Attached files

| file | filename |

|---|---|

| 8-K - CURRENT REPORT - ADVANCED DRAINAGE SYSTEMS, INC. | d249576d8k.htm |

| EX-99.1 - PRESS RELEASE - ADVANCED DRAINAGE SYSTEMS, INC. | d249576dex991.htm |

First Quarter Fiscal 2017 Financial Results Exhibit 99.2

Management Presenters Joe Chlapaty Chairman and Chief Executive Officer Scott Cottrill Executive Vice President, Chief Financial Officer, Secretary and Treasurer Mike Higgins Director, Investor Relations & Business Strategy 2

Safe Harbor and Non-GAAP Financial Metrics Certain statements in this presentation may be deemed to be forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Such statements include, but are not limited to, statements regarding the anticipated timing for the issuance of additional historic and future financial information and related filings. These statements are not historical facts but rather are based on the Company’s current expectations, estimates and projections regarding the Company’s business, operations and other factors relating thereto. Words such as “may,” “will,” “could,” “would,” “should,” “anticipate,” “predict,” “potential,” “continue,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,” “confident” and similar expressions are used to identify these forward-looking statements. Factors that could cause actual results to differ from those reflected in forward-looking statements relating to our operations and business include: fluctuations in the price and availability of resins and other raw materials and our ability to pass any increased costs of raw materials on to our customers in a timely manner; volatility in general business and economic conditions in the markets in which we operate, including, without limitation, factors relating to availability of credit, interest rates, fluctuations in capital and business and consumer confidence; cyclicality and seasonality of the non-residential and residential construction markets and infrastructure spending; the risks of increasing competition in our existing and future markets, including competition from both manufacturers of high performance thermoplastic corrugated pipe and manufacturers of products using alternative materials; our ability to continue to convert current demand for concrete, steel and PVC pipe products into demand for our high performance thermoplastic corrugated pipe and Allied Products; the effect of weather or seasonality; the loss of any of our significant customers; the risks of doing business internationally; the risks of conducting a portion of our operations through joint ventures; our ability to expand into new geographic or product markets; our ability to achieve the acquisition component of our growth strategy; the risk associated with manufacturing processes; our ability to manage our assets; the risks associated with our product warranties; our ability to manage our supply purchasing and customer credit policies; the risks associated with our self-insured programs; our ability to control labor costs and to attract, train and retain highly-qualified employees and key personnel; our ability to protect our intellectual property rights; changes in laws and regulations, including environmental laws and regulations; our ability to project product mix; the risks associated with our current levels of indebtedness; our ability to meet future capital requirements and fund our liquidity needs; the risk that additional information may arise during the course of the Company’s ongoing accounting review that would require the Company to make additional adjustments or revisions or to restate further the financial statements and other financial data for certain prior periods and any future periods; a conclusion that the Company’s disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) of the Exchange Act) were ineffective; the review of potential weaknesses or deficiencies in the Company’s disclosure controls and procedures, and discovering further weaknesses of which we are not currently aware or which have not been detected; additional uncertainties related to accounting issues generally and other risks and uncertainties described in the Company’s filings with the Securities and Exchange Commission. New risks and uncertainties emerge from time to time and it is not possible for the Company to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this press release. In light of the significant uncertainties inherent in the forward-looking information included herein, the inclusion of such information should not be regarded as a representation by the Company or any other person that the Company’s expectations, objectives or plans will be achieved in the timeframe anticipated or at all. Investors are cautioned not to place undue reliance on the Company’s forward-looking statements and the Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. This presentation includes certain non-GAAP financial measures to describe the Company’s performance. The reconciliation of those measures to GAAP measures are provided within the appendix of the presentation. Those disclosures should not be viewed as a substitute for operating results determined in accordance with GAAP, nor are they necessarily comparable to non-GAAP performance measures that may be presented by other companies.

Solid first quarter performance driven by successful execution of our conversion strategy. 1 Q1 2017 Highlights 2 3 4 Continued growth in core domestic construction markets offset weaker than expected performance in the agriculture market and Mexico. Strong profits driven by lower raw material costs and effective price management. Favorable cash flow generation supporting debt reduction and growth investments.

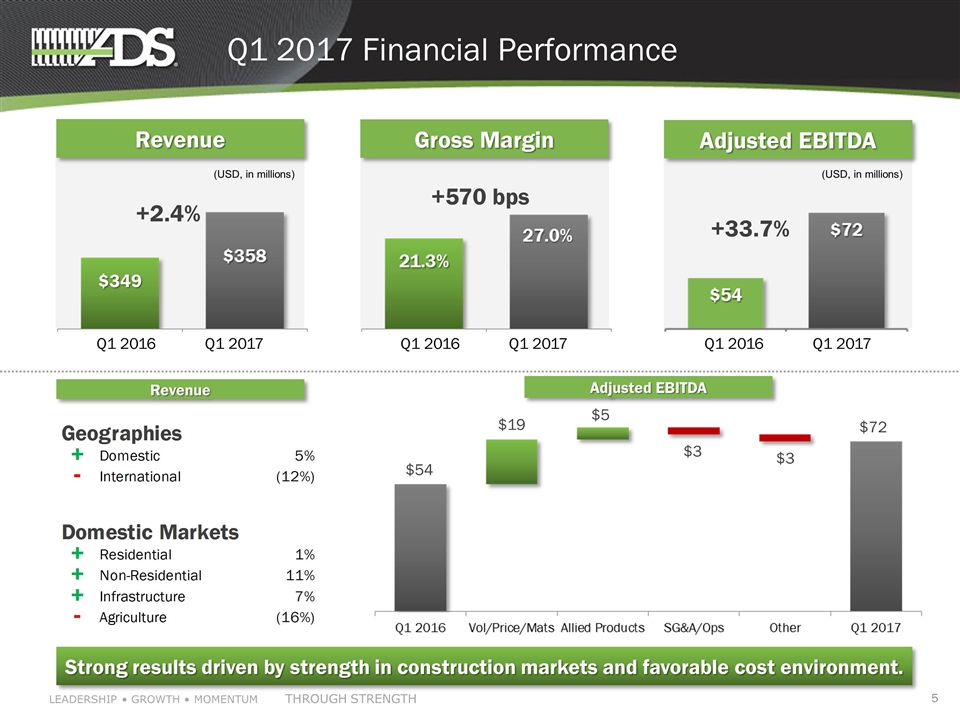

Q1 2017 Financial Performance Revenue Gross Margin Adjusted EBITDA Strong results driven by strength in construction markets and favorable cost environment. Q1 2017 Q1 2016 Q1 2017 Q1 2016 Q1 2017 Q1 2016 +2.4% +570 bps +33.7% (USD, in millions) (USD, in millions) $349 $54 $72 $19 $5 $3 Revenue Adjusted EBITDA $3 Operating Income Geographies • Vol/price/mix/other: Op Margin: +60 bps EPS: +0.03 + Domestic 5% Operating Margin - International (12%) • Cost reductions: Op Margin: +320 bps EPS: +$0.13 GAAPQ2 2016 Adjusted*Q2 2016 GAAPYTD - Q2 2016 Adjusted*YTD - Q2 2016 Domestic Markets Xylem Consolidated + Residential 1% Revenue + Non-Residential 0.11 Overall Growth + Infrastructure 7.0000000000000007E-2 Key Performance Drivers Constant Currency Growth - Agriculture (16%) • Organic growth in-line with expectations Earnings per Share • Cost inflation: Op Margin: -170 bps EPS: -$0.07 Segment Results • Investments: Op Margin: -90 bps EPS -$0.04 Pipe Products • Acquisitions: Op Margin: -20 bps EPS: $0.00 Revenue • Other: Tax Rate 20.9% Share Count 179.9M Overall Growth Constant Currency Growth Organic Growth Operating Income Operating Margin Allied Products Revenue Overall Growth Constant Currency Growth Organic Growth Operating Income Operating Margin

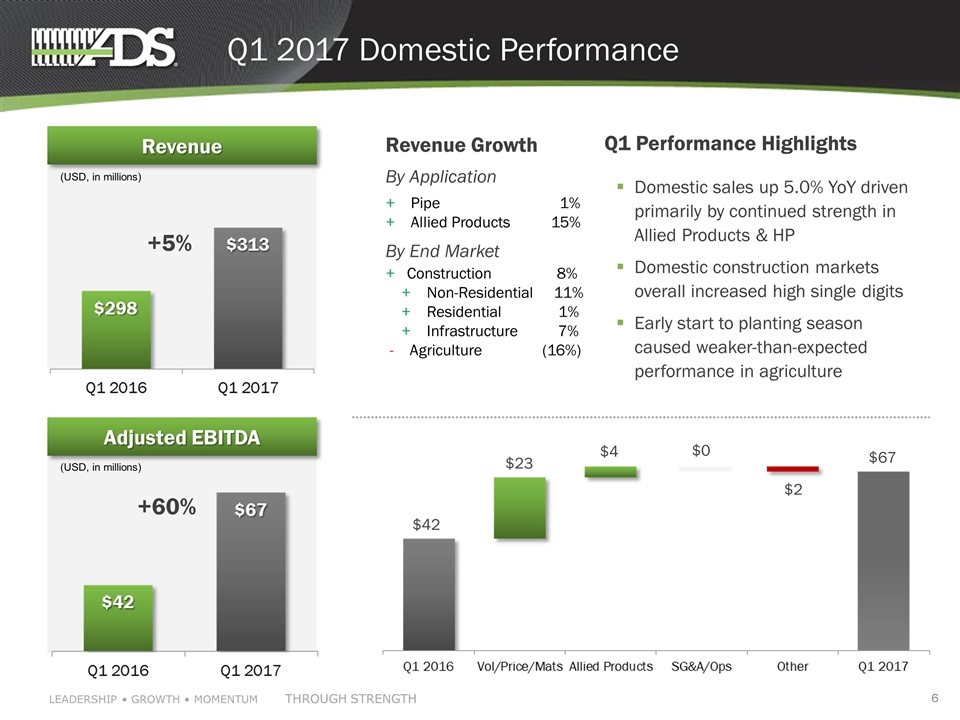

Q1 Performance Highlights Domestic sales up 5.0% YoY driven primarily by continued strength in Allied Products & HP Domestic construction markets overall increased high single digits Early start to planting season caused weaker-than-expected performance in agriculture Revenue Q1 2017 Domestic Performance 6 Adjusted EBITDA +5% Revenue Growth By Application + Pipe 1% + Allied Products 15% By End Market + Construction 8% + Non-Residential 11% + Residential 1% + Infrastructure7% - Agriculture (16%) +60% (USD, in millions) (USD, in millions) $23 $4 $0 $2 $42 $67

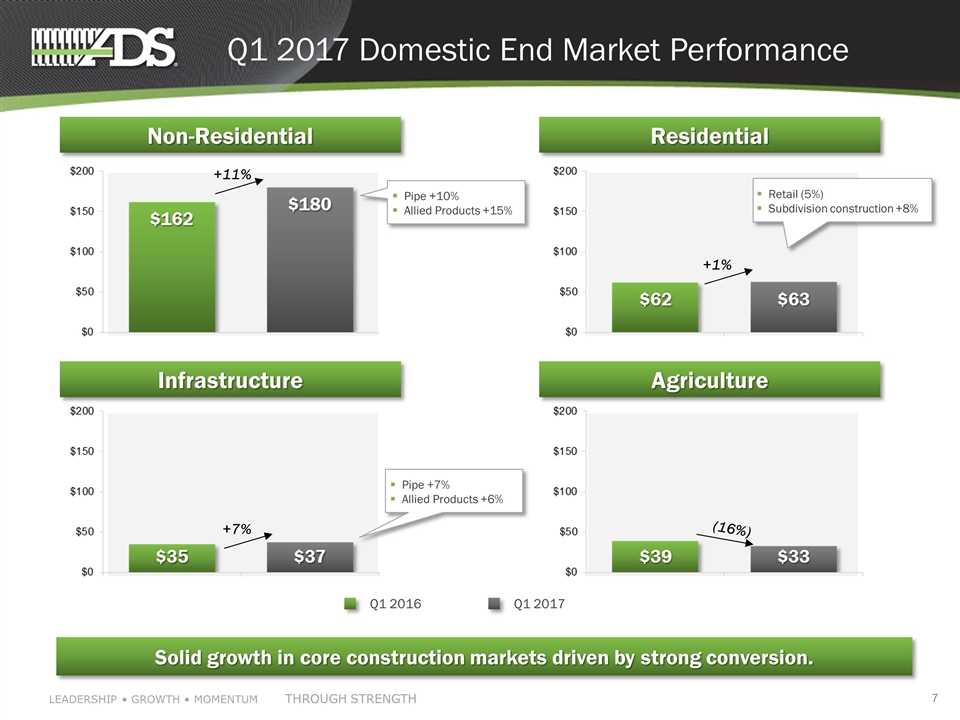

Q1 2016 Q1 2017 Q1 2017 Domestic End Market Performance Non-Residential Infrastructure Residential Agriculture Solid growth in core construction markets driven by strong conversion. +11% +1% +7% (16%) Pipe +10% Allied Products +15% Retail (5%) Subdivision construction +8% Pipe +7% Allied Products +6%

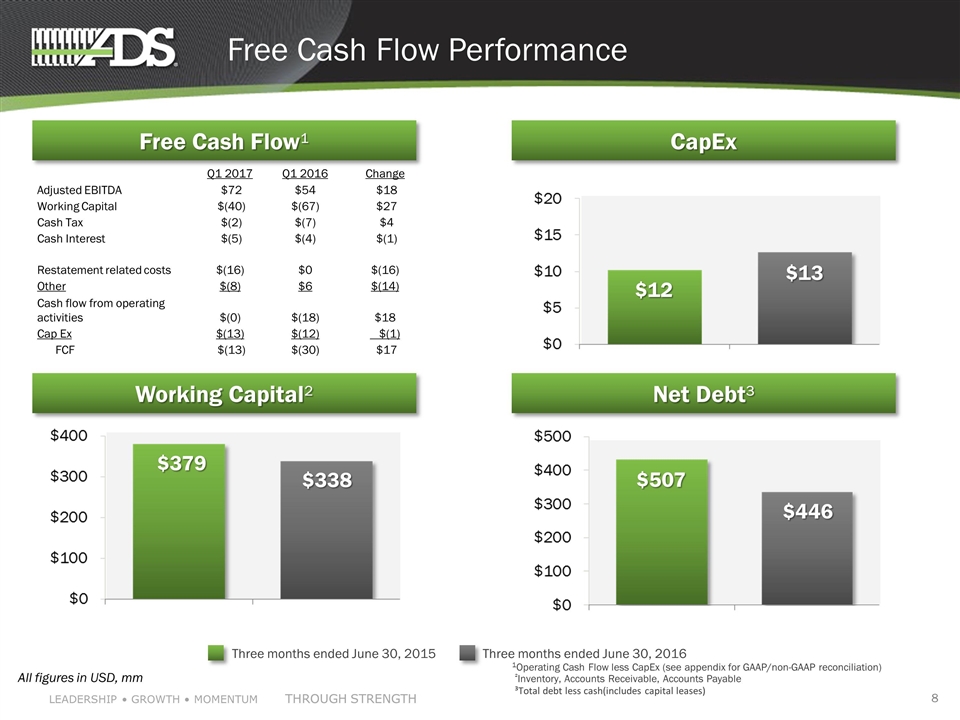

Three months ended June 30, 2015 Three months ended June 30, 2016 Free Cash Flow¹ Free Cash Flow Performance % of Sales 2.7% 3.5% ²Inventory, Accounts Receivable, Accounts Payable All figures in USD, mm 8 Working Capital² CapEx Net Debt³ $12 $13 $507 $446 $379 $338 Q1 2017 Q1 2016 Change Adjusted EBITDA $72 $54 $18 Working Capital $(40) $(67) $27 Cash Tax $(2) $(7) $4 Cash Interest $(5) $(4) $(1) Restatement related costs $(16) $0 $(16) Other $(8) $6 $(14) Cash flow from operating activities $(0) $(18) $18 Cap Ex $(13) $(12) $(1) FCF $(13) $(30) $17 1Operating Cash Flow less CapEx (see appendix for GAAP/non-GAAP reconciliation) ³Total debt less cash(includes capital leases)

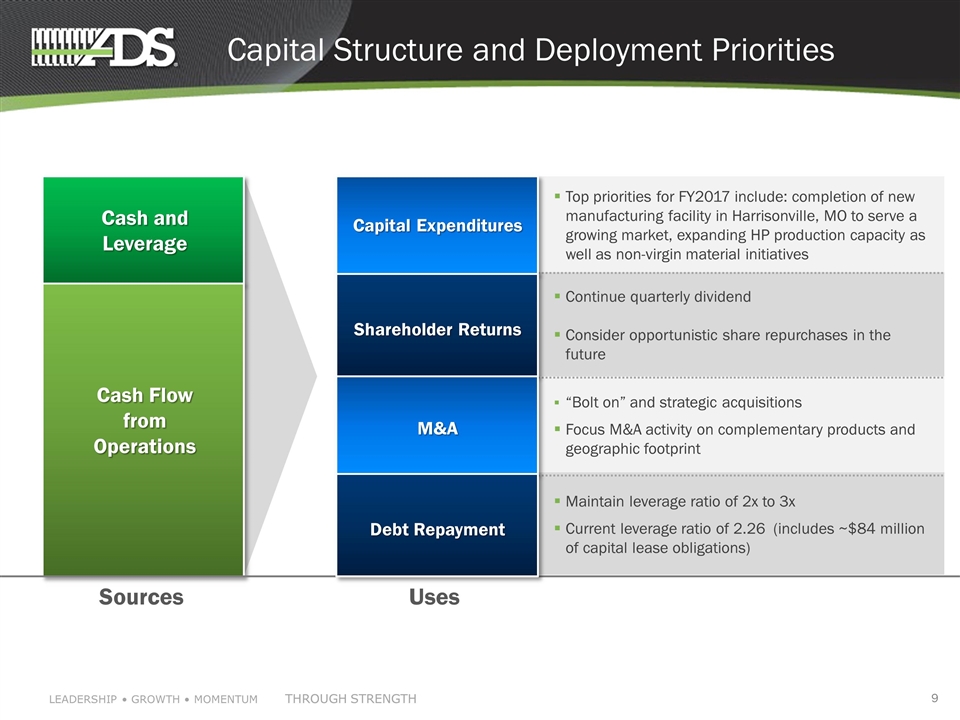

Capital Structure and Deployment Priorities Cash and Leverage Cash Flow from Operations Sources Uses Top priorities for FY2017 include: completion of new manufacturing facility in Harrisonville, MO to serve a growing market, expanding HP production capacity as well as non-virgin material initiatives Continue quarterly dividend Consider opportunistic share repurchases in the future “Bolt on” and strategic acquisitions Focus M&A activity on complementary products and geographic footprint Maintain leverage ratio of 2x to 3x Current leverage ratio of 2.26 (includes ~$84 million of capital lease obligations) 9 Capital Expenditures Shareholder Returns M&A Debt Repayment

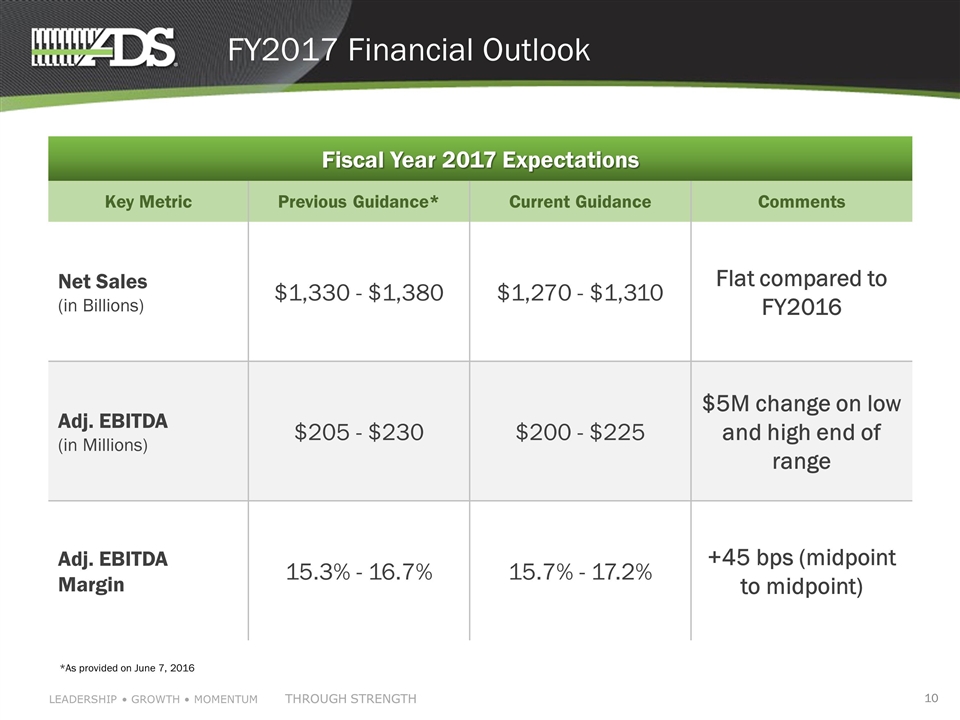

FY2017 Financial Outlook Key Metric Previous Guidance* Current Guidance Comments Net Sales (in Billions) $1,330 - $1,380 $1,270 - $1,310 Flat compared to FY2016 Adj. EBITDA (in Millions) $205 - $230 $200 - $225 $5M change on low and high end of range Adj. EBITDA Margin 15.3% - 16.7% 15.7% - 17.2% +45 bps (midpoint to midpoint) Fiscal Year 2017 Expectations *As provided on June 7, 2016

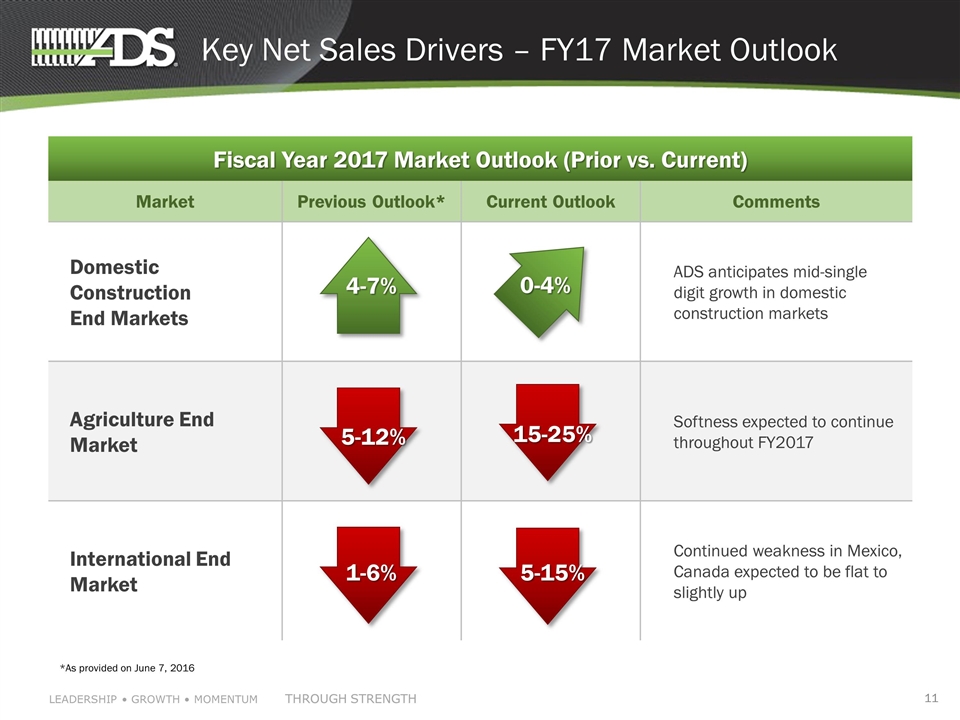

Market Previous Outlook* Current Outlook Comments Domestic Construction End Markets ADS anticipates mid-single digit growth in domestic construction markets Agriculture End Market Softness expected to continue throughout FY2017 International End Market Continued weakness in Mexico, Canada expected to be flat to slightly up Key Net Sales Drivers – FY17 Market Outlook Fiscal Year 2017 Market Outlook (Prior vs. Current) 5-12% 1-6% 5-15% 15-25% 4-7% 0-4% *As provided on June 7, 2016

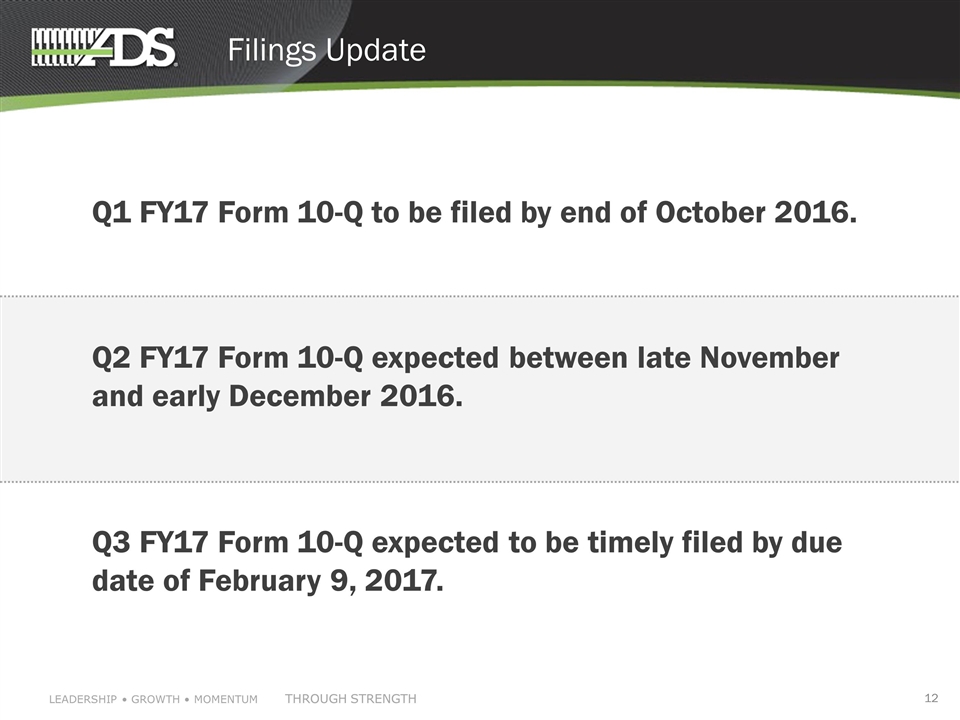

Filings Update Q1 FY17 Form 10-Q to be filed by end of October 2016. Q2 FY17 Form 10-Q expected between late November and early December 2016. Q3 FY17 Form 10-Q expected to be timely filed by due date of February 9, 2017. 12

Q&A Session

Closing Remarks Solid net sales growth in domestic construction markets, partially offset by softness in agriculture and international. 1 2 3 4 Underlying fundamentals of the business remain strong with significant opportunity ahead to continue driving above-market growth. Favorable adjusted EBITDA trends expected to continue throughout the remainder of FY2017. Well positioned to execute on conversion strategies from traditional materials to yield above-market growth.

Appendix

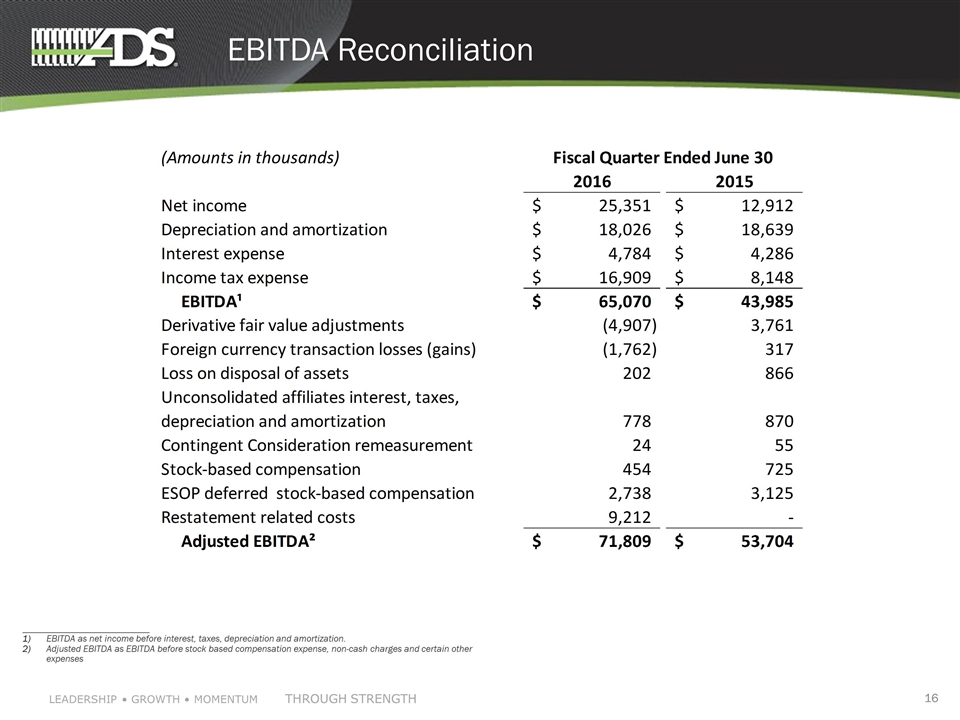

EBITDA Reconciliation ___________________________ EBITDA as net income before interest, taxes, depreciation and amortization. Adjusted EBITDA as EBITDA before stock based compensation expense, non-cash charges and certain other expenses (Amounts in thousands) Fiscal Quarter Ended June 30 2016 2015 Net income $25,351 $12,912 Depreciation and amortization $18,026 $18,639 Interest expense $4,784 $4,286 Income tax expense $16,909 $8,148 EBITDA¹ $65,070 $43,985 Derivative fair value adjustments -4,907 3,761 Foreign currency transaction losses (gains) -1,762 317 Loss on disposal of assets 202 866 Unconsolidated affiliates interest, taxes, depreciation and amortization 778 870 Contingent Consideration remeasurement 24 55 Stock-based compensation 454 725 ESOP deferred stock-based compensation 2,738 3,125 Restatement related costs 9,212 0 Adjusted EBITDA² $71,809 $53,704

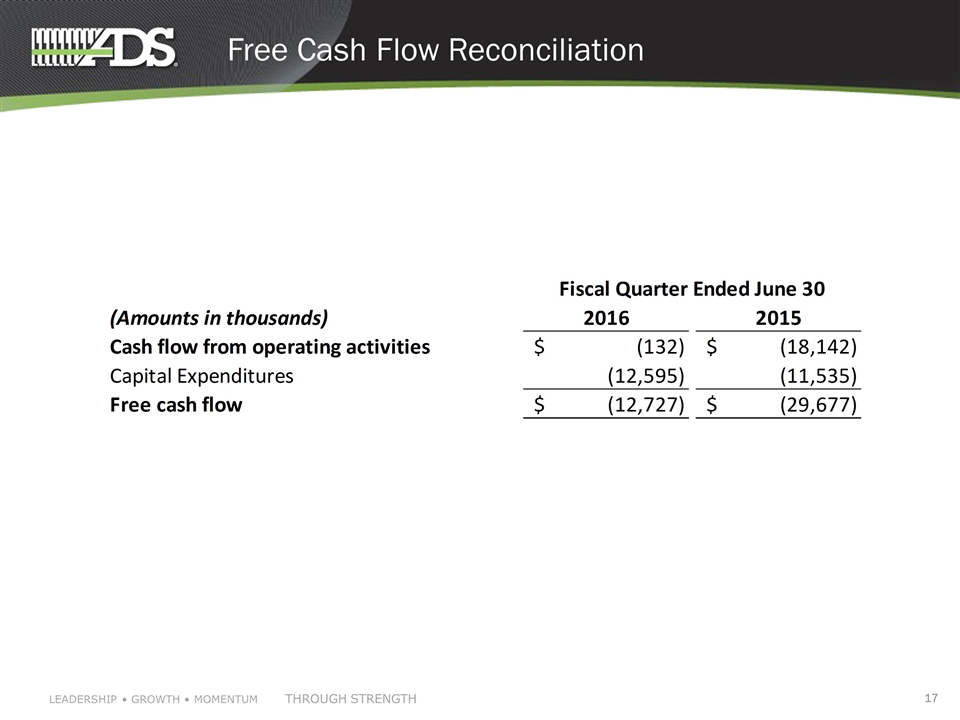

Free Cash Flow Reconciliation Fiscal Quarter Ended June 30 (Amounts in thousands) 2016 2015 Cash flow from operating activities $-,132 $,-18,142 Capital Expenditures ,-12,595 ,-11,535 Free cash flow $,-12,727 $,-29,677