Attached files

| file | filename |

|---|---|

| 10-K - 10-K - TREDEGAR CORP | tg-20161231x10k.htm |

| EX-32.2 - EXHIBIT 32.2 - TREDEGAR CORP | tg-ex322_20161231x10k.htm |

| EX-32.1 - EXHIBIT 32.1 - TREDEGAR CORP | tg-ex321_20161231x10k.htm |

| EX-31.2 - EXHIBIT 31.2 - TREDEGAR CORP | tg-ex312_20161231x10k.htm |

| EX-31.1 - EXHIBIT 31.1 - TREDEGAR CORP | tg-ex311_20161231x10k.htm |

| EX-23.3 - EXHIBIT 23.3 - TREDEGAR CORP | tg-ex233_20161231x10k.htm |

| EX-23.2 - EXHIBIT 23.2 - TREDEGAR CORP | tg-ex232_20161231x10k.htm |

| EX-23.1 - EXHIBIT 23.1 - TREDEGAR CORP | tg-ex231_20161231x10k.htm |

Consolidated Financial Statements

For the Years Ended

December 31, 2016, 2015 and 2014

kaleo, Inc. and subsidiary

kaleo, Inc. and subsidiary

Contents

Page

Independent Auditors’ Reports 1-3

Consolidated Financial Statements

Consolidated Balance Sheets 4

Consolidated Statements of Operations 5

Consolidated Statements of Comprehensive Loss 6

Consolidated Statements of Changes in Shareholders’ Equity (Deficit) 7

Consolidated Statements of Cash Flows 8

Notes to Consolidated Financial Statements 9-26

Report of Independent Auditors

The Board of Directors and Shareholders

kaleo, Inc. and subsidiary

We have audited the accompanying consolidated financial statements of kaleo, Inc., which comprise the consolidated

balance sheet as of December 31, 2016, and the related consolidated statements of operations, comprehensive loss,

changes in shareholders’ equity (deficit) and cash flows for the year then ended, and the related notes to the

consolidated financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements in conformity with

U.S. generally accepted accounting principles; this includes the design, implementation, and maintenance of internal

control relevant to the preparation and fair presentation of financial statements that are free of material misstatement,

whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We conducted our audit

in accordance with auditing standards generally accepted in the United States. Those standards require that we plan

and perform the audit to obtain reasonable assurance about whether the financial statements are free of material

misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the financial

statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of

material misstatement of the financial statements, whether due to fraud or error. In making those risk assessments, the

auditor considers internal control relevant to the entity’s preparation and fair presentation of the financial statements

in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the entity’s internal control. Accordingly, we express no such opinion. An audit also

includes evaluating the appropriateness of accounting policies used and the reasonableness of significant accounting

estimates made by management, as well as evaluating the overall presentation of the financial statements.

A member firm of Ernst & Young Global Limited

Ernst & Young LLP

The Edgeworth Building

Suite 201

2100 East Cary Street

Richmond, VA 23223

Tel: +1 804 344 6000

Fax: +1 804 344 4514

ey.com

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit

opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the consolidated

financial position of kaleo, Inc. at December 31, 2016 and the consolidated results of its operations and its cash flows

for the year then ended in conformity with U.S. generally accepted accounting principles.

February 17, 2017

A member firm of Ernst & Young Global Limited

3

The accompanying notes are an integral part of these consolidated financial statements.

4

kaleo, Inc. and subsidiary

Consolidated Balance Sheets

December 31, December 31,

2016 2015

Current assets

Cash and cash equivalents 102,329,255$ 91,844,084$

Restricted cash 30,628 8,181,623

Accounts receivable trade, net 6,990,412 405,475

Inventory, net 7,075,123 8,085,936

Prepaid expenses 1,325,936 578,571

Total current assets 117,751,354 109,095,689

Property and equipment, net 13,011,056 8,452,668

Other long-term assets 471,839 2,903,610

Total assets 131,234,249$ 120,451,967$

Current liabilities

Accounts payable - trade 6,391,999$ 1,500,191$

Accrued rebates, discounts and returns 28,545,340 2,571,897

Other accrued expenses 13,627,368 4,619,653

Accrued interest 1,568,976 1,568,976

Total current liabilities 50,133,683 10,260,717

Long-term debt, net 143,380,248 142,696,382

Other long-term liabilities 822,156 552,107

Total liabilities 194,336,087 153,509,206

Commitments and contingencies (Note 8)

Shareholders' deficit

Series A-1 Preferred Stock 462 462

Convertible Preferred Stock 24,899,511 23,921,294

Common stock

($0.001 par value; 17,939,140 shares authorized; issued and outstanding 6,827,818 in 2016) 6,828 6,823

Paid-in capital (6,135,300) (6,913,609)

Accumulated deficit (81,873,339) (50,072,209)

Total shareholders' deficit (63,101,838) (33,057,239)

Total liabilities and shareholders' deficit 131,234,249$ 120,451,967$

Assets

Liabilities and Shareholders' Deficit

The accompanying notes are an integral part of these consolidated financial statements.

5

kaleo, Inc. and subsidiary

Consolidated Statements of Operations

2016 2015 2014

Revenues

Product sales, net 56,187,594$ 10,304,423$ 2,037,569$

Royalties - 25,426,854 19,118,066

Total revenues 56,187,594 35,731,277 21,155,635

Costs and Expenses

Cost of goods sold 15,427,749 14,146,801 3,800,718

Research and development 7,850,950 7,019,345 6,906,514

Selling, general and administrative 62,391,109 35,995,168 25,013,367

Total costs and expenses 85,669,808 57,161,314 35,720,599

Operating loss (29,482,214) (21,430,037) (14,564,964)

Other income (expense)

Gain on contract termination (Note 3) 18,074,875 - -

Interest expense (19,511,591) (20,012,679) (16,556,047)

Interest income 46,319 89,905 24,990

Other 84,668 (104,759) 3,694

Other income (expense), net (1,305,729) (20,027,533) (16,527,363)

Loss before income taxes (30,787,943) (41,457,570) (31,092,327)

Income tax expense (benefit) 34,970 481,280 (8,100,307)

Net loss (30,822,913)$ (41,938,850)$ (22,992,020)$

Years Ended December 31,

The accompanying notes are an integral part of these consolidated financial statements.

6

kaleo, Inc. and subsidiary

Consolidated Statements of Comprehensive Loss

2016 2015 2014

Net loss (30,822,913)$ (41,938,850)$ (22,992,020)$

Other comprehensive income (loss)

Unrealized gain (loss) on short-term investments - 8,960 (8,960)

Tax impact of adjustments to other comprehensive income - - -

Other comprehensive income (loss) - 8,960 (8,960)

Comprehensive loss $ (30,822,913) $ (41,929,890) $ (23,000,980)

Years Ended December 31,

T

h

e

a

c

c

o

m

p

a

n

yi

n

g

n

o

te

s

a

re

a

n

i

n

te

g

ra

l

p

a

rt

o

f

th

e

s

e

c

o

n

s

o

lid

a

te

d

f

in

a

n

c

ia

l

s

ta

te

m

e

n

ts

.

7

ka

le

o,

In

c.

a

nd

s

ub

si

di

ar

y

C

on

so

lid

at

ed

S

ta

te

m

en

ts

o

f C

ha

ng

es

in

S

ha

re

ho

ld

er

s'

E

qu

ity

(D

ef

ic

it)

R

et

ai

ne

d

A

cc

um

ul

at

ed

S

er

ie

s

A

-1

C

on

ve

rt

ib

le

E

ar

ni

ng

s

O

th

er

P

re

fe

rr

ed

P

re

fe

rr

ed

C

om

m

on

P

ai

d-

In

(A

cc

um

ul

at

ed

C

om

pr

eh

en

si

ve

St

oc

k

St

oc

k

St

oc

k

C

ap

ita

l

D

ef

ic

it)

Lo

ss

To

ta

l

B

al

an

ce

(d

ef

ic

it)

-

D

ec

em

be

r

31

, 2

01

3

4

6

2

$

-

$

6

,5

2

8

$

(8

,8

3

6

,7

1

7

)

$

1

6

,8

0

9

,7

4

8

$

-

$

7

,9

8

0

,0

2

1

$

D

iv

id

e

n

d

s

a

c

c

ru

e

d

o

n

r

e

d

e

e

m

a

b

le

p

re

fe

rr

e

d

s

to

c

k

-

-

-

-

(9

7

5

,5

4

3

)

-

(9

7

5

,5

4

3

)

S

to

c

k

c

o

m

p

e

n

s

a

ti

o

n

-

-

-

3

7

3

,7

4

2

-

-

3

7

3

,7

4

2

P

ro

c

e

e

d

s

f

ro

m

e

xe

rc

is

e

o

f

s

to

c

k

o

p

ti

o

n

s

/w

a

rr

a

n

ts

in

c

lu

d

in

g

r

e

la

te

d

e

xc

e

s

s

t

a

x

b

e

n

e

fi

ts

o

f

$

1

4

,9

8

6

-

-

2

4

4

2

2

1

,7

5

9

-

-

2

2

2

,0

0

3

U

n

re

a

liz

e

d

g

a

in

(

lo

s

s

)

o

n

s

h

o

rt

-t

e

rm

i

n

v

e

s

tm

e

n

ts

-

-

-

-

-

(8

,9

6

0

)

(8

,9

6

0

)

N

e

t

lo

s

s

-

-

-

-

(2

2

,9

9

2

,0

2

0

)

-

(2

2

,9

9

2

,0

2

0

)

B

al

an

ce

(d

ef

ic

it)

-

D

ec

em

be

r

31

, 2

01

4

4

6

2

-

6

,7

7

2

(8

,2

4

1

,2

1

6

)

(

7

,1

5

7

,8

1

5

)

(8

,9

6

0

)

(1

5

,4

0

0

,7

5

7

)

D

iv

id

e

n

d

s

a

c

c

ru

e

d

o

n

p

re

fe

rr

e

d

s

to

c

k

-

-

-

-

(9

7

5

,5

4

4

)

-

(9

7

5

,5

4

4

)

S

to

c

k

c

o

m

p

e

n

s

a

ti

o

n

-

-

-

6

3

4

,5

2

1

-

-

6

3

4

,5

2

1

P

ro

c

e

e

d

s

f

ro

m

e

xe

rc

is

e

o

f

s

to

c

k

o

p

ti

o

n

s

/w

a

rr

a

n

ts

,

in

c

lu

d

in

g

r

e

la

te

d

e

xc

e

s

s

t

a

x

b

e

n

e

fi

ts

o

f

$

0

-

-

5

1

6

6

,4

2

4

-

-

6

6

,4

7

5

U

n

re

a

liz

e

d

g

a

in

(

lo

s

s

)

o

n

s

h

o

rt

-t

e

rm

i

n

v

e

s

tm

e

n

ts

-

-

-

-

-

8

,9

6

0

8

,9

6

0

R

e

c

la

s

s

if

ic

a

ti

o

n

o

f

c

o

n

v

e

rt

ib

le

p

re

fe

rr

e

d

s

to

c

k

(

N

o

te

1

0

)

-

2

3

,9

2

1

,2

9

4

-

-

-

-

2

3

,9

2

1

,2

9

4

R

e

c

la

s

s

if

ic

a

ti

o

n

o

f

w

a

rr

a

n

t

(N

o

te

1

0

)

-

-

-

6

2

6

,6

6

2

-

-

6

2

6

,6

6

2

N

e

t

lo

s

s

-

-

-

-

(

4

1

,9

3

8

,8

5

0

)

-

(4

1

,9

3

8

,8

5

0

)

B

al

an

ce

(d

ef

ic

it)

-

D

ec

em

be

r

31

, 2

01

5

4

6

2

2

3

,9

2

1

,2

9

4

6

,8

2

3

(6

,9

1

3

,6

0

9

)

(5

0

,0

7

2

,2

0

9

)

-

(3

3

,0

5

7

,2

3

9

)

D

iv

id

e

n

d

s

a

c

c

ru

e

d

o

n

p

re

fe

rr

e

d

s

to

c

k

-

9

7

8

,2

1

7

-

-

(9

7

8

,2

1

7

)

-

-

S

to

c

k

c

o

m

p

e

n

s

a

ti

o

n

-

-

-

7

7

5

,6

5

9

-

-

7

7

5

,6

5

9

P

ro

c

e

e

d

s

f

ro

m

e

xe

rc

is

e

o

f

s

to

c

k

o

p

ti

o

n

s

/w

a

rr

a

n

ts

,

in

c

lu

d

in

g

r

e

la

te

d

e

xc

e

s

s

t

a

x

b

e

n

e

fi

ts

o

f

$

0

-

-

5

2

,6

5

0

-

-

2

,6

5

5

N

e

t

lo

s

s

-

-

-

-

(3

0

,8

2

2

,9

1

3

)

-

(3

0

,8

2

2

,9

1

3

)

B

al

an

ce

(d

ef

ic

it)

-

D

ec

em

be

r

31

, 2

01

6

4

6

2

$

2

4

,8

9

9

,5

1

1

$

6

,8

2

8

$

(6

,1

3

5

,3

0

0

)

$

(8

1

,8

7

3

,3

3

9

)

$

-

$

(6

3

,1

0

1

,8

3

8

)

$

Y

ea

rs

e

nd

ed

D

ec

em

be

r

31

, 2

01

6,

2

01

5

an

d

20

14

The accompanying notes are an integral part of these consolidated financial statements.

8

kaleo, Inc. and subsidiary

Consolidated Statements of Cash Flows

2016 2015 2014

Cash flows from operating activities

Net loss (30,822,913)$ (41,938,850)$ (22,992,020)$

Adjustments to reconcile to net cash from operating activities:

Depreciation and amortization 4,550,959 2,999,466 2,420,105

Amortization of debt issuance costs 683,866 709,444 673,556

Amortization of debt discount - - 214,205

Inventory reserve 6,016,590 6,565,528 2,981,813

Deferred taxes - - (1,676,431)

Stock compensation 775,659 634,521 373,742

Non cash gain on contract termination (8,074,875) - -

Other 2,374,269 127,255 -

Change in:

Accounts receivable trade, net (6,584,937) (405,475) -

Accounts receivable royalties - 2,315,483 570,585

Inventory (5,005,777) (6,074,947) (11,558,330)

Prepaid expenses (747,365) (14,620) (404,072)

Other long-term assets (10,500) (77,500) -

Accounts payable - trade 4,891,808 (1,724,190) 1,968,014

Accrued rebates, discounts and returns 25,973,443 2,279,196 292,701

Other current liabilities 8,981,052 1,582,941 1,017,439

Income taxes (receivable) / payable 26,663 6,459,881 (3,824,379)

Other long-term liabilities 270,049 (68,683) (174,246)

Net cash from operating activities 3,297,991 (26,630,550) (30,117,318)

Cash flows from investing activities

Short-term Investments - 21,249,998 (21,249,998)

Patent costs - (369,297) (491,964)

Purchase of property and equipment (966,470) (495,219) (2,461,943)

Net cash from investing activities (966,470) 20,385,482 (24,203,905)

Cash flows from financing activities

Proceeds from exercise of stock options 2,655 66,475 222,003

Proceeds from long-term borrowings - - 150,000,000

Restricted cash from long-term borrowings - - (20,000,000)

Change in restricted cash, net 8,150,995 6,316,819 5,501,558

Costs incurred for debt issuance - - (3,085,197)

Payments on long-term debt - (4,642,198) (15,529,167)

Net cash from financing activities 8,153,650 1,741,096 117,109,197

Net change in cash and cash equivalents 10,485,171 (4,503,972) 62,787,974

Cash and cash equivalents - beginning of period 91,844,084 96,348,056 33,560,082

Cash and cash equivalents - end of period 102,329,255$ 91,844,084$ 96,348,056$

Supplemental disclosure of cash flow information

Cash paid for interest (net of amounts capitalized) 18,827,724$ 19,417,934$ 13,268,490$

Cash paid for income taxes 8,517$ 479,195$ 5,681$

Cash received from refunds of income taxes paid 210$ 6,465,673$ 2,620,164$

Supplemental disclosure of noncash investing and financing activities

Unrealized (gain) loss on short-term investments -$ (8,960)$ 8,960$

Years Ended

December 31,

9

kaleo, Inc. and subsidiary

Notes to Consolidated Financial Statements

Years Ended December 31, 2016, 2015 and 2014

Unless the context requires otherwise in these Notes to Consolidated Financial Statements, references to

“Company,” “kaleo,” “we,” “us” and “our” refer to kaleo, Inc., including its consolidated subsidiary.

1. Organization and Nature of Business

Background

kaleo, Inc., headquartered in Richmond, Virginia, is a pharmaceutical company dedicated to building

innovative solutions for serious and life-threatening medical conditions. Our mission is to provide innovative

solutions that empower patients to confidently take control of their medical conditions. We believe patients and

caregivers are the experts on how their medical condition impacts their lives and are an integral part of our

product development process. Each kaléo product combines an established drug with an innovative delivery

platform and proprietary technology.

AUVI-Q® and ALLERJECT® (epinephrine injection, USP)

AUVI-Q is a prescription auto-injector approved by the U.S. Food and Drug Administration (FDA) in 2012

used to treat life-threatening allergic reactions, including anaphylaxis, in people who are at risk for or have a

history of serious allergic reactions.

From 2013 to 2015, sanofi-aventis U.S. LLC (Sanofi) sold these epinephrine auto-injectors under both the

AUVI-Q (in the U.S.) and ALLERJECT (in Canada) brand names and made royalty payments to the Company

under the terms of a North American license and development agreement. In October 2015, Sanofi announced

a voluntary recall of all epinephrine auto-injectors on the market under the brand names AUVI-Q and

ALLERJECT. In February 2016, Sanofi and the Company executed an agreement to terminate the license and

development agreement, at which time all U.S. and Canadian rights reverted to the Company. In February

2017, the Company made AUVI-Q available for prescription in the U.S.

See Note 3 for additional information on the license and development agreement and the related termination

agreement with Sanofi.

EVZIO® (naloxone hydrochloride injection)

EVZIO is a prescription auto-injector approved by the FDA in 2014 as an opioid antagonist indicated for the

emergency treatment of known or suspected opioid overdose, as manifested by respiratory and/or central

nervous system depression. EVZIO is intended for immediate administration as emergency therapy in settings

where opioids may be present.

10

Pipeline

The Company continues to develop additional products for targeted therapeutic areas that leverage its

intellectual property and know-how with the goal of creating personal medical products that provide superiority

over the existing standards of care and cost effectiveness. The Company has an active pipeline of products in

various stages of development across a range of therapeutic areas. The Company plans to self-commercialize

certain of its pipeline products and to partner with companies on other pipeline products.

2. Summary of Significant Accounting Policies

Principles of Consolidation

The consolidated financial statements include the accounts and operations of kaleo, Inc. and its wholly-owned

subsidiary. The financial statements are consolidated in accordance with generally accepted accounting

principles in the United States (GAAP). All intercompany transactions and accounts have been eliminated.

New Accounting Pronouncements

In 2014, the Financial Accounting Standards Board (FASB) issued guidance for recognizing revenue in

contracts with customers. The new guidance is effective for public entities for annual reporting periods

beginning after December 15, 2017 and for nonpublic entities for annual reporting periods beginning after

December 15, 2018. A nonpublic entity may elect early application, but no earlier than the effective date for

public entities. The Company has not yet evaluated the impact this guidance would have on its consolidated

financial statements.

In 2015, the FASB issued guidance which simplifies the measurement of inventory by using only the lower of

cost or net realizable value. The guidance is effective for public and nonpublic entities for annual reporting

periods beginning after December 15, 2016. The Company does not believe that adoption will have a material

effect on its consolidated financial statements.

In 2016, the FASB issued guidance, which amends a number of aspects of lease accounting, including requiring

lessees to recognize operating leases with a term greater than one year on their balance sheet as a right-of-use

asset and corresponding lease liability, measured at the present value of the lease payments. The new guidance

is effective for public entities for annual reporting periods beginning after December 15, 2018 and for nonpublic

entities for annual reporting periods beginning after December 15, 2019. The Company has not yet evaluated

the impact this guidance would have on its consolidated financial statements.

In 2016 the FASB issued guidance which amends several aspects of the accounting for share-based payment

transactions, including income tax consequences, accounting for forfeitures and measurement of the expected

term of an award for private companies. The Company has elected to adopt this guidance prospectively for its

2016 financial statements and the adoption did not have a significant impact on the Company’s consolidated

financial statements.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash on hand in excess of daily operating requirements and highly liquid

investments purchased with original maturities of three months or less. The carrying value of cash and cash

equivalents approximates fair value because of the short maturities of those financial instruments.

11

Restricted Cash

Cash and cash equivalents that are not immediately available to the Company due to contractual requirements

are classified as restricted cash. The Company entered into a note purchase agreement with PDL BioPharma,

Inc. (see Note 6). As part of this agreement, a portion of EVZIO and AUVI-Q net sales are deposited into bank

accounts of a wholly-owned subsidiary of the Company. Funds held in these accounts are controlled by the

trustee and are used to satisfy interest and principal payments, subject to quarterly maximum caps, as well as

trustee expenses. Any funds in excess of the respective quarterly cap are sent to accounts of the Company on

a quarterly basis free of restrictions. Any funds maintained in bank accounts controlled by the trustee on behalf

of the Company are classified as restricted cash. Changes in the account balances of restricted cash are reported

in the financing activities section of the consolidated statements of cash flows.

Concentrations

Financial instruments that potentially subject the Company to concentrations of credit risk consist primarily of

cash, cash equivalents and accounts receivable. The Company maintains deposit accounts in federally insured

financial institutions in excess of federally insured limits. However, management believes the Company is not

exposed to significant credit risk due to the financial position of the depository institutions in which these

deposits are held. Additionally, the Company has established guidelines regarding investment instruments and

their maturities, which are designed to preserve principal and maintain liquidity.

Based on the Company’s operations at December 31, 2016, the primary sources of revenue and accounts

receivable applicable to the Company are derived from EVZIO net sales. As discussed in Note 1, in February

2017, the Company made AUVI-Q available for prescription in the U.S.

The Company’s production and assembly operations are outsourced to third-party suppliers including certain

located internationally. The Company owns equipment at these third-party suppliers, including $1.9 million of

net property and equipment located outside the United States at December 31, 2016. A failure to perform by

these third-party suppliers could significantly impact the Company’s operations.

The Company generally sells its commercial products to wholesale distributors, its principal customer. The

Company’s five largest wholesalers represented 89% of its sales volume in the year ended 2016.

Fair Value of Financial Instruments

The carrying amounts of the Company’s financial instruments reflected in the consolidated balance sheets for

cash and cash equivalents, restricted cash, receivables, prepaid expenses, other current assets, accounts payable

and accrued expenses approximate their fair values due to their short maturities.

Accounts Receivable

Accounts receivable are reported in the consolidated balance sheets at outstanding amounts, less an allowance

for doubtful accounts. The Company’s accounts receivable trade are recorded on gross product sales, net of

estimated other allowances such as temporary discounts, prompt pay discounts, product returns, wholesaler fees

and chargebacks, as described in the accounting policy for revenue recognition.

The Company extends credit without requiring collateral. The Company evaluates the collectability of accounts

receivable on a regular basis and writes off uncollectible receivables when the likelihood of collection is remote.

An allowance for uncollectible receivables is based upon various factors including the financial condition and

payment history of customers, an overall review of collections experience on other accounts, and economic

factors or events expected to affect future collections. No accounts were written off during the periods ended

12

December 31, 2016, 2015 and 2014. No allowance for uncollectible receivables was recorded at December 31,

2016 or 2015.

Inventory

Inventory cost, which includes amounts related to materials, labor, depreciation and production overhead, is

determined in a manner that approximates the first-in, first-out method. Certain components of the Company’s

products are provided by a limited number of vendors. The Company’s production, assembly and distribution

operations are outsourced to third-parties where substantially all of the Company’s inventory is located.

Inventory is evaluated for impairment by consideration of factors such as lower of cost or market, net realizable

value, obsolescence or expiry. The Company’s inventories have carrying values that do not exceed market cost

nor do they exceed net realizable value. The Company evaluates its expiry risk by evaluating current and future

product demand relative to product shelf life. The Company regularly reviews its inventories for impairment

and reserves are established when necessary.

Property and Equipment

Property and equipment include costs of assets constructed or purchased, related delivery and installation costs

and interest incurred on significant capital projects during their construction periods. Improvements and

replacements of property and equipment are capitalized. Maintenance and repairs that do not improve or extend

the lives of property and equipment are charged to expense as incurred. When assets are sold or retired, their

cost and related accumulated depreciation are removed from the accounts and any gain or loss is reported in the

consolidated statements of operations. Depreciation is provided over the estimated useful life of each class of

depreciable assets and is computed using the straight-line method for financial statement purposes.

The estimated useful lives for property and equipment are as follows:

Furniture and equipment 3 - 5 years

Manufacturing equipment 5 years

Leasehold improvements 3 - 7 years

Accounting for the Impairment of Long-Lived Assets

The Company reviews long-lived assets for possible impairment when events or changes in circumstances

indicate that the carrying amount of an asset may not be recoverable. Asset impairment is determined to exist

if estimated future undiscounted cash flows are less than the carrying amount. If the undiscounted cash flow is

less than the carrying amount of the asset, an impairment loss is recognized and such loss is computed based

on the estimated fair value of the asset, generally determined on a discounted cash flow basis. No impairment

losses were recorded for the periods presented.

Patents

The Company generally expenses direct costs paid to third parties for internally developed patent application

costs based on the uncertainty of the future economic benefits associated with these costs. The Company

concluded that due to uncertainty associated with the future economic benefits from its patents at the time the

costs were incurred, that $2.3 million of patent costs previously capitalized should have been recorded as selling,

general and administrative costs. The Company made an adjustment to properly state these costs in 2016. The

Company believes this adjustment is not material to the consolidated financial statements of any year

presented.

13

Other Accrued Expenses

Other accrued expenses include but are not limited to estimates for unpaid compensation, estimated amounts

due under the Services Agreement (Note 8) and bonuses and services performed and not billed.

Research and Development Expenses

For each of the Company’s research and development (“R&D”) programs, the Company incurs both external

and internal expenses. External R&D expenses include costs related to clinical and non-clinical activities

performed by contract research organizations, consulting fees, laboratory services, purchases of drug product

materials and third-party manufacturing development costs. Internal R&D expenses primarily includes

employee-related expenses. All costs associated with research and development are expensed as incurred.

Revenue Recognition

Based on the Company’s operations, the sources of revenue for the periods presented include net sales of

commercial products and royalties on product sales. Specifically, the Company accounts for each of the items

as follows:

Gross Product Sales - The Company generally sells its commercial products to wholesale distributors,

its principal customers. Product sales revenue is recognized when title has transferred to the customer

and the customer has assumed the risks and rewards of ownership, which typically occurs on delivery

to the customer. The Company’s product revenues consist of U.S. sales of EVZIO and are recognized

once it meets all four revenue recognition criteria: persuasive evidence of an arrangement exists,

delivery of products has occurred, collectability is reasonably assured, and amounts payable are fixed

or determinable.

Product Sales Allowances - As is customary in the pharmaceutical industry, the Company’s gross

product sales are subject to a variety of product sales allowances in arriving at reported net product

sales. When gross revenue from the sale of product is recognized, an estimate of the related product

sales allowances is recorded, which reduces the gross product revenues. Accounts receivable and/or

accrued rebates, discounts, copay assistance and returns are also reduced and/or increased by the

product sales allowances. The estimates of the product sales allowances take into consideration the

terms of the Company’s agreements with customers, historical product returns, rebates or discounts

taken, estimated levels of inventory in the distribution channel, the shelf life of the product, and

specific known market events. If actual future results vary from the Company’s estimates, the

Company may need to adjust these estimates, which could have a material effect on product sales

and earnings in the period of adjustment.

The Company’s most significant product sales allowances include:

o Prompt Pay Discounts - The Company generally offers cash discounts to its customers,

typically a percentage of the sales price, as an incentive for prompt payment. Based on the

Company’s experience, it expects the customers to comply with the payment terms to earn

the cash discount. The discount is typically reflected as a reduction to the cash payment

made by the customer. The reserve for sales discounts is based on invoices outstanding. The

Company assumes, based on past experience, that all available discounts will be taken.

o Product Returns - Under certain conditions, the Company allows customers to return product

for credit. The Company’s estimate of the provision for returns is based upon historical

experience and current trends of actual customer returns. Additionally, other factors are

14

considered when estimating the current period returns provision, including levels of

inventory in the distribution channel, as well as significant market changes which may impact

future expected returns.

o Wholesaler Fees - The Company offers contractually determined fees to certain wholesale

distributors that purchase directly from the Company. Fees are accrued based on contracted

rates.

o Chargebacks - The Company provides discounts to authorized users of the Federal Supply

Schedule (FSS), Public Health Services (PHS) and certain other entities. These entities

purchase products from the wholesale distributors at a discounted price, and the wholesale

distributors then charge back to the Company the difference between the current retail price

and the discounted price the entities paid for the product. Sales related to FSS contracts also

incur an Industrial Funding Fee that the Company estimates based on estimated FSS sales.

The chargeback reserve varies with changes in product mix, changes in customer pricing and

changes to estimated wholesaler inventories. The provision for chargebacks also takes into

account an estimate of the expected wholesaler sell-through levels to indirect customers at

certain contract prices. The Company validates the chargeback accrual through a review of

customer information to verify the estimated liability for future chargeback claims based on

historical chargeback and contract rates.

o Rebates - Rebates include volume related incentives to direct and indirect customers, third-

party managed care and Medicare Part D rebates, Medicaid rebates and other government

rebates. Rebates are accrued based on an estimate of claims to be paid for product sold. These

rebate programs include contracted rebates based on customers’ purchases made during an

applicable monthly, quarterly or annual period. The provision for third-party rebates is

estimated based on our customers’ contracted rebate programs and the Company’s historical

experience of rebates paid. Any significant changes to the customer rebate programs are

considered in establishing the provision for rebates. The provisions for government rebates

are based upon historical experience of claims submitted by the various states/authorities,

contractual terms and government regulations.

o Copay Assistance Programs - The Company offers co-pay assistance programs in which

patients receive certain discounts off their prescription co-pays. The discounts, initially paid

by a third party vendor, are reimbursed by the Company. To evaluate the adequacy of the

co-pay reserve, the reserve is reviewed against actual data. The Company monitors its co-

pay reserve and adjusts its estimates if it believes that actual payments will differ from

established accruals.

The Company’s estimates related to the above gross to net sales adjustments require a high degree of

judgment and are subject to material changes based on its experience and certain quantitative and qualitative

factors.

Royalties. The Company recognizes revenue from royalties based on licensees’ sales of products or

services using the Company’s licensed products under the respective licensing agreement. Royalties

are recognized as earned in accordance with the contract terms when royalties from licensees can be

reasonably estimated and collectability is reasonably assured. If the collectability of a royalty amount

is not reasonably assured, royalties are recognized as revenue when the cash is received.

Product Shipping and Handling Costs

Product shipping and handling costs are included in cost of goods sold.

15

Advertising Costs

Advertising costs are expensed as incurred. Advertising expenses were $1.0 million, $0.1 million and less than

$0.1 million for the years ended December 31, 2016, 2015 and 2014, respectively.

Share-Based Compensation

The Company measures the share-based compensation cost at grant date, based on the estimated fair value of

the award, and recognizes the cost as expense on a straight-line basis over the requisite service period, if any,

which generally is the vesting period. The Company has elected to account for forfeitures when they occur.

Fair value of the entity’s common stock is determined based on a valuation performed by an independent third

party firm to establish the exercise price for equity awards at the time of the grant. The Company uses the

Black-Scholes formula to value the shares or options awarded.

Income Taxes

The Company makes certain estimates and judgments in determining income tax expense for financial statement

purposes. These estimates and judgments occur in the calculation of certain tax assets and liabilities, which

arise from differences in the timing of recognition of revenue and expense for tax and financial statement

purposes.

As part of the process of preparing its consolidated financial statements, the Company is required to estimate

its income taxes in each of the jurisdictions in which the Company operates. This process involves the Company

estimating its current tax exposure under the most recent tax laws and assessing temporary differences resulting

from differing treatment of items for tax and accounting purposes. These differences result in deferred tax assets

and liabilities, which are included in the Company’s consolidated balance sheet (see Note 7).

In order for the Company to record the benefit of a tax position in its financial statements, it must determine

that it is more likely than not that the position will be sustained, based on the technical merits of the position, if

the taxing authority examines the position and the dispute is litigated. The determination is made on the basis

of all the facts, circumstances and information available as of the reporting date. The Company has determined

that it does not have any material unrecognized tax benefits or obligations as of December 31, 2016.

The Company considers all available evidence, both positive and negative, including historical levels of income,

expectations and risks associated with estimates of future taxable income and ongoing prudent and feasible tax

planning strategies in assessing the need for a valuation allowance. If it is not considered “more likely than not”

that the Company will recover its deferred tax assets, the Company will increase its provision for taxes by

recording a valuation allowance against the deferred tax assets that the Company estimates may not ultimately

be recoverable.

Tax years ended December 31, 2013, 2015 and 2016 remain subject to examination by federal tax authorities.

Tax years ended December 31, 2012 to 2016 remain subject to examination by certain state tax authorities. The

Company recognizes interest and penalties related to income tax matters as a component of income tax expense.

To date, there have been de minimis interest or penalties charged to the Company in relation to the

underpayment of income taxes.

Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make

estimates and assumptions that affect the reported amounts of revenues, expenses, assets and liabilities and the

disclosure of contingent assets and liabilities at the date of the consolidated financial statements and the reported

16

amounts of revenues and expenses during the reporting period. The Company’s significant accounting

estimates include those related to the timing and amount of revenue recognition, inventory valuation including

reserves, the valuation of equity instruments used in stock-based compensation, the valuation of the assets

received in connection with the termination of the license agreement (Note 3), disputes on certain rebate

amounts (Note 8), the estimation of the termination fee under the Services Agreement (Note 8), income taxes

and accrued expense amounts. Actual results could differ materially from those estimates and assumptions.

Reclassifications

Certain amounts reported in prior periods have been reclassified to conform to the current year presentation.

Subsequent Events

The Company evaluated all subsequent events through February 17, 2017, the date the consolidated financial

statements were available to be issued.

3. Termination of Licensing Agreement

As discussed in Note 1, in 2016, Sanofi and the Company executed an agreement to terminate the license and

development agreement associated with an epinephrine auto-injector utilizing certain of the Company’s

technology platforms under the brand names of AUVI-Q and ALLERJECT. For the years ended December 31,

2015 and 2014, the Company recognized $25.4 million and $19.1 million, respectively, of royalty revenues

under the license and development agreement with Sanofi. The Company recorded no royalty revenues under

the license and development agreement in 2016.

Under the termination agreement, the rights to the epinephrine auto-injectors were returned to the Company

and the Company received cash and certain other assets from Sanofi. The Company did not assume any

liabilities under the termination agreement. The Company valued the assets received from Sanofi at fair market

value and recorded a gain on contract termination associated with these assets. The following is a summary of

the fair market value assigned to the assets received:

Cash 10,000,000$

Manufacturing Equipment 8,074,875

18,074,875$

4. Inventory

The components of inventory consisted of the following as of December 31:

2016 2015

Finish d oods 5,093,957$ 6,563,427$

Semi-finished goods 7,656,483 7,412,751

Raw materials 4,299,066 3,529,236

Inventory reserve (9,974,383) (9,419,478)

7,075,123$ 8,085,936$

Based on its evaluation of current and future product demand relative to product shelf life, the Company has

recorded an inventory obsolescence reserve for the periods ended December 31, 2016 and 2015.

17

5. Property and Equipment

Property and equipment consisted of the following as of December 31:

2016 2015

Ma ufacturing equipment 22,206,922$ 13,733,917$

Furni ure, equipment and leasehold improvements 756,869 486,684

Construction in progress 684,513 386,358

23,648,304 14,606,959

Less - accumulated depreciation and amortization (10,637,248) (6,154,291)

13,011,056$ 8,452,668$

6. Debt

The Company’s long-term debt, net consisted of the following as of December 31:

2016 2015

PDL debt 144,828,635$ 144,828,635$

Debt issuance costs (1,448,387) (2,132,253)

Long-term debt, net 143,380,248$ 142,696,382$

PDL Debt

In April 2014, the Company, through its subsidiary, entered into a note purchase agreement (Note Agreement)

with PDL BioPharma, Inc. (PDL). Under the terms of the Note Agreement, the Company borrowed $150

million at an interest rate of 13% with a maturity date of June 1, 2029 and issued to PDL a promissory note

evidencing the loan.

The note is secured by a portion of the net sales or royalties of AUVI-Q/ALLERJECT and EVZIO (collectively,

the “Revenue Interests”). Once the note is repaid, the Company will resume retaining 100% of all product

royalties and net sales. As discussed in Note 2, the Revenue Interests are initially deposited into restricted bank

accounts controlled by the trustee and are either used to satisfy interest and principal payments or returned

unrestricted to the Company. At inception of the loan, the Company also deposited $20 million in a restricted

account that has been used to satisfy interest payments on the note. The $20 million restricted deposit was

reported in the financing activities section of the consolidated statements of cash flows. Subsequent changes

in the balance of these restricted cash balances are also reflected in the financing activities section of the

consolidated statements of cash flows. As of December 31, 2016 and 2015, there was less than $0.1 million

and $8.2 million, respectively, in these restricted bank accounts.

The Company is required to pay interest on the outstanding principal balance each quarter. The principal

balance of the note is required to be repaid to the extent that the Revenue Interests exceed the quarterly interest

payment, as limited by the respective quarterly payment cap. The Company may also prepay the note subject

to certain prepayment charges which decline over the term of the note. The Company made no principal

payments during the year ended December 31, 2016. The Company made $4.6 million of principal payments

during the year ended December 31, 2015 due to the Revenue Interest exceeding the quarterly interest payments.

There are no minimum principal payments required prior to the final maturity of the note and the note does not

contain a principal amortization schedule. The principal payments will be dependent upon the timing and

18

amount of Revenue Interests over the term of the note. Therefore, the Company has reported all of the debt as

long-term until such time as the Company has available information or commitments supporting the timing of

principal payments based on the level of Revenue Interests.

The note specifies certain reporting requirements to PDL and contains covenants for the Company and its

subsidiary. The Company may not assign, pledge or sell its rights to net sales or royalty streams already pledged

for the service of the PDL note. The Company and its subsidiary were in compliance with the covenants under

the Note Agreement as of December 31, 2016.

The Company incurred debt issuance costs related to the Note Agreement of $3.4 million. The unamortized

debt issuance costs are shown as a direct deduction from the related debt liability and are being expensed to

interest expense over the period the note is outstanding. The Company is unable to estimate the fair value of

the note at December 31, 2016 and 2015 due to the uncertainty associated with projecting future note principal

payments.

Future Principal Payments

Future contractual principal payments under the Company’s debt obligations as of December 31, 2016, were as

follows:

Year Principal Due

2017 to 2021 -$

Thereafter 144,828,635

Total 144,828,635$

While there are no scheduled principal payments prior to final maturity as reflected in the table above, if the

Revenue Interests exceed the specified quarterly interest amounts, principal payments will be made on the note

prior to its scheduled maturity.

Interest Expense

Interest expense on the consolidated statements of operations reflects the stated interest rate on the debt as well

as amounts recorded in interest expense over the term of the debt for debt issuance costs. Interest expense prior

to 2016 also includes changes in the fair value of liabilities for warrants issued in connection with debt as

described in Note 10. In 2014, the Company capitalized $0.3 million related to interest. No interest was

capitalized in 2015 and 2016.

7. Income Taxes

The components of income tax expense (benefit) for the respective years ended December 31, 2016, 2015 and

2014 were as follows:

19

2016 2015 2014

Current income taxes:

Federal -$ 473,555$ (5,443,928)$

State 34,970 7,725 (979,948)

Total 34,970 481,280 (6,423,876)

Deferred income taxes:

Federal -$ -$ (1,539,042)$

State - - (137,389)

Total - - (1,676,431)

Total income tax expense (benefit) 34,970$ 481,280$ (8,100,307)$

The following is a reconciliation between the U.S. federal statutory income tax rate and the effective income

tax rate on a year-to-date basis as of:

2 16 2015 2014

Federal statutory income tax rate 35.0 % 35.0 % 35.0 %

State income taxes, net of federal tax benefit 2.5 3.2 3.5

V luation allowance (31.2) (39.9) (11.9)

Nondeductible items (2.6) (3.3) (0.6)

Change in deferred tax rates (3.7) - -

Other (0.1) 3.8 0.1

Effective income tax rate (0.1) % (1.2) % 26.1 %

Deferred income taxes reflect the net tax effects of net operating loss and tax credit carryovers and temporary

differences between the carrying amounts of assets and liabilities for financial reporting purposes and the

amounts used for income tax purposes. Significant components of the Company’s deferred tax assets and

deferred tax liabilities were as follows as of December 31:

20

2016 2015

Deferred tax assets

Net operating losses (NOL) 13,872,929$ 14,264,207$

Inventory adjustments 3,630,090 3,666,527

Accrued rebates, discounts and returns 8,506,944 1,740,903

Other 4,797,750 2,978,569

Valuation allowance (29,967,949) (20,362,206)

Net deferred tax asset 839,764 2,288,000

Deferred tax liabilities

Property and equipment, primarily depreciation (757,621) (2,181,841)

Other (82,143) (106,159)

Total deferred tax liability (839,764) (2,288,000)

Net deferred tax asset (liability) -$ -$

The Company had an estimated Federal NOL carryforward of $36.8 million as of December 31, 2016, which

is subject to annual limitations and will expire in 2034 to 2036.

8. Commitments and Contingencies

Operating Leases and Other Commitments

The Company leases certain property and equipment for use in its operations. Rental expense under the

Company’s operating leases totaled approximately $0.3 million, $0.2 million and $0.2 million for the years

ended December 31, 2016, 2015 and 2014, respectively. Approximately $0.1 million was included in other

long-term liabilities on the balance sheets as deferred rent at December 31, 2016 and 2015, respectively. The

following table represents the Company rental payments due under its operating leases and other commitments

for certain services as of December 31, 2016:

Operating

L ases

Other

Commitments Total

2017 413,949$ 571,220$ 985,169$

2018 476,644 603,960 1,080,604

2019 424,168 638,901 1,063,069

2020 372,047 312,100 684,147

2021 - - -

1,686,808$ 2,126,181$ 3,812,989$

21

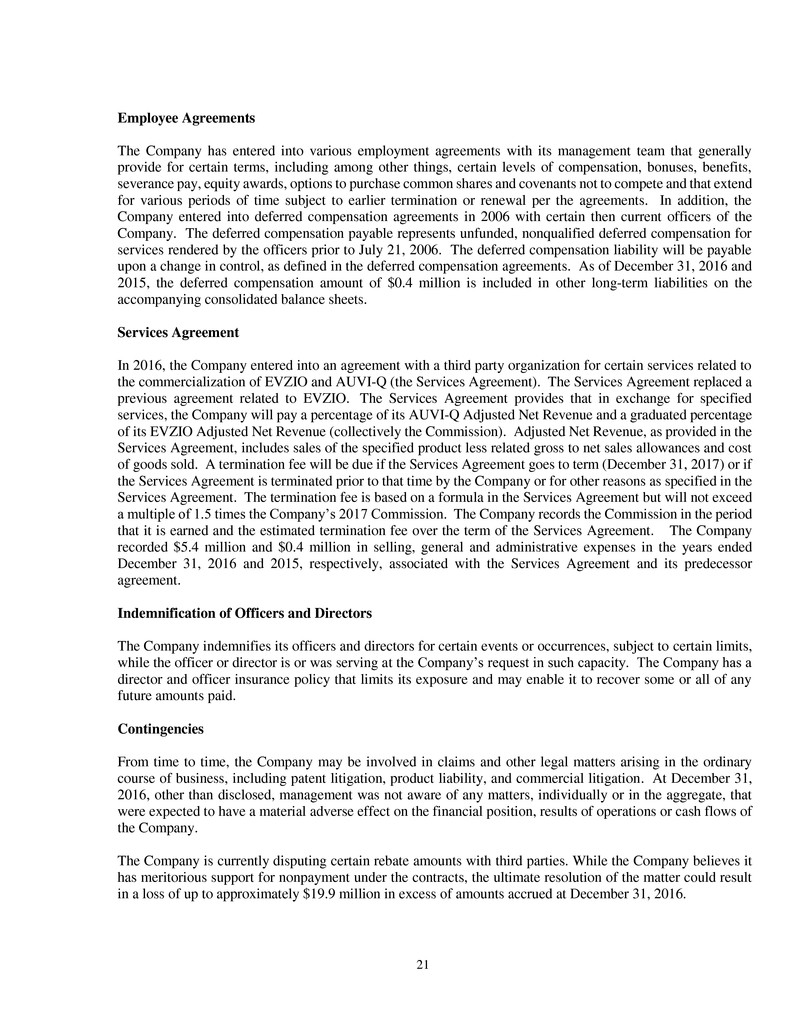

Employee Agreements

The Company has entered into various employment agreements with its management team that generally

provide for certain terms, including among other things, certain levels of compensation, bonuses, benefits,

severance pay, equity awards, options to purchase common shares and covenants not to compete and that extend

for various periods of time subject to earlier termination or renewal per the agreements. In addition, the

Company entered into deferred compensation agreements in 2006 with certain then current officers of the

Company. The deferred compensation payable represents unfunded, nonqualified deferred compensation for

services rendered by the officers prior to July 21, 2006. The deferred compensation liability will be payable

upon a change in control, as defined in the deferred compensation agreements. As of December 31, 2016 and

2015, the deferred compensation amount of $0.4 million is included in other long-term liabilities on the

accompanying consolidated balance sheets.

Services Agreement

In 2016, the Company entered into an agreement with a third party organization for certain services related to

the commercialization of EVZIO and AUVI-Q (the Services Agreement). The Services Agreement replaced a

previous agreement related to EVZIO. The Services Agreement provides that in exchange for specified

services, the Company will pay a percentage of its AUVI-Q Adjusted Net Revenue and a graduated percentage

of its EVZIO Adjusted Net Revenue (collectively the Commission). Adjusted Net Revenue, as provided in the

Services Agreement, includes sales of the specified product less related gross to net sales allowances and cost

of goods sold. A termination fee will be due if the Services Agreement goes to term (December 31, 2017) or if

the Services Agreement is terminated prior to that time by the Company or for other reasons as specified in the

Services Agreement. The termination fee is based on a formula in the Services Agreement but will not exceed

a multiple of 1.5 times the Company’s 2017 Commission. The Company records the Commission in the period

that it is earned and the estimated termination fee over the term of the Services Agreement. The Company

recorded $5.4 million and $0.4 million in selling, general and administrative expenses in the years ended

December 31, 2016 and 2015, respectively, associated with the Services Agreement and its predecessor

agreement.

Indemnification of Officers and Directors

The Company indemnifies its officers and directors for certain events or occurrences, subject to certain limits,

while the officer or director is or was serving at the Company’s request in such capacity. The Company has a

director and officer insurance policy that limits its exposure and may enable it to recover some or all of any

future amounts paid.

Contingencies

From time to time, the Company may be involved in claims and other legal matters arising in the ordinary

course of business, including patent litigation, product liability, and commercial litigation. At December 31,

2016, other than disclosed, management was not aware of any matters, individually or in the aggregate, that

were expected to have a material adverse effect on the financial position, results of operations or cash flows of

the Company.

The Company is currently disputing certain rebate amounts with third parties. While the Company believes it

has meritorious support for nonpayment under the contracts, the ultimate resolution of the matter could result

in a loss of up to approximately $19.9 million in excess of amounts accrued at December 31, 2016.

22

9. Defined Contribution Retirement Plan

The Company has a 401(k) defined contribution plan which permits eligible employees to voluntarily contribute

a portion of their compensation up to limits established by the Internal Revenue Service. The plan permits the

Company to make discretionary contributions; however, the Company has made no employer contributions to

the plan to date.

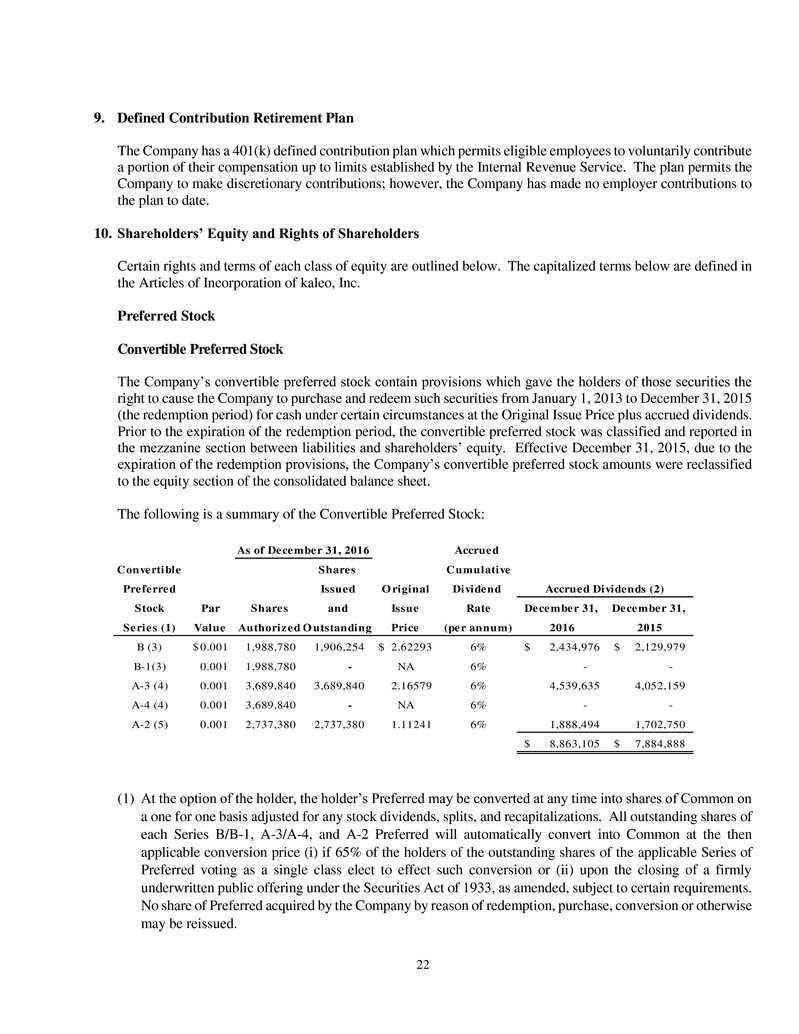

10. Shareholders’ Equity and Rights of Shareholders

Certain rights and terms of each class of equity are outlined below. The capitalized terms below are defined in

the Articles of Incorporation of kaleo, Inc.

Preferred Stock

Convertible Preferred Stock

The Company’s convertible preferred stock contain provisions which gave the holders of those securities the

right to cause the Company to purchase and redeem such securities from January 1, 2013 to December 31, 2015

(the redemption period) for cash under certain circumstances at the Original Issue Price plus accrued dividends.

Prior to the expiration of the redemption period, the convertible preferred stock was classified and reported in

the mezzanine section between liabilities and shareholders’ equity. Effective December 31, 2015, due to the

expiration of the redemption provisions, the Company’s convertible preferred stock amounts were reclassified

to the equity section of the consolidated balance sheet.

The following is a summary of the Convertible Preferred Stock:

Accrued

onvertible Shares Cumulative

Preferred Issued O riginal Dividend

Stock Par Shares and Issue Rate December 31, December 31,

S ies (1) Value Authorized O utstanding Price (per annum) 2016 2015

B (3) 0.001$ 1,988,780 1,906,254 2.62293$ 6% 2,434,976$ 2,129,979$

B-1(3) 0.001 1,988,780 - NA 6% - -

A-3 (4) 0.001 3,689,840 3,689,840 2.16579 6% 4,539,635 4,052,159

A-4 (4) 0.001 3,689,840 - NA 6% - -

A-2 (5) 0.001 2,737,380 2,737,380 1.11241 6% 1,888,494 1,702,750

8,863,105$ 7,884,888$

Accrued Dividends (2)

As of December 31, 2016

(1) At the option of the holder, the holder’s Preferred may be converted at any time into shares of Common on

a one for one basis adjusted for any stock dividends, splits, and recapitalizations. All outstanding shares of

each Series B/B-1, A-3/A-4, and A-2 Preferred will automatically convert into Common at the then

applicable conversion price (i) if 65% of the holders of the outstanding shares of the applicable Series of

Preferred voting as a single class elect to effect such conversion or (ii) upon the closing of a firmly

underwritten public offering under the Securities Act of 1933, as amended, subject to certain requirements.

No share of Preferred acquired by the Company by reason of redemption, purchase, conversion or otherwise

may be reissued.

23

(2) The accrued dividends reflected in the table above have been recorded in shareholders’ equity as charges

to retained earnings, but not paid. The amount reported on the consolidated balance sheet for each of these

series of Preferred represents the proceeds from the original issuance of the applicable series of Preferred

plus the amount of accrued but unpaid cumulative dividends since such issuance. If the Company chooses

to pay dividends, such dividends are to be paid in order of preference to the following series of capital:

B/B-1 Preferred Stock, A-3/A-4 Preferred Stock; A-2 Preferred Stock; common stock.

(3) Subject to certain exceptions, if the Company issues or sells additional shares of Common or Common

deemed to be issued for an effective price less than the then effective Series B Preferred Conversion Price,

the then existing Series B Preferred Conversion Price shall be reduced based on a weighted average formula.

In the event any holder of shares of Series B Preferred does not participate in a financing triggering a

reduction in the Series B Preferred Conversion Price, then each share of Series B Preferred shall

automatically be converted into one share of Series B-1 Preferred and the Series B-1 Preferred Conversion

Price shall not be reduced. No Series B-1 Preferred Stock has been issued.

(4) Subject to certain exceptions, if the Company issues or sells additional shares of Common or Common

deemed to be issued for an effective price less than the then effective Series A-3 Preferred Conversion

Price, the then existing Series A-3 Preferred Conversion Price shall be reduced based on a weighted average

formula. If any holder of shares of Series A-3 Preferred does not participate in a financing triggering a

reduction in the Series A-3 Preferred Conversion Price, then each share of Series A-3 Preferred held by

such holder shall automatically be converted into a share of Series A-4 Preferred and the Series A-4

Preferred Conversion Price shall not be reduced. No Series A-4 Preferred Stock has been issued.

(5) The Series A-2 Preferred has no price based anti-dilution rights.

The changes in the balance for each series of outstanding convertible preferred stock are presented in the chart

below.

Series B

Preferred

Stock

Series A-3

Preferred

Stock

Series A-2

Preferred

Stock

Total

Convertible

Preferred

Stock

Ba nc t D c mber 31, 2013 $ 6,521,622 $ 11,071,312 $ 4,377,273 $ 21,970,207

Divi ends accrued 304,164 486,143 185,236 975,543

Balance at December 31, 2014 6,825,786 11,557,455 4,562,509 22,945,750

Dividends accrued 304,164 486,144 185,236 975,544

Balance at December 31, 2015 7,129,950 12,043,599 4,747,745 23,921,294

Dividends accrued 304,997 487,476 185,744 978,217

Balance at December 31, 2016 $ 7,434,947 $ 12,531,075 $ 4,933,489 $ 24,899,511

Co v rtibl Pr ferred Stock

Series A-1 Preferred Stock

As of December 31, 2016 and 2015, the Company had 462,000 shares of Series A-1 Preferred Stock authorized,

issued and outstanding which has a par value of $0.001 and an aggregate liquidation preference of $607,502.

The Series A-1 Preferred Stock is not entitled to dividends under any circumstances. In addition, so long as

any shares of Series B/B-1 Preferred, Series A-3/A-4 Preferred, or Series A-2 Preferred are outstanding, the

Company shall not make any distribution on or redeem the Series A-1 Preferred Stock, except in certain limited

circumstances as described in the Articles of Incorporation. Shares of Series A-1 Preferred are not convertible

into any other shares of stock. The Company shall have the right, the Series A-1 Call Right, to purchase all of

the Series A-1 Preferred Shares in one installment for a per share purchase price equal to two times the Series

24

A-1 Original Issue Price of $0.65747 per share. No shares of Series A-1 Preferred acquired by the Company

shall be reissued.

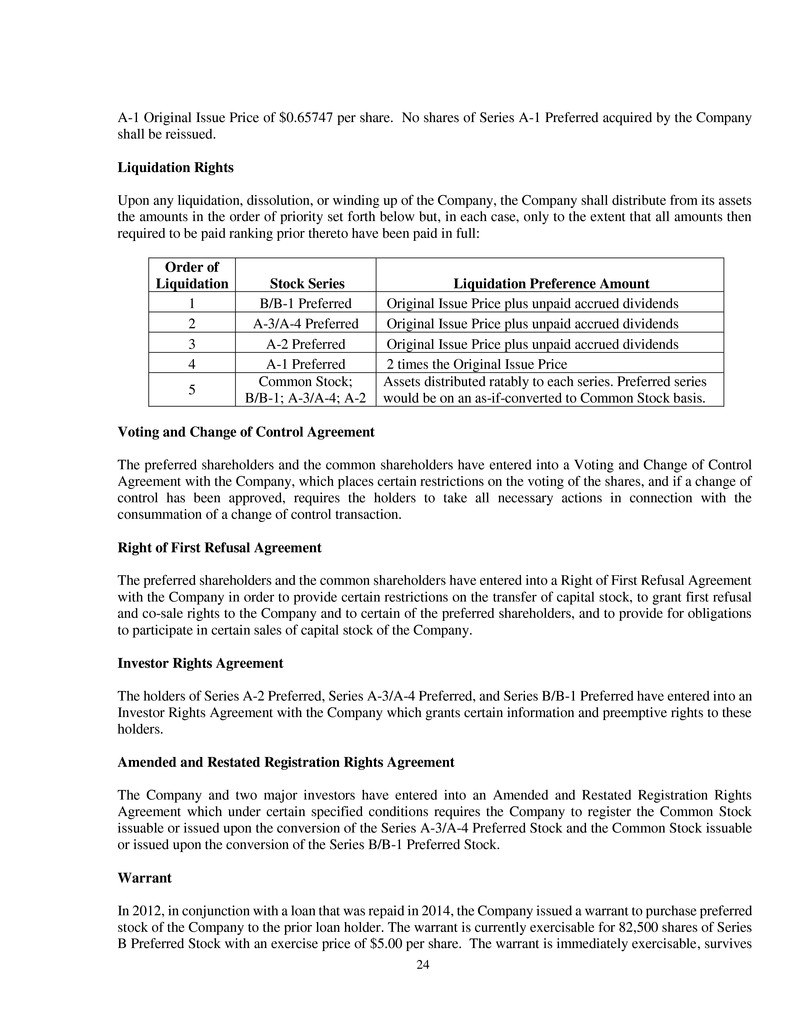

Liquidation Rights

Upon any liquidation, dissolution, or winding up of the Company, the Company shall distribute from its assets

the amounts in the order of priority set forth below but, in each case, only to the extent that all amounts then

required to be paid ranking prior thereto have been paid in full:

Order of

Liquidation Stock Series Liquidation Preference Amount

1 B/B-1 Preferred Original Issue Price plus unpaid accrued dividends

2 A-3/A-4 Preferred Original Issue Price plus unpaid accrued dividends

3 A-2 Preferred Original Issue Price plus unpaid accrued dividends

4 A-1 Preferred 2 times the Original Issue Price

5

Common Stock;

B/B-1; A-3/A-4; A-2

Assets distributed ratably to each series. Preferred series

would be on an as-if-converted to Common Stock basis.

Voting and Change of Control Agreement

The preferred shareholders and the common shareholders have entered into a Voting and Change of Control

Agreement with the Company, which places certain restrictions on the voting of the shares, and if a change of

control has been approved, requires the holders to take all necessary actions in connection with the

consummation of a change of control transaction.

Right of First Refusal Agreement

The preferred shareholders and the common shareholders have entered into a Right of First Refusal Agreement

with the Company in order to provide certain restrictions on the transfer of capital stock, to grant first refusal

and co-sale rights to the Company and to certain of the preferred shareholders, and to provide for obligations

to participate in certain sales of capital stock of the Company.

Investor Rights Agreement

The holders of Series A-2 Preferred, Series A-3/A-4 Preferred, and Series B/B-1 Preferred have entered into an

Investor Rights Agreement with the Company which grants certain information and preemptive rights to these

holders.

Amended and Restated Registration Rights Agreement

The Company and two major investors have entered into an Amended and Restated Registration Rights

Agreement which under certain specified conditions requires the Company to register the Common Stock

issuable or issued upon the conversion of the Series A-3/A-4 Preferred Stock and the Common Stock issuable

or issued upon the conversion of the Series B/B-1 Preferred Stock.

Warrant

In 2012, in conjunction with a loan that was repaid in 2014, the Company issued a warrant to purchase preferred

stock of the Company to the prior loan holder. The warrant is currently exercisable for 82,500 shares of Series

B Preferred Stock with an exercise price of $5.00 per share. The warrant is immediately exercisable, survives

25

the payoff of the loan and expires at the earlier of (i) ten years after the date of issuance (expiration in May

2022), or (ii) 5 years after the Company’s initial public offering, if applicable. If the Company is acquired, the

warrant will terminate upon the acquisition subject to certain conditions and levels of cash consideration. Under

certain conditions, if the Company has a future round of equity financing, the warrant could be modified to

represent the right to purchase certain shares of the future preferred stock class.

Prior to December 31, 2015, the underlying preferred stock associated with the warrant was puttable at the

option of the holder which resulted in changes in the fair value of the warrant being recorded as an increase or

decrease in interest expense. The Company recognized a decrease in interest expense of approximately $0.1

million and an increase in interest expense of approximately $0.1 million due to a computed change in the fair

value of the warrants during the years ended December 31, 2015 and 2014, respectively.

On December 31, 2015, the fair value of the warrant of $0.6 million was reclassified to equity as the redemption

feature on the underlying preferred stock expired.

Stock Plans

The Company has a stock incentive plan under which stock options may be granted to purchase a specified

number of shares of Common Stock. Option awards are granted with an exercise price equal to the Company’s

estimate of fair value of its Common Stock at the date of grant, based on a valuation performed by an

independent third party firm. Options vest over various periods of time and generally may be exercised within

ten years of the date of grant. Prior to 2009, the Company also issued warrants to purchase shares of Common

Stock under the plan.

Under the terms of the Company’s stock incentive plan, as amended, the maximum aggregate number of

Common Stock shares that may be granted under the plan is 4,306,000 shares. At December 31, 2016, there

were 560,361 shares available for future issuance of Common Stock under the plan.

A summary of outstanding options as follows:

Weighted Average

Weighted Average Contractual Term

Options Exercise Price (Years)

Outstand - December 31, 2015 1,802,643 3.03$

Grante 455,030 6.28

Exercised (5,159) 0.51

F rfeited (119,653) 4.89

Outstanding - December 31, 2016 (1) 2,132,861 3.63 6.0

Exercisable - December 31, 2016 1,451,097 2.57$ 4.5

(1) The outstanding equity awards have a range of exercise prices of $0.37 to $6.28 per share.

The weighted average grant date fair value of options issued during the years ended December 31, 2016, 2015

and 2014 was $3.52, $2.93 and $2.82, respectively. The total intrinsic value of stock options exercised during

the years ended December 31, 2016, 2015 and 2014 was less than $0.1 million, $0.2 million and $1.0 million,

respectively. As of December 31, 2016, the total intrinsic value of outstanding equity awards is $5.7 million

and the total intrinsic value of the exercisable equity awards is $5.4 million.

26

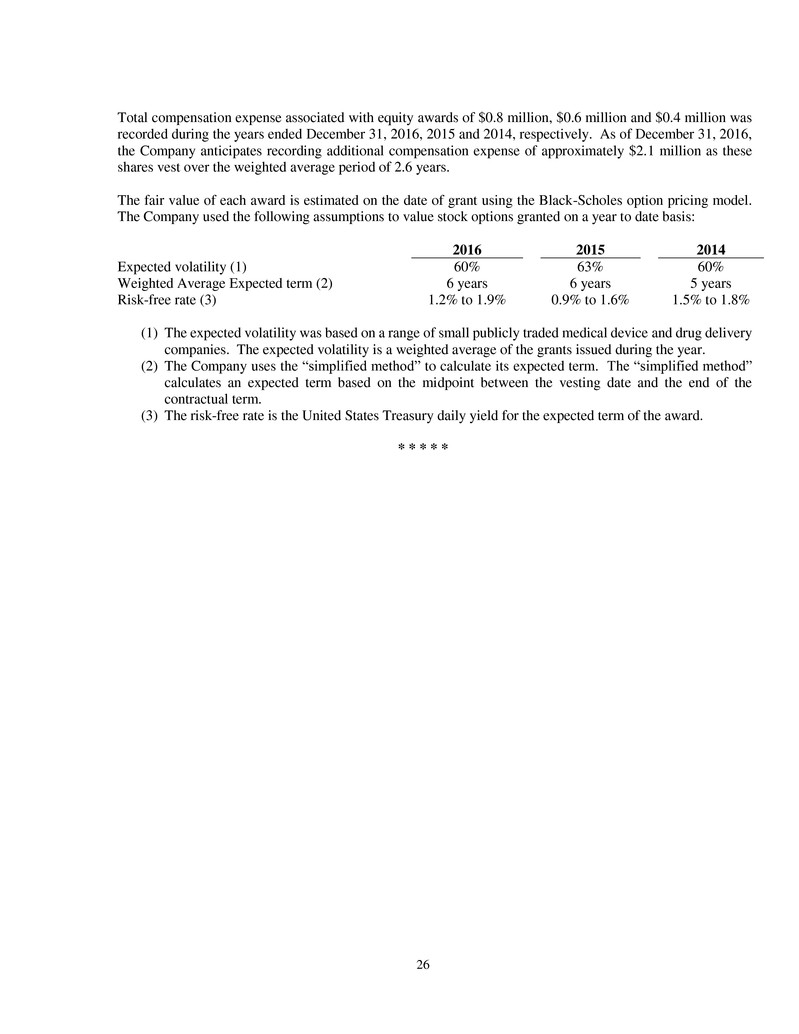

Total compensation expense associated with equity awards of $0.8 million, $0.6 million and $0.4 million was

recorded during the years ended December 31, 2016, 2015 and 2014, respectively. As of December 31, 2016,

the Company anticipates recording additional compensation expense of approximately $2.1 million as these

shares vest over the weighted average period of 2.6 years.

The fair value of each award is estimated on the date of grant using the Black-Scholes option pricing model.

The Company used the following assumptions to value stock options granted on a year to date basis:

2016 2015 2014

Expected volatility (1) 60% 63% 60%

Weighted Average Expected term (2) 6 years 6 years 5 years

Risk-free rate (3) 1.2% to 1.9% 0.9% to 1.6% 1.5% to 1.8%

(1) The expected volatility was based on a range of small publicly traded medical device and drug delivery

companies. The expected volatility is a weighted average of the grants issued during the year.

(2) The Company uses the “simplified method” to calculate its expected term. The “simplified method”

calculates an expected term based on the midpoint between the vesting date and the end of the

contractual term.

(3) The risk-free rate is the United States Treasury daily yield for the expected term of the award.

* * * * *