Attached files

| file | filename |

|---|---|

| EX-10.4 - EX-10.4 - PennyMac Mortgage Investment Trust | pmt-ex104_6.htm |

| EX-10.3 - EX-10.3 - PennyMac Mortgage Investment Trust | pmt-ex103_7.htm |

| EX-10.2 - EX-10.2 - PennyMac Mortgage Investment Trust | pmt-ex102_9.htm |

| EX-10.1 - EX-10.1 - PennyMac Mortgage Investment Trust | pmt-ex101_8.htm |

| 8-K - 8-K - PennyMac Mortgage Investment Trust | pmt-8k_20160912.htm |

PennyMac Mortgage Investment Trust September 14, 2016 Barclays Global Financial Services Conference Exhibit 99.1

Forward-Looking Statements This presentation contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, regarding management’s beliefs, estimates, projections and assumptions with respect to, among other things, the Company’s financial results, future operations, business plans and investment strategies, as well as industry and market conditions, all of which are subject to change. Words like “believe,” “expect,” “anticipate,” “promise,” “plan,” and other expressions or words of similar meanings, as well as future or conditional verbs such as “will,” “would,” “should,” “could,” or “may” are generally intended to identify forward-looking statements. Actual results and operations for any future period may vary materially from those projected herein, from past results discussed herein, or illustrative examples provided herein. Factors which could cause actual results to differ materially from historical results or those anticipated include, but are not limited to: changes in our investment objectives or investment or operational strategies, including any new lines of business or new products and services that may subject us to additional risks; volatility in our industry, the debt or equity markets, the general economy or the real estate finance and real estate markets specifically, whether the result of market events or otherwise; events or circumstances which undermine confidence in the financial markets or otherwise have a broad impact on financial markets, such as the sudden instability or collapse of large depository institutions or other significant corporations, terrorist attacks, natural or man-made disasters, or threatened or actual armed conflicts; changes in general business, economic, market, employment and political conditions, or in consumer confidence and spending habits from those expected; declines in real estate or significant changes in U.S. housing prices or activity in the U.S. housing market; the availability of, and level of competition for, attractive risk-adjusted investment opportunities in mortgage loans and mortgage-related assets that satisfy our investment objectives; the inherent difficulty in winning bids to acquire mortgage loans, and our success in doing so; the concentration of credit risks to which we are exposed; the degree and nature of our competition; our dependence on our manager and servicer, potential conflicts of interest with such entities and their affiliates, and the performance of such entities; changes in personnel and lack of availability of qualified personnel at our manager, servicer or their affiliates; the availability, terms and deployment of short-term and long-term capital; the adequacy of our cash reserves and working capital; our ability to maintain the desired relationship between our financing and the interest rates and maturities of our assets; the timing and amount of cash flows, if any, from our investments; unanticipated increases or volatility in financing and other costs, including a rise in interest rates; the performance, financial condition and liquidity of borrowers; the ability of our servicer, which also provides us with fulfillment services, to approve and monitor correspondent sellers and underwrite loans to investor standards; incomplete or inaccurate information or documentation provided by customers or counterparties, or adverse changes in the financial condition of our customers and counterparties; our indemnification and repurchase obligations in connection with mortgage loans we purchase and later sell or securitize; the quality and enforceability of the collateral documentation evidencing our ownership and rights in the assets in which we invest; increased rates of delinquency, default and/or decreased recovery rates on our investments; our ability to foreclose on our investments in a timely manner or at all; increased prepayments of the mortgages and other loans underlying our mortgage-backed securities or relating to our mortgage servicing rights , excess servicing spread and other investments; the degree to which our hedging strategies may or may not protect us from interest rate volatility; the effect of the accuracy of or changes in the estimates we make about uncertainties, contingencies and asset and liability valuations when measuring and reporting upon our financial condition and results of operations; our failure to maintain appropriate internal controls over financial reporting; technologies for loans and our ability to mitigate security risks and cyber intrusions; our ability to obtain and/or maintain licenses and other approvals in those jurisdictions where required to conduct our business; our ability to detect misconduct and fraud; our ability to comply with various federal, state and local laws and regulations that govern our business; developments in the secondary markets for our mortgage loan products; legislative and regulatory changes that impact the mortgage loan industry or housing market; changes in regulations or the occurrence of other events that impact the business, operations or prospects of government agencies or government-sponsored entities, or such changes that increase the cost of doing business with such entities; the Dodd-Frank Wall Street Reform and Consumer Protection Act and its implementing regulations and regulatory agencies, and any other legislative and regulatory changes that impact the business, operations or governance of mortgage lenders and/or publicly-traded companies; the Consumer Financial Protection Bureau and its issued and future rules and the enforcement thereof; changes in government support of homeownership; changes in government or government-sponsored home affordability programs; limitations imposed on our business and our ability to satisfy complex rules for us to qualify as a real estate investment trust (REIT) for U.S. federal income tax purposes and qualify for an exclusion from the Investment Company Act of 1940 and the ability of certain of our subsidiaries to qualify as REITs or as taxable REIT subsidiaries for U.S. federal income tax purposes, as applicable, and our ability and the ability of our subsidiaries to operate effectively within the limitations imposed by these rules; changes in governmental regulations, accounting treatment, tax rates and similar matters (including changes to laws governing the taxation of REITs, or the exclusions from registration as an investment company); the effect of public opinion on our reputation; the occurrence of natural disasters or other events or circumstances that could impact our operations; and our organizational structure and certain requirements in our charter documents. You should not place undue reliance on any forward-looking statement and should consider all of the uncertainties and risks described above, as well as those more fully discussed in reports and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements or any other information contained herein, and the statements made in this presentation are current as of the date of this presentation only. 2016 Barclays Global Financial Services Conference

PMT's Model Is Well-Positioned for Today's Mortgage Investment Opportunities 2016 Barclays Global Financial Services Conference Investment Highlights A real estate investment trust (REIT) with access to unique mortgage-related investment strategies enabled by the operational capabilities of our manager and service provider PennyMac Financial Services, Inc. (NYSE: PFSI) Emphasis on repeatable, organically created investments resulting from our correspondent production activities Focused on delivering appropriate risk-adjusted returns for shareholders and distribution of dividends Diversified mortgage-related investment vehicle with $5.8 billion(1) in assets; focused on GSE Credit Risk Transfers (CRT), Mortgage Servicing Rights (MSRs), Excess Servicing Spread (ESS), Distressed residential loans, Agency and non-Agency mortgage-backed securities (MBS), and Private-label securitization interests Highly experienced management team with distinctive expertise Variable cost structure and performance-based incentives under PMT’s management and services agreements with PFSI (1) As of June 30, 2016

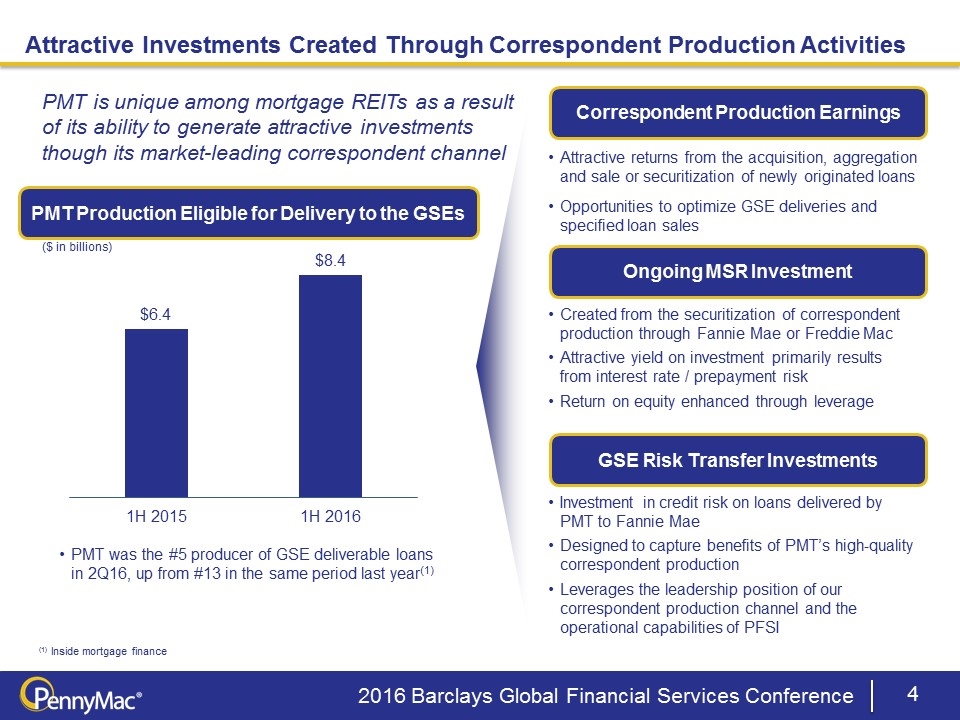

GSE Risk Transfer Investments Ongoing MSR Investment Correspondent Production Earnings Attractive Investments Created Through Correspondent Production Activities Investment in credit risk on loans delivered by PMT to Fannie Mae Designed to capture benefits of PMT’s high-quality correspondent production Leverages the leadership position of our correspondent production channel and the operational capabilities of PFSI PMT Production Eligible for Delivery to the GSEs Attractive returns from the acquisition, aggregation and sale or securitization of newly originated loans Opportunities to optimize GSE deliveries and specified loan sales Created from the securitization of correspondent production through Fannie Mae or Freddie Mac Attractive yield on investment primarily results from interest rate / prepayment risk Return on equity enhanced through leverage 2016 Barclays Global Financial Services Conference PMT is unique among mortgage REITs as a result of its ability to generate attractive investments though its market-leading correspondent channel ($ in billions) PMT was the #5 producer of GSE deliverable loans in 2Q16, up from #13 in the same period last year(1) (1) Inside mortgage finance

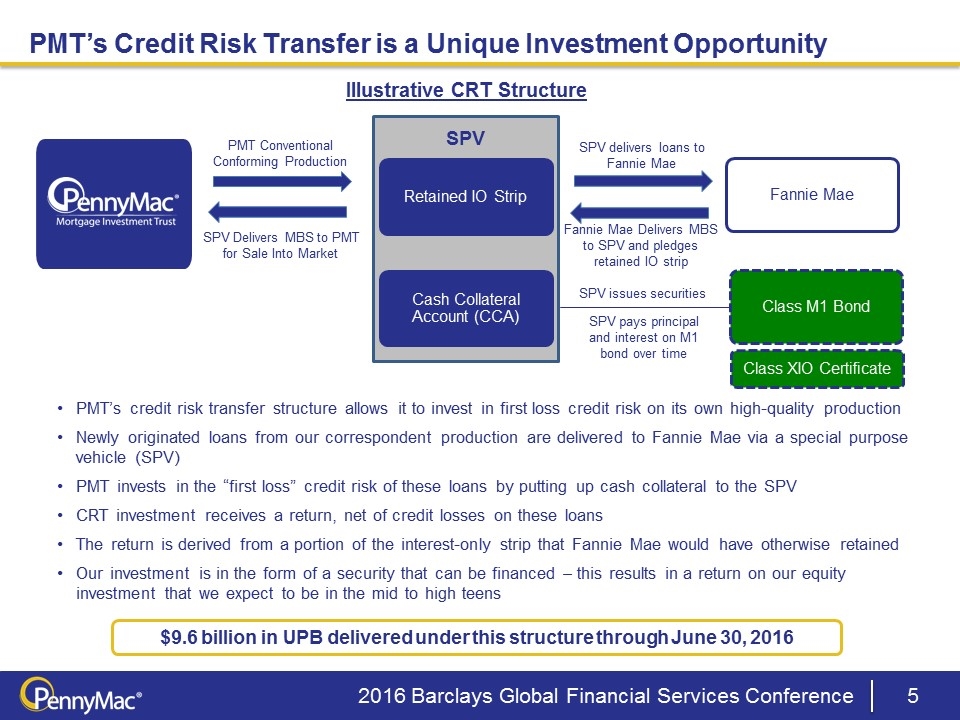

PMT’s Credit Risk Transfer is a Unique Investment Opportunity 2016 Barclays Global Financial Services Conference $9.6 billion in UPB delivered under this structure through June 30, 2016 SPV PMT Conventional Conforming Production Retained IO Strip Fannie Mae Cash Collateral Account (CCA) Class M1 Bond SPV delivers loans to Fannie Mae SPV pays principal and interest on M1 bond over time SPV issues securities SPV Delivers MBS to PMT for Sale Into Market Fannie Mae Delivers MBS to SPV and pledges retained IO strip Class XIO Certificate Illustrative CRT Structure PMT’s credit risk transfer structure allows it to invest in first loss credit risk on its own high-quality production Newly originated loans from our correspondent production are delivered to Fannie Mae via a special purpose vehicle (SPV) PMT invests in the “first loss” credit risk of these loans by putting up cash collateral to the SPV CRT investment receives a return, net of credit losses on these loans The return is derived from a portion of the interest-only strip that Fannie Mae would have otherwise retained Our investment is in the form of a security that can be financed – this results in a return on our equity investment that we expect to be in the mid to high teens

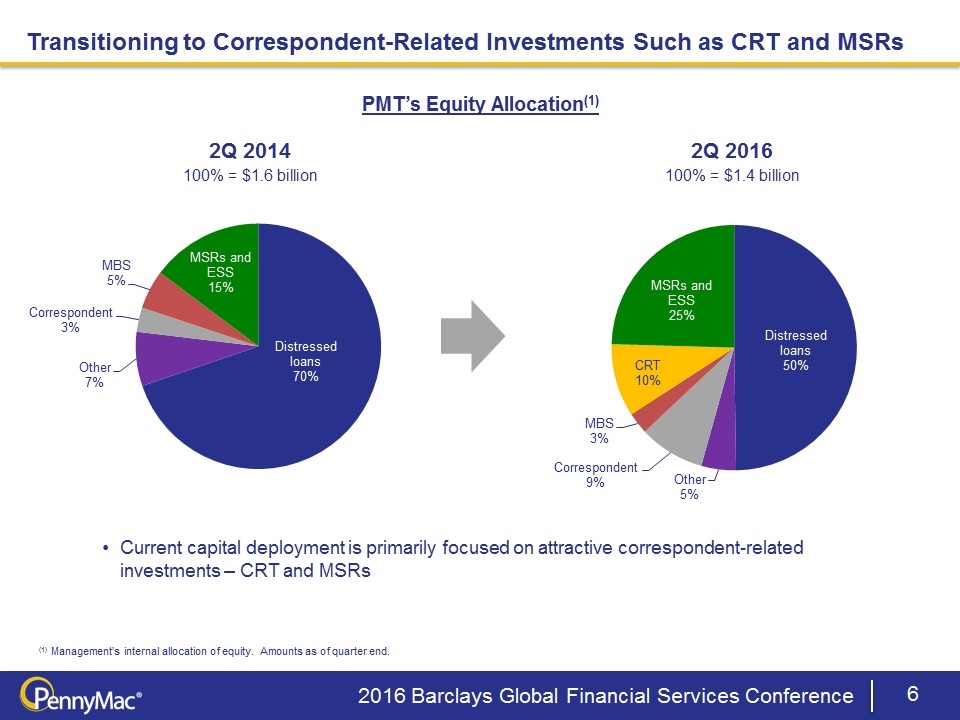

Transitioning to Correspondent-Related Investments Such as CRT and MSRs 2Q 2014 100% = $1.6 billion Current capital deployment is primarily focused on attractive correspondent-related investments – CRT and MSRs 2Q 2016 100% = $1.4 billion PMT’s Equity Allocation(1) (1) Management’s internal allocation of equity. Amounts as of quarter end. 2016 Barclays Global Financial Services Conference

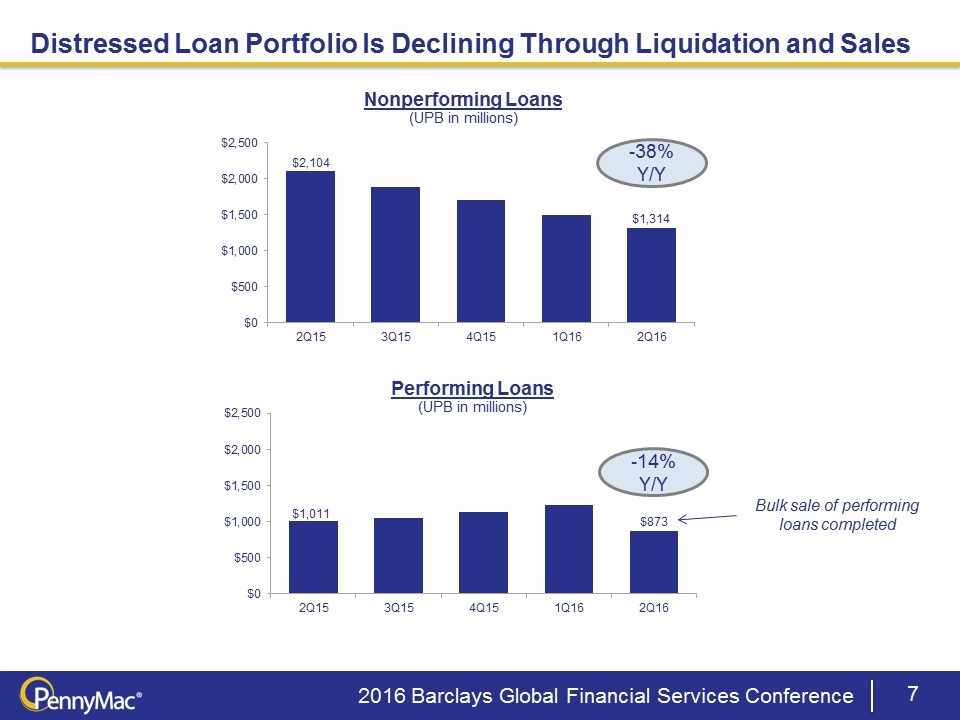

Distressed Loan Portfolio Is Declining Through Liquidation and Sales Bulk sale of performing loans completed -38% Y/Y -14% Y/Y 2016 Barclays Global Financial Services Conference

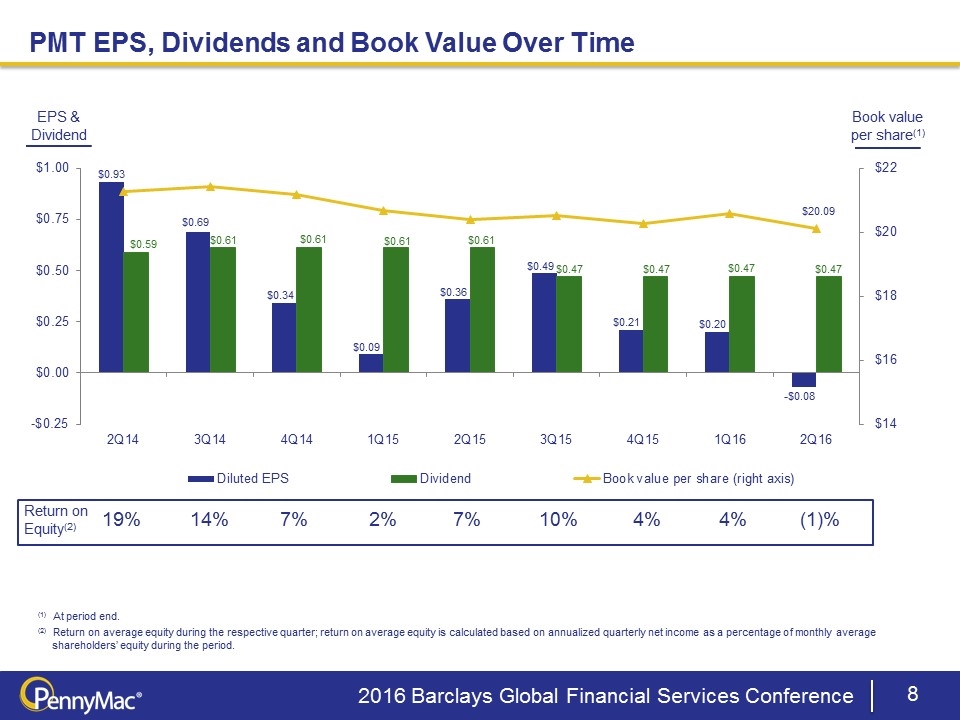

Book value per share(1) PMT EPS, Dividends and Book Value Over Time 19% 14% 7% 7% Return on Equity(2) (1) At period end. (2) Return on average equity during the respective quarter; return on average equity is calculated based on annualized quarterly net income as a percentage of monthly average shareholders’ equity during the period. 2% EPS & Dividend 10% 4% 4% (1)% 2016 Barclays Global Financial Services Conference

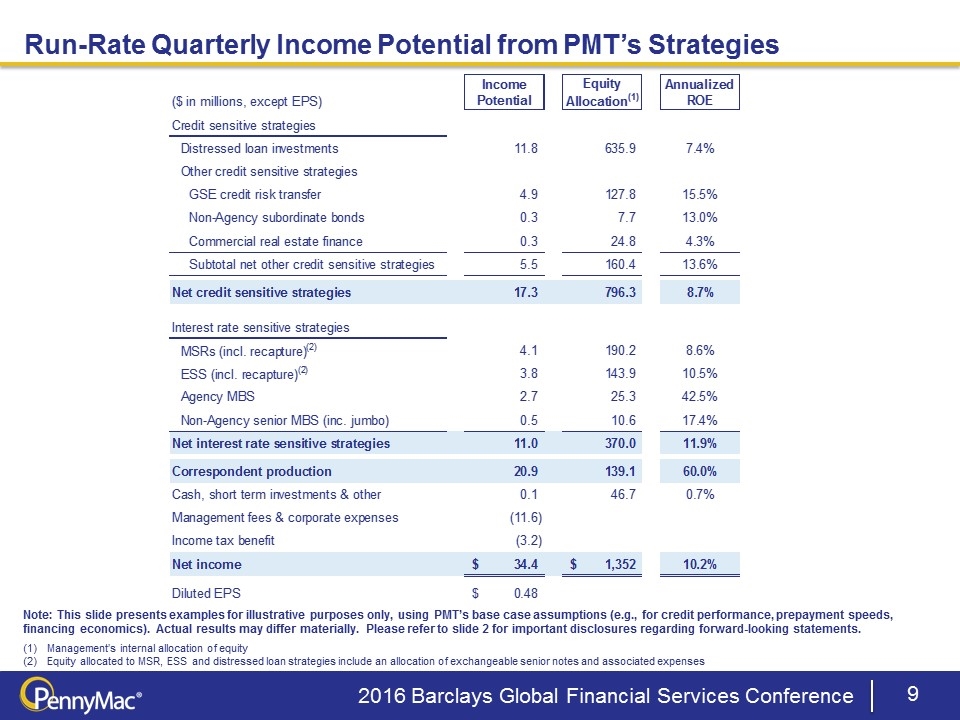

Note: This slide presents examples for illustrative purposes only, using PMT’s base case assumptions (e.g., for credit performance, prepayment speeds, financing economics). Actual results may differ materially. Please refer to slide 2 for important disclosures regarding forward-looking statements. Management’s internal allocation of equity Equity allocated to MSR, ESS and distressed loan strategies include an allocation of exchangeable senior notes and associated expenses Run-Rate Quarterly Income Potential from PMT’s Strategies 2016 Barclays Global Financial Services Conference

Update on Partnership Between PMT and PFSI PMT and PFSI recently renewed the agreements that govern the arrangements between the two companies This renewal extends the term of the agreements for another four years, through September 2020 Modest changes from the prior agreements, including: Mortgage Banking Services Agreement: Fulfillment fee for correspondent production services generally 35 bps for conventional loans (85 bps for all other loans) Flow Servicing Agreement: Modified certain fees for servicing of distressed whole loans to be contemporary with market We anticipate that at current activity levels, the modest changes will reduce PMT’s expenses paid to PFSI by approximately $2 million per quarter The Related Party Matters Committees of the PMT and PFSI Boards, each comprised solely of independent members, reviewed and approved these agreements 2016 Barclays Global Financial Services Conference

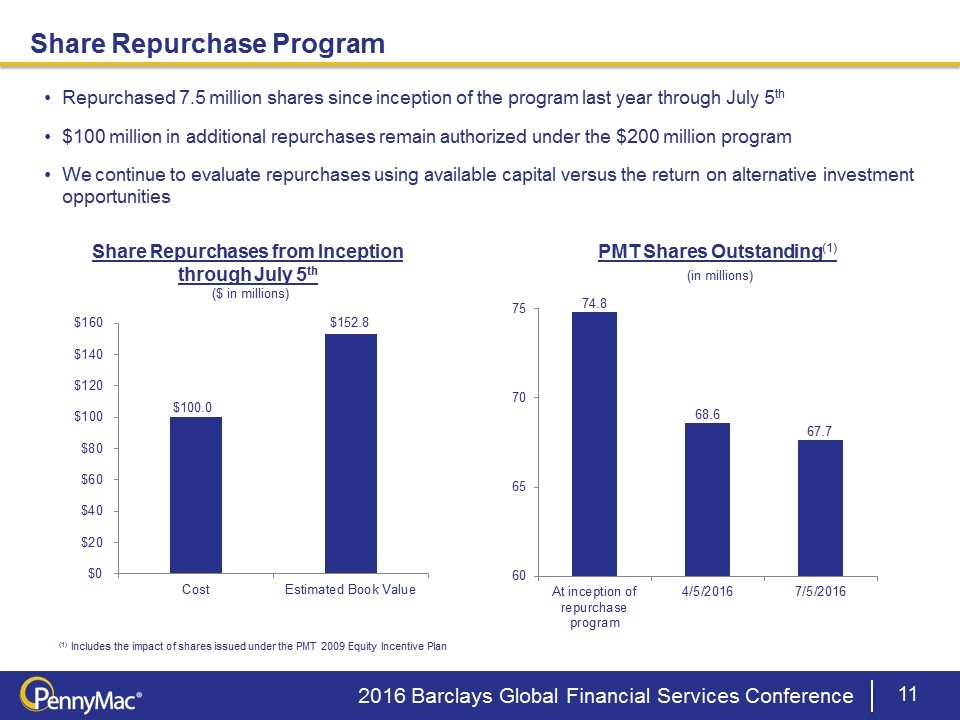

Share Repurchase Program Repurchased 7.5 million shares since inception of the program last year through July 5th $100 million in additional repurchases remain authorized under the $200 million program We continue to evaluate repurchases using available capital versus the return on alternative investment opportunities (1) Includes the impact of shares issued under the PMT 2009 Equity Incentive Plan Share Repurchases from Inception through July 5th PMT Shares Outstanding(1) ($ in millions) (in millions) 2016 Barclays Global Financial Services Conference