Attached files

| file | filename |

|---|---|

| EXCEL - IDEA: XBRL DOCUMENT - Consumer Capital Group, Inc. | Financial_Report.xls |

| EX-32.1 - EXHIBIT 32.1 - Consumer Capital Group, Inc. | v239546_ex32-1.htm |

| EX-31.1 - EXHIBIT 31.1 - Consumer Capital Group, Inc. | v239546_ex31-1.htm |

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

|

x

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the quarterly period ended September 30, 2011

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE EXCHANGE ACT

|

For the transition period from to

Commission File No. 333-152330

Consumer Capital Group Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

Delaware

|

26-2517432

|

|

|

(State or Other Jurisdiction of

Incorporation or Organization)

|

(I.R.S. Employer

Identification No.)

|

|

35 North Lake Avenue, Suite 280, Pasadena, CA 91101

|

(626) 568-3368

|

|

|

(Address of Principal Executive Offices)

|

(Issuer’s Telephone Number)

|

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

|

|

Accelerated filer

|

|||

|

Non-accelerated filer

|

|

|

Smaller reporting company

|

x

|

||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes No x

The number of shares outstanding of the Issuer’s Common Stock as of November 12, 2011 was 18,888,889 shares.

1

CONSUMER CAPITAL GROUP INC.

TABLE OF CONTENTS

|

PART I — FINANCIAL INFORMATION

|

3

|

|

Item 1. Financial Statements (unaudited)

|

3

|

|

Condensed Consolidated Balance Sheets at September 30, 2011 and December 31, 2010

|

3

|

|

Condensed Consolidated Statements of Operations and Comprehensive Income for the three and nine months ended September 30, 2011 and 2010

|

4

|

|

Condensed Consolidated Statements of Cash Flows for the nine months ended September 30, 2011 and 2010

|

5

|

|

Notes to Condensed Consolidated Financial Statements

|

6

|

|

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

31

|

|

Item 3. Quantitative and Qualitative Disclosures About Market Risk

|

40

|

|

Item 4. Controls and Procedures

|

40

|

|

PART II — OTHER INFORMATION

|

41

|

|

Item 1. Legal Proceedings

|

41

|

|

Item 1A. Risk Factors

|

41

|

|

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

|

41

|

|

Item 3. Defaults Upon Senior Securities

|

41

|

|

Item 4. Removed and Reserved

|

41

|

|

Item 5. Other Information

|

41

|

|

Item 6. Exhibits

|

42

|

|

SIGNATURES

|

43

|

2

PART I — FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS.

Consumer Capital Group, Inc.

Condensed Consolidated Balance Sheets

|

September 30,

2011

|

December 31,

|

|||||||

|

(Unaudited)

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Cash & cash equivalents

|

$

|

774,648

|

$

|

3,015,219

|

||||

|

Accounts receivable

|

225,744

|

306,935

|

||||||

|

Inventory

|

844,200

|

334,972

|

||||||

|

Prepaid expenses

|

157,688

|

259,272

|

||||||

|

Other receivables

|

70,814

|

64,512

|

||||||

|

Related party receivable

|

-

|

125,528

|

||||||

|

Total current assets

|

2,073,094

|

4,106,438

|

||||||

|

Equipment, net

|

61,414

|

47,644

|

||||||

|

Other assets

|

186,149

|

258,285

|

||||||

|

Total assets

|

$

|

2,320,657

|

$

|

4,412,367

|

||||

|

Accounts payable

|

$

|

1,013,674

|

$

|

531,729

|

||||

|

Accrued liabilities

|

60,043

|

759,983

|

||||||

|

Deferred revenue

|

17,528

|

125,455

|

||||||

|

Taxes payable

|

2,880

|

494,057

|

||||||

|

Other payables

|

260,580

|

19,199

|

||||||

|

Related party payables

|

395,101

|

256,199

|

||||||

|

Total current liabilities

|

1,749,806

|

2,186,622

|

||||||

|

Stockholders' equity

|

||||||||

|

Common stock, $0.0001 par value, 100,000,000 shares authorized 18,888,889 and 17,777,778 shares issued and outstanding as of September 30, 2011 and December 31, 2010, respectively

|

$

|

1,889

|

$

|

1,778

|

||||

|

Discount on common stock issued to founders

|

(130,875

|

)

|

(130,741

|

)

|

||||

|

Additional paid-in capital (1)

|

2,218,252

|

2,253,354

|

||||||

|

Subscription receivable

|

-

|

-

|

||||||

|

Accumulated other comprehensive income

|

26,551

|

78,775

|

||||||

|

Accumulated earnings (Deficit)

|

(1,548,591

|

)

|

21,540

|

|||||

|

Total Consumer Capital Group stockholders' equity

|

567,226

|

2,224,706

|

||||||

|

Noncontrolling interest in subsidiary

|

3,625

|

1,039

|

||||||

|

Total liabilities and equity

|

$

|

2,320,657

|

$

|

4,412,367

|

||||

(1) The December 31, 2010 capital accounts of the Company have been retroactively restated to reflect the equivalent number of common shares based on the exchange ratio of the merger transaction. See Note 2.

The accompanying notes are an integral part of these condensed consolidated financial statements

3

Consumer Capital Group, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income

(Unaudited)

|

For The Three Months Ended

September 30,

|

For The Nine Months Ended

September 30,

|

|||||||||||||||

|

2011

|

2010

|

2011

|

2010

|

|||||||||||||

|

Net revenues - ecommerce

|

$

|

449,084

|

$

|

6,977,138

|

$

|

1,637,493

|

$

|

6,977,138

|

||||||||

|

Net revenues - distribution

|

1,861,485

|

-

|

3,966,961

|

-

|

||||||||||||

|

Total net revenues

|

2,310,569

|

6,977,138

|

5,604,454

|

6,977,138

|

||||||||||||

|

Cost of sales - distribution

|

1,842,721

|

-

|

3,919,587

|

-

|

||||||||||||

|

Gross profit

|

467,848

|

6,977,138

|

1,684,867

|

6,977,138

|

||||||||||||

|

Operating expenses:

|

||||||||||||||||

|

Selling expenses

|

429,867

|

5,235,924

|

1,283,376

|

5,235,924

|

||||||||||||

|

General & administrative expenses

|

223,771

|

64,987

|

2,011,532

|

207,970

|

||||||||||||

|

Total operating expenses

|

653,638

|

5,300,911

|

3,294,908

|

5,443,894

|

||||||||||||

|

Operating loss

|

(185,790

|

)

|

1,676,227

|

|

(1,610,041

|

)

|

1,533,244

|

|

||||||||

|

Other income

|

12,935

|

-

|

113,729

|

-

|

||||||||||||

|

Other (expense)

|

-

|

14,669

|

|

-

|

-

|

|||||||||||

|

Total other income (expense)

|

12,935

|

14,669

|

|

113,729

|

-

|

|||||||||||

|

Income (loss) before taxes

|

(172,855

|

)

|

1,690,896

|

|

(1,496,312

|

)

|

1,533,244

|

|

||||||||

|

Provision for income taxes

|

1,499

|

-

|

73,820

|

652,334

|

||||||||||||

|

Net income (loss)

|

(174,354

|

)

|

1,690,896

|

|

(1,570,132

|

)

|

880,910

|

|

||||||||

|

Net income attributable to noncontrolling interest

|

1,788

|

-

|

2,585

|

-

|

||||||||||||

|

Net income (loss) attributable to Consumer Capital Group, Inc.

|

$

|

(176,142

|

)

|

$

|

1,690,896

|

|

$

|

(1,572,717

|

)

|

$

|

880,910

|

|

||||

|

Income(Loss) per share - basic and diluted

|

$

|

(0.01

|

)

|

$

|

0.12

|

|

$

|

(0.09

|

)

|

$

|

0.07

|

|

||||

|

Weighted average number of common shares outstanding - basic and diluted (2)

|

18,888,888

|

14,442,039

|

16,609,686

|

13,453,223

|

||||||||||||

|

Net income (loss)

|

$

|

(174,354

|

)

|

$

|

1,690,896

|

|

$

|

(1,570,132

|

)

|

880,910

|

|

|||||

|

Other comprehensive income (loss)

|

||||||||||||||||

|

Foreign currency translation adjustment

|

(32,434

|

)

|

(5

|

)

|

(52,224

|

)

|

10,081

|

|

||||||||

|

Net comprehensive loss

|

$

|

(206,788

|

)

|

$

|

1,690,891

|

|

$

|

(1,622,356

|

)

|

$

|

890,991

|

|

||||

(2) The capital accounts of the Company have been retroactively restated to reflect the equivalent number of common shares based on the exchange ratio of the merger transaction in determining the basic and diluted weighted average shares. See Note 2.

4

Consumer Capital Group, Inc.

Condensed Consolidated Statements of Cash Flows

(Unaudited)

|

Nine months ended September 30,

|

||||||||

|

2011

|

2010

|

|||||||

|

Cash flows from operating activities

|

||||||||

|

Net (Loss) Income

|

$

|

(1,570,132

|

)

|

$

|

880,910

|

|

||

|

Adjustments to reconcile net cash provided by (used in) operating activities

|

||||||||

|

Depreciation

|

9,448

|

2,451

|

||||||

|

Shares issued for services

|

-

|

299,400

|

|

|||||

|

Cancellation of stock to service providers

|

(35,125

|

)

|

-

|

|||||

|

Change in operating assets and liabilities

|

||||||||

|

Accounts receivable

|

81,191

|

|

-

|

|||||

|

Other assets

|

72,136

|

-

|

|

|||||

|

Other receivables

|

(6,302

|

)

|

(383,855

|

)

|

||||

|

Inventories

|

(509,228

|

)

|

-

|

|||||

|

Prepaid expenses

|

101,584

|

(417,476

|

)

|

|||||

|

Accounts payable

|

481,945

|

3,203,743

|

|

|||||

|

Accrued liabilities

|

(699,940

|

)

|

7,185

|

|||||

|

Deferred revenue

|

(107,927

|

)

|

713,059

|

|

||||

|

Taxes payable

|

(491,177

|

)

|

1,292,753

|

|||||

|

Other payables

|

241,381

|

1,415,684

|

|

|||||

|

Net cash provided by (used in) operating activities

|

(2,432,146

|

)

|

7,013,854

|

|||||

|

Cash flows from investing activities

|

||||||||

|

Acquisition of equipments

|

(23,218

|

)

|

(10,359

|

)

|

||||

|

Net cash used in investing activities

|

(23,218

|

)

|

(10,359

|

)

|

||||

|

Cash flows from financing activities

|

||||||||

|

Proceeds from subscription of common stock

|

-

|

1,120,413

|

||||||

|

Short term borrowing

|

-

|

|

(250,100

|

)

|

||||

|

Proceeds from related party payable

|

2,366,992

|

120,760

|

||||||

|

Payments to related party payable

|

(2,102,562

|

)

|

(278,157

|

)

|

||||

|

Net cash provided by financing activities

|

264,430

|

712,916

|

|

|||||

|

Effect of exchange rate fluctuation

|

(49,637

|

)

|

10,081

|

|||||

|

Net increase (decrease) in cash

|

(2,240,571

|

)

|

7,726,492

|

|||||

|

Cash and cash equivalents at beginning of period

|

3,015,219

|

266,096

|

||||||

|

Cash and cash equivalents at end of period

|

$

|

774,648

|

$

|

7,992,588

|

||||

|

Supplemental disclosure of non-cash financing activities:

|

||||||||

|

Common stock issued for member incentives

|

$

|

-

|

$

|

113,342

|

||||

|

Common stock issued to service providers

|

$

|

-

|

$

|

299,400

|

||||

|

Supplemental disclosure of cash flow information

|

||||||||

|

Income taxes paid

|

$

|

73,820

|

$

|

319,374-

|

||||

The accompanying notes are an integral part of these condensed consolidated financial statements

5

CONSUMER CAPITAL GROUP, INC AND SUBSIDIARIES

SEPTEMBER 30, 2011

(Unaudited)

NOTE 1 - ORGANIZATION AND BASIS OF PRESENTATION

ORGANIZATION

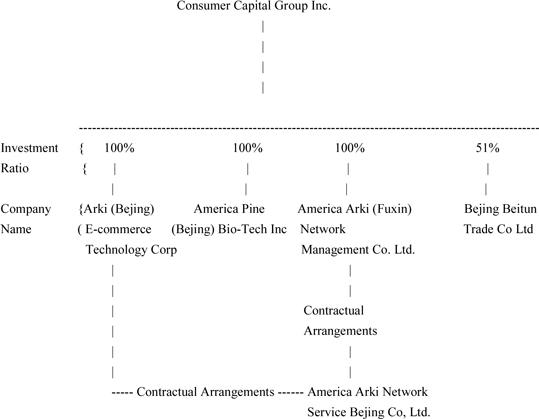

Consumer Capital Group, Inc. ("CCG" or the "Company") is incorporated in Delaware on April 25, 2008. The accompanying condensed consolidated financial statements include the financial statements of the Company, its wholly owned subsidiaries, and an affiliated PRC entity ("Affiliated PRC Entity") which is controlled through contractual arrangements. On February 5, 2010, in connection with the execution of a Stock Right Transfer Agreement, America Pine Group Inc. transferred both 100% of the stock rights of its wholly owned subsidiary Arki (Beijing) E-commerce Technology Co., Ltd. and 100% of its stock rights of America Pine (Beijing) Bio-Tech to Consumer Capital Group, Inc., a California corporation and wholly owned subsidiary of the Company (“CCG California”). The initial capitalization of the Company was through an investment of $420,000 and a registered capital of $300,000 to the Company.

On February 4, 2011, pursuant to a Plan and Agreement of Merger by and among Mondas Minerals Corp., its wholly owned subsidiary, CCG Acquisition Corp., a Delaware corporation (“CCG Delaware”), CCG California, and Scott D. Bengfort., Mondas Minerals Corp. merged its wholly-owned subsidiary CCG Delaware into CCG California, with CCG California surviving and CCG Delaware ceasing to exist. On February 7, 2011 the Company formed a new wholly-owned subsidiary by the name of “Consumer Capital Group Inc.” (“CCG Name Sub”) in Delaware solely for purposes of changing its corporate name to “Consumer Capital Group Inc.” in conjunction with the closing of the Merger. On February 17, 2011, the Company changed its name to Consumer Capital Group Inc. pursuant to Certificate of Ownership filed with the Secretary of State of Delaware by merging CCG Name Sub into the Company with the Company surviving and CCG Name Sub ceasing to exist. Unless the context specifies otherwise, references to the "Company" refers to CCG California prior to the Merger and the Company, its subsidiaries and Affiliated PRC Entity combined after the Merger. The Company is principally engaged in the development and operation of its nationwide online retailing platform "Chinese Consumer Market Network" at www.ccmus.com, which provides a variety of manufacturers and distributors a platform to promote and sell products and services directly to consumers. The Company's principal operations and geographic markets are in the People's Republic of China ("PRC").

Post Merger, Consumer Capital Group Inc. is authorized to issue up to 100,000,000 shares of common stock, par value $0.0001 per share. On February 4, 2011, Consumer Capital Group Inc. effected a reverse stock split (the "Stock Split"), as a result of which each 21.96 shares of Consumer Capital Group's common stock then issued and outstanding was converted into one share of Mondas Minerals' common stock.

6

Immediately prior to the Merger, Consumer Capital Group, Inc. had 390,444,109 shares of its common stock issued and outstanding. In connection with the Merger, Mondas Minerals issued 17,777,778 shares of its common stock in exchange for the issued and outstanding shares of common stock of Subsidiary. Immediately prior to the closing of the Merger, there were 2,500,000 issued and outstanding shares of the Company's common stock, 60% of which were held by the then-principal stockholder, CEO, and sole director of the Company, Mr. Bengfort. As a part of the Merger, CCG paid USD $335,000 in cash to Mr. Bengfort in exchange for his agreement to enter into various transaction agreements relating to the Merger, as well as the cancellation of 1,388,889 shares of the Company's common stock directly held by him, constituting 92.6% of his pre-Merger holdings of Company common stock.

Details of the Company's wholly owned subsidiaries and its Affiliated PRC Entity as of September 30, 2011 are as follows:

7

|

Percentage of

|

|||||||||

|

Date of

|

Place of

|

Ownership by

|

Principal

|

||||||

|

Company

|

Establishment

|

Establishment

|

the Company

|

Activities

|

|||||

|

Consumer Capital Group Inc. ("CCGCalifornia")

|

October 14, 2009

|

California USA

|

100%

|

US holding company and headquarters of the consolidated entities, Commencing in July 2011, CCG performs the US e-commerce operations

|

|||||

|

Arki Beijing E-commerce Technology Corp. ("Arki Beijing")

|

March 6, 2008

|

PRC

|

100

|

% (2)

|

Maintains the various computer systems, software and data. Owns the intellectual property rights of the "consumer market network". Performed principal e-commerce operations prior to December 2010

|

||||

|

America Pine Beijing Bio-Tech, Inc. ("America Pine Beijing")

|

March 21, 2007

|

PRC

|

100

|

% (2)

|

Import and sales of healthcare products from the PRC. This operations ceased February 5, 2010. It currently assist in payment collection for the Company’s Ecommerce business

|

||||

|

America Arki Fuxin Network Management Co. Ltd. ("Arki Fuxin")

|

November 26, 2010

|

PRC

|

100

|

% (2)

|

Commencing in December 2010, performs the principal daily e-commerce operations, transactions and management of the "consumer market network"

|

||||

|

Beijing Beitun Trade Co. Ltd. ("Beitun")

|

November 29, 2010

|

PRC

|

51

|

% (2)(2)

|

Wholesale distribution and import/export of domestic food and meat products. Separate business segment of the Company

|

||||

|

America Arki Network Service Beijing Co. Ltd. ("Arki Network contractual Service" and "Affiliated PRC Entity")

|

November 26, 2010

|

PRC

|

0

|

%(2)(2)(2)

|

Entity under common control through relationships between Fei Gao and the Company. Holds the business license and permits necessary to conduct e-commerce operations in the PRC and maintains compliance with applicable PRC laws

|

||||

(2)(2) Joint venture

(2)(2)(2) VIE

8

In order to comply with the PRC law and regulations which prohibit foreign control of companies involved in internet content, the Company operates its website using the licenses and permits held by Arki Network Service, a 100% domestically owned entity. The equity interests of Arki Network Service are legally held directly by Mr. Jian Min Gao and Mr. Fei Gao, shareholders and directors of the Company. The effective control of Arki Network Service is held by Arki Beijing and Arki Fuxin through a series of contractual arrangements (the "Contractual Agreements"). As a result of the Contractual Agreements, Arki Beijing and Arki Fuxin maintain the ability to control Arki Network Service, and are entitled to substantially all of the economic benefits from Arki Network Service and are obligated to absorb all of Arki Network Services' expected losses. Therefore, the Company consolidates Arki Network Service in accordance with SEC Regulation SX-3A-02 and Accounting Standards Codification ("ASC") 810, Consolidation.

The following is a summary of the Contractual Agreements:

LOAN AGREEMENT

The shareholders of Arki Network Service, namely Mr. Jian Min Gao and Mr. Fei Gao, entered into a loan agreement with Arki Fuxin on February 3, 2011. Under this loan agreement, Arki Fuxin granted an interest-free loan of RMB 1.0 million to Mr. Jian Min Gao and Mr. Fei Gao, collectively, for their capital contributions to Arki Network Service, as required by the PRC. The term of the loan is for ten years from the date of execution until the date when Arki Fuxin requests repayment. Arki Fuxin may request repayment of the loan with 30 days advance notice. The loan is not repayable at the discretion of the shareholders and is eliminated upon consolidation.

EXCLUSIVE CALL OPTION AGREEMENT

The shareholders of Arki Network Service entered into an option agreement with Arki Fuxin on February 3, 2011, under which the shareholders of Arki Network Service jointly and severally granted to Arki Fuxin an option to purchase their equity interests in Arki Network Service. The purchase price will be set off against the loan repayment under the loan agreement. Arki Fuxin may exercise such option at any time until it has acquired all equity interests of Arki Network Service or freely transferred the option to any third party and such third party assumes the rights and obligations of the option agreement.

9

EXCLUSIVE BUSINESS COOPERATION AGREEMENT

Arki Fuxin and Arki Network Service entered into an exclusive business cooperation agreement deemed effective on November 26, 2010, under which Arki Network Service engages Arki Fuxin as its exclusive provider of technical support, consulting services, maintenance and other commercial services. Arki Network Service shall pay to Arki Fuxin service fees determined based on the net income of Arki Network Service. Arki Fuxin shall exclusively own any intellectual property arising from the performance of this agreement. This agreement has a term of ten years from the effective date and can only be terminated mutually by the parties in a written agreement. During the term of the agreement, Arki Network Service may not enter into any agreement with third parties for the provision of identical or similar service without the prior consent of Arki Fuxin.

SHARE PLEDGE AGREEMENT

The shareholders of Arki Network Service entered into a share pledge agreement with Arki Fuxin on February 3, 2011 under which the shareholders pledged all of their equity interests in Arki Network Service to Arki Fuxin as collateral for all of the payments due to Arki Fuxin and to secure their obligations under the above agreements. The shareholders of Arki Network Service may not transfer or assign the shares or the rights and obligations in the share pledge agreement or create or permit any pledges which may have an adverse effect on the rights or benefits of Arki Fuxin without Arki Fuxin's preapproval. Arki Fuxin is entitled to transfer or assign in full or in part the shares pledged. In the event of default, Arki Fuxin as the pledgee, will be entitled to request immediate repayment of the loan or to dispose of the pledged equity interests through transfer or assignment.

POWER OF ATTORNEY

The shareholders of Arki Network Service entered into a power of attorney agreement with Arki Fuxin effective on November 26, 2010 under which the shareholders irrevocably appointed Arki Beijing and Arki Fuxin to vote on their behalf on all matters they are entitled to vote on, including matters relating to the transfer of any or all of their respective equity interests in the entity and the appointment of the chief executive officer and other senior management members.

The Company cooperates with a Chinese bank named Fuxin bank in China to issue cobranded debit cards. The Company then authorizes certain vendors the right to issue cobranded debit cards. The Company charges each participating vendor a percentage of transactions with the vendor. Each vendor will receive a percentage of future transactions of the cards issued by the vendor. Cardholders will receive certain amounts of cash refund from participating vendors and certain virtue money to be spent on the Company’s ecommerce website www.ccmus.com. Further, the Company hires dealers to develop vendor’s network as well as manage the issuance of the cobranded debit cards. As of September 30, 2011, the Company has issued over 600,000 cards, and has 30 province-level and 210 city-level dealers and about 5,300 vendors. For the nine months ended September 30, 2011, no revenue from this business model has been realized. The Company has signed dealer agreements with large companies like China Unionpay during the nine months ended September 30, 2011. China Unionpay is the only card management company like Vis and Master in China. It has installed millions of POS machines all over China. The Company has just completed testing the system in November 2011. Management will further develop the debit card business and it will become the Company’s main business in 2012.

10

NOTE 2 - SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

REVERSE MERGER ACCOUNTING

Since former CCG California security holders owned, after the Merger, approximately 94% of Consumer Capital Group Inc. shares of common stock, and as a result of certain other factors, including that all members of the Company's executive management are from Subsidiary, Subsidiary is deemed to be the acquiring company for accounting purposes and the Merger was accounted for as a reverse merger and a recapitalization in accordance with generally accepted accounting principles in the United States ("GAAP"). These condensed consolidated financial statements reflect the historical results of Subsidiary prior to the Merger and that of the combined Company following the Merger, and do not include the historical financial results of Consumer Capital Group Inc. prior to the completion of the Merger. Common stock and the corresponding capital amounts of the Company pre-Merger have been retroactively restated as capital stock shares reflecting the exchange ratio in the Merger.

BASIS OF PRESENTATION

The accompanying unaudited consolidated financial statements have been prepared in accordance with United States generally accepted accounting principles ("U.S.GAAP").

PRINCIPLES OF CONSOLIDATION

The accompanying unaudited condensed consolidated financial statements primarily reflect the financial position, results of operations and cash flows of the Company (as discussed above). The accompanying unaudited condensed consolidated financial statements of the Company have been prepared in accordance with GAAP for interim financial information and pursuant to the instructions to Form 10-Q and Article 10 of Regulation S-X of the Securities and Exchange Commission. Accordingly, these interim financial statements do not include all of the information and footnotes required by GAAP for annual financial statements. In the opinion of management, all adjustments (consisting only of normal recurring adjustments) considered necessary for a fair presentation have been included. Operating results for the nine months ended September 30, 2011 are not necessarily indicative of the results that may be expected for the year ending December 31, 2011, or for any other period. Amounts related to disclosures of December 31, 2010, balances within those interim condensed consolidated financial statements were derived from the audited 2010 consolidated financial statements and notes thereto filed on Form 8-K on February 10, 2011.

The consolidated financial statements include the accounts of the Company and its wholly-owned subsidiaries based in the PRC, which include America Pine (Beijing), Bio-Tech, Inc., Arki (Beijing), E-Commerce Technology Corp., Beijing Beitun Trading Co., Ltd. and America Arki (Fuxin) Network Management Co. Ltd. As a result of contractual arrangements with Arki Network Service, the Company consolidates Arki Network Service in accordance with SEC Regulation SX-3A-02 and Accounting Standards Codification ("ASC") 810, Consolidation (see Note1). All significant intercompany transactions and balances have been eliminated in consolidation.

11

USE OF ESTIMATES

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Significant estimates and assumptions reflected in the Company's financial statements include, but are not limited to, customer incentives, allowances for doubtful accounts, lower of cost or market of inventories, useful lives of long-lived assets, share-based compensation expense and uncertain tax positions. Actual results could differ from those estimates.

FOREIGN CURRENCY TRANSLATION

The reporting currency is the U.S. dollar. The functional currency of the Company is the local currency, the Chinese Yuan (RMB). The financial statements of the Company are translated into United States dollars in accordance with ASC 830, FOREIGN CURRENCY MATTERS, using year-end rates of exchange for assets and liabilities, and average rates of exchange for the period for revenues, costs, and expenses and historical rates for equity. Translation adjustments resulting from the process of translating the local currency financial statements into U.S. dollars are included in determining comprehensive income. At September 30, 2011 and December 31, 2010, the cumulative translation adjustment of $26,551 and $78,775, respectively, was classified as an item of other comprehensive income in the stockholders' equity (deficit) section of the consolidated balance sheets. For the nine months ended September 30, 2011 and September 30, 2010, the foreign currency translation adjustment to accumulated other comprehensive loss was $52,224 and to accumulated other comprehensive income of $10,081, respectively. For the three months ended September 30, 2011 and September 30, 2010, the foreign currency translation adjustment to accumulated other comprehensive loss was $32,434 and $5, respectively.

REVENUE RECOGNITION

We recognize revenue from product sales or services rendered when the following four revenue recognition criteria are met: persuasive evidence of an arrangement exists, delivery has occurred or services have been rendered, the selling price is fixed or determinable, and collectability is reasonably assured.

E-COMMERCE REVENUE RECOGNITION

We evaluate whether it is appropriate to record the net amount of sales earned as commissions. We are not the primary obligor nor are we subject to inventory risk as the agreements with our suppliers specify that they have the responsibility to provide the product or service to the customer. Also, the amounts we earn from our vendors/suppliers is based on a fixed percentage and bound contractually. Additionally, the Company does not have any obligation to resolve disputes between the vendors and the customers that purchase the products on our website. Any disputes involving damaged, non-functional, product returns, and / or warranty defects are resolved between the customer and the vendor. The Company has no obligation for right of return and / or warranty for any of the sales completed using its website. Since we are not primarily obligated and amounts earned are determined using a fixed percentage, a fixed-payment schedule, or a combination of the two, we record our revenues as commissions earned on a net basis.

12

Our sales are net of promotional discounts and rebates and are recorded when the products are shipped and title passes to customers. Revenues are recorded net of sales and consumption taxes. We periodically provide incentive offers to our customers to encourage purchases. Such offers include current discount offers, such as percentage discounts off current purchases, inducement offers, such as daily sweepstakes reward opportunities which is based on volume of purchases, and other similar offers. Current discount offers and inducement offers are presented as a net amount in "Net revenues."

The Company records deferred revenue when cash is received in advance of the performance of services or delivery of goods. Deferred revenue is also recorded to account for the 7 day grace period offered to customers for potential product disputes, if any. Deferred revenues totaled $17,528 and $125,455 as of September 30, 2011 and December 31, 2010, respectively.

We offered a temporary limited time promotion for a fixed period during the year ended December 31, 2010 where customers were incentivized to purchase from our E-commerce platform and in exchange, were awarded points which were then converted to common shares of the Company. The value of these shares were deducted from revenues. For the year ended December 31, 2010, $301,462 was recognized as contra revenue on a "net" basis. During the three and nine months ended September 30, 2011, there were no promotional expenses incurred due to cancellation of the program.

DISTRIBUTION REVENUE RECOGNITION

Product sales and shipping revenues, net of return allowances, are recorded when the products are shipped and title passes to customers. Return allowances, which reduce product revenue, are estimated using historical experience. Revenue from product sales and services rendered is recorded net of sales and consumption taxes.

REWARD PROGRAMS

The Reward Programs are designed for customers residing in China. Customers may earn reward points from the purchase of merchandise and services from the Company. Points are earned based on the amount and types of merchandise and services purchased. Customers residing in China may redeem the reward points for drawings into the Company's lottery sweepstakes for chances to win cash prizes. In addition, customers may attain a tiered membership status based on the value of merchandise and services purchased over the past twelve months. Membership status entitles the holder to certain discounts on future purchases of selected items on the Company's website. The Company accrues for the estimated cost of redeeming the benefits at the time the benefits are earned by the customer. The estimated lottery expense for the nine months ending September 30, 2011 and 2010 was $695,563 and $0, respectively. The estimated lottery expense for the three months ending September 30, 2011 and 2010 was $107,428 and $0, respectively.

COST OF SALES

Cost of sales consists of the purchase price of consumer products and content sold by us, inbound and outbound shipping charges, and packaging supplies. Shipping charges to receive products from our suppliers are included in inventory cost, and recognized as "Cost of sales" upon sale of products to our customers. Payment processing and related transaction costs, including those associated with seller transactions, are classified in "Selling Expenses" on our consolidated statements of operations.

13

SHIPPING ACTIVITIES

Outbound shipping charges to customers are included in "Net sales." Outbound shipping-related costs are included in "Cost of sales."

NONCONTROLLING INTEREST

Noncontrolling interests in our subsidiary is recorded as a component of our equity, separate from the parent's equity. Purchase or sale of equity interests that do not result in a change of control are accounted for as equity transactions. Results of operations attributable to the noncontrolling interest are included in our consolidated results of operations and, upon loss of control, the interest sold, as well as interest retained, if any, will be reported at fair value with any gain or loss recognized in earnings.

COMPREHENSIVE INCOME (LOSS)

Comprehensive income (loss) is defined to include all changes in equity except those resulting from investments by owners and distributions to owners. Among other disclosures, ASC 220, Comprehensive income (loss) requires that all items that are required to be recognized under current accounting standards as components of comprehensive income be reported in a financial statement that is displayed with the same prominence as other financial statements. For the years presented, the Company's comprehensive income (loss) includes net income (loss) and foreign currency translation adjustments and is presented in the consolidated statements of changes in operations.

INCOME TAXES

We have implemented certain provisions of ASC 740, INCOME Taxes ("ASC 740"), which clarifies the accounting and disclosure for uncertain in tax positions, as defined. ASC 740 seeks to reduce the diversity in practice associated with certain aspects of the recognition and measurement related to accounting for income taxes. We adopted the provisions of ASC 740 as of January 1, 2007, and have analyzed filing positions in each of the Peoples Republic of China ("PRC") jurisdictions where we are required to file income tax returns, as well as all open tax years in these jurisdictions. We have identified the PRC as our "major" tax jurisdiction. Generally, we remain subject to PRC examination of our income tax returns. We believe that our income tax filing positions and deductions will be sustained on audit and do not anticipate any adjustments that will result in a material change to our financial position. Therefore, no reserves for uncertain income tax positions have been recorded pursuant to ASC 740. In addition, we did not record a cumulative effect adjustment related to the adoption of ASC 740. Our policy for recording interest and penalties associated with income-based tax audits is to record such items as a component of income taxes. Our tax provision for interim periods is determined using an estimate of our annual effective tax rate based on rates established within the PRC and, adjusted for discrete items, if any, that are taken into account in the relevant period. Each quarter we update our estimate of the annual effective tax rate, and if our estimated tax rate changes, we make a cumulative adjustment. The 2011 and 2010 annual effective tax rates are estimated to be the 25% PRC statutory rate primarily based on the expected taxable net income of our operating subsidiaries, Arki Beijing and Arki Fuxin. Taxes payable as of September 30, 2011 and December 31, 2010 were $2,880 and $494,057, respectively.

14

NET INCOME (LOSS) PER SHARE

We calculate basic earnings per share ("EPS") by dividing our net income (loss) by the weighted average number of common shares outstanding for the period, without considering common stock equivalents. Diluted EPS is computed by dividing net income (loss) by the weighted average number of common shares outstanding for the period and the weighted average number of dilutive common stock equivalents, such as options and warrants. Options and warrants are only included in the calculation of diluted EPS when their effect is not anti-dilutive. The Company had no dilutive securities as of September 30, 2011 and December 31, 2010.

CASH AND CASH EQUIVALENTS

We consider all investments with an original maturity of three months or less to be cash equivalents. Cash equivalents primarily represent funds invested in bank checking accounts, money market funds and domestic Chinese bank certificates of deposit. At September 30, 2011 and December 31, 2010, the Company had invested cash of $0 and $153,846 in a highly liquid investment instrument with a PRC bank.

ACCOUNTS RECEIVABLE

Accounts receivable are carried at realizable value. The Company considers many factors in assessing the collectability of its receivables, such as, the age of the amounts due, the customer's payment history and creditworthiness. An allowance for doubtful accounts is recorded in the period in which a loss is determined to be probable. Accounts receivable balances are written off after all collection efforts have been exhausted. Bad debt expense for the three and nine months ending September 30, 2011 and 2010 was $0 and there was no allowance for doubtful accounts at September 30, 2011 and December 31, 2010.

INVENTORIES

Inventories, consisting of food products available for sale, are accounted for using the first-in first-out method, and are valued at the lower of cost or market. This valuation requires the Company to make judgments, based on currently available information, about the likely method of disposition, such as through sales to individual customers, returns to product vendors, or liquidations, and expected recoverable values of each disposition category.

EQUIPMENT, NET

Equipment is recorded at cost, consists of computer equipment, office equipment and furniture and is depreciated using the straight-line method over the estimated useful lives of the related assets (generally three years or less). Costs incurred for maintenance and repairs are expensed as incurred and expenditures for major replacements and improvements are capitalized and depreciated over their estimated remaining useful lives. Depreciation expense for the nine months ending September 30, 2011 and 2010 was $9,448 and $2,451, respectively. Depreciation expense for the three months ending September 30, 2011 and 2010 was $3,466 and $800, respectively. Accumulated depreciation for the Company's equipment was $25,650 and $13,341 at September 30, 2011 and December 31, 2010, respectively.

15

IMPAIRMENT OF LONG-LIVED ASSETS

We evaluate long-lived assets for impairment whenever events or changes in circumstances (such as a significant adverse change to market conditions that will impact the future use of the assets) indicate their net book value may not be recoverable. When these events occur, we compare the projected undiscounted future cash flows associated with the related asset or group of assets over their estimated useful lives against their respective carrying amount. Impairment, if any, is based on the excess of the carrying amount over the fair value, based on market value when available, or discounted expected cash flows, of those assets and is recorded in the period in which the determination is made. The Company's management currently believes there is no impairment of its long-lived assets. There can be no assurance, however, that market conditions will not change or demand for the Company's products will continue. Either of these could result in the future impairment of long-lived assets.

SEGMENT REPORTING

The Company follows ASC 280, SEGMENT REPORTING. The Company's chief operating decision maker, who has been identified as the executive chairman of the board of directors and the chief executive officer, reviews the individual results of the e-commerce and distribution businesses when making decisions about allocating resources and assessing the performance of the Company as a whole and hence, the Company has two reportable segments. The Company's operating business are organized and based on the nature of markets and customers. As the Company's long-lived assets are substantially all located in the PRC and substantially all the Company's revenues are derived from within the PRC, no geographical segments are presented.

FAIR VALUE OF FINANCIAL INSTRUMENTS

The Company's financial instruments include cash and cash equivalents, accounts receivable, accounts payables and accrued liabilities. These financial instruments are measured at their respective fair values. For fair value measurement, U.S. GAAP establishes a three-tier hierarchy which prioritizes the inputs used in the valuation methodologies in measuring fair value:

|

·

|

Level 1 observable inputs that reflect quoted prices (unadjusted) for identical assets or liabilities in active markets.

|

|

·

|

Level 2 include other inputs that are directly or indirectly observable in the marketplace.

|

|

·

|

Level 3 unobservable inputs which are supported by little or no market activity.

|

16

Fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. The Company's cash and cash equivalents are classified within Level 1 using quoted prices. The Company's carrying value of its investment in Beitun is classified within Level 2 since it is valued using market observable inputs.

FINANCIAL INSTRUMENTS: The estimated fair values of our financial assets and liabilities that are recognized at fair value on a recurring basis, using available market information and other observable data are as follows:

|

September 30, 2011

|

||||||||||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Quoted

Prices in

Active

Markets or

Identical

Assets

|

Significant

Other

Observable

Inputs

|

Significant

Unobservable

Input

|

||||||||||||||

|

ASSETS:

|

||||||||||||||||

|

Cash & cash equivalents

|

$

|

774,648

|

$

|

-

|

$

|

-

|

$

|

774,648

|

||||||||

|

December 31, 2010

|

||||||||||||||||

|

Level 1

|

Level 2

|

Level 3

|

Total

|

|||||||||||||

|

Quoted

Prices in

Active

Markets or

Identical

Assets

|

Significant

Other

Observable

Inputs

|

Significant

Unobservable

Input

|

||||||||||||||

|

ASSETS:

|

||||||||||||||||

|

Cash & cash equivalents

|

$

|

3,015,219

|

$

|

-

|

$

|

-

|

$

|

3,015,219

|

||||||||

17

Common stock was issued in exchange for consulting services to be provided to the Company over the next two years for the purpose of advising management on public company matters. As a result, the Company recorded an asset to be amortized over the term of the consulting contract, that was measured at its fair value on the date of grant based on Level 2 inputs reflecting market based and our own assumptions consistent with reasonably available assumptions made by other market participants. These valuations require significant judgment. The calculated fair values of the stock-based payment are amortized to expense over the term of the contract. The carrying value of accounts receivable, trade payables and accrued liabilities approximates their fair value due to their short-term maturities.

SHARE-BASED COMPENSATION

The Company applies ASC 718, Compensation-Stock Compensation to account for its service providers' share-based payments. Common stock of the Company was given to service providers to retain their assistance in becoming a U.S. public company, assistance with public company regulations, investors' communications and public relations with broker-dealers, market makers and other investment professionals. In accordance with ASC 718, the Company determines whether a share payment should be classified and accounted for as a liability award or equity award. All grants of share-based payments to service providers classified as equity awards are recognized in the financial statements based on their grant date fair values which are calculated using an option pricing model. The Company has elected to recognize compensation expense using the straight-line method for all equity awards granted with graded vesting based on service conditions provided that the amount of compensation cost recognized at any date is at least equal to the portion of the grant-date value of the options that are vested at that date. To the extent the required vesting conditions are not met resulting in the forfeiture of the share-based awards, previously recognized compensation expense relating to those awards are reversed. ASC 718 requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent period if actual forfeitures differ from initial estimates. Share-based compensation expense was recorded net of estimated forfeitures such that expense was recorded only for those share-based awards that are expected to vest. Share-based compensation expenses amounted to $0 for the three and nine months ended September 30, 2011. Share-based compensation expenses amounted to $299,400 for the three and nine months ended September 30, 2010.

CONCENTRATION OF CREDIT RISK

Assets that potentially subject the Company to significant concentration of credit risk primarily consist of cash and cash equivalents, other receivables and held-to-maturity investments. The maximum exposure of such assets to credit risk is their carrying amounts as of the balance sheet dates. As of September 30, 2011, substantially all of the Company's cash and cash equivalents were deposited in financial institutions located in the PRC, which management believes are of high credit quality.

CONCENTRATION OF CUSTOMERS AND SUPPLIERS

There are no revenues from customers or purchases from suppliers which individually represent greater than 10% of the total revenues or purchases at September 30, 2011 and December 31, 2010.

18

CURRENCY CONVERTIBILITY RISK

The Company transacts all of its business in RMB, which is not freely convertible into foreign currencies. On January 1, 1994, the PRC government abolished the dual rate system and introduced a single rate of exchange as quoted daily by the People's Bank of China (the "PBOC"). However, the unification of the exchange rates does not imply that the RMB may be readily convertible into United States dollars or other foreign currencies. All foreign exchange transactions continue to take place either through the PBOC or other banks authorized to buy and sell foreign currencies at the exchange rates quoted by the PBOC.

Approval of foreign currency payments by the PBOC or other institutions requires submitting a payment application form together with suppliers' invoices, shipping documents and signed contracts.

Additionally, the value of the RMB is subject to changes in central government policies and international economic and political developments affecting supply and demand in the PRC foreign exchange trading system market.

FOREIGN CURRENCY EXCHANGE RATE RISK

From July 21, 2005, the RMB is permitted to fluctuate within a narrow and managed band against a basket of certain foreign currencies. The depreciation of the U.S. dollar against RMB was approximately 3.78% and 1.71% for the nine months ending September 30, 2011 and 2010, respectively. While the international reaction to the RMB appreciation has generally been positive, there remains significant international pressure on the PRC government to adopt an even more flexible currency policy, which could result in a further and more significant appreciation of the RMB against the U.S. dollar.

BUSINESS RISK

Foreign ownership of Internet-based businesses is subject to significant restrictions under current PRC laws and regulations. Foreign investors are not allowed to own more than a 50% equity interest in any entity with an Internet content distribution business. Currently, the Company conducts its operations in China through a series of contractual arrangements entered into among Arki (Beijing) E-Commerce Technology Corp., America Arki (Fuxin) Network Management Co. Ltd. and America Arki Network Service Beijing Co., Ltd. The relevant regulatory authorities may find the current ownership structure, contractual arrangements and businesses to be in violation of any existing or future PRC laws or regulations. If so, the relevant regulatory authorities would have broad discretion in dealing with such violations.

From time to time, we may become involved in disputes, litigation and other legal actions. We estimate the range of liability related to any pending litigation where the amount and range of loss can be estimated. We record our best estimate of a loss when the loss is considered probable. Where a liability is probable and there is a range of estimated loss with no best estimate in the range, we record a charge equal to at least the minimum estimated liability for a loss contingency when both of the following conditions are met: (i) information available prior to issuance of the financial statements indicates that it is probable that an asset had been impaired or a liability had been incurred at the date of the financial statements and (ii) the range of loss can be reasonably estimated.

19

NOTE 3 - RECENTLY ISSUED AND ADOPTED ACCOUNTING PRONOUCEMENTS

In June 2011, the FASB issued ASU 2011-05, “Presentation of Comprehensive Income” (“ASU 2011-05”). In accordance with ASU 2011-05, an entity has the option to present the total of comprehensive income, the components of net income, and the components of other comprehensive income either in a single continuous statement of comprehensive income or in two separate but consecutive statements. In both choices, an entity is required to present each component of net income along with total net income, each component of other comprehensive income along with a total for other comprehensive income, and a total amount for comprehensive income. ASU 2011-05 eliminates the option to present the components of other comprehensive income as part of the statement of changes in stockholders’ equity. ASU 2011-05 does not change the items that must be reported in other comprehensive income or when an item of other comprehensive income must be reclassified to net income. ASU 2011-05 is effective retrospectively for fiscal years, and interim periods within those years, beginning after December 15, 2011. We are currently evaluating the impact of this standard on our consolidated financial statements.

In May 2011, the FASB issued ASU 2011-04, “Amendments to Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRS” (“ASU 2011-04”). The amendments in ASU 2011-04 result in common fair value measurement and disclosure requirements in U.S. GAAP and IFRSs. Consequently, ASU 2011-04 changes the wording used to describe many of the requirements in U.S. GAAP for measuring fair value and for disclosing information about fair value measurements. For many of the requirements, the FASB does not intend for the amendments in ASU 2011-04 to result in a change in the application of the requirements in Topic 820. ASU 2011-04 is effective prospectively for interim and annual reporting periods beginning after December 15, 2011. This ASU will become effective for the company beginning in the quarter ended January 31, 2012 and we do not expect an impact on our consolidated financial statements.

In September 2011, the FASB issued guidance on testing goodwill for impairment. The new guidance provides an entity the option to first perform a qualitative assessment to determine whether it is more likely than not that the fair value of a reporting unit is less than its carrying amount. If an entity determines that this is the case, it is required to perform the currently prescribed two-step goodwill impairment test to identify potential goodwill impairment and measure the amount of goodwill impairment loss to be recognized for that reporting unit (if any). If an entity determines that the fair value of a reporting unit is less than its carrying amount, the two-step goodwill impairment test is not required. The new guidance will be effective for us beginning July 1, 2012.

Inventory consisted of the following at September 30, 2011 and December 31, 2010:

|

September 30,

2011

|

December

31, 2010

|

|||||||

|

Finished goods - packaged food

|

$

|

844,200

|

$

|

334,972

|

||||

|

Less: reserve for inventory

|

-

|

-

|

||||||

|

Total inventory

|

$

|

844,200

|

$

|

334,972

|

||||

20

NOTE 5 - PREPAID EXPENSES

Prepaid expenses consisted of the following at September 30, 2011 and December 31, 2010:

|

September 30,

2011

|

December

31, 2010

|

|||||||

|

Prepaid professional fees

|

$

|

-

|

$

|

218,265

|

||||

|

Prepaid services

|

133,290

|

22,409

|

||||||

|

Deposits

|

24,398

|

18,598

|

||||||

|

Total prepaid expenses

|

$

|

157,688

|

$

|

259,272

|

||||

Property and equipment consisted of the following at September 30, 2011 and December 31, 2010:

|

September 30,

2011

|

December

31, 2010

|

|||||||

|

Office equipment & computers

|

$

|

20,045

|

$

|

14,775

|

||||

|

Equipment

|

9,137

|

4,199

|

||||||

|

Vehicles

|

17,433

|

17,287

|

||||||

|

Office furniture & fixtures

|

40,449

|

24,724

|

||||||

|

87,064

|

60,985

|

|||||||

|

Less: Accumulated depreciation

|

25,650

|

13,341

|

||||||

|

Total equipment, net

|

$

|

61,414

|

$

|

47,644

|

||||

21

For the nine months ending September 30, 2011 and 2010, depreciation expense was $9,448 and $2,451, respectively. For the three months ending September 30, 2011 and 2010, depreciation expense was $3,466 and $800, respectively.

Other assets consisted of the following at September 30, 2011 and December 31, 2010:

|

September 30,

2011

|

December

31, 2010

|

|||||||

|

Common stock issued for services

|

$

|

93,705

|

$

|

166,333

|

||||

|

Deposit for office

|

92,444

|

89,340

|

||||||

|

Other

|

-

|

2,612

|

||||||

|

Total other assets

|

$

|

186,149

|

$

|

258,285

|

||||

The prepaid consulting service contracts have a term of 24 months. Amortization for the nine months ending September 30, 2011 and 2010 was $73,500 and $0, respectively. Amortization for the three months ending September 30, 2011 and 2010 was $22,728 and $0, respectively. On March 31, 2011, the Company cancelled 227,609 shares due to early termination of a portion of a service contract with a consultant. The adjustment to prepaid assets and equity of $41,374 was recorded as of September 30, 2011 (see Note 10 - Share Based Compensation).

Accrued liabilities consisted of the following at September 30, 2011 and December 31, 2010:

|

September 30,

2011

|

December

31, 2010

|

|||||||

|

Accrued customer incentives

|

$

|

41,945

|

$

|

745,056

|

||||

|

Advances

|

-

|

-

|

||||||

|

Accrued payroll

|

18,098

|

8,998

|

||||||

|

Other

|

-

|

5,929

|

||||||

|

Total accrued liabilities

|

$

|

60,043

|

$

|

759,983

|

||||

22

NOTE 9 - STOCKHOLDERS' EQUITY

The Company's stockholder base consists of approximately 9,200 stockholders as of September 30, 2011.

COMMON STOCK ISSUED TO SERVICE PROVIDERS AND MEMBER CUSTOMERS

During 2010, Company management issued stock to customer members, which represented sales inducement incentives to make purchases through the Company's website. Certain service providers were also granted stock for the value of their services provided to the Company. Common stock issued to service providers and member customers throughout 2010 were measured at the date of grant, and based on Level 2 fair value measurements which uses observable inputs reflecting our own and market based assumptions, consistent with reasonably available assumptions made by other market participants. These valuations require significant judgment. The calculated fair values of the share-based sales inducement offers are deducted from revenues when granted. Share-based awards to service providers are expensed when services are incurred. The Company estimates the fair value of these share issuances using Level 2 inputs and determined that the value of each share is $0.01. For the nine months ending September 30, 2011, there were no incentives offered to member customers.

As of December 31, 2010, $200,000 was recognized in stockholders' equity for common stock issued for services. As of September 30, 2011, 227,609 shares of common stock and $35,102 was reduced from Additional Paid in Capital as a result of early termination of one of service provider contracts. For the nine months ending September 30, 2011 and 2010, $73,500 and zero was amortized to general and administrative expense for the pro-rata portion of the remaining service contract realized (see Note 10 - Share Based Compensation). For the three months ending September 30, 2011 and 2010, $22,728 and zero was amortized to general and administrative expense for the pro-rata portion of the remaining service contract realized.

COMMON STOCK

At March 13, 2011, the Company cancelled 227,609 retroactively restated to reflect the recapitalization of common stock originally issued to a service provider due to management deciding to early termination of their related contract. Immediately after the cancellation, the Company reissued the 227,609 shares to management for no consideration and $23 was recognized as a discount on common stock issued.

Immediately prior to the closing of the Merger on February 4, 2011, there were 2,500,000 issued and outstanding shares of the Company's common stock, 60% of which were held by the then-principal stockholder, CEO, and sole director of the Company, Mr. Bengfort. As a part of the Merger, CCG paid USD $335,000 in cash to Mr. Bengfort in exchange for his agreement to enter into various transaction agreements relating to the Merger, as well as the cancellation of 1,388,889 shares of the Company's common stock directly held by him, constituting 92.6% of his pre-Merger holdings of Company common stock.

In August, September and December 2010, the Company issued 2,628,419 shares retroactively restated to reflect the recapitalization of common stock to related parties of the Company's founders and officer of the Company for no par value. As a result, the Company recorded a discount on common stock issued to the officer and relatives of the Company's founders of $26,284 due to issuance of the common stock below $0.01 par value.

23

In September 2010, the Company issued 910,644 retroactively restated to reflect the recapitalization of common stock as consideration for consulting services with a term of 24 months. At March 13, 2011, the Company cancelled 227,609 retroactively restated to reflect the recapitalization of common stock originally issued to a service provider due to management deciding to early termination of their related contract. Immediately after the cancellation, the Company reissued the 227,609 shares to management for no consideration and $23 was recognized as a discount on common stock issued.

In December 2010, the Company issued 45,532 retroactively restated to reflect the recapitalization of common stock to the owners of Beitun as consideration for the Company's 51% ownership interest of Beitun. The fair value of the shares issued for the acquisition was $10,000.

NOTE 10 - SHARE BASED COMPENSATION

Stock-based compensation cost is measured at the date of grant, based on the calculated fair value of the stock-based award, and is recognized as expense over the service providers' requisite service period (generally the vesting period of the award). The Company estimates the fair value of stock for service granted using the Black-Scholes Option Pricing Model. Key assumptions used to estimate the fair value of stock options include the exercise price of the award, the fair value of the Company's common stock on the date of grant, the expected option term, the risk free interest rate at the date of grant, the expected volatility and the expected annual dividend yield on the Company's common stock.

In September 2010, the Company issued 910,644 retroactively restated to reflect the recapitalization of common stock as consideration for consulting services with a term of 24 months. At March 13, 2011, the Company cancelled 227,609 retroactively restated to reflect the recapitalization of common stock originally issued to a service provider due to management deciding to early termination of their related contract. Immediately after the cancellation, the Company reissued the 227,609 shares to management for no consideration and $23 was recognized as a discount on common stock issued.

The following weighted average assumptions were used in estimating the fair value of the share-based payment arrangements to service providers:

|

September 30, 2011

|

||||

|

Annual dividends

|

0

|

|||

|

Expected volatility

|

40% - 75

|

%

|

||

|

Risk-free interest rate

|

0.75

|

%

|

||

|

Expected life

|

2 years

|

|||

24

Since there is insufficient stock price history that is at least equal to the expected or contractual terms of the Company's share-based payments, the Company has calculated volatility using the historical volatility of similar public entities in the Company's industry. In making this determination and identifying a similar public company, the Company considered the industry, stage, life cycle, size and financial leverage of such other entities. This resulted in an expected volatility of 40% to 75%. The expected option term in years is calculated using an average of the vesting period and the option term, in accordance with the "simplified method" for "plain vanilla" stock options allowed under GAAP. The risk free interest rate is the rate on the U.S. Treasury securities 2-year constant maturity with a remaining term equal to the expected option term. The expected volatility is derived from an industry-based index, in accordance with the calculated value method.

The Company is required to estimate the number of forfeitures expected to occur and record expense based upon the number of awards expected to vest. The Company expects all remaining awards issued will be fully vested over the expected life of the awards. There were no forfeitures during the quarter ended September 30, 2011.

A summary of share-based compensation activity for the nine months ended September 30, 2011 is as follows:

|

Number of

Shares

|

Weighted

Average

Fair Value

|

Amount

|

||||||||||

|

Share-based compensation outstanding at January 1, 2010

|

-

|

$

|

-

|

$

|

-

|

|||||||

|

Granted

|

910,644

|

0.01

|

9,106

|

|||||||||

|

Cancelled

|

-

|

-

|

-

|

|||||||||

|

Forfeited

|

-

|

-

|

-

|

|||||||||

|

Share-based compensation outstanding at January 1, 2011

|

910,644

|

0.01

|

9,106

|

|||||||||

|

Granted

|

-

|

-

|

-

|

|||||||||

|

Cancelled

|

(227,609

|

)

|

0.01

|

(2,276

|

)

|

|||||||

|

Forfeited

|

-

|

-

|

-

|

|||||||||

|

Share-based compensation outstanding at September 30, 2011

|

683,035

|

$

|

0.01

|

$

|

6,830

|

|||||||

For the nine months ended September 30, 2011 and 2010, $78,828 and $0, respectively were amortized to general and administrative expense to recognize the incurred cost of the service providers. For the three months ended September 30, 2011 and 2010, $41,428 and $0, respectively were amortized to general and administrative expense to recognize the incurred cost of the service providers. The future expense amortization as of September 30, 2011 is as follows:

25

a) Related parties:

|

Name of related parties

|

Relationship with the Company

|

|

|

Mr. Jack Gao

|

Stockholder, Chief Executive Officer, Chief Financial Officer and Chairman of the Board of the Company

|

|

|

Ms. Ling Zhang

|

Stockholder, director and Corporate Secretary

|

|

|

Mr. Fei Gao

|

Stockholder, director and Chief Operating Officer

|

|

|

Ms. Wei Guo

|

Stockholder and Managing Director of Beitun

|

b) The Company had the following related party balances at September 30, 2011 and December 31, 2010:

|

September 30, 2011

|

December 31, 2010

|

|||||||

|

Loan from Mr. Jack Gao

|

$

|

227,431

|

$

|

51,425

|

||||

|

Loan from Ms. Wei Guo

|

167,670

|

204,774

|

||||||

|

Total related party payables

|

395,101

|

256,199

|

||||||

|

Loan to Mr. Jack Gao

|

-

|

125,528

|

||||||

|

Total related party, net

|

$

|

395,101

|

$

|

130,671

|

||||

The related party payable and receivable are non-interest bearing and have no specified maturity date. Mr. Jack Gao is the CEO of the Company. Ms. Wei Guo is the CEO of Beitun. The Company obtains these payables for funding operation purposes when the Company or one of the subsidiaries are short of cash resources. For the nine months ended September 30, 2011, the Company borrowed approximately $703,251 form Mr. Jack Gao and made payments of approximately $440,704 back to him. For the nine months ended September 30, 2011, the Company borrowed approximately $1,663,741 from Ms. Wei Guo and made payments of approximately $1,661,858 back to her.

26

c) Starting from July 1, 2011, the Company has formed an agreement with Ms. Ling Zhang’s company Capitalco Cooperation (“Capitalco”). In the agreement, the Company has agreed that the Company will pay a certain percentage commission to Capitalco for each client Capitalco has marketed for the Company’s US online store. As of September 30, 2011, Ms. Zhang has signed an agreement to sell her company to an unrelated party. A total of $162,404 was paid as commission to Capitalco, which was owned by Mrs. Ling Zhang and which was sold on August, 2011.

NOTE 12 - COMMITMENTS AND CONTINGENCIES

LEASE COMMITMENTS

Our Company has entered into a sub-lease agreement for its Pasadena office facility beginning August 1, 2010 and ending November 30, 2012. Our full service gross monthly rental rate is $2,567. Rent expense (including related common area maintenance charges) totaled $23,103 for nine months ended September 30, 2011. Rent expense (including related common area maintenance charges) totaled $7,701 for three months ended September 30, 2011.

In China, we have entered into a lease agreement in the Beijing Chaoyang District for our Arki (Beijing) E-commerce Technology Co., Ltd. wholly owned subsidiary beginning June 7, 2010 and ending May 30, 2012. Our full service gross monthly rental rate is $3,400. Rent expense (including related common area maintenance charges) totaled $30,600 for nine months ended September 30, 2011. Rent expense (including related common area maintenance charges) totaled $10,200 for three months ended September 30, 2011.