Attached files

| file | filename |

|---|---|

| 8-K - 8-K - Wesco Aircraft Holdings, Inc | wair-3312016x8k.htm |

| EX-99.1 - EXHIBIT 99.1 - Wesco Aircraft Holdings, Inc | wair-3312016xex991.htm |

Q2 2016 EARNINGS CALL PRESENTATION May 5, 2016 Dave Castagnola President and Chief Executive Officer Rick Weller Executive Vice President and Chief Financial Officer

Wesco Aircraft Proprietary Visit www.wescoair.com Disclaimer 2 Wesco Aircraft - Investor Relations This presentation contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning Wesco Aircraft Holdings, Inc. (“Wesco Aircraft “ or the “Company”). These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial condition, or otherwise, based on current beliefs of management, as well as assumptions made by, and information currently available to, management. In some cases, you can identify forward-looking statements by words such as “achieve,” “begin,” “believe,” “drive,” “expand,” “expect,” “forecast,” “future,” “grow,” “improve,” “increase,” “intend,” “opportunity,” “outlook,” “plan,” “should,” “target,” “will” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, the following: general economic and industry conditions; conditions in the credit markets; changes in military spending; risks unique to suppliers of equipment and services to the U.S. government; risks associated with the Company’s long-term, fixed-price agreements that have no guarantee of future sales volumes; risks associated with the loss of significant customers, a material reduction in purchase orders by significant customers or the delay, scaling back or elimination of significant programs on which the Company relies; the Company’s ability to effectively compete in its industry; the Company’s ability to effectively manage its inventory; the Company’s ability to fully integrate the acquired business of Haas and realize anticipated benefits of the combined operations; risks relating to unanticipated costs of integration; the Company’s suppliers’ ability to provide it with the products the Company sells in a timely manner, in adequate quantities and/or at a reasonable cost; the Company’s ability to maintain effective information technology systems; the Company’s ability to retain key personnel; risks associated with the Company’s international operations, including exposure to foreign currency movements; risks associated with assumptions the Company makes in connection with its critical accounting estimates (including goodwill) and legal proceedings; the Company’s dependence on third-party package delivery companies; fuel price risks; the Company’s ability to establish and maintain effective internal control over financial reporting; fluctuations in the Company’s financial results from period-to-period; environmental risks; risks related to the handling, transportation and storage of chemical products; risks related to the aerospace industry and the regulation thereof; risks related to the Company’s indebtedness; and other risks and uncertainties. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that affect the Company’s business, including those described in the Company’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed from time to time with the Securities and Exchange Commission. All forward-looking statements included in this presentation (including information included or incorporated by reference herein) are based upon information available to the Company as of the date hereof, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. The Company utilizes and discusses Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow, which are non-GAAP measures its management uses to evaluate its business, because the Company believes they assist investors and analysts in comparing its performance across reporting periods on a consistent basis by excluding items that the Company does not believe are indicative of its core operating performance. The Company believes these metrics are used in the financial community, and the Company presents these metrics to enhance investors’ understanding of its operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as alternatives to Net Income, determined in accordance with GAAP, as an indicator of operating performance. Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See the Appendix for a reconciliation of Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow to the most directly comparable financial measures calculated and presented in accordance with GAAP.

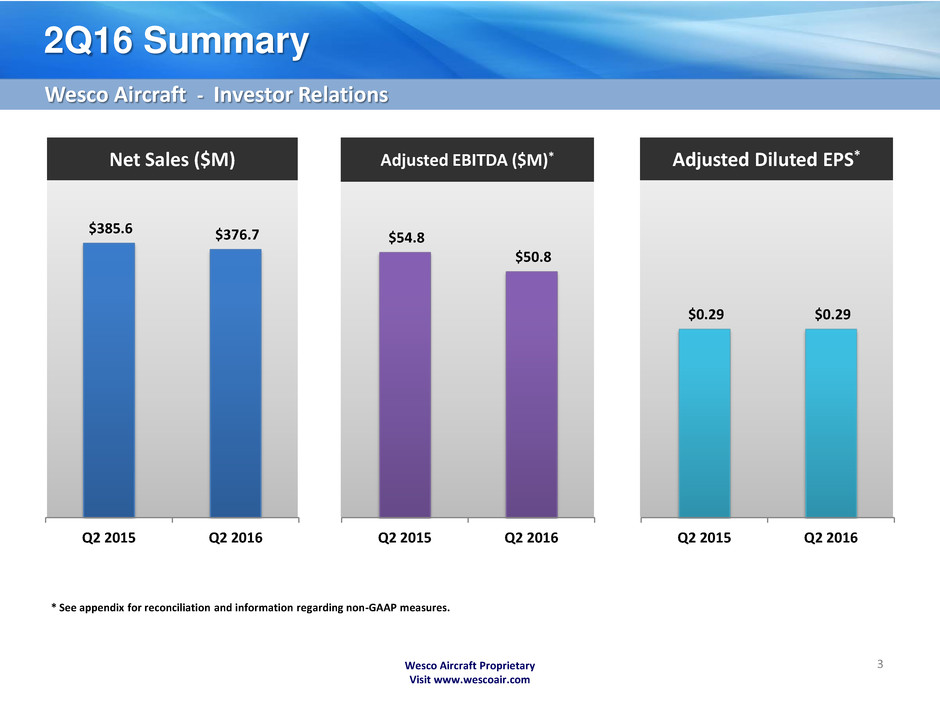

Wesco Aircraft Proprietary Visit www.wescoair.com 2Q16 Summary 3 Wesco Aircraft - Investor Relations $385.6 $376.7 Q2 2015 Q2 2016 $54.8 $50.8 Q2 2015 Q2 2016 $0.29 $0.29 Q2 2015 Q2 2016 * See appendix for reconciliation and information regarding non-GAAP measures. Net Sales ($M) Adjusted Diluted EPS* Adjusted EBITDA ($M)*

Focus on growing sales; renewals and wins on contracts Developing and implementing supply chain strategies Drove costs lower; improving facilities structure and flow Free cash flow impacted primarily by timing Paid down $25 million in debt in Q2 4 Highlights Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Consistent Execution Across Business Positioning for Sustained Performance

Contract sales higher in Q2 Strategic customer wins continue New business and scope expansion Renewals of hardware and chemical services Pipeline expansion; opportunities progressing MRO activities improve; pipeline growing Ad hoc sales lower, orders higher in Q2 5 Sales Highlights Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Well Positioned with Broad Portfolio Driving Future Growth

Increasing focus on process, standard work and metrics Engaging suppliers at a strategic level Progressing alignment of material acquisition to demand SIOP process beginning to mature Communications, engagement and training 6 Supply Chain Management Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Accelerating the Pace of Change Improving Delivery Performance and Working Capital

Reduced SG&A expense Site consolidations continue – 13 facility closures to-date – Opened multi-commodity hub facility – Lean improvements to increase velocity Deploying continuous improvement across all functions 7 Cost and Efficiency Improvements Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Ongoing Focus on Cost Management and Efficiency Delivering Cost Savings Commitment

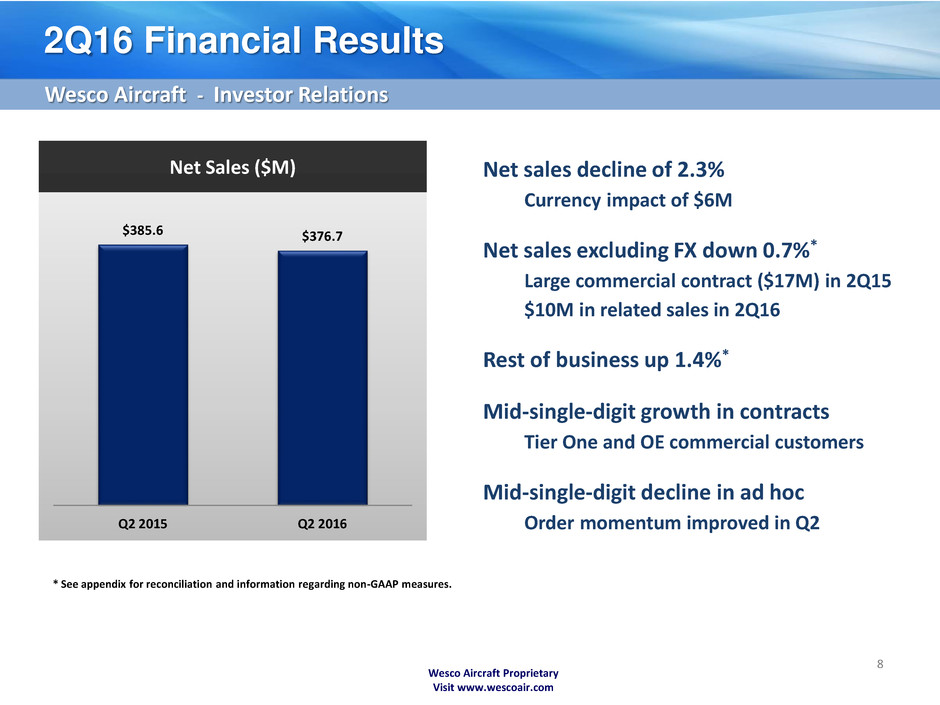

Net sales decline of 2.3% Currency impact of $6M Net sales excluding FX down 0.7%* Large commercial contract ($17M) in 2Q15 $10M in related sales in 2Q16 Rest of business up 1.4%* Mid-single-digit growth in contracts Tier One and OE commercial customers Mid-single-digit decline in ad hoc Order momentum improved in Q2 Wesco Aircraft Proprietary Visit www.wescoair.com 2Q16 Financial Results 8 Wesco Aircraft - Investor Relations Net Sales ($M) * See appendix for reconciliation and information regarding non-GAAP measures. $385.6 $376.7 Q2 2015 Q2 2016

Wesco Aircraft Proprietary Visit www.wescoair.com 2Q16 Financial Results Adjusted EBITDA margin lower: (70) bps Gross margin (110) bps SG&A percent of sales (60) bps Gross margin: Large commercial contract, net (70) bps Currency (50) bps SG&A expense: People costs, professional fees, facilities costs, bad debt and FX Adjusted diluted EPS Adjusted EBITDA decline, offset by Lower income tax expense 9 Wesco Aircraft - Investor Relations Adjusted Diluted EPS* Adjusted EBITDA ($M)* * See appendix for reconciliation and information regarding non-GAAP measures. ** As a percent of net sales $54.8 $50.8 Q2 2015 Q2 2016 $0.29 $0.29 Q2 2015 Q2 2016 14.2%** 13.5%**

Wesco Aircraft Proprietary Visit www.wescoair.com 2Q16 Segments – North America 10 Wesco Aircraft - Investor Relations * See appendix for reconciliation and information regarding non-GAAP measures. ** As a percent of net sales. Net Sales ($M) Adjusted EBITDA ($M)* $43.3 $35.9 Q2 2015 Q2 2016 14.1%** 11.9%** Sales decline of 1.8% Large commercial contract ($13M) in 2Q15 $10M in related sales in 2Q16 Rest of business down 0.7%* Adjusted EBITDA margin 220 bps lower Net sales decline and mix Large contract gross margin net impact Partially offset by lower SG&A $307.4 $302.0 Q2 2015 Q2 2016

Wesco Aircraft Proprietary Visit www.wescoair.com 2Q16 Segments – Rest of World 11 Wesco Aircraft - Investor Relations * See appendix for reconciliation and information regarding non-GAAP measures. ** As a percent of net sales. Net Sales ($M) Adjusted EBITDA ($M)* $78.2 $74.7 Q2 2015 Q2 2016 $11.5 $14.9 Q2 2015 Q2 2016 14.6%** 19.9%** Sales decline of 4.4% Large commercial contract ($4M) in 2Q15 Currency impact ($6M) Rest of business up 9.8%* Adjusted EBITDA margin 530 bps higher Sales volume/mix Lower SG&A expense

Wesco Aircraft Proprietary Visit www.wescoair.com Financial Summary 12 * See appendix for reconciliation and information regarding non-GAAP measures. Wesco Aircraft - Investor Relations (Dollars in Millions) Mar 31, 2016 Dec 31, 2015 Sept 30, 2015 At period end: Cash and cash equivalents $63.0 $85.7 $82.9 Accounts receivable 274.7 238.1 253.3 Net inventory 710.8 723.6 701.5 Total debt 922.9 947.9 952.9 Stockholders’ equity 856.0 834.3 817.6

Wesco Aircraft Proprietary Visit www.wescoair.com Cash Flow Summary 13 * See appendix for reconciliation and information regarding non-GAAP measures. Wesco Aircraft - Investor Relations (Dollars in Millions) Mar 31, 2016 Dec 31, 2015 Mar 31, 2015 Quarter ended: Net income $23.5 $20.6 $23.0 Adjustments to reconcile to operating cash flow 13.3 13.1 17.6 Working capital change (32.6) (23.0) (2.5) Net cash from operating activities 4.2 10.7 38.1 Capital expenditures (6.1) (1.2) (1.6) Free cash flow* (1.9) 9.5 36.5 Adjusted net income* 28.0 24.2 28.2 Cash flow conversion (7%) 39% 129%

14 Fiscal 2016 Outlook Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Net sales percentage growth Low Single-Digit Higher contract growth Stronger second-half expected SG&A reduction $25-30M Reduction in headcount, sites and spend $10M from non-recurring items Adjusted EBITDA margin improvement ~100 bps Primarily through SG&A reductions Free cash flow conversion >100% Primary usage to pay down debt Other items Interest expense Capital expenditures Effective tax rate $35-40M $10-15M 31-32%

Transformational change Significant process improvement Business continues to mature Showing steady progress Committed to organizational evolution Closing performance gaps Concluding Remarks 15 Wesco Aircraft Proprietary Visit www.wescoair.com Balance Execution While Driving Long-term Shareholder Value

APPENDIX 16

Wesco Aircraft Proprietary Visit www.wescoair.com Non-GAAP Financial Information 17 Wesco Aircraft - Investor Relations ‘‘Adjusted EBITDA’’ represents Net Income before: (i) income tax provision, (ii) net interest expense, (iii) depreciation and amortization and (iv) unusual or non-recurring items. ‘‘Adjusted Net Income’’ represents Net Income before: (i) amortization of intangible assets, (ii) amortization or write-off of deferred financing costs and original issue discount, (iii) unusual or non-recurring items and (iv) the tax effect of items (i) through (iii) above calculated using an assumed effective tax rate. “Adjusted Basic EPS” represents Basic EPS calculated using Adjusted Net Income as opposed to Net Income. “Adjusted Diluted EPS” represents Diluted EPS calculated using Adjusted Net Income as opposed to Net Income. “Net sales excluding currency effects” represent net sales for the fiscal 2016 second quarter and year-to-date translated at the corresponding fiscal 2015 periodical average exchange rates. “Free Cash Flow” represents cash from operations less purchases of property and equipment. Wesco Aircraft utilizes and discusses Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow, which are non-GAAP measures our management uses to evaluate our business, because we believe they assist investors and analysts in comparing our performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance. We believe these metrics are used in the financial community, and we present these metrics to enhance investors’ understanding of our operating performance. You should not consider Adjusted EBITDA and Adjusted Net Income as alternatives to Net Income, determined in accordance with GAAP, as an indicator of operating performance. Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow are not measurements of financial performance under GAAP, and these metrics may not be comparable to similarly titled measures of other companies. See following slides for a reconciliation of Adjusted EBITDA, Adjusted Net Income, Adjusted Basic EPS, Adjusted Diluted EPS, Net Sales Excluding Currency Effects and Free Cash Flow to the most directly comparable financial measures calculated and presented in accordance with GAAP.

Non-GAAP Financial Information 18 Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com (1) Unusual and non-recurring items in the first quarter of fiscal 2016 consisted of integration and other related expenses of $447 and business realignment expenses of $182. Unusual and non-recurring items in the second quarter and year-to-date periods of fiscal 2016 consisted of integration and other related expenses of $608 and $1,055, respectively, as well as business realignment and other expenses of $1,330 and $1,512, respectively. Unusual and non-recurring items in the second quarter and year-to-date periods of fiscal 2015 consisted of integration and other related expenses of $2,319 and $4,562, respectively, as well as business realignment and other expenses of $645 and $1,096, respectively. Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information (UNAUDITED) (In thousands, except share data) Three Months Ended Six Months Ended December 31, 2015 March 31, 2016 March 31, 2015 March 31, 2016 March 31, 2015 EBITDA & Adjusted EBITDA Net income $ 23,492 $ 23,046 $ 44,101 $ 42,776 Provision for income taxes 9,167 12,716 17,546 23,152 Interest expense, net 9,114 9,346 18,111 18,719 Depreciation and amortization 7,055 6,680 14,053 13,262 EBITDA 48,828 51,788 93,811 97,909 Unusual or non-recurring items (1) 1,938 2,964 2,567 5,658 Adjusted EBITDA $ 50,766 $ 54,752 $ 96,378 $ 103,567 Adjusted Net Income Net income $ 20,609 $ 23,492 $ 23,046 $ 44,101 $ 42,776 Amortization of intangible assets 3,963 3,955 3,993 7,919 8,000 Amortization of deferred financing costs 828 925 1,139 1,753 2,158 Unusual or non-recurring items (1) 629 1,938 2,964 2,567 5,658 Adjustments for tax effect (1,856 ) (2,267 ) (2,920 ) (4,123 ) (5,742 ) Adjusted Net Income $ 24,173 $ 28,043 $ 28,222 $ 52,217 $ 52,850 Adjusted Basic Earnings Per Share Weighted-average number of basic shares outstanding 97,390,636 96,906,736 97,303,808 96,884,680 Adjusted Net Income Per Basic Share $ 0.29 $ 0.29 $ 0.54 $ 0.55 Adjusted Diluted Earnings Per Share Weighted-average number of diluted shares outstanding 98,075,389 97,726,054 97,999,018 97,738,624 Adjusted Net Income Per Diluted Share $ 0.29 $ 0.29 $ 0.53 $ 0.54

Non-GAAP Financial Information 19 Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com (1) In the second quarter and year-to-date periods of fiscal 2015, the company sold $17,459 and $36,172, respectively, of commercial hardware under a contract that ended on March 31, 2015, as previously disclosed. In the second quarter of fiscal 2016, the company sold $9,782 of additional commercial hardware related to this contract. March 31, 2016 March 31, 2015 Increase / (Decrease) Percent Change March 31, 2016 March 31, 2015 Increase / (Decrease) Percent Change Consolidated Consolidated sales $376,742 $385,559 ($8,817) -2.3% $736,585 $759,255 ($22,670) -3.0% Currency effects 6,205 - 6,205 12,462 - 12,462 Organic sales $382,947 $385,559 ($2,612) -0.7% $749,047 $759,255 ($10,208) -1.3% Large commercial contract (9,782) (17,459) 7,677 (9,782) (36,172) 26,390 Adjusted Organic sales $373,165 $368,100 $5,065 1.4% $739,265 $723,083 $16,182 2.2% North America North America sales $301,981 $307,373 ($5,393) -1.8% $588,941 $603,098 ($14,157) -2.3% Large commercial contract (9,782) (12,999) 3,217 (9,782) (28,162) 18,380 North America adjusted organic sales $292,199 $294,375 ($2,176) -0.7% $579,159 $574,936 $4,223 0.7% Rest of World Rest of World sales $74,762 $78,186 ($3,425) -4.4% $147,644 $156,157 ($8,513) -5.5% Currency effects 6,205 - 6,205 12,462 - 12,462 Rest of World organic sales $80,966 $78,186 $2,780 3.6% $160,106 $156,157 $3,949 2.5% Large commercial contract - (4,460) 4,460 - (8,010) 8,010 Rest of World adjusted organic sales $80,966 $73,726 $7,240 9.8% $160,106 $148,147 $11,960 8.1% Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information (UNAUDITED) (In thousands) Three Months Ended Six Months Ended

Non-GAAP Financial Information 20 Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com March 31, 2016 March 31, 2015 March 31, 2016 March 31, 2015 Consolidated EBITDA & Adjusted EBITDA Net income $23,492 $23,046 $44,101 $42,776 Provision for income taxes 9,167 12,716 17,546 23,152 Interest expense, net 9,114 9,346 18,111 18,719 Depreciation and amortization 7,055 6,680 14,053 13,262 EBITDA 48,828 51,788 93,811 97,909 Unusual or non-recurring items 1,938 2,964 2,567 5,658 Adjusted EBITDA $50,766 $54,752 $96,378 $103,567 North America EBITDA & Adjusted EBITDA Net income $13,306 $16,960 $27,548 $32,157 Provision for income taxes 6,617 9,948 13,022 18,456 Interest expense, net 8,041 8,149 15,840 16,191 Depreciation and amortization 6,048 5,662 12,002 11,154 EBITDA 34,013 40,719 68,412 77,958 Unusual or non-recurring items 1,907 2,597 2,535 5,246 Adjusted EBITDA $35,919 $43,316 $70,948 $83,204 Rest of World EBITDA & Adjusted EBITDA Net income $10,186 $6,086 $16,553 $10,619 Provision for income taxes 2,549 2,768 4,523 4,696 Interest expense, net 1,073 1,197 2,271 2,528 Depreciation and amortization 1,007 1,018 2,051 2,108 EBITDA 14,815 11,069 25,398 19,951 Unusual or non-recurring items 32 367 32 412 Adjusted EBITDA $14,847 $11,436 $25,430 $20,363 Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information (UNAUDITED) (In thousands) Three Months Ended Six Months Ended

Non-GAAP Financial Information 21 Wesco Aircraft - Investor Relations Wesco Aircraft Proprietary Visit www.wescoair.com Wesco Aircraft Holdings, Inc. Non-GAAP Financial Information - Free Cash Flow (UNAUDITED) (Dollars in thousands) Three Months Ended March 31, 2016 March 31, 2015 Increase (Decrease) Percent Change Free Cash Flow Net cash provided by operating activities $ 4,162 $ 38,155 $ (33,993 ) (89.1)% Purchase of property and equipment (6,071 ) (1,613 ) (4,458 ) 276.4% Free cash flow $ (1,909 ) $ 36,542 $ (38,451 ) (105.2)% Six Months Ended March 31, 2016 March 31, 2015 Increase (Decrease) Percent Change Free Cash Flow Net cash provided by operating activities $ 14,826 $ 49,472 $ (34,646 ) (70.0)% Purchase of property and equipment (7,233 ) (2,912 ) (4,321 ) 148.4% Free cash flow $ 7,593 $ 46,560 $ (38,967 ) (83.7)%

For more information, please visit www.wescoair.com. THANK YOU FOR YOUR INTEREST IN WESCO AIRCRAFT