Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - Impax Laboratories, LLC | ipxl-11x09x2016x8kxex991.htm |

| 8-K - 8-K - Impax Laboratories, LLC | ipxl-11x09x2016x8k.htm |

1

Third Quarter 2016

Financial Results and Business Update

November 9, 2016

2

Impax Cautionary Statement Regarding

Forward Looking Statements

"Safe Harbor" statement under the Private Securities Litigation Reform Act of 1995:

To the extent any statements made in this presentation contain information that is not historical; these statements are forward-looking in nature

and express the beliefs and expectations of management. Such statements are based on current expectations and involve a number of known

and unknown risks and uncertainties that could cause the Company’s future results, performance, or achievements to differ significantly from

the results, performance, or achievements expressed or implied by such forward-looking statements. Such risks and uncertainties include, but

are not limited to: fluctuations in revenues and operating income; the Company’s ability to successfully develop and commercialize

pharmaceutical products in a timely manner; reductions or loss of business with any significant customer; the substantial portion of the

Company’s total revenues derived from sales of a limited number of products; the impact of consolidation of the Company’s customer base; the

impact of competition; the Company’s ability to sustain profitability and positive cash flows; any delays or unanticipated expenses in connection

with the operation of the Company’s manufacturing facilities; the effect of foreign economic, political, legal, and other risks on the Company’s

operations abroad; the uncertainty of patent litigation and other legal proceedings; the increased government scrutiny on the Company’s

agreements with brand pharmaceutical companies; product development risks and the difficulty of predicting FDA filings and approvals;

consumer acceptance and demand for new pharmaceutical products; the impact of market perceptions of the Company and the safety and

quality of the Company’s products; the Company’s determinations to discontinue the manufacture and distribution of certain products; the

Company’s ability to achieve returns on its investments in research and development activities; changes to FDA approval requirements ; the

Company’s ability to successfully conduct clinical trials; the Company’s reliance on third parties to conduct clinical trials and testing; the

Company’s lack of a license partner for commercialization of NUMIENT™ (IPX066) outside of the United States; impact of illegal distribution

and sale by third parties of counterfeits or stolen products; the availability of raw materials and impact of interruptions in the Company’s supply

chain; the Company’s policies regarding returns, allowances and chargebacks; the use of controlled substances in the Company’s products; the

effect of current economic conditions on the Company’s industry, business, results of operations and financial condition; disruptions or failures

in the Company’s information technology systems and network infrastructure caused by third party breaches or other events; the Company’s

reliance on alliance and collaboration agreements; the Company’s reliance on licenses to proprietary technologies; the Company’s dependence

on certain employees; the Company’s ability to comply with legal and regulatory requirements governing the healthcare industry; the regulatory

environment; the effect of certain provisions in the Company’s government contracts; the Company’s ability to protect its intellectual property;

exposure to product liability claims; risks relating to goodwill and intangibles; changes in tax regulations; the Company’s ability to manage

growth, including through potential acquisitions and investments; risks related to the Company’s acquisitions of or investments in technologies,

products or businesses; the restrictions imposed by the Company’s credit facility and indenture; the Company’s level of indebtedness and

liabilities and the potential impact on cash flow available for operations; uncertainties involved in the preparation of the Company’s financial

statements; the Company’s ability to maintain an effective system of internal control over financial reporting; the effect of terrorist attacks on the

Company’s business; the location of the Company’s manufacturing and research and development facilities near earthquake fault lines;

expansion of social media platforms and other risks described in the Company’s periodic reports filed with the Securities and Exchange

Commission. Forward-looking statements speak only as to the date on which they are made, and the Company undertakes no obligation to

update publicly or revise any forward-looking statement, regardless of whether new information becomes available, future developments occur

or otherwise.

Trademarks referenced herein are the property of their respective owners.

©2016 Impax Laboratories, Inc. All Rights Reserved.

3

Agenda

• 3Q16 Financial Results

• Business Update

Fred Wilkinson

President & CEO

• 3Q16 Financial Review

• 2016 Financial Guidance Update

Bryan Reasons

SVP & CFO

• Q&A Executive Team

4

3Q16 Results and

Business Update

Fred Wilkinson

President & Chief Executive Officer

5

• Quarter results essentially in line with our expectations

› Marketing and operational strategies drove revenue growth of 112% in

Epinephrine Auto-Injector and oxymorphone compared to 3Q15

› Recapturing generic Adderall XR® share but at significantly lower price

› Launched 3 generic products

• Short-term Albenza® supply interruption impacted Specialty Division results

• Increased intensity of generic pricing impacting a number of products

• Post Teva Transaction close:

› Higher price concessions to retain key customers

› Reduced price due to competition

› Lower expected cash flows triggered a non-cash impairment charge

3Q16 and Recent Market Events

6

Impax Year Over Year Change in Generic

Volume and Price

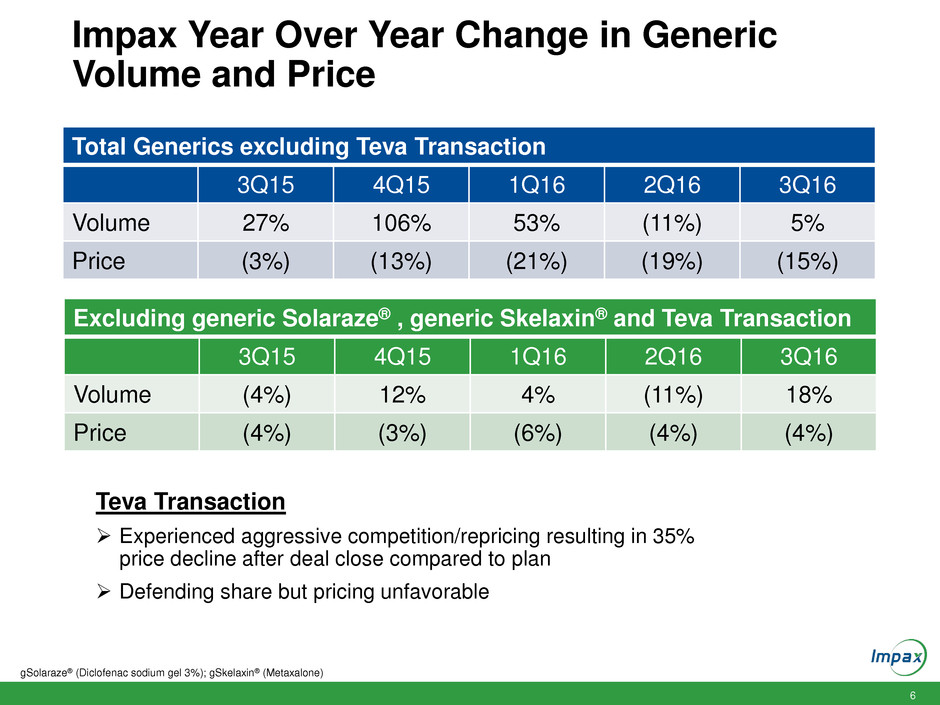

Total Generics excluding Teva Transaction

3Q15 4Q15 1Q16 2Q16 3Q16

Volume 27% 106% 53% (11%) 5%

Price (3%) (13%) (21%) (19%) (15%)

gSolaraze® (Diclofenac sodium gel 3%); gSkelaxin® (Metaxalone)

Excluding generic Solaraze® , generic Skelaxin® and Teva Transaction

3Q15 4Q15 1Q16 2Q16 3Q16

Volume (4%) 12% 4% (11%) 18%

Price (4%) (3%) (6%) (4%) (4%)

Teva Transaction

Experienced aggressive competition/repricing resulting in 35%

price decline after deal close compared to plan

Defending share but pricing unfavorable

7

Segment Revenue Results

$175 $181

$53 $40

3Q16 3Q15

Third Quarter

$ millions

Generic

• 112% increase in sales of epinephrine auto injector (authorized

generic to Adrenaclick®) and oxymorphone

• 62% decline in sales of generics Solaraze®, Skelaxin® and

Adderall XR® due to significant decline in price and volume

• Approximately 7 weeks of sales from products acquired from

Teva/Allergan and 3 new product launches

Brand

• 52% increase in Rytary®

• 68% increase in Zomig® nasal spray

• Albenza® supply disruption from third-party manufacturer

resolved in September

Generic

• 113% increase in sales of epinephrine auto injector (authorized

generic to Adrenaclick®) and oxymorphone

• 49% decline in sales of generics Skelaxin® and Adderall XR® due

to significant decline in price and volume

• Approximately 7 weeks of sales from products acquired from

Teva/Allergan and 6 new product launches

Brand

• 96% increase in Rytary®

• 20% increase in Zomig® nasal spray

• 59% increase in Albenza®

• Launched Emverm®

Nine Months Ended

$ millions

Revenue Commentary

Revenue Commentary

$228 $221

$467 $484

$159 $94

Sep-16 Sep-15

$626

$578

Specialty

up 30.1%

Generic

down 3.0%

Specialty

up 68.5%

Generic

down 3.5%

8

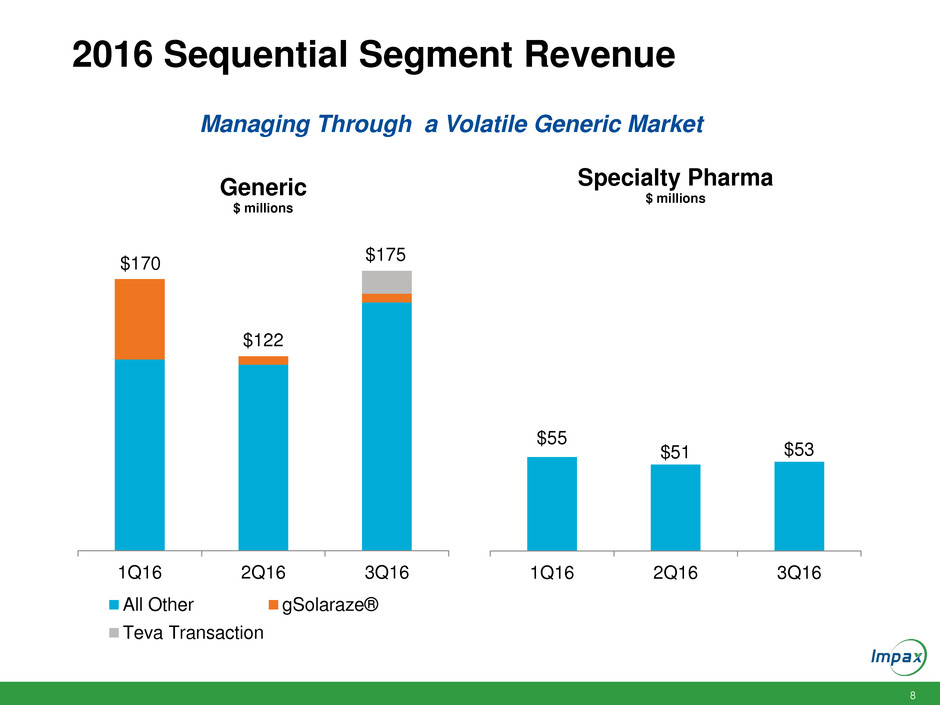

2016 Sequential Segment Revenue

1Q16 2Q16 3Q16

Generic

$ millions

All Other gSolaraze®

Teva Transaction

$55

$51 $53

1Q16 2Q16 3Q16

Specialty Pharma

$ millions

$170

$122

$175

Managing Through a Volatile Generic Market

9

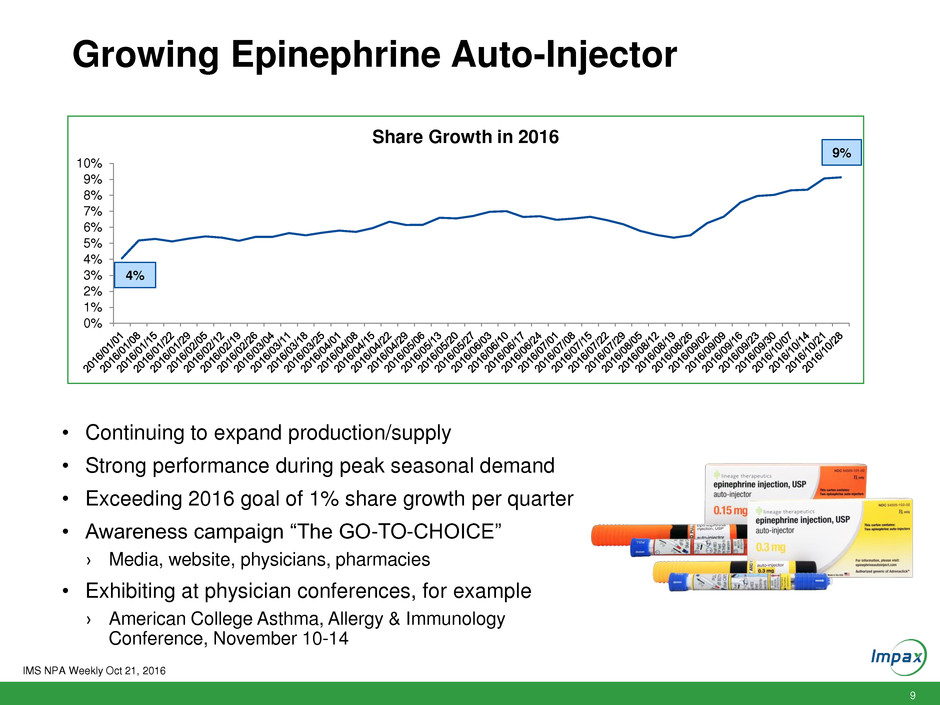

Growing Epinephrine Auto-Injector

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

10%

Share Growth in 2016

4%

9%

• Continuing to expand production/supply

• Strong performance during peak seasonal demand

• Exceeding 2016 goal of 1% share growth per quarter

• Awareness campaign “The GO-TO-CHOICE”

› Media, website, physicians, pharmacies

• Exhibiting at physician conferences, for example

› American College Asthma, Allergy & Immunology

Conference, November 10-14

IMS NPA Weekly Oct 21, 2016

10

Growing Oxymorphone / Recaptured Generic

Adderall XR® - Share Growth in 2016

0%

10%

20%

30%

40%

50%

60%

2

0

1

6

/0

1

/0

1

2

0

1

6

/0

1

/1

5

2

0

1

6

/0

1

/2

9

2

0

1

6

/0

2

/1

2

2

0

1

6

/0

2

/2

6

2

0

1

6

/0

3

/1

1

2

0

1

6

/0

3

/2

5

2

0

1

6

/0

4

/0

8

2

0

1

6

/0

4

/2

2

2

0

1

6

/0

5

/0

6

2

0

1

6

/0

5

/2

0

2

0

1

6

/0

6

/0

3

2

0

1

6

/0

6

/1

7

2

0

1

6

/0

7

/0

1

2

0

1

6

/0

7

/1

5

2

0

1

6

/0

7

/2

9

2

0

1

6

/0

8

/1

2

2

0

1

6

/0

8

/2

6

2

0

1

6

/0

9

/0

9

2

0

1

6

/0

9

/2

3

2

0

1

6

/1

0

/0

7

2

0

1

6

/1

0

/2

1

Oxymorphone ER

5, 10, 20, 30, 40 mg 7.5 & 15 mg

0%

2%

4%

6%

8%

10%

12%

2

0

1

6

/0

1

/0

1

2

0

1

6

/0

1

/1

5

2

0

1

6

/0

1

/2

9

2

0

1

6

/0

2

/1

2

2

0

1

6

/0

2

/2

6

2

0

1

6

/0

3

/1

1

2

0

1

6

/0

3

/2

5

2

0

1

6

/0

4

/0

8

2

0

1

6

/0

4

/2

2

2

0

1

6

/0

5

/0

6

2

0

1

6

/0

5

/2

0

2

0

1

6

/0

6

/0

3

2

0

1

6

/0

6

/1

7

2

0

1

6

/0

7

/0

1

2

0

1

6

/0

7

/1

5

2

0

1

6

/0

7

/2

9

2

0

1

6

/0

8

/1

2

2

0

1

6

/0

8

/2

6

2

0

1

6

/0

9

/0

9

2

0

1

6

/0

9

/2

3

2

0

1

6

/1

0

/0

7

2

0

1

6

/1

0

/2

1

Generic Adderall XR®

IMS NPA Weekly Oct 21, 2016

34%

45%

47%

56%

10%

7%

11

Status of Generic Product Launches in 2016

Source of sales data: IMS NPS Sep 2016;

Launch/Approval data as of Nov 4, 2016;

TA = Tentative Approval

U.S. Brand/Generic market sales of $5.3B

Progress of Targeted Launches Products Launched through October

Products Approved Launched

Oxycodone TR ER tablet (OxyContin®)

Authorized

Generic

March

Amphetamine Salts ER capsule (Adderall

XR®) – Impax ANDA

February 2016 April

Glyburide IR tablet (Diabeta®) September 2015 June

Methyltestosterone IR tablets(Android®) October 1974 August

Phenytoin chewable tablet (Dilantin®) November 2014 September

Methylphenidate ER capsules

(Metadate CD®)

July 2016 September

Additional FDA Approvals in 2016

Ezetimibe and simvastatin tablet (Vytorin®) TA – January April 2017 (1)

Amphetamine Salts ER capsule (Adderall

XR®) – CorePharma ANDA

TA – April NA (2)

Morphine Sulfate ER capsule (Kadian®) April TBD

Morphine Sulfate ER tablet

(MS-Contin®)

July TBD

Fenofibric Acid DR capsule (Trilipix®) September TBD (3)

Aspirin and dipyridamole ER capsule

(Aggrenox®)

TA –September

January

2017

Desipramine Hydrochloride Tablets

(Norpramin®)

October TBD

2 2

1

1 1

1

2

1H16A 3Q16A 4Q16E

Pending FDA Approval

2016 Approval

Pre 2016 Approval Not Yet Launched or Re-introduction

3 products

launched

3 products

launched

Targeting

up to 4

product

launches

(1) Assuming receipt of final FDA approval launch following patent expiration in April 2017

(2) Launched Hayward ANDA

(3) Launched AG

12

Investing in Generic R&D – Current Pipeline

Source of sales data: IMS NPA Sept 2016; Pipeline data as of Nov. 4, 2016; FTF=First to file; FTM=First to market

Generic Pipeline of 40 Products

Current U.S. Brand/Generic Market $20B

20 Pending

at FDA -$10B

35% Potential

or Confirmed

FTF or FTM

20 Under

Development - $10B

75% Potential

FTF or FTM

Potential High-Value Generic

Opportunities Pending Approval

Product

FTM

Colesevelam IR Tablet (Welchol®)

• $644M U.S. brand/generic market

• Target action date received

FTM

Sevelamer Carbonate IR Tablet (Renvela®)

• $1.9B U.S. brand/generic market

• Target action date received

FTM

Ezetimibe Simvastatin IR Tablet (Vytorin®)

• $693M U.S. brand/generic market

• Received tentative approval

• Launch April 2017 patent expiration

Methylphenidate HCI ER Tablet (Concerta®)

• $1.8B U.S. brand/generic market

• Target action date received

• Settlement with JNJ allows launch upon

approval

13

Focused on Growing CNS Franchise

0.0%

1.0%

2.0%

3.0%

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

CD

L

D

S

h

a

re

T

R

x

Monthly TRx and Share of National CD-LD TRx Since Launch

Rytary TRx CD-LD Share

• Completed sales force expansion and remapped territories in June

• Redefined clinical and dosage messaging

• Launched myRytary Patient Support Program www.myrytary.com

• 3Q16 TRx’s up 65% compared to 3Q15

• 88% of commercial Rx and Medicare Part D Rx being approved

Source: IMS NPA Monthly Sept 2016

14

Rytary® Patient Support Program

15

Focused on Growing CNS Franchise

0%

25%

50%

2,000

4,000

6,000

8,000

10,000

12,000

14,000

Nov-15 Dec-15 Jan-16 Feb-16 Mar-16 Apr-16 May-16 Jun-16 Jul-16 Aug-16 Sep-16 Oct-16

Nas

a

l

T

rip

ta

n

S

h

a

re

T

R

x

Monthly TRx and Share of Nasal Triptan TRx

TRx Nasal Triptan Share

• Consistent performance as second position detail

• Solid growth from general neurologists, headache specialists

and pediatricians

• 16% year over year growth in share of Nasal Triptan segment

• Share in the high 30% range

Source: IMS NPA Monthly Sept 2016

16

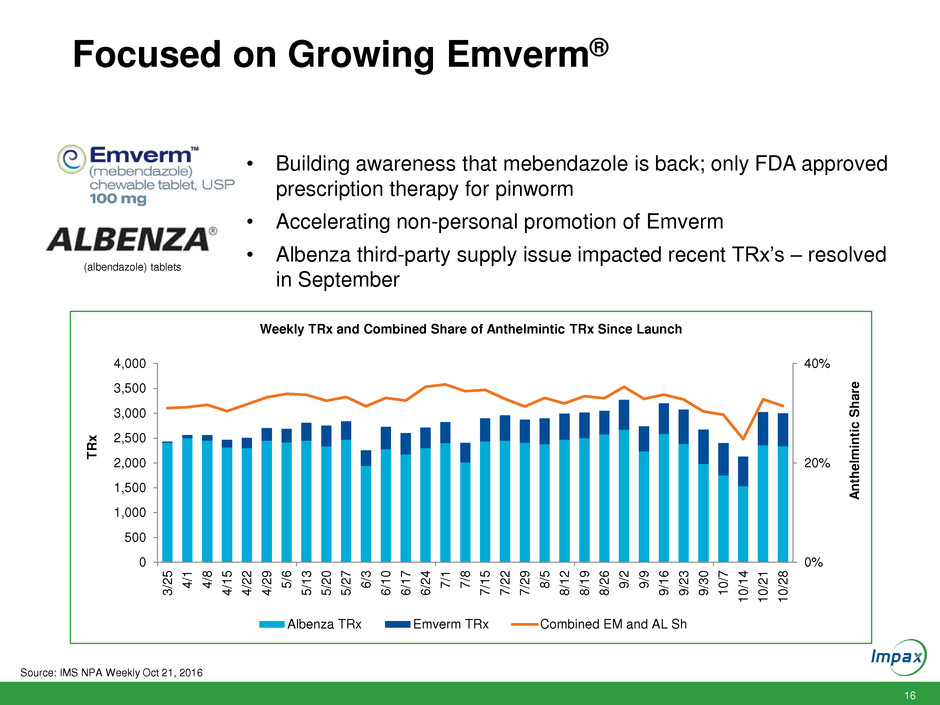

Focused on Growing Emverm®

0%

20%

40%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

3

/2

5

4

/1

4

/8

4

/1

5

4

/2

2

4

/2

9

5

/6

5

/1

3

5

/2

0

5

/2

7

6

/3

6

/1

0

6

/1

7

6

/2

4

7

/1

7

/8

7

/1

5

7

/2

2

7

/2

9

8

/5

8

/1

2

8

/1

9

8

/2

6

9

/2

9

/9

9

/1

6

9

/2

3

9

/3

0

1

0

/7

1

0

/1

4

1

0

/2

1

1

0

/2

8

A

n

th

elmin

tic

S

h

a

re

T

R

x

Weekly TRx and Combined Share of Anthelmintic TRx Since Launch

Albenza TRx Emverm TRx Combined EM and AL Sh

(albendazole) tablets

• Building awareness that mebendazole is back; only FDA approved

prescription therapy for pinworm

• Accelerating non-personal promotion of Emverm

• Albenza third-party supply issue impacted recent TRx’s – resolved

in September

Source: IMS NPA Weekly Oct 21, 2016

17

IPX203: Product Development Update

Investigator Assessment of Motor State

Off Time (h) On Time (h)

Immediate-release CD-LD 7.3 2.7

Rytary 5.5* 4.4*

IPX203 4.6 * + 5.4 * +

* p ≤ 0.0002 compared to IR CD-LD + p < 0.05 compared with Rytary

Improvement from Baseline in

MDS-UPDRS Part III

• First patient enrolled in Phase 2b multiple dose study in patients with advanced

Parkinson’s disease

• Phase 2b interim results by end of first half 2017

• FDA meeting in Feb. 2017 to discuss Phase 3 development plan

Positive Phase2a Study

18

Financial Review and

2016 Financial Guidance

Bryan Reasons

Senior Vice President & Chief Financial Officer

19

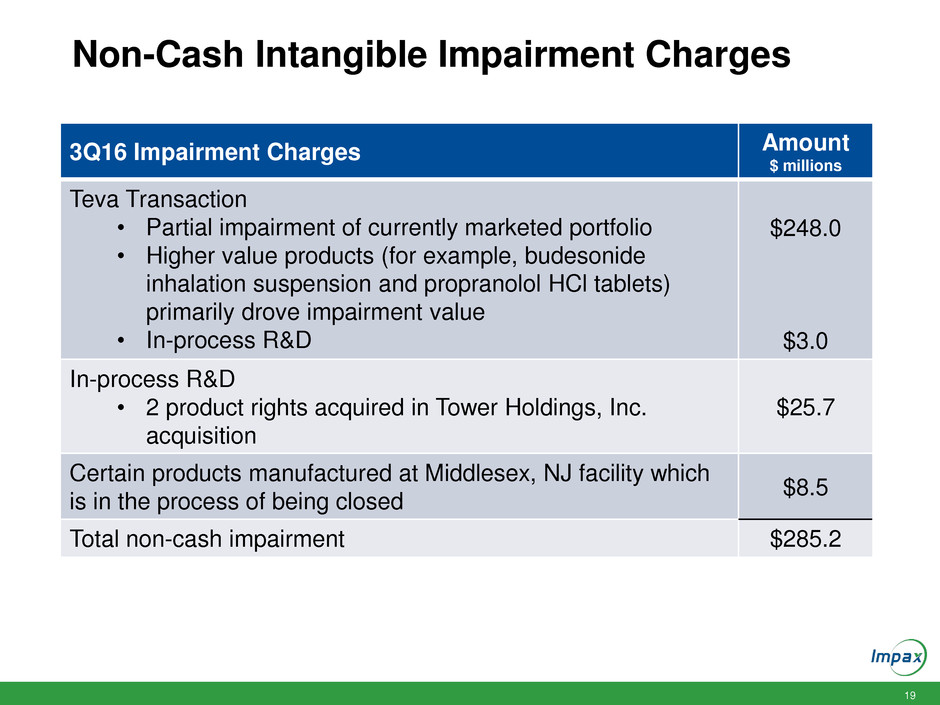

Non-Cash Intangible Impairment Charges

3Q16 Impairment Charges Amount

$ millions

Teva Transaction

• Partial impairment of currently marketed portfolio

• Higher value products (for example, budesonide

inhalation suspension and propranolol HCl tablets)

primarily drove impairment value

• In-process R&D

$248.0

$3.0

In-process R&D

• 2 product rights acquired in Tower Holdings, Inc.

acquisition

$25.7

Certain products manufactured at Middlesex, NJ facility which

is in the process of being closed

$8.5

Total non-cash impairment $285.2

20

3Q16 Generic Division Results

$ millions

GAAP

3Q16

Adjustments

Adjusted

3Q16

GAAP

3Q15

Adjustments

Adjusted

3Q15

Adjusted

Change

Revenues $175.3 --- $175.3 $180.7 --- $180.7 (3.0%)

Gross (Loss) Profit ($196.2) $273.1 $76.9 $68.0 $9.3 $77.3 (0.5%)

Gross Margin (111.9%) --- 43.8% 37.6% --- 42.8% 1.0ppts

SG&A Expense $6.1 ($0.1) $6.0 $5.1 ($0.1) $5.0 20.0%

R&D Expense $15.4 ($0.6) $14.8 $14.3 ($0.8) $13.5 9.6%

In-process R&D

Impairment Charges

$15.5 ($15.5) $0.0 $0.0 --- $0.0 0.0%

Patent Litigation $0.1 --- $0.1 $0.4 --- $0.4 (75.0%)

Operating (Loss) Income ($233.3) $289.3 $56.0 $48.1 $10.2 58.3 (3.9%)

Operating Margin (133.1%) --- 31.9% 26.6% --- 32.3% (0.4)pts

Note: The sum of the GAAP and Adjustments may not equal the Adjusted amount due to rounding

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

SG&A = Selling, general and administrative

R&D = Research & development

21

3Q16 Specialty Pharma Division Results

$ millions

GAAP

3Q16

Adjustments

Adjusted

3Q16

GAAP

3Q15

Adjustments

Adjusted

3Q15

Adjusted

Change

Revenues $52.6 --- $52.6 $40.4 --- $40.4 30.1%

Gross Profit $30.7 $7.5 $38.2 $25.6 $8.2 $33.8 13.0%

Gross Margin 58.4% --- 72.5% 63.3% --- 83.7% (11.2)ppts

SG&A Expense $16.4 --- $16.4 $11.4 --- $11.4 43.9%

R&D Expense $4.7 --- $4.7 $4.3 --- $4.3 9.3%

In-process R&D

Impairment Charges

$13.2 ($13.2) $0.0 $0.0 --- $0.0 $0.0

Patent Litigation $3.1 --- $3.1 $0.7 --- $0.7 342.9%

Operating (Loss) Income ($6.7) $20.6 $13.9 $9.2 $8.2 $17.5 (20.6%)

Operating Margin (12.7%) --- 26.4% 22.8% --- 43.3% (16.9)ppts

Note: The sum of the GAAP and Adjustments may not equal the Adjusted amount due to rounding

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

SG&A = Selling, general and administrative

R&D = Research & development

22

3Q16 Consolidated Results

$ millions

GAAP

3Q16

Adjustments

Adjusted

3Q16

GAAP

3Q15

Adjustments

Adjusted

3Q15

Adjusted

Change

Revenues $227.9 --- $227.9 $221.1 --- $221.1 3.1%

Gross (Loss) Profit ($165.4) $283.4 $115.0 $93.5 $17.6 $111.1 3.5%

Gross Margin (72.6%) --- 50.5% 42.3% --- 50.3% 0.2ppts

Operating (Loss) Income ($272.6) $317.5 $44.9 $27.6 $22.1 $49.7 (9.7%)

Operating Margin (119.6%) --- 19.7% 12.5% --- 22.5% (2.8)ppts

EPS Diluted ($2.51) $2.88 $0.37 $0.49 ($0.09) $0.40 (7.5%)

Note: The sum of the GAAP and Adjustments may not equal the Adjusted amount due to rounding

Refer to the GAAP to non-GAAP reconciliation tables in the appendix for a reconciliation of non-GAAP results

SG&A = Selling, general and administrative

R&D = Research & development

EPS = Earnings per share

23

2016 Updated Guidance

Item

As of

August 9

Updated

November 9

Revenue $900M to $940M $840M to $855M

Adjusted Gross Margin Low 50% range 48% to 50%

Adjusted R&D Expense $100M to $105M $90M to $95M

Adjusted SG&A Expense $190M to $200M $185M to $190M

Tax Rate 34% to 36% 34% to 35%

Adjusted Interest Expense $18M No Change

Adjusted EPS $1.57 to $1.70 $1.10 to $ 1.20

SG&A = Selling, general and administrative

R&D = Research & development

EPS = Earnings per share

The Company does not provide forward-looking diluted earnings per share and related guidance metrics as outlined above on

a GAAP basis as certain financial information, such as the amortization of recently acquired intangible assets, restructuring

and impairment charges and other items used to determine such measures are not available and cannot be reasonably

estimated. The Company’s full year updated 2016 estimates are based on management’s current expectations, including with

respect to prescription trends, pricing levels, inventory levels, and the anticipated timing of future product launches and

events. The statements listed above are forward looking and actual results could differ materially depending on market

conditions and the factors set forth under our “Safe Harbor” statement.

24

Fourth Quarter Priorities

Focus on quality and operations

Aggressively pursue share growth within generic portfolio

Effectively execute on Rytary® and Emverm® growth initiatives

Maximize new generic product launches

Continue to pursue organic growth opportunities through R&D

Explore additional expense savings and efficiency opportunities

25

Q&A

26

Appendix

27

20 Pending ANDAs at FDA

Source of sales data: IMS NPS September 2016; Pipeline data as of November 4, 2016; TA = tentative approval

1 Launched authorized generic in April 2016

2 Assuming final FDA approval, earliest potential launch date/timing based on settlement or patent expiration date

First-to-market opportunity

Disclosed ANDAs

Greneric Product Name Strengths Brand IMS Sales Potential Launch Timing*

Oxycodone ER tablet (new formulation) 1 10, 15, 20, 30, 40, 60, 80 mg OxyContin® $2.4B Settled, not disclosed

Sevelamer Carbonate IR tablet 800 mg Renvela® $1.9B Approval

Methylphenidate HCI ER tablet 18, 27, 36, 54 mg Concerta® $1.8B Approval

Ezetimibe Simvastatin IR tablet – TA 2

10 mg/10 mg, 10 mg/20 mg,

10 mg/40 mg, 10 mg/80 mg

Vytorin® $693M April 2017

Colesevelam IR tablet 625 mg Welchol® $644M Approval

Oxymorphone ER tablet (new formulation) 5, 7.5, 10, 15, 20, 30, 40 mg Opana ER® $315M Pending litigation

Aspirin Dipyridamole ER capsule - TA 25/200mg Aggrenox® $255M January 2017

Fentanyl Buccal IR tablet 100, 200, 400, 600, 800 mcg Fentora® $153M Settled, not disclosed

Dutasteride/Tamsulosin IR capsule 0.5 mg/0.4 mg Jalyn® $59M Approval

Risedronate Sodium DR tablet 35 mg Atelvia® $38M Approval

28

GAAP to Adjusted Net Income Reconciliation

The following table reconciles reported net loss to adjusted net income.

(Unaudited, amounts in thousands, except per share and per share data)

Three months ended

September 30,

2016 2015

Net (loss) income $ (179,337) $ 35,755

Adjusted to add (deduct):

Amortization 18,367 10,307

Business development expenses 2,072 3,682

Hayward facility remediation costs - 3,546

Tower acquisition severance - -

Philadelphia packaging and distribution restructuring 84 2,767

Middlesex manufacturing restructuring 5,516 -

Payments for licensing agreements 622 750

Fair value of inventory step-up - 1,104

Ticking Fees - -

Non-cash interest expense 5,890 5,097

Reserve for Turing receivable - -

Intangible asset impairment charge 285,232 -

Loss on debt extinguishment - -

Gain on sale of asset - (45,574)

Net change in fair value of derivatives - 4,000

Deferred financing costs - -

Turing legal expenses 5,443 -

Lease termination for office consolidation 144 -

Income tax effect (117,884) 7,772

Adjusted net income $ 26,149 $ 29,206

Adjusted net income per diluted share $ 0.37 $ 0.40

Net (loss) income per diluted share $ (2.51) $ 0.49

Diluted weighted-average common shares outstanding 71,542 72,778

Refer to the Third Quarter 2016 Earnings Release for an explanation of adjusted items.

29

GAAP to Adjusted Results Reconciliation

The following table reconciles total Company reported cost of revenues to adjusted cost of revenues.

(Unaudited, amounts in thousands)

Refer to the Third Quarter 2016 Earnings Release for an explanation of adjusted items.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

Three months ended

September 30,

2016 2015

Cost of revenues $ 136,873 $ 127,550

Adjusted to deduct:

Amortization 18,367 10,307

Hayward facility remediation costs - 3,546

Philadelphia packaging and distribution restructuring 53 2,608

Middlesex manufacturing restructuring 5,516 -

Lease termination for office consolidation 53 -

Fair value of inventory step-up - 1,104

Adjusted cost of revenues $ 112,884 $ 109,985

Adjusted gross profit (a) $ 115,025 $ 111,114

Adjusted gross margin (a) 50.5% 50.3%

Research and development expenses $ 20,115 $ 18,631

Adjusted to deduct:

Payments for licensing agreements 622 750

Adjusted research and development expenses $ 19,493 $ 17,881

Selling, general and administrative expenses $ 55,038 $ 46,307

Adjusted to deduct:

Business development expenses 2,072 3,682

Tower acquisition severance - -

Philadelphia packaging and distribution restructuring 31 159

Turing legal expenses 5,443 -

Lease termination for office consolidation 91 -

Adjusted selling, general and administrative expenses $ 47,401 $ 42,466

30

Generic Division GAAP to Adjusted

Results Reconciliation

The following tables reconcile the Impax Generics Division reported cost of revenues to adjusted cost of revenues, adjusted gross

profit, adjusted gross margin and adjusted operating income.

(Unaudited, amounts in thousands)

Refer to the Third Quarter 2016 Earnings Release for an explanation of adjusted items.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

Three Months Ended

September 30,

2016 2015

GAAP Income from operations $ (233,330) $ 48,104

Adjusted to add (deduct):

Amortization 10,951 3,083

Hayward facility remediation costs - 3,546

Tower acquisition severance - -

Hayward technical operations and R&D restructuring - -

Philadelphia packaging and distribution restructuring 53 2,767

Middlesex manufacturing restructuring 5,516 -

Intangible asset impairment charge 272,005 -

Lease termination for office consolidation 144 -

Fair value of inventory step-up - 92

Payments for licensing agreements 622 750

Adjusted Income from operations $ 55,961 $ 58,342

Three months ended

September 30,

2016 2015

Cost of revenues $ 115,020 $ 112,716

Adjusted to deduct:

Amortization 10,951 3,083

Hayward facility remediation costs - 3,546

Philadelphia packaging and distribution restructuring 53 2,608

Middlesex manufacturing restructuring 5,516 -

Lease termination for office consolidation 53 -

Fair value of inventory step-up - 92

Adjusted cost of revenues $ 98,447 $ 103,387

Adjusted gross profit (a) $ 76,873 $ 77,279

Adjusted gross margin (a) 43.8% 42.8%

31

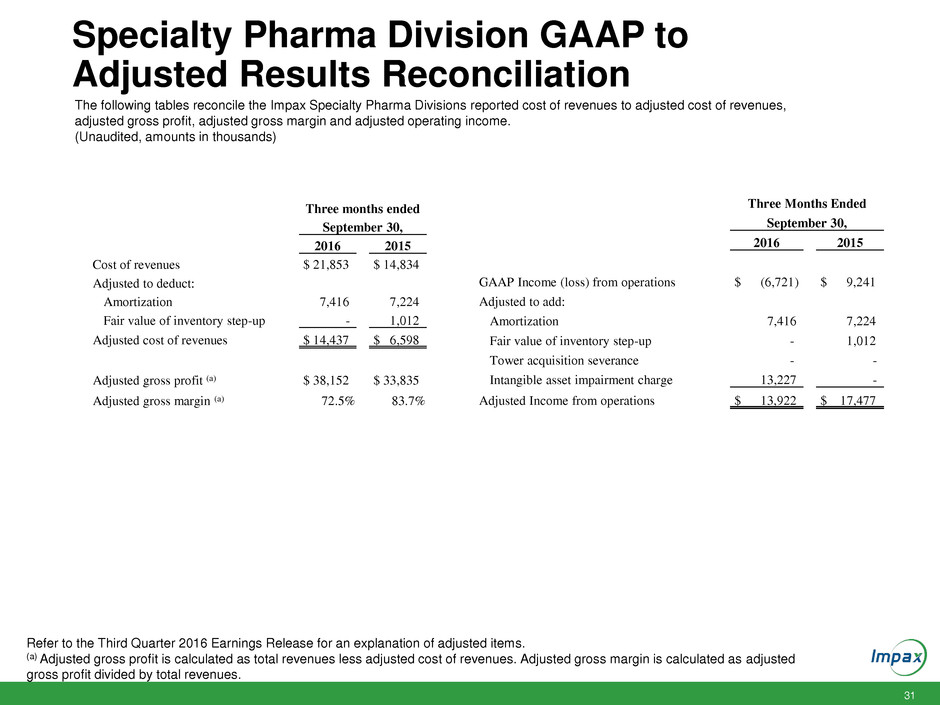

Specialty Pharma Division GAAP to

Adjusted Results Reconciliation

The following tables reconcile the Impax Specialty Pharma Divisions reported cost of revenues to adjusted cost of revenues,

adjusted gross profit, adjusted gross margin and adjusted operating income.

(Unaudited, amounts in thousands)

Refer to the Third Quarter 2016 Earnings Release for an explanation of adjusted items.

(a) Adjusted gross profit is calculated as total revenues less adjusted cost of revenues. Adjusted gross margin is calculated as adjusted

gross profit divided by total revenues.

Three months ended

September 30,

2016 2015

Cost of revenues $ 21,853 $ 14,834

Adjusted to deduct:

Amortization 7,416 7,224

Fair value of inventory step-up - 1,012

Adjusted cost of revenues $ 14,437 $ 6,598

Adjusted gross profit (a) $ 38,152 $ 33,835

Adjusted gross margin (a) 72.5% 83.7%

Three Months Ended

September 30,

2016 2015

GAAP Income (loss) from operations $ (6,721) $ 9,241

Adjusted to add:

Amortization 7,416 7,224

Fair value of inventory step-up - 1,012

Tower acquisition severance - -

Intangible asset impairment charge 13,227 -

Adjusted Income from operations $ 13,922 $ 17,477