Attached files

| file | filename |

|---|---|

| 8-K - 8-K WITH INVESTOR PRESENTATION - RLJ ENTERTAINMENT, INC. | rlje-8k_20161117.htm |

A Premium Digital Channel Company for Distinct Audiences November 18, 2016

Safe Harbor This presentation includes “forward-looking statements” that involve risks and uncertainties within the meaning of the United States Private Securities Litigation Reform Act of 1995. Words such as “will,” “should,” “could,” “may,” “might,” “expect,” “plan,” “possible,” “potential,” “predict,” “anticipate,” “believe,” “estimate,” “continue,” “future,” “intend,” “project” or similar expressions are intended to identify such forward-looking statements and may include statements regarding industry prospects, future results of operations or financial position, and statements of our intent, belief and current expectations about our strategic direction, prospective and future results and condition. RLJ Entertainment’s actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward looking statements as predictions of future events. Important factors that could cause or contribute to differences from expectations, estimates and projections include those discussed in “Risk Factors” in our Annual Report on Form 10-K filed on April 15, 2016, our subsequent Quarterly Reports on Form 10-Q and other reports we file from time to time with the Securities and Exchange Commission. All forward-looking statements should be evaluated with the understanding of inherent uncertainty. The inclusion of such forward-looking statements should not be regarded as a representation that contemplated future events, plans or expectations will be achieved. Unless otherwise required by law, we undertake no obligation to release publicly any updates or revisions to any such forward-looking statements that may reflect events or circumstances occurring after the date of this presentation. You are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date made.

Investment Highlights High Growth PSVOD Channels Proprietary SVOD Channels , Acorn TV and UMC, growing 100% annually since Launch date Recurring revenue model with expanding gross and EBITDA margins Outstanding operational subscriber metrics Exclusive & Unique Content Strong slate of original and exclusive television dramas Owns 64% of Agatha Christie Ltd, and IP ownership through Acorn Media Enterprises Acquires, develops, and controls exclusive rights for television episodic programming and feature films Significant Addressable Market Five year CAGR of 11.4% in North America and 15.0% Globally for SVOD revenue services (PwC) RLJE estimates the potential audience for Acorn TV to be ~ 10 million and UMC to be ~20 million Improving Capital Structure Recently refinanced the senior debt and reduced the senior cost of debt from ~11% to ~6% 2% to 3% of senior interest expense is converted at $3 share price Plan to further de-lever the balance sheet through refinancing and/or cash from operations Experienced Management Team Strong industry leadership and expertise led by Robert L. Johnson, founder of BET and RLJ Companies and Miguel Penella, former CEO of Acorn Media Group Proven track record of developing online brands and targeted programming to reach distinct audiences

RLJE is quickly developing into a premium digital channel company serving premium audiences through its Acorn and UMC brands Its proprietary SVOD channels, Acorn TV and UMC, have consistently maintained a 100% YOY growth rate since launch in 2011 and 2015 respectively RLJE exclusively controls, co-produces, and owns a large library of British Dramas, Independent Feature Films and Urban content RLJE content IP ownership includes a 64% equity participation in Agatha Christie Ltd. (ACL) RLJE’s IP licensing and media distribution operations support its SVOD channels by increasing program flow and monetizing content across all windows of exploitation About RLJ Entertainment Corporate Overview Ticker: RLJE Headquarters: Silver Spring, MD Offices: Los Angeles, CA; London, UK; Sydney, Australia Employees: 97 2015 Revenue: $125m (Pro-Forma* $100m) 2015 Pro-Forma * EBITDA: $12m * Adjusted for the discontinued U.S. catalog/ecommerce business

Top 10 SVOD entertainment channel Named by a leading consumer report among “Top 5 Streaming Sites” Available on Apple TV, iOS mobile, Amazon Prime Add-ons, Roku, Samsung TVs & more New shows added every week with strong slate of original and exclusive dramas Only niche SVOD to receive Emmy nomination (Curtain/Poirot) Consistent coverage by leading media outlet: NY Times, Wall Street Journal, Variety, USA Today, Los Angeles Times, CNN and NPR Acorn TV offers high quality, carefully curated British and other international television content to discerning viewers Demo: British TV fans, 35+ Audience Size: North America 10-12M Launched: July 2011 Pricing: 7 day free trial then $4.99/monthly or $49.99/year Acorn TV

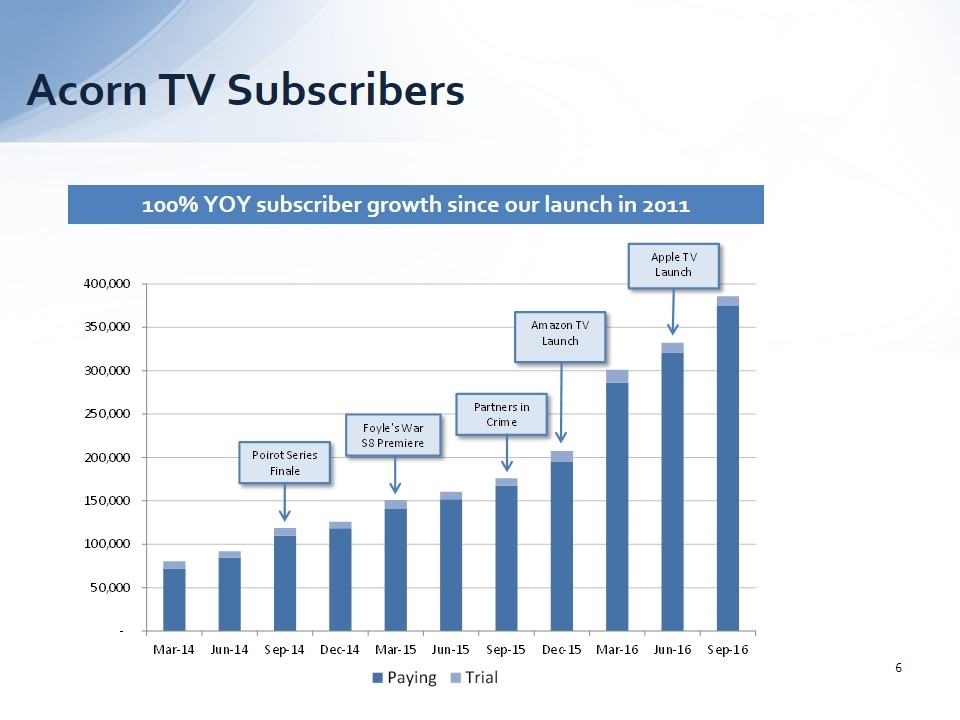

100% YOY subscriber growth since our launch in 2011 Acorn TV Subscribers

Broad variety of genres featuring today’s top talent and up-coming stars Available on web, tablet, smartphone, Amazon Fire, Amazon Prime “Add-ons” in US , iOS mobile & other platforms available soon Selectively adding new titles to target urban audiences Growing slate of new releases/exclusives added monthly Key marketing: search/PPC, social media, press with support from Robert L. Johnson (founder of BET), and banner ads – additional marketing in place when key content is premiered Demo: African American and Urban audiences, 25-54 Audience Size: 20M connected households; 5M SVOD consumers in US Launched: November 2014 (beta), February 2015 (full) Pricing: 14 day free trial then $4.99/month or $49.99/year Urban Movie Channel features quality entertainment showcasing feature films, documentaries, comedy and other exclusive content for urban audiences. UMC

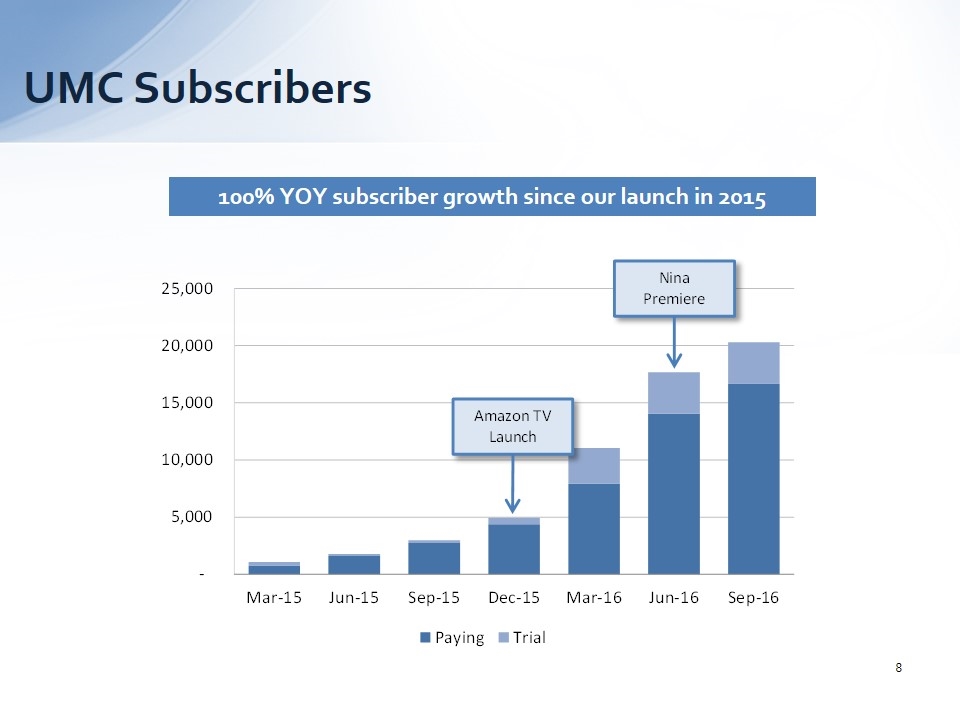

UMC Subscribers 100% YOY subscriber growth since our launch in 2015

Revenue Channels Wholesale IP/Content Development Includes intellectual property owned/developed by RLJE Consists primarily of 64% majority interest in Agatha Christie Ltd IP Licensing revenue generates solid margins over long periods Consists of wholesale distribution of broadcast, digital and physical rights in North America, the UK and Australia Niche premium content offers key differentiation to our distribution partners, while offering exploitation across multiple platforms RLJE actively manages all windows of exploitation to maximize revenue and margins Consists of proprietary streaming OTT channels Acorn TV and UMC are the fastest growing and highest margin businesses for RLJE Promotion is based on frequent new original and exclusive releases, and supported by partnerships with OTT platforms Proprietary SVOD

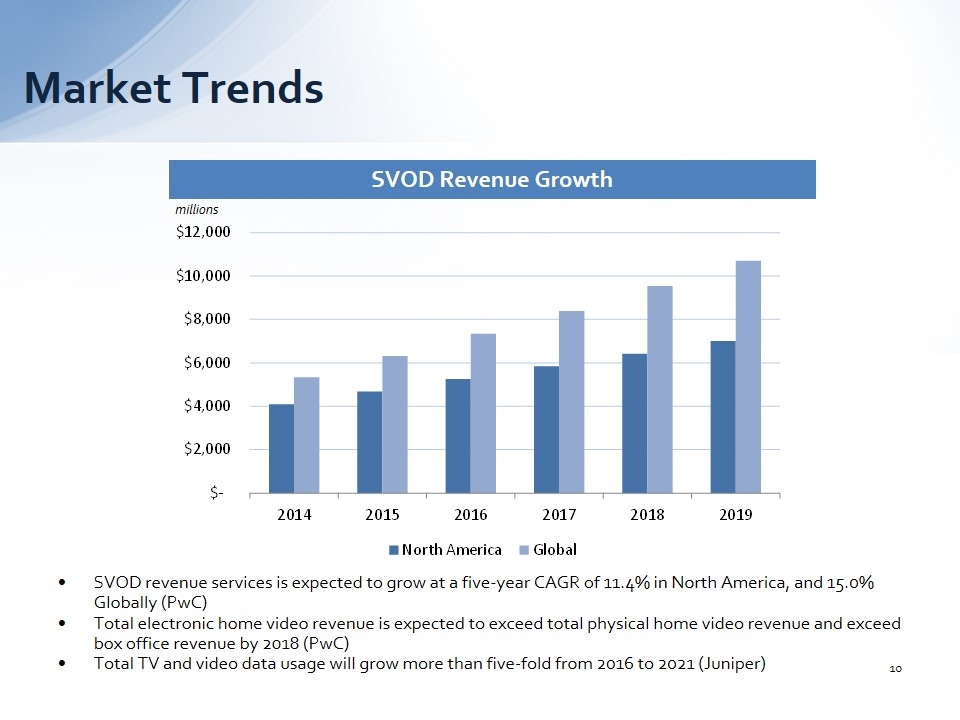

SVOD revenue services is expected to grow at a five-year CAGR of 11.4% in North America, and 15.0% Globally (PwC) Total electronic home video revenue is expected to exceed total physical home video revenue and exceed box office revenue by 2018 (PwC) Total TV and video data usage will grow more than five-fold from 2016 to 2021 (Juniper) Market Trends SVOD Revenue Growth millions

Drama Urban Fitness Sports Other OTT landscape

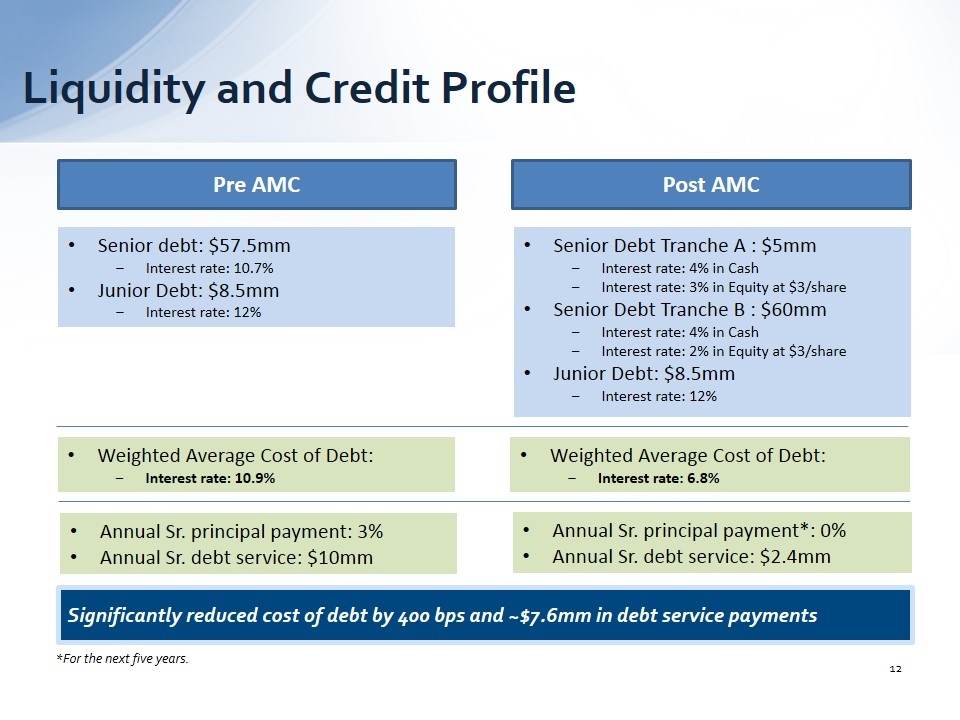

Liquidity and Credit Profile Pre AMC Post AMC Senior debt: $57.5mm Interest rate: 10.7% Junior Debt: $8.5mm Interest rate: 12% Weighted Average Cost of Debt: Interest rate: 10.9% Senior Debt Tranche A : $5mm Interest rate: 4% in Cash Interest rate: 3% in Equity at $3/share Senior Debt Tranche B : $60mm Interest rate: 4% in Cash Interest rate: 2% in Equity at $3/share Junior Debt: $8.5mm Interest rate: 12% Weighted Average Cost of Debt: Interest rate: 6.8% Annual Sr. principal payment: 3% Annual Sr. debt service: $10mm Annual Sr. principal payment*: 0% Annual Sr. debt service: $2.4mm Significantly reduced cost of debt by 400 bps and ~$7.6mm in debt service payments *For the next five years.

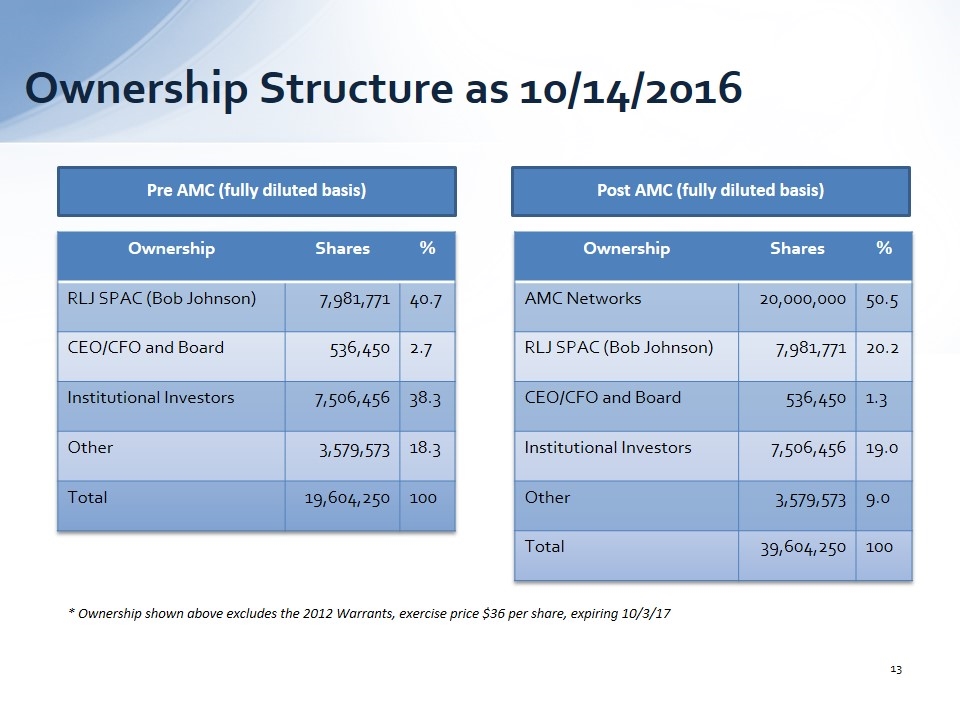

Ownership Structure as 10/14/2016 Pre AMC (fully diluted basis) Post AMC (fully diluted basis) Ownership Shares % RLJ SPAC (Bob Johnson) 7,981,771 40.7 CEO/CFO and Board 536,450 2.7 Institutional Investors 7,506,456 38.3 Other 3,579,573 18.3 Total 19,604,250 100 Ownership Shares % AMC Networks 20,000,000 50.5 RLJ SPAC (Bob Johnson) 7,981,771 20.2 CEO/CFO and Board 536,450 1.3 Institutional Investors 7,506,456 19.0 Other 3,579,573 9.0 Total 39,604,250 100 * Ownership shown above excludes the 2012 Warrants, exercise price $36 per share, expiring 10/3/17

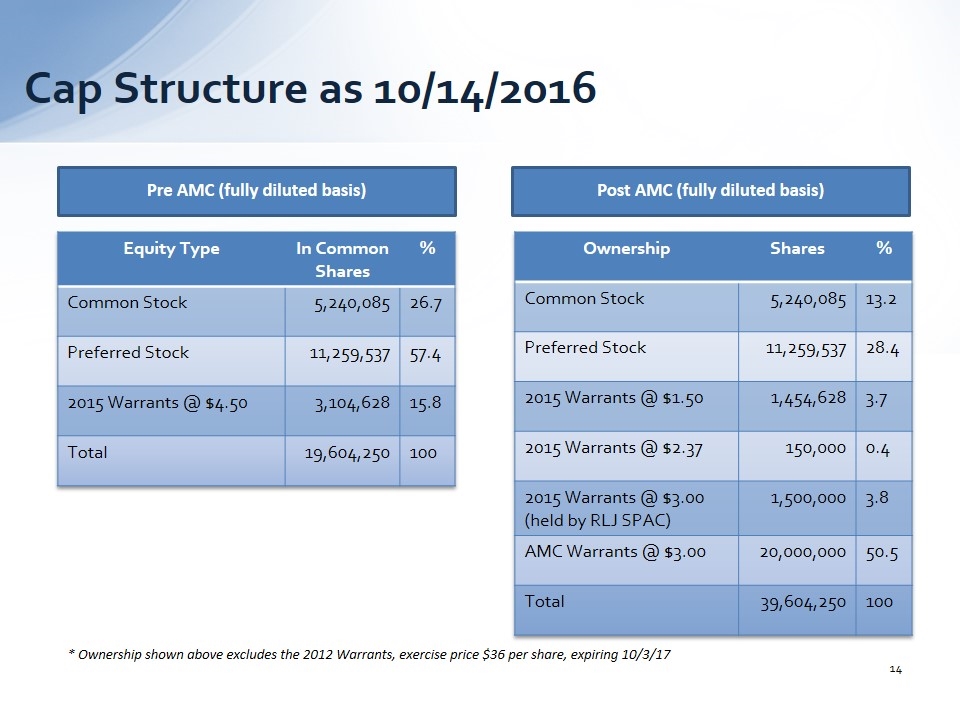

Pre AMC (fully diluted basis) Post AMC (fully diluted basis) Equity Type In Common Shares % Common Stock 5,240,085 26.7 Preferred Stock 11,259,537 57.4 2015 Warrants @ $4.50 3,104,628 15.8 Total 19,604,250 100 Ownership Shares % Common Stock 5,240,085 13.2 Preferred Stock 11,259,537 28.4 2015 Warrants @ $1.50 1,454,628 3.7 2015 Warrants @ $2.37 150,000 0.4 2015 Warrants @ $3.00 (held by RLJ SPAC) 1,500,000 3.8 AMC Warrants @ $3.00 20,000,000 50.5 Total 39,604,250 100 * Ownership shown above excludes the 2012 Warrants, exercise price $36 per share, expiring 10/3/17 Cap Structure as 10/14/2016