Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Santander Consumer USA Holdings Inc. | exhibit991december3120161.htm |

| 8-K - 8-K - Santander Consumer USA Holdings Inc. | scusa8-k12x31x16earningsfi.htm |

01.25.2017

SANTANDER CONSUMER USA HOLDINGS INC.

Fourth Quarter and Full Year 2016

2IMPORTANT INFORMATION

Forward-Looking Statements

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Any statements about our

expectations, beliefs, plans, predictions, forecasts, objectives, assumptions, or future events or performance are not historical facts and may be forward-looking.

These statements are often, but not always, made through the use of words or phrases such as anticipates, believes, can, could, may, predicts, potential, should,

will, estimates, plans, projects, continuing, ongoing, expects, intends, and similar words or phrases. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, these statements are not guarantees of future performance and involve risks and uncertainties that are subject to

change based on various important factors, some of which are beyond our control. For additional discussion of these risks, refer to the section entitled Risk Factors

and elsewhere in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q filed by us with the U.S. Securities and Exchange Commission (SEC).

Among the factors that could cause the forward-looking statements in this presentation and/or our financial performance to differ materially from that suggested

by the forward-looking statements are (a) the inherent limitations in internal controls over financial reporting; (b) our ability to remediate any material weaknesses

in internal controls over financial reporting completely and in a timely manner; (c) continually changing federal, state, and local laws and regulations could

materially adversely affect our business; (d) adverse economic conditions in the United States and worldwide may negatively impact our results; (e) our business

could suffer if our access to funding is reduced; (f) significant risks we face implementing our growth strategy, some of which are outside our control; (g)

unexpected costs and delays in connection with exiting our personal lending business; (h) our agreement with Fiat Chrysler Automobiles US LLC may not result in

currently anticipated levels of growth and is subject to certain performance conditions that could result in termination of the agreement; (i) our business could

suffer if we are unsuccessful in developing and maintaining relationships with automobile dealerships; (j) our financial condition, liquidity, and results of operations

depend on the credit performance of our loans; (k) loss of our key management or other personnel, or an inability to attract such management and personnel; (l)

certain regulations, including but not limited to oversight by the Office of the Comptroller of the Currency, the Consumer Financial Protection Bureau, the

European Central Bank, and the Federal Reserve, whose oversight and regulation may limit certain of our activities, including the timing and amount of dividends

and other limitations on our business; and (m) future changes in our relationship with Banco Santander that could adversely affect our operations. If one or more

of the factors affecting our forward-looking information and statements proves incorrect, our actual results, performance or achievements could differ materially

from those expressed in, or implied by, forward-looking information and statements. Therefore, we caution the reader not to place undue reliance on any forward-

looking information or statements. The effect of these factors is difficult to predict. Factors other than these also could adversely affect our results, and the reader

should not consider these factors to be a complete set of all potential risks or uncertainties. New factors emerge from time to time, and management cannot

assess the impact of any such factor on our business or the extent to which any factor, or combination of factors, may cause results to differ materially from those

contained in any forward-looking statement. Any forward-looking statements only speak as of the date of this document, and we undertake no obligation to

update any forward-looking information or statements, whether written or oral, to reflect any change, except as required by law. All forward-looking statements

attributable to us are expressly qualified by these cautionary statements.

3

» Net income for the year of $766 million, or $2.13 per diluted common share, down 7% year-over-year

» Interest on individually acquired retail installment contracts of $4.6 billion, up 3%

» Net finance and other interest income of $4.7 billion, flat

» Expense ratio of 2.2%, up 10 basis points

» Return on average assets of 2.0%, Return on average equity of 15.8%

» Total auto originations of $21.9 billion, down 20%

» Average managed assets of $52.7 billion, up 8%

» Retail installment contract ("RIC") net charge-off ratio of 7.9%, up 150 basis points1

» Average FICO of retained originations 598, up 14 points

» Issued $8.0 billion in securitizations

» Originated more than $170 million through our online, direct-to-consumer platform, Roadloans.com

» Real-time call monitoring rolled out for all inbound/outbound call center lines in 2016

FY 2016 HIGHLIGHTS

Setting SC up for long-term success by delivering value to shareholders while focusing on disciplined

underwriting, compliance and being simple, personal and fair.

1 Versus adjusted 2015 ratio of 6.4% versus GAAP ratio of 6.7%, details found in Table 8 of the press release issued January 25, 2017, reconciliation of non-GAAP measures

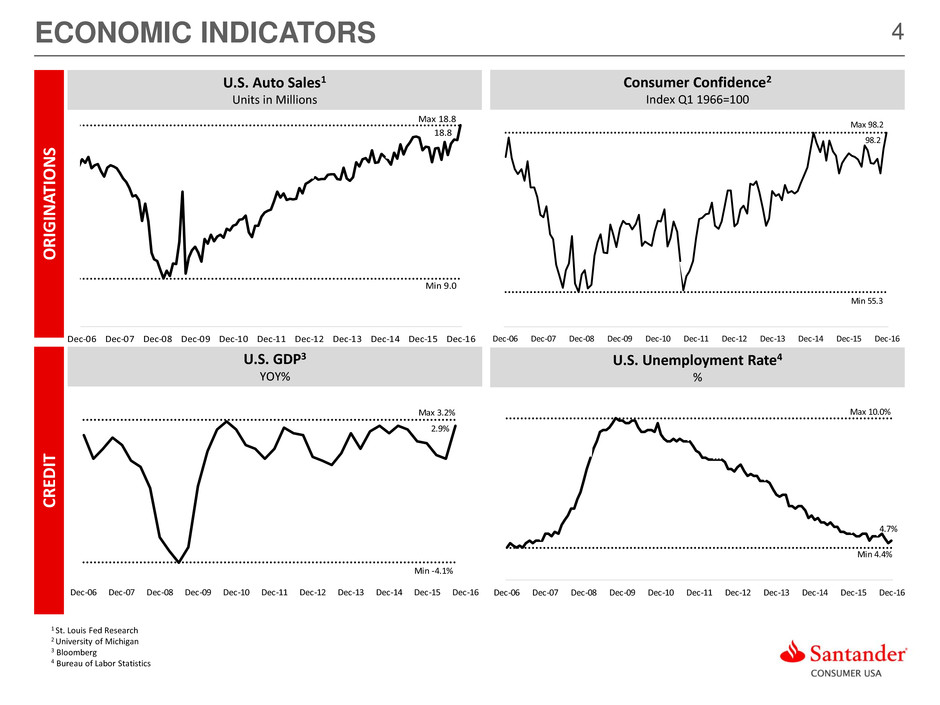

4ECONOMIC INDICATORS

U.S. Auto Sales1

Units in Millions

1 St. Louis Fed Research

2 University of Michigan

3 Bloomberg

4 Bureau of Labor Statistics

Consumer Confidence2

Index Q1 1966=100

U.S. GDP3

YOY%

U.S. Unemployment Rate4

%

OR

IGIN

A

TI

O

N

S

CRE

D

IT

98.2

Max 98.2

Min 55.3

Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

4.7%

Max 10.0%

Min 4.4%

Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

2.9%

Max 3.2%

Min -4.1%

Dec-06 Dec-07 Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

18.8

Max 18.8

Min 9.0

Dec-06 Dec-07 Dec-08 - 9 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16

5

8.4%

0.0

2.0

4.0

6.0

8.0

10.0

12.0

14.0

Nov-06 Nov-08 Nov-10 Nov-12 Nov-14 Nov-16

43.0%

48.1%

0

Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16 Dec-16

SC Auction Only Recovery Rate SC Auction Plus Recovery Rate

4.8%

0.0

1.0

2.0

3.0

4.0

5.0

6.0

Nov-06 Nov-08 Nov-10 Nov-12 Nov-14 Nov-16

85

90

95

100

105

110

115

120

125

110

115

120

125

130

Dec-12 Jun-13 Dec-13 Jun-14 Dec-14 Jun-15 Dec-15 Jun-16 Dec-16

Manheim (Left Axis) NADA (Right Axis)

AUTO INDUSTRY ANALYSIS

Used Vehicle Indices1

Manheim: Seasonally Adjusted NADA: Not Seasonally Adjusted

1 Manheim, Inc.; Indexed to a basis of 100 at 1995 levels; National Automotive Dealers Association

2 Auction Only - includes all auto-related recoveries including inorganic/purchased receivables from auction lanes only

2 Auction Plus – GAAP Recoveries which also includes insurance proceeds, bankruptcy/deficiency sales, and timing impacts – Q4 2016

3 Standard & Poor’s Rating Services (ABS Auto Trust Data – two-month lag on data, as of December 31, 2016)

SC Recovery Rates2

Industry Net Loss Rates3

Nonprime

Industry 60+ Day Delinquency Rates3

Nonprime

SE

V

ER

IT

Y

CRE

D

IT

6

VEHICLE FINANCE

LEVERAGING TECHNOLOGY IS INTEGRAL TO THE FOUR PILLARS OF OUR FOCUSED BUSINESS MODEL

FOCUSED BUSINESS MODEL

DISCIPLINED APPROACH TO MARKET

SIMPLE, PERSONAL, FAIR APPROACH WITH

CUSTOMERS, EMPLOYEES AND ALL CONSTITUENCIES

SERVICED FOR OTHERS

FUNDING AND LIQUIDITY CULTURE OF COMPLIANCE

7

$ in millions Q4 2015 Q4 2016 2015 2016 Quarterly YoY FYoFY

Total Core Retail Auto 1,981$ 2,010$ 10,826$ 8,250$ 1% (24%)

Chrysler Capital Loans (<640)1 1,234 768 5,473 3,722 (38%) (32%)

Chrysler Capital Loans (≥640)1 1,714 775 5,813 4,328 (55%) (26%)

Total Chrysler Capital Retail 2,948 1,543 11,286 8,051 (48%) (29%)

Total Leases2 1,012 973 5,199 5,592 (4%) 8%

Total Auto Originations 5,941 4,526 27,311 21,892 (24%) (20%)

Total Personal Lending 305 190 887 199 N/A (78%)

Total Originations 6,246$ 4,716$ 28,199$ 22,091$ (24%) (22%)

Asset Sales 1,869 1,381 9,179 4,563 (26%) (50%)

Serviced for Others Portfolio 15,047 11,945 15,047 11,945 (21%) (21%)

Average Managed Assets 52,486 52,039 48,919 52,731 (1%) 8%

Quarterly Originations Full Year Originations % Variance

Balances Balances

DISCIPLINED LOAN UNDERWRITING CONTINUES IN 4Q16

1 Approximate FICO score

2 Includes some capital lease originations

Full year average managed assets increased. Auto origination decreases driven by disciplined underwriting in a competitive market.

8

61%

51% 57% 56% 53%

39%

49% 43% 44% 47%

4Q15 1Q16 2Q16 3Q16 4Q16

New/Used Originations

($ in millions)

Used

New

ORIGINATIONS EXHIBIT DISCIPLINED UNDERWRITING

1 Loans to commercial borrowers; no FICO score obtained

Originations < 640 were down $590 million YoY

Average 598 FICO for retained 2016 originations, up 14

points versus 2015 retained originations

Higher percentage of used vehicles YoY and stable

throughout 2016

Average loan balances on originations down YoY, reflecting

larger percentage of used vehicles and lower LTVs

Average loan balance

in dollars

$23,721 $21,745 $21,929 $21,482 $21,488

$3,723

4% 4% 3% 2% 2%

12% 14% 13% 12% 11%

12% 15% 12% 13% 15%

20%

22%

20% 23%

24%

12%

13%

13%

14% 15%

39%

32%

40% 35%

32%

4Q15 1Q16 2Q16 3Q16 4Q16

Originations by Credit (RIC only)

($ in millions)

>640

600-639

540-599

<540

No FICO

Commercial

$4,929 $5,162 $3,553$3,723 $3,861

$2,416

$3,007

$3,861 $3,553$5,162$4,929

1

9

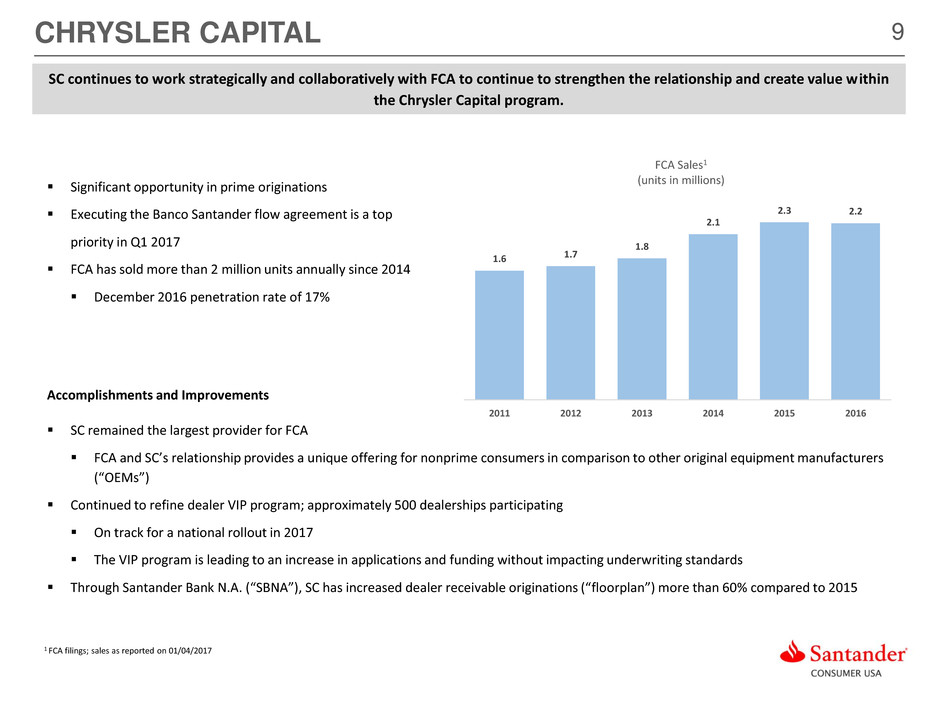

Significant opportunity in prime originations

Executing the Banco Santander flow agreement is a top

priority in Q1 2017

FCA has sold more than 2 million units annually since 2014

December 2016 penetration rate of 17%

Accomplishments and Improvements

SC remained the largest provider for FCA

FCA and SC’s relationship provides a unique offering for nonprime consumers in comparison to other original equipment manufacturers

(“OEMs”)

Continued to refine dealer VIP program; approximately 500 dealerships participating

On track for a national rollout in 2017

The VIP program is leading to an increase in applications and funding without impacting underwriting standards

Through Santander Bank N.A. (“SBNA”), SC has increased dealer receivable originations (“floorplan”) more than 60% compared to 2015

CHRYSLER CAPITAL

1 FCA filings; sales as reported on 01/04/2017

SC continues to work strategically and collaboratively with FCA to continue to strengthen the relationship and create value within

the Chrysler Capital program.

1.6 1.7

1.8

2.1

2.3 2.2

2011 2012 2013 2014 2015 2016

FCA Sales1

(units in millions)

10

$15,047

$14,235

$13,034

$12,157 $11,945

4Q15 1Q16 2Q16 3Q16 4Q16

$ in Millions

Flow Programs 1,081 860 659 794 477

CCART 788 904

Recent decrease in total balance

related to lower prime originations

Growth in SFO remains dependent

upon Chrysler Capital Penetration

SERVICED FOR OTHERS PLATFORM

Composition at

12/31/2016

RIC 77%

Leases 16%

RV/Marine 7%

Total 100%

Serviced for Others Balances

Flow programs continue to drive asset

sales

Recent CCART sale helped offset

continued amortization

*Sales with retained servicing during period

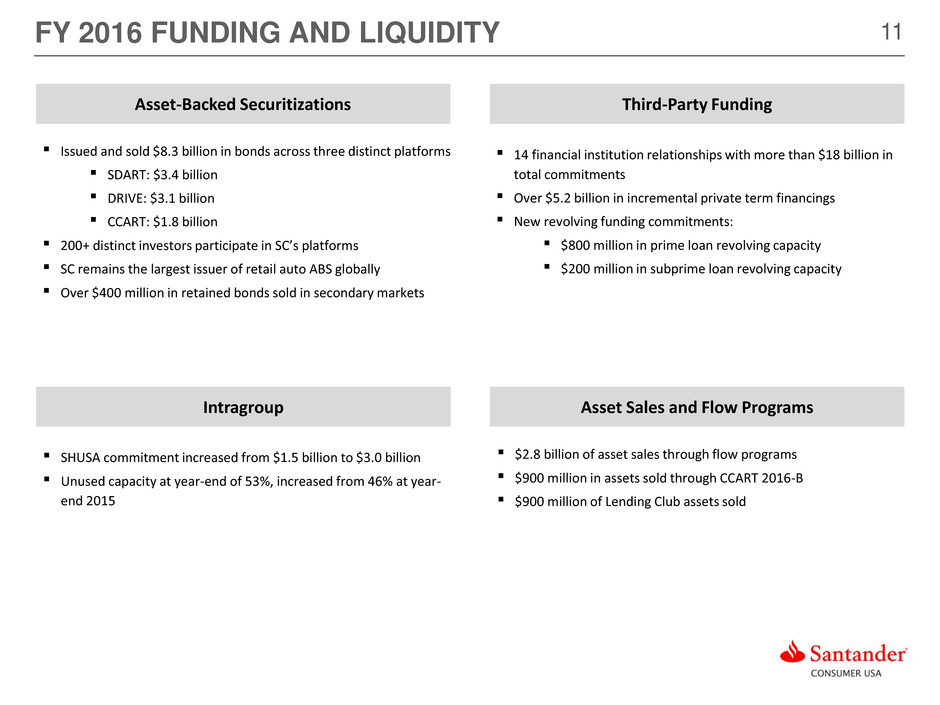

11FY 2016 FUNDING AND LIQUIDITY

▪ Issued and sold $8.3 billion in bonds across three distinct platforms

▪ SDART: $3.4 billion

▪ DRIVE: $3.1 billion

▪ CCART: $1.8 billion

▪ 200+ distinct investors participate in SC’s platforms

▪ SC remains the largest issuer of retail auto ABS globally

▪ Over $400 million in retained bonds sold in secondary markets

Asset-Backed Securitizations

Asset Sales and Flow ProgramsIntragroup

Third-Party Funding

▪ $2.8 billion of asset sales through flow programs

▪ $900 million in assets sold through CCART 2016-B

▪ $900 million of Lending Club assets sold

▪ SHUSA commitment increased from $1.5 billion to $3.0 billion

▪ Unused capacity at year-end of 53%, increased from 46% at year-

end 2015

▪ 14 financial institution relationships with more than $18 billion in

total commitments

▪ Over $5.2 billion in incremental private term financings

▪ New revolving funding commitments:

▪ $800 million in prime loan revolving capacity

▪ $200 million in subprime loan revolving capacity

12

» Net income of $61 million, or $0.17 per diluted common share

» Non-recurring expense of $0.03 cents per diluted common share

» Total auto originations of $4.5 billion

» Core up 1% year-over-year

» Total finance and other interest income of $1.6 billion, up 4%

» Net finance and other interest income of $1.1 billion, down 5%

» CET1 ratio of 13.4%, demonstrating SC’s ability to generate earnings and capital

» Issued $3.3 billion in securitizations

» Continued strength in ABS platforms evidenced by the upgrade of 30 ABS tranches by Moody’s, S&P and

Fitch across multiple platforms during the quarter, positively impacting more than $2.7 billion in securities

Q4 2016 HIGHLIGHTS

Setting SC up for long-term success by delivering value to shareholders while focusing on disciplined

underwriting, compliance and being simple, personal and fair.

13Q4 2016 FINANCIAL RESULTS

December 31, 2016 September 30, 2016 December 31, 2015 QoQ YoY

Interest on finance receivables and loans 1,222,468$ 1,246,386$ 1,270,072$ (2%) (4%)

Net leased vehicle income 122,791 135,771 86,854 (10%) 41%

Other finance and interest income 3,695 3,638 (5,251) 2% (170%)

Interest expense 216,980 207,175 157,893 5% 37%

Net finance and other interest income 1,131,974 1,178,620 1,193,782 (4%) (5%)

Provision for credit losses 685,711 610,398 850,723 12% (19%)

Profit sharing 12,176 6,400 10,649 90% 14%

Total other income (47,996) 26,682 (97,587) (280%) (51%)

Total operating expenses 295,905 284,484 256,622 4% 15%

Income before tax 90,186 304,020 (21,799) (70%) N/M

Income tax expense 28,911 90,473 (2,244) (68%) N/M

Net income 61,275 213,547 (19,555) (71%) N/M

Diluted EPS ($) 0.17$ 0.59$ (0.05)$ (71%) N/M

Average total assets 38,513,454$ 38,473,832$ 36,039,289$ 0% 7%

Average managed assets 52,038,692$ 52,675,379$ 52,485,567$ (1%) (1%)

Three Months Ended

(Unaudited, Dollars in Thousands, except per share) % Variance

14Q4 2016 EXCLUDING PERSONAL LENDING

*Additional details can be found in Appendix

December 31,

2016

September 30,

2016

December 31,

2015

QoQ YoY

Interest on finance receivables and loans 1,142,176$ 1,167,675$ 1,154,720$ (2%) (1%)

Net leased vehicle income 122,791 135,771 86,854 (10%) 41%

Other finance and interest income 3,695 3,638 (5,251) 2% (170%)

Interest expense 206,259 196,984 142,309 5% 45%

Net finance and other interest income 1,062,403 1,110,100 1,094,014 (4%) (3%)

Provision for credit losses 685,711 610,398 850,723 12% (19%)

Profit sharing 9,219 10,957 10,649 (16%) (13%)

Investment gains (losses), net (22,614) (10,404) 7,185 117% (415%)

Servicing fee income 32,205 36,447 42,357 (12%) (24%)

Fees, commissions and other 39,616 46,426 41,713 (15%) (5%)

Total other income 49,207$ 72,469$ 91,255$ (32%) (46%)

Average gross individually acquired retail installment contracts 28,604,117$ 28,970,039$ 27,560,674$ (1%) 4%

Average gross operating leases 9,586,090$ 9,347,620$ 7,096,406$ 3% 35%

Three Months Ended

(Unaudited, Dollars in Thousands) % Variance

15

31-Dec-15 31-Mar-16 30-Jun-16 30-Sep-16 31-Dec-16

Reported Total Other Income (Loss) (97,587)$ 77,558$ 37,302$ 26,682$ (47,996)$

Reported Investment Gains (Losses), Net (229,212)$ (69,056)$ (101,309)$ (106,050)$ (168,344)$

Add back:

Personal Lending LOCM Adjustments 236,396 64,213 94,767 95,646 145,730

Other 14,226 6,451 7,330 6,639 -

Normalized Investment Gains (Losses), Net 21,410 1,608 788 (3,765) (22,614)

Servicing Fee Income 42,357 44,494 42,988 36,447 32,205

Fees, Commissions, and Other1 89,268 102,120 95,623 96,285 88,143

Normalized Total Other Income 153,035$ 148,222$ 139,399$ 128,967$ 97,734$

Customer Default Activity 123,254 101,347 97,169 114,477 116,097

Fair Value Discount 113,142 (37,134) (2,402) (18,831) 29,633

Denotes quarters with CCART sales

Three Months Ended

(Unaudited, Dollars in Thousands)

TOTAL OTHER INCOME

SC’s strategy is to price loans sold under flow agreements close to par, with minimal investment gains (losses), to generate further growth

in the serviced for others platform and drive increased fee income

In Q3 2015, SC designated the personal lending portfolio as held for sale and released any allowance associated with the portfolio; any

lower of cost or market (“LOCM”) impact related to personal lending in Q3 2015 was recognized through provision for credit losses

Beginning in Q4 2015, net investment gains (losses) include the impact of personal lending assets

Customer defaults, as part of LOCM adjustments on the personal lending portfolio designated as held for sale, are recognized through

net investment gains (losses)

Seasonal balances will impact magnitude of LOCM adjustments; this quarter included higher LOCM adjustments driven by seasonal

increases in the personal lending portfolio

1 Fees, commissions and other includes fee income from the personal lending and auto portfolios

16CREDIT QUALITY: LOSS PERFORMANCE

Gross Losses

*Retained originations only

1Auction fees included in net losses. Financial statements reflect auction fees in repossession expense, therefore, net losses included on this slide are higher

2First half vintage describes January through June vintage performance through the end of December, for each respective year

Net Losses1

6.7%

7.2%

6.5%

6.0%

6.2%

6.4%

6.6%

6.8%

7.0%

7.2%

7.4%

1H 2014 1H 2015 1H 2016

First Half Vintage Performance2

Early indications show the first half of the 2016 vintage is outperforming the 2015 vintage on a gross and net loss basis, as of the

end of the year each vintage was originated.

4.0%

4.4%

3.9%

3.6%

3.8%

4.0%

4.2%

4.4%

4.6%

1H 2014 1H 2015 1H 2016

First Half Vintag Performance2

17

$3,413

$113

$154 $20 ($278)

$3,422

$3,000

$3,100

$3,200

$3,300

$3,400

$3,500

$3,600

$3,700

$3,800

Q3 2016 New

Volume

TDR

Migration

Performance

Adjustment

Liquidations

& Other

Q4 2016

Q3 2016 to Q4 2016 ALLL Reserve Walk2

($ in millions)

$851

$660

$512

$610

$686

11.9%

12.0%

12.6%

12.4%

12.6%

11.4%

11.6%

11.8%

12.0%

12.2%

12.4%

12.6%

12.8%

$0

$200

$400

$600

$800

$1,000

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Provision Expense and Allowance Ratio

($ in millions)

Provision for credit losses Allowance Ratio

PROVISION AND RESERVES

Allowance to loans ratio increased to 12.6% QoQ, primarily

driven by the increased balance of loans classified as TDRs

and the denominator effect of slower portfolio growth

Provision for credit losses decreased YoY primarily driven by

a qualitative reserve in the prior year quarter for loans with

limited credit experience

QoQ allowance increased $9 million

New volume and TDR migration1 were offset by

liquidations and other

1 TDR migration – the allowance for assets classified as TDRs or “troubled debt restructuring” takes into consideration expected lifetime losses, requiring additional coverage

2 Explanation of quarter over quarter variance are estimates

18

16.6% 16.3%

14.2%

17.2%

18.1%

8.9%

7.6%

5.7%

8.7%

9.4%

46%

53% 60%

49%

48%

0%

10%

20%

30%

40%

50%

60%

70%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

14.0%

16.0%

18.0%

20.0%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Credit: Individually Acquired Retail Installment Contracts,

Held for Investment

Gross Charge-

off Ratio

Net Charge-off

Ratio

Recovery Rate

(as % of

recorded

investment)

9.1%

6.9%

9.0% 9.2%

10.0%

3.8%

4.4%

3.1%

4.2%

4.6%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

12.0%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Delinquency: Individually Acquired Retail Installment Contracts,

Held for Investment

31-60

61+LOSS AND DELINQUENCY

YoY delinquency increased for each delinquency bucket

Primary drivers:

2015 originations more nonprime in nature

Slower portfolio growth

YoY gross loss increased 150 basis points

Primary drivers:

2015 originations more nonprime in nature

Slower portfolio growth

Recovery rates and net losses in Q2 2016 benefited by

proceeds from bankruptcy sales1

1 Excluding bankruptcy sales, recovery rates would have been 59%

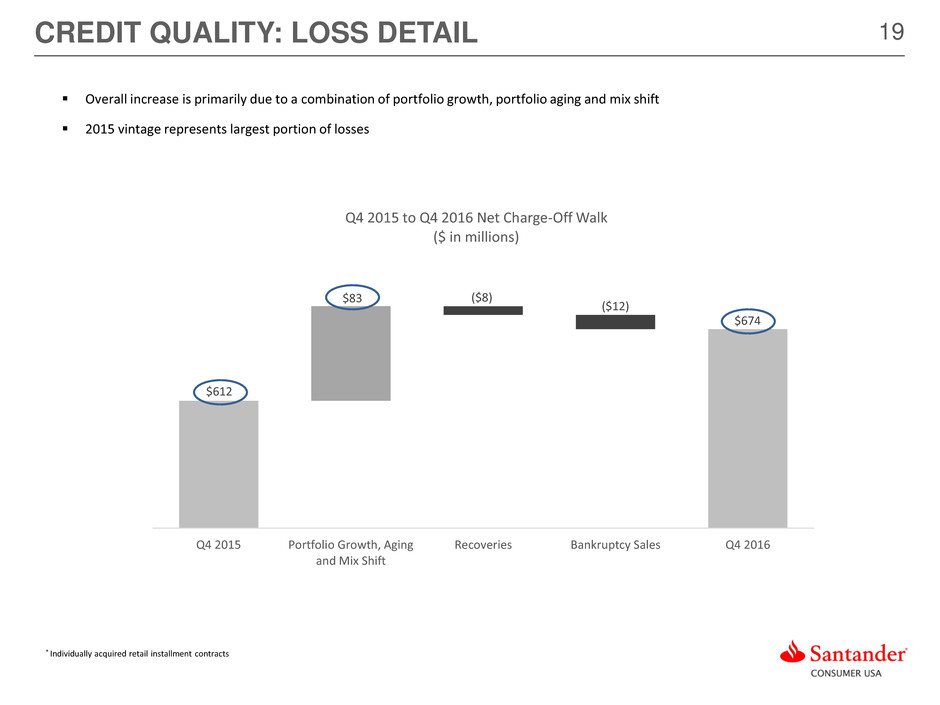

19

$612

$674

$83 ($8)

($12)

Q4 2015 Portfolio Growth, Aging

and Mix Shift

Recoveries Bankruptcy Sales Q4 2016

Q4 2015 to Q4 2016 Net Charge-Off Walk

($ in millions)

CREDIT QUALITY: LOSS DETAIL

Overall increase is primarily due to a combination of portfolio growth, portfolio aging and mix shift

2015 vintage represents largest portion of losses

* Individually acquired retail installment contracts

20

$52,486 $52,962 $53,237 $52,675 $52,039

$257

$291

$272

$284

$296

2.0%

2.2% 2.0% 2.2%

2.3%

0.0%

2.0%

4.0%

6.0%

8.0%

10.0%

$2

$10,002

$20,002

$30,002

$40,002

$50,002

$60,002

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

Average Managed

Assets

($ millions)

Total Expenses

($ millions)

EXPENSE MANAGEMENT

Operating expenses totaled $296 million, an increase of 15% versus the same quarter last year, driven by higher compensation expenses, a

non-recurring expense of $13 million and higher repo expenses

Excluding non-recurring expenses, increase of 10%

21

2.4 3.0

2.5

3.3

Q3 2016 Q4 2016

Unused

Used

8.3 6.9

2.5 3.8

Q3 2016 Q4 2016

Unused Used

Q4 2016 FUNDING AND LIQUIDITY

Total committed liquidity of $38.5 billion at end of Q4 2016, up 5% from $36.8 billion at the end of Q3 2016

Asset-Backed Securities

($ Billions)

Private Financings

($ Billions)

Banco Santander & Subsidiaries

($ Billions)

Asset Sales

($ Billions)

Executed across all ABS platforms in Q4 2016

$6.3 billion in total commitments

53% unused capacity at Q4 2016

Increase driven by CCART transaction

Amortizing Revolving

10.8

$18.7 billion in commitments from 14 lenders

36% unused capacity on revolving lines at Q4 2016

10.7

4.8

6.3

12.4 13.5

Q3 2016 Q4 2016

8.8

8.0

Q3 2016 Q4 2016

0.8

1.4

Q3 2016 Q4 2016

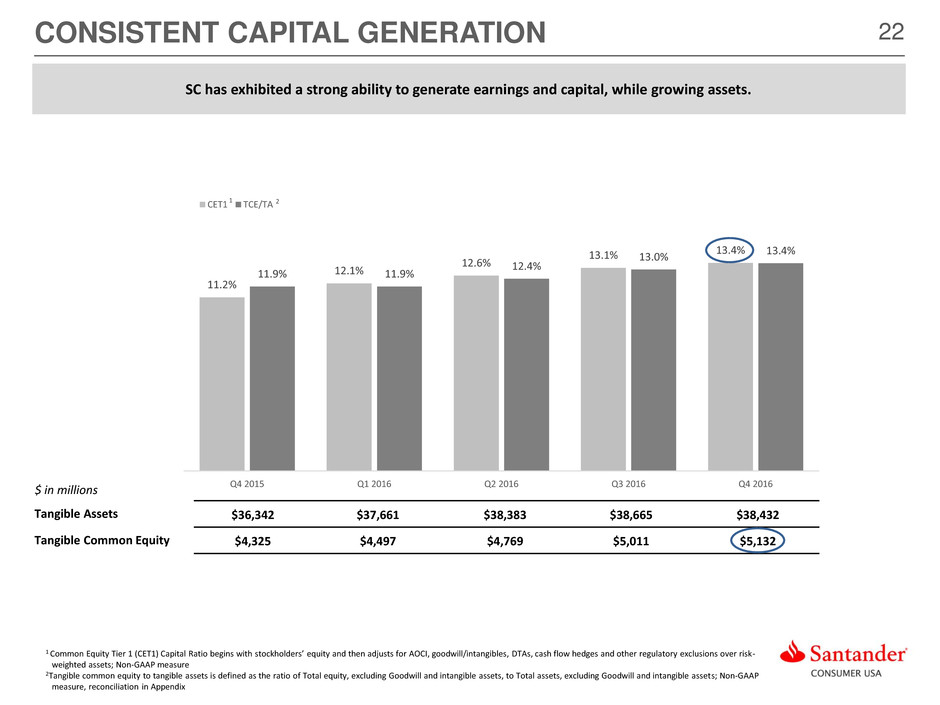

22CONSISTENT CAPITAL GENERATION

1 Common Equity Tier 1 (CET1) Capital Ratio begins with stockholders’ equity and then adjusts for AOCI, goodwill/intangibles, DTAs, cash flow hedges and other regulatory exclusions over risk-

weighted assets; Non-GAAP measure

2Tangible common equity to tangible assets is defined as the ratio of Total equity, excluding Goodwill and intangible assets, to Total assets, excluding Goodwill and intangible assets; Non-GAAP

measure, reconciliation in Appendix

1 2

SC has exhibited a strong ability to generate earnings and capital, while growing assets.

Tangible Assets $36,342 $37,661 $38,383 $38,665 $38,432

Tangible Common Equity $4,325 $4,497 $4,769 $5,011 $5,132

11.2%

12.1%

12.6%

13.1% 13.4%

11.9% 11.9%

12.4%

13.0%

13.4%

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

CET1 TCE/TA

$ in millions

APPENDIX

24SANTANDER CONSUMER USA HOLDINGS INC.

1 As of December 31, 2016

2 DDFS LLC is an entity owned by former Chairman and Chief Executive Officer, Tom Dundon. This purchase would result in SHUSA owning approximately 68.8% of SC.

3 Chrysler Capital is a dba of Santander Consumer USA

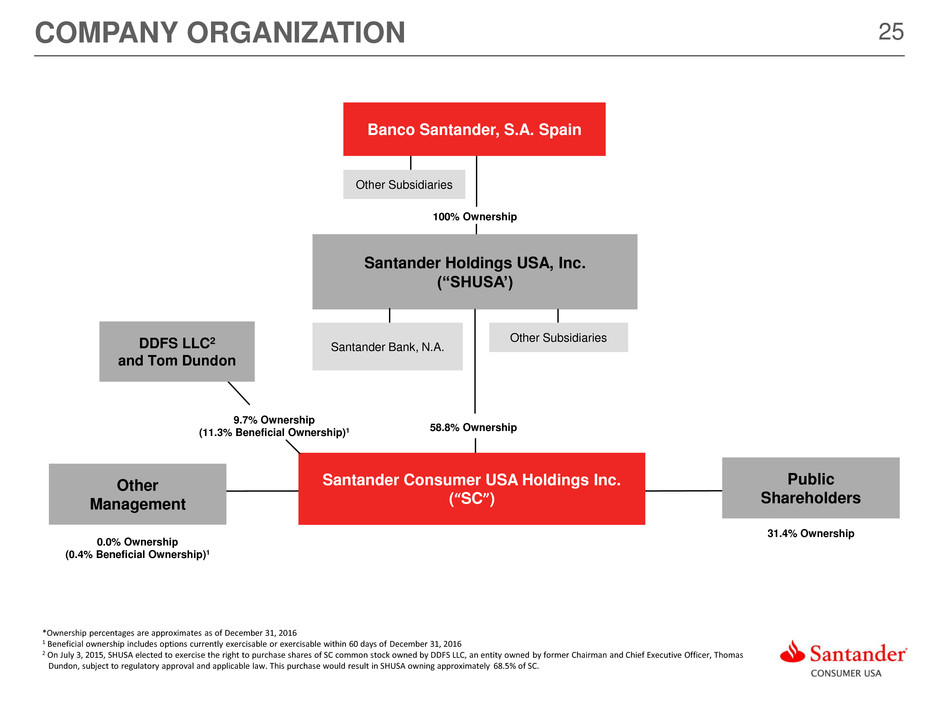

• Santander Consumer USA Holdings Inc. (NYSE:SC) (“SC”) is approximately 58.9%1 owned by Santander Holdings USA, Inc.

(“SHUSA”), a wholly-owned subsidiary of Banco Santander, S.A. (NYSE:SAN)

• On July 3, 2015, SHUSA elected to exercise its right to purchase all of the shares of SC common stock owned by DDFS LLC,

subject to regulatory approval and applicable law2

▪ SC is a full-service, technology-driven consumer finance company focused on vehicle finance, third-party servicing and providing

superior customer service

• Historically focused on nonprime markets; established presence in prime and lease

▪ Approximately 5,100 full-time, 80 part-time and 1,500 vendor-based employees across multiple locations in the U.S. and the

Caribbean

▪ Our strategy is to leverage our efficient, scalable technology and risk infrastructure and data to underwrite, originate and service

profitable assets while treating employees, customers and all stakeholders in a simple, personal and fair manner

▪ Unparalleled compliance and responsible practices focus

▪ Continuously optimizing the mix of assets retained vs. assets sold and serviced for others

▪ Presence in prime markets through Chrysler Capital3

▪ Efficient funding through key third-party relationships, secondary markets and Santander

▪ Solid capital base

Overview

Strategy

25COMPANY ORGANIZATION

Other Subsidiaries

100% Ownership

Santander Holdings USA, Inc.

(“SHUSA’)

58.8% Ownership

Santander Consumer USA Holdings Inc.

(“SC”)

Santander Bank, N.A.

Other Subsidiaries

9.7% Ownership

(11.3% Beneficial Ownership)1

DDFS LLC2

and Tom Dundon

0.0% Ownership

(0.4% Beneficial Ownership)1

31.4% Ownership

Other

Management

Public

Shareholders

Banco Santander, S.A. Spain

*Ownership percentages are approximates as of December 31, 2016

1 Beneficial ownership includes options currently exercisable or exercisable within 60 days of December 31, 2016

2 On July 3, 2015, SHUSA elected to exercise the right to purchase shares of SC common stock owned by DDFS LLC, an entity owned by former Chairman and Chief Executive Officer, Thomas

Dundon, subject to regulatory approval and applicable law. This purchase would result in SHUSA owning approximately 68.5% of SC.

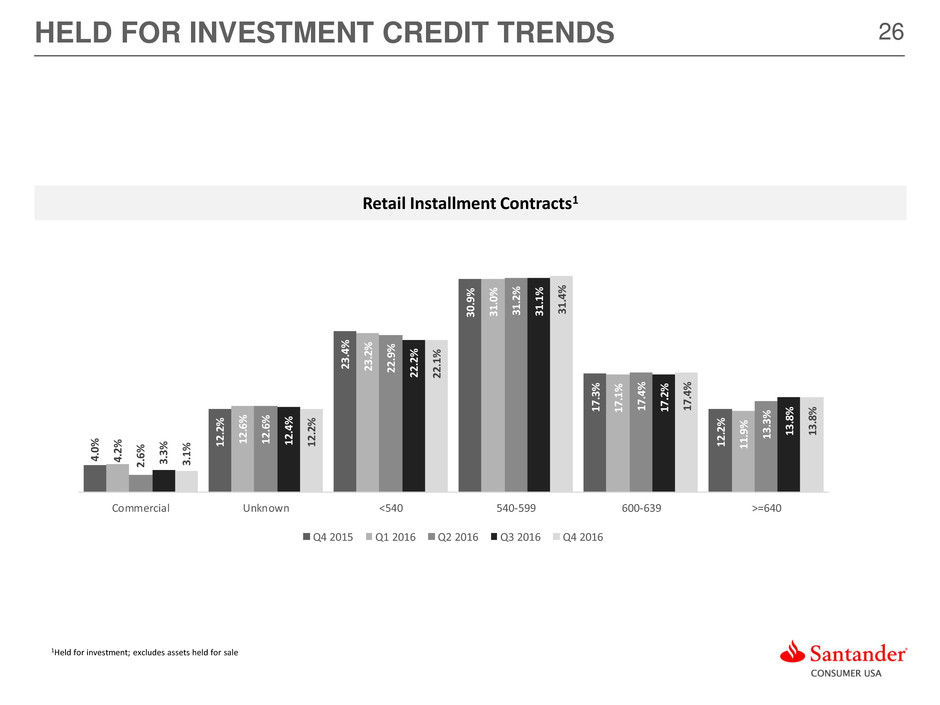

26HELD FOR INVESTMENT CREDIT TRENDS

Retail Installment Contracts1

1Held for investment; excludes assets held for sale

4.0

% 12.

2%

23.

4%

30.

9%

17.

3%

12.

2%

4.2

% 12

.6%

23.

2%

31.

0%

17.

1%

11.

9%

2.6

% 1

2.6

%

22.

9%

31.

2%

17.

4%

13.

3%

3.3

% 12

.4%

22.

2%

31.

1%

17.

2%

13.

8%

3.1

% 12

.2%

22.

1%

31.

4%

17.

4%

13.

8%

Commercial Unknown <540 540-599 600-639 >=640

Q4 2015 Q1 2016 Q2 2016 Q3 2016 Q4 2016

27Q4 2016 EXCLUDING PERSONAL LENDING DETAIL

As Reported

Personal

Lending

Excluding

Personal

Lending

As Reported

Personal

Lending

Excluding

Personal

Lending

As Reported

Personal

Lending

Excluding

Personal

Lending

Interest on finance receivables and loans $ 1,222,468 $ 80,292 $ 1,142,176 $ 1,246,386 $ 78,711 $ 1,167,675 $ 1,270,072 $ 115,352 $ 1,154,720

Net leased vehicle income 122,791 - 122,791 135,771 - 135,771 86,854 - 86,854

Other finance and interest income 3,695 - 3,695 3,638 - 3,638 (5,251) - (5,251)

Interest expense 216,980 10,721 206,259 207,175 10,191 196,984 157,893 15,584 142,309

Net finance and other interest income 1,131,974 69,571 1,062,403 1,178,620 68,520 1,110,100 1,193,782 99,768 1,094,014

Provision for credit losses 685,711 - 685,711 610,398 - 610,398 850,723 - 850,723

Profit sharing 12,176 2,957 9,219 6,400 (4,557) 10,957 10,649 - 10,649

Investment gains (losses), net (168,344) (145,730) (22,614) (106,050) (95,646) (10,404) (229,212) (236,397) 7,185

Servicing fee income 32,205 - 32,205 36,447 - 36,447 42,357 - 42,357

Fees, commissions and other 88,143 48,527 39,616 96,285 49,859 46,426 89,268 47,555 41,713

Total other income $ (47,996) $ (97,203) $ 49,207 $ 26,682 $ (45,787) $ 72,469 $ (97,587) $ (188,842) $ 91,255

Average gross individually acquired retail

installment contracts

$ 28,604,117 - $ 28,970,039 - $ 27,560,674 -

Average gross personal loans - $ 1,405,187 - $ 1,343,099 - $ 2,309,474

Average gross operating leases $ 9,586,090 - $ 9,347,620 - $ 7,096,406 -

As of and for the Three Months Ended

($ in Thousands)

December 31, 2016 September 30, 2016 December 31, 2015

28FY 2016 EXCLUDING PERSONAL LENDING DETAIL

As Reported

Personal

Lending

Excluding

Personal

Lending

Interest on finance receivables and loans $ 5,026,790 $ 337,912 $ 4,688,878

Net leased vehicle income 492,212 - 492,212

Other finance and interest income 15,135 - 15,135

Interest expense 807,484 43,443 764,041

Net finance and other interest income 4,726,653 294,469 4,432,184

Provision for credit losses 2,468,200 - 2,468,200

Profit sharing 47,816 4,010 43,806

Investment gains (losses), net (444,759) (407,770) (36,989)

Servicing fee income 156,134 - 156,134

Fees, commissions and other 382,171 202,617 179,554

Total other income $ 93,546 $ (205,153) $ 298,699

Average gross individually acquired retail

installment contracts

$ 28,652,897 -

Average gross personal loans - $ 1,413,440

Average gross operating leases $ 8,818,704 -

For the Year Ended

($ in Thousands)

December 31, 2016

29CONSOLIDATED BALANCE SHEETS

(Unaudited, dollars in thousands) December 31, 2016 December 31, 2015

Assets

Cash and cash equivalents $ 160,180 $ 18,893

Finance receivables held for sale, net 2,123,415 2,859,575

Finance receivables held for investment, net 23,481,001 23,367,788

Restricted cash 2,757,299 2,236,329

Accrued interest receivable 373,274 395,387

Leased vehicles, net 8,564,628 6,497,310

Furniture and equipment, net 67,509 58,007

Federal, state and other income taxes receivable 87,352 267,636

Related party taxes receivable 1,087 71

Goodwill 74,056 74,056

Intangible assets, net 32,623 33,016

Due from affil iates 31,270 58,599

Other assets 785,410 582,291

Total assets $ 38,539,104 $ 36,448,958

Liabilities and Equity

Liabilities:

Notes payable — credit facil ities $ 6,886,681 $ 6,902,779

Notes payable — secured structured financings 21,462,025 20,872,900

Notes payable — related party 2,975,000 2,600,000

Accrued interest payable 33,346 22,544

Accounts payable and accrued expenses 379,021 413,269

Federal, state and other income taxes payable 18,201 2,462

Deferred tax liabilities, net 1,278,064 881,225

Due to affil iates 50,620 58,148

Other l iabilities 217,527 263,082

Total l iabilities $ 33,300,485 $ 32,016,409

Equity:

Common stock, $0.01 par value 3,589 3,579

Additional paid-in capital 1,657,611 1,644,151

Accumulated other comprehensive income (loss), net 28,259 2,125

Retained earnings 3,549,160 2,782,694

Total stockholders’ equity 5,238,619 4,432,549

Total l iabilities and equity $ 38,539,104 $ 36,448,958

30CONSOLIDATED INCOME STATEMENTS

December 31, December 31,

2016 2015

Interest on finance receivables and loans $ 5,026,790 $ 5,031,829

Leased vehicle income 1,487,671 1,037,793

Other finance and interest income 15,135 18,162

Total finance and other interest income 6,529,596 6,087,784

Interest expense 807,484 628,791

Leased vehicle expense 995,459 726,420

Net finance and other interest income 4,726,653 4,732,573

Provision for credit losses 2,468,200 2,785,871

Net finance and other interest income after provision for credit losses 2,258,453 1,946,702

Profit sharing 47,816 57,484

Net finance and other interest income after provision for credit losses and profit sharing 2,210,637 1,889,218

Investment gains (losses), net (444,759) (95,214)

Servicing fee income 156,134 131,113

Fees, commissions, and other 382,171 385,744

Total other income 93,546 421,643

Compensation expense 498,224 434,041

Repossession expense 293,355 241,522

Other operating costs 351,893 345,686

Total operating expenses 1,143,472 1,021,249

Income before income taxes 1,160,711 1,289,612

Income tax expense 394,245 465,572

Net income $ 766,466 $ 824,040

Net income per common share (basic) $ 2.14 $ 2.32

Net income per common share (diluted) $ 2.13 $ 2.31

Weighted average common shares (basic) 358,280,814 355,102,742

Weighted average common shares (diluted) 359,165,172 356,163,076

For the Year Ended

(Unaudited, dollars in thousands, except per share amounts)

31CONSOLIDATED INCOME STATEMENTS

December 31, September 30, December 31,

2016 2016 2015

Interest on finance receivables and loans $ 1,222,468 $ 1,246,386 $ 1,270,072

Leased vehicle income 401,020 388,501 295,109

Other finance and interest income 3,695 3,638 (5,251)

Total finance and other interest income 1,627,183 1,638,525 1,559,930

Interest expense 216,980 207,175 157,893

Leased vehicle expense 278,229 252,730 208,255

Net finance and other interest income 1,131,974 1,178,620 1,193,782

Provision for credit losses 685,711 610,398 850,723

Net finance and other interest income after provision for credit losses 446,263 568,222 343,059

Profit sharing 12,176 6,400 10,649

Net finance and other interest income after provision for credit losses and profit sharing 434,087 561,822 332,410

Investment gains (losses), net (168,344) (106,050) (229,212)

Servicing fee income 32,205 36,447 42,357

Fees, commissions, and other 88,143 96,285 89,268

Total other income (47,996) 26,682 (97,587)

Compensation expense 126,982 128,056 108,458

Repossession expense 75,539 75,920 66,456

Other operating costs 93,384 80,508 81,708

Total operating expenses 295,905 284,484 256,622

Income before income taxes 90,186 304,020 (21,799)

Income tax expense 28,911 90,473 (2,244)

Net income $ 61,275 $ 213,547 $ (19,555)

Net income per common share (basic) $ 0.17 $ 0.60 $ (0.05)

Net income per common share (diluted) $ 0.17 $ 0.59 $ (0.05)

Weighted average common shares (basic) 358,582,203 358,343,781 357,927,012

Weighted average common shares (diluted) 360,323,179 360,087,749 361,956,163

For the Three Months Ended

(Unaudited, dollars in thousands, except per share amounts)

32RECONCILIATION OF NON-GAAP MEASURES

December 31, September 30, June 30, March 31, December 31,

2016 2016 2016 2016 2015

Total equity $ 5,238,619 $ 5,117,657 $ 4,876,712 $ 4,604,739 $ 4,432,549

Deduct: Goodwill and intangibles 106,679 107,084 107,737 107,971 107,072

Tangible common equity $ 5,131,940 $ 5,010,573 $ 4,768,975 $ 4,496,768 $ 4,325,477

Total assets $ 38,539,104 $ 38,771,636 $ 38,490,611 $ 37,768,959 $ 36,448,958

Deduct: Goodwill and intangibles 106,679 107,084 107,737 107,971 107,072

Tangible assets $ 38,432,425 $ 38,664,552 $ 38,382,874 $ 37,660,988 $ 36,341,886

Equity to assets ratio 13.6% 13.2% 12.7% 12.2% 12.2%

Tangible common equity to tangible assets 13.4% 13.0% 12.4% 11.9% 11.9%

(Unaudited, dollars in thousands)