Attached files

| file | filename |

|---|---|

| 8-K - 8-K - SPECTRANETICS CORP | a20178kjpmdeck.htm |

1

A LOOK AHEAD: 2017

35th Annual J.P. Morgan Healthcare Conference

2

Safe Harbor Statement

This presentation contains forward‐looking statements within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the

Private Securities Litigation Reform Act of 1995. You can identify these statements because they do not relate strictly to historical or current facts. Such statements may include

words such as “anticipate,” “will,” “estimate,” “expect,” “look forward,” “strive,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” “enable,” “potential,” and other words

and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies,

clinical trials and regulatory approvals, regulatory or competitive environments, outcome of litigation, our intellectual property and product development. These forward‐looking

statements include, but are not limited to, statements regarding our competitive position, product development and commercialization schedule, expectation of continued growth

and the reasons for that growth, growth rates, strength, integration and product launches, and 2016 and 2017 outlook and projected results including projected revenue and

expenses, net loss and gross margin. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ

materially. You are cautioned not to place undue reliance on these forward‐looking statements and to note they speak only as of the date of this presentation. These risks and

uncertainties may include financial results differing from guidance, increasing competition and consolidation in our industry, the impact of rapid technological change, slower

revenue growth and losses, inability to successfully integrate AngioScore and Stellarex into our business and the inaccuracy of our assumptions regarding AngioScore and Stellarex,

market acceptance of our technology and products, our inability to manage growth, increased pressure on expense levels resulting from expanded sales, marketing, product

development and clinical activities, uncertain success of our strategic direction, dependence on new product development and successful commercialization of new products, loss

of key personnel, uncertain success of or delays in our clinical trials, costs of and adverse results in any ongoing or future legal proceedings, adverse impact to our business of

healthcare reform and related legislation and regulations, including changes in reimbursements, adverse conditions in the general domestic and global economic markets and

volatility and disruption of the credit markets, our inability to protect our intellectual property and intellectual property claims of third parties, availability of inventory and

components from suppliers, adverse outcome of FDA inspections, including FDA warning letters and any remediation efforts, the receipt of FDA clearance and other regulatory

approvals to market new products or applications and the timeliness of any clearance and approvals, product defects or recalls and product liability claims, cybersecurity breaches,

ability to manufacture sufficient volumes to fulfill customer demand, our dependence on third party vendors, suppliers, consultants and physicians, unexpected delays or costs

associated with any planned improvements to our manufacturing processes, risks associated with international operations, lack of cash necessary to satisfy our cash obligations

under our outstanding 2.625% Convertible Senior Notes due 2034 and our term loan and revolving loan facilities, our debt adversely affecting our financial health and preventing

us from fulfilling our debt service and other obligations, and share price volatility due to the initiation or cessation of coverage, or changes in ratings, by securities analysts. For a

further list and description of such risks and uncertainties that could cause our actual results, performance or achievements to materially differ from any anticipated results,

performance or achievements, please see our previously filed SEC reports, including those risks set forth in our 2015 Annual Report on Form 10‐K and our Quarterly Reports on

Form 10‐Q. We disclaim any intention or obligation to update or revise any financial or other projections or other forward‐looking statements, whether because of new

information, future events or otherwise.

2

3

• Two business units, attractive

markets

• Taking share

• Top-tier gross margin profile

• Comprehensive product

portfolio & pipeline backed by

clinical data

• Path to profitability

• On the path to profitability

Growth Company

3

4

Milestones

Achieved in 2016

* Not approved for sale in the United States

Solid execution of sales force expansion, taking share

Launching Turbo-Power™, AngioSculptX®*, Bridge™,

Stellarex™ BTK*

Bridge™ is saving lives

1,100 patients - 12-month top-tier safety & efficacy* data

Key franchises launching in emerging markets

Commercial team expansion »

Expand innovation pipeline »

Improve safety of lead extraction »

Promising first-in-human data »

Expanding global presence »

We did it.We said it.

4

5

Growth Track Record

A look back

CAGR* ~16%

*Calculated at midpoint of 2016 guidance

2016 SNAPSHOT

Q1-Q3

• Double digit growth

• Top-tier gross margin

• Successful product launches

• Expanding global footprint

• Compelling clinical data

5

(

i

n

m

i

l

l

i

o

n

s

)

6

Large Market Opportunity. Growing. Underserved.

Vascular Intervention

~$5B

Lead Management

~$0.5‐1B

• Market leader

• Taking share

• Underpenetrated patient

population

• Developing market

• Large, attractive market

• Taking share

• DCBs becoming the standard

of care in PAD

• Unique position in growing

complex coronary

6

7

Life Saving Portfolio

lead management

7

8

“Most significant

innovation in lead

management since

the laser.”

—Dr. Jude Clancy

Yale University Group

BRIDGE TO

SURGERY

8

9

Limb Saving Portfolio

vascular intervention

*

* Not approved for sale in the United States

*

9

10

DCB: fastest growing

segment in PAD

SPNC: well-positioned,

comprehensive portfolio,

compelling clinical data*

STANDARD OF

CARE EVOLUTION ~30% CAGR ̶ next 5 years

DCBs Growing Rapidly1

EU and US DCB Market Estimates

(

i

n

m

i

l

l

i

o

n

s

)

1. Third-party market research reports

* Stellarex not approved for sale in the United States10

11

Clinically Proven,

Differentiated DCB Portfolio

* Not approved for sale in the United States

*

*

- Only drug-coated scoring balloon on the market

- Top-tier efficacy and safety evidence

- Anticipate US PMA approval 2H 2017

- CE mark in November 2016

- US IDE pending

*

Above-the-Knee

Below-the-Knee

Coronary

11

12

Randomized Data - Similar Patient Characteristics

2 2 2

1. Renal insufficiency not reported, number represents renal failure * Not approved for sale in the United States12

13

ILLUMENATE

Pivotal

The Most Complex

Patient Group Studied

in DCB IDE Trials

* Stellarex not approved for sale in the United States

*

13 1. Renal insufficiency not reported, number represents renal failure

1

14

“First-generation drug-

coated balloons forced us

to make a choice between

top-tier clinical outcomes

and the potential safety

advantages of a lower

drug dose. Based on the

compelling Stellarex DCB

study results, we no longer

need to compromise.”

– Dr. Prakash Krishnan

Mount Sinai, New York

ILLUMENATE

Pivotal*

No Compromise.

>82%

primary patency

achieved in

complex

patients

*Stellarex not approved for sale in the United States

14

15

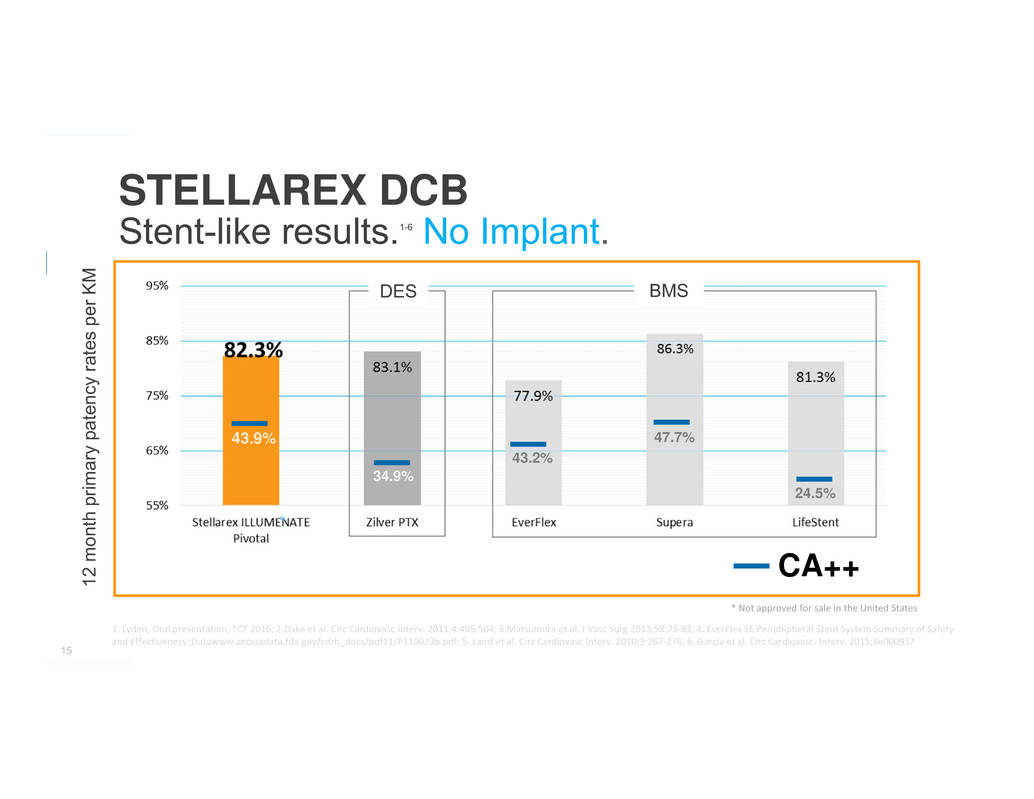

DE

STELLAREX DCB

Stent-like results.1-6 No Implant.

DES BMS

43.9%

34.9%

43.2%

47.7%

24.5%

1. Lyden, Oral presentation, TCT 2016; 2.Dake et al. Circ Cardiovasc Interv. 2011;4:495‐504; 3.Matsumura et al. J Vasc Surg 2013;58:73‐83; 4. EverFlex SE Periphipheral Stent System Summary of Safety

and Effectiveness ;Datawww.accessdata.fda.gov/cdrh_docs/pdf11/P110023b.pdf; 5. Laird et al. Circ Cardiovasc Interv. 2010;3:267‐276; 6. Garcia et al. Circ Cardiovasc. Interv. 2015;8e000937

* Not approved for sale in the United States

*

15

CA++

1

2

m

o

n

t

h

p

r

i

m

a

r

y

p

a

t

e

n

c

y

r

a

t

e

s

p

e

r

K

M

16

Clinically Proven,

Differentiated DCB

Portfolio

▶ ONLY DCB proven in

complex disease

▶ ONLY drug-coated scoring

balloon in the market

▶ Top-tier safety & efficacy with

a low drug dose

* Not approved for sale in the United States

*

*

16

Drug‐Coated

Angioplasty Balloon

17

OUR STORY.

17

18

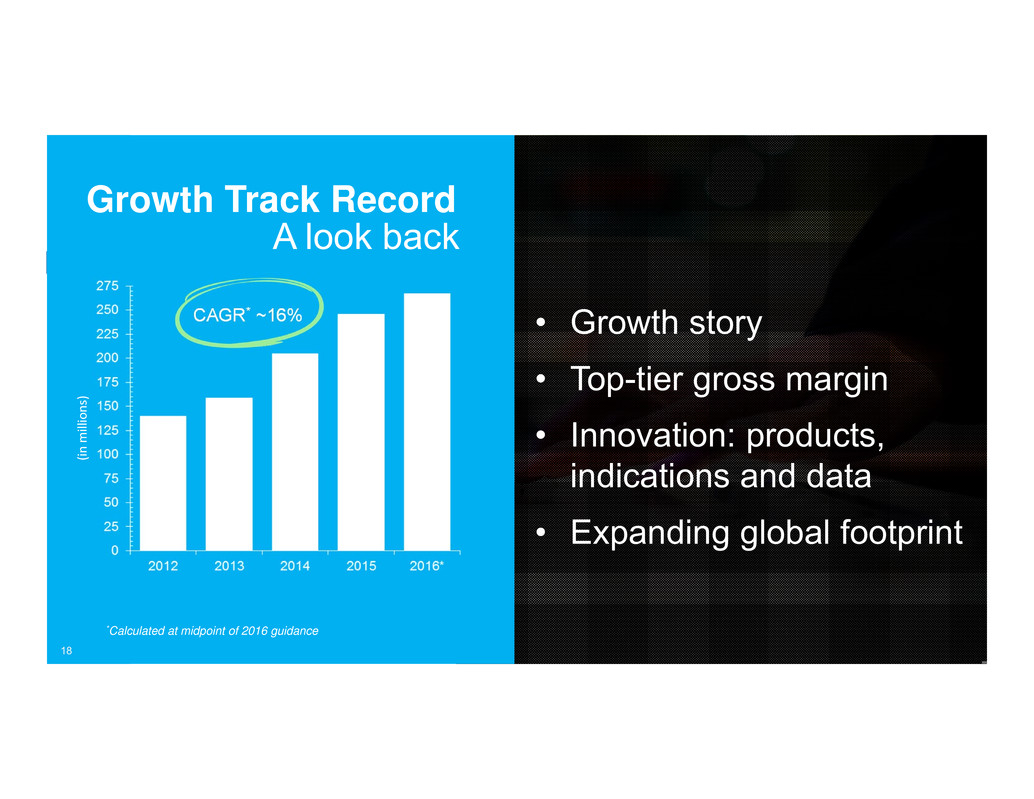

Growth Track Record

A look back

CAGR* ~16% • Growth story

• Top-tier gross margin

• Innovation: products,

indications and data

• Expanding global footprint

*Calculated at midpoint of 2016 guidance

18

(

i

n

m

i

l

l

i

o

n

s

)

19

NEXT 5 YEARS

Vision

2017 and Beyond

Goals, not guidance

• Focus on growth

• Expanding gross margin

• Robust pipeline

• Global expansion

• Profitability

19

(

i

n

m

i

l

l

i

o

n

s

)

20