Attached files

| file | filename |

|---|---|

| 8-K - 8-K - California Resources Corp | form8-kbarclaysenergypower.htm |

CEO Energy-Power Conference

Barclays

Todd Stevens| President & CEO| New York, NY| September 6-8, 2016

Barclays 2016

Forward-Looking / Cautionary Statements

This presentation contains forward-looking statements that involve risks and uncertainties that could materially affect our expected results of

operations, liquidity, cash flows and business prospects. Such statements specifically include our expectations as to our future financial position, drilling

and workover program, production, projected costs, future operations, hedging activities, future transactions, planned capital investments and other

guidance. Actual results may differ from anticipated results, sometimes materially, and reported results should not be considered an indication of future

performance. For any such forward-looking statement that includes a statement of the assumptions or bases underlying such forward-looking

statement, we caution that, while we believe such assumptions or bases to be reasonable and make them in good faith, assumed facts or bases almost

always vary from actual results, sometimes materially. Factors (but not necessarily all the factors) that could cause results to differ include: commodity

price fluctuations; the ability of our lenders to limit our borrowing capacity; other liquidity constraints; the effect of our debt on our financial flexibility;

limitations on our ability to enter efficient hedging transactions; insufficiency of our operating cash flow to fund planned capital expenditures; faster

than expected production decline rates; inability to implement our capital investment program; inability to replace reserves; inability to obtain

government permits and approvals; inability to monetize selected assets; restrictions and changes in restrictions imposed by regulations including those

related to our ability to obtain, use, manage or dispose of water or use advanced well stimulation techniques like hydraulic fracturing; risks of drilling;

tax law changes; competition with larger, better funded competitors for and costs of oilfield equipment, services, qualified personnel and acquisitions;

the subjective nature of estimates of proved reserves and related future net cash flows; risks related to our disposition and acquisition activities;

restriction of operations to, and concentration of exposure to events such as industrial accidents, natural disasters and labor difficulties in, California; the

recoverability of resources; concerns about climate change and air quality issues; lower-than-expected production from development projects or

acquisitions; catastrophic events for which we may be uninsured or underinsured; effects of litigation; cyber attacks; operational issues that restrict

market access; and uncertainties related to the Spin-off and the agreements related thereto. Material risks are further discussed in “Risk Factors” in our

Annual Report on Form 10-K and subsequent 10Qs available on our website at crc.com. Words such as "aim," "anticipate," "believe," "budget,"

"continue," "could," "effort," "estimate," "expect," "forecast," "goal," "guidance," "intend," "likely," "may," "might," "objective," "outlook," "plan,"

"potential," "predict," "project," "seek," "should," "target, "will" or "would" or similar expressions that convey the prospective nature of events or

outcomes generally indicate forward-looking statements. Any forward-looking statement speaks only as of the date on which such statement is made

and CRC undertakes no obligation to correct or update any forward-looking statement, whether as a result of new information, future events or

otherwise, except as required by applicable law.

Some of the data in this presentation is from external sources as noted. While we believe it is accurate, we have not independently verified the data and

do not represent or warrant that it is accurate, complete or reliable.

This presentation includes financial measures that are not in accordance with United States generally accepted accounting principles (“GAAP”), including

PV-10 and adjusted EBITDAX. While management believes that such measures are useful for investors, they should not be used as a replacement for

financial measures that are in accordance with GAAP. For a reconciliation of adjusted EBITDAX and PV-10 to the nearest comparable measure in

accordance with GAAP, please see the Appendix.

2

Barclays 2016

Cautionary Statements Regarding

Hydrocarbon Quantities

We have provided internally generated estimates for proved reserves and aggregated proved, probable and possible reserves (“3P Reserves”) as of

December 31, 2015 in this presentation, with each category of reserves estimated in accordance with SEC guidelines and definitions, though we have

not reported all such estimates to the SEC. As used in this presentation:

• Probable reserves. We use deterministic methods to estimate probable reserve quantities, and when deterministic methods are used, it is as

likely as not that actual remaining quantities recovered will exceed the sum of estimated proved plus probable reserves.

• Possible reserves. We use deterministic methods to estimate possible reserve quantities, and when deterministic methods are used to

estimate possible reserve quantities, the total quantities ultimately recovered from a project have a low probability of exceeding proved plus

probable plus possible reserves.

The SEC prohibits companies from aggregating proved, probable and possible reserves estimated using deterministic estimation methods in filings with

the SEC due to the different levels of certainty associated with each reserve category.

Actual quantities that may be ultimately recovered from our interests may differ substantially from the estimates in this presentation. Factors affecting

ultimate recovery include the scope of our ongoing drilling program, which will be directly affected by commodity prices, the availability of capital,

regulatory approvals, drilling and production costs, availability of drilling services and equipment, drilling results, lease expirations, transportation

constraints and other factors; actual drilling results, which may be affected by geological, mechanical and other factors that determine recovery rates;

and budgets based upon our future evaluation of risk, returns and the availability of capital.

We use the term “oil-in-place” and “resource inventory” in this presentation to describe estimates of potentially recoverable hydrocarbons remaining in

the applicable reservoir. These resources are not proved reserves in accordance with SEC regulations and SEC guidelines restrict us from including these

measures in filings with the SEC. These have been estimated internally without review by independent engineers and may include shale resources which

are not considered in most older, publicly available estimates. Actual recovery of these potential resource volumes is inherently more speculative than

recovery of estimated reserves and any such recovery will be dependent upon future design and implementation of a successful development plan and

the actual geologic characteristics of the reservoirs. Management’s estimate of original hydrocarbons in place includes historical production plus

estimates of proved, probable and possible reserves and a gross resource estimate that has not been reduced by appropriate factors for potential

recovery and as a result differs significantly from estimates of hydrocarbons that can potentially be recovered. “Resource inventory” includes

contingent resources as well as prospective resources that are estimated as part of Management’s planning activity. Ultimate recoveries will be

dependent upon numerous factors including those noted above.

3

Barclays 2016 NY00813G / 589203_1.WOR

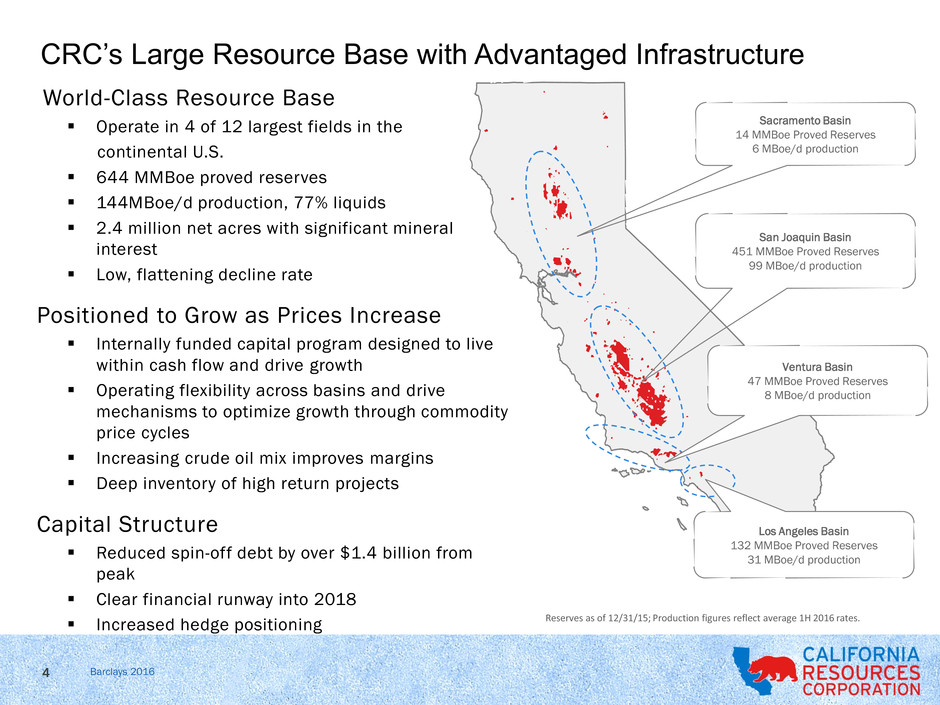

Sacramento Basin

14 MMBoe Proved Reserves

6 MBoe/d production

San Joaquin Basin

451 MMBoe Proved Reserves

99 MBoe/d production

Ventura Basin

47 MMBoe Proved Reserves

8 MBoe/d production

Los Angeles Basin

132 MMBoe Proved Reserves

31 MBoe/d production

World-Class Resource Base

Operate in 4 of 12 largest fields in the

continental U.S.

644 MMBoe proved reserves

144MBoe/d production, 77% liquids

2.4 million net acres with significant mineral

interest

Low, flattening decline rate

Positioned to Grow as Prices Increase

Internally funded capital program designed to live

within cash flow and drive growth

Operating flexibility across basins and drive

mechanisms to optimize growth through commodity

price cycles

Increasing crude oil mix improves margins

Deep inventory of high return projects

Capital Structure

Reduced spin-off debt by over $1.4 billion from

peak

Clear financial runway into 2018

Increased hedge positioning

CRC’s Large Resource Base with Advantaged Infrastructure

Reserves as of 12/31/15; Production figures reflect average 1H 2016 rates.

4

Barclays 2016

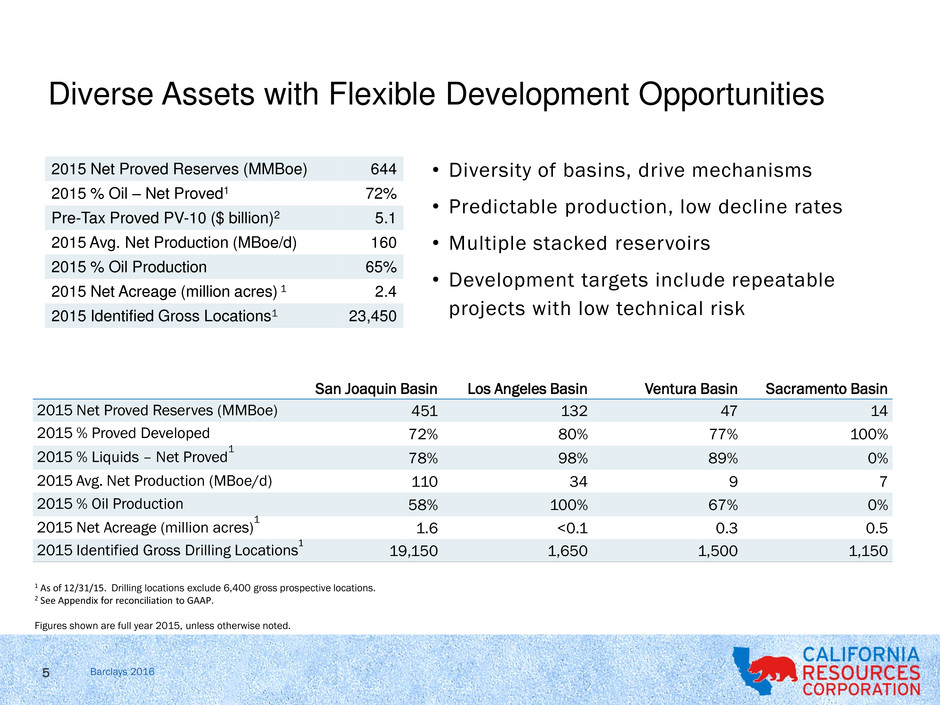

2015 Net Proved Reserves (MMBoe) 644

2015 % Oil – Net Proved1 72%

Pre-Tax Proved PV-10 ($ billion)2 5.1

2015 Avg. Net Production (MBoe/d) 160

2015 % Oil Production 65%

2015 Net Acreage (million acres) 1 2.4

2015 Identified Gross Locations1 23,450

1 As of 12/31/15. Drilling locations exclude 6,400 gross prospective locations.

2 See Appendix for reconciliation to GAAP.

Figures shown are full year 2015, unless otherwise noted.

San Joaquin Basin Los Angeles Basin Ventura Basin Sacramento Basin

2015 Net Proved Reserves (MMBoe) 451 132 47 14

2015 % Proved Developed 72% 80% 77% 100%

2015 % Liquids – Net Proved

1

78% 98% 89% 0%

2015 Avg. Net Production (MBoe/d) 110 34 9 7

2015 % Oil Production 58% 100% 67% 0%

2015 Net Acreage (million acres)

1

1.6 <0.1 0.3 0.5

2015 Identified Gross Drilling Locations

1

19,150 1,650 1,500 1,150

Diverse Assets with Flexible Development Opportunities

• Diversity of basins, drive mechanisms

• Predictable production, low decline rates

• Multiple stacked reservoirs

• Development targets include repeatable

projects with low technical risk

5

Barclays 20166

2016 Strategic Focus

• Protect the Base

• Defend our Margins

• Deleverage the Balance Sheet for Flexibility

• Prepare for Change in Cycle

Barclays 2016

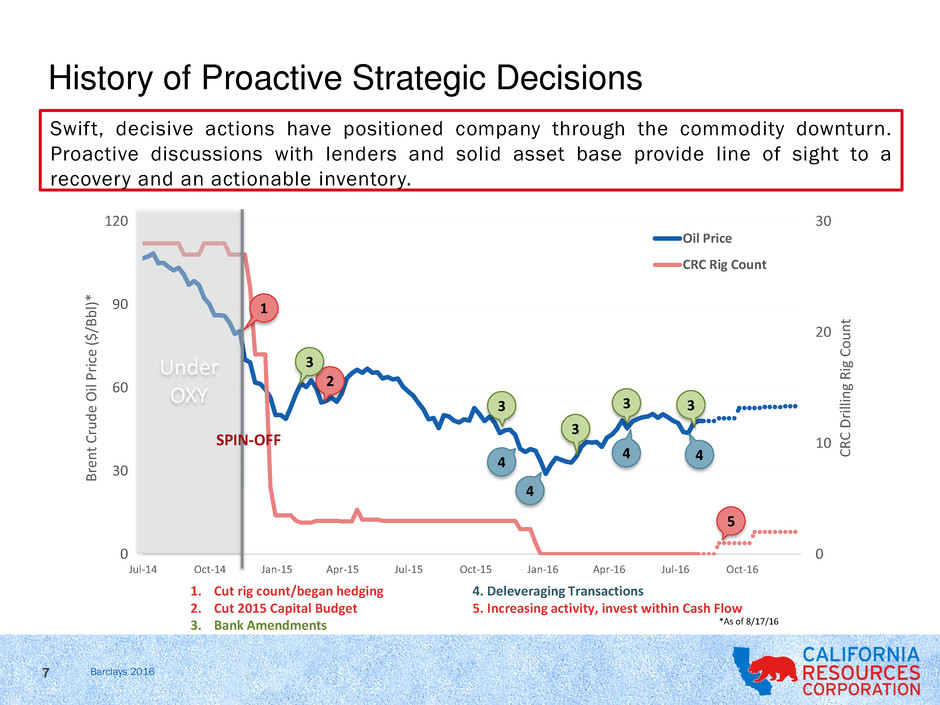

History of Proactive Strategic Decisions

7

Swift, decisive actions have positioned company through the commodity downturn.

Proactive discussions with lenders and solid asset base provide line of sight to a

recovery and an actionable inventory.

0

10

20

30

0

30

60

90

120

Jul-14 Oct-14 Jan-15 Apr-15 Jul-15 Oct-15 Jan-16 Apr-16 Jul-16 Oct-16

C

R

C

D

rilli

n

g

Ri

g

C

o

u

n

t

B

re

n

t

C

ru

d

e

Oil

P

rice

($

/B

b

l)

*

Oil Price

CRC Rig Count

Under

OXY

SPIN-OFF

4

3

2

1

4

*As of 8/17/16

5

3

3

1. Cut rig count/began hedging 4. Deleveraging Transactions

2. Cut 2015 Capital Budget 5. Increasing activity, invest within Cash Flow

3. Bank Amendments

4

4

3

3

Barclays 2016

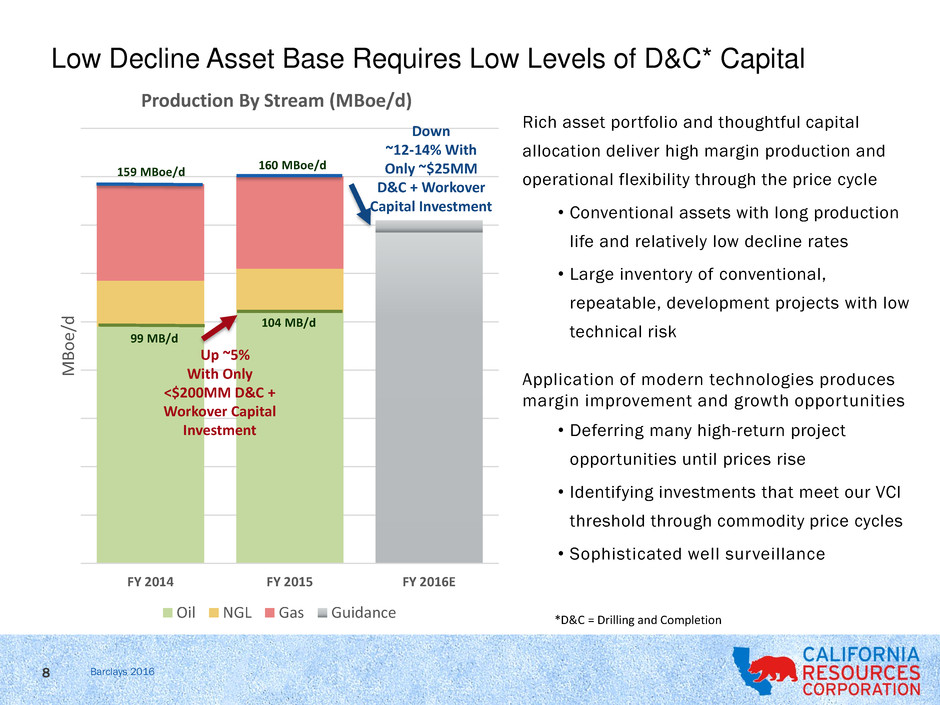

Low Decline Asset Base Requires Low Levels of D&C* Capital

Rich asset portfolio and thoughtful capital

allocation deliver high margin production and

operational flexibility through the price cycle

• Conventional assets with long production

life and relatively low decline rates

• Large inventory of conventional,

repeatable, development projects with low

technical risk

Application of modern technologies produces

margin improvement and growth opportunities

• Deferring many high-return project

opportunities until prices rise

• Identifying investments that meet our VCI

threshold through commodity price cycles

• Sophisticated well surveillance

8

FY 2014 FY 2015 FY 2016E

MB

o

e/

d

Production By Stream (MBoe/d)

Oil NGL Gas Guidance

99 MB/d

104 MB/d

Down

~12-14% With

Only ~$25MM

D&C + Workover

Capital Investment

Up ~5%

With Only

<$200MM D&C +

Workover Capital

Investment

160 MBoe/d

159 MBoe/d

*D&C = Drilling and Completion

Barclays 2016

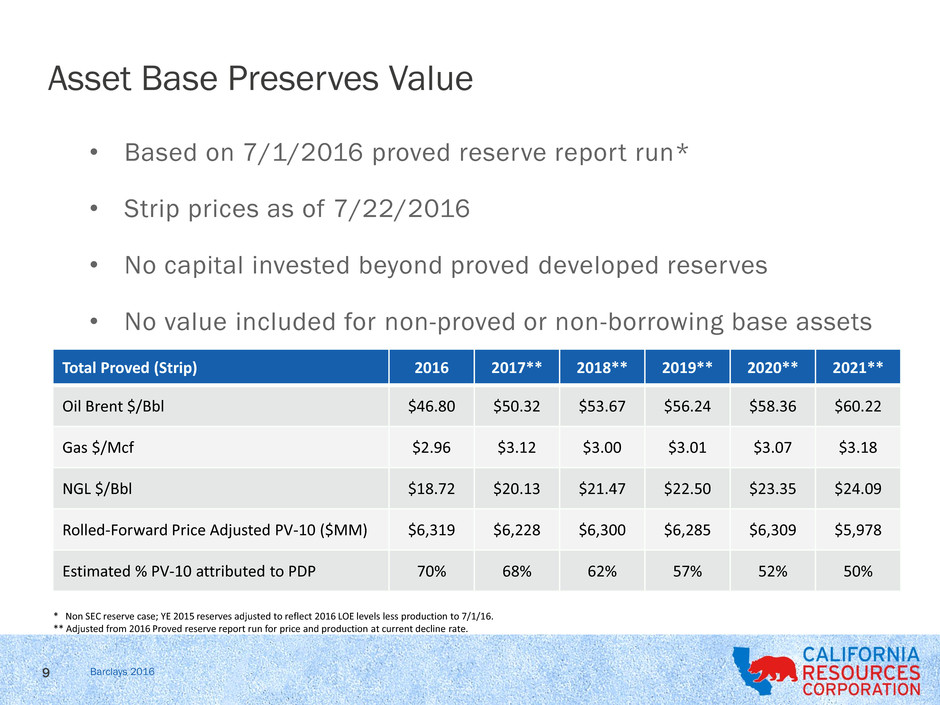

Asset Base Preserves Value

9

• Based on 7/1/2016 proved reserve report run*

• Strip prices as of 7/22/2016

• No capital invested beyond proved developed reserves

• No value included for non-proved or non-borrowing base assets

Total Proved (Strip) 2016 2017** 2018** 2019** 2020** 2021**

Oil Brent $/Bbl $46.80 $50.32 $53.67 $56.24 $58.36 $60.22

Gas $/Mcf $2.96 $3.12 $3.00 $3.01 $3.07 $3.18

NGL $/Bbl $18.72 $20.13 $21.47 $22.50 $23.35 $24.09

Rolled-Forward Price Adjusted PV-10 ($MM) $6,319 $6,228 $6,300 $6,285 $6,309 $5,978

Estimated % PV-10 attributed to PDP 70% 68% 62% 57% 52% 50%

* Non SEC reserve case; YE 2015 reserves adjusted to reflect 2016 LOE levels less production to 7/1/16.

** Adjusted from 2016 Proved reserve report run for price and production at current decline rate.

Barclays 2016

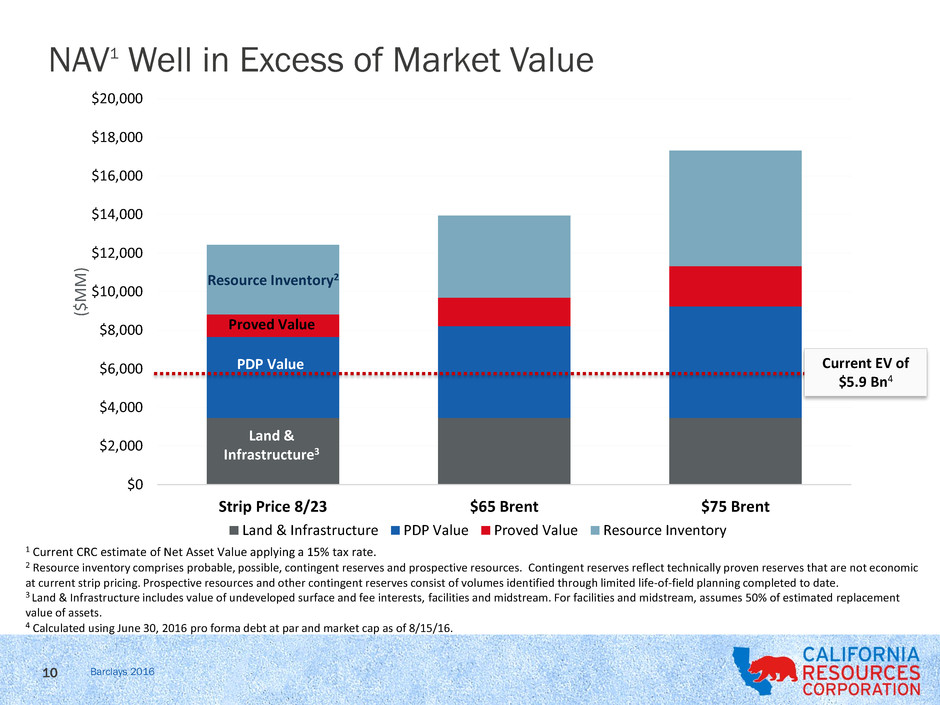

NAV1 Well in Excess of Market Value

10

1 Current CRC estimate of Net Asset Value applying a 15% tax rate.

2 Resource inventory comprises probable, possible, contingent reserves and prospective resources. Contingent reserves reflect technically proven reserves that are not economic

at current strip pricing. Prospective resources and other contingent reserves consist of volumes identified through limited life-of-field planning completed to date.

3 Land & Infrastructure includes value of undeveloped surface and fee interests, facilities and midstream. For facilities and midstream, assumes 50% of estimated replacement

value of assets.

4 Calculated using June 30, 2016 pro forma debt at par and market cap as of 8/15/16.

Land &

Infrastructure3

PDP Value

Proved Value

Resource Inventory2

$0

$2,000

$4,000

$6,000

$8,000

$10,000

$12,000

$14,000

$16,000

$18,000

$20,000

Strip Price 8/23 $65 Brent $75 Brent

($MM

)

Land & Infrastructure PDP Value Proved Value Resource Inventory

Current EV of

$5.9 Bn4

Barclays 2016

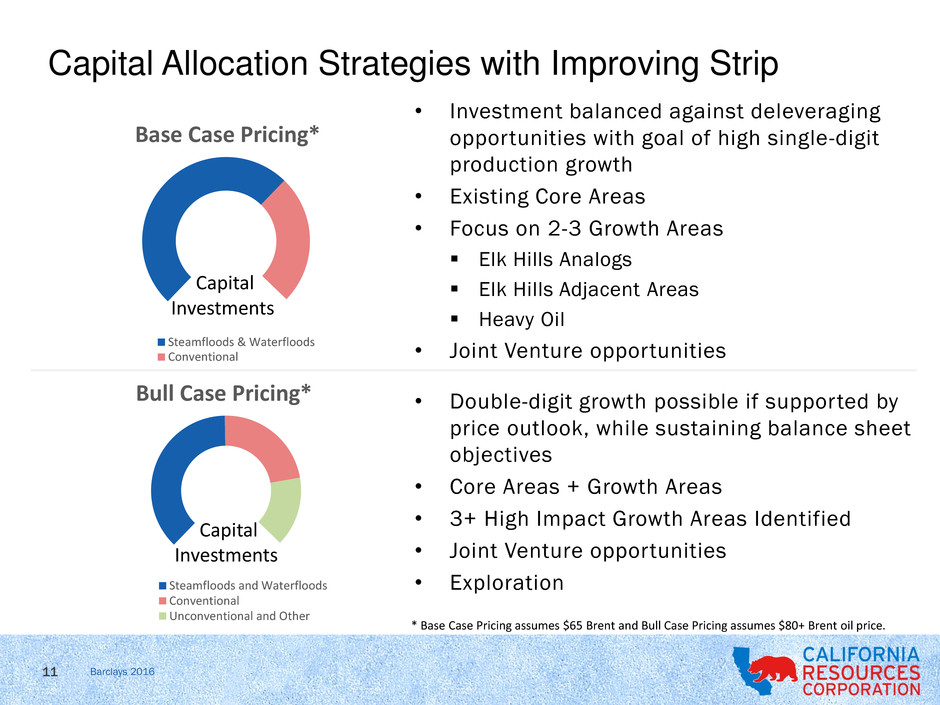

• Investment balanced against deleveraging

opportunities with goal of high single-digit

production growth

• Existing Core Areas

• Focus on 2-3 Growth Areas

Elk Hills Analogs

Elk Hills Adjacent Areas

Heavy Oil

• Joint Venture opportunities

• Double-digit growth possible if supported by

price outlook, while sustaining balance sheet

objectives

• Core Areas + Growth Areas

• 3+ High Impact Growth Areas Identified

• Joint Venture opportunities

• Exploration

Capital Allocation Strategies with Improving Strip

11

Base Case Pricing*

Steamfloods & Waterfloods

Conventional

Bull Case Pricing*

Steamfloods and Waterfloods

Conventional

Unconventional and Other

Capital

Investments

Capital

Investments

* Base Case Pricing assumes $65 Brent and Bull Case Pricing assumes $80+ Brent oil price.

Barclays 2016

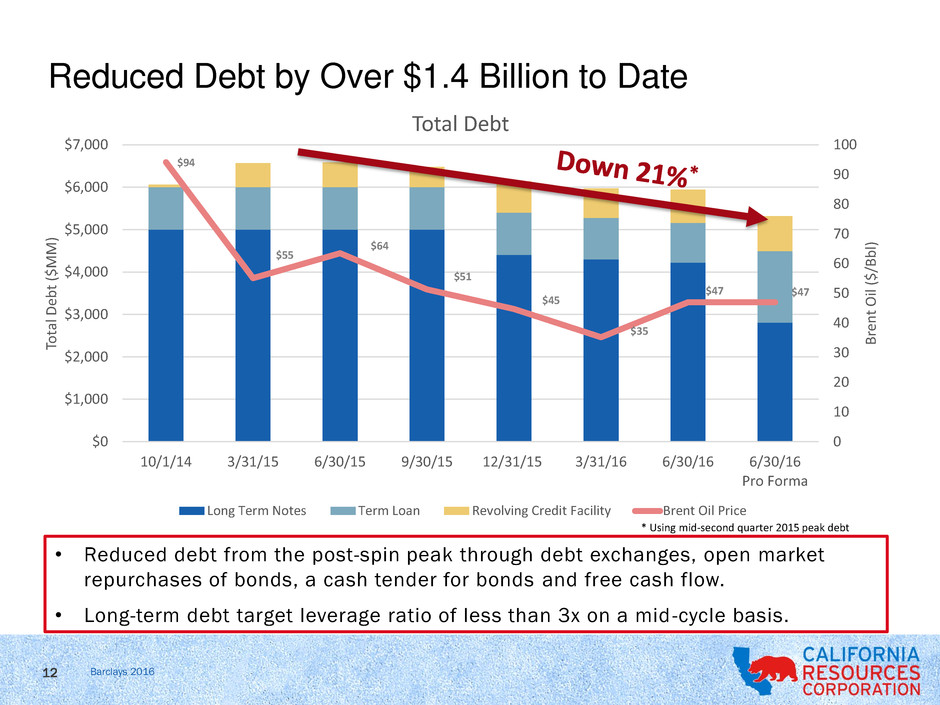

$94

$55

$64

$51

$45

$35

$47 $47

0

10

20

30

40

50

60

70

80

90

100

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

10/1/14 3/31/15 6/30/15 9/30/15 12/31/15 3/31/16 6/30/16 6/30/16

Pro Forma

B

re

n

t

Oil ($

/B

b

l)

Total

D

eb

t

($

M

M

)

Total Debt

Long Term Notes Term Loan Revolving Credit Facility Brent Oil Price

Reduced Debt by Over $1.4 Billion to Date

12

• Reduced debt from the post-spin peak through debt exchanges, open market

repurchases of bonds, a cash tender for bonds and free cash flow.

• Long-term debt target leverage ratio of less than 3x on a mid -cycle basis.

* Using mid-second quarter 2015 peak debt

Barclays 2016

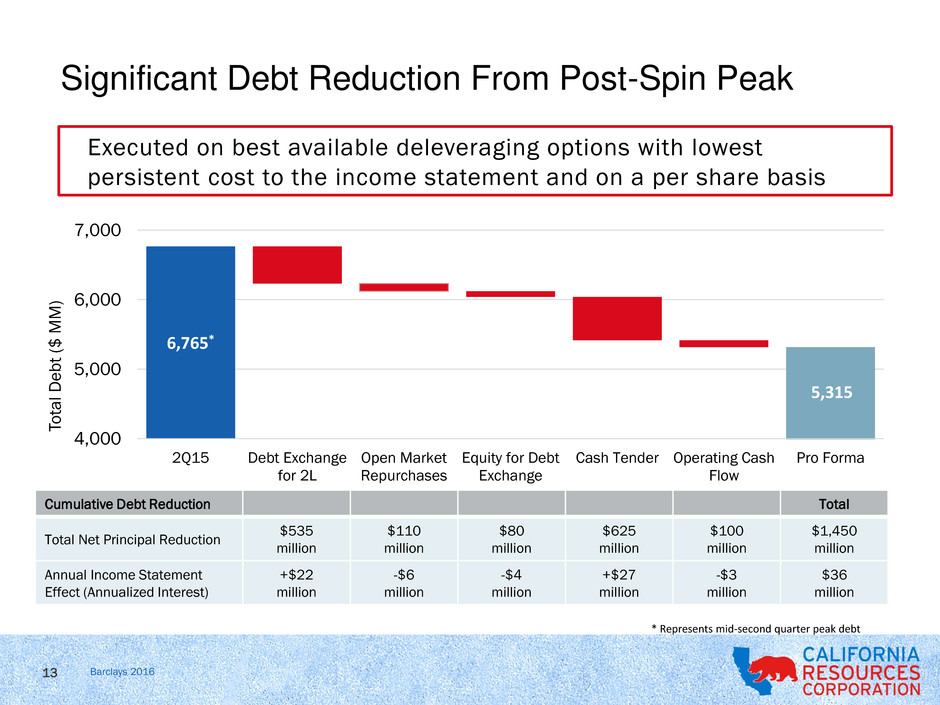

6,765*

5,315

4,000

5,000

6,000

7,000

2Q15 Debt Exchange

for 2L

Open Market

Repurchases

Equity for Debt

Exchange

Cash Tender Operating Cash

Flow

Pro Forma

To

ta

l D

e

b

t

($

MM

)

Significant Debt Reduction From Post-Spin Peak

Executed on best available deleveraging options with lowest

persistent cost to the income statement and on a per share basis

13

Cumulative Debt Reduction Total

Total Net Principal Reduction

$535

million

$110

million

$80

million

$625

million

$100

million

$1,450

million

Annual Income Statement

Effect (Annualized Interest)

+$22

million

-$6

million

-$4

million

+$27

million

-$3

million

$36

million

* Represents mid-second quarter peak debt

Barclays 2016

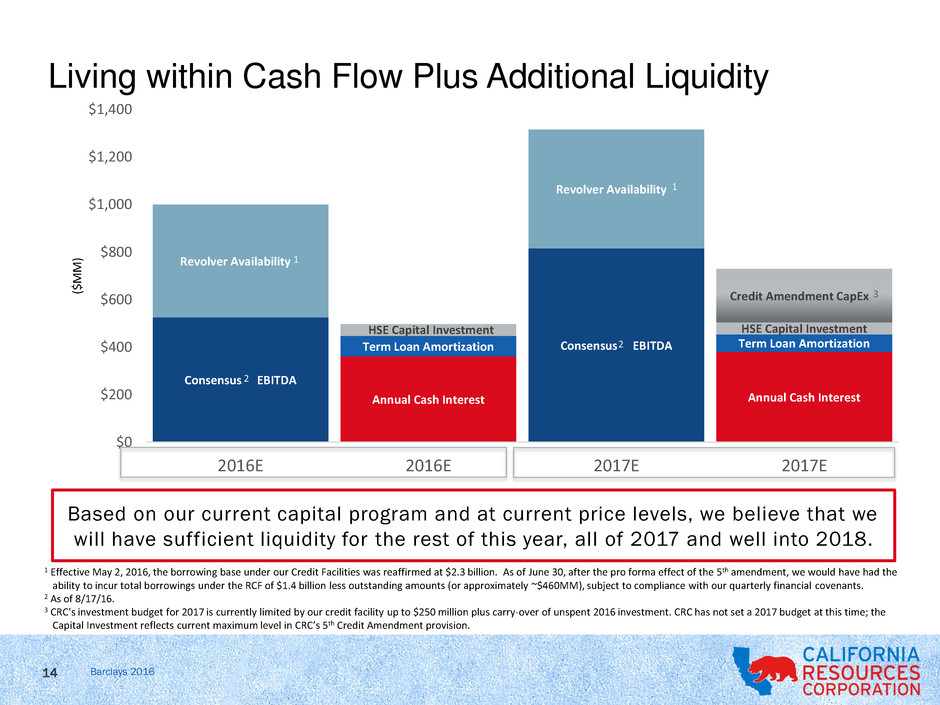

Living within Cash Flow Plus Additional Liquidity

14

Based on our current capital program and at current price levels, we believe that we

will have sufficient liquidity for the rest of this year, all of 2017 and well into 2018.

Consensus2 EBITDA

Consensus2 EBITDA

Revolver Availability 1

Revolver Availability 1

Annual Cash Interest Annual Cash Interest

Term Loan Amortization Term Loan Amortization

HSE Capital Investment HSE Capital Investment

Credit Amendment CapEx 2

$0

$200

$400

$600

$800

$1,000

$1,200

$1,400

2016E 2016E 2017E 2017E

($MM

)

2

1 Effective May 2, 2016, the borrowing base under our Credit Facilities was reaffirmed at $2.3 billion. As of June 30, after the pro forma effect of the 5th amendment, we would have had the

ability to incur total borrowings under the RCF of $1.4 billion less outstanding amounts (or approximately ~$460MM), subject to compliance with our quarterly financial covenants.

2 As of 8/17/16.

3 CRC’s investment budget for 2017 is currently limited by our credit facility up to $250 million plus carry-over of unspent 2016 investment. CRC has not set a 2017 budget at this time; the

Capital Investment reflects current maximum level in CRC’s 5th Credit Amendment provision.

1

1

3

2

Barclays 2016

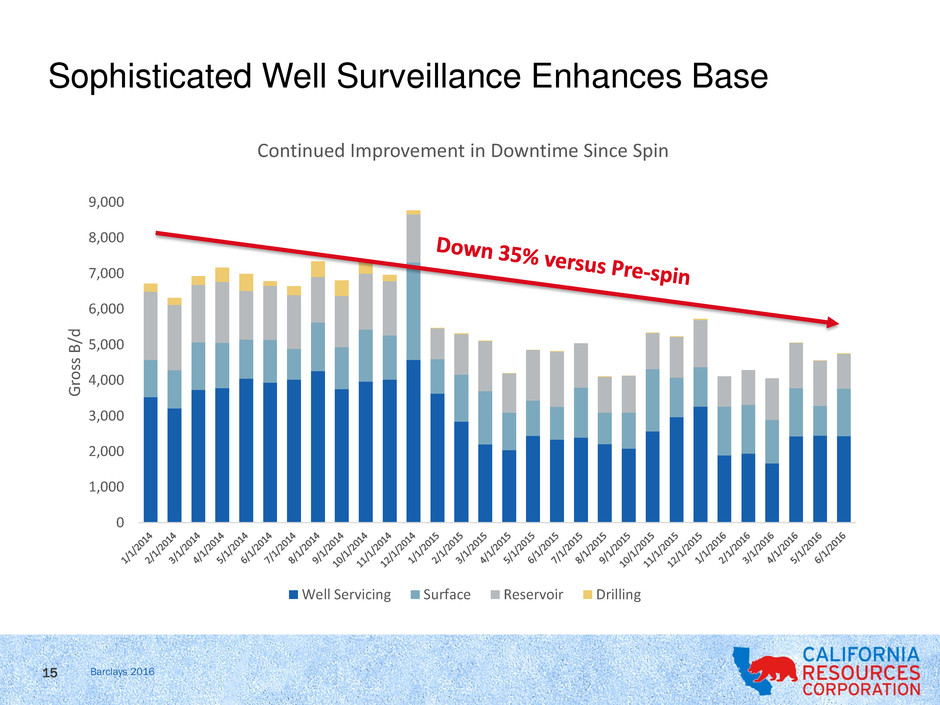

Sophisticated Well Surveillance Enhances Base

15

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

G

ro

ss

B

/d

Continued Improvement in Downtime Since Spin

Well Servicing Surface Reservoir Drilling

Barclays 2016

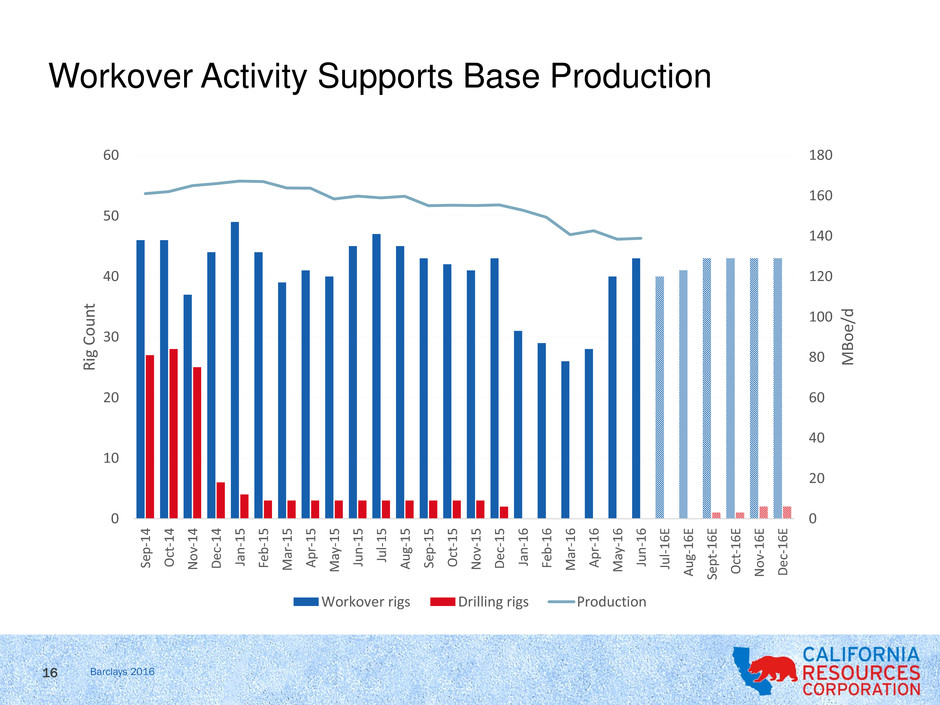

Workover Activity Supports Base Production

16

0

20

40

60

80

100

120

140

160

180

0

10

20

30

40

50

60

Se

p

-1

4

O

ct-

1

4

N

o

v-

14

D

ec-

1

4

Ja

n

-1

5

Fe

b

-1

5

M

ar

-1

5

A

p

r-1

5

M

ay-

1

5

Ju

n

-1

5

Ju

l-

1

5

A

u

g-1

5

Se

p

-1

5

O

ct-

1

5

N

o

v-

15

D

ec-

1

5

Ja

n

-1

6

Fe

b

-1

6

M

ar

-1

6

A

p

r-1

6

M

ay-

1

6

Ju

n

-1

6

Ju

l-

1

6E

A

u

g-1

6

E

Se

p

t-

16

E

O

ct-1

6

E

N

o

v-

16

E

D

ec-

1

6

E

MBo

e/

d

R

ig

C

o

u

n

t

Workover rigs Drilling rigs Production

Barclays 2016

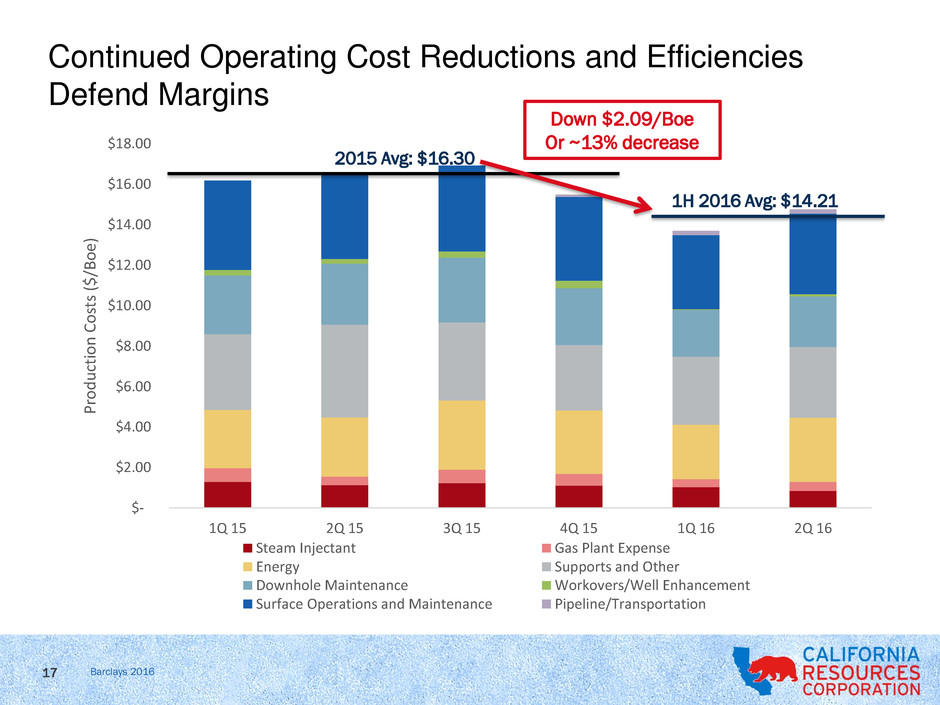

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

1Q 15 2Q 15 3Q 15 4Q 15 1Q 16 2Q 16

P

ro

d

u

ct

io

n

C

o

st

s ($

/B

o

e)

Steam Injectant Gas Plant Expense

Energy Supports and Other

Downhole Maintenance Workovers/Well Enhancement

Surface Operations and Maintenance Pipeline/Transportation

17

Continued Operating Cost Reductions and Efficiencies

Defend Margins

1H 2016 Avg: $14.21

2015 Avg: $16.30

Down $2.09/Boe

Or ~13% decrease

Barclays 2016

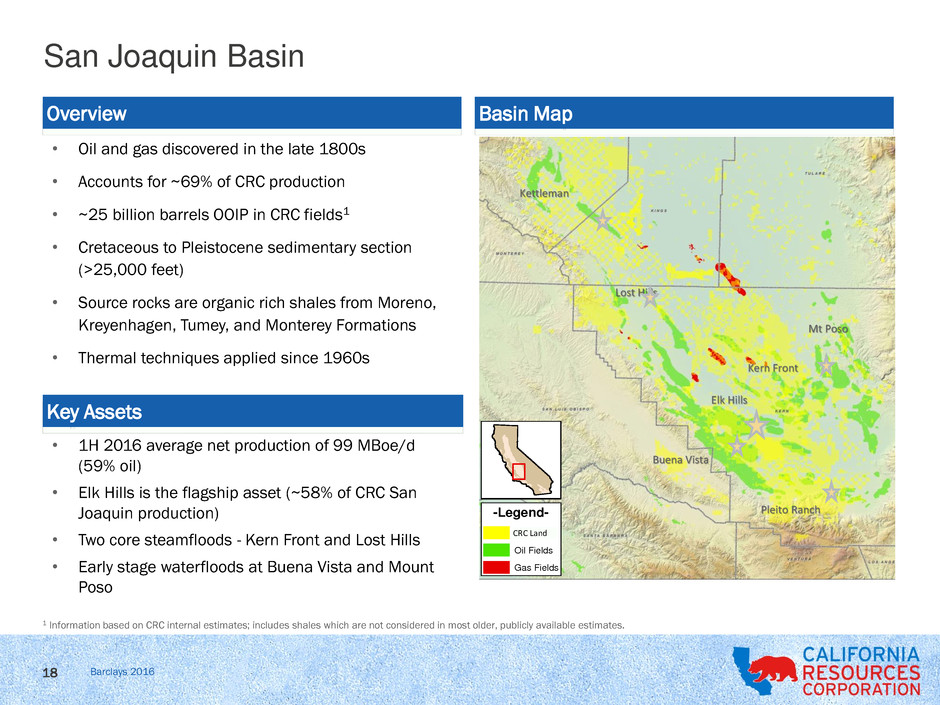

San Joaquin Basin

• Oil and gas discovered in the late 1800s

• Accounts for ~69% of CRC production

• ~25 billion barrels OOIP in CRC fields1

• Cretaceous to Pleistocene sedimentary section

(>25,000 feet)

• Source rocks are organic rich shales from Moreno,

Kreyenhagen, Tumey, and Monterey Formations

• Thermal techniques applied since 1960s

• 1H 2016 average net production of 99 MBoe/d

(59% oil)

• Elk Hills is the flagship asset (~58% of CRC San

Joaquin production)

• Two core steamfloods - Kern Front and Lost Hills

• Early stage waterfloods at Buena Vista and Mount

Poso

Overview

Key Assets

Basin Map

-Legend-

Oxy Land

Oil Fields

Gas Fields

Buena Vista

Pleito Ranch

Elk Hills

Kettleman

Lost Hills

Mt Poso

CRC Land

Kern Front

1 Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates.

18

Barclays 2016

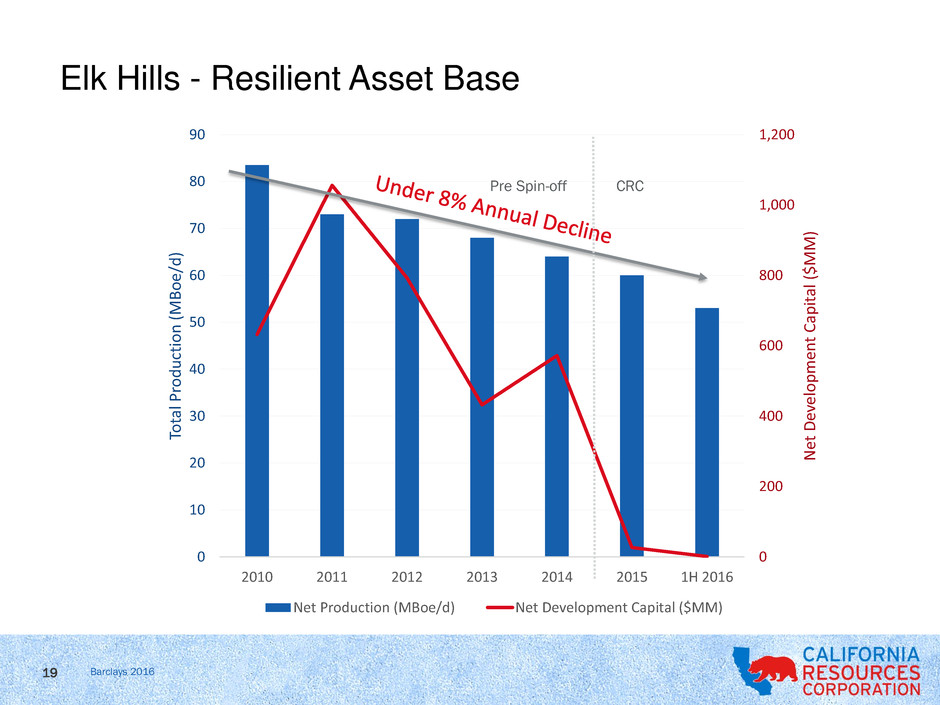

0

200

400

600

800

1,000

1,200

0

10

20

30

40

50

60

70

80

90

2010 2011 2012 2013 2014 2015 1H 2016

N

et

D

ev

el

o

pme

n

t

Ca

p

it

al

(

$MM

)

To

ta

l P

ro

d

u

ct

io

n

(

MBo

e/d

)

Net Production (MBoe/d) Net Development Capital ($MM)

CRCPre Spin-off

Elk Hills - Resilient Asset Base

19

Barclays 2016

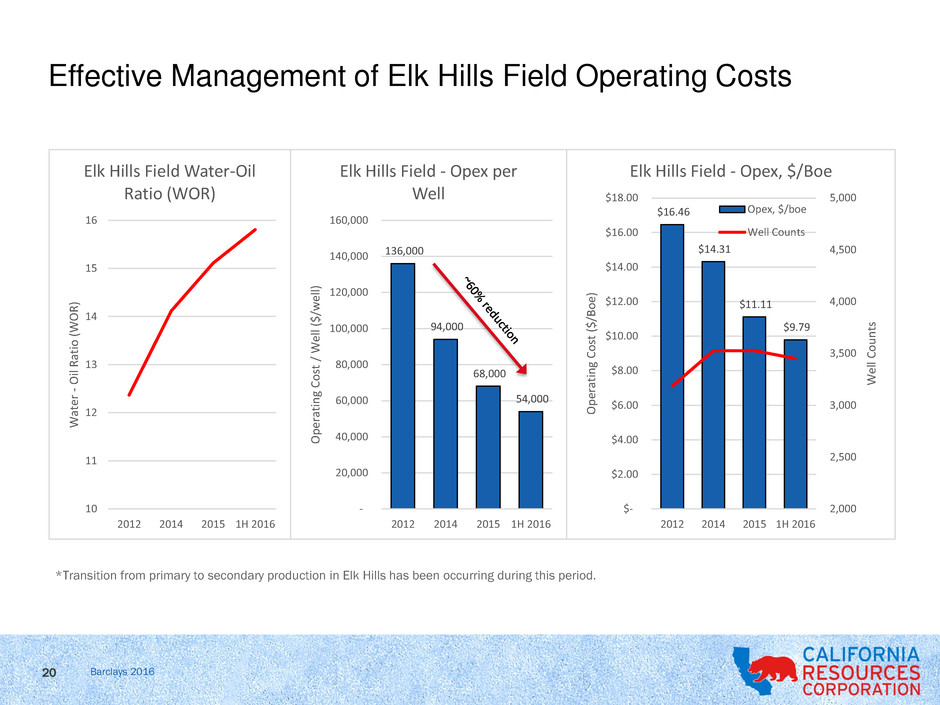

Effective Management of Elk Hills Field Operating Costs

20

136,000

94,000

68,000

54,000

-

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

2012 2014 2015 1H 2016

O

p

er

ati

n

g Co

st

/

We

ll

($

/w

ell

)

Elk Hills Field - Opex per

Well

10

11

12

13

14

15

16

2012 2014 2015 1H 2016

W

ater

-

Oil R

ati

o

(W

O

R

)

Elk Hills Field Water-Oil

Ratio (WOR)

$16.46

$14.31

$11.11

$9.79

2,000

2,500

3,000

3,500

4,000

4,500

5,000

$-

$2.00

$4.00

$6.00

$8.00

$10.00

$12.00

$14.00

$16.00

$18.00

2012 2014 2015 1H 2016

We

ll

Co

u

n

ts

O

p

er

ati

n

g

Co

st

($

/Bo

e)

Elk Hills Field - Opex, $/Boe

Opex, $/boe

Well Counts

*Transition from primary to secondary production in Elk Hills has been occurring during this period.

Barclays 2016

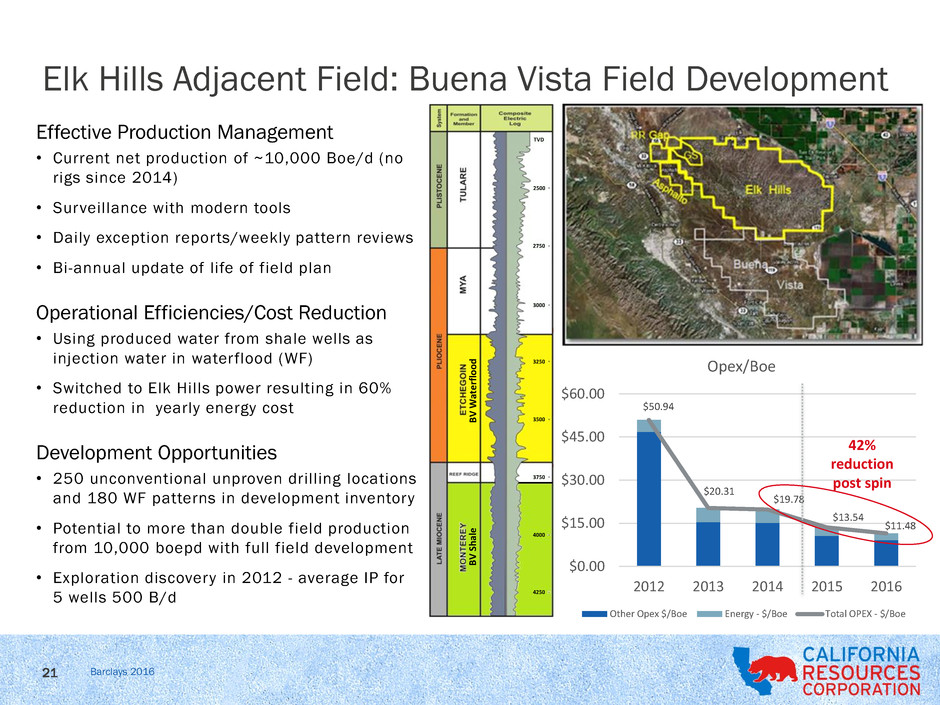

Elk Hills Adjacent Field: Buena Vista Field Development

21

2500

TVD

2750

3000

3250

3750

4000

4250

3500

B

V

S

ha

le

B

V

W

at

e

rf

loo

d

Effective Production Management

• Current net production of ~10,000 Boe/d (no

rigs since 2014)

• Surveillance with modern tools

• Daily exception reports/weekly pattern reviews

• Bi-annual update of life of field plan

Operational Efficiencies/Cost Reduction

• Using produced water from shale wells as

injection water in waterflood (WF)

• Switched to Elk Hills power resulting in 60%

reduction in yearly energy cost

Development Opportunities

• 250 unconventional unproven drilling locations

and 180 WF patterns in development inventory

• Potential to more than double field production

from 10,000 boepd with full field development

• Exploration discovery in 2012 - average IP for

5 wells 500 B/d

$50.94

$20.31

$19.78

$13.54

$11.48

$0.00

$15.00

$30.00

$45.00

$60.00

2012 2013 2014 2015 2016

Opex/Boe

Other Opex $/Boe Energy - $/Boe Total OPEX - $/Boe

42%

reduction

post spin

Barclays 2016

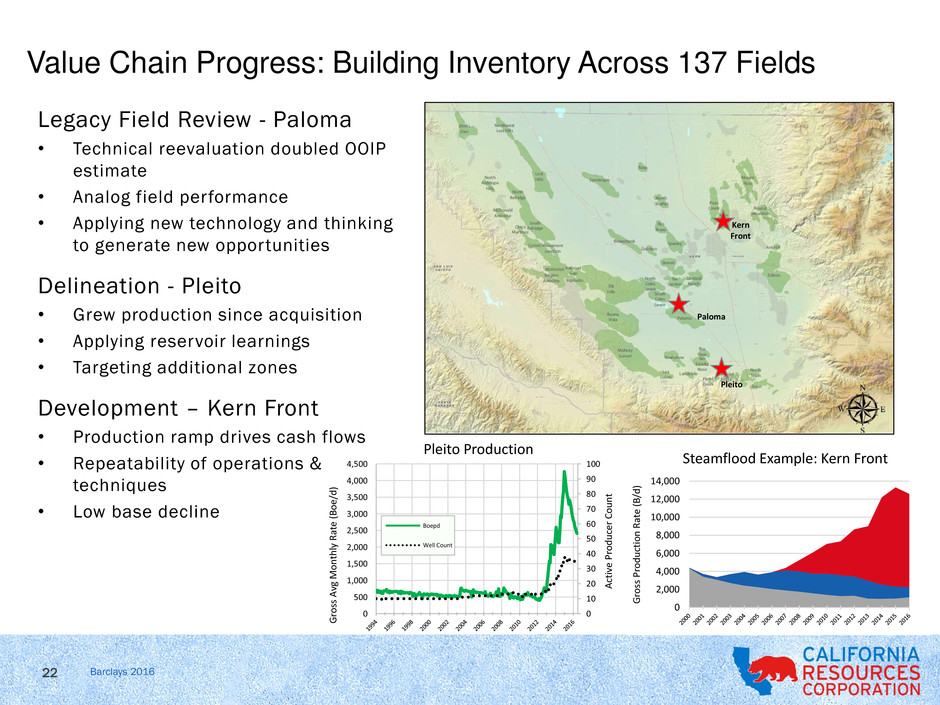

Value Chain Progress: Building Inventory Across 137 Fields

22

Legacy Field Review - Paloma

• Technical reevaluation doubled OOIP

estimate

• Analog field performance

• Applying new technology and thinking

to generate new opportunities

Delineation - Pleito

• Grew production since acquisition

• Applying reservoir learnings

• Targeting additional zones

Development – Kern Front

• Production ramp drives cash flows

• Repeatability of operations &

techniques

• Low base decline

0

10

20

30

40

50

60

70

80

90

100

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

A

ct

iv

e

P

ro

d

u

ce

r Co

u

n

t

G

ro

ss

A

vg

M

o

n

th

ly

R

at

e

(B

o

e/

d

)

Pleito Production

Boepd

Well Count

0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

G

ro

ss

P

ro

d

u

ct

io

n

R

at

e

(B

/d

)

Steamflood Example: Kern Front

Kern

Front

Paloma

Pleito

Barclays 2016

Progressing Inventory to VCI Threshold

23

Economic Project Inventory

Brent Marker Price ($/Bbl)

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

2015 2016 2015 2016 2015 2016

$40 $50 $60

Dri

llin

g

an

d

W

o

rk

o

ver

C

ap

ex

(

$

M

M

)

VCI > 1.0

VCI > 1.3

Barclays 2016

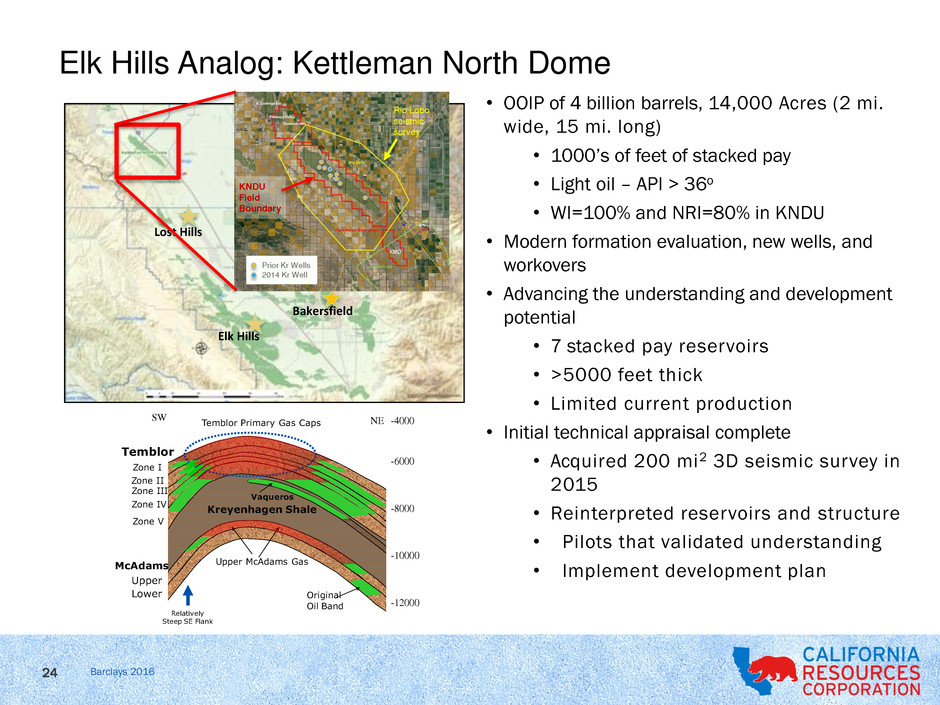

Elk Hills Analog: Kettleman North Dome

24

• OOIP of 4 billion barrels, 14,000 Acres (2 mi.

wide, 15 mi. long)

• 1000’s of feet of stacked pay

• Light oil – API > 36o

• WI=100% and NRI=80% in KNDU

• Modern formation evaluation, new wells, and

workovers

• Advancing the understanding and development

potential

• 7 stacked pay reservoirs

• >5000 feet thick

• Limited current production

• Initial technical appraisal complete

• Acquired 200 mi2 3D seismic survey in

2015

• Reinterpreted reservoirs and structure

• Pilots that validated understanding

• Implement development plan

Bakersfield

Elk Hills

Lost Hills

Relatively

Steep SE Flank

-4000

-6000

-8000

-10000

-12000

Temblor

McA ams

Upper

Lower

Zone I

Zone II

Zone III

Zone IV

Zone V

SW NE

Vaqueros

Upper McAdams Gas

Original

Oil Band

Temblor Primary Gas Caps

Kreyenhagen Shale

Prior Kr Wells

2014 Kr Well

Rio Lobo

seismic

survey

KNDU

Field

Boundary

Barclays 2016 NY00813G / 589203_1.WOR

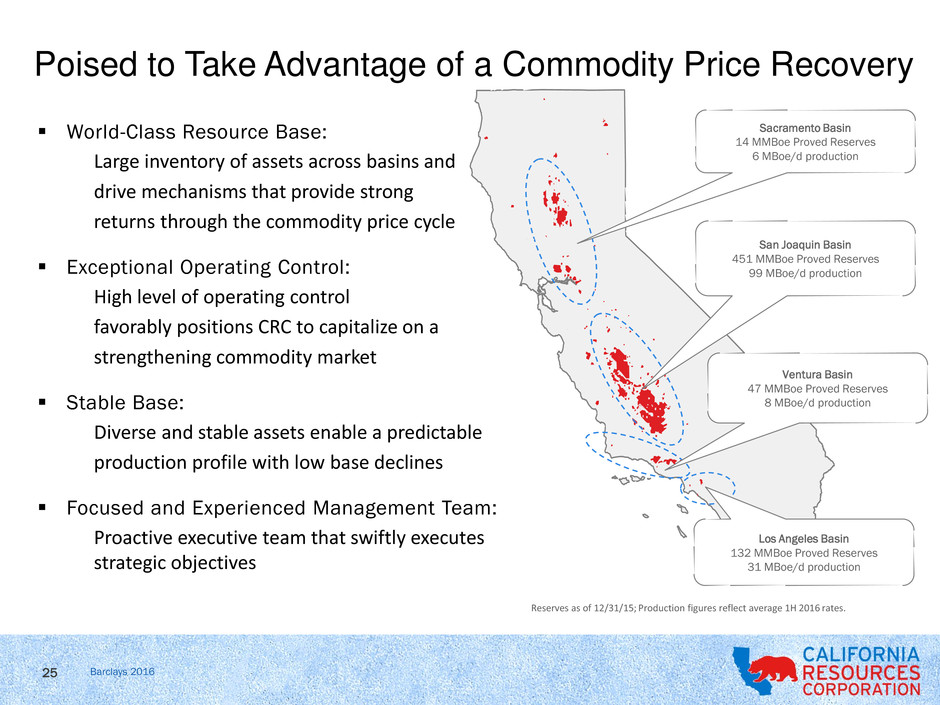

Sacramento Basin

14 MMBoe Proved Reserves

6 MBoe/d production

San Joaquin Basin

451 MMBoe Proved Reserves

99 MBoe/d production

Ventura Basin

47 MMBoe Proved Reserves

8 MBoe/d production

Los Angeles Basin

132 MMBoe Proved Reserves

31 MBoe/d production

World-Class Resource Base:

Large inventory of assets across basins and

drive mechanisms that provide strong

returns through the commodity price cycle

Exceptional Operating Control:

High level of operating control

favorably positions CRC to capitalize on a

strengthening commodity market

Stable Base:

Diverse and stable assets enable a predictable

production profile with low base declines

Focused and Experienced Management Team:

Proactive executive team that swiftly executes

strategic objectives

Poised to Take Advantage of a Commodity Price Recovery

Reserves as of 12/31/15; Production figures reflect average 1H 2016 rates.

25

Barclays 2016

California Resources Corporation

Appendix

26

Barclays 2016

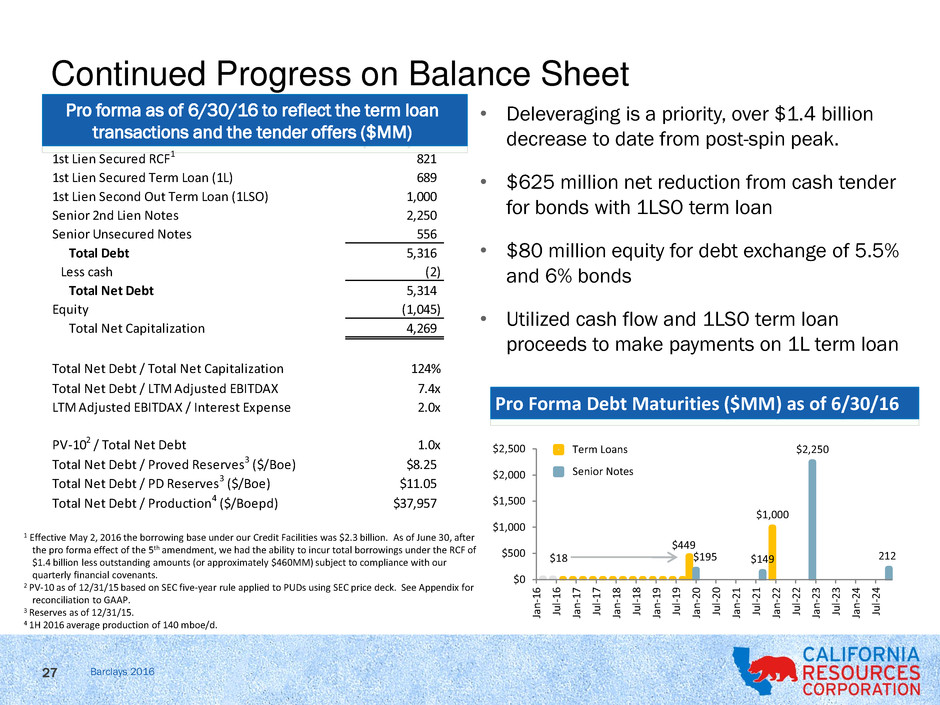

Pro forma as of 6/30/16 to reflect the term loan

transactions and the tender offers ($MM)

$18

$449

$1,000

$195 $149

$2,250

212

$0

$500

$1,000

$1,500

$2,000

$2,500

Ja

n

-1

6

Ju

l-1

6

Ja

n

-1

7

Ju

l-1

7

Ja

n

-1

8

Ju

l-1

8

Ja

n

-1

9

Ju

l-1

9

Ja

n

-2

0

Ju

l-2

0

Ja

n

-2

1

Ju

l-2

1

Ja

n

-2

2

Ju

l-2

2

Ja

n

-2

3

Ju

l-2

3

Ja

n

-2

4

Ju

l-2

4

Term Loans

Senior Notes

Pro Forma Debt Maturities ($MM) as of 6/30/16

Continued Progress on Balance Sheet

• Deleveraging is a priority, over $1.4 billion

decrease to date from post-spin peak.

• $625 million net reduction from cash tender

for bonds with 1LSO term loan

• $80 million equity for debt exchange of 5.5%

and 6% bonds

• Utilized cash flow and 1LSO term loan

proceeds to make payments on 1L term loan

1 Effective May 2, 2016 the borrowing base under our Credit Facilities was $2.3 billion. As of June 30, after

the pro forma effect of the 5th amendment, we had the ability to incur total borrowings under the RCF of

$1.4 billion less outstanding amounts (or approximately $460MM) subject to compliance with our

quarterly financial covenants.

2 PV-10 as of 12/31/15 based on SEC five-year rule applied to PUDs using SEC price deck. See Appendix for

reconciliation to GAAP.

3 Reserves as of 12/31/15.

4 1H 2016 average production of 140 mboe/d.

1st Lien Secured RCF1 821

1st Lien Secured Term Loan (1L) 689

1st Lien Second Out Term Loan (1LSO) 1,000

Senior 2nd Lien Notes 2,250

Senior Unsecured Notes 556

Total Debt 5,316

Less cash (2)

Total Net Debt 5,314

Equity (1,045)

Total Net Capitalization 4,269

Total Net Debt / Total Net Capitalization 124%

Total Net Debt / LTM Adjusted EBITDAX 7.4x

LTM Adjusted EBITDAX / Interest Expense 2.0x

PV-102 / Total Net Debt 1.0x

Total Net Debt / Proved Reserves3 ($/Boe) $8.25

Total Net Debt / PD Res rves3 ($/Boe) $11.05

Total Net Debt / Production4 ($/Boepd) $37,957

27

Barclays 2016

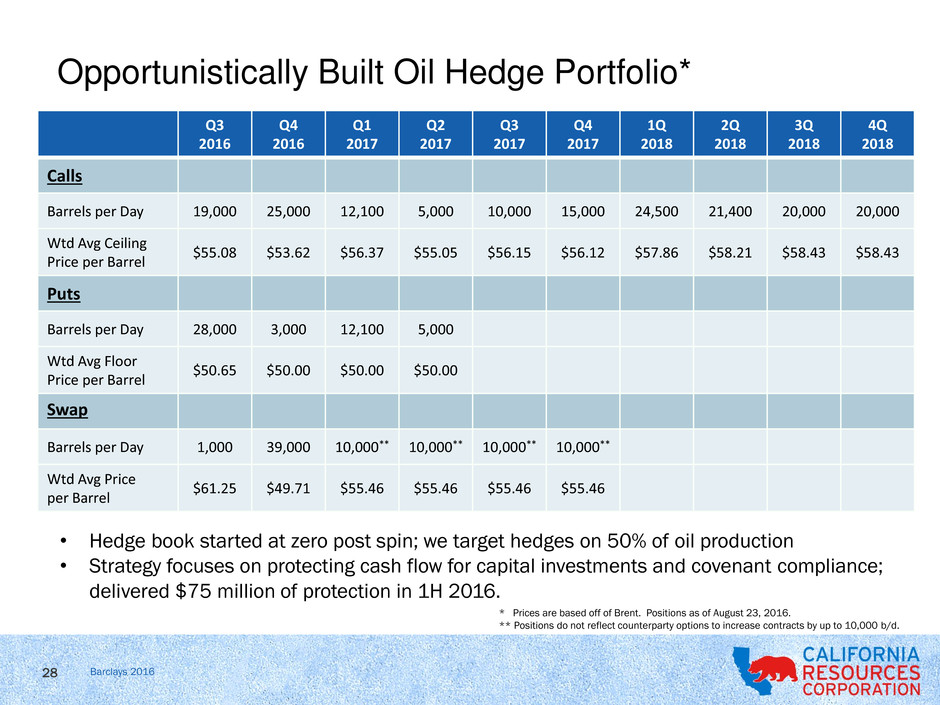

Opportunistically Built Oil Hedge Portfolio*

• Hedge book started at zero post spin; we target hedges on 50% of oil production

• Strategy focuses on protecting cash flow for capital investments and covenant compliance;

delivered $75 million of protection in 1H 2016.

Q3

2016

Q4

2016

Q1

2017

Q2

2017

Q3

2017

Q4

2017

1Q

2018

2Q

2018

3Q

2018

4Q

2018

Calls

Barrels per Day 19,000 25,000 12,100 5,000 10,000 15,000 24,500 21,400 20,000 20,000

Wtd Avg Ceiling

Price per Barrel

$55.08 $53.62 $56.37 $55.05 $56.15 $56.12 $57.86 $58.21 $58.43 $58.43

Puts

Barrels per Day 28,000 3,000 12,100 5,000

Wtd Avg Floor

Price per Barrel

$50.65 $50.00 $50.00 $50.00

Swap

Barrels per Day 1,000 39,000 10,000** 10,000** 10,000** 10,000**

Wtd Avg Price

per Barrel

$61.25 $49.71 $55.46 $55.46 $55.46 $55.46

28

* Prices are based off of Brent. Positions as of August 23, 2016.

** Positions do not reflect counterparty options to increase contracts by up to 10,000 b/d.

Barclays 2016

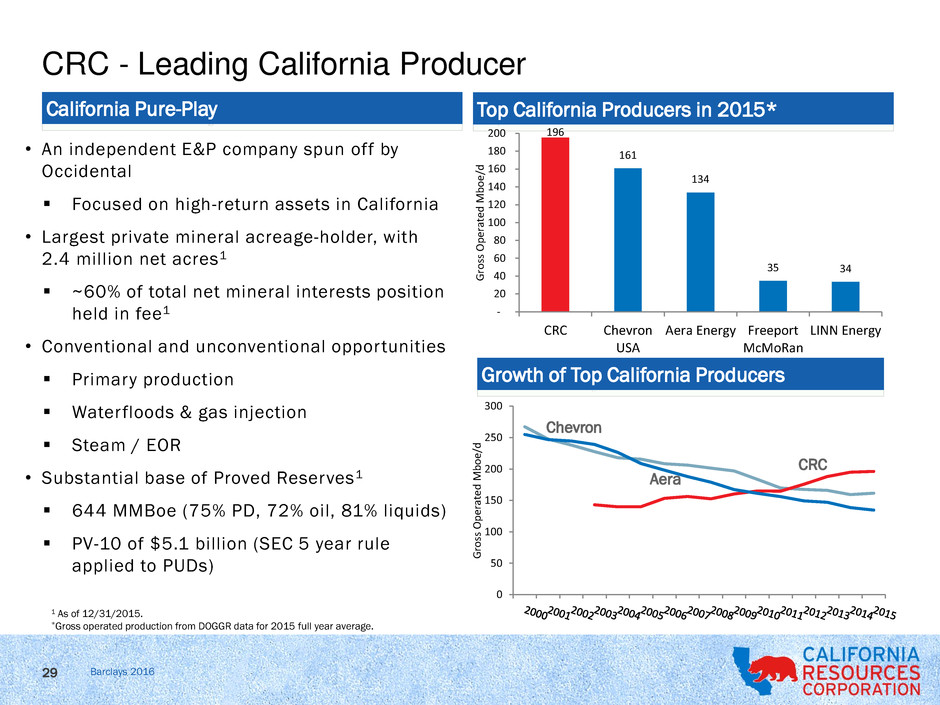

CRC - Leading California Producer

California Pure-Play Top California Producers in 2015*

• An independent E&P company spun off by

Occidental

Focused on high-return assets in California

• Largest private mineral acreage-holder, with

2.4 million net acres1

~60% of total net mineral interests position

held in fee1

• Conventional and unconventional opportunities

Primary production

Waterfloods & gas injection

Steam / EOR

• Substantial base of Proved Reserves1

644 MMBoe (75% PD, 72% oil, 81% liquids)

PV-10 of $5.1 billion (SEC 5 year rule

applied to PUDs)

1 As of 12/31/2015.

*Gross operated production from DOGGR data for 2015 full year average.

29

0

50

100

150

200

250

300

G

ro

ss

O

p

era

te

d

M

b

o

e/

d

Growth of Top California Producers

196

161

134

35 34

-

20

40

60

80

100

120

140

160

180

200

CRC Chevron

USA

Aera Energy Freeport

McMoRan

LINN Energy

G

ro

ss

O

p

era

te

d

M

b

o

e/

d

Aera

Chevron

CRC

Barclays 2016

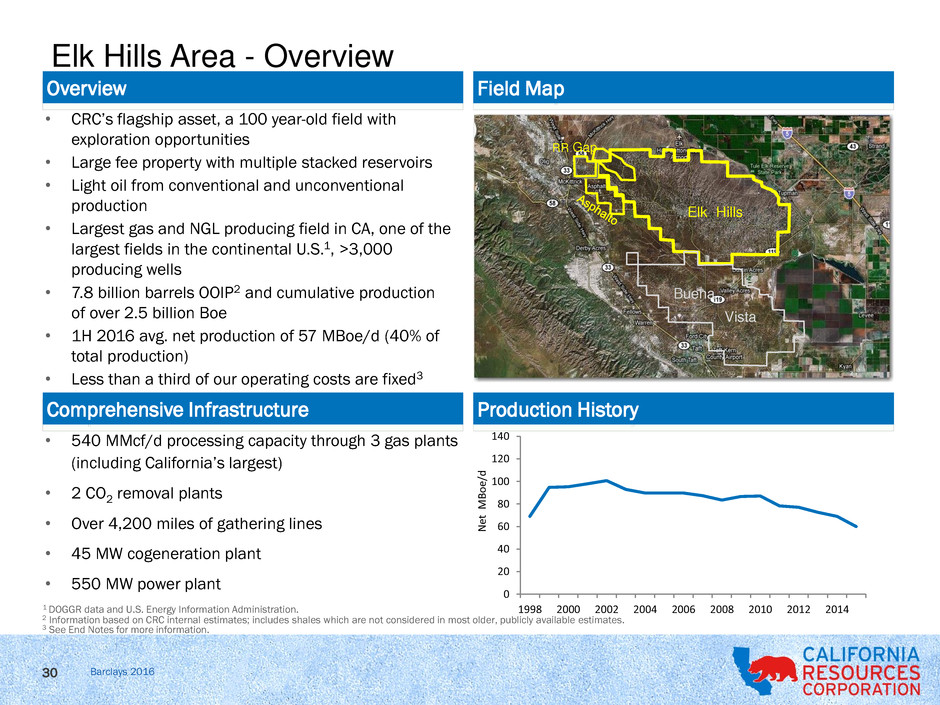

0

20

40

60

80

100

120

140

1998 2000 2002 2004 2006 2008 2010 2012 2014

N

et

MB

o

e/

d

• CRC’s flagship asset, a 100 year-old field with

exploration opportunities

• Large fee property with multiple stacked reservoirs

• Light oil from conventional and unconventional

production

• Largest gas and NGL producing field in CA, one of the

largest fields in the continental U.S.1, >3,000

producing wells

• 7.8 billion barrels OOIP2 and cumulative production

of over 2.5 billion Boe

• 1H 2016 avg. net production of 57 MBoe/d (40% of

total production)

• Less than a third of our operating costs are fixed3

• 540 MMcf/d processing capacity through 3 gas plants

(including California’s largest)

• 2 CO2 removal plants

• Over 4,200 miles of gathering lines

• 45 MW cogeneration plant

• 550 MW power plant

Overview

Comprehensive Infrastructure

Field Map

Production History

1 DOGGR data and U.S. Energy Information Administration.

Elk Hills

Buena

Vista

RR Gap

Elk Hills Area - Overview

2 Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates.

30

3 See End Notes for more information.

Barclays 2016

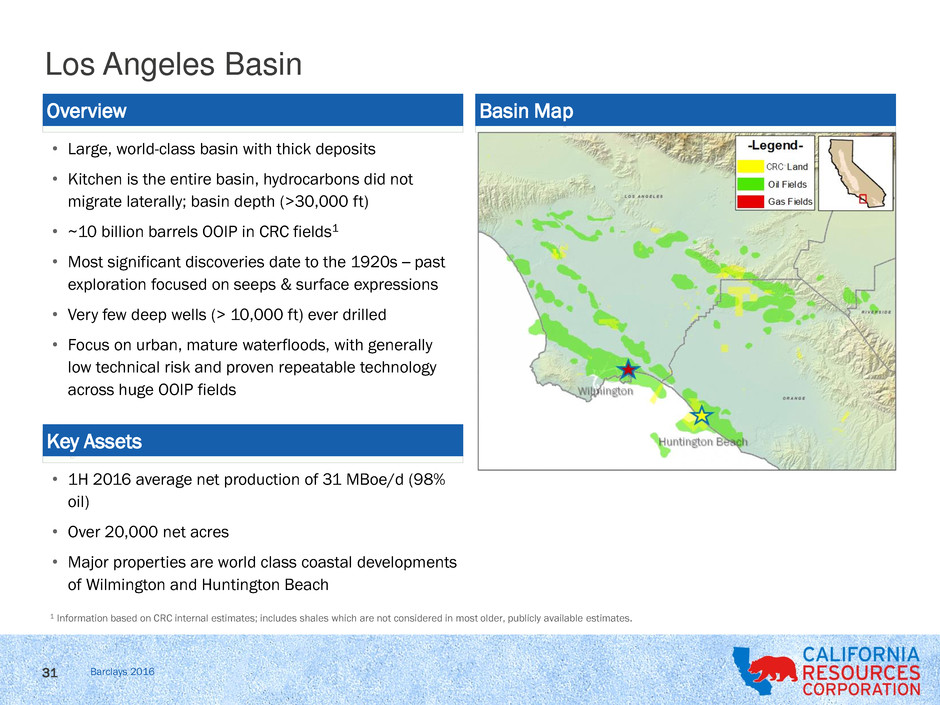

Los Angeles Basin

• Large, world-class basin with thick deposits

• Kitchen is the entire basin, hydrocarbons did not

migrate laterally; basin depth (>30,000 ft)

• ~10 billion barrels OOIP in CRC fields1

• Most significant discoveries date to the 1920s – past

exploration focused on seeps & surface expressions

• Very few deep wells (> 10,000 ft) ever drilled

• Focus on urban, mature waterfloods, with generally

low technical risk and proven repeatable technology

across huge OOIP fields

• 1H 2016 average net production of 31 MBoe/d (98%

oil)

• Over 20,000 net acres

• Major properties are world class coastal developments

of Wilmington and Huntington Beach

Overview

Key Assets

Basin Map

31

1 Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates.

Barclays 2016

-

50

100

150

200

250

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

M

M

B

o

e

Net Proved Reserves Production to Date

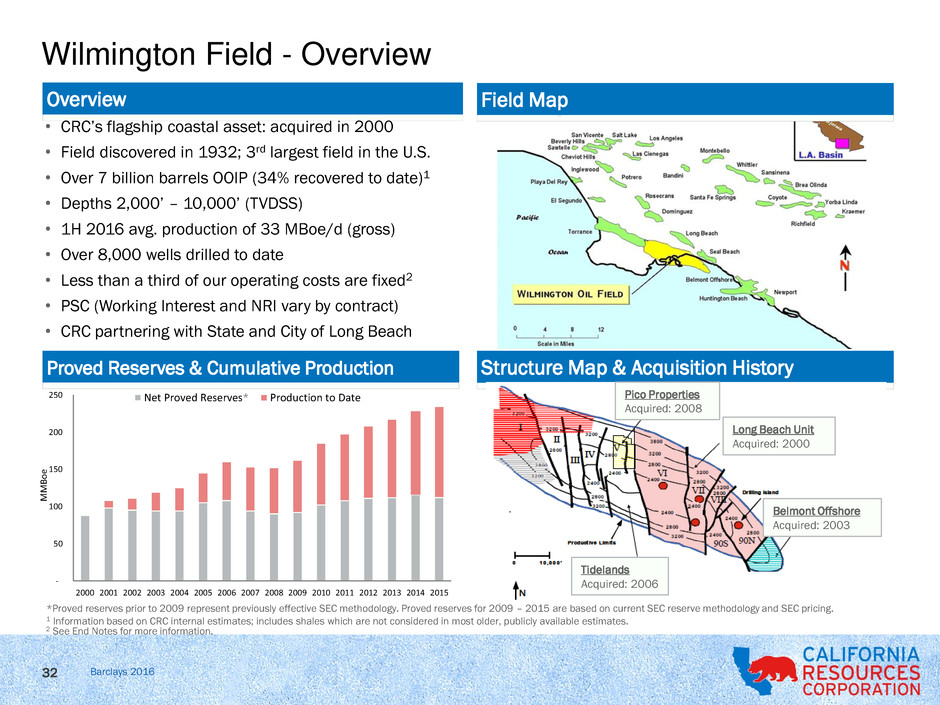

Overview Field Map

Proved Reserves & Cumulative Production Structure Map & Acquisition History

*

• CRC’s flagship coastal asset: acquired in 2000

• Field discovered in 1932; 3rd largest field in the U.S.

• Over 7 billion barrels OOIP (34% recovered to date)1

• Depths 2,000’ – 10,000’ (TVDSS)

• 1H 2016 avg. production of 33 MBoe/d (gross)

• Over 8,000 wells drilled to date

• Less than a third of our operating costs are fixed2

• PSC (Working Interest and NRI vary by contract)

• CRC partnering with State and City of Long Beach

*Proved reserves prior to 2009 represent previously effective SEC methodology. Proved reserves for 2009 – 2015 are based on current SEC reserve methodology and SEC pricing.

1 Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates.

Tidelands

Acquired: 2006

Belmont Offshore

Acquired: 2003

Long Beach Unit

Acquired: 2000

Pico Properties

Acquired: 2008

Wilmington Field - Overview

32

2 See End Notes for more information.

Barclays 2016

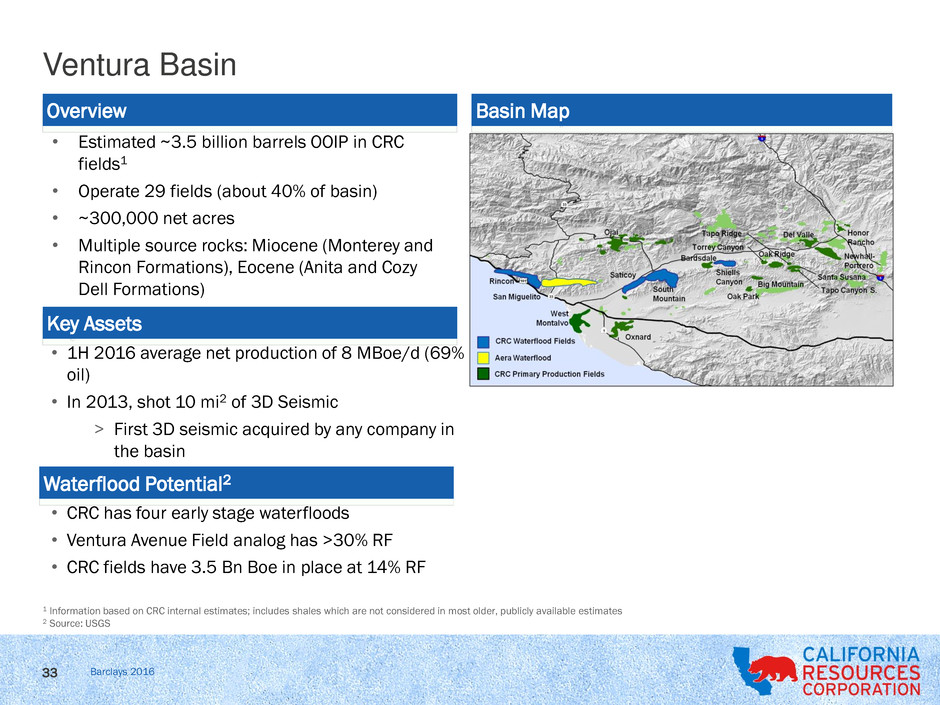

Ventura Basin

• Estimated ~3.5 billion barrels OOIP in CRC

fields1

• Operate 29 fields (about 40% of basin)

• ~300,000 net acres

• Multiple source rocks: Miocene (Monterey and

Rincon Formations), Eocene (Anita and Cozy

Dell Formations)

• 1H 2016 average net production of 8 MBoe/d (69%

oil)

• In 2013, shot 10 mi2 of 3D Seismic

> First 3D seismic acquired by any company in

the basin

Overview

Key Assets

Basin Map

• CRC has four early stage waterfloods

• Ventura Avenue Field analog has >30% RF

• CRC fields have 3.5 Bn Boe in place at 14% RF

Waterflood Potential2

1 Information based on CRC internal estimates; includes shales which are not considered in most older, publicly available estimates

2 Source: USGS

33

Barclays 2016

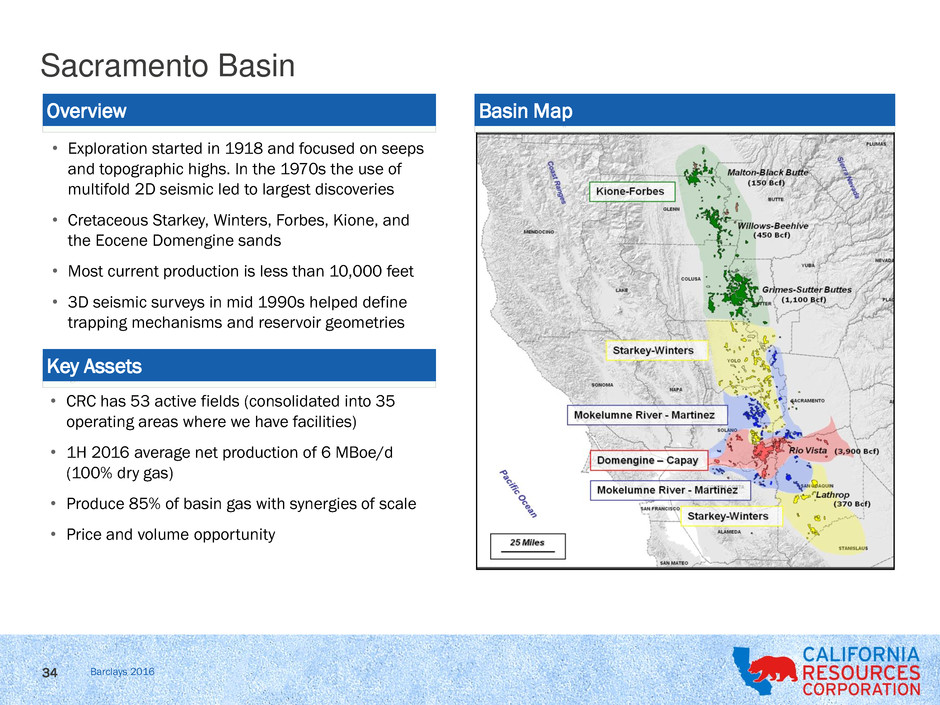

Sacramento Basin

• Exploration started in 1918 and focused on seeps

and topographic highs. In the 1970s the use of

multifold 2D seismic led to largest discoveries

• Cretaceous Starkey, Winters, Forbes, Kione, and

the Eocene Domengine sands

• Most current production is less than 10,000 feet

• 3D seismic surveys in mid 1990s helped define

trapping mechanisms and reservoir geometries

• CRC has 53 active fields (consolidated into 35

operating areas where we have facilities)

• 1H 2016 average net production of 6 MBoe/d

(100% dry gas)

• Produce 85% of basin gas with synergies of scale

• Price and volume opportunity

Overview

Key Assets

Basin Map

34

Barclays 2016

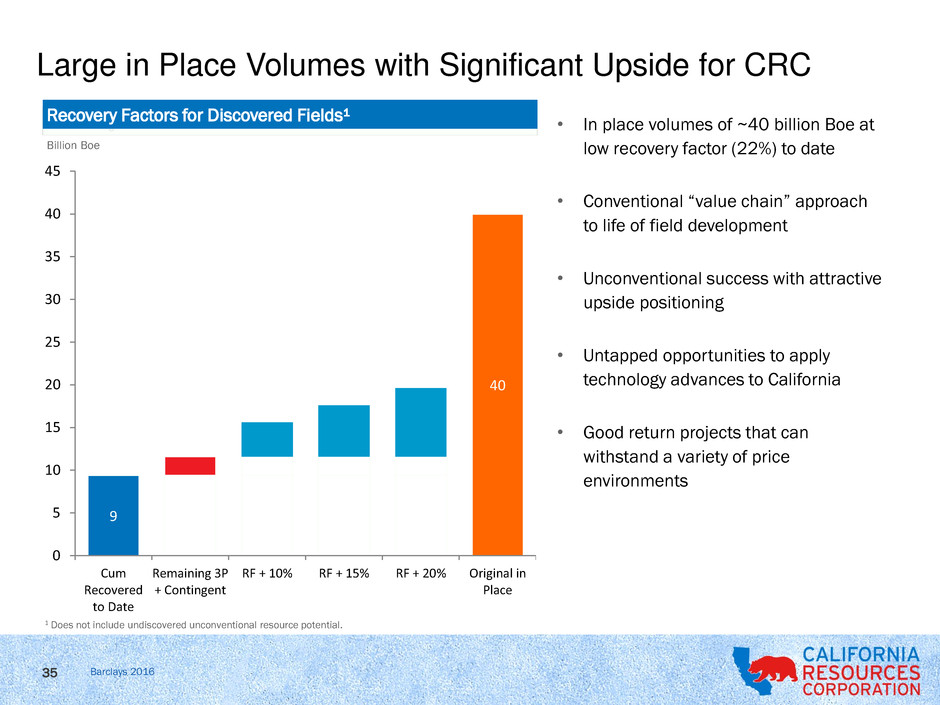

Recovery Factors for Discovered Fields¹

9

40

0

5

10

15

20

25

30

35

40

45

Cum

Recovered

to Date

Remaining 3P

+ Contingent

RF + 10% RF + 15% RF + 20% Original in

Place

Billion Boe

1 Does not include undiscovered unconventional resource potential.

• In place volumes of ~40 billion Boe at

low recovery factor (22%) to date

• Conventional “value chain” approach

to life of field development

• Unconventional success with attractive

upside positioning

• Untapped opportunities to apply

technology advances to California

• Good return projects that can

withstand a variety of price

environments

Large in Place Volumes with Significant Upside for CRC

35

Barclays 2016

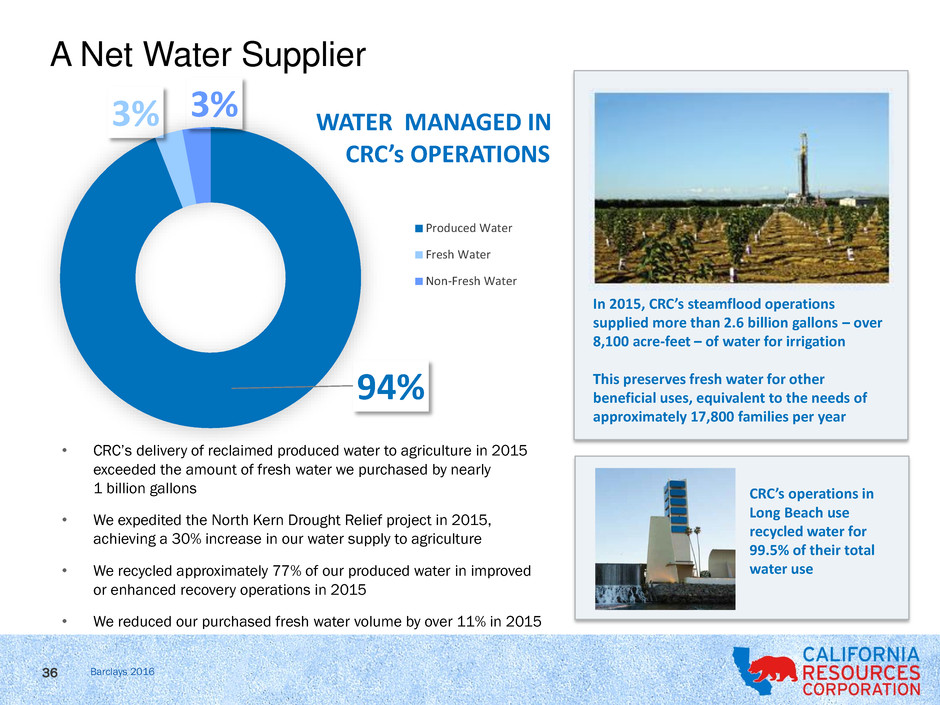

A Net Water Supplier

• CRC’s delivery of reclaimed produced water to agriculture in 2015

exceeded the amount of fresh water we purchased by nearly

1 billion gallons

• We expedited the North Kern Drought Relief project in 2015,

achieving a 30% increase in our water supply to agriculture

• We recycled approximately 77% of our produced water in improved

or enhanced recovery operations in 2015

• We reduced our purchased fresh water volume by over 11% in 2015

94%

3% 3% WATER MANAGED IN

CRC’s OPERATIONS

Produced Water

Fresh Water

Non-Fresh Water

In 2015, CRC’s steamflood operations

supplied more than 2.6 billion gallons – over

8,100 acre-feet – of water for irrigation

This preserves fresh water for other

beneficial uses, equivalent to the needs of

approximately 17,800 families per year

36

CRC’s operations in

Long Beach use

recycled water for

99.5% of their total

water use

Barclays 2016

End Notes:

37

(1) Our total production costs consist of variable costs that tend to vary depending on production levels, and fixed costs that typically do not vary with changes in production

levels or well counts, especially in the short term. The substantial majority of our near-term fixed costs become variable over the longer term because we manage them

based on the field’s stage of life and operating characteristics. For example, portions of labor and material costs, energy, workovers and maintenance expenditures

correlate to well count, production and activity levels. Portions of these same costs can be relatively fixed over the near term; however, they are managed down as fields

mature in a manner that correlates to production and commodity price levels. While a certain amount of costs for facilities, surface support, surveillance and related

maintenance can be regarded as fixed in the early phases of a program, as the production from a certain area matures, well count increases and daily per well production

drops, such support costs can be reduced and consolidated over a larger number of wells, reducing costs per operating well. Further, many of our other costs, such as

property taxes and oilfield services, are variable and will respond to activity levels and tend to correlate with commodity prices. Overall, we believe less than one-third of

our operating costs are fixed over the life cycle of our fields. We actively manage our fields to optimize production and costs. If we see growth in a field we increase

capacities, and similarly if a field neared the end of its economic life we would manage the costs while it remains economically viable to produce.

(2) Determination of Identified Drilling Locations

Proven Drilling Locations –

We use production data and experience gained from our development programs to identify and prioritize this proven drilling inventory. These drilling locations are

included in our inventory only after they have been evaluated technically and are deemed to have a high likelihood of being drilled within a five-year time frame. As a

result of rigorous technical evaluation of geologic and engineering data, it can be estimated with reasonable certainty that reserves from these locations will be

commercially recoverable in accordance with SEC guidelines. Management considers the availability of local infrastructure, drilling support assets, state and local

regulations and other factors it deems relevant in determining such locations.

Unproven Drilling Locations –

We have also identified drilling locations that are not associated with proved undeveloped reserves but are specifically identified on a field-by-field basis considering

the applicable geologic, engineering and production data. We analyze past field development practices and identify analogous drilling opportunities taking into

consideration historical production performance, estimated drilling and completion costs, spacing and other performance factors. These drilling locations primarily

include (i) infill drilling locations, (ii) additional locations due to field extensions or (iii) potential IOR and EOR project expansions, some of which are currently in the

pilot phase across our properties, but have yet to be moved to the proven category. We believe the assumptions and data used to estimate these drilling locations are

consistent with established industry practices with well spacing selected based on the type of recovery process we are using.

Exploration Drilling Locations –

Our portfolio of prospective drilling locations contains unrisked exploration drilling locations that are located in proven formations, the majority of which are located

near existing producing fields. We use internally generated information and proprietary models consisting of data from analog plays, 3D seismic data, open hole and

mud log data, cores, and reservoir engineering data to help define the extent of the targeted intervals and the potential ability of such intervals to produce

commercial quantities of hydrocarbons. Information used to identify exploration locations includes both our own proprietary as well as industry data available in the

public domain. After defining the reservoir target area, we identified our exploration drilling locations within the applicable intervals by applying the well spacing we

have historically utilized for the applicable type of recovery process used.

Prospective Resource Drilling Locations –

We have unrisked prospective resource drilling locations identified in the lower Monterey, Kreyenhagen, and Moreno resource plays based on screening criteria that

contain geologic and economic considerations and very limited production information. Prospective play areas are defined by geologic data consisting of well cuttings,

hydrocarbon shows, open-hole well logs, geochemical data, available 3D or 2D seismic data and formation pressure data where available. Information used to identify

our prospective locations includes both our own proprietary data, as well as industry, data available in the public domain. Prospective resource drilling locations were

based on an assumption of 80-acre spacing per well throughout the prospective area for each resource play.

Barclays 2016

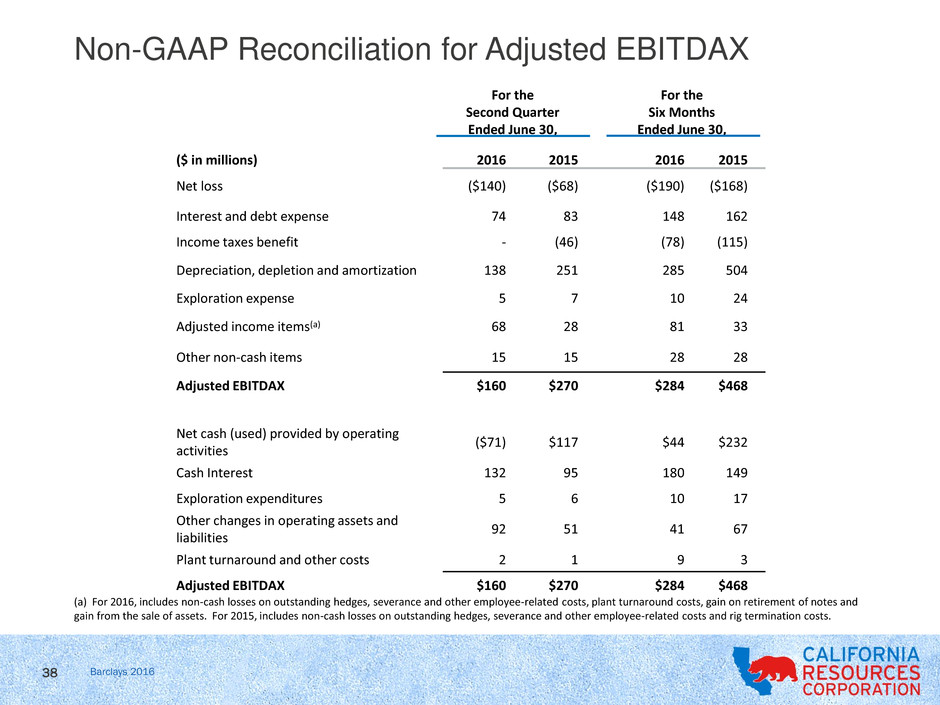

Non-GAAP Reconciliation for Adjusted EBITDAX

For the

Second Quarter

Ended June 30,

For the

Six Months

Ended June 30,

($ in millions) 2016 2015 2016 2015

Net loss ($140) ($68) ($190) ($168)

Interest and debt expense 74 83 148 162

Income taxes benefit - (46) (78) (115)

Depreciation, depletion and amortization 138 251 285 504

Exploration expense 5 7 10 24

Adjusted income items(a) 68 28 81 33

Other non-cash items 15 15 28 28

Adjusted EBITDAX $160 $270 $284 $468

Net cash (used) provided by operating

activities

($71) $117 $44 $232

Cash Interest 132 95 180 149

Exploration expenditures 5 6 10 17

Other changes in operating assets and

liabilities

92 51 41 67

Plant turnaround and other costs 2 1 9 3

Adjusted EBITDAX $160 $270 $284 $468

38

(a) For 2016, includes non-cash losses on outstanding hedges, severance and other employee-related costs, plant turnaround costs, gain on retirement of notes and

gain from the sale of assets. For 2015, includes non-cash losses on outstanding hedges, severance and other employee-related costs and rig termination costs.

Barclays 2016

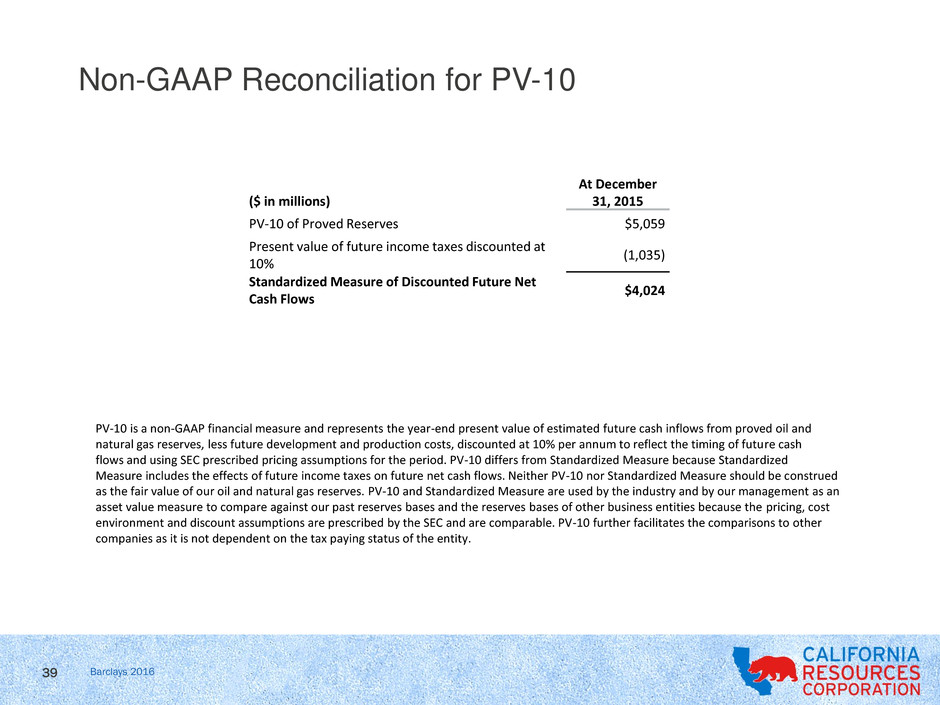

Non-GAAP Reconciliation for PV-10

($ in millions)

At December

31, 2015

PV-10 of Proved Reserves $5,059

Present value of future income taxes discounted at

10%

(1,035)

Standardized Measure of Discounted Future Net

Cash Flows

$4,024

PV-10 is a non-GAAP financial measure and represents the year-end present value of estimated future cash inflows from proved oil and

natural gas reserves, less future development and production costs, discounted at 10% per annum to reflect the timing of future cash

flows and using SEC prescribed pricing assumptions for the period. PV-10 differs from Standardized Measure because Standardized

Measure includes the effects of future income taxes on future net cash flows. Neither PV-10 nor Standardized Measure should be construed

as the fair value of our oil and natural gas reserves. PV-10 and Standardized Measure are used by the industry and by our management as an

asset value measure to compare against our past reserves bases and the reserves bases of other business entities because the pricing, cost

environment and discount assumptions are prescribed by the SEC and are comparable. PV-10 further facilitates the comparisons to other

companies as it is not dependent on the tax paying status of the entity.

39