Attached files

| file | filename |

|---|---|

| EX-32 - EX-32 - LANCASTER COLONY CORP | lanc-2016630exhibit32.htm |

| EX-31.2 - EX-31.2 - LANCASTER COLONY CORP | lanc-2016630exhibit312.htm |

| EX-31.1 - EX-31.1 - LANCASTER COLONY CORP | lanc-2016630exhibit311.htm |

| EX-23 - EX-23 - LANCASTER COLONY CORP | lanc-2016630exhibit23.htm |

| EX-21 - EX-21 - LANCASTER COLONY CORP | lanc-2016630exhibit21.htm |

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

Form 10-K |

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended June 30, 2016

or

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 000-04065

Lancaster Colony Corporation | ||

(Exact name of registrant as specified in its charter) | ||

Ohio | 13-1955943 | |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |

37 West Broad Street Columbus, Ohio | 43215 | |

(Address of principal executive offices) | (Zip Code) | |

614-224-7141 | ||

(Registrant’s telephone number, including area code) | ||

Securities registered pursuant to Section 12(b) of the Act: | ||

Title of each class | Name of each exchange on which registered | |

Common Stock, without par value | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one.)

Large accelerated filer | x | Accelerated filer | ¨ | |

Non-accelerated filer | ¨ | (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of Common Stock held by non-affiliates of the registrant computed by reference to the price at which such Common Stock was last sold as of December 31, 2015 was $2,138.9 million.

As of August 4, 2016, there were 27,423,693 shares of Common Stock, without par value, outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive proxy statement to be filed for its November 2016 Annual Meeting of Shareholders are incorporated by reference into Part III of this Annual Report on Form 10-K.

LANCASTER COLONY CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

2

PART I

Item 1. Business

GENERAL

Lancaster Colony Corporation, an Ohio corporation, is a manufacturer and marketer of specialty food products for the retail and foodservice channels. We began our operations in 1961 as a Delaware corporation. In 1992, we reincorporated as an Ohio corporation. Our principal executive offices are located at 37 West Broad Street, Columbus, Ohio 43215 and our telephone number is 614-224-7141.

In recent years, our strategy has shifted away from operating businesses in a variety of industries towards emphasizing the growth and success we have achieved in our Specialty Foods business. Consistent with this strategy, on January 30, 2014, we sold effectively all of the net operating assets of our candle manufacturing and marketing operations. This sale marked the divestiture of our last remaining non-food business. The financial results of these operations for 2014, previously included in our Glassware and Candles segment, are reported as discontinued operations.

As used in this Annual Report on Form 10-K and except as the context otherwise may require, the terms “we,” “us,” “our,” “registrant,” or “the Company” mean Lancaster Colony Corporation and its consolidated subsidiaries, except where it is clear that the term only means the parent company. Unless otherwise noted, references to “year” pertain to our fiscal year which ends on June 30; for example, 2016 refers to fiscal 2016, which is the period from July 1, 2015 to June 30, 2016.

Available Information

Our Internet web site address is http://www.lancastercolony.com. Our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 are available free of charge through our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the Securities and Exchange Commission. The information contained on our web site or connected to it is not incorporated into this Annual Report on Form 10-K.

DESCRIPTION OF AND FINANCIAL INFORMATION ABOUT BUSINESS SEGMENT

We operate in one business segment – “Specialty Foods.” The financial information relating to our business segment for the three years ended June 30, 2016, 2015 and 2014 is included in Note 10 to the consolidated financial statements, and located in Part II, Item 8 of this Annual Report on Form 10-K. Further description of the business segment within which we operate is provided below.

Specialty Foods Segment

The following table presents the primary food products we manufacture and sell under our brand names:

Food Products | Brand Names | |

Salad dressings and sauces | Marzetti, Marzetti Simply Dressed, Cardini’s, Girard’s, Katherine’s Kitchen | |

Vegetable dips and fruit dips | Marzetti | |

Frozen garlic breads | New York BRAND Bakery, Mamma Bella, Mamma Bella’s | |

Frozen Parkerhouse style yeast rolls and dinner rolls | Sister Schubert’s, Mary B’s | |

Premium dry egg noodles | Inn Maid, Amish Kitchen | |

Frozen specialty noodles | Reames, Aunt Vi’s | |

Croutons and salad toppings | New York BRAND Bakery, New York BRAND Bakery Texas Toast, Chatham Village, Cardini’s, Marzetti Simply Dressed, Marzetti | |

Flatbread wraps and pizza crusts | Flatout | |

Caviar | Romanoff | |

We also manufacture and sell other products pursuant to brand license agreements, including Olive Garden® dressing, Jack Daniel’s® mustards and Hungry Girl® flatbreads. A portion of our sales are products sold under private label to retailers, distributors and restaurants primarily in the United States. Additionally, a small portion of our sales are dressing packets, frozen specialty noodles, pasta and flatbreads sold to industrial customers for use as ingredients or components in their products.

3

Sales are made to retail and foodservice channels. The vast majority of the products we sell in the retail and foodservice channels are sold primarily through sales personnel, food brokers and distributors. We have strong placement of products in U.S. grocery produce departments through our refrigerated salad dressings, vegetable and fruit dips, and croutons. Our flatbread products are generally placed in the deli section of the grocery store. We also have products typically marketed in grocery aisles involving shelf-stable salad dressing, slaw dressing, dry egg noodles and croutons. Within the frozen aisles of grocery retailers, we also have prominent market positions of frozen yeast rolls, garlic breads and egg noodles. Products we sell in the foodservice channel are often custom-formulated and include salad dressings, sandwich and dipping sauces, frozen breads and yeast rolls.

Net sales attributable to McLane Company, Inc. (“McLane”), a wholesale distribution subsidiary of Berkshire Hathaway, Inc., totaled 19%, 18% and 18% of consolidated net sales for 2016, 2015 and 2014, respectively. Net sales attributable to Wal-Mart Stores, Inc. (“Wal-Mart”) totaled 16%, 16% and 17% of consolidated net sales for 2016, 2015 and 2014, respectively. No other customer accounted for more than 10% of our total net sales during these years. Although we have the leading market share in several product categories, all of the markets in which we sell food products are highly competitive in the areas of price, quality and customer service.

We continue to rely upon our strong retail brands, innovation expertise, geographic and channel expansion and customer relationships for future growth. Our category-leading retail brands and commitment to new product development helps drive increased consumer demand in our retail channel. In the foodservice channel, we grow our business with established customers and pursue new opportunities by leveraging our culinary skills and experience to support the development of new products and menu offerings. Strategic acquisitions are also part of our future growth plans, with a focus on fit and value.

A significant portion of our product lines is manufactured at our 15 food plants located throughout the United States. Certain items are also manufactured and packaged by third parties located in the United States, Canada and Europe.

Efficient and cost-effective production remains a key focus. In 2015 we completed a significant processing capacity expansion at our Horse Cave, Kentucky dressing facility to help improve throughput and meet demand for our dressing products.

Our sales are affected by seasonal fluctuations, primarily in the fiscal second quarter and the Easter holiday season when sales of frozen retail products tend to be most pronounced. The impacts on working capital are not significant. We do not utilize any franchises or concessions. In addition to the owned and licensed trademarks discussed above, we also own and operate under innumerable other intellectual property rights, including patents, copyrights, formulas, proprietary trade secrets, technologies, know-how processes and other unregistered rights. We consider our owned and licensed intellectual property rights to be essential to our business.

NET SALES BY CLASS OF PRODUCTS

The following table sets forth information with respect to the percentage of net sales contributed by each class of similar products that account for at least 10% of our consolidated net sales in any year from 2014 through 2016:

2016 | 2015 | 2014 | |||

Specialty Foods | |||||

Non-frozen | 69% | 67% | 65% | ||

Frozen | 31% | 33% | 35% | ||

RESEARCH AND DEVELOPMENT

The estimated amount spent during each of the last three years on research and development activities determined in accordance with generally accepted accounting principles was less than 1% of net sales.

BACKLOG

Orders are generally filled in three to seven days. We do not view the amount of backlog at any particular point in time as a meaningful indicator of longer-term shipments.

COMPETITION

All the markets in which we sell products are highly competitive. We face competition from a number of domestic and foreign manufacturers of various sizes and capabilities. We compete with competitor branded products, as well as an increasing presence of retailers’ store branded products. Our ability to compete depends upon a variety of factors, including the position of our branded goods within various categories, product quality, product innovation, promotional and marketing activity, pricing and our ability to service customers.

4

ENVIRONMENTAL MATTERS

Our operations are subject to various federal, state and local environmental protection laws. Based upon available information, compliance with these laws and regulations did not have a material effect upon the level of capital expenditures, earnings or our competitive position in 2016 and is not expected to have a material impact in 2017.

EMPLOYEES AND LABOR RELATIONS

As of June 30, 2016 we had 2,700 employees, 21% of which are represented under various collective bargaining contracts. 7% of our employees are represented under a collective bargaining contract that expired on April 30, 2016. We are currently renegotiating this contract. 9% of our employees are represented under a collective bargaining contract that will expire within one year. While we believe that labor relations with all our employees are satisfactory, a prolonged labor dispute or an organizing attempt could have a material effect on our business and results of operations.

FOREIGN OPERATIONS AND EXPORT SALES

Over 95% of our products are sold in the United States. Foreign operations and export sales have not been significant in the past and are not expected to be significant in the future based upon existing operations. We do not have any fixed assets located outside of the United States.

RAW MATERIALS

During 2016, we obtained adequate supplies of raw materials and packaging. We rely on a variety of raw materials and packaging for the day-to-day production of our products, including soybean oil, various sweeteners, eggs, dairy-related products, flour, various films and plastic and paper packaging materials.

We purchase the majority of these materials on the open market to meet current requirements, but we also have some fixed-price contracts with terms generally one year or less. See further discussion in our “Risk Factors” section below and our contractual obligations disclosure in Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”). Although the availability and price of certain of these materials are influenced by weather, disease and the level of global demand, we anticipate that future sources of supply will generally be available and adequate for our needs.

Item 1A. Risk Factors

An investment in our common stock is subject to certain risks inherent in our business. Before making an investment decision, you should carefully consider the risks and uncertainties described below, together with all of the other information included or incorporated by reference in this Annual Report on Form 10-K.

If any of the following risks occur, our financial condition and results of operations could be materially and adversely affected. If this were to happen, the value of our common stock could decline significantly.

Increases in the costs or limitations to the availability of raw materials we use to produce our products could adversely affect our business by increasing our costs to produce goods.

Our principal raw-material needs include soybean oil, various sweeteners, eggs, dairy-related products, flour, various films, plastic and paper packaging materials and water. Our ability to manufacture and/or sell our products may be impaired by damage or disruption to our manufacturing or distribution capabilities, or to the capabilities of our suppliers or contract manufacturers, due to factors that are hard to predict or beyond our control, such as adverse weather conditions, natural disasters, fire, terrorism, pandemics, strikes or other events. Production of the agricultural commodities used in our business may also be adversely affected by drought, water scarcity, temperature extremes, scarcity of suitable agricultural land, worldwide demand, livestock disease (for example, avian influenza), crop disease and/or crop pests.

We purchase a majority of our key raw materials on the open market. Our ability to avoid the adverse effects of a pronounced, sustained price increase in our raw materials is limited. We have observed increased volatility in the costs of many of these raw materials in recent years. Beginning in the fourth quarter of 2015, we experienced a significant increase in our egg-based ingredient costs as a direct result of a highly pathogenic strain of avian influenza that affected the primary egg-producing region in the United States. This increase was very sudden and significant and it adversely affected our results for the fourth quarter of 2015 and first half of 2016. In the past, fluctuating petroleum prices have impacted our costs of resin-based packaging and our costs of inbound freight on all purchased materials.

We try to limit our exposure to price fluctuations for raw materials by periodically entering into longer-term, fixed-price contracts for certain raw materials, but there can be no assurance that we will be successful in limiting our exposure to these price fluctuations. We may experience further increases in the costs of raw materials, and we may try to offset such cost increases with higher prices or other measures. However, we may be unable to successfully implement offsetting measures.

5

Such cost increases, as well as an inability to effectively implement additional measures to offset higher costs, could have a material adverse effect on our business and results of operations.

McLane, a foodservice distributor, is our largest customer and an adverse change in the financial condition of its business could have a material adverse impact on our results of operations and cash flows. Additionally, the loss of, or a significant reduction in, our business with the underlying foodservice customers could cause our sales and net income to decrease.

Our net sales to McLane represented 19% of consolidated net sales for the year ended June 30, 2016. Our accounts receivable balance from McLane as of June 30, 2016 was $11.2 million. McLane is a large national distributor that sells and distributes our products to several of our foodservice national chain customers, principally in the quick service and casual dining channels. In general, our foodservice national chain customers have direct relationships with us, but many choose to buy our products through McLane, who acts as their distributor. McLane orders our products on behalf of these customers and we invoice McLane for these sales. Thus, unfavorable changes in the financial condition of McLane could have a material adverse effect on our profitability. In addition, the loss of, or significant reduction in our business with the underlying foodservice customers, or other disruptions, such as decreased consumer demand or stronger competition, could also have a material adverse effect on our business and results of operations. We believe that our relationship with McLane and the underlying foodservice customers is good, but we cannot assure that we will be able to maintain these relationships. McLane and the underlying foodservice customers are not typically committed to long-term contractual obligations with us, and they may switch to other suppliers that offer lower prices, differentiated products or customer service that McLane and/or the underlying foodservice customers perceive to be more favorable. In addition, changes in the general business model of McLane, or the underlying foodservice customers, could have an adverse effect on our business, results of operations and financial condition.

Wal-Mart is our second largest customer and an adverse change in the financial condition of its business could have a material adverse impact on our results of operations and cash flows. Additionally, the loss of, or a significant reduction in, its business could cause our sales and net income to decrease.

Our net sales to Wal-Mart represented 16% of consolidated net sales for the year ended June 30, 2016. Our accounts receivable balance from Wal-Mart as of June 30, 2016 was $16.6 million. While our relationship with Wal-Mart has been long-standing and believed to be good, we cannot assure that we will be able to maintain this relationship. Wal-Mart is not contractually obligated to purchase from us. In addition, changes in Wal-Mart’s general business model, such as reducing the shelf space devoted to the branded products we market, or devoting more shelf space to competing products, could adversely affect the profitability of our business with Wal-Mart, even if we maintain a good relationship. The loss of, or a significant reduction in, this business could have a material adverse effect on our sales and profitability. Unfavorable changes in Wal-Mart’s financial condition or other disruptions to Wal-Mart, such as decreased consumer demand or stronger competition, could also have a material adverse effect on our business and results of operations.

Competitive conditions within our markets could impact our sales volumes and operating profits.

Competition within all of our markets is intense and is expected to remain so. Numerous competitors exist, many of which are larger than us in size. These competitive conditions could lead to significant downward pressure on the prices of our products, which could have a material adverse effect on our sales and profitability.

Competitive considerations in the various product categories in which we sell are numerous and include price, product innovation, product quality, brand recognition and loyalty, effectiveness of marketing, promotional activity and the ability to identify and satisfy consumer preferences and trends. In order to protect existing market share or capture increased market share among our retail and foodservice channels, we may decide to increase our spending on marketing and promotional costs, advertising and new product innovation. The success of marketing, advertising and new product innovation is subject to risks, including uncertainties about trade and consumer acceptance. As a result, any increased expenditures we make may not maintain or enhance market share and could result in lower profitability.

We may be subject to product recalls or other claims for mislabeled, adulterated, contaminated or spoiled food products.

Our results of operations could be impacted by both real and unfounded claims regarding our products, our competitors’ products and our suppliers’ products. Under certain circumstances, we may need to recall some of our products if they are, or have the potential to be, mislabeled, adulterated or contaminated. Any of these circumstances could necessitate a voluntary or mandatory recall due to a substantial product hazard, a need to change a product’s labeling or out of an abundance of caution for consumer safety. A pervasive product recall may have an adverse effect on our results of operations due to the costs of a recall, related legal claims, the destruction of product inventory, lost sales due to the unavailability of product for a period of time, or a loss of customer and consumer sentiment. In addition, we may also be liable if any of our products causes bodily injury or illness.

6

Any claim or product recall could stem from, or result in, noncompliance with federal or state food laws and regulations. Such an action could force us to stop selling our products and create significant adverse publicity that could harm our credibility and decrease market acceptance of our products.

If we are required to defend against a product liability or other claim, whether or not we are found liable under the claim, we could incur substantial costs, our reputation could suffer and our customers might substantially reduce their existing or future orders from us.

Adverse publicity or consumer concern regarding the safety and quality of food products or health concerns, whether with our products or for food products in the same food group as our products, may result in the loss of sales.

We are highly dependent upon consumers’ perception of the safety, quality and possible dietary attributes of our products. As a result, substantial negative publicity concerning one or more of our products, or other foods similar to or in the same food group as our products, could lead to a loss of consumer confidence in our products, removal of our products from retailers’ shelves and/or reduced prices and sales of our products. Product quality issues, whether actual or perceived, or allegations of product contamination, even when false or unfounded, could hurt the image of our brands and cause consumers to choose other products. Furthermore, any product recall, whether our own or by a third party within one of our categories or due to real or unfounded allegations, could damage our brand image and reputation. Any of these events could have a material adverse effect on our business, results of operations and financial condition.

If we conduct operations in a market channel that suffers a loss in consumer confidence as to the safety and quality of food products, our business could be materially affected. The food industry has recently been subject to negative publicity concerning the health implications of GMOs, obesity, trans fat, diacetyl, artificial growth hormones, and bacterial contamination, such as salmonella and listeria. Consumers may increasingly require that foods meet stricter standards than are required by applicable governmental agencies, thereby increasing the cost of manufacturing such foods and ingredients. Developments in any of these areas, including, but not limited to, a negative perception about our formulations could cause our operating results to differ materially from expected results. Any of these events could materially reduce our sales, materially increase our costs and have a material adverse effect on our business, results of operations and financial condition.

We rely on the value of the brands we sell, and the failure to maintain and enhance these brands could adversely affect our business.

We rely on the success of our well-recognized brand names. Maintaining and enhancing our brand image and recognition is essential to our long-term success and maintaining license agreements under which we market and sell certain brands is important to our business. The failure to do either could have a material adverse effect on our business, financial condition and results of operations. We seek to maintain and enhance our brands through a variety of efforts, including the delivery of quality products, extending our brands into new markets and new products and investing in marketing and advertising. The costs of maintaining and enhancing our brands, including maintaining our rights to brands under license agreements, may increase. These increased costs could have a material adverse impact on our business, financial condition and results of operations.

We manufacture and sell numerous products pursuant to brand license agreements, including without limitation Olive Garden® dressing, Jack Daniel’s® mustards and Hungry Girl® flatbreads. We believe that our relationships with our brand licensors are good, but we cannot assure that we will maintain those relationships. Many of our brand license agreements can be terminated or not renewed at the option of the licensor upon short notice to us. The termination of our brand license agreements, the failure to renew our brand license agreements on terms favorable to us, or the impairment of our relationship with our brand licensors could have a material adverse effect on our sales, profitability and results of operations.

In addition, we increasingly rely on electronic marketing, such as social media platforms and the use of online marketing strategies, to support and enhance our brands. This marketplace is growing and evolving quickly and allows for the rapid dissemination of information regarding our brands by us and consumers. We may not be able to successfully adapt our marketing efforts to this marketplace, which could have a material adverse impact on our business, financial condition and results of operations. Further, negative opinions or commentary posted online regarding our brands, regardless of their underlying merits or accuracy, could diminish the value of our brands and adversely affect our business, financial condition and results of operations.

7

We rely on the performance of major retailers, wholesalers, food brokers, distributors, foodservice customers and mass merchants for the success of our business, and should they perform poorly or give higher priority to other brands or products, our business could be adversely affected.

We sell our products principally to retail and foodservice channels, including traditional supermarkets, mass merchants, warehouse clubs, specialty food distributors, foodservice distributors and national restaurant chain accounts. Poor performance by our major wholesalers, retailers or chains, or our foodservice customers, or our inability to collect accounts receivable from our customers, could have a material adverse effect on our results of operations and financial condition.

In addition, many of our retail customers offer competitor branded and their own store branded products that compete directly with our products for shelf space and consumer purchases. Accordingly, there is a risk that these customers may give higher priority or promotional support to their store branded products or to the products of our competitors or discontinue the use of our products in favor of their store branded products or other competing products. Failure to maintain our retail shelf space or priority with these customers could have a material adverse effect on our business and results of operations.

Increases in energy-related costs could negatively affect our business by increasing our costs to produce goods.

We are subject to volatility in energy-related costs that affect the cost of producing and distributing our products, including our petroleum-derived packaging materials. While energy costs have generally trended lower over the past several quarters, sudden and dramatic increases in these types of costs could have a material adverse effect on our business and results of operations.

We limit our exposure to price fluctuations in energy-related costs by periodically entering into longer-term, fixed-price contracts for natural gas and electricity supply to some of our manufacturing facilities, but there can be no assurance that we will be successful in fully limiting our exposure to future price fluctuations.

Manufacturing capacity constraints may have a material adverse effect on us.

Our current manufacturing resources may be inadequate to meet significantly increased demand for some of our food products. Our ability to increase our manufacturing capacity depends on many factors, including the availability of capital, steadily increasing consumer demand, equipment delivery, construction lead-times, installation, qualification, regulatory permitting and regulatory requirements. Increasing capacity through the use of third party manufacturers depends on our ability to develop and maintain such relationships and the ability of such third parties to devote additional capacity to fill our orders.

A lack of sufficient manufacturing capacity to meet demand could cause our customer service levels to decrease, which may negatively affect customer demand for our products and customer relations generally, which in turn could have a material adverse effect on us. In addition, operating facilities at or near capacity may also increase production and distribution costs and negatively affect relations with our employees or contractors, which could result in disruptions in our operations.

A disruption of production at certain manufacturing facilities could result in an inability to provide adequate levels of customer service.

Because we source certain products from single manufacturing sites and use third party manufacturers for significant portions of our production needs for certain products, it is possible that we could experience a production disruption that results in a reduction or elimination of the availability of some of our products. Should we not be able to obtain alternate production capability in a timely manner, or on favorable terms, a negative impact on our results of operations could result, including the potential for long-term loss of product placement with various customers.

We are also subject to risks of other business disruptions associated with our dependence on production facilities and distribution systems. Natural disasters, terrorist activity or other unforeseen events could interrupt production or distribution and have a material adverse effect on our business and results of operations, including the potential for long-term loss of product placement with our customers.

The availability and cost of transportation for our products is vital to our success, and the loss of availability or increase in the cost of transportation could have an unfavorable impact on our business and results of operations.

Our ability to obtain adequate and reasonably priced methods of transportation to distribute our products is a key factor to our success. A substantial portion of our products requires the use of refrigerated trailers for shipping. Delays in transportation, including weather-related delays, could have a material adverse effect on our business and results of operations. Further, increased line haul costs due to industry capacity constraints and high fuel costs could also negatively impact our financial results. We are often required to pay fuel surcharges that fluctuate with the price of diesel fuel to third-party transporters of our products. While diesel fuel prices have trended lower over the past several quarters, our fuel surcharges can be substantial. Accordingly, any sudden or dramatic increases in the price of diesel fuel would serve to increase our fuel surcharges and our cost of goods sold. If we were unable to pass those higher costs to our customers in the form of price increases, those higher costs could have a material adverse effect on our business and results of operations.

8

Our inability to successfully renegotiate collective bargaining contracts and any prolonged work stoppages could have an adverse effect on our business and results of operations.

We believe that our labor relations with employees under collective bargaining contracts are satisfactory, but our inability to negotiate the renewal of these contracts could have a material adverse effect on our business and results of operations. Any prolonged work stoppages could also have an adverse effect on our results of operations. We are currently renegotiating the labor contract for our Bedford Heights, Ohio plant facility, which produces various garlic bread products.

Technology failures could disrupt our operations and negatively impact our business.

We increasingly rely on information technology systems to conduct and manage our business operations, including the processing, transmitting, and storing of electronic information. For example, our sales group and our production and distribution facilities utilize information technology to increase efficiencies and limit costs. Furthermore, a significant portion of the communications between our personnel, customers, and suppliers depends on information technology. Our information technology systems may be vulnerable to a variety of interruptions due to events beyond our control, including, but not limited to, natural disasters, terrorist attacks, telecommunications failures and other security issues. If we are unable to adequately protect against these vulnerabilities, our operations could be disrupted, or we may suffer financial damage or loss because of lost or misappropriated information.

Cyber attacks or other breaches of network or other information technology security could have an adverse effect on our business.

Cyber attacks or other breaches of network or information technology security may cause equipment failures or disruptions to our operations. Our inability to operate our networks as a result of such events, even for a limited period of time, may result in significant expenses. Cyber attacks, which include the use of malware, computer viruses and other means for disruption or unauthorized access, have increased in frequency, scope and potential harm in recent years. To date, we have not been subject to cyber attacks or other cyber incidents that, individually or in the aggregate, have been material to our operations or financial condition. While we believe we take reasonable steps to protect the security of our information relative to our perceived risks, our preventative actions may be insufficient to defend against a major cyber attack in the future. The costs associated with a major cyber attack could include increased expenditures on cyber security measures, lost revenues from business interruption, litigation, regulatory fines and penalties and damage to our reputation. If we fail to prevent the theft of valuable information such as financial data, sensitive information about the Company and intellectual property, or if we fail to protect the privacy of customer, consumer and employee confidential data against breaches of network or information technology security, it could result in damage to our reputation and brand image, which could adversely impact our employee, customer and investor relations. Any of these occurrences could have a material adverse effect on our business, results of operations, financial condition and cash flows.

We are subject to federal, state and local government regulations that could adversely affect our business and results of operations.

Our business operations are subject to regulation by various federal, state and local government entities and agencies. As a producer of food products for human consumption, our operations are subject to stringent production, packaging, quality, labeling and distribution standards, including regulations promulgated under the Federal Food, Drug and Cosmetic Act and the Food Safety Modernization Act. We cannot predict whether future regulation by various federal, state and local governmental entities and agencies would adversely affect our business and results of operations.

In addition, our business operations and the past and present ownership and operation of our properties, including idle properties, are subject to extensive and changing federal, state and local environmental laws and regulations pertaining to the discharge of materials into the environment, the handling and disposition of wastes (including solid and hazardous wastes) or otherwise relating to protection of the environment. Although most of our properties have been subjected to periodic environmental assessments, these assessments may be limited in scope and may not include or identify all potential environmental liabilities or risks associated with any particular property. We cannot be certain that our environmental assessments have identified all potential environmental liabilities or that we will not incur material environmental liabilities in the future.

We cannot assure that environmental issues relating to presently known matters or identified sites or to other matters or sites will not require additional, currently unanticipated investigation, assessment or expenditures. If we do incur or discover any material environmental liabilities or potential environmental liabilities in the future, we may face significant remediation costs and find it difficult to sell or lease any affected properties.

9

Increased government regulations to limit carbon dioxide and other greenhouse gas emissions as a result of concern over climate change may result in increased compliance costs, capital expenditures and other financial obligations for us. We use significant amounts of water, natural gas, diesel fuel, and electricity in the manufacture and distribution of our products. Legislation or regulations affecting these inputs could affect our profitability. In addition, climate change legislation or regulations could affect our ability to procure needed commodities at costs and in quantities we currently experience and may require us to make additional unplanned expenditures.

We may incur liabilities related to multiemployer pension plans which could adversely affect our financial results.

We contribute to two multiemployer pension plans under certain collective bargaining contracts that provide pension benefits to employees and retired employees who are part of the plan. Generally, as a contributor, we are responsible for making periodic contributions to these plans. Our required contributions to these plans could increase, however, based upon a number of factors, including our ability to renegotiate collective bargaining contracts successfully, current and future regulatory requirements, the performance of the pension plan’s investments, the number of participants who are entitled to receive benefits from the plan, a shrinking contribution base as a result of the insolvency or withdrawal of other companies that currently contribute to these plans, the inability or failure of withdrawing companies to pay their withdrawal liability, low interest rates and other funding deficiencies. An increase in our required contributions to these plans could have a material adverse effect on our business, financial condition, results of operations and cash flows.

In addition, if we choose to voluntarily withdraw from a plan, we would be responsible for our proportionate share of the plan’s underfunded vested liability. We currently estimate that our liability for a complete withdrawal from both plans could exceed $16 million. However, that amount can vary at any given time based upon a number of factors, including current and future regulatory requirements, the performance of the pension plan’s investments, the number of participants who are entitled to receive benefits from the plan, the number of other contributors who participate in or withdraw from the plan and whether the plan is terminated. These factors may cause our withdrawal liability to increase, which could have a material adverse effect on our business, financial condition, results of operations and cash flows.

We may not be able to successfully consummate proposed acquisitions or divestitures and integrating acquired businesses may present financial, managerial and operational challenges.

We continually evaluate acquiring other businesses that would strategically fit within our operations. If we are unable to consummate, successfully integrate and grow these acquisitions and to realize contemplated revenue growth, synergies and cost savings, our financial results could be adversely affected. In addition, we may, from time to time, divest businesses, product lines or other operations that are less of a strategic fit within our portfolio or do not meet our growth or profitability targets. As a result, our profitability may be impacted by either gains or losses on the sales of divested assets or lost operating income or cash flows from those businesses.

We may incur asset impairment or restructuring charges related to acquired or divested assets, which may reduce our profitability and cash flows. Finally, a buyer’s inability to fulfill contractual obligations that were assigned as part of a divestiture, including those relating to customer contracts, could lead to future financial loss on our part. These potential acquisitions or divestitures present financial, managerial and operational challenges, including diversion of management attention from ongoing businesses, difficulty with integrating or separating personnel and financial and other systems, increased expenses, assumption of unknown liabilities, indemnities and potential disputes with the buyers or sellers.

The loss of the services of one or more members of our senior management team could have a material adverse effect on our business, financial condition and results of operations.

Our operations and prospects depend in large part on the performance of our senior management team, several of which are long-serving employees with significant knowledge of our business model and operations. Should we not be able to find qualified replacements for any of these individuals if their services were no longer available, our ability to manage our operations or successfully execute our business strategy may be materially and adversely affected.

Mr. Gerlach, our Chief Executive Officer and Chairman of our Board of Directors, has a significant ownership interest in our Company.

As of June 30, 2016, Mr. Gerlach owned or controlled 30% of the outstanding shares of our common stock. Accordingly, Mr. Gerlach has significant influence on all matters submitted to a vote of the holders of our common stock, including the election of directors. Mr. Gerlach’s voting power also may have the effect of discouraging transactions involving an actual or a potential change of control of our Company, regardless of whether a premium is offered over then-current market prices.

The interests of Mr. Gerlach may conflict with the interests of other holders of our common stock. This conflict of interest may have an adverse effect on the price of our common stock.

10

Anti-takeover provisions could make it more difficult for a third party to acquire us.

Certain provisions of our charter documents, including provisions limiting the ability of shareholders to raise matters at a meeting of shareholders without giving advance notice and provisions classifying our Board of Directors, may make it more difficult for a third party to acquire us or influence our Board of Directors. This may have the effect of delaying or preventing changes of control or management, which could have an adverse effect on the market price of our stock.

Additionally, Ohio corporate law contains certain provisions that could have the effect of delaying or preventing a change of control. The Ohio Control Share Acquisition Act found in Chapter 1701 of the Ohio Revised Code provides that certain notice and informational filings and a special shareholder meeting and voting procedures must be followed prior to consummation of a proposed “control share acquisition,” as defined in the Ohio Revised Code. Assuming compliance with the prescribed notice and information filings, a proposed control share acquisition may be accomplished only if, at a special meeting of shareholders, the acquisition is approved by both a majority of the voting power represented at the meeting and a majority of the voting power remaining after excluding the combined voting power of the “interested shares,” as defined in the Ohio Revised Code. The Interested Shareholder Transactions Act found in Chapter 1704 of the Ohio Revised Code generally prohibits certain transactions, including mergers, majority share acquisitions and certain other control transactions, with an “interested shareholder,” as defined in the Ohio Revised Code, for a three-year period after becoming an interested shareholder, unless our Board of Directors approved the initial acquisition. After the three-year waiting period, such a transaction may require additional approvals under this Act, including approval by two-thirds of our voting shares and a majority of our voting shares not owned by the interested shareholder. The application of these provisions of the Ohio Revised Code, or any similar anti-takeover law adopted in Ohio, could have the effect of delaying or preventing a change of control, which could have an adverse effect on the market price of our stock.

Also, our Board of Directors has the authority to issue up to 1,150,000 shares of Class B Voting Preferred Stock and 1,150,000 shares of Class C Nonvoting Preferred Stock and to determine the price, rights, preferences, privileges and restrictions of those shares without any further vote or action by the shareholders. The rights of the holders of our common stock may be subject to, and may be adversely affected by, the rights of the holders of any Class B Voting Preferred Stock and Class C Nonvoting Preferred Stock that may be issued in the future. The Company could use these rights to put in place a shareholder rights plan, or “poison pill,” that could be used in connection with a bid or proposal of acquisition for an inadequate price.

Item 1B. Unresolved Staff Comments

None.

Item 2. Properties

We use 1.8 million square feet of space for our operations. Of this space, 0.5 million square feet are leased.

The following table summarizes our locations (including aggregation of multiple facilities) that are considered the principal manufacturing and warehousing operations of our Specialty Foods segment:

Location | Principal Products Involved | Terms of Occupancy | ||

Altoona, IA (1) | Frozen pasta | Owned/Leased | ||

Bedford Heights, OH (2) | Frozen breads | Owned/Leased | ||

Columbus, OH (2) | Sauces, dressings, dips, distribution of frozen foods | Owned/Leased | ||

Grove City, OH | Distribution of non-frozen foods | Owned | ||

Horse Cave, KY | Sauces, dressings, dips, frozen rolls | Owned | ||

Luverne, AL | Frozen rolls | Owned | ||

Milpitas, CA (3) | Sauces and dressings | Owned/Leased | ||

Saline, MI (2) | Flatbread wraps and pizza crusts | Owned/Leased | ||

Wareham, MA (4) | Croutons | Leased | ||

(1) | Part leased for term expiring in fiscal 2020 |

(2) | Part leased for term expiring in fiscal 2017 |

(3) | Part leased for term expiring in fiscal 2021 |

(4) | Fully leased for term expiring in fiscal 2019 |

11

Item 3. Legal Proceedings

From time to time we are a party to various legal proceedings. While we believe that the ultimate outcome of these various proceedings, individually and in the aggregate, will not have a material effect on our consolidated financial statements, litigation is always subject to inherent uncertainties, and unfavorable rulings could occur. An unfavorable ruling could include monetary damages or an injunction prohibiting us from manufacturing or selling one or more products or could lead to us altering the manner in which we manufacture or sell one or more products, which could have a material impact on net income for the period in which the ruling occurs and future periods.

Item 4. Mine Safety Disclosures

Not applicable.

12

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

Our common stock trades on The NASDAQ Global Select Market under the symbol LANC. The following table sets forth the high and low prices for Lancaster Colony Corporation common shares and the dividends paid for each quarter of 2016 and 2015. Stock prices were provided by The NASDAQ Stock Market LLC.

Stock Prices | Dividends Paid Per Share | ||||||||||

High | Low | ||||||||||

2016 | |||||||||||

First Quarter | $ | 101.63 | $ | 89.62 | $ | 0.46 | |||||

Second Quarter (includes special dividend of $5.00 per share) | $ | 118.74 | $ | 95.47 | 5.50 | ||||||

Third Quarter | $ | 119.80 | $ | 95.78 | 0.50 | ||||||

Fourth Quarter | $ | 128.07 | $ | 107.29 | 0.50 | ||||||

Year | $ | 6.96 | |||||||||

2015 | |||||||||||

First Quarter | $ | 97.44 | $ | 84.48 | $ | 0.44 | |||||

Second Quarter | $ | 96.95 | $ | 81.96 | 0.46 | ||||||

Third Quarter | $ | 96.43 | $ | 86.85 | 0.46 | ||||||

Fourth Quarter | $ | 97.77 | $ | 87.23 | 0.46 | ||||||

Year | $ | 1.82 | |||||||||

The number of shareholders of record as of August 4, 2016 was approximately 770. This is not the actual number of beneficial owners of our common stock, as shares are held in “street name” by brokers and others on behalf of individual owners. The highest and lowest prices for our common stock from July 1, 2016 to August 4, 2016 were $132.06 and $124.90.

We have increased our regular cash dividends for 53 consecutive years. Future dividends will depend on our earnings, financial condition and other factors.

Issuer Purchases of Equity Securities

In November 2010, our Board of Directors approved a share repurchase authorization of 2,000,000 shares, of which 1,418,152 shares remained authorized for future repurchases at June 30, 2016. This share repurchase authorization does not have a stated expiration date. In the fourth quarter, we did not repurchase any of our common stock.

Period | Total Number of Shares Purchased | Average Price Paid Per Share | Total Number of Shares Purchased as Part of Publicly Announced Plans | Maximum Number of Shares that May Yet be Purchased Under the Plans | ||||||||

April 1-30, 2016 | — | $ | — | — | 1,418,152 | |||||||

May 1-31, 2016 | — | $ | — | — | 1,418,152 | |||||||

June 1-30, 2016 | — | $ | — | — | 1,418,152 | |||||||

Total | — | $ | — | — | 1,418,152 | |||||||

13

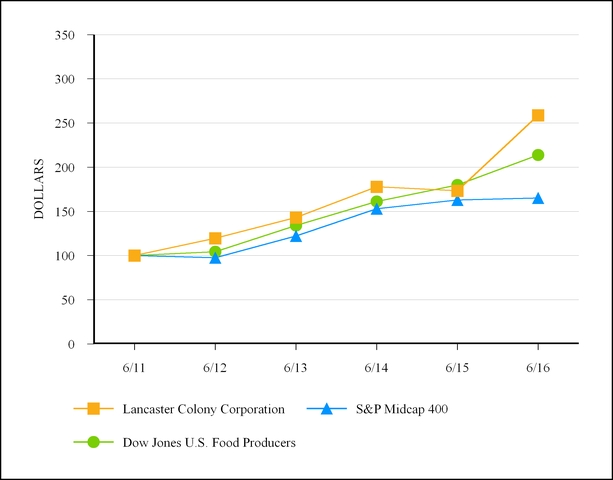

PERFORMANCE GRAPH

COMPARISON OF FIVE-YEAR CUMULATIVE TOTAL SHAREHOLDER RETURN

OF LANCASTER COLONY CORPORATION, THE S&P MIDCAP 400 INDEX

AND THE DOW JONES U.S. FOOD PRODUCERS INDEX

The graph set forth below compares the five-year cumulative total return from investing $100 on June 30, 2011 in each of our Common Stock, the S&P Midcap 400 Index and the Dow Jones U.S. Food Producers Index. It is assumed that all dividends are reinvested, including any special dividends.

Cumulative Total Return (Dollars) | ||||||||||||

6/11 | 6/12 | 6/13 | 6/14 | 6/15 | 6/16 | |||||||

Lancaster Colony Corporation | 100.00 | 119.63 | 143.00 | 178.01 | 173.40 | 258.95 | ||||||

S&P Midcap 400 | 100.00 | 97.67 | 122.27 | 153.12 | 162.92 | 165.09 | ||||||

Dow Jones U.S. Food Producers | 100.00 | 104.38 | 134.10 | 161.28 | 180.00 | 213.95 | ||||||

There can be no assurance that our stock performance will continue into the future with the same or similar trends depicted in the above graph.

14

Item 6. Selected Financial Data

LANCASTER COLONY CORPORATION AND SUBSIDIARIES

FIVE YEAR FINANCIAL SUMMARY

Years Ended June 30, | |||||||||||||||||||

(Thousands Except Per Share Figures) | 2016 | 2015 | 2014 | 2013 | 2012 | ||||||||||||||

Operations | |||||||||||||||||||

Net Sales (1) | $ | 1,191,109 | $ | 1,104,514 | $ | 1,041,075 | $ | 1,013,803 | $ | 988,937 | |||||||||

Gross Profit (1) | $ | 299,629 | $ | 257,692 | $ | 248,568 | $ | 244,707 | $ | 223,428 | |||||||||

Percent of Net Sales | 25.2 | % | 23.3 | % | 23.9 | % | 24.1 | % | 22.6 | % | |||||||||

Income From Continuing Operations Before Income Taxes (1) | $ | 184,633 | $ | 154,552 | $ | 153,279 | $ | 153,818 | $ | 141,216 | |||||||||

Percent of Net Sales | 15.5 | % | 14.0 | % | 14.7 | % | 15.2 | % | 14.3 | % | |||||||||

Taxes Based on Income (1) | $ | 62,869 | $ | 52,866 | $ | 52,293 | $ | 49,958 | $ | 48,867 | |||||||||

Income From Continuing Operations (1) | $ | 121,764 | $ | 101,686 | $ | 100,986 | $ | 103,860 | $ | 92,349 | |||||||||

Percent of Net Sales | 10.2 | % | 9.2 | % | 9.7 | % | 10.2 | % | 9.3 | % | |||||||||

Continuing Operations Diluted Net Income Per Common Share (1) | $ | 4.44 | $ | 3.72 | $ | 3.69 | $ | 3.79 | $ | 3.38 | |||||||||

Cash Dividends Per Common Share - Regular | $ | 1.96 | $ | 1.82 | $ | 1.72 | $ | 1.52 | $ | 1.41 | |||||||||

Cash Dividends Per Common Share - Special | $ | 5.00 | $ | — | $ | — | $ | 5.00 | $ | — | |||||||||

Financial Position | |||||||||||||||||||

Total Assets (2) | $ | 634,732 | $ | 702,156 | $ | 627,301 | $ | 606,260 | $ | 669,467 | |||||||||

Property, Plant and Equipment-Net (1) | $ | 169,595 | $ | 172,311 | $ | 168,674 | $ | 168,074 | $ | 161,029 | |||||||||

Property Additions (1) (3) | $ | 16,671 | $ | 18,298 | $ | 15,645 | $ | 23,460 | $ | 15,506 | |||||||||

Depreciation and Amortization (1) | $ | 24,147 | $ | 21,111 | $ | 18,993 | $ | 17,617 | $ | 17,589 | |||||||||

Long-Term Debt | $ | — | $ | — | $ | — | $ | — | $ | — | |||||||||

Shareholders’ Equity | $ | 513,598 | $ | 580,918 | $ | 528,597 | $ | 501,222 | $ | 564,267 | |||||||||

Per Common Share | $ | 18.73 | $ | 21.23 | $ | 19.33 | $ | 18.34 | $ | 20.68 | |||||||||

Weighted Average Common Shares Outstanding-Diluted | 27,373 | 27,327 | 27,308 | 27,285 | 27,265 | ||||||||||||||

(1) | Amounts for 2012-2014 exclude the impact of the discontinued Glassware & Candles segment operations. |

(2) | Certain prior-year balances were reclassified in 2016 to reflect the impact of the adoption of new accounting guidance about the presentation of deferred tax assets and liabilities. With the adoption, our net deferred tax liability for all periods presented has been classified as noncurrent. |

(3) | Amount for 2015 excludes property of $6.9 million obtained in the Flatout acquisition. |

15

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Our fiscal year begins on July 1 and ends on June 30. Unless otherwise noted, references to “year” pertain to our fiscal year; for example, 2016 refers to fiscal 2016, which is the period from July 1, 2015 to June 30, 2016.

The following discussion should be read in conjunction with the “Selected Financial Data” in Item 6 and our consolidated financial statements and the notes thereto in Item 8 of this Annual Report on Form 10-K. The forward-looking statements in this section and other parts of this report involve risks, uncertainties and other factors, including statements regarding our plans, objectives, goals, strategies, and financial performance. Our actual results could differ materially from the results anticipated in these forward-looking statements as a result of factors set forth under the caption “Forward-Looking Statements” and those set forth in Item 1A.

OVERVIEW

Business Overview

Lancaster Colony Corporation is a manufacturer and marketer of specialty food products for the retail and foodservice channels.

We previously manufactured and marketed candles for the food, drug and mass markets until that business was sold on January 30, 2014. The financial results of these operations for 2014, previously included in our Glassware and Candles segment, are reported as discontinued operations.

In March 2015 we acquired all of the issued and outstanding capital stock of Flatout Holdings, Inc. (“Flatout”), a privately owned manufacturer and marketer of flatbread wraps and pizza crusts based in Saline, Michigan. The purchase price was $92.2 million, net of cash acquired. This transaction is discussed in further detail in Note 2 to the consolidated financial statements.

Part of our future growth may result from acquisitions. We continue to review potential acquisitions that we believe will complement our existing product lines, enhance our profitability and/or offer good expansion opportunities in a manner that fits our overall strategic goals.

Our operations are organized into one reportable segment: “Specialty Foods.” Our sales are predominately domestic.

Our business has the potential to achieve future growth in sales and profitability due to attributes such as:

• | leading retail market positions in several product categories with a high-quality perception; |

• | recognized innovation in retail products; |

• | a broad customer base in both retail and foodservice accounts; |

• | well-regarded culinary expertise among foodservice customers; |

• | recognized leadership in foodservice product development; |

• | experience in integrating complementary business acquisitions; and |

• | historically strong cash flow generation that supports growth opportunities. |

Our goal is to grow both retail and foodservice sales over time by:

• | leveraging the strength of our retail brands to increase current product sales; |

• | introducing new retail products and expanding distribution; |

• | growing our foodservice sales through the strength of our reputation in product development and quality; and |

• | pursuing acquisitions that meet our strategic criteria. |

In our retail channel, we utilize numerous branded products to support growth and maintain market competitiveness. We place great emphasis on our product innovation and development efforts to enhance growth by providing distinctive new products or extensions of our current product lines to meet the evolving needs and preferences of consumers.

Our foodservice sales primarily consist of products sold to restaurant chains, either directly or through distributors. Over the long-term, we have experienced broad-based growth in our foodservice sales, as we build on our strong reputation for product development and quality.

We have made substantial capital investments to support our existing food operations and future growth opportunities. For example, in 2015 we completed a significant processing capacity expansion at our Horse Cave, Kentucky dressing facility to help meet demand for our dressing products. Based on our current plans and expectations, we believe our capital expenditures for 2017 could total approximately $20 to $22 million. We anticipate we will be able to fund all of our capital needs in 2017 with cash generated from operations.

Summary of 2016 Results

Consolidated net sales reached $1,191 million during 2016, increasing by 8% as compared to prior-year net sales of $1,105 million, driven by increased retail and foodservice volumes, pricing actions and the contribution from Flatout.

16

Gross profit increased 16% to $299.6 million from the prior-year total of $257.7 million. The increase resulted from higher sales, reduced commodity costs and lower freight costs.

Net income totaled $121.8 million in 2016, or $4.44 per diluted share, compared to net income of $101.7 million, or $3.72 per diluted share, in 2015. Net income in 2014 totaled $75.0 million, or $2.74 per diluted share, which included an after-tax loss on the sale of our candle manufacturing and marketing operations of $29.1 million.

Looking Forward

For 2017, we expect volume-driven growth in our retail sales channel with support from recent and upcoming new product introductions along with increased sales from Flatout. In the first half of 2017, we expect volume-driven growth from continuing customers in our foodservice channel will be largely offset by the influence of lower pricing (due to lower commodity costs, particularly eggs) and the impact of our customer rationalization initiative which began in the third quarter of 2016.

We will also continue to consider acquisition opportunities that are consistent with our growth strategy and represent good value or otherwise provide significant strategic benefits.

Among the many factors that may impact our ability to improve sales and operating margins in the coming year are the success of our continued investment in innovation and new products, growth from Flatout and the level of efficiency gains we ultimately achieve from our supply chain and other cost-saving initiatives.

Based on current market conditions, we foresee modestly favorable material cost comparisons in the first half of 2017, due mainly to the impact of lower egg costs and continued favorable trends in certain other key commodities. However, in the second half of 2017, we anticipate a more neutral pricing environment as we anniversary many comparisons on various key ingredients. Future changes in ingredient costs, as well as other material costs, will be influenced by the size of agricultural harvests in both the U.S. and other parts of the world and related global demand, economic conditions and the regulatory environment.

Overall, we continue to limit some of our exposure to volatile swings in food commodity costs through a structured forward purchasing program for certain key materials such as soybean oil and flour. For a more-detailed discussion of the effect of commodity costs, see the “Impact of Inflation” section of this MD&A below. Changes in other notable recurring costs, such as marketing, transportation and production costs, may also impact our overall results.

We will continue to periodically reassess our allocation of capital to ensure that we maintain adequate operating flexibility while providing appropriate levels of cash returns to our shareholders.

RESULTS OF CONSOLIDATED OPERATIONS

Net Sales and Gross Profit

Year Ended June 30, | Change | ||||||||||||||||||||||||

(Dollars in thousands) | 2016 | 2015 | 2014 | 2016 vs. 2015 | 2015 vs. 2014 | ||||||||||||||||||||

Net Sales | $ | 1,191,109 | $ | 1,104,514 | $ | 1,041,075 | $ | 86,595 | 8 | % | $ | 63,439 | 6 | % | |||||||||||

Gross Profit | $ | 299,629 | $ | 257,692 | $ | 248,568 | $ | 41,937 | 16 | % | $ | 9,124 | 4 | % | |||||||||||

Gross Margin | 25.2 | % | 23.3 | % | 23.9 | % | |||||||||||||||||||

In March 2015 we acquired Flatout and its results of operations have been included in our consolidated financial statements from the date of acquisition. Flatout contributed approximately $42 million in net sales to our 2016 results. Flatout net sales were not material to our consolidated financial statements in 2015, with Flatout contributing $13 million in net sales.

2016 to 2015

Consolidated net sales for the year ended June 30, 2016 increased 8% to a new record of $1,191 million from the prior-year record total of $1,105 million. This growth was driven by the contribution from Flatout, increased retail and foodservice volumes and pricing actions. Our overall sales volume, as measured by pounds shipped, improved by 5%. Pricing actions were taken in response to significantly higher egg costs incurred in our first half. In general, the net impact of higher pricing represented more than 1% of net sales for 2016.

Retail net sales increased 10% due to the addition of Flatout and higher sales of certain product lines including Olive Garden® retail dressings and Marzetti® refrigerated dressings, including Simply Dressed®. Foodservice net sales improved 6% as demand from national chain restaurants remained strong. As a percentage of total net sales, retail net sales increased slightly to 52% from 51% in 2015.

Excluding sales contributed by Flatout, consolidated net sales increased 5% in 2016.

17

Our gross margin increased to 25.2% in 2016 compared with 23.3% in 2015 due to the influence of our net pricing actions and lower commodity and freight costs. The significantly higher egg costs attributed to the avian influenza outbreak we experienced in the first half of the year were more than offset by lower costs of certain other raw materials throughout the year, specifically soybean oil, dairy-based products, flour and resin packaging. Excluding any pricing actions, total raw-material costs positively affected our gross margins by less than 1% of net sales.

2015 to 2014

Consolidated net sales for the year ended June 30, 2015 increased 6% to a then record of $1,105 million from the prior-year record total of $1,041 million. This growth was primarily driven by volume and mix. Retail net sales increased 6% due to higher sales of New York BRAND® frozen garlic bread and Olive Garden® retail dressings and the impact of Flatout, but were offset in part by increased promotional spending on some retail product offerings and placement costs for new products. Foodservice net sales also improved 6% primarily due to increased sales to national chain restaurants. Our overall sales volume, as measured by pounds shipped, improved by 5%. Incremental net sales from Flatout accounted for less than 1% of the volume increase. The influence of a more favorable sales mix was estimated to be less than 1%. The net impact of pricing for both retail and foodservice was insignificant. As a percentage of net sales, sales of retail products remained relatively unchanged at 51%.

Our gross margin declined to 23.3% in 2015 compared with 23.9% in 2014 as the benefits from the improved sales volumes and modestly lower material costs were offset by increased operating costs due to capacity constraints in our dressing manufacturing, higher freight expense, increased placement costs for new products and certain nonrecurring charges related to Flatout. The higher levels of operating inefficiencies were most pronounced during the first half of 2015. We estimate that lower ingredient costs beneficially affected our gross margins by less than 1% of net sales.

Selling, General and Administrative Expenses

Year Ended June 30, | Change | ||||||||||||||||||||||||

(Dollars in thousands) | 2016 | 2015 | 2014 | 2016 vs. 2015 | 2015 vs. 2014 | ||||||||||||||||||||

SG&A Expenses | $ | 115,059 | $ | 102,831 | $ | 94,801 | $ | 12,228 | 12 | % | $ | 8,030 | 8 | % | |||||||||||

SG&A Expenses as a Percentage of Net Sales | 9.7 | % | 9.3 | % | 9.1 | % | |||||||||||||||||||

Selling, general and administrative expenses for 2016 totaled $115.1 million and increased 12% as compared with the 2015 total of $102.8 million, which had increased 8% from the 2014 total of $94.8 million. The 2016 increase in these costs reflected the influence of overall higher sales volumes, higher levels of consumer spending on our key retail product lines, as well as the new consumer and trade activities related to Flatout and amortization expense attributable to the Flatout intangible assets. The 2015 increase in these costs reflected higher consumer promotional spending on new products, transaction expenses related to the Flatout acquisition and increased amortization expense attributable to the Flatout intangible assets.

Operating Income

Year Ended June 30, | Change | ||||||||||||||||||||||||

(Dollars in thousands) | 2016 | 2015 | 2014 | 2016 vs. 2015 | 2015 vs. 2014 | ||||||||||||||||||||

Operating Income | |||||||||||||||||||||||||

Specialty Foods | $ | 196,592 | $ | 167,095 | $ | 165,383 | $ | 29,497 | 18 | % | $ | 1,712 | 1 | % | |||||||||||

Corporate Expenses | (12,022 | ) | (12,234 | ) | (11,616 | ) | 212 | (2 | )% | (618 | ) | 5 | % | ||||||||||||

Total | $ | 184,570 | $ | 154,861 | $ | 153,767 | $ | 29,709 | 19 | % | $ | 1,094 | 1 | % | |||||||||||

Operating Income as a Percentage of Net Sales | |||||||||||||||||||||||||

Specialty Foods | 16.5 | % | 15.1 | % | 15.9 | % | |||||||||||||||||||

Total | 15.5 | % | 14.0 | % | 14.8 | % | |||||||||||||||||||

Due to the factors discussed above, the Specialty Foods segment’s operating income for 2016 totaled $196.6 million, an 18% increase from 2015 operating income of $167.1 million. The 2015 total was 1% higher than 2014 operating income of $165.4 million.

The level of the 2016 corporate expenses presented above was consistent with our expectations and was similar to those of 2015 and 2014.

18

Income From Continuing Operations Before Income Taxes

As affected by the factors discussed above, our income from continuing operations before income taxes for 2016 of $184.6 million increased 19% from the 2015 total of $154.6 million. The 2014 income from continuing operations before income taxes was $153.3 million.

Taxes Based on Income

Our effective tax rate was 34.1%, 34.2% and 34.1% in 2016, 2015 and 2014, respectively. Given the nature of our operations (predominately U.S. based for both sales and manufacturing), our effective tax rates typically stay within a fairly narrow range. See Note 9 to the consolidated financial statements for a reconciliation of the statutory rate to the effective rate for each year.

Income From Continuing Operations

Income from continuing operations for 2016 of $121.8 million increased from 2015 income from continuing operations of $101.7 million. Income from continuing operations was $101.0 million in 2014. Diluted weighted average common shares outstanding for each of the years ended June 30, 2016, 2015 and 2014 have remained relatively stable. As a result, and due to the change in income from continuing operations for each year, diluted income from continuing operations per share totaled $4.44, $3.72 and $3.69 for 2016, 2015 and 2014, respectively.

Discontinued Operations

There were no discontinued operations in 2016 and 2015. In 2014, we recorded a loss from discontinued operations of $26.0 million, net of tax, or $0.95 per diluted share, including an after-tax loss of $29.1 million on the sale of our candle manufacturing and marketing operations in January 2014. Income from discontinued operations, net of tax, was $3.1 million in 2014.

Net Income

As influenced by the factors discussed above, net income for 2016 of $121.8 million increased from the 2015 net income of $101.7 million, which had increased from 2014 net income of $75.0 million. Diluted net income per share totaled $4.44 in 2016, an increase from the 2015 total of $3.72 per diluted share. The 2014 net income per share totaled $2.74 per diluted share, which included the loss on the sale of discontinued operations.

FINANCIAL CONDITION

Liquidity and Capital Resources

We maintain sufficient flexibility in our capital structure to ensure our capitalization is adequate to support our future internal growth prospects, acquire food businesses consistent with our strategic goals, and maintain cash returns to our shareholders through cash dividends and share repurchases. Our balance sheet maintained fundamental financial strength during 2016 as we ended the year with $118 million in cash and equivalents, along with shareholders’ equity of $514 million and no debt.

Under our unsecured revolving credit facility (“Facility”), we may borrow up to a maximum of $150 million at any one time. We had no borrowings outstanding under the Facility at June 30, 2016. At June 30, 2016, we had $4.7 million of standby letters of credit outstanding, which reduced the amount available for borrowing on the Facility. The Facility expires in April 2021, and all outstanding amounts are then due and payable. Interest is variable based upon formulas tied to LIBOR or an alternative base rate defined in the Facility, at our option. We must also pay facility fees that are tied to our then-applicable consolidated leverage ratio. Loans may be used for general corporate purposes. Due to the nature of its terms, when we have outstanding borrowings under the Facility, they will be classified as long-term debt.

The Facility contains certain restrictive covenants, including limitations on indebtedness, asset sales and acquisitions, and financial covenants relating to interest coverage and leverage. At June 30, 2016, we were in compliance with all applicable provisions and covenants of the Facility, and we exceeded the requirements of the financial covenants by substantial margins. At June 30, 2016, we were not aware of any event that would constitute a default under the Facility.

We currently expect to remain in compliance with the Facility’s covenants for the foreseeable future. However, a default under the Facility could accelerate the repayment of any outstanding indebtedness and limit our access to $75 million of additional credit available under the Facility. Such an event could require a reduction in or curtailment of cash dividends or share repurchases, reduce or delay beneficial expansion or investment plans, or otherwise impact our ability to meet our obligations when due.

19

We believe that cash provided by operating activities and our existing balances in cash and equivalents, in addition to that available under the Facility, should be adequate to meet our cash requirements through 2017. If we were to borrow outside of the Facility under current market terms, our average interest rate may increase significantly and have an adverse effect on our results of operations.

Cash Flows

Year Ended June 30, | Change | ||||||||||||||||||||||||

(Dollars in thousands) | 2016 | 2015 | 2014 | 2016 vs. 2015 | 2015 vs. 2014 | ||||||||||||||||||||

Provided By Operating Activities | $ | 142,585 | $ | 132,772 | $ | 129,091 | $ | 9,813 | 7 | % | $ | 3,681 | 3 | % | |||||||||||

(Used In) Provided By Investing Activities | $ | (17,423 | ) | $ | (112,325 | ) | $ | 8,475 | $ | 94,902 | 84 | % | $ | (120,800 | ) | N/M | |||||||||

Used In Financing Activities | $ | (189,284 | ) | $ | (49,784 | ) | $ | (49,412 | ) | $ | (139,500 | ) | N/M | $ | (372 | ) | (1 | )% | |||||||

Cash provided by operating activities remains the primary source of financing for our internal growth.