Attached files

| file | filename |

|---|---|

| 8-K - FORM 8-K - SYNTHESIS ENERGY SYSTEMS INC | f8k_013117.htm |

EXHIBIT 99.1

Synthesis Energy Systems, Inc. Clean - Economic - Sustainable Global Energy January 31, 2017 Growth With Blue Skies

SES Forward - looking Statements This presentation includes "forward - looking statements" within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . All statements other than statements of historical fact are forward - looking statements . Forward - looking statements are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected . Among those risks, trends and uncertainties are the ability of our project with Yima to produce earnings and pay dividends ; our ability to develop and expand business of the TSEC joint venture in the joint venture territory ; our ability to successfully partner our technology business ; our ability to develop our power business unit and marketing arrangement with GE and our other business verticals, including DRI steel, through our marketing arrangement with Midrex Technologies, and renewables ; our ability to successfully develop the SES licensing business ; the ability of the ZZ Joint Venture to retire existing facilities and equipment and build another SGT facility ; the ability of Batchfire management to successfully grow and develop Callide operations ; the economic conditions of countries where we are operating ; events or circumstances which result in an impairment of our assets ; our ability to reduce operating costs ; our ability to make distributions and repatriate earnings from our Chinese operations ; our ability to successfully commercialize our technology at a larger scale and higher pressures ; commodity prices, including in particular natural gas, crude oil, methanol and power, the availability and terms of financing ; our ability to obtain the necessary approvals and permits for future projects, our ability to raise additional capital, if any, our ability to estimate the sufficiency of existing capital resources ; the sufficiency of internal controls and procedures ; and our results of operations in countries outside of the U . S . , where we are continuing to pursue and develop projects . Although SES believes that in making such forward - looking statements our expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected by us . SES cannot assure you that the assumptions upon which these statements are based will prove to have been correct . 2

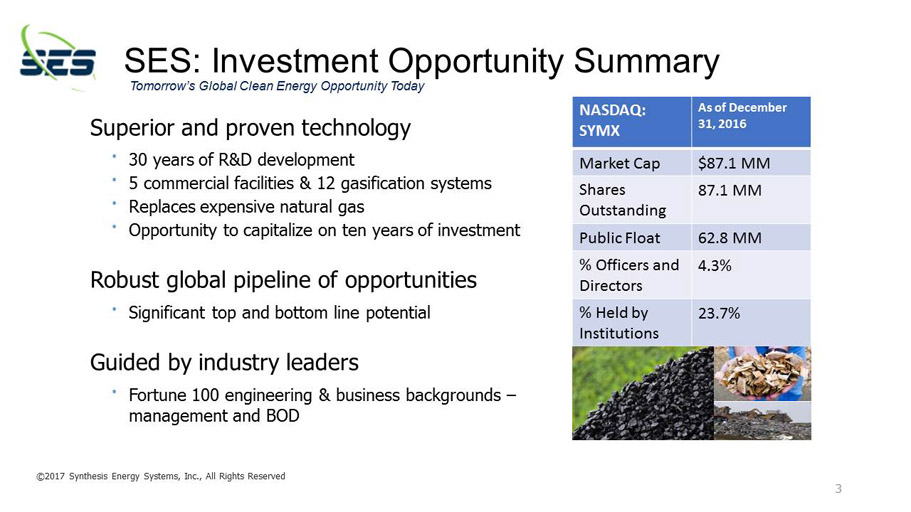

SES: Investment Opportunity Summary Superior and proven technology • 30 years of R&D development • 5 commercial facilities & 12 gasification systems • Replaces expensive natural gas • Opportunity to capitalize on ten years of investment Robust global pipeline of opportunities • Significant top and bottom line potential Guided by industry leaders • Fortune 100 engineering & business backgrounds – management and BOD ©2017 Synthesis Energy Systems, Inc., All Rights Reserved NASDAQ: SYMX As of December 31, 2016 Market Cap $87.1 MM Shares Outstanding 87.1 MM Public Float 62.8 MM % Officers and Directors 4.3% % Held by Institutions 23.7% Tomorrow’s Global Clean Energy Opportunity Today 3

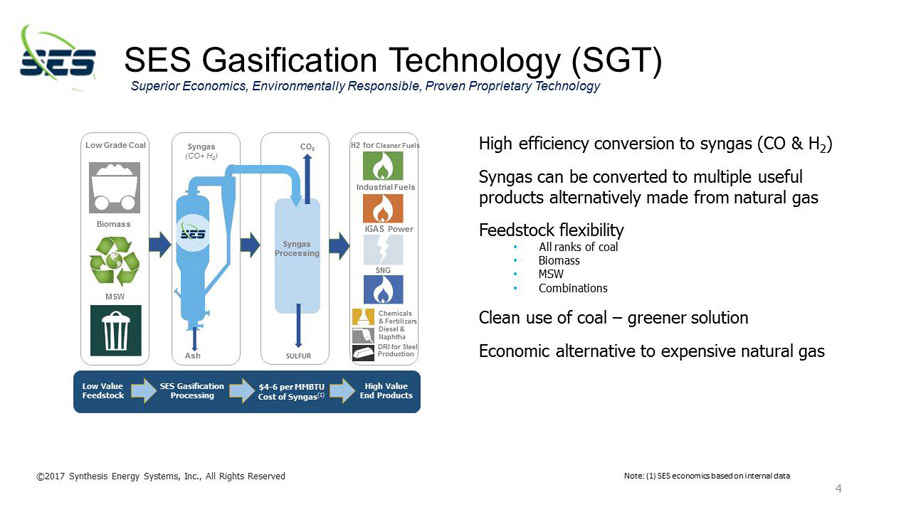

CO 2 Low Grade Coal Biomass Syngas Processing Syngas (CO+ H 2 ) SULFUR Ash iGAS Power Low Value Feedstock SES Gasification Processing $4 - 6 per MMBTU Cost of Syngas (1) High Value End Products MSW Industrial Fuels Chemicals & Fertilizers SNG DRI for Steel Production Diesel & Naphtha 4 H2 for Cleaner Fuels SES Gasification Technology (SGT) High efficiency conversion to syngas (CO & H 2 ) Syngas can be converted to multiple useful products alternatively made from natural gas Feedstock flexibility • All ranks of coal • Biomass • MSW • Combinations Clean use of coal – greener solution Economic alternative to expensive natural gas ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Superior Economics, Environmentally Responsible, Proven Proprietary Technology Note: (1) SES economics based on internal data

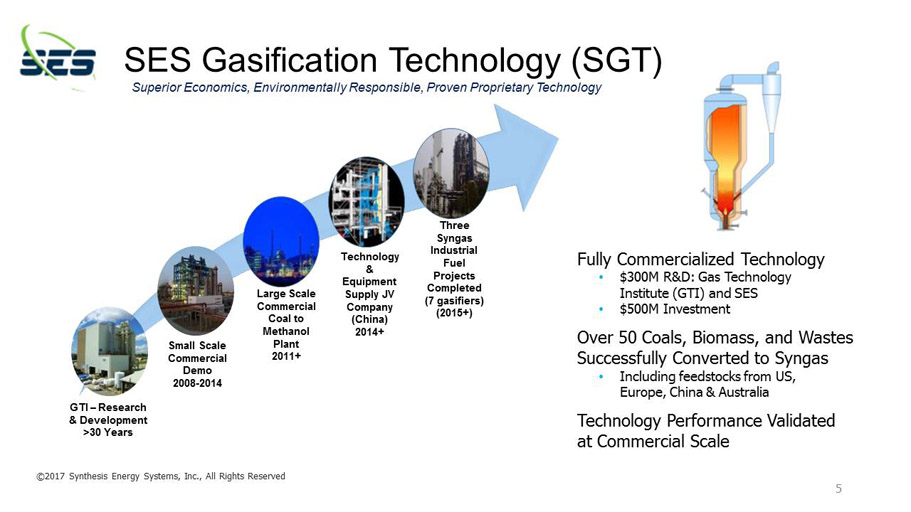

Fully Commercialized Technology • $300M R&D: Gas Technology Institute (GTI) and SES • $500M Investment Over 50 Coals, Biomass, and Wastes Successfully Converted to Syngas • Including feedstocks from US, Europe, China & Australia Technology Performance Validated at Commercial Scale 5 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved GTI – Research & Development >30 Years Small Scale Commercial Demo 2008 - 2014 Large Scale Commercial Coal to Methanol Plant 2011+ Technology & Equipment Supply JV Company (China) 2014+ Three Syngas Industrial Fuel Projects Completed (7 gasifiers) (2015+) SES Gasification Technology (SGT) Superior Economics, Environmentally Responsible, Proven Proprietary Technology

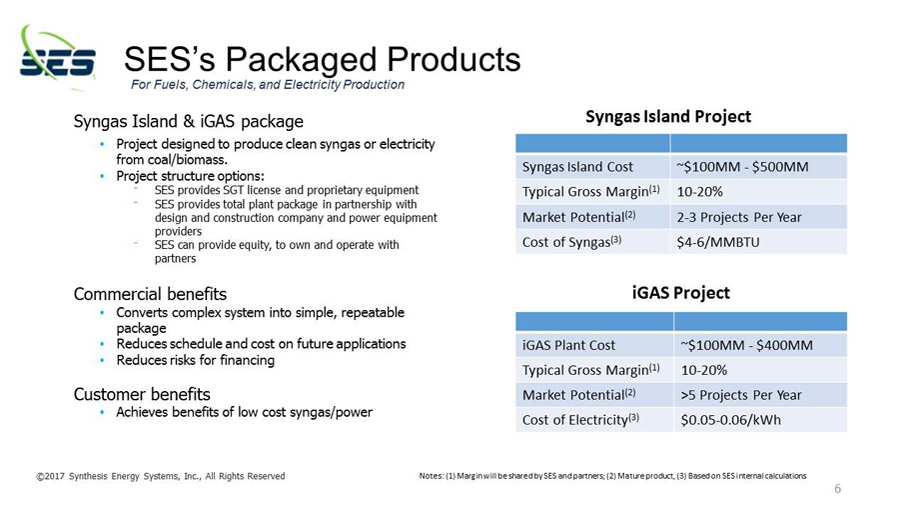

SES’s Packaged Products Syngas Island & iGAS package • Project designed to produce clean syngas or electricity from coal/biomass. • Project structure options: ⁻ SES provides SGT license and proprietary equipment ⁻ SES provides total plant package in partnership with design and construction company and power equipment providers ⁻ SES can provide equity, to own and operate with partners Commercial benefits • Converts complex system into simple, repeatable package • Reduces schedule and cost on future applications • Reduces risks for financing Customer benefits • Achieves benefits of low cost syngas/power For Fuels, Chemicals, and Electricity Production Syngas Island Cost ~$100MM - $500MM Typical Gross Margin (1) 10 - 20% Market Potential (2) 2 - 3 Projects Per Year Cost of Syngas (3) $4 - 6/MMBTU 6 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Notes: (1) Margin will be shared by SES and partners; (2) Mature product, (3) Based on SES internal calculations iGAS Plant Cost ~$100MM - $400MM Typical Gross Margin (1) 10 - 20% Market Potential (2) >5 Projects Per Year Cost of Electricity (3) $0.05 - 0.06/kWh Syngas Island Project iGAS Project

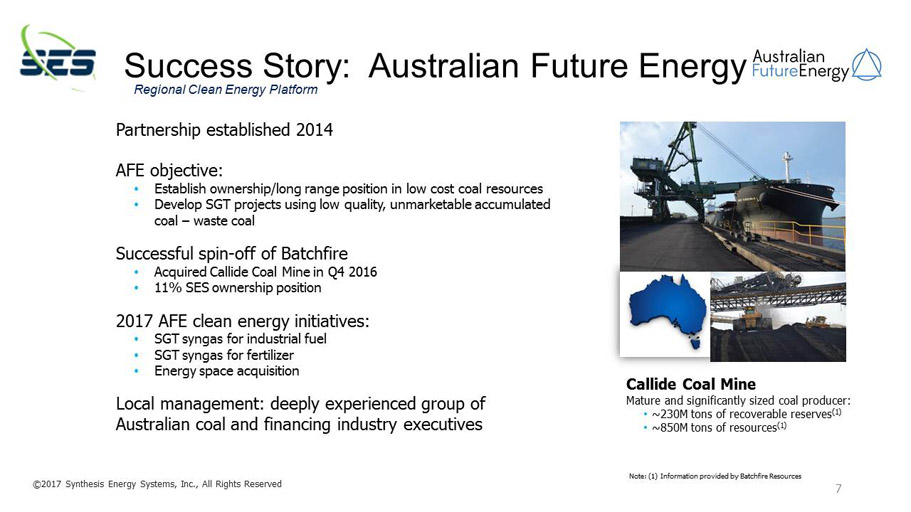

Success Story: Australian Future Energy Partnership established 2014 AFE objective: • Establish ownership/long range position in low cost coal resources • Develop SGT projects using low quality, unmarketable accumulated coal – waste coal Successful spin - off of Batchfire • Acquired Callide Coal Mine in Q4 2016 • 11% SES ownership position 2017 AFE clean energy initiatives: • SGT syngas for industrial fuel • SGT syngas for fertilizer • Energy space acquisition Local management: deeply experienced group of Australian coal and financing industry executives Note: (1) Information provided by Batchfire Resources Callide Coal Mine Mature and significantly sized coal producer: • ~230M tons of recoverable reserves (1) • ~850M tons of resources (1) 7 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Regional Clean Energy Platform

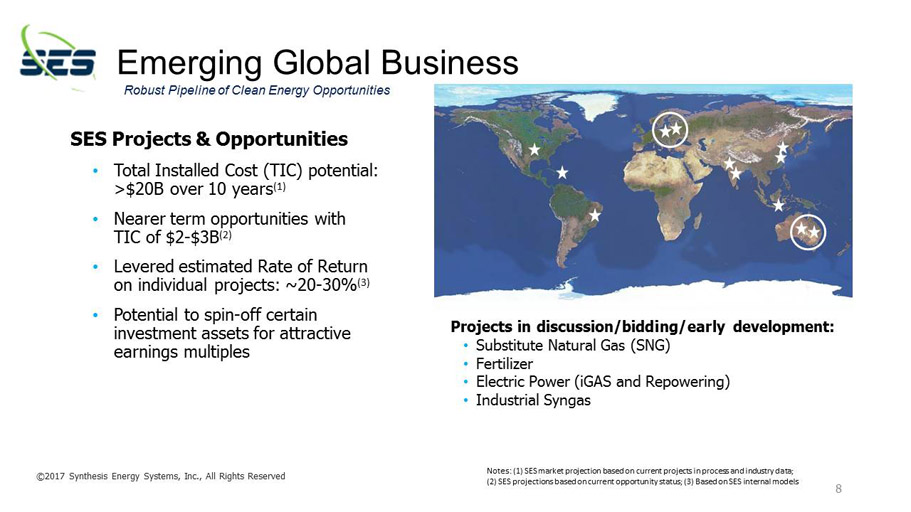

Emerging Global Business Projects in discussion/bidding/early development: • Substitute Natural Gas (SNG) • Fertilizer • Electric Power ( iGAS and Repowering) • Industrial Syngas SES Projects & Opportunities • Total Installed Cost (TIC) potential: >$20B over 10 years (1) • Nearer term opportunities with TIC of $2 - $ 3B (2) • Levered estimated Rate of Return on individual projects: ~20 - 30 % (3) • Potential to spin - off certain investment assets for attractive earnings multiples 8 ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Robust Pipeline of Clean Energy Opportunities Notes: (1) SES market projection based on current projects in process and industry data; ( 2 ) SES projections based on current opportunity status; (3) Based on SES internal models

Why Synthesis Energy Systems Now 9 • Superior and proven technology » 5 Projects, with 12 SGT Systems; $800M invested over 40 years » Fully commercialized clean energy solution • Positioned to move outside of China » SES’s business development strategy has shifted into more commercially viable markets: South America, Caribbean, Eastern Europe, India and Africa • SES near - term performance drivers » $2 - 3B (1) TIC nearer term opportunities outside of China, with topline and bottom line potential for SES » Pipeline projects represent significant opportunity in multiple countries for SES » Additional emerging opportunities in packaged products and regional platforms • Guided by industry leaders » Fortune 100 engineering & business backgrounds – management and BOD ©2017 Synthesis Energy Systems, Inc., All Rights Reserved Superior Economics, Environmentally Responsible, Proven Technology Note: (1 ) SES projections based on current opportunity status

Nasdaq: SYMX synthesisenergy.com Growth With Blue Skies