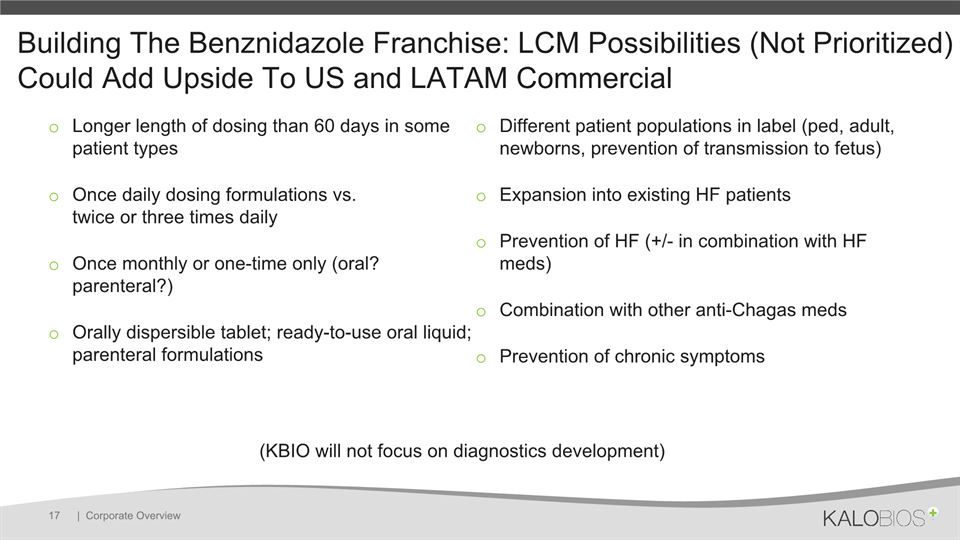

Building The Benznidazole Franchise: LCM Possibilities (Not Prioritized) Could Add Upside To US and LATAM Commercial Longer length of dosing than 60 days in some patient typesOnce daily dosing formulations vs. twice or three times dailyOnce monthly or one-time only (oral? parenteral?)Orally dispersible tablet; ready-to-use oral liquid; parenteral formulations Different patient populations in label (ped, adult, newborns, prevention of transmission to fetus)Expansion into existing HF patientsPrevention of HF (+/- in combination with HF meds)Combination with other anti-Chagas medsPrevention of chronic symptoms | Corporate Overview 17 (KBIO will not focus on diagnostics development)

Building The Benznidazole Franchise: Priority Review Voucher (PRV) May Create Options for Significant Potential Return | Corporate Overview 18 Range of disclosed sale prices for PRVs is $67.5MM - $350MM Rare Pediatric Diseases (RPD) Neglected Tropical Diseases (NTD) Holder of PRV can receive priority review for any NDA/BLA PRV can be sold to company seeking a competitive jumpKaloBios open to novel potential PRV transaction structuresPRV sale could be part of an overall partnering package alongside other elements of the benz franchise

Benznidazole Franchise Conclusions Comprises US commercial (+/- HF linkages), LATAM commercial, manufacturing potential partnerships, LCM upside and PRV saleUS commercial footprint may allow for leverage with synergistic products and is small, focused and scalable Overall package valuable and significant portion of that value may be unlocked near-term, with PRV sale potentially occurring in late 2018 | Corporate Overview 19

Lenzilumab a potential pipeline in a product | Corporate Overview 20

High unmet needPatients typically unsuitable for stem cell transplant40-90% patients show hypersensitivity to GM-CSF CMML overview | Corporate Overview 21 Recently classified as separate disease with distinct natural history* Median overall survival rate in months Newly diagnosed US patients per year Age at diagnosis ~1,100 * Formerly classified as subtype of the myelodysplastic syndromes (MDS) 60+ a rare hematologic cancer 20 KEY TAKEAWAYS

No FDA-approved treatmentClear unmet needPotential for a rare pediatric disease PRVGM-CSF hypersensitivity is hallmarkPediatric oncology largely ignored in clinical development JMML overview | Corporate Overview 22 Event-free survival rate at 5 years (with bone marrow transplant) New US cases per year Age of majority of patients at diagnosis is 4 years or younger ~420 very rare, frequently lethal pediatric leukemia ~52% KEY TAKEAWAYS

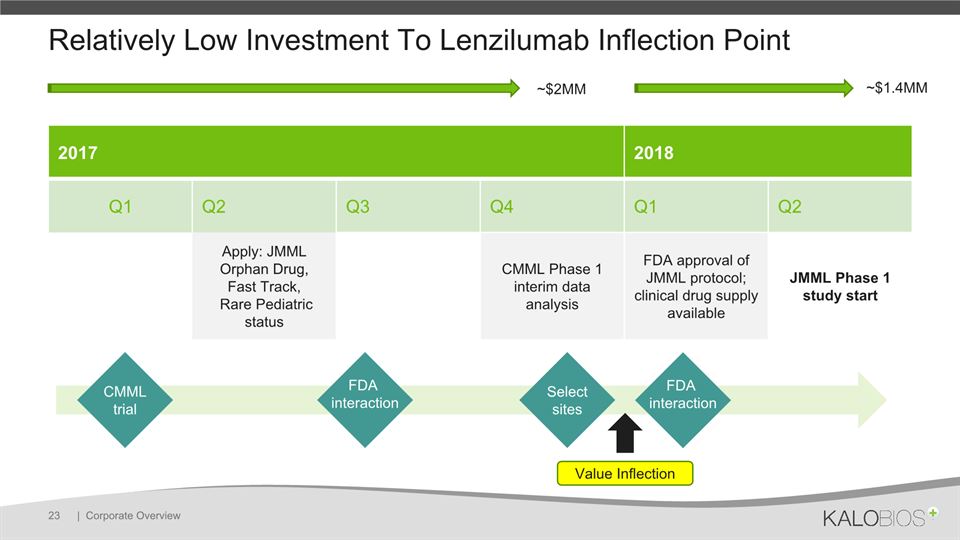

Relatively Low Investment To Lenzilumab Inflection Point | Corporate Overview 23 2017 2018 Q1 Q2 Q3 Q4 Q1 Q2 Apply: JMML Orphan Drug, Fast Track, Rare Pediatric status CMML Phase 1 interim data analysis FDA approval of JMML protocol; clinical drug supply available JMML Phase 1 study start CMML trial FDA interaction FDA interaction Select sites Value Inflection ~$2MM ~$1.4MM

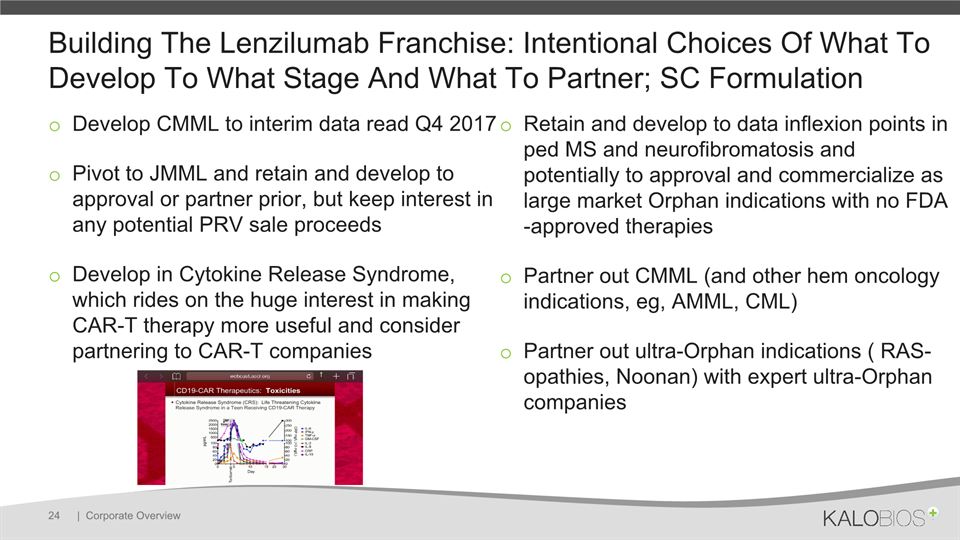

Building The Lenzilumab Franchise: Intentional Choices Of What To Develop To What Stage And What To Partner; SC Formulation Develop CMML to interim data read Q4 2017Pivot to JMML and retain and develop to approval or partner prior, but keep interest in any potential PRV sale proceedsDevelop in Cytokine Release Syndrome, which rides on the huge interest in making CAR-T therapy more useful and consider partnering to CAR-T companies Retain and develop to data inflexion points in ped MS and neurofibromatosis and potentially to approval and commercialize as large market Orphan indications with no FDA-approved therapies Partner out CMML (and other hem oncology indications, eg, AMML, CML) Partner out ultra-Orphan indications ( RAS-opathies, Noonan) with expert ultra-Orphan companies | Corporate Overview 24

Lenzilumab Franchise Conclusions Comprises US development and partnering, ex-US partnering, US focused Orphan commercial, LCM upside and PRV saleUS commercial Orphan footprint could be scaled independently or via partnerships Potential opportunity to benefit from CAR-T interest US and ex-US ultra-Orphan potential partnerships with expert players adds further valueOverall potential for significant value through LCM with additional indications around the ‘pipeline-in-a-product’ strategy, with PRV sale potentially adding non-dilutive capital in 3-4 years | Corporate Overview 25

Benznidazole franchise- Potential approval with market exclusivity plus potential PRV sale in 2018 - Standalone, highly-focused commercial product launch in US post-approval; partnership opps- 2019 commercial infrastructure can be leveraged with synergistic products- Large market in LATAM - LCM planLenzilumab franchise- Multiple potential indications plus potential PRV- Significant markets in Orphan areas - Multiple licensing and commercial opportunities - LCM plan New management with proven track record 30+ FDA approved drugs developed, approved, commercialized, licensed Focus on High Commercial Potential, Rare/Neglected Diseases | Corporate Overview 26

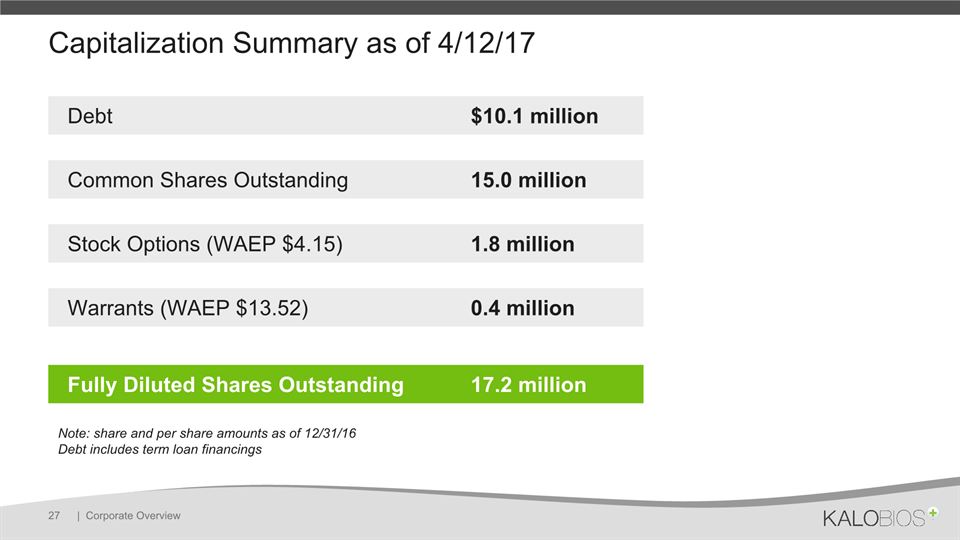

Capitalization Summary as of 4/12/17 | Corporate Overview 27 Debt $10.1 million Common Shares Outstanding 15.0 million Stock Options (WAEP $4.15) 1.8 million Warrants (WAEP $13.52) 0.4 million Fully Diluted Shares Outstanding 17.2 million Note: share and per share amounts as of 12/31/16 Debt includes term loan financings

Summary Attractive asset portfolio with potential to deliver shareholder value quicklyUnique near-term/long-term potential value creation opportunity Business strategy that leverages existing U.S. regulatory and development incentives to build unique, high value franchises around key assetsDeeply focused new management team with a demonstrated track record of execution | Corporate Overview 28