Attached files

| file | filename |

|---|---|

| EX-99.2 - EX-99.2 - Destination Maternity Corp | d320994dex992.htm |

| 8-K - FORM 8-K - Destination Maternity Corp | d320994d8k.htm |

Exhibit 99.1

|

|

Exhibit 99.1

ORCHESTRA PRÉMAMAN / DESTINATION MATERNITY

JANUARY 11, 2017

|

|

Forward- Looking Statements

Some of the information in this presentation, including the information incorporated by reference, contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements involve a number of risks and uncertainties related to operating performance and outlook of Destination and the combined businesses of Destination and Orchestra. following the Merger, as well as other future events and their potential effects on Destination and the combined company that are subject to risks and uncertainties. The following factors, among others, in the future could cause Destination’s or Orchestra’s actual results, performance, achievements or industry results to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. These factors include, but are not limited to, statements relating to (i) the possibility that the Merger does not close when expected or at all, or that Destination and Orchestra, in order to achieve governmental and regulatory approvals, may be required to modify aspects of the Merger or to accept conditions that could adversely affect the combined company or the expected benefits of the proposed Merger; (ii) the ability to obtain the requisite Destination and Orchestra stockholder approvals, on the proposed terms and timeframe; (iii) the benefits of the Merger, including future financial and operating results of the combined company, Destination and Orchestra’s plans, objectives, expectations and intentions, and the ability to realize the expected synergies or savings from the proposed Merger in the amounts or in the timeframe anticipated; (iv) the risk that competing offers or acquisition proposals will be made; (v) the ability to integrate Destination’s and Orchestra’s businesses in a timely and cost-efficient manner; (vi) the inherent uncertainty associated with financial projections; (vii) the potential impact of the announcement or closing of the proposed Merger on customer, supplier, employee and other relationships; and (viii) other factors referenced in Destination’s Annual Report on Form 10-K or Orchestra’s Registration Document (document de référence), including those set forth under the caption “Risk Factors.” In addition, these forward-looking statements necessarily depend upon assumptions, estimates and dates that may be incorrect or imprecise and involve known and unknown risks, uncertainties and other factors. Accordingly, any forward-looking statements included in this announcement do not purport to be predictions of future events or circumstances and may not be realized. Forward-looking statements can be identified by, among other things, the use of forward- looking terms such as “believes,” “expects,” “may,” “will,” “should,” “seeks,” “pro forma,” “anticipates,” “intends,” “continues,” “could,” “estimates,” “plans,” “potential,” “predicts,” “goal,” “objective,” or the negative of any of these terms, or comparable terminology, or by discussions of our outlook, plans, goals, strategy or intentions. Forward-looking statements speak only as of the date made. Except as required by applicable law, including the securities laws of the United States and the rules and regulations of the SEC, we assume no obligation to update any of these forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting these forward-looking statements.

Nothing contained herein shall be deemed to be a forecast, projection or estimate of the future financial performance of Destination and Orchestra, or the combined company, following the implementation of the proposed Merger or otherwise. No statement in this presentation should be interpreted to mean that the earnings per share, profits, margins or cash flows of Destination or the combined company for the current or future financial years would necessarily match or exceed the historical published figures.

1

|

|

Agenda

1 | ORCHESTRA OVERVIEW

2 | THE ORCHESTRA CONCEPT

3 | MERGER WITH DESTINATION MATERNITY

4 | APPENDIX

2

|

|

1 | ORCHESTRA

OVERVIEW

A European leader in children’s clothing and childcare products

3

|

|

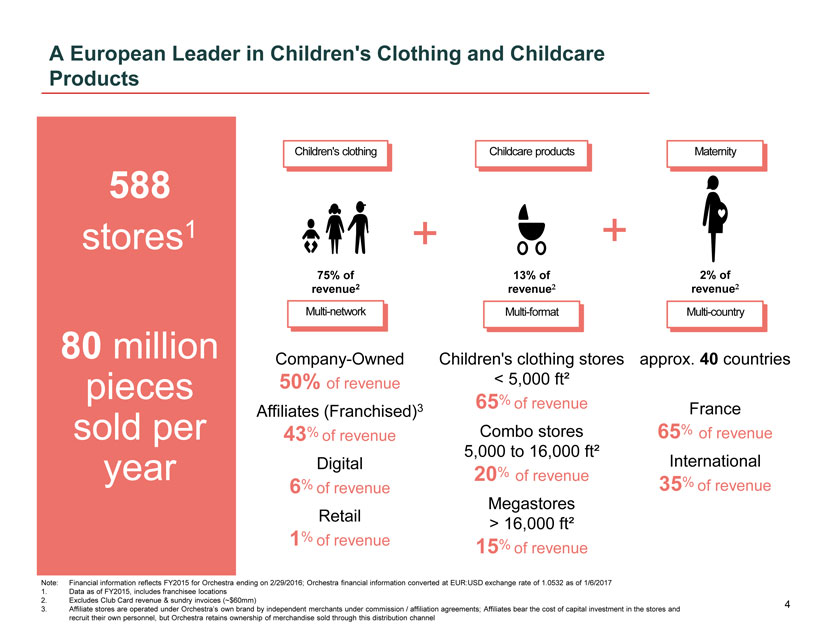

A European Leader in Children’s Clothing and Childcare Products

588 stores1

80 million pieces sold per year

Children’s clothing Childcare products Maternity

75% of 13% of 2% of

revenue(2) revenue(2) revenue(2)

Multi-network Multi-format Multi-country

Company-Owned Children’s clothing stores approx. 40 countries

50% of revenue < 5,000 ft²

Affiliates (Franchised)(3) 65(%) of revenue France

43(%) of revenue Combo stores 65(%) of revenue

5,000 to 16,000 ft²

Digital International

20(%) of revenue

6(%) of revenue 35(%) of revenue

Megastores

Retail > 16,000 ft²

1(%) of revenue 15(%) of revenue

Note: Financial information reflects FY2015 for Orchestra ending on 2/29/2016; Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

1. Data as of FY2015, includes franchisee locations

2. Excludes Club Card revenue & sundry invoices (~$60mm)

3. Affiliate stores are operated under Orchestra’s own brand by independent merchants under commission / affiliation agreements; Affiliates bear the cost of capital investment in the stores and recruit their own personnel, but Orchestra retains ownership of merchandise sold through this distribution channel

| 4 |

|

|

|

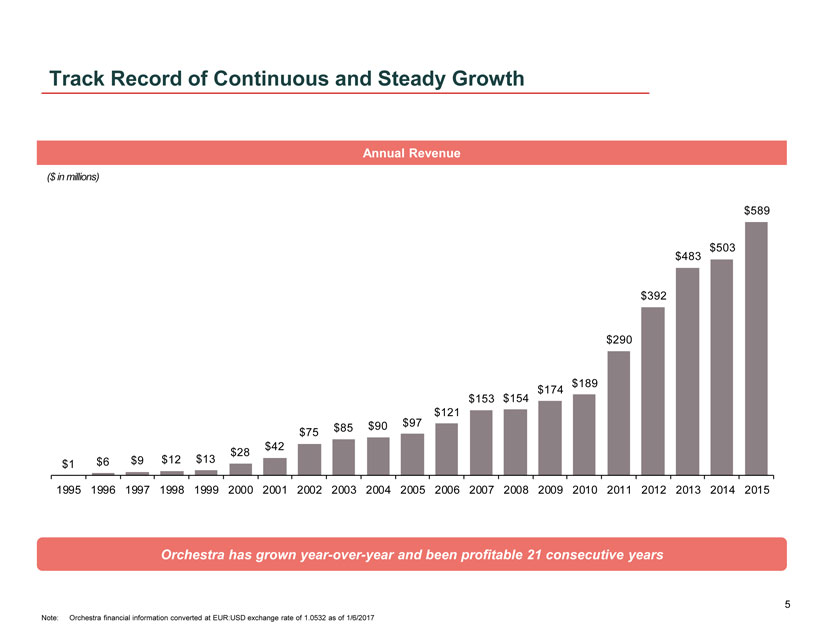

Track Record of Continuous and Steady Growth

Annual Revenue

($ in millions)

Orchestra has grown year-over-year and been profitable 21 consecutive years

Note: Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

5

|

|

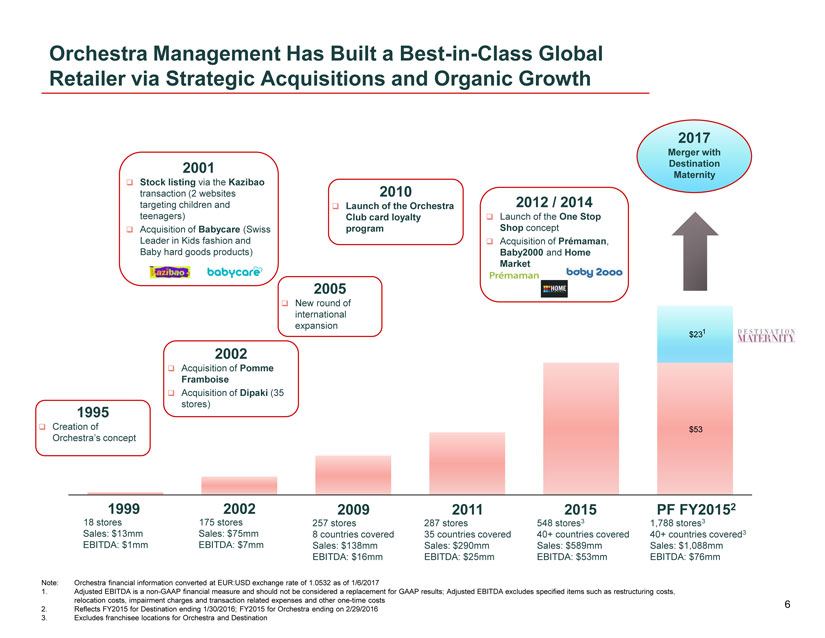

Orchestra Management Has Built a Best-in-Class Global Retailer via Strategic Acquisitions and Organic Growth

2001

Stock listing via the Kazibao transaction (2 websites targeting children and teenagers) Acquisition of Babycare (Swiss Leader in Kids fashion and Baby hard goods products)

2010

Launch of the Orchestra Club card loyalty program

2012 / 2014

Launch of the One Stop Shop concept Acquisition of Prémaman,

Baby2000 and Home Market

2017

Merger with Destination Maternity

2005

New round of international expansion

2002

Acquisition of Pomme

Framboise

Acquisition of Dipaki (35 stores)

1995

Creation of

Orchestra’s concept

1999

18 stores Sales: $13mm EBITDA: $1mm

2002

175 stores Sales: $75mm EBITDA: $7mm

2009

257 stores

8 countries covered Sales: $138mm EBITDA: $16mm

2011

287 stores

35 countries covered Sales: $290mm EBITDA: $25mm

2015

548 stores3

40+ countries covered Sales: $589mm EBITDA: $53mm

PF FY20152

1,788 stores3

40+ countries covered3 Sales: $1,088mm EBITDA: $76mm

Note: Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

1. Adjusted EBITDA is a non-GAAP financial measure and should not be considered a replacement for GAAP results; Adjusted EBITDA excludes specified items such as restructuring costs, relocation costs, impairment charges and transaction related expenses and other one-time costs

2. Reflects FY2015 for Destination ending 1/30/2016; FY2015 for Orchestra ending on 2/29/2016

3. Excludes franchisee locations for Orchestra and Destination

6

|

|

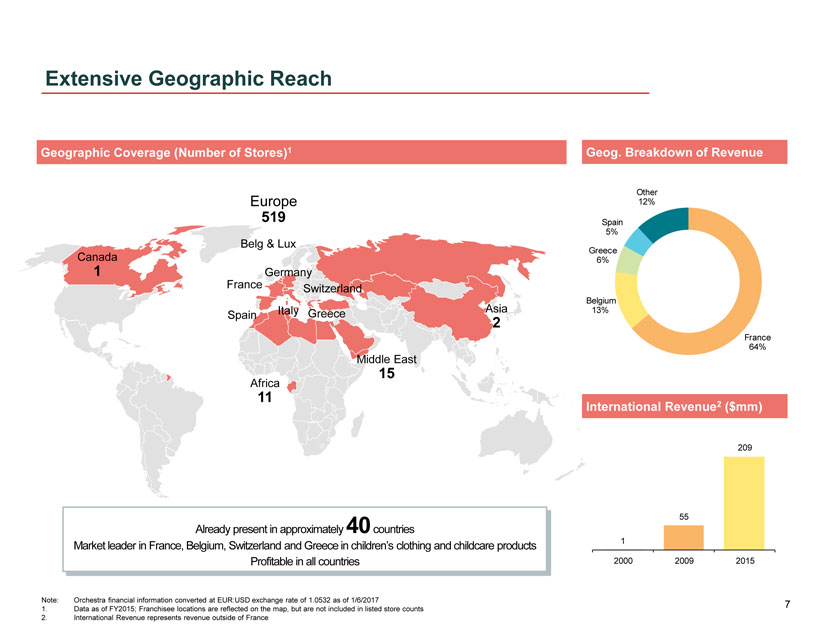

Extensive Geographic Reach

Geographic Coverage (Number of Stores)1 Geog. Breakdown of Revenue

Europe

519

Belg & Lux Canada

1 Germany

France Switzerland

Italy Greece Asia Spain

2

Middle East

15

Africa

11

Other 12%

Spain 5%

Greece 6%

Belgium 13%

France 64%

International Revenue2 ($mm)

Already present in approximately 40 countries

Market leader in France, Belgium, Switzerland and Greece in children’s clothing and childcare products Profitable in all countries

Note: Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

1. Data as of FY2015; Franchisee locations are reflected on the map, but are not included in listed store counts

2. International Revenue represents revenue outside of France

7

|

|

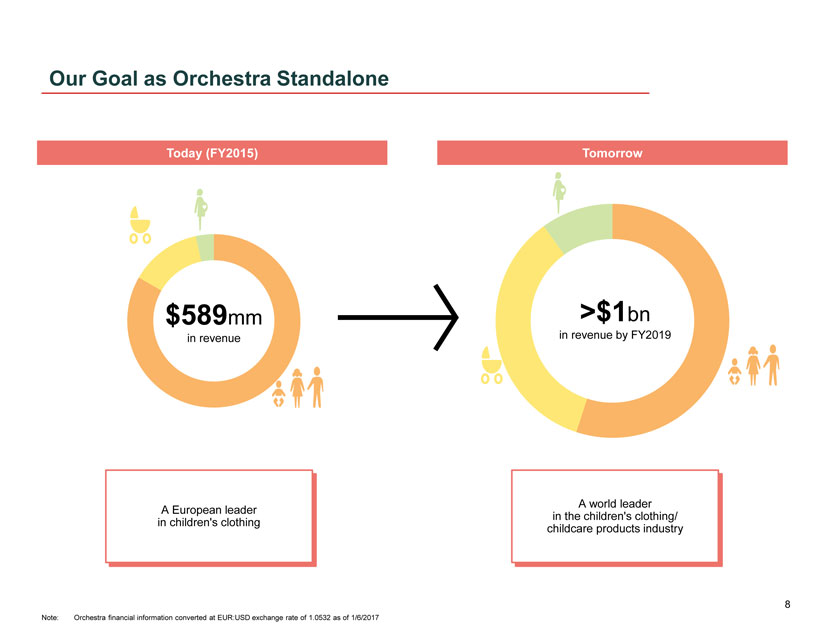

Our Goal as Orchestra Standalone

Today (FY2015) Tomorrow

$589mm >$1bn

in revenue in revenue by FY2019

A world leader A European leader in the children’s clothing/ in children’s clothing childcare products industry

Note: Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

8

|

|

2 | THE

ORCHESTRA CONCEPT

9

|

|

Orchestra Video

[Video not being filed with SEC]

10

|

|

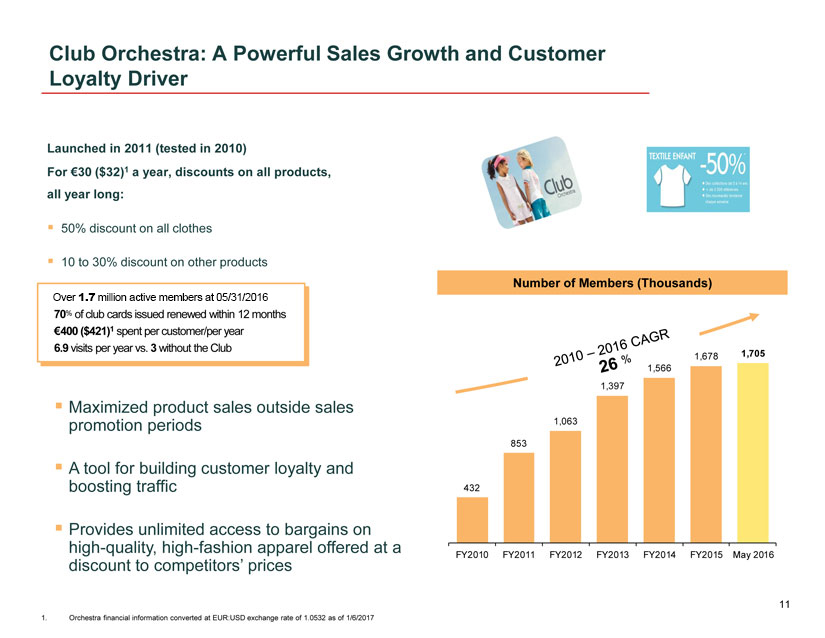

Club Orchestra: A Powerful Sales Growth and Customer Loyalty Driver

Launched in 2011 (tested in 2010)

For €30 ($32)1 a year, discounts on all products, all year long:

50% discount on all clothes

10 to 30% discount on other products

Over 1.7 million active members at 05/31/2016

70% of club cards issued renewed within 12 months €400 ($421)1 spent per customer/per year

6.9 visits per year vs. 3 without the Club

Maximized product sales outside sales promotion periods

A tool for building customer loyalty and boosting traffic

Provides unlimited access to bargains on high-quality, high-fashion apparel offered at a discount to competitors’ prices

Number of Members (Thousands)

1. Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

11

|

|

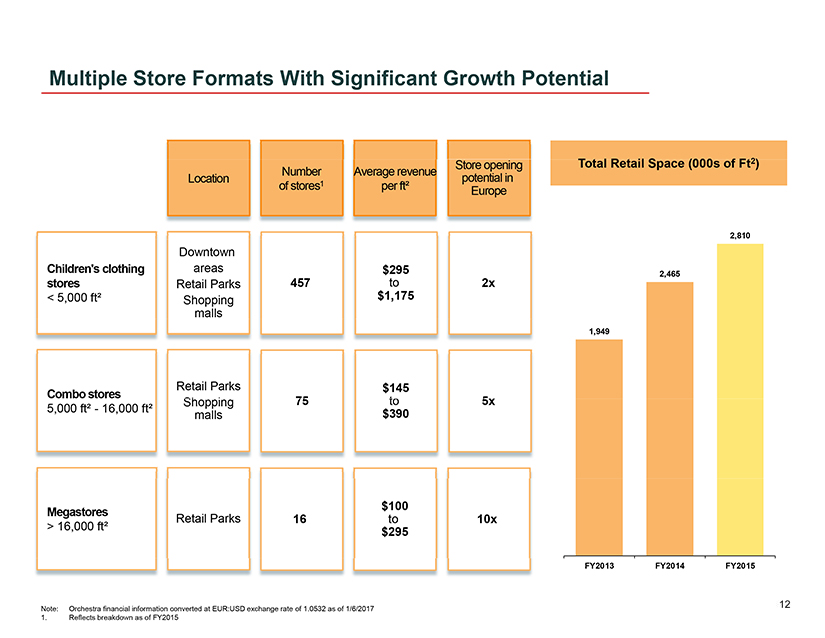

Multiple Store Formats With Significant Growth Potential

Store opening Number Average revenue Location potential in of stores1 per ft² Europe

Downtown

Children’s clothing areas $295 stores Retail Parks 457 to 2x

< 5,000 ft² Shopping $1,175 malls

Retail Parks $145

Combo stores

Shopping 75 to 5x 5,000 ft²—16,000 ft² malls $390

$100 Megastores

Retail Parks 16 to 10x

> 16,000 ft² $295

Recent Square Footage Growth by Format (both in 000s of Ft²)

FY2013 FY2014 FY2015

Total

Retail Space: 1,949 2,465 2,810

Megastores Combo Stores Children’s Clothing Stores

Note: Orchestra financial information converted at EUR: USD exchange rate of 1.0532 as of 1/6/2017

1. Reflects breakdown as of FY2015

12

|

|

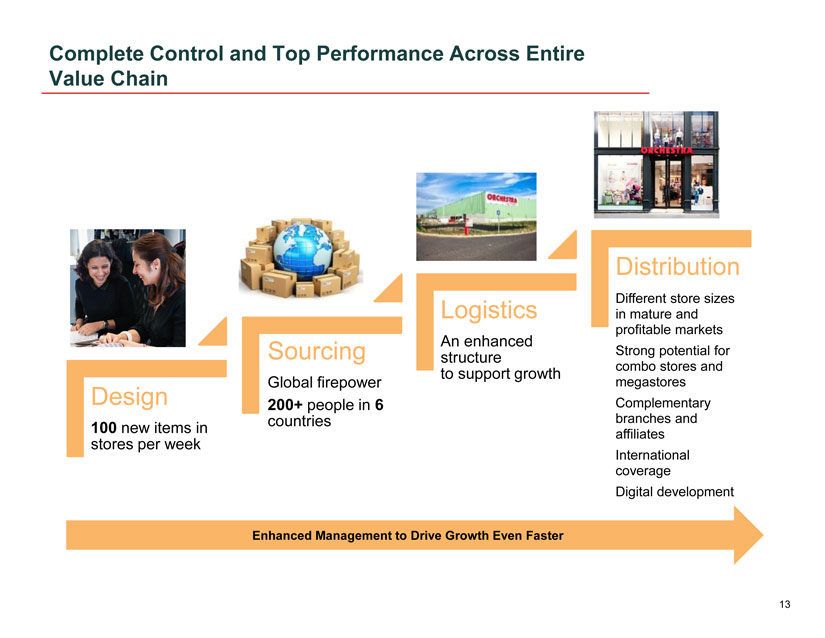

Complete Control and Top Performance Across Entire Value Chain

Design

100 new items in stores per week

Sourcing

Global firepower 200+ people in 6 countries

Logistics

An enhanced structure to support growth

Distribution

Different store sizes in mature and profitable markets Strong potential for combo stores and megastores Complementary branches and affiliates International coverage Digital development

Enhanced Management to Drive Growth Even Faster

13

|

|

3 | MERGER

WITH

DESTINATION MATERNITY

14

|

|

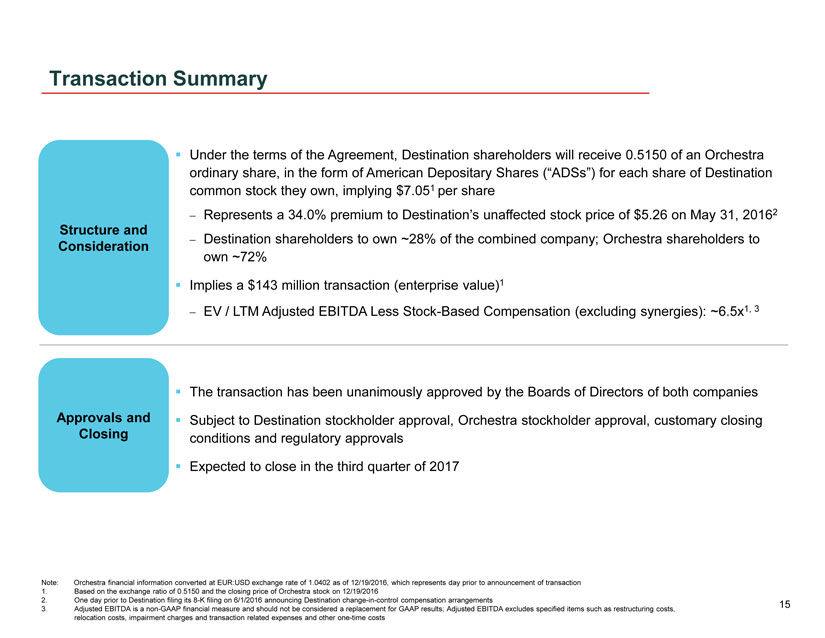

Transaction Summary

Structure and Consideration

Under the terms of the Agreement, Destination shareholders will receive 0.5150 of an Orchestra ordinary share, in the form of American Depositary Shares (“ADSs”) for each share of Destination common stock they own, implying $7.051 per share

- Represents a 34.0% premium to Destination’s unaffected stock price of $5.26 on May 31, 20162

- Destination shareholders to own ~28% of the combined company; Orchestra shareholders to own ~72%

Implies a $143 million transaction (enterprise value)1

- EV / LTM Adjusted EBITDA Less Stock-Based Compensation (excluding synergies): ~6.5x1, 3

Approvals and Closing

The transaction has been unanimously approved by the Boards of Directors of both companies

Subject to Destination stockholder approval, Orchestra stockholder approval, customary closing conditions and regulatory approvals

Expected to close in the third quarter of 2017

Note: Orchestra financial information converted at EUR:USD exchange rate of 1.0402 as of 12/19/2016, which represents day prior to announcement of transaction

1. Based on the exchange ratio of 0.5150 and the closing price of Orchestra stock on 12/19/2016

2. One day prior to Destination filing its 8-K filing on 6/1/2016 announcing Destination change-in-control compensation arrangements

3. Adjusted EBITDA is a non-GAAP financial measure and should not be considered a replacement for GAAP results; Adjusted EBITDA excludes specified items such as restructuring costs, relocation costs, impairment charges and transaction related expenses and other one-time costs

15

|

|

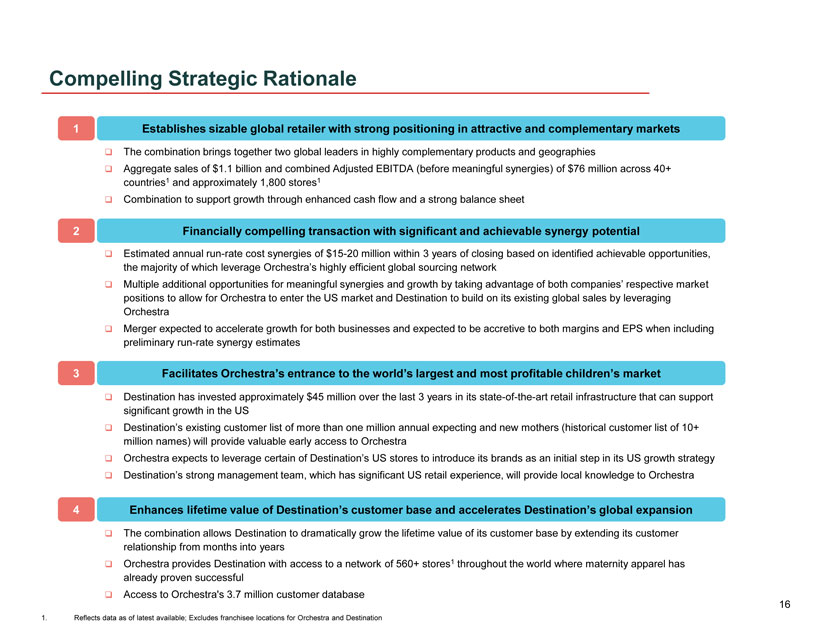

Compelling Strategic Rationale

1 Establishes sizable global retailer with strong positioning in attractive and complementary markets

The combination brings together two global leaders in highly complementary products and geographies

Aggregate sales of $1.1 billion and combined Adjusted EBITDA (before meaningful synergies) of $76 million across 40+ countries1 and approximately 1,800 stores1 Combination to support growth through enhanced cash flow and a strong balance sheet

2 Financially compelling transaction with significant and achievable synergy potential

Estimated annual run-rate cost synergies of $15-20 million within 3 years of closing based on identified achievable opportunities, the majority of which leverage Orchestra’s highly efficient global sourcing network Multiple additional opportunities for meaningful synergies and growth by taking advantage of both companies’ respective market positions to allow for Orchestra to enter the US market and Destination to build on its existing global sales by leveraging Orchestra Merger expected to accelerate growth for both businesses and expected to be accretive to both margins and EPS when including preliminary run-rate synergy estimates

3 Facilitates Orchestra’s entrance to the world’s largest and most profitable children’s market

Destination has invested approximately $45 million over the last 3 years in its state-of-the-art retail infrastructure that can support significant growth in the US

Destination’s existing customer list of more than one million annual expecting and new mothers (historical customer list of 10+ million names) will provide valuable early access to Orchestra Orchestra expects to leverage certain of Destination’s US stores to introduce its brands as an initial step in its US growth strategy

Destination’s strong management team, which has significant US retail experience, will provide local knowledge to Orchestra

4 Enhances lifetime value of Destination’s customer base and accelerates Destination’s global expansion

The combination allows Destination to dramatically grow the lifetime value of its customer base by extending its customer relationship from months into years Orchestra provides Destination with access to a network of 560+ stores1 throughout the world where maternity apparel has already proven successful Access to Orchestra’s 3.7 million customer database

1. Reflects data as of latest available; Excludes franchisee locations for Orchestra and Destination

16

|

|

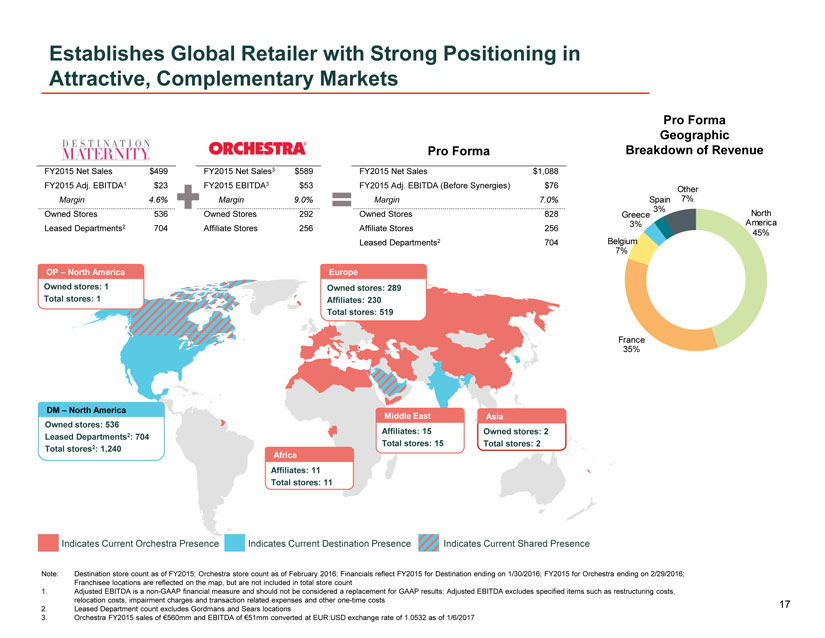

Establishes Global Retailer with Strong Positioning in Attractive, Complementary Markets

Pro Forma Geographic Breakdown of Revenue

FY2015 Net Sales $499 FY2015 Adj. EBITDA1 $23

Margin 4.6%

Owned Stores 536 Leased Departments2 704

FY2015 Net Sales3 $589 FY2015 EBITDA3 $53

Margin 9.0%

Owned Stores 292 Affiliate Stores 256

Pro Forma

FY2015 Net Sales $1,088 FY2015 Adj. EBITDA (Before Synergies) $76

Margin 7.0%

Owned Stores 828 Affiliate Stores 256 Leased Departments2 704

OP – North America Owned stores: 1 Total stores: 1

Europe

Owned stores: 289 Affiliates: 230 Total stores: 519

DM – North America Owned stores: 536 Leased Departments2: 704 Total stores2: 1,240

Africa Affiliates: 11 Total stores: 11

Middle East Affiliates: 15 Total stores: 15

Asia

Owned stores: 2 Total stores: 2

Indicates Current Orchestra Presence Indicates Current Destination Presence Indicates Current Shared Presence

Note: Destination store count as of FY2015; Orchestra store count as of February 2016; Financials reflect FY2015 for Destination ending on 1/30/2016; FY2015 for Orchestra ending on 2/29/2016; Franchisee locations are reflected on the map, but are not included in total store count

1. Adjusted EBITDA is a non-GAAP financial measure and should not be considered a replacement for GAAP results; Adjusted EBITDA excludes specified items such as restructuring costs, relocation costs, impairment charges and transaction related expenses and other one-time costs

2. Leased Department count excludes Gordmans and Sears locations

3. Orchestra FY2015 sales of €560mm and EBITDA of €51mm converted at EUR:USD exchange rate of 1.0532 as of 1/6/2017

17

|

|

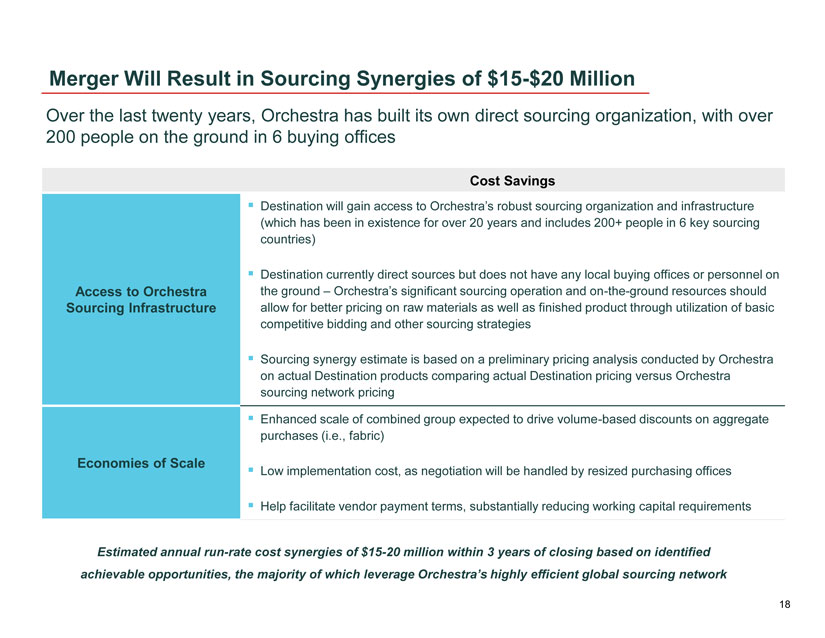

Merger Will Result in Sourcing Synergies of $15-$20 Million

Over the last twenty years, Orchestra has built its own direct sourcing organization, with over 200 people on the ground in 6 buying offices

Access to Orchestra Sourcing Infrastructure

Cost Savings

Destination will gain access to Orchestra’s robust sourcing organization and infrastructure

(which has been in existence for over 20 years and includes 200+ people in 6 key sourcing countries)

Destination currently direct sources but does not have any local buying offices or personnel on the ground – Orchestra’s significant sourcing operation and on-the-ground resources should allow for better pricing on raw materials as well as finished product through utilization of basic competitive bidding and other sourcing strategies

Sourcing synergy estimate is based on a preliminary pricing analysis conducted by Orchestra on actual Destination products comparing actual Destination pricing versus Orchestra sourcing network pricing

Economies of Scale

Enhanced scale of combined group expected to drive volume-based discounts on aggregate purchases (i.e., fabric)

Low implementation cost, as negotiation will be handled by resized purchasing offices

Help facilitate vendor payment terms, substantially reducing working capital requirements

Estimated annual run-rate cost synergies of $15-20 million within 3 years of closing based on identified achievable opportunities, the majority of which leverage Orchestra’s highly efficient global sourcing network

18

|

|

Significant Global Revenue Synergies

Selling Orchestra Products in the U.S. to Gain a Share of the ~$25 Billion U.S. Baby and

Children’s Market

Online

Orchestra and Destination product sold online through a new U.S. Orchestra website Orchestra products sold online through

Destination’s current websites

Brick and Mortar

Orchestra product offered in existing Destination stores enhancing sales and profitability per square foot

Orchestra and Destination product sold in new standalone Orchestra stores including opportunistically converting certain Destination doors into Orchestra doors where appropriate (including some Destination stores marked for closure)

Selling Orchestra product in third party department and specialty stores

Jumpstart Orchestra’s U.S. launch through use of Destination’s customer list of over 10 million customers with children 10 years old and younger, as well as marketing Orchestra brand through Destination’s stores and websites

Selling Destination Products Outside of North

America through Orchestra’s Retail Network to

Gain a Bigger Share of the Overall Global Maternity Market

Online

Roll-out maternity wear offerings to

Orchestra’s online customers

Leverage Orchestra client base, web traffic and the awareness built through corners in Orchestra stores

Integrate Destination products to broaden the portfolio, creating the largest European portfolio of maternity wear

Orchestra’s database of parents can be tailored specifically for the distribution of Destination products

Brick and Mortar

Distribution of Destination products in Orchestra stores

Leverage the Destination collections and Orchestra footprint/client base to build a relevant collection within the EMEA market

Increase the number of existing maternity corners within

Orchestra’s network of stores from

100 to 300 in the midterm

Could potentially create a network of standalone maternity stores and/or corners in department stores in Europe

Potential for greater revenue / sq. ft. than existing Orchestra stores

19

|

|

Conclusion

Establishes global retailer of scale with strong positioning in attractive, complementary segments

Financially compelling transaction with significant and achievable synergy potential

Facilitates Orchestra’s entrance to the world’s largest and most profitable children’s market

Enhances lifetime value of Destination’s customer base and accelerates Destination’s global expansion

20

|

|

4 | APPENDIX

21

|

|

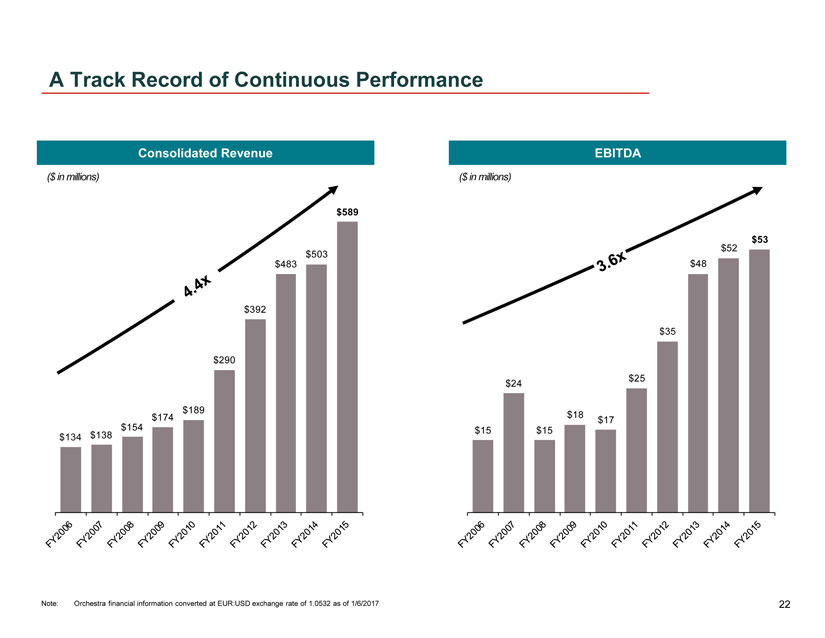

A Track Record of Continuous Performance

Consolidated Revenue

($ in millions)

EBITDA

($ in millions)

Note: Orchestra financial information converted at EUR:USD exchange rate of 1.0532 as of 1/6/2017

22

|

|

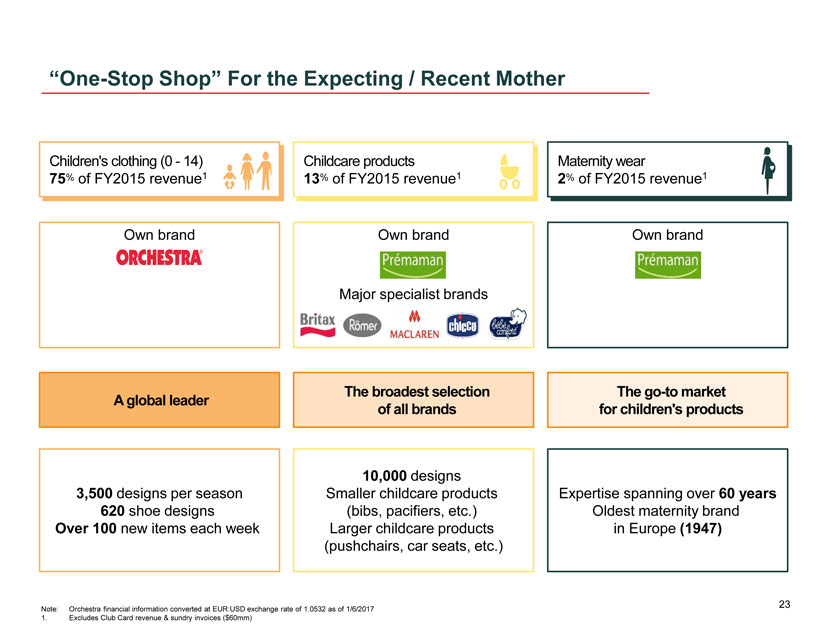

“One-Stop Shop” For the Expecting / Recent Mother

Children’s clothing (0—14)

75% of FY2015 revenue1

Childcare products

13% of FY2015 revenue1

Own brand Own brand Own brand

Major specialist brands

A global leader

The broadest selection of all brands

The go-to market for children’s products

3,500 designs per season 620 shoe designs Over 100 new items each week

10,000 designs

Smaller childcare products (bibs, pacifiers, etc.) Larger childcare products (pushchairs, car seats, etc.)

Expertise spanning over 60 years Oldest maternity brand in Europe (1947)

Note: Orchestra financial information converted at EUR:USD exchange rate of 1.0532 as of 1/6/2017

1. Excludes Club Card revenue & sundry invoices ($60mm)

23

|

|

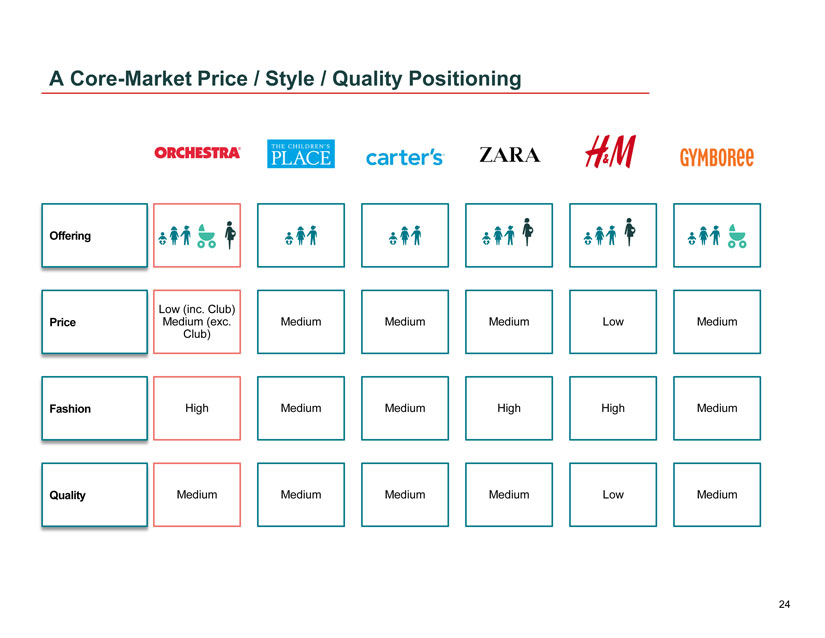

A Core-Market Price / Style / Quality Positioning

Offering

Price

Low (inc. Club) Medium (exc.

Club)

Medium Medium Medium Low Medium

Fashion High Medium Medium High High Medium

Quality Medium Medium Medium Medium Low Medium

24

|

|

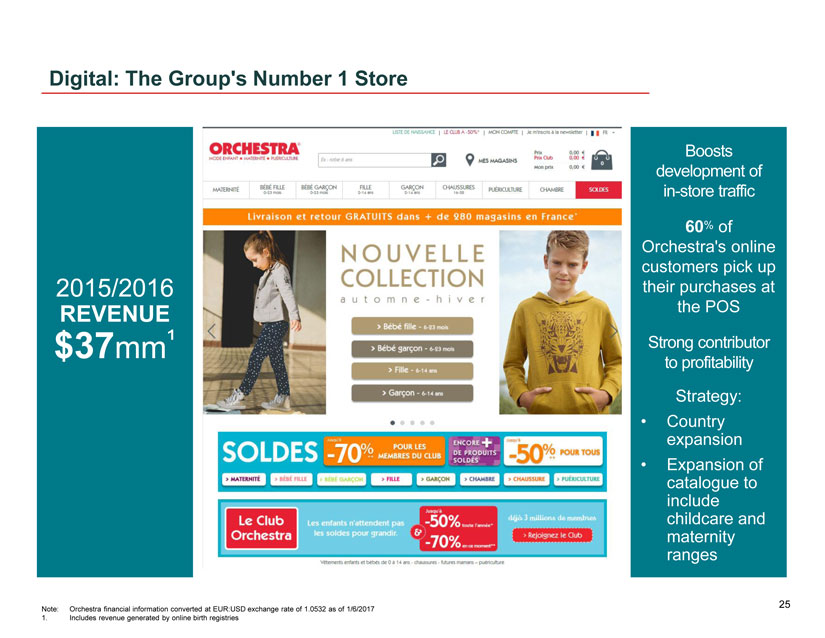

Digital: The Group’s Number 1 Store

2015/2016

REVENUE

$37mm¹

Boosts development of in-store traffic

60% of Orchestra’s online customers pick up their purchases at the POS

Strong contributor to profitability

Strategy:

Country expansion

Expansion of catalogue to include childcare and maternity ranges

Note: Orchestra financial information converted at EUR:USD exchange rate of 1.0532 as of 1/6/2017

1. Includes revenue generated by online birth registries

25

|

|

Safe Harbor Statement

Additional Information

This presentation does not constitute an offer to buy or solicitation of any offer to sell securities or a solicitation of any vote or approval. It does not constitute a prospectus or prospectus equivalent document. This presentation relates to the proposed business combination between Destination and Orchestra (the “Merger”). The proposed combination will be submitted to Destination’s and Orchestra’s stockholders for their consideration and approval. In connection with the proposed combination, Destination and Orchestra will file relevant materials with (i) the SEC, including an

Orchestra registration statement on Form F-4 that will include a proxy statement of Destination and a prospectus of Orchestra, and (ii) the Autorité des Marchés Financiers (“AMF”) in France. Destination will mail the proxy statement/prospectus to its stockholders and Orchestra will make the Securities Note and other relevant materials available to its stockholders. This presentation is not a substitute for the F-4 registration statement, proxy statement/prospectus, Securities Note (note d’opération), Orchestra’s registration document (document de référence) or other document(s) that Destination and/or Orchestra may file with the SEC or the AMF in connection with the proposed transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ CAREFULLY THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC AND THE SECURITIES NOTE AS REGISTERED WITH THE AMF WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT DESTINATION, ORCHESTRA AND THE PROPOSED TRANSACTION. Investors and security holders may obtain free copies of these documents (when they are available) and other related documents filed with the SEC at the SEC’s web site at www.sec.gov, and the related documents filed with the AMF either on Orchestra’s website at http://www.orchestra-kazibao.com/informations-financieres/ or at the AMF’s website at http://www.amf-france.org/. Investors may request copies of the documents filed with the SEC by Destination by directing a request to Destination’s Investor Relations department at Destination Maternity, Attention: Investor Relations, 232 Strawbridge Drive, Moorestown, NJ 08057 or to Destination’s Investor Relations department at 203-682-8225 or by email to DestinationMaternityIR@icrinc.com. Investors may request copies of the documents filed with the AMF or the SEC by Orchestra by directing a request to ACTIFIN, Attention: Stéphane Ruiz or to Stéphane Ruiz at +33 01 56 88 11 15 in France or by email to sruiz@actifin.fr.

Participants in the Solicitation

Destination, Orchestra and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from stockholders in connection with the approval of the Merger and may have direct or indirect interests in the Merger. Information about Orchestra’s directors and executive officers is set forth in Orchestra’s 2015 Registration Document (Document de Référence 2015) filed with the AMF on June

30, 2016 under number R.16-063 (and also available in a convenience English translation version) incorporating its accounts 2015, as the same may be amended, updated or superseded from time to time, which may be obtained free of charge at http://www.orchestra-kazibao.com/informations-financieres/. Information about Destination’s directors and executive officers and their respective interests in Destination by security holdings or otherwise is set forth in Destination’s Proxy Statement on Schedule 14A for its 2016 Annual Meeting of Stockholders, which was filed with the SEC on April 18, 2016, and its Annual Report on Form 10-K for the fiscal year ended January 30, 2016, which was filed with the

SEC on April 14, 2016. These documents are available free of charge at the SEC’s website at www.sec.gov and from the “Investors” section of Destination’s website at www.investor.destinationmaternity.com. Additional information regarding the interests of participants in the solicitation of proxies in connection with the Merger will be included in the proxy statement/prospectus and the registration statement that Orchestra will file with the SEC in connection with the solicitation of proxies from Destination’s stockholders to approve the Merger.

26