Attached files

| file | filename |

|---|---|

| EX-23.1 - EXHIBIT 23.1 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit231.htm |

| EX-32 - EXHIBIT 32 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit32.htm |

| EX-31.2 - EXHIBIT 31.2 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit312.htm |

| EX-31.1 - EXHIBIT 31.1 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit311.htm |

| EX-21.1 - EXHIBIT 21.1 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit211.htm |

| EX-10.22 - EXHIBIT 10.22 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit1022.htm |

| EX-10.21 - EXHIBIT 10.21 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit1021.htm |

| EX-10.20 - EXHIBIT 10.20 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhibit1020.htm |

| EX-10.19 - EXHIBIT 10.19 - TerraForm Power NY Holdings, Inc. | terraform-123117xexhbit1019.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________________________________________________

FORM 10-K

_____________________________________________________________________________

(Mark One)

x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year ended December 31, 2017

OR

o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-36542

______________________________________________________________

TerraForm Power, Inc.

(Exact name of registrant as specified in its charter)

_____________________________________________________________________________

Delaware | 46-4780940 | |

(State or other jurisdiction of incorporation or organization) | (I. R. S. Employer Identification No.) | |

7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland | 20814 | |

(Address of principal executive offices) | (Zip Code) | |

240-762-7700

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class | Name of Exchange on Which Registered | |

Common Stock, Class A, par value $0.01 | NASDAQ Global Select Market | |

Securities registered pursuant to Section 12(g) of the Act: None

___________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of the registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | x | Accelerated filer | o | |||

Non-accelerated filer | o (Do not check if a smaller reporting company) | Smaller reporting company | o | |||

Emerging growth company | o | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of June 30, 2017, the last business day of the registrant's most recently completed second fiscal quarter, the aggregate market value of the voting and non-voting common equity of the registrant, held by non-affiliates of the registrant (based upon the closing sale price of shares of Class A common stock of the registrant on the NASDAQ Global Select Market on such date), was approximately $1.1 billion.

As of February 28, 2018, there were 148,086,027 shares of Class A common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant's definitive proxy statement relating to its 2018 annual meeting of stockholders (the “2018 Proxy Statement”) are incorporated by reference into Part III of this Form 10-K where indicated. The 2018 Proxy Statement will be filed with the U.S. Securities and Exchange Commission within 120 days after the end of the fiscal year to which this report relates.

TerraForm Power, Inc. and Subsidiaries

Table of Contents

Form 10-K

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

Item 15. | ||

CAUTIONARY STATEMENT CONCERNING FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. These statements involve estimates, expectations, projections, goals, assumptions, known and unknown risks, and uncertainties and typically include words or variations of words such as “expect,” “anticipate,” “believe,” “intend,” “plan,” “seek,” “estimate,” “predict,” “project,” “goal,” “guidance,” “outlook,” “objective,” “forecast,” “target,” “potential,” “continue,” “would,” “will,” “should,” “could,” or “may” or other comparable terms and phrases. All statements that address operating performance, events, or developments that the Company expects or anticipates will occur in the future are forward-looking statements. They may include estimates of expected cash available for distribution, earnings, revenues, capital expenditures, liquidity, capital structure, future growth, financing arrangements and other financial performance items (including future dividends per share), descriptions of management’s plans or objectives for future operations, products, or services, or descriptions of assumptions underlying any of the above. Forward-looking statements provide the Company’s current expectations or predictions of future conditions, events, or results and speak only as of the date they are made. Although the Company believes its expectations and assumptions are reasonable, it can give no assurance that these expectations and assumptions will prove to have been correct and actual results may vary materially.

Important factors that could cause actual results to differ materially from our expectations, or cautionary statements, are listed below and further disclosed under the section entitled Item 1A. Risk Factors:

• | risks related to the transition to Brookfield Asset Management Inc. sponsorship, including our ability to realize the expected benefits of the sponsorship; |

• | risks related to wind conditions at our wind assets or to weather conditions at our solar assets; |

• | risks related to the effectiveness of our internal controls over financial reporting; |

• | pending and future litigation; |

• | the willingness and ability of counterparties to fulfill their obligations under offtake agreements; |

• | price fluctuations, termination provisions and buyout provisions in offtake agreements; |

• | our ability to enter into contracts to sell power on acceptable prices and terms, including as our offtake agreements expire; |

• | our ability to compete against traditional and renewable energy companies; |

• | government regulation, including compliance with regulatory and permit requirements and changes in tax laws, market rules, rates, tariffs, environmental laws and policies affecting renewable energy; |

• | risks related to the proposed relocation of the Company’s headquarters; |

• | the condition of the debt and equity capital markets and our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward; |

• | operating and financial restrictions placed on us and our subsidiaries related to agreements governing indebtedness; |

• | risks related to the expected timing and likelihood of completion of the tender offer for the shares of Saeta Yield, S.A., including the timing or receipt of any governmental approvals; |

• | risks related to our financing of the tender offer for the shares of Saeta Yield, S.A., including our ability to issue equity on terms that are accretive to our shareholders and our ability to implement our permanent funding plan; |

• | our ability to successfully identify, evaluate and consummate acquisitions; and |

• | our ability to integrate the projects we acquire from third parties, including Saeta Yield, S.A., or otherwise and realize the anticipated benefits from such acquisitions. |

The Company disclaims any obligation to publicly update or revise any forward-looking statement to reflect changes in underlying assumptions, factors, or expectations, new information, data, or methods, future events, or other changes, except as required by law. The foregoing list of factors that might cause results to differ materially from those contemplated in the forward-looking statements should be considered in connection with information regarding risks and uncertainties, which are described in this Annual Report on Form 10-K, as well as additional factors we may describe from time to time in other filings with the SEC. We operate in a competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and you should understand that it is not possible to predict or identify all such factors and, consequently, you should not consider any such list to be a complete set of all potential risks or uncertainties.

GLOSSARY OF TERMS

When the following terms and abbreviations appear in the text of this report, they have the meanings indicated below:

Adjusted EBITDA | Adjusted EBITDA is defined as net income (loss) plus depreciation, accretion and amortization, non-cash general and administrative costs, interest expense, income tax (benefit) expense, acquisition related expenses, and certain other non-cash charges, unusual or non-recurring items and other items that we believe are not representative of our core business or future operating performance. | |

Cash available for distribution | Cash available for distribution is defined as adjusted EBITDA (i) minus cash distributions paid to non-controlling interests in our renewable energy facilities, if any, (ii) minus annualized scheduled interest and project-level amortization payments in accordance with the related borrowing arrangements, (iii) minus average annual sustaining capital expenditures (based on the long-sustaining capital expenditure plans) which are recurring in nature and used to maintain the reliability and efficiency of our power generating assets over our long-term investment horizon, (iv) plus or minus operating items as necessary to present the cash flows we deem representative of our core business operations. For items determined on an annualized basis, we used actual cash payments as a proxy for an annualized number prior to the period commencing January 1, 2018. | |

GWh | Gigawatt hours | |

ITC | Investment tax credit | |

MW | Megawatt | |

MWh | Megawatt hours | |

Nameplate capacity | Nameplate capacity for solar generation facilities represents the maximum generating capacity at standard test conditions of a facility (in direct current, “DC”) multiplied by our percentage ownership of that facility (disregarding any equity interests held by any non-controlling member or lessor under any sale-leaseback financing or any non-controlling interests in a partnership). Nameplate capacity for wind power plants represents the manufacturer’s maximum nameplate generating capacity of each turbine (in alternating current, “AC”) multiplied by the number of turbines at a facility multiplied by our percentage ownership of that facility (disregarding any equity interests held by any tax equity investor or lessor under any sale-leaseback financing or any non-controlling interests in a partnership). | |

PPA | As applicable, Power Purchase Agreement, energy hedge contract and/or REC or SREC contract | |

PTC | Production tax credit | |

REC | Renewable energy certificate or SREC | |

Renewable energy facilities | Solar generation facilities and wind power plants | |

SREC | Solar renewable energy certificate | |

PART I

Item 1. Business.

Overview

TerraForm Power, Inc. (“TerraForm Power”) owns and operates a high-quality, diversified portfolio of solar and wind assets located primarily in the United States and underpinned by long-term contracts, totaling more than 2,600 MW of installed capacity. TerraForm Power’s goal is to acquire operating solar and wind assets in North America and Western Europe and it is sponsored by Brookfield Asset Management Inc. (“Brookfield”), a leading global alternative asset manager with more than $265 billion of assets under management.

TerraForm Power's objective is to deliver an attractive risk-adjusted return to its shareholders. We expect to generate this total return with a regular dividend, which we intend to grow at 5 to 8% per annum, that is backed by stable cash flows.

TerraForm Power is a holding company and its only material asset is an equity interest in TerraForm Power, LLC, or “Terra LLC.” TerraForm Power is the managing member of Terra LLC and operates, controls and consolidates the business affairs of Terra LLC. Unless otherwise indicated or otherwise required by the context, references to “we,” “our,” “us” or the “Company” refer to TerraForm Power and its consolidated subsidiaries.

Our principal executive offices are located at 7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814, and our telephone number is (240) 762-7700. Our website address is www.terraformpower.com. Information contained on our website is not incorporated by reference into this Annual Report on Form 10-K and does not constitute part of this Annual Report on Form 10-K.

6

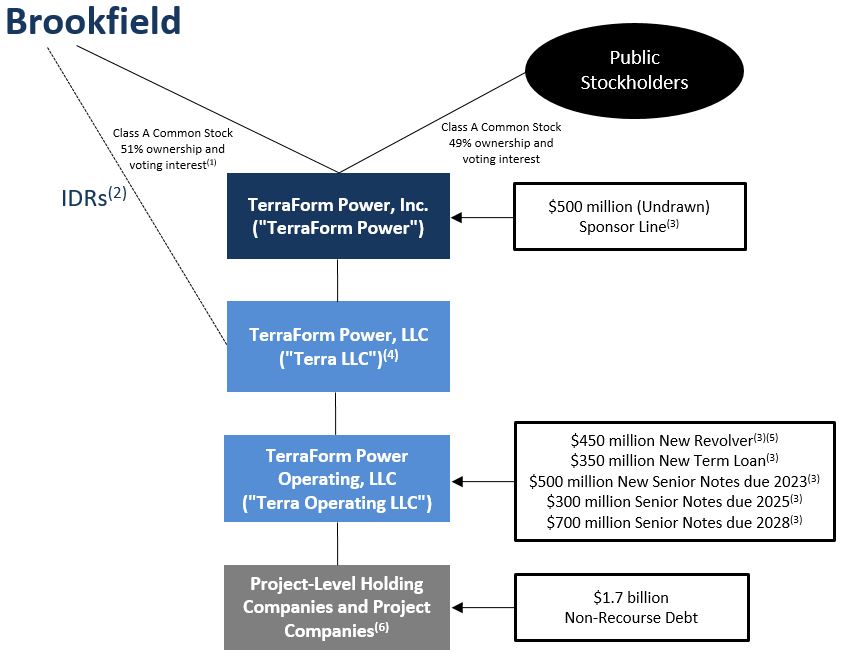

The diagram below is a summary depiction of our organizational and capital structure as of December 31, 2017:

—————

(1) | As of December 31, 2017, there were 148,086,027 Class A shares of TerraForm Power outstanding, of which Orion US Holdings 1 L.P. (“Orion Holdings”) owns 51%. In turn, Orion Holdings is managed and controlled by Brookfield. |

(2) | Incentive distribution rights (“IDRs”) represent a variable interest in distributions by Terra LLC and therefore cannot be expressed as a fixed percentage ownership interest in Terra LLC. BRE Delaware, Inc. (the “Brookfield IDR Holder”) holds all of the IDRs of Terra LLC. Brookfield IDR Holder is an indirect wholly owned subsidiary of Brookfield. |

(3) | See Liquidity and Capital Resources within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations for discussion regarding these financing arrangements. |

(4) | Terra LLC is a guarantor of the indebtedness of Terra Operating LLC. |

(5) | Represents total borrowing capacity as of December 31, 2017. As of December 31, 2017, there were $60.0 million of revolving loans and $102.6 million of letters of credit outstanding under the New Revolver, with availability of $287.4 million as of such date. |

(6) | Certain project-level holding companies are guarantors of the indebtedness of Terra Operating LLC. These specific project-level holding companies do not have any indebtedness. |

7

Our Business Strategy

Our primary business strategy is to acquire, own and operate solar and wind assets in North America and Western Europe. We are the owner and operator of a 2,600 MW diversified portfolio of high-quality solar and wind assets, located primarily in the United States and underpinned by long-term contracts. Significant diversity across technologies and locations coupled with contracts across a large, diverse group of creditworthy counterparties significantly reduces the impact of resource variability on cash available for distribution and limits our exposure to any individual counterparty.

On April 21, 2016, SunEdison, Inc. (together with its consolidated subsidiaries excluding the Company and TerraForm Global, Inc. and its subsidiaries, “SunEdison”), our previous sponsor, and certain of its domestic and international subsidiaries (the “SunEdison Debtors”) voluntarily filed for protection under Chapter 11 of the U.S. Bankruptcy Code (the “SunEdison Bankruptcy”). In response to SunEdison’s financial and operating difficulties, we initiated a process for the exploration and evaluation of potential strategic alternatives for the Company. This process resulted in our entry into a definitive merger and sponsorship transaction agreement (the “Merger Agreement”) on March 6, 2017 with Orion Holdings and BRE TERP Holdings Inc. (“Merger Sub”), a wholly-owned subsidiary of Orion Holdings, which are both affiliates of Brookfield. At the same time, we also entered into a settlement agreement (the “Settlement Agreement”) and a voting and support agreement (the “Voting and Support Agreement”) with SunEdison to, among other things, facilitate the closing of the merger transaction and the settlement of claims between the Company and SunEdison.

On October 16, 2017, Merger Sub merged with and into TerraForm Power (the “Merger”), with TerraForm Power continuing as the surviving corporation in the Merger, and the Company entered into a suite of support and sponsorship arrangements (the “Sponsorship Transaction”) with Brookfield and certain of its affiliates, as described in greater detail below. In this Annual Report on Form 10-K, we generally refer to these collective transactions, and any other agreements or arrangements entered into in connection therewith, as the “Merger and Sponsorship Transaction.”

In connection with the successful completion of the Merger and Sponsorship Transaction, Brookfield replaced SunEdison as our sponsor and all outstanding claims between us and SunEdison that may have existed prior to the closing of the Merger and Sponsorship Transaction were finally settled, and all agreements between the Company and the SunEdison Debtors were deemed rejected, subject to certain limited exceptions, without further liability, claims or damages on the part of the Company.

Our goal is to pay dividends to our shareholders that are sustainable on a long-term basis while retaining within our operations sufficient liquidity for recurring growth capital expenditures and general purposes. We expect to generate this return with a regular dividend, which we intend to grow at 5 to 8% per annum, that is supported by a target payout ratio of 80 to 85% of cash available for distribution and our stable cash flows. We expect to achieve this growth and deliver returns by focusing on the following initiatives:

• | Margin Enhancements: |

We believe there is significant opportunity to enhance our cash flow through productivity enhancements by rationalizing our headcount and implementing a more efficient organizational structure. In addition, we plan to automate a number of processes that are currently very labor intensive and expect to realize cost savings through reductions in operations and maintenance (“O&M”) expenses and the in-sourcing of asset management and certain back office functions.

• | Organic Growth: |

We plan to develop a robust organic growth pipeline comprised of opportunities to invest in our existing fleet on an accretive basis as well as add-on acquisitions across our scope of operations. We have identified a number of opportunities which we believe may be compelling to invest in our fleet, including asset repowerings, site expansions and potentially adding energy storage to existing sites.

• | Value-oriented acquisitions: |

We expect to evaluate a number of acquisition opportunities with a focus on sourcing off-market transactions at more attractive valuations than auction processes. Our recently announced tender offer for the outstanding shares of Saeta Yield, S.A. (as described below under Irrevocable Agreement to Launch Tender Offer for the Common Shares of Saeta Yield) is an example of these acquisition opportunities. We believe that multi-faceted transactions such as take-privates and recapitalizations may enable us to acquire high quality assets at attractive relative values.

8

We have a right of first offer (“ROFO”) to acquire certain renewable power assets in North America and Western Europe owned by Brookfield and its affiliates. The ROFO portfolio currently stands at 3,500 MW. Over time, as Brookfield entities look to sell these assets, we will have the opportunity to make offers for these assets and potentially purchase them if the prices meet our investment objectives and are the most favorable offered to Brookfield. We also continue to maintain a call right over 0.5 GW (net) of operating wind power plants that are owned by a warehouse vehicle that was owned and arranged by SunEdison. SunEdison sold its equity interest in this warehouse vehicle to an unaffiliated third party in 2017.

We believe we are well positioned to benefit from Brookfield's deep operational expertise in owning, operating and developing renewable assets, as well as its significant deal sourcing capabilities and access to capital. Brookfield is a leading global alternative asset manager and has a more than 100-year history of owning and operating assets with a focus on renewable power, property, infrastructure and private equity. Brookfield has approximately $40 billion in renewable power assets under management, representing approximately 16,400 MW of generation capacity in 14 countries. It also employs over 2,000 individuals with extensive operating, development and power marketing capabilities and has a demonstrated ability to deploy capital in a disciplined manner, having developed or acquired 12,000 MW of renewable generation capacity since 2012.

Sponsorship Arrangements

On October 16, 2017, in connection with the consummation of the Merger, TerraForm Power entered into the following:

• | Master Services Agreement (the “Brookfield MSA”), with Brookfield, BRP Energy Group L.P., Brookfield Asset Management Private Institutional Capital Adviser (Canada), L.P., Brookfield Global Renewable Energy Advisor Limited, Terra LLC and Terra Operating LLC, pursuant to which Brookfield and certain of its affiliates will provide certain management and administrative services, including the provision of strategic and investment management services, to TerraForm Power and its subsidiaries. |

• | Relationship Agreement (the “Relationship Agreement”) with Brookfield, Terra LLC and Terra Operating LLC, which governs certain aspects of the relationship between Brookfield and TerraForm Power and its subsidiaries. Pursuant to the Relationship Agreement, during the term of the agreement, TerraForm Power and its subsidiaries serve as the primary vehicle through which Brookfield and its affiliates will acquire operating solar and wind assets in certain countries in North America and Western Europe, and Brookfield grants TerraForm Power a right of first offer on any proposed transfer of certain existing projects and all future operating solar and wind projects located in such countries developed by persons sponsored by or under the control of Brookfield. |

• | Governance Agreement (the “Governance Agreement”) with Orion Holdings and any controlled affiliate of Brookfield (other than TerraForm Power and its controlled affiliates) (together with Brookfield, the “Sponsor Group”) that by the terms of the Governance Agreement from time to time becomes a party thereto. The Governance Agreement establishes certain rights and obligations of TerraForm Power and members of the Sponsor Group that own voting securities of TerraForm Power relating to the governance of TerraForm Power and the relationship between such members of the Sponsor Group and TerraForm Power and its controlled affiliates. |

We also entered into an amended and restated limited liability company agreement with Brookfield IDR Holder and a $500.0 million sponsor line of credit with Brookfield and one of its affiliates as discussed in Liquidity and Capital Resources within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Recent Corporate Governance and Management Changes

Certain corporate governance changes were implemented following the completion of the Merger and Sponsorship Transaction. As part of the Merger and Sponsorship Transaction, TerraForm Power’s corporate governance was simplified to better align the interests of all of our stakeholders. We now have a single class of A shares worth one vote each, as opposed to our previous dual-class structure. Upon consummation of the Merger and Sponsorship Transaction, the size of our Board of Directors (the “Board”) was set at seven members, of whom four are designated by Brookfield and three are independent and were initially chosen by our Board prior to the Merger and Sponsorship Transaction. On November 16, 2017, one of our three independent directors resigned as a director, and as a result, a new independent director was appointed to our Board on February 5, 2018.

In addition, we have experienced changes to our executive officers and senior management, including the departure of our interim Chief Executive Officer, Chief Financial Officer and General Counsel upon the closing of the Merger and Sponsorship Transaction. The governance agreements entered into between the Company and Brookfield in connection with the

9

Merger and Sponsorship Transaction provide for Brookfield to appoint our Chief Executive Officer, Chief Financial Officer and General Counsel. These three executive officers are not employees of the Company and their services are provided pursuant to the Brookfield MSA.

Our Board has established an Audit Committee and a Conflicts Committee, consisting of our independent directors. The Conflicts Committee will consider, among other things, matters in which a conflict of interest exists between our company and Brookfield. Our Board has also established a Nominating and Governance Committee, which consists of three directors, one of whom is a director designated by Brookfield and two of whom are independent directors. See Item 10. Directors, Executive Officers and Corporate Governance for further discussion regarding our executive officers, directors and corporate governance.

Changes within Our Portfolio

The following table provides an overview of the changes within our portfolio from December 31, 2016 through December 31, 2017:

Net Nameplate Capacity (MW)¹ | ||||||||

Facility Type | Number of Sites | |||||||

Description | ||||||||

Total Portfolio as of December 31, 2016 | 2,983.1 | 2,503 | ||||||

Sale of U.K. Utility Solar Portfolio | Solar | (208.4 | ) | (14 | ) | |||

Sale of Fairwinds & Crundale | Solar | (55.9 | ) | (2 | ) | |||

Sale of Stonehenge Q1 | Solar | (41.2 | ) | (3 | ) | |||

Sale of Stonehenge Operating | Solar | (23.6 | ) | (3 | ) | |||

Sale of Says Court | Solar | (19.8 | ) | (1 | ) | |||

Sale of Crucis Farm | Solar | (16.1 | ) | (1 | ) | |||

Sale of Resi 2015 Portfolio 1 | Solar | (8.9 | ) | (1,246 | ) | |||

Sale of Resi 2014 Portfolio 1 | Solar | (2.8 | ) | (700 | ) | |||

Total Portfolio as of December 31, 2017 | 2,606.4 | 533 | ||||||

(1) | Net nameplate capacity represents the maximum generating capacity at standard test conditions of a facility multiplied by the Company's percentage of economic ownership of that facility after taking into account any redeemable preference shares and stockholder loans the Company holds. Our percentage of economic ownership is subject to change in future periods for certain facilities. |

10

Our Portfolio

Our current portfolio consists of renewable energy facilities located in the United States (including Puerto Rico), Canada, Chile and the United Kingdom with a combined nameplate capacity of 2,606.4 MW as of December 31, 2017. These renewable energy facilities generally have long-term PPAs with creditworthy counterparties. As of December 31, 2017, on a weighted average basis (based on MW), our PPAs had a remaining life of 14 years and our counterparties to our PPAs had an investment grade credit rating.

The following table lists the renewable energy facilities that comprise our portfolio as of December 31, 2017:

Facility Category / Portfolio | Location | Nameplate Capacity (MW) | Net Nameplate Capacity (MW) | Number of Sites | Weighted Average Remaining Duration of PPA (Years)1 | |||||||||

Solar Distributed Generation: | ||||||||||||||

CD DG Portfolio | U.S.2 | 77.8 | 77.8 | 42 | 15 | |||||||||

DG 2015 Portfolio 2 | U.S.2 | 48.1 | 48.1 | 30 | 18 | |||||||||

U.S. Projects 2014 | U.S.2 | 45.4 | 45.4 | 41 | 17 | |||||||||

DG 2014 Portfolio 1 | U.S.2 | 44.0 | 44.0 | 46 | 17 | |||||||||

TEG | U.S.2 | 33.8 | 32.0 | 56 | 12 | |||||||||

HES | U.S.2 | 25.2 | 25.2 | 67 | 12 | |||||||||

MA Solar | Massachusetts | 21.1 | 21.1 | 4 | 24 | |||||||||

Summit Solar Projects | U.S.2 | 19.6 | 19.6 | 50 | 10 | |||||||||

U.S. Projects 2009-2013 | U.S.2 | 15.2 | 15.2 | 73 | 12 | |||||||||

SUNE XVIII | U.S.2 | 16.1 | 16.1 | 21 | 19 | |||||||||

California Public Institutions | California | 13.5 | 7.0 | 5 | 16 | |||||||||

Enfinity | U.S.2 | 13.2 | 13.2 | 15 | 14 | |||||||||

MA Operating | Massachusetts | 12.2 | 12.2 | 4 | 16 | |||||||||

Duke Operating | North Carolina | 10.0 | 10.0 | 3 | 13 | |||||||||

SunE Solar Fund X | U.S.2 | 8.8 | 8.8 | 12 | 13 | |||||||||

Summit Solar Projects | Ontario | 3.8 | 3.8 | 7 | 14 | |||||||||

MPI | Ontario | 4.7 | 4.7 | 13 | 16 | |||||||||

Total Solar Distributed Generation | 412.5 | 404.2 | 489 | 16 | ||||||||||

Solar Utility: | ||||||||||||||

Mt. Signal | California | 265.8 | 265.8 | 1 | 21 | |||||||||

Regulus Solar | California | 81.6 | 81.6 | 1 | 17 | |||||||||

Blackhawk Solar Portfolio | U.S.2 | 72.8 | 72.8 | 10 | 20 | |||||||||

North Carolina Portfolio | North Carolina | 26.4 | 26.4 | 4 | 12 | |||||||||

Atwell Island | California | 23.5 | 23.5 | 1 | 20 | |||||||||

Nellis | Nevada | 14.0 | 14.0 | 1 | 10 | |||||||||

Alamosa | Colorado | 8.2 | 8.2 | 1 | 10 | |||||||||

CalRENEW-1 | California | 6.3 | 6.3 | 1 | 12 | |||||||||

Northern Lights | Ontario | 25.4 | 25.4 | 2 | 16 | |||||||||

Marsh Hill | Ontario | 18.5 | 18.5 | 1 | 17 | |||||||||

SunE Perpetual Lindsay | Ontario | 15.5 | 15.5 | 1 | 17 | |||||||||

Norrington | U.K. | 11.1 | 11.1 | 1 | 11 | |||||||||

CAP | Chile | 101.6 | 101.6 | 1 | 16 | |||||||||

Total Solar Utility | 670.7 | 670.7 | 26 | 18 | ||||||||||

11

Facility Category / Portfolio | Location | Nameplate Capacity (MW) | Net Nameplate Capacity (MW) | Number of Sites | Weighted Average Remaining Duration of PPA (Years)1 | |||||||||

Wind Utility: | ||||||||||||||

South Plains I | Texas | 200.0 | 200.0 | 1 | 10 | |||||||||

California Ridge | Illinois | 217.1 | 195.6 | 1 | 15 | |||||||||

Bishop Hill | Illinois | 211.4 | 190.5 | 1 | 15 | |||||||||

Rattlesnake | Texas | 207.2 | 186.7 | 1 | 10 | |||||||||

Prairie Breeze | Nebraska | 200.6 | 180.7 | 1 | 21 | |||||||||

Cohocton | New York | 125.0 | 125.0 | 1 | 2 | |||||||||

Stetson I & II | Maine | 82.5 | 82.5 | 2 | 2 | |||||||||

Rollins | Maine | 60.0 | 60.0 | 1 | 14 | |||||||||

Mars Hill | Maine | 42.0 | 42.0 | 1 | 2 | |||||||||

Sheffield | Vermont | 40.0 | 40.0 | 1 | 10 | |||||||||

Bull Hill | Maine | 34.5 | 34.5 | 1 | 9 | |||||||||

Kaheawa Wind Power I | Hawaii | 30.0 | 30.0 | 1 | 8 | |||||||||

Kahuku | Hawaii | 30.0 | 30.0 | 1 | 13 | |||||||||

Kaheawa Wind Power II | Hawaii | 21.0 | 21.0 | 1 | 15 | |||||||||

Steel Winds I & II | New York | 35.0 | 35.0 | 2 | 2 | |||||||||

Raleigh | Ontario | 78.0 | 78.0 | 1 | 13 | |||||||||

Total Wind Utility | 1,614.3 | 1,531.5 | 18 | 11 | ||||||||||

Total Renewable Energy Facilities | 2,697.5 | 2,606.4 | 533 | 14 | ||||||||||

———

(1) | Calculated as of December 31, 2017. |

(2) | These portfolios consist of renewable energy facilities located in multiple locations within the U.S., as follows: |

• | CD DG Portfolio: California, Massachusetts, New Jersey, New York and Pennsylvania |

• | DG 2015 Portfolio 2: Arizona, California, Connecticut, Massachusetts, New Jersey, Utah and Vermont |

• | U.S. Projects 2014: Arizona, California, Connecticut, Georgia, Massachusetts, New Jersey, New York and Puerto Rico |

• | DG 2014 Portfolio 1: Arizona, California, Georgia, Hawaii, Massachusetts, Maryland, New Jersey, New York, Oregon, Texas, Vermont and Puerto Rico |

• | TEG: Arizona, California, Connecticut, Massachusetts, New Jersey and Pennsylvania |

• | HES: Massachusetts, New Jersey and Pennsylvania |

• | Summit Solar Projects (U.S.): California, Connecticut, Florida, Maryland and New Jersey |

• | U.S. Projects 2009-2013: California, Colorado, Connecticut, Massachusetts, New Jersey, Oregon and Puerto Rico |

• | SUNE XVIII: Arizona, California, Hawaii, Massachusetts, Maryland, Minnesota, New Hampshire, New York and Texas |

• | Enfinity: Arizona, California and Ohio |

• | SunE Solar Fund X: California, Maryland and New Mexico |

• | Blackhawk Solar Portfolio: Utah, Florida, Nevada and California |

Seasonality and Resource Availability

The amount of electricity produced and revenues generated by our solar generation facilities is dependent in part on the amount of sunlight, or irradiation, where the assets are located. As shorter daylight hours in winter months result in less irradiation, the electricity generated by these facilities will vary depending on the season. Irradiation can also be variable at a particular location from period to period due to weather or other meteorological patterns, which can affect operating results. As the great majority of our solar power plants are located in the Northern hemisphere, our solar portfolio’s power generation will be at its lowest during the first and fourth quarters of each year. Therefore, we expect our first and fourth quarter solar revenue generation to be lower than other quarters.

12

Similarly, the electricity produced and revenues generated by our wind power plants depend heavily on wind conditions, which are variable and difficult to predict. Operating results for wind power plants vary significantly from period to period depending on the wind conditions during the periods in question. As our wind power plants are located in geographies with different profiles, there is some flattening of the seasonal variability associated with each individual wind power plant’s generation, and we expect that as the fleet expands the effect of such wind resource variability may be favorably impacted, although we cannot guarantee that we will purchase wind power facilities that will achieve such results in part or at all. Historically, our wind production is greater in the first and fourth quarters which can partially offset the lower solar revenue expected to be generated in those quarters.

We do not expect seasonality to have a material effect on our ability to pay a regular dividend. We intend to mitigate the effects of any seasonality that we experience by reserving a portion of our cash available for distribution and otherwise maintain sufficient liquidity, including cash on hand in order to, among other things, facilitate the payment of dividends to our stockholders.

Competition

Power generation is a capital-intensive business with numerous industry participants. We compete to acquire new renewable energy facilities with renewable energy developers who retain renewable energy asset ownership, independent power producers, financial investors and certain utilities. We compete to supply energy to our potential customers with utilities and other providers of distributed generation. We compete with other renewable energy developers, independent power producers and financial investors based on our cost of capital, development expertise, pipeline, global footprint and brand reputation. To the extent we re-contract renewable energy facilities upon termination of a PPA or sell electricity into the merchant power market, we compete with traditional utilities and other independent power producers primarily based on low cost of capital, generation located at customer sites, operations and management expertise, price (including predictability of price), green attributes (such as RECs and tax incentives) of renewable power and the ease by which customers can switch to electricity generated by our renewable energy facilities. In our merchant power sales, we also compete with other types of generation resources, including gas and coal-fired power plants.

Environmental Matters

We are subject to environmental laws and regulations in the jurisdictions in which we own and operate renewable energy facilities. These laws and regulations generally require that governmental permits and approvals be obtained and maintained both before construction and during operation of these renewable energy facilities. We incur costs in the ordinary course of business to comply with these laws, regulations and permit requirements. We do not anticipate material capital expenditures for environmental compliance for our renewable energy facilities in the next several years. While we do not expect that the costs of compliance would generally have a material impact on our business, financial condition or results of operations, it is possible that as the size of our portfolio grows we may become subject to new or modified regulatory regimes that may impose unanticipated requirements on our business as a whole that were not anticipated with respect to any individual renewable energy facility. Additionally, environmental laws and regulations frequently change and often become more stringent, or subject to more stringent interpretation or enforcement, and therefore future changes could require us to incur materially higher costs which could have a material negative impact on our financial performance or results of operations.

Regulatory Matters

All of the renewable energy facilities located in the United States that we own are qualifying small power production facilities (“QFs”) as defined under the Public Utilities Regulatory Policies Act of 1978, as amended (“PURPA”) or Exempt Wholesale Generators (“EWGs”). As a result, they and their upstream owners are exempt from the books and records access provisions of the Public Utilities Holding Company Act of 2005, as amended (“PUHCA”), and most are exempt from state organizational and financial regulation of electric utilities. Depending upon the power production capacity of the renewable energy facility in question, our QFs and their immediate project company owners may be entitled to various exemptions from ratemaking and certain other regulatory provisions of the Federal Power Act, as amended (“FPA”).

All of the renewable energy facility companies that we own outside of the United States are Foreign Utility Companies, as defined in PUHCA. They are exempt from state organizational and financial regulation of electric utilities and from most provisions of PUHCA and FPA.

We own a number of renewable energy facilities in the United States that are subject to the jurisdiction of the Federal Energy Regulatory Commission (“FERC”), and that have obtained “market based rate authorization” and associated blanket authorizations and waivers from FERC pursuant to the FPA, which allows it to sell electricity, capacity and ancillary services at

13

wholesale or negotiated market based rates, instead of cost-of-service rates, as well as waivers of, and blanket authorizations under, certain FERC regulations that are commonly granted to market based rate sellers. FERC requires market based rate holders to make additional filings upon certain triggering events in order to maintain market based rate authority. The failure to make timely filings can result in revocation or suspension of market based rate authority, refunds of revenues previously collected and the imposition of civil penalties.

Under Section 203 of the FPA (“FPA Section 203”), prior authorization by FERC is generally required for any direct or indirect acquisition of control over, or merger or consolidation with, a “public utility” or in certain circumstances an “electric utility company,” as such terms are used for purposes of FPA Section 203. All of our renewable energy facilities that sell their output at wholesale in the continental U.S. (except in Texas) and Evergreen Gen Lead, LLC (which owns electric transmission facilities) are public utilities, and all are electric utility companies (including those in Texas) for the purposes of FPA Section 203. FERC generally presumes that the acquisition of direct or indirect voting power of 10% or more in an entity results in a change in control of such entity. Transfers of transmission facilities associated with our electric generation facilities or the whole of any such generation facility could also trigger the need to obtain prior approval from FERC under FPA Section 203. Violation of FPA Section 203 can result in civil or criminal liability under the FPA, including civil penalties, and the possible imposition of other sanctions by FERC. Depending upon the circumstances, liability for violation of FPA Section 203 may attach to a public utility, the parent holding company of a public utility or an electric utility company, or to an acquirer of the voting securities of such holding company or its public utility or electric utility company subsidiaries.

Certain of our renewable energy facilities are also subject to compliance with the mandatory Reliability Standards developed by the North American Electric Reliability Corporation (“NERC”) and approved by FERC. Violation of such Reliability Standards can result in civil penalties under the FPA assessed to the owners and/or operators of such renewable energy facilities. In the United Kingdom, Canada and Chile, the Company is also generally subject to the regulations of the relevant energy regulatory agencies applicable to all producers of electricity under the relevant feed-in tariff or other governmental incentive programs (collectively “FIT”) (including the FIT rates); however it is generally not subject to regulation as a traditional public utility, i.e., regulation of our financial organization and rates other than FIT rates.

As the size of our portfolio grows, it may become subject to new or modified regulatory regimes that may impose unanticipated requirements on its business as a whole that were not anticipated with respect to any individual renewable energy facility. For example, the NERC rules approved by FERC impose fleetwide cyber security requirements regarding electronic and physical access to generating facilities in order to protect system reliability; such requirements expand in scope after the point at which a single owner has more than 1,500 MW of reliability assets under its control in a single connection and expand again once the owner has more than 3,000 MW under construction. Such future changes in our regulatory status or the makeup of our fleet could require it to incur materially higher costs which could have a material adverse impact on its financial performance or results of operations. Similarly, although we are not currently subject to regulation as an electric utility in the foreign markets in which we provide our renewable energy services, our regulatory position in these markets could change in the future. Any local, state, federal or international regulations could place significant restrictions on our ability to operate our business and execute our business plan by prohibiting or otherwise restricting the sale of electricity by us. If we were deemed to be subject to the same state, federal or foreign regulatory authorities as traditional utility companies, or if new regulatory bodies were established to oversee the renewable energy industry in the United States or in our foreign markets, our operating costs could materially increase, adversely affecting our results of operations.

Government Incentives and Legislation

Each of the countries in which we operate has established various incentives and financial mechanisms to reduce the cost of renewable energy and to accelerate the adoption of solar and wind energy. These incentives include tax credits, cash grants, favorable tax treatment and depreciation, rebates, RECs or green certificates, net energy metering programs and other incentives. These incentives help catalyze private sector investments in renewable energy and efficiency measures. Changes in the government incentives in each of these jurisdictions could have a material impact on our financial performance.

United States

Federal government support for renewable energy

On December 22, 2017, the U.S. government enacted comprehensive tax legislation commonly referred to as the Tax Cuts and Jobs Act (the “Tax Act”). The Tax Act makes broad and complex changes to the U.S. tax code, including, but not limited to, (i) reducing the U.S. federal corporate rate from 35% to 21%; (ii) requiring companies to pay a one-time transition tax on certain unrepatriated earnings (where applicable) of foreign subsidiaries; (iii) generally eliminating the U.S. federal income tax on dividends received from foreign subsidiaries; (iv) requiring current inclusion in the U.S. federal taxable income

14

of certain earnings of controlled foreign corporations; (v) eliminating the corporate alternative minimum tax (“AMT”) and changing how existing AMT credits may be realized; (vi) creating the base erosion anti-abuse tax (“BEAT”), a new minimum tax; (vii) creating a new limitation on the deductible interest expense; and (viii) changing rules related to uses and limitations of net operating loss carryforwards created in tax years beginning after December 31, 2017. The Tax Act is expected to have a neutral effect on our current business portfolio. The federal corporate tax rate reduction is expected to have a favorable impact on our business but this favorable impact is expected to be offset by a more or less equal negative impact of the interest expense deduction and loss carryforward limitations. The other measures of the Tax Act are not expected to significantly impact our current portfolio.

The U.S. federal government provides an uncapped investment tax credit, or “Federal ITC,” that allows a taxpayer to claim a credit of 30% of qualified expenditures for a residential or commercial solar generation facility. The Tax Act did not make any changes to the existing laws surrounding tax credits for renewable energy. The Federal ITC is currently scheduled to be reduced to 26% for solar generation facility construction that begins on or after January 1, 2020 and to 22% for solar generation facility construction that begins on or after January 1, 2021. A permanent 10% Federal ITC is available for non-residential solar generation facility construction that begins on or after January 1, 2022.

Certain wind facilities are eligible for PTCs, which are federal income tax credits related to the quantity of renewable energy produced and sold during a taxable year, or ITCs in lieu of PTCs. These credits are available only for wind power plants that began construction on or prior to December 31, 2019 but are reduced over time. The wind PTC (and ITC in lieu of PTC) are 100% in the case of a facility for which construction began by December 31, 2016, 80% in the case of any facility for which construction began in 2017, 60% in the case of a facility for which construction begins in 2018, and 40% in the case of a facility for which construction begins in 2019. ITCs, PTCs and accelerated tax depreciation benefits generated by constructing and operating renewable energy facilities can be monetized by entering into tax equity financing agreements with investors that can utilize the tax benefits, which have been a key financing tool for renewable energy facilities. The federal government also provides accelerated depreciation for eligible renewable energy facilities. Based on our portfolio of assets, we will benefit from Federal ITC, Federal PTC and an accelerated tax depreciation schedule, and we will rely on financing structures that monetize a substantial portion of these benefits and provide financing for our renewable energy facilities at the lowest cost of capital.

U.S. state government support for renewable energy

Many states offer a personal and/or corporate investment or production tax credit for renewable energy facilities, which is additive to the Federal ITC. Further, more than half of the states, and many local jurisdictions, have established property tax incentives for renewable energy facilities that include exemptions, exclusions, abatements and credits. Certain of our renewable energy facilities in the U.S. have been financed with a tax equity financing structure, whereby the tax equity investor is a member holding equity in the limited liability company that directly or indirectly owns the solar generation facility or wind power plant and receives the benefits of various tax credits.

Many state governments, utilities, municipal utilities and co-operative utilities offer a rebate or other cash incentive for the installation and operation of a renewable energy facility for energy efficiency measures. Capital costs or “up-front” rebates provide funds to solar customers based on the cost, size or expected production of a customer’s renewable energy facility. Performance-based incentives provide cash payments to a system owner based on the energy generated by their renewable energy facility during a pre-determined period, and they are paid over that time period. Some states also have established FIT programs that are a type of performance-based incentive where the system owner-producer is paid a set rate for the electricity their system generates over a set period of time.

There are 40 states that have a regulatory policy known as net metering. Net metering typically allows our customers to interconnect their on-site solar generation facilities to the utility grid and offset their utility electricity purchases by receiving a bill credit at the utility’s retail rate for energy generated by their solar generation facility in excess of electric load that is exported to the grid. At the end of the billing period, the customer simply pays for the net energy used or receives a credit at the retail rate if more energy is produced than consumed. Some states require utilities to provide net metering to their customers until the total generating capacity of net metered systems exceeds a set percentage of the utilities’ aggregate customer peak demand.

Many states also have adopted procurement requirements for renewable energy production. There are 29 states that have adopted a renewable portfolio standard (“RPS”) that requires regulated utilities to procure a specified percentage of total electricity delivered to customers in the state from eligible renewable energy sources, such as solar and wind power generation facilities, by a specified date. To prove compliance with such mandates, utilities must procure and retire RECs. System owners often are able to sell RECs to utilities directly or in REC markets.

15

RPS programs and targets have been one of the key drivers of the expansion of solar and wind power and are expected to continue to contribute to solar and wind power installations in many areas of the United States. In addition to the 29 states with RPS programs, eight other states have non-binding goals supporting renewable energy.

International

The international markets in which we operate or may operate in the future also typically have in place regimes to promote renewable energy. These mechanisms vary from country to country. Our objective is to grow our dividend through the growth of our portfolio in North America and Western Europe, including through our recently announced tender offer to acquire Saeta Yield, S.A., a Spanish corporation, that is expected to close in the second quarter of 2018 (as described below under Irrevocable Agreement to Launch Tender Offer for the Common Shares of Saeta Yield). In seeking to achieve this growth, we may rely on governmental incentives in these jurisdictions. For example, a meaningful portion of our existing portfolio is located in the Canadian province of Ontario. With installed capacity of approximately 4,800 MW of wind and 2,300 MW of solar, Ontario, one of our provincial markets, leads Canada in installed wind and solar power capacity. While the current Long Term Energy Plan for Ontario, released in October 2017, no longer specifies targets for renewable energy, it continues to focus on measures supporting innovation and grid modernization, including in respect of renewable distributed generation.

Financial Information about Segments

We have two reportable segments: Solar and Wind. These segments comprise our entire portfolio of renewable energy assets and are determined based on the management approach. This approach designates the internal reporting used by management for making decisions and assessing performance as the source of the reportable segments. Our operating segments consist of Distributed Generation, North America Utility and International Utility that are aggregated into the Solar reportable segment and Northeast Wind, Central Wind and Hawaii Wind that are aggregated into the Wind reportable segment. The operating segments have been aggregated as they have similar economic characteristics and meet all of the aggregation criteria. Corporate expenses include general and administrative expenses, acquisition costs, interest expense on corporate-level indebtedness, stock-based compensation, depreciation, accretion and amortization expense and loss on extinguishment of corporate-level indebtedness. All net operating revenues for the years ended December 31, 2017, 2016 and 2015 were earned by our reportable segments from external customers in the United States (including Puerto Rico), Canada, the United Kingdom and Chile.

Customer Concentration

For the year ended December 31, 2017, significant customers representing greater than 10% of total operating revenue were Tennessee Valley Authority and San Diego Gas & Electric, which accounted for 13.1% and 10.5%, respectively, of our consolidated operating revenues, net.

Employees

Prior to 2017, the Company did not have any of its own employees as the personnel that managed our operations were employees of SunEdison and their services were provided to the Company under the management services agreement or project-level asset management and O&M services agreements with SunEdison. Following the SunEdison Bankruptcy, as part of our efforts to create a stand-alone corporate organization, we established a retention program for key employees. As of January 1, 2017, the key employees that provided most of our corporate-level services were hired directly by the Company to ensure continuity of corporate operations, and throughout the first half of 2017, we hired additional employees from SunEdison who provided services to us, a majority of which focused on project-level operations. However, we continue to depend on a substantial number of outside contractors. As of December 31, 2017, we had 119 employees, the majority of which were located in the United States.

In connection with the expected relocation of our headquarters to New York, New York, we expect to experience departures of a significant number of these employees. 66 of the Company's employees as of December 31, 2017 are employed under short-term transition agreements, which range from three to nine months of service subsequent to the Merger closing date on October 16, 2017. In addition, we have experienced changes to our executive officers and senior management, including the departure of our interim Chief Executive Officer, Chief Financial Officer and General Counsel upon the closing of the Sponsorship Transaction. The governance agreements entered into between the Company and Brookfield in connection with the Merger and Sponsorship Transaction provide for Brookfield to appoint our Chief Executive Officer, Chief Financial Officer and General Counsel. These three executive officers are not employees of the Company and their services are provided pursuant to the Brookfield MSA.

16

Geographic Information

The following table reflects operating revenues, net for the years ended December 31, 2017, 2016 and 2015 by geographic location:

Year Ended December 31, | ||||||||||||

(In thousands) | 2017 | 2016 | 2015 | |||||||||

United States (including Puerto Rico) | $ | 519,551 | $ | 528,513 | $ | 368,117 | ||||||

Chile | 31,282 | 28,065 | 27,148 | |||||||||

United Kingdom | 15,002 | 51,600 | 55,542 | |||||||||

Canada | 44,636 | 46,378 | 18,699 | |||||||||

Total operating revenues, net | $ | 610,471 | $ | 654,556 | $ | 469,506 | ||||||

Long-lived assets, net consist of renewable energy facilities and intangible assets as of December 31, 2017 and 2016. The following table is a summary of long-lived assets, net by geographic area:

As of December 31, | ||||||||

(In thousands) | 2017 | 2016 | ||||||

United States (including Puerto Rico) | $ | 5,270,988 | $ | 5,524,136 | ||||

Chile | 168,440 | 175,204 | ||||||

United Kingdom | 17,284 | 16,045 | ||||||

Canada | 422,999 | 419,978 | ||||||

Total long-lived assets, net | 5,879,711 | 6,135,363 | ||||||

Current assets | 341,536 | 893,016 | ||||||

Other non-current assets1 | 165,774 | 677,486 | ||||||

Total assets | $ | 6,387,021 | $ | 7,705,865 | ||||

———

(1) | As of December 31, 2016, includes $532.7 million and $19.5 million of non-current assets held for sale located in the United Kingdom and United States, respectively. There are no similar amounts as of December 31, 2017 as the sale of these renewable energy facilities closed in the first half of 2017. |

Irrevocable Agreement to Launch Tender Offer for the Common Shares of Saeta Yield

On February 7, 2018, we announced that we intend to launch a voluntary tender offer (the “Tender Offer”) to acquire 100% of the outstanding shares of Saeta Yield, S.A. (“Saeta Yield”), a Spanish corporation and a publicly-listed European owner and operator of wind and solar assets, located primarily in Spain. The Tender Offer will be for 12.20 Euros per share of Saeta Yield. The Tender Offer is expected to be completed in the second quarter of 2018, subject to certain closing conditions.

In connection with this Tender Offer, on February 6, 2018, TERP Spanish HoldCo, S.L. (“TERP Spanish HoldCo”), a subsidiary of the Company, entered into an irrevocable undertaking agreement for the launch and acceptance of the takeover bid for the shares of Saeta Yield with Cobra Concesiones, S.L., a company incorporated under the laws of Spain (“Cobra”), and GIP II Helios, S.à r.l., a société à responsabilité limitée organized under the laws of the Grand Duchy of Luxembourg (“GIP”), as well as two separate irrevocable undertaking agreements with Mutuactivos, S.A.U., S.G.I.I.C., a company incorporated under the laws of Spain (“Mutuactivos”), and with Sinergia Advisors 2006, A.V., S.A., a company incorporated under the laws of Spain (“Sinergia” and, together with Cobra, GIP and Mutuactivos, the “Selling Stockholders”). Under the terms of these irrevocable undertaking agreements, the Selling Stockholders have irrevocably and unconditionally agreed to tender their combined 50.338% interest in Saeta Yield in the Tender Offer.

Our acceptance of the shares of Saeta Yield tendered in the Tender Offer is conditioned upon us obtaining compulsory authorization required from the European Commission and Cobra and GIP irrevocably accepting the Tender Offer in respect of their shares of Saeta Yield representing no less than 48.222% of Saeta Yield’s voting share capital.

The aggregate value of the shares of Saeta Yield held by the Selling Stockholders is approximately $600 million. If we successfully acquire all of the remaining Saeta Yield shares in the Tender Offer, the aggregate purchase price (including the value of the Selling Stockholders shares) will be approximately $1.2 billion. Assuming a $1.2 billion acquisition price, we

17

intend to finance the acquisition with a $400 million equity issuance of our Class A common stock (the “Equity Offering”) and the remaining $800 million will be financed from available liquidity, which we expect will include borrowings under the Sponsor Line Agreement and the New Revolver (as defined and discussed in Liquidity and Capital Resources within Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations). We expect to repay these borrowings with a combination of sources, including new non-recourse financings of our currently unencumbered wind and solar assets and certain cash released from Saeta Yield’s assets.

In connection with the launch of the Tender Offer, we were required to post a bank guarantee (the “Bank Guarantee”) with the Spanish National Securities Market Commission (Comisión Nacional del Mercado de Valores) (the “CNMV”) for the maximum amount payable in the Tender Offer of approximately $1.2 billion. On March 6, 2018, TERP Spanish HoldCo entered into two letter of credit facilities (the “LC Agreements”) pursuant to which two banks posted the Bank Guarantee with the CNMV for the maximum amount payable in the Tender Offer. On March 6, 2018, TerraForm Power entered into two letter agreements (the “Letter Agreements” and together with the LC Agreements, the “Letter of Credit Facilities”) with those banks. The LC Agreements govern TERP Spanish HoldCo’s obligations to reimburse those banks upon any drawing under the Bank Guarantee. The Letter Agreements govern TerraForm Power’s obligation to utilize drawings on its New Revolver and Sponsor Line Agreement or proceeds from an equity offering of its Class A common stock to contribute funds to TERP Spanish HoldCo to enable TERP Spanish HoldCo to satisfy its reimbursement obligations under the LC Agreements. The Letter of Credit Facilities also contain customary fees, representations and warranties, covenants and events of default. Under the terms of the Letter of Credit Facilities, we are required to maintain minimum liquidity requirements of $500.0 million under the Sponsor Line Agreement and $400.0 million under the New Revolver. In addition, if any amount is drawn under the Bank Guarantee, or if an event of default occurs under the Letter of Credit Facilities, we may be required to cash collateralize the entire amount of the Bank Guarantee that has not been drawn.

Saeta Yield's portfolio is comprised of 100% owned, recently constructed assets located primarily in Spain with additional assets located in Portugal and Uruguay, including 778 MW of onshore wind and 250 MW of concentrated solar, with an average age of six years and a remaining useful life in excess of 25 years as of the date of our tender offer announcement. 100% of Saeta Yield's revenues are generated under stable frameworks with investment grade counterparties. Over 80% of Saeta Yield's revenues are regulated under the Spanish renewable power regime with limited resource and market price risk, and the remaining 20% of revenues are under long-term power purchase or concession agreements. Saeta Yield's revenues have an average remaining regulatory/contractual term of 15 years.

Backstop Agreement with Brookfield

On February 6, 2018, we entered into a support agreement with Brookfield. Pursuant to this agreement, Brookfield agreed that, if requested by us, Brookfield would provide a back-stop to us for up to 100% of the Equity Offering (such agreement, the “Back-Stop”) if the offering price per Class A share of our common stock in the Equity Offering equals the five-day volume weighted average price of the Class A shares ending the trading day prior to our announcement of the Tender Offer, which was $10.66 per share. Brookfield’s obligations in relation to the provision of the Back-Stop under the support agreement are subject to successful commencement of the Tender Offer and to prior effectiveness of a registration statement, if required, that we would file in connection with the Equity Offering and such obligation would not apply to any Equity Offering commenced prior to May 1, 2018 or after September 30, 2018.

Available Information

We make available free of charge through our website (www.terraformpower.com) the reports we file with the SEC, including our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as soon as reasonably practicable after we electronically file such material with, or furnish it to, the SEC. The SEC maintains an internet site containing these reports and proxy and information statements at http://www.sec.gov. Any materials we file can be read and copied online at that site or at the SEC's Public Reference Room at 100 F Street, NE, Washington DC 20549, on official business days during the hours of 10:00 am and 3:00 pm. Information on the operation of the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330.

The following corporate governance documents are posted on our website at www.terraformpower.com:

•The TerraForm Power, Inc. Audit Committee Charter;

•The TerraForm Power, Inc. Code of Business Conduct and Ethics;

•The TerraForm Power, Inc. Conflicts Committee Charter;

•The TerraForm Power, Inc. Anti-Bribery and Corruption Policy;

•The TerraForm Power, Inc. Nominating and Corporate Governance Committee Charter; and

18

•The TerraForm Power, Inc. Board of Directors Charter.

If you would like a printed copy of any of these corporate governance documents, please send your request to 7550 Wisconsin Avenue, 9th Floor, Bethesda, Maryland 20814.

The information on our website is not incorporated by reference into this Annual Report on Form 10-K and does not constitute part of this Annual Report on Form 10-K.

Item 1A. Risk Factors.

The following pages discuss the principal risks we face. Any of these risk factors could have a significant or material adverse effect on our businesses, results of operations, financial condition or liquidity. They could also cause significant fluctuations and volatility in the trading price of our securities. Readers should not consider any descriptions of these factors to be a complete set of all potential risks and uncertainties that could affect us. These factors should be considered carefully together with the other information contained in this Annual Report on Form 10-K and the other reports and materials filed by us with the SEC. Furthermore, many of these risks are interrelated, and the occurrence of certain of them may in turn cause the emergence or exacerbate the effect of others. Such a combination could materially increase the severity of the impact of these risks on our businesses, results of operations, financial condition and liquidity.

Risks Related to Our Business

We may not realize the expected benefits of the Merger and Sponsorship Transaction.

Following the closing of the Merger and Sponsorship Transaction, the Company may not perform as we expect, or as the market expects, which could have an adverse effect on the price of our Class A common stock. Concurrently with the closing of the Merger and Sponsorship Transaction, Brookfield and the Company entered into the new sponsorship agreements, which include, among other things, for Brookfield to provide strategic and investment management services to the Company, for Brookfield, subject to certain terms and conditions, to provide the Company with a right of first offer on certain operating wind and solar assets that are located in North America and Western Europe and developed by persons sponsored by or under the control of Brookfield and for Brookfield to provide TerraForm Power with a $500 million secured revolving credit facility to fund certain acquisitions or growth capital expenditures.

The Company may not realize expected benefits of Brookfield’s management services and the other aspects of the sponsorship arrangements. For example, the Company may fail to realize expected operational or margin improvements, synergies or other cost savings or reductions, may not achieve expected growth in its portfolio through organic growth or third-party acquisitions and may not be able to acquire assets from Brookfield. The Company may also not be able to effectively utilize the $500 million revolving credit facility provided by Brookfield for accretive acquisitions or at all. Our failure to realize these aspects of the Sponsorship Transaction may have an adverse effect on the price of our Class A common stock and on our business, growth and the results of our operations.

The Merger and Sponsorship Transaction and related uncertainty could cause disruptions in our business, which could have an adverse effect on our business and financial results and the price of our Class A common stock.

We have important counterparties at every level of operations, including offtakers under our PPAs, corporate and project-level lenders and tax equity investors, suppliers and service providers. Uncertainty about the effect of the sponsorship with Brookfield may negatively affect our relationship with our counterparties due to concerns about the Brookfield sponsorship and its impact on our business. These concerns may cause counterparties to be more likely to reduce utilization of our services (or the provision of supplies or services) where the counterparty has flexibility in volume or duration or otherwise seeks to change the terms on which they do business with us. These concerns may also cause our existing or potential new counterparties to be less likely to enter into new agreements or to demand more expensive or onerous terms, credit support, security or other conditions. Damage to our existing or potential future counterparty relationships may materially and adversely affect our business, financial condition and results of operations, including our growth strategy and the price of our Class A common stock.

The production of wind energy depends heavily on suitable wind conditions, and the production of solar depends on irradiance, which is the amount of solar energy received at a particular site. If wind or solar conditions are unfavorable or below our estimates, our electricity production, and therefore our revenue, may be substantially below our expectations.

The electricity produced and revenues generated by a wind power plant depend heavily on wind conditions, which are

19

variable and difficult to predict. Operating results for wind power plants vary significantly from period to period depending on the wind conditions during the periods in question. The electricity produced and the revenues generated by a solar power plant depends heavily on insolation, which is the amount of solar energy received at a site. While somewhat more predictable than wind conditions, operating results for solar power plants can also vary from period to period depending on the solar conditions during the periods in question. We have based our decisions about which sites to develop in part on the findings of long-term wind, irradiance and other meteorological data and studies conducted in the proposed area, which, as applicable, measure the wind’s speed and prevailing direction, the amount of solar irradiance a site is expected to receive and seasonal variations. Actual conditions at these sites, however, may not conform to the measured data in these studies and may be affected by variations in weather patterns, including any potential impact of climate change. Therefore, the electricity generated by our power plants may not meet our anticipated production levels or the rated capacity of the turbines or solar panels located there, which could adversely affect our business, financial condition and results of operations. In some quarters the wind resources at our operating wind power plants, while within the range of our long-term estimates, have varied from the averages we expected. If the wind or solar resources at a facility are below the average level we expect, our rate of return for the facility would be below our expectations and we would be adversely affected. Projections of wind resources also rely upon assumptions about turbine placement, interference between turbines and the effects of vegetation, land use and terrain, which involve uncertainty and require us to exercise considerable judgment. Projections of solar resources depend on assumptions about weather patterns (including snow), shading, and other assumptions which involve uncertainty and also require us to exercise considerable judgment. We or our consultants may make mistakes in conducting these wind, irradiance and other meteorological studies. Any of these factors could cause our sites to have less wind or solar potential than we expected and may cause us to pay more for wind and solar power plants in connection with acquisitions than we otherwise would have paid had such mistakes not been made, which could cause the return on our investment in these wind and solar power plants to be lower than expected.

If our wind and solar energy assessments turn out to be wrong, our business could suffer a number of material adverse consequences, including:

• | our energy production and sales may be significantly lower than we predict; |

• | our hedging arrangements may be ineffective or more costly; |

• | we may not produce sufficient energy to meet our commitments to sell electricity or RECs and, as a result, we may have to buy electricity or RECs on the open market to cover our obligations or pay damages; and |

• | our wind and solar power plants may not generate sufficient cash flow to make payments of principal and interest as they become due on the notes and our non-recourse debt, and we may have difficulty obtaining financing for future wind power plants. |

Our failure to achieve and maintain effective internal control over financial reporting in accordance with Section 404 of the Sarbanes-Oxley Act could have a material adverse effect on our business and share price.

We are required to comply with Section 404(a) of the Sarbanes-Oxley Act in the course of preparing our financial statements, and our management is required to report on the effectiveness of our internal control over financial reporting for such year. Additionally, our independent registered public accounting firm is required pursuant to Section 404(b) of the Sarbanes-Oxley Act to attest to the effectiveness of our internal control over financial reporting on an annual basis. The rules governing the standards that must be met for our management to assess our internal control over financial reporting are complex and require significant documentation, testing and possible remediation.

Internal control over financial reporting is a process designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with GAAP. A material weakness is a deficiency, or combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of the entity’s financial statements will not be prevented or detected on a timely basis. The existence of any material weakness would require management to devote significant time and incur significant expense to remediate any such material weaknesses and management may not be able to remediate any such material weaknesses in a timely manner.

As of December 31, 2017, we did not maintain an effective control environment attributable to certain identified material weaknesses. We describe these material weaknesses in Item 9A. Controls and Procedures in this Annual Report on Form 10-K. These control deficiencies create a reasonable possibility that a material misstatement to the consolidated financial statements will not be prevented or detected on a timely basis, and therefore we concluded that the deficiencies represent material weaknesses in the Company’s internal control over financial reporting and our internal control over financial reporting

20

was not effective as of December 31, 2017.