Attached files

| file | filename |

|---|---|

| EX-32.1 - EXHIBIT 32.1 - ROYAL HAWAIIAN ORCHARDS, L.P. | ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - ROYAL HAWAIIAN ORCHARDS, L.P. | ex31-1.htm |

| EX-21.1 - EXHIBIT 21.1 - ROYAL HAWAIIAN ORCHARDS, L.P. | ex21-1.htm |

| EX-11.1 - EXHIBIT 11.1 - ROYAL HAWAIIAN ORCHARDS, L.P. | ex11-1.htm |

| EX-3.2 - EXHIBIT 3.2 - ROYAL HAWAIIAN ORCHARDS, L.P. | ex3-2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2016

1-9145

Commission File Number

|

|

ROYAL HAWAIIAN ORCHARDS, L.P.

(Exact name of registrant as specified in its charter)

|

STATE OF DELAWARE |

99-0248088 |

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

688 Kinoole Street, Suite 121, Hilo, Hawaii 96720

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (808) 747-8471

SECURITIES REGISTERED PURSUANT TO SECTION 12(b) OF THE ACT: NONE

SECURITIES REGISTERED PURSUANT TO SECTION 12(g) OF THE ACT:

|

Title of Each Class |

|

Depositary Units Representing |

Indicate by check mark if the registrant is a well-known seasoned issuer as defined in Rule 405 of the Securities Act Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 of 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☐ |

Accelerated filer ☐ |

|

Non-accelerated filer ☐ |

Smaller reporting company ☒ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

The aggregate market value of registrant’s voting and non-voting equity (consisting of Class A Units) held by non-affiliates as of June 30, 2016, was $7,855,053 based on the last reported sales price on the OTCQX on that date of $2.80 per Unit.

The number of outstanding Class A Units as of March 15, 2017, was 11,100,000.

DOCUMENTS INCORPORATED BY REFERENCE

None.

|

Page | ||

| PART I | ||

|

ITEM 1. |

3 | |

|

ITEM 1A. |

7 | |

|

ITEM 1B. |

21 | |

|

ITEM 2. |

21 | |

|

ITEM 3. |

24 | |

|

ITEM 4. |

24 | |

|

ITEM 5. |

MARKET FOR REGISTRANT’S UNITS, RELATED UNITHOLDER MATTERS AND ISSUER PURCHASES OF UNITS |

25 |

|

ITEM 6. |

26 | |

|

ITEM 7. |

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

26 |

|

ITEM 7A. |

38 | |

|

ITEM 8. |

39 | |

|

ITEM 9. |

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE |

37 |

|

ITEM 9A. |

37 | |

|

ITEM 9B. |

40 | |

|

ITEM 10. |

41 | |

|

ITEM 11. |

44 | |

|

ITEM 12. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED UNITHOLDER MATTERS |

47 |

|

ITEM 13. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE |

47 |

|

ITEM 14. |

48 | |

|

ITEM 15. |

49 | |

|

ITEM 16. |

52 | |

FORWARD-LOOKING STATEMENTS

Statements that are not historical facts contained in or incorporated by reference into this prospectus are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “anticipate,” “goal,” “seek,” “project,” “strategy,” “future,” “likely,” “may,” “should,” “will,” “estimate,” “expect,” “plan,” “intend,” “target” and similar expressions (including negative and grammatical variations) and references to future periods, as they relate to us, are intended to identify forward-looking statements. Forward-looking statements include statements we make regarding:

|

● |

projections of revenues, expenses, income or loss; |

|

● |

our plans, objectives and expectations, including those relating to regulatory actions, business plans, products or services; |

|

● |

competition in the markets in which we operate; |

|

● |

expected costs to produce kernel; |

|

● |

renewal of our trademark; |

|

● |

ability to pass along increased costs; |

|

● |

water needs of maturing orchards and effects on production of insufficient irrigation; |

|

● |

the sufficiency of our irrigation wells; |

|

● |

nut roasting and other measures to maintain product quality and prevent contamination; |

|

● |

industry trends; |

|

● |

use of nut-in-shell inventories for the manufacture of branded products; |

|

● |

relations with employees; |

|

● |

assumptions impacting expenses and liabilities related to our pension obligations; |

|

● |

anticipated contributions to our pension plan; |

|

● |

lower yields and cash flows from newer orchards; |

|

● |

anticipated nut production; |

|

● |

plans for the branded products segment, including the number of stores we expect to be in, gaining greater shelf space, increasing market share, higher growth and the introduction of new products; |

|

● |

the sufficiency of our working capital and financing sources to fund our operations; |

|

● |

our plans to raise equity or refinance or extend our debt; |

|

● |

seasonality of nut production and sales of branded products; |

|

● |

our ability to engage third parties to process our nuts and the cost of such processing; |

|

● |

factors that influence consumer purchases; |

|

● |

consumer demands regarding food standards and their impact on our costs and operating results; |

|

● |

potential loss of shelf space; |

|

● |

reliance on third-party manufacturers; |

|

● |

delays in production or delivery of nuts; |

|

● |

use of herbicides, fertilizers and pesticides; |

|

● |

our belief that we are in compliance with environmental regulations; |

|

● |

tax implications of owning our Units; |

|

● |

the expected renegotiation of certain leases; |

|

● |

a lessor’s exercise of its contractual right to take back orchards; |

|

● |

the adequacy of our insurance, including product liability and crop insurance; and |

|

● |

impact of new accounting rules. |

Forward-looking statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. Our actual results could differ materially from those in such statements. Factors that could cause actual results to differ from those contemplated by such forward-looking statements include, without limitation:

|

● |

the factors discussed in Item 1A – Risk Factors of this Annual Report on Form 10-K; |

|

● |

our ability to sell equity, extend or refinance our debt, or to otherwise raise funds to meet our current obligations and debt service requirements; |

|

● |

changing interpretations of accounting principles generally accepted in the United States of America; |

|

● |

outcomes of litigation, claims, inquiries or investigations; |

|

● |

world market conditions relating to macadamia nuts; |

|

● |

the weather and local conditions in Hawaii affecting macadamia nut production; |

|

● |

diseases and pests affecting macadamia nut production |

|

● |

legislation or regulatory environments, requirements or changes adversely affecting our businesses; |

|

● |

labor relations; |

|

● |

general economic conditions; |

|

● |

geopolitical events and regulatory changes; |

|

● |

our ability to retain and attract skilled employees; |

|

● |

our success in finding purchasers for our macadamia nut production at acceptable prices; |

|

● |

increasing competition in the snack food market; |

|

● |

the availability of and our ability to negotiate acceptable agreements with third parties that are necessary for our business, including those with manufacturers, nut processors, co-packers, and distributors; |

|

● |

market acceptance of our products in the branded segment; |

|

● |

the availability and cost of raw materials; |

|

● |

availability and cost of labor, fuel, materials, equipment, and insurance; |

|

● |

nonperformance by a significant customer; and |

|

● |

our success at managing the risks involved in the foregoing items. |

Forward-looking statements speak only as of the date on which such statements are made. We undertake no obligation to update any forward-looking statement, whether as a result of new information, future events or otherwise. All forward-looking statements are expressly qualified by these cautionary statements.

Part I

|

BUSINESS OF THE PARTNERSHIP |

Royal Hawaiian Orchards, L.P. (the “Partnership”) is a master limited partnership organized in 1986 under the laws of the State of Delaware. The Partnership is managed by its sole general partner, Royal Hawaiian Resources, Inc. (the “Managing Partner”). On October 1, 2012, the Partnership changed its name from ML Macadamia Orchards, L.P. to Royal Hawaiian Orchards, L.P. to better enable the Partnership to brand its products. Royal Hawaiian was the original brand name used to market the macadamia nuts grown from 1946 until 1973 on the acreage that now comprises our orchards. Branded product sales are made through the Partnership’s wholly owned subsidiary, Royal Hawaiian Macadamia Nut, Inc. (“Royal”). Unless the context otherwise requires, Royal Hawaiian Orchards, L.P. and its subsidiaries are referred to in this report as the Partnership and “we,” “us” or “our.”

Our principal executive offices are located at 688 Kinoole Street, Suite 121, Hilo, Hawaii 96720, and our telephone number is (808) 747-8471. Our Depositary Units Representing Class A Units of Limited Partnership Interests (“Units”) are currently traded on the OTCQX platform under the symbol “NNUTU.”

Overview

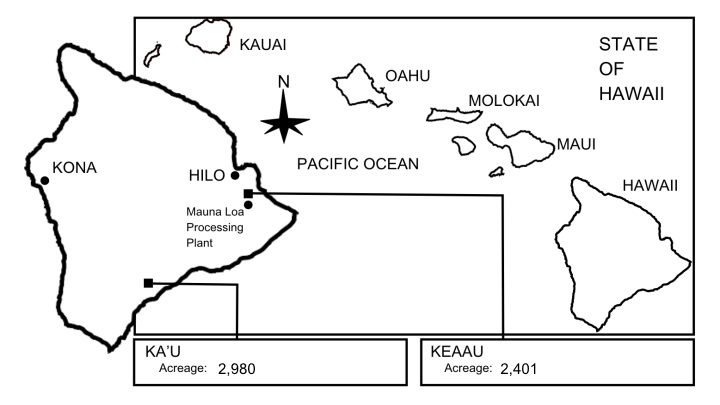

We are a producer, marketer and distributor of high-quality macadamia nut-based products. We are the largest macadamia nut farmer in Hawaii, farming approximately 5,381 tree acres of orchards that we own or lease in two locations on the island of Hawaii, including 641 tree acres that we own and lease to another party. We also farm approximately 433 tree acres of macadamia orchards in Hawaii for other orchard owners.

In 2012, we established a branded products company to manufacture and sell a line of macadamia snacks under the brand name ROYAL HAWAIIAN ORCHARDS®. In 2014, we completed construction of the first phase of our drying facility, which affords us more control over processing our nuts and reduces our processing costs. By the end of fourth quarter of 2015, the second and final phase of our drying plant was completed, and the plant became fully operational in January 2016.

Business Segments

We have two business segments: orchards and branded products. The orchards segment derives its revenues from the sale of wet-in-shell (“WIS”) macadamia nuts, sale of dry-in-shell (“DIS”) macadamia nuts, sale of macadamia nut kernel to Royal, revenues from contract farming, and orchard lease income. The branded products segment derives its revenues from the sale of branded macadamia nut products and bulk macadamia nut kernel by Royal.

Information concerning industry segments is set forth in Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 4 – Segment Information to the Consolidated Financial Statements included in Part II, Item 8 of this Annual Report on Form 10-K.

Orchards Segment

The orchards segment grows and farms macadamia nuts for sale WIS and DIS, and for sale of macadamia nut kernel to Royal for the processing and sale of branded products and the sale of bulk kernel. The orchards segment also provides contract farming services and leases orchards.

From 1986 through 2006 and from 2010 through the end of 2012, we sold all of our nut production WIS to Mauna Loa Macadamia Nut Corporation (“Mauna Loa”) pursuant to various agreements with Mauna Loa. During 2013 and 2014, we reduced the number of pounds that we sold to Mauna Loa. As of January 1, 2015, only three long-term agreements remain, which represented approximately 18% of our production in both 2016 and 2015.

Nuts retained by us for use in our branded products segment are dried and then sent to a third-party processor for shelling. In November 2014, the Partnership completed the construction of the first phase of its drying facility located in the Ka’u district of the island of Hawaii, near our producing orchards, and we began drying the WIS nuts harvested from our orchards not sold to Mauna Loa.

Competition. Demand for macadamia nuts in the United States and Hawaii has been strong. Our nuts are sold to Royal and under long-term contracts to Mauna Loa. We compete with other growers in Hawaii for labor and for WIS nuts to process and sell through Royal.

Macadamia Farming. We farm approximately 5,381 tree acres of orchards that we own or lease, including 641 tree acres that we own and lease to another party. We also farm approximately 433 tree acres of macadamia orchards in Hawaii for other orchard owners.

All orchards are located in two separate regions on the island of Hawaii (“Keaau” and “Ka’u”). Because each region has different terrain and weather conditions, farming methods vary somewhat between the regions.

Branded Products Segment

In 2012, we commenced marketing branded products under the ROYAL HAWAIIAN ORCHARDS® brand name. As of December 2016, our branded products were in approximately 20,000 grocery, natural foods and mass merchant stores nationwide. Key elements of our branded product strategy are as follows:

Capitalize on the Health Benefits of Macadamia Nuts. Our strategy is to capitalize on consumers’ views of nuts as a healthy snack that can command prices above traditional mass-marketed products. According to research conducted by Mintel International, consumers view fruit and nuts, respectively, as the number one and two healthiest snacks. Our products contain no artificial ingredients, contain no genetically modified organisms (“GMOs”), are gluten-free, and have no sulfites. We are leveraging the existing nutritional properties inherent in tree nuts in our line of macadamia-based healthy snacks. Our strategy is based on promoting the health benefits of macadamia nuts, which are similar to those of almonds, a food product that has achieved strong market positioning based on growing consumer awareness of associated wellness properties. As part of this strategy, the Partnership sells better for you macadamia snacks under the brand name ROYAL HAWAIIAN ORCHARDS®.

Distribute Our Products through Retailers that Target Consumers who Desire Premium Healthy Snacks. We sell our products to national, regional and independent grocery and drug store chains, as well as mass merchandisers, club stores and other retail channels, that target consumers with healthy eating habits and the disposable income necessary to afford premium products. In accordance with this strategy, we seek to secure product placement in mainstream aisles. We believe this leads more consumers to purchase our products.

Mitigate our Exposure to Fluctuating Commodity Prices. By pursuing a branded product strategy and continuing to farm macadamia nuts, we believe that we have a pricing advantage because we are able to produce nuts from our own orchards at a relatively fixed and currently favorable cost and do not have to compete to purchase nuts from third parties. Furthermore, we believe that if wholesale market prices for macadamia nuts decline below our actual production costs, we would be better positioned to profitably sell the nuts as branded products, thereby mitigating our exposure to fluctuating market prices.

Use of Co-packers. Royal has contracted with third-party manufacturers, also known as co-packers, in California, Minnesota, and Washington, to manufacture the ROYAL HAWAIIAN ORCHARDS® branded products. Utilizing co-packers provides us with the flexibility of producing different products and the ability to develop new products quickly and economically. We selected our co-packers based on production capabilities in producing products of these types.

Customers. Royal markets its retail products to wholesale customers directly and through food brokers and to consumers through Royal’s e-commerce site. The food brokers represent multiple manufacturers and are paid a percentage of sales. Royal’s customers are national, regional and independent grocery and drug store chains, as well as mass merchandisers, club stores and other retail channels that purchase the products under payment terms approved by Royal based on their creditworthiness. Royal’s customers resell the macadamia nut products to end-consumers in retail outlets in the United States. Royal also sells bulk kernel to nut brokers and companies who use the kernel in their products.

Marketing Strategy. Royal’s marketing strategy focuses on building brand awareness for its brand and line of better for you macadamia snacks using social media, grassroots marketing such as sampling, public relations and participation in community events and festivals. We utilize a combination website and integrated e-commerce store at www.royalhawaiianorchards.com and sell our products on Amazon.com. Royal also uses Facebook and Twitter accounts and several other strategies to build its customer base. A key marketing strategy is consistent social media presence, where Royal can connect directly with potential target consumers.

Product Distribution. We developed a product distribution network to support sales growth and provide superior customer service in an efficient manner. Distribution of our products is executed through a third-party distribution center. We primarily use common carriers to deliver products from these distribution points to our customers.

Competition. The snack food market is highly competitive. Our products compete against food and snack products sold by many regional and national companies, some of which are substantially larger and have greater resources than the Partnership. We believe that additional competitors will enter the markets in which we operate. In the macadamia snack food market, we are focused on North America where our competitors are the larger macadamia nut companies and private labels. We also compete for shelf space of retail grocers, convenience stores, drug stores, mass merchandisers, natural food stores and club stores. We compete primarily on the basis of product quality, ability to satisfy specific consumer needs (including gluten-free needs), brand recognition, brand loyalty, service, marketing, advertising and price. Substantial advertising and promotional expenditures are required to maintain or improve a brand’s market position or to introduce a new product, and participants in our industry are engaging with new media, including customer outreach through social media and web-based vehicles, which require additional staffing and financial resources. Our principal competitors in the macadamia snack food market are Mauna Loa, Mac Farms and companies who sell under private labels.

Environmental Matters. Our operations are subject to various federal, state and local environmental laws and regulations. We believe the Partnership is in compliance with all material environmental regulations affecting our facilities and operations.

Research and Development. We consider research and development of new products to be a significant part of our overall philosophy, and we are committed to developing new products that incorporate macadamia nuts. As we expand our snack nut product range, we believe we can gain greater shelf space in retail stores and increase our market share. In 2016, we introduced macadamia nut milk, macadamia nut butter, and convenient, on-the-go, portion-sized packages that appeal to health-conscious consumers. We believe that our innovations differentiate our products from those of our competitors, leading to increased brand loyalty and higher consumer awareness. In addition to developing new products, we are focused on improving our existing products and are making incremental improvements based on customer feedback.

Trademarks and Patents. We market and sell our products primarily under the ROYAL HAWAIIAN ORCHARDS® brand, which is protected with trademark registration with the U.S. Patent and Trademark Office, as well as in various other jurisdictions. We expect to continue to maintain this trademark in effect. We have no patents.

Governmental Regulations

As an agricultural company, we are subject to extensive government regulation, including regulation of the manner in which we cultivate and fertilize as well as process our macadamia nuts. Furthermore, the branded products segment of our business subjects us to additional regulation regarding the manufacturing, distribution, and labeling of our products.

Manufacturers and marketers of food products are subject to extensive regulation by the Food and Drug Administration (“FDA”), the U.S. Department of Agriculture (“USDA”), and other national, state and local authorities. The Food, Drug and Cosmetic Act and the Food Safety Modernization Act and their regulations govern, among other things, the manufacturing, composition and ingredients, packaging and safety of foods. Under these acts, the FDA regulates manufacturing practices for foods through its current “good manufacturing practices” regulations, imposes ingredient specifications and requirements for many foods, requires specialized training and record keeping to identify and prevent hazards within food production facilities, and inspects food facilities and issues recalls for tainted food products.

Food manufacturing facilities and products are also subject to periodic inspection by federal, state and local authorities. State regulations are not always consistent with federal or other state regulations.

Seasonality

While sales of our branded products are anticipated to be only slightly seasonal, with the fourth quarter of the calendar year somewhat higher, macadamia nut production is very seasonal, with the largest quantities typically being produced and then inventoried from September through November, resulting in large inventories that will be converted into finished product and sold throughout the following year.

Significant Customer

Mauna Loa has historically been and still is our largest customer. WIS nut sales to Mauna Loa represented approximately 19% of our nut production in 2016 and 2015. In addition, in 2016 Mauna Loa began buying macadamia nut kernel. Sales of WIS nuts and kernel totaled $6.9 million in 2016 compared to $3.1 million in 2015 and represented 26% and 17% of net sales in 2016 and 2015, respectively. See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operation.

Employees

As of December 31, 2016, we employed 244 people: 90 full-time employees; 149 seasonal employees; and five part-time employees. Of the total, 18 are in farming supervision and management, 206 are in production, maintenance and agricultural operations, 17 are in accounting and administration, and three are in sales.

We are a party to two collective bargaining agreements with the International Longshore and Warehouse Union (“ILWU”) Local 142. These agreements cover all production, maintenance and agricultural employees of the Ka’u and Keaau orchards. On January 8, 2017, we and ILWU Local 142 agreed to two new three-year contracts, which are effective June 1, 2016 through May 31, 2019. Although we believe that relationships with our employees and the ILWU are good, there is no assurance that we will be able to extend these agreements on terms satisfactory to it when they expire.

Taxation

The Partnership has a grandfathered tax status, which allows it to be treated as a partnership for tax purposes, even though it is publicly traded, provided that it pays a 3.5% federal tax on gross income from the active conduct of the trade and business of the Partnership. The Partnership will cease to be treated as a partnership for tax purposes if the Partnership engages in a substantially new line of business. A substantially new line of business conducted through a wholly owned corporate subsidiary of the Partnership is not deemed to be a new line of business for tax purposes. Accordingly, the Partnership manufactures, markets and sells its branded products through its wholly owned corporate subsidiary, Royal. Any income or gain the Partnership derives from transactions with Royal would be included in income or gain of the Partnership that would flow through to the unitholders. Conversely, tax losses in Royal may not be available to offset the taxable income of the Partnership. As a result, the Partnership may have income allocable to unitholders on which the unitholders are obligated to pay taxes, yet have no cash available for distribution. See Item 1A – Risk Factors – Tax Risks of Owning Our Units - Our branded products line of business operates through a corporate subsidiary, which may result in increased taxes and – Your tax liability from the ownership of Units may exceed your distributions from the Partnership. The Partnership intends to maintain its status of being taxed as a partnership.

Available Information and Website Address

We are subject to the information requirements of the Exchange Act, and in accordance therewith, we file annual, quarterly and current reports and other information with the SEC. You may read and copy any of these documents at the SEC’s Public Reference Room at 100 F Street N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information on the operation of the Public Reference Room. The SEC maintains a website that contains the reports, proxy and information statements, and other information we file at http://www.sec.gov. Our SEC filings are also available on our website at www.rholp.com. The contents of our website are not incorporated by reference into this report.

Recent Developments

Sale of Managing Partner. On June 30, 2016, the Partnership entered into a definitive Stock Purchase Agreement with Crescent River Agriculture LLC, a Wyoming limited liability company (“Crescent River”) and related party, pursuant to which the Partnership sold all of the issued and outstanding shares of capital stock of the Managing Partner to Crescent River for $224,000.

The only asset of the Managing Partner consists of a one percent general partnership interest in the Partnership. The general partnership interest is unregistered and non-transferrable. Pursuant to the terms of the Amended and Restated Agreement of Limited Partnership, dated as of October 1, 2012, and as amended November 1, 2013 and February 15, 2017 (the “Partnership Agreement”), the Managing Partner is also entitled to an annual management fee equal to two percent of Operating Cash Flow (as defined by the Partnership Agreement) and an incentive fee if net cash flow of the partnership exceeds certain levels defined in the Partnership Agreement. The management fee has been waived by the Managing Partner since it became a wholly subsidiary of the Partnership in 2005. The incentive fee has not been earned by the Managing Partner for at least 15 years. As part of the transaction, the Managing Partner agreed to waive both the management fee and the incentive fee for fiscal 2016, 2017, and 2018. After 2018, the Managing Partner will be eligible to earn the management fee and the incentive fee. Pursuant to the Partnership Agreement, the Partnership is still required to reimburse the Managing Partner for expenses incurred in managing the Partnership.

There was no immediate impact on the Partnership as a result of the change of ownership of the Managing Partner. The Managing Partner continues to own its one percent general partnership interest in the Partnership and serves as managing partner of the Partnership. The board of directors and officers of the Managing Partner remain unchanged. Prior to the sale of the Managing Partner, the board of directors of the Managing Partner self-determined annually on behalf of the Partnership whether any changes should be made to the board of directors. The board of directors of the Managing Partner is now elected annually by Crescent River. The sale of the Managing Partner returned the management structure of the Partnership to the original structure that was established when the Partnership was formed, which continued in effect until the purchase of the Managing Partner by the Partnership in 2005. Therefore, no changes to the Partnership Agreement were necessary as a result of the sale.

Settlement Agreement with Olson Trust. On February 14, 2017, the Partnership entered into a settlement agreement with Edmund C. Olson as Trustee for the EDMUND C. OLSON TRUST No. 2 dated August 21, 1985 (the “Olson Trust”) with respect to the lawsuit filed by the Olson Trust (as lessor) against the Partnership (as lessee) on January 22, 2015, seeking declaratory judgment that the Partnership had breached the terms of two orchard leases.

Upon completion of the transactions contemplated by the settlement agreement, we will gain ownership of 653 acres of land, which includes 382 acres of trees and the land underlying our garage, husking, drying and office facilities. We will have relinquished 515 acres of leased land (the lease for 423 acres of which was scheduled to expire in 2034 and 92 acres of which was scheduled to expire in 2045), including 348 acres of trees, and 30 acres of owned land, including 24 acres of trees. Under the terms of the settlement agreement, each of the parties has released all claims against the other related to the lawsuit and the leases at issue, other than those associated with enforcing the Settlement Agreement. For additional information concerning the terms of the settlement, see Item 3 – Legal Proceedings.

|

RISK FACTORS |

Our business, financial condition, and results of operations are subject to significant risks. We urge you to consider the following risk factors in addition to the other information contained in, or incorporated by reference into, this Form 10-K and our other periodic reports filed with the Securities and Exchange Commission (the “SEC”). If any of the following risks actually occur, our business, financial condition, results of operations or cash flows could be materially adversely affected.

Risk Factors Related to Our Business

We need to obtain financing to repay indebtedness, and our current circumstances raise substantial doubt about our ability to continue to operate as a going concern.

Our cash and cash equivalents are not sufficient to repay our 2015 bridge loan when due on July 15, 2017, and, unless we can extend or refinance our revolving credit facility, to repay our revolving credit facility maturing on July 15, 2017. We plan to issue equity to raise funds to satisfy our maturing debt or to extend the terms of our debt; however, there can be no assurances that we will be able to raise sufficient funds on terms that are acceptable to us or that we will be able to extend the terms of our debt. If we are unable to issue sufficient equity, extend the terms of our debt, or otherwise raise funds in the short-term, management has determined that substantial doubt exists about our ability to maintain our operations as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of recorded assets or the amounts of and classification of liabilities that might be necessary in the event we cannot continue in existence. We continue to experience net operating losses.

We have a substantial amount of indebtedness. In the event we do not repay or refinance such indebtedness, we will face substantial liquidity issues and might be required to sell some of our assets to meet our debt payment obligations.

We have a substantial amount of indebtedness. As of December 31, 2016, we have a total of approximately $13.2 million of short-term indebtedness, all of which we will need to refinance or repay in the next few months. There can be no assurances we will be able to refinance our indebtedness (1) on commercially reasonable terms, (2) on terms, including with respect to interest rates, as favorable as our current debt or (3) at all. If we are unable to refinance or renegotiate our debt, we will not be able to repay our 2015 bridge loan due July 15, 2017, and we may not be able to generate enough cash flows from operations to service our remaining debt or to extend or refinance our revolving credit facility. Although we have maintained, renegotiated and extended a revolving credit facility with our current lender and its predecessor for over 15 years, there is no assurance that we will be able to do so given our current financial condition.

We rely upon external financing which is secured by a pledge of all of our real and personal property. If we are unable to comply with the terms of our loan agreements, we could lose our assets.

We rely on external financing, currently being provided by an Amended and Restated Credit Agreement with American AgCredit, PCA (“AgCredit PCA”) and a Credit Agreement with American AgCredit, FLCA (“AgCredit FLCA”), through a revolving credit facility and several term notes. These agreements contain various terms and conditions, including financial ratios and covenants, and are secured by all of the real and personal property of the Partnership. On multiple occasions during the last several years and as recently as the end of 2016, we have failed to comply with various financial covenants under our credit agreements but have been able to obtain waivers or modifications of the agreements to avoid a default. If we are unable to meet the terms and conditions of our credit agreements or to obtain waivers or modifications of such credit agreements, we could be in default under our credit agreements, and the lenders would be able to accelerate the obligations and foreclose on the collateral securing the indebtedness. There is no assurance that we will be able to comply with our credit agreements or obtain waivers or modifications in the future to avoid a default. See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations – Liquidity and Capital Resources for further information.

We have a history of losses and our future profitability on a quarterly or annual basis is uncertain, which could have a harmful effect on our business and the value of our Units.

Since we launched our branded products in November 2012 and thru the most current period, we have not generated enough revenue to exceed our expenditures within any twelve-month fiscal period. We have financed our operations primarily through our cash flow from operations, our revolving credit facility and offerings of Units. As of December 31, 2016, we had debt outstanding of $22.3 million, of which $13.2 million is short-term, including a $2.835 million bridge loan maturing on July 15, 2017. If we cannot raise equity or refinance or extend the terms of our debt, we will not be able to repay the 2015 bridge loan or our revolving credit facility, both of which mature on July 15, 2017. This could force us to sell assets or cease operations.

Our substantial level of indebtedness could adversely affect our ability to address the needs of our business and to react to changes in our business. In addition, if we fail to comply with our covenants, our debt could be accelerated.

As a result of our substantial indebtedness:

|

● |

we may be more vulnerable to general adverse economic or industry conditions; |

|

● |

we may find it more difficult to obtain additional financing to fund capital investments or other general partnership requirements or to refinance our existing indebtedness; |

|

● |

we are or will be required to dedicate a substantial portion of our cash flows from operations to the payment of principal or interest on our debt, thereby reducing the available cash flows to fund other projects; |

|

● |

we may have limited flexibility in planning for, or reacting to, changes in our business or in the industry; |

|

● |

we may have a competitive disadvantage relative to other companies in our industry with less debt; |

|

● |

we may be adversely impacted by changes in interest rates; |

|

● |

we may be required to sell some of our assets, possibly on unfavorable terms, in order to meet obligations; and |

|

● |

we may be limited in our ability to take advantage of strategic business opportunities, including mergers and acquisitions. |

Currently we have credit agreements in place that limit in certain circumstances our ability to incur additional indebtedness, pay dividends, create liens, sell assets, or engage in certain mergers and acquisitions, among other things. In addition, our credit agreements contain financial covenants. Our ability to comply with these covenants or to satisfy our debt obligations will depend on our future operating performance. If we violate the restrictions in our credit agreements or fail to comply with our applicable financial covenants, we will be in default under the agreements, which in some cases would cause the maturity of a substantial portion of our long-term indebtedness to be accelerated.

ROYAL HAWAIIAN ORCHARDS® products were launched in November 2012 and have a limited retail distribution history, and thus far, our branded products have not been profitable. Our future ability to grow our revenues and generate profits depends upon continued sell-in and sell-through sales of these new products and increasing efficiencies, decreasing costs and/or modifying prices related to the manufacture and sale of our products.

Prior to November 2012, we had never pursued the sale of macadamia nut products to customers or the sale of nuts in kernel form to others for incorporation into their products. Any adverse developments with respect to the sale of ROYAL HAWAIIAN ORCHARDS® macadamia products could significantly reduce revenues and have a material adverse effect on our ability to achieve profitability and future growth. We cannot be certain that we will be able to continue to commercialize our macadamia products or that our products will be accepted in retail markets. Specifically, the following factors, among others, could affect continued market acceptance, revenues and profitability of ROYAL HAWAIIAN ORCHARDS® snack products:

|

● |

the introduction of competitive products into the healthy snack market; |

|

● |

the level and effectiveness of our sales and marketing efforts; |

|

● |

our ability to effectively manage costs of product development, manufacturing, inventory, transportation and sales; |

|

● |

any unfavorable publicity regarding nut products or similar products; |

|

● |

litigation or threats of litigation with respect to these products; |

|

● |

the price of the product relative to other competing products; |

|

● |

price increases resulting from rising commodity, manufacturing, storage and transportation costs; |

|

● |

regulatory developments affecting the manufacture, marketing or use of these products; and |

|

● |

the inability to gain significant customers. |

There is no assurance that this effort will be successful or that we will receive a return on our investment.

We have historically depended on a single nut purchaser.

In each of 2016 and 2015, we sold approximately 19% of our WIS nut production to Mauna Loa. In 2016, we also sold kernel to Mauna Loa totaling $4.4 million and together with WIS sales representing 25% of our total net revenue. Mauna Loa is a significant customer, and any disruption of the Mauna Loa relationship could significantly adversely affect us if we are not able to find alternative purchasers of our nut production at comparable prices.

We are subject to the risk that market prices of macadamia nuts may not be adequate to cover our costs of production.

We have three long-term agreements requiring Mauna Loa to purchase the nuts from orchards that we purchased from International Air Service Co., Ltd. (“IASCO”). The IASCO orchards have historically represented approximately 20% (18% in 2016) of our nut production. These contracts expire in 2029, 2078 and 2080 and provide for market-determined prices. We either use our remaining nuts in our branded products or sell them to willing buyers at market prices. We are subject to the risk that world market prices could decline such that we would not be able to sell our nuts at prices that covers our cost of production.

A disruption at any of our production facilities would significantly decrease production, which could increase our cost of sales and reduce our net sales and income from operations.

We plan to dry our nuts at our new drying plant and process and manufacture into products at third-party processor and manufacturing facilities. A temporary or extended interruption in operations at any of these facilities, whether due to technical or labor difficulties, destruction or damage from fire, flood or earthquake, infrastructure failures such as power or water shortages, raw material shortage or any other reason, whether or not covered by insurance, could interrupt our process and manufacturing operations, disrupt communications with our customers and suppliers, and cause us to lose sales and write off inventory. Any prolonged disruption in the operations of these facilities would have a significant negative impact on our ability to manufacture and package our products on our own and may cause us to seek additional third-party arrangements, thereby increasing production costs or, in the case of our drying facility, prevent us from having sufficient nuts for our branded products business. These third parties may not be as efficient as we and our current processors and manufacturers are and may not have the capabilities to process and package some of our products, which could adversely affect sales or operating income. Further, current and potential customers might not purchase our products if they perceive our lack of alternate manufacturing facilities to be a risk to their continuing source of products.

We are dependent on third-party manufacturers to manufacture all of our products, and the loss of a manufacturer or the inability of a manufacturer to fulfill our orders could adversely affect our ability to make timely deliveries of product.

We currently rely on and may continue to rely on third-party manufacturers to produce all of our branded products. If one of these manufacturers were unable or unwilling to produce sufficient quantities of our products in a timely manner or renew contracts with us, we would have to identify and qualify new manufacturers, and we may be unable to do so. Due to industry and customer requirements that manufacturers of food products be certified and/or audited for compliance with food safety standards, the number of qualified manufacturers is constrained. As we expand our operations, we may have to seek new manufacturers and suppliers or enter into new arrangements with existing ones. However, only a limited number of manufacturers may have the ability to produce a high volume of our products, and it could take a significant period of time to locate and qualify such alternative production sources. In addition, we may encounter difficulties or be unable to negotiate pricing or other terms as favorable as those that we currently enjoy.

There can be no assurance that we would be able to identify and qualify new manufacturers in a timely manner or that such manufacturers could allocate sufficient capacity to meet our requirements, which could materially adversely affect our ability to make timely deliveries of product. In addition, there can be no assurance that the capacity of our current manufacturers will be sufficient to fulfill our orders, and any supply shortfall could materially and adversely affect our business, financial condition and results of operations. Currently, some of our products are produced by a single third-party source that maintains only one facility. The risks of interruption described above are exacerbated with respect to such single-source, single-facility manufacturer.

Our manufacturers are required to comply with quality and food production standards. The failure of our manufacturers to maintain the quality of our products could adversely affect our reputation in the marketplace and result in product recalls and product liability claims.

Our manufacturers are required to maintain the quality of our products and to comply with our product specifications and requirements for certain certifications for food safety from third-party organizations. In addition, our manufacturers are required to comply with all federal, state and local laws with respect to food safety. However, there can be no assurance that our manufacturers will continue to produce products that are consistent with our standards or in compliance with applicable laws and standards, and we cannot guarantee that we will be able to identify instances in which our manufacturers fail to comply with such standards or applicable laws. We would have the same issue with new suppliers. The failure of any manufacturer to produce products that conform to applicable standards could materially and adversely affect our reputation in the marketplace and result in product recalls, product liability claims and severe economic loss.

Any significant delays of shipments to or from our warehouses could adversely affect our sales.

Shipments to and from our warehouses could be delayed for a variety of reasons, including weather conditions, strikes, and shipping delays. Any significant delay in the shipments of product would have a material adverse effect on our business, results of operations and financial condition, and could cause our sales and earnings to fluctuate during a particular period or periods. We have from time to time experienced, and may in the future experience, delays in the production and delivery of product.

Our farming operations face a competitive labor market in Hawaii.

Our farming operations require a large number of workers, many on a seasonal basis. The labor market on the island of Hawaii is very competitive, and most of our employees are unionized under contracts that expire in May 2019. In the event that we are not able to obtain and retain both permanent and seasonal workers to conduct our farming operations, or in the event that we are not able to maintain satisfactory relationships with our unionized workers, the Partnership’s financial results could be negatively impacted.

Our operations rely on certain key personnel who are critical to our business.

Our future operating results depend substantially upon the continued service of key personnel and our ability to attract and retain qualified management and technical and support personnel. We cannot guarantee success in attracting or retaining qualified personnel. There may be only a limited number of persons with the requisite skills and relevant industry experience to serve in those positions. Our business, financial condition and results of operations could be materially adversely affected by the loss of any of our key employees, by the failure of any key employee to perform in his or her current position, or by our inability to attract and retain skilled employees.

Our farming operations are subject to environmental laws and regulations, and any failure to comply could result in significant fines or clean-up costs.

We use herbicides, fertilizers and pesticides, some of which may be considered hazardous or toxic substances. Various federal, state, and local environmental laws, ordinances and regulations regulate our properties and farming operations and could make us liable for costs of removing or cleaning up hazardous or toxic substances on, under, or in property that we currently own or lease, that we previously owned or leased, or upon which we currently or previously conducted farming operations. These laws could impose liabilities without regard to whether we knew of, or were responsible for, the presence of hazardous or toxic substances. The presence of hazardous or toxic substances, or the failure to properly clean up such substances when present, could jeopardize our ability to use, sell or collateralize certain real property and result in significant fines or clean-up costs, which could adversely affect our business, financial condition and results of operations. Future environmental laws could impact our farming operations or increase our cost of revenues.

Our business is subject to seasonal fluctuations.

Because we experience seasonal fluctuations in production and thus sales from our orchards, our quarterly results fluctuate, and our annual performance has depended largely on results from two quarters. Our business is highly seasonal, reflecting the general pattern of peak production and consumer demand for nut products during the months of October, November and December. Historically, a substantial portion of our revenues occurred during our third and fourth quarters, and we generally experienced lower revenues during our first and second quarters together with losses. Weather conditions may delay harvesting from December into early January, which may result in a fiscal year with lower than normal revenues. With the launch of our branded products business, WIS revenue continues to be highly seasonal, while branded products revenue is more evenly distributed throughout the year.

Our branded products require us to carry additional inventory, which increases our working capital needs and our reliance on generating additional income from sales or obtaining additional external financing.

Although branded products revenues are more evenly distributed throughout the year, this change has required us to carry larger quantities of inventory, increasing our working capital needs. If we are unable to generate additional working capital from product sales or obtain external financing, we may not be able to build the inventory necessary to maintain a sufficient and consistent supply of our branded products to meet customer demands, which could have a material adverse effect on our business, results of operations, liquidity, financial condition and brand image.

The price at which we can sell our macadamia nuts may not always exceed our cost of revenues.

During 2016, our costs to farm and produce macadamia nuts, including depreciation of the trees, varied between 87.1 cents and 91.5 cents per WIS pound (depending on the orchard) or an average of approximately 89.6 cents per WIS pound and some WIS was sold for less than its cost. Macadamia orchards are required to be cultivated and farmed in order to maintain the trees, even in years where the price at which the macadamia nuts could be sold do not cover the cost of revenues in any specific orchard. In such event, we could suffer losses from certain orchards, and our financial performance could be adversely affected. There is no assurance that the prices of macadamia nuts in the future will exceed the costs of production.

Additional regulation could increase our costs of production, and our business could be adversely affected.

As an agricultural company, we are subject to extensive government regulation, including regulation of the manner in which we cultivate, fertilize and process our macadamia nuts. Furthermore, processing and selling our branded products subject us to additional regulations regarding the manufacturing, distribution, and labeling of our products. There may be changes to the legal or regulatory environment, and governmental agencies and jurisdictions where we operate may impose new manufacturing, importation, processing, packaging, storage, distribution, labeling or other restrictions, which could increase our costs and affect our financial performance.

Many of our production costs are not within our control, and we may not be able to recover cost increases in the form of price increases from our customers.

We purchase water, electricity and fuel, fertilizer, pesticides, equipment and other products to conduct our farming operations and produce macadamia nuts. Transportation costs, including fuel and labor, also represent a significant portion of the cost of our nuts. These costs could fluctuate significantly over time due to factors that may be beyond our control. Our business and financial performance could be negatively impacted if there are material increases in the costs we incur that are not offset by price increases for the products sold.

We are subject to the risk of product liability claims.

The production and sale of food products for human consumption involves the risk of injury to consumers. This risk increases as we move from primarily a farming operation into the marketing and sale of branded products. Although we believe we have implemented practices and procedures in our operations to promote high-quality and safe food products, we cannot assure you that consumption of our products will not cause a health-related illness or injury in the future or that we will not be subject to claims or lawsuits relating to such matters.

Diseases and pests can adversely affect nut production.

Macadamia trees are susceptible to various diseases and pests that can affect the health of the trees and resultant nut production. There are several types of fungal diseases that can affect flower and nut development. One of these is Phytophthora capsici, which affects the macadamia flowers and developing nuts, and another, Botrytis cinerea, causes senescence of the macadamia blossom before pollination is completed. These types of fungal disease are generally controllable with fungicides. Historically, these fungi have infested the reproductive plant parts at orchards located in Keaau during periods of persistent inclement weather. Tree losses may occur due to a problem known as Macadamia Quick Decline (“MQD”). This affliction is caused by Phytophthora tropicalis, which is associated with high moisture and poor drainage conditions. The Keaau orchards are areas with high moisture conditions and may be more susceptible to the MQD problem. Afflicted trees in these regions are replaced with cultivars that are intolerant to MQD. The Partnership’s Keaau orchards experienced tree replacement of 1.6% in 2016 and 2% in 2015.

The Southern Green Stink Bug causes unattractive stippling to the mature kernels and causes pre-mature drop of young nuts. It has potential to reduce the crop size and quality. Stink bug damage has historically increased during dry periods. As their preferred fabaceous host plants in pasturelands neighboring our orchards succumb to the dry weather and die, the stink bugs migrate to the macadamia trees as a secondary host plant. Losses from stink bug increased to 3.5% over the previous year average of 1.7%, in part due to dry weather from December 2015 to April 2016. Two natural enemies, a wasp and a fly, generally keep nut losses at acceptable levels. An insect known as the Koa Seed Worm (“KSW”) causes full-sized nuts to fall that have not completed kernel development. The Tropical Nut Borer Beetle (“TNB”) bores through the mature macadamia shell and feeds on the kernel. Nut damage caused by the TNB is not recorded as a defect by Royal Hawaiian. However, field surveys in 2016 indicate that nut losses attributed to TNB increased to 3.9%. Damages caused by each insect may fluctuate when unfavorable environmental conditions affect the natural enemy populations.

In March 2005, a foreign insect pest, the Macadamia Felted Coccid (“MFC”), or Eriococcus ironsidei, was detected on macadamia trees in the South Kona area on the island of Hawaii. The insect originates from Australia, where populations are kept under control from native predators and parasites. In Hawaii, however, in the absence of its natural enemies, MFC has become a serious problem on macadamia nut trees. The insect causes defoliation, weakening and breakage of large branches and limbs, and, in severe cases, may cause or contribute to tree death. Yearly surveys conducted in Ka’u have shown MFC to be present extensively throughout the orchards. Climatic conditions, particularly extremely dry weather, are conducive for increased MFC activity. Collaboration continued in 2016 with other growers and the State of Hawaii to control this pest. At this point in time, MFC is not fully understood. In particular, there is a deficit of information on how MFC is able to cause so much damage to such large trees and what level of production loss is attributed to MFC. Research is currently being conducted by the University of Hawaii to assess the level of crop loss due to MFC. Chemical treatments using products approved for use under federal and state laws are being performed throughout our Ka’u orchards. In 2016, 1,647 acres were sprayed for MFC in the Ka’u orchards. The populations are tracked in both treated and untreated areas. MFC was detected in our Keaau orchard in the spring of 2015. Treatment was administered shortly after detection. Both treated and untreated areas in the Keaau orchard continue to be monitored for MFC; however, due to the expedience of the treatment and the normal high levels of rainfall, the MFC population was low in 2016.

As indicated above, natural enemies are relied upon to manage insects that contribute to nut loss. Without these natural enemies, greater losses are possible. Approved pesticides may be available to manage economically significant insect pests, however their use is limited to situations where treatment costs and nut loss justify their use, and when their use does not disrupt the natural enemy population.

Honey bees are placed in the orchards to supplement other insect pollinators during the flowering season. In late 2008, the Hawaii Department of Agriculture identified the Varroa mite on feral honey bees near the port of Hilo, Hawaii. This mite is an ectoparasite that attaches to the body of honey bees and weakens them, and can result in the destruction of bee hives and colonies. Apiaries that place hives in the macadamia nut orchards must manage this pest with miticide in order to maintain healthy bee colonies and avoid the development of resistance to the miticide.

Increases in these diseases and pests or our inability to successfully control these diseases and pests could result in decreases in production, including loss of trees in affected orchards, which could have a material adverse effect on our business, financial condition and results of operations.

Our orchards are susceptible to natural hazards such as wildfires, rainstorms, floods and windstorms, which may adversely affect nut production.

Our orchards are located in areas on the island of Hawaii that are susceptible to natural hazards, including drought, wildfires, heavy rains, floods, and windstorms. Our orchards located in the Ka’u region are susceptible to wildfires during periods of drought. In June and July 2012, a wildfire caused widespread damage to agricultural crops in the Ka’u region. The fire resulted in damage to irrigation pipes and approximately 24 tree acres of our macadamia nut orchards. Our orchards are also located in areas that are susceptible to storms which produce heavy rainfall. Twenty-seven major windstorms have occurred on the island of Hawaii since 1961, and six of those caused material losses to our orchards. In November 2000, the Ka’u region was affected by flooding, resulting in some nut loss. Since the flood in 2000, heavy rain and flooding in the Ka’u region has not been as damaging, but continue to be potential risks that can affect our nut production. On August 7, 2014, Tropical Storm Iselle made landfall on the island of Hawaii with high winds and heavy rain resulting in some tree damage and loss, increases in immature nut drop, and mature nut loss due to storm run-off. In January 2015, another windstorm swept through the Ka’u region and caused a 1% loss of canopy and trees in our orchards. Most of our orchards are surrounded by windbreak trees, which provide limited protection. Younger trees that have not developed extensive root systems are particularly vulnerable to windstorms. The occurrence of any natural disaster affecting a material portion of our orchards could have a material adverse effect on our business, financial condition and results of operations.

Our orchards are subject to risks from active volcanoes.

Our orchards are located on the island of Hawaii, where there are two active volcanoes. To date, no lava flows from either volcano have affected or threatened the orchards, but the risk remains.

Our business may be adversely affected by adverse or unseasonal weather conditions and climate change.

Poor, severe, or unusual weather conditions, whether caused by climate change or other factors, may adversely affect our nut production and our ability to harvest. Because our nut production is significantly influenced by weather, substantial changes to historical weather patterns in Hawaii, including changing temperature levels, changing rainfall patterns, and changing storm patterns and intensities, could significantly impact our future business, financial condition and results of operations.

The amount and timing of rainfall can materially impact nut production.

The productivity of orchards depends in large part on moisture conditions. Inadequate rainfall can reduce nut yields significantly, whereas excessive rain without adequate drainage can foster disease and hamper harvesting operations. Although rainfall at the orchards located in the Keaau region has generally been adequate and at times excessive for the orchards, the orchards located in the Ka’u area generally receive less rainfall. To supplement natural rainfall, a portion of the Ka’u orchards is presently irrigated. Irrigation can mitigate some of the effects of a drought, but currently it cannot completely supplement the complete needs of the trees and crops. The timing of rainfall relative to key development stages in the growing season can impact nut production. Excessive rains during the flowering season affects pollination and nut set at the Keaau orchards where flowering and the rainy season coincide. During 2016, the Ka’u and Keaau areas recorded 102% and 109%, respectively, of the 20-year average rainfall. However, the rainfall in Ka’u from December 2015 through April 2016, which is a critical flowering and nut development period, was recorded as 22% of the 20-year average, and negatively impacted nut set and nut retention for the 2016 crop. Regardless of the timing, lack of or excess of adequate rainfall for prolonged periods of time will also negatively affect nut production.

We rely on irrigation water for our Ka’u orchards and orchards acquired from IASCO. If the capacities of those wells diminish or fail, we may not have an adequate water supply to irrigate our orchards, which could adversely affect our nut production.

With the May 2000 acquisition of the farming business, we acquired an irrigation well (the “Sisal Well”), which supplies water to our orchards in the Ka’u region. Historically, the quantity of water available from the Sisal Well has been generally sufficient to irrigate these orchards in accordance with prudent farming practices. The irrigated portion of the Ka’u II orchards is expected to need greater quantities of water as the orchards mature. We anticipate that the amount of water available from the Sisal Well will be generally sufficient, assuming average levels of rainfall, to irrigate the irrigated orchards in accordance with prudent farming practices for the next several years. If the amount of water provided by the Sisal Well becomes insufficient to irrigate the above-named orchards, we may need to incur additional costs to increase the capacity of the Sisal Well, drill an alternative well into the historical source that provides water to the Sisal Well or obtain water from other sources in order to avoid diminished yields.

Included in the assets we purchased from IASCO is an irrigation well (the “Palima Well”) that supplies water for the IASCO orchards, orchards owned by New Hawaii Macadamia Nut Co. (“NHMNC”), and trees owned by us on leased land from the State of Hawaii. Under a prior agreement with IASCO, NHMNC received a portion of the water pumped out of the Palima Well, and we, as the new owner of this well, are obligated to continue this service. The well provides supplemental irrigation and is generally sufficient, assuming average levels of rainfall, to sustain nut production at historical norms.

If insufficient irrigation water is available to the irrigated orchards, then diminished yields of macadamia nut production can be expected, which could have a material adverse effect on nut production.

Our insurance may not be sufficient to reimburse us for crop losses.

We obtain tree insurance each year under a federally subsidized program. The tree insurance for 2016 provides coverage up to a maximum of approximately $19.8 million against catastrophic loss of trees due to wind, fire or volcanic activity. Crop insurance was purchased for the 2015-2016 crop season and provides coverage for up to a maximum of approximately $8.6 million against loss of nuts due to wind, fire, volcanic activity, earthquake, adverse weather, wildlife damage and failure of irrigation water supplies. There is no assurance that such insurance will cover all losses incurred by the Partnership or that such insurance will be available or purchased in the same amount in future periods.

Fluctuations in various food and supply costs, as well as increased costs associated with product processing and transportation, could materially adversely affect our business, financial condition and operating results.

Both we and our manufacturers obtain some of the key ingredients used in our products from third-party suppliers. As with most food products, the availability and cost of raw materials used in our products can be significantly affected by a number of factors beyond our control, such as general economic conditions, growing decisions, government programs (including government programs and mandates relating to ethanol), weather conditions such as frosts, drought, and floods, and plant diseases, pests and other acts of nature. Because we do not control the production of raw materials, we are also subject to delays caused by interruptions in production of raw materials based on conditions not within our control. Such conditions include job actions or strikes by employees of suppliers, weather, crop conditions, transportation interruptions, natural disasters, sustainability issues and boycotts of products or other catastrophic events.

There can be no assurance that we or our manufacturers will be able to obtain alternative sources of raw materials at favorable prices, or at all, should there be shortages or other unfavorable conditions. In some instances, we enter into forward purchase commitments to secure the costs of projected commodity requirements needed to produce our finished goods. These commitments are stated at a firm price, or as a discount or premium from a future commodity price, and are placed with our manufacturers or directly with ingredient or packaging suppliers. There can be no assurance that our pricing commitments will result in the lowest available cost for the commodities used in our products. Our key raw material is macadamia nuts. We currently obtain the macadamia nuts for our products solely from our production in Hawaii. The inability to obtain macadamia nuts due to poor weather or for any reason could have an adverse effect on our business. In addition, energy is required to process and produce our products. Transportation costs, including fuel and labor, also impact the cost of manufacturing our products. These costs fluctuate significantly over time due to factors that may be beyond our control.

Our inability or our manufacturers’ inabilities to obtain adequate supplies of raw materials for our products or energy at favorable prices, or at all, as a result of any of the foregoing factors or otherwise could cause an increase in our cost of sales and a corresponding decrease in gross margin, or cause our sales and earnings to fluctuate from period to period. Such fluctuations and decrease in gross margin could have a material adverse effect on our business, results of operations and financial conditions. There is no assurance that we would be able to pass along any cost increases to our customers in the form of price increases.

Our advertising is subject to regulation by the Federal Trade Commission under the Federal Trade Commission Act, which prohibits dissemination of false or misleading advertising.

The National Advertising Division of the Council of Better Business Bureaus, Inc. (“NAD”), administers a self-regulatory program of the advertising industry to ensure truth and accuracy in national advertising. NAD monitors national advertising and entertains inquiries and challenges from competing companies and consumers. Should our advertising be determined to be false or misleading, we may have to pay damages, withdraw our campaign and possibly face fines or sanctions, which could have a material adverse effect on our sales and operating results.

Adverse publicity or consumer concern regarding the safety and quality of food products or health concerns, whether with our products or for food products in the same food group as our products, may result in the loss of sales.

We are highly dependent upon consumers’ perception of the safety, quality and possible dietary benefits of our products. As a result, substantial negative publicity concerning one or more of our products or other foods similar to or in the same food group as our products could lead to a loss of consumer confidence in our products, removal of our products from retailers’ shelves and reduced prices and sales of our products. Product quality, contamination, or safety issues, actual or perceived, or allegations of product contamination, even when false or unfounded, could hurt the image of our brands and cause consumers to choose other products. Furthermore, any product recall, whether our own or by a third party within one of our categories or due to real or unfounded allegations, could damage our brand image and reputation. By way of example, there have been recent recalls of pistachio and macadamia nuts produced by third parties due to Salmonella contamination. While we roast all of the nuts in our branded products to limit the risk of bacterial contamination and our purchasers of bulk kernel are expected to roast the nuts prior to sale, we cannot assure you that roasting will be conducted sufficiently or will prevent all instances of contamination, that our processors, co-packers and distributors will comply with our specifications, or that every purchaser of our nuts in bulk will in fact roast and properly handle the nuts prior to sale. Any of these events could subject us to significant liability and have a material adverse effect on our business, results of operations and financial condition. If we conduct operations in a market segment that suffers a loss in consumer confidence as to the safety and quality of food products, our business could be materially adversely affected. The food industry has recently been subject to negative publicity concerning the health implications of GMOs, obesity, trans fat, diacetyl, artificial growth hormones, arsenic in rice and bacterial contamination, such as Salmonella and aflatoxins. Consumers may increasingly require that foods meet stricter standards than are required by applicable governmental agencies, thereby increasing the cost of manufacturing such foods and ingredients. Developments in any of these areas, including, but not limited to, a negative perception about our formulations, could cause our operating results to differ materially from expected results. Any of these events could harm our sales, increase our costs and hurt our operating results, perhaps significantly.

We may experience increased competition for raw materials and from other producers of food products if the trend for non-GMO products continues, as well as increased regulation of our products, which could have a material adverse effect on our business.

Our products contain only non-GMO ingredients. The food industry has been experiencing a significant trend in which an increasing number of consumers are requiring only non-GMO ingredients in their foods. Legislation could require companies to move to non-GMO labeling or ingredients. Such industry trends or legislation could result in changes to our labeling, advertising or packaging. As additional retailers require or consider requiring all of their products to be non-GMO, we may face increased competition for sources of raw materials that are non-GMO. Such industry pressure may be particularly problematic in the United States, where most farmers produce genetically modified foods, making it difficult to source non-GMO ingredients and raw materials. There is also a risk of contamination of non-GMO farms by neighboring GMO farms. Although the trend toward non-GMO products could be positive for our sales, an increase in competition and regulatory requirements could have a material adverse effect on our business, financial conditions and results of operations.

As our business increases in size, we will need to locate and contract qualified co-packers with sufficient dedicated space for our non-GMO, gluten-free products, and there is no assurance that we will be able to do so.

We rely on a single co-packer for certain products. If demand for gluten-free products grows, we will need to increase our production through additional co-packers to ensure that we have sufficient supply to meet increasing demand. There is no assurance that we will be able to find available, qualified co-packers or that we will be able to negotiate contracts with them on commercially reasonable terms or at all.

Our business operations are subject to numerous laws and governmental regulations, exposing us to potential claims and compliance costs that could adversely affect our operations.

Manufacturers and marketers of food products are subject to extensive regulation by the FDA, the USDA, and other national, state and local authorities. For example, the Food, Drug and Cosmetic Act and the new Food Safety Modernization Act and their regulations govern, among other things, the manufacturing, composition and ingredients, packaging and safety of foods. Under these acts, the FDA regulates manufacturing practices for foods through its current “good manufacturing practices” regulations, imposes ingredient specifications and requirements for many foods, inspects food facilities and issues recalls for tainted food products. Additionally, the USDA has adopted regulations with respect to a national organic labeling and certification program.

Food manufacturing facilities and products are also subject to periodic inspection by federal, state and local authorities. State regulations are not always consistent with federal regulations or other state regulations.

Any changes in laws and regulations applicable to food products could increase the cost of developing and distributing our products and otherwise increase the cost of conducting our business, any of which could materially adversely affect our financial condition. In addition, if we fail to comply with applicable laws and regulations, including future laws and regulations, we may be subject to civil liability, including fines, injunctions, recalls or seizures, as well as potential criminal sanctions, any of which could have a material adverse effect on our business, financial condition, results of operations or liquidity.