Attached files

United

States Securities and Exchange Commission

Washington,

D.C. 20549

FORM

10-K

(Mark

One)

☒ ANNUAL

REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF

1934

FOR

THE FISCAL YEAR ENDED DECEMBER 31, 2016

☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES

EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM __________ TO

__________.

|

Commission File

Number 0-1665

|

KINGSTONE

COMPANIES, INC.

(Exact name of

registrant as specified in its charter)

|

Delaware

|

36-2476480

|

|

(State or other

jurisdiction of incorporation or organization)

|

(I.R.S. Employer

Identification No.)

|

|

15 Joys Lane, Kingston, New York

|

12401

|

|

(Address of

principal executive offices)

|

(Zip

Code)

|

|

(845)

802-7900

|

|

(Registrant’s

telephone number, including area code)

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common

Stock

|

NASDAQ

|

Securities

registered pursuant to Section 12(g) of the Act:

None

Indicate by check

mark if the registrant is a well-known seasoned issuer, as defined

in Rule 405 of the Securities Act. Yes ☐ No

☒

Indicate by check

mark if the registrant is not required to file reports pursuant to

Section 13 or Section 15(d) of the Exchange Act. Yes ☐ No

☒

Indicate by check

mark whether the registrant (1) has filed all reports required to

be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period

that the registrant was required to file such reports), and (2) has

been subject to such filing requirements for the past 90 days. Yes

☒ No

☐

Indicate by check

mark whether the registrant has submitted electronically and posted

on its corporate Web site, if any, every Interactive Data File

required to be submitted and posted pursuant to Rule 405 of

Regulation S-T during the preceding 12 months (or for such shorter

period that the registrant was required to submit and post such

files). Yes ☒ No ☐

Indicate by check

mark if disclosure of delinquent filers pursuant to Item 405 of

Regulation S-K is not contained herein, and will not be contained,

to the best of registrant’s knowledge, in definitive proxy or

information statements incorporated by reference in Part III of

this Form 10-K or any amendment to this Form 10-K.

☒

Indicate by check

mark whether the registrant is a large accelerated filer, an

accelerated filer, a non-accelerated filer, or a smaller reporting

company. See the definitions of “large accelerated

filer,” “accelerated filer”” and

“smaller reporting company” in Rule 12b-2 of the

Exchange Act. (Check one):

|

Large accelerated

filer ☐

|

Accelerated filer

☐

|

|

|

|

|

Non-accelerated

☐ (Do not check if a smaller reporting company)

|

Smaller reporting

company ☒

|

Indicate by check

mark whether the registrant is a shell company (as defined in Rule

12b-2 of the Exchange Act). Yes ☐ No ☒

As of June 30,

2016, the aggregate market value of the registrant’s common

stock held by non-affiliates of the registrant was $54,758,366

based on the closing sale price as reported on the NASDAQ Capital

Market. As of March 13, 2017, there were 10,621,367 shares of

common stock outstanding.

DOCUMENTS

INCORPORATED BY REFERENCE

None

INDEX

|

|

|

Page

No.

|

|

|

Forward-Looking

Statements

|

2

|

||

|

PART

I

|

|

|

|

|

Item

1.

|

Business.

|

3

|

|

|

Item

1A.

|

Risk

Factors.

|

21

|

|

|

Item

1B.

|

Unresolved Staff

Comments.

|

21

|

|

|

Item

2.

|

Properties.

|

21

|

|

|

Item

3.

|

Legal

Proceedings.

|

21

|

|

|

Item

4.

|

Mine Safety

Disclosures.

|

21

|

|

|

PART

II

|

|

|

|

|

Item

5.

|

Market for

Registrant’s Common Equity, Related Stockholder Matters and

Issuer Purchases of Equity Securities.

|

22

|

|

|

Item

6.

|

Selected Financial

Data.

|

23

|

|

|

Item

7.

|

Management’s

Discussion and Analysis of Financial Condition and Results of

Operations.

|

23

|

|

|

Item

7A.

|

Quantitative and

Qualitative Disclosures About Market Risk.

|

63

|

|

|

Item

8.

|

Financial

Statements and Supplementary Data.

|

63

|

|

|

Item

9.

|

Changes in and

Disagreements With Accountants on Accounting and Financial

Disclosure.

|

63

|

|

|

Item

9A.

|

Controls and

Procedures.

|

63

|

|

|

Item

9B.

|

Other

Information.

|

64

|

|

|

PART

III

|

|

|

|

|

Item

10.

|

Directors,

Executive Officers and Corporate Governance.

|

65

|

|

|

Item

11.

|

Executive

Compensation.

|

69

|

|

|

Item

12.

|

Security Ownership

of Certain Beneficial Owners and Management and Related Stockholder

Matters.

|

72

|

|

|

Item

13.

|

Certain

Relationships and Related Transactions, and Director

Independence.

|

75

|

|

|

Item

14.

|

Principal

Accountant Fees and Services.

|

75

|

|

|

PART

IV

|

|

|

|

|

Item

15.

|

Exhibits and

Financial Statement Schedules.

|

76

|

|

|

Item

16.

|

Form 10-K

Summary.

|

77

|

|

|

Signatures

|

|

78

|

|

1

PART I

Forward-Looking Statements

This Annual Report

contains forward-looking statements as that term is defined in the

federal securities laws. The events described in forward-looking

statements contained in this Annual Report may not occur. Generally

these statements relate to business plans or strategies, projected

or anticipated benefits or other consequences of our plans or

strategies, projected or anticipated benefits from acquisitions to

be made by us, or projections involving anticipated revenues,

earnings or other aspects of our operating results. The words

“may,” “will,” “expect,”

“believe,” “anticipate,”

“project,” “plan,” “intend,”

“estimate,” and “continue,” and their

opposites and similar expressions are intended to identify

forward-looking statements. We caution you that these statements

are not guarantees of future performance or events and are subject

to a number of uncertainties, risks and other influences, many of

which are beyond our control, which may influence the accuracy of

the statements and the projections upon which the statements are

based. Factors which may affect our results include, but are not

limited to, the risks and uncertainties discussed in Item 7 of this

Annual Report under “Factors That May Affect Future Results

and Financial Condition”.

Any one or more of

these uncertainties, risks and other influences could materially

affect our results of operations and whether forward-looking

statements made by us ultimately prove to be accurate. Our actual

results, performance and achievements could differ materially from

those expressed or implied in these forward-looking statements. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether from new information, future

events or otherwise.

2

ITEM

1. BUSINESS.

(a) Business

Development

General

As used in this

Annual Report on Form 10-K (the “Annual Report”),

references to the “Company”, “we”,

“us”, or “our” refer to Kingstone

Companies, Inc. (“Kingstone”) and its

subsidiaries.

We offer property

and casualty insurance products to individuals and small businesses

in New York State through our wholly owned subsidiary, Kingstone

Insurance Company (“KICO”). KICO is a licensed property

and casualty insurance company in New York, New Jersey,

Connecticut, Pennsylvania, Rhode Island and Texas; however, KICO

writes substantially all of its business in New York.

Recent

Developments

Developments During 2017

● Public

Offering of Common Stock

In January and

February 2017, we sold a total of 2,692,500 newly issued shares of

common stock in a public offering at a public offering price of

$12.00 per share. We received net proceeds from the public offering

of approximately $30,230,000 after deducting underwriting discounts

and commissions, and other offering expenses. Concurrently, selling

shareholders sold a total of 700,000 shares of our common stock. On

March 1, 2017, we used $23,000,000 of the net proceeds from the

offering to contribute capital to KICO in support of our ratings

upgrade plan and anticipated growth, including geographic and

product expansion. A registration statement relating to the shares

that were sold was filed with the Securities and Exchange

Commission and became effective in January 2017.

Developments During 2016

● Expanded

Licensing to Additional State; New Jersey Rate

Approval

In 2016, KICO

expanded its ability to write property and casualty insurance by

obtaining a license to write insurance policies in Rhode Island.

Also in 2016, KICO’s Homeowners insurance rate, rule, and

policy form filing was approved by the New Jersey Department of

Banking and Insurance. We anticipate to start writing business in

New Jersey in the first half of 2017.

● A.M.

Best Rating

In 2016, A.M. Best

revised the outlook to positive from stable for the issuer credit

rating (“ICR”) of KICO. A.M. Best also affirmed

KICO’s financial strength rating of B++ (Good) and ICR of

“bbb”, and affirmed our ICR of

“bb”.

3

● Increased Catastrophe Reinsurance

Coverage

Effective July 1,

2016, KICO increased the top limit of its catastrophe reinsurance

coverage to $252,000,000, which equates to more than a 1-in-250

year storm event according to the primary industry catastrophe

model that we follow.

● Continued

Quarterly Dividends

Dividends of $.0625

per share were declared on each of February 8, 2016, May 12, 2016,

August 11, 2016 and November 10, 2016 and were paid on March 15,

2016, June 15, 2016, September 15, 2016, and December 15, 2016,

respectively.

● Private

Placement of Common Stock

In April 2016,

we sold

595,238 newly issued shares of common stock to RenaissanceRe

Ventures Ltd., a subsidiary of RenaissanceRe Holdings Ltd.

(“RenaissanceRe”), for a purchase price of $8.40 per

share. We received $4,808,000 in net proceeds from the sale.

RenaissanceRe is a global provider of catastrophe and specialty

reinsurance and insurance.

Developments During 2015

● Reduced

Reliance on Quota Share Reinsurance

Effective July 1,

2015, KICO reduced the ceding percentage for its personal lines

quota share reinsurance treaty from 55% to 40%. In addition, the

treaty structure was changed from a ‘gross’ to a

‘net’ basis meaning that KICO now pays the entire cost

of catastrophe reinsurance instead of sharing the cost and benefit

of this reinsurance with quota share reinsurers. The reduction of

the quota share ceding percentage allows KICO to retain a higher

portion of its premiums.

● Implemented

Electronic Content Management and Workflow System

In July 2015, KICO

implemented Vertafore’s ImageRight® software, an

insurance industry leading electronic content management and

workflow system. The new software enhancement has streamlined

underwriting and claims processes and created a less

paper-intensive environment, allowing for greater efficiency and

increased production to support KICO’s continued

growth.

● Expanded

Licensing to Additional States

In 2015, KICO

expanded its ability to write property and casualty insurance by

obtaining licenses to write insurance policies in New Jersey,

Connecticut and Texas.

● A.M.

Best Rating

In 2015, the A.M.

Best financial strength rating for KICO was upgraded from B+ (Good)

to B++ (Good).

● Increased

Rate of Dividends Declared

4

In November 2015,

we increased the quarterly dividends on our common stock from $.05

per share to $.0625 per share. Dividends of $.05 per share were

declared on each of February 6, 2015, May 12, 2015 and August 11,

2015 and were paid on March 13, 2015 and June 15, 2015 and

September 14, 2015, respectively. A dividend of $.0625 per share

was declared on November 10, 2015 and was paid on December 14,

2015.

(b) Business

Property

and Casualty Insurance

Overview

Generally, property

and casualty insurance companies write insurance policies in

exchange for premiums paid by their customers (the

“insureds”). An insurance policy is a contract between

the insurance company and its insureds where the insurance company

agrees to pay for losses suffered by the insured that are covered

under the contract. Such contracts are subject to legal

interpretation by courts, sometimes involving legislative rulings

and/or arbitration. Property insurance generally covers the

financial consequences of accidental losses to the insured’s

property, such as a home and the personal property in it, or a

business’ building, inventory and equipment. Casualty

insurance (often referred to as liability insurance) generally

covers the financial consequences related to the legal liability of

an individual or an organization resulting from negligent acts and

omissions causing bodily injury and/or property damage to a third

party. Claims for property coverage generally are reported and

settled in a relatively short period of time, whereas those for

casualty coverage can take many years to settle.

We generate

revenues from earned premiums, ceding commissions from quota share

reinsurance, net investment income generated from our investment

portfolio, and net realized gains and losses on investment

securities. We also receive installment fee income and fees charged

to reinstate a policy after it has been cancelled for non-payment.

Earned premiums represent premiums received from insureds, which

are recognized as revenue over the period of time that insurance

coverage is provided (i.e., ratably over the life of the policy). A

significant period of time can elapse between the receipt of

insurance premiums and the payment of insurance claims. During this

time, KICO invests the premiums, earns investment income and

generates net realized and unrealized investment gains and losses

on investments.

Insurance companies

incur a significant amount of their total expenses from

policyholder losses, which are commonly referred to as claims. In

settling policyholder losses, various loss adjustment expenses

(“LAE”) are incurred such as insurance adjusters’

fees and legal expenses. In addition, insurance companies incur

policy acquisition expenses, such as commissions paid to producers

and premium taxes, and other expenses related to the underwriting

process, including their employees’ compensation and

benefits.

The key measure of

relative underwriting performance for an insurance company is the

combined ratio. An insurance company’s combined ratio is

calculated by adding the ratio of incurred loss and LAE to earned

premiums (the “loss and LAE ratio”) to the ratio of

policy acquisition and other underwriting expenses to earned

premiums (the “expense ratio”). A combined ratio under

100% indicates that an insurance company is generating an

underwriting profit prior to the impact of investment income. After

considering investment income and investment gains or losses,

insurance companies operating at a combined ratio of greater than

100% can also be profitable.

5

General;

Strategy

We are a

property and casualty insurance holding company whose principal

operating subsidiary is Kingstone Insurance Company

(“KICO”), domiciled in the State of New York. We are a

multi-line regional property and casualty insurance company writing

business exclusively through independent retail and wholesale

agents and brokers (“producers”). We are licensed to

write insurance policies in New York, New Jersey, Connecticut,

Pennsylvania, Rhode Island and Texas.

We seek to deliver

an attractive return on capital and to provide consistent earnings

growth through underwriting profits and income from our investment

portfolio. Our goal is to allocate capital efficiently to those

lines of business that generate sustainable underwriting profits

and to avoid lines of business for which an underwriting profit is

not likely. Our strategy is to be the preferred multi-line property

and casualty insurance company for selected producers in the

geographic markets in which we operate. We believe producers place

profitable business with us because we provide excellent,

consistent service to policyholders and claimants and provide a

consistent market with stable and competitive rate and commission

structures. We offer a wide array of personal and commercial lines

policies, which further differentiates us from other insurance

companies that also distribute through our selected

producers.

Our principal

objectives are to increase the volume of profitable business that

we write while managing risk through prudent use of reinsurance in

order to preserve and grow our capital base. We seek to generate

underwriting income by writing profitable insurance policies and by

effectively managing our other underwriting and operating expenses.

We are pursuing profitable growth by selectively expanding the

geographic regions in which we operate, increasing the volume of

business that we write with existing producers, developing new

selected producer relationships, and introducing niche insurance

products that are relevant to our producers and

policyholders.

For

the year ended December 31, 2016, our gross written premiums

totaled $103.2 million, an increase of 13.4% from the $91.0 million

in gross written premium for the year ended December 31, 2015. For

the year ended December 31, 2016, our gross written premiums from

our continuing lines of business grew by 14.0% compared to the year

ended December 31, 2015.

Product Lines

Our product lines

include the following:

Personal lines - Our largest line of

business is personal lines, consisting of homeowners, dwelling

fire, 3-4 family dwelling package, cooperatives and condominiums,

renters, equipment breakdown, service line and personal umbrella

policies. Personal lines policies accounted for 76.8% of our gross

written premiums for the year ended December 31, 2016.

Commercial liability - We offer

businessowners policies which consist primarily of small business

retail, service and office risks without a residential exposure. We

also write artisan’s liability policies for small independent

contractors with seven or fewer employees. In addition, we

write special multi-peril policies for larger and more specialized

businessowners risks, including those with limited residential

exposures. In the fourth quarter of 2016, we began offering

commercial umbrella policies written above our supporting

commercial lines policies. Commercial lines policies accounted for

12.4% of our gross written premiums for the year ended December 31,

2016.

6

Livery physical damage - We write

for-hire vehicle physical damage only policies for livery and car

service vehicles and taxicabs. These policies insure only the

physical damage portion of insurance for such vehicles, with no

liability coverage included. These policies accounted for 10.6% of

our gross written premiums for the year ended December 31,

2016.

Other - We write canine legal liability

policies and also have a small participation in mandatory state

joint underwriting associations. These policies accounted for 0.2%

of our gross written premiums for the year ended December 31,

2016.

Our Competitive Strengths

History of Growing Our Profitable Operations

Our insurance

company subsidiary, KICO, has been in operation in the State of New

York for 130 years. We have consistently increased the volume of

profitable business that we write by introducing new insurance

products, increasing the volume of business that we write with our

selected producers and developing new producer relationships. KICO

has earned an underwriting profit in each of the past ten years,

including in 2012 and 2013 when our financial results were

adversely impacted by Superstorm Sandy. The extensive heritage of

our insurance company subsidiary and our commitment to the markets

in which we operate is a competitive advantage with producers and

policyholders.

Strong Producer Relationships

Within our selected

producers’ offices, we compete with other property and

casualty insurance carriers available to those producers. We

carefully select the producers that distribute our insurance

policies and continuously monitor and evaluate their performance.

We believe our insurance producers value their relationships with

us because we provide excellent, consistent personal service

coupled with competitive rates and commission levels. We have

consistently been rated by insurance producers as above average in

the important areas of underwriting, claims handling and service.

In the biennial performance surveys conducted by the Professional

Insurance Agents of New York and New Jersey of its membership since

2010, KICO was rated as one of the top performing insurance

companies in New York, twice ranking as the top rated carrier among

all those surveyed.

We offer our

selected producers the ability to write a wide array of personal

lines and commercial lines policies, including some which are

unique to us. Many of our producers write multiple lines of

business with us which provides an advantage over those competitors

who are focused on a single product. We provide a multi-policy

discount on homeowners policies in order to attract and retain more

of this multi-line business. We have had a consistent presence in

the New York market and we believe that producers value the

longevity of our relationship with them. We believe that the

excellent service we provide to our selected producers, our broad

product offerings, and our consistent market presence provide a

strong foundation for continued profitable growth.

Sophisticated Underwriting and Risk Management

Practices

We believe that we

have a significant underwriting advantage due to our local market

presence and expertise. Our underwriting process evaluates and

screens out certain risks based on property reports, individual

insurance scoring, information collected from physical property

inspections, and driving records. We maintain certain policy

exclusions that reduce our exposure to risks that can create severe

losses. We target a more preferred risk profile in order to reduce

adverse selection from risks seeking the lowest premiums by

selecting only minimal coverage levels.

7

Our underwriting

procedures, premium rates and policy terms support the underwriting

profitability of our personal lines policies. We apply premium

surcharges for certain coastal properties and maintain deductibles

for hurricane-prone exposures in order to provide an appropriate

premium rate for the risk of loss. We manage coastal risk exposure

through the use of individual catastrophe risk scoring and through

prudent use of reinsurance.

Our underwriting

expertise and risk management practices enable us to profitably

write personal and commercial lines business in our markets without

the need for frequent rate adjustments, in contrast to many of our

competitors. We believe that the consistency in rates and the

reliable availability of our insurance products are important

factors in maintaining our selected producer

relationships.

Effective Utilization of Reinsurance

Our reinsurance

treaties allow us to limit our exposure to the financial impact of

catastrophe losses and to reduce our net liability on individual

risks. Our reinsurance program is structured to enable us to grow

our premium volume while maintaining regulatory capital and other

financial ratios within thresholds used for regulatory oversight

purposes.

Our reinsurance

program also provides income as a result of ceding commissions

earned pursuant to the quota share reinsurance contracts. The

income we earn from ceding commissions typically exceeds our fixed

operating costs, which consist of other underwriting expenses.

Quota share reinsurance treaties transfer a portion of the profit

(or loss) associated with the subject insurance policies to the

reinsurers. We believe that a prudent reduction in our reliance on

quota share reinsurance could increase our overall net underwriting

profits and

improve our ability to obtain an upgrade to our financial strength

rating from A.M. Best.

Experienced Management Team

Our management team

has significant expertise in underwriting, agency management and

claims management. Barry Goldstein, our Chairman and Chief

Executive Officer, has extensive experience in the insurance

industry and managing public companies, serving in his current

capacity since 2001. Benjamin Walden, Executive Vice President and

Chief Actuary of KICO, has 27 years of experience with both large

and small insurance carriers and has also worked for actuarial

consulting firms. Throughout his career, he has specialized in many

of the markets that are a primary focus for KICO. Our underwriting

and claims managers have extensive experience in the insurance

industry with an average of 27 years of experience.

Scalable, Low-Cost Operations

We focus on

keeping expenses low, but invest in tools and processes that

improve the efficiency and effectiveness of underwriting risks and

processing claims. We evaluate the costs and benefits of each new

tool or process in order to achieve optimal results. While the

majority of our policies are written for risks in downstate New

York, our Kingston, New York location provides a significantly

lower cost operating environment. We also take a proactive approach

to settling outstanding claims rather than engaging in protracted

litigation, which results in more favorable claim outcomes and

reduced reserve uncertainty.

8

We have made

investments to develop online application and quoting systems for

many of our personal lines and commercial products. Currently, 98%

of the business submitted to KICO comes from online raters. This

has resulted in increased business submissions from our producers

due to the greater ease of placing business with us. We plan to

expand these online capabilities to all lines of business. We have

also leveraged a paperless workflow management and document storage

tool in order to further improve efficiency and reduce costs. Our

ability to control the growth of our operating and other expenses

while expanding our operations and growing revenue at a higher rate

is a key component of our business model and is important to our

future financial success.

Underwriting and Claims Management Philosophy

Our underwriting

philosophy is to target niche risk segments for which we have

detailed expertise and can take advantage of market conditions. We

monitor results on a regular basis and all of our selected

producers are reviewed by management on a quarterly

basis.

We believe that our

rates are competitive with other carriers’ rates in our

markets. We believe that rate consistency and the reliable

availability of our insurance products is important to our

producers. We do not seek to grow by competing based solely

upon price. We seek to develop long-term relationships with

our selected producers who understand and appreciate the consistent

path we have chosen. We carefully underwrite our business

utilizing the CLUE industry claims database, insurance scoring

reports, physical inspection of risks and other individual risk

underwriting tools. In the event that a material misrepresentation

is discovered in the underwriting application, the policy is

voided. If a material misrepresentation is discovered after a claim

is presented, we deny the claim. We write homeowners and dwelling

fire business in New York City and Long Island and are cognizant of

our exposure to hurricanes. We have mitigated this risk through

application of mandatory hurricane deductibles in these areas. Our

claim and underwriting expertise enables us to profitably write

personal lines business in all areas of New York City and Long

Island.

Distribution

We generate

business through our relationships with over 350 independent

producers. We carefully select our producers by evaluating several

factors such as their need for our products, premium production

potential, loss history with other insurance companies that they

represent, product and market knowledge, and the size of the

agency. We only distribute through independent agents and have

never sought to distribute our products direct to the consumer. We

will not appoint any agency owned or controlled by another carrier

which distributes its products direct to the consumer. We monitor

and evaluate the performance of our producers through periodic

reviews of volume and profitability. Our senior executives are

actively involved in managing our producer

relationships.

Each producer is

assigned to a personal and commercial lines underwriter and the

producer can call that underwriter directly on any matter. We

believe that the close relationship with their underwriters is a

principal reason producers place their business with us. Our online

application and quoting systems have streamlined the process of

placing business with KICO. Our producers have access to a KICO

website portal that contains links to our policy applications,

quoting screens, policy forms and underwriting guidelines for all

lines of business. We send out frequent electronic “Producer

Grams” in order to inform our producers of updates at KICO.

In addition, we have an active Producer Council and have at least

one annual meeting with all of our producers.

9

Competition; Market

The insurance

industry is highly competitive. We constantly assess and project

the market conditions and prices for our products, but we cannot

fully know our profitability until all claims have been reported

and settled.

Our policyholders

are located primarily in New York State. Our market primarily

consists of New York City, Long Island and Westchester County,

which we collectively define as downstate New York. We also offer

property and casualty insurance products in other areas of New York

State and in the Commonwealth of Pennsylvania. In addition, we are

licensed to write insurance policies in New Jersey, Connecticut,

Rhode Island and Texas. KICO’s Homeowners insurance rate,

rule and policy form filing was approved by the New Jersey

Department of Banking and Insurance in October 2016. We anticipate

we will start writing business in New Jersey in the first half of

2017. New Jersey is

the eleventh largest state in the country with a current estimated

population of approximately 8.9 million, according to the U.S.

Census Bureau. New Jersey is the seventh largest property and

casualty insurance market in the U.S., and also the tenth largest

homeowners and dwelling fire insurance market in the U.S. The New

Jersey homeowners market aligns well with the niche markets that

have generated profitable results in New York, and we believe that

our market expertise can be effectively transferred to this new

market.

New York State is

the fourth largest property and casualty insurance market in the

U.S. and also the fourth largest homeowners and dwelling fire

insurance market in the U.S. In 2015, KICO was the 16th largest

writer of homeowners and dwelling fire insurance in the State of

New York, according to data compiled by SNL Financial LC. Based on

the same data, in 2015, we had a 1.0% market share for this

combined group of personal lines property business. We compete with

large national carriers as well as regional and local carriers in

the property and casualty marketplace in New York. We believe that

many national and regional carriers have chosen to limit their rate

of premium growth or to decrease their presence in the downstate

New York property insurance market and other similar property

insurance markets in northeastern states due to the relatively high

coastal population and associated catastrophe risk that exists in

the region.

Given present

market conditions, we believe that we have the opportunity to

significantly expand the size of our personal and commercial lines

business in both New York and in the other northeastern states in

which we are licensed, beginning with New Jersey.

Loss and Loss Adjustment Expense Reserves

We are required to

establish reserves for incurred losses that are unpaid, including

reserves for claims and loss adjustment expenses

(“LAE”), which represent the expenses of settling and

adjusting those claims. These reserves are balance sheet

liabilities representing estimates of future amounts required to

pay losses and loss expenses for claims that have occurred at or

before the balance sheet date, whether already known to us or not

yet reported. We establish these reserves after considering all

information known to us as of the date they are

recorded.

Loss reserves fall

into two categories: case reserves for reported losses and LAE

associated with specific reported claims, and reserves for losses

and LAE that are incurred but not reported (“IBNR”). We

establish these two categories of loss reserves as

follows:

10

Reserves for reported losses - When a

claim is received, we establish a case reserve for the estimated

amount of its ultimate settlement and its estimated loss expenses.

We establish case reserves based upon the known facts about each

claim at the time the claim is reported and we may subsequently

increase or reduce the case reserves as additional facts and

information about each claim develops.

IBNR reserves - We also estimate and

establish reserves for loss and LAE amounts incurred but not yet

reported. IBNR reserves are calculated in bulk as an estimate of

ultimate losses and LAE less reported losses and LAE. There are two

types of IBNR. One type includes a provision for claims that have

occurred but are not yet reported or known. Another type of IBNR

provides a provision for expected future development on known

claims from the evaluation date until the time claims are settled

and closed. Ultimate losses driving the determination of

appropriate IBNR levels are projected by using generally accepted

actuarial techniques.

The

liability for loss and LAE represents our best estimate of the

ultimate cost of all reported and unreported losses that are unpaid

as of the balance sheet date. The liability for loss and LAE is

estimated on an undiscounted basis, using individual case-basis

valuations, statistical analyses and various actuarial procedures.

The projection of future claim payment and reporting is based on an

analysis of our historical experience, supplemented by analyses of

industry loss data. We believe that the reserves for loss and LAE

are adequate to cover the ultimate cost of losses and claims to

date; however, because of the uncertainty from various sources,

including changes in reporting patterns, claims settlement

patterns, judicial decisions, legislation, and economic conditions,

actual loss experience may not conform to the assumptions used in

determining the estimated amounts for such liability at the balance

sheet date. As adjustments to these estimates become necessary,

such adjustments are reflected in expense for the period in which

the estimates are changed. Because of the nature of the business

historically written, we believe that we have limited exposure to

asbestos and environmental claim liabilities.

We engage an

independent external actuarial specialist (the ‘Appointed

Actuary’) to opine on our recorded statutory reserves. The

Appointed Actuary estimates a range of ultimate losses, along with

a range and recommended central estimate of IBNR reserve amounts.

Our carried IBNR reserves are based on an internal actuarial

analysis and reflect management’s best estimate of unpaid

loss and LAE liabilities.

11

Reconciliation of Loss and Loss Adjustment Expenses

The

table below shows the reconciliation of loss and LAE on a gross and

net basis, reflecting changes in losses incurred and paid

losses:

|

|

Years ended

|

|

|

|

December 31,

|

|

|

|

2016

|

2015

|

|

|

|

|

|

Balance

at beginning of period

|

$39,876,500

|

$39,912,683

|

|

Less

reinsurance recoverables

|

(16,706,364)

|

(18,249,526)

|

|

Net

balance, beginning of period

|

23,170,136

|

21,663,157

|

|

|

|

|

|

Incurred

related to:

|

|

|

|

Current

year

|

27,853,010

|

23,642,998

|

|

Prior

years

|

(63,349)

|

(462,998)

|

|

Total

incurred

|

27,789,661

|

23,180,000

|

|

|

|

|

|

Paid

related to:

|

|

|

|

Current

year

|

16,496,648

|

13,172,870

|

|

Prior

years

|

8,503,310

|

8,500,151

|

|

Total

paid

|

24,999,958

|

21,673,021

|

|

|

|

|

|

Net

balance at end of period

|

25,959,839

|

23,170,136

|

|

Add

reinsurance recoverables

|

15,776,880

|

16,706,364

|

|

Balance

at end of period

|

$41,736,719

|

$39,876,500

|

Our

claims reserving practices are designed to set reserves that, in

the aggregate, are adequate to pay all claims at their ultimate

settlement value.

Loss and Loss Adjustment Expenses Development

The

table below shows the net loss development for business written

each year from 2006 through 2016. The table reflects the changes in

our loss and loss adjustment expense reserves in subsequent years

from the prior loss estimates based on experience as of the end of

each succeeding year.

The

next section of the table sets forth the re-estimates in later

years of incurred losses, including payments for the years

indicated. The following section of the table shows by year, the

cumulative amounts of loss and loss adjustment expense payments,

net of amounts recoverable from reinsurers, as of the end of each

succeeding year. For example, with respect to the net loss reserves

of $4,370,000 as of December 31, 2006, by December 31, 2008 (two

years later), $3,303,000 had actually been paid in settlement of

the claims that relate to liabilities as of December 31,

2006.

The

“cumulative redundancy (deficiency)” represents, as of

December 31, 2016, the difference between the latest re-estimated

liability and the amounts as originally estimated. A redundancy

means that the original estimate was higher than the current

estimate. A deficiency means that the current estimate is higher

than the original estimate. Estimates for the liabilities in place

as of December 31, 2014 and December 31, 2015 have both developed

favorably relative to initial estimates.

12

|

(in thousands of $)

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Reserve

for loss and loss adjustment expenses, net of reinsurance

recoverables

|

4,370

|

4,799

|

5,823

|

6,001

|

7,280

|

8,520

|

12,065

|

17,139

|

21,663

|

23,170

|

25,960

|

|

Net

reserve estimated as of One year later

|

4,844

|

5,430

|

6,119

|

6,235

|

7,483

|

9,261

|

13,886

|

18,903

|

21,200

|

23,107

|

|

|

Two

years later

|

5,591

|

5,867

|

6,609

|

6,393

|

8,289

|

11,022

|

16,875

|

18,332

|

21,501

|

|

|

|

Three

years later

|

5,792

|

6,433

|

6,729

|

6,486

|

9,170

|

12,968

|

16,624

|

18,687

|

|

|

|

|

Four

years later

|

6,260

|

6,569

|

6,711

|

7,182

|

10,128

|

12,552

|

16,767

|

|

|

|

|

|

Five

years later

|

6,343

|

6,683

|

7,261

|

7,766

|

9,925

|

12,440

|

|

|

|

|

|

|

Six

years later

|

6,429

|

7,245

|

7,727

|

7,602

|

9,932

|

|

|

|

|

|

|

|

Seven

years later

|

6,886

|

7,721

|

7,554

|

7,615

|

|

|

|

|

|

|

|

|

Eight

years later

|

7,318

|

7,568

|

7,511

|

|

|

|

|

|

|

|

|

|

Nine

years later

|

7,160

|

7,527

|

|

|

|

|

|

|

|

|

|

|

Ten

years later

|

7,069

|

|

|

|

|

|

|

|

|

|

|

|

Net

cumulative redundancy (deficiency)

|

(2,699)

|

(2,728)

|

(1,688)

|

(1,614)

|

(2,652)

|

(3,920)

|

(4,702)

|

(1,548)

|

162

|

63

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands of $)

|

2006

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Cumulative

amount of reserve paid, net of reinsurance recoverable

through

|

|

|

|

|

|

||||||

|

One

year later

|

2,018

|

1,855

|

2,533

|

2,307

|

3,201

|

3,237

|

4,804

|

6,156

|

8,500

|

8,503

|

|

|

Two

years later

|

3,303

|

3,339

|

3,974

|

3,992

|

4,947

|

5,661

|

8,833

|

10,629

|

12,853

|

|

|

|

Three

years later

|

4,036

|

4,339

|

5,054

|

4,659

|

6,199

|

8,221

|

11,873

|

13,571

|

|

|

|

|

Four

years later

|

4,471

|

5,146

|

5,373

|

5,238

|

7,737

|

10,100

|

13,785

|

|

|

|

|

|

Five

years later

|

5,079

|

5,424

|

5,717

|

5,997

|

8,585

|

10,903

|

|

|

|

|

|

|

Six

years later

|

5,305

|

5,738

|

6,224

|

6,562

|

8,941

|

|

|

|

|

|

|

|

Seven

years later

|

5,594

|

6,247

|

6,718

|

6,749

|

|

|

|

|

|

|

|

|

Eight

years later

|

5,966

|

6,740

|

6,853

|

|

|

|

|

|

|

|

|

|

Nine

years later

|

6,377

|

6,875

|

|

|

|

|

|

|

|

|

|

|

Ten

years later

|

6,468

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

reserve -

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31,

|

4,370

|

4,799

|

5,823

|

6,001

|

7,280

|

8,520

|

12,065

|

17,139

|

21,663

|

23,170

|

25,960

|

|

*

Reinsurance Recoverable

|

6,523

|

6,693

|

9,766

|

10,512

|

10,432

|

9,960

|

18,420

|

17,364

|

18,250

|

16,707

|

15,777

|

|

*

Gross reserves -

|

|

|

|

|

|

|

|

|

|

|

|

|

December

31,

|

10,893

|

11,492

|

15,589

|

16,513

|

17,712

|

18,480

|

30,485

|

34,503

|

39,913

|

39,877

|

41,737

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

re-estimated reserve

|

7,069

|

7,527

|

7,511

|

7,615

|

9,932

|

12,440

|

16,767

|

18,687

|

21,501

|

23,107

|

|

|

Re-estimated

reinsurance recoverable

|

11,183

|

11,151

|

12,849

|

12,833

|

13,486

|

13,884

|

27,970

|

20,218

|

19,450

|

16,674

|

|

|

Gross

re-estimated reserve

|

18,252

|

18,678

|

20,360

|

20,448

|

23,418

|

26,324

|

44,737

|

38,905

|

40,951

|

39,781

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

cumulative redundancy (deficiency)

|

(7,359)

|

(7,186)

|

(4,771)

|

(3,935)

|

(5,706)

|

(7,844)

|

(14,252)

|

(4,402)

|

(1,038)

|

96

|

|

See “Management’s Discussion

and Analysis of Financial Condition and Results of Operations

– Factors That May Affect

Future Results and Financial Condition” in Item 7 of this

Annual Report.

13

Reinsurance

We

purchase reinsurance to reduce our net liability on individual

risks, to protect against possible catastrophes, to remain within a

target ratio of net premiums written to policyholders’

surplus, and to expand our underwriting capacity. Participation in

reinsurance arrangements does not relieve us from our obligations

to policyholders. Our reinsurance program is structured to reflect

our obligations and goals.

Reinsurance

via quota share allows for a carrier to write business without

increasing its underwriting leverage above a ratio determined by

management. The business written under a quota share

reinsurance structure obligates a reinsurer to assume some portion

of the risks involved, and gives the reinsurer the profit (or loss)

associated with such in exchange for a ceding commission. We

have determined it to be in the best interests of our shareholders

to prudently reduce our reliance on quota share reinsurance.

This will result in higher earned premiums and a reduction in

ceding commission revenue in future years, but will allow us to

retain more net income from our profitable business.

Our

quota share reinsurance treaties in effect for the year ended

December 31, 2016 for our personal lines business, which primarily

consists of homeowners’ policies, were covered under the July

1, 2015/June 30, 2016 treaty year (“2015/2016 Treaty”)

and July 1, 2016/June 30, 2017 treaty year (“2016/2017

Treaty”). The expired 2015/2016 Treaty was at a 40% quota

share percentage and the current 2016/2017 Treaty remains at a 40%

quota share percentage.

Excess

of loss contracts provide coverage for individual loss occurrences

exceeding a certain threshold. The quota share reinsurance treaties

inure to the benefit of our excess of loss treaties, as the maximum

net retention on any single risk occurrence is first limited

through the excess of loss treaty, and then that loss is shared

again through the quota share reinsurance treaty. Our maximum net

retention under the quota share and excess of loss treaties for any

one personal lines occurrence for dates of loss on or after July 1,

2016 is $500,000. Commercial lines policies are not subject to a

quota share reinsurance treaty. Our maximum net retention under the

excess of loss treaties for any one commercial general liability

occurrence for dates of loss on or after July 1, 2016 is

$500,000.

We

earn ceding commission revenue under the quota share reinsurance

treaties based on a provisional commission rate on all premiums

ceded to the reinsurers as adjusted by a sliding scale based on the

ultimate treaty year loss ratios on the policies reinsured under

each agreement. The sliding scale provides minimum and maximum

ceding commission rates in relation to specified ultimate loss

ratios.

Under

the 2016/2017 Treaty and 2015/2016 Treaty, KICO is receiving a

higher upfront fixed provisional rate than in prior years’

treaties. In exchange for the higher provisional rate, KICO has a

reduced opportunity to earn sliding scale contingent

commissions.

The

2016/2017 Treaty and the 2015/2016 Treaty are on a

“net” of catastrophe reinsurance basis, as opposed to

the “gross” arrangement that existed in prior treaties.

Under a “net” arrangement, all catastrophe reinsurance

coverage is purchased directly by us. Since we pay for all of the

catastrophe coverage, none of the losses covered under a

catastrophic event will be included in the quota share ceded

amounts, drastically reducing the adverse impact that a

catastrophic event can have on ceding commissions.

In

2016, we purchased catastrophe reinsurance to provide coverage of

up to $252,000,000 for losses associated with a single event. One

of the most commonly used catastrophe forecasting models prepared

for us indicates that the catastrophe reinsurance treaties provide

coverage in excess of our estimated probable maximum loss

associated with a single more than one-in-250 year storm event. The

direct retention for any single catastrophe event is $5,000,000.

Losses on personal lines policies are subject to the 40% quota

share treaty, which results in a net retention by us of $3,000,000

of exposure per catastrophe occurrence. Effective July 1, 2016, we

have reinstatement premium protection on the first $20,000,000

layer of catastrophe coverage in excess of $5,000,000. This

protects us from having to pay an additional premium to reinstate

catastrophe coverage for an event up to this level.

14

Investments

Our

investment portfolio, including cash and cash equivalents, and

short term investments, as of December 31, 2016 and 2015, is

summarized in the table below by type of investment.

|

|

December 31, 2016

|

December 31, 2015

|

||

|

|

Carrying

|

% of

|

Carrying

|

% of

|

|

Category

|

Value

|

Portfolio

|

Value

|

Portfolio

|

|

|

|

|

|

|

|

Cash

and cash equivalents

|

$12,044,520

|

11.2%

|

$13,551,372

|

15.0%

|

|

|

|

|

|

|

|

Held

to maturity

|

|

|

|

|

|

U.S.

Treasury securities and

|

|

|

|

|

|

obligations

of U.S. government

|

|

|

|

|

|

corporations

and agencies

|

606,427

|

0.6%

|

606,389

|

0.7%

|

|

|

|

|

|

|

|

Political

subdivisions of states,

|

|

|

|

|

|

territories

and possessions

|

1,349,916

|

1.3%

|

1,417,679

|

1.6%

|

|

|

|

|

|

|

|

Corporate

and other bonds

|

|

|

|

|

|

Industrial

and miscellaneous

|

3,138,559

|

2.9%

|

3,114,804

|

3.4%

|

|

|

|

|

|

|

|

Available

for sale

|

|

|

|

|

|

Political

subdivisions of states,

|

|

|

|

|

|

territories

and possessions

|

8,205,888

|

7.6%

|

12,555,098

|

13.9%

|

|

|

|

|

|

|

|

Corporate

and other bonds

|

|

|

|

|

|

Industrial

and miscellaneous

|

53,685,189

|

49.9%

|

44,956,468

|

49.7%

|

|

|

|

|

|

|

|

Residential

backed mortgage securities

|

18,537,751

|

17.2%

|

4,990,498

|

5.5%

|

|

|

|

|

|

|

|

Preferred

stocks

|

5,685,001

|

5.3%

|

2,915,650

|

3.2%

|

|

|

|

|

|

|

|

Common

stocks

|

4,302,685

|

4.0%

|

6,288,620

|

7.0%

|

|

Total

|

$107,555,936

|

100.0%

|

$90,396,578

|

100.0%

|

15

The

table below summarizes the credit quality of our fixed-maturity

securities available-for-sale as of December 31, 2016 and 2015 as

rated by Standard and Poor’s (or if unavailable from Standard

and Poor’s, then Moody’s or Fitch):

|

|

December 31, 2016

|

December 31, 2015

|

||

|

|

|

Percentage of

|

|

Percentage of

|

|

|

Fair Market

|

Fair Market

|

Fair Market

|

Fair Market

|

|

|

Value

|

Value

|

Value

|

Value

|

|

|

|

|

|

|

|

Rating

|

|

|

|

|

|

U.S.

Treasury securities

|

$-

|

0.0%

|

$-

|

0.0%

|

|

|

|

|

|

|

|

Corporate

and municipal bonds

|

|

|

|

|

|

AAA

|

1,801,106

|

2.2%

|

2,218,147

|

3.5%

|

|

AA

|

7,236,457

|

9.0%

|

9,060,781

|

14.5%

|

|

A

|

13,944,784

|

17.3%

|

10,639,888

|

17.0%

|

|

BBB

|

38,908,731

|

48.4%

|

35,592,750

|

57.1%

|

|

Total

corporate and municipal bonds

|

61,891,078

|

76.9%

|

57,511,566

|

92.1%

|

|

|

|

|

|

|

|

Residential

mortgage backed securities

|

|

|

|

|

|

AA

|

14,143,828

|

17.7%

|

-

|

0.0%

|

|

A

|

173,973

|

0.2%

|

216,077

|

0.3%

|

|

CCC

|

513,369

|

0.6%

|

457,889

|

0.7%

|

|

CC

|

-

|

0.0%

|

402,558

|

0.6%

|

|

C

|

112,136

|

0.1%

|

-

|

0.0%

|

|

D

|

3,594,444

|

4.5%

|

3,913,974

|

6.3%

|

|

Total

residential mortgage backed securities

|

18,537,750

|

23.1%

|

4,990,498

|

7.9%

|

|

|

|

|

|

|

|

Total

|

$80,428,828

|

100.0%

|

$62,502,064

|

100.0%

|

Additional

financial information regarding our investments is presented under

the subheading “Investments” in Item 7 of this Annual

Report.

Ratings

Many insurance

buyers, agents, brokers and secured lenders use the ratings

assigned by A.M. Best and other agencies to assist them in

assessing the financial strength and overall quality of the

companies with which they do business and from which they are

considering purchasing insurance or in determining the financial

strength of the company that provides insurance with respect to the

collateral they hold. A.M. Best financial strength ratings are

derived from an in-depth evaluation of an insurance company’s

balance sheet strengths, operating performances and business

profiles. A.M. Best evaluates, among other factors, the

company’s capitalization, underwriting leverage, financial

leverage, asset leverage, capital structure, quality and

appropriateness of reinsurance, adequacy of reserves, quality and

diversification of assets, liquidity, profitability, spread of

risk, revenue composition, market position, management, market risk

and event risk. A.M. Best financial strength ratings are intended

to provide an independent opinion of an insurer’s ability to

meet its obligations to policyholders and are not an evaluation

directed at investors.

In 2009, KICO, our

operating subsidiary, applied for its initial A.M. Best rating, and

was assigned a letter rating of B (Fair) by A.M. Best in 2010.

KICO’s financial strength rating was upgraded to B+ (Good) in

2011 and B++ (Good) in 2015. KICO’s current A.M. Best issuer

credit rating is “bbb” with a positive

outlook.

16

In March, 2017, we

contributed $23,000,000 in capital to KICO in connection with our

recently completed public offering. We also have been considering

taking certain other actions, including modifying KICO’s

personal lines net quota share treaty and enhancing its catastrophe

excess of loss reinsurance treaties. We believe that such completed

and contemplated actions could lead to an upgrade of KICO’s

financial strength rating to “A- (Excellent)”. An A.M.

Best financial strength rating of A- (Excellent) or better could

create additional demand from new producers and policyholders. No

assurances can be given, however, that we will be able to satisfy

all of the conditions necessary to achieve a ratings upgrade. KICO

also has a Demotech financial stability rating of A (Exceptional)

which generally makes its policies acceptable to mortgage lenders

that require homeowners to purchase insurance from highly rated

carriers.

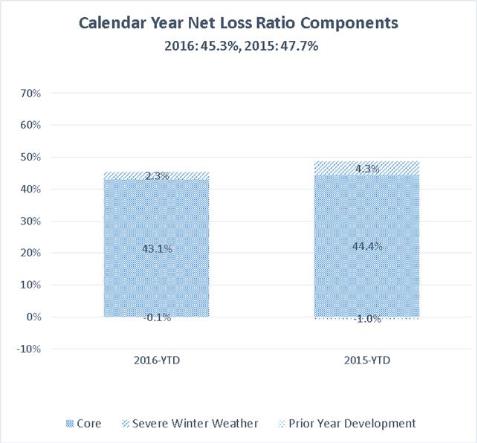

Severe Winter Weather

Our predominant

market, downstate New York, suffered severe weather during the

winters of 2016 and 2015. We include

severe winter weather in our definition of catastrophe. The

catastrophe component of the 2016 and 2015 severe winter was

determined by the number of claims in excess of our threshold of

average claims from severe winter weather. These claims were

primarily from losses due to frozen pipes, weight of snow and ice,

and other water-related structural damage as a result of excess

snow and below normal temperatures for an extended period.

The effects of severe winter weather increased our net loss ratio

by 2.3 and 4.3 percentage points in 2016 and 2015,

respectively.

The computation to

determine contingent ceding commission revenue includes direct

catastrophe losses and loss adjustment expenses incurred from

severe winter weather. Such losses increased our ceded loss ratio

in our July 1, 2014/June 30, 2015

personal lines quota share treaties which reduced our

contingent ceding commission revenue by $1,300,000 million for the

year ended December 31, 2015. Catastrophe losses for 2016 had no

impact on our contingent ceding commission revenue since the

ultimate loss ratio used to determine these commissions was not

affected by the 2016 severe winter weather. Due to these impacts on

ceding commission levels, the effects of severe winter weather

increased our net underwriting expense ratio by 0.0 and 2.7

percentage points in 2016 and 2015, respectively.

Government Regulation

Holding Company Regulation

We,

as the parent of KICO, are subject to the insurance holding company

laws of the state of New York. These laws generally require an

insurance company to register with the New York State Department of

Financial Services (the “DFS”) and to furnish annually

financial and other information about the operations of companies

within our holding company system. Generally under these laws, all

material transactions among companies in the holding company system

to which KICO is a party must be fair and reasonable and, if

material or of a specified category, require prior notice and

approval or acknowledgement (absence of disapproval) by the

DFS.

17

Change of Control

The

insurance holding company laws of the state of New York require

approval by the DFS for any change of control of an insurer.

“Control” is generally defined as the possession,

direct or indirect, of the power to direct or cause the direction

of the management and policies of the company, whether through the

ownership of voting securities, by contract or otherwise. Control

is generally presumed to exist through the direct or indirect

ownership of 10% or more of the voting securities of a domestic

insurance company or any entity that controls a domestic insurance

company. Any future transactions that would constitute a change of

control of KICO, including a change of control of Kingstone

Companies, Inc., would generally require the party acquiring

control to obtain the approval of the DFS (and in any other state

in which KICO may operate). Obtaining these approvals may result in

the material delay of, or deter, any such transaction. These laws

may discourage potential acquisition proposals and may delay, deter

or prevent a change of control of Kingstone Companies, Inc.,

including through transactions, and in particular unsolicited

transactions, that some or all of our stockholders might consider

to be desirable.

State Insurance Regulation

Insurance

companies are subject to regulation and supervision by the

department of insurance in the state in which they are domiciled

and, to a lesser extent, other states in which they conduct

business. The primary purpose of such regulatory powers is to

protect individual policyholders. State insurance authorities have

broad regulatory, supervisory and administrative powers, including,

among other things, the power to grant and revoke licenses to

transact business, set the standards of solvency to be met and

maintained, determine the nature of, and limitations on,

investments and dividends, approve policy forms and rates, and in

some instances to regulate unfair trade and claims

practices.

KICO

is required to file detailed financial statements and other reports

with the insurance regulatory authorities in the states in which it

is licensed to transact business. These financial statements are

subject to periodic examination by the insurance

regulators.

In

addition, many states have laws and regulations that limit an

insurer’s ability to withdraw from a particular market. For

example, states may limit an insurer’s ability to cancel or

not renew policies. Furthermore, certain states prohibit an insurer

from withdrawing from one or more lines of business written in the

state, except pursuant to a plan that is approved by the insurance

regulatory authority. The state regulator may disapprove a plan

that may lead to market disruption. Laws and regulations, including

those in New York, that limit cancellation and non-renewal and that

subject program withdrawals to prior approval requirements may

restrict the ability of KICO to exit unprofitable markets. Such

laws did not affect KICO’s ability to withdraw from the

commercial auto market in New York State.

Federal and State Legislative and Regulatory Changes

From

time to time, various regulatory and legislative changes have been

proposed in the insurance industry. Among the proposals that have

in the past been or at the present being considered are the

possible introduction of Federal regulation in addition to, or in

lieu of, the current system of state regulation of insurers, and

proposals in various state legislatures (some of which proposals

have been enacted) to conform portions of their insurance laws and

regulations to various model acts adopted by the National

Association of Insurance Commissioners (the

“NAIC”).

In

2016, the DFS proposed new comprehensive cybersecurity regulations.

In 2017, the regulations were finalized and became effective on

March 1, 2017 with transitional implementation periods. When fully

implemented, the regulations require covered entities, including

KICO, to establish a cybersecurity policy, a chief information

security officer, oversight over third party service providers,

penetration and vulnerability assessments, secure systems to

maintain an audit trail, risk assessments to include access

privileges to nonpublic information, use of multi-factor

authentication, and an incident response plan, among other

provisions. KICO has until August 28, 2017 to become compliant with

many of the provisions. Commencing February 15, 2018, and annually

thereafter, KICO must certify compliance to the DFS with the

applicable cybersecurity regulatory provisions.

18

In

2010, President Obama signed into law the Dodd-Frank Wall Street

Reform and Consumer Protection Act (the “Dodd-Frank

Act”) that established a Federal Insurance Office (the

“FIO”) within the U.S. Department of the Treasury. The

FIO is initially charged with monitoring all aspects of the

insurance industry (other than health insurance, certain long-term

care insurance and crop insurance), gathering data, and conducting

a study on methods to modernize and improve the insurance

regulatory system in the United States. In December 2013, the FIO

issued a report (as required under the Dodd-Frank Act) entitled

“How to Modernize and Improve the System of Insurance

Regulation in the United States” (the “Report”),

which stated that, given the “uneven” progress the

states have made with several near-term state reforms, should the

states fail to accomplish the necessary modernization reforms in

the near term, “Congress should strongly consider direct

federal involvement.” The FIO continues to support the

current state-based regulatory regime, but will consider federal

regulation should the states fail to take steps to greater

uniformity (e.g., federal licensing of insurers). In 2017, the new

President indicated that the provisions of this law should be

reviewed.

State Regulatory Examinations

As

part of their regulatory oversight process, state regulatory

authorities conduct periodic detailed examinations of the financial

reporting of insurance companies domiciled in their states,

generally once every three to five years. Examinations are

generally carried out in cooperation with the insurance regulators

of other states under guidelines promulgated by the NAIC. The New

York DFS commenced its examination of KICO in 2016. As of the date

of this Annual Report, the examination is still in

progress.

Risk-Based Capital Regulations

State

regulatory authorities impose risk-based capital

(“RBC”) requirements on insurance enterprises. The RBC

Model serves as a benchmark for the regulation of insurance

companies. RBC provides for targeted surplus levels based on

formulas, which specify various weighting factors that are applied

to financial balances or various levels of activity based on the

perceived degree of risk, and are set forth in the RBC

requirements. Such formulas focus on four general types of risk:

(a) the risk with respect to the company’s assets (asset

or default risk); (b) the risk of default on amounts due from

reinsurers, policyholders, or other creditors (credit risk);

(c) the risk of underestimating liabilities from business

already written or inadequately pricing business to be written in

the coming year (underwriting risk); and (d) the risk

associated with items such as excessive premium growth, contingent

liabilities, and other items not reflected on the balance sheet

(off-balance sheet risk). The amount determined under such formulas

is called the authorized control level RBC

(“ACL”).

The

RBC guidelines define specific capital levels based on a

company’s ACL that are determined by the ratio of the

company’s total adjusted capital (“TAC”) to its

ACL. TAC is equal to statutory capital, plus or minus certain other

specified adjustments. KICO’s TAC is far above the ACL and is

in compliance with New York’s RBC requirements as of December

31, 2016.

Dividend Limitations

Our ability to receive dividends from KICO is

restricted by the state laws and insurance regulations of New York.

These restrictions are related to surplus and net investment

income. Dividends are restricted to the lesser of 10% of

surplus or 100% of investment income (on a statutory accounting

basis) for the trailing 36 months, less dividends by KICO paid