Attached files

| file | filename |

|---|---|

| 8-K - 8-K-INVESTOR PRESENTATION - KEMET CORP | fy2017_q2xform8kxinvestorp.htm |

Deutsche Bank

24th Annual Leveraged Finance Conference

September 27, 2016

Presenter: William M. Lowe, Jr.

EVP & Chief Financial Officer

Cautionary Statement

Certain statements included herein contain forward-looking statements within the meaning of federal securities laws about KEMET

Corporation's (the "Company") financial condition and results of operations that are based on management's current expectations,

estimates, and projections about the markets in which the Company operates, as well as management's beliefs and assumptions.

Words such as "expects," "anticipates," "believes," "estimates," variations of such words, and other similar expressions are intended

to identify such forward-looking statements. These statements are not guarantees of future performance and involve certain risks,

uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what

is expressed or forecasted in, or implied by, such forward-looking statements. Readers are cautioned not to place undue reliance on

these forward-looking statements, which reflect management's judgment only as of the date hereof. The Company undertakes no

obligation to update publicly any of these forward-looking statements to reflect new information, future events or otherwise.

Factors that may cause the actual outcomes and results to differ materially from those expressed in, or implied by, these forward-

looking statements include, but are not necessarily limited to the following: (i) adverse economic conditions could impact our ability

to realize operating plans if the demand for our products declines, and such conditions could adversely affect our liquidity and ability

to continue to operate; (ii) continued net losses could impact our ability to realize current operating plans and could materially

adversely affect our liquidity and our ability to continue to operate; (iii) adverse economic conditions could cause the write down of

long-lived assets or goodwill; (iv) an increase in the cost or a decrease in the availability of our principal or single-sourced

purchased materials; (v) changes in the competitive environment; (vi) uncertainty of the timing of customer product qualifications in

heavily regulated industries; (vii) economic, political, or regulatory changes in the countries in which we operate; (viii) difficulties,

delays or unexpected costs in completing the restructuring plans; (ix) equity method investment in NEC TOKIN exposes us to a

variety of risks; (x) possible acquisition of NEC TOKIN may not achieve all of the anticipated results; (xi) acquisitions and other

strategic transactions expose us to a variety of risks; (xii) our business could be negatively impacted by increased regulatory

scrutiny and litigation; (xiii) inability to attract, train and retain effective employees and management; (xiv) inability to develop

innovative products to maintain customer relationships and offset potential price erosion in older products; (xv) exposure to claims

alleging product defects; (xvi) the impact of laws and regulations that apply to our business, including those relating to

environmental matters; (xvii) the impact of international laws relating to trade, export controls and foreign corrupt practices;

(xviii) volatility of financial and credit markets affecting our access to capital; (xix) the need to reduce the total costs of our products

to remain competitive; (xx) potential limitation on the use of net operating losses to offset possible future taxable income;

(xxi) restrictions in our debt agreements that limit our flexibility in operating our business; (xxii) failure of our information technology

systems to function properly or our failure to control unauthorized access to our systems may cause business disruptions;

(xxiii) additional exercise of the warrant by K Equity which could potentially result in the existence of a significant stockholder who

could seek to influence our corporate decisions; and (xxiv) fluctuation in distributor sales could adversely affect our results of

operations.

2

A global company – A historic brand

Simpsonville

Ciudad Victoria,

Monterrey (2) & Matamoros (2),

Mexico

Evora,

Portugal

Pontecchio, Italy

Landsberg, Germany

Kyustendil, Bulgaria

Anting-Shanghai, China

Carson City, NV

Batam,

Indonesia

Chicago

Suomussalmi, Finland Granna & Farjestaden,

Sweden

Suzhou,

China (2)

Skopje, Macedonia

Founded in

1919

18 Manufacturing

Plants

9,200

Employees

EASY

TO BUY

FROM

1,145

Components

shipped per

second

Weymouth, UK

Military & Aerospace Medical Industrial

Computer Automotive Consumer

Segments where we play

Military & Aerospace Medical Industrial

Computer Automotive Consumer

Segments where we play

Automotive Electronics

KEMET’s Automotive Capabilities

Automotive Electronics

Which of our parts are used?

Aluminum

Capacitors

EMI

Devices

Film

Capacitors

Ceramic

Capacitors

Tantalum

Capacitors

Where are our parts used?

Drivetrain example

Fuel Pump

Speed Sensor

Rectifier

Inverter

Motor Drive ERS

TCU

Power Steering

Throttle Sensor

O2 Sensor

Direct Injection

Traction Control

ECU

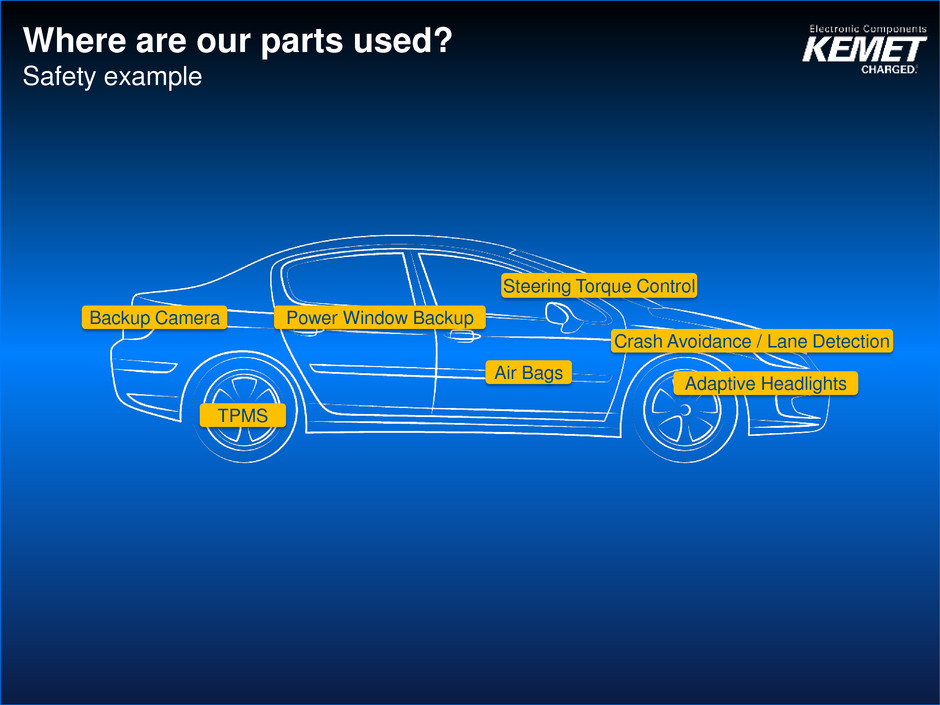

Where are our parts used?

Safety example

Power Window Backup Backup Camera

TPMS

Air Bags

Steering Torque Control

Crash Avoidance / Lane Detection

Adaptive Headlights

Where are our parts used?

Infotainment example

Infotainment Module

Cluster

CAN Controller

Body Control Module

Next 10 years

Major Drivers

“More Personal”

Smartphone, TVs,

Medical, Consumer

Devices, PCs

“Big Data”

Servers,

Communication,

Medical Infrastructure

“Energy Efficiency”

Automotive, Industrial,

Consumer

13

What Comes Next?

Intelligent Assistance

5 ni.com

The Industrial Internet of Things

Image Recognition

Augmented & Virtual Reality Internet of Things

13

14

• GaN (Gallium Nitride)

• SiC (Silicon Carbide)

Computer Assisted Health Care Autonomous Vehicles

New Semiconductor Technologies Autonomous Drones

What Comes Next?

14

15

= KEMET parts

Augmented & Virtual Reality

31% 2015-2020 CAAGR

15

= KEMET parts

Wearable Devices tied to Internet of Things

30% 2015-2020 CAAGR

16

= KEMET parts

Autonomous Drones

151% 2015-2020 CAAGR

17

Aluminum

Capacitors

EMI

Devices

Film

Capacitors

Tantalum

Capacitors

New technologies drive passive

component industry volume growth,

capacity utilization, price stabilization and

increased profitability

Ceramic

Capacitors

Summary Financial Information

FY16 Q1 & FY17 Q1 Comparison

U.S. GAAP (Unaudited)

Margin trends continue to improve

Quarter Ended

($ in millions) Jun 2015 Jun 2016

Net Sales 187.6$ 184.9$

Cost of sales 147.9 142.4

Gross Margin 39.7 42.5

% Margin 21.2% 23.0%

SG&A Expenses 30.4 25.9

Operating Income 1.2 8.9

% Margin 0.6% 4.8%

Net Income (Loss) (37.1)$ (12.2)$

20

FY16 Q1 & FY17 Q1 Comparison

Non-GAAP (Unaudited)

Quarter Ended

($ in millions) Jun 2015 Jun 2016

Net Sales 187.6$ 184.9$

Adjusted Gross Margin 40.3 43.2

% Margin 21.5% 23.4%

Adjusted SG&A Expenses 24.0 22.0

A justed Operating Income 10.1 14.4

% Margin 5.4% 7.8%

Adjusted Net Income 0.7$ 3.3$

Adjusted EBITDA 20.2$ 24.3$

% Margin 10.8% 13.1%

21

Sales Summary – FY2017 Q1

(Unaudited)

22

Cost Rationalization Drives Margin Improvement

U.S. GAAP (Unaudited)

1.9%

2.7%

3.0%

3.3% 3.3%

4.4%

5.5%

0.0%

1.0%

2.0%

3.0%

4.0%

5.0%

6.0%

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016

LTM Operating Income Margins

23

11.2% 11.1%

11.5%

11.8%

11.6%

12.4%

13.0%

10.0%

10.5%

11.0%

11.5%

12.0%

12.5%

13.0%

13.5%

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016

LTM Adjusted EBITDA Margins

Cost Rationalization Drives Margin Improvement

Non-GAAP (Unaudited)

24

Quarterly Financial Summary

Non-GAAP (Unaudited)

$201 $194 $188 $186 $177 $184 $185

$-

$50

$100

$150

$200

$250

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016

Revenue

$28

$18

$20

$24 $24 $23

$24

$-

$5

$10

$15

$20

$25

$30

Dec 2014 Mar 2015 Jun 2015 Sep 2015 Dec 2015 Mar 2016 Jun 2016

Adjusted EBITDA

25

Revenue and Adjusted EBITDA Margins Adjusted EBITDA

Capital Expenditures (Adjusted EBITDA – CapEx)

CAPEX

As a % of

Revenue

3.9% 2.7% 2.8%

Note: Amounts shown remove effects of machining business

$ In millions $ In millions

$ In millions $ In millions

$834 $823 $735

8.5%

11.1% 12.4%

$0

$200

$400

$600

$800

$1,000

FY 2014 FY 2015 FY 2016

$71

$92 $91

$0

$50

$100

$150

FY 2014 FY 2015 FY 2016

$39

$70 $71

$0

$20

$40

$60

$80

FY 2014 FY 2015 FY 2016

$32

$22

$20

$0

$5

$10

$15

$20

$25

$30

$35

FY 2014 FY 2015 FY 2016

Annual Financial Summary

Non-GAAP (Unaudited)

26

(1) Includes $1.8M of restricted cash for Jun 2015 and $0.0M for Mar 2016 and Jun 2016

(2) Calculated as accounts receivable, net, plus inventories, net, less accounts payable

(3) Current quarter’s accounts receivable divided by annualized current quarter’s net sales multiplied by 365

(4) Current quarter’s accounts payable divided by annualized current quarter’s cost of goods sold multiplied by 365

(Amounts in millions, except DSO and DPO) Jun 2015 Mar 2016 Jun 2016

Cash and cash equivalents (1) $ 32.9 $ 65.0 $ 52.9

Capital expenditures $ 5.8 $ 6.3 $ 6.2

Short-term debt $ 6.0 $ 2.0 $ -

Long-term debt 388.0 386.9 386.9

Debt premium and issuance costs (1.5) (1.1) (0.9)

Total debt $ 392.5 $ 387.8 $ 386.0

Net working capital (2) $ 202.7 $ 191.1 $ 190.2

Days in receivables (DSO) (3) 47 46 44

Days in payables (DPO) (4) 48 46 43

27

Financial Highlights

(Unaudited)

Financial Trends

Cash and Cash Equivalents (Unaudited)

(in millions)

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

Q1 Q2 Q3 Q4

FY2016 FY2017

* FY2017 Q2 through Q4 cash balances reflect the Company’s most recent estimates and exclude

any impact of additional debt repurchases authorized by the Board. Actual operating results may vary.

*

28

NEC TOKIN Acquisition Update

Since the beginning of the equity investment KEMET have had the intention of

acquiring the remaining interest for a 100% stake.

Beginning in March 2014, NT was notified that it was being investigated by

numerous government authorities for alleged antitrust violations dating back

as early as 2002. The uncertain impact of the investigations and related civil

litigation on NT’s financial results has caused a delay in KEMET’s completion of

the NT acquisition.

Recent NT settlements with regulators and class-action plaintiffs have provided

clarity and removed significant obstacles to the completion of the transaction.

Several jurisdictions have yet to provide their conclusions.

KEMET and NEC remain in discussion concerning the terms of the acquisition.

It is anticipated that the final structure and mechanics of this transaction will be

announced with the completion of a definitive agreement. It may vary from the

existing agreement between the parties. Current expectation remains a closing

by the end of KEMET’s current fiscal year.

29

Follow KEMET

Social Media

Appendix

Adjusted Gross Margin

Non-GAAP (Unaudited)

(Amounts in thousands, except percentages) Jun 2015 Jun 2016

Net Sales $ 187,590 $ 184,935

Gross margin $ 39,713 $ 42,523

Gross margin as a percentage of net sales 21.2% 23.0%

Adjustments:

Plant start-up costs 195 308

Stock-based compensation expense 413 384

Adjusted gross margin $ 40,321 $ 43,215

Adjusted gross margin as a percentage of net sales 21.5% 23.4%

Quarter Ended

32

Adjusted Selling, General, and Administrative Expenses

Non-GAAP (Unaudited)

(Amounts in thousands, except percentages) Jun 2015 Jun 2016

Net Sales $ 187,590 $ 184,935

Selling, general, and administrative expenses $ 30,430 $ 25,914

Selling, general, and administrative expenses as a percentage of net sales 16.2% 14.0%

Adjustments:

ERP integration costs / IT transition costs 4,369 1,768

Stock-based compensation expense 843 785

Legal expenses related to antitrust class actions 718 1,175

NEC TOKIN investment-related expenses 224 206

Pension plan adjustment 312 -

Adjusted selling, general, and administrative expenses $ 23,964 $ 21,980

Adjusted selling, general, and administrative expenses as a percentage of net sales 12.8% 11.9%

Quarter Ended

33 33

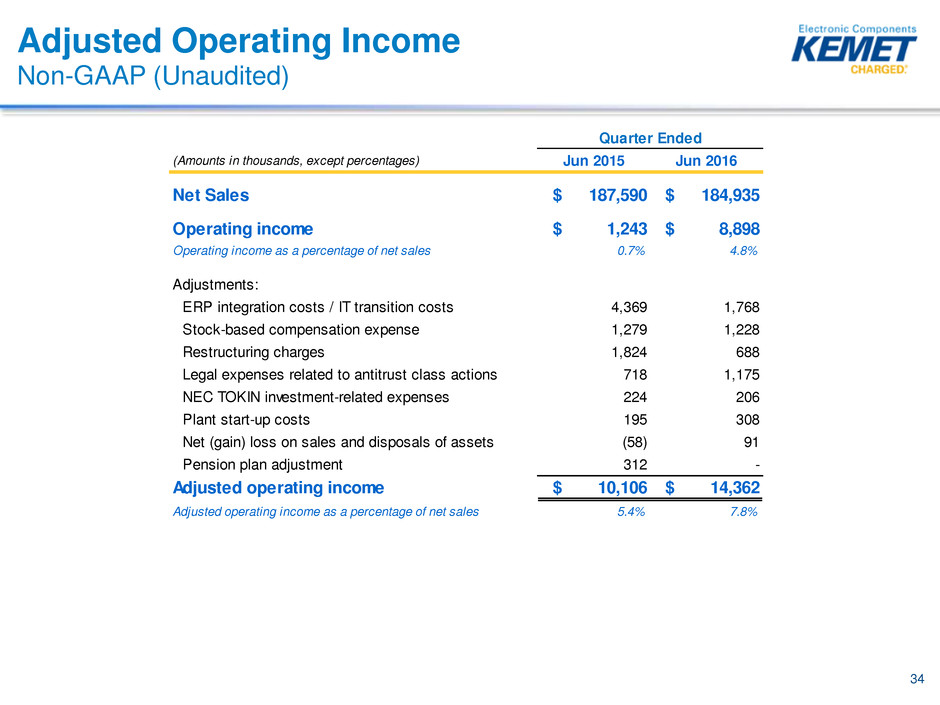

Adjusted Operating Income

Non-GAAP (Unaudited)

(Amounts in thousands, except percentages) Jun 2015 Jun 2016

Net Sales $ 187,590 $ 184,935

Operating income $ 1,243 $ 8,898

Operating income as a percentage of net sales 0.7% 4.8%

Adjustments:

ERP integration costs / IT transition costs 4,369 1,768

Stock-based compensation expense 1,279 1,228

Restructuring charges 1,824 688

Legal expenses related to antitrust class actions 718 1,175

NEC TOKIN investment-related expenses 224 206

Plant start-up costs 195 308

Net (gain) loss on sales and disposals of assets (58) 91

Pension plan adjustment 312 -

Adjusted operating income $ 10,106 $ 14,362

Adjusted operating income as a percentage of net sales 5.4% 7.8%

Quarter Ended

34

(Amounts in thousands, except percentages) Jun 2015 Jun 2016

Net Sales $ 187,591 $ 184,935

Net income (loss) $ (37,050) $ (12,205)

Net income (loss) as a percentage of net sales -19.8% -6.6%

Adjustments:

Change in value of NEC TOKIN options 29,200 12,000

Equity (gain) loss from NEC TOKIN (1,585) (223)

Restructuring charges 1,824 688

ERP integration costs / IT transition costs 4,369 1,768

Stock-based compensation expense 1,279 1,228

Legal expenses related to antitrust class actions 718 1,175

Net foreign exchange (gain) loss 1,049 (1,920)

NEC TOKIN investment-related expenses 224 206

Plant start-up costs 195 308

Amortization included in interest expense 220 190

Net (gain) loss on sales and disposals of assets (58) 91

Pension plan adjustment 312 -

Income tax effect of Non-GAAP adjustments (37) -

Adjusted net income $ 660 $ 3,306

Adjusted net income as a percentage of net sales 0.4% 1.8%

Adjusted net income per share - basic $ 0.01 $ 0.07

Adjusted net income per share - diluted $ 0.01 $ 0.06

Weighted avg. shares - basic 45,552 46,349

Weighted avg. shares - diluted 52,276 52,097

Quarter Ended

Adjusted Net Income

Non-GAAP (Unaudited)

35

Quarter Ended LTM

(Amounts in thousands, except percentages) Mar 2014 Jun 2014 Sep 2014 Dec 2014 Dec 2014

Net Sales $ 215,821 $ 212,881 $ 215,293 $ 201,310 $ 845,305

Net income (loss) (14,447) (3,540) 6,330 2,914 (8,743)

Income tax expense (benefit) (2,811) 1,282 2,583 1,359 2,413

Interest expense, net 10,658 10,453 10,284 9,933 41,328

Depreciation and amortization 12,175 10,797 10,177 9,720 42,869

EBITDA 5,575 18,992 29,374 23,926 77,867

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (1,777) (4,100) (6,600) (2,500) (14,977)

Equity (gain) loss from NEC TOKIN 4,127 1,675 (232) (1,367) 4,203

Restructuring charges 5,954 1,830 1,687 6,063 15,534

ERP integration costs / IT transition costs 837 895 409 671 2,812

Stock-based compensation expense 579 994 958 1,232 3,763

Legal expenses related to antitrust class actions - - - 409 409

Net foreign exchange (gain) loss (449) 527 (1,351) (1,257) (2,530)

NEC TOKIN investment-related expenses 618 580 487 485 2,170

Plant start-up costs 669 1,647 1,114 1,144 4,574

Plant shut-down costs 2,668 889 - - 3,557

Net (gain) loss on sales and disposals of assets (39) 365 (550) (574) (798)

(Income) loss from discontinued operations (103) (6,943) 1,400 164 (5,482)

(Gain) loss on early extinguishment of debt - - - (1,003) (1,003)

Professional fees related to financing activities - - - 1,142 1,142

Inventory revaluation - 2,676 (821) (927) 928

Write down of long-lived assets 1,118 - - - 1,118

Infrastructure tax 1,079 - - - 1,079

Adjusted EBITDA $ 20,856 $ 20,027 $ 25,875 $ 27,608 $ 94,366

Adjusted EBITDA Margin 9.7% 9.4% 12.0% 13.7% 11.2%

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

36

Quarter Ended LTM

(Amounts in thousands, except percentages) Sep 2014 Dec 2014 Mar 2015 Jun 2015 Jun 2015

Net Sales $ 215,293 $ 201,310 $ 193,708 $ 187,590 $ 797,901

Net income (loss) 6,330 2,914 (19,847) (37,050) (47,653)

Income tax expense (benefit) 2,583 1,359 3 (248) 3,697

Interest expense, net 10,284 9,933 10,016 10,010 40,243

Depreciation and amortization 10,177 9,720 10,074 9,917 39,888

EBITDA 29,374 23,926 246 (17,371) 36,175

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (6,600) (2,500) 11,100 29,200 31,200

Equity (gain) loss from NEC TOKIN (232) (1,367) 2,093 (1,585) (1,091)

Restructuring charges 1,687 6,063 3,437 1,824 13,011

ERP integration costs / IT transition costs 409 671 1,273 4,369 6,722

Stock-based compensation expense 958 1,232 1,328 1,279 4,797

Legal expenses related to antitrust class actions - 409 435 718 1,562

Net foreign exchange (gain) loss (1,351) (1,257) (2,168) 1,049 (3,727)

NEC TOKIN investment-related expenses 487 485 226 224 1,422

Plant start-up costs 1,114 1,144 651 195 3,104

Net (gain) loss on sales and disposals of assets (550) (574) 538 (58) (644)

Pension plan adjustment - - - 312 312

(Income) loss from discontinued operations 1,400 164 - - 1,564

(Gain) loss on early extinguishment of debt - (1,003) - - (1,003)

Professional fees related to financing activities - 1,142 - - 1,142

Inventory revaluation (821) (927) (928) - (2,676)

Adjusted EBITDA $ 25,875 $ 27,608 $ 18,231 $ 20,156 $ 91,870

Adjusted EBITDA Margin 12.0% 13.7% 9.4% 10.7% 11.5%

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

37

Quarter Ended LTM

(Amounts in thousands, except percentages) Dec 2014 Mar 2015 Jun 2015 Sep 2015 Sep 2015

Net Sales $ 201,310 $ 193,708 $ 187,590 $ 186,123 $ 768,731

Net income (loss) 2,914 (19,847) (37,050) 7,194 (46,789)

Income tax expense (benefit) 1,359 3 (248) 1,438 2,552

Interest expense, net 9,933 10,016 10,010 9,808 39,767

Depreciation and amortization 9,720 10,074 9,917 9,265 38,976

EBITDA 23,926 246 (17,371) 27,705 34,506

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (2,500) 11,100 29,200 (2,200) 35,600

Equity (gain) loss from NEC TOKIN (1,367) 2,093 (1,585) (162) (1,021)

Restructuring charges 6,063 3,437 1,824 23 11,347

ERP integration costs / IT transition costs 671 1,273 4,369 282 6,595

Stock-based compensation expense 1,232 1,328 1,279 1,328 5,167

Legal expenses related to antitrust class actions 409 435 718 541 2,103

Net foreign exchange (gain) loss (1,257) (2,168) 1,049 (3,171) (5,547)

NEC TOKIN investment-related expenses 485 226 224 186 1,121

Plant start-up costs 1,144 651 195 187 2,177

Net (gain) loss on sales and disposals of assets (574) 538 (58) (304) (398)

Pension plan adjustment - - 312 - 312

(Income) loss from discontinued operations 164 - - - 164

(Gain) loss on early extinguishment of debt (1,003) - - - (1,003)

Professional fees related to financing activities 1,142 - - - 1,142

Inventory revaluation (927) (928) - - (1,855)

Adjusted EBITDA $ 27,608 $ 18,231 $ 20,156 $ 24,415 $ 90,410

Adjusted EBITDA Margin 13.7% 9.4% 10.7% 13.1% 11.8%

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

38

Quarter Ended LTM

(Amounts in thousands, except percentages) Mar 2015 Jun 2015 Sep 2015 Dec 2015 Dec 2015

Net Sales $ 193,708 $ 187,590 $ 186,123 $ 177,184 $ 744,605

Net income (loss) (19,847) (37,050) 7,194 (8,600) (58,303)

Income tax expense (benefit) 3 (248) 1,438 2,760 3,953

Interest expense, net 10,016 10,010 9,808 9,848 39,682

Depreciation and amortization 10,074 9,917 9,265 9,674 38,930

EBITDA 246 (17,371) 27,705 13,682 24,262

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options 11,100 29,200 (2,200) (700) 37,400

Equity (gain) loss from NEC TOKIN 2,093 (1,585) (162) 6,505 6,851

Restructuring charges 3,437 1,824 23 1,714 6,998

ERP integration costs / IT transition costs 1,273 4,369 282 167 6,091

Stock-based compensation expense 1,328 1,279 1,328 1,154 5,089

Legal expenses related to antitrust class actions 435 718 541 1,300 2,994

Net foreign exchange (gain) loss (2,168) 1,049 (3,171) (1,036) (5,326)

NEC TOKIN investment-related expenses 226 224 186 225 861

Plant start-up costs 651 195 187 160 1,193

Plant shut-down costs - - - 231 231

Net (gain) loss on sales and disposals of assets 538 (58) (304) 129 305

Pension plan adjustment - 312 - - 312

Inventory revaluation (928) - - - (928)

Adjusted EBITDA $ 18,231 $ 20,156 $ 24,415 $ 23,531 $ 86,333

Adjusted EBITDA Margin 9.4% 10.7% 13.1% 13.3% 11.6%

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

39

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

Quarter Ended LTM

(Amounts in thousands, except percentages) Sep 2015 Dec 2015 Mar 2016 Jun 2016 Jun 2016

Net Sales $ 186,123 $ 177,184 $ 183,926 $ 184,935 $ 732,168

Net income (loss) 7,194 (8,600) (15,173) (12,205) (28,784)

Income tax expense (benefit) 1,438 2,760 2,056 1,800 8,054

Interest expense, net 9,808 9,848 9,925 9,920 39,501

Depreciation and amortization 9,265 9,674 10,160 9,436 38,535

EBITDA 27,705 13,682 6,968 8,951 57,306

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (2,200) (700) - 12,000 9,100

Equity (gain) loss from NEC TOKIN (162) 6,505 11,648 (223) 17,768

Restructuring charges 23 1,714 617 688 3,042

ERP integration costs / IT transition costs 282 167 859 1,768 3,076

Stock-based compensation expense 1,328 1,154 1,013 1,228 4,723

Legal expenses related to antitrust class actions 541 1,300 482 1,175 3,498

Net foreign exchange (gain) loss (3,171) (1,036) 122 (1,920) (6,005)

NEC TOKIN investment-related expenses 186 225 265 206 882

Plant start-up costs 187 160 319 308 974

Plant shut-down costs - 231 141 - 372

Net (gain) loss on sales and disposals of assets (304) 129 608 91 524

Adjusted EBITDA $ 24,415 $ 23,531 $ 23,042 $ 24,272 $ 95,260

Adjusted EBITDA Margin 13.1% 13.3% 12.5% 13.1% 13.0%

40

(Amounts in thousands, except percentages) 2014 2015 2016

Net Sales $ 833,666 $ 823,192 $ 734,823

Net income (loss) (68,503) (14,143) (53,629)

Income tax expense (benefit) 1,482 5,227 6,006

Interest expense, net 40,767 40,686 39,591

Depreciation and amortization 49,527 40,768 39,016

EBITDA 23,273 72,538 30,984

Excluding the following items (Non-GAAP):

Change in value of NEC TOKIN options (3,111) (2,100) 26,300

Equity (gain) loss from NEC TOKIN 7,090 2,169 16,406

Restructuring charges 14,122 13,017 4,178

ERP integration costs / IT transition costs 3,880 3,248 5,677

Stock-based compensation expense 2,909 4,512 4,774

Legal expenses related to antitrust class actions - 844 3,041

Net foreign exchange (gain) loss (304) (4,249) (3,036)

NEC TOKIN investment-related expenses 2,299 1,778 900

Plant start-up costs 3,336 4,556 861

Plant shut-down costs 2,668 889 372

Net (gain) loss on sales and disposals of assets 32 (221) 375

Pension plan adjustment - - 312

(Income) loss from discontinued operations 3,634 (5,379) -

(Gain) loss on early extinguishment of debt - (1,003) -

Professional fees related to financing activities - 1,142 -

Write down of long-lived assets 4,476 - -

Inventory write-downs 3,886 - -

Long-term receivable write down 1,444 - -

Infrastructure tax 1,079 - -

Adjusted EBITDA $ 70,713 $ 91,741 $ 91,144

Adjusted EBITDA Margin 8.5% 11.1% 12.4%

Fiscal Year

Adjusted EBITDA Reconciliation

Non-GAAP (Unaudited)

41

Non-GAAP Financial Measures

Non-GAAP Financial Measures

Included in this presentation are certain non-GAAP financial measures designed to complement the financial information presented in accordance with

generally accepted accounting principles in the United States of America because management believes such measures are useful to investors for the

reasons described below.

Adjusted gross margin

Adjusted gross margin represents net sales less cost of sales excluding adjustments which are outlined in the quantitative reconciliation provided earlier

in this presentation. We use Adjusted gross margin to facilitate our analysis and understanding of our business operations by excluding the items

outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make comparisons of our ongoing business with

prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted gross margin is useful to investors because it

provides a supplemental way to understand the underlying operating performance of the Company. Adjusted gross margin should not be considered as

an alternative to gross margin or any other performance measure derived in accordance with U.S. GAAP.

Adjusted selling, general, and administrative expenses

Adjusted selling, general, and administrative expenses represents selling, general, and administrative expenses excluding adjustments which are

outlined in the quantitative reconciliation provided earlier in this presentation. We use Adjusted selling, general, and administrative expenses to facilitate

our analysis and understanding of our business operations by excluding the items outlined in the quantitative reconciliation provided earlier in this

presentation which might otherwise make comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing

operations. The company believes that Adjusted selling, general, and administrative expenses is useful to investors because it proves a supplemental

way to understand the underlying operating performance of the Company. Adjusted selling, general, and administrative expenses should not be

considered as an alternative to selling, general, and administrative expenses or any other performance measure derived in accordance with U.S. GAAP.

Adjusted operating income

Adjusted operating income represents operating income, excluding adjustments which are outlined in the quantitative reconciliation provided earlier in

this presentation. We use Adjusted operating income to facilitate our analysis and understanding of our business operations by excluding the items

outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make comparisons of our ongoing business with

prior periods more difficult and obscure trends in ongoing operations. The Company believes that Adjusted operating income is useful to investors to

provide a supplemental way to understand our underlying operating performance and monitor and understand changes in our ability to generate income

from ongoing business operations. Adjusted operating income should not be considered as an alternative to operating income or any other performance

measure derived in accordance with U.S. GAAP.

42

Adjusted net income and Adjusted EPS

Adjusted net income and Adjusted EPS represents net income (loss) and EPS, excluding adjustments which are more specifically outlined in the

quantitative reconciliation provided earlier in this presentation. We use Adjusted net income and Adjusted EPS to evaluate our operating

performance by excluding the items outlined in the quantitative reconciliation provided earlier in this presentation which might otherwise make

comparisons of our ongoing business with prior periods more difficult and obscure trends in ongoing operations. The Company believes that

Adjusted net income and Adjusted EPS are useful to investors because it provides a supplemental way to understand our underlying operating

performance and allows investors to monitor and understand changes in our ability to generate income from ongoing business operations.

Adjusted net income and Adjusted EPS should not be considered as alternatives to net income (loss), EPS, operating income (loss), or any

other performance measures derived in accordance with U.S. GAAP.

Adjusted EBITDA

Adjusted EBITDA represents net income (loss) before income tax expense (benefit), interest expense, net, and depreciation and amortization

expense, excluding adjustments which are more specifically outlined in the quantitative reconciliation provided earlier in this presentation. We

present Adjusted EBITDA as a supplemental measure of our performance and ability to service debt. We also present Adjusted EBITDA

because we believe such measure is frequently used by securities analysts, investors, and other interested parties in the evaluation of

companies in our industry. Adjusted EBITDA is also used as a measure to determine incentive compensation.

We believe Adjusted EBITDA is an appropriate supplemental measure of debt service capacity because cash expenditures on interest are, by

definition, available to pay interest, and tax expense is inversely correlated to interest expense because tax expense goes down as deductible

interest expense goes up; and depreciation and amortization are non-cash charges. The other items excluded from Adjusted EBITDA are

excluded in order to better reflect our continuing operations.

In evaluating Adjusted EBITDA, you should be aware that in the future we may incur expenses similar to the adjustments in this presentation.

Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by these types of

adjustments. Adjusted EBITDA is not a measurement of our financial performance under U.S. GAAP and should not be considered as an

alternative to net income (loss), operating income (loss), or any other performance measures derived in accordance with U.S. GAAP or as an

alternative to cash flow from operating activities as a measure of our liquidity.

Non-GAAP Financial Measures

Continued

43

Non-GAAP Financial Measures

Continued

Our Adjusted EBITDA measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for

analysis of our results as reported under U.S. GAAP. Some of these limitations are:

• it does not reflect our cash expenditures, future requirements for capital expenditures, or contractual commitments;

• it does not reflect changes in, or cash requirements for, our working capital needs;

• it does not reflect the significant interest expense or the cash requirements necessary to service interest or principal payment

on our debt;

• although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to

be replaced in the future, and our Adjusted EBITDA measure does not reflect any cash requirements for such replacements;

• it is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows;

• it does not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing

operations;

• it does not reflect limitations on or costs related to transferring earnings from our subsidiaries to us; and

• other companies in our industry may calculate this measure differently than we do, limiting its usefulness as a comparative

measure.

Because of these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to

invest in the growth of our business or as a measure of cash that will be available to us to meet our obligations. You should

compensate for these limitations by relying primarily on our U.S. GAAP results and using Adjusted EBITDA as supplementary

information.

44