Attached files

| file | filename |

|---|---|

| EX-12.1 - EXHIBIT 12.1 - SPECTRANETICS CORP | ex121ratioofearningstofixe.htm |

| EX-32.2 - EXHIBIT 32.2 - SPECTRANETICS CORP | ex32212312016.htm |

| EX-32.1 - EXHIBIT 32.1 - SPECTRANETICS CORP | ex32112312016.htm |

| EX-31.2 - EXHIBIT 31.2 - SPECTRANETICS CORP | ex31212312016.htm |

| EX-31.1 - EXHIBIT 31.1 - SPECTRANETICS CORP | ex31112312016.htm |

| EX-23.1 - EXHIBIT 23.1 - SPECTRANETICS CORP | ex231consentofindependenta.htm |

| EX-21.1 - EXHIBIT 21.1 - SPECTRANETICS CORP | ex211subsidiaries2016.htm |

| EX-10.100 - EXHIBIT 10.100 - SPECTRANETICS CORP | ex10100shuttonoffer.htm |

| EX-10.99 - EXHIBIT 10.99 - SPECTRANETICS CORP | ex1099amendmentno1torevo.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the year ended December 31, 2016 | |

or | |

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to | |

Commission file number 0-19711

THE SPECTRANETICS CORPORATION

(Exact name of Registrant as specified in its charter)

Delaware (State or other jurisdiction of incorporation or organization) | 84-0997049 (I.R.S. Employer Identification No.) |

9965 Federal Drive

Colorado Springs, Colorado 80921

(Address of principal executive offices and zip code)

Registrant’s Telephone Number, Including Area Code:

(719) 633-8333

Securities registered pursuant to Section 12(b) of the Act:

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act Yes o No x

Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of Registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer x | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company o | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act): Yes o No x

The aggregate market value of the voting stock of the Registrant, as of June 30, 2016, the last business day of the registrant’s most recently completed second fiscal quarter was $789,573,001, as computed by reference to the closing sale price of the voting stock held by non-affiliates on such date. As of February 21, 2017, there were outstanding 43,475,091 shares of Common Stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s definitive Proxy Statement for its 2017 Annual Meeting of Stockholders, to be filed with the Securities and Exchange Commission not later than April 30, 2017, are incorporated by reference into Part III as specified herein.

TABLE OF CONTENTS

PART I | ||

PART II | ||

PART III | ||

PART IV | ||

ITEM 16. | Form 10-K Summary | |

ii

PART I

The information in this annual report on Form 10-K includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and is subject to the safe harbor created by that section. Forward-looking statements in this report or incorporated herein by reference constitute our expectations or forecasts of future events as of the date this report was filed with the Securities and Exchange Commission (“SEC”) and are not statements of historical fact. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Such statements may include words such as “anticipate,” “will,” “estimate,” “seek,” “expect,” “project,” “intend,” “should,” “plan,” “believe,” “hope,” and other words and terms of similar meaning in connection with any discussion of, among other things, future operating or financial performance, strategic initiatives and business strategies, regulatory or competitive environments, our intellectual property and product development. You are cautioned not to place undue reliance on these forward-looking statements and to note they speak only as of the date hereof. Factors that could cause actual results to differ materially from those set forth in the forward-looking statements are in the risk factors listed from time to time in our filings with the SEC and those set forth in Item 1A, “Risk Factors.” We disclaim any intention or obligation to update or revise any financial projections or forward-looking statements due to new information or other events. Some industry and market data in this annual report on Form 10-K are based on independent industry publications, including those generated by the Millennium Research Group and IMS Health, or other publicly available information. This information involves several assumptions and limitations. Although we believe that each source is reliable as of its respective date, we have not independently verified the accuracy or completeness of this information. Certain percentage amounts included herein may not add due to rounding.

ITEM 1. Business

The Company

We develop, manufacture, market and distribute single-use medical devices used in minimally invasive procedures within the cardiovascular system. Our products are used to cross, prepare, and treat arterial blockages in the legs and heart and to remove pacemaker and defibrillator cardiac leads. We believe that the diversified nature of our business allows us to respond to a wide range of physician and patient needs. The innovative products and services we offer are divided into three categories:

• | Vascular Intervention (“VI”): Our broad portfolio of VI devices consists of laser and aspiration catheters, AngioSculpt® scoring balloon catheters, which are a specialty balloon market leader, support catheters, and drug coated balloon (“DCB”) catheters including our Stellarex™ and AngioSculptX™ products. |

• | Lead Management (“LM”): We are a global leader in devices for the removal of pacemaker and defibrillator cardiac leads. Our primary LM devices consist of our excimer laser sheaths, non-laser mechanical sheaths, our Bridge™ Occlusion Balloon, and cardiac lead management accessories. |

• | Laser, service, and other: Our proprietary excimer laser system, the CVX-300®, is the only laser system approved in the United States (“U.S.”), Europe, Japan, China and select other major global markets for use in multiple minimally invasive cardiovascular procedures. We sell, rent and service our CVX-300 laser systems. |

In January 2015, we acquired certain assets and liabilities related to Covidien LP’s Stellarex (“Stellarex”) over the wire percutaneous transluminal angioplasty balloon catheter with a paclitaxel coated balloon. The Stellarex DCB platform is designed to treat peripheral arterial disease. Stellarex uses EnduraCoat™ technology, a durable, uniform coating designed to prevent drug loss during transit and facilitate controlled, efficient drug delivery to the treatment site. Stellarex products currently are approved for use in Europe but currently are not approved in the U.S. except for investigational purposes.

1

In June 2014, we acquired AngioScore Inc., a U.S. market leader in specialty scoring balloon catheters. AngioScore develops, manufactures and markets the AngioSculpt scoring balloon catheter for the treatment of peripheral and coronary disease. The AngioSculpt catheter combines a semi-compliant balloon with a nitinol scoring element to address specific limitations of conventional balloon angioplasty catheters and rotational atherectomy. In August 2016, the Company received Conformité Européene (CE) mark approval of AngioSculptX, which is the world’s first drug-coated scoring balloon to treat coronary disease.

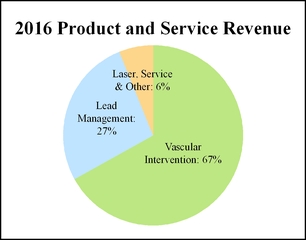

Our disposable devices include VI and LM products. For the years ended December 31, 2016, 2015, and 2014, our disposable products generated 94%, 94% and 90%, respectively, of our consolidated revenue, of which VI accounted for 67%, 66% and 58%, respectively, and LM accounted for 27%, 28%, and 32%, respectively. The remainder of our revenue is derived from sales and rental of our laser systems and related service.

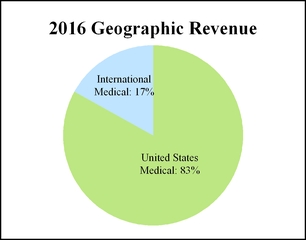

Our two operating segments are U.S. Medical and International Medical. U.S. Medical includes direct sales operations in the U.S. and Canada. International Medical includes product availability in over 65 countries outside of the U.S. and Canada, including our direct sales operations in certain countries in Europe and Puerto Rico and a network of approximately 60 distributors throughout Europe, Asia Pacific and Latin America. Total international revenue in 2016 was 17% of our consolidated revenue. For financial information about our segments and by geographic area for each of the last three fiscal years, please see Note 10, “Segment and Geographic Reporting,” of the consolidated financial statements in Part IV, Item 15 of this annual report

Our business strategy emphasizes:

• | Saving lives and limbs: We focus on inventing and delivering technology that allow patients to live life fully, free from health conditions that stand in the way. Our technology enables physicians to complete procedures confidently and successfully, as they treat cardiovascular disease and its complications. |

• | Proven solutions: We focus on proven algorithms of treatment for the most complex and challenging cardiovascular cases. |

• | Expanding our reach: We invest to broaden our solutions portfolio and deliver treatment options for complex diseases through: |

▪ | organic growth via new product development; |

▪ | new clinical indications for our existing products; |

▪ | continued execution of our commercial, educational, and clinical programs; |

▪ | capitalizing on our expanded sales force; |

▪ | continued global expansion; and |

▪ | acquisitions that leverage our current customer base and expand our portfolio of products. |

2

Vascular Intervention Products

We are focused on the most complex challenges in peripheral (PAD) and coronary (CAD) artery disease with a vision to eradicate restenosis and reduce amputations. We partner with our customers to deliver meaningful solutions to solve the challenges of chronic total occlusions, in-stent restenosis, critical limb ischemia and complex coronary disease.

PAD is a global pandemic estimated to impact over 200 million people in the world, growing 25% from 2000 to 2010. In the U.S. and Europe alone, approximately 25 million people are afflicted with PAD; however, only approximately 10 million of these patients suffer from typical symptoms such as leg pain while walking or resting. PAD patients are often underdiagnosed and undertreated with one million patients receiving endovascular treatment each year, according to internal estimates using leading market research data.

CAD is a very large market with over two million interventions in the US and Europe. With advancements in medical therapy, total CAD procedures are flat, yet complex coronary revascularization interventions are growing rapidly with aging population and increased comorbidities of diabetes, obesity and renal disease.

Peripheral Vascular Intervention Products

Our portfolio is aligned with how physicians treat PAD: crossing the lesion, preparing the vessel, and finally treating the lesion.

In crossing, we are a U.S. market leader in support catheters, according to IMS Health data. Our crossing solutions products support vascular access in the arterial system to enable both coronary and peripheral interventions. Our primary crossing products include the Quick-Cross™, Quick-Cross Select, and Quick-Cross Extreme support catheters.

Vessel preparation is the core of our business driven by our laser atherectomy and AngioSculpt specialty scoring balloon catheter platforms. Our Turbo-Elite™, Turbo-Tandem™ and Turbo-Power™ laser atherectomy catheters treat stenoses and occlusions both above and below the knee. Our Turbo-Tandem and Turbo-Power laser catheters are the only atherectomy devices indicated to treat in-stent restenosis that are backed by level one clinical data (EXCITE) showing superior safety and effectiveness over PTA alone. We also are a U.S. market leader in the specialty balloon category. Our AngioSculpt products provide benefits to our patients in vessel preparation of complex lesions, combining a semi-compliant balloon with a nitinol scoring element to address specific limitations of conventional balloon angioplasty catheters, including a lower occurrence of flow-limiting dissections and balloon slippage.

Physicians typically treat PAD by using balloon angioplasty (either a scoring balloon, DCB or PTA), or by placing a stent (either drug-coated, bare metal or covered) in the artery. AngioSculpt peripheral scoring balloon catheters can be used for treatment of many lesion types, including highly calcified lesions, non-stent zones, and in-stent or native-vessel restenotic disease.

The acquisition of the Stellarex DCB in January 2015 further complemented our portfolio of products to treat PAD. The Stellarex DCB has been thoroughly evaluated in five significant clinical studies enrolling over 1,100 patients, including two randomized controlled trials. It has shown top tier results in patient groups comparable to randomized controlled trials of competitive products as well as in patient populations with a high percentage of severe calcium (>40%). For more information, refer to “Clinical Trials”, in Part 1 of this annual report. Stellarex DCB received CE mark in the European Union in December 2014, and we launched the product in Europe in late January 2015. We expect to attain U.S. Food and Drug Administration (“FDA”) premarket approval of the Stellarex DCB in 2017.

3

Coronary Vascular Intervention Products

In the coronary market, our disposable catheters are used to cross, prepare and treat complex CAD as an adjunctive treatment to traditional percutaneous coronary interventions using balloons and stents. For crossing and vessel preparation, we offer the ELCA™ laser ablation catheter and AngioSculpt scoring balloon catheters. For treatment, we launched AngioSculptX in Europe in the fourth quarter of 2016. AngioSculptX is a paclitaxel coated DCB on the AngioSculpt platform. In the coronary thrombus management market, we offer aspiration catheters, such as our QuickCat™ aspiration catheter, designed for quick deliverability and efficient thrombus removal from vessels in the arterial system.

Lead Management Products

We are a global leader in devices for the removal of pacemaker and defibrillation cardiac leads. The Heart Rhythm Society’s list of indications for lead extraction includes several well-defined scenarios involving non-functional leads, functional leads and venous occlusion. We believe that more than 300,000 patients worldwide are indicated every year for a potential lead extraction as a result of an infection, which is classified by the Heart Rhythm Society as a Class I Indication for Extraction of Cardiac Leads. In addition, Heart Rhythm Society recommends lead extraction in the event of malfunction, system upgrade, venous occlusion, and other less common reasons, which are classified as Class II Indications for Extraction of Cardiac Leads. We believe that this results in a market potential of over $700 million with approximately 25% from Class I indications and approximately 75% from Class II indications. Although infection is a Class I indication for lead extraction, we believe that a majority of patients with cardiac device infections are not being treated. The near-term consequence of delayed device removal for infection is an increase in the mortality rate of such patients. Recognizing this, in 2009, the Heart Rhythm Society strengthened recommendations for extraction of infected leads.

We also believe that the majority of the Class II non-infected leads are capped and left in the body as a predominant mode of practice, based on physician perception of risk associated with removal and perception that abandoned leads are benign. The long-term consequences associated with abandoned leads may be more significant than currently perceived and clinical data supporting the safety of lead removal, will be instrumental in reshaping perceptions around this procedure as a mainstream treatment option for patients with devices.

Our primary LM products include the GlideLight™ and SLS™ II; laser sheaths; Lead Locking Devices; and our mechanical tools, including the TightRail™ Rotating Dilator Sheath and SightRail™ Manual Dilator Sheath; and our Bridge Occlusion Balloon catheter.

We received 510(k) regulatory clearance and CE Mark for our Bridge Occlusion Balloon product in the first half of 2016. Bridge is designed to dramatically reduce blood loss, helping the physician maintain control, in the rare event of a tear in the superior vena cava during a lead extraction procedure. The device is designed to give the physician adequate time to stabilize and safely transition the patient to surgical repair and to give the surgeon the benefit of a clear field of view to repair the tear. By the end of 2016, Bridge was credited with providing beneficial results during a number of patient procedures, four of which were published in the Heart Rhythm Journal. Physicians who have incorporated Bridge into their procedural workflows report higher levels of confidence and control in approaching lead extraction procedures. Although a superior vena cava tear is a rare occurrence, we believe that this product is an important innovation that affirms our commitment to our goal of eliminating mortality as a risk during lead extraction procedures.

4

Laser Equipment and Service

We sell or rent our CVX-300 excimer laser systems to hospitals and physicians’ offices, and our field service engineers service the laser systems on a periodic basis.

Corporate Information

The Spectranetics Corporation is a Delaware corporation formed in 1984. Our principal executive offices are located at 9965 Federal Drive, Colorado Springs, Colorado 80921. Our telephone number is (719) 633-8333.

Our corporate website is www.spnc.com. A link to a third-party website is provided at our corporate website to access our SEC filings free of charge promptly after such material is electronically filed with, or furnished to, the SEC. We do not intend for information found on our website to be part of this document.

Research and Development

We believe research and development investments are critical to increasing our revenue and revenue growth rate. Our product development and technology teams are engaged in developing additional disposable devices addressing the VI and LM markets, and further developing our laser system. Our team of research scientists, engineers and technicians, supported by third-party research and engineering organizations, performs substantially all of our research and development activities. We believe in the near-term our primary pipeline research and development effort and expense will be within our DCB programs.

Our research and development expense, which also includes clinical studies costs, regulatory costs, and royalty costs, totaled $67.5 million in 2016, $64.4 million in 2015 and $28.7 million in 2014. In 2016, research and development expense also included costs we incurred in response to a warning letter from the FDA related to observed non-conformities with current Good Manufacturing Practice (“GMP”), as defined by the FDA, at our Colorado Springs, Colorado facility. We plan to continue to respond timely and fully to the FDA’s requests and we are working diligently to fully remediate the FDA’s observations. We anticipate that we will incur incremental expenses ranging from approximately $10 million to approximately $15 million in 2017 in connection with remediating the warning letter.

Clinical Trials

Clinical studies or trials often are required in order for us to obtain regulatory approval or clearance for new products, and expanded indications for our existing products under development. The goal of a clinical trial is to meet the primary endpoint or endpoints, which measure effectiveness and/or safety of a device based on the product’s ability to achieve a pre-specified outcome or outcomes. Primary endpoints for clinical trials are selected based on the proposed intended use of the medical device. A medical device pivotal study (or pivotal trial) is a definitive study designed to gather evidence to evaluate the safety and effectiveness of a product prior to its marketing. While results in clinical trials form the basis for approval or clearance of the product, results in clinical practice may be more or less favorable than in trials, because there may be variables in clinical practice that are controlled in the clinical trial setting.

Current and Recent Clinical Trials

The trials listed below represent the significant clinical work we are currently conducting or have recently conducted. This is not a complete listing of every trial conducted or underway. We may not complete some or all of the trials underway, and the clinical results of the completed trials may not be favorable, or even if favorable, they may not be sufficient to support approval or clearance of a new device or a new indication for a currently approved or cleared device.

5

Stellarex DCB ILLUMENATE clinical trials

There are five ILLUMENATE clinical studies evaluating the safety and effectiveness of the Stellarex DCB platform to support U.S., Canadian, and other foreign regulatory filings. These clinical data represent over 1,100 patients worth of rigorous clinical evidence.

• | The ILLUMENATE First-In-Human (FIH) Study was a non-randomized, multi-center study that enrolled 80 patients. In the pre-dilatation arm (n=50), the primary patency rate at was 89.5% at 12 months and 80.3% at 24 months. |

• | The ILLUMENATE Pharmacokinetic Study measured the paclitaxel drug levels in the blood of 25 patients enrolled at two sites. Results demonstrated low and limited systemic exposure to paclitaxel. |

• | The ILLUMENATE European Randomized Clinical Trial (“EU RCT”) is a prospective, randomized controlled, multi-center trial with 328 patients enrolled at 18 European sites. The primary safety and effectiveness endpoints were met and superiority over PTA was demonstrated in both. The 12-month primary patency rate was 89.0% vs. 65.0% in the PTA arm. |

• | The ILLUMENATE Pivotal Trial is a prospective, randomized controlled, multicenter trial with 300 patients enrolled at 43 U.S. sites to support U.S. FDA approval. The primary safety and effectiveness endpoints were met and superiority over PTA was demonstrated in both. With the most complex patient population ever studied in a DCB Superficial Femoral Artery (“SFA”) Investigational Device Exemption (“IDE”) trial, the 12-month primary patency rate was 82.3% at 12 months. Co-morbidities for the DCB arm included high rates of severe calcification (43.9%), diabetes (49.5%), renal insufficiency (18.0%), and cardiovascular disease (45.0%). |

• | The ILLUMENATE Global Study is a prospective, single arm, multi-center trial which enrolled 371 patients. The treated lesions were highly complex, including a high proportion of chronic total occlusions (31%) and severe calcification (41%), as reported by an independent angiographic core-laboratory. The 12-month primary patency rate was 81.4% |

Stellarex DCB Future Studies

We began sponsorship of a large, multicenter, multi-year registry in Europe in 2016, referred to as the Stellarex Vascular e-Registry (“SAVER”). The purpose of SAVER is to continue to assess the Stellarex DCB in femoral-popliteal arteries according to the instructions for use in a broad, real-world, claudicant or ischemic rest pain patient population per the institution’s standard practice. SAVER has 169 patients enrolled. In addition, we will continue to advance physician-initiated studies to evaluate long and calcified lesions.

EXCITE ISR

The EXCImer Laser Randomized Controlled Study for the Treatment of Femoropopliteal arteries (above and behind the knee) ISR (“EXCITE ISR”) study, conducted under an IDE granted by the FDA in 2011, was designed to investigate the safety and efficacy of treatment with laser atherectomy in subjects with ISR. The EXCITE ISR study incorporated a 2:1 randomization plan, in which one group of patients was treated with laser ablation using our Turbo-Tandem and Turbo-Elite laser ablation devices followed by adjunctive balloon angioplasty and a second control group was treated only with balloon angioplasty. The primary efficacy endpoint was freedom from TLR through six months following the procedure. The primary safety endpoint is freedom from major adverse events (“MAE”), such as death, major amputation, or TLR, at 30 days following the procedure. We announced early termination of the EXCITE ISR study in March 2014, having achieved statistically significant results in both safety and efficacy and meeting the endpoints of the study. In January 2015, the complete six month results of the EXCITE ISR trial were presented at the Leipzig Interventional Course (LINC) conference.

6

In July 2014, we announced FDA 510(k) clearance of Turbo-Tandem and Turbo-Elite for the treatment of peripheral ISR in bare nitinol stents, when used in conjunction with percutaneous transluminal angioplasty. FDA clearance was based on the EXCITE ISR clinical findings. In December 2015, FDA clearance was granted for the 7Fr Turbo-Power atherectomy device, which includes usage for the treatment of ISR. This product line was expanded to include a 6 Fr Turbo-Power atherectomy device in January 2017. These products are now the only devices cleared by the FDA for the treatment of ISR.

Sales and Marketing

Our primary goal is to increase the global use of our vascular and cardiovascular products in new and existing accounts. We seek to educate and train physicians and institutions regarding the safety, efficacy, and ease of use of our VI and LM product portfolios. Through published studies of clinical applications and training initiatives, we share clinical outcomes with customers and potential customers to demonstrate that our products are proven safe and effective.

Our marketing team supports our VI and LM sales organizations, the Stellarex DCB program and global product development initiatives. Our team includes marketing and product managers responsible for all marketing activities for each of our core businesses. Our marketing activities are designed to support our direct sales teams and include branding, sales enablement tools, advertising and product publicity in trade journals, newsletters, continuing education programs, public relations and attendance at trade shows and professional association meetings.

We are dedicated to helping physicians cross, prepare and treat complex clinical challenges of peripheral and coronary artery disease. Throughout much of 2016, we have had a dedicated cross-functional team preparing for the launch of Stellarex in the U.S. and we are continuing to expand our sales force to address the DCB market opportunity competitively.

U.S. Sales and Marketing

Due to differentiated selling strategies and physician specialties, our U.S. sales organization is divided into two strategic groups, one focusing on VI and the other on LM. This strategic segmentation allows our sales teammates to better understand the needs of the customers within their respective product lines. Our VI commercial team works with interventional cardiologists, vascular surgeons and interventional radiologists who perform vascular procedures. Our LM commercial team works with electrophysiologists and cardiac surgeons who perform lead extraction procedures.

Our VI and LM educational sessions include hands-on training with a unique simulation system. The simulation technology augments traditional procedural training for physicians on the use of our products by permitting hands-on practice with extraction tools, catheter navigation and laser techniques in multiple case scenarios in a virtual operating environment.

International Sales and Marketing

International Medical includes product availability in over 65 countries outside of the U.S. and Canada, including our direct sales operations in certain countries in Europe and Puerto Rico and a network of approximately 60 distributors throughout Europe, Asia Pacific and Latin America. We also have a global marketing presence in key markets internationally that drives commercial execution of our full line of products to our direct international sales force and distributor partners. We sell substantially all of our products internationally, including Stellarex, which we sell in Europe; however, Stellarex is not approved in the U.S., where it is currently limited to investigational use.

We sell our products through direct sales and distributors in Japan, China and an expanding set of countries in the Asia Pacific and Latin America regions. We market and sell our products in Europe, the Middle East and

7

Russia through our wholly-owned subsidiary, Spectranetics International, B.V., and its wholly-owned international subsidiaries and through distributors.

Competition

The medical device industry is highly competitive, subject to rapid change and significantly affected by new product introductions and other activities of industry participants. Our primary competitors are manufacturers of products used in competing therapies to cross, prepare and treat disease within the peripheral and coronary markets, such as mechanical methods to remove arterial blockages, balloon angioplasty and stents, specialty balloon angioplasty alternatives to our specialty scoring balloons, bypass surgery and amputation. Principal competitive factors in our markets include the ability to treat a variety of lesions safely and effectively as demonstrated by credible clinical data; ease of use of products; the impact of managed care practices, related reimbursement to the healthcare provider and procedure costs; the size and effectiveness of sales forces; and research and development capabilities. Primary competitors in the vascular intervention market include, but are not limited to, Medtronic, Boston Scientific Corporation, C.R. Bard, Inc., Cook Medical, Inc., QT Vascular, Biotronik and Cardiovascular Systems, Inc. In the lead management market our competitors include, but are not limited to, Cook Medical, Inc. and Biotronik internationally.

Manufacturing

We manufacture substantially all of our products and have vertically integrated a number of manufacturing processes in an effort to provide increased quality and reliability. We believe that our level of manufacturing integration allows us to better control lead time, costs, quality and process advancements, to accelerate new product development cycle time, to provide greater design flexibility, and to scale manufacturing, should market demand increase. Many of our manufacturing processes are proprietary.

We manufacture a significant number of our disposable products and all of our CVX-300 laser systems at our corporate headquarters in Colorado Springs, Colorado. We maintain manufacturing capabilities at another location in Colorado Springs for business continuity contingency planning purposes. We manufacture AngioSculpt products at our facility in Fremont, California. The Stellarex products are manufactured in a separate facility, also located in Fremont, California.

Our manufacturing facilities are subject to periodic inspections and audits by federal, state, international, and other regulatory authorities, including inspections by the FDA and audits by our Notified Body (currently the British Standards Institution (“BSI”)), which is authorized by the European Commission (“EC”) to conduct such audits on behalf of the European Union (“EU”). Most raw materials, components and subassemblies used in our laser and disposable products are purchased from outside suppliers and are generally readily available from multiple sources. We purchase certain components of our CVX-300 laser system and select disposable products from several sole source suppliers. We do not have guaranteed commitments from these suppliers.

Patents and Proprietary Rights

We hold numerous issued U.S. patents and trademarks and have rights to additional U.S. patents under license agreements in the name of The Spectranetics Corporation and AngioScore, Inc. We also hold issued patents and trademarks in other countries. In addition, we also have pending U.S. and international patent applications that cover numerous inventions, including general features of the laser system, our catheters, our scoring balloon technology platform, the coatings of our DCB platform, and other technologies. We also maintain trademarks in the U.S. and other countries as well as pending trademark applications in the U.S. and other countries.

It is our policy to require our employees and consultants to execute confidentiality agreements upon the commencement of an employment or consulting relationship with us. Each agreement provides that all confidential

8

information developed or made known to the individual during the relationship will be kept confidential and not disclosed to third parties except in specified circumstances. In the case of employees, the agreements provide that all inventions developed by the individual pursuant to their employment are our exclusive property. In the case of consultants, those agreements often provide that inventions developed by the consultant under the agreement are either our exclusive property or provide us a license thereto. These agreements may not provide meaningful protection if unauthorized use or disclosure of such information occurs.

We also rely on trade secrets and unpatented know how to protect our proprietary technology and may be vulnerable to competitors who attempt to copy our products or gain access to our trade secrets and know how.

We are party to license agreements under which we license patents and technology covering certain aspects of our products. For example, we have an amended vascular laser angioplasty catheter license agreement with SurModics, Inc., under which SurModics has granted us a worldwide non-exclusive license to use a lubricious coating that is applied to our products using certain SurModics patents. We currently pay SurModics royalties as a specified percentage of net sales of products using its patents, subject to a quarterly minimum royalty. The license agreement expires on the later of the expiration of the last licensed patent or the fifteenth anniversary of the date a licensed product is first sold unless terminated earlier under certain circumstances, including if the royalties we pay SurModics are not greater than specified levels. In 2016, we incurred royalties of approximately $1.4 million to SurModics under this license agreement.

In December 2009, we entered into a license agreement with Peter Rentrop, M.D. As part of the agreement, we received a worldwide, exclusive license to certain patents and patent applications owned by Dr. Rentrop, which, in general, apply to laser catheters with a tip diameter less than one millimeter. We pay Dr. Rentrop royalties of a specified percentage of net sales of products using his patents subject to a quarterly minimum royalty. The license agreement expires in January 2020, unless terminated earlier in accordance with its terms. In 2016, we incurred royalties of approximately $3.0 million to Dr. Rentrop under this license agreement.

In March 2010, AngioScore entered into a development and license agreement with InnoRa GmbH, Ulrich Speck and Bruno Scheller. As part of the agreement, AngioScore received an exclusive license to certain InnoRa intellectual property related to drug coatings of certain balloon catheters in the field of the treatment of coronary artery disease and peripheral arterial disease, and AngioScore obtained ownership of any new technology developed under the agreement. AngioScore pays InnoRa royalties of a specified percentage of net sales of products developed under the agreement. The exclusive rights granted by InnoRa are subject to AngioScore meeting certain milestones. If AngioScore does not satisfy the milestones, then the exclusive license rights will convert to a non-exclusive license, and AngioScore will license certain new technology developed under the agreement to InnoRa. In 2016, AngioScore incurred an immaterial amount in royalties under this license agreement.

Third-Party Reimbursement

U.S. Third-Party Reimbursement

Reimbursement remains an important strategic consideration in the development and marketing of medical devices and procedures. We rely on appropriate insurance reimbursement to create favorable markets for our products, while providers depend on this reimbursement to incorporate new products into their medical practices. Failure to obtain insurance coverage or appropriate reimbursement can be significant barriers to the commercial success of a new product or procedure. The consequences can include slow adoption in the marketplace and inadequate payment levels that can continue over periods of time.

Our products are purchased principally by hospitals or physicians, which typically bill various third-party payers, such as governmental programs (e.g., Medicare and Medicaid), private insurance plans and managed care

9

plans, for the healthcare services provided to their patients. Most third-party payers cover and reimburse for procedures using our products.

Our customers are typically reimbursed on a fixed fee, or prospective payment basis rather than at cost. This incentivizes customers to purchase the least costly device, though quality and efficacy are usually factors in the purchasing decision. Additional reimbursement is sometimes available for higher cost, newer technology, for a period of time.

International Third-Party Reimbursement

Market acceptance of our products in international markets is dependent in part upon the availability of reimbursement from healthcare payment systems. Reimbursement and healthcare payment systems in international markets vary significantly by country. The main types of healthcare payment systems in international markets are government-sponsored healthcare and private insurance. Countries with government-sponsored healthcare, such as the United Kingdom, have a centralized, nationalized healthcare system. New devices are brought into the system through negotiations between departments at individual hospitals at the time of budgeting. In many foreign countries, there are also private insurance systems that may offer payments for alternative therapies.

Government Regulation

Overview of Medical Device Regulation. Our products are medical devices subject to extensive regulation by the FDA under the Federal Food, Drug, and Cosmetic Act (“FDCA”). FDA regulations govern, among other things, the following activities related to our products:

• | product design, development, manufacture and testing; |

• | pre-clinical and clinical studies; |

• | product labeling; |

• | product storage; |

• | premarket clearance or approval; |

• | recordkeeping; |

• | marketing, advertising and promotion; |

• | product sales and distribution; and |

• | post-market safety reporting. |

The FDA classifies medical devices into one of three classes-Class I, Class II or Class III-based on the degree of risk the FDA determines to be associated with a device and the level of regulatory control deemed necessary to ensure the device’s safety and effectiveness. Most Class I devices and some Class II devices are exempt from pre-market review and can be marketed without prior authorization from the FDA. Most of our products are Class II non-exempt medical devices and must either be approved through an application for Premarket Approval (“PMA”) or be found “substantially equivalent” by the FDA (following the agency’s review pursuant to Section 510(k) of the FDCA) to a legally marketed medical device not subject to a PMA. The PMA pathway is much more costly, lengthy and uncertain than the 510(k) process.

After a device is placed on the market, numerous regulatory requirements apply, such as FDA labeling regulations and Federal Trade Commission (“FTC”) regulations, that prohibit promoting products for unapproved or “off-label” uses, the Medical Device Reporting regulation that requires reporting to the FDA of devices that may have malfunctioned or contributed to a death or serious injury, and the Reports of Corrections and Removals regulation that requires the reporting of recalls and field actions to the FDA.

10

The FDA enforces these requirements by inspection and market surveillance. If the FDA finds a violation, it can institute a wide variety of enforcement actions, ranging from a public untitled, “it has come to our attention” letter, or warning letter to more severe sanctions such as:

• | fines, injunctions, and civil penalties; |

• | recall or seizure of products; |

• | operating restrictions, partial suspension or total shutdown of production; |

• | refusing requests for 510(k) clearance or PMA of new products; |

• | withdrawing 510(k) clearance or PMAs already granted; and |

• | criminal prosecution. |

International Regulations. International sales of our products are subject to foreign regulations, including health and medical safety regulations. The regulatory review process varies from country to country. Many countries also impose product standards, packaging and labeling requirements and import restrictions on devices.

The Medical Device Directive (“MDD”) is a directive that covers the regulatory requirements for medical devices in the European Union and, upon successful completion, the MDD process results in the approval to apply for a CE mark. We have received CE mark registration for the majority of our current products. The CE mark indicates a product is certified for sale throughout the European Union and that the manufacturer of the product complies with applicable safety and quality standards.

Environmental Regulations. We are also subject to certain federal, state and local regulations regarding environmental protection and hazardous substance controls, among others. Compliance with such environmental regulations has not had a material effect on our capital expenditures or competitive position.

Corporate Compliance and Corporate Integrity Agreement. We have processes, policies and procedures designed to maintain compliance with applicable federal, state and foreign laws and regulations governing our operations. We entered a five-year Corporate Integrity Agreement (“CIA”) with the Office of Inspector General of the U.S. Department of Health and Human Services (“OIG”) in December 2009 to resolve a federal investigation. The CIA was completed in April 2015.

Product Liability Insurance

Our business entails the risk of product liability claims. We maintain product liability insurance for $25 million per occurrence with an annual aggregate maximum of $25 million.

Employees

As of December 31, 2016, we had 960 full time employees worldwide, an increase from 892 at December 31, 2015, primarily due to continued overall growth.

11

ITEM 1A. Risk Factors

Risks related to our business and industry

Regulatory compliance is expensive, complex and uncertain, and a failure to comply could lead to enforcement actions against us and other negative consequences for our business.

The FDA and similar state and foreign agencies regulate our products as medical devices. Complying with these regulations is costly, time consuming, complex and uncertain. FDA regulations and regulations of similar state and foreign agencies are wide-ranging and include oversight of:

• | product design, development, manufacture (including supply chain) and testing; |

• | pre-clinical and clinical studies; |

• | product safety and efficacy; |

• | product labeling; |

• | product storage and shipping; |

• | record keeping; |

• | pre-market clearance or approval; |

• | marketing, advertising and promotion; |

• | product sales and distribution; |

• | product changes; |

• | product recalls; and |

• | post-market surveillance and reporting of deaths or serious injuries. |

All of our potential products and improvements of our current products are subject to extensive regulation and will likely require permission from regulatory agencies and ethics boards to conduct clinical trials, and clearance or approval from the FDA and foreign regulatory agencies prior to commercial sale and distribution. Failure to comply with applicable U.S. requirements regarding, for example, promoting, manufacturing or labeling our products, may subject us to a variety of administrative or judicial actions and sanctions, such as Form 483 deficiency notices, warning letters, product recalls, product seizures, total or partial suspension of production or distribution, injunctions, fines, civil penalties, and criminal prosecution. The FDA can also refuse to approve pending applications. Any enforcement action by the FDA and foreign regulatory agencies could have a material adverse impact on our business.

In January 2016, following an inspection of certain of our manufacturing facilities from late 2015 to early 2016, the FDA issued us a Form 483 notice, identifying certain observed non-conformities with current Good Manufacturing Practice (“GMP”), as defined by the FDA. Following the receipt of the Form 483, we provided written responses to the FDA detailing corrective actions underway to address the FDA’s observations. In May 2016, we received a warning letter from the FDA related to observed non-conformities with current GMP, at our Colorado Springs, Colorado facility. We plan to continue to respond timely and fully to the FDA’s requests, and we are working diligently to fully remediate the FDA’s observations regarding the Colorado Springs facility. We anticipate that we will incur incremental expenses ranging from approximately $10 million to approximately $15 million in 2017 in connection with remediating the warning letter. We are continuing to manufacture and ship disposable products from the Colorado Springs facility and we currently do not anticipate that customer orders will be impacted while we work to resolve the FDA’s concerns. Until the violations are corrected, we may be subject to additional regulatory action by the FDA and foreign regulatory agencies, including recalls, delays, suspension or withdrawal of approvals or clearances, and fines or civil penalties.

12

Our products may be subject to recalls after receiving FDA or foreign approval or clearance, which could divert managerial and financial resources, harm our reputation, and adversely affect our business.

The FDA and similar foreign governmental authorities have the authority to require the recall of our products because of any failure to comply with applicable laws and regulations, or defects in design or manufacture. A government mandated or voluntary product recall by us could occur because of, for example, component failures, device malfunctions, or other adverse events, such as serious injuries or deaths, or quality-related issues such as manufacturing errors or design or labeling defects. We have conducted voluntary recalls in the past and may do so in the future. For a discussion of a recent voluntary recall, please refer to Note 13, “Commitments and Contingencies,” to our consolidated financial statements included in Part IV, Item 15 of this annual report. Any future recalls of our products could divert managerial and financial resources, harm our reputation and adversely affect our business. The FDA may also order us to reimburse parties affected by the recall of our products.

In addition, we are subject to medical device reporting regulations that require us to report to the FDA or similar foreign governmental authorities if one of our products may have caused or contributed to a death or serious injury or if we become aware that it has malfunctioned in a way that would be likely to cause or contribute to a death or serious injury if the malfunction recurred. Failures to properly identify reportable events or to file timely reports can subject us to sanctions and penalties. Physicians, hospitals and other healthcare providers may make similar reports. Any such reports may trigger an investigation by the FDA or similar foreign regulatory bodies, which could divert managerial and financial resources, harm our reputation and adversely affect our business.

We may be unable to compete successfully with larger companies in our highly competitive industry.

The medical device industry is highly competitive. Our primary competitors are manufacturers of products used in competing therapies within the peripheral and coronary atherectomy and lead management markets, such as:

• | atherectomy and thrombectomy, using mechanical methods to remove arterial blockages; |

• | balloon angioplasty and stents; |

• | specialty balloon angioplasty, such as scoring balloons, pillowing balloons, cutting balloons and drug-coated balloons; |

• | bypass surgery; |

• | amputation; and |

• | mechanical lead removal tools. |

We believe that the primary competitive factors in the interventional peripheral and coronary markets include:

• | the ability to treat a variety of lesions safely and effectively as demonstrated by credible clinical data; |

• | ease of use; |

• | the impact of managed care practices, related reimbursement to the healthcare provider and procedure costs; |

• | size and effectiveness of sales forces; and |

• | research and development capabilities. |

Many of our competitors have substantially greater financial, manufacturing, commercial and technical resources than we do. There has been consolidation in the industry, and we expect that to continue. Larger competitors may have substantially larger sales and marketing operations than we do. This may allow those competitors to spend more time with potential customers and to focus on a larger number of potential customers, which gives them a significant advantage over our sales and marketing team and our international distributors in making sales. At times, we have experienced significant sales personnel turnover, and sales personnel turnover could be an issue in the future.

13

Larger competitors may also have broader product lines, which enables them to offer customers bundled purchase contracts and quantity discounts. These competitors may have more experience than we have in research and development, marketing, manufacturing, preclinical testing, conducting clinical trials, obtaining FDA and foreign regulatory approvals and marketing approved products. Our competitors may discover technologies and techniques, or enter into partnerships and collaborations, to develop competing products that are more effective or less costly than our products or the products we may develop. This may render our technology or products obsolete or noncompetitive. Academic institutions, government agencies, and other public and private research organizations may seek patent protection regarding potentially competitive products or technologies and may establish exclusive collaborative or licensing relationships with our competitors. Our competitors may be better equipped than we are to respond to competitive pressures. Competition will likely intensify.

Technological change may adversely affect sales of our products and may cause our products to become obsolete.

The medical device market is characterized by extensive research and development and rapid technological change. Technological progress or new developments in our industry could adversely affect sales of our products. Our products could be rendered obsolete because of future innovations by our competitors or others in the treatment of cardiovascular disease.

We may be unable to sustain our revenue growth.

Our ability to continue to increase our revenue in future periods will depend on our ability to successfully penetrate our target markets and increase sales of our VI products and LM products and generate significant sales from our Stellarex DCB catheters and new and improved products we introduce, which will, in turn, depend in part on our success in growing our customer base and obtaining orders from those customers. New products will also need to be developed and approved or cleared by the FDA and foreign regulatory agencies to sustain revenue growth in our markets. Additional clinical data and new products may be necessary to grow revenue. We may not be able to generate, sustain, or increase revenue on a quarterly or annual basis. If we cannot achieve or sustain revenue growth for an extended period, our financial results will be adversely affected and our stock price may decline.

Our products may not achieve or maintain market acceptance.

Even if we obtain FDA and foreign regulatory approval or clearance of our products, or new indications for our products, market acceptance of our products in the healthcare community, including physicians, patients and third-party payers, depends on many factors, including:

• | our ability to provide incremental clinical and economic data that shows the safety and clinical efficacy and cost effectiveness of, and patient benefits from, our products; |

• | the availability of alternative treatments; |

• | whether our products are included on insurance company formularies; |

• | the willingness and ability of patients and the healthcare community to adopt new technologies; |

• | the convenience and ease of use of our products relative to other treatment methods; |

• | the pricing and reimbursement of our products relative to other treatment methods; and |

• | the marketing and distribution support for our products. |

Even if we obtain all necessary FDA and foreign regulatory approvals and clearances, any of our products may fail to achieve market acceptance. If we do not educate physicians about PAD and the need to address cardiac device infection through lead removal and the existence of our products, these products may not gain market acceptance, as many physicians do not routinely screen for PAD while screening for coronary artery disease and are not aware of the need to remove and replace coronary leads when treating cardiac device infections. If our products achieve market acceptance, they may not maintain that market acceptance over time if competing products or technologies are introduced that are received more favorably or are more cost effective. Our Lead Management

14

products are used, in part, to remove advisory leads, which are leads for which a physician advisory has been issued by the manufacturer of the lead. When the advisory leads are extracted or become inactive, the market for our Lead Management products will be reduced. Failure to achieve or maintain market acceptance would limit our ability to generate revenue and would have a material adverse effect on our business, financial condition, and results of operations.

If we do not achieve our projected development and commercialization goals, our business may be harmed.

For planning, we estimate the timing of the accomplishment of various scientific, clinical, regulatory and other product development and commercialization goals, which we sometimes refer to as milestones. These milestones may include the commencement or completion of scientific studies and clinical trials and the submission of regulatory filings. From time to time, we publicly announce the expected timing of some of these milestones. We base these milestones on a variety of assumptions, which are subject to numerous risks and uncertainties. There is a risk we will not achieve these milestones on a timely basis or at all. Even if we achieve these milestones, the actual timing of the achievement of these milestones can vary dramatically compared to our estimates, often for reasons beyond our control, depending on numerous factors, including:

• | the rate of progress, costs and results of our clinical trials and research and development activities; |

• | our ability to identify and enroll patients who meet clinical trial eligibility criteria; |

• | the extent of scheduling conflicts with participating physicians and clinical institutions; |

• | adverse reactions reported during clinical trials or commercialization; |

• | the ability of our products to meet the standards for clearance or approval; |

• | the receipt of IDEs, marketing approvals and clearances by our competitors and by us from the FDA and foreign regulatory agencies; and |

• | other actions by regulators, including actions related to a class of products. |

If we do not meet these milestones for our products or if we are delayed in achieving these milestones, the development and commercialization of new products, modifications of existing products or sales of existing products for new approved indications may be prevented or delayed, which could damage our reputation or materially adversely affect our business. Even if we achieve a milestone for a product, market acceptance for the product is not assured.

We have a history of losses and may not return to profitability.

We incurred net losses from our inception in 1984 until 2000, and again in 2002, 2006, from 2008 to 2010 and from 2013 to 2016. At December 31, 2016, we had accumulated $252.7 million in net losses since inception. We may not be profitable in the future.

We have made certain assumptions relating to the AngioScore and Stellarex acquisitions that have proven in the past and may prove in the future to be materially inaccurate.

We have made certain assumptions relating to the AngioScore and Stellarex acquisitions that relate to numerous matters, including:

• | projections of future revenue and revenue growth rates; |

• | the amount of goodwill and intangibles resulting from the acquisitions; |

• | certain other purchase accounting adjustments that are being recorded in our financial statements in connection with the acquisitions; |

• | our ability to maintain, develop and deepen relationships with customers; and |

• | other financial and strategic risks of the acquisitions. |

15

Certain assumptions relating to the AngioScore and Stellarex acquisitions may prove to be inaccurate. For example, for 2015 and 2016, the first two full fiscal years subsequent to the AngioScore acquisition, we failed to achieve the revenue growth that we projected at the time of the acquisition. Our assumptions relating to the AngioScore and Stellarex acquisitions may be inaccurate in the future, which may result in our failure to realize the expected benefits of the acquisitions, failure to realize expected revenue growth rates, failure to receive product clearances or approvals in a timely manner or at all, higher than expected operating, transaction and integration costs, failure to integrate acquired personnel, loss of key employees, loss of key vendors, as well as general economic and business conditions that may adversely affect us following the acquisitions. If our assumptions regarding these acquisitions prove to be inaccurate and we cannot achieve or sustain revenue growth or we experience higher costs for an extended period, our financial results will be adversely affected and our stock price may decline.

If we cannot obtain additional funding, we may be unable to make desirable acquisitions or fund expanding growth and operations.

We may require additional funds to make acquisitions of desirable companies, products or technologies, or fund expanding growth and operations. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital may restrict our ability to grow and may reduce our ability to make desirable acquisitions. Any equity or convertible debt financing may result in substantial dilution to our existing stockholders.

If we do not manage our growth or control costs related to growth, our results of operations will suffer.

We intend to grow our business by expanding our customer base, sales force and product offerings, including through additional acquisitions or other business combinations. Growth could place significant strain on our management, employees, operations, operating and financial systems, and other resources. To accommodate significant growth, we could be required to open additional facilities, expand and improve our information systems and procedures and hire, train, motivate and manage a growing workforce, all of which would increase our costs. Our systems, facilities, procedures and personnel may not be adequate to support our future operations. Further, we may not maintain or accelerate our current growth, manage our expanding operations or achieve planned growth on a timely and profitable basis.

Litigation and other legal proceedings may adversely affect our business.

From time to time we are involved in legal proceedings relating to patent and other intellectual property matters, product liability claims, employee claims, tort or contract claims, federal regulatory investigations, securities class action, and other legal proceedings or investigations, which could have an adverse impact on our reputation, business and financial condition and divert the attention of our management from the operation of our business. Litigation is inherently unpredictable and can result in excessive or unanticipated verdicts and/or injunctive relief that affect how we operate our business. We could incur judgments or enter into settlements of claims for monetary damages or for agreements to change the way we operate our business, or both. There may be an increase in the scope of these matters or there may be additional lawsuits, claims, proceedings or investigations in the future, which could have a material adverse impact on us. Adverse publicity about regulatory or legal action against us could damage our reputation and brand image, undermine our customers’ confidence and reduce long-term demand for our products, even if the regulatory or legal action is unfounded or not material to our operations.

We must indemnify officers and directors, including, in certain circumstances, former employees and directors, against all losses, including expenses, incurred by them in legal proceedings and advance their reasonable legal defense expenses, unless certain conditions apply. We are indemnifying and advancing legal defense expenses for an officer and former officer in connection with the securities class action litigation described below, and we also have incurred significant advancement costs in connection with AngioScore’s litigation with a former director as

16

described below. Insurance for claims of this nature does not apply in all such circumstances, may be denied or may not be adequate to cover all legal or other costs related to the proceeding. A prolonged uninsured expense and indemnification obligation could have a material adverse impact on us.

We have been named as a defendant in a securities class action lawsuit that may result in substantial costs and could divert management’s attention.

On August 27, 2015, a person purporting to represent a class of persons who purchased our securities between February 19, 2015 and July 23, 2015 filed a lawsuit against us and certain of our officers in the U.S. District Court for the District of Colorado. The lawsuit asserts claims under Sections 10(b) and 20 of the Securities Exchange Act of 1934, alleging that certain of our public statements concerning our projected revenue for 2015 were false and misleading. Plaintiff seeks unspecified monetary damages on behalf of the alleged class, interest, and attorney’s fees and costs of litigation. On March 1, 2016, the plaintiffs filed an amended complaint, including additional allegations challenging certain statements made by us. The class period in the amended complaint runs from February 27, 2014 to July 23, 2015. We filed a motion to dismiss the amended complaint in June 2016, plaintiffs filed their response in July 2016, and we filed our reply brief in August 2016.

We are not able to predict the ultimate outcome of this action. It is possible it could be resolved adversely to us, result in substantial costs, result in derivative actions and additional claims, and divert management’s attention and resources, which could harm our business. While we maintain director and officer liability insurance and have submitted this claim to our carriers who have acknowledged coverage and reserved their rights under the policies, the amount of insurance coverage may not be sufficient to cover a claim, and the continued availability of this insurance cannot be assured. Protracted litigation, including any adverse outcomes, may have an adverse impact on our business, results of operations or financial condition, could subject us to adverse publicity, and require us to incur significant legal fees.

We may incur substantial costs because of litigation or other proceedings relating to patent and other intellectual property rights, which could cause substantial costs and liability.

There may be patents and patent applications owned by others relating to peripheral and coronary atherectomy products, lead management products, specialty balloons, drug-coated balloons, or other technologies, which, if determined to be valid and enforceable, may be infringed by us. Holders of certain patents, including holders of patents involving the use of lasers, catheters, specialty balloons or drug-coated balloons in the body, may contact us and request we enter into license agreements for the underlying technology and pay them royalties, which could be substantial.

If we need to obtain a license to use any intellectual property, we may be unable to obtain such license on favorable terms or at all or we may be required to make substantial royalty or other payments to use this intellectual property or we may become involved in litigation regarding the use of the relevant intellectual property.

Litigation concerning patents and proprietary rights is time-consuming, expensive and unpredictable, and could divert the attention of our management from our business operations. We cannot guarantee that other patent holders will not sue us and prevail. An adverse ruling could subject us to significant liability, require us to seek licenses, and restrict our ability to manufacture and sell our products. We are, and in the past have been, a party to legal proceedings involving our intellectual property and may be a party to future proceedings. For a discussion of our legal proceedings, please refer to Note 13, “Commitments and Contingencies,” to our consolidated financial statements included in Part IV, Item 15 of this annual report. Some of our competitors may be able to sustain the costs of complex litigation more effectively than we can because they have substantially greater resources. An unfavorable outcome in an interference proceeding or patent infringement suit could require us to pay substantial damages, to lose our patent protection, to cease using the technology or to license rights, potentially at a substantial cost, from prevailing third parties. There is no guarantee that any prevailing party would offer us a license or that we

17

could acquire any license on commercially acceptable terms. Even if we can obtain rights to a third-party’s patented intellectual property, those rights may be non-exclusive, and therefore our competitors may obtain access to the same intellectual property. Ultimately, we may have to cease some of our business operations because of patent infringement claims, which could severely harm our business. To the extent we are found to be infringing on the intellectual property rights of others, we may not develop or otherwise obtain alternative technology. If we need to redesign our products to avoid third-party patents, we may suffer significant regulatory delays associated with conducting additional studies or submitting technical, manufacturing or other information related to any redesigned product and, ultimately, in obtaining regulatory approval. Further, any such redesigns may result in less effective or less commercially desirable products or both.

AngioScore is subject to pending litigation that may materially harm its intellectual property and our business.

Prior to our acquisition of AngioScore, AngioScore filed a lawsuit in federal district court in California against Eitan Konstantino, a former director of AngioScore and founder of TriReme Medical, LLC (“Trireme”), Quattro Vascular Pte Ltd. (“Quattro”) and QT Vascular Ltd. (“QT Vascular”), which sell a balloon angioplasty device sold under the name “Chocolate.” The lawsuit alleged infringement of an AngioScore patent, and state law claims of breach of fiduciary duties by Konstantino while serving as a director of AngioScore, and aiding and abetting of that breach by the other defendants. In July 2015, the district court ruled in favor of AngioScore, finding that Konstantino breached his fiduciary duties to AngioScore, that TriReme and Quattro aided and abetted that breach, and that QT Vascular was liable for the acts of TriReme and Quattro. The district court awarded AngioScore $20.034 million against all defendants plus disgorgement from Konstantino of all benefits he accrued from his breach of fiduciary duties. In September 2015, a jury found against AngioScore in the patent infringement case.

In July 2016, an appellate court reversed the state law rulings on procedural grounds, finding that the district court lacked jurisdiction to hear those claims, and affirmed the district court’s ruling that the defendants were not entitled to attorneys’ fees in the patent infringement case. In August 2016, AngioScore filed a petition for rehearing of the order reversing the state law rulings, which the appellate court denied. The appellate court remanded the matter to the district court for dismissal of the state law claims, which the district court did in February 2017.

In May 2014, Konstantino filed claims for advancement of fees and costs and indemnification by AngioScore against the breach of fiduciary duty claims. A court held in August 2014 that AngioScore was required to advance the former director’s attorneys’ fees. AngioScore filed a motion for summary judgment, and in November 2015, the court granted in part AngioScore’s motion for summary judgment and ordered that TriReme is liable for 50% of advanced fees and costs, and must pay all fees and costs to be advanced moving forward until such fees and costs equal the fees and costs paid by AngioScore, and thereafter, the fees and costs must be advanced 50% by TriReme and 50% by AngioScore. A judge or jury could determine that AngioScore must ultimately pay the former director’s legal fees and costs defending against the breach of fiduciary duty and other claims, and the fees and costs associated with the dispute regarding indemnification, which could be material. As of December 31, 2015, AngioScore had incurred approximately $12.8 million in advancement costs, which may not be covered by insurance. AngioScore did not incur any advancement costs in 2016.

In June 2014, TriReme sued AngioScore seeking to change the inventorship of certain patents owned by AngioScore. TriReme alleges that an Israeli physician, Chaim Lotan, should be named as a co-inventor on three patents owned by AngioScore. Dr. Lotan allegedly assigned any rights he may have had in the three patents to TriReme. In March 2015, the court granted AngioScore’s motion to dismiss this case. In February 2016, an appellate court reversed the lower court’s ruling dismissing the case and remanded the case for further proceedings. In January 2017, AngioScore filed a motion for summary judgment requesting the court to dismiss the case.

Regardless of whether AngioScore ultimately prevails in this litigation, the defendants and other third parties may use the AngioScore discoveries or technologies without paying damages, licensing fees or royalties to

18

us, which could significantly diminish the value of the AngioScore intellectual property. We cannot at this time determine the likelihood of any outcome. As of December 31, 2016, we had no amounts accrued for potential damages. During the years ended December 31, 2016 and 2015, we incurred $1.8 million and $19.9 million, respectively, of legal fees associated with these matters, including amounts advanced for certain of Konstantino’s attorneys’ fees and costs in 2015. A judge or jury could determine that AngioScore must ultimately pay the former director’s legal fees and costs defending against the breach of fiduciary duty and other claims, and the fees and costs associated with the dispute regarding indemnification. The cost of this litigation may continue to be material to us and may not be covered by insurance. Any of the foregoing could have a material adverse effect on our business, results of operations, financial position, or liquidity.

Healthcare reform initiatives and other administrative and legislative proposals may adversely affect our business, financial condition, results of operations and cash flows in our key markets.

There have been and continue to be proposals by the federal government, state governments, regulators and third-party payers to control or manage the increased costs of health care and, more generally, to reform the U.S. healthcare system. Certain of these proposals could limit the prices we are able to charge for our products or the coverage and reimbursement available for our products and could limit the acceptance and availability of our products. The adoption of proposals to control costs could have a material adverse effect on our financial position and results of operations.

The Patient Protection and Affordable Care Act (“PPACA”) has made significant changes to the way healthcare is financed by both federal and state governments and private insurers, and has directly impacted the medical device and pharmaceutical industries. The PPACA includes, with limited exceptions, a deductible excise tax of 2.3% on sales of medical devices by entities, including us, which manufacture or import certain medical devices offered for sale in the U.S., including many of our products. The tax was effective January 1, 2013, but is currently suspended under a two-year moratorium that began January 1, 2016. Revenue from many of our products is subject to that excise tax. Congress is currently considering whether to permanently repeal the medical device excise tax.

Congress has adopted other legislative changes regarding healthcare since it enacted the PPACA. On August 2, 2011, the Budget Control Act of 2011 created measures for spending reductions by Congress. A Joint Select Committee on Deficit Reduction, tasked with recommending a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, could not reach required goals, triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions to Medicare payments to providers of up to 2% per fiscal year. The 2% Medicare payment reductions went into effect in April 2013 and, unless additional Congressional action is taken, will stay in effect through 2025 due to the Bipartisan Budget Act of 2015 signed into law in November 2015. The American Taxpayer Relief Act (“ATRA”) also reduced Medicare payments to several providers, including hospitals, imaging centers and cancer treatment centers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years. These laws may cause additional reductions in Medicare and other healthcare funding, which could have a material adverse effect on our customers and our financial condition.

Various new healthcare reform proposals are emerging at the federal and state level. Any new federal and state healthcare initiatives that may be adopted could limit the amounts that federal and state governments will pay for healthcare products and services, and could have a material adverse effect on our industry and our results of operations.

Product clearances and approvals can often be denied or significantly delayed.

Under FDA regulations, unless exempt, a new medical device may only be commercially distributed after it has received 510(k) clearance or is the subject of an approved PMA. The FDA will clear marketing of a medical

19