Attached files

| file | filename |

|---|---|

| EX-31.1 - Consumer Capital Group, Inc. | ccgn10k050216ex31_1.htm |

| EX-21.1 - Consumer Capital Group, Inc. | ccgn10k050216e21_1.htm |

| EX-32.1 - Consumer Capital Group, Inc. | ccgn10k050216ex32_1.htm |

| EX-32.2 - Consumer Capital Group, Inc. | ccgn10k050216ex32_2.htm |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[x] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2015

or

[ ] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________to ___________

Commission File Number: 000-54998

CONSUMER CAPITAL GROUP, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-2517432 | |

State or other jurisdiction of incorporation or organization |

(I.R.S. Employer Identification No.) | |

136-82 39th Ave, 4th Floor, Unit B Flushing, New York |

11354 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (718) 395-8150

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Name of each exchange on which registered: |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.0001 per share

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [x]

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes [ ] No [x]

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [ ] No [x]

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes [ ] No [x]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | [ ] | Accelerated filer | [ ] | |

| Non-accelerated filer | [ ] | Smaller reporting company | [x] | |

| (Do not check if a smaller reporting company) |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes [ ] No [x]

The aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, as of the last business day of the registrant’s most recently completed second fiscal quarter was $62,396,586.

As of May 4, 2016, the registrant had 31,165,740 shares of common stock, par value $0.0001 per share, outstanding.

Documents incorporate by reference: None.

CONSUMER CAPITAL GROUP, INC.

ANNUAL REPORT ON FORM 10-K

| Page | ||||||

| PART I | ||||||

| ITEM 1. | Business | 2 | ||||

| ITEM 1A. | Risk Factors | 13 | ||||

| ITEM 1B. | Unresolved Staff Comments | 32 | ||||

| ITEM 2. | Properties | 32 | ||||

| ITEM 3. | Legal Proceedings | 33 | ||||

| ITEM 4. | Mine Safety Disclosures | 33 | ||||

| PART II | ||||||

| ITEM 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 34 | ||||

| ITEM 6. | Selected Financial Data | 35 | ||||

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations | 35 | ||||

| ITEM 7A. | Quantitative and Qualitative Disclosures About Market Risk | 45 | ||||

| ITEM 8. | Financial Statements and Supplementary Data | 46 | ||||

| ITEM 9. | Changes In and Disagreements With Accountants on Accounting and Financial Disclosure | 46 | ||||

| ITEM 9A. | Controls and Procedures | 46 | ||||

| ITEM 9B. | Other Information | 48 | ||||

| PART III | ||||||

| ITEM 10. | Directors, Executive Officers and Corporate Governance | 48 | ||||

| ITEM 11. | Executive Compensation | 50 | ||||

| ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 51 | ||||

| ITEM 13. | Certain Relationships and Related Transactions, and Director Independence | 52 | ||||

| ITEM 14. | Principal Accountant Fees and Services | 53 | ||||

| PART IV | ||||||

| ITEM 15. | Exhibits and Financial Statement Schedules | 54 | ||||

| Signatures | ||||||

EXPLANATORY NOTE

Consumer Capital Group, Inc. (“Consumer Capital,” or the “Company,” “we,” “us” or “our”) is filing this comprehensive Annual Report on Form 10-K for the fiscal years ended December 31, 2015 and 2014 and the quarterly periods ended March 31, 2015, June 30, 2015, and September 30, 2015 (the “Comprehensive Form 10-K”) as part of its efforts to become current in its filing obligations under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Although the Company has regularly made filings through Current Reports on Form 8-K when deemed appropriate, this Comprehensive Form 10-K is the Company’s first annual periodic filing with the Securities and Exchange Commission (the “Commission”) since the filing of its Annual Report on Form 10-K for the year ended December 31, 2013. Included in this Comprehensive Form 10-K are the Company’s audited financial statements for the fiscal years ended December 31, 2014 and 2015, which have not been previously filed with the Commission.

Readers should be aware that several aspects of this report differ from other annual reports. First, this report is for each of the fiscal years ended December 31, 2015 and 2014, in lieu of filing separate reports for each of those fiscal years. Second, because of the amount of time that has passed since our last periodic report was filed with the SEC, the information relating to our business and related matters is focused on our more recent periods, including certain information for periods after September 30, 2014 and through the day of filing this report.

Background for Filing Delay: We were unable to file the above referenced periodic reports due to certain allegations disclosed in the Current Report on Form 8-K filed on May 29, 2015. Because of the allegations, Company was not able to complete its audit for the fiscal year ended December 31, 2014 until April 29, 2016 when the Company satisfied requests from its independent accounting firm in addressing the issue. An Investigation Committee formed by the Company internally also believes that the allegations to be without merit. This Comprehensive Form 10-K should be read together and in connection with the other reports filed by us with the SEC for a comprehensive description of our current financial condition and operating results. In the interest of complete and accurate disclosure, we have included current information in this annual report for all material events and developments that have taken place through the date of filing of this annual report with the SEC.

FORWARD-LOOKING STATEMENTS

Certain statements made in this Annual Report on Form 10-K are “forward-looking statements” made under the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995 regarding the plans and objectives of management for future operations. Such statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. These statements use words such as “believe,” “expect,” “should,” “strive,” “plan,” “intend,” “estimate,” “anticipate” or similar expressions. The forward-looking statements included herein are based on our current beliefs, assumptions, and expectations, and are subject to numerous risks and uncertainties. Our plans and objectives are based, in part, on assumptions of the continuing expansion of business. Assumptions relating to the foregoing involve judgments with respect to, among other things, future economic, competitive and market conditions, and future business decisions, all of which are difficult or impossible to predict accurately, and many of which are beyond our control. Although we believe our assumptions underlying the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance, or achievements. These forward-looking statements are made as of the date of this report, and we assume no obligation to update these forward-looking statements whether as a result of new information, future events, or otherwise, other than as required by law. In light of these assumptions, risks, and uncertainties, the forward-looking events discussed in this report might not occur and actual results and events may vary significantly from those discussed in the forward-looking statements.

USE OF CERTAIN DEFINED TERMS

In this Report, unless otherwise noted or as the context otherwise requires: “the Company,” “we,” “us,” and “our” refers to the combined company Consumer Capital Group, Inc. and its subsidiaries and Variable Interest Entities.

PART I

Item 1. Business.

Overview

We have been primarily engaging in internet financing services since the first quarter of 2015. Prior to that, we operated an online retail platform in China at www.ccmus.com through Arki (Beijing) E-Commerce Technology Corp., our wholly owned subsidiary, and an online retail platform at www.ccgusa.com in the United States. In addition to e-commerce services, we tried to develop a debit card business, through America Arki Fuxin Network Management Co. Ltd., our wholly owned subsidiary. Prior to April 2014, we also operated our meat distribution business through Beijing Beitun Trading Co., Ltd., our 51% owned subsidiary. Through Beijing Beitun Trading Co., Ltd., we purchased meats from suppliers and distributed them to restaurants and food producers in China. On April 1, 2014, the Company sold its entire 51% equity of Beijing Beitun Trading Co. Ltd. As a result of the sale of our equity in Beitun Trading, we no longer operate in the distribution of meat products. Because of the lack of sales generated on our two online retail platforms, we also ceased our E-commerce business in first quarter of 2015.

We currently operate our business through our variable interest entity, America Arki Network Service Beijing Co., Ltd, which holds 51% interest in America Arki (Tianjin) Capital Management Partnership (“Arki Tianjin”), a wealth management firm, and Shanghai Zhong Hui Financial Information Service Corp. (“Zhong Hui”), an online consumer finance platform that matches mass retail investors and companies that needs to raise capital through debt or equity financing.

Corporate History

We were originally incorporated under the name “Mondas Minerals Corp.” in Delaware on April 25, 2008 and was engaged in the acquisition, exploration, and development of natural resource properties. The principal executive offices were previously located at 13983 West Stone Avenue, Post Falls, ID 83854.

We were an exploration stage company with no revenues or operating history prior to our merger on February 4, 2011 described below. We owned a 100% undivided interest in a mineral property, the Ram 1-4 Mineral Claims (known as the “Ram Property.”) The Ram Property consists of an area of 82.64 acres located in the Lida Quadrangle Area, Esmeralda County, Nevada. Title to the Ram Property was held by Mondas. Our plan of operation was to conduct mineral exploration activities on the property in order to assess whether it contains mineral deposits capable of commercial extraction.

As of December 31, 2010 and immediately prior to the merger transaction described below, we were an exploration stage company with nominal assets, no revenues, or operating history. On January 11, 2011, the Company changed its fiscal year end from June 30 to December 31.

On February 4, 2011, the Company acquired Consumer Capital Group, Inc., a California corporation (“CCG California”), a consumer e-commerce business with operations in the People’s Republic of China (“PRC”) in a reverse merger transaction (the “Merger”) pursuant to an Agreement and Plan of Merger (“Merger Agreement”) by and among the Company, the Company’s wholly owned subsidiary CCG Acquisition Corp., a Delaware corporation (“CCG Delaware”), CCG California, and Scott D. Bengfort.

In the Merger, CCG Delaware merged into CCG California with CCG California as the surviving corporation. As a result, CCG California became our wholly-owned subsidiary, and the subsidiaries of CCG Delaware including America Pine (Beijing) Bio-Tech, Inc. (“America Pine”), Arki (Beijing) E-Commerce Technology Corp. (“Arki Beijing”), Beijing Beitun Trading Co., Ltd. (“Beitun”), and America Arki (Fuxin) Network Management Co. Ltd. (“Arki Fuxin”), all of which incorporated in China (collectively, the “PRC Subsidiaries”), became Mondas’s indirect subsidiaries. Arki (Beijing) E-Commerce Technology Corp. has a contractual relationship with America Arki Network Service Beijing Co., Ltd. (“Arki Network Service”), a PRC limited liability company, which is 100% owned by two of CCG California’s former major shareholders and officers. CCG California, the PRC Subsidiaries, and Arki Network Service are collectively referred to as the “CCG Group.”

On January 7, 2011, the Company formed a new wholly-owned subsidiary by the name of “Consumer Capital Group Inc.” (“CCG Name Sub”) in Delaware solely for purposes of changing its corporate name to “Consumer Capital Group Inc.” in conjunction with the closing of the Merger. On February 17, 2011, the Company changed its name to Consumer Capital Group Inc. pursuant to Certificate of Ownership filed with the Secretary of State of Delaware by merging CCG Name Sub into the Company with the Company surviving and CCG Name Sub ceasing to exist.

Under the Merger Agreement, the Company issued an aggregate of 17,777,778 shares of its common stock to the shareholders of CCG California immediately prior to the Merger (“CCG Shareholders”) at an exchange rate of one (1) share of our common stock for each 21.96 shares of CCG California common stock.

Immediately prior to the closing of the Merger, there were 2,500,000 issued and outstanding shares of the Company’s common stock, 60% of which were held by the then-principal stockholder, CEO, and sole director of the Company, Mr. Bengfort. As a part of the Merger, CCG California paid USD $335,000 in cash to Mr. Bengfort in exchange for his agreement to enter into various transaction agreements relating to the Merger, as well as the cancellation of 1,388,889 shares of the Company’s common stock directly held by him, constituting 92.6% of his pre-Merger holdings of the Company’s common stock.

In connection with the Merger, the mining rights held by the Company were assigned to Mr. Bengfort, and in turn, Mr. Bengfort personally assumed all liabilities of the Company existing immediately prior to the closing, under the terms of an Assignment and Assumption Agreement between the Company and Mr. Bengfort effective on the closing date of the Merger (the “Assignment and Assumption Agreement”). Mr. Bengfort also agreed to discharge and forego his rights to be repaid approximately $16,000, which the Company owed to him immediately prior to the closing of the Merger, along with all other claims against the Company, by executing a release agreement (“Release”) effective on the closing date of the Merger. Mr. Bengfort also agreed to be a party to the Merger Agreement, including various representations and warranties. Further, Mr. Bengfort executed an indemnification agreement (“Indemnification Agreement”) in favor of CCG California and its shareholders to indemnify them for any breach of the Merger Agreement or unpaid or unresolved liabilities of the Company that may materialize within a one year period after the closing. The closing of the Merger was on February 4, 2011.

In connection with the closing, Mr. Bengfort resigned from his role as the Company’s sole officer and director. New directors took office, and appointed new officers of the Company promptly following the closing of the Merger.

There was no trading of our shares prior to the Merger. Since the Merger, there has been limited trading of our shares. From and after the closing of the Merger, our primary operations now consist of the business and operations of the CCG Group, which are primarily conducted in the PRC.

Our current principal offices are located at 136-82 39th Ave, 4th Floor, Unit B, Flushing, NY 11354. Our trading symbol on the OTC Markets is “CCGN.”

CCG HISTORY AND ORGANIZATION

The Founders formed America Pine Group Inc. (“America Pine California”) in California on November 27, 2006. America Pine California was in the business of selling healthcare products imported from the United States of America to residents in the PRC. The founders formed America Pine Beijing in the PRC on March 21, 2007 as a wholly owned subsidiary of America Pine California to conduct operations for this business in the PRC. These operations ceased on February 5, 2010.

The founders formed Arki Beijing in the PRC on March 6, 2008 as a wholly owned subsidiary of America Pine California with an intention to develop the CCG Group’s current consumer e-commerce business.

On February 5, 2010, in connection with the execution of a Stock Right Transfer Agreement, America Pine California transferred all of its equity interests in both Arki Beijing and America Pine Beijing Consumer Capital Group, Inc., a California corporation and wholly owned subsidiary of the Company (“CCG California”), which was formed in California on October 14, 2009.

On November 26, 2010, CCG California formed Arki Fuxin as its wholly owned subsidiary.

On November 29, 2010, CCG California received approval from the Beijing Fangshan District Business Council in the PRC to acquire the controlling interest of Beitun Trading, which engages in the wholesale distribution of various food and meat products. Beitun Trading has a registered capital of RMB500,000 (approximately $80,250), of which RMB255,000 (approximately $40,928) was contributed by CCG and RMB245,000 (approximately $39,323) was contributed by Wei Guo. On April 1, 2014, we sold its entire 51% equity of Beijing Beitun Trading Co. Ltd. (“Beitun”) to Yifan Zhang for $41,030 (RMB255,000). Yifan Zhang is the daughter of Ms. Wei Guo, the stockholder and managing director of Beitun. As of the date of this Annual Report, we have ceased our operation in the wholesale distribution of meat products.

On November 26, 2010, Arki Beijing, Arki Network Service, and its shareholders entered into contractual arrangements, and on December 2010, Arki Fuxin, Arki Network Service, and its shareholders entered into contractual arrangements, to operate the consumer e-commerce website. Arki Network Service is owned by CCG’s two largest shareholders, Mr. Jianmin Gao and Mr. Fei Gao. These arrangements are more fully described below.

Corporate Structure

Contractual Arrangements among Arki Beijing, Arki Network Service, and Arki Fuxin

Our relationships with Arki Network Service, its stockholders, and Arki Beijing are governed by a series of contractual arrangements, as we (including our direct and indirect subsidiaries) do not own any equity interests in Arki Network Service. PRC law currently has limits on foreign ownership of certain companies. To comply with these restrictions, Arki Network Service and its shareholders entered into two sets of contractual arrangements with Arki Beijing and Arki Fuxin in November 2010:

Powers of Attorney. The equity owners irrevocably appointed Arki Beijing and Arki Fuxin to vote on their behalf on all matters they are entitled to vote on, including matters relating to the transfer of any or all of their respective equity interests in the entity and the appointment of the chief executive officer and other senior management members.

Share Pledge Agreements. The equity owners pledged their respective equity interests in the entity as a guarantee for the payment by the entity of consulting and services fees under the business cooperation agreements and repayment under the loan agreements.

Business Cooperation Agreement. Arki Beijing and Arki Fuxin provide the entity with technical support, consulting services, and other commercial services to Arki Network Service. The initial term of these agreements is ten years. In consideration for those services, Arki Network Service agrees to pay Arki Beijing and Arki Fuxin service fees. The service fees are eliminated upon consolidation.

Loan Agreements. Loans were granted to the equity owners of Arki Network Service by Arki Fuxin with the sole and exclusive purpose of providing funds necessary for its capitalization as required by the laws of the PRC.

Exclusive Option Agreements. Shareholders of Arki Network Service granted an option contract to Arki Beijing and Arki Fuxin to purchase their respective equity interests in the entity.

As of December 31, 2015, we conduct substantially all of our internet finance business operations through Arki Fuxin, which holds substantial control over Arki Network Service’s operations through their contractual arrangements.

Current Corporate Structure

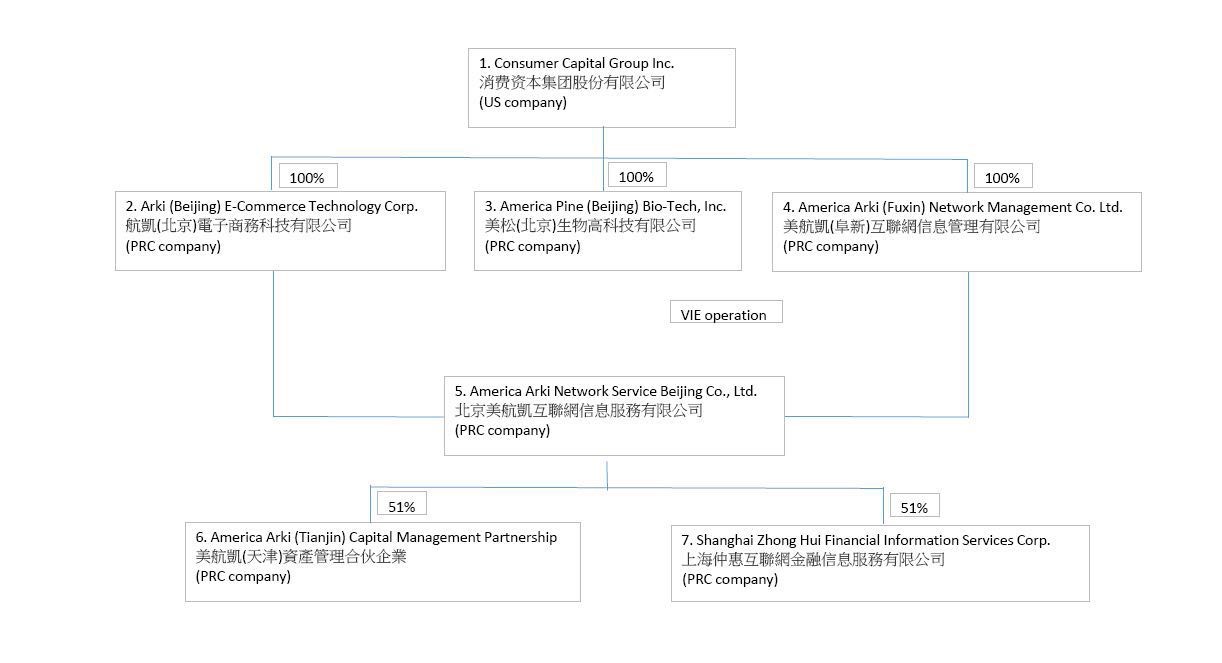

The following diagram illustrates our corporate structure:

Our Business

From and after the closing of the Merger, our primary operations now consist of the business and operations of the CCG Group, which are primarily conducted in the PRC. CCG is a holding company that, prior to December 2010, through Arki (Beijing) E-Commerce Technology Corp. (“Arki Beijing”) and its subsidiary, Arki Network Service, operated a consumer e-commerce business in the PRC. Beginning in January 2015, the internet finance business operations are being conducted through America Arki (Fuxin) Network Management Co. Ltd., a PRC corporation (“Arki Fuxin”), Arki Network Service, and Arki Beijing through respective contractual arrangements among those parties. These contractual arrangements are necessary to comply with laws of the PRC limiting foreign ownership of companies that operate in the e-commerce space. Through such contractual arrangements, we have the ability to substantially influence Arki Network Service’s daily business operations and financial affairs, appoint its management, and approve all matters requiring stockholder approval.

CCG also owns 100% equity interests in America Pine (Beijing) Bio-Tech, Inc., a PRC corporation (“America Pine Beijing”), which currently does not have substantial operations.

Wealth Management Business

Arki Network Service through its subsidiary, Arki Tianjin, engages in wealth management business. Arki Tianjin operates its business on its crowdfunding platform “Bangnitou”, which translates to “Help You Invest” in English and attracts capital from investors to invest in fixed income opportunities such as inter-bank loans, currency exchange products and other equity investment opportunities to help investor obtain return on their investment. Bangnitou has a number of financial products that aims to generate annual return ranging from 8-12%. The platform allows retail investors to invest in products for as little as RMB 100 (or approximately US$15). Once each product reaches its maximum subscription or the end of its offering period, the investments are held for a period of time before being redeemable by the investors, along with the return. Arki Tianjin generates its revenue through the performance of each financial product, as it keeps all return in excess of the return that is marketed to the retail investors for the product.

Bangnitou focuses on offering fixed income products, which refer to projects that are distributed or managed by Arki Tianjin with potential prospective fixed rates of return and which mainly include investments in short-term loans to banks, bridge loans or currency exchange products either directly or via vehicles set up by Arki Tianjin. Arki Tianjin derived substantially all of its revenues from the return proceeds received from distribution of fixed income products in connection with the underlying product.

Peer-to-Peer Lending

Arki Network operates its peer-to-peer lending business through its subsidiary, Zhong Hui, which is an online consumer finance marketplace in the PRC connecting investors and corporate borrowers. Zhong Hui’s online platform automates key aspects of its operations and enables it to efficiently match borrowers with investors and execute loan transactions. Leveraging the extensive experience of its management team, Zhong Hui provides an effective solution to address largely underserved investor and corporate borrower demand in China. Borrowers and investors using Zhong Hui’s platform come from a variety of channels, including online sources, such as the internet and mobile applications, as well as offline sources, such as referrals from Zhong Hui’s on-the-ground sales network. Zhong Hui generates revenues primarily from fees charged for services in matching investors with corporate borrowers and for other services Zhong Hui provide over the life of a loan. Zhong Hui charges borrowers transaction fees for services provided through its platform in facilitating loan transactions, and charge investors service fees for using its automated investing tool or self-directed investing tool.

Competition

The online consumer finance marketplace industry in China is intensely competitive and we compete with other consumer finance marketplaces. Our key competitors include Yirendai, which is a public company listed on the NYSE, Ren Ren Dai and Lufax. In light of the low barriers to entry in the online consumer finance industry, more players may enter this market and increase the level of competition. We anticipate that more established internet, technology and financial services companies that possess large, existing user bases, substantial financial resources and established distribution channels may enter the market in the future.

We also compete with other financial products and companies that attract borrowers, investors or both. With respect to borrowers, we compete with other consumer finance marketplaces and traditional financial institutions, such as consumer finance business units in commercial banks, credit card issuers and other consumer finance companies. With respect to investors, we primarily compete with other investment products and asset classes, such as equities, bonds, investment trust products, bank savings accounts and real estate.

Intellectual Property

We regard our trademarks, domain names, know-how, proprietary technologies and similar intellectual property as critical to our success, and we rely on trademark and trade secret law and confidentiality, invention assignment and non-compete agreements with our employees and others to protect our proprietary rights. Arki Tianjin holds the domain and ICP license to the website www.bangnitou.net, whereas Zhong Hui holds those to the website www.fubangdai.com. Both companies also hold the technologies for their respective mobile application.

Despite our efforts to protect our proprietary rights, unauthorized parties may attempt to copy or otherwise obtain and use our technology. Monitoring unauthorized use of our technology is difficult and costly, and we cannot be certain that the steps we have taken will prevent misappropriation of our technology. From time to time, we may have to resort to litigation to enforce our intellectual property rights, which could result in substantial costs and diversion of our resources.

In addition, third parties may initiate litigation against us alleging infringement of their proprietary rights or declaring their non-infringement of our intellectual property rights. In the event of a successful claim of infringement and our failure or inability to develop non-infringing technology or license the infringed or similar technology on a timely basis, our business could be harmed. Moreover, even if we are able to license the infringed or similar technology, license fees could be substantial and may adversely affect our results of operations.

Marketing and Sales

A majority of our clients have come to us through referrals from existing clients and we believe word-of-mouth is an especially effective marketing tool for the wealth management product, as our product mainly targets retail investors. We intend to engage in nationwide marketing initiatives to further raise our brand awareness while continuing to improve client satisfaction to strengthen our word-of-mouth referrals. We also encourage our employees to introduce or recommend new clients to us by providing incentive bonus.

In addition to word-of-mouth and internal referrals and recommendations, we also enhance our brand recognition and attract potential high-net-worth clients through a variety of offline and online marketing methods:

Offline Marketing Activities. Both Arki Tianjin and Zhong Hui have sales force on the ground stationed in various cities throughout the PRC. We rely on the sales teams to reach out to our potential clients through cold phone calls or personal meetings. The sales force receives commission for successful generation of product subscription. In addition, we leverage their presence in local cities to promote and raise awareness of our products.

Online Marketing Activities. To further promote our brand, we also take advantage of the Internet and various mobile social network applications, such as Wechat and Weibo, through which we introduce basic products and services information, market research and updates to our members.

Insurance

We maintain property insurance policies covering certain equipment and other property that are essential to our business operation to safeguard against risks and unexpected events. We also provide social security insurance including pension insurance, unemployment insurance, work-related injury insurance and medical insurance for our employees. We do not maintain business interruption insurance or general third-party liability insurance, nor do we maintain product liability insurance or key-man insurance. We consider our insurance coverage to be sufficient for our business operations in China.

Seasonality

We experience seasonality in our business, reflecting seasonal fluctuations in internet usage and traditional personal consumption patterns, as our individual borrowers typically use their borrowing proceeds to finance their personal consumption needs. For example, we generally experience lower transaction value on our online consumer finance marketplace during national holidays in China, particularly during the Chinese New Year holiday season in the first quarter of each year. Overall, the historical seasonality of our business has been mild due to our rapid growth but may increase further in the future. Due to our limited operating history, the seasonal trends that we have experienced in the past may not apply to, or be indicative of, our future operating results.

PRC Regulations

Online commerce in China is subject to a number of laws and regulations. This section summarizes all material PRC laws and regulations relevant to our business and operations in China and the key provisions of such regulations.

Corporate Laws and Industry Catalogue Relating to Foreign Investment

The establishment, operation, and management of corporate entities in China are governed by the Company Law of the PRC, or the Company Law, effective in 1994, as amended in 1999, 2004, and 2005, respectively. The Company Law is applicable to our PRC subsidiaries and affiliated PRC entity unless the PRC laws on foreign investment have stipulated otherwise.

The establishment, approval, registered capital requirement, and day-to-day operational matters of wholly foreign-owned enterprises (“WFOE”), such as our PRC subsidiary, Arki Network Service, are regulated by the WFOE Law of the PRC effective in 1986, as amended in 2000, and the Implementation Rules of the WFOE Law of the PRC effective in 1990, as amended in 2001.

Investment activities in the PRC by foreign investors are principally governed by the Guidance Catalogue of Industries for Foreign Investment, or the Catalogue, which was promulgated and is amended from time to time by the Ministry of Commerce and the National Development and Reform Commission. The Catalogue divides industries into three categories: encouraged, restricted, and prohibited. Industries not listed in the Catalogue are generally open to foreign investment unless specifically restricted by other PRC regulations.

Establishment of WFOEs is generally permitted in encouraged industries. Some restricted industries are limited to equity or contractual joint ventures, while in some cases Chinese partners are required to hold the majority interests in such joint ventures.

For example, sales and distribution of audio and video products are among the restricted categories, and only contractual joint ventures in which Chinese partners holding majority interests can engage in the distribution of audio and video products in China.

In addition, restricted category projects are also subject to higher-level government approvals. Foreign investors are not allowed to invest in industries in the prohibited category.

Regulations Relating to Telecommunications Services

In September 2000, the State Council issued the Regulations on Telecommunications of China (“the Telecommunications Regulations”), to regulate telecommunications activities in China. The telecommunications industry in China is governed by a licensing system based on the classifications of the telecommunications services set forth under the Telecommunications Regulations.

The Ministry of Industry and Information Technology (“MIIT”) together with the provincial-level communications administrative bureaus, supervises and regulates the telecommunications industry in China. The Telecommunications Regulations divide the telecommunications services into two categories: infrastructure telecommunications services and value-added telecommunications services. The operation of value-added telecommunications services is subject to the examination, approval, and the granting of licenses by MIIT or the provincial-level communications administrative bureaus. According to the Catalogue of Classification of Telecommunications Businesses effective in April 2003, provision of information services through the internet, such as the operation of our website, is classified as value-added telecommunications services.

Regulations Relating to Foreign Investment in Value-added Telecommunications Industry

According to the Administrative Rules for Foreign Investment in Telecommunications Enterprises issued by the State Council effective in January 2002, as amended in September 2008, a foreign investor may hold no more than a 50% equity interest in a value-added telecommunications services provider in China, and such foreign investor must have experience in providing value-added telecommunications services overseas and maintain a good track record.

The Circular on Strengthening the Administration of Foreign Investment in and Operation of Value-added Telecommunications Business (“the Circular”), issued by the former Ministry of Information Industry (“MII”) in July 2006, reiterated the regulations on foreign investment in telecommunications businesses, which require foreign investors to set up foreign-invested enterprises and obtain an internet content provider, or ICP, license to conduct any value-added telecommunications business in China. Under the Circular, a domestic company that holds an ICP license is prohibited from leasing, transferring, or selling the license to foreign investors in any form, and from providing any assistance, including providing resources, sites, or facilities, to foreign investors that conduct value-added telecommunications business illegally in China. Furthermore, certain relevant assets, such as the relevant trademarks and domain names that are used in the value-added telecommunications business must be owned by the local ICP license holder or its shareholders. The Circular further requires each ICP license holder to have the necessary facilities for its approved business operations and to maintain such facilities in the regions covered by its license. In addition, all value-added telecommunications service providers are required to maintain network and information security in accordance with the standards set forth under relevant PRC regulations. If an ICP license holder fails to comply with the requirements in the Circular and also fails to remedy such non-compliance within a specified period of time, MII or its local counterparts have the discretion to take administrative measures against such license holder, including revoking its ICP license. We believe Arki Network Service is in compliance with the Circular.

Regulations Relating to Internet Information Services and Content of Internet Information

In September 2000, the State Council issued the Administrative Measures on Internet Information Services (“the Internet Measures”), to regulate the provision of information services to online users through the internet. According to the Internet Measures, internet information services are divided into two categories: services of an operative nature and services of a non-operative nature. Our business conducted through our website involves operating internet information services, which requires us to obtain an ICP license. If an internet information service provider fails to obtain an ICP license, the relevant local branch of MII may levy fines, confiscate its income, or even block its website. Due to the PRC law restriction that foreign investors cannot hold more than a 50% equity interest in a value-added telecommunications services provider, we hold our ICP license through Arki Network Service. Arki Network Service currently holds an ICP license issued by Beijing Communications Administration, a local branch of MII.

The Internet Measures further specify that the internet information services regarding, among others, news, publication, education, medical and health care, and pharmacy and medical appliances are required to be examined, approved, and regulated by the relevant authorities. Internet content providers are prohibited from providing services beyond that included in the scope of their business license or other required licenses or permits. Furthermore, the Internet Measures clearly specify a list of prohibited content. Internet content providers must monitor and control the information posted on their websites. We are subject to this rule as a result of our operation of our online marketplace program.

Regulations Relating to Privacy Protection

As an internet content provider, we are subject to regulations relating to protection of privacy. Under the Internet Measures, internet content providers are prohibited from producing, copying, publishing or distributing information that is humiliating or defamatory to others or that infringes the lawful rights and interests of others. Internet content providers that violate the prohibition may face criminal charges or administrative sanctions by PRC security authorities. In addition, relevant authorities may suspend their services, revoke their licenses or temporarily suspend or close down their websites. Furthermore, under the Administration of Internet Bulletin Board Services issued by the MII in November 2000, internet content providers that provide electronic bulletin board services must keep users’ personal information confidential and are prohibited from disclosing such personal information to any third party without the consent of the users, unless otherwise required by law. The regulation further authorizes relevant telecommunication authorities to order internet content providers to rectify any unauthorized disclosure. Internet content providers could be subject to legal liabilities if unauthorized disclosure causes damages or losses to internet users. However, the PRC government retains the power and authority to order internet content providers to provide the personal information of internet users if the users post any prohibited content or engage in illegal activities through the internet. We believe that we are currently in compliance with these regulations in all material aspects.

Regulations Relating to Taxation

In January 2008, the PRC Enterprise Income Tax Law (The “EIT” Law) took effect. The EIT applies a uniform 25% enterprise income tax rate to both foreign-invested enterprises and domestic enterprises, unless where tax incentives are granted to special industries and projects. Under the EIT Law and its implementation regulations, dividends generated from the business of a PRC subsidiary after January 1, 2008 and payable to its foreign investor may be subject to a withholding tax rate of 10% if the PRC tax authorities determine that the foreign investor is a non-resident enterprise, unless there is a tax treaty with China that provides for a preferential withholding tax rate. Distributions of earnings generated before January 1, 2008 are exempt from PRC withholding tax.

Under the EIT Law, an enterprise established outside China with “de facto management bodies” within China is considered a “resident enterprise” for PRC enterprise income tax purposes and is generally subject to a uniform 25% enterprise income tax rate on its worldwide income. A circular issued by the State Administration of Taxation in April 2009 regarding the standards used to classify certain Chinese-invested enterprises controlled by Chinese enterprises or Chinese enterprise groups and established outside of China as “resident enterprises” clarified that dividends and other income paid by such PRC “resident enterprises” will be considered PRC-source income and subject to PRC withholding tax, currently at a rate of 10%, when paid to non-PRC enterprise shareholders. This circular also subjects such PRC “resident enterprises” to various reporting requirements with the PRC tax authorities.

Under the implementation regulations to the EIT Law, a “de facto management body” is defined as a body that has material and overall management and control over the manufacturing and business operations, personnel and human resources, finances, and properties of an enterprise. In addition, the tax circular mentioned above specifies that certain PRC-invested overseas enterprises controlled by a Chinese enterprise or a Chinese enterprise group in the PRC will be classified as PRC resident enterprises if the following are located or residence in the PRC: senior management personnel and departments that are responsible for daily production, operation, and management; financial and personnel decision making bodies; key properties, accounting books, the company seal, and minutes of board meetings and shareholders’ meetings; and half or more of the senior management or directors having voting rights.

Regulations Relating to Foreign Exchange

Pursuant to the Regulations on the Administration of Foreign Exchange issued by the State Council and effective in 1996, as amended in January 1997 and August 2008, current account transactions, such as sale or purchase of goods, are not subject to PRC governmental control or restrictions. Certain organizations in the PRC, including foreign-invested enterprises, may purchase, sell, and/or remit foreign currencies at certain banks authorized to conduct foreign exchange business upon providing valid commercial documents. Approval of the PRC State Administration of Foreign Exchange (“SAFE”), however, is required for capital account transactions.

In August 2008, SAFE issued a circular on the conversion of foreign currency into Renminbi by a foreign-invested company that regulates how the converted Renminbi may be used. The circular requires that the registered capital of a foreign-invested enterprise converted into Renminbi from foreign currencies may only be utilized for purposes within its business scope. For example, such converted amounts may not be used for investments in or acquisitions of other PRC companies, unless specifically provided otherwise, which can inhibit the ability of companies to consummate such transactions. In addition, SAFE strengthened its oversight of the flow and use of the Renminbi registered capital of foreign-invested enterprises converted from foreign currencies. The use of such Renminbi capital may not be changed without SAFE’s approval, and may not in any case be used to repay Renminbi loans if the proceeds of such loans have not been utilized. Violations may result in severe penalties, such as heavy fines.

Regulations Relating to Labor

Pursuant to the PRC Labor Law effective in 1995 and the PRC Labor Contract Law effective in 2008, a written labor contract is required when an employment relationship is established between an employer and an employee. Other labor-related regulations and rules of the PRC stipulate the maximum number of working hours per day and per week as well as the minimum wages. An employer is required to set up occupational safety and sanitation systems, implement the national occupational safety and sanitation rules and standards, educate employees on occupational safety and sanitation, prevent accidents at work, and reduce occupational hazards.

In the PRC, workers dispatched by an employment agency are normally engaged in temporary, auxiliary, or substitute work. Pursuant to the PRC Labor Contract Law, an employment agency is the employer for workers dispatched by it and must perform an employer’s obligations toward them. The employment contract between the employment agency and the dispatched workers, and the placement agreement between the employment agency and the company that receives the dispatched workers must be in writing. Also, the company that accepts the dispatched workers must bear joint and several liabilities for any violation of the Labor Contract Law by the employment agencies arising from their contracts with dispatched workers. An employer is obligated to sign an indefinite term labor contract with an employee if the employer continues to employ the employee after two consecutive fixed-term labor contracts. The employer also has to pay compensation to the employee if the employer terminates an indefinite term labor contract. Except where the employer proposes to renew a labor contract by maintaining or raising the conditions of the labor contract and the employee is not agreeable to the renewal, an employer is required to compensate the employee when a definite term labor contract expires. Furthermore, under the Regulations on Paid Annual Leave for Employees issued by the State Council in December 2007 and effective as of January 2008, employees who have served an employer for more than one (1) year and less than ten years are entitled to a 5-day paid vacation, those whose service period ranges from 10 to 20 years are entitled to a 10-day paid vacation, and those who have served for more than 20 years are entitled to a 15-day paid vacation. An employee who does not use such vacation time at the request of the employer shall be compensated at three times their normal salaries for each waived vacation day.

Pursuant to the Regulations on Occupational Injury Insurance effective in 2004 and the Interim Measures concerning the Maternity Insurance for Enterprise Employees effective in 1995, PRC companies must pay occupational injury insurance premiums and maternity insurance premiums for their employees. Pursuant to the Interim Regulations on the Collection and Payment of Social Insurance Premiums effective in 1999 and the Interim Measures concerning the Administration of the Registration of Social Insurance effective in 1999, basic pension insurance, medical insurance, and unemployment insurance are collectively referred to as social insurance. Both PRC companies and their employees are required to contribute to the social insurance plans. Pursuant to the Regulations on the Administration of Housing Fund effective in 1999, as amended in 2002, PRC companies must register with applicable housing fund management centers and establish a special housing fund account in an entrusted bank. Both PRC companies and their employees are required to contribute to the housing funds. The PRC Subsidiaries and Arki Network Service are in process of applying for registration for social insurance and opening a housing fund account.

Regulations on Dividend Distribution

Wholly foreign-owned companies in the PRC may pay dividends only out of their accumulated profits after tax as determined in accordance with PRC accounting standards. Remittance of dividends by a wholly foreign-owned enterprise out of China is subject to examination by the banks designated by SAFE. Wholly foreign-owned companies may not pay dividends unless they set aside at least 10% of their respective accumulated profits after tax each year, if any, to fund certain reserve funds, until such time as the accumulative amount of such fund reaches 50% of the wholly foreign-owned company’s registered capital. In addition, these companies also may allocate a portion of their after-tax profits based on PRC accounting standards to staff welfare and bonus funds at their discretion. These reserve funds and staff welfare and bonus funds are not distributable as cash dividends.

Safe Regulations on Offshore Special Purpose Companies Held by PRC Residents or Citizens

Pursuant to the Notice on Relevant Issues Concerning Foreign Exchange Administration for PRC Residents to Engage in Financing and Inbound Investment via Overseas Special Purpose Vehicles, or Circular No. 75, issued in October 2005 by SAFE and its supplemental notices, PRC citizens or residents are required to register with SAFE or its local branch in connection with their establishment or control of an offshore entity established for the purpose of overseas equity financing involving a roundtrip investment whereby the offshore entity acquires or controls onshore assets or equity interests held by the PRC citizens or residents. In addition, such PRC citizens or residents must update their SAFE registrations when the offshore special purpose vehicle undergoes material events relating to increases or decreases in investment amount, transfers or exchanges of shares, mergers or divisions, long-term equity or debt investments, external guarantees, or other material events that do not involve roundtrip investments. Subsequent regulations further clarified that PRC subsidiaries of an offshore company governed by the SAFE regulations are required to coordinate and supervise the filing of SAFE registrations in a timely manner by the offshore holding company’s shareholders who are PRC citizens or residents. If these shareholders fail to comply, the PRC subsidiaries are required to report to the local SAFE branches. If the shareholders of the offshore holding company who are PRC citizens or residents do not complete their registration with the local SAFE branches, the PRC subsidiaries may be prohibited from distributing their profits and proceeds from any reduction in capital, share transfer or liquidation to the offshore company, and the offshore company may be restricted in its ability to contribute additional capital to its PRC subsidiaries. Moreover, failure to comply with the SAFE registration and amendment requirements described above could result in liability under PRC law for evasion of applicable foreign exchange restrictions.

M&A Rules

On August 8, 2006, six PRC regulatory agencies, including China Securities Regulatory Commission (“CSRC”), promulgated a rule entitled Provisions Regarding Mergers and Acquisitions of Domestic Enterprises by Foreign Investors (“the M&A Rules”) to regulate foreign investment in PRC domestic enterprises. The M&A rules, among other things, requires an overseas special purpose vehicle(“SPV”), formed for listing purposes through acquisitions of PRC domestic companies and controlled by PRC companies or individuals, to obtain the approval of CSRC prior to publicly listing their securities on an overseas stock exchange. We believe that while the CSRC generally has jurisdiction over overseas listings of SPVs like us, CSRC’s approval is not required for this offering given the fact that no provision in the M&A Rules classifies the respective contractual arrangements between Arki Network Service and Arki Beijing and between Arki Network Service and Arki Fuxin as a type of acquisition transaction falling under the M&A Rules. There remains some uncertainty as to how this regulation will be interpreted or implemented in the context of an overseas offering. If the CSRC or another PRC regulatory agency subsequently determines that approval is required for this offering, we may face sanctions by the CSRC or another PRC regulatory agency.

The M&A Rules also establish procedures and requirements that could make some acquisitions of Chinese companies by foreign investors more time-consuming and complex, including requirements in some instances that the Ministry of Commerce be notified in advance of any change-of-control transaction in which a foreign investor takes control of a Chinese domestic enterprise.

Acquisition of China based P2P (peer-to-peer) lending company

On December 23, 2014, the Company and Shanghai Zhong Hui Financial Information Services Corp., a company established under the laws of People’s Republic of China (“Zhong Hui”), entered into a Share Exchange Agreement (the “Agreement”), pursuant to which the Company agreed to acquire 51% of the capital stock of Zhong Hui (the “Acquisition”). Pursuant to the term of the Agreement, the Company agreed to issue 5,000,000 shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), to certain individuals affiliated with Zhong Hui (the “Affiliates”), valued at $1.00 per share for a total of $5,000,000 or approximately 31,000,000 RMB, to exchange 51% of the capital stock of Zhong Hui.

Shanghai Zhong Hui Financial Information Services Corp. is established in May 2014. The company engages business through its website www.fubangdai.cn (“Fubangdai”), which is an internet-based platform that offers financing and investment opportunities for small to midsize business and investors, as well as other related asset management services.

P2P lending has been experiencing rapid growth since 2007. In 2013, P2P lending transaction volume nationwide crossed 80 billion RMB. Many industry insiders predicted growth in 2015 would be even stronger. However, due to lack of government regulations in China, some P2P lending companies have been operating without proper licenses and the creating negative publicity recently. P2P lending business in China is expected to subject to more strict scrutiny and new regulations from the government and authorities.

Safe Regulations on Employee Share Options

On March 28, 2007, SAFE promulgated the Application Procedure of Foreign Exchange Administration for Domestic Individuals Participating in Employee Share Holding Plan or Share Option Plan of Overseas Listed Company, or the Share Option Rule. Pursuant to the Share Option Rule, Chinese citizens who are granted share options by an overseas publicly listed company are required to register with SAFE through a Chinese agent or Chinese subsidiary of the overseas publicly listed company and complete certain other procedures. Our PRC employees who have been granted share options will be subject to these regulations. Failure of our PRC share option holders to complete their SAFE registrations may subject these PRC employees to fines and legal sanctions and may also limit our ability to contribute additional capital into our PRC subsidiaries and limit our PRC subsidiaries’ ability to distribute dividends to us.

Employees

As of April 27, 2016, we had approximately 52 full-time employees and no part-time employees.

Item 1A. Risk Factors.

We have a limited operating history in a new and evolving market, which makes it difficult to evaluate our future prospects.

The market for China’s online consumer finance marketplaces is new and may not develop as expected. The regulatory framework for this market is also evolving and may remain uncertain for the foreseeable future. Potential borrowers and investors may not be familiar with this market and may have difficulty distinguishing our services from those of our competitors. Convincing potential new borrowers and investors of the value of our services is critical to increasing the volume of loan transactions facilitated through our marketplace and to the success of our business.

We launched our online marketplace in 2015 and have a limited operating history. As our business develops or in response to competition, we may continue to introduce new products or make adjustments to our existing products, or make adjustments to our business model. In connection with the introduction of new products or in response to general economic conditions, we may impose more stringent borrower qualifications to ensure the quality of loans on our platform, which may negatively affect the growth of our business. Any significant change to our business model may not achieve expected results and may have a material and adverse impact on our financial conditions and results of operations. It is therefore difficult to effectively assess our future prospects. The risks and challenges we encounter or may encounter in this developing and rapidly evolving market may have impacts on our business and prospects. These risks and challenges include our ability to, among other things:

| • | navigate an evolving regulatory environment; |

| • | expand the base of borrowers and investors served on our marketplace; |

| • | broaden our loan product offerings; |

| • | enhance our risk management capabilities; |

| • | improve our operational efficiency; |

| • | cultivate a vibrant consumer finance ecosystem; |

| • | maintain the security of our platform and the confidentiality of the information provided and utilized across our platform; |

| • | attract, retain and motivate talented employees; and |

| • | defend ourselves against litigation, regulatory, intellectual property, privacy or other claims. |

If we fail to educate potential borrowers and investors about the value of our platform and services, if the market for our marketplace does not develop as we expect, or if we fail to address the needs of our target market, or other risks and challenges, our business and results of operations will be harmed.

If we are unable to maintain or increase the volume of loan transactions facilitated through our marketplace or if we are unable to retain existing borrowers or investors or attract new borrowers or investors, our business and results of operations will be adversely affected.

To maintain the high growth momentum of our marketplace, we must continuously increase the volume of loan transactions by retaining current participants and attracting more users. We intend to continue to dedicate significant resources to our user acquisition efforts, including establishing new acquisition channels, particularly as we continue to grow our marketplace and introduce new loan products. If there are insufficient qualified loan requests, investors may be unable to deploy their capital in a timely or efficient manner and may seek other investment opportunities. If there are insufficient investor commitments, borrowers may be unable to obtain capital through our marketplace and may turn to other sources for their borrowing needs and investors who wish to exit their investments prior to maturity on the secondary loan market may not be able to do so in a timely manner.

The overall transaction volume may be affected by several factors, including our brand recognition and reputation, the interest rates offered to borrowers and investors relative to market rates, the effectiveness of our risk control, the repayment rate of borrowers on our marketplace, the efficiency of our platform, the macroeconomic environment and other factors. In connection with the introduction of new products or in response to general economic conditions, we may also impose more stringent borrower qualifications to ensure the quality of loans on our platform, which may negatively affect the growth of loan volume. If any of our current user acquisition channels become less effective, if we are unable to continue to use any of these channels or if we are not successful in using new channels, we may not be able to attract new borrowers and investors in a cost-effective manner or convert potential borrowers and investors into active borrowers and investors, and may even lose our existing borrowers and investors to our competitors. If we are unable to attract qualified borrowers and sufficient investor commitments or if borrowers and investors do not continue to participate in our marketplace at the current rates, we might be unable to increase our loan transaction volume and revenues as we expect, and our business and results of operations may be adversely affected.

The laws and regulations governing the peer-to-peer lending service industry in China are developing and evolving and subject to changes. If our practice is deemed to violate any PRC laws or regulations, our business, financial conditions and results of operations would be materially and adversely affected.

Due to the relatively short history of the peer-to-peer lending service industry in China, the regulatory framework governing our industry is under development by the PRC government. Currently, the PRC government has yet to officially promulgate any specific rules, laws or regulations to specially regulate the peer-to-peer lending service industry. On July 18, 2015 the PBOC together with nine other PRC regulatory agencies jointly issued a series of policy measures applicable to the online peer-to-peer lending service industry titled the Guidelines on Promoting the Healthy Development of Internet Finance, or the Guidelines. The Guidelines introduced formally for the first time the regulatory framework and basic principles for administering the peer-to-peer lending service industry in China.

The Guidelines call for active government support of China’s internet finance industry, including the online peer-to-peer lending service industry, and clarify the division of responsibility among regulatory agencies. The Guidelines specify that the China Banking Regulatory Commission, or the CBRC, will have primary regulatory responsibility for the online peer-to-peer lending service industry in China and state that online peer-to-peer lending service providers should operate as information intermediaries and are prohibited from engaging in illegal fund-raising and providing “credit enhancement services,” which we believe are generally perceived in the online peer-to-peer lending industry to mean providing guarantees to investors in relation to the return of loan principal and interest. This interpretation is based upon comments made at a public forum held on September 27, 2014, during which a senior CBRC officer mentioned several requirements that the CBRC is contemplating for future regulation of the peer-to-peer lending service industry, which include, among others, that a peer-to-peer lending service provider (i) is neither a credit intermediary bearing credit risk nor a transaction platform, but an information intermediary between lenders and borrowers, (ii) should not hold investors’ funds or set up any capital pools, and (iii) must not provide guarantees for lenders in relation to the loan principal and interest, or bear any system risk or liquidity risk. In addition to prohibiting illegal fund-raising and the provision of “credit enhancement services,” the Guidelines provide additional requirements for China’s internet finance industry, including the use of custody accounts with qualified banks to hold customer funds as well as information disclosure requirements, among others. However, the Guidelines only set out the basic principles for promoting and administering the online peer-to-peer lending service industry, and were not accompanied by any implementing rules. The Guidelines instead urge the relevant regulatory agencies to adopt implementing rules at the appropriate time.

On December 28, 2015, the CBRC published a discussion draft of the Interim Administrative Measures for the Business Activities of Peer-to-Peer Lending Information Intermediaries, or the Draft Measures. The Draft Measures define the “peer-to-peer lending information intermediaries,” or the Information Intermediaries, as the financial information intermediaries that are engaged in peer-to-peer lending information business and provide lenders and borrowers with lending information services, such as information collection and publication, credit rating, information interaction and loan facilitation. In consistency with the Guidelines, the Draft Measures prohibit the Information Intermediaries from providing “credit enhancement services” or creating “capital pools,” and require, among other things, (i) that the Information Intermediary operating telecommunication services must apply for relevant telecommunication licenses; (ii) that the Information Intermediary intending to provide peer-to-peer lending information agency services (excluding its subsidiaries and branches) must make relevant filings and registrations with local financial regulatory authorities with which it is registered after obtaining business license; and (iii) that the name of Information Intermediary must contain the phrase “peer-to-peer lending information intermediary.”

The Draft Measures list the following businesses that an Information Intermediary must not, by itself or on behalf of a third party, participate in: (i) using its internet financing platform to finance itself or its affiliates; (ii) directly and indirectly collecting and consolidating funds from lenders; (iii) providing security or guarantee of principals and interests to lenders; (iv) advertising or introducing financing projects to non-real-name registered users; (v) extending loans, except as otherwise permitted by laws and regulations; (vi) dividing maturity periods of financing projects; (vii) selling bank wealth management products, securities firm assets management products, funds, insurance or trust products; (viii) mixing or bundling its business with, or acting as an agent for, the investment, sales, promotion or brokerage or other businesses of any other institutions, except as otherwise permitted by laws, regulations and applicable peer-to-peer lending rules; (ix) deliberately fabricating or exaggerating the veracity or profitability of financing projects, concealing their defects and risks, advertising or promoting with ambiguous languages or through other deceptive means, falsifying information or disseminating inaccurate or incomplete information to tarnish the reputations of others and to mislead lenders and borrowers; (x) providing peer-to-peer information agency services for financing projects of which the purpose is to invest in stock market; (xi) carrying on equity crowdfunding, in-kind crowdfunding or other similar business; and (xii) other activities prohibited by laws, regulations and relevant peer-to-peer lending rules.

The Draft Measures also set out certain additional requirements applicable to Information Intermediaries on, among other things, the real-name registration of lenders and borrowers, the limitation of offline business of Information Intermediaries, the risk control, cyber and information security, the limit of fund collection period (up to 10 business days), allocation of charges, personal credit management, file management, lenders and borrowers protection, prohibition on making decisions by Information Intermediaries on behalf of lenders, administration of electronic signatures and information disclosure.

Any violation of the Draft Measures by an Information Intermediary after they come into effect, may subject such Information Intermediary to certain penalties as determined by applicable laws, and regulations, or by relevant government authorities if the applicable laws and regulations are silent on the penalties. The applicable penalties may include but not limited to, criminal liabilities, warning, rectification, tainted integrity record and fines up to RMB30,000 (US$4,631).

It is uncertain when the Draft Measures would be signed into law and whether the final version would have any substantial changes to the current draft. If the Draft Measures are enacted as proposed, we may have to adjust our operating practices. For instance, we may need to modify the existing or develop a new process for investors who wish to use our automated investing tool to ensure that all the investment decisions are made and confirmed by investors as required by the Draft Measures, which may in turn cause us to incur additional operating expenses. The enactment of the Draft Measures may also materially impact our corporate governance practice and increase our compliance costs.

In addition to the Guidelines and the Draft Measures, there are certain other rules, laws and regulations relevant or applicable to the online peer-to-peer lending service industry, including the PRC Contract Law, the General Principles of the Civil Law of the PRC, and related judicial interpretations promulgated by the Supreme People’s Court. See “Item 4. Information on the Company—B. Business Overview—Regulation—Regulations Relating to Online Peer-to-Peer Lending.”

To comply with existing rules, laws, regulations and governmental policies relating to the peer-to-peer lending service industry, we have implemented various policies and procedures, which we believe set the best practice in the industry, including, without limitation, the following: (i) we do not use our own capital to invest in loans facilitated through our online marketplace; (ii) we do not commit to provide guarantees to investors under any agreement for the full return of loan principal and interest; (iii) we do not hold investors’ funds and funds loaned through our platform are deposited into and settled by a third-party custody account managed by a qualified bank, China Guangfa Bank; (iv) we have obtained the internet information services license, or the ICP license, as an internet information provider from the relevant local counterpart of the Ministry of Industry and Information Technology in accordance with applicable laws; (v) we fully disclose on our website all relevant information to investors and borrowers, such as disclosure to borrowers regarding interest rates, payment schedule, transaction fees, and other charges and penalties; and (vi) we have been making strong effort to maintain the security of our platform and the confidentiality of the information provided and utilized across our platform. However, due to the lack of detailed rules and the fact that the rules, laws and regulations are expected to continue to evolve in this newly emerging industry, we cannot be certain that our existing practices would not be deemed to violate any existing or future rules, laws and regulations.

In particular, we cannot rule out the possibility that some of the services we provide to investors, such as the automated investing tool and our services to a trust, might be viewed as not being in full compliance. Our automated investing tool automatically allocates committed funds from multiple investors among multiple approved borrowers, which goes beyond the simple one-to-one matching between investors and borrowers and could be viewed as violating some of these requirements. In addition, if our automated investing tool fails to match committed investors with approved borrowers in a timely manner, we might be deemed to hold investors’ funds and form a capital pool incidentally.

Moreover, although the Guidelines prohibit online peer-to-peer lending service providers from providing “credit enhancement services,” it is uncertain how the “credit enhancement services” mentioned in the Guidelines will be interpreted due to the lack of detailed implementing rules in the Guidelines. However, given (i) the prohibition by the Draft Measures on providing security or guarantee of principals and interests to lenders, and (ii) the requirements mentioned by the CBRC officer during the public forum held on the September 27, 2014, we believe it is generally perceived in the online peer-to-peer lending industry to mean providing guarantees to investors in relation to the return of loan principal and interest. Under our risk reserve fund arrangement, if a loan is delinquent for a certain period of time, we may withdraw a sum from the risk reserve fund to repay investors the principal and accrued interest for the defaulted loan unless the risk reserve fund is depleted. In order to continue to attract new and retain existing investors and to remain consistent with the current industry practice in China, our current risk reserve funding policy aims to have sufficient cash in the risk reserve fund to cover expected payouts, which is based on our current business intention but not legal obligation. Subject to the terms and limits in our agreements with investors, we currently allow investors to fully recover their outstanding principal and accrued interest in the event of loan default. We intend to continue this practice for the foreseeable future. However, as the industry continues to evolve and becomes more sophisticated and our business develops, we may revisit our policy or the terms on which we offer the risk reserve fund service such that investors may recover less than 100% of the outstanding principal and accrued interest of the defaulted loan. Although the purpose of the risk reserve fund is to limit investor losses due to borrower defaults and not to provide investors with guarantees in relation to the return of loan principal and interest, we cannot rule out the possibility that our current risk reserve fund model or any variations thereof might be viewed by the PRC regulatory bodies as providing, to a certain extent, a form of guarantee or otherwise a form of “credit enhancement service” prohibited under the Guidelines. Furthermore, if the risk reserve fund is viewed by the PRC regulatory bodies as providing a form of guarantee, under the Provisions on Several Issues Concerning Laws Applicable to Trials of Private Lending Cases, or the Private Lending Judicial Interpretations, issued by the Supreme People’s Court on August 6, 2015 and being effective on September 1, 2015, if requested by the investor with the court, we may be required to assume the obligations as to the defaulted loan as a guarantor.

As of the date of this annual report, we have not been subject to any material fines or other penalties under any PRC laws or regulations including those governing the peer-to-peer lending service industry in China. The Guidelines do not set out the liabilities that will be imposed on the service providers who fail to comply with the principles and requirements contained thereunder, nor do other applicable rules, laws and regulations contain specific liability provisions specially as to the peer-to-peer lending platform or similar online marketplace like us. However, if our practice is deemed to violate any rules, laws or regulations, we may face injunctions, including orders to cease illegal activities, and may be exposed to other penalties as determined by the relevant government authorities as well. If such situations occur, our business, financial condition and prospects would be materially and adversely affected. In addition, given the evolving regulatory environment in which we operate, we cannot rule out the possibility that the PRC government will institute a licensing regime covering our industry. If such a licensing regime were introduced, we cannot assure you that we would be able to obtain any newly required license in a timely manner, or at all, which could materially and adversely affect our business and impede our ability to continue our operations.

If our loan products do not achieve sufficient market acceptance, our financial results and competitive position will be harmed.

We incur expenses and consume resources upfront to develop, acquire and market new loan products. New loan products must achieve high levels of market acceptance in order for us to recoup our investment in developing, acquiring and bringing them to market.

Our existing or new loan products and changes to our platform could fail to attain sufficient market acceptance for many reasons, including but not limited to:

| • | our failure to predict market demand accurately and supply loan products that meet this demand in a timely fashion; |

| • | borrowers and investors using our platform may not like, find useful or agree with any changes; |

| • | our failure to properly price new loan products; |

| • | defects, errors or failures on our platform; |

| • | negative publicity about our loan products or our platform’s performance or effectiveness; |

| • | views taken by regulatory authorities that the new products or platform changes do not comply with PRC laws, rules or regulations applicable to us; and |

| • | the introduction or anticipated introduction of competing products by our competitors. |