Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - QUANTUM CORP /DE/ | q317exhibit991pre-release.htm |

| 8-K - CURRENT REPORT - QUANTUM CORP /DE/ | q317pre-release8xk.htm |

1 © 2017 Quantum Corporation

QUANTUM INVESTOR PRESENTATION

January 2017

2 © 2017 Quantum Corporation

Safe Harbor

Safe Harbor Statement

“Safe Harbor” Statement under the U.S. Private Securities Litigation Reform Act of 1995: This presentation contains “forward-looking”

statements within the meaning of the Private Securities Litigation Reform Act of 1995. Specifically, without limitation, statements regarding

anticipated market forecasts and trends, and Quantum’s financial forecast, business prospects and strategies are forward-looking statements

within the meaning of the Safe Harbor. All forward-looking statements are based on information available to Quantum on the date hereof.

These statements involve known and unknown risks, uncertainties and other factors that may cause Quantum’s actual results to differ

materially from those implied by the forward-looking statement. More detailed information about these risk factors, and additional risk

factors, are set forth in Quantum’s periodic filings with the Securities and Exchange Commission, including, but not limited to, those risks and

uncertainties listed in the section entitled “Risk Factors,” in Quantum’s Annual Report on Form 10-K filed with the Securities and Exchange

Commission on June 3, 2016. Quantum expressly disclaims any obligation to update or alter its forward-looking statements, whether as a

result of new information, future events or otherwise.

Non-GAAP Financial Measures

Quantum believes that non-GAAP financial measures provide useful and supplemental information to investors regarding its quarterly financial

performance. The non-GAAP financial measures Quantum uses are not prepared in accordance with generally accepted accounting principles

and may be different from non-GAAP financial measures used by other companies. For a description of the specific adjustments Quantum

makes in preparing its non-GAAP financial measures, and the rationale for these adjustments, please refer to the section entitled “Use of Non-

GAAP Financial Measures” in Quantum’s most recent quarterly earnings release filed on Form 8-K with the Securities and Exchange

Commission October 26, 2016.

3 © 2017 Quantum Corporation

Key Investment Highlights

Profit/Cash-Generating

Data Protection

Portfolio, Install Base

and Channel

High-Growth

Scale-out Tiered

Storage Portfolio

37-Year Storage

Specialist and

Leader in

Key Markets

Scalable Financial

Model Providing

Significant Leverage

4 © 2017 Quantum Corporation

Who We Are

Enable customers to capture, share and preserve digital assets over their entire

lifecycle, creating new opportunities to maximize data’s business value

What We Do

A leading expert in highly scalable storage, data protection and archive

focused on the most demanding workflow challenges

5 © 2017 Quantum Corporation

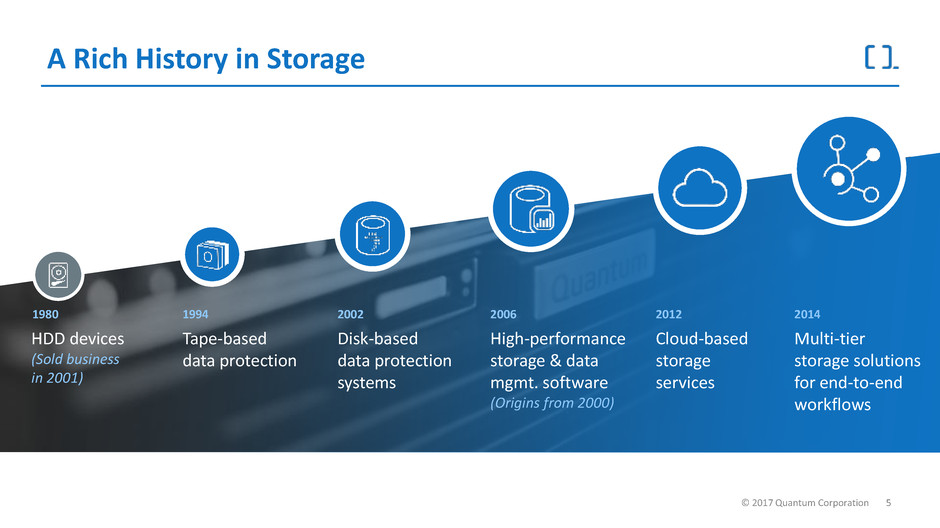

A Rich History in Storage

2014

HDD devices

(Sold business

in 2001)

Tape-based

data protection

Disk-based

data protection

systems

High-performance

storage & data

mgmt. software

(Origins from 2000)

Cloud-based

storage

services

Multi-tier

storage solutions

for end-to-end

workflows

1994 2002 2006 2012 1980

6 © 2017 Quantum Corporation

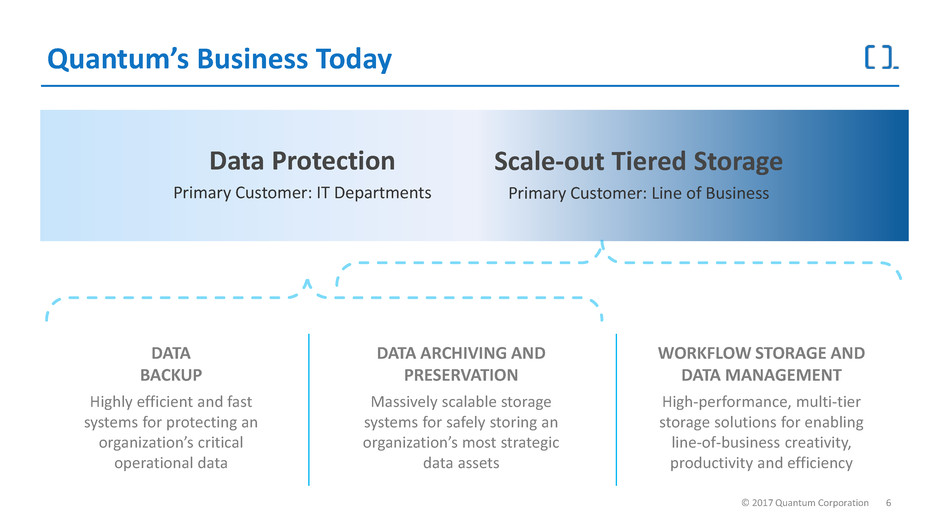

Quantum’s Business Today

SPECIALIZED STORAGE

Data Protection

Primary Customer: IT Departments

Scale-out Tiered Storage

Primary Customer: Line of Business

High-performance, multi-tier

storage solutions for enabling

line-of-business creativity,

productivity and efficiency

WORKFLOW STORAGE AND

DATA MANAGEMENT

Highly efficient and fast

systems for protecting an

organization’s critical

operational data

DATA

BACKUP

Massively scalable storage

systems for safely storing an

organization’s most strategic

data assets

DATA ARCHIVING AND

PRESERVATION

7 © 2017 Quantum Corporation

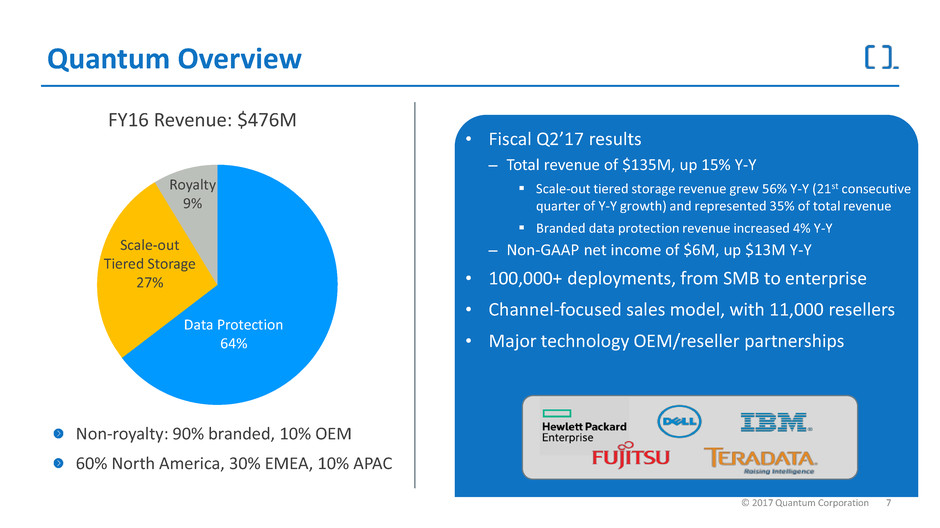

Quantum Overview

FY16 Revenue: $476M

Data Protection

64%

Scale-out

Tiered Storage

27%

Royalty

9%

Non-royalty: 90% branded, 10% OEM

60% North America, 30% EMEA, 10% APAC

• Fiscal Q2’17 results

– Total revenue of $135M, up 15% Y-Y

Scale-out tiered storage revenue grew 56% Y-Y (21st consecutive

quarter of Y-Y growth) and represented 35% of total revenue

Branded data protection revenue increased 4% Y-Y

– Non-GAAP net income of $6M, up $13M Y-Y

• 100,000+ deployments, from SMB to enterprise

• Channel-focused sales model, with 11,000 resellers

• Major technology OEM/reseller partnerships

8 © 2017 Quantum Corporation

Proven Market Leader

100,000+ customer deployments Awards and other honors

9 © 2017 Quantum Corporation

Tightly Integrated with the Ecosystem

10 © 2017 Quantum Corporation

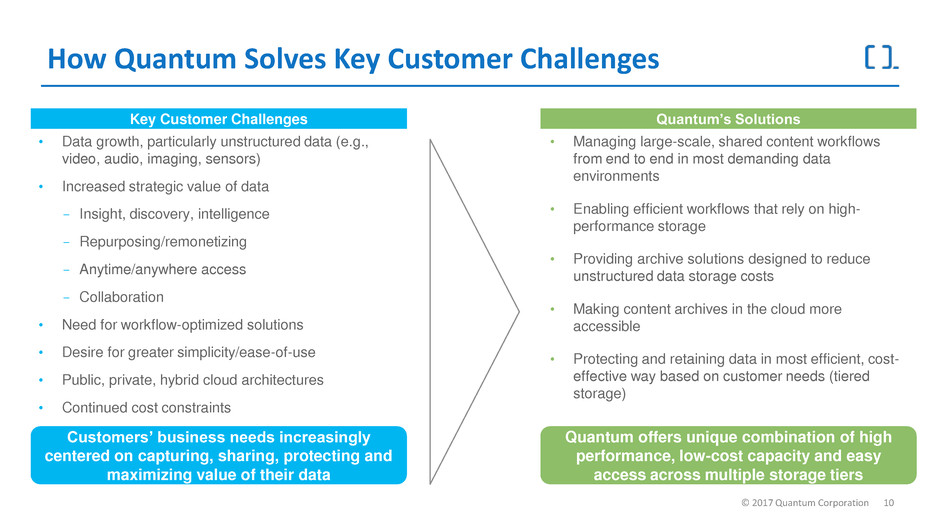

How Quantum Solves Key Customer Challenges

• Data growth, particularly unstructured data (e.g.,

video, audio, imaging, sensors)

• Increased strategic value of data

- Insight, discovery, intelligence

- Repurposing/remonetizing

- Anytime/anywhere access

- Collaboration

• Need for workflow-optimized solutions

• Desire for greater simplicity/ease-of-use

• Public, private, hybrid cloud architectures

• Continued cost constraints

Key Customer Challenges Quantum’s Solutions

• Managing large-scale, shared content workflows

from end to end in most demanding data

environments

• Enabling efficient workflows that rely on high-

performance storage

• Providing archive solutions designed to reduce

unstructured data storage costs

• Making content archives in the cloud more

accessible

• Protecting and retaining data in most efficient, cost-

effective way based on customer needs (tiered

storage)

Customers’ business needs increasingly

centered on capturing, sharing, protecting and

maximizing value of their data

Quantum offers unique combination of high

performance, low-cost capacity and easy

access across multiple storage tiers

11 © 2017 Quantum Corporation

SCALE-OUT TIERED

STORAGE SOLUTIONS

12 © 2017 Quantum Corporation

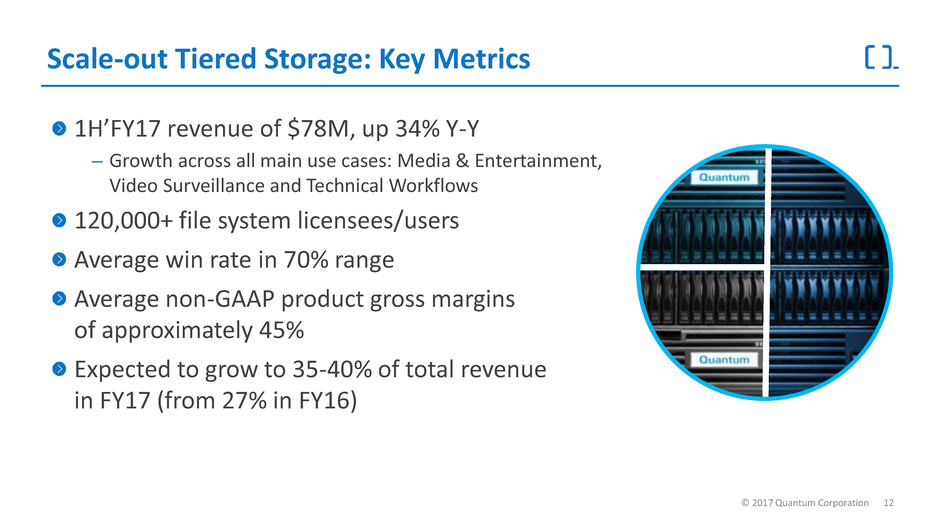

Scale-out Tiered Storage: Key Metrics

1H’FY17 revenue of $78M, up 34% Y-Y

– Growth across all main use cases: Media & Entertainment,

Video Surveillance and Technical Workflows

120,000+ file system licensees/users

Average win rate in 70% range

Average non-GAAP product gross margins

of approximately 45%

Expected to grow to 35-40% of total revenue

in FY17 (from 27% in FY16)

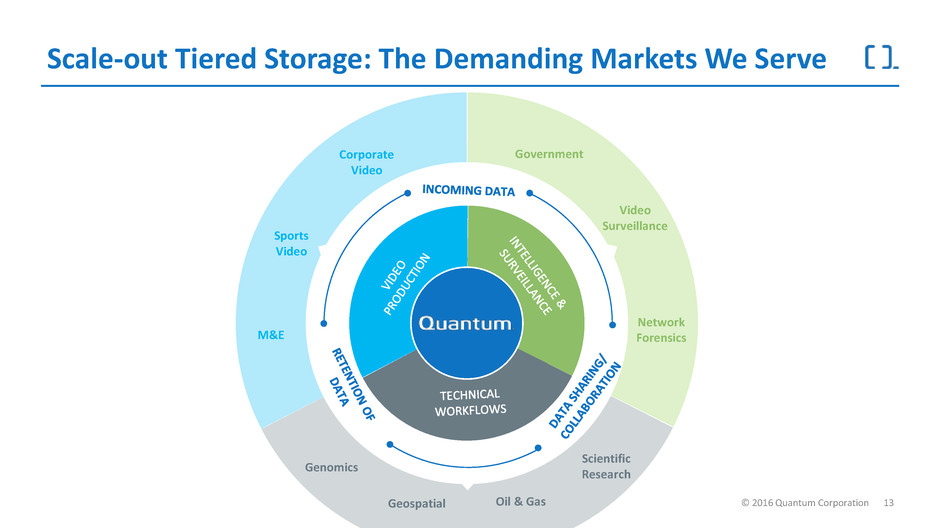

13 © 2017 Quantum Corporation Oil & Gas

Genomics

Geospatial

Scientific

Research

Government

Video

Surveillance

Network

Forensics

Corporate

Video

Sports

Video

M&E

Scale-out Tiered Storage: The Demanding Markets We Serve

6

14 © 2017 Quantum Corporation

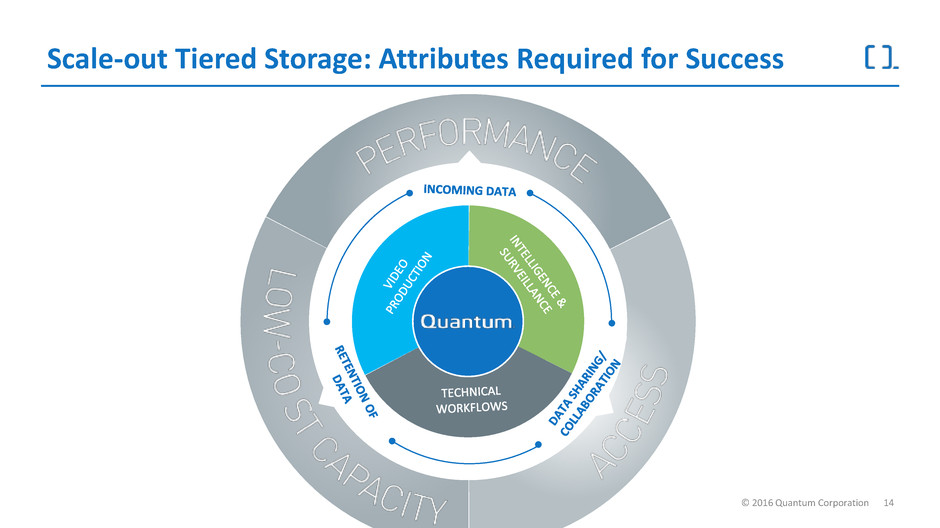

Scale-out Tiered Storage: Attributes Required for Success

6

15 © 2017 Quantum Corporation

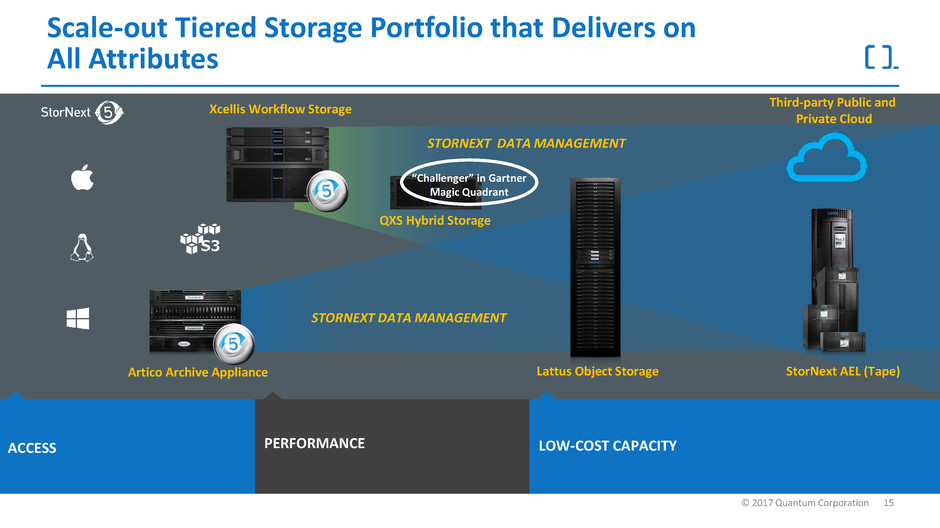

Scale-out Tiered Storage Portfolio that Delivers on

All Attributes

LOW-COST CAPACITY PERFORMANCE

Artico Archive Appliance

STORNEXT DATA MANAGEMENT

STORNEXT DATA MANAGEMENT

StorNext AEL (Tape) Lattus Object Storage

Third-party Public and

Private Cloud

Xcellis Workflow Storage

QXS Hybrid Storage

ACCESS

“Challenger” in Gartner

Magic Quadrant

16 © 2017 Quantum Corporation

Scale-out Tiered Storage: Quantum Growth Drivers

Extend M&E leadership (e.g., corporate video, sports video, ad agencies)

Build on video surveillance momentum

Capitalize on unstructured data archive opportunities in technical workflows

Leverage data protection assets and unified sales organization

Further expand our solution set to the cloud and cloud providers

17 © 2017 Quantum Corporation

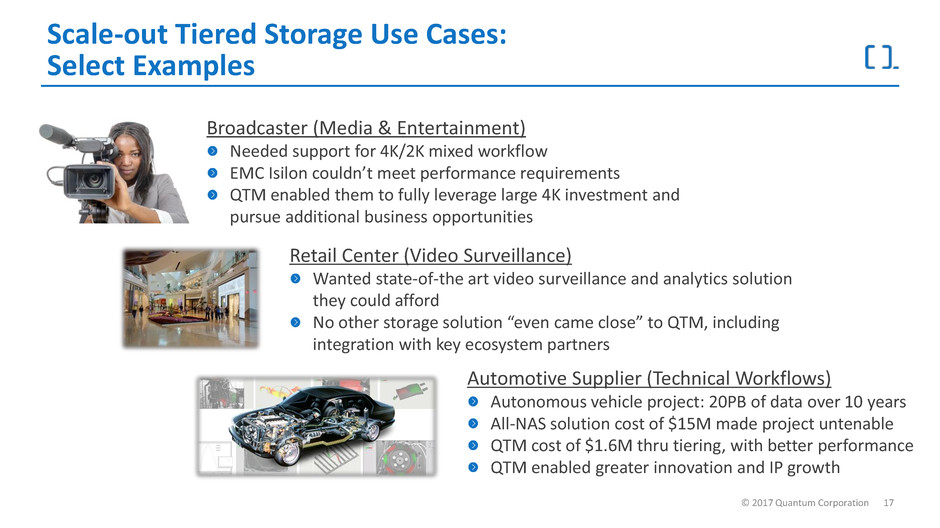

Scale-out Tiered Storage Use Cases:

Select Examples

Automotive Supplier (Technical Workflows)

Autonomous vehicle project: 20PB of data over 10 years

All-NAS solution cost of $15M made project untenable

QTM cost of $1.6M thru tiering, with better performance

QTM enabled greater innovation and IP growth

Retail Center (Video Surveillance)

Wanted state-of-the art video surveillance and analytics solution

they could afford

No other storage solution “even came close” to QTM, including

integration with key ecosystem partners

Broadcaster (Media & Entertainment)

Needed support for 4K/2K mixed workflow

EMC Isilon couldn’t meet performance requirements

QTM enabled them to fully leverage large 4K investment and

pursue additional business opportunities

18 © 2017 Quantum Corporation

DATA PROTECTION SOLUTIONS

19 © 2017 Quantum Corporation

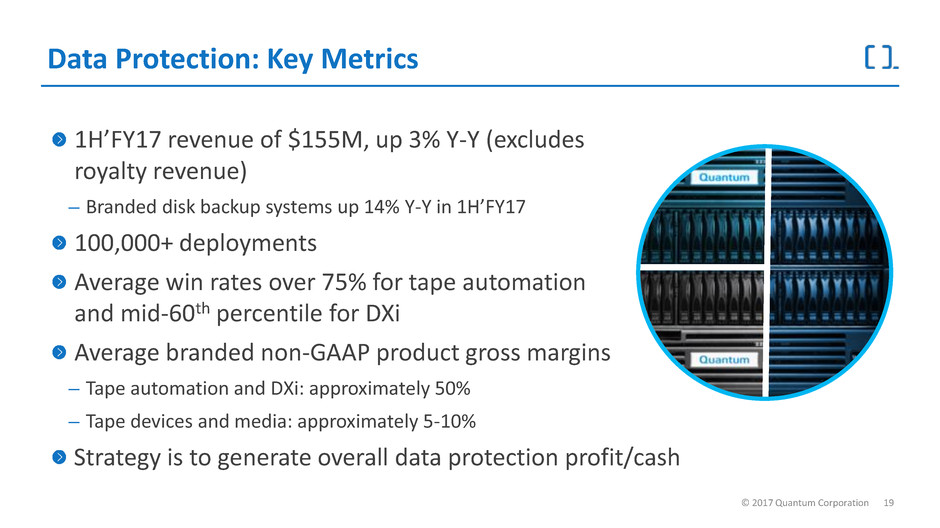

Data Protection: Key Metrics

1H’FY17 revenue of $155M, up 3% Y-Y (excludes

royalty revenue)

– Branded disk backup systems up 14% Y-Y in 1H’FY17

100,000+ deployments

Average win rates over 75% for tape automation

and mid-60th percentile for DXi

Average branded non-GAAP product gross margins

– Tape automation and DXi: approximately 50%

– Tape devices and media: approximately 5-10%

Strategy is to generate overall data protection profit/cash

20 © 2017 Quantum Corporation

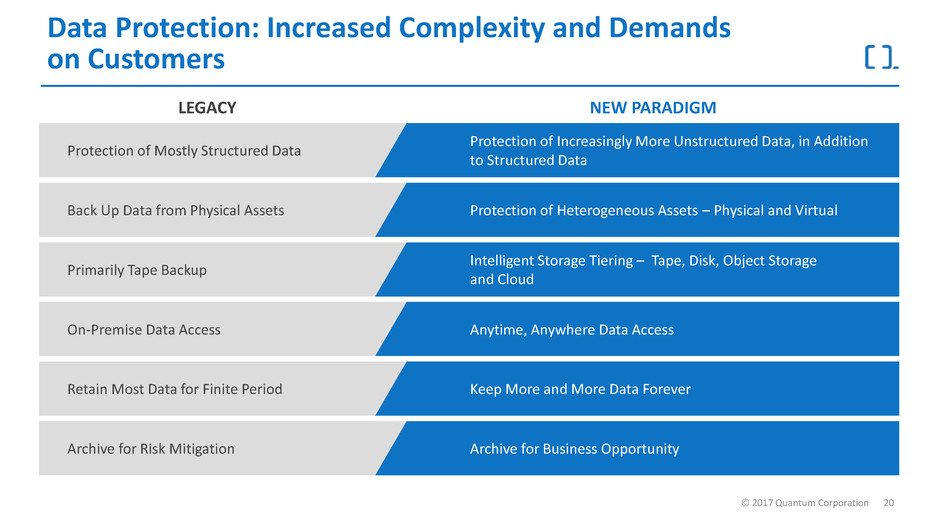

Data Protection: Increased Complexity and Demands

on Customers

Protection of Increasingly More Unstructured Data, in Addition

to Structured Data

Protection of Heterogeneous Assets – Physical and Virtual

Intelligent Storage Tiering – Tape, Disk, Object Storage

and Cloud

Anytime, Anywhere Data Access

Keep More and More Data Forever

Protection of Mostly Structured Data

Back Up Data from Physical Assets

Primarily Tape Backup

On-Premise Data Access

Retain Most Data for Finite Period

Archive for Risk Mitigation Archive for Business Opportunity

LEGACY NEW PARADIGM

21 © 2017 Quantum Corporation

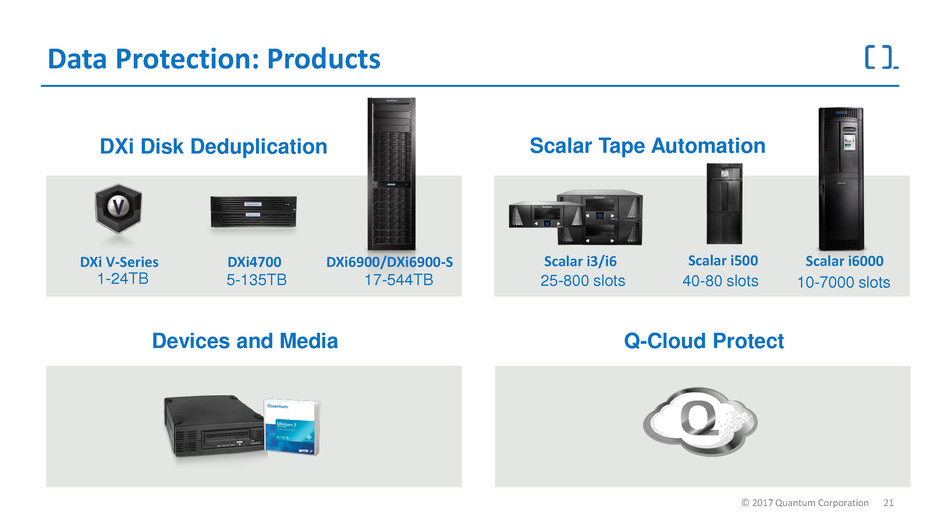

Data Protection: Products

25-800 slots

Scalar i3/i6

40-80 slots

Scalar i500

10-7000 slots

Scalar i6000

1-24TB

DXi V-Series

5-135TB

DXi4700

17-544TB

DXi6900/DXi6900-S

DXi Disk Deduplication

Q-Cloud Protect Devices and Media

Scalar Tape Automation

22 © 2017 Quantum Corporation

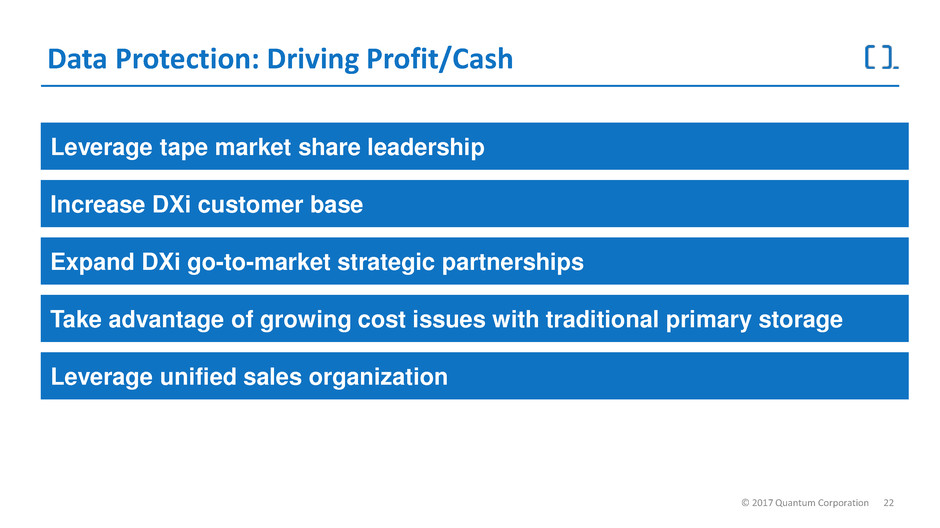

Data Protection: Driving Profit/Cash

Leverage tape market share leadership

Increase DXi customer base

Expand DXi go-to-market strategic partnerships

Leverage unified sales organization

Take advantage of growing cost issues with traditional primary storage

23 © 2017 Quantum Corporation

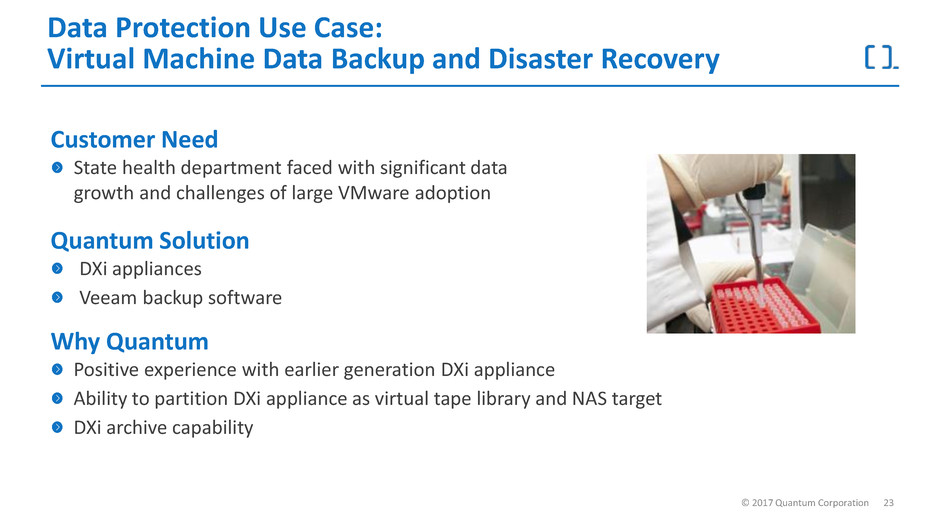

Data Protection Use Case:

Virtual Machine Data Backup and Disaster Recovery

Customer Need

State health department faced with significant data

growth and challenges of large VMware adoption

Quantum Solution

DXi appliances

Veeam backup software

Why Quantum

Positive experience with earlier generation DXi appliance

Ability to partition DXi appliance as virtual tape library and NAS target

DXi archive capability

24 © 2017 Quantum Corporation

FINANCIALS AND GUIDANCE

25 © 2017 Quantum Corporation

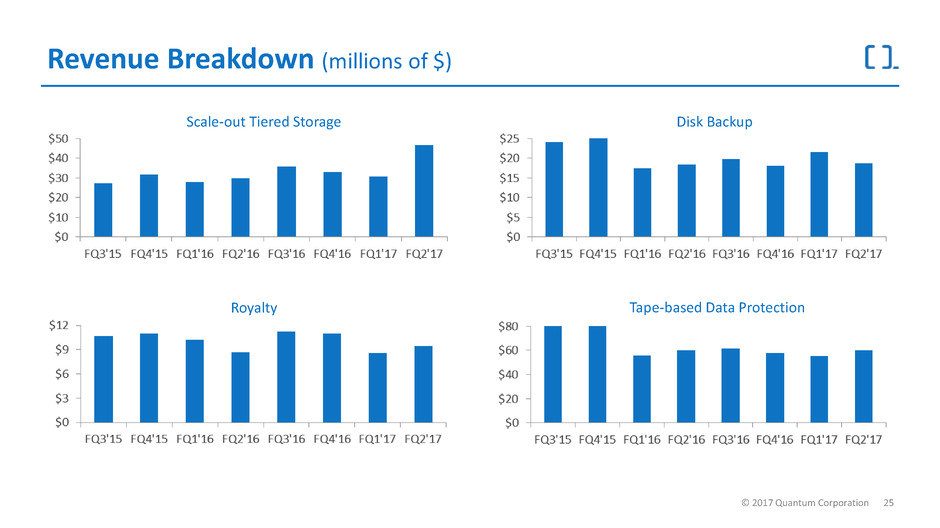

Revenue Breakdown (millions of $)

Royalty

Scale-out Tiered Storage

Tape-based Data Protection

Disk Backup

26 © 2017 Quantum Corporation

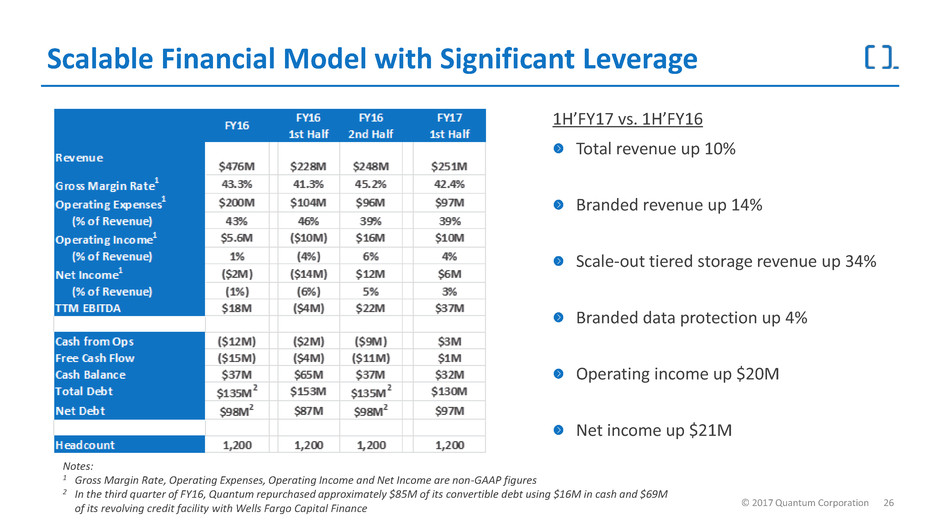

Scalable Financial Model with Significant Leverage

Notes:

1 Gross Margin Rate, Operating Expenses, Operating Income and Net Income are non-GAAP figures

2 In the third quarter of FY16, Quantum repurchased approximately $85M of its convertible debt using $16M in cash and $69M

of its revolving credit facility with Wells Fargo Capital Finance

1H’FY17 vs. 1H’FY16

Total revenue up 10%

Branded revenue up 14%

Scale-out tiered storage revenue up 34%

Branded data protection up 4%

Operating income up $20M

Net income up $21M

27 © 2017 Quantum Corporation

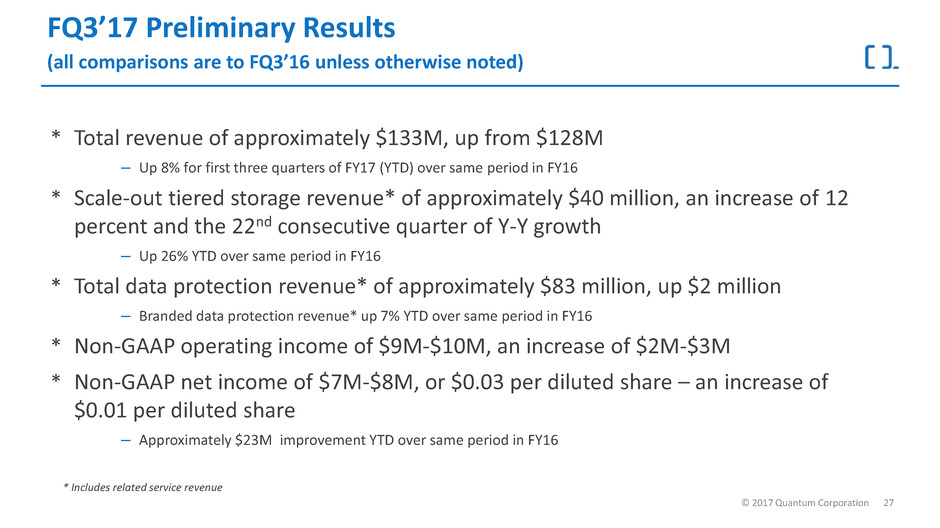

FQ3’17 Preliminary Results

(all comparisons are to FQ3’16 unless otherwise noted)

* Total revenue of approximately $133M, up from $128M

– Up 8% for first three quarters of FY17 (YTD) over same period in FY16

* Scale-out tiered storage revenue* of approximately $40 million, an increase of 12

percent and the 22nd consecutive quarter of Y-Y growth

– Up 26% YTD over same period in FY16

* Total data protection revenue* of approximately $83 million, up $2 million

– Branded data protection revenue* up 7% YTD over same period in FY16

* Non-GAAP operating income of $9M-$10M, an increase of $2M-$3M

* Non-GAAP net income of $7M-$8M, or $0.03 per diluted share – an increase of

$0.01 per diluted share

– Approximately $23M improvement YTD over same period in FY16

* Includes related service revenue

28 © 2017 Quantum Corporation

Additional Information and Where to Find It

Quantum Corporation (the “Company”), its directors and certain executive officers will be participants in the solicitation of proxies from stockholders in

connection with the Company’s Annual Meeting of Stockholders for the fiscal year ended March 31, 2016 (the “Annual Meeting”). The Company has

received a notice of nominations for the election of directors from VIEX Capital Advisors, LLC in connection with the Annual Meeting and it is possible

that there may be a contested solicitation in connection with the Annual Meeting. The Company plans to file a proxy statement (the “Proxy Statement”)

with the Securities and Exchange Commission (the “SEC”) in connection with the solicitation of proxies for the Annual Meeting.

The members of the Board of Directors of the Company and Fuad Ahmad, Chief Financial Officer, would be participants in the Company’s solicitation of

proxies in connection with the Annual Meeting. As of December 31, 2016, the holdings of the participants in the Company’s common stock were as

follows: Robert I. Anderson – 49,277 shares; Paul R. Auvil III – 597,509 shares; Louis DiNardo – 292,871 shares; Fuad Ahmad – 0 shares; Dale L. Fuller –

197,542 shares; Jon W. Gacek – 1,726,628 shares and options to purchase 1,300,000 shares exercisable within 60 days; David A. Krall – 342,354 shares;

Gregg J. Powers – 15,423,566 shares, of which 14,594,195 shares are held in managed accounts of Private Capital Management, LLC, of which Mr.

Powers is CEO and Portfolio Manager, and as to which Mr. Powers disclaims beneficial ownership; Clifford Press – 0 shares; and David E. Roberson –

329,263 shares. Additional information regarding such participants, including updated information as to their direct or indirect interests, by security

holdings or otherwise, will be included in the Proxy Statement and other relevant documents to be filed with the SEC in connection with the Annual

Meeting. To the extent that holdings of the Company’s securities change from the amounts reflected in the foregoing, such changes will be reflected on

Statements of Change in Ownership on Form 4 filed with the SEC.

Promptly after filing its definitive Proxy Statement with the SEC, the Company will mail the definitive Proxy Statement to each stockholder entitled to

vote at the Annual Meeting. STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ANY AMENDMENTS OR SUPPLEMENTS

THERETO) AND ANY OTHER RELEVANT DOCUMENTS THAT THE COMPANY WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION. Stockholders may obtain, free of charge, the Company’s preliminary proxy statement, any amendments or

supplements thereto and any other relevant documents filed by the Company with the SEC in connection with the Annual Meeting at the SEC’s website

(http://www.sec.gov). Copies of the Company’s definitive proxy statement, any amendments or supplements thereto and any other relevant documents

filed by the Company with the SEC in connection with the Annual Meeting will also be available, free of charge, at the Company’s website

(www.quantum.com) or by writing to Investor Relations, Quantum Corporation, 224 Airport Parkway, Suite 550, San Jose, CA 95110.

29 © 2017 Quantum Corporation 2017 uantu Corporation.