Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - ASSOCIATED BANC-CORP | asb12312016ex-991.htm |

| 8-K - FORM 8-K - ASSOCIATED BANC-CORP | asb-12312016form8xkpr.htm |

FOURTH QUARTER 2016

EARNINGS PRESENTATION

JANUARY 19, 2017

Exhibit 99.2

FORWARD-LOOKING STATEMENTS

Important note regarding forward-looking statements:

Statements made in this presentation which are not purely historical are forward-looking statements, as

defined in the Private Securities Litigation Reform Act of 1995. This includes any statements regarding

management’s plans, objectives, or goals for future operations, products or services, and forecasts of its

revenues, earnings, or other measures of performance. Such forward-looking statements may be

identified by the use of words such as “believe,” “expect,” “anticipate,” “plan,” “estimate,” “should,” “will,”

“intend,” “outlook” or similar expressions. Forward-looking statements are based on current management

expectations and, by their nature, are subject to risks and uncertainties. Actual results may differ

materially from those contained in the forward-looking statements. Factors which may cause actual

results to differ materially from those contained in such forward-looking statements include those

identified in the Company’s most recent Form 10-K and subsequent SEC filings. Such factors are

incorporated herein by reference.

1

2016 HIGHLIGHTS

Balance

Sheet

Management

Loans reached $20 billion at year

end; full year margin of 2.80%

Average loans were up

$1.4 billion, or 8% from 2015

Average deposits were up

$1.1 billion, or 6% from 2015

Fee

Businesses

Capital markets increased

significantly year over year

Mortgage banking increased

18% year over year

Insurance commissions increased

7% year over year

Expense

Management

Efficiency ratio improved for the

fifth consecutive year

Expenses in-line with guidance,

excluding severance

Capital

Management

Return on average common equity

Tier 1 (CET1) of 9.9%

Dividend payout ratio of 35%

CET1 ratio of 9.5% at year end

2

Growing

Revenues

Stabilizing

Margin

Improving

Efficiency

Expanding

Bottom Line

2016: Net income available to common equity of $191 million, or $1.26 per common share

4Q 2016: Net income available to common equity of $52 million, or $0.34 per common share

($148)

($82)

($19)

$76

$218

$233

$502

$618

$1.8 $1.6 $1.5 $1.5 $1.4

$4.4 $4.6 $4.9 $5.5

$6.2

$3.4 $3.7

$4.0

$4.2

$4.7

$5.1

$5.8

$6.5

$7.0

$7.4

2012 2013 2014 2015 2016

Home equity & Other consumer Residential mortgage

Commercial real estate Commercial & business

CRE Investor

18%

Construction

6%

Commercial &

business

38%

Residential

mortgage

31%

Home equity

5%

Other

consumer

2%

LOAN PORTFOLIO – ANNUAL TRENDS

$19.7

$16.8

$18.3

$15.7

$14.7

Average Net Loan Change (from 2015)

Loan Mix – 2016 (Average)

Average Annual Loans

($ in billions)

($ in millions)

Total

Commercial

& Business

+5%

Home equity & Other consumer

Commercial real estate

Residential mortgage

Power & Utilities

Mortgage warehouse

REIT

General commercial

Oil and Gas

3

CRE Investor

18%

Construction

7%

Commercial &

business

37%

Residential

mortgage

31%

Home equity

5%

Other

consumer

2%

($ in millions)

$1.4 $1.4 $1.4 $1.4 $1.3

$5.8 $5.9 $6.1 $6.3 $6.3

$4.4 $4.5 $4.7

$4.9 $4.9

$6.9 $7.1

$7.5 $7.6 $7.4

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Home equity & Other consumer Residential mortgage

Commercial real estate Commercial & business

($202)

($57)

($26)

($18)

$44

$59

$61

$63

LOAN PORTFOLIO – QUARTERLY TRENDS

Average Net Loan Change (from 3Q 2016)

Loan Mix – 4Q 2016 (Average)

Average Quarterly Loans

$18.5

Total

Commercial

& Business

-2%

$18.9

$19.6 $20.1

Home equity & Other consumer

Commercial real estate

Residential mortgage

Power & Utilities

Mortgage warehouse

REIT

($ in billions)

General commercial

Oil and Gas

$20.0

4

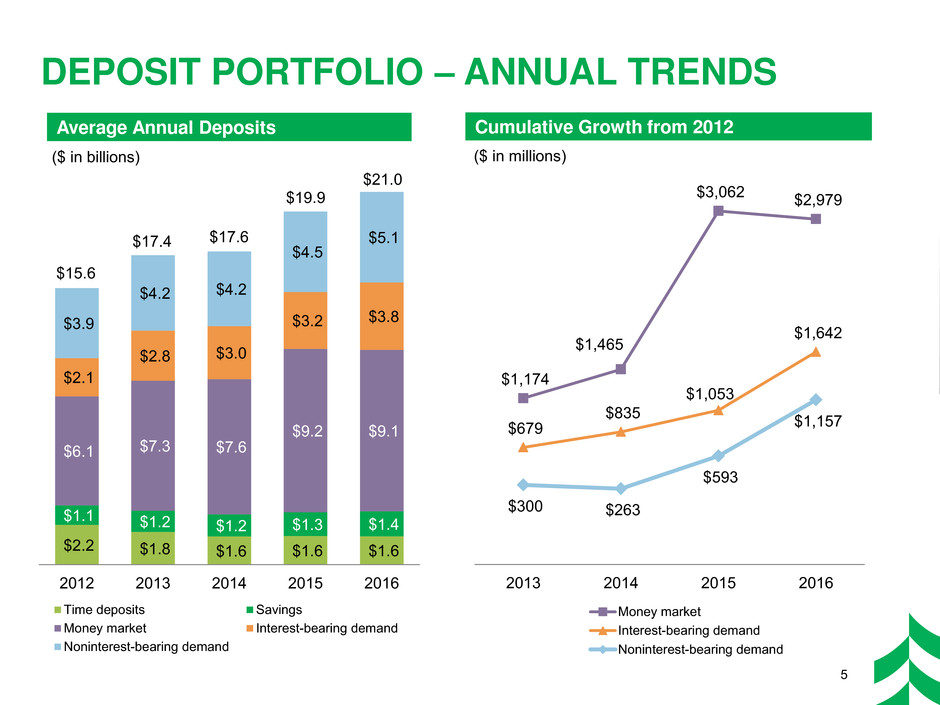

$2.2 $1.8 $1.6 $1.6 $1.6

$1.1 $1.2 $1.2 $1.3 $1.4

$6.1 $7.3 $7.6

$9.2 $9.1

$2.1

$2.8 $3.0

$3.2 $3.8 $3.9

$4.2 $4.2

$4.5

$5.1

2012 2013 2014 2015 2016

Time deposits Savings

Money market Interest-bearing demand

Noninterest-bearing demand

DEPOSIT PORTFOLIO – ANNUAL TRENDS

Cumulative Growth from 2012 Average Annual Deposits

($ in billions)

$21.0

5

$19.9

$1,174

$1,465

$3,062 $2,979

$679

$835

$1,053

$1,642

$300 $263

$593

$1,157

2013 2014 2015 2016

Money market

Interest-bearing demand

Noninterest-bearing demand

($ in millions)

$17.6 $17.4

$15.6

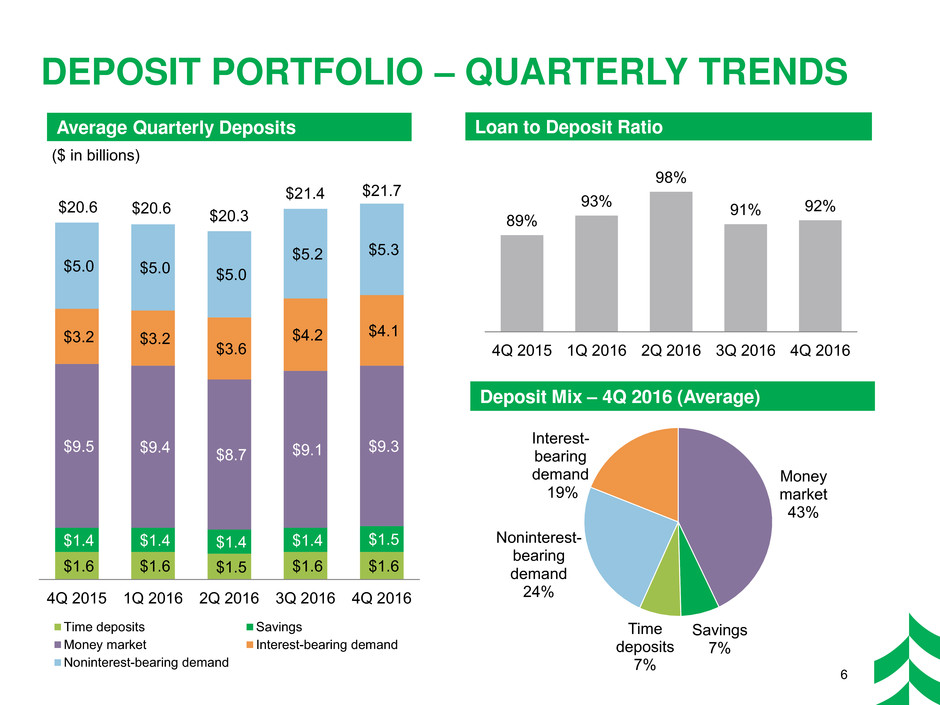

$1.6 $1.6 $1.5 $1.6 $1.6

$1.4 $1.4 $1.4 $1.4 $1.5

$9.5 $9.4 $8.7 $9.1 $9.3

$3.2 $3.2

$3.6

$4.2 $4.1

$5.0 $5.0 $5.0

$5.2 $5.3

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Time deposits Savings

Money market Interest-bearing demand

Noninterest-bearing demand

Money

market

43%

Savings

7%

Time

deposits

7%

Noninterest-

bearing

demand

24%

Interest-

bearing

demand

19%

DEPOSIT PORTFOLIO – QUARTERLY TRENDS

Loan to Deposit Ratio

Deposit Mix – 4Q 2016 (Average)

Average Quarterly Deposits

$20.6 $20.6 $20.3

$21.4

($ in billions)

$21.7

89%

93%

98%

91% 92%

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

6

$253

$185 $177 $158 $128

$20

$147

2012 2013 2014 2015 2016

Oil and Gas

1.9% 1.7% 1.5% 1.5% 1.4%

5.6% 5.7%

2012 2013 2014 2015 2016

ALLL / Total Loans

Oil and Gas ALLL / Oil and Gas Loans

CREDIT QUALITY – ANNUAL TRENDS

($ IN MILLIONS)

$361

$235

$190 $178

$276

$124

$75

2012 2013 2014 2015 2016

Oil and Gas

$84

$39

$15

$30

$6

2012 2013 2014 2015 2016

Oil and Gas

Potential Problem Loans – Year End Nonaccrual Loans – Year End

Net Charge Offs Allowance to Total Loans / Oil and Gas Loans

$302

$351

$178

$275

7

$65

$59

Note: All amounts at or for the year ended

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Oil and Gas

$8

$4 $2

$(4)

$3

$13 $19 $22

$6

1.5% 1.4% 1.4% 1.4% 1.4%

5.6%

6.5%

5.6% 5.5% 5.7%

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

ALLL / Total Loans

Oil and Gas ALLL / Oil and Gas Loans

CREDIT QUALITY – QUARTERLY TRENDS

($ IN MILLIONS)

$178

$251 $281 $270 $276

$124

$150

$176 $171

$75

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Oil and Gas

$158 $157 $154 $163 $128

$20

$129 $129 $127 $147

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Oil and Gas

Potential Problem Loans Nonaccrual Loans

Net Charge Offs (Recoveries) Allowance to Total Loans / Oil and Gas Loans

$302

$401

$457 $441

$351

$178

$286 $283 $290 $275

$21

$18

$9

$17

8

OIL AND GAS UPDATE

$608

$477 $451

$398

$446

$124

$150 $176

$171 $75

$20

$129 $129

$127

$147

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Pass Potential Problem Loans Nonaccrual

$752 $756 $756

$696

$668

Period End Loans by Credit Quality Oil and Gas Allowance

$42

$49

$42 $38 $38

5.6%

6.5%

5.6% 5.5% 5.7%

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Oil and Gas Allowance

Oil and Gas Allowance / Oil and Gas Loans

($ in millions) ($ in millions)

9

Total O&G Portfolio

Year end December 31, 2016

61 credits ~$1 billion commitments

$668 million

outstandings

3%

of total loans

New business in 2016 14 credits

$310 million

commitments

$187 million

outstandings

1%

of total loans

$626 $646

$681 $676

$707

2012 2013 2014 2015 2016

Net interest income

3.30%

3.17% 3.08%

2.84% 2.80%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

$- $4

$8 $12

$16 $20

$24 $28

$32 $36

$40 $44

$48 $52

$56 $60

$64 $68

$72 $76

$80 $84

$88 $92

$96 $100

$104 $108

$112 $116

$120 $124

$128 $132

$136 $140

$144 $148

$152 $156

$160 $164

$168 $172

$176 $180

NET INTEREST INCOME AND MARGIN

ANNUAL TRENDS

0.36%

0.24% 0.20% 0.22%

0.32%

2012 2013 2014 2015 2016

Interest-bearing deposit costs Other funding costs

0.40%

0.31%

0.62%

0.40% 0.42%

Net interest margin

Yield on Interest-earning Assets Net Interest Income & Net Interest Margin

Cost of Interest-bearing Liabilities

($ in millions)

3.77%

3.47% 3.32% 3.15% 3.12%

4.07%

3.77% 3.58% 3.40% 3.38%

2.86%

2.59% 2.59% 2.45% 2.34%

2012 2013 2014 2015 2016

Total interest-earning assets Total loans

Investments and other

10

2.82% 2.81% 2.81% 2.77% 2.80%

0.00%

0.50%

1.00%

1.50%

2.00%

2.50%

3.00%

3.50%

4.00%

$-

$4

$8

$12

$16

$20

$24

$28

$32

$36

$40

$44

$48

$52

$56

$60

$64

$68

$72

$76

$80

$84

$88

$92

$96

$100

$104

$108

$112

$116

$120

$124

$128

$132

$136

$140

$144

$148

$152

$156

$160

$164

$168

$172

$176

$180

$169 $171

$176 $178 $178

$2 $1

$1 $1 $2

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Interest recoveries, prepayment fees, & deferred fees

Net interest income net of interest recoveries, prepayment fees, &

deferred fees

3.14% 3.16% 3.12% 3.09% 3.12%

3.37% 3.41% 3.35% 3.35% 3.40%

2.47% 2.43% 2.38% 2.29% 2.25%

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Total interest-earning assets Total loans

Investments and other

0.22%

0.30% 0.31% 0.32% 0.33%

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Interest-bearing deposit costs Other funding costs

Net interest margin

Yield on Interest-earning Assets Net Interest Income & Net Interest Margin

NET INTEREST INCOME AND MARGIN

QUARTERLY TRENDS

($ in millions)

0.41%

0.45%

0.41%

$172

$179

0.39%

$177

$171

$180

Cost of Interest-bearing Liabilities

0.42%

11

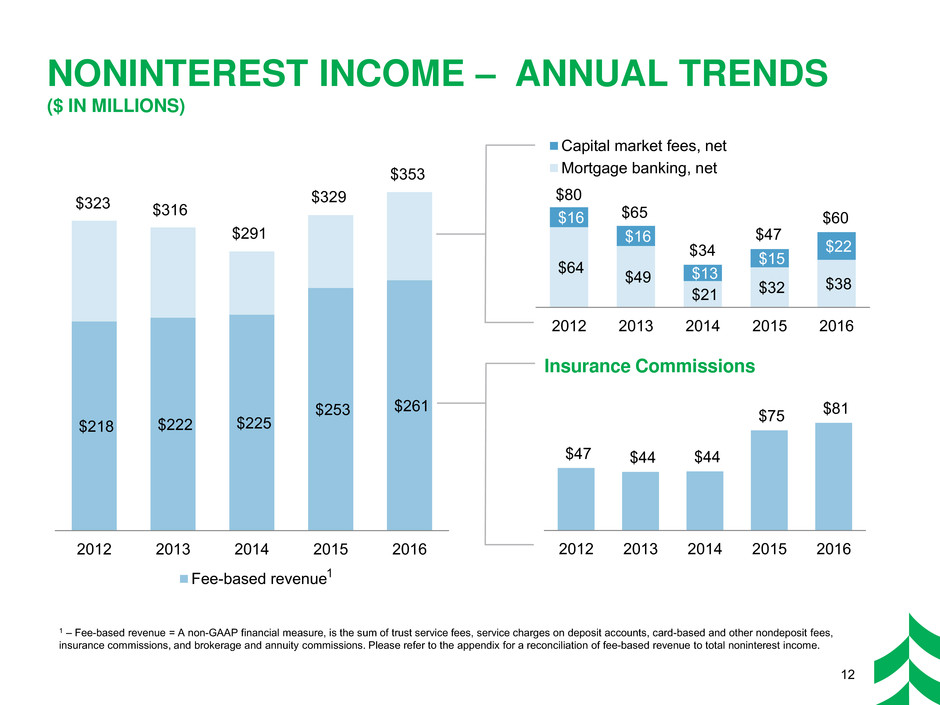

$218 $222 $225

$253 $261

2012 2013 2014 2015 2016

Fee-based revenue

NONINTEREST INCOME – ANNUAL TRENDS

($ IN MILLIONS)

$323

$64 $49

$21 $32

$38

$16

$16

$13

$15

$22

2012 2013 2014 2015 2016

Capital market fees, net

Mortgage banking, net

$47 $44 $44

$75 $81

2012 2013 2014 2015 2016

$316

$291

$329

$353

Insurance Commissions

12

1 – Fee-based revenue = A non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees,

insurance commissions, and brokerage and annuity commissions. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income.

1

$80

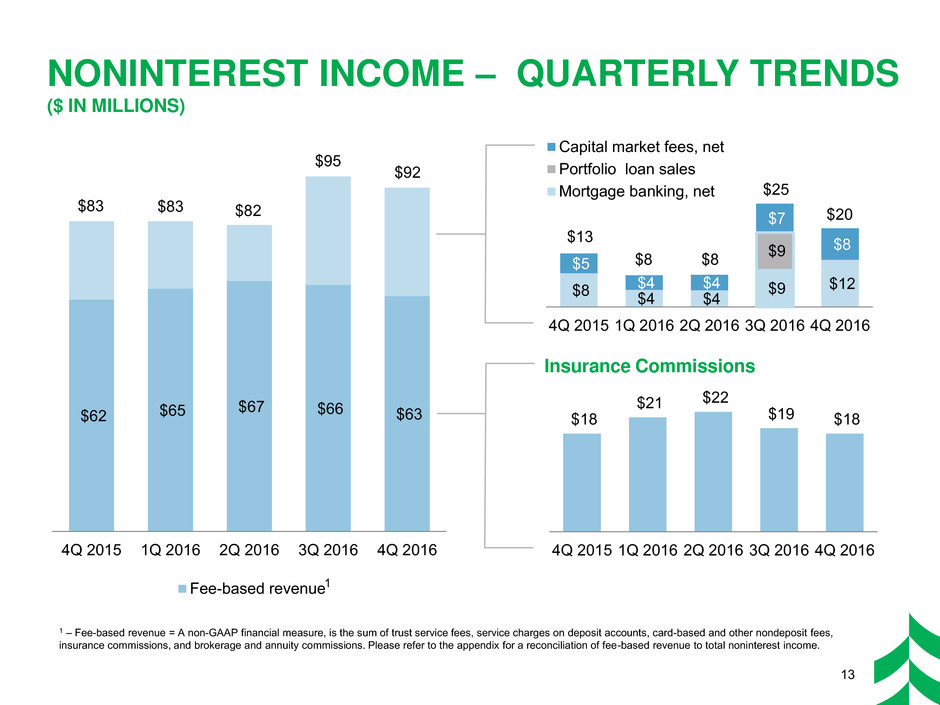

$65

$34

$47

$60

$8 $4 $4

$9 $12

$9

$5

$4 $4

$7

$8

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Capital market fees, net

Portfolio loan sales

Mortgage banking, net

NONINTEREST INCOME – QUARTERLY TRENDS

($ IN MILLIONS)

$62 $65 $67 $66 $63

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Fee-based revenue

$92

$83 $83 $82

Insurance Commissions

$18

$21 $22

$19 $18

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

13

$95

$13

$8 $8

$25

$20

1 – Fee-based revenue = A non-GAAP financial measure, is the sum of trust service fees, service charges on deposit accounts, card-based and other nondeposit fees,

insurance commissions, and brokerage and annuity commissions. Please refer to the appendix for a reconciliation of fee-based revenue to total noninterest income.

1

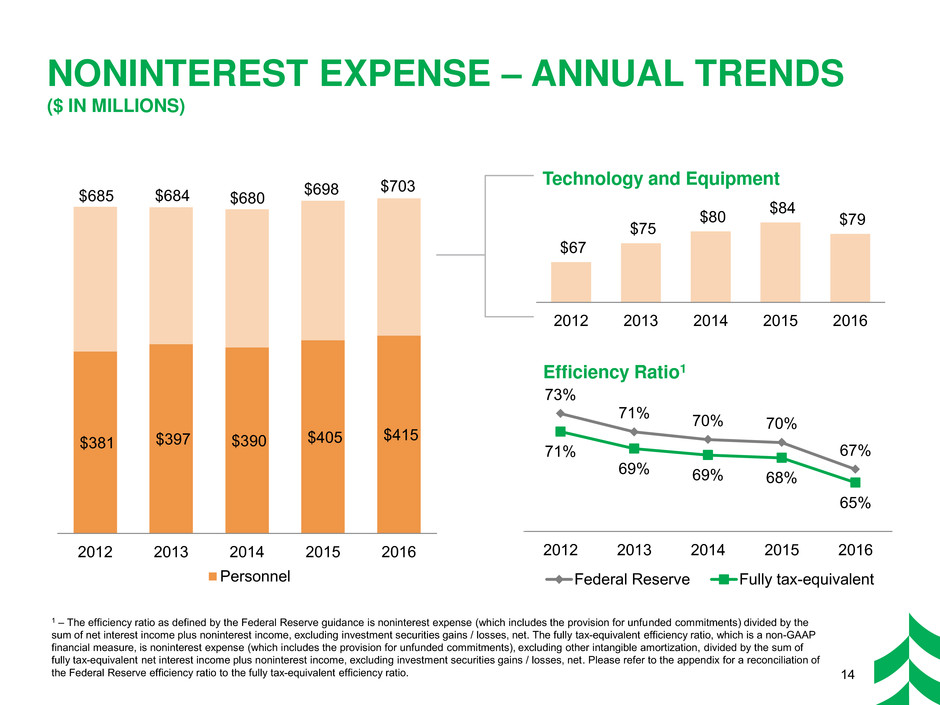

$381 $397 $390 $405 $415

2012 2013 2014 2015 2016

Personnel

NONINTEREST EXPENSE – ANNUAL TRENDS

($ IN MILLIONS)

$685

$67

$75

$80 $84 $79

2012 2013 2014 2015 2016

$684 $680 $698

$703 Technology and Equipment

Efficiency Ratio1

1 – The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments) divided by the

sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent efficiency ratio, which is a non-GAAP

financial measure, is noninterest expense (which includes the provision for unfunded commitments), excluding other intangible amortization, divided by the sum of

fully tax-equivalent net interest income plus noninterest income, excluding investment securities gains / losses, net. Please refer to the appendix for a reconciliation of

the Federal Reserve efficiency ratio to the fully tax-equivalent efficiency ratio. 14

73%

71% 70% 70%

67% 71%

69% 69% 68%

65%

2012 2013 2014 2015 2016

Federal Reserve Fully tax-equivalent

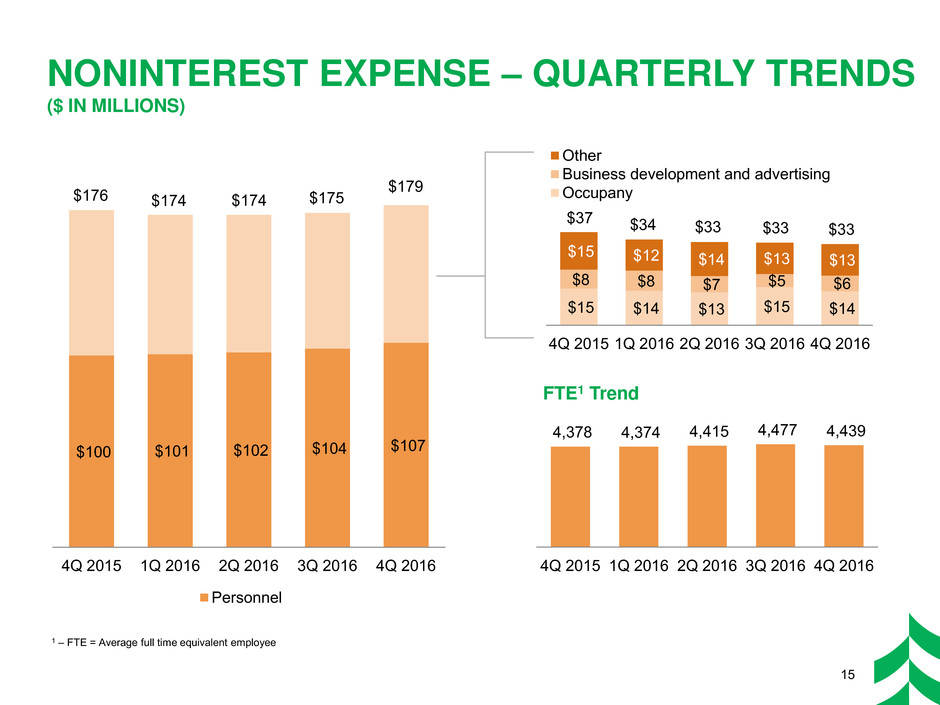

$15 $14 $13 $15 $14

$8 $8 $7 $5 $6

$15 $12 $14 $13 $13

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Other

Business development and advertising

Occupany

$100 $101 $102 $104 $107

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

Personnel

NONINTEREST EXPENSE – QUARTERLY TRENDS

($ IN MILLIONS)

1 – FTE = Average full time equivalent employee

FTE1 Trend

$176 $174 $174 $175

4,378 4,374 4,415 4,477 4,439

4Q 2015 1Q 2016 2Q 2016 3Q 2016 4Q 2016

$179

15

$37 $34 $33 $33 $33

2017 OUTLOOK

Balance

Sheet

Management

Mid-to-high single digit annual

average loan growth

Maintain Loan to Deposit ratio

under 100%

Stable to improving NIM trend,

assuming additional Federal

Reserve action to raise rates

Fee

Businesses

Improving fee-based and

capital markets revenues

Declining mortgage banking

Increasing tax credit

investment activity

Expense

Management

Approximately 1% higher than

the prior year

Continued improvement to our

efficiency ratio

Capital

&

Credit

Management

Continue to follow stated

corporate priorities for capital

deployment

Expected to adjust with changes

to risk grade, other indications of

credit quality, and loan volume

16

This outlook reflects a similar economy to what we experienced in 2016 and includes our

expectation of two interest rate increases in 2017. It does not reflect any changes to the regulatory

environment or to corporate tax rates. We may adjust our outlook if, and when, we have more

clarity on any one, or more, of these factors.

RECONCILIATION AND DEFINITIONS OF

NON-GAAP ITEMS

17

Efficiency Ratio 2012 2013 2014 2015 2016

Federal Reserve efficiency ratio 73.21% 71.14% 70.29% 69.96% 66.95%

Fully tax-equivalent adjustment (1.59) (1.45) (1.35) (1.41) (1.29)

Other intangible amortization (0.44) (0.42) (0.39) (0.31) (0.20)

Fully tax-equivalent efficiency ratio 71.18% 69.27% 68.55% 68.24% 65.46%

The efficiency ratio as defined by the Federal Reserve guidance is noninterest expense (which includes the provision for unfunded commitments)

divided by the sum of net interest income plus noninterest income, excluding investment securities gains / losses, net. The fully tax-equivalent

efficiency ratio, which is a non-GAAP financial measure, is noninterest expense (which includes the provision for unfunded commitments),

excluding other intangible amortization, divided by the sum of fully tax-equivalent net interest income plus noninterest income, excluding

investment securities gains / losses, net. Management believes the fully tax-equivalent efficiency ratio, which adjusts net interest income for the

tax-favored status of certain loans and investment securities, to be the preferred industry measurement as it enhances the comparability of net

interest income arising from taxable and tax-exempt sources.

Fee-based Revenue ($ millions) 2012 2013 2014 2015 2016

4Q

2015

1Q

2016

2Q

2016

3Q

2016

4Q

2016

Trust service fees $41 $46 $49 $49 $47 $12 $12 $12 $12 $12

Service charges on deposit accounts 69 70 69 66 67 17 16 16 18 16

Card-based and other nondeposit fees 46 47 47 48 50 11 12 13 13 13

Insurance commissions 47 44 44 75 81 18 21 22 19 18

Brokerage and annuity commissions 15 15 16 15 16 4 4 4 4 4

Total Fee-based revenue $218 $222 $225 $253 $261 $62 $65 $67 $66 $63

Other 105 94 66 76 92 21 18 15 29 29

Total noninterest income $323 $316 $291 $329 $353 $83 $83 $82 $95 $92