Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Riverview Financial Corp | d313241dex992.htm |

| EX-10.2 - EX-10.2 - Riverview Financial Corp | d313241dex102.htm |

| 8-K - FORM 8-K - Riverview Financial Corp | d313241d8k.htm |

| Exhibit 99.1

|

Common Stock Offering

November 2016

Confidential

Page | 1

|

|

Disclaimer

This confidential presentation has been prepared by Riverview Financial Corporation (“Riverview” or the “Company”) solely for informational purposes based on its own information, as well as information from public sources. This presentation has been prepared to assist interested parties in making their own evaluation of Riverview and does not purport to contain all of the information that they may deem relevant. In all cases, interested parties should conduct their own investigation and analysis of Riverview and the data set forth in this presentation and other information provided by or on behalf of Riverview. This presentation is not an offer and offers can only be made by the PPM.

Except as otherwise indicated, this presentation speaks as of the date hereof. The delivery of this presentation shall not, under any circumstances, create any implication that there has been no change in the affairs of the Company after the date hereof. Certain of the information contained herein may be derived from information provided by industry sources. The Company believes that such information is accurate and that the sources from which it has been obtained are reliable. The Company cannot guarantee the accuracy of such information, however, and has not independently verified such information.

This presentation contains forward-looking statements, including projections, predictions, expectations or statements as to beliefs or future events or results or refer to other matters that are not historical facts. In some cases you can identify these forward-looking statements by words like “may”, “will”, “should”, “expect”, “plan”, “anticipate”, “intend”, “believe”, “estimate”, “predict”, “potential”, or “continue”. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about the Company’s industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. Accordingly, you are cautioned that any such forward-looking statements are not guarantees of future performance and are subject to certain risks, uncertainties and assumptions that are difficult to predict. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the expected results expressed or implied by such forward-looking statements.

Important factors that could cause our actual results to differ materially from those in the forward-looking statements include, but are not limited to: our ability to achieve the intended benefits of acquisitions and integration of previously acquired businesses; restructuring initiatives; changes in interest rates; economic conditions, particularly in our market area; legislative and regulatory changes and the ability to comply with the significant laws and regulations governing the banking and financial services business; monetary and fiscal policies of the U.S. government, including policies of the U.S. Department of Treasury and the Federal Reserve System; credit risk associated with lending activities and changes in the quality and composition of our loan and investment portfolios; demand for loan and other products; deposit flows; competition; changes in the values of real estate and other collateral securing the loan portfolio, particularly in our market area; changes in relevant accounting principles and guidelines; and inability of third party service providers to perform.

The forward-looking statements contained in this presentation speak only as of the date of this presentation, and the Company undertakes no obligation to update any forward-looking statement to reflect events or circumstances after the date of this presentation or to reflect the occurrence of unanticipated events. This presentation is subject to the Confidentiality Agreement between Recipient and Ambassador Financial Group, Inc. as placement agent for Riverview.

Page | 2

|

|

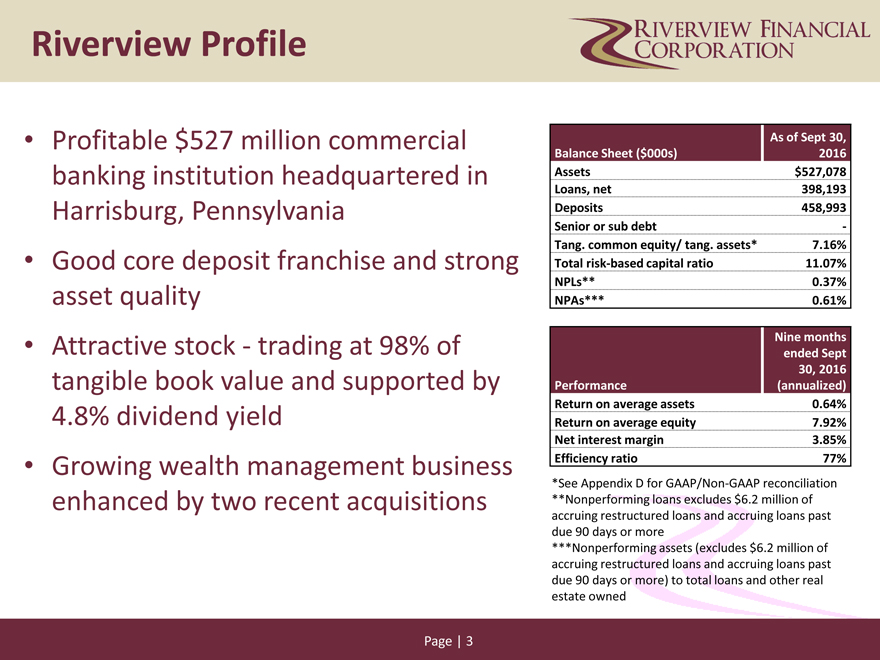

Riverview Profile

Profitable $527 million commercial banking institution headquartered in Harrisburg, Pennsylvania

Good core deposit franchise and strong asset quality

Attractive stock—trading at 98% of tangible book value and supported by 4.8% dividend yield

Growing wealth management business enhanced by two recent acquisitions

As of Sept 30,

Balance Sheet ($000s) 2016

Assets $527,078

Loans, net 398,193

Deposits 458,993

Senior or sub debt -

Tang. common equity/ tang. assets* 7.16%

Total risk-based capital ratio 11.07%

NPLs** 0.37%

NPAs*** 0.61%

Nine months

ended Sept

30, 2016

Performance (annualized)

Return on average assets 0.64%

Return on average equity 7.92%

Net interest margin 3.85%

Efficiency ratio 77%

*See Appendix D for GAAP/Non-GAAP reconciliation

**Nonperforming loans excludes $6.2 million of

accruing restructured loans and accruing loans past

due 90 days or more

***Nonperforming assets (excludes $6.2 million of

accruing restructured loans and accruing loans past

due 90 days or more) to total loans and other real

estate owned

Page | 3

|

|

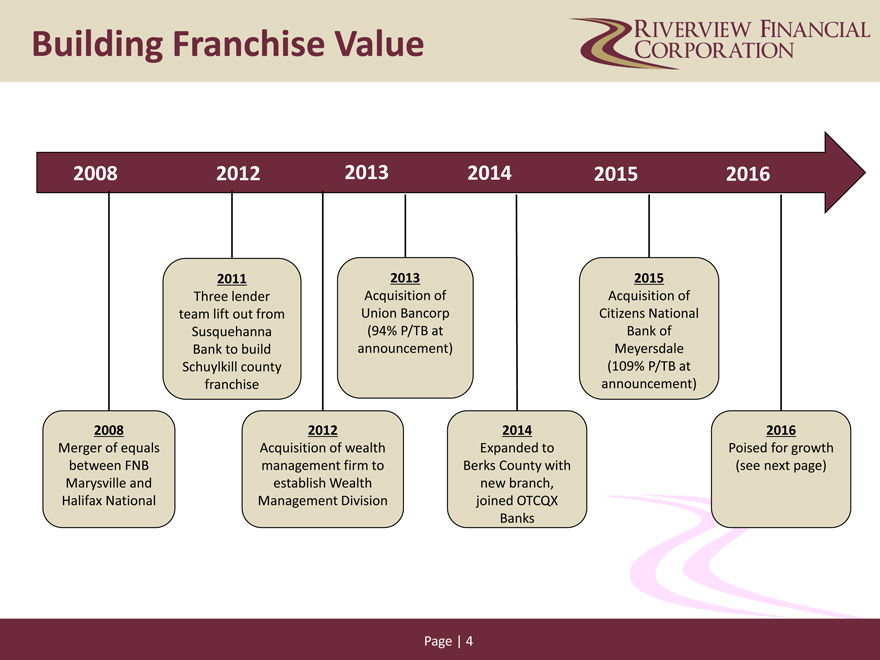

Building Franchise Value

2012 201320142015

2008 2012 2013201420152016

2011 20132015

Three lender Acquisition of Acquisition of

team lift out from Union Bancorp Citizens National

Susquehanna (94% P/TB at Bank of

Bank to build announcement) Meyersdale

Schuylkill county (109% P/TB at

franchise announcement)

2008 201220142016

Merger of equals Acquisition of wealth Expanded to Poised for growth

between FNB management firm to Berks County with(see next page)

Marysville and establish Wealth new branch,

Halifax National Management Division joined OTCQX

Banks

Page | 4

|

|

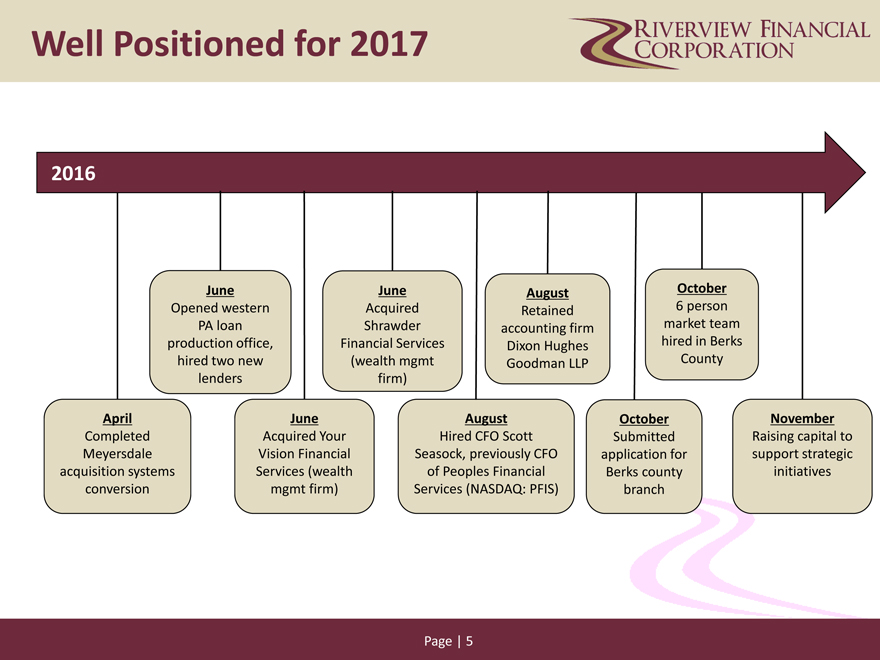

Well Positioned for 2017

2012 2013 20142015

2016

June June August October

Opened western Acquired Retained 6 person

PA loan Shrawder accounting firm market team

production office, Financial Services Dixon Hughes hired in Berks

hired two new (wealth mgmt Goodman LLP County

lenders firm)

April June August October November

Completed Acquired Your Hired CFO Scott Submitted Raising capital to

Meyersdale Vision Financial Seasock, previously CFO application for support strategic

acquisition systems Services (wealth of Peoples Financial Berks county initiatives

conversion mgmt firm) Services (NASDAQ: PFIS) branch

Page | 5

|

|

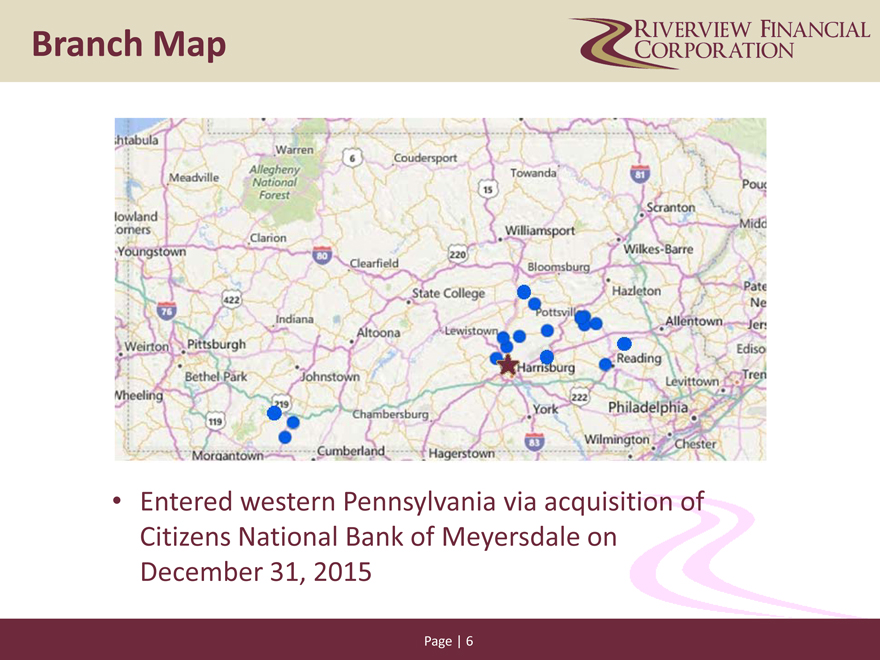

Branch Map

Entered western Pennsylvania via acquisition of Citizens National Bank of Meyersdale on December 31, 2015

Page | 6

|

|

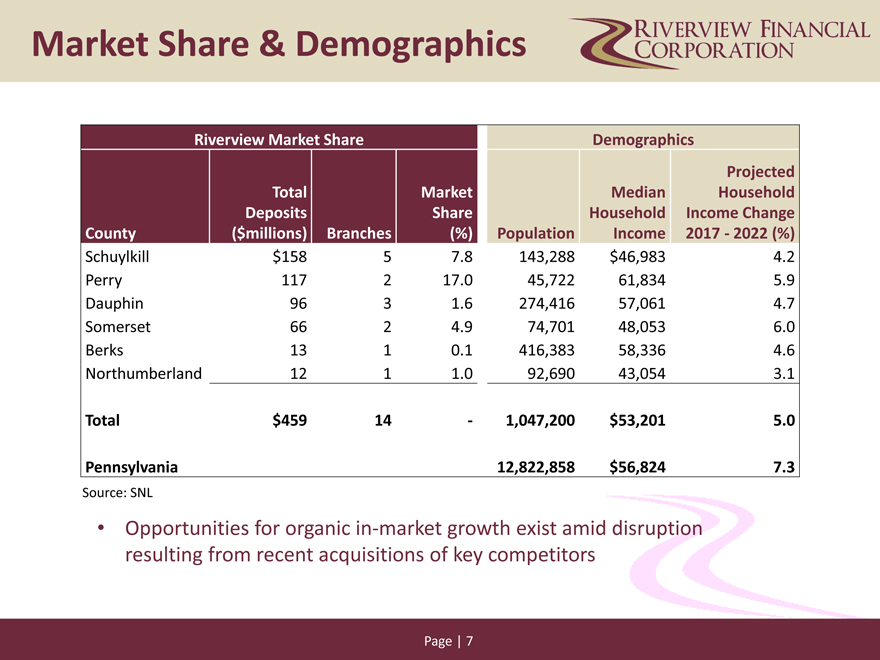

Market Share & Demographics

Riverview Market Share Demographics

Projected

Total Market Median Household

Deposits Share Household Income Change

County ($millions) Branches (%) Population Income 2017—2022 (%)

Schuylkill $158 57.8143,288$46,9834.2

Perry 117 217.045,72261,8345.9

Dauphin 96 31.6274,41657,0614.7

Somerset 66 24.974,70148,0536.0

Berks 13 10.1416,38358,3364.6

Northumberland 12 11.092,69043,0543.1

Total $459 14-1,047,200$53,2015.0

Pennsylvania 12,822,858$56,8247.3

Source: SNL

Opportunities for organic in-market growth exist amid disruption

resulting from recent acquisitions of key competitors

Page | 7

|

|

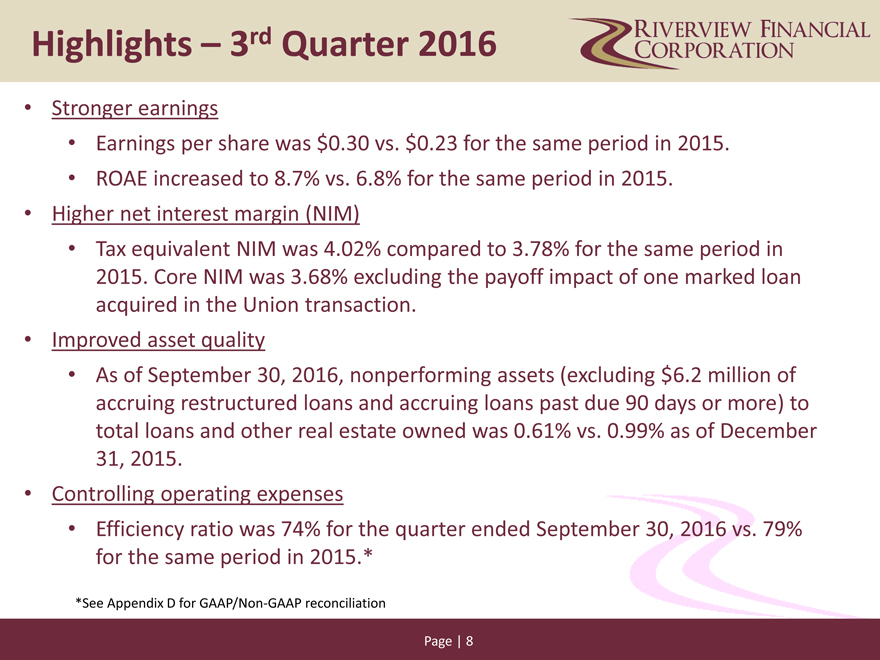

Highlights – 3rd Quarter 2016

Stronger earnings

Earnings per share was $0.30 vs. $0.23 for the same period in 2015.

ROAE increased to 8.7% vs. 6.8% for the same period in 2015.

Higher net interest margin (NIM)

Tax equivalent NIM was 4.02% compared to 3.78% for the same period in 2015. Core NIM was 3.68% excluding the payoff impact of one marked loan acquired in the Union transaction.

Improved asset quality

As of September 30, 2016, nonperforming assets (excluding $6.2 million of accruing restructured loans and accruing loans past due 90 days or more) to total loans and other real estate owned was 0.61% vs. 0.99% as of December 31, 2015.

Controlling operating expenses

Efficiency ratio was 74% for the quarter ended September 30, 2016 vs. 79% for the same period in 2015.*

*See Appendix D for GAAP/Non-GAAP reconciliation

Page | 8

|

|

Our Strategy

Successfully integrate past acquisitions and position for new opportunities

Strategically focus on revenue growth

Maintain strong credit quality in all business cycles

Grow diversified streams of non-interest income to decrease reliance on net interest margin (NIM)

Emphasize client relationships and continue to attract core deposits

Introduce mobile banking capabilities next quarter

Page | 9

|

|

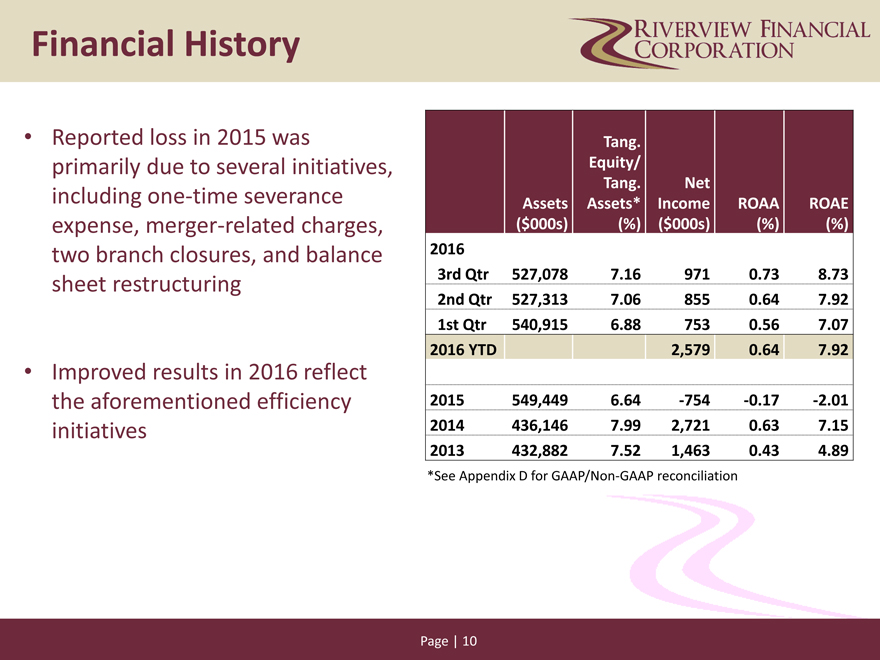

Financial History

Reported loss in 2015 was primarily due to several initiatives, including one-time severance expense, merger-related charges, two branch closures, and balance sheet restructuring

Improved results in 2016 reflect the aforementioned efficiency initiatives

Tang.

Equity/

Tang.Net

Assets Assets* Income ROAA ROAE

($000s) (%)($000s)(%)(%)

2016

3rd Qtr 527,078 7.169710.738.73

2nd Qtr 527,313 7.068550.647.92

1st Qtr 540,915 6.887530.567.07

2016 YTD 2,5790.647.92

2015 549,449 6.64-754-0.17-2.01

2014 436,146 7.992,7210.637.15

2013 432,882 7.521,4630.434.89

*See Appendix D for GAAP/Non-GAAP reconciliation

Page | 10

|

|

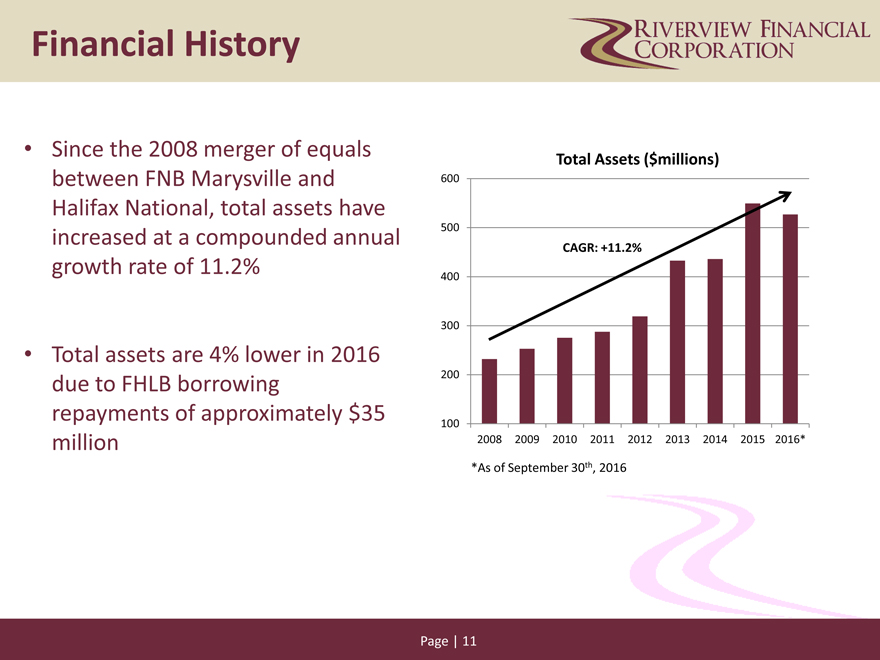

Financial History

Since the 2008 merger of equals between FNB Marysville and Halifax National, total assets have increased at a compounded annual growth rate of 11.2%

Total assets are 4% lower in 2016 due to FHLB borrowing repayments of approximately $35 million

Total Assets ($millions)

600

500

CAGR: +11.2%

400

300

200

100

2008 2009 2010 2011 2012 2013 2014 20152016*

*As of September 30th, 2016

Page | 11

|

|

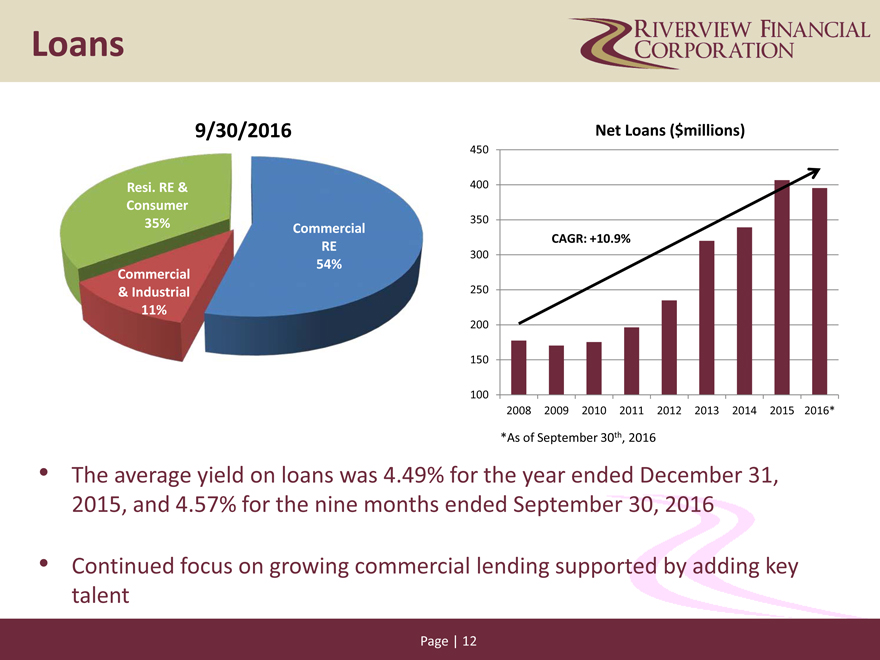

Loans

9/30/2016 Net Loans ($millions)

450

Resi. RE & 400

Consumer

35% Commercial350

RECAGR: +10.9%

300

Commercial 54%

& Industrial 250

11%

200

150

100

2008 2009 2010 2011 2012 2013 201420152016*

*As of September 30th, 2016

The average yield on loans was 4.49% for the year ended December 31, 2015, and 4.57% for the nine months ended September 30, 2016

Continued focus on growing commercial lending supported by adding key talent

Page | 12

|

|

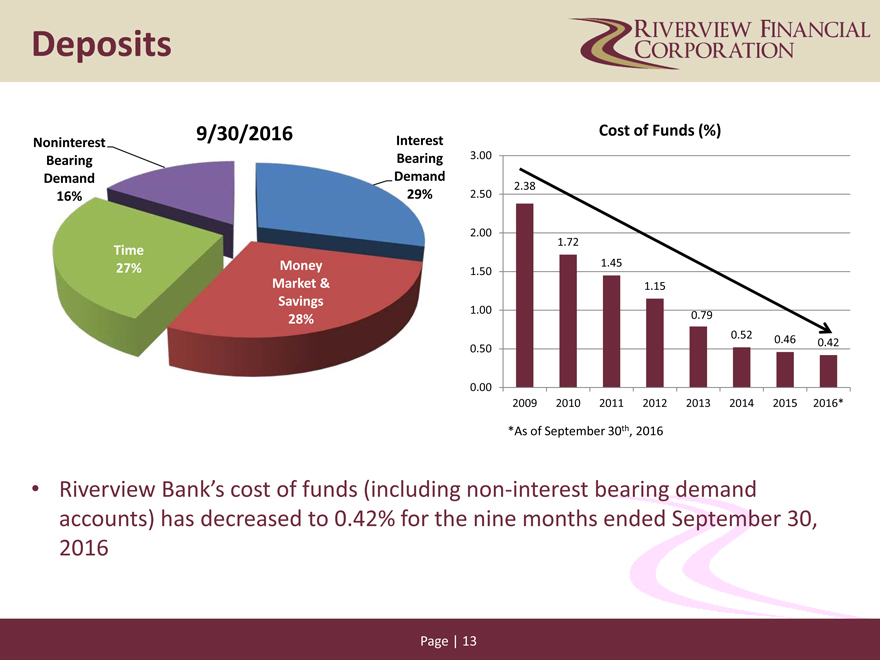

Deposits

Noninterest 9/30/2016 Interest Cost of Funds (%)

Bearing Bearing 3.00

Demand Demand

16% 29%2.502.38

2.00

Time 1.72

27% Money 1.501.45

Market &1.15

Savings1.00

28%0.79

0.520.460.42

0.50

0.00

2009 2010 2011 2012 2013 2014 2015 2016*

*As of September 30th, 2016

Riverview Bank’s cost of funds (including non-interest bearing demand

accounts) has decreased to 0.42% for the nine months ended September 30,

2016

Page | 13

|

|

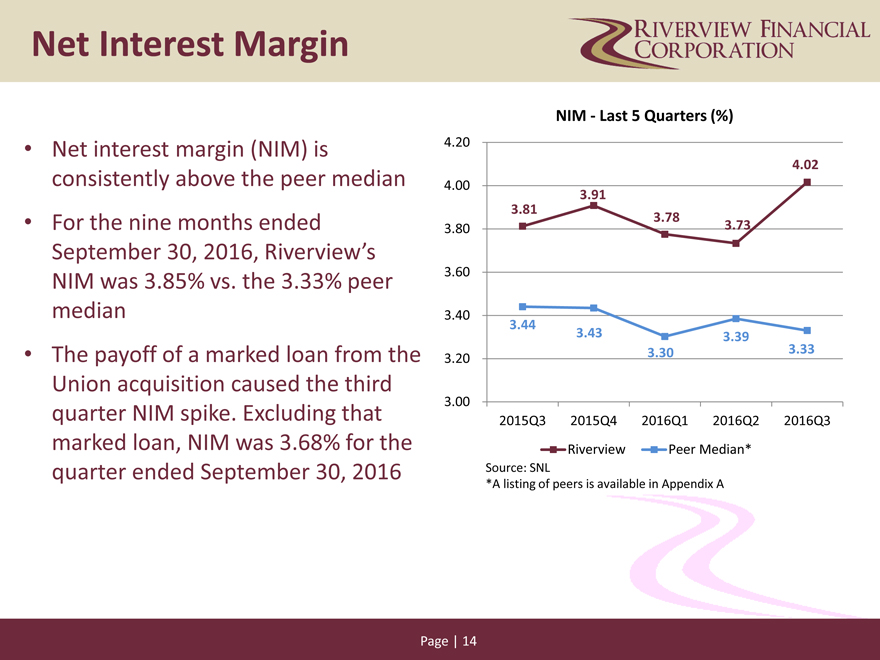

Net Interest Margin

NIM—Last 5 Quarters (%)

Net interest margin (NIM) is 4.20

4.02

consistently above the peer median 4.003.91

For the nine months ended 3.803.813.783.73

September 30, 2016, Riverview’s

NIM was 3.85% vs. the 3.33% peer 3.60

median 3.40

3.443.433.39

The payoff of a marked loan from the 3.203.303.33

Union acquisition caused the third

quarter NIM spike. Excluding that 3.002015Q32015Q42016Q12016Q22016Q3

marked loan, NIM was 3.68% for the RiverviewPeer Median*

quarter ended September 30, 2016 Source: SNL

*A listing of peers is available in Appendix A

Page | 14

|

|

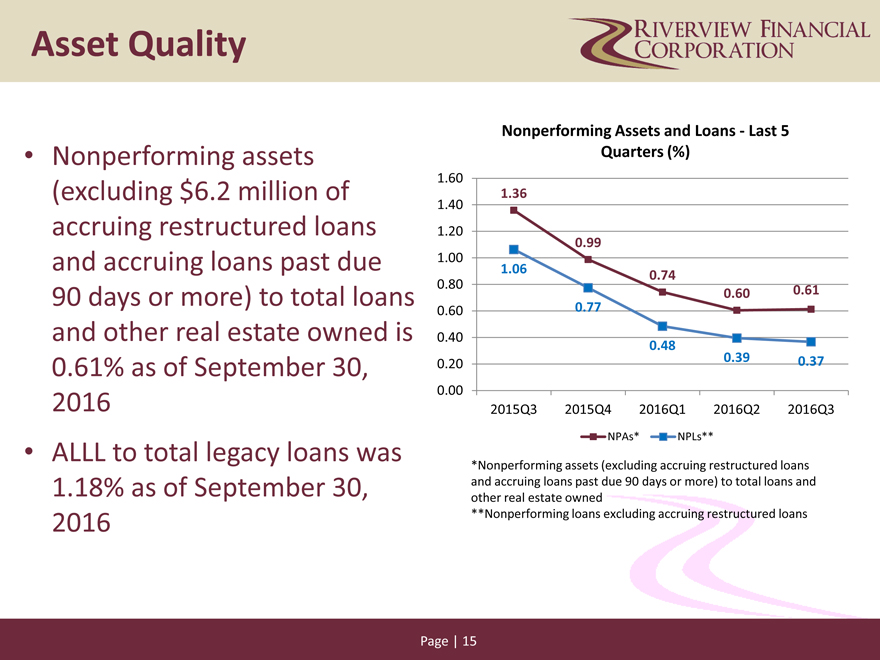

Asset Quality

Nonperforming Assets and Loans—Last 5

Nonperforming assets Quarters (%)

(excluding $6.2 million of 1.601.36

1.40

accruing restructured loans 1.20

0.99

and accruing loans past due 1.001.

060.74

90 days or more) to total loans 0.800.600.61

0.600.77

and other real estate owned is 0.400.48

0.61% as of September 30, 0.200.390.37

2016 0.00

2015Q32015Q42016Q12016Q22016Q3

ALLL to total legacy loans was NPAs*NPLs**

*Nonperforming assets (excluding accruing restructured loans

1.18% as of September 30, and accruing loans past due 90 days or more) to total loans and

other real estate owned

2016 **Nonperforming loans excluding accruing restructured loans

Page | 15

|

|

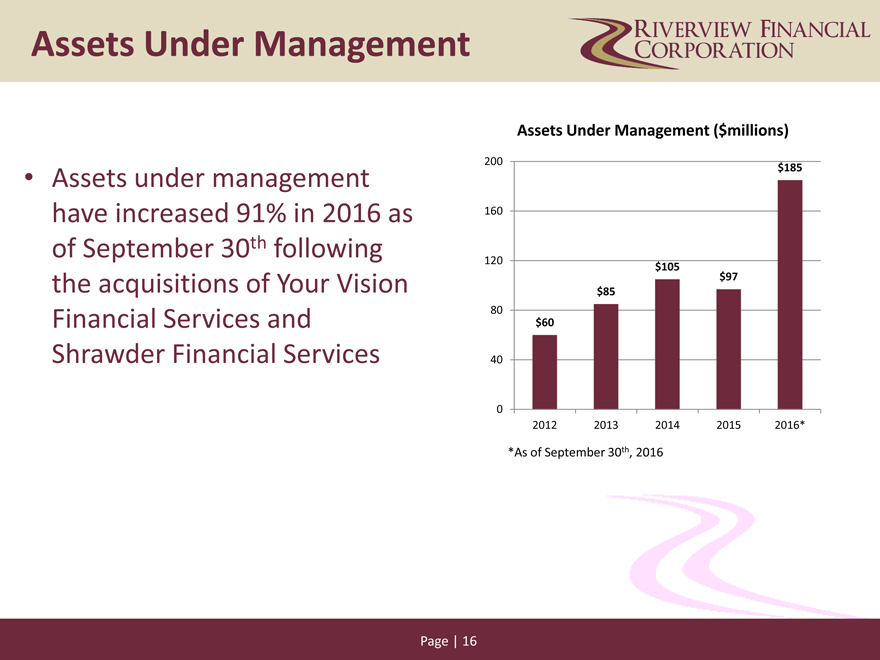

Assets Under Management

Assets Under Management ($millions)

Assets under management 200$185

have increased 91% in 2016 as 160

of September 30th following

120$105

the acquisitions of Your Vision $97

$85

80

Financial Services and $60

Shrawder Financial Services 40

0

20122013201420152016*

*As of September 30th, 2016

Page | 16

|

|

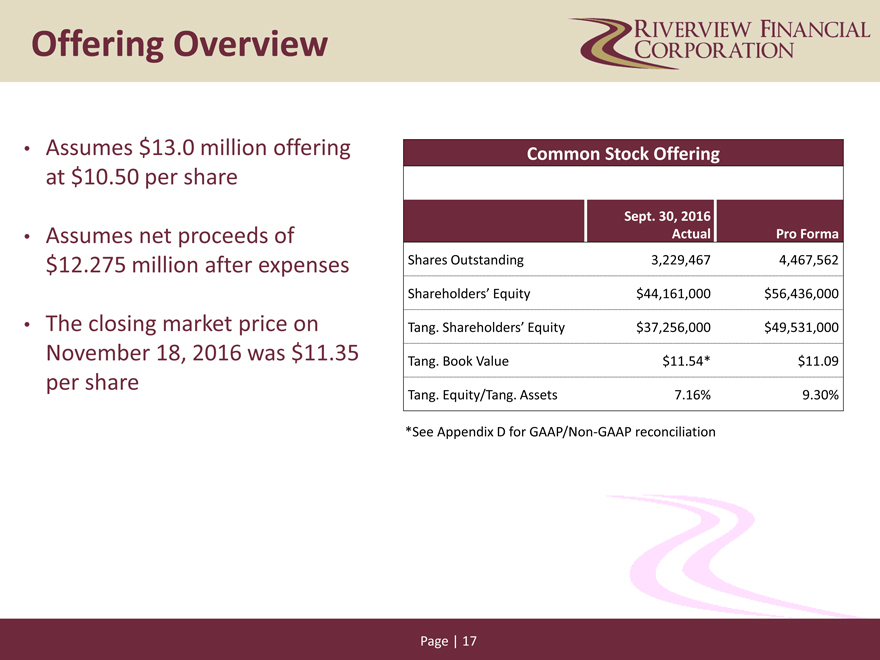

Offering Overview

Assumes $13.0 million offering Common Stock Offering

at $10.50 per share

Sept. 30, 2016

Assumes net proceeds of ActualPro Forma

$12.275 million after expenses Shares Outstanding 3,229,4674,467,562

Shareholders’ Equity $44,161,000$56,436,000

The closing market price on Tang. Shareholders’ Equity $37,256,000$49,531,000

November 18, 2016 was $11.35 Tang. Book Value $11.54*$11.09

per share Tang. Equity/Tang. Assets 7.16%9.30%

*See Appendix D for GAAP/Non-GAAP reconciliation

Page | 17

|

|

Reasons for the Offering

Support strategic organic growth opportunities

Help generate increased earnings power through growth which can achieve better economies of scale

Strengthen position to better compete for acquisition opportunities

Improve shareholder liquidity

Page | 18

|

|

Compelling Investment

Growing company with desirable franchise value

Disciplined acquirer operating in attractive markets

Experienced management team with approximately 8% insider ownership

Attractive valuation

As of November 18th 2016, trading at 98% of tangible book value vs. the peer median* of 110%

Priced at a discount to market

Consistent dividend

4.8% dividend yield based on current market price of $11.05

$0.55 per share paid in 2014, 2015, and thus far in 2016 on an annualized basis.

*A listing of peers is available in Appendix A

Page | 19

|

|

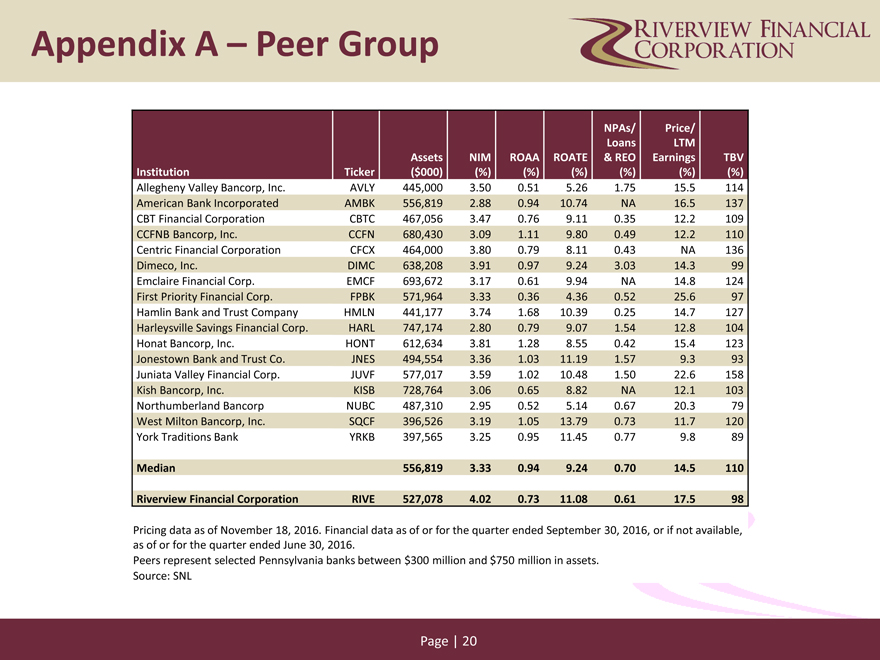

Appendix A – Peer Group

NPAs/Price/

LoansLTM

AssetsNIMROAAROATE& REOEarningsTBV

Institution Ticker ($000)(%)(%)(%)(%)(%)(%)

Allegheny Valley Bancorp, Inc. AVLY 445,0003.500.515.261.7515.5114

American Bank Incorporated AMBK 556,8192.880.9410.74NA16.5137

CBT Financial Corporation CBTC 467,0563.470.769.110.3512.2109

CCFNB Bancorp, Inc. CCFN 680,4303.091.119.800.4912.2110

Centric Financial Corporation CFCX 464,0003.800.798.110.43NA136

Dimeco, Inc. DIMC 638,2083.910.979.243.0314.399

Emclaire Financial Corp. EMCF 693,6723.170.619.94NA14.8124

First Priority Financial Corp. FPBK 571,9643.330.364.360.5225.697

Hamlin Bank and Trust Company HMLN 441,1773.741.6810.390.2514.7127

Harleysville Savings Financial Corp. HARL 747,1742.800.799.071.5412.8104

Honat Bancorp, Inc. HONT 612,6343.811.288.550.4215.4123

Jonestown Bank and Trust Co. JNES 494,5543.361.0311.191.579.393

Juniata Valley Financial Corp. JUVF 577,0173.591.0210.481.5022.6158

Kish Bancorp, Inc. KISB 728,7643.060.658.82NA12.1103

Northumberland Bancorp NUBC 487,3102.950.525.140.6720.379

West Milton Bancorp, Inc. SQCF 396,5263.191.0513.790.7311.7120

York Traditions Bank YRKB 397,5653.250.9511.450.779.889

Median 556,8193.330.949.240.7014.5110

Riverview Financial Corporation RIVE 527,0784.020.7311.080.6117.598

Pricing data as of November 18, 2016. Financial data as of or for the quarter ended September 30, 2016, or if not available,

as of or for the quarter ended June 30, 2016.

Peers represent selected Pennsylvania banks between $300 million and $750 million in assets.

Source: SNL

Page | 20

|

|

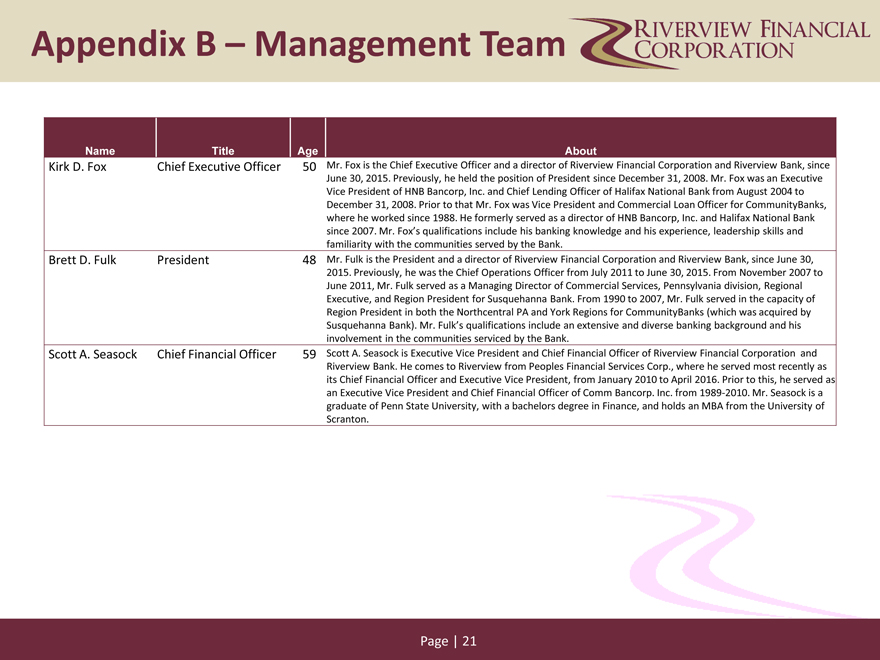

Appendix B – Management Team

Name Title AgeAbout

Kirk D. Fox Chief Executive Officer 50Mr. Fox is the Chief Executive Officer and a director of Riverview Financial Corporation and Riverview Bank, since

June 30, 2015. Previously, he held the position of President since December 31, 2008. Mr. Fox was an Executive

Vice President of HNB Bancorp, Inc. and Chief Lending Officer of Halifax National Bank from August 2004 to

December 31, 2008. Prior to that Mr. Fox was Vice President and Commercial Loan Officer for CommunityBanks,

where he worked since 1988. He formerly served as a director of HNB Bancorp, Inc. and Halifax National Bank

since 2007. Mr. Fox’s qualifications include his banking knowledge and his experience, leadership skills and

familiarity with the communities served by the Bank.

Brett D. Fulk President 48Mr. Fulk is the President and a director of Riverview Financial Corporation and Riverview Bank, since June 30,

2015. Previously, he was the Chief Operations Officer from July 2011 to June 30, 2015. From November 2007 to

June 2011, Mr. Fulk served as a Managing Director of Commercial Services, Pennsylvania division, Regional

Executive, and Region President for Susquehanna Bank. From 1990 to 2007, Mr. Fulk served in the capacity of

Region President in both the North central PA and York Regions for CommunityBanks (which was acquired by

Susquehanna Bank). Mr. Fulk’s qualifications include an extensive and diverse banking background and his

involvement in the communities serviced by the Bank.

Scott A. Seasock Chief Financial Officer 59Scott A. Seasock is Executive Vice President and Chief Financial Officer of Riverview Financial Corporation and

Riverview Bank. He comes to Riverview from Peoples Financial Services Corp., where he served most recently as

its Chief Financial Officer and Executive Vice President, from January 2010 to April 2016. Prior to this, he served as

an Executive Vice President and Chief Financial Officer of Comm Bancorp. Inc. from 1989-2010. Mr. Seasock is a

graduate of Penn State University, with a bachelors degree in Finance, and holds an MBA from the University of

Scranton.

Page | 21

|

|

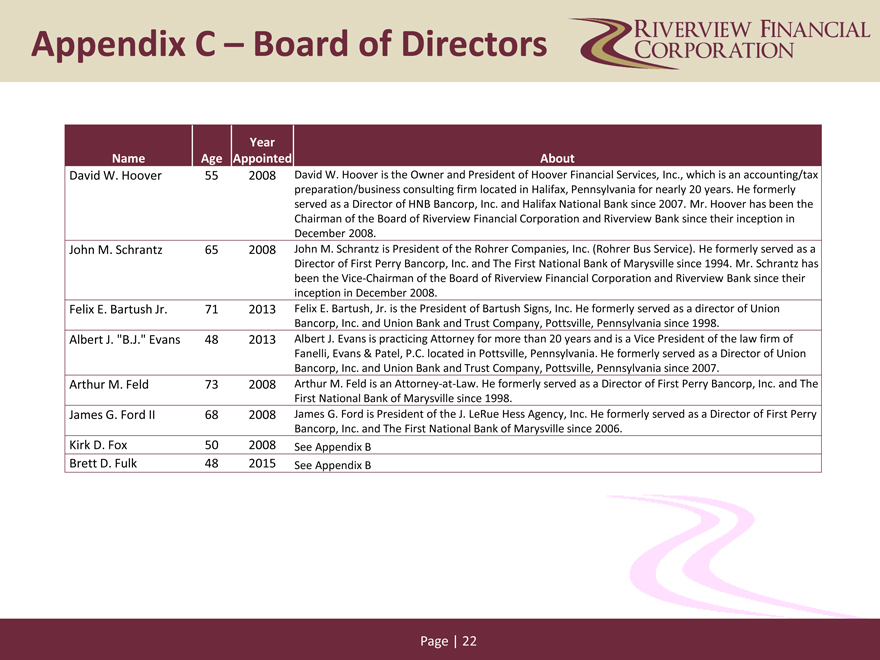

Appendix C – Board of Directors

Year

Name Age Appointed About

David W. Hoover 55 2008David W. Hoover is the Owner and President of Hoover Financial Services, Inc., which is an accounting/tax

preparation/business consulting firm located in Halifax, Pennsylvania for nearly 20 years. He formerly

served as a Director of HNB Bancorp, Inc. and Halifax National Bank since 2007. Mr. Hoover has been the

Chairman of the Board of Riverview Financial Corporation and Riverview Bank since their inception in

December 2008.

John M. Schrantz 65 2008John M. Schrantz is President of the Rohrer Companies, Inc. (Rohrer Bus Service). He formerly served as a

Director of First Perry Bancorp, Inc. and The First National Bank of Marysville since 1994. Mr. Schrantz has

been the Vice-Chairman of the Board of Riverview Financial Corporation and Riverview Bank since their

inception in December 2008.

Felix E. Bartush Jr. 71 2013Felix E. Bartush, Jr. is the President of Bartush Signs, Inc. He formerly served as a director of Union

Bancorp, Inc. and Union Bank and Trust Company, Pottsville, Pennsylvania since 1998.

Albert J. “B.J.” Evans 48 2013Albert J. Evans is practicing Attorney for more than 20 years and is a Vice President of the law firm of

Fanelli, Evans & Patel, P.C. located in Pottsville, Pennsylvania. He formerly served as a Director of Union

Bancorp, Inc. and Union Bank and Trust Company, Pottsville, Pennsylvania since 2007.

Arthur M. Feld 73 2008Arthur M. Feld is an Attorney-at-Law. He formerly served as a Director of First Perry Bancorp, Inc. and The

First National Bank of Marysville since 1998.

James G. Ford II 68 2008James G. Ford is President of the J. LeRue Hess Agency, Inc. He formerly served as a Director of First Perry

Bancorp, Inc. and The First National Bank of Marysville since 2006.

Kirk D. Fox 50 2008See Appendix B

Brett D. Fulk 48 2015See Appendix B

Page | 22

|

|

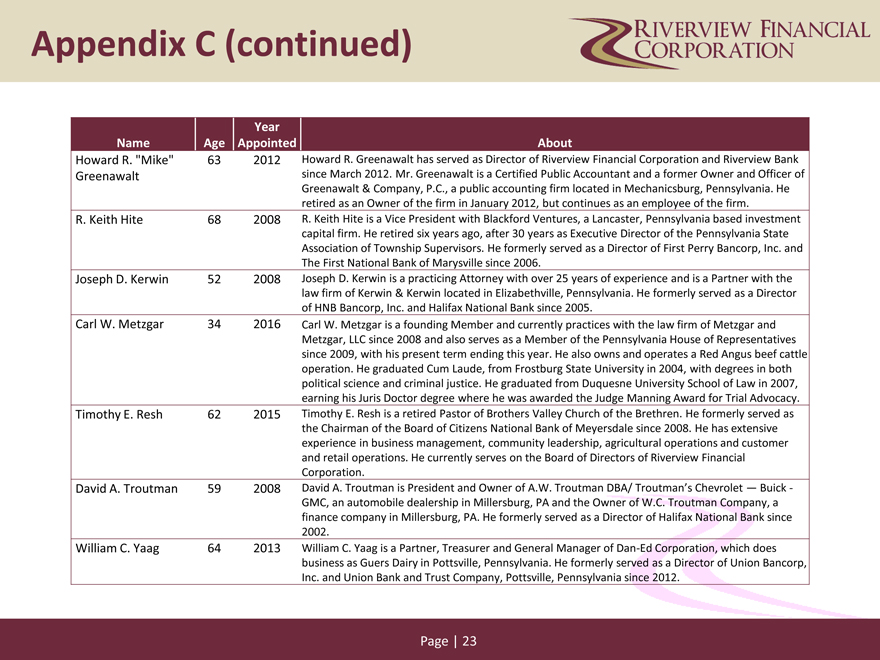

Appendix C (continued)

Year

Name Age AppointedAbout

Howard R. “Mike” 63 2012Howard R. Greenawalt has served as Director of Riverview Financial Corporation and Riverview Bank

Greenawalt since March 2012. Mr. Greenawalt is a Certified Public Accountant and a former Owner and Officer of

Greenawalt & Company, P.C., a public accounting firm located in Mechanicsburg, Pennsylvania. He

retired as an Owner of the firm in January 2012, but continues as an employee of the firm.

R. Keith Hite 68 2008R. Keith Hite is a Vice President with Blackford Ventures, a Lancaster, Pennsylvania based investment

capital firm. He retired six years ago, after 30 years as Executive Director of the Pennsylvania State

Association of Township Supervisors. He formerly served as a Director of First Perry Bancorp, Inc. and

The First National Bank of Marysville since 2006.

Joseph D. Kerwin 52 2008Joseph D. Kerwin is a practicing Attorney with over 25 years of experience and is a Partner with the

law firm of Kerwin & Kerwin located in Elizabethville, Pennsylvania. He formerly served as a Director

of HNB Bancorp, Inc. and Halifax National Bank since 2005.

Carl W. Metzgar 34 2016Carl W. Metzgar is a founding Member and currently practices with the law firm of Metzgar and

Metzgar, LLC since 2008 and also serves as a Member of the Pennsylvania House of Representatives

since 2009, with his present term ending this year. He also owns and operates a Red Angus beef cattle

operation. He graduated Cum Laude, from Frostburg State University in 2004, with degrees in both

political science and criminal justice. He graduated from Duquesne University School of Law in 2007,

earning his Juris Doctor degree where he was awarded the Judge Manning Award for Trial Advocacy.

Timothy E. Resh 62 2015Timothy E. Resh is a retired Pastor of Brothers Valley Church of the Brethren. He formerly served as

the Chairman of the Board of Citizens National Bank of Meyersdale since 2008. He has extensive

experience in business management, community leadership, agricultural operations and customer

and retail operations. He currently serves on the Board of Directors of Riverview Financial

Corporation.

David A. Troutman 59 2008David A. Troutman is President and Owner of A.W. Troutman DBA/ Troutman’s Chevrolet — Buick -

GMC, an automobile dealership in Millersburg, PA and the Owner of W.C. Troutman Company, a

finance company in Millersburg, PA. He formerly served as a Director of Halifax National Bank since

2002.

William C. Yaag 64 2013William C. Yaag is a Partner, Treasurer and General Manager of Dan-Ed Corporation, which does

business as Guers Dairy in Pottsville, Pennsylvania. He formerly served as a Director of Union Bancorp,

Inc. and Union Bank and Trust Company, Pottsville, Pennsylvania since 2012.

Page | 23

|

|

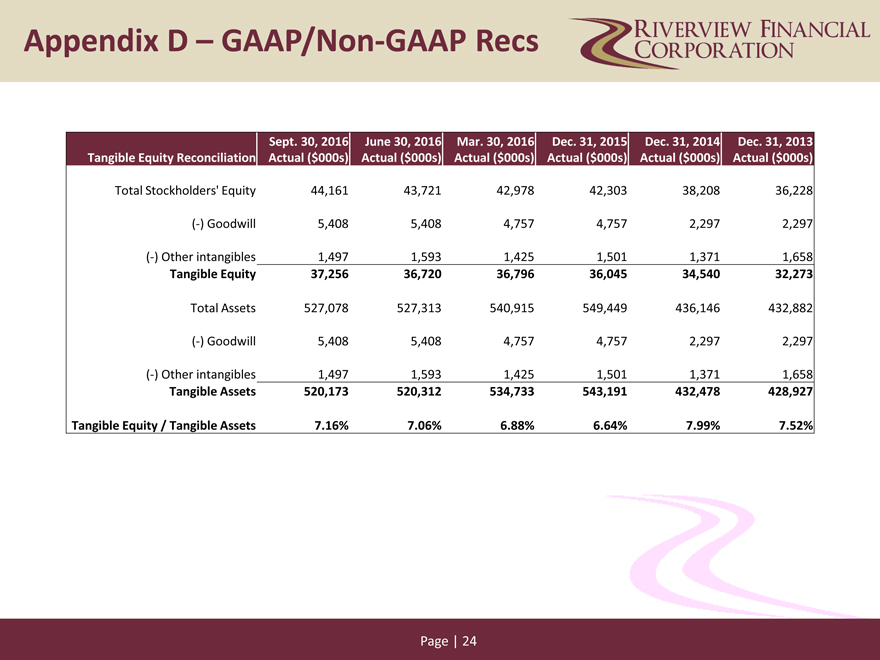

Appendix D – GAAP/Non-GAAP Recs

Sept. 30, 2016 June 30, 2016Mar. 30, 2016Dec. 31, 2015Dec. 31, 2014Dec. 31, 2013

Tangible Equity Reconciliation Actual ($000s) Actual ($000s)Actual ($000s)Actual ($000s)Actual ($000s)Actual ($000s)

Total Stockholders’ Equity 44,161 43,72142,97842,30338,20836,228

(-) Goodwill 5,408 5,4084,7574,7572,2972,297

(-) Other intangibles 1,497 1,5931,4251,5011,3711,658

Tangible Equity 37,256 36,72036,79636,04534,54032,273

Total Assets 527,078 527,313540,915549,449436,146432,882

(-) Goodwill 5,408 5,4084,7574,7572,2972,297

(-) Other intangibles 1,497 1,5931,4251,5011,3711,658

Tangible Assets 520,173 520,312534,733543,191432,478428,927

Tangible Equity / Tangible Assets 7.16% 7.06%6.88%6.64%7.99%7.52%

Page | 24

|

|

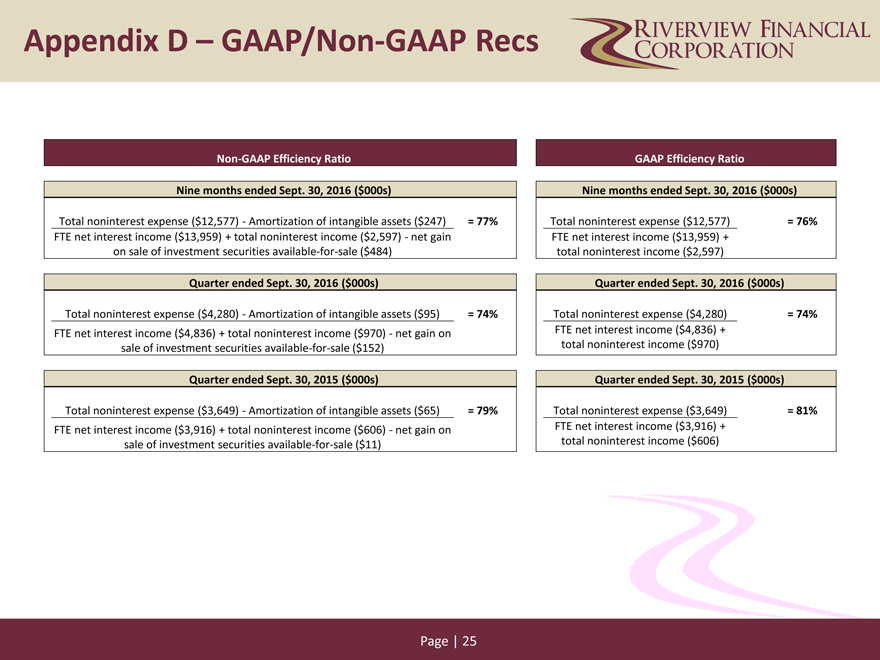

Appendix D – GAAP/Non-GAAP Recs

Non-GAAP Efficiency Ratio GAAP Efficiency Ratio

Nine months ended Sept. 30, 2016 ($000s) Nine months ended Sept. 30, 2016 ($000s)

Total noninterest expense ($12,577)—Amortization of intangible assets ($247) = 77% Total noninterest expense ($12,577)= 76%

FTE net interest income ($13,959) + total noninterest income ($2,597)—net gain FTE net interest income ($13,959) +

on sale of investment securities available-for-sale ($484) total noninterest income ($2,597)

Quarter ended Sept. 30, 2016 ($000s) Quarter ended Sept. 30, 2016 ($000s)

Total noninterest expense ($4,280)—Amortization of intangible assets ($95) = 74% Total noninterest expense ($4,280)= 74%

FTE net interest income ($4,836) + total noninterest income ($970)—net gain on FTE net interest income ($4,836) +

sale of investment securities available-for-sale ($152) total noninterest income ($970)

Quarter ended Sept. 30, 2015 ($000s) Quarter ended Sept. 30, 2015 ($000s)

Total noninterest expense ($3,649)—Amortization of intangible assets ($65) = 79% Total noninterest expense ($3,649)= 81%

FTE net interest income ($3,916) + total noninterest income ($606)—net gain on FTE net interest income ($3,916) +

sale of investment securities available-for-sale ($11) total noninterest income ($606)

Page | 25

|

|

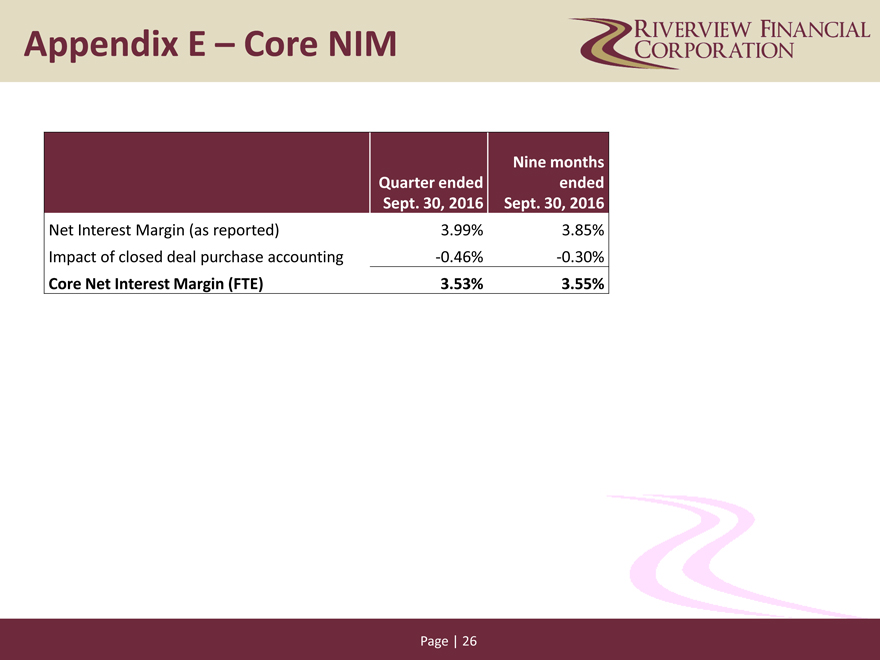

Appendix E – Core NIM

Nine months

Quarter ended ended

Sept. 30, 2016 Sept. 30, 2016

Net Interest Margin (as reported) 3.99% 3.85%

Impact of closed deal purchase accounting -0.46% -0.30%

Core Net Interest Margin (FTE) 3.53% 3.55%

Page | 26