Attached files

| file | filename |

|---|---|

| EX-32.2 - EX-32.2 - CNB FINANCIAL CORP/PA | d295426dex322.htm |

| EX-32.1 - EX-32.1 - CNB FINANCIAL CORP/PA | d295426dex321.htm |

| EX-31.2 - EX-31.2 - CNB FINANCIAL CORP/PA | d295426dex312.htm |

| EX-31.1 - EX-31.1 - CNB FINANCIAL CORP/PA | d295426dex311.htm |

| EX-23.1 - EX-23.1 - CNB FINANCIAL CORP/PA | d295426dex231.htm |

| EX-21 - EX-21 - CNB FINANCIAL CORP/PA | d295426dex21.htm |

| 10-K - FORM 10-K - CNB FINANCIAL CORP/PA | d295426d10k.htm |

Exhibit 99.1

2 0 1 6 A N N UA L R E P O R T

TAbLE Of cONTENTs Consolidated Financial Highlights 4 Message to the Shareholders 5 Executive Management and Board of Directors 8 Officers 9 Shareholder Information 12 2016 ANNUAL REPORT HIGHLIGHTS 3

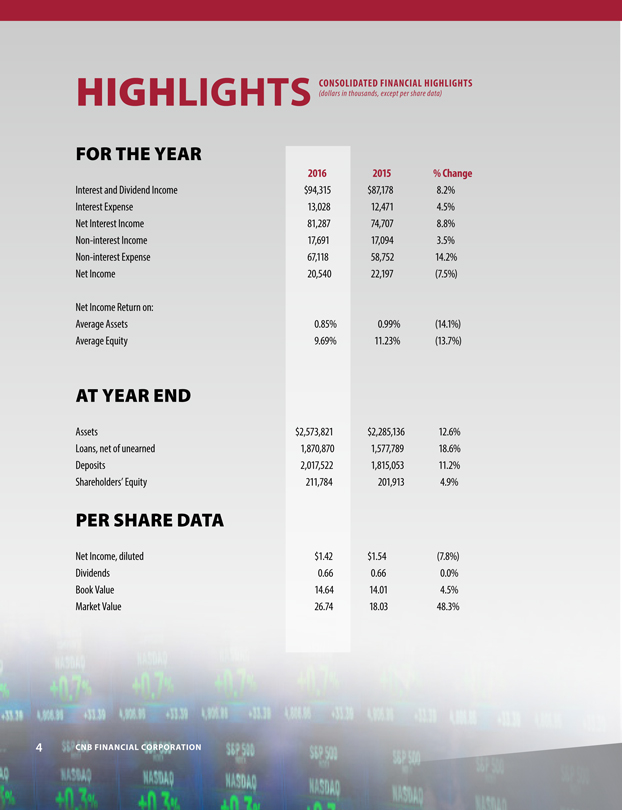

CONSOLIDATED FINANCIAL HIGHLIGHTS hIGhLIGHTS (dollars in thousands, except per share datafOR ThE YEAR 2016 2015 % Change Interest and Dividend Income $94,315 $87,178 8.2% Interest Expense 13,028 12,471 4.5% Net Interest Income 81,287 74,707 8.8% Non-interest Income 17,691 17,094 3.5% Non-interest Expense 67,118 58,752 14.2% Net Income 20,540 22,197 (7.5%) Net Income Return on: Average Assets 0.85% 0.99% (14.1%) Average Equity 9.69% 11.23% (13.7%) AT YEAR ENd Assets $2,573,821 $2,285,136 12.6% Loans, net of unearned 1,870,870 1,577,789 18.6% Deposits 2,017,522 1,815,053 11.2% Shareholders’ Equity 211,784 201,913 4.9% PER shARE dATA Net Income, diluted $1.42 $1.54 (7.8%) Dividends 0.66 0.66 0.0% Book Value 14.64 14.01 4.5% Market Value 26.74 18.03 48.3% 4 CNB FINANCIAL CORPORATION

MESSAGE TO OUR SHAREHOLDERS, CUSTOMERS, EMPLOYEES & FRIENDS: CNB Financial Corporation entered 2016 having just completed a major renovation and expansion of its headquarters. Upon completion of this investment, several other strategic initiatives began—including upgrades to the core processing system with enhanced electronic banking services; the construction of three new facilities across the Bank’s divisions; and various staffing enhancements to better serve our growth and to provide better coverage of the continued increase in regulatory burdens. It’s a pleasure to announce that the system upgrade is complete and already improving our ability to provide modern, state-of-the-art services to our customers. Also, as you read this report, all three new offices, including the FCBank headquarters in Worthington, Ohio, the ERIEBANK office in Ashtabula, Ohio, and the CNB Bank office in Blair County, Pennsylvania, are open and serving their respective communities. Finally, we have added an appropriate number of new positions to our operations staff to fully support our growth in the near future. In short, our major infrastructure projects are complete. Several other significant initiatives occurred over the past year. Some of these initiatives had a negative impact on 2016 earnings; however, each project better positions CNB for future growth and stronger earnings. In the second quarter, CNB prepaid $40 million of Federal Home Loan Bank of Pittsburgh fixed-rate borrowings. This will give CNB a positive reduction in cost of funds. Early in the third quarter, we completed the acquisition of Lake National Bank. The two new locations, as well as their staff and customers (including a significant number of manufacturing companies in Lake County, Ohio), have been welcomed into our ERIEBANK division. We are highly optimistic that this merger will provide CNB with a major growth area for many years to come, especially in the commercial and industrial sector. Also in the third quarter, CNB Financial Corporation announced a $50 million subordinated debenture offering. The proceeds of this issuance have been contributed to CNB Bank to increase its capital ratios and provide further support of future growth. In addition to this debt issuance to improve capital, a common stock offering was announced and completed in the first quarter of 2017 to raise $20 million. This capital will bolster the Corporation’s tangible common equity position. CNB expects to see earnings improve from 2016 as the growth in earning assets and the updated infrastructure continue to be put to work. The internal growth of capital through enhanced earnings should provide a continual source of capital for the future. CNB’s most exciting news in 2016 was the announcement of its newest division, Bank on Buffalo, which will serve Erie County of New York along with the surrounding counties of Western New York. The decision to move into this region with a de novo operation came after an extensive evaluation of the market and the competition, as well as a search for the key executive from the area to spearhead the market’s development. Just prior to this announcement, two large regional financial institutions (KeyBank and First Niagara Bank) announced their merger. This merger of two companies that hold significant market share in the area only increases the excitement for our newest division. Bank on Buffalo, which has already opened its first full-service office and has two other sites under agreement to open in the late second or early third quarter of 2017, will primarily focus on the large number of commercial and industrial businesses that operate in the market. All of the previously noted events resulted from management’s implementation of the Board-approved strategic plan, which revolves around the philosophy, “Look for a way to say yes to your customers, co-workers, and community, every time.” This very simple statement encompasses our company’s culture in a succinct way. The plan further defines this philosophy with five pillars of success: 1. Leadership in Local Communities – a differentiating factor is CNB’s level of investment and leadership in local communities. 2. Exceptional Customer Experience – CNB staff must provide consistently exceptional customer service, which in turn will lead to positive customer experiences (CX); an enterprise-wide CX plan has been implemented.

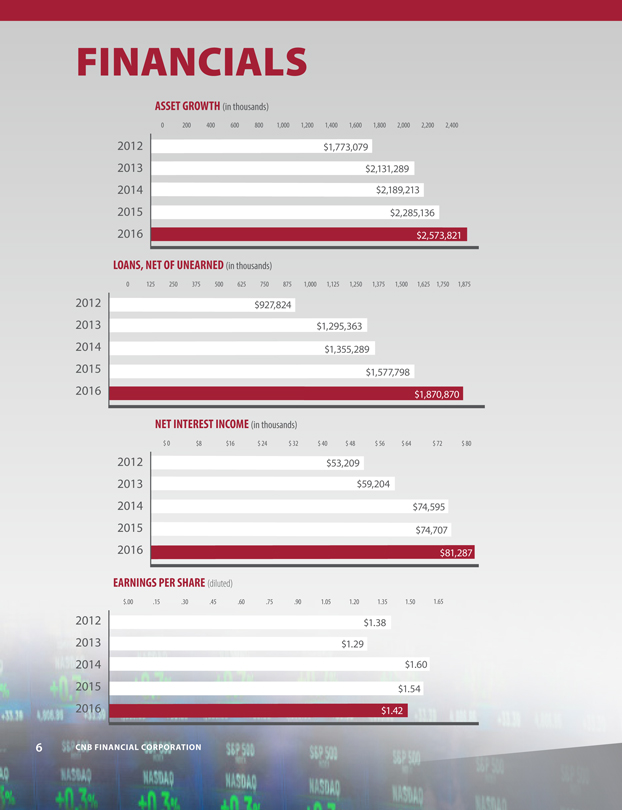

fINANcIALs ASSET GROWTH (in thousands) 0 200 400 600 800 1,000 1,200 1,400 1,600 1,800 2,000 2,200 2,400 2012 $1,773,079 2013 $2,131,289 2014 $2,189,213 2015 $2,285,136 2016 $2,573,821 LOANS, NET OF UNEARNED (in thousands) 0 125 250 375 500 625 750 875 1,000 1,125 1,250 1,375 1,500 1,625 1,750 1,875 2012 $927,824 2013 $1,295,363 2014 $1,355,289 2015 $1,577,798 2016 $1,870,870 NET INTEREST INCOME (in thousands) $ 0 $8 $16 $ 24 $ 32 $ 40 $ 48 $ 56 $ 64 $ 72 $ 80 2012 $53,209 2013 $59,204 2014 $74,595 2015 $74,707 2016 $81,287 EARNINGS PER SHARE (diluted) $.00 .15 .30 .45 .60 .75 .90 1.05 1.20 1.35 1.50 1.65 2012 $1.38 2013 $1.29 2014 $1.60 2015 $1.54 2016 $1.42 6 CNB FINANCIAL CORPORATION

Message to the Shareholders continued… 3. Employee Development – a critical component of workplace culture and employee satisfaction is the continued training and development of staff. 4. A Consistent Approach to Growth – CNB will proactively evaluate targets for de novo and/or acquisition potential. This includes both geographical areas and financial institutions. CNB Bank will continue to operate as CNB Bank, ERIEBANK, FCBank, and Bank on Buffalo; each market has a unique marketing and growth strategy with operational support from the bank, but is led by market Presidents. 5. A Solid Foundation of Technology – Deeply entwined in every aspect of our service model is the need for current technology. As noted, employee development is critical to CNB’s success. Efforts to provide a comfortable and pleasant work environment include competitive compensation, a wellness program, and up-to-date technology. Our team is also provided with a significant retirement plan opportunity so that each associate can have peace of mind regarding retirement and better focus on today’s challenges. In addition to all of this, each employee has access to a comprehensive benefits package that offers flexibility depending on his or her individual needs. There is a school of thought that asks, “What if we train them and they leave?” To which we respond, “What if we don’t and they stay?” Training is paramount and continuous for our entire team. From online courses to off-site training provided by experts in their field, everyone in the Corporation has formal training each year. Today’s technology and ever-increasing regulations are just two of the many reasons we must continue to evolve our training methods. Recently, CNB developed a two-year Leadership Institute that focuses on management techniques as well as individual characteristics and demeanor. CNB will continue to evolve its training methods with the constant changes that occur in the banking industry. Perhaps the most humbling and memorable event of the year occurred in November 2016. CNB Financial Corporation was invited to ring the closing bell at NASDAQ National Markets on the day following Election Day. It was, without a doubt, a very historic day. The market reacted very positively and the day closed with a total green board behind us. CNB’s stock was included in the rally and I, personally, felt very honored to represent the Corporation along with eleven executives and directors. Change, challenge, and opportunity are the focus for 2017. Many things in business can be controlled, but for everything that can, there is something that can’t. Regulations, consumers, the economy, and politics are some examples. This year appears to be poised for unpredictability, which began with the latest election, as many changes are being considered. Regulatory relief and tax reform appear to be on the horizon. In addition, oil and gas exploration and development are beginning to ramp up. Whatever the changes are, we must be prepared for their impact on the bank and its customers. Our Corporation is in touch with both the state and federal associations that help to drive the policy for each body’s regulatory agenda. Through this involvement, our voices are being heard and we are hopeful that changes will be made to benefit our customers. Regardless of the outcome, we will stay very close to the discussions so that we can address any resulting challenges. We truly appreciate your ownership and interest in CNB Financial Corporation. Joseph B. Bower, Jr. President and Chief Executive Officer

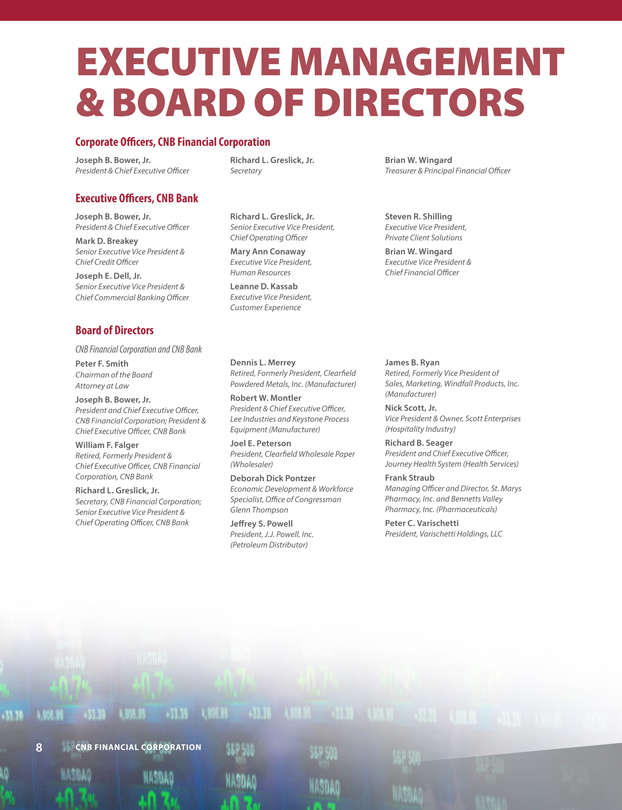

& EXEcUTIVE bOARd Of mANAGEmENT dIREcTORs Corporate Officers, CNB Financial Corporation Joseph B. Bower, Jr. Richard L. Greslick, Jr. Brian W. Wingard President & Chief Executive Officer Secretary Treasurer & Principal Financial Officer Executive Officers, CNB Bank Joseph B. Bower, Jr. Richard L. Greslick, Jr. Steven R. Shilling President & Chief Executive Officer Senior Executive Vice President, Executive Vice President, Mark D. Breakey Chief Operating Officer Private Client Solutions Senior Executive Vice President & Mary Ann Conaway Brian W. Wingard Chief Credit Officer Executive Vice President, Executive Vice President & Joseph E. Dell, Jr. Human Resources Chief Financial Officer Senior Executive Vice President & Leanne D. Kassab Chief Commercial Banking Officer Executive Vice President, Customer Experience Board of Directors CNB Financial Corporation and CNB Bank Peter F. Smith Dennis L. Merrey James B. Ryan Chairman of the Board Retired, Formerly President, Clearfield Retired, Formerly Vice President of Attorney at Law Powdered Metals, Inc. (Manufacturer) Sales, Marketing, Windfall Products, Inc. Robert W. Montler (Manufacturer) Joseph B. Bower, Jr. Nick Scott, Jr. President and Chief Executive Officer, President & Chief Executive Officer, CNB Financial Corporation; President & Lee Industries and Keystone Process Vice President & Owner, Scott Enterprises Chief Executive Officer, CNB Bank Equipment (Manufacturer) (Hospitality Industry) William F. Falger Joel E. Peterson Richard B. Seager Retired, Formerly President & President, Clearfield Wholesale Paper President and Chief Executive Officer, Chief Executive Officer, CNB Financial (Wholesaler) Journey Health System (Health Services) Corporation, CNB Bank Deborah Dick Pontzer Frank Straub Richard L. Greslick, Jr. Economic Development & Workforce Managing Officer and Director, St. Marys Secretary, CNB Financial Corporation; Specialist, Office of Congressman Pharmacy, Inc. and Bennetts Valley Senior Executive Vice President & Glenn Thompson Pharmacy, Inc. (Pharmaceuticals) Chief Operating Officer, CNB Bank Jeffrey S. Powell Peter C. Varischetti President, J.J. Powell, Inc. President, Varischetti Holdings, LLC (Petroleum Distributor) 8 CNB FINANCIAL CORPORATION

OffIcERs Administrative Services Timothy A. Bracken Shannon L. Irwin John H. Sette Thomas B. Gilmore Vice President, Controller Assistant Vice President, Human Assistant Vice President, Information Technology Manager Carolyn B. Smeal Resources Information Systems Amy B. Potter Vice President, Operations Paul A. McDermott B.J. Sterndale Marketing Officer Susan M. Warrick Assistant Vice President, Facilities Assistant Vice President, Training Jessica A. Shaffner Vice President, Operations Kylie Ogden Erin L. Brimmeier Enterprise Support Officer Becky A. Coleman Assistant Vice President, Compliance Operations Officer Brenda L. Terry Assistant Vice President, Operations Banking Officer CNB Bank Greg M. Dixon Christopher L. Stott Judy L. Barry Alesia N. McElwee CNB Market Executive Vice President, Banking Officer, Portfolio Manager Community Office Manager, Jeffrey W. Alabran Director of Private Banking Lori L. Curtis Clearfield Main Office Senior Vice President, Mary A. Baker Community Office Manager, Dustin A. Minarchick Commercial Banking, Indiana Assistant Vice President, Market Philipsburg Plaza Office Commercial/Retail Banking Officer Michael E. Haines Manager, Northern Cambria Office Autumn F. Farley Andrew V. Nedzinski Vice President, Vickie L. Baker Commercial Banking Officer Assistant Commercial Banking Officer Commercial Banking, St. Marys Assistant Vice President, Beverly A. Greene Nadine J. Rodgers Karen R. Pfingstler Market Manager, Bradford Main Office Banking Officer, Portfolio Manager Banking Officer, Indiana Vice President, Katie M. Whysong Douglas M. Shaffer Caroline Henry Commercial Banking, DuBois Assistant Vice President, Community Office Manager, Community Office Manager, Matthew Q. Raptosh Commercial Banking Philipsburg Presqueisle Street Office Punxsutawney Office Regional Vice President, James C. Davidson Lori D. Shimel Tyler A. Kirkwood Commercial Banking, Blair County Assistant Vice President, Commercial Banking Officer Community Office Manager, Private Banking Joseph H. Yaros Heather Koptchak Houtzdale and Madera Offices Vice President, Denise J. Greene Sherry Wallace Market Manager Commercial Banking, Bradford Assistant Vice President, Jacklyn M. Lantzy Mortgage Banking Officer David W. Ogden Private Banking Community Office Manager, Gregory R. Williams Vice President, Credit Administration Cory K. Johnston Banking Officer, Clearfield Blair County Office Eileen F. Ryan Assistant Vice President, Credit Administration Lisa A. Marchiori Joel M. Zupich Vice President, Mortgage Lending Credit Officer Community Office Manager, Ruth Anne Ryan-Catalano Katie A. Penoyer DuBois Office Kevin C. Wain Assistant Vice President, Vice President, Retail Banking James V. Masone Community Office Assistant Manager, Treasury Services C. Brett Stewart Assistant Commercial Banking Officer Clearfield Industrial Park Road Office Vice President, Heather D. Serafini Assistant Vice President, Commercial Banking, Indiana Private Banking Wealth & Asset Management Services Craig C. Ball Calvin R. Thomas, Jr. R. Michael Love Vice President, Wealth & Asset Vice President, Wealth & Asset Assistant Vice President, Wealth & Asset Management Management Management Eric A. Johnson Andrew D. Franson Dorthy M. Turner Vice President, Wealth & Asset Assistant Vice President, Wealth & Asset Wealth & Asset Management Officer Management Management Glenn R. Pentz Vice President, Wealth & Asset Management 2016 ANNUAL REPORT HIGHLIGHTS 9

OffIcERs & AffILIATEs ERIEBANK, a Division of CNB Bank David J. Zimmer Joshua P. Miller Carla M. Higgins Robert P. Cannon President Vice President, ERIEBANK Investment Assistant Vice President, Commercial Community Office Manager, Midland Steven M. Cappellino Advisors Banking Office Senior Vice President, Larry G. Morton, Jr. Allison M. Hodas Tracie A. Harmon Regional Manager, Crawford County Vice President, ERIEBANK Investment Assistant Vice President, Treasury Community Office Manager, Vernon William L. DeLuca, Jr. Advisors Services Office Senior Vice President, Commercial Gregory A. Noon Katie J. Jones Jaclyn R. Italiani Banking Vice President, Commercial Banking, Assistant Vice President, Market Community Office Manager, Andrew L. Meinhold Warren Office Manager Downtown Office Senior Vice President, Regional John M. Schulze Barbara A. Macks Brenda G. Shaffer Manager, Lake County Vice President, Commercial Banking Assistant Vice President, ERIEBANK Community Office Manager, David P. Bogardus Investment Advisors Harborcreek Office William J. Vitron, Jr. Vice President, Commercial Banking, Vice President, ERIEBANK Investment Julie L. Martin Helicia E. Sonney Ashtabula Office Advisors Assistant Vice President, Commercial Community Office Manager, Asbury Betsy C. Bort Thomas J. Walker Services Office Vice President, Commercial Banking Vice President, Commercial Banking, James R. Miale Theresa L. Swanson Scott O. Calhoun Warren Office Assistant Vice President, Commercial Community Office Manager, Warren Vice President, Commercial Banking J. Allen Weaver Banking, Meadville Office Office Timothy A. Flenner Vice President, Commercial Banking Timothy J. Roberts Mary J. Taormina Vice President, Commercial Banking, Team Leader, Mentor Center Office Assistant Vice President, Commercial Community Office Manager, Mentor Center Office Kelly S. Buck Banking Meadville Office Christine Hartog Assistant Vice President, Private Paul D. Sallie John R. VanTassel Vice President, Market Manager, Banking Assistant Vice President, Private Treasury Services Officer Community Office Manager, Mentor Chrystal M. Fairbanks Banking Abigail L. Williams Center Office Assistant Vice President, Community Russell G. Daniels Community Office Manager, Eryn C. Medved Office Manager/Private Banking, Commercial Banking Officer West 12th Street Office Vice President, Commercial Banking & Ashtabula Office Erin L. Bednaro Debra A. Masone Treasurey Services, Mentor Center Office Denise E. Gelofsack Community Office Manager, Community Office Assistant Manager, Assistant Vice President, Portfolio Interchange Office Meadville Office Manager, Mentor Center Office ERIEBANK Regional Board of Advisors David J. Zimmer Jane M. Earll Charles “Boo” Hagerty Lance F. Osborne Chairman of the Board, President, Esquire, (Senator, Retired) President, Hamot Health Foundation President, Osborne Captial Group (Real ERIEBANK David K. Galey (Health Services) Estate Investment) Joseph B. Bower, Jr. Retired, Former Treasurer and Chief Thomas M. Kennedy Thomas W. Reams President and Chief Executive Officer, Financial Officer, Greenleaf Corporation President, Professional Development Vice President, C. H. Reams & Associates, CNB Financial Corporation, CNB Bank (Manufacturer) Associates, Inc. (Business and Real Inc. (Insurance) Mark D. Breakey Richard L. Greslick, Jr. Estate Development) Nick Scott, Jr. Senior Executive Vice President & Secretary, CNB Financial Corporation; Jerome T. Osborne, III Vice President & Owner, Scott Chief Credit Officer, CNB Bank Senior Executive Vice President & President, JTO, Inc. (Real Estate Enterprises (Hospitality Industry) Gary L. Clark Chief Operating Officer, CNB Bank Developer) James E. Spoden Chief Executive Officer, Reed Esquire, MacDonald Illig Jones & Manufacturing Company Britton, LLP (Law Office) ERIEBANK Ohio Regional Board of Advisors Dr. Lundon Albrecht Jennifer Brown Bryce A. Heinbaugh Shawn Neece Owner, Albrecht Family Dentistry Economic Development Specialist, CT Managing Partner, IEN Risk Director, NMS Certified Public Dental Consultant, Coltene Whaledent Consultants (Municipal Government, Management Consultants (Insurance Accountants Public Entities) Brokers & Agencies) Joseph T. Svete Richard T. Flenner, Jr. Richard J. Kessler President, Svete & McGee Co., LPA Retired, Former President, Lake President, Society of Rehabilitation (Law Office) National Bank (Serves Individuals with Disabilities) 10 CNB FINANCIAL CORPORATION

FCBank, a Division of CNB Bank J. Andrew Dale Jack L. Trachtenberg Wendy L. Moreland J. Ralph Parker President Vice President, Private Banking Assistant Vice President, Treasury Senior Credit Officer Neal S. Clark Dean J. Vande Water Services Teri A. Slate Vice President, Senior Commercial Vice President, Commercial Banking Jillian V. Price Community Office Manager, Shiloh Banking Jeffrey P. Scholl Assistant Vice President, Market Office Donna M. Conley Manager Travis M. Smith Vice President, Market Manager Vice President, Commercial Banking/ Frank Sudal Thomas J. Szabo Banking Officer, Portfolio Manager Community Office Manager, Bucyrus Assistant Vice President, Commercial Elaine M. Wilson Vice President, FC Financial Services North Brian C. Bach Banking Community Office Manager, Terrance E. Hamm Jared Butler Fredericktown Office Assistant Vice President, Agriculture Vice President, Commercial Banking Network Adminstrator, Facilities Officer Christopher A. Winegardner John G. Hock Lending Annette D. Lester Community Office Manager, William R. Diehl Vice President, Commercial Banking Community Office Manager, Worthington Office Assistant Vice President, Portfolio Steven W. Howard Cardington Office Clara J. McClung Manager Michelle P. Muchow Community Office Assistant Manager, Vice President, FC Financial Services Bernard J. McGuinness Scot D. Lewis Executive Assistant, Banking Officer Worthington Office Assistant Vice President, Commercial Vice President, Commercial Banking Banking FCBank Regional Board of Advisors J. Andrew Dale Jennifer Carney Richard L. Greslick, Jr. David Royer Chairman of the Board, President, Partner and Co-Founder, Carney Ranker Secretary, CNB Financial Corporation; Vice President of Finance & FCBank Architects, Ltd. Senior Executive Vice President & Development, Continental Real Estate Joseph B. Bower, Jr. Patrick J. Drouhard Chief Operating Officer, CNB Bank Companies (Real Estate Developer) President and Chief Executive Officer, Retired, Former Cardington-Lincoln R. Duane Hord J. Randall Schoedinger CNB Financial Corporation, CNB Bank President, Hord Livestock, Inc. CEO, Schoedinger Funeral and School District Superintendent Mark D. Breakey (Agriculture) Cremation Services Senior Executive Vice President & Lawrence A. Morrison Chief Credit Officer, CNB Bank CPA and Partner, Kleshinski, Morrison & Morris, LLP (Accounting) Bank on Buffalo, a Division of CNB Bank Martin T. Griffith Gregory G. Emminger Kathleen B. Kane David G. Hawker President Vice President, Commercial Banking Vice President, Regional Retail Market Assistant Vice President, Portfolio Manager Manager Holiday Financial Services Corporation, a Subsidiary of CNB Financial Corporation BOARD OF DIRECTORS CORPORATE OFFICERS Joseph B. Bower, Jr. Brian W. Wingard Joseph P. Strouse Chairman Director President Richard L. Greslick, Jr. Secretary CNB Securities Corporation, a Subsidiary of CNB Financial Corporation, Wilmington, DE BOARD OF DIRECTORS CORPORATE OFFICERS Elizabeth F. Bothner Timothy A. Bracken Brian W. Wingard Secretary, Wilmington Trust SP Services, Director President Inc. Glenn R. Pentz Donald R. McLamb, Jr. Director Treasurer, Wilmington Trust SP Services, Donald R. McLamb, Jr. Inc. Wilmington Trust SP Services, Inc. 2016 ANNUAL REPORT HIGHLIGHTS 11

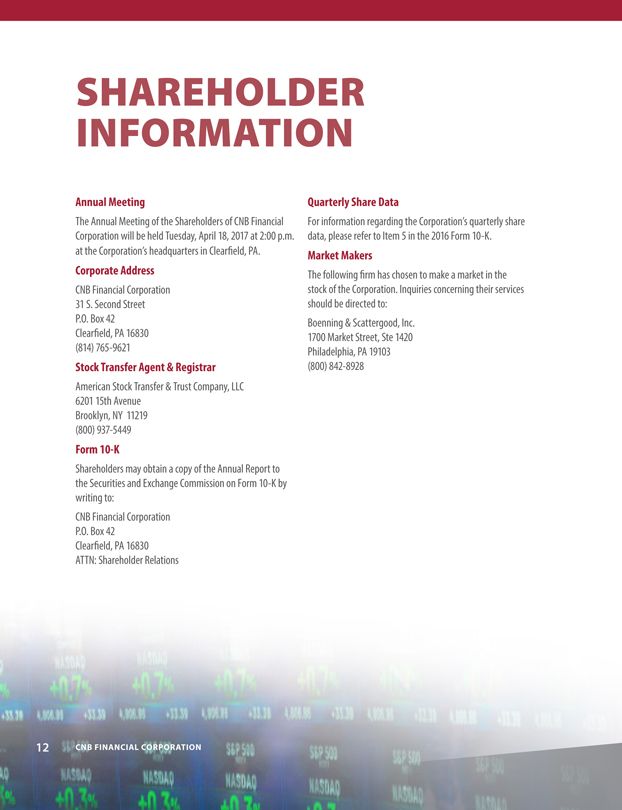

INfORmATION shAREhOLdER Annual Meeting Quarterly Share Data The Annual Meeting of the Shareholders of CNB Financial For information regarding the Corporation’s quarterly share Corporation will be held Tuesday, April 18, 2017 at 2:00 p.m. data, please refer to Item 5 in the 2016 Form 10-K. at the Corporation’s headquarters in Clearfield, PA. Market Makers Corporate Address The following firm has chosen to make a market in the CNB Financial Corporation stock of the Corporation. Inquiries concerning their services 31 S. Second Street should be directed to: P.O. Box 42 Boenning & Scattergood, Inc. Clearfield, PA 16830 1700 Market Street, Ste 1420 (814) 765-9621 Philadelphia, PA 19103 Stock Transfer Agent & Registrar (800) 842-8928 American Stock Transfer & Trust Company, LLC 6201 15th Avenue Brooklyn, NY 11219 (800) 937-5449 Form 10-K Shareholders may obtain a copy of the Annual Report to the Securities and Exchange Commission on Form 10-K by writing to: CNB Financial Corporation P.O. Box 42 Clearfield, PA 16830 ATTN: Shareholder Relations 12 CNB FINANCIAL CORPORATION

Corporate Profile ERIEBANK CNB Financial Corporation is a leader in providing inte- Headquartered in Erie, Pennsylvania, ERIEBANK is a division grated financial solutions which create value for both of CNB Bank. Presently, there are eight full service offices consumers and businesses. These solutions encompass in Pennsylvania, which house its commercial, retail and deposit accounts, private banking, real estate, commercial, Private Banking divisions. Five offices are in Erie, two in industrial, residential and consumer loans and lines of cred- Meadville, and one in Warren, Pennsylvania. ERIEBANK also it, credit cards, treasury services, online banking, mobile has three full-service offices in Ohio, one in Ashtabula and banking, merchant credit card processing, remote deposit two in Mentor. In addition, ERIEBANK Investment Advisors and accounts receivable handling. In addition, the Corpo- provides wealth and asset management services, retire-ration provides wealth and asset management services, ment plans and other employee benefit plans. retirement plans and other employee benefit plans. FCBANK CNB Bank FCBank, a division of CNB Bank, is headquartered in Worth-A subsidiary of CNB Financial Corporation, CNB is a regional ington, Ohio with nine full service offices in the communties independent community bank in North Central Pennsylva- of Bucyrus, Shiloh, Mt. Hope, Cardington, Fredericktown, nia with over 500 employees who make customer service Worthington, Dublin, and Upper Arlington. FCBank also has more responsive and reliable. For over 150 years, the Bank one loan production office in Lancaster, Ohio. FCBank is has strived to be more customer-driven than its competi- driven by a strong focus on meeting the financial needs of tors and to build long-term customer relationships by being businesses and individuals in a way only a community bank reliable and competitively priced. can deliver. FCBank offers commercial, retail, and Private CNB continually seeks innovative ways to execute a person- Banking services, along with wealth and asset manageal, quality-driven customer service strategy and prides itself ment services through FC Financial Services. on being first-to-market for many of these innovations. To satisfy customers’ financial needs and expectations, it Bank on Buffalo offers a variety of delivery channels, which include twenty-two full-service offices, nineteen ATMs, telephone bank- Bank on Buffalo, a division of CNB Bank, was formed in ing (1-866-224-7314), Internet banking (www.CNBBank. 2016 and a loan production office was opened in the bank), mobile banking, and a centralized customer service Electric Tower building in downtown Buffalo, New York. center (1-800-492-3221). This loan production office was converted to a full-service office in February 2017, and two additional Bank on Buffalo full-service offices will be opened in 2017 in Williamsville and Orchard Park, New York. Holiday Financial Services Holiday Financial Services, a subsidiary of CNB Financial Corporation, is a consumer loan company, and currently has ten convenient office locations in State College, Bradford, Clearfield, Hollidaysburg, Erie, Ridgway, Johnstown, Ebens-burg, Indiana, and Clarion, Pennsylvania. 2016 ANNUAL REPORT HIGHLIGHTS 13

Each depositor insured to at least $250,000 Backed by the full faith and credit of the United States FDIC government Federal Deposit Insurance Corporation •www.fdic.gov The common stock of the Corporation trades on the NASDAQ Global Select Market under the symbol CCNE.

CNB Financial Corporation 31 South Second Street, P.O. Box 42 Clearfield, PA 16830 800-492-3221 www.CNBBank.bank