Attached files

| file | filename |

|---|---|

| EX-99.1 - EXHIBIT 99.1 - SCANSOURCE, INC. | a2016-q4exhibit99106302016.htm |

| 8-K - 8-K - SCANSOURCE, INC. | a2016-q4form8xk06302016.htm |

Q4 AND FY16 FINANCIAL RESULTS

CONFERENCE CALL

August 29, 2016 at 5:00 pm ET

Exhibit 99.2

SAFE HARBOR AND NON-GAAP

Safe Harbor Statement

This presentation contains certain comments that are

“forward-looking” statements, including sales, GAAP diluted

EPS, and non-GAAP diluted EPS, that involve plans,

strategies, economic performance and trends, projections,

expectations, costs or beliefs about future events and other

statements that are not descriptions of historical facts.

Forward-looking information is inherently subject to risks and

uncertainties.

Any number of factors could cause actual results to differ

materially from anticipated results, including declines in sales

and margins, currency fluctuations, difficulties in integrating

acquisitions and general economic factors. For more

information concerning factors that could cause actual results

to differ from anticipated results, see the “Risk Factors”

included in the Company’s annual report on Form 10-K for

the fiscal year ended June 30, 2016, filed with the Securities

and Exchange Commission (“SEC”).

Although ScanSource believes the expectations in its

forward-looking statements are reasonable, it cannot

guarantee future results, levels of activity, performance or

achievement. ScanSource disclaims any obligation to

update or revise any forward-looking statements, whether as

a result of new information, future events, or otherwise,

except as may be required by law.

Non-GAAP Financial Information

In addition to disclosing results that are determined in

accordance with United States Generally Accepted

Accounting Principles (“GAAP”), the Company also discloses

certain non-GAAP measures, including non-GAAP operating

income, non-GAAP operating margin, non-GAAP net income,

non-GAAP diluted earnings per share, return on invested

capital (“ROIC”) and the percentage change in net sales

excluding the impact of foreign currency exchange rates. A

reconciliation of the Company's non-GAAP financial

information to GAAP financial information is provided in the

Appendix and in the Company’s Form 8-K, filed with the

SEC, with the quarterly earnings press release for the period

indicated.

2

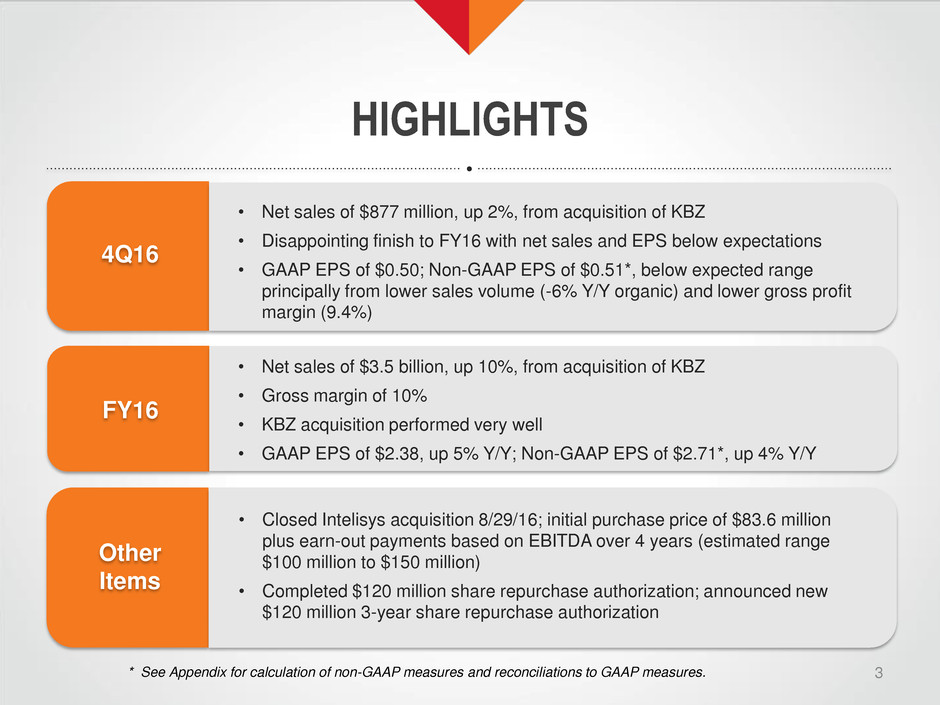

HIGHLIGHTS

3

• Net sales of $877 million, up 2%, from acquisition of KBZ

• Disappointing finish to FY16 with net sales and EPS below expectations

• GAAP EPS of $0.50; Non-GAAP EPS of $0.51*, below expected range

principally from lower sales volume (-6% Y/Y organic) and lower gross profit

margin (9.4%)

4Q16

FY16

Other

Items

• Net sales of $3.5 billion, up 10%, from acquisition of KBZ

• Gross margin of 10%

• KBZ acquisition performed very well

• GAAP EPS of $2.38, up 5% Y/Y; Non-GAAP EPS of $2.71*, up 4% Y/Y

• Closed Intelisys acquisition 8/29/16; initial purchase price of $83.6 million

plus earn-out payments based on EBITDA over 4 years (estimated range

$100 million to $150 million)

• Completed $120 million share repurchase authorization; announced new

$120 million 3-year share repurchase authorization

* See Appendix for calculation of non-GAAP measures and reconciliations to GAAP measures.

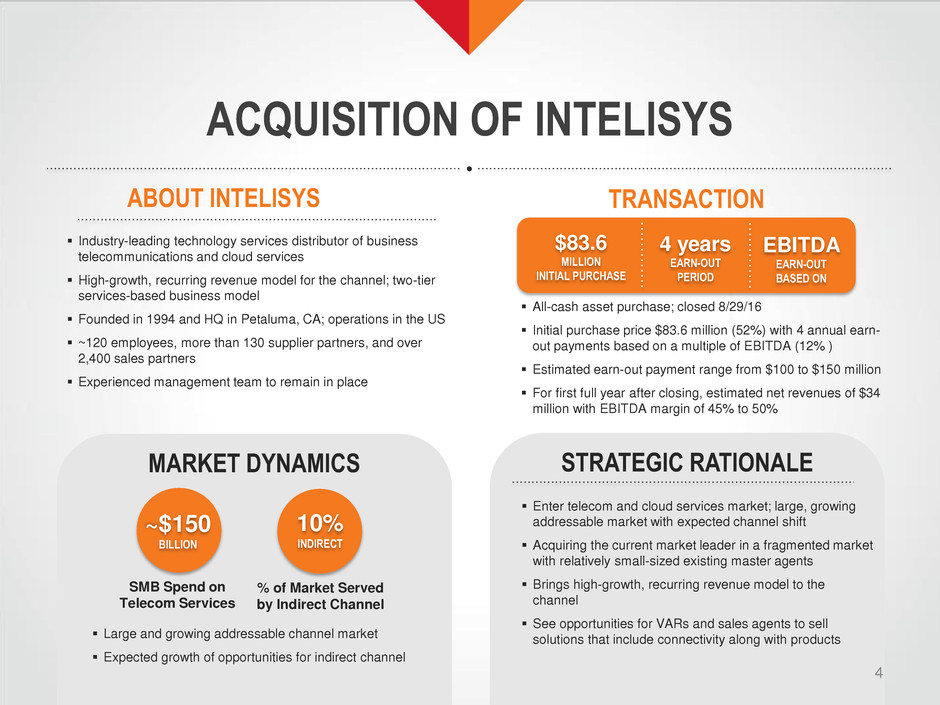

ACQUISITION OF INTELISYS

TRANSACTION

4

ABOUT INTELISYS

SMB Spend on

Telecom Services

Industry-leading technology services distributor of business

telecommunications and cloud services

High-growth, recurring revenue model for the channel; two-tier

services-based business model

Founded in 1994 and HQ in Petaluma, CA; operations in the US

~120 employees, more than 130 supplier partners, and over

2,400 sales partners

Experienced management team to remain in place

MARKET DYNAMICS STRATEGIC RATIONALE

~$150

BILLION

10%

INDIRECT

% of Market Served

by Indirect Channel

Large and growing addressable channel market

Expected growth of opportunities for indirect channel

$83.6

MILLION

INITIAL PURCHASE

4 years

EARN-OUT

PERIOD

EBITDA

EARN-OUT

BASED ON

All-cash asset purchase; closed 8/29/16

Initial purchase price $83.6 million (52%) with 4 annual earn-

out payments based on a multiple of EBITDA (12% )

Estimated earn-out payment range from $100 to $150 million

For first full year after closing, estimated net revenues of $34

million with EBITDA margin of 45% to 50%

Enter telecom and cloud services market; large, growing

addressable market with expected channel shift

Acquiring the current market leader in a fragmented market

with relatively small-sized existing master agents

Brings high-growth, recurring revenue model to the

channel

See opportunities for VARs and sales agents to sell

solutions that include connectivity along with products

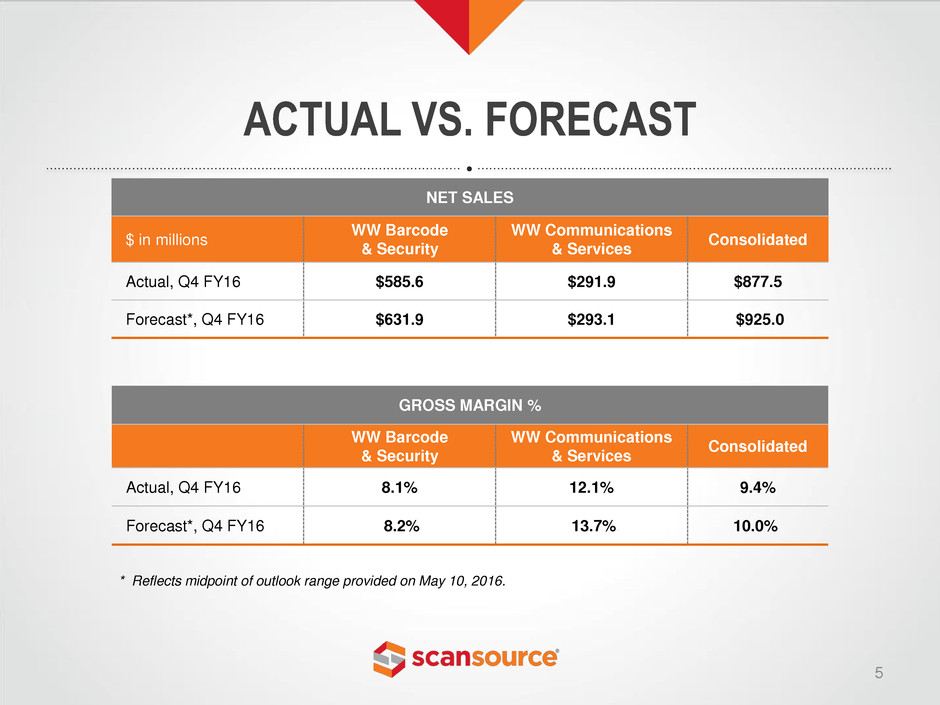

NET SALES

$ in millions

WW Barcode

& Security

WW Communications

& Services

Consolidated

Actual, Q4 FY16 $585.6 $291.9 $877.5

Forecast*, Q4 FY16 $631.9 $293.1 $925.0

ACTUAL VS. FORECAST

5

GROSS MARGIN %

WW Barcode

& Security

WW Communications

& Services

Consolidated

Actual, Q4 FY16 8.1% 12.1% 9.4%

Forecast*, Q4 FY16 8.2% 13.7%. 10.0%

* Reflects midpoint of outlook range provided on May 10, 2016.

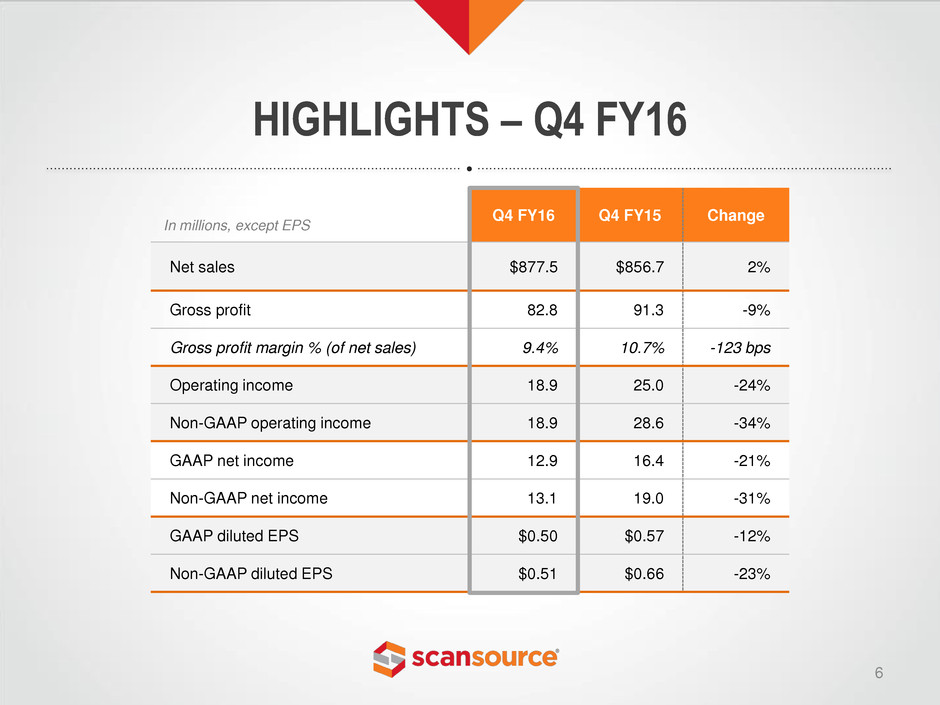

Q4 FY16 Q4 FY15 Change

Net sales $877.5 $856.7 2%

Gross profit 82.8 91.3 -9%

Gross profit margin % (of net sales) 9.4% 10.7% -123 bps

Operating income 18.9 25.0 -24%

Non-GAAP operating income 18.9 28.6 -34%

GAAP net income 12.9 16.4 -21%

Non-GAAP net income 13.1 19.0 -31%

GAAP diluted EPS $0.50 $0.57 -12%

Non-GAAP diluted EPS $0.51 $0.66 -23%

HIGHLIGHTS – Q4 FY16

6

In millions, except EPS

FOURTH QTR: Q4 FY16 – Y/Y % CHANGE

Reported

Constant

Currency

Organic

Growth*

WW Barcode & Security 5.4% 5.9% -8.4%

WW Comms. & Services -3.1% -1.5% -1.5%

Consolidated 2.4% 3.3% -6.0%

SALES GROWTH SUMMARY

7

FULL YEAR: FY16 – Y/Y % CHANGE

Reported

Constant

Currency

Organic

Growth*

WW Barcode & Security 11.6% 15.3% 0.8%

WW Comms. & Services 6.9% 9.0% -1.6%

Consolidated 10.0% 13.2% 0.0%

* Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency

translation and acquisitions.

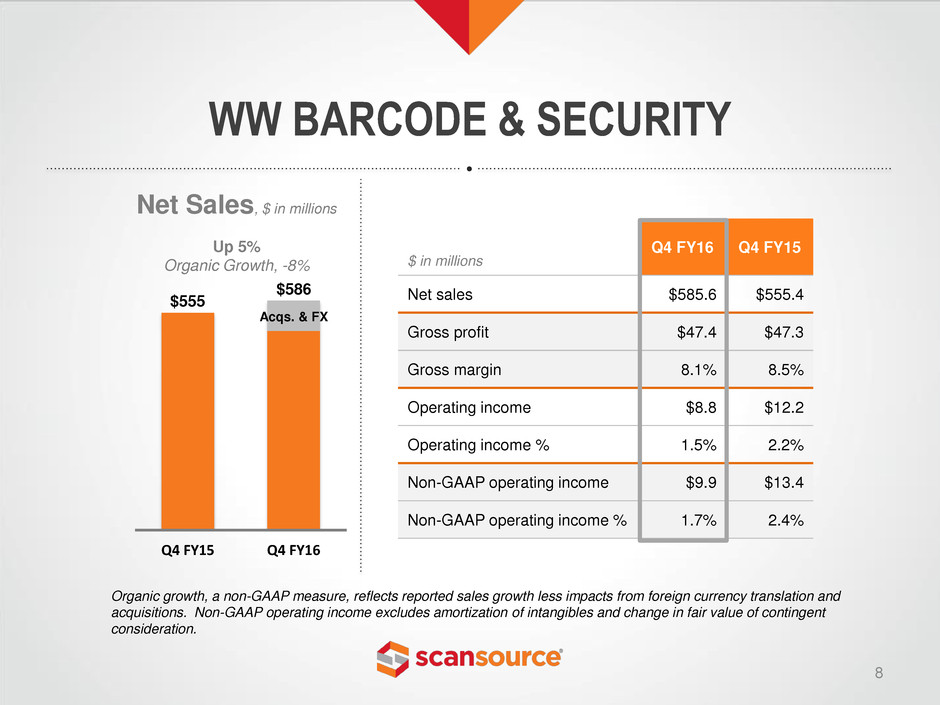

Q4 FY16 Q4 FY15

Net sales $585.6 $555.4

Gross profit $47.4 $47.3

Gross margin 8.1% 8.5%

Operating income $8.8 $12.2

Operating income % 1.5% 2.2%

Non-GAAP operating income $9.9 $13.4

Non-GAAP operating income % 1.7% 2.4%

Q4 FY15 Q4 FY16

Net Sales, $ in millions

Up 5%

Organic Growth, -8%

WW BARCODE & SECURITY

8

$ in millions

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

$555

$586

Acqs. & FX

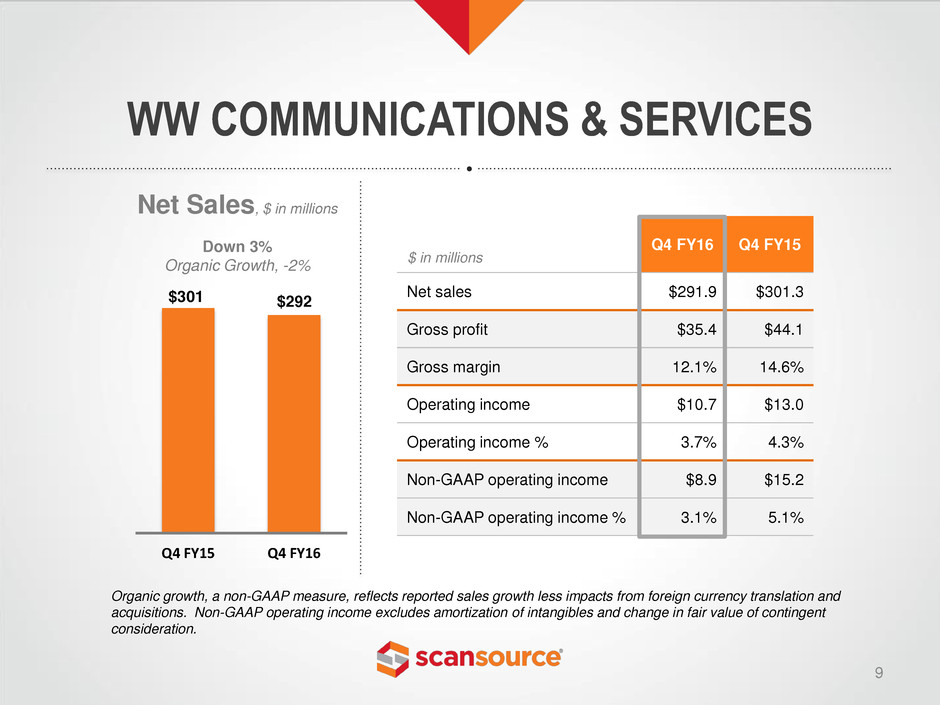

Q4 FY16 Q4 FY15

Net sales $291.9 $301.3

Gross profit $35.4 $44.1

Gross margin 12.1% 14.6%

Operating income $10.7 $13.0

Operating income % 3.7% 4.3%

Non-GAAP operating income $8.9 $15.2

Non-GAAP operating income % 3.1% 5.1%

WW COMMUNICATIONS & SERVICES

9

Q4 FY15 Q4 FY16

Net Sales, $ in millions

Down 3%

Organic Growth, -2%

$ in millions

$292 $301

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

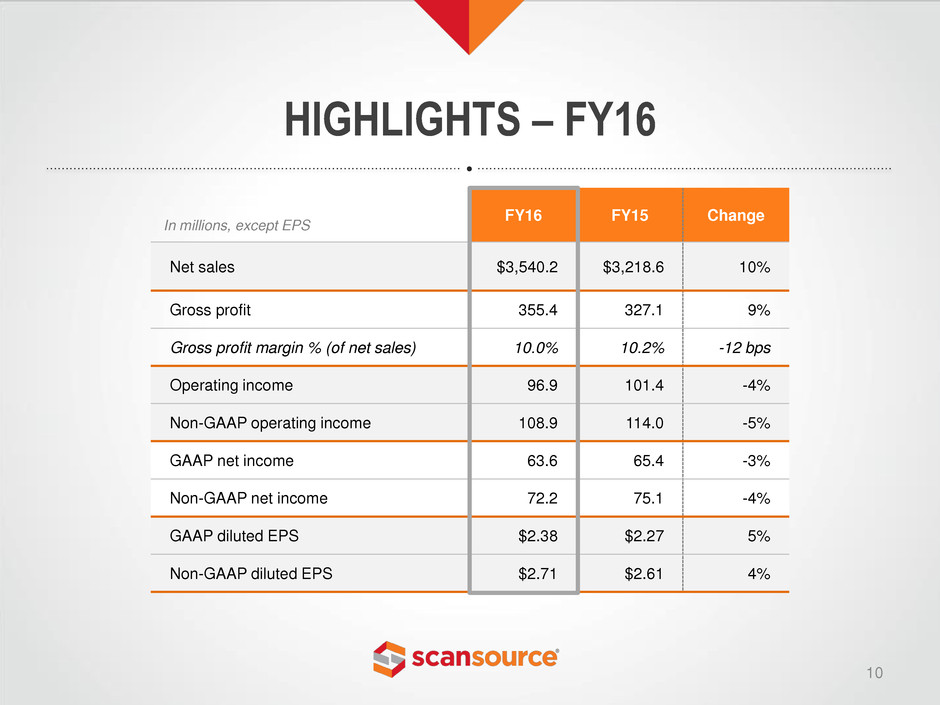

FY16 FY15 Change

Net sales $3,540.2 $3,218.6 10%

Gross profit 355.4 327.1 9%

Gross profit margin % (of net sales) 10.0% 10.2% -12 bps

Operating income 96.9 101.4 -4%

Non-GAAP operating income 108.9 114.0 -5%

GAAP net income 63.6 65.4 -3%

Non-GAAP net income 72.2 75.1 -4%

GAAP diluted EPS $2.38 $2.27 5%

Non-GAAP diluted EPS $2.71 $2.61 4%

HIGHLIGHTS – FY16

10

In millions, except EPS

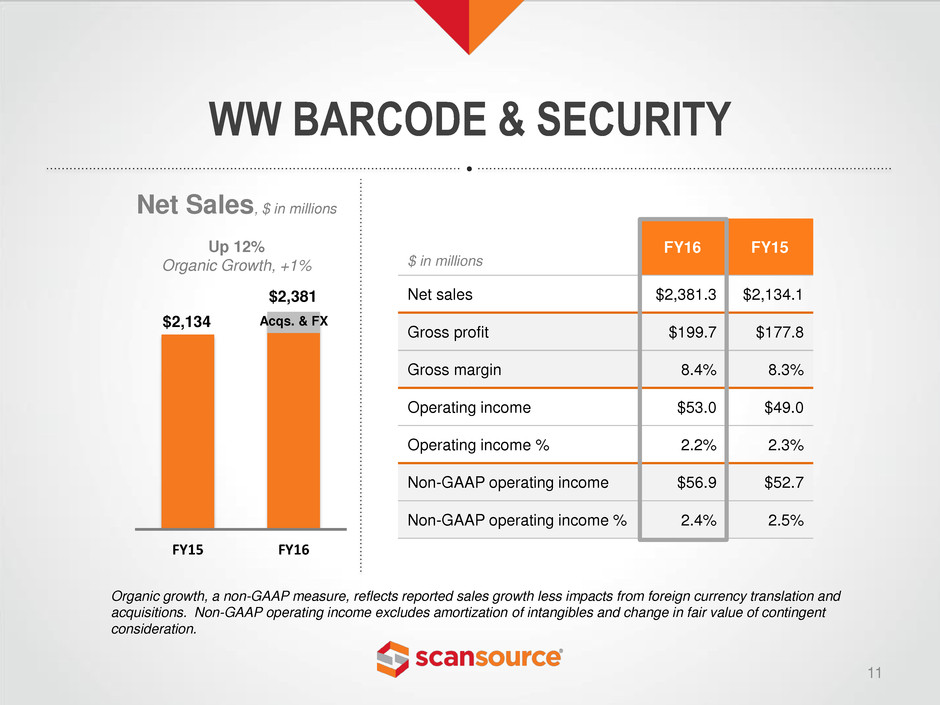

FY16 FY15

Net sales $2,381.3 $2,134.1

Gross profit $199.7 $177.8

Gross margin 8.4% 8.3%

Operating income $53.0 $49.0

Operating income % 2.2% 2.3%

Non-GAAP operating income $56.9 $52.7

Non-GAAP operating income % 2.4% 2.5%

FY15 FY16

Net Sales, $ in millions

Up 12%

Organic Growth, +1%

WW BARCODE & SECURITY

11

$ in millions

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

$2,134

$2,381

Acqs. & FX

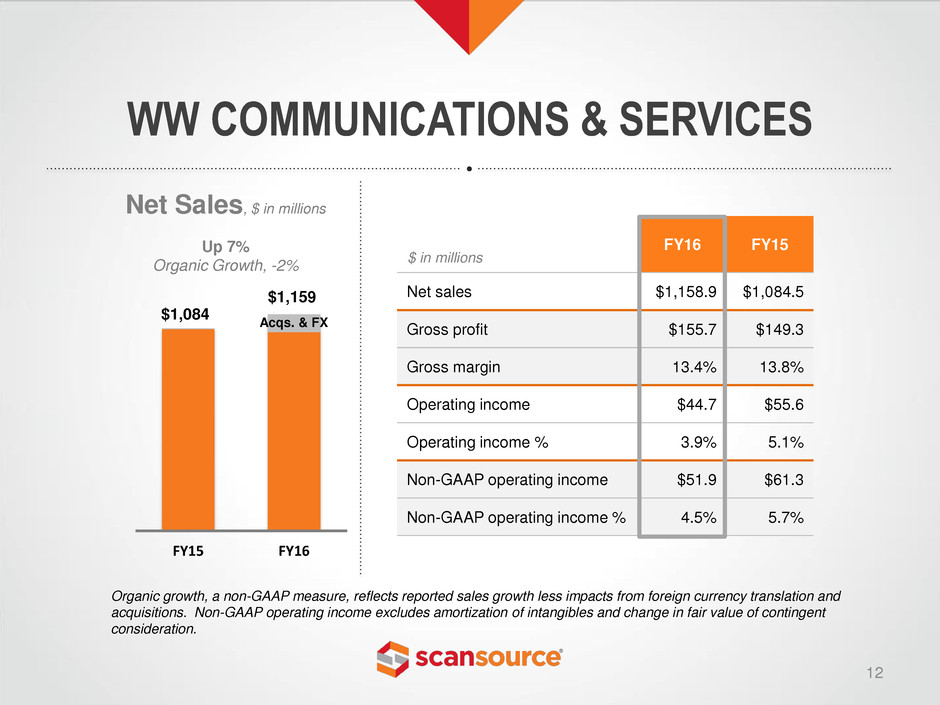

FY16 FY15

Net sales $1,158.9 $1,084.5

Gross profit $155.7 $149.3

Gross margin 13.4% 13.8%

Operating income $44.7 $55.6

Operating income % 3.9% 5.1%

Non-GAAP operating income $51.9 $61.3

Non-GAAP operating income % 4.5% 5.7%

WW COMMUNICATIONS & SERVICES

12

FY15 FY16

Net Sales, $ in millions

Up 7%

Organic Growth, -2%

$ in millions

$1,159

$1,084

Organic growth, a non-GAAP measure, reflects reported sales growth less impacts from foreign currency translation and

acquisitions. Non-GAAP operating income excludes amortization of intangibles and change in fair value of contingent

consideration.

Acqs. & FX

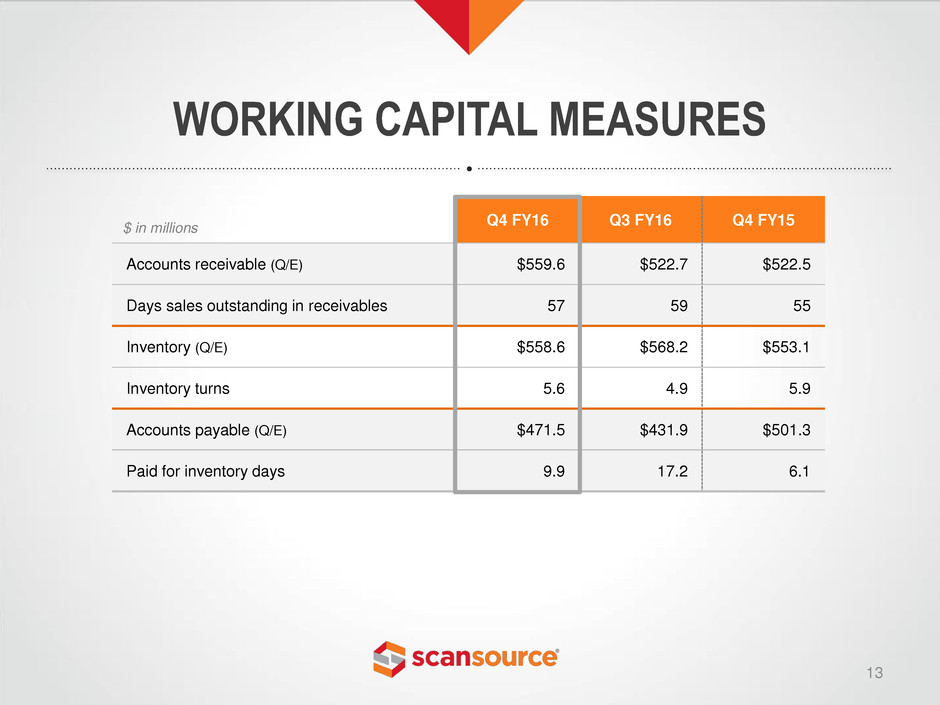

Q4 FY16 Q3 FY16 Q4 FY15

Accounts receivable (Q/E) $559.6 $522.7 $522.5

Days sales outstanding in receivables 57 59 55

Inventory (Q/E) $558.6 $568.2 $553.1

Inventory turns 5.6 4.9 5.9

Accounts payable (Q/E) $471.5 $431.9 $501.3

Paid for inventory days 9.9 17.2 6.1

WORKING CAPITAL MEASURES

$ in millions

13

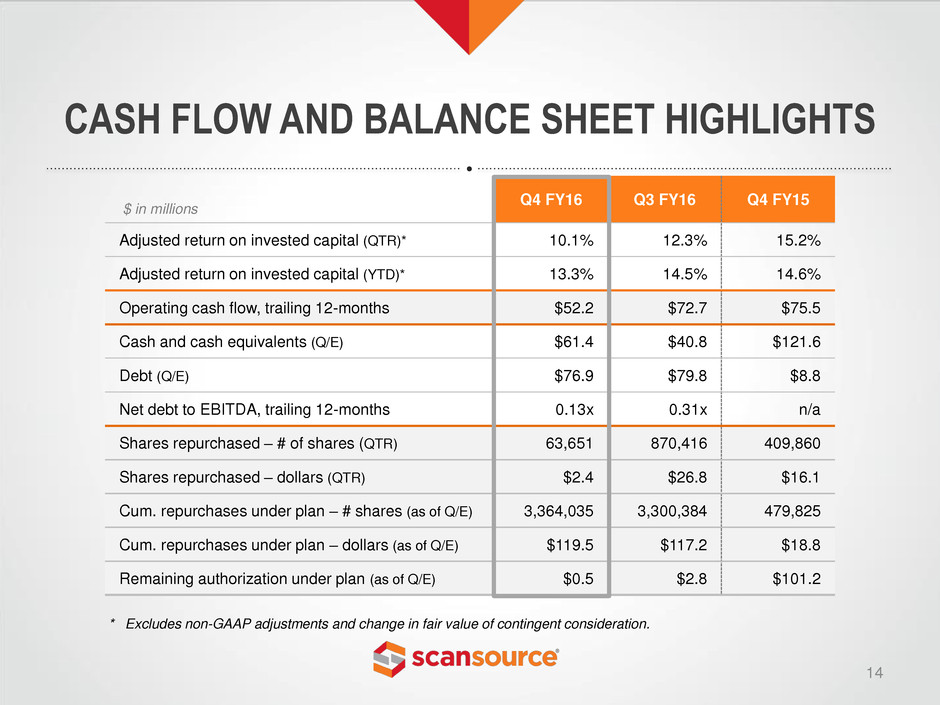

Q4 FY16 Q3 FY16 Q4 FY15

Adjusted return on invested capital (QTR)* 10.1% 12.3% 15.2%

Adjusted return on invested capital (YTD)* 13.3% 14.5% 14.6%

Operating cash flow, trailing 12-months $52.2 $72.7 $75.5

Cash and cash equivalents (Q/E) $61.4 $40.8 $121.6

Debt (Q/E) $76.9 $79.8 $8.8

Net debt to EBITDA, trailing 12-months 0.13x 0.31x n/a

Shares repurchased – # of shares (QTR) 63,651 870,416 409,860

Shares repurchased – dollars (QTR) $2.4 $26.8 $16.1

Cum. repurchases under plan – # shares (as of Q/E) 3,364,035 3,300,384 479,825

Cum. repurchases under plan – dollars (as of Q/E) $119.5 $117.2 $18.8

Remaining authorization under plan (as of Q/E) $0.5 $2.8 $101.2

CASH FLOW AND BALANCE SHEET HIGHLIGHTS

$ in millions

14

* Excludes non-GAAP adjustments and change in fair value of contingent consideration.

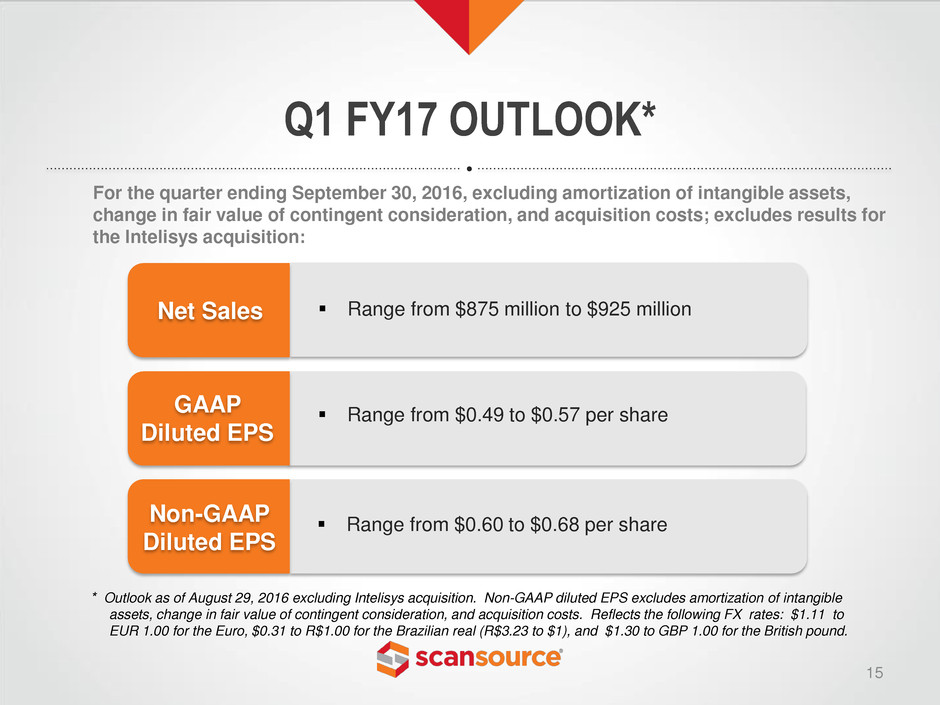

Q1 FY17 OUTLOOK*

15

* Outlook as of August 29, 2016 excluding Intelisys acquisition. Non-GAAP diluted EPS excludes amortization of intangible

assets, change in fair value of contingent consideration, and acquisition costs. Reflects the following FX rates: $1.11 to

EUR 1.00 for the Euro, $0.31 to R$1.00 for the Brazilian real (R$3.23 to $1), and $1.30 to GBP 1.00 for the British pound.

For the quarter ending September 30, 2016, excluding amortization of intangible assets,

change in fair value of contingent consideration, and acquisition costs; excludes results for

the Intelisys acquisition:

Range from $875 million to $925 million

Range from $0.49 to $0.57 per share

Net Sales

GAAP

Diluted EPS

Range from $0.60 to $0.68 per share

Non-GAAP

Diluted EPS

APPENDIX: NON-GAAP FINANCIAL INFORMATION

16

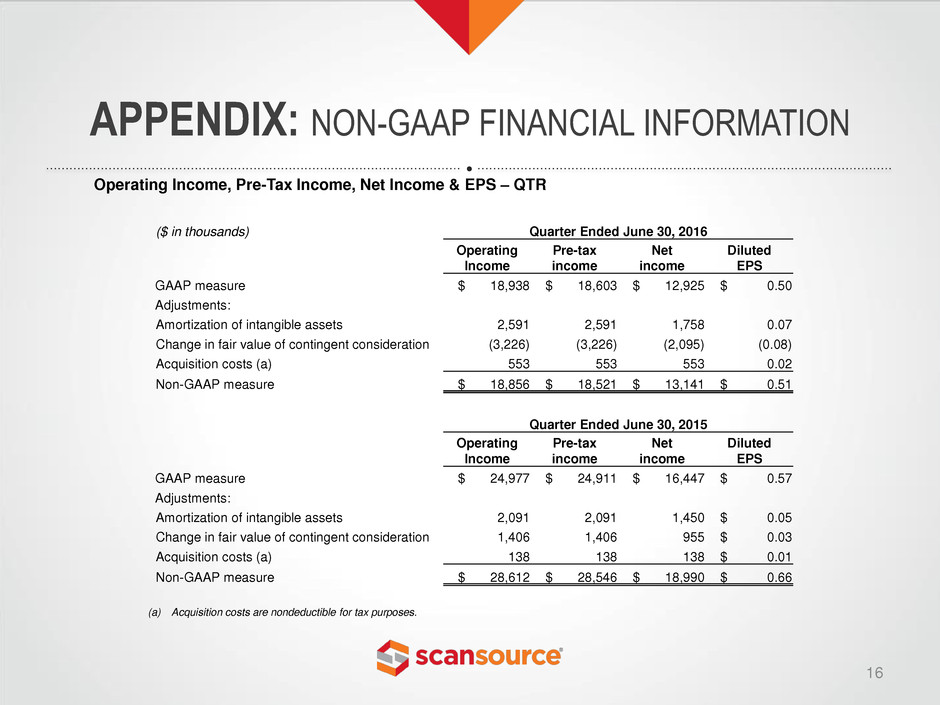

Operating Income, Pre-Tax Income, Net Income & EPS – QTR

($ in thousands) Quarter Ended June 30, 2016

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 18,938 $ 18,603 $ 12,925 $ 0.50

Adjustments:

Amortization of intangible assets 2,591 2,591 1,758 0.07

Change in fair value of contingent consideration (3,226) (3,226) (2,095) (0.08)

Acquisition costs (a) 553 553 553 0.02

Non-GAAP measure $ 18,856 $ 18,521 $ 13,141 $ 0.51

Quarter Ended June 30, 2015

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 24,977 $ 24,911 $ 16,447 $ 0.57

Adjustments:

Amortization of intangible assets 2,091 2,091 1,450 $ 0.05

Change in fair value of contingent consideration 1,406 1,406 955 $ 0.03

Acquisition costs (a) 138 138 138 $ 0.01

Non-GAAP measure $ 28,612 $ 28,546 $ 18,990 $ 0.66

(a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

17

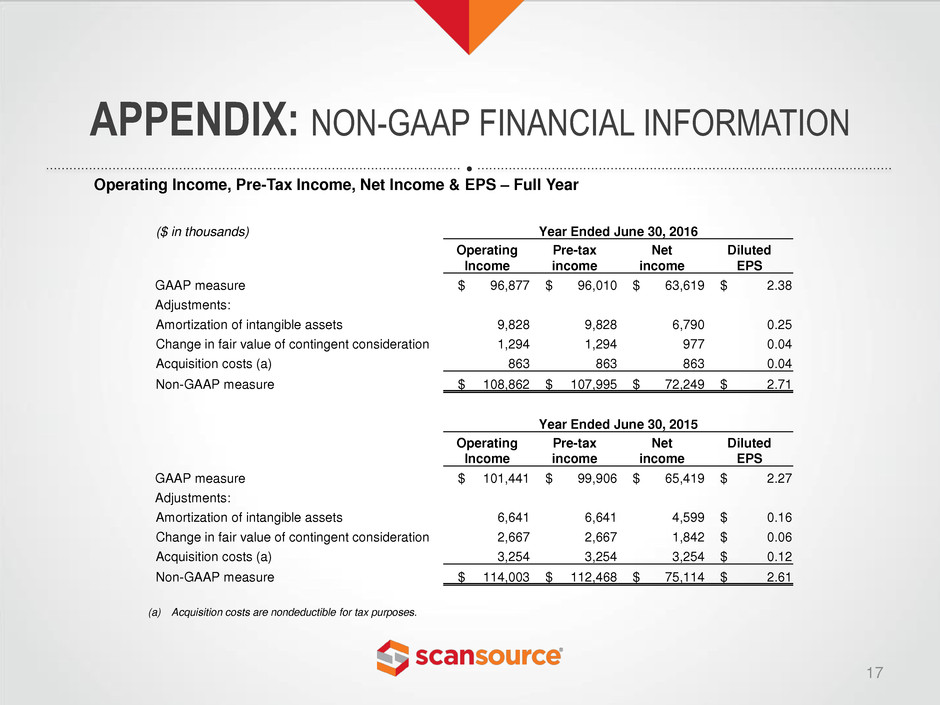

Operating Income, Pre-Tax Income, Net Income & EPS – Full Year

($ in thousands) Year Ended June 30, 2016

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 96,877 $ 96,010 $ 63,619 $ 2.38

Adjustments:

Amortization of intangible assets 9,828 9,828 6,790 0.25

Change in fair value of contingent consideration 1,294 1,294 977 0.04

Acquisition costs (a) 863 863 863 0.04

Non-GAAP measure $ 108,862 $ 107,995 $ 72,249 $ 2.71

Year Ended June 30, 2015

Operating

Income

Pre-tax

income

Net

income

Diluted

EPS

GAAP measure $ 101,441 $ 99,906 $ 65,419 $ 2.27

Adjustments:

Amortization of intangible assets 6,641 6,641 4,599 $ 0.16

Change in fair value of contingent consideration 2,667 2,667 1,842 $ 0.06

Acquisition costs (a) 3,254 3,254 3,254 $ 0.12

Non-GAAP measure $ 114,003 $ 112,468 $ 75,114 $ 2.61

(a) Acquisition costs are nondeductible for tax purposes.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

18

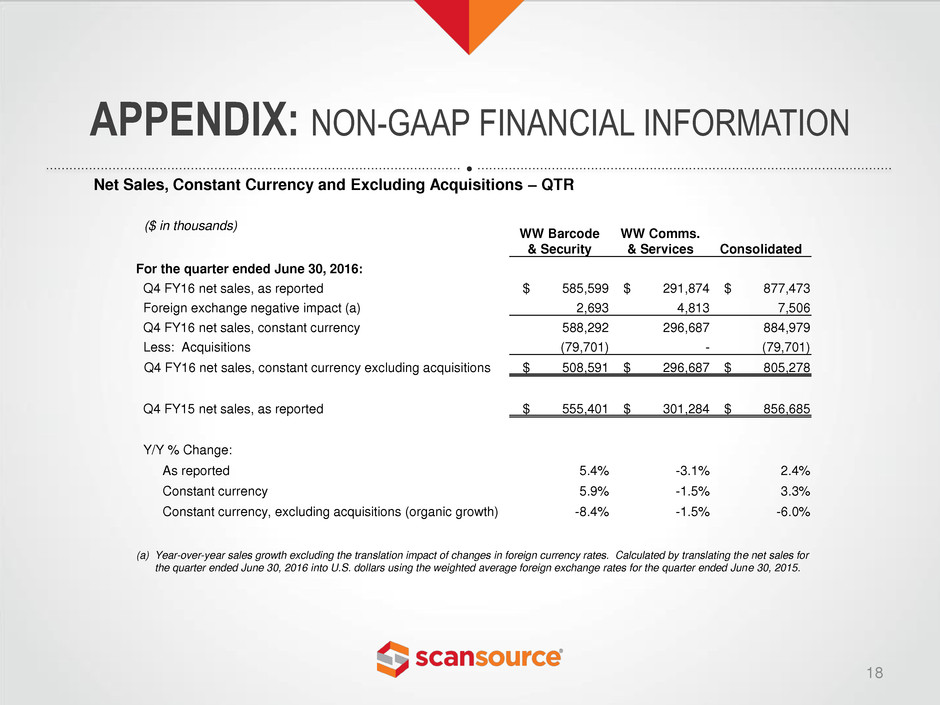

Net Sales, Constant Currency and Excluding Acquisitions – QTR

($ in thousands)

WW Barcode

& Security

WW Comms.

& Services Consolidated

For the quarter ended June 30, 2016:

Q4 FY16 net sales, as reported $ 585,599 $ 291,874 $ 877,473

Foreign exchange negative impact (a) 2,693 4,813 7,506

Q4 FY16 net sales, constant currency 588,292 296,687 884,979

Less: Acquisitions (79,701) - (79,701)

Q4 FY16 net sales, constant currency excluding acquisitions $ 508,591 $ 296,687 $ 805,278

Q4 FY15 net sales, as reported $ 555,401 $ 301,284 $ 856,685

Y/Y % Change:

As reported 5.4% -3.1% 2.4%

Constant currency 5.9% -1.5% 3.3%

Constant currency, excluding acquisitions (organic growth) -8.4% -1.5% -6.0%

(a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating the net sales for

the quarter ended June 30, 2016 into U.S. dollars using the weighted average foreign exchange rates for the quarter ended June 30, 2015.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

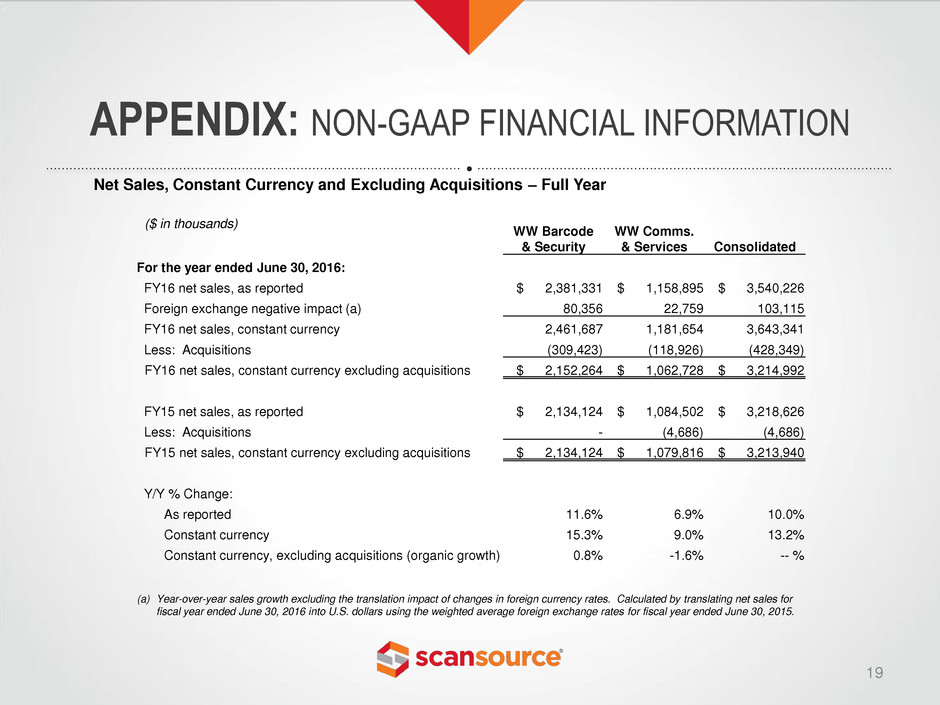

19

Net Sales, Constant Currency and Excluding Acquisitions – Full Year

($ in thousands)

WW Barcode

& Security

WW Comms.

& Services Consolidated

For the year ended June 30, 2016:

FY16 net sales, as reported $ 2,381,331 $ 1,158,895 $ 3,540,226

Foreign exchange negative impact (a) 80,356 22,759 103,115

FY16 net sales, constant currency 2,461,687 1,181,654 3,643,341

Less: Acquisitions (309,423) (118,926) (428,349)

FY16 net sales, constant currency excluding acquisitions $ 2,152,264 $ 1,062,728 $ 3,214,992

FY15 net sales, as reported $ 2,134,124 $ 1,084,502 $ 3,218,626

Less: Acquisitions - (4,686) (4,686)

FY15 net sales, constant currency excluding acquisitions $ 2,134,124 $ 1,079,816 $ 3,213,940

Y/Y % Change:

As reported 11.6% 6.9% 10.0%

Constant currency 15.3% 9.0% 13.2%

Constant currency, excluding acquisitions (organic growth) 0.8% -1.6% -- %

(a) Year-over-year sales growth excluding the translation impact of changes in foreign currency rates. Calculated by translating net sales for

fiscal year ended June 30, 2016 into U.S. dollars using the weighted average foreign exchange rates for fiscal year ended June 30, 2015.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

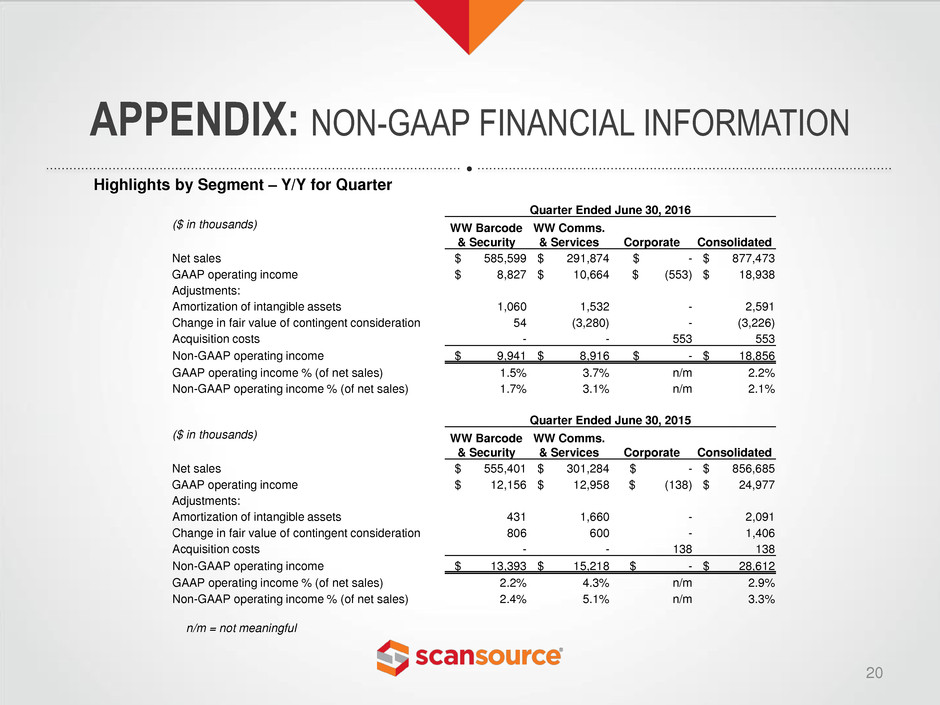

20

Highlights by Segment – Y/Y for Quarter

Quarter Ended June 30, 2016

($ in thousands) WW Barcode

& Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 585,599 $ 291,874 $ - $ 877,473

GAAP operating income $ 8,827 $ 10,664 $ (553) $ 18,938

Adjustments:

Amortization of intangible assets 1,060 1,532 - 2,591

Change in fair value of contingent consideration 54 (3,280) - (3,226)

Acquisition costs - - 553 553

Non-GAAP operating income $ 9,941 $ 8,916 $ - $ 18,856

GAAP operating income % (of net sales) 1.5% 3.7% n/m 2.2%

Non-GAAP operating income % (of net sales) 1.7% 3.1% n/m 2.1%

Quarter Ended June 30, 2015

($ in thousands) WW Barcode

& Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 555,401 $ 301,284 $ - $ 856,685

GAAP operating income $ 12,156 $ 12,958 $ (138) $ 24,977

Adjustments:

Amortization of intangible assets 431 1,660 - 2,091

Change in fair value of contingent consideration 806 600 - 1,406

Acquisition costs - - 138 138

Non-GAAP operating income $ 13,393 $ 15,218 $ - $ 28,612

GAAP operating income % (of net sales) 2.2% 4.3% n/m 2.9%

Non-GAAP operating income % (of net sales) 2.4% 5.1% n/m 3.3%

n/m = not meaningful

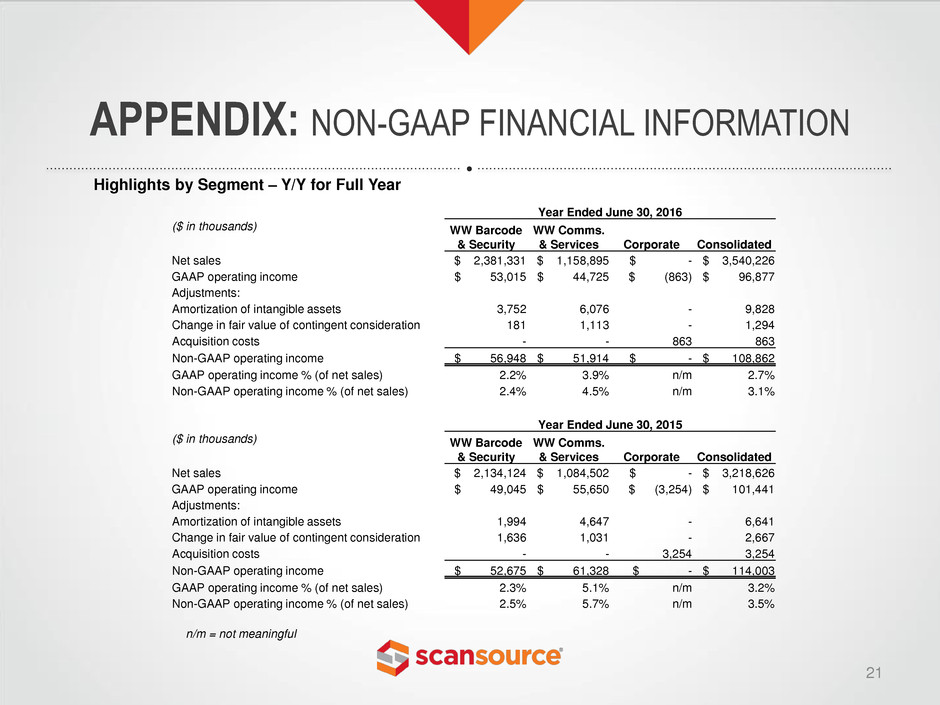

APPENDIX: NON-GAAP FINANCIAL INFORMATION

21

Highlights by Segment – Y/Y for Full Year

Year Ended June 30, 2016

($ in thousands) WW Barcode

& Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 2,381,331 $ 1,158,895 $ - $ 3,540,226

GAAP operating income $ 53,015 $ 44,725 $ (863) $ 96,877

Adjustments:

Amortization of intangible assets 3,752 6,076 - 9,828

Change in fair value of contingent consideration 181 1,113 - 1,294

Acquisition costs - - 863 863

Non-GAAP operating income $ 56,948 $ 51,914 $ - $ 108,862

GAAP operating income % (of net sales) 2.2% 3.9% n/m 2.7%

Non-GAAP operating income % (of net sales) 2.4% 4.5% n/m 3.1%

Year Ended June 30, 2015

($ in thousands) WW Barcode

& Security

WW Comms.

& Services Corporate Consolidated

Net sales $ 2,134,124 $ 1,084,502 $ - $ 3,218,626

GAAP operating income $ 49,045 $ 55,650 $ (3,254) $ 101,441

Adjustments:

Amortization of intangible assets 1,994 4,647 - 6,641

Change in fair value of contingent consideration 1,636 1,031 - 2,667

Acquisition costs - - 3,254 3,254

Non-GAAP operating income $ 52,675 $ 61,328 $ - $ 114,003

GAAP operating income % (of net sales) 2.3% 5.1% n/m 3.2%

Non-GAAP operating income % (of net sales) 2.5% 5.7% n/m 3.5%

n/m = not meaningful

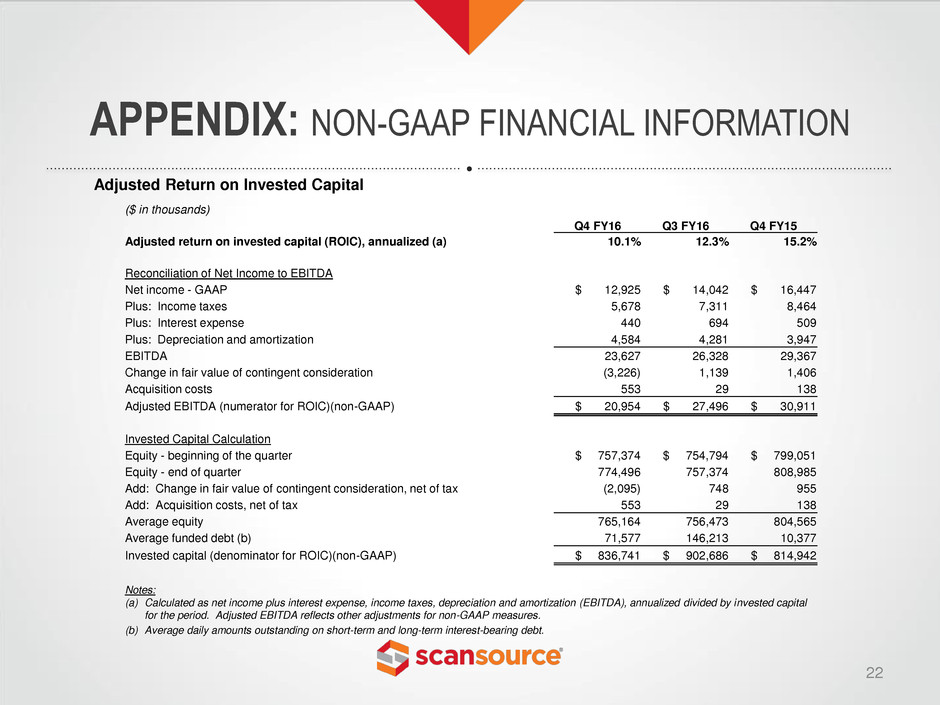

APPENDIX: NON-GAAP FINANCIAL INFORMATION

22

Adjusted Return on Invested Capital

($ in thousands)

Q4 FY16 Q3 FY16 Q4 FY15

Adjusted return on invested capital (ROIC), annualized (a) 10.1% 12.3% 15.2%

Reconciliation of Net Income to EBITDA

Net income - GAAP $ 12,925 $ 14,042 $ 16,447

Plus: Income taxes 5,678 7,311 8,464

Plus: Interest expense 440 694 509

Plus: Depreciation and amortization 4,584 4,281 3,947

EBITDA 23,627 26,328 29,367

Change in fair value of contingent consideration (3,226) 1,139 1,406

Acquisition costs 553 29 138

Adjusted EBITDA (numerator for ROIC)(non-GAAP) $ 20,954 $ 27,496 $ 30,911

Invested Capital Calculation

Equity - beginning of the quarter $ 757,374 $ 754,794 $ 799,051

Equity - end of quarter 774,496 757,374 808,985

Add: Change in fair value of contingent consideration, net of tax (2,095) 748 955

Add: Acquisition costs, net of tax 553 29 138

Average equity 765,164 756,473 804,565

Average funded debt (b) 71,577 146,213 10,377

Invested capital (denominator for ROIC)(non-GAAP) $ 836,741 $ 902,686 $ 814,942

Notes:

(a) Calculated as net income plus interest expense, income taxes, depreciation and amortization (EBITDA), annualized divided by invested capital

for the period. Adjusted EBITDA reflects other adjustments for non-GAAP measures.

(b) Average daily amounts outstanding on short-term and long-term interest-bearing debt.

APPENDIX: NON-GAAP FINANCIAL INFORMATION

23

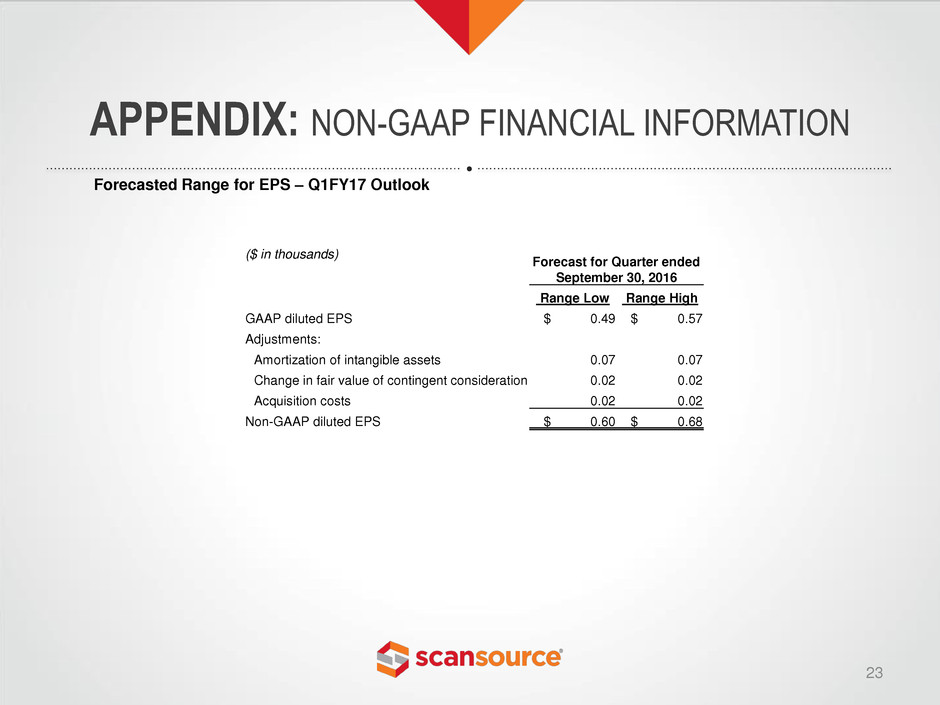

Forecasted Range for EPS – Q1FY17 Outlook

($ in thousands)

Forecast for Quarter ended

September 30, 2016

Range Low Range High

GAAP diluted EPS $ 0.49 $ 0.57

Adjustments:

Amortization of intangible assets 0.07 0.07

Change in fair value of contingent consideration 0.02 0.02

Acquisition costs 0.02 0.02

Non-GAAP diluted EPS $ 0.60 $ 0.68