Attached files

Exhibit 99.2

TerraForm PowerSupplemental Information Requested by BondholdersJuly 26, 2016

Forward Looking Statements This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that TerraForm Power expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected adjusted EBITDA, cash available for distribution (CAFD), earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide TerraForm Power’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although TerraForm Power believes its respective expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially. By their nature, forward-looking statements are subject to risks and uncertainties that could cause actual results to differ materially from those suggested by the forward-looking statements. Factors that might cause such differences include, but are not limited to, our relationship with SunEdison, including SunEdison’s bankruptcy filings and our reliance on SunEdison to perform under material intercompany agreements and to provide management and accounting services, project level operation and maintenance and asset management services, to maintain critical information technology and accounting systems and to provide our employees; our ability to integrate the projects we acquire from third parties or otherwise realize the anticipated benefits from such acquisitions; actions of third parties, including but not limited to the failure of SunEdison, to fulfill its obligations; price fluctuations, termination provisions and buyout provisions in offtake agreements; delays or unexpected costs during the completion of projects under construction; our ability to successfully identify, evaluate, and consummate acquisitions from SunEdison or third parties or changes in expected terms and timing of any acquisitions; regulatory requirements and incentives for production of renewable power; operating and financial restrictions under agreements governing indebtedness; the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets; the impact of foreign exchange rate fluctuations; our ability to compete against traditional and renewable energy companies; hazards customary to the power production industry and power generation operations, such as unusual weather conditions and outages or other curtailment of our power plants; departure of some or all of SunEdison’s employees that are dedicated to the Company; pending and future litigation; and our ability to operate our business efficiently, to operate and maintain our information technology, technical, accounting and generation monitoring systems, to manage and complete governmental filings on a timely basis, and to manage our capital expenditures. Furthermore, any dividends are subject to available capital, market conditions, and compliance with associated laws and regulations. Many of these factors are beyond TerraForm Power’s control. TerraForm Power disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties which are described in TerraForm Power’s Form 10-K for the fiscal year ended December 31, 2014, and Forms 10-Q with respect to the first, second and third quarters of 2015, as well as additional factors it may describe from time to time in other filings with the Securities and Exchange Commission or incorporated herein. You should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

Introduction & Importance of our Updated Risk Factors The following information is being provided at the request of bondholders and their advisorsThe financial information presented on the following slides is preliminary and unaudited. Financial information may change materially as a result of the completion of the audit for fiscal year 2015The information does not represent a complete picture of the financial position, results of operation or cash flows of TerraForm Power (“TerraForm Power” or the “Company”), and is not a replacement for full financial statements prepared in accordance with U.S. GAAPThe Company’s last annual or quarterly report was its Form 10-Q for the period ended September 30, 2015. The Company has not filed its Form 10-K for 2015. The circumstances of the Company and the risks it faces have changed substantially since the date of its last filing on Form 10-Q in November 2015. You should review the updated Risk Factors relating to the Company provided simultaneously with this presentation, which include a description of important new risks relating to the chapter 11 proceedings of SunEdison, the consequences of the absence of audited financial information, pending litigation and other matters. These materials and the Risk Factors also have been filed with the SEC on a Form 8-K, dated July 26, 2016

Situation Update Management is motivated to maximize value for all stakeholders and position TerraForm Power for long-term growthTerraForm Power is focused on key areas of executionContinuity of operationsIndependence: governance, systems, employeesStrengthen balance sheetOptimize portfolio through non-recourse project financings and selective divestituresUpdate on the Sale of SunEdison’s Interests in the Company:SunEdison has requested that the Company share confidential information about the Company and take other steps to facilitate the marketing of SunEdison’s interests in the Company, and the Company is considering this requestTerraForm Power has announced that it is working with SunEdison to explore potential value creating options for SunEdison’s interests in the Company. The Company has made no decision to support any particular bidder, structure or transactionThe Company adopted a stockholder protection rights agreement in response to the potential sale by SunEdison and the announced accumulation of TerraForm Power’s Class A shares by third parties

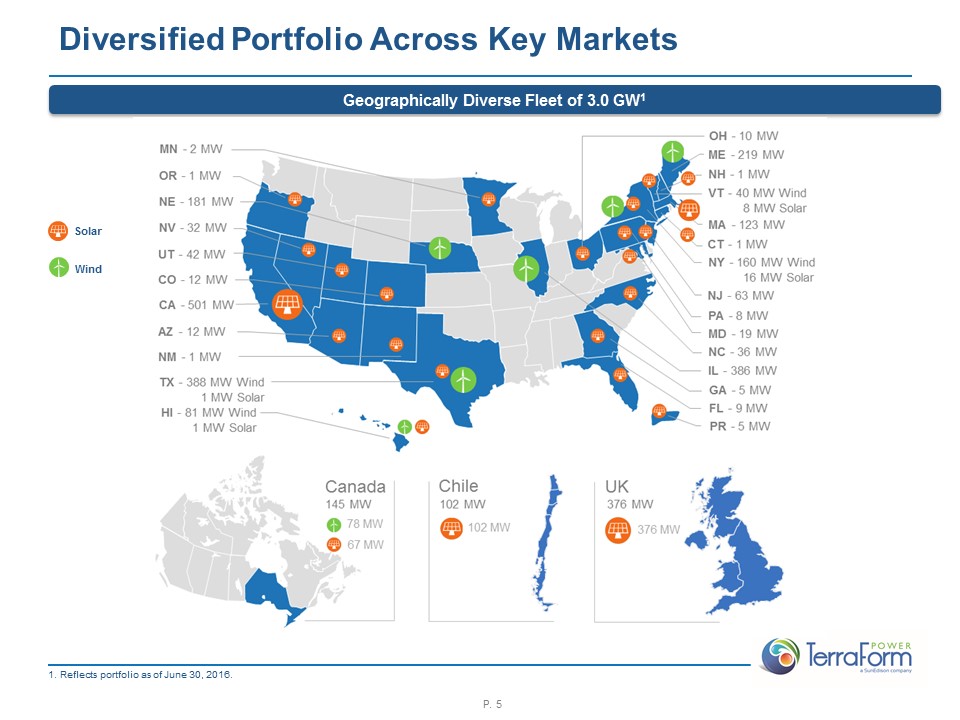

Geographically Diverse Fleet of 3.0 GW1 Wind Solar Reflects portfolio as of June 30, 2016. Diversified Portfolio Across Key Markets

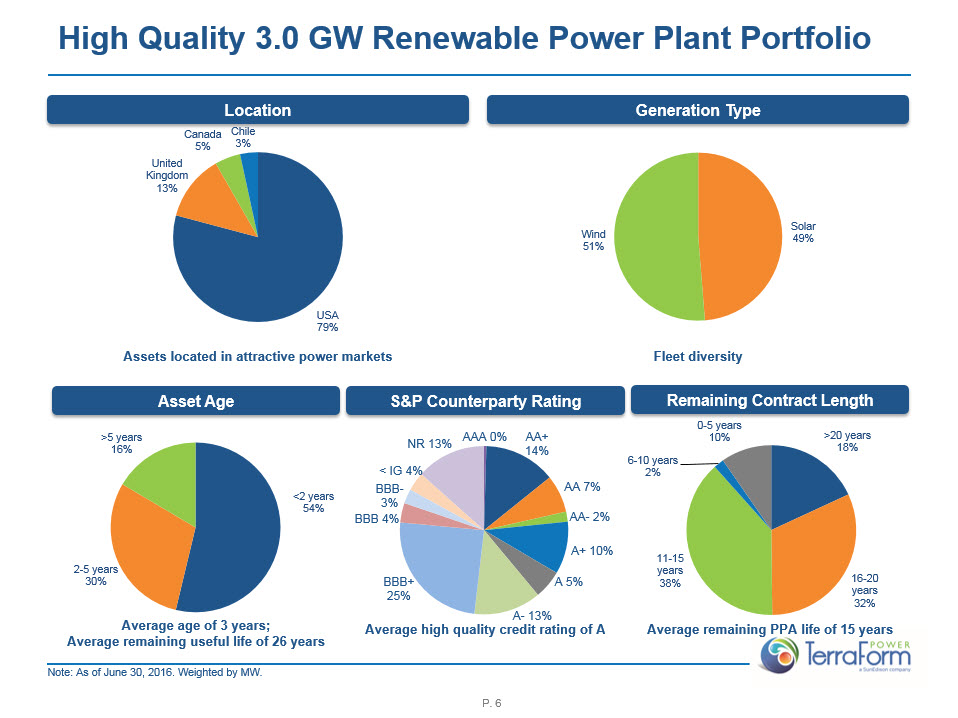

High Quality 3.0 GW Renewable Power Plant Portfolio Location Asset Age Assets located in attractive power markets Remaining Contract Length Average remaining PPA life of 15 years Average age of 3 years; Average remaining useful life of 26 years S&P Counterparty Rating Average high quality credit rating of A Generation Type Fleet diversity Note: As of June 30, 2016. Weighted by MW.

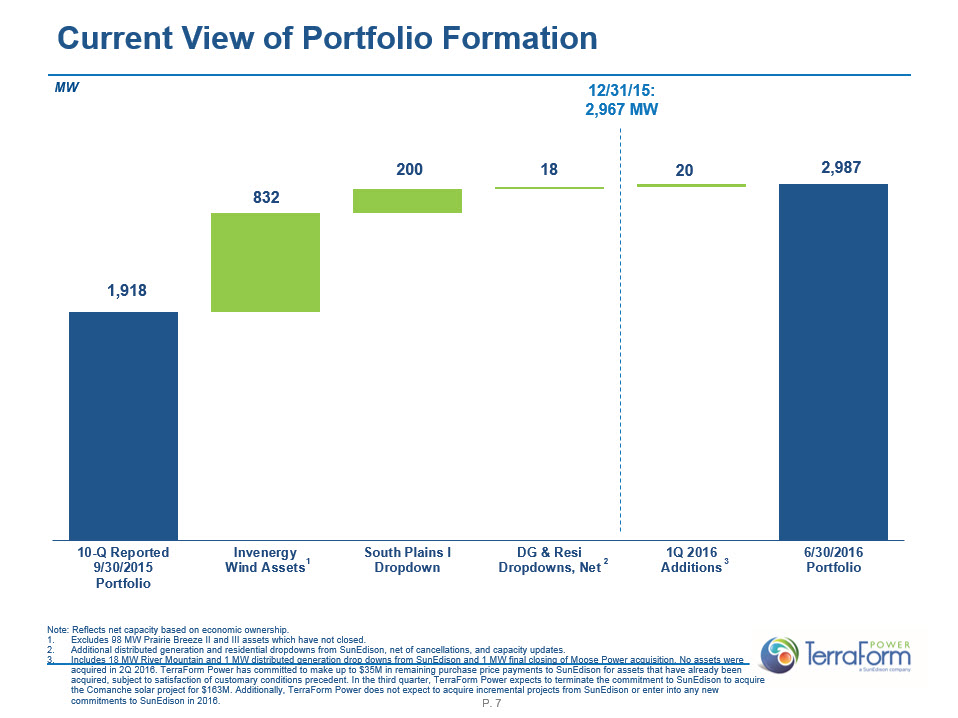

MW Current View of Portfolio Formation Note: Reflects net capacity based on economic ownership.Excludes 98 MW Prairie Breeze II and III assets which have not closed.Additional distributed generation and residential dropdowns from SunEdison, net of cancellations, and capacity updates.Includes 18 MW River Mountain and 1 MW distributed generation drop downs from SunEdison and 1 MW final closing of Moose Power acquisition. No assets were acquired in 2Q 2016. TerraForm Power has committed to make up to $35M in remaining purchase price payments to SunEdison for assets that have already been acquired, subject to satisfaction of customary conditions precedent. In the third quarter, TerraForm Power expects to terminate the commitment to SunEdison to acquire the Comanche solar project for $163M. Additionally, TerraForm Power does not expect to acquire incremental projects from SunEdison or enter into any new commitments to SunEdison in 2016. 1 12/31/15: 2,967 MW 2 3

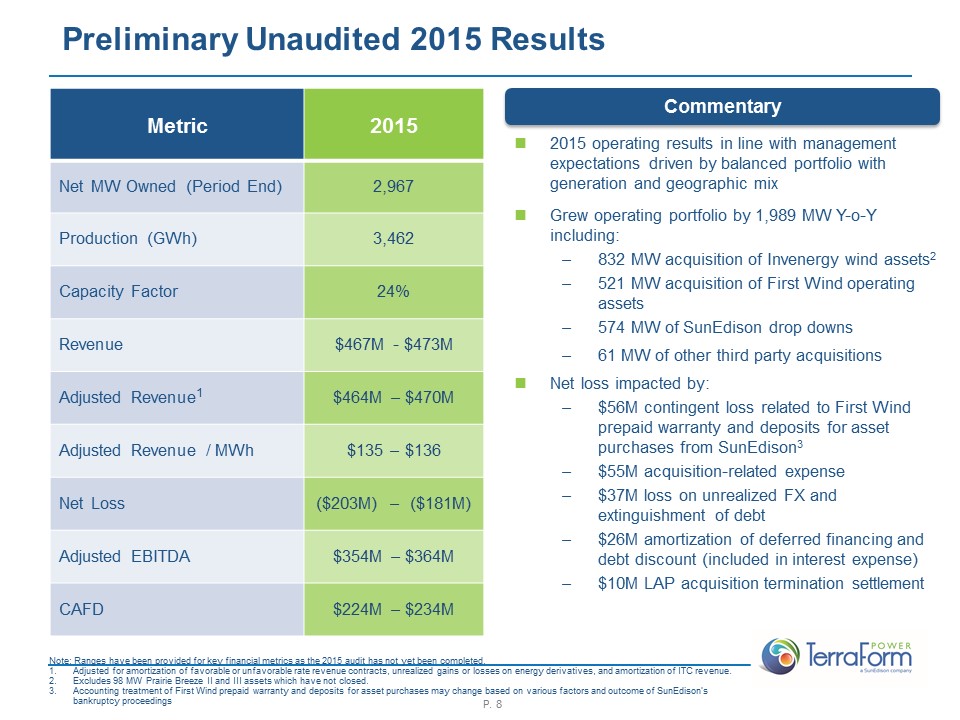

Preliminary Unaudited 2015 Results Note: Ranges have been provided for key financial metrics as the 2015 audit has not yet been completed.Adjusted for amortization of favorable or unfavorable rate revenue contracts, unrealized gains or losses on energy derivatives, and amortization of ITC revenue.Excludes 98 MW Prairie Breeze II and III assets which have not closed.Accounting treatment of First Wind prepaid warranty and deposits for asset purchases may change based on various factors and outcome of SunEdison’s bankruptcy proceedings Commentary 2015 operating results in line with management expectations driven by balanced portfolio with generation and geographic mixGrew operating portfolio by 1,989 MW Y-o-Y including: 832 MW acquisition of Invenergy wind assets2521 MW acquisition of First Wind operating assets574 MW of SunEdison drop downs 61 MW of other third party acquisitionsNet loss impacted by:$56M contingent loss related to First Wind prepaid warranty and deposits for asset purchases from SunEdison3$55M acquisition-related expense$37M loss on unrealized FX and extinguishment of debt$26M amortization of deferred financing and debt discount (included in interest expense)$10M LAP acquisition termination settlement Metric 2015 Net MW Owned (Period End) 2,967 Production (GWh) 3,462 Capacity Factor 24% Revenue $467M - $473M Adjusted Revenue1 $464M – $470M Adjusted Revenue / MWh $135 – $136 Net Loss ($203M) – ($181M) Adjusted EBITDA $354M – $364M CAFD $224M – $234M

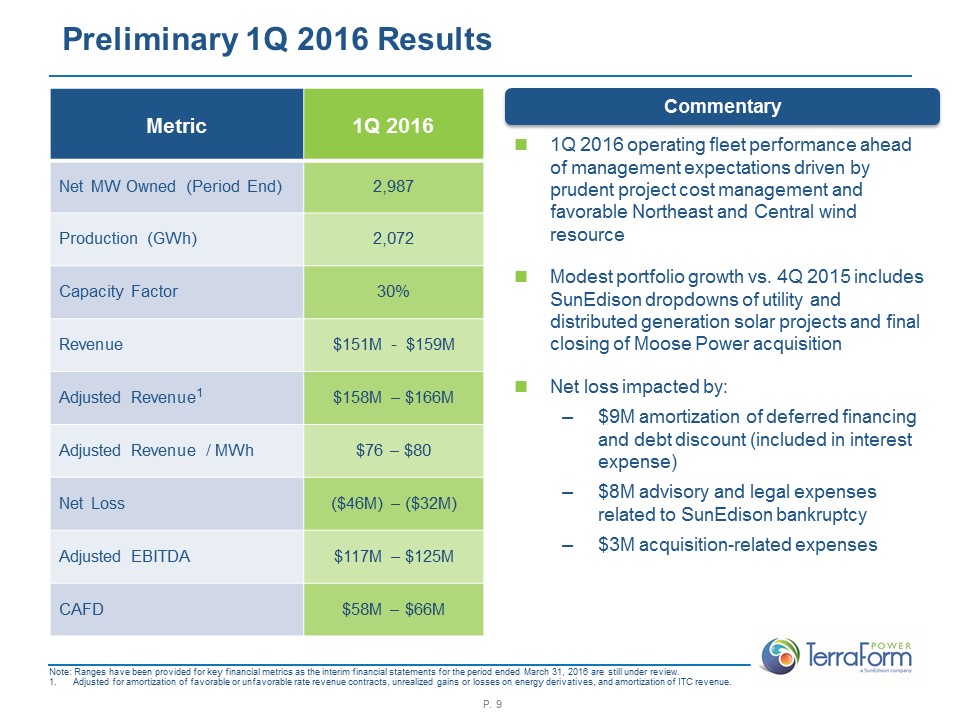

Preliminary 1Q 2016 Results Note: Ranges have been provided for key financial metrics as the interim financial statements for the period ended March 31, 2016 are still under review.Adjusted for amortization of favorable or unfavorable rate revenue contracts, unrealized gains or losses on energy derivatives, and amortization of ITC revenue. Commentary 1Q 2016 operating fleet performance ahead of management expectations driven by prudent project cost management and favorable Northeast and Central wind resource Modest portfolio growth vs. 4Q 2015 includes SunEdison dropdowns of utility and distributed generation solar projects and final closing of Moose Power acquisitionNet loss impacted by:$9M amortization of deferred financing and debt discount (included in interest expense) $8M advisory and legal expenses related to SunEdison bankruptcy$3M acquisition-related expenses Metric 1Q 2016 Net MW Owned (Period End) 2,987 Production (GWh) 2,072 Capacity Factor 30% Revenue $151M - $159M Adjusted Revenue1 $158M – $166M Adjusted Revenue / MWh $76 – $80 Net Loss ($46M) – ($32M) Adjusted EBITDA $117M – $125M CAFD $58M – $66M

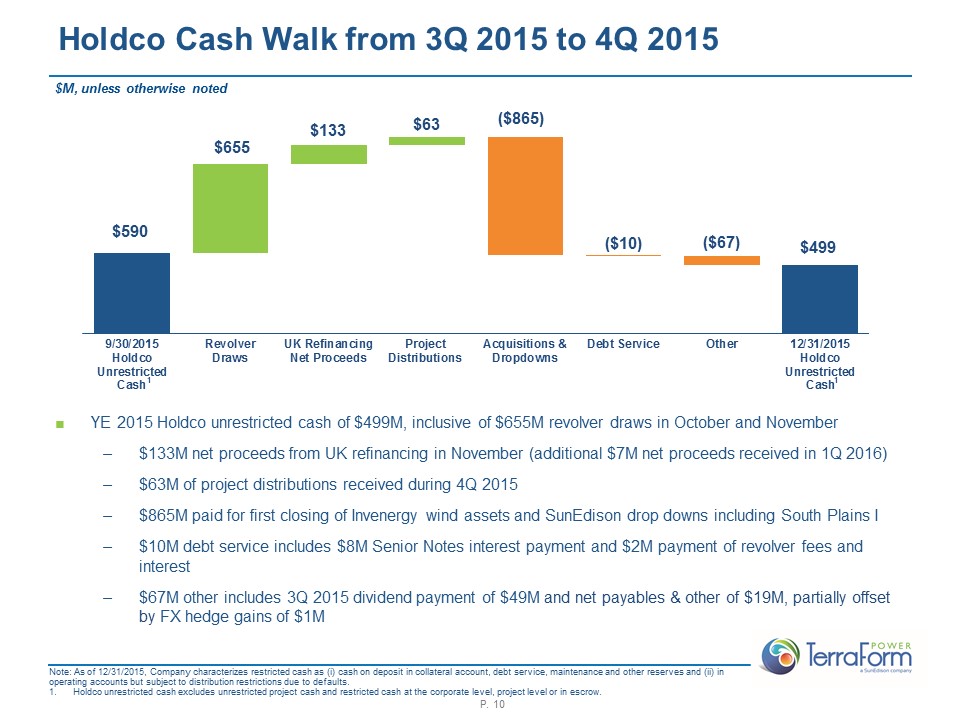

$M, unless otherwise noted Holdco Cash Walk from 3Q 2015 to 4Q 2015 Note: As of 12/31/2015, Company characterizes restricted cash as (i) cash on deposit in collateral account, debt service, maintenance and other reserves and (ii) in operating accounts but subject to distribution restrictions due to defaults.Holdco unrestricted cash excludes unrestricted project cash and restricted cash at the corporate level, project level or in escrow. 1 1 YE 2015 Holdco unrestricted cash of $499M, inclusive of $655M revolver draws in October and November$133M net proceeds from UK refinancing in November (additional $7M net proceeds received in 1Q 2016)$63M of project distributions received during 4Q 2015$865M paid for first closing of Invenergy wind assets and SunEdison drop downs including South Plains I $10M debt service includes $8M Senior Notes interest payment and $2M payment of revolver fees and interest$67M other includes 3Q 2015 dividend payment of $49M and net payables & other of $19M, partially offset by FX hedge gains of $1M

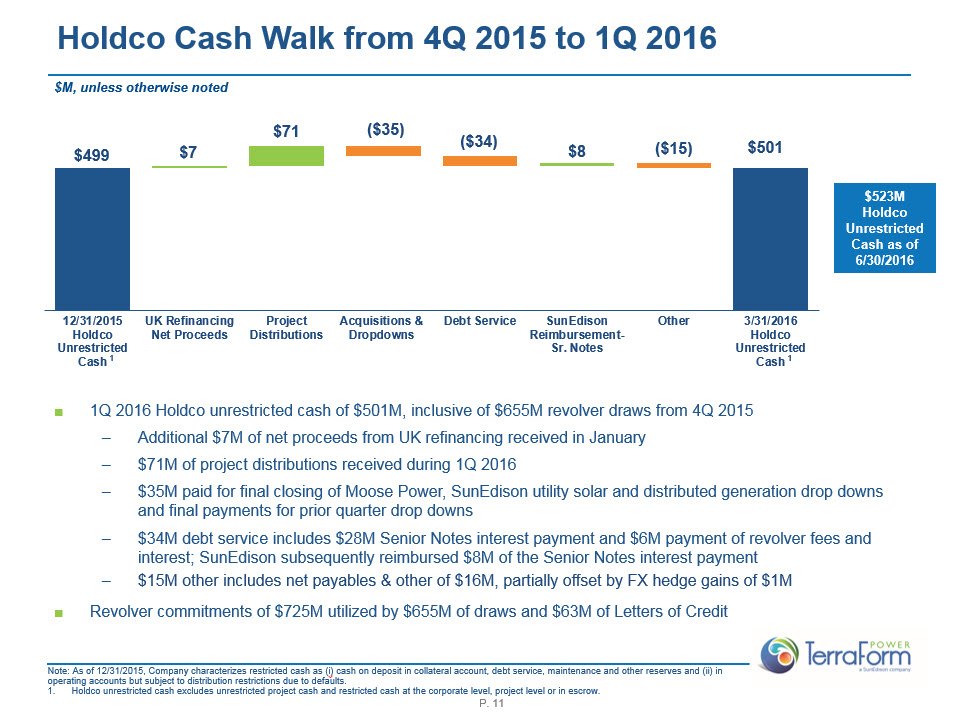

$M, unless otherwise noted Holdco Cash Walk from 4Q 2015 to 1Q 2016 Note: As of 12/31/2015, Company characterizes restricted cash as (i) cash on deposit in collateral account, debt service, maintenance and other reserves and (ii) in operating accounts but subject to distribution restrictions due to defaults.Holdco unrestricted cash excludes unrestricted project cash and restricted cash at the corporate level, project level or in escrow. 1 1 1Q 2016 Holdco unrestricted cash of $501M, inclusive of $655M revolver draws from 4Q 2015Additional $7M of net proceeds from UK refinancing received in January$71M of project distributions received during 1Q 2016$35M paid for final closing of Moose Power, SunEdison utility solar and distributed generation drop downs and final payments for prior quarter drop downs$34M debt service includes $28M Senior Notes interest payment and $6M payment of revolver fees and interest; SunEdison subsequently reimbursed $8M of the Senior Notes interest payment$15M other includes net payables & other of $16M, partially offset by FX hedge gains of $1MRevolver commitments of $725M utilized by $655M of draws and $63M of Letters of Credit $523M Holdco Unrestricted Cash as of 6/30/2016

Appendix

Risk Factors Please refer to the risk factors provided simultaneously and to be read in conjunction with this presentation

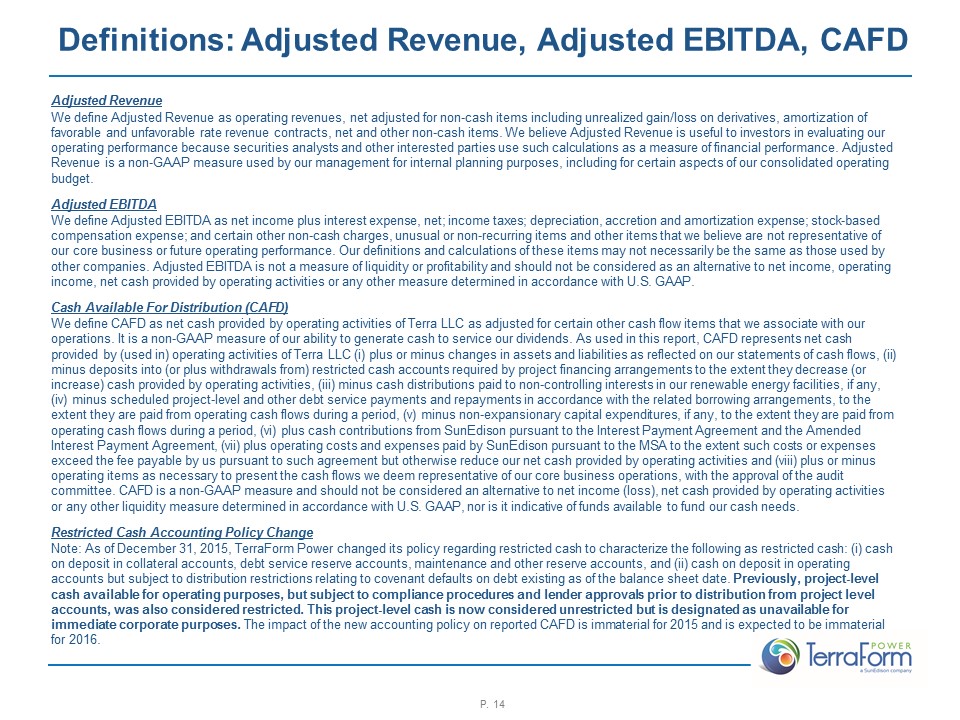

Definitions: Adjusted Revenue, Adjusted EBITDA, CAFD Adjusted RevenueWe define Adjusted Revenue as operating revenues, net adjusted for non-cash items including unrealized gain/loss on derivatives, amortization of favorable and unfavorable rate revenue contracts, net and other non-cash items. We believe Adjusted Revenue is useful to investors in evaluating our operating performance because securities analysts and other interested parties use such calculations as a measure of financial performance. Adjusted Revenue is a non-GAAP measure used by our management for internal planning purposes, including for certain aspects of our consolidated operating budget.Adjusted EBITDAWe define Adjusted EBITDA as net income plus interest expense, net; income taxes; depreciation, accretion and amortization expense; stock-based compensation expense; and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business or future operating performance. Our definitions and calculations of these items may not necessarily be the same as those used by other companies. Adjusted EBITDA is not a measure of liquidity or profitability and should not be considered as an alternative to net income, operating income, net cash provided by operating activities or any other measure determined in accordance with U.S. GAAP.Cash Available For Distribution (CAFD)We define CAFD as net cash provided by operating activities of Terra LLC as adjusted for certain other cash flow items that we associate with our operations. It is a non-GAAP measure of our ability to generate cash to service our dividends. As used in this report, CAFD represents net cash provided by (used in) operating activities of Terra LLC (i) plus or minus changes in assets and liabilities as reflected on our statements of cash flows, (ii) minus deposits into (or plus withdrawals from) restricted cash accounts required by project financing arrangements to the extent they decrease (or increase) cash provided by operating activities, (iii) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (iv) minus scheduled project-level and other debt service payments and repayments in accordance with the related borrowing arrangements, to the extent they are paid from operating cash flows during a period, (v) minus non-expansionary capital expenditures, if any, to the extent they are paid from operating cash flows during a period, (vi) plus cash contributions from SunEdison pursuant to the Interest Payment Agreement and the Amended Interest Payment Agreement, (vii) plus operating costs and expenses paid by SunEdison pursuant to the MSA to the extent such costs or expenses exceed the fee payable by us pursuant to such agreement but otherwise reduce our net cash provided by operating activities and (viii) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations, with the approval of the audit committee. CAFD is a non-GAAP measure and should not be considered an alternative to net income (loss), net cash provided by operating activities or any other liquidity measure determined in accordance with U.S. GAAP, nor is it indicative of funds available to fund our cash needs.Restricted Cash Accounting Policy ChangeNote: As of December 31, 2015, TerraForm Power changed its policy regarding restricted cash to characterize the following as restricted cash: (i) cash on deposit in collateral accounts, debt service reserve accounts, maintenance and other reserve accounts, and (ii) cash on deposit in operating accounts but subject to distribution restrictions relating to covenant defaults on debt existing as of the balance sheet date. Previously, project-level cash available for operating purposes, but subject to compliance procedures and lender approvals prior to distribution from project level accounts, was also considered restricted. This project-level cash is now considered unrestricted but is designated as unavailable for immediate corporate purposes. The impact of the new accounting policy on reported CAFD is immaterial for 2015 and is expected to be immaterial for 2016.

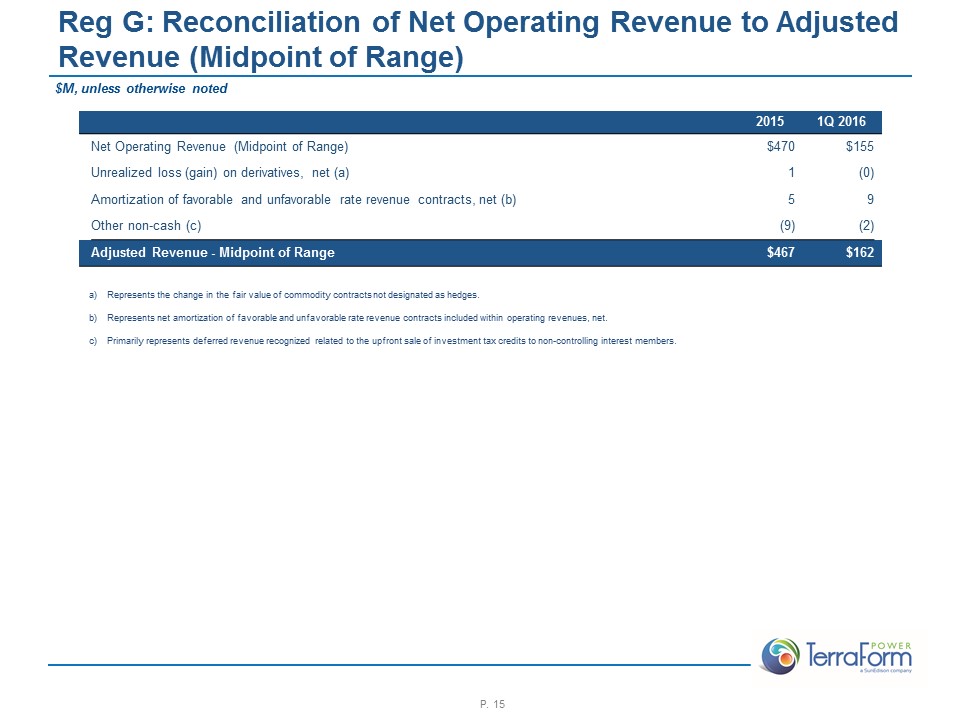

Reg G: Reconciliation of Net Operating Revenue to Adjusted Revenue (Midpoint of Range) Represents the change in the fair value of commodity contracts not designated as hedges.Represents net amortization of favorable and unfavorable rate revenue contracts included within operating revenues, net.Primarily represents deferred revenue recognized related to the upfront sale of investment tax credits to non-controlling interest members. 2015 1Q 2016 Net Operating Revenue (Midpoint of Range) $470 $155 Unrealized loss (gain) on derivatives, net (a) 1 (0) Amortization of favorable and unfavorable rate revenue contracts, net (b) 5 9 Other non-cash (c) (9) (2) Adjusted Revenue - Midpoint of Range $467 $162 $M, unless otherwise noted

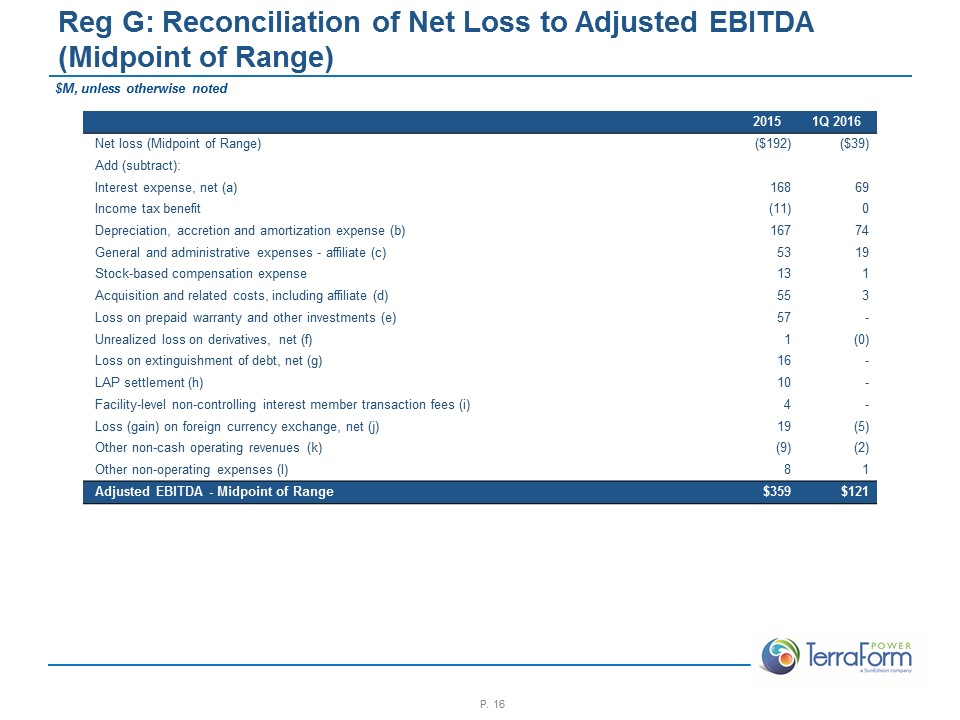

Reg G: Reconciliation of Net Loss to Adjusted EBITDA (Midpoint of Range) 2015 1Q 2016 Net loss (Midpoint of Range) ($192) ($39) Add (subtract): Interest expense, net (a) 168 69 Income tax benefit (11) 0 Depreciation, accretion and amortization expense (b) 167 74 General and administrative expenses - affiliate (c) 53 19 Stock-based compensation expense 13 1 Acquisition and related costs, including affiliate (d) 55 3 Loss on prepaid warranty and other investments (e) 57 - Unrealized loss on derivatives, net (f) 1 (0) Loss on extinguishment of debt, net (g) 16 - LAP settlement (h) 10 - Facility-level non-controlling interest member transaction fees (i) 4 - Loss (gain) on foreign currency exchange, net (j) 19 (5) Other non-cash operating revenues (k) (9) (2) Other non-operating expenses (l) 8 1 Adjusted EBITDA - Midpoint of Range $359 $121 $M, unless otherwise noted

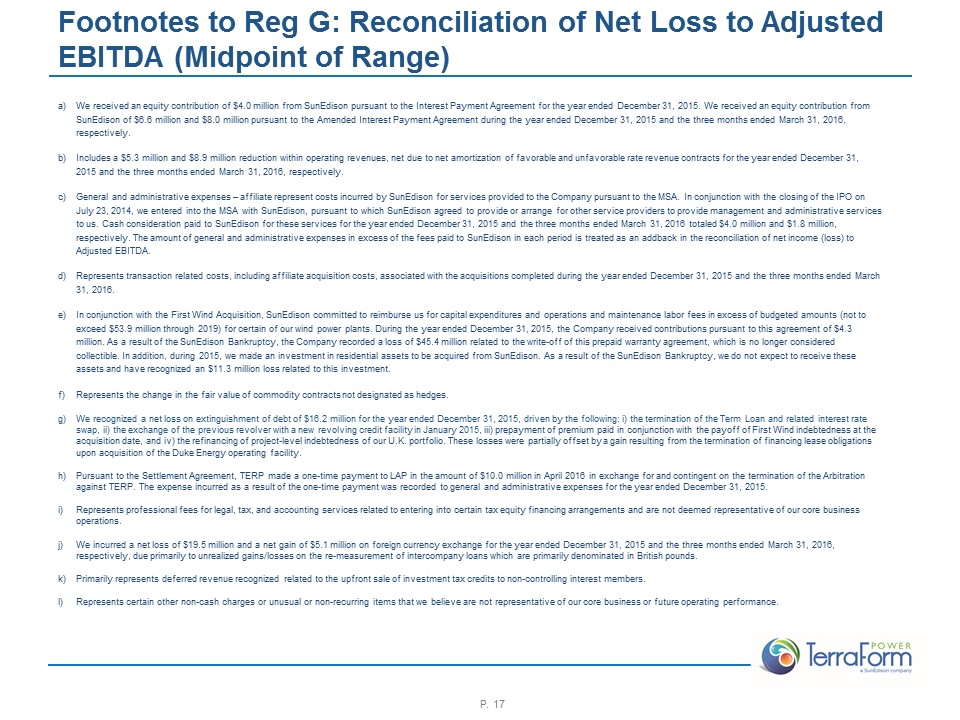

Footnotes to Reg G: Reconciliation of Net Loss to Adjusted EBITDA (Midpoint of Range) We received an equity contribution of $4.0 million from SunEdison pursuant to the Interest Payment Agreement for the year ended December 31, 2015. We received an equity contribution from SunEdison of $6.6 million and $8.0 million pursuant to the Amended Interest Payment Agreement during the year ended December 31, 2015 and the three months ended March 31, 2016, respectively.Includes a $5.3 million and $8.9 million reduction within operating revenues, net due to net amortization of favorable and unfavorable rate revenue contracts for the year ended December 31, 2015 and the three months ended March 31, 2016, respectively.General and administrative expenses – affiliate represent costs incurred by SunEdison for services provided to the Company pursuant to the MSA. In conjunction with the closing of the IPO on July 23, 2014, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. Cash consideration paid to SunEdison for these services for the year ended December 31, 2015 and the three months ended March 31, 2016 totaled $4.0 million and $1.8 million, respectively. The amount of general and administrative expenses in excess of the fees paid to SunEdison in each period is treated as an addback in the reconciliation of net income (loss) to Adjusted EBITDA.Represents transaction related costs, including affiliate acquisition costs, associated with the acquisitions completed during the year ended December 31, 2015 and the three months ended March 31, 2016.In conjunction with the First Wind Acquisition, SunEdison committed to reimburse us for capital expenditures and operations and maintenance labor fees in excess of budgeted amounts (not to exceed $53.9 million through 2019) for certain of our wind power plants. During the year ended December 31, 2015, the Company received contributions pursuant to this agreement of $4.3 million. As a result of the SunEdison Bankruptcy, the Company recorded a loss of $45.4 million related to the write-off of this prepaid warranty agreement, which is no longer considered collectible. In addition, during 2015, we made an investment in residential assets to be acquired from SunEdison. As a result of the SunEdison Bankruptcy, we do not expect to receive these assets and have recognized an $11.3 million loss related to this investment.Represents the change in the fair value of commodity contracts not designated as hedges.We recognized a net loss on extinguishment of debt of $16.2 million for the year ended December 31, 2015, driven by the following: i) the termination of the Term Loan and related interest rate swap, ii) the exchange of the previous revolver with a new revolving credit facility in January 2015, iii) prepayment of premium paid in conjunction with the payoff of First Wind indebtedness at the acquisition date, and iv) the refinancing of project-level indebtedness of our U.K. portfolio. These losses were partially offset by a gain resulting from the termination of financing lease obligations upon acquisition of the Duke Energy operating facility.Pursuant to the Settlement Agreement, TERP made a one-time payment to LAP in the amount of $10.0 million in April 2016 in exchange for and contingent on the termination of the Arbitration against TERP. The expense incurred as a result of the one-time payment was recorded to general and administrative expenses for the year ended December 31, 2015.Represents professional fees for legal, tax, and accounting services related to entering into certain tax equity financing arrangements and are not deemed representative of our core business operations. We incurred a net loss of $19.5 million and a net gain of $5.1 million on foreign currency exchange for the year ended December 31, 2015 and the three months ended March 31, 2016, respectively, due primarily to unrealized gains/losses on the re-measurement of intercompany loans which are primarily denominated in British pounds.Primarily represents deferred revenue recognized related to the upfront sale of investment tax credits to non-controlling interest members. Represents certain other non-cash charges or unusual or non-recurring items that we believe are not representative of our core business or future operating performance.

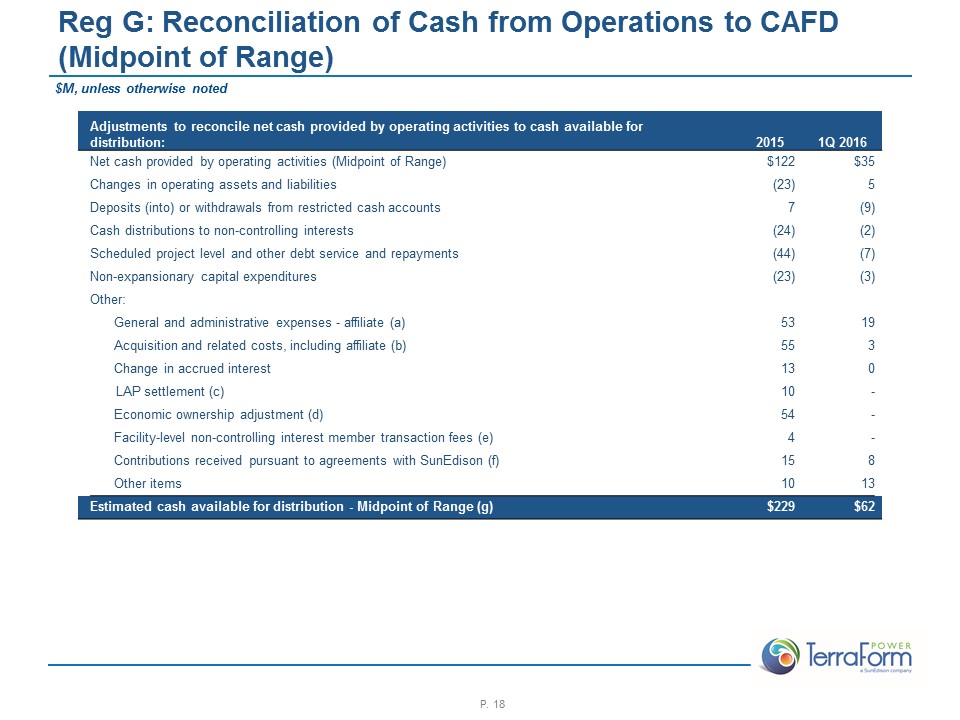

Reg G: Reconciliation of Cash from Operations to CAFD (Midpoint of Range) Adjustments to reconcile net cash provided by operating activities to cash available for distribution: 2015 1Q 2016 Net cash provided by operating activities (Midpoint of Range) $122 $35 Changes in operating assets and liabilities (23) 5 Deposits (into) or withdrawals from restricted cash accounts 7 (9) Cash distributions to non-controlling interests (24) (2) Scheduled project level and other debt service and repayments (44) (7) Non-expansionary capital expenditures (23) (3) Other: General and administrative expenses - affiliate (a) 53 19 Acquisition and related costs, including affiliate (b) 55 3 Change in accrued interest 13 0 LAP settlement (c) 10 - Economic ownership adjustment (d) 54 - Facility-level non-controlling interest member transaction fees (e) 4 - Contributions received pursuant to agreements with SunEdison (f) 15 8 Other items 10 13 Estimated cash available for distribution - Midpoint of Range (g) $229 $62 $M, unless otherwise noted

Footnotes to Reg G: Reconciliation of Cash from Operations to CAFD (Midpoint of Range) General and administrative expenses – affiliate represent costs incurred by SunEdison for services provided to the Company pursuant to the MSA. In conjunction with the closing of the IPO on July 23, 2014, we entered into the MSA with SunEdison, pursuant to which SunEdison agreed to provide or arrange for other service providers to provide management and administrative services to us. Cash consideration paid to SunEdison for these services for the year ended December 31, 2015 and the three months ended March 31, 2016 totaled $4.0 million and $1.8 million, respectively. The amount of general and administrative expenses in excess of the fees paid to SunEdison in each period is treated as an addback in the reconciliation of net cash provided by operating activities to CAFD.Represents transaction related costs, including affiliate acquisition costs, associated with the acquisitions completed during the year ended December 31, 2015 and the three months ended March 31, 2016.Pursuant to the Settlement Agreement, TERP made a one-time payment to LAP in the amount of $10.0 million in April 2016 in exchange for and contingent on the termination of the Arbitration against TERP. The expense incurred as a result of the one-time payment was recorded to general and administrative expenses for the year ended December 31, 2015.Represents economic ownership of certain acquired operating assets which accrued to us prior to the acquisition close date. The amount recognized for the year ended December 31, 2015 primarily related to our acquisition of Invenergy Wind, First Wind, and Northern Lights. Per the terms of the Invenergy Wind acquisition, we received economic ownership of the Invenergy Wind assets effective July 1, 2015 and $40.6 million of CAFD accrued to us from July 1, 2015 through the December 15, 2015 closing date. Per the terms of the First Wind acquisition, we received economic ownership of the First Wind operating assets effective January 1, 2015 and $7.2 million of CAFD accrued to us from January 1, 2015 through the January 29, 2015 closing date. Per the terms of the Northern Lights acquisition, we received economic ownership of the Northern Lights facilities effective January 1, 2015 and $3.7 million of CAFD accrued to us from January 1, 2015 through the June 30, 2015 closing date. The remaining $2.7 million of economic ownership related to our acquisitions of Moose Power and Integrys, which both closed in the second quarter of 2015.Represents professional fees for legal, tax, and accounting services related to entering into certain tax equity financing arrangements and are not deemed representative of our core business operations. We received an equity contribution of $4.0 million from SunEdison pursuant to the Interest Payment Agreement for the year ended December 31, 2015. We received an equity contribution from SunEdison of $6.6 million and $8.0 million pursuant to the Amended Interest Payment Agreement during the year ended December 31, 2015 and the three months ended March 31, 2016, respectively. In addition, in conjunction with the First Wind Acquisition, SunEdison committed to reimburse us for capital expenditures and operations and maintenance labor fees in excess of budgeted amounts (not to exceed $53.9 million through 2019) for certain of our wind power plants. During the year ended December 31, 2015, the Company received contributions pursuant to this agreement of $4.3 million. TERP implemented an updated policy for the accounting for restricted cash effective for the year ending December 31, 2015. The impact of the new accounting policy on reported CAFD is immaterial for 2015 and is expected to be immaterial for 2016. However, the new policy causes timing differences in quarter-to-quarter CAFD recognition within a calendar year, and 1Q 2016 CAFD would be estimated to be in the range of $20 million to $28 million if reported under the prior policy. For a full discussion of the new policy for accounting for restricted cash, please refer to page 14 of this document.